Empirical Investigation of the Sources of Inflation in Sri Lanka: Assessing the Roles of Global and Domestic Drivers

Abstract

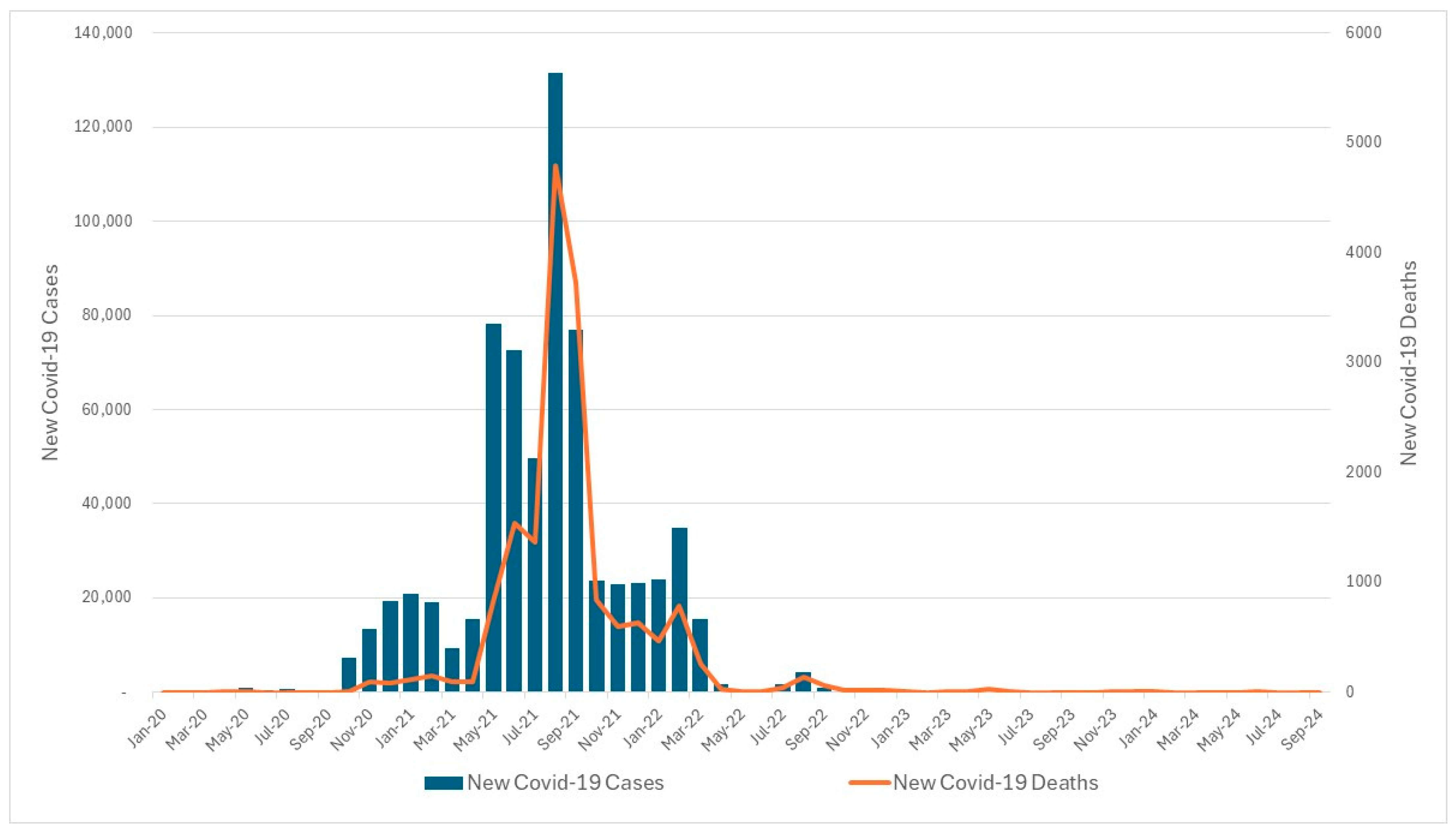

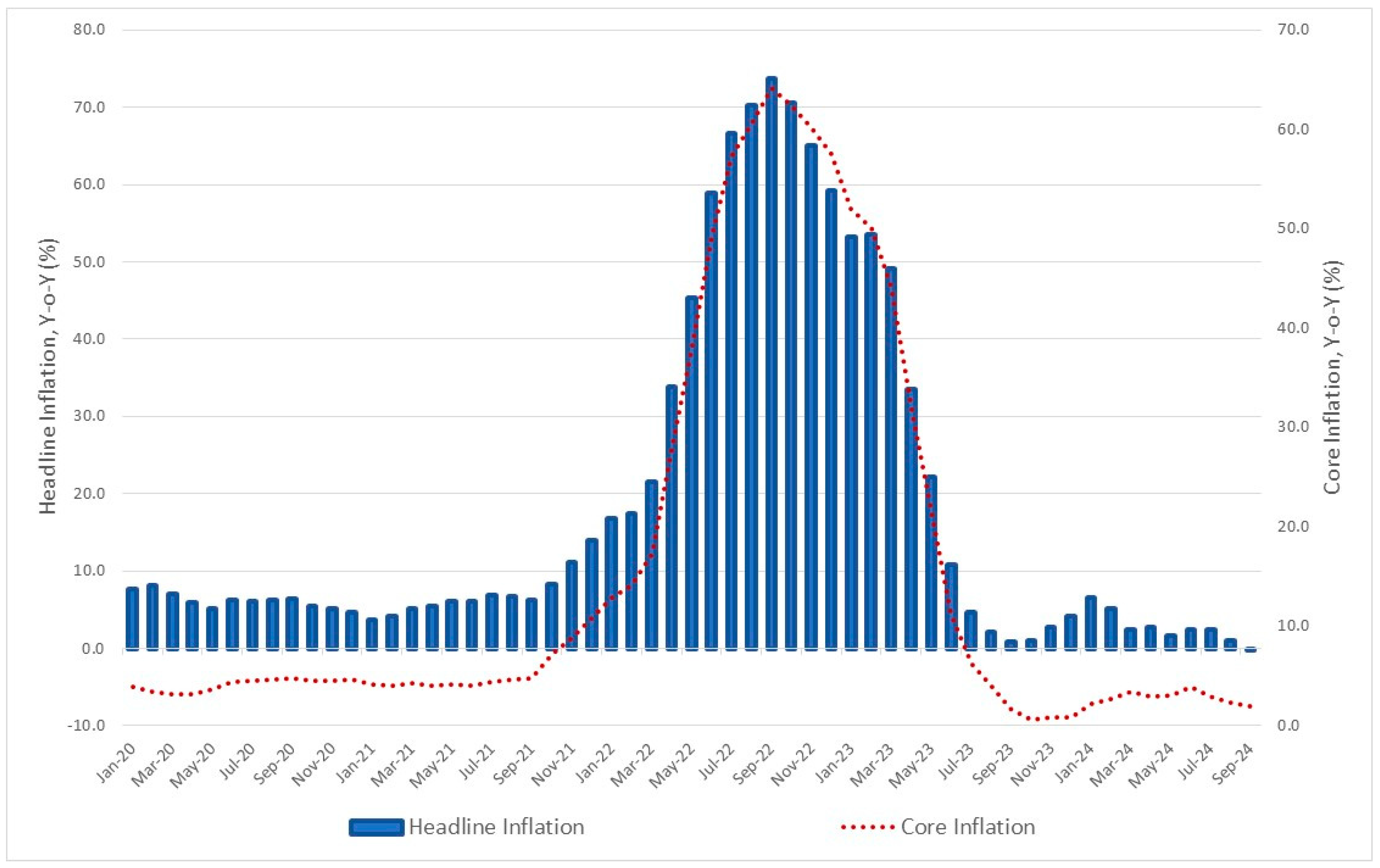

