Abstract

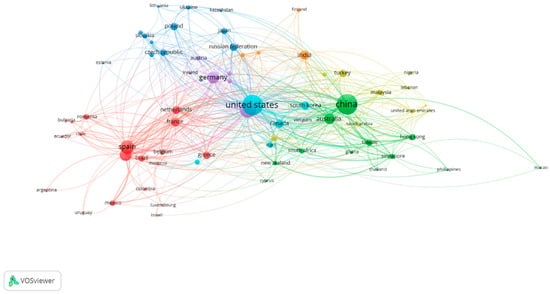

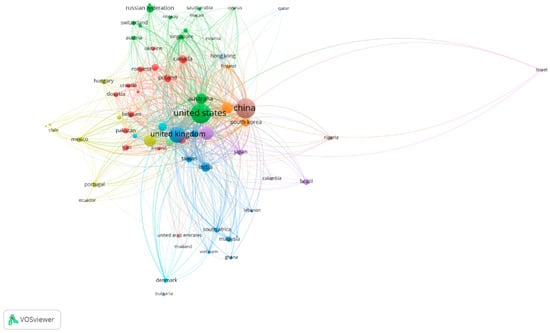

This study presents a bibliometric and thematic analysis of economic convergence analysis from 1982 to 2025, based on a corpus of 2924 Scopus-indexed articles. Using VOSviewer and the bibliometrix R package, this research maps the field’s intellectual structure, identifying five main thematic clusters: (1) formal statistical models, (2) institutional-contextual approaches, (3) theoretical–statistical foundations, (4) nonlinear historical dynamics, and (5) normative and policy assessments. These reflect a shift from descriptive to explanatory and prescriptive frameworks, with growing integration of sustainability, spatial analysis, and institutional factors. The most productive journals include Journal of Econometrics (121 articles), Applied Economics (117), and Journal of Cleaner Production (81), while seminal contributions by Quah, Im et al., and Levin et al. anchor the co-citation network. International collaboration is significant, with 25.99% of publications involving cross-country co-authorship, particularly in European and North American networks. The field has grown at a compound annual rate of 14.4%, accelerating after 2000 and peaking in 2022–2024, indicating sustained academic interest. These findings highlight the maturation of convergence analysis as a multidisciplinary domain. Practically, this study underscores the value of composite indicators and spatial econometric models for monitoring regional, environmental, and technological convergence—offering policymakers tools for inclusive growth, climate resilience, and innovation strategies. Moreover, the emergence of clusters around sustainability and digital transformation reveals fertile ground for future research at the intersection of transitions in energy, digital, and institutional domains and sustainable development (a broader sense of structural change).

1. Introduction

The study of economic convergence has its theoretical foundations in the neoclassical growth model of Solow (1956) and the empirical frameworks developed by Barro and Sala-i-Martin (1992), which established the conditions under which poorer economies tend to grow faster than richer ones, closing income gaps over time. These foundational theories, centered on the concepts of absolute and conditional convergence, have shaped decades of research on structural adjustment and development dynamics. However, the field has since evolved beyond its original econometric and growth theory roots, expanding into institutional, spatial, technological, and sustainability-oriented domains—a transformation that has not yet been systematically mapped.

The economic convergence analysis has gained increasing importance today due to the profound structural, technological, social, and environmental transformations faced by economies and territories within a global context characterized by interdependence, technological disruption, pressure on natural resources, and new sustainable development challenges. Within this framework, convergence is not merely a technical–economic phenomenon but a critical category for evaluating the effectiveness of public policies, compliance with international commitments, and progress toward scenarios of greater equity, resilience, and regional integration (Agovino et al., 2021; M. Ahmad & Law, 2024; Akram et al., 2023; Maza & Villaverde, 2009a, 2009b, 2011).

Despite the extensive literature on convergence, a significant gap remains: most studies focus on isolated methodological approaches or specific thematic domains, lacking a comprehensive, integrative bibliometric and thematic mapping that captures the full intellectual structure and evolutionary trajectory of the field, particularly in the 2015–2025 period. Previous reviews have not systematically combined quantitative network analysis with qualitative content synthesis to identify emerging clusters, influential contributions, and underexplored research frontiers. This study addresses that gap by offering a holistic, up-to-date analysis that integrates bibliometric rigor with thematic depth, thereby providing a structured overview of how the field has evolved conceptually, methodologically, and geographically.

The theoretical body developed around convergence analysis during the 2015–2025 period draws upon classical frameworks such as those formulated by Barro and Sala-i-Martin (1992) and Sala-i-Martin (1994), as well as their subsequent developments (Sala-i-Martin, 1996, 2006), while also incorporating substantial methodological advancements. Contemporary studies, beyond examining the empirical existence of convergence, have expanded their scope to include the identification of structural and contingent mechanisms that determine it, as well as its interaction with institutional, spatial, institutional development, and sectoral integration.

This thematic breadth is accompanied by a richer conceptualization that distinguishes various forms of convergence: absolute, conditional, club-based or subgroup convergence, as well as spatial and temporal convergence. Moreover, the notion of convergence as an indicator of systemic efficiency has been introduced, interpreting it as a sign of collective improvement in the performance of analyzed systems, without necessarily assuming an equitable distribution of the benefits (Ab-Rahim et al., 2018; N. Ahmad et al., 2019; Akram et al., 2023; Alataş, 2023).

From an epistemological perspective, convergence analysis is framed within a relational and evolutionary approach. It is relational because it does not examine the attributes of a unit in absolute terms, but rather in terms of its comparative evolution relative to others. It is also evolutionary, as the focus is not solely on static levels, but on cumulative change processes and structural adaptation over time (Adeeko et al., 2023; Aghion & Jaravel, 2015).

Hence, convergence is closely linked to concepts such as organizational learning, technology transfer, institutional integration, regulatory harmonization, and territorial cohesion (Aaldering et al., 2019; M. Ahmad & Law, 2024). At a more abstract level, convergence can be understood as an emergent property of complex adaptive systems, in which multiple agents interact, learn, and adjust their behavior based on shared signals, thereby generating progressive patterns of alignment over time. Within this framework, the concept of convergence connects to dynamics such as coevolution, synchronization, systemic resilience, and adaptive feedback (Agovino et al., 2021; M. Ahmad & Law, 2024).

In this regard, economic convergence studies not only provide valuable insights for the academic understanding of structural adjustment processes but also offer a rigorous empirical foundation for the design of strategies aimed at reducing territorial or sectoral disparities (Hi, 2020; Hryhorkiv et al., 2017; Jadhav, 2023; Ud Din et al., 2023). The utility of convergence analysis lies precisely in its potential to generate actionable knowledge for decision-making in areas such as regional planning, public policy design, and the assessment of structural reforms.

Moreover, convergence analysis is vital for monitoring the distributive effects of contemporary structural transitions. In the context of the energy transition, digitalization, and the implementation of the Sustainable Development Goals (SDGs), convergence allows for the assessment of whether the benefits of these processes are being shared equitably or whether “multiple trajectories” are emerging, where only certain groups, regions, or sectors capture the gains from change (Agovino et al., 2021; Akhtar et al., 2024; Akram et al., 2024).

Convergence analysis acquires strategic value within the sustainability and resilience agenda. In a world marked by increasing asymmetries of power, technology access, and exposure to global risks, studying convergence enables the projection of future scenarios of cohesion or fragmentation, integration or polarization, and shared prosperity or exclusionary growth. Evaluating whether territories and sectors are approaching minimum desirable levels of well-being, efficiency, or sustainability is no longer merely a descriptive exercise but a prerequisite for designing inclusive, sustainable, and adaptive pathways (Dhaigude et al., 2025; M. Hu et al., 2025; Navarro Claro & Bayona Soto, 2025).

In terms of its current relevance, convergence analysis offers an appropriate framework to address critical questions regarding territorial justice, intertemporal equity, resilience to crises, and the distributive effectiveness of public policies. In the context of structural transitions such as digitalization, decarbonization, or the achievement of the SDGs, assessing the presence or absence of convergence becomes a normative criterion to judge the inclusive or exclusionary nature of these transformations (Eleftheriou et al., 2024; Goto & Sueyoshi, 2023).

