From Click to Cargo: The Role of Digitalization, Cross-Border E-Commerce, and Logistics in Deepening the China–Africa Trade

Abstract

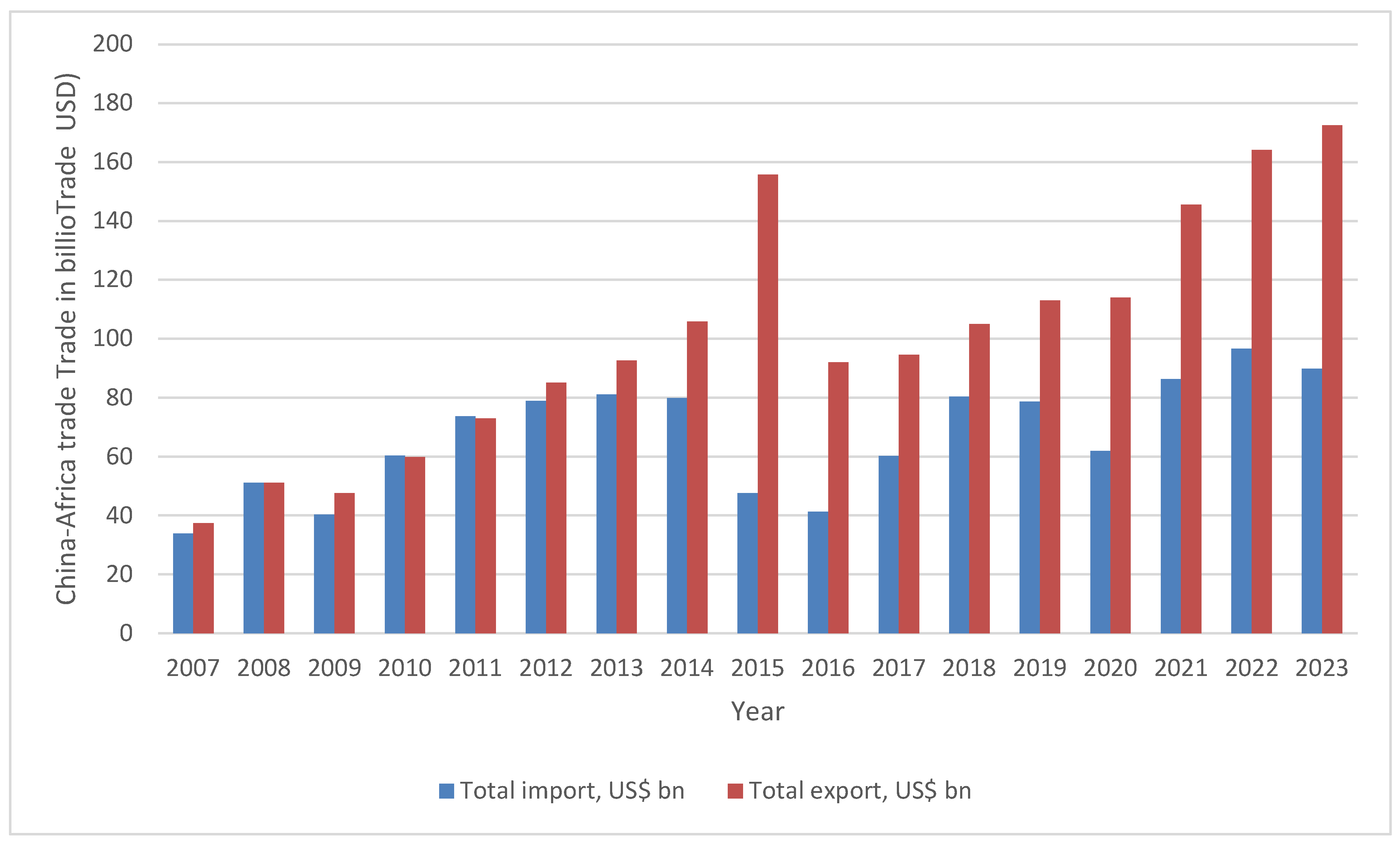

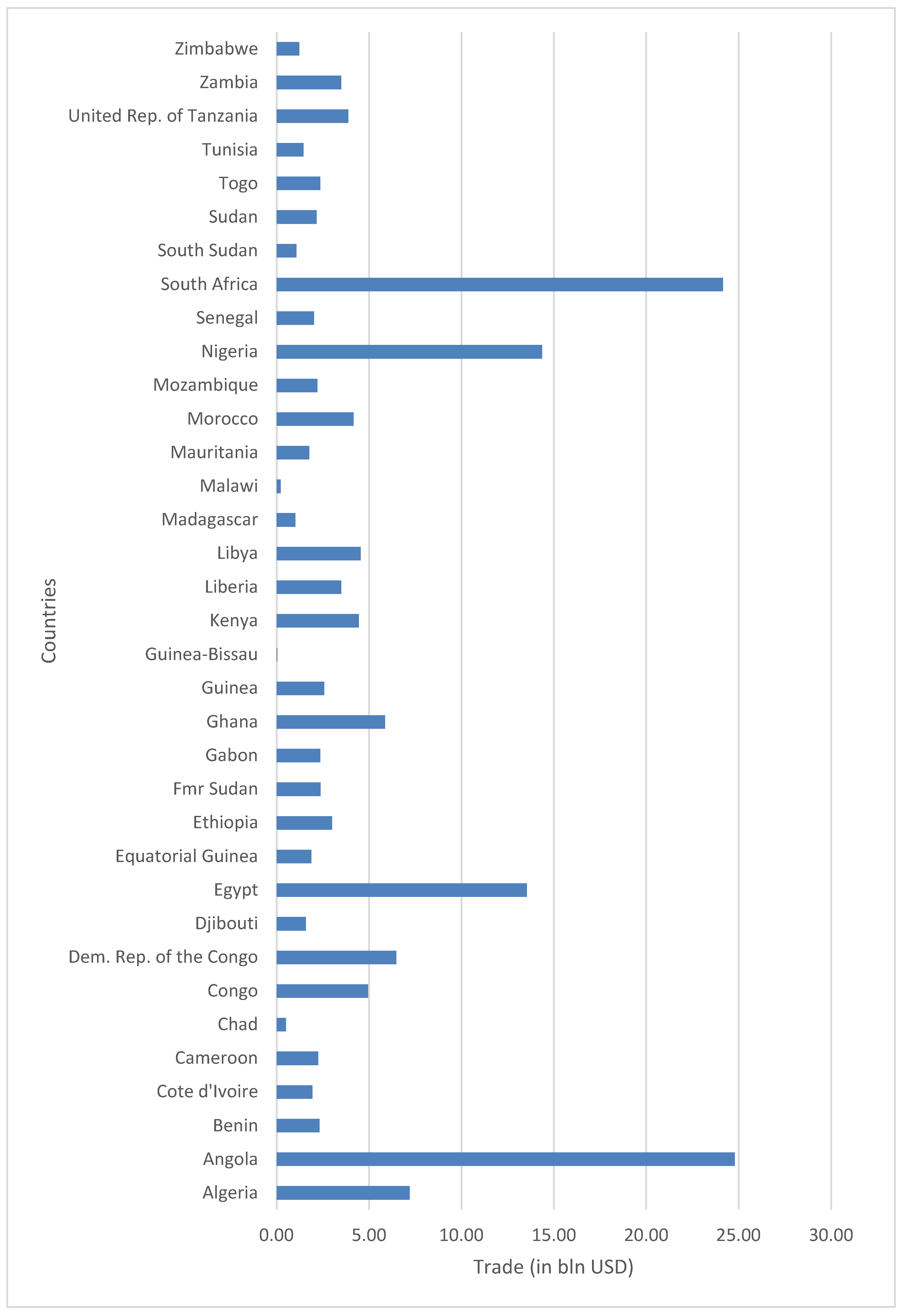

1. Introduction

2. Literature Review

2.1. Digital Connectivity, CE, and Trade Flow

2.2. LP and Trade Flow

2.3. Summary and Research Gap

3. Methodology and Data

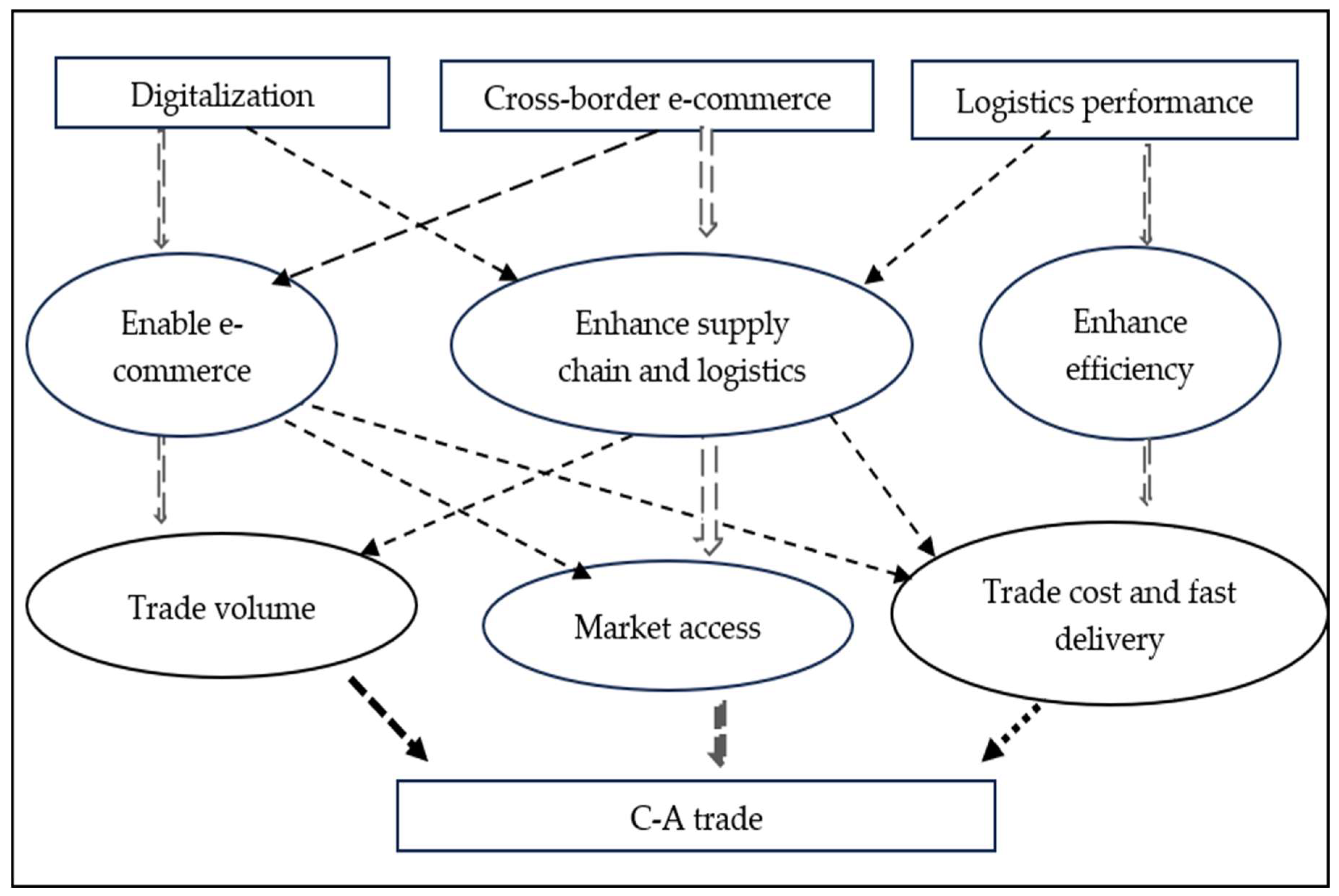

3.1. Theoretical Underpinnings of Model Construction

3.2. Variables Measurement and Data

3.3. Method of Analysis

4. Results and Findings

4.1. Correlation Analysis

4.2. Baseline Results

4.3. Robustness Analysis

4.3.1. Heteroscedasticity Issue

4.3.2. Further Robustness Analysis

4.4. Heterogeneity Analysis

4.4.1. The Role of Income and Demographic Heterogeneity

4.4.2. The Role of IQ and Resources Heterogeneity

4.5. The Role of Digitalization and LP Distance

5. Discussions and Theoretical and Practical Implications

5.1. Discussions

5.2. Theoretical Contributions

5.3. Practical Implications

5.4. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| RE vs. FE | |

|---|---|

| Hausman test | H0: RE is preferred. H1: FE is preferred. |

| p-Value | 0.680 |

| Decision | RE is preferred. |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Tijt | 901 | 1855.085 | 3354.666 | 0.000 | 24,223.770 |