1. Introduction

2. Review of Literature

3. Methodology and Data

3.1. Estimation Methodology

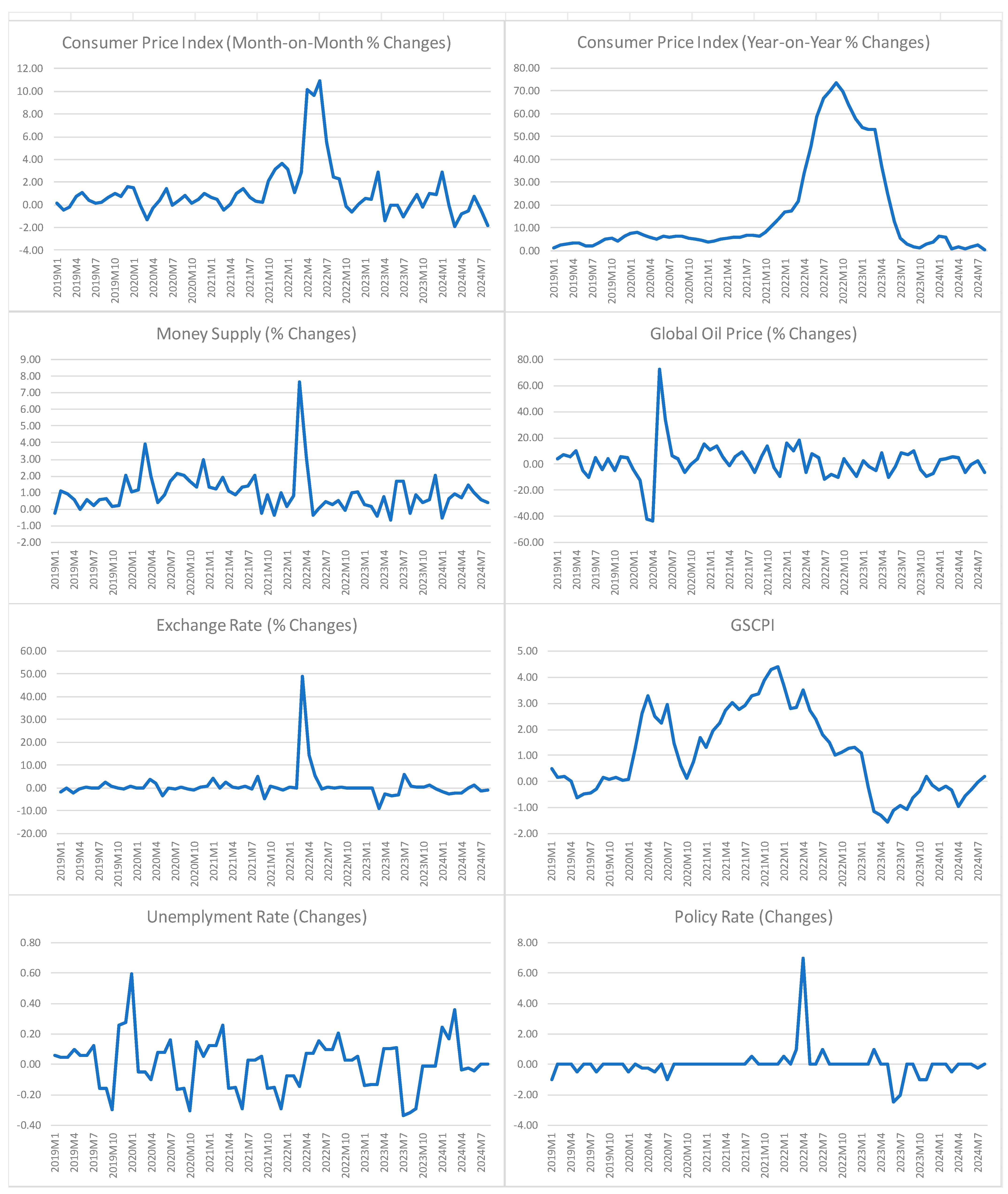

3.2. Data and Data Sources

4. Results and Discussions