Unlike previous reviews of convergence studies, this paper makes a distinctive contribution in three complementary dimensions. First, the temporal scope spans more than four decades (1982–2025), which allows us to trace both the foundational roots of the literature and the most recent developments related to sustainability, digitalization, and the energy transition. Second, the methodological integration combines advanced bibliometric tools (VOSviewer version 1.6.20, bibliometrix package in R version 4.4.3) with a systematic qualitative analysis of thematic clusters, ensuring not only the identification of citation patterns but also the substantive interpretation of underlying theoretical and methodological frameworks. Third, the study adopts an explicit orientation toward economic policy and sustainable development, showing how bibliometric findings translate into strategic implications for public policy design, territorial cohesion, and resilience to global crises.

This threefold contribution positions the article as an integrative effort that goes beyond the fragmentation of earlier reviews, by simultaneously providing a comprehensive map of intellectual evolution, a rigorous methodological characterization, and a normative connection to contemporary challenges of equity and sustainability. In this way, the research consolidates convergence analysis as a tool not only for academic inquiry but also for strategic policy formulation in the twenty-first century.

Against this backdrop, the present study aims to conduct a comprehensive and systematic analysis of recent literature on convergence analysis, with the goal of constructing a robust theoretical framework for understanding its foundations, applications, and current challenges. This review seeks to identify the main conceptual and methodological contributions in the field, as well as to detect underexplored areas requiring further attention. By integrating theoretical and empirical perspectives, the study intends to offer a meaningful contribution to the specialized literature, providing analytical inputs useful for both the development of new research and the design of evidence-based policies. Specifically, the objectives are: (1) to map the intellectual structure of the field through bibliometric analysis; (2) to identify dominant thematic clusters and their evolution; (3) to highlight the role of technological, institutional, and policy dimensions in shaping convergence research; and (4) to propose future research directions grounded in the identified gaps.

In this sense, understanding and managing convergence processes becomes an essential competence for designing effective responses to the challenges of the 21st century (Celati, 2023; F. Fan et al., 2025; Koutsougeras & Meo, 2018; T. Nguyen et al., 2024; Pattinson & Woodside, 2007).

The remainder of this paper is structured as follows. Section 2 presents a comprehensive literature review aligned with our first two research objectives. It examines the conceptual foundations of convergence analysis (Section 2.1), evaluates its relevance to structural transitions toward sustainability and equity (Section 2.2), analyzes methodological approaches and their applications (Section 2.3), and positions convergence as a strategic analytical category for policy design (Section 2.4). Building on this theoretical foundation, Section 3 outlines our mixed-methods bibliometric approach to mapping the intellectual structure of the field and identifying key thematic clusters. Section 4 presents empirical findings, while Section 5 discusses their implications and outlines future research directions. Finally, Section 6 offers concluding reflections that connect our methodological and theoretical contributions to the broader normative challenges of designing inclusive pathways in the twenty-first century. This structure supports our aim of bridging the gap between empirical insights and their strategic application to equity and sustainability.

2. Literature Review

Convergence analysis has emerged as a key tool for understanding adjustment dynamics among economies, sectors, or regions in their development trajectories. In general terms, convergence refers to the process through which units of analysis—whether countries, regions, industries, or other aggregates—tend to reduce disparities in income levels, productivity, infrastructure, or environmental indicators, moving toward a common steady state or a set of equilibria (Akram et al., 2023; Alataş, 2023). The relevance of the concept has transcended the traditional focus exclusively on per capita income, expanding into domains such as carbon emissions (Akram et al., 2024; Tang et al., 2025; Zhong et al., 2025), social public spending (Akram et al., 2023; Mishra et al., 2020; Onaran et al., 2022b), and energy efficiency (Alataş et al., 2021; D. Fan et al., 2024; Hou et al., 2024).

2.1. Conceptualizing Convergence Analysis

The concept of convergence has gained a central position in economic analysis—as well as in other social and environmental disciplines—as a theoretical and empirical framework for evaluating the evolution of disparities among heterogeneous units over time. Its most classical formulation originates in the field of economic growth, where it is posited that, under certain assumptions, economies with lower income levels will tend to grow faster than wealthier ones, thereby converging toward a common steady state (Alataş, 2023; Alemu et al., 2024). However, the concept has undergone substantial semantic and methodological expansion in recent decades, leading to its application in structural, social, technological, institutional, and environmental contexts (Agovino et al., 2021; M. Ahmad & Law, 2024; Akram & Ali, 2022).

In general terms, convergence can be defined as a dynamic process in which observed differences among units—whether countries, regions, sectors, organizations, or individuals—tend to diminish over time with respect to a specific attribute or set of attributes. This implies a trajectory of alignment toward a common reference pattern or a shared pathway (Ab-Rahim et al., 2018; Alataş, 2023). The notion requires a longitudinal and comparative perspective, whereby measuring the relative or absolute distance between units across multiple time periods allows for inferences about structural, institutional, or performance-based alignment trends. Convergence, in this sense, is not a static point but rather a behavioral tendency that may be total, partial, conditional, fragile, or even reversible, depending on the adjustment mechanisms involved (N. Ahmad et al., 2019; Akram et al., 2023).

From an epistemological perspective, convergence analysis is framed within a relational and evolutionary approach. It is relational because it does not examine the attributes of a unit in absolute terms, but rather in terms of its comparative evolution relative to others. It is also evolutionary, as the focus is not solely on static levels, but on cumulative change processes and structural adaptation over time (Adeeko et al., 2023; Aghion & Jaravel, 2015). Hence, convergence is closely linked to concepts such as organizational learning, technology transfer, institutional integration, regulatory harmonization, and territorial cohesion (Aaldering et al., 2019; M. Ahmad & Law, 2024).

Convergence analysis also draws on a plural conceptualization in terms of its forms and categories. Literature traditionally distinguishes between absolute (or unconditional) convergence and conditional convergence. Absolute convergence posits that all units will tend toward the same steady state regardless of their initial conditions, implying strong structural homogeneity among them.

In contrast, conditional convergence acknowledges that units may converge toward their own steady states if they share similar structural characteristics—such as savings rates, levels of human capital, or institutional quality—thus allowing for heterogeneity (Alataş, 2023; Alemu et al., 2024). This distinction not only enables the classification of evolution patterns but also supports theorizing about the structural determinants that facilitate or hinder convergence processes.

Moreover, the notion of convergence can be analyzed at different levels of aggregation. Sigma convergence (σ-convergence) refers to a reduction in the statistical dispersion (variance or standard deviation) among units over time, whereas beta convergence (β-convergence) assesses whether units with lower initial levels of a given attribute exhibit higher growth rates, as an expression of compensatory dynamics (N. Ahmad et al., 2019; Alataş, 2023). Although conceptually related, these two approaches are not equivalent: β-convergence is a necessary but not sufficient condition for σ-convergence, which suggests that adjustment mechanisms do not always lead to an effective narrowing of gaps (Ab-Rahim et al., 2018; Akram et al., 2024).

Another central component in contemporary conceptualization is the notion of club convergence, which posits that not all units converge toward a single equilibrium, but rather that there are subsets that share common adjustment trajectories toward differentiated equilibria. These patterns reflect similarities in productive structures, capital endowments, or institutional conditions (Aboal et al., 2023; Akram & Ali, 2022). This approach acknowledges the existence of multiple equilibria and development paths, thereby expanding the analytical scope of the classical paradigm and aligning with theories of path dependence and capability-driven growth.

To clarify the distinctions among these forms of convergence and their empirical applications, Table 1 synthesizes four principal types identified in the literature: absolute β-convergence, conditional β-convergence, σ-convergence, and club convergence, providing concise definitions, illustrative examples, and key references.

Table 1.

Types of Economic Convergence: Definitions, Examples, and Key References from Literature *.

