Abstract

Research Objective: This study aims to examine the impact of religious-based family management (RBFM) on absolute poverty through two main factors: short-term vision and uncontrolled consumption among low-income families. Research Methods and Approach: This study analyzed 172 respondents (low-income families) using a quantitative approach with the Amos Structural Equation Modeling (SEM) method. A questionnaire was the main instrument in this study of six regions in South Sulawesi. Findings and Research Novelty: The findings reveal that, as an “agent of change”, RBFM has a significant negative effect on short-term vision, uncontrolled consumption, and absolute poverty. These results underscore the role of integrating religious values in family management to curb excessive consumption behavior and strengthen long-term financial planning, thereby potentially breaking the cycle of poverty. The novelty of this research lies in employing Human Capital Theory (HCT) and the Theory of Planned Behavior (TPB) to elucidate the role of religion in the economic dynamics of family life. Research Implications: This study provides important implications for poverty alleviation policies, particularly in developing value-based programs that integrate religious principles with financial literacy. Such interventions are expected to enhance financial management practices among low-income families and foster their economic sustainability.

1. Introduction

Poverty, especially absolute poverty, remains a persistent and critical issue in developing countries like Indonesia. While many poverty alleviation strategies focus on economic and social interventions, the role of family dynamics, particularly religious values, has received limited attention. This study explores how religious-based family management (RBFM) can act as a guiding force—an agent of change—to reshape financial behavior among low-income families. RBFM is not simply about religious practices; it offers a holistic approach to managing resources by emphasizing values such as patience, discipline, and trust in divine power. These values encourage families to curb unnecessary spending, prioritize financial planning, and adopt behaviors that can help break the cycle of poverty.

While many studies have explored the role of religiosity in promoting well-being and emotional resilience, the direct influence of religious values on financial behavior and their potential to alleviate poverty remain underexplored. Addressing this gap, this study investigates how religious-based family management (RBFM) influences short-term vision, uncontrolled consumption, and absolute poverty in low-income families (Ajzen, 2020; Colin & Weil, 2020; Tamsah et al., 2023).

The findings are expected to offer actionable insights for policymakers, religious leaders, and community organizations in designing culturally rooted programs that integrate financial literacy with religious principles. Such programs could empower families to break the cycle of poverty through disciplined financial planning and reduced impulsive spending. Our goal in this study is to demonstrate how religious values and financial literacy, when integrated, can provide a sustainable approach to poverty alleviation among low-income families.

1.1. Background

Poverty is a complex problem influenced by multiple factors. Previous studies highlight the significance of religiosity and family structures in economic outcomes, such as happiness and well-being (Mauricio & Albuquerque, 2021; Rajafi et al., 2020). However, research linking religious-based family management to poverty remains scarce. While religiosity has been associated with both positive outcomes, such as improved emotional well-being, and challenges like increased financial stress, its direct influence on spending habits and financial planning is still not well understood (Heiden-Rootes et al., 2019).

Unlike prior studies that focus on macroeconomic interventions, this research provides a novel perspective by examining how family-level religious management serves as an ’agent of change’ for financial behaviors. By integrating Human Capital Theory (HCT) and the Theory of Planned Behavior (TPB), this study explains how religious values can guide families toward better consumption practices and financial resilience (Behrman et al., 2017; McDermott et al., 2015).

Short-term financial focus and impulsive consumption are often defining characteristics of low-income households. Families with limited resources tend to prioritize immediate needs, leaving little room for savings or long-term planning (Tamsah et al., 2023). This short-sighted approach traps families in poverty, as resources are quickly depleted. Although social finance instruments like zakat have demonstrated the potential for poverty alleviation through redistribution (Siregar et al., 2023; Widiastuti et al., 2022), the underlying mechanisms—how religious principles influence financial decision-making—are still unclear. This study aims to fill that gap by examining how RBFM can guide families toward better consumption habits and financial stability.

Human Capital Theory (HCT) and the Theory of Planned Behavior (TPB) serve as the foundation for our investigation. In order to improve economic results, especially in poor nations, HCT highlights the importance of investing in education and skills (Colin & Weil, 2020; Olopade et al., 2019). However, without adequate financial management, these investments often fail to lift families out of poverty (Behrman et al., 2017; Colin & Weil, 2020). Meanwhile, the TPB explains how attitudes, family norms, and perceived behavioral control shape spending and saving behaviors (Ajzen & Kruglanski, 2019; McDermott et al., 2015). By combining these two perspectives, we aim to provide a clearer understanding of how religious-based values influence financial behaviors.

1.2. Hypothesis Development

The theoretical foundation for this study is built upon Human Capital Theory (HCT) and the Theory of Planned Behavior (TPB). HCT emphasizes the role of investments in education, skills, and values as critical components for long-term economic growth and resilience (Colin & Weil, 2020; Olopade et al., 2019). In the context of this study, religious values embedded within family management (RBFM) serve as non-material human capital that influences financial discipline, long-term vision, and consumption behaviors (Behrman et al., 2017). Families that adhere to religious principles are expected to allocate resources more effectively, reducing impulsive spending and achieving financial stability.

The TPB, on the other hand, explains how attitudes, norms, and perceived control shape financial behaviors (Ajzen & Kruglanski, 2019). Subjective norms derived from religious teachings promote prudent consumption and discourage excessive spending. By fostering behavioral control and influencing short-term decision-making, the TPB supports the hypothesis that religious values can reduce short-term vision and consumption-related poverty (Gupta et al., 2023; McDermott et al., 2015). Based on this theoretical foundation, the following hypotheses are proposed in Table 1.

Table 1.

Proposed hypotheses and supporting theories.