| GDPCjjt | 874 | 5281.240 | 1981.491 | 2308.984 | 14,818.580 |

| Dij | 897 | 11,250.32 | 1558.757 | 8250 | 13682 |

| DDijt | 738 | 0.301 | 0.252 | 0.000 | 1.605 |

| WTOij | 901 | 0.811 | 0.391 | 0.000 | 1.000 |

| IQjt | 897 | −0.040 | 2.225 | −5.940 | 5.610 |

| IQit | 901 | 0.529 | 1.581 | −1.519 | 3.394 |

| CBit | 901 | 568.833 | 427.896 | 59.367 | 1324.865 |

| DGit | 848 | 0.874 | 1.295 | −1.297 | 2.961 |

| DGjt | 768 | 0.468 | 1.472 | −1.361 | 7.286 |

| LPit | 848 | 3.554 | 0.108 | 3.320 | 3.700 |

| LPjt | 834 | 2.476 | 0.327 | 1.340 | 3.775 |

| Variables | a | b | c | d | e | f | g | h | i | j | k | l |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| lnTijt (a) | 1 | |||||||||||

| lnGDPCijt (b) | 0.23 | 1 | ||||||||||

| lnDDij (c) | −0.37 | −0.07 | 1 | |||||||||

| Dijt (d) | 0.09 | −0.02 | −0.17 | 1 | ||||||||

| WTOij (e) | 0.14 | −0.09 | 0.34 | −0.04 | 1 | |||||||

| lnIQjt (f) | −0.08 | 0.03 | 0.13 | −0.05 | 0.14 | 1 | ||||||

| lnLPjt (g) | 0.17 | 0.13 | −0.11 | 0.08 | 0.12 | 0.44 | 1 | |||||

| lnDGjt (h) | 0.32 | 0.57 | −0.08 | 0.04 | 0.06 | 0.35 | 0.40 | 1 | ||||

| lnIQit (i) | 0.20 | 0.59 | 0.05 | 0.01 | 0.04 | 0.00 | 0.17 | 0.54 | 1 | |||

| lnLPit (j) | 0.22 | 0.59 | 0.05 | 0.04 | 0.04 | 0.01 | 0.20 | 0.57 | 0.88 | 1 | ||

| lnCEit (k) | 0.23 | 0.53 | 0.05 | 0.03 | 0.04 | 0.01 | 0.21 | 0.60 | 0.93 | 0.95 | 1 | |

| lnDGit (l) | 0.23 | 0.53 | 0.06 | 0.02 | 0.04 | 0.01 | 0.21 | 0.60 | 0.90 | 0.97 | 0.98 | 1 |

| Variables | I | II | III | IV | V |

|---|---|---|---|---|---|

| Control variables | Yes | Yes | Yes | Yes | Yes |

| lnDGit | 0.429 ** (0.184) | ||||

| lnDGjt | 0.379 *** (0.119) | ||||

| lnCEit | 0.133 ** (0.066) | ||||

| lnLPit | 0.793 * (0.430) | ||||

| lnLPjt | 0.020 (0.095) | ||||

| Obs. | 658 | 604 | 658 | 658 | 550 |

| R2 | 0.603 | 0.581 | 0.626 | 0.558 | 0.510 |

| Variables | I | II | III | IV | V |

|---|---|---|---|---|---|

| Control variables | Yes | Yes | Yes | Yes | Yes |

| lnDGit | 0.876 *** (0.236) | ||||

| lnDGjt | 0.521 *** (0.186) | ||||

| lnCEit | 0.619 *** (0.167) | ||||

| lnLPit | 0.867 * (0.500) | ||||

| lnLPjt | 0.144 (0.108) | ||||

| Obs. | 305 | 275 | 305 | 305 | 276 |

| R2 | 0.600 | 0.611 | 0.609 | 0.577 | 0.590 |

| Aggregate Digitalization Indicator for China | |||

|---|---|---|---|

| Component | Eigenvalue | Proportion | Cumulative |

| Comp1 | 2.929 | 0.976 | 0.976 |

| Comp2 | 0.057 | 0.019 | 0.996 |

| Comp3 | 0.013 | 0.004 | 1.000 |

| Variable | Comp1 | Comp2 | Comp3 |

| Individuals using the Internet (% of the population) | 0.581 | −0.220 | −0.784 |

| Mobile cellular subscriptions (per 100 people) | 0.578 | −0.567 | 0.587 |

| Fixed telephone subscriptions (per 100 people) | 0.574 | 0.794 | 0.202 |

| Aggregate digitalization indicator for African countries | |||

| Component | Eigenvalue | Proportion | Cumulative |

| Comp1 | 2.061 | 0.687 | 0.687 |

| Comp2 | 0.670 | 0.224 | 0.911 |

| Comp3 | 0.269 | 0.090 | 1.000 |

| Variable | Comp1 | Comp2 | Comp3 |

| Fixed telephone subscriptions (per 100 people) | 0.494 | 0.855 | 0.158 |

| Mobile cellular subscriptions (per 100 people) | 0.599 | −0.466 | 0.651 |

| Individuals using the Internet (% of the population) | 0.630 | −0.227 | −0.743 |