At a more abstract level, convergence can be understood as an emergent property of complex adaptive systems, in which multiple agents interact, learn, and adjust their behavior based on shared signals, thereby generating progressive patterns of alignment over time. Within this framework, the concept of convergence connects to dynamics such as coevolution, synchronization, systemic resilience, and adaptive feedback (Agovino et al., 2021; M. Ahmad & Law, 2024). Incorporating this complex system’s perspective has led to an expansion of the notion of convergence beyond purely quantitative parameters toward qualitative dimensions such as institutional quality, governance, and shared values.

Convergence, as a concept, represents a versatile and expanding analytical category that enables the capture of directional adjustment processes across units in multiple domains. Its conceptual richness lies in its capacity to describe dynamics of alignment, integration, or synchronization over time, as well as in its cross-cutting applicability across different levels of analysis and types of systems. Consequently, its application requires not only conceptual clarity, but also methodological rigor and a well-defined problematization of the phenomenon under study.

2.2. Contemporary Relevance of Convergence Studies

The study of convergence analysis has gained increasing importance due to the profound structural, technological, social, and environmental transformations faced by economies and territories within a global context marked by interdependence, technological disruption, resource pressures, and sustainable development challenges. Within this framework, convergence is not merely a technical–economic phenomenon but a critical category for evaluating the effectiveness of public policies, compliance with international commitments, and progress toward greater equity, resilience, and regional integration (Agovino et al., 2021; M. Ahmad & Law, 2024; Akram et al., 2023).

A central justification for the current interest in convergence analysis lies in its capacity to detect persistent patterns of structural inequality—both between countries and across regions within the same state. While economic integration, trade liberalization, and technological diffusion are often expected to homogenize productive and institutional capacities, empirical evidence reveals a more complex reality: convergence is neither automatic nor universal. Studies show that gaps in income, human capital, productivity, and infrastructure often persist or even widen, challenging assumptions of automatic equalization (Alataş, 2023; Alemu et al., 2024). For instance, Padilla et al. (2024) document structural heterogeneity and divergence within the European Monetary Union, highlighting the fragility of convergence under asymmetric shocks. This diagnostic function is fundamental for designing cohesion policies, territorial redistribution, and balanced development strategies.

Moreover, convergence analysis is essential for monitoring the distributive effects of contemporary structural transitions. In the context of energy transition, digitalization, and the SDGs, it allows assessment of whether benefits are shared equitably or whether “multiple trajectories” emerge, where only certain groups, regions, or sectors capture the gains from change (Agovino et al., 2021; Akhtar et al., 2024; Akram et al., 2024). This introduces a normative dimension, enabling comparison between principles such as interregional justice, intergenerational equity, and international solidarity, and the actual dynamics observed in the data. At the same time, empirical findings reveal that convergence is often conditional and reversible: Jerzmanowski (2006) and Tyrowicz et al. (2025) show that growth trajectories can shift between regimes, with some economies stagnating in low-growth clubs while others advance rapidly.

Another key contribution of convergence analysis is its explanatory power in understanding differential performance during external shocks—such as financial crises, pandemics, or geopolitical disruptions. Units with similar structural characteristics often exhibit homogeneous responses, reinforcing club convergence patterns and limiting the effectiveness of uniform policy responses (M. Ahmad & Law, 2024; Alexakis et al., 2021). This highlights the need for differentiated strategies tailored to the specific structural gaps of each group, rather than one-size-fits-all interventions.

The contemporary scope of convergence studies has also expanded into diverse non-economic domains. Recent literature applies the concept to carbon emissions (Borozan, 2024; Liu et al., 2025; Zhong et al., 2025), social public spending (Akram et al., 2023; Mishra et al., 2020; Onaran et al., 2022b), energy and material productivity (Alataş et al., 2021; Balado-Naves et al., 2023; Sun et al., 2025), and sectoral efficiency in manufacturing (Adeeko et al., 2023; Lin et al., 2018; Stergiou & Kounetas, 2022). This thematic broadening demonstrates that convergence is no longer confined to per capita income but has become a cross-cutting tool to assess whether desired transformations reach all stakeholders or if exclusionary and lagging dynamics persist. The methodological sophistication of these studies enhances both the scientific relevance of the field and its practical applicability for decision-making.

Convergence analysis thus acquires strategic value within the sustainability and resilience agenda. In a world marked by asymmetries in power, technology access, and exposure to global risks, studying convergence enables the projection of future scenarios—of cohesion or fragmentation, integration or polarization, shared prosperity or exclusionary growth. Evaluating whether territories and sectors are approaching minimum desirable levels of well-being, efficiency, or sustainability is no longer merely descriptive but a prerequisite for designing inclusive, adaptive, and equitable pathways (Dhaigude et al., 2025; Z. Hu et al., 2025; Navarro Claro & Bayona Soto, 2025).

Today, convergence analyses constitute an indispensable approach for examining the equity, effectiveness, and sustainability of contemporary transformations. Their study helps unravel the logic of alignment or structural divergence among social, territorial, and economic units, providing key tools to guide public action toward more balanced, resilient, and inclusive development. However, as the evidence shows, convergence is not a foregone conclusion: it depends on institutional quality, policy design, and structural conditions. Recognizing both its potential and its limitations strengthens the analytical and normative value of the concept in a complex and unequal world.

2.3. Methodological Approach to Convergence Analysis and Its Applications

Convergence analysis has become a versatile methodological approach, grounded in well-established theoretical foundations and supported by a continuously expanding technical repertoire. Its application enables the evaluation of whether multiple units, be they territorial, institutional, sectoral, or functional, tend to reduce their differences regarding one or more variables over time. From a methodological standpoint, convergence analysis is based on the study of dynamic trajectories, the identification of structural adjustment patterns, and the detection of heterogeneous or clustered behaviors. To this end, a variety of quantitative techniques are available that respond to different assumptions, scales of analysis, and inferential objectives (M. Ahmad & Law, 2024; Akhtar et al., 2024; Akram et al., 2024).

Among the most widely used approaches are beta convergence (β-convergence) and sigma convergence (σ-convergence). The former is based on regression models that assess whether there is a negative relationship between the initial level of a variable (e.g., productivity, income, or efficiency) and its subsequent growth rate. A negative slope implies that units with lower initial levels tend to grow faster than more advanced ones, suggesting a tendency to close gaps (N. Ahmad et al., 2019; Alataş, 2023). This approach admits variants: absolute β-convergence assumes structural homogeneity among units, while conditional β-convergence allows for controlling structural factors (human capital, infrastructure, institutional quality), recognizing the existence of differentiated trajectories toward their own equilibria (Alemu et al., 2024; German-Soto & Brock, 2022; Navarro-Chávez et al., 2025).

Sigma convergence (σ-convergence), on the other hand, focuses on the evolution of dispersion among units over time. σ-convergence is considered to exist when the variance or coefficient of variation of a variable systematically decreases, indicating a process of progressive alignment. This approach captures the dynamics of aggregate concentration or dispersion, although it may not always reflect underlying processes if divergent trajectories exist within subsets (N. Ahmad et al., 2019; Rodríguez Benavides et al., 2022). Therefore, both methodologies are often used complementarily, as β-convergence is a necessary but not sufficient condition for σ-convergence.

In addition to these classical tools, more sophisticated methodologies have been developed, such as stochastic convergence, which examines the stationarity of the difference between trajectories of two or more units, typically through unit root and cointegration tests. This approach evaluates whether gaps tend to revert in the long term, even if temporary shocks occur, reflecting a statistically more robust form of convergence (Afzal & Sibbertsen, 2021; Apergis et al., 2025; N. U. P. Nguyen & Moehrle, 2023). It has been argued that this approach is more suitable when analyzing the persistence of adjustment, as it explicitly incorporates temporal dynamics and short-term effects. To illustrate the methodological evolution from classical to advanced approaches and highlight their respective strengths and limitations, Table 2 provides a comparative overview of key techniques in convergence analysis.

Table 2.

Classical vs. Advanced Methodological Approaches in Convergence Analysis *.