2. Methodology

2.1. Sample Criteria

Six places in Indonesia’s South Sulawesi—Jeneponto Regency, Makassar City, North Luwu Regency, Selayar Regency, North Toraja Regency, and Bone Regency—comprised the study setting. The high concentration of low-income households in these areas led to their selection. The study’s areas are typical of South Sulawesi’s main ethnic groupings, such as the Bugis, Makassar, and Toraja. Tamsah (2011), Hasmin and Mariah (2015), Tamsah et al. (2021), and Tamsah and Nurung (2024) used prior research as a basis for sampling design. For instance, Makassar City, as an urban center, illustrates the contrast between urban poverty and limited access to social support, while rural areas like North Luwu and North Toraja highlight issues such as agricultural dependency and limited infrastructure (Tamsah et al., 2021, 2023).

Respondents were low-income families whose earnings fell below the poverty line and who primarily communicated in local dialects. To facilitate data collection and ensure accurate comprehension of the questionnaire, trained field assistants were deployed in each location. These field assistants underwent a comprehensive briefing and training program before starting data collection. Although all low-income families in the study areas were invited to participate, only 172 families completed the questionnaire within the two-month data collection period. Their responses were deemed valid and suitable for analysis.

Table 2 summarizes the demographic details of the respondents, highlighting their socio-economic challenges, such as low educational attainment, high dependency ratios, and limited daily income. These characteristics provide critical context for understanding the economic vulnerabilities addressed in this study.

Table 2.

Respondent demographics.

Table 2 summarizes the demographic details of the 172 respondents. Notably, 60.47% of respondents were between the ages of 41 and 50, and 30.81% of them had completed primary school, while 26.16% had no formal education. The majority of responses (42.44%) were from Makassar, with Jeneponto Regency (14.53%) and Selayar Regency (10.47%) following closely behind. Most of the respondents made between IDR 20,000 and IDR 50,000 a day (36.63%) or less than IDR 20,000 a day (29.65%). Five to six people made up the great majority of respondents’ households (52.33%), followed by one to three people (37.79%). The socioeconomic difficulties encountered by the low-income communities this study is aimed at are highlighted by this demographic profile.

2.2. Variable Measurement

In this study, complicated models were analyzed quantitatively utilizing AMOS 24 software and Structural Equation Modeling (SEM). A 5-point Likert scale, which was intended to capture the negative correlations between variables, was used in the structured questionnaires used to gather the data.

- Religious-based family management (RBFM):This variable was measured using positively framed statements. Higher scores (1 = strongly agree) indicated stronger adherence to religious values, which were hypothesized to positively influence family welfare. Six indicators were initially included: effort in prayer, awareness of divine observation, adherence to religious rules, belief in divine power, patience for divine will, and consistent worship. However, RBFM6 (“We continuously pray and strive for a better life”) was removed due to conceptual redundancy with RBFM1 (“We always strive earnestly in prayer”), as identified during the pilot test (Carradus et al., 2020; Tamsah et al., 2023). The remaining five indicators adequately capture the core dimensions of RBFM, ensuring conceptual clarity and reliability.

- Short-term vision (STV), uncontrolled consumption (UC), and absolute poverty (AP):These variables were measured using negatively framed statements. Higher scores (5 = strongly agree) reflected worse economic conditions.

- ▪

- STV indicators include necessity-driven spending, lack of savings orientation, and limited financial planning (Tamsah et al., 2023).

- ▪

- UC indicators include unplanned consumption, debt-inducing purchases, and consumption driven by basic desires (Tamsah et al., 2023).

- ▪

- AP indicators are based on the Indonesian government’s poverty benchmarks, such as access to quality health services, adequate housing, and sustainable natural resources (Tamsah et al., 2023).

This measurement approach was tailored to capture the hypothesized negative correlations between RBFM and the other variables. By contrasting positive and negative scales, the design effectively highlights how increased adherence to religious values mitigates the adverse effects of short-term financial focus (STV), impulsive consumption (UC), and poverty (AP) (Behrman et al., 2017; Chen et al., 2024).

Table 3 provides further details on the operationalization of these variables, demonstrating their alignment with theoretical constructs and empirical frameworks.

Table 3.

Measurement of variables.

3. Results

3.1. Normality Test

To ensure stable results for the normality test and model fit, data were triplicated using the bootstrap method, yielding a total of 516 samples (172 families × 3). The Bollen–Stine bootstrap test revealed improved model fit for 468 samples, while 48 showed poorer fit. Notably, none of the bootstrap samples matched the original dataset exactly. With a p-value of 0.10—higher than the standard threshold of 0.05—the data are confirmed to meet normality assumptions, making them suitable for further analysis.

3.2. Statistical Results

Table 4 summarizes the validity and reliability results for the four key variables: religious-based family management (RBFM), short-term vision (STV), uncontrolled consumption (UC), and absolute poverty (AP). All indicators showed significant standardized estimates (p < 0.01) and Critical Ratio (CR) values above 1.96, confirming strong validity for each item.

Table 4.

Statistical results.

Reliability measures were equally robust, with Construct Reliability (CR) values exceeding 0.95 and Average Variance Extracted (AVE) values above 0.84, demonstrating excellent internal consistency and convergent validity. To refine the model, low-performing indicators were removed, leaving only the most reliable ones. This adjustment enhanced the clarity and precision of the variable measurements.

