International Tourism and Economic Growth: Exploring the Unexplored for the ASEAN Region

Abstract

1. Introduction

2. Literature Review

2.1. Development of Hypothesis

2.1.1. Tourism and Economic Growth

2.1.2. Control Variables and Economic Growth

3. Research Design and Estimation

3.1. Model Specification

3.2. Definition of Variables

3.3. Data Collection and Sample

3.4. Estimation Strategy

3.5. Preliminary Testing

4. Results and Discussions

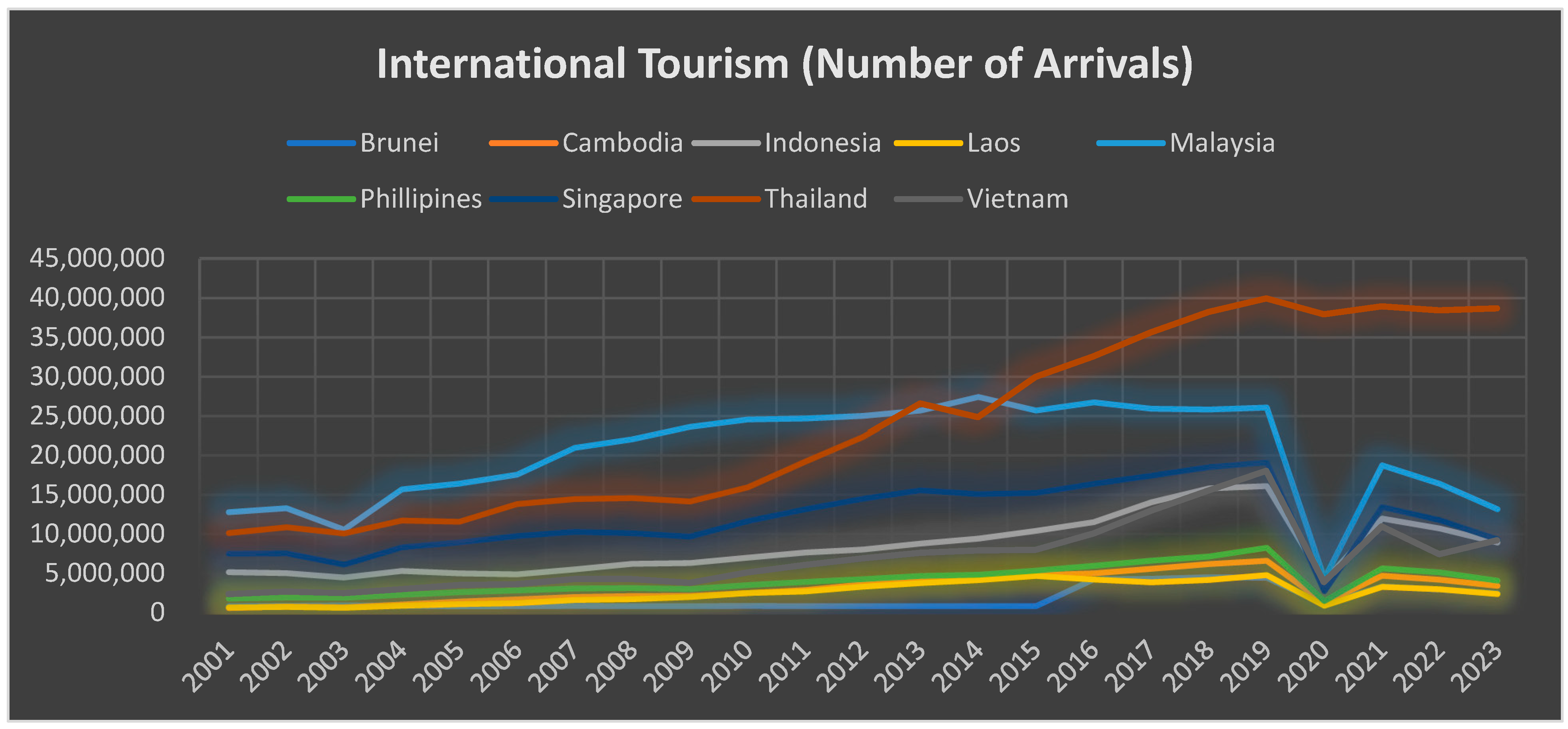

4.1. Descriptive Analysis

4.2. Correlation Analysis

4.3. Discussion on Long-Run Results

4.4. Robustness Analysis

5. Causality Findings

6. Conclusions, Implications, and Limitations

6.1. Summary Remarks

6.2. Policy Implications

- 1.