Appendix B. Sample of Countries Trading with China

| Algeria +* | Ethiopia + | Niger + |

| Angola +* | Gabon * | Nigeria +* |

| Benin * | Gambia | Rwanda |

| Botswana * | Ghana +* | Senegal * |

| Burkina Faso | Guinea * | Seychelles * |

| Burundi | Guinea-Bissau | Sierra Leone * |

| Cabo Verde * | Kenya +* | Somalia |

| Cameroon +* | Lesotho * | South Africa +* |

| Central African Rep. | Liberia | South Sudan |

| Chad | Libya * | Sudan + |

| Comoros * | Madagascar + | São Tomé and Príncipe * |

| Congo, Dem. Rep. + | Malawi | Tanzania +* |

| Congo, Rep. * | Mali + | Togo |

| Côte d’Ivoire * | Mauritania * | Tunisia * |

| Djibouti * | Mauritius * | Uganda + |

| Egypt +* | Morocco +* | Zambia * |

| Equatorial Guinea * | Mozambique + | Zimbabwe * |

| Eritrea | Namibia * | |

| + More-populated, * Middle-income. | ||

| 1 | The results will be available based on requests. |

| 2 | Based on information available: https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups, (accessed on: 5 June 2024). |

References

- Abendin, S., Pingfang, D., & Nkukpornu, E. (2022). Bilateral trade in west Africa: Does digitalization matter? The International Trade Journal, 36(6), 477–501. [Google Scholar] [CrossRef]

- Ai, W., Yang, J., & Wang, L. (2016). Revelation of cross-border logistics performance for the manufacturing industry development. International Journal of Mobile Communications, 14(6), 593. [Google Scholar] [CrossRef]

- Almeida, R. K., & Margarida, F. A. (2006). Openness and technological innovations in developing countries: Evidence from firm-level surveys (World Bank Working Number 3985). World Bank. Available online: http://documents.worldbank.org/curated/en/591151468314080407 (accessed on 12 January 2025).

- Añón Higón, D., & Bonvin, D. (2024). Digitalization and trade participation of SMEs. Small Business Economics, 62(3), 857–877. [Google Scholar] [CrossRef]

- Asante, R. (2018). China and Africa: Model of South-South cooperation? China Quarterly of International Strategic Studies, 4(02), 259–279. [Google Scholar] [CrossRef]

- Barakat, M., Madkour, T., & Moussa, A. M. (2023). The role of logistics performance index on trade openness in Europe. International Journal of Economics and Business Research, 25(3), 379–394. [Google Scholar] [CrossRef]

- Bellucci, C., Rubínová, S., & Piermartini, R. (2023). Better together: How digital connectivity and regulation reduce trade costs (ERSD Staff Working Paper 07). World Trade Organization. [Google Scholar]

- Bhukiya, S., & Patel, R. (2023). The relationship between logistics performance index and international trade: An empirical analysis. International Journal of Research Publication and Reviews, 4(3), 1505–1508. [Google Scholar] [CrossRef]

- Bo, H., Lawal, R., & Sakariyahu, R. (2024). China’s infrastructure investments in Africa: An imperative for attaining sustainable development goals or a debt-trap? The British Accounting Review, 101472. [Google Scholar] [CrossRef]

- Bugarčić, F. Ž., Skvarciany, V., & Stanišić, N. (2020). Logistics performance index in international trade: Case of Central and Eastern European and Western Balkans countries. Verslas: Teorija Ir Praktika, 21(2), 452–459. [Google Scholar] [CrossRef]

- Cantore, N., & Cheng, C. F. C. (2018). International trade of environmental goods in gravity models. Journal of Environmental Management, 223, 1047–1060. [Google Scholar] [CrossRef]

- Chakamera, C., & Pisa, N. M. (2021). Associations between logistics and economic growth in Africa. South African Journal of Economics, 89(3), 417–438. [Google Scholar] [CrossRef]

- Chen, K., Luo, S., & Kin Tong, D. Y. (2024). Cross border e-commerce development and enterprise digital technology innovation-empirical evidence from listed companies in China. Heliyon, 10(15), e34744. [Google Scholar] [CrossRef]

- Chen, W., Wu, B., & Guo, Q. (2024). The efficiency of China’s export trade with Africa and its influence mechanism. African Development Review, 36(2), 187–200. [Google Scholar] [CrossRef]

- Chen, Y., Li, M., Song, J., Ma, X., Jiang, Y., Wu, S., & Chen, G. L. (2022). A study of cross-border E-commerce research trends: Based on knowledge mapping and literature analysis. Frontiers in Psychology, 13, 1009216. [Google Scholar] [CrossRef] [PubMed]

- Clarke, G. R. G., & Wallsten, S. J. (2006). Has the Internet increased trade? Developed and developing country evidence. Economic Inquiry, 44(3), 465–484. [Google Scholar] [CrossRef]

- Cui, Z., Fu, X., Wang, J., Qiang, Y., Jiang, Y., & Long, Z. (2022). How does COVID-19 pandemic impact cities’ logistics performance? An evidence from China’s highway freight transport. Transport Policy, 120, 11–22. [Google Scholar] [CrossRef]

- Çelebi, D. (2019). The role of logistics performance in promoting trade. Maritime Economics & Logistics, 21, 307–323. [Google Scholar]

- Doh, J., Rodrigues, S., Saka-Helmhout, A., & Makhija, M. (2017). International business responses to institutional voids. Journal of International Business Studies, 48(3), 293–307. [Google Scholar] [CrossRef]

- Fan, X. (2021). Digital economy development, international trade efficiency and trade uncertainty. China Finance and Economic Review, 10(3), 89–110. [Google Scholar] [CrossRef]

- Fan, X., & Yu, S. (2015). ‘Maritime Silk Road’ logistics performance and its impact on China’s import and export trade. Journal of Xi’an Jiaotong University, 35, 13–20. [Google Scholar]

- Freund, C., & Weinhold, D. (2004). On the effect of the internet on international trade. Journal of International Economics, 62, 171–189. [Google Scholar] [CrossRef]

- Gani, A. (2017). The logistics performance effect in international trade. The Asian Journal of Shipping and Logistics, 33(4), 279–288. [Google Scholar] [CrossRef]