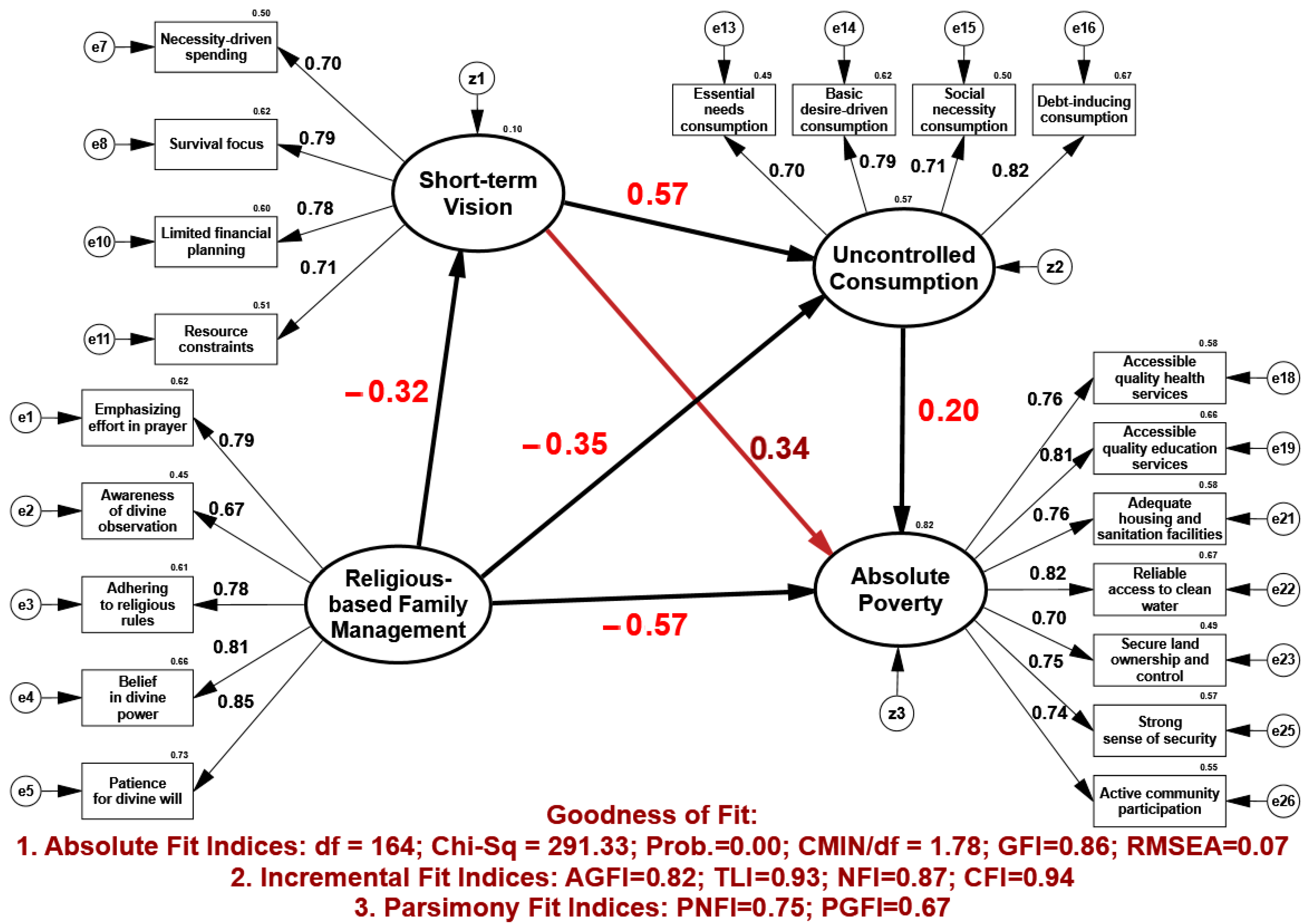

The model’s overall fit is presented in Table 5. The Absolute Fit Indices indicate an acceptable model fit, with a CMIN/df score of 1.78 and an RMSEA of 0.07. While the Chi-Square value (X2 = 291.33, df = 164) and GFI (0.86) suggest a marginal fit, these values remain within tolerable limits.

Table 5.

Goodness of fit.

The Incremental Fit Indices further strengthen the model’s credibility, with TLI (0.93) and CFI (0.94) reflecting a strong fit, and AGFI (0.82) reflecting a moderate one. The Parsimonious Fit Indices, such as PNFI (0.75) and PGFI (0.67), highlight the model’s efficiency in explaining the data with minimal parameters. Overall, the indices demonstrate that the model effectively represents the data, despite some marginal scores.

Figure 1 depicts the relationships between RBFM, STV, UC, and AP.

Figure 1.

Final model of SEM-Amos analysis.

- ▪

- Religious-based family management significantly reduces short-term vision (β = −0.32), uncontrolled consumption (β = −0.35), and absolute poverty (β = −0.57).

- ▪

- Short-term vision positively influences uncontrolled consumption (β = 0.57) and absolute poverty (β = 0.34).

- ▪

- Uncontrolled consumption also contributes positively to absolute poverty (β = 0.20).

These findings emphasize the roles of short-term vision and uncontrolled consumption as mediators between RBFM and absolute poverty. The model fit indices (CMIN/df = 1.78, RMSEA = 0.07, TLI = 0.93, CFI = 0.94, PNFI = 0.75, PGFI = 0.67) provide a comprehensive understanding of this relationship.

3.3. Hypothesis Testing

Table 6 presents the results of the hypothesis testing for the effects of RBFM, STV, and UC on AP. All hypotheses were supported at p < 0.01.

Table 6.

Hypothesis testing.

- ▪

- RBFM significantly reduces STV (β = −0.32, CR = −3.53) and UC (β = −0.35, CR = −4.38), and directly impacts AP (β = −0.57, CR = −7.61).