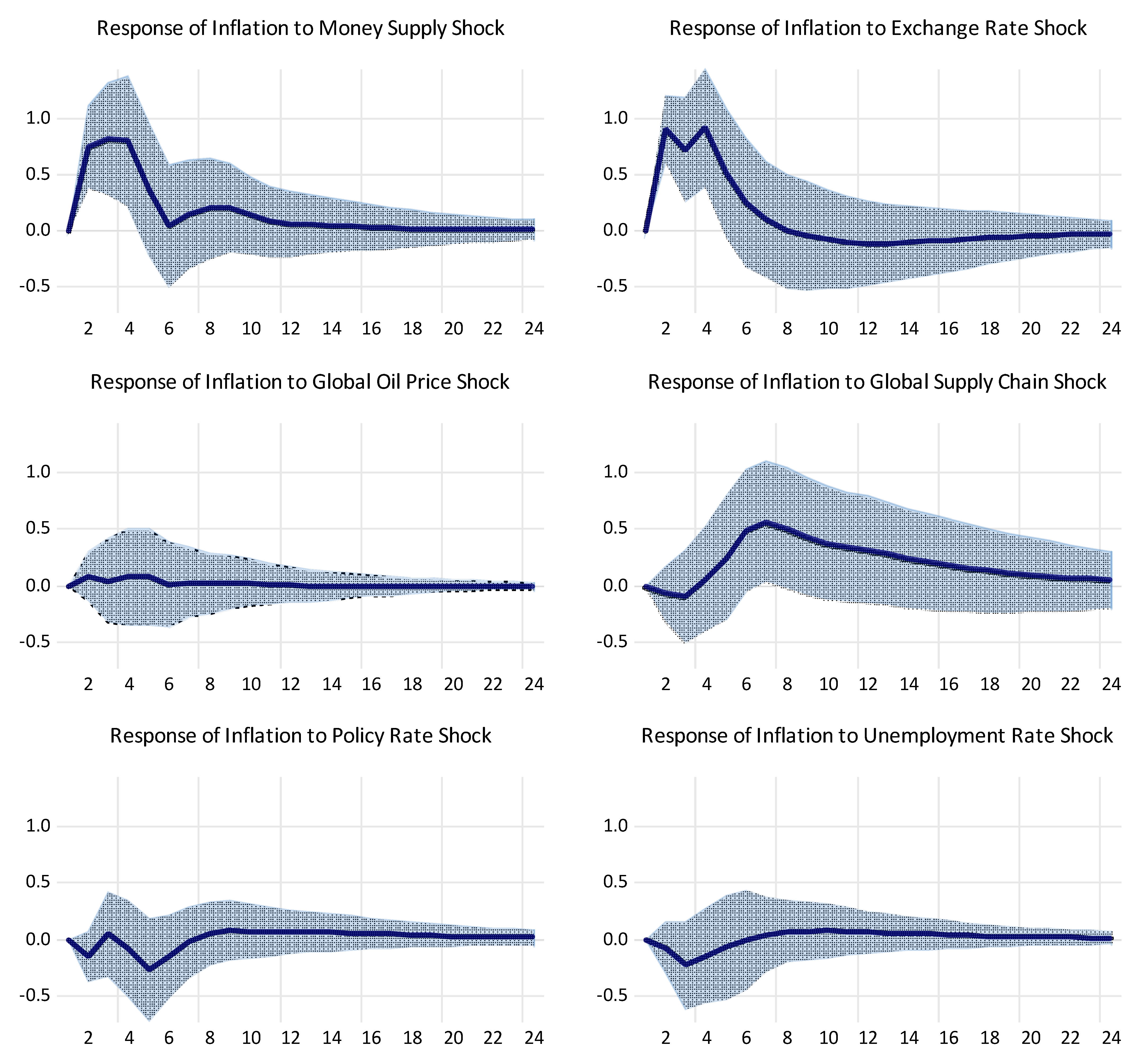

4.1. Results of Variance Decomposition Analysis and Impulse Response Functions

4.2. Unit-Root Tests and Cointegration Tests

4.3. Regression Analysis

4.4. Granger Causality Tests

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alturki, S., & Olson, E. (2022). Oil sentiment and the U.S. inflation premium. Energy Economics, 114, 1–13. [Google Scholar] [CrossRef]