- Gold, K., & Rasiah, R. (2022). China’s bilateral trade in Africa: Is institutional structure a determinant? Chinese Management Studies, 16(3), 673–687. [Google Scholar] [CrossRef]

- Górecka, A. K., Pavlić Skender, H., & Zaninović, P. A. (2022). Assessing the effects of logistics performance on energy trade. Energies, 15(1), 191. [Google Scholar] [CrossRef]

- Greene, W. (2012). Econometric analysis (7th ed.). Prentice Hall. [Google Scholar]

- Gregory, G. D., Ngo, L. V., & Karavdic, M. (2019). Developing e-commerce marketing capabilities and efficiencies for enhanced performance in business-to-business export ventures. Industrial Marketing Management, 78, 146–157. [Google Scholar] [CrossRef]

- Guo, Y., Bao, Y., Stuart, B. J., & Le-Nguyen, K. (2018). To sell or not to sell: Exploring sellers’ trust and risk of chargeback fraud in cross-border electronic commerce. Information Systems Journal, 28(2), 359–383. [Google Scholar] [CrossRef]

- Hardi, I., Ray, S., Attari, M. U. Q., Ali, N., & Idroes, G. M. (2024). Innovation and economic growth in the top five Southeast Asian economies: A decomposition analysis. Ekonomikalia Journal of Economics, 2(1), 1–14. [Google Scholar] [CrossRef]

- Hausman, W. H., Lee, H. L., & Subramanian, U. (2013). The impact of logistics performance on trade. Production and Operations Management, 22(2), 236–252. [Google Scholar] [CrossRef]

- He, Y. (2024). E-commerce and foreign direct investment: Pioneering a new era of trade strategies. Humanities & Social Sciences Communications, 11(1), 566. [Google Scholar] [CrossRef]

- Herman, P. R., & Oliver, S. (2023). Trade, policy, and economic development in the digital economy. Journal of Development Economics, 164(103135), 103135. [Google Scholar] [CrossRef]

- Holslag, J. (2017). How China’s new silk road threatens European trade. The International Spectator: A Quarterly Journal of the Istituto Affari Internazionali, 52(1), 46–60. [Google Scholar] [CrossRef]

- Huang, Z., & Cao, X. (2023). The lure of technocracy? Chinese aid and local preferences for development leadership in Africa. Foreign Policy Analysis, 19(3), orad010. [Google Scholar] [CrossRef]

- ITU. (2022). Measuring digital development: Facts and figures 2022. ITU Publications. Available online: https://www.itu.int/en/ITU-D/Statistics/Pages/facts/default.aspx (accessed on 15 January 2025).

- Jayathilaka, R., Jayawardhana, C., Embogama, N., Jayasooriya, S., Karunarathna, N., Gamage, T., & Kuruppu, N. (2022). Gross domestic product and logistics performance index drive the world trade: A study based on all continents. PLoS ONE, 17(3), e0264474. [Google Scholar] [CrossRef] [PubMed]

- Jean, R.-J., Kim, D., & Cavusgil, E. (2020). Antecedents and outcomes of digital platform risk for international new ventures’ internationalization. Journal of World Business, 55(1), 101021. [Google Scholar] [CrossRef]

- Kere, S., & Zongo, A. (2023). Digital technologies and intra-African trade. International Economics, 173, 359–383. [Google Scholar] [CrossRef]

- Kong, N., Wang, B., Zhang, Y., & Zhou, N. (2024). How does digital technology affect export in services? Journal of Asian Economics, 95, 101814. [Google Scholar] [CrossRef]

- Kumari, M., & Bharti, N. (2021). Trade and logistics performance: Does country size matter? Maritime Economics & Logistics, 23, 401–423. [Google Scholar]

- Kuteyi, D., & Winkler, H. (2022). Logistics challenges in Sub-Saharan Africa and opportunities for digitalization. Sustainability, 14(4), 2399. [Google Scholar] [CrossRef]

- Labhard, V., & Lehtimäki, J. (2022). Digitalizaation, institutions and governance, and growth: Mechanisms and evidence (Working Paper Series 2735). European Central Bank. [Google Scholar]

- Landry, D. (2024). Does governance matter? Comparing the determinants of Chinese and Western trade with Africa. Global Policy, 15(2), 342–354. [Google Scholar] [CrossRef]

- Lee, H. L., & Shen, Z. J. M. (2020). Supply chain and logistics innovations with the Belt and Road Initiative. Journal of Management Science and Engineering, 5(2), 77–86. [Google Scholar] [CrossRef]

- Li, Y., & Li, Z. (2024). Research on B2C cross-border electronic commerce return logistics model selection based on estimated return rate. Journal of Theoretical and Applied Electronic Commerce Research, 19(2), 1034–1059. [Google Scholar] [CrossRef]

- Liang, Y., Guo, L., Li, J., Zhang, S., & Fei, X. (2021). The impact of trade facilitation on cross-border E-commerce transactions: Analysis based on the marine and land cross-border logistical practices between China and countries along the “Belt and Road”. Water, 13(24), 3567. [Google Scholar] [CrossRef]

- López González, J., Sorescu, S., & Kaynak, P. (2023). Of bytes and trade: Quantifying the impact of digitalisation on trade (OECD Trade Policy Paper 273). Organization for Economic Co-Operation and Development. [Google Scholar]

- Lu, X., Zhang, C., & Geng, L. (2024). Impact of logistics performance on international trade—A test based on meta-analysis. The Journal of International Trade & Economic Development, 1–28. [Google Scholar] [CrossRef]

- Ma, S., Huang, S., & Wu, P. (2024). Intelligent manufacturing and cross-border e-commerce export diversification. International Review of Economics & Finance, 94, 103369. [Google Scholar] [CrossRef]

- Martí, L., Puertas, R., & García, L. (2014). The importance of the Logistics Performance Index in international trade. Applied Economics, 46(24), 2982–2992. [Google Scholar] [CrossRef]