- ▪

- STV positively influences UC (β = 0.57, CR = 5.86) and AP (β = 0.34, CR = 4.06).

- ▪

- UC also positively affects AP (β = 0.20, CR = 2.19).

Indirectly, RBFM mitigates AP through its influence on STV and UC (β = −0.21). This finding underscores the potential of religious-based family management to address absolute poverty by improving financial discipline and reducing impulsive behaviors.

4. Discussion

4.1. The Impact of Religious-Based Family Management on Short-Term Vision, Uncontrolled Consumption, and Absolute Poverty

This study found that religious-based family management (RBFM) has a significant negative relationship with short-term vision (−0.32), uncontrolled consumption (−0.35), and absolute poverty (−0.57). These results align with previous research highlighting the crucial role of religious family dynamics in influencing economic behavior, particularly among low-income families (Azouz et al., 2022; Heiden-Rootes et al., 2019; Pusztai & Fényes, 2022; Tamsah et al., 2023). According to Human Capital Theory (HCT), investing in human capital—including spiritual education—enhances economic resilience by fostering values such as discipline, patience, and long-term planning. These values mitigate the adverse effects of short-term vision by encouraging a balance between spiritual and economic priorities (Chen et al., 2024; Colin & Weil, 2020; Olopade et al., 2019).

The Theory of Planned Behavior (TPB) further explains how subjective norms and perceived behavioral control influenced by religious beliefs govern financial decision-making. Religious-based family management instills societal norms discouraging excessive spending while promoting thrift, thereby reducing uncontrolled consumption (Ajzen, 2020; Gupta et al., 2023; Huang et al., 2020; Wijaya et al., 2024). This disciplined approach to consumption reduces unnecessary expenses, which often exacerbate economic burdens and hinder families from escaping poverty (Casabayó et al., 2020; McDermott et al., 2015).

The significant negative association between RBFM and absolute poverty demonstrates that religious family management fosters sustainable economic behavior patterns. By reinforcing financial discipline and resilience, RBFM contributes to poverty alleviation. This finding aligns with prior studies on the effectiveness of religious financial systems, such as zakat, in redistributing resources and reducing economic inequality (Siregar et al., 2023; Widiastuti et al., 2022). HCT posits that human capital development through education, skills, and spiritual awareness is essential to breaking the poverty cycle, especially in communities heavily reliant on social capital (Qi et al., 2024). This study extends HCT by emphasizing the role of religious values as a form of human capital, which strengthens families’ economic resilience and ability to withstand financial pressures.

These findings expand existing theoretical frameworks by integrating religious values into HCT and the TPB, showcasing how religiosity influences financial behavior. This study highlights that spiritual education, when combined with behavioral control and subjective norms, equips families to better manage resources and reduce poverty. The findings also provide a foundation for culturally sensitive interventions aimed at enhancing financial literacy and promoting disciplined consumption behavior among low-income families (Ajzen & Kruglanski, 2019; Oldekop et al., 2019; Paul et al., 2022; Reyes, 2021; Schweiger, 2019).

4.2. The Impact of Short-Term Vision on Uncontrolled Consumption and Absolute Poverty

This study demonstrates that short-term vision has a significant positive influence on uncontrolled consumption (β = 0.57) and absolute poverty (β = 0.34). These findings align with previous research suggesting that short-term orientation fosters impulsive consumption behavior among low-income families (Tamsah et al., 2023). Measured through urgent expenditures and limited financial planning, short-term vision drives consumption based on immediate desires, such as unplanned and social spending, often leading to debt accumulation (Ajzen, 2020; Moran et al., 2019).

The Theory of Planned Behavior (TPB) explains this phenomenon by highlighting how resource constraints shape family norms and attitudes toward financial decision-making. Families experiencing financial insecurity often prioritize immediate needs over strategic planning, driven by social pressures and a perceived lack of control over future outcomes (Ajzen, 2020; McDermott et al., 2015). These subjective norms and behavioral tendencies exacerbate impulsive consumption, reinforcing the cycle of poverty (Gupta et al., 2023; Sheehy-skeffington, 2020). Strengthening perceived behavioral control through financial education and empowerment could mitigate these negative tendencies.

Furthermore, the significant impact of short-term vision on uncontrolled consumption highlights how prioritizing immediate needs undermines strategic financial planning, exacerbating absolute poverty (Tamsah et al., 2023). Families focused on meeting urgent necessities often struggle to break the poverty cycle (Colin & Weil, 2020; Qi et al., 2024). Overconsumption stemming from basic and social needs remains a critical factor that worsens poverty (Matos et al., 2019).

From a Human Capital Theory (HCT) perspective, the lack of long-term financial planning directly hampers investments in education and skill development—key pathways to poverty alleviation (Behrman et al., 2017; Olopade et al., 2019). For example, families with a short-term focus are less likely to allocate resources toward children’s education or professional training, prioritizing immediate consumption instead. This underutilization of human capital potential increases their vulnerability to poverty over time (Attanasio et al., 2022; Chen et al., 2024). Addressing this requires targeted interventions that combine financial literacy with accessible skill-building programs to encourage long-term investments.

Additionally, financial constraints frequently lead to suboptimal consumption choices, such as unhealthy food expenditures, draining resources for low-income households (Janssens et al., 2021; Ravikumar et al., 2022). These behaviors, driven by immediate needs, not only reduce household welfare, but also create barriers to economic mobility. By addressing these behaviors through structured financial literacy programs, families could be guided toward more sustainable consumption patterns, improving their economic resilience (Miller, 2017; Rentschler & Leonova, 2023).