- Alvarez, L. J., Hurtado, S., Sanchez, I., & Thomas, C. (2011). The impact of oil price changes on Spanish and Euro Area consumer price inflation. Economic Modelling, 28(1–2), 422–431. [Google Scholar] [CrossRef]

- Arsić, M., Mladenović, Z., & Nojković, A. (2022). Macroeconomic performance of inflation targeting in European and Asian emerging economies. Journal of Policy Modeling, 44(3), 675–700. [Google Scholar] [CrossRef]

- Basse, T., & Wegener, C. (2022). Inflation expectations: Australian consumer survey data versus the bond market. Journal of Economic Behavior and Organization, 203, 416–430. [Google Scholar] [CrossRef]

- Behera, H. K., & Patra, M. D. (2022). Measuring trend inflation in India. Journal of Asian Economics, 80, 1–13. [Google Scholar] [CrossRef]

- Bilici, B., & Cekin, S. E. (2020). Inflation persistence in Turkey: A TVP-estimation approach. The Quarterly Review of Economics and Finance, 78, 64–69. [Google Scholar] [CrossRef]

- Bonam, D., & Smădu, A. (2021). The long-run effects of pandemics on inflation: Will this time be different? Economics Letters, 208, 110065. [Google Scholar] [CrossRef] [PubMed]

- Chen, H., Lioa, H., Tang, B. J., & Wei, Y. M. (2016). Impacts of OPEC’s political risk on the international crude oil prices; an empirical analysis based on the SVAR models. Energy Economics, 57, 42–49. [Google Scholar] [CrossRef]

- Chowdhury, K. B., & Garg, B. (2022). Has COVID-19 intensified the oil price–exchange rate nexus? Economic Analysis and Policy, 76, 280–298. [Google Scholar] [CrossRef]

- Cochrane, J. H. (2022). The fiscal roots of inflation. Review of Economic Dynamics, 45, 22–40. [Google Scholar] [CrossRef]

- Congregado, E., & Esteve, V. (2022). Cointegration with structural changes and classical model of inflation in Spain, 1830–1998. Structural Change and Economic Dynamics, 60, 376–388. [Google Scholar] [CrossRef]

- Correa, W. L., & Lopes, L. S. (2023). Monetary policy transmission, productive activity, and inflation in Brazil: Does uncertainty matter? The Journal of Economic Asymmetries, 27, 1–17. [Google Scholar] [CrossRef]

- Cruz, C. J. (2022). Reduced macroeconomic volatility after adoption of inflation targeting: Impulses or propagation? International Review of Economics and Finance, 82, 759–770. [Google Scholar] [CrossRef]

- Diaz, E. M., Cunado, J., & de Garcia, F. P. (2024). Global drivers of inflation: The role of supply chain disruptions and commodity price shocks. Economic Modelling, 140, 106860. [Google Scholar] [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of American Statistical Association, 74(366), 427–431. [Google Scholar] [CrossRef]

- Doho, L. R., Some, S. M., & Banto, J. M. (2023). Inflation and West African sectoral stock price indices: An asymmetric kernel method analysis. Emerging Markets Review, 54, 1–15. [Google Scholar] [CrossRef]

- Dumitrescu, B. A., Kagitci, M., & Cepoi, C. O. (2022). Nonlinear effects of public debt on inflation. Does the size of the shadow economy matter? Finance Research Letters, 46, 102255. [Google Scholar] [CrossRef]

- Elbahnasawy, N. G., & Ellis, M. A. (2022). Inflation and the Structure of Economic and Political Systems. Structural Change and Economic Dynamics, 60, 59–74. [Google Scholar] [CrossRef]

- Federal Reserve Bank of New York. (2024). Global supply chain pressure index. Available online: https://www.newyorkfed.org/research/policy/gscpi (accessed on 10 December 2024).