- Firstly, the policymakers of ASEAN are suggested to provide a more feasible environment for the promotion of the tourism sector as it positively contributes to the growth performance. In this regard, tourism facilitation centers along with better facilities of accommodation and transportation would enhance the economic performance which is desirable.

- 2.

- Secondly, the authorities and policymakers of ASEAN are required to liberalize their trade regime further by relaxing all sorts of trade restrictions, including tariff and non-tariff barriers. Similarly, some incentives for the export sector would also help the policymakers to achieve higher trade volumes. Enhanced trade volume would eventually accelerate the growth performance of ASEAN member economies.

- 3.

- Thirdly, human capital has played a dominant role in explaining the overall growth performance as confirmed by results. Therefore, the rational policy would be to focus on increasing both the volume of human capital as well as the quality of human capital using several policies. Furthermore, the policymakers of the ASEAN region are encouraged to focus on improving the skills of population.

- 4.

- Finally, the policymakers of ASEAN are encouraged to control the inflationary pressure using suitable policy responses, as it is harmful for economic performance.

6.3. Limitations and Future Research Directions

- 1.

- The first limitation of the study is that it focuses on the ASEAN economies, which are unique. Therefore, potential researchers are encouraged to test the models of our study by focusing on some other group of economies, such as G-20 and OECD, to address the issue of robustness and results generalization.

- 2.

- The variable used for the measurement of international tourism is narrow. Therefore, future studies on the subject are advised to use a more detailed proxy for the measurement of international tourism to provide more robust evidence.

- 3.

- The current study has only focused on a few determinants of economic growth, while economic growth may be influenced by several factors, including research development, political stability, and entrepreneurial activities. Therefore, future studies should include research and development, political stability, and entrepreneurial activities in their research models to assess the true impact of international tourism on economic growth. The inclusion of the variables mentioned in our estimated model would provide more in-depth insights.

- 4.

- Lastly, the present study conducted empirical analysis only using traditional econometric techniques. However, due to the limited number of cross-sections, the present study did not use the GMM estimator. Future research studies are recommended to utilize more comprehensive samples of countries and apply the GMM estimator.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Test Name | Model | Test-Score | Degree of Freedom | Prob. Value | Conclusion |

|---|---|---|---|---|---|

| Pesaran CD Test | 1 | −0.135 | 36 | 0.8919 | “Ho is not rejected” |

| 2 | −0.943 | 36 | 0.3453 | “Ho is not rejected” | |

| 3 | −0.861 | 36 | 0.3891 | “Ho is not rejected” | |

| 4 | −0.853 | 36 | 0.3933 | “Ho is not rejected” |

| Test Name | Model | Test-Score | Prob. Value | Conclusion |

|---|---|---|---|---|

| Cross-Section Random | 1 | 66.824 | 0.000 | “Ho is rejected” |

| 2 | 60.730 | 0.000 | “Ho is rejected” | |

| 3 | 49.321 | 0.000 | “Ho is rejected” | |

| 4 | 52.896 | 0.000 | “Ho is rejected” |

| Correlation | Variance | VIF |

|---|---|---|

| 0.001330 | 1.417303 | |

| 0.055063 | 2.273638 | |

| 0.025812 | 1.078219 | |

| 0.004645 | 1.377476 | |

| 6.75 × 10−5 | 1.207254 | |

| 0.009825 | 1.531639 |

References

- Ady, S. U., Moslehpour, M., Van, D. N., Johari, S. M., Thuy, V. V. T., & Hieu, V. M. (2022). The impact of Sustainable tourism growth on the economic development: Evidence from a developing economy. Cuadernos de Economía, 45(127), 130–139. [Google Scholar]

- Aida, N. E. L. I., Palupi, W. A., & Husain, F. R. (2023). What is the role of tourism, foreign direct investment, and institutions in economic growth in ASEAN. WSEAS Transactions on Environment and Development, 19, 571–581. [Google Scholar] [CrossRef]