These findings underscore the importance of integrating financial literacy with community-based support systems to mitigate the adverse effects of short-term vision on uncontrolled consumption and absolute poverty. Public policy initiatives must also prioritize access to affordable education and financial planning tools to strengthen families’ long-term resilience (Oldekop et al., 2019; Paul et al., 2022).

4.3. Uncontrolled Consumption and Its Impact on Absolute Poverty

This study demonstrates that uncontrolled consumption significantly influences absolute poverty (β = 0.20), supporting earlier research indicating that unplanned spending exacerbates poverty, especially among low-income families (Tamsah et al., 2023). Consumption behaviors driven by social pressures, reliance on debt, and limited behavioral control create persistent economic burdens, aligning with the Theory of Planned Behavior (Ajzen, 2020; McDermott et al., 2015). The TPB highlights how subjective norms and perceived lack of control over financial decisions encourage non-productive spending, further deepening economic vulnerability among impoverished families (Huang et al., 2020; Simões & Leder, 2022). For instance, expenditures on non-essential goods, such as lavish celebrations or alcohol, divert resources from critical needs, restricting families’ ability to escape poverty (Gupta et al., 2023; Nyakutsikwa et al., 2021).

Low-income households frequently allocate resources toward short-term gratification instead of long-term welfare improvement. Excessive energy consumption, for example, contributes to energy poverty and strains already limited household budgets (Liu et al., 2022; Rentschler & Leonova, 2023). The TPB emphasizes that social norms often normalize such behaviors, creating barriers to more disciplined financial management.

From the perspective of Human Capital Theory (HCT), uncontrolled consumption undermines the potential for human capital development by diverting resources away from education, health, and skill acquisition—key factors in breaking the cycle of poverty (Attanasio et al., 2017; Behrman et al., 2017; Olopade et al., 2019). Families that prioritize non-essential consumption are less likely to invest in sustainable development, such as improving children’s education or accessing quality healthcare (Chen et al., 2024; Wang et al., 2021). Over time, these behaviors reduce access to fundamental needs like clean water and housing, perpetuating poverty across generations (Attanasio et al., 2022; Ravikumar et al., 2022). Addressing these patterns requires interventions that promote resource allocation toward human capital development and away from non-productive expenditures.

These findings highlight the necessity of financial literacy and behavior management strategies to mitigate the adverse effects of uncontrolled consumption on poverty. Practical interventions, such as workshops on budgeting, debt management, and consumption prioritization, can empower low-income families to break intergenerational poverty cycles (Colin & Weil, 2020; Miller, 2017; Paul et al., 2022). Additionally, community-based support systems that encourage shared accountability for financial behaviors could reinforce positive spending habits while reducing the influence of harmful social norms (Ajzen, 2020; Gupta et al., 2023).

Policymakers should also prioritize structural solutions, such as subsidies for essential goods and access to affordable financial planning tools, to reduce the economic burden on low-income families. By addressing both individual behaviors and structural barriers, these initiatives can enhance household financial stability and promote sustainable poverty alleviation (Rentschler & Leonova, 2023; Schweiger, 2019).

4.4. Short-Term Vision and Uncontrolled Consumption as Intervening Variables of Religious-Based Family Management on Absolute Poverty

This study found that short-term vision and uncontrolled consumption serve as significant intervening variables in the relationship between religious-based family management (RBFM) and absolute poverty, with a negative indirect effect of −0.21. These findings align with prior research suggesting that RBFM enhances financial behavior by instilling values such as discipline, patience, and prudent financial planning (Gupta et al., 2023; Pusztai & Fényes, 2022). By reducing tendencies toward impulsive consumption and shifting focus from immediate needs to long-term goals, RBFM mitigates the adverse effects of short-term vision (Tamsah et al., 2023).

Religious values such as consistent prayer and awareness of divine oversight reinforce financial planning and controlled consumption by cultivating stronger subjective norms and perceived behavioral control. This supports the Theory of Planned Behavior (TPB), which posits that norms and control mechanisms derived from religiosity encourage responsible financial decisions (Ajzen, 2020; McDermott et al., 2015). For instance, families guided by religious principles are more likely to resist social pressures that drive unplanned spending, instead allocating resources toward productive investments like education and healthcare (Sarofim et al., 2020; Wijaya et al., 2024). These behaviors reduce financial vulnerability and increase economic resilience.

From a Human Capital Theory (HCT) perspective, religiosity strengthens families’ ability to allocate resources effectively, promoting investments in education, skills development, and health. This enables families to mitigate the effects of short-term vision and uncontrolled consumption, thereby enhancing their likelihood of escaping poverty (Attanasio et al., 2017; Behrman et al., 2017; Olopade et al., 2019). For example, consistent worship and moral teachings foster habits of saving and resource prioritization, which are critical for sustainable poverty alleviation (Chen et al., 2024; Liu et al., 2022; Qi et al., 2024; Rentschler & Leonova, 2023). RBFM thus acts as a mechanism for strengthening human capital by encouraging families to plan for future needs rather than immediate consumption.

Moreover, social pressure-induced consumption negatively impacts the financial well-being of low-income families, as expenditures on non-essential goods divert resources from essential needs like housing and education (Gupta et al., 2023; Nyakutsikwa et al., 2021). By fostering better consumption management and emphasizing ethical financial behavior, RBFM emerges as a protective mechanism against poverty, contributing to sustainable economic resilience (Miller, 2017). These findings suggest that culturally embedded financial literacy programs could further amplify the protective effects of RBFM, enabling families to make informed financial decisions aligned with both spiritual and economic goals.