- Garzón, A. J., & Hierro, L. A. (2022). Inflation, oil prices and exchange rates. The Euro’s dampening effect. Journal of Policy Modeling, 44, 130–146. [Google Scholar] [CrossRef]

- Gordon, M., & Clark, T. (2023). The impact of supply chain disruptions on inflation. Economics Commentary, EC 2023-08. [Google Scholar] [CrossRef]

- Granger, C. W. J. (1969). Some recent development in a concept of causality. Journal of Econometrics, 39(1–2), 199–211. [Google Scholar] [CrossRef]

- Granger, C. W. J. (1988). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37, 424–438. [Google Scholar] [CrossRef]

- Hall, S. G., Tavlas, G. S., & Wang, Y. (2023). Drivers and spillover effects of inflation: The United States, the euro area, and the United Kingdom. Journal of International Money and Finance, 131, 102276. [Google Scholar] [CrossRef]

- Han, Z., Ma, X., & Mao, R. (2022). The role of dispersed information in inflation and inflation expectations. Review of Economic Dynamics, 48, 72–106. [Google Scholar] [CrossRef]

- Jiang, T., Liu, T., Tang, K., & Zeng, J. (2022). Online prices and inflation during the nationwide COVID-19 quarantine period: Evidence from 107 Chinese websites. Finance Research Letters, 19, 103166. [Google Scholar] [CrossRef]

- Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12(2–3), 231–254. [Google Scholar] [CrossRef]

- Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica, 59(6), 1551–1580. [Google Scholar] [CrossRef]

- Kantur, Z., & Özcan, G. (2021). What pandemic inflation tells: Old habits die hard. Economics Letters, 204, 109907. [Google Scholar] [CrossRef]

- Kilian, L., & Zhou, X. (2022). The impact of rising oil prices on U.S. inflation and inflation expectations in 2020–23. Energy Economics, 113, 106228. [Google Scholar] [CrossRef]

- Kwiatkowski, D., Phillips, P. C. B., Schmidt, P., & Shin, Y. (1992). Testing the null hypothesis of stationary against the alternative of a unit root. Journal of Econometrics, 54, 159–178. [Google Scholar] [CrossRef]

- MacKinnon, J. G., Haug, A. A., & Michelis, L. (1999). Numerical distribution functions of likelihood ratio tests for cointegration. Journal of Applied Econometrics, 14, 563–577. [Google Scholar]

- Makin, A. J., Robson, A., & Ratnasiri, S. (2017). Missing money found causing Australia’s inflation. Economic Modelling, 66, 156–162. [Google Scholar] [CrossRef]

- Mishra, A., & Dubey, A. (2022). Inflation targeting and its spillover effects on financial stability in emerging market economies. Journal of Policy Modeling, 44(6), 1198–1218. [Google Scholar] [CrossRef]

- Ooft, G., Bhaghoe, S., & Franses, P. H. (2021). Forecasting annual inflation in Suriname. Journal of International Financial Markets, Institutions & Money, 73, 101357. [Google Scholar] [CrossRef]

- Ozdemir, M. (2020). The role of exchange rate in inflation targeting: The case of Turkey. Applied Economics, 52(29), 3138–3152. [Google Scholar] [CrossRef]

- Piergallini, A. (2022). Average inflation targeting and macroeconomic stability. Economics Letters, 219, 110790. [Google Scholar] [CrossRef]

- Sekine, A. (2020). Oil price pass-through to consumer prices and the inflationary environment: A STAR approach. Applied Economic Letters, 27(6), 484–488. [Google Scholar] [CrossRef]

- Valogo, M. K., Duodu, E., Yusif, H., & Baidoo, S. T. (2023). Effect of exchange rate on inflation in the inflation targeting framework: Is the threshold level relevant? Research in Globalization, 6, 100119. [Google Scholar] [CrossRef]