- Miao, M., Lang, Q., Borojo, D. G., Yushi, J., & Zhang, X. (2020). The impacts of Chinese FDI and China–Africa trade on economic growth of African countries: The role of institutional quality. Economies, 8(3), 53. [Google Scholar] [CrossRef]

- Miao, Y., Du, R., Li, J., & Westland, J. C. (2019). A two-sided matching model in the context of B2B export cross-border e-commerce. Electronic Commerce Research, 19(4), 841–861. [Google Scholar] [CrossRef]

- Mishrif, A., Antimiani, A., & Khan, A. (2024). Examining the contribution of logistics and supply chain in boosting Oman’s trade network. Economies, 12(3), 70. [Google Scholar] [CrossRef]

- Mou, J., Cui, Y., & Kurcz, K. (2019). Bibliometric and visualized analysis of research on major e-commerce journals using Citespace. Journal of Electronic Commerce Research, 20, 219–237. [Google Scholar]

- OECD. (2019). Unpacking E-commerce: Business models, trends and policies. OECD Publishing. [Google Scholar]

- Ohakwe, C. R., & Wu, J. (2025). The impact of macroeconomic indicators on logistics performance: A comparative analysis using simulated scenarios. Sustainable Futures, 9, 100567. [Google Scholar] [CrossRef]

- Omonijo, O. N., & Zhang, Y. (2025). China’s innovation model- lessons and applicability in Africa. Cogent Economics & Finance, 13(1), 2442747. [Google Scholar] [CrossRef]

- Osnago, A., & Tan, S. W. (2016). Disaggregating the impact of the Internet on international trade (Policy Research Working Paper 7785). World Bank. [Google Scholar]

- Pejić-Bach, M. (2021). Electronic commerce in the time of COVID-19-perspectives and challenges. Journal of Theoretical and Applied Electronic Commerce Research, 16, I. [Google Scholar] [CrossRef]

- Portugal-Perez, A., & Wilson, J. S. (2009). Why trade facilitation matters to Africa. World Trade Review, 8(3), 379–416. [Google Scholar] [CrossRef]

- Qi, X., Qin, W., & Lin, B. (2024). Case study on synergistic development strategy of cross-border e-commerce and logistics: An empirically model estimation. PLoS ONE, 19(6), e0304393. [Google Scholar] [CrossRef]

- Rodríguez-Crespo, E., & Martínez-Zarzoso, I. (2019). The effect of ICT on trade: Does product complexity matter? Telematics and Informatics, 41, 182–196. [Google Scholar] [CrossRef]

- Rubínová, S., & Sebti, M. (2021). The WTO global trade costs index and its determinants (WTO Staff Working Paper No. ERSD-2021-6). World Trade Organization. [Google Scholar]

- Sawadogo, F., & Wandaogo, A.-A. (2020). Does mobile money services adoption foster intra-African goods trade? Economics Letters, 199, 109681. [Google Scholar] [CrossRef]

- See, K. F., Guo, Y., & Yu, M.-M. (2024). Enhancing logistics performance measurement: An effectiveness-based hierarchical data envelopment analysis approach. INFOR. Information Systems and Operational Research, 62(3), 449–479. [Google Scholar] [CrossRef]

- Shao, X., Yang, Q., & Liu, Z. (2025). China’s aid-giving modalities: Impacts on sustainable growth in China-Africa trade. China Economic Review, 90, 102370. [Google Scholar] [CrossRef]

- Shikur, Z. H. (2022). The role of logistics performance in international trade: A developing country perspective. World Review of Intermodal Transportation Research, 11(1), 53. [Google Scholar] [CrossRef]

- Silva, J. M. C. S., & Tenreyro, S. (2006). The log of gravity. The Review of Economics and Statistics, 88(4), 641–658. [Google Scholar] [CrossRef]

- Song, M.-J., & Lee, H.-Y. (2022). The relationship between international trade and logistics performance: A focus on the South Korean industrial sector. Research in Transportation Business & Management, 44, 100786. [Google Scholar] [CrossRef]

- Tao, H., Zhao, L., Luckstead, J., & Xie, C. (2021). Does population aging increase pork trade in Asia? Singapore Economic Review, 66, 1733–1758. [Google Scholar] [CrossRef]

- Tinbergen, J. (1962). Shaping the world economy. The International Executive, 5(1), 27–30. [Google Scholar] [CrossRef]

- Usman, Z., & Tang, X. (2024). How is China’s economic transition affecting its relations with Africa? Carnegie Endowment for International Peace.

- Visser, R. (2019). The effect of diplomatic representation on trade: A panel data analysis. World Economy, 42(1), 197–225. [Google Scholar] [CrossRef]

- Wang, C. (2021). Analyzing the effects of cross-border E-commerce industry transfer using big data. Mobile Information Systems, 2021, 1–12. [Google Scholar] [CrossRef]

- Wang, C., Liu, T., Wen, D., Li, D., Vladislav, G., & Zhu, Y. (2021). The impact of international electronic commerce on export trade: Evidence from China. Journal of Theoretical and Applied Electronic Commerce Research, 16(7), 2579–2593. [Google Scholar] [CrossRef]

- Wang, H., & Liu, B. (2022). A role of production on E-commerce and foreign policy influencing one belt one road: Mediating effects of international relations and international trade. Frontiers in Psychology, 12, 793383. [Google Scholar] [CrossRef]

- Wang, W., Wu, Q., Su, J., & Li, B. (2024). The impact of international logistics performance on import and export trade: An empirical case of the “Belt and Road” initiative countries. Humanities & Social Sciences Communications, 11(1), 1028. [Google Scholar] [CrossRef]

- Wang, Y., Wang, Y., & Lee, S. (2017). The effect of cross-border E-commerce on China’s international trade: An empirical study based on transaction cost analysis. Sustainability, 9(11), 2028. [Google Scholar] [CrossRef]

- WB. (2024). Digital transformation drives development in Africa. World Bank. Available online: https://www.worldbank.org/en/results/2024/01/18/digital-transformation-drives-development-in-afe-afw-africa (accessed on 2 January 2025).