4.4.1. Theoretical and Managerial Implications

Theoretical Implications

The concept of religious-based family management (RBFM) as an “agent of change” underscores its role in driving behavioral transformation through subjective norms and perceived behavioral control, ultimately improving family financial management. This study integrates Human Capital Theory (HCT) and the Theory of Planned Behavior (TPB) to demonstrate how RBFM reduces short-term vision, curtails uncontrolled consumption, and strengthens financial discipline. By linking religiosity with human capital development, the findings highlight how spiritual and ethical values reinforce financial resilience. This theoretical contribution expands the application of HCT by incorporating non-material dimensions, such as religious values, into human capital investment, while also extending the TPB to include cultural and spiritual contexts influencing financial behavior. These insights provide a foundation for developing religion-based programs integrated with financial literacy to help low-income families break the cycle of intergenerational poverty.

Managerial Implications

This study offers actionable recommendations for policymakers, community leaders, and religious institutions to address poverty through culturally sensitive strategies.

- (1)

- Collaboration Between Government and Religious Institutions: Policymakers should collaborate with religious organizations to design programs that integrate financial literacy with religious teachings. For example, combining financial education with moral guidance in religious gatherings, such as sermons or study groups, can encourage disciplined financial behaviors among low-income families.

- (2)

- Community-Based Workshops: Religious leaders and community organizations can organize workshops focusing on budgeting, savings, and investment strategies. These workshops should leverage religious narratives promoting patience, self-control, and accountability, helping families shift their focus from short-term consumption to long-term financial goals.

- (3)

- Incorporating Religious Values into Public Campaigns: Public awareness campaigns can incorporate religious principles to influence financial behavior on a larger scale. For instance, campaigns emphasizing the importance of financial restraint, resource stewardship, and ethical spending can resonate deeply with religious communities, fostering widespread behavioral change.

- (4)

- Policy Development for Poverty Alleviation: Governments can develop poverty alleviation policies that recognize the role of cultural and religious values in shaping financial decisions. These policies could include tax incentives for organizations conducting religion-based financial education programs or grants for community projects that integrate sustainable financial practices with spiritual guidance.

- (5)

- Integration into Education Systems: Introducing financial education courses in schools that align with religious and moral values can create long-term cultural shifts in financial behavior. Embedding such courses into the curricula ensures that future generations are equipped with both practical skills and ethical foundations, fostering disciplined financial management and reducing poverty risks.

5. Conclusions

This study concludes that religious-based family management (RBFM) plays a crucial role in reducing short-term vision and uncontrolled consumption, which are significant contributors to absolute poverty. By promoting long-term financial planning, self-restraint, and disciplined spending habits, RBFM empowers low-income families to allocate resources more effectively and enhance financial resilience. These findings emphasize the value of integrating religious values into poverty alleviation strategies at both community and governmental levels.

From a practical perspective, policymakers should collaborate with religious organizations to develop community-based programs that combine financial literacy training with religious teachings. These programs could include workshops on budgeting, savings, and investment strategies, reinforced by religious narratives that encourage patience, responsibility, and future-oriented thinking. Additionally, leveraging the influence of religious leaders through government-led initiatives can further promote prudent financial behaviors among low-income households, creating a ripple effect in poverty reduction efforts.

The findings also highlight the potential of integrating religious values into educational curricula and public awareness campaigns to amplify poverty alleviation efforts. By addressing both behavioral and structural causes of poverty, this dual approach aligns financial literacy with cultural and moral values, fostering sustainable and impactful solutions. Ultimately, this study contributes to the broader discourse on how culturally sensitive and ethically grounded strategies can effectively address complex socio-economic challenges.

Author Contributions

Conceptualization, H.H.; methodology, H.H.; software, H.H.; validation, J.N.; formal analysis, H.H.; investigation, J.N.; resources, G.B.I.; data curation, G.B.I.; writing—original draft preparation, J.N.; writing—review and editing, H.H.; visualization, G.B.I.; supervision, H.H.; project administration, J.N.; funding acquisition, G.B.I. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Ministry of Education, Culture, Research, and Technology of Indonesia through the Directorate of Research, Technology, and Community Service (DRTPM) under Grant Number 196/LL9/PK.OO.PG/2022. The article processing charge (APC) was self-funded by the authors.

Informed Consent Statement

All respondents were informed prior to completing the questionnaire that their data would be used solely for research purposes and would not be shared with any third party.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to privacy and ethical restrictions.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| RBV | Resource-Based View |

| HCT | Human Capital Theory |

| TPB | Theory of Planned Behavior |

| SEM | Structural Equation Modeling |

| RBFM | Religious-Based Family Management |

| STV | Short-term Vision |

| UC | Uncontrolled Consumption |

| AP | Absolute Poverty |

References

- Ajzen, I. (2020). The theory of planned behavior: Frequently asked questions. Human Behavior and Emerging Technologies, 2(4), 314–324. [Google Scholar] [CrossRef]

- Ajzen, I., & Kruglanski, A. W. (2019). Reasoned action in the service of goal pursuit. Psychological Review, 126(5), 774–786. [Google Scholar] [CrossRef]

- Arbuckle, J. L. (2009). Amos 18 user’s guide. Amos Development Corporation. Available online: https://www.sussex.ac.uk/its/pdfs/Amos_18_Users_Guide.pdf (accessed on 20 October 2024).