- Yilmazkuday, H. (2022). Drivers of Turkish inflation. Quarterly Review of Economics and Finance, 84, 315–323. [Google Scholar] [CrossRef]

| Month | S.E. | INF | MS | EXR | OP | SC | PR | UR |

|---|---|---|---|---|---|---|---|---|

| 1 | 0.988 | 100.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2 | 1.568 | 49.98 | 25.09 | 21.95 | 0.20 | 1.31 | 1.25 | 0.21 |

| 3 | 1.889 | 34.44 | 33.50 | 28.26 | 0.14 | 1.39 | 0.88 | 1.38 |

| 4 | 2.197 | 25.58 | 35.25 | 35.53 | 0.21 | 1.19 | 0.71 | 1.53 |

| 5 | 2.302 | 23.84 | 34.10 | 36.30 | 0.28 | 2.60 | 1.34 | 1.54 |

| 6 | 2.369 | 22.70 | 32.34 | 35.05 | 0.27 | 6.61 | 1.52 | 1.51 |

| 7 | 2.435 | 21.57 | 30.96 | 33.24 | 0.26 | 11.07 | 1.46 | 1.44 |

| 8 | 2.491 | 20.69 | 30.03 | 31.77 | 0.25 | 14.47 | 1.40 | 1.38 |

| 9 | 2.536 | 20.06 | 29.34 | 30.72 | 0.24 | 16.88 | 1.39 | 1.36 |

| 10 | 2.570 | 19.61 | 28.74 | 30.03 | 0.24 | 18.63 | 1.40 | 1.36 |

| 11 | 2.597 | 19.25 | 28.21 | 29.58 | 0.24 | 19.93 | 1.42 | 1.37 |

| 12 | 2.618 | 18.97 | 27.78 | 29.28 | 0.23 | 20.92 | 1.44 | 1.38 |

| 13 | 2.635 | 18.75 | 27.45 | 29.07 | 0.23 | 21.65 | 1.47 | 1.38 |

| 14 | 2.648 | 18.58 | 27.19 | 28.93 | 0.23 | 22.18 | 1.50 | 1.39 |

| 15 | 2.658 | 18.45 | 27.00 | 28.83 | 0.23 | 22.56 | 1.52 | 1.40 |

| 16 | 2.665 | 18.36 | 26.87 | 28.76 | 0.23 | 22.84 | 1.54 | 1.41 |

| 17 | 2.670 | 18.30 | 26.77 | 28.71 | 0.23 | 23.03 | 1.55 | 1.42 |

| 18 | 2.674 | 18.25 | 26.70 | 28.68 | 0.23 | 23.17 | 1.56 | 1.42 |

| 19 | 2.677 | 18.21 | 26.64 | 28.65 | 0.23 | 23.27 | 1.57 | 1.42 |

| 20 | 2.679 | 18.19 | 26.61 | 28.63 | 0.23 | 23.35 | 1.57 | 1.42 |

| 21 | 2.680 | 18.17 | 26.58 | 28.62 | 0.23 | 23.41 | 1.58 | 1.43 |

| 22 | 2.681 | 18.16 | 26.56 | 28.61 | 0.23 | 23.45 | 1.58 | 1.43 |

| 23 | 2.682 | 18.15 | 26.54 | 28.60 | 0.23 | 23.48 | 1.58 | 1.43 |

| 24 | 2.683 | 18.14 | 26.53 | 28.59 | 0.23 | 23.50 | 1.59 | 1.43 |

| Variable | ADF Test | KPSS Test | ||

|---|---|---|---|---|

| Level | Difference | Level | Difference | |

| CPI | −1.044 (0.957) | −6.072 *** (0.000) | 0.280 *** | 0.069 |

| MS | −0.998 (0.941) | −11.207 *** (0.000) | 0.245 *** | 0.075 |

| EXR | −2.536 (0.310) | −9.676 *** (0.000) | 0.267 *** | 0.043 |

| OP | −2.212 (0.479) | −10.271 *** (0.000) | 0.244 *** | 0.057 |

| PR | −2.142 (0.518) | −10.554 *** (0.000) | 0.124 * | 0.046 |

| SC | −1.805 (0.692) | −8.042 *** (0.000) | 0.271 *** | 0.039 |

| UR | −3.421 * (0.052) | −10.650 *** (0.000) | 0.117 | 0.066 |

| Hypothesized | Trace Test | Maximum Eigenvalues Test | ||

|---|---|---|---|---|

| No. of CE(s) | Trace Statistic | p-Value | Max. EV Statistic | p-Value |

| 0 | 226.27 *** | 0.0000 | 69.25 *** | 0.0000 |

| 1 | 157.02 *** | 0.0000 | 52.16 *** | 0.0014 |