- Aini, Y. N. (2024). Sustainable tourism in Southeast Asia: Balancing economic growth, employment, and carbon emissions through evidence-based strategies. Jurnal Kepariwisataan Indonesia: Jurnal Penelitian dan Pengembangan Kepariwisataan Indonesia, 18(1), 157–174. [Google Scholar]

- Alam, M. B., Tahir, M., Omar Ali, N., Naveed Jan, M., & Sayal, A. U. (2025). The moderating role of terrorism on the insurance–growth nexus: Empirical evidence from the 14 MENA countries. Journal of Economic and Administrative Sciences, 41(2), 720–734. [Google Scholar]

- Alfalih, A. A., Azid, T., Jaboob, M., & Tahir, M. (2025). Natural resources management as drivers of economic growth: Fresh insights from a time series analysis of Saudi Arabia. Sustainability, 17(4), 1728. [Google Scholar] [CrossRef]

- Antonakakis, N., Dragouni, M., & Filis, G. (2015). How strong is the linkage between tourism and economic growth in Europe? Economic Modelling, 44, 142–155. [Google Scholar] [CrossRef]

- Ardra, U., & Martawardaya, B. (2017). Tourism and economic development in ASEAN 1998–2013. Economics and Finance in Indonesia, 63(2), 2. [Google Scholar]

- Barro, R. J. (1998). Human capital and growth in cross-country regressions (pp. 1–56). Harvard University. [Google Scholar]

- Barro, R. J. (2013). Education and economic growth. Annals of Economics and Finance, 14(2), 301–328. [Google Scholar]

- Barro, R. J., & Lee, J. W. (2013). A new data set of educational attainment in the world, 1950–2010. Journal of development economics, 104, 184–198. [Google Scholar]

- Brida, J. G., Gómez, D. M., & Segarra, V. (2020). On the empirical relationship between tourism and economic growth. Tourism Management, 81, 104131. [Google Scholar] [CrossRef]

- Dollar, D. (1992). Outward-oriented developing economies really do grow more rapidly: Evidence from 95 LDCs, 1976–1985. Economic Development and Cultural Change, 40(3), 523–544. [Google Scholar] [CrossRef]

- Durbarry, R. (2004). Tourism and economic growth: The case of Mauritius. Tourism Economics, 10(4), 389–401. [Google Scholar] [CrossRef]

- Edwards, S. (1998). Openness, productivity and growth: What do we really know? The Economic Journal, 108(447), 383–398. [Google Scholar] [CrossRef]

- Eugenio-Martin, J. L., Morales, N. M., & Scarpa, R. (2004). Tourism and economic growth in Latin American countries: A panel data approach (No. 26.2004). Nota di Lavoro. [Google Scholar]

- Fayissa, B., Nsiah, C., & Tadasse, B. (2008). Impact of tourism on economic growth and development in Africa. Tourism Economics, 14(4), 807–818. [Google Scholar] [CrossRef]

- Gökovali, U., & Bahar, O. (2006). Contribution of tourism to economic growth: A panel data approach. Anatolia, 17(2), 155–167. [Google Scholar] [CrossRef]

- Gwenhure, Y., & Odhiambo, N. M. (2017). Tourism and economic growth: A review of international literature. Tourism: An International Interdisciplinary Journal, 65(1), 33–44. [Google Scholar]

- Gyimah-Brempong, K., Paddison, O., & Mitiku, W. (2006). Higher education and economic growth in Africa. The Journal of Development Studies, 42(3), 509–529. [Google Scholar] [CrossRef]

- Khayrulloevna, A. M. (2020). The substantial economic benefits of tourism. Academy, 3(54), 39–40. [Google Scholar]

- Nguyen, C. V. (2024). Air transport resilience, tourism and its impact on economic growth. Economies, 12(9), 236. [Google Scholar] [CrossRef]

- Öztürk, M., Ihtiyar, A., & Aras, O. N. (2019). The relationship between tourism industry and economic growth: A panel data analysis for ASEAN member countries. In Quantitative tourism research in Asia: Current status and future directions (pp. 35–58). Springer Nature. [Google Scholar]