- Attanasio, O., Cattan, S., & Meghir, C. (2022). Early childhood development, human capital, and poverty. Annual Review of Economics, 14, 853–892. [Google Scholar] [CrossRef]

- Attanasio, O., Meghir, C., Nix, E., & Salvati, F. (2017). Human capital growth and poverty: Evidence from Ethiopia and Peru. Review of Economic Dynamics, 25, 234–259. [Google Scholar] [CrossRef]

- Azouz, A., Antheaume, N., & Charles-Pauvers, B. (2022). Looking at the Sky: An ethnographic study of how religiosity influences business family resilience. Family Business Review, 35(2), 184–208. [Google Scholar] [CrossRef]

- Behrman, J. R., Schott, W., Mani, S., Crookston, B. T., Dearden, K., Duc, L. T., Fernald, L. C. H., & Stein, A. D. (2017). Intergenerational transmission of poverty and inequality: Parental resources and schooling attainment and children’s human capital in Ethiopia, India, Peru, and Vietnam. Economic Development and Cultural Change, 65(4), 657–697. [Google Scholar] [CrossRef]

- Carradus, A., Zozimo, R., & Discua Cruz, A. (2020). Exploring a faith-led open-systems perspective of stewardship in family businesses. Journal of Business Ethics, 163(4), 701–714. [Google Scholar] [CrossRef]

- Casabayó, M., Dávila, J. F., & Rayburn, S. W. (2020). Thou shalt not covet: Role of family religiosity in anti-consumption. International Journal of Consumer Studies, 44(5), 445–454. [Google Scholar] [CrossRef]

- Chen, H., Yu, J., Zhang, Z., Li, Y., Qin, L., & Qin, M. (2024). How human capital prevents intergenerational poverty transmission in rural China: Evidence based on the Chinese general social survey. Journal of Rural Studies, 105, 103220. [Google Scholar] [CrossRef]

- Colin, M., & Weil, D. (2020). The effect of increasing human capital investment on economic growth and poverty. Journal of Human Capital, 14(1), 43–83. [Google Scholar] [CrossRef]

- Dash, G., & Paul, J. (2021). CB-SEM vs. PLS-SEM methods for research in social sciences and technology forecasting. Technological Forecasting and Social Change, 173, 121092. [Google Scholar] [CrossRef]

- Gupta, S., Lim, W. M., Verma, H. V., & Polonsky, M. (2023). How can we encourage mindful consumption? Insights from mindfulness and religious faith. Journal of Consumer Marketing, 40(3), 344–358. [Google Scholar] [CrossRef]

- Hair, J. F., Black, W., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis: A global perspective (7th ed.). Pearson. [Google Scholar]

- Hasmin, & Mariah. (2015). Analisis kemiskinan ditinjau dari tempat tinggal, pekerjaan, pendapatan, dan pendidikan di sulawesi selatan. Jurnal Bisnis & Kewirausahaan, 4(1), 31–40. [Google Scholar]

- Heiden-Rootes, K., Wiegand, A., & Bono, D. (2019). Sexual minority adults: A national survey on depression, religious fundamentalism, parent relationship quality & acceptance. Journal of Marital and Family Therapy, 45(1), 106–119. [Google Scholar] [CrossRef] [PubMed]

- Huang, J., Antonides, G., & Nie, F. (2020). Social-psychological factors in food consumption of rural residents: The role of perceived need and habit within the theory of planned behavior. Nutrients, 12(4), 1203. [Google Scholar] [CrossRef]

- Janssens, W., Pradhan, M., de Groot, R., Sidze, E., Donfouet, H. P. P., & Abajobir, A. (2021). The short-term economic effects of COVID-19 on low-income households in rural Kenya: An analysis using weekly financial household data. World Development, 138, 105280. [Google Scholar] [CrossRef]

- Liu, J., Jain, V., Sharma, P., Ali, S. A., Shabbir, M. S., & Ramos-Meza, C. S. (2022). The role of sustainable development goals to eradicate the multidimensional energy poverty and improve social wellbeing’s. Energy Strategy Reviews, 42, 100885. [Google Scholar] [CrossRef]

- Mani, A., Mullainathan, S., Shafir, E., & Zhao, J. (2020). Scarcity and cognitive function around payday: A conceptual and empirical analysis. Journal of the Association for Consumer Research, 5(4), 365–376. [Google Scholar] [CrossRef]

- Matos, C. A. D., Vieira, V., Bonfanti, K., & Mette, F. M. B. (2019). Antecedents of indebtedness for low-income consumers: The mediating role of materialism. Journal of Consumer Marketing, 36(1), 92–101. [Google Scholar] [CrossRef]

- Mauricio, J., & Albuquerque, M. (2021). Negative impact of family religious and spiritual beliefs in schizophrenia—A 2 year follow-up case. European Psychiatry, 64(S1), S683. [Google Scholar] [CrossRef]

- McDermott, M. S., Oliver, M., Svenson, A., Simnadis, T., Beck, E. J., Coltman, T., Iverson, D., Caputi, P., & Sharma, R. (2015). The theory of planned behaviour and discrete food choices: A systematic review and meta-analysis. International Journal of Behavioral Nutrition and Physical Activity, 12(1), 162. [Google Scholar] [CrossRef]

- Miller, Z. D. (2017). The enduring use of the theory of planned behavior. Human Dimensions of Wildlife, 22(6), 583–590. [Google Scholar] [CrossRef]

- Moran, A. J., Khandpur, N., Polacsek, M., & Rimm, E. B. (2019). What factors influence ultra-processed food purchases and consumption in households with children? A comparison between participants and non-participants in the Supplemental Nutrition Assistance Program (SNAP). Appetite, 134(2019), 1–8. [Google Scholar] [CrossRef]

- Nyakutsikwa, B., Britton, J., & Langley, T. (2021). The effect of tobacco and alcohol consumption on poverty in the UK. Addiction, 116(1), 150–158. [Google Scholar] [CrossRef] [PubMed]