| 2 | 104.86 *** | 0.0000 | 37.22 ** | 0.0192 |

| 3 | 67.65 *** | 0.0003 | 29.20 ** | 0.0307 |

| 4 | 38.44 *** | 0.0040 | 19.67 * | 0.0791 |

| 5 | 18.78 ** | 0.0154 | 15.71 ** | 0.0293 |

| 3.06 | 0.1008 | 3.06 | 0.1008 | |

| Variable | OLS | FMOLS | DOLS | RLS |

|---|---|---|---|---|

| 9.4292 *** (0.001) | 9.5430 *** (0.000) | 8.1902 *** (0.002) | 7.0378 *** (0.001) | |

| 0.6901 ** (0.017) | 0.9157 *** (0.000) | 0.2889 * (0.071) | 0.1921 * (0.087) | |

| 0.0141 (0.511) | 0.0117 (0.609) | 0.2760 ** (0.013) | 0.0125 (0.618) | |

| −0.0171 (0.641) | −0.0163 (0.110) | −0.0161 (0.820) | −0.0099 (0.347) | |

| 0.8972 *** (0.000) | 0.4400 *** (0.005) | 0.2399 * (0.091) | 0.9335 *** (0.000) | |

| 0.5414 *** (0.001) | 0.7548 *** (0.000) | 0.5569 *** (0.002) | 0.4186 *** (0.000) | |

| −2.7806 *** (0.001) | −2.4995 *** (0.000) | −2.0998 *** (0.006) | −1.3986 *** (0.001) | |

| 0.5771 | 0.5239 | 0.8997 | 0.5870 | |

| 56 | 56 | 55 | 56 |

| Null Hypothesis | Number of Observations | F-Statistic | p-Value |

|---|---|---|---|

| MS does not Granger cause INF | 54 | 9.701 *** | 0.0003 |

| INF does not Granger cause MS | 0.447 | 0.6419 | |

| EXR does not Granger cause INF | 54 | 25.143 *** | 0.0000 |

| INF does not Granger cause EXR | 0.650 | 0.5267 | |

| OP does not Granger cause INF | 54 | 0.269 | 0.7654 |

| INF does not Granger cause OP | 1.971 | 0.1502 | |

| SC does not Granger cause INF | 54 | 2.643 * | 0.0967 |

| INF does not Granger cause SC | 0.510 | 0.6039 | |

| PR does not Granger cause INF | 54 | 3.274 ** | 0.0463 |

| INF does not Granger cause PR | 0.580 | 0.5638 | |

| UN does not Granger cause INF | 54 | 1.043 | 0.3601 |

| INF does not Granger cause UN | 1.493 | 0.2348 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ekanayake, E.M.; Dissanayake, P.M.A.L. Empirical Investigation of the Sources of Inflation in Sri Lanka: Assessing the Roles of Global and Domestic Drivers. Economies 2025, 13, 102. https://doi.org/10.3390/economies13040102

Ekanayake EM, Dissanayake PMAL. Empirical Investigation of the Sources of Inflation in Sri Lanka: Assessing the Roles of Global and Domestic Drivers. Economies. 2025; 13(4):102. https://doi.org/10.3390/economies13040102

Chicago/Turabian StyleEkanayake, E. M., and P. M. A. L. Dissanayake. 2025. "Empirical Investigation of the Sources of Inflation in Sri Lanka: Assessing the Roles of Global and Domestic Drivers" Economies 13, no. 4: 102. https://doi.org/10.3390/economies13040102

APA StyleEkanayake, E. M., & Dissanayake, P. M. A. L. (2025). Empirical Investigation of the Sources of Inflation in Sri Lanka: Assessing the Roles of Global and Domestic Drivers. Economies, 13(4), 102. https://doi.org/10.3390/economies13040102