- Pablo-Romero, M. D. P., & Molina, J. A. (2013). Tourism and economic growth: A review of empirical literature. Tourism Management Perspectives, 8, 28–41. [Google Scholar] [CrossRef]

- Rahmiati, F., Jokhu, J. R., Arquisola, M. J., Advincula, G., & Rasid, R. (2021). Tourism Impact the Economic Growth of ASEAN Countries. Lesson Learned for Post-Pandemic Covid-19 Recovery. Journal of Technology Management and Technopreneurship (JTMT), 9(2), 29–38. [Google Scholar]

- Risso, W. A. (2018). Tourism and economic growth: A worldwide study. Tourism Analysis, 23(1), 123–135. [Google Scholar] [CrossRef]

- Sak, N., & Karymshakov, K. (2012). Relationship between tourism and economic growth: A panel Granger causality approach. Asian Economic and Financial Review, 2(5), 591. [Google Scholar]

- Sara, I., Dharmanegara, I. B. A., & KORRI, I. (2018). The dynamics of international tourism and economic growth convergence in ASEAN+ 3. Journal of Environmental Management and Tourism, 9(4), 2018. [Google Scholar] [CrossRef] [PubMed]

- Tahir, M., & Alam, M. B. (2022). Does well banking performance attract FDI? Empirical evidence from the SAARC economies. International Journal of Emerging Markets, 17(2), 413–432. [Google Scholar] [CrossRef]

- Tahir, M., & Azid, T. (2015). The relationship between international trade openness and economic growth in the developing economies: Some new dimensions. Journal of Chinese Economic and Foreign Trade Studies, 8(2), 123–139. [Google Scholar] [CrossRef]

- Tahir, M., & Khan, I. (2014). Trade openness and economic growth in the Asian region. Journal of Chinese Economic and Foreign Trade Studies, 7(3), 136–152. [Google Scholar] [CrossRef]

- Van Trung, H. (2025). Tourism, FDI, renewable energy and growth: An analysis of ASEAN countries. Revista Tur smo & Desenvolvimento| n. o, 48, 599–623. [Google Scholar]

- Walton, J. (2018). Tourism and economic development in ASEAN. In Tourism in South-East Asia (pp. 214–233). Routledge. [Google Scholar]

- Wijesekara, C., Tittagalla, C., Jayathilaka, A., Ilukpotha, U., Jayathilaka, R., & Jayasinghe, P. (2022). Tourism and economic growth: A global study on Granger causality and wavelet coherence. PLoS ONE, 17(9), e0274386. [Google Scholar] [CrossRef]

- W.T.B. (2025). World Tourism Barometer. UN Tourism Publications. [Google Scholar] [CrossRef]

- Wu, T. P., Wu, H. C., Ye, G., Wu, X., & Pan, B. (2024). The contribution of international tourism development to economic growth in Chinese economy. Journal of Policy Research in Tourism, Leisure and Events, 16(4), 575–589. [Google Scholar] [CrossRef]

| Descriptives | |||||||

|---|---|---|---|---|---|---|---|

| Mean | 3.273 | 9,185,740 | 2.513 | 26.319 | 134.613 | 3.794 | 11.860 |

| Maximum | 14.430 | 39,916,000 | 4.351 | 40.891 | 437.326 | 31.230 | 29.576 |

| Minimum | −10.548 | 605,000 | 1.552 | 13.543 | 32.972 | −2.314 | 4.809 |

| Std. Dev. | 3.418 | 9,051,253 | 0.535 | 5.075 | 88.795 | 4.367 | 5.053 |

| N | 207 | 207 | 207 | 207 | 207 | 207 | 207 |

| Correlation | |||||||

|---|---|---|---|---|---|---|---|

| 1.000 ---- | |||||||

| 0.063 (0.372) | 1.000 ---- | ||||||

| 0.031 (0.656) | 0.483 *** (0.000) | 1.000 ---- | |||||

| −0.033 (0.640) | −0.077 (0.276) | −0.257 *** (0.0003) | 1.000 ---- | ||||

| 0.104 (0.142) | 0.307 *** (0.000) | 0.431 *** (0.000) | −0.097 (0.170) | 1.000 ---- | |||