One of the most relevant methodological innovations is the use of the club convergence approach, formally proposed by Phillips and Sul (2007), which allows identifying subsets of units converging toward common trajectories without assuming global homogeneity. This technique is based on decomposing the series into deterministic and stochastic components and applying an iterative algorithm to classify units into groups exhibiting similar convergence patterns (Aboal et al., 2023; Akram & Ali, 2022; Akram et al., 2024). This perspective acknowledges the existence of multiple equilibria, which is especially useful in contexts with strong structural heterogeneity. Club convergence analysis enables the capture of partial convergence dynamics that would be invisible under traditional aggregate-level methods.

The choice of methodological approach depends on factors such as (i) the nature and quality of available data, (ii) the temporal and spatial scale of analysis, (iii) the characteristics of the units under study, and (iv) the type of underlying theoretical hypothesis (adjustment toward a single equilibrium, multiple trajectories, stochastic reversion, etc.) (N. Ahmad et al., 2019; Alataş, 2023; Alataş et al., 2021). Therefore, best methodological practices often involve combining multiple techniques to triangulate results and enhance the internal and external validity of inferences.

Regarding its theoretical applications, the convergence framework has been used to evaluate processes such as technological diffusion, productive efficiency, intersectoral learning, normative harmonization, institutional cohesion, environmental sustainability, and equity in the provision of public goods. From the endogenous growth theory perspective, convergence is interpreted as the result of knowledge externalities, technological spillovers, or heterogeneous absorptive capacities (Balado-Naves et al., 2023; Stergiou & Kounetas, 2022; Zhao et al., 2019). From the institutional economics standpoint, convergence is associated with the diffusion of norms, practices, and regulatory frameworks that induce similar behaviors among heterogeneous agents. Meanwhile, from the sustainable development perspective, it represents a criterion of intertemporal and territorial distributive justice, where all units are expected to reach minimally acceptable levels of economic, social, and ecological performance (Agovino et al., 2021; Ahouangbe & Turcu, 2024).

Convergence analysis constitutes a methodologically sophisticated and conceptually flexible field that enables the investigation of a broad range of theoretical questions concerning dynamic adjustment processes among structurally diverse units. The recent evolution of its techniques has expanded its applicability to environments characterized by high complexity, heterogeneity, and profound transitions, establishing it as a central instrument for comparative empirical analysis across multiple domains.

2.4. Convergence as a Strategic Analytical Category

Based on the preceding review, it can be affirmed that convergence analysis has consolidated itself as a strategic analytical category, whose conceptual evolution, contemporary relevance, and methodological sophistication make it a key tool to interpret processes of structural adjustment and differentiation in complex, changing, and heterogeneous contexts. Its theoretical richness lies in its ability to articulate a dynamic view of inequality, development, and integration, while providing solid foundations to evaluate the differential impact of policies, shocks, and global transformations.

Conceptually, convergence has moved beyond its original formulation limited to per capita income, becoming a transversal notion that encompasses multiple dimensions of development—economic, social, institutional, technological, and environmental—allowing the analysis of patterns of alignment or divergence among structurally differentiated units. This expansion has been accompanied by explicit recognition of heterogeneous trajectories, the existence of multiple equilibria, and the importance of conditioning factors that shape the speed, depth, and directionality of convergence processes (Ahouangbe & Turcu, 2024; Alataş, 2023).

In terms of its current relevance, convergence analysis offers an appropriate framework to address critical questions regarding territorial justice, intertemporal equity, resilience to crises, and the distributive effectiveness of public policies. In the context of structural transitions such as digitalization, decarbonization, or the achievement of the SDGs, assessing the presence or absence of convergence becomes a normative criterion to judge the inclusive or exclusionary nature of these transformations (Eleftheriou et al., 2024; Goto & Sueyoshi, 2023; Z. Hu et al., 2025; Lyulyov et al., 2024). It also enables empirical measurement of persistent asymmetries that limit the potential for integration and functional interdependence among economic, social, or institutional units.

Methodologically, the field has advanced toward a robust set of quantitative tools capable of capturing the dynamic, nonlinear, and fragmented nature of observed processes. Techniques such as β-convergence, σ-convergence, stochastic analysis, and convergence clubs provide different approaches which, when used integratively, allow for a nuanced understanding of development trajectories and their determinants. This methodological progress has strengthened the approach’s adaptability across various scales, domains, and empirical conditions, favoring its applicability in multiple fields of knowledge (M. Ahmad & Law, 2024; Akram et al., 2024).

However, this theoretical and methodological consolidation is not without challenges. Identifying convergence processes require consistent longitudinal data, which is not always available across certain thematic domains or units of analysis. Likewise, the interpretation of convergence must avoid deterministic simplifications: the existence of statistical patterns of convergence does not, by itself, imply structural improvement or social welfare, and may be influenced by regressive processes or regression to the mean effects. Therefore, it is essential to combine quantitative analysis with solid theoretical and contextual problematization to interpret findings within appropriate explanatory frameworks (Afzal & Sibbertsen, 2021; M. Ahmad & Law, 2024).

To ensure its strategic value, convergence analysis must be applied with careful attention to real-world policy contexts and potential misinterpretations. It has informed key initiatives such as the European Union’s Cohesion Policy, where diagnostics of income and productivity convergence guide the allocation of structural funds to lagging regions (Aboal et al., 2023; Padilla et al., 2024), and climate governance frameworks, where convergence in per capita emissions underpins equity-based burden-sharing agreements (Akram et al., 2024; Borozan, 2024).

However, these applications require critical awareness: β-convergence does not imply equitable development if growth occurs from a low base, and σ-convergence may mask a general decline rather than true improvement. Club convergence patterns, while empirically robust (Aboal et al., 2023; Tyrowicz et al., 2025), can reflect structural exclusion rather than successful adjustment. Moreover, spatial spillovers and omitted variables may generate spurious convergence signals (Balado-Naves et al., 2023; Zoltán & Imre, 2024). Therefore, while convergence remains a powerful analytical lens, its results must be interpreted alongside complementary indicators of sustainability, equity, and institutional quality to avoid policy pitfalls.

Ultimately, convergence analysis today represents a first-order analytical tool for applied social research, territorial diagnosis, and the design of structural policies. Its capacity to reveal patterns of adjustment or divergence across multiple dimensions and levels offers a powerful lens to understand contemporary transformations and their distributive effects. Consequently, its integration into comparative studies, policy evaluations, and planning strategies constitutes not only a methodological option but an epistemic imperative considering the growing need to build more equitable, resilient, and sustainable development trajectories.

3. Methodology

This study adopts a mixed-methods approach combining quantitative bibliometric analysis and qualitative thematic mapping, aimed at examining the conceptual evolution, emerging trends, and gaps in the academic literature on economic convergence analysis. The methodological strategy is structured following the recommendations of Donthu et al. (2021) and Öztürk et al. (2024), integrating automated scientific mining tools with interpretative procedures to ensure a comprehensive and systematic understanding of the field.

Data collection was conducted through the Scopus database, selected for its broad coverage of economic and social sciences as well as its capacity to incorporate standardized bibliometric indicators. The search strategy was designed using Boolean operators and specific filters to ensure thematic, disciplinary, documental, and linguistic relevance. The areas of interest were limited to the categories of Economics (ECON) and Business (BUSI), and only peer-reviewed articles published between 1982 and 2026, written in English, were included. Search terms were carefully selected to capture studies related to economic convergence analysis, growth, productivity, and econometric methods. Detailed search parameters are presented in Table 3.

Table 3.

Bibliographic Search Strategy.

The Scopus database was selected as the primary source for bibliographic data due to its extensive coverage of peer-reviewed literature in economics and business, its robust integration of citation metrics, and its advanced application programming interface (API) for automated data retrieval and analysis. Scopus offers broader inclusion of non-English journals and a more comprehensive representation of research output from emerging economies compared to Web of Science, making it particularly suitable for studies aiming to capture global scientific trends (Donthu et al., 2021; Öztürk et al., 2024). Furthermore, its consistent indexing of author affiliations and institutional data enhances the accuracy of collaboration and productivity analyses.