- WTO. (2018). The economics of how digital technologies impact trade. World Trade Organization. Available online: https://www.wto.org/english/res_e/publications_e/wtr18_3_e.pdf (accessed on 22 January 2025).

- Wu, H., Qiao, Y., & Luo, C. (2024). Cross-border e-commerce, trade digitisation and enterprise export resilience. Finance Research Letters, 65, 105513. [Google Scholar] [CrossRef]

- Wu, Y., Wang, X., & Hu, C. (2024). The impact of China’s financing to Africa on bilateral trade intensity under the Belt and Road Initiative. Applied Economics, 56(37), 4507–4527. [Google Scholar] [CrossRef]

- Xing, Z. (2018). The impacts of Information and Communications Technology (ICT) and E-commerce on bilateral trade flows. International Economics and Economic Policy, 15(3), 565–586. [Google Scholar] [CrossRef]

- Xu, X., Li, X., Qi, G., Tang, L., & Mukwereza, L. (2016). Science, technology, and the politics of knowledge: The case of China’s agricultural technology demonstration centers in Africa. World Development, 81, 82–91. [Google Scholar] [CrossRef]

- Ya, Z., & Pei, K. (2022). Factors influencing agricultural products trade between China and Africa. Sustainability, 14(9), 5589. [Google Scholar] [CrossRef]

- Yeo, A. D., Deng, A., & Nadiedjoa, T. Y. (2020). The effect of infrastructure and logistics performance on economic performance: The mediation role of international trade. Foreign Trade Review, 55(4), 450–465. [Google Scholar] [CrossRef]

- Yin, Z. H., & Choi, C. H. (2023). The effects of China’s cross-border e-commerce on its exports: A comparative analysis of goods and services trade. Electronic Commerce Research, 23(1), 443–474. [Google Scholar] [CrossRef]

- Yin, Z. H., & Choi, C. H. (2024). How does digitalization affect trade in goods and services? Evidence from G20 countries. Journal of the Knowledge Economy, 16(1), 3614–3638. [Google Scholar] [CrossRef]

- Zhang, C., & Huang, Z. (2023). Foreign aid, norm diffusion, and local support for gender equality: Comparing evidence from the World Bank and China’s aid projects in Africa. Studies in Comparative International Development, 58(4), 584–615. [Google Scholar] [CrossRef]

| Variables | (I) | (II) | (III) | (IV) | (V) | (VI) |

|---|---|---|---|---|---|---|

| lnGDPCijt | 1.840 *** (0.201) | 1.627 *** (0.235) | 1.762 *** (0.211) | 1.654 *** (0.235) | 1.644 *** (0.235) | 2.041 *** (0.201) |

| lnDDij | −0.261 *** (0.085) | −0.299 *** (0.088) | −0.252 *** (0.086) | −0.294 *** (0.088) | −0.296 *** (0.088) | −0.197 ** (0.088) |

| lnDijt | −0.133 * (0.078) | −0.141 * (0.079) | −0.042 (0.082) | −0.141 * (0.079) | −0.141 * (0.079) | −0.145 * (0.082) |

| WTOij | 1.351 ** (0.569) | 1.396 ** (0.569) | 1.304 ** (0.548) | 1.390 ** (0.569) | 1.392 ** (0.569) | 1.602 *** (0.597) |

| lnIQjt | 0.188 * (0.097) | 0.193 ** (0.098) | 0.082 (0.108) | 0.189 * (0.098) | 0.190 * (0.098) | 0.140 (0.107) |

| lnIQit | 0.771 *** (0.232) | |||||

| lnDGit | 0.603 *** (0.201) | |||||

| lnDGjt | 0.423 *** (0.124) | |||||

| lnCEit | 0.393 *** (0.140) | |||||

| lnLPit | 1.500 *** (0.524) | |||||

| lnLPjt | 0.014 (0.081) | |||||

| Cons | 25.482 *** (7.795) | 29.141 *** (8.052) | 25.261 *** (7.873) | 27.395 *** (7.941) | 24.184 *** (7.770) | 19.630 ** (8.056) |

| Obs. | 714 | 714 | 714 | 714 | 714 | 676 |

| R2 | 0.602 | 0.599 | 0.604 | 0.598 | 0.599 | 0.589 |

| Variables | (I) | (II) | (III) | (IV) | (V) |

|---|---|---|---|---|---|

| lnGDPCijt | 1.308 *** (0.231) | 1.317 *** (0.157) | 1.380 *** (0.225) | 1.557 *** (0.165) | 1.796 *** (0.070) |

| lnDDij | −0.252 ** (0.108) | −0.182 * (0.105) | −0.234 ** (0.108) | −0.193 * (0.102) | −0.097 (0.098) |

| lnDijt | −0.013 (0.077) | 0.053 (0.079) | −0.020 (0.077) | −0.033 (0.077) | −0.031 (0.080) |

| lnIQjt | 0.254 ** (0.102) | 0.148 (0.111) | 0.247 ** (0.102) | 0.228 ** (0.100) | 0.163 (0.109) |

| WTOij | 1.254 ** (0.602) | 1.047 * (0.619) | 1.229 ** (0.606) | 1.177 * (0.613) | 1.391 ** (0.647) |

| lnDGit | 0.379 ** (0.165) | ||||

| lnDGjt | 0.385 *** (0.114) | ||||

| lnCEit | 0.120 ** (0.059) | ||||

| lnLPit | 0.686 * (0.396) | ||||

| lnLPjt | 0.035 (0.083) | ||||

| _cons | 25.428 ** (9.866) | 19.477 ** (9.547) | 23.456 ** (9.725) | 17.785 ** (8.831) | 10.814 (8.814) |