| −0.008 (0.899) | −0.167 ** (0.018) | −0.338 *** (0.000) | 0.106 (0.136) | −0.191 *** (0.006) | 1.000 ---- | ||

| −0.011 (0.868) | 0.081 (0.252) | 0.456 *** (0.000) | −0.026 (0.708) | −0.022 (0.754) | −0.333 *** (0.000) | 1.000 ---- |

| Regressors | “Model-1” | “Model-2” | “Model-3” | “Model-4” |

|---|---|---|---|---|

| Fixed | Fixed | Fixed | Fixed | |

| “Coefficient” | “Coefficient” | “Coefficient” | “Coefficient” | |

| 0.211 *** (0.022) | 0.184 *** (0.027) | 0.170 *** (0.052) | 0.156 *** (0.047) | |

| 2.980 *** (0.195) | 2.932 *** (0.178) | 2.994 *** (0.191) | 2.943 *** (0.176) | |

| 0.008 (0.110) | 0.006 0.105 | 0.020 (0.113) | 0.014 (0.108) | |

| 0.0.905 *** (0.076) | 0.918 *** (0.071) | 0.943 *** (0.080) | 0.945 *** (0.072) | |

| −0.015 ** (0.007) | −0.014 ** (0.006) | |||

| 0.155 (0.142) | 0.111 (0.118) | |||

| CONSTANT | −1.662 (0.578) | −1.204 (0.632) | −1.637 (0.587) | −1.204 (0.632) |

| Country Effect | Yes | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes | Yes |

| Diagnostics | R2 (Adj): 0.957 S.E.R: 0.258 F: 136.741 Prob. 0.000 Hausman: 66.8224 *** N: 9 | R2 (Adj): 0.959 S.E.R: 0.252 F: 139.310 Prob. 0.000 Hausman: 60.730 *** N: 9 | R2 (Adj): 0.956 S.E.R: 0.258 F: 133.302 Prob. 0.000 Hausman: 49.321 *** N: 9 | R2 (Adj): 0.958 S.E.R: 0.253 F: 135.323 Prob. 0.000 Hausman: 39.905 *** N: 9 |

| Variables | “Model-5” | “Model-6” | “Model-7” | “Model-8” | “Model-9” | “Model-10” | “Model-11” | “Model-12” |

|---|---|---|---|---|---|---|---|---|

| FGLS | FGLS | FGLS | FGLS | 2SLS | 2SLS | 2SLS | 2SLS | |

| “Coefficient” | “Coefficient” | “Coefficient” | “Coefficient” | “Coefficient” | “Coefficient” | “Coefficient” | “Coefficient” | |

| 0.155 *** (0.021) | 0.182 *** (0.022) | 0.112 *** (0.024) | 0.132 *** (0.026) | 0.191 *** (0.031) | 0.166 *** (0.032) | 0.101 ** (0.040) | 0.090 ** (0.040) | |

| 3.446 *** (0.165) | 3.279 *** (0.171) | 3.453 *** (0.163) | 3.260 *** (0.167) | 2.638 *** (0.220) | 2.625 *** (0.215) | 2.593 *** (0.223) | 2.589 *** (0.219) | |

| 0.084 (0.065) | 0.061 0.067 | 0.125 * (0.65) | 0.119 * (0.069) | −0.048 (0.110) | −0.046 (0.108) | 0.056 (0.115) | 0.046 (0.113) | |

| 0.750 *** (0.055) | 0.792 *** (0.054) | 0.793 *** (0.054) | 0.845 *** (0.054) | 1.148 *** (0.073) | 1.156 *** (0.072) | 1.269 *** (0.084) | 1.260 *** (0.082) | |

| −0.009 *** (0.002) | −0.009 *** (0.002) | −0.014 *** (0.004) | −0.012 ** (0.004) | |||||

| 0.276 *** (0.066) | 0.273 *** (0.067) | 0.431 *** (0.123) | 0.381 *** (0.123) | |||||

| CONSTANT | −0.722 (0.400) | −1.089 (0.425) | −1.060 (0.399) | −1.396 (0.422) | −2.010 (0.609) | −1.598 (0.610) | −2.527 (0.637) | −2.119 (0.645) |