The resulting corpus was processed using specialized scientific analysis tools. VOSviewer software was employed to visualize co-citation networks, keyword co-occurrence, and thematic clustering maps. This tool enabled a graphical representation of the conceptual structure of the field and the detection of relevant scientific communities through modularity algorithms. Additionally, the R 4.4.2 programming language was used along with the bibliometrix, igraph, and tm packages to perform statistical analysis, text mining, and graphical representation of bibliometric indicators.

The analysis was conducted in three phases. First, automated filters were applied alongside a manual review based on a 20% random sample of the final dataset of 2924 peer-reviewed articles on economic convergence analysis to ensure the thematic relevance of the selected documents. Two researchers conducted cross-validation to confirm the consistency of the inclusion criteria. Second, a quantitative analysis was carried out to extract bibliometric indicators. Author, country, and institutional productivity were measured, along with cumulative citations (with an average of 34.06 per document) and collaboration dynamics, revealing that 25.99% of the documents involved international co-authorship. Thematic clusters were identified using community detection algorithms in VOSviewer, enabling a structural mapping of the field based on keyword co-occurrence and citation linkages.

Finally, a qualitative interpretation was conducted to label and characterize the algorithmically generated clusters. This process—referred to as “systematic coding” in the original description—consisted of analyzing the most frequent and central keywords, as well as the titles, abstracts, and theoretical frameworks of the most representative and highly cited documents within each cluster. Two researchers independently reviewed these elements to assign coherent thematic labels (e.g., “formal statistical models”, “institutional-contextual approaches”) based on recurring concepts, methodologies, and application domains. Discrepancies were resolved through discussion and consensus. This interpretive phase allowed for the integration of bibliometric results with thematic insights, reinforcing the identification of recurrent patterns, consolidated research lines, and emerging gaps, while ensuring transparency and replicability in the labeling process.

The validity of the process was ensured through cross-review between researchers and the use of automated tools that reduce human variability in data processing. To enhance the transparency and replicability of this study, a structured summary of the methodological approach is presented below (see Table 4).

Table 4.

Summary of the methodological approach *.

The methodological design of this study combines quantitative rigor with qualitative depth, allowing for a comprehensive exploration of the intellectual landscape surrounding economic convergence analysis. By integrating advanced bibliometric techniques with systematic content interpretation, the approach ensures both analytical robustness and thematic relevance. The following section presents the main empirical findings, organized around the structural patterns, emerging trends, and conceptual gaps identified in the literature.

4. Results

The findings presented below arise from a comprehensive analysis of the compiled bibliographic corpus, reflecting both the structural evolution of the field of economic convergence analysis and the thematic and collaborative dynamics that shape it. First, quantitative results obtained through bibliometric techniques are shown, followed by a qualitative interpretation of the identified patterns. This section offers insight not only into the intensity and distribution of the generated knowledge but also into the predominant conceptual frameworks and emerging theoretical gaps revealed by the analysis.

4.1. Temporal Evolution of Scientific Production

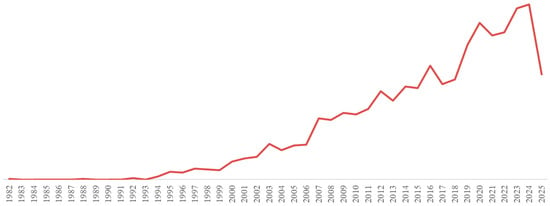

The annual progression of publications related to the subject under study reveals a pattern of steady growth in academic attention to the topic. Although the earliest records date back to 1982, production during the first two decades was sparse and sporadic, rarely exceeding 10 articles per year until the mid-1990s. From 1995 onwards, a more sustained upward trend is evident, with gradual increases in the number of publications annually. This growth intensifies from the year 2000, marking an inflection point that leads to continuous expansion. Between 1982 and 2024, the annual volume of publications grew at an approximate compound annual growth rate (CAGR) of 14.4%, reflecting the notable dynamism in the consolidation of the field (see Figure 1).

Figure 1.

Annual evolution of publications related to the subject of study (1982–2025). Scientific output on economic convergence has grown at a compound annual rate of 14.4% since 2000, signaling sustained consolidation and rising global interest in the field. Note: The drop in 2025 reflects the database cutoff date; data for the full year were not yet available at the time of analysis.

Between 2000 and 2010, scientific output multiplied, increasing from 23 articles in 2000 to 84 in 2010. This expansion continued into the following decade, reaching its highest point in the 2022–2024 period, with over 220 publications annually. Notably, 2024 recorded the highest number across the entire analyzed timeframe (226 articles), reflecting growing interest from the scientific community, driven by the consolidation of the field, advances in new analytical methodologies, and the intersection with emerging research topics. It is worth noting that although 2025 shows a decline compared to the previous year (136 articles), this drop can be attributed to the cutoff timing of the database used, as the current year had not yet concluded at the time of analysis. Overall, the data demonstrates a sustained consolidation of the topic as a significant area within international scientific production.

4.2. Journals with the Highest Publication Volume

The analysis of source journals reveals a high concentration of articles within a limited set of specialized journals, suggesting the existence of established scientific dissemination hubs centered on the study topic. In total, the ten most productive journals account for over 25% of the articles identified in the database, reflecting both thematic specialization and the field’s relevance within certain academic communities (see Table 5).

Table 5.

Top Ten Journals by Number of Publications on the Topic *.

Leading the list is the Journal of Econometrics with 121 publications, representing 4.14% of the total sample. It is followed by Applied Economics (4.00%) and Journal of Cleaner Production (2.77%), the latter reflects an interdisciplinary focus linking economics with sustainability and environmental issues. Applied-oriented journals such as Energy Economics (2.74%) and Applied Economics Letters (2.39%) also stand out, highlighting the growing interest in quantitative approaches to contemporary economic challenges. Meanwhile, publications like Technological Forecasting and Social Change and Knowledge-Based Systems demonstrate the field’s expansion toward prospective and computational intelligence-based perspectives. This diversity suggests an increasing convergence among economic, technological, and social disciplines in addressing the phenomena under study.

The Herfindahl-Hirschman Index (HHI), calculated based on the distribution of 2924 articles across 739 journals, yields a value of approximately 1250, indicating a low concentration level in scientific production. The top 10 journals account for 20.01% of all articles, while the top 30 journals represent 39.06%, suggesting moderate inequality in distribution. This pattern aligns with Lotka’s Law, characterized by a long tail where a few journals produce many articles and many journals publish only sporadically. Collectively, the analyses reveal a typical dynamic of complex bibliometric systems: a relatively small minority of journals dominate quantitatively, while the vast majority contribute marginally, evidencing a balance between specialization and diversification in scientific communication.

The dominance of journals such as Journal of Econometrics, Applied Economics, and Empirical Economics reflects the enduring centrality of rigorous econometric and panel data methodologies in convergence analysis, particularly in testing for β-convergence, club convergence, and stochastic stationarity. These journals serve as natural outlets for methodological innovation, which remains a core driver of the field’s evolution. At the same time, the strong presence of Journal of Cleaner Production, Energy Economics, and Technological Forecasting and Social Change signals a significant thematic shift: convergence research is increasingly embedded in sustainability science, energy transitions, and long-term socio-technical forecasting.

This expansion aligns with global policy agendas such as the SDGs and the European Green Deal, which incentivize research on equitable and environmentally sustainable development. Furthermore, the inclusion of journals focused on computational intelligence (Knowledge-Based Systems) and nonlinear dynamics (Nonlinear Analysis: Real World Applications) highlights the field’s embrace of advanced modeling techniques to capture complex, heterogeneous adjustment processes. Together, these patterns suggest that the journal ecosystem mirrors the intellectual trajectory of the field itself: from a narrow focus on income dynamics to a multidisciplinary domain where economic convergence is analyzed in tandem with environmental performance, technological diffusion, and institutional resilience.