| Obs. | 714 | 714 | 714 | 714 | 714 |

| Variables | (I) | (II) | (III) | (IV) | (V) |

|---|---|---|---|---|---|

| Control variables | Yes | Yes | Yes | Yes | |

| lnDGit | 1.100 *** (0.217) | ||||

| lnDGjt | 0.782 ** (0.206) | ||||

| lnCEit | 0.732 *** (0.152) | ||||

| lnLPit | 2.774 *** (0.565) | ||||

| lnLPjt | 0.335 ** (0.146) | ||||

| Obs. | 714 | 656 | 714 | 714 | 676 |

| R2 | 0.954 | 0.951 | 0.953 | 0.948 | 0.852 |

| Ramsey (p-value) | 0.293 | 0.495 | 0.428 | 0.188 | 0.540 |

| Panel A: Middle-Income African Countries | |||||

| Variables | (I) | (II) | (III) | (IV) | (V) |

| Control variables | Yes | Yes | Yes | Yes | |

| lnDGit | 0.547 ** (0.249) | ||||

| lnDGjt | 0.633 *** (0.229) | ||||

| lnCEit | 0.353 ** (0.174) | ||||

| lnLPit | 1.355 ** (0.647) | ||||

| lnLPjt | −0.006 (0.109) | ||||

| Obs. | 392 | 392 | 419 | 419 | 391 |

| R2 | 0.601 | 0.535 | 0.590 | 0.590 | 0.574 |

| Panel B: Low-Income African Countries | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| lnDGit | 0.824 (0.996) | ||||

| lnDGjt | 0.275 * (0.142) | ||||

| lnCEit | −0.904 (0.717) | ||||

| lnLPit | 0.473 (0.787) | ||||

| lnLPjt | 0.089 (0.126) | ||||

| Obs. | 295 | 264 | 295 | 295 | 285 |

| R2 | 0.646 | 0.643 | 0.647 | 0.608 | 0.610 |

| Panel A: C-A Trade (Highly Populated African Countries) | |||||

| Variables | I | II | III | IV | V |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| lnDGit | 0.960 ** (0.490) | ||||

| lnDGjt | 0.547 *** (0.241) | ||||

| lnCEit | 0.627 *** (0.169) | ||||

| lnLPit | 0.701 (0.816) | ||||

| lnLPjt | 0.423 *** (0.149) | ||||

| Obs. | 271 | 250 | 271 | 435 | 375 |

| R2 | 0.566 | 0.564 | 0.600 | 0.588 | 0.500 |

| Panel B: C-A trade (Less-populated African countries) | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| lnDGit | 0.473 *** (0.182) | ||||

| lnDGjt | 0.371 *** (0.131) | ||||

| lnCEit | 0.100 (0.066) | ||||

| lnLPit | 0.959 *** (0.463) | ||||

| lnLPjt | −0.106 (0.108) | ||||

| Obs. | 443 | 406 | 443 | 443 | 360 |

| Wald test | 0.540 | 0.543 | 0.542 | 0.505 | 0.530 |

| Panel A: African Countries with IQ Greater than the Average | |||||

| Variables | I | II | III | IV | V |

| Control variables | Yes | Yes | Yes | Yes | |

| lnDGit | 1.143 *** (0.316) | ||||

| lnDGjt | 0.349 *** (0.175) | ||||

| lnCEit | 0.764 ** (0.221) | ||||

| lnLPit | 2.896 *** (0.824) | ||||

| lnLPjt | 0.033 (0.111) | ||||

| Obs. | 426 | 410 | 426 | 714 | 398 |

| R2 | 0.589 | 0.582 | 0.568 | 0.589 | 0.565 |

| Panel B: African Countries with IQ Less than the Average | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| lnDGit | 0.435 (0.275) | ||||

| lnDGjt | 0.627 *** (0.185) | ||||

| lnCEit | 0.280 (0.191) | ||||

| lnLPit | 1.075 (0.715) | ||||

| lnLPjt | −0.016 (0.137) | ||||

| Obs. | 288 | 246 | 288 | 288 | 278 |

| R2 | 0.633 | 0.661 | 0.632 | 0.632 | 0.631 |

| Panel A: Resource-Rich African Countries | |||||

| Variables | II | II | III | IV | V |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| lnDGit | 0.728 *** (0.261) | ||||

| lnDGjt | 0.617 *** (0.173) | ||||

| lnCEit | 0.485 *** (0.183) | ||||

| lnLPit | 1.839 *** (0.681) | ||||

| lnLPjt | 0.074 (0.127) | ||||

| Obs. | 435 | 392 | 435 | 435 | 375 |

| R2 | 0.589 | 0.595 | 0.588 | 0.588 | 0.500 |

| Panel B: Non-Resource African Countries | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| lnDGit | 1.377 *** (0.378) | ||||

| lnDGjt | 0.262 (0.176) | ||||

| lnCEit | 0.901 *** (0.265) | ||||

| lnLPit | 3.443 *** (0.989) | ||||

| lnLPjt | 0.109 (0.112) | ||||

| Obs. | 279 | 264 | 279 | 279 | 231 |

| R2 | 0.683 | 0.668 | 0.680 | 0.681 | 0.641 |

| Variables | I | II |

|---|---|---|

| Control variables | Yes | Yes |

| Digital_distanceijt | −0.302 ** (0.147) | |

| LP_distanceijt | −0.055 (0.087) | |

| Obs. | 656 | 606 |

| R2 | 0.557 | 0.529 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Borojo, D.G.; Weimin, H. From Click to Cargo: The Role of Digitalization, Cross-Border E-Commerce, and Logistics in Deepening the China–Africa Trade. Economies 2025, 13, 171. https://doi.org/10.3390/economies13060171

Borojo DG, Weimin H. From Click to Cargo: The Role of Digitalization, Cross-Border E-Commerce, and Logistics in Deepening the China–Africa Trade. Economies. 2025; 13(6):171. https://doi.org/10.3390/economies13060171

Chicago/Turabian StyleBorojo, Dinkneh Gebre, and Huang Weimin. 2025. "From Click to Cargo: The Role of Digitalization, Cross-Border E-Commerce, and Logistics in Deepening the China–Africa Trade" Economies 13, no. 6: 171. https://doi.org/10.3390/economies13060171

APA StyleBorojo, D. G., & Weimin, H. (2025). From Click to Cargo: The Role of Digitalization, Cross-Border E-Commerce, and Logistics in Deepening the China–Africa Trade. Economies, 13(6), 171. https://doi.org/10.3390/economies13060171