| Diagnostics | R2 (Adj): 0.960 S.E.R: 0.242 F: 665.454 Prob. 0.000 | R2 (Adj): 0.962 S.E.R: 0.234 F: 578.224 Prob. 0.000 | R2 (Adj): 0.961 S.E.R: 0.237 F: 642.930 Prob. 0.000 | R2 (Adj): 0.963 S.E.R: 0.230 F: 577.343 Prob. 0.000 | R2 (Adj): 0.963 S.E.R: 0.230 F: 577.343 Prob. 0.000 | R2 (Adj): 0.958 S.E.R: 0.254 F: 603.260 Prob. 0.000 | R2 (Adj): 0.955 S.E.R: 0.262 F: 604.639 Prob. 0.000 | R2 (Adj): 0.956 S.E.R: 0.257 F: 590.857 Prob. 0.000 |

| “Null Hypothesis (HO)” | Zbar-Stat. | Prob. |

|---|---|---|

| to | 4.255 *** | 2 × 10−5 |

| to | 1.592 | 0.1113 |

| to | −1.235 | 0.2166 |

| to | 2.750 *** | 0.0059 |

| to | 0.228 | 0.8194 |

| to | 1.575 | 0.1150 |

| to | −0.777 | 0.4368 |

| to | 4.412 *** | 1 × 10−5 |

| to | −0.889 | 0.3739 |

| to | 0.768 | 0.4424 |

| to | −0.240 | 0.8096 |

| to | 2.392 ** | 0.0167 |

| to | 1.377 | 0.1684 |

| to | 0.321 | 0.7479 |

| to | 1.546 | 0.1219 |

| to | 0.190 | 0.8493 |

| to | 2.275 ** | 0.0229 |

| to | 7.042 *** | 2 × 10−12 |

| to | −1.294 | 0.1953 |

| to | 0.717 | 0.4729 |

| to | 4.313 *** | 2×10−5 |

| to | 3.990 *** | 7×10-5 |

| to | 1.302 | 0.1927 |

| to | 2.617 *** | 0.0088 |

| to | 0.645 | 0.5187 |

| to | 6.573 *** | 5 × 10−11 |

| to | −0.432 | 0.6651 |

| to | −0.650 | 0.5151 |

| to | −0.518 | 0.6043 |

| to | 0.378 | 0.7051 |

| to | 0.907 | 0.3640 |

| to | 3.482 *** | 0.0005 |

| to | 1.646 * | 0.0997 |

| to | 2.890 *** | 0.0038 |

| to | 2.139 ** | 0.0324 |

| to | 1.477 | 0.1396 |

| to | 1.829 * | 0.0673 |

| to | 1.529 | 0.1261 |

| to | 0.104 | 0.9171 |

| to | 0.392 | 0.6946 |

| to | 0.699 | 0.4840 |

| to | −0.257 | 0.7971 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alsabhan, T.H.; Tahir, M.; Burki, U.; Abuhulaibah, T.F.; Alnahedh, Z.K.; Jaboob, M. International Tourism and Economic Growth: Exploring the Unexplored for the ASEAN Region. Economies 2025, 13, 291. https://doi.org/10.3390/economies13100291

Alsabhan TH, Tahir M, Burki U, Abuhulaibah TF, Alnahedh ZK, Jaboob M. International Tourism and Economic Growth: Exploring the Unexplored for the ASEAN Region. Economies. 2025; 13(10):291. https://doi.org/10.3390/economies13100291

Chicago/Turabian StyleAlsabhan, Talal H., Muhammad Tahir, Umar Burki, Talal F. Abuhulaibah, Zeyad K. Alnahedh, and Mohammad Jaboob. 2025. "International Tourism and Economic Growth: Exploring the Unexplored for the ASEAN Region" Economies 13, no. 10: 291. https://doi.org/10.3390/economies13100291

APA StyleAlsabhan, T. H., Tahir, M., Burki, U., Abuhulaibah, T. F., Alnahedh, Z. K., & Jaboob, M. (2025). International Tourism and Economic Growth: Exploring the Unexplored for the ASEAN Region. Economies, 13(10), 291. https://doi.org/10.3390/economies13100291