4.3. Most Prolific Authors in Literature on the Topic

In terms of individual productivity, there is a significant concentration of publications within a small group of authors, indicating the presence of a well-established research community focused on the topic. For this analysis, only those authors who have published more than 10 articles on the subject were considered, focusing attention on those who have demonstrated sustained and relevant output. As shown in Table 6, the author Wang Y leads with a total of 33 articles, followed by Wang X (17), Phillips PCB (13), and a group of authors with between 11 and 12 publications, among whom Li Y, Wang Z, Zhang H, Li X, Zhang J, Zhang L, Zhang X, Zhang Y, Zhang Z, and Chen Y stand out.

Table 6.

Most prolific authors on the topic (more than 10 articles) *.

As shown in the table, the recurrence of certain surnames, particularly of Chinese origin, such as Wang, Zhang, and Li, suggests a strong presence of authors affiliated with Asian institutions, especially those based in China, in the scientific production on the topic. However, it should be noted that the presence of homonyms may affect the accuracy of the count, which is a common limitation in automated bibliometric analyses.

The pronounced presence of authors with Chinese surnames—particularly Wang, Zhang, and Li—reflects a broader trend of increasing scientific leadership from China in applied econometrics and regional development research. This geographic concentration is likely driven by national research priorities in economic restructuring, regional equity, and innovation-driven growth, which align closely with the core themes of convergence analysis. Institutions in China have heavily invested in studies of urban-rural disparities, energy efficiency convergence, and industry-university-research collaboration—topics that dominate recent publications.

At the same time, the sustained contribution of Western scholars like Phillips PCB highlights the continued influence of methodological innovation from established academic centers, particularly in the development of club convergence and distribution dynamics techniques. Together, these patterns suggest a dual engine of scientific production: one rooted in policy-driven research from emerging economies, and another in theoretical and statistical advancement from long-standing research hubs. This dynamic underscore the field’s evolution into a globally distributed, yet thematically cohesive, area of study.

4.4. Co-Citation Analysis Among Authors

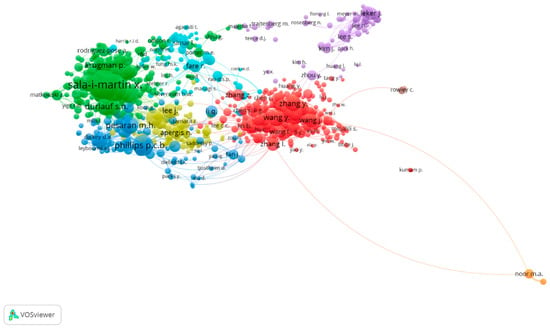

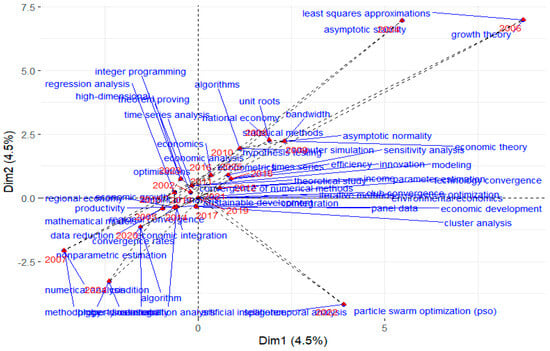

The examined database records a total of 1000 authors organized into eight clusters generated using VOSviewer software (see Figure 2).

Figure 2.

Co-citation Map. Eight co-citation clusters reveal the field’s intellectual structure, with the two main clusters—centered on seminal works on panel unit roots and convergence clubs (Im et al., 2003; Quah, 1996)—accounting for 63.8% of authors and showing strong thematic polarization.

The distribution shows a high concentration within the first two clusters: Cluster 1 accounts for 33.6% of all authors, while Cluster 2 includes 30.2%. Together, these two groups encompass nearly two-thirds of all authors connected through co-citations, indicating a strong thematic or citation-based polarization. Clusters 3, 4, and 5 exhibit moderate participation, with proportions ranging between 8.6% and 10.5%, whereas Clusters 6, 7, and 8 represent distinctly minor cores; in particular, Clusters 7 and 8 each account for only 0.2%. This distribution suggests the presence of highly hierarchical structures in the analyzed field, with central communities of authors that are densely interconnected and a peripheral set characterized by lower relational density.

The analysis of the authors grouped in Cluster 1 (red) reveals a significant evolution in the theoretical and methodological approaches to the study of convergence, showing an increasingly broad and sophisticated scope. From a theoretical standpoint, convergence is conceived as a multidimensional phenomenon that transcends the classical focus on per capita income. Recent studies explore its manifestation in diverse domains such as energy productivity, ecological efficiency, technological innovation, institutional development, and sectoral integration. This thematic breadth is accompanied by a richer conceptualization that distinguishes various forms of convergence: absolute, conditional, club-based or subgroup convergence, as well as spatial and temporal convergence. Moreover, the notion of convergence as an indicator of systemic efficiency has been introduced, interpreting it as a sign of collective improvement in the performance of analyzed systems, without necessarily assuming an equitable distribution of the benefits.

In this context, the structural and dynamic determinants of convergence gain centrality, with emphasis on variables such as human capital, productive structure, institutional quality, technological intensity, and demographic configuration. Recent literature tends to integrate explanatory frameworks from endogenous growth theory, institutional theory, and resource economics, while highlighting the importance of externalities and spillover effects—technological, financial, and environmental. Of note is the emergence of the concept of institutional proximity, understood as a key mechanism in generating convergence between units with similar normative structures or governmental capacities, beyond their geographical proximity.

From a methodological perspective, the reviewed works stand out for a notable sophistication in econometric treatment. There is intensive use of nonlinear dynamic models and methods designed to address nonstationary time series, such as log-t estimators, cointegration models with structural breaks, semiparametric and nonparametric approaches, and estimators robust to misspecification errors or cross-sectional dependence. Spatial panel data techniques—such as spatial autoregressive models and Tobit models with regional effects—are frequently employed to capture patterns of heterogeneous convergence. In addition, the identification of convergence clubs through probabilistic classification methods or clustering techniques allows researchers to move beyond the global convergence hypothesis and recognize differentiated trajectories among homogeneous subsets.

Particular attention is devoted to the precise estimation of convergence rates, the development of asymptotic properties of estimators, and validation through Monte Carlo simulations. Several studies combine these tools with machine learning models, neural networks, and high-frequency estimation, enabling them to address empirical challenges stemming from noise, data asynchronicity, or high dimensionality. Finally, a distinctive feature of contemporary literature is the incorporation of spatiotemporal approaches, in which the dynamics of convergence are analyzed simultaneously over time and space using methods such as spatial Markov chains or evolving density kernels. Taken together, these contributions reflect a mature and diversified research agenda that addresses convergence from a comprehensive, flexible, and methodologically rigorous perspective.

The studies grouped within Cluster 3 (dark blue) represent an analytical strand focused on the rigorous formalization of the concept of convergence, with a strong emphasis on statistical consistency, identification of structural assumptions, and robust validation of econometric hypotheses. Unlike the approaches found in Clusters 1 and 2, which are more oriented toward empirical characterization of convergence patterns and contextual or institutional analysis of their determinants, this group is distinguished by a predominantly theoretical and methodological approach aimed at precisely delineating the statistical foundations of the convergence concept and the conditions under which its existence can be asserted.

Theoretically, these works adopt a narrower conceptual framework, defining convergence in terms of stochastic behavior, dynamic equilibrium, or long-term properties of economic processes. There is a clear emphasis on distinguishing between different notions of convergence (such as convergence in mean, in distribution, or in probability) and establishing strong links between these notions and underlying economic growth models. This orientation marks a significant departure from Cluster 1, where convergence was addressed across multiple thematic dimensions, and from Cluster 2, which prioritized contextual and institutional explanations of the phenomenon.

Methodologically, this cluster is characterized by a strong focus on rigorous statistical inference, with intensive use of formal convergence testing methods. Commonly employed techniques include unit root tests, stationarity tests, cointegration techniques, variance tests, and common components decomposition, among others. Many studies pay special attention to model assumption robustness, correction of estimation biases, and the sensitivity of results to different specifications. In contrast to Cluster 1, where applied dynamic models and simulations predominated, and Cluster 2, which leaned more toward adaptive techniques and contextual analyses, concentrates on methodological development per se, aiming to clarify the internal validity of metrics and criteria used to assert convergence.