- Oldekop, J. A., Sims, K. R. E., Karna, B. K., Whittingham, M. J., & Agrawal, A. (2019). Reductions in deforestation and poverty from decentralized forest management in Nepal. Nature Sustainability, 2(5), 421–428. [Google Scholar] [CrossRef]

- Olopade, B. C., Okodua, H., Oladosun, M., & Asaleye, A. J. (2019). Human capital and poverty reduction in OPEC member-countries. Heliyon, 5(8), e02279. [Google Scholar] [CrossRef]

- Paul, B., Kirubakaran, R., Isaac, R., Dozier, M., Grant, L., & Weller, D. (2022). Theory of planned behaviour-based interventions in chronic diseases among low health-literacy population: Protocol for a systematic review. Systematic Reviews, 11(1), 127. [Google Scholar] [CrossRef]

- Pusztai, G., & Fényes, H. (2022). Religiosity as a factor supporting parenting and its perceived effectiveness in Hungarian school children’s families. Religions, 13(10), 945. [Google Scholar] [CrossRef]

- Qi, P., Deng, L., & Li, H. (2024). Does the county-based poverty reduction policy matter for children’s human capital development? China Economic Review, 85, 102147. [Google Scholar] [CrossRef]

- Rajafi, A., Hamhij, N. A., & Ladiqi, S. (2020). The meaning of happiness and religiosity for pre-prosperous family: Study in Manado, Bandar Lampung, and Yogyakarta. Al-Ihkam: Jurnal Hukum Dan Pranata Sosial, 15(1), 50–66. [Google Scholar] [CrossRef]

- Ravikumar, D., Spyreli, E., Woodside, J., McKinley, M., & Kelly, C. (2022). Parental perceptions of the food environment and their influence on food decisions among low-income families: A rapid review of qualitative evidence. BMC Public Health, 22(1), 9. [Google Scholar] [CrossRef]

- Rentschler, J., & Leonova, N. (2023). Global air pollution exposure and poverty. Nature Communications, 14(1), 4432. [Google Scholar] [CrossRef] [PubMed]

- Reyes, A. M. (2021). Mitigating poverty through the formation of extended family households: Race and ethnic differences. Social Problems, 67(4), 782–799. [Google Scholar] [CrossRef] [PubMed]

- Sarofim, S., Minton, E., Hunting, A., Bartholomew, D. E., Zehra, S., Montford, W., Cabano, F., & Paul, P. (2020). Religion’s influence on the financial well-being of consumers: A conceptual framework and research agenda. Journal of Consumer Affairs, 54(3), 1028–1061. [Google Scholar] [CrossRef]

- Schweiger, G. (2019). Religion and poverty. Palgrave Communications, 5(1), 3–5. [Google Scholar] [CrossRef]

- Sheehy-skeffington, J. (2020). The effects of socioeconomic status on cognitive functioning and decision-making. Current Opinion in Psychology, 33, 183–188. [Google Scholar] [CrossRef]

- Simões, G. M. F., & Leder, S. M. (2022). Energy poverty: The paradox between low income and increasing household energy consumption in Brazil. Energy and Buildings, 268, 112234. [Google Scholar] [CrossRef]

- Siregar, N. A., Amri, K., & Riyaldi, M. H. (2023). Peran belanja pemerintah daerah dalam memoderasi pengaruh zakat terhadap kemiskinan di provinsi aceh. Journal of Law and Economics, 2(2), 80–89. [Google Scholar] [CrossRef]

- Tamsah, H. (2011). Analisis kemiskinan di kota makassar. Universitas Hasanuddin. [Google Scholar]

- Tamsah, H., & Nurung, J. (2024). The dynamics of poverty in South Sulawesi: Perspectives from the community, NGOs, and government. Economics and Digital Business Review, 5(2), 166–176. Available online: https://ojs.stieamkop.ac.id/index.php/ecotal/article/view/1127/816 (accessed on 20 October 2024).

- Tamsah, H., Ilyas, G. B., Nur, Y., Yusriadi, Y., & Asrifan, A. (2021). Uncontrolled consumption and life quality of low-income families: A study of three major tribes in south Sulawesi. Management Science Letters, 10(4), 1171–1174. [Google Scholar] [CrossRef]

- Tamsah, H., Ilyas, G. B., Nurung, J., & Yusriadi, Y. (2023). Model testing and contribution of antecedent variable to absolute poverty: Low income family perspective in Indonesia. Sustainability, 15(8), 6894. [Google Scholar] [CrossRef]

- Van Laar, S., & Braeken, J. (2021). Understanding the comparative fit Index: It’s all about the base! Practical Assessment, Research, and Evaluation, 26(26), 1–23. Available online: https://scholarworks.umass.edu/pare/vol26/iss1/26 (accessed on 20 October 2024).

- Wang, Q. S., Hua, Y. F., Tao, R., & Moldovan, N. C. (2021). Can health human capital help the Sub-Saharan Africa out of the poverty trap? An ARDL model approach. Frontiers in Public Health, 9, 697826. [Google Scholar] [CrossRef] [PubMed]

- Widiastuti, T., Mawardi, I., Zulaikha, S., Herianingrum, S., Robani, A., Al Mustofa, M. U., & Atiya, N. (2022). The nexus between Islamic social finance, quality of human resource, governance, and poverty. Heliyon, 8(12), e11885. [Google Scholar] [CrossRef]

- Wijaya, H. R., Hati, S. R. H., Ekaputra, I. A., & Kassim, S. (2024). The impact of religiosity and financial literacy on financial management behavior and well-being among Indonesian Muslims. Humanities and Social Sciences Communications, 11(1), 830. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).