A distinctive element of this cluster is the systematic attention given to error structure and cross-sectional dependence, as well as the treatment of issues such as non-stationarity and unobserved heterogeneity. This technical focus seeks to improve the quality of empirical inferences, even at the expense of thematic or interpretative diversity. Additionally, there is growing interest in the asymptotic properties of estimators, efficiency under various sampling conditions, and the identification of critical theoretical thresholds for test validity.

Overall, this cluster represents a specialized contribution within the convergence literature, primarily oriented toward strengthening methodological foundations and ensuring consistency in empirical claims through solid statistical architecture. Its divergence from the more applied, institutional, or contextual approaches positions it as a complementary line of work, essential for analytically underpinning the inferences made in other clusters but less focused on the substantive interpretation of the underlying economic and social processes driving convergence.

Cluster 4 (lime green) is characterized by a perspective focused on the interaction between convergence processes and long-term structural dynamics, with particular interest in the analysis of nonlinear trajectories, regime transitions, and endogenous transformations. Unlike Cluster 1, which centers on identifying multiple forms of convergence across different dimensions of development, and Cluster 2, which introduces a critical and institutional approach, this group stands out by linking convergence with historical processes of structural transformation, growth cycles, and technological or institutional transitions. The conceptual framework thus shifts from a static equilibrium view toward a more dynamic understanding, in which convergence is seen as a contingent outcome of evolutionary trajectories subject to ruptures, persistence, and reconfigurations.

From a theoretical standpoint, convergence is approached as a time-dependent, nonlinear, and potentially reversible phenomenon, calling into question the assumptions of stability and uniqueness of long-term equilibrium that predominate in other approaches. References to evolutionary theories, long-term structural transformations, and unbalanced growth are frequently incorporated, alongside notions drawn from comparative institutional economics and complexity theory. Unlike Cluster 3, which emphasizes the statistical formalization of the convergence concept under ideal conditions, Cluster 4 highlights the historicity and contingency of the process, recognizing that trajectories of approximation between units are subject to bifurcations, lock-ins, and path dependence generated by internal or exogenous factors.

Methodologically, this cluster exhibits a clear inclination toward approaches that detect structural breaks, identify multiple trajectories, and model discontinuous change processes. It employs regime-switching models (Markov-switching models), endogenous structural break tests, temporal segmentation techniques, nonlinear conditional convergence models, and local convergence analysis. These tools overcome the homogeneous view of the convergence process and acknowledge the coexistence of divergent dynamics within the same sample or period. In contrast to Cluster 1, which predominantly uses spatial panel models, or Cluster 2, which incorporates adaptive analyses with an institutional focus, this group favors detailed temporal analysis and evaluation of phase transitions without assuming continuity or symmetry in the processes.

Another distinctive characteristic of this cluster is its concern for the temporal validity of results, reflected in extensive use of period-specific sensitivity analyses, rolling estimations, and robust checks against structural shocks. Rather than seeking a global generalization of convergent patterns, it emphasizes the identification of episodes, windows of opportunity, and phases of temporal divergence. This approach captures more precisely the unstable nature of convergence processes, contrasting with the universal pattern search characteristic of Cluster 3.

Cluster 4 offers a unique contribution to the study of convergence by proposing an interpretation centered on structural dynamics, temporal heterogeneity, and the complexity of historical trajectories. In contrast to the more normative, formalist, or structuralist approaches of previous clusters, this group leans toward a processual and contingent understanding of convergence, where patterns of approximation are not an expected regularity, but a possibility conditioned by sectoral transformations and critical transitions over time.

Cluster 5 (purple) is characterized by a strong normative and practical orientation towards evaluating convergence processes, adopting a transversal approach that seeks to link technical analysis with interpretative frameworks in economic policy, sustainability, and inclusive development. Unlike the previous clusters—where agendas focused mainly on empirical estimation, institutional exploration, or statistical validation—this group of studies introduces a marked interest in the normative significance and socioeconomic implications of convergence, situating the analysis within broader debates on equity, welfare, and institutional design.

Theoretically, convergence is conceived not only as an empirical or dynamic property of economic systems but as a desirable goal connected to distributive justice and structural harmonization. This perspective departs from the more neutral or formal conceptualizations found in Clusters 3 and 4, if convergence may signal progress toward collective objectives such as cohesion, resilience, or sustainability. Within this framework, theoretical elements from political economy, development theory, and multilevel governance approaches are integrated, allowing convergence to be viewed as the outcome of both endogenous dynamics and deliberate institutional decisions.

Methodologically, this cluster is distinguished by a plurality of empirical approaches, with deliberate use of composite indicators, synthetic indices, and multidimensional metrics of convergence. Priority is given to incorporating indicators that capture structural and social aspects not directly observed in traditional economic accounting, such as institutional capacities, environmental performance, inclusion, and systemic resilience. Unlike Cluster 1, dominated by highly parameterized dynamic models, or Cluster 3, focused on statistical validity of tests, the works grouped here employ more flexible tools oriented toward comparability, such as normalized scales, multicriteria analysis, and aggregated distance measures. This approach facilitates the representation of complex trajectories across multiple dimensions without requiring rigid econometric structures.

A distinctive element of this cluster is the articulation between quantitative analysis and qualitative or normative interpretation. Empirical results are discussed regarding their relevance for public policy design, evaluation of regional or global targets, and monitoring of multilateral commitments. This contrasts with earlier clusters where the focus was primarily on endogenous system patterns or internal model dynamics. Here, convergence is assumed not only to be observed but also to be promoted, evaluated, and governed, introducing a prescriptive dimension that enriches academic debate while demanding more integrative theoretical frameworks.

Cluster 5 represents a research line that integrates empirical analysis, normative reflection, and strategic orientation, focusing on the practical value of the convergence concept as an evaluative tool and guide for action. In contrast to the more technical–formalist or structuralist orientations of previous clusters, this group proposes a more engaged reading, sensitive to development goals and open to constructing composite indicators that reflect the multiple meanings convergence can assume in contemporary contexts.

Taken together, the eight clusters illustrate complementary but distinct ways of advancing convergence theory. Cluster 1 expands the scope of convergence beyond income toward multidimensional domains, while Cluster 2 emphasizes institutional and contextual determinants, making them mutually reinforcing in linking structural factors with broader applications. In contrast, Cluster 3 narrows the lens to methodological rigor, ensuring the statistical validity of the empirical claims made in Clusters 1 and 2. Cluster 4 introduces a dynamic and historical dimension, highlighting nonlinear trajectories and structural breaks, thereby contrasting with the more equilibrium-oriented perspectives of Clusters 1–3.

Finally, Cluster 5 brings a normative and policy-oriented perspective, translating empirical findings into actionable insights for governance and sustainability. In this sense, the clusters collectively form a layered understanding: Clusters 1 and 2 provide breadth, Cluster 3 guarantees methodological depth, Cluster 4 stresses historical contingency, and Cluster 5 bridges academic analysis with real-world application.

Clusters 6, 7, and 8, although not discussed in depth, represent very small and peripheral author groups (together less than 1% of the network). Their marginal size and low relational density suggest that they do not substantially shape the core of convergence theory. However, they provide niche or emerging perspectives that enrich the intellectual map and may signal potential directions for future specialized inquiry.

4.5. Most Cited Documents at the Global Level

Table 7 presents the five articles that constitute an essential theoretical and methodological foundation for understanding the empirical and analytical evolution of the concept of economic convergence, as they have received the highest number of citations.

Table 7.

The five most cited articles *.

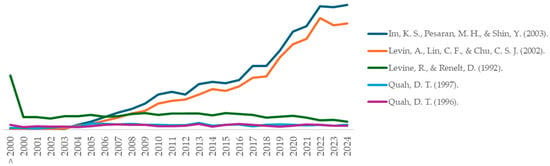

On the one hand, the works of Im et al. (2003) and Levin et al. (2002) provide robust econometric tools for panel time series analysis, which are fundamental for empirically testing the existence of unit roots—a necessary condition to evaluate the stationarity of income trajectories among countries or regions. On the other hand, the articles by Levine and Renelt (1992) and Quah (1996); Quah (1997) explore convergence from the perspective of economic growth, either by questioning the robustness of growth determinants or by proposing new analytical frameworks based on dynamic distributions. This thematic and methodological convergence toward a better understanding of economic convergence partly explains the high citation counts of these works, as they have been foundational both for empirical and theoretical researchers studying income evolution at national, regional, or global levels.

The work by Im et al. (2003) stands out for offering a flexible solution to the problem of heterogeneity in unit root testing for panel data. Their methodological proposal, the IPS test, allows for the analysis of whether time series with diverse individual structures converges toward a common trajectory, overcoming previous limitations that assumed homogeneity in individual dynamics. This tool is particularly useful in economic convergence studies where countries are expected to follow different growth patterns but eventually converge. The method’s high applicability and strong statistical foundation justify its elevated annual citation rate (420.26), making it one of the most widely used instruments to evaluate convergence hypotheses in macroeconomic contexts.

In the same methodological field, the article by Levin et al. (2002) presents an alternative unit root test for panels which, although it imposes homogeneity in temporal persistence, offers analytical advantages in terms of statistical power. Its contribution lies in providing a rigorous methodology to analyze income or per capita GDP series through panel data, a fundamental tool for research aiming to confirm or refute the convergence hypothesis among countries or regions. The LLC test has been widely used due to its ease of implementation and solid asymptotic framework, which explains its considerable number of citations (8160) and methodological influence on subsequent studies.

Meanwhile, Levine and Renelt (1992) adopt a critical approach toward the empirical literature on economic growth, questioning the stability of the determinants traditionally associated with long-term growth. Their sensitivity analysis introduces an essential dimension to the convergence debate: the robustness of correlations between structural variables (such as investment or international trade) and income growth. This work is crucial for understanding that evidence of convergence may depend on empirical model specifications and does not necessarily reflect strong structural relationships. Their approach has been fundamental in designing and evaluating policies aimed at development and convergence, especially in comparative cross-country studies.

Danny Quah’s (1996, 1997) two articles represent a conceptual shift in how economic convergence is approached, moving away from traditional regression models to focus on the dynamic distribution of income. Instead of studying whether growth rates negatively correlate with initial income levels (as in beta convergence), Quah analyzes the evolution of income distribution across countries, identifying patterns of polarization, stratification, and the formation of convergence clubs. His theoretical proposal introduces the concept of “twin peaks,” which describes the persistence of two differentiated groups of countries—rich and poor—thus challenging the global convergence hypothesis. These works have had a significant impact not only on economics but also on related disciplines interested in inequality and development, explaining their lasting academic influence.

The combined influence of these five articles extends beyond their individual contributions. Levine and Renelt (1992) permanently altered the standards of empirical research by introducing robustness checks as a prerequisite for any claim about convergence or growth determinants. Their work forced scholars to confront the fragility of cross-country regressions and created a lasting culture of methodological rigor that continues to guide applied economics today.

Quah’s (1996, 1997) contributions redirected the convergence debate from uniform trajectories to the dynamics of income distributions. His findings on polarization, stratification, and convergence clubs reshaped the analytical agenda, shifting attention toward the persistence of inequality and the conditions that generate heterogeneous growth paths. These insights have influenced not only macroeconomics but also development economics, labor economics, and inequality studies, where the “twin peaks” and club convergence frameworks remain central reference points.

The econometric advances of Levin et al. (2002) and Im et al. (2003) completed this transformation by providing tools capable of testing persistence and heterogeneity in panel data. The LLC and IPS tests became standard instruments in long-term macroeconomic analysis, enabling robust evaluation of hypotheses about convergence, purchasing power parity, and the effects of fiscal and monetary policy. Together, these methodological breakthroughs and conceptual innovations forged a new research paradigm. Current literature on convergence and inequality is built directly upon this legacy, asking not only whether convergence occurs but also how it evolves, which groups participate, and under what institutional or structural conditions it can be sustained.

To better illustrate the enduring influence of these foundational contributions, a timeline chart of their citation trajectories can be included. Such a visualization highlights not only the early reception of each article but also the persistence of their academic impact over time, making clear how methodological and theoretical innovations continue to shape current research agendas (see Figure 3).

Figure 3.

Citation Trajectories of Foundational Works on Economic Convergence. Annual citation trends of the five most influential articles showing the lasting impact of their methodological and theoretical contributions to convergence research (Im et al., 2003; Levin et al., 2002; Levine & Renelt, 1992; Quah, 1996, 1997).

Together, these five articles have become pillars in economic convergence analysis, whether by refining econometric tools or through theoretical frameworks that allow for a more nuanced understanding of growth and global distribution. Their high citation rates respond not only to the technical quality of their contributions but also to their capacity to address key questions about the dynamics of economic development, the persistence of inequalities, and the conditions under which convergence among economies is possible—or not.

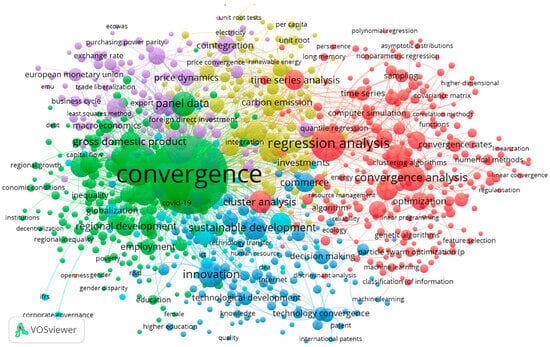

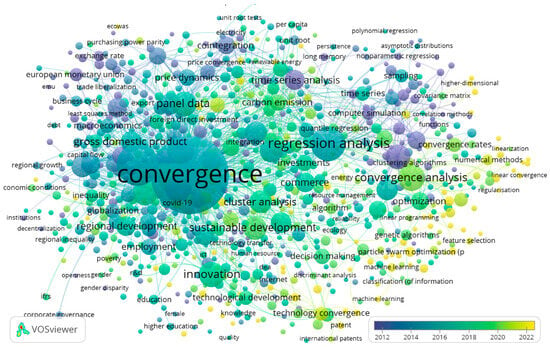

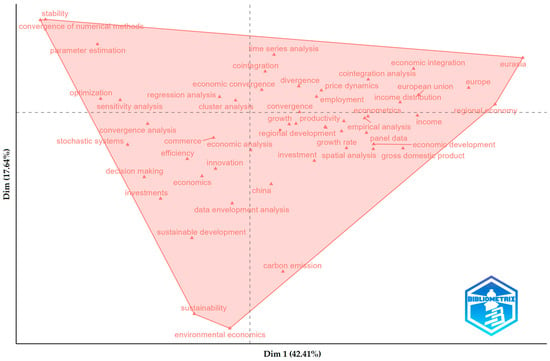

Figure 4 presents a co-occurrence map of keywords obtained through bibliometric analysis, aiming to visualize thematic relationships within the literature on convergence analysis. The map was generated using VOSviewer software, which enables the identification of conceptual clusters based on the frequency and association of key terms used in scientific publications in the field. Different colors represent thematic clusters grouping terms with high co-occurrence, facilitating the exploration of the main research lines and methodological approaches present in the discipline.

Figure 4.

Co-occurrence Map. Six thematic clusters structure the economic convergence literature, from formal models and institutional approaches to sustainability assessments, showing a field that combines methodological rigor with policy and environmental applications. In the figure, the clusters are identified by the following color coding and thematic focus: Cluster 1 (red)—Mathematical and computational foundations; Cluster 2 (green)—Economic and territorial dimensions; Cluster 3 (blue)—Digital transformation and innovation; Cluster 4 (yellow)—Environmental and energy sustainability; Cluster 5 (violet)—Applied econometric analysis; Cluster 6 (light blue)—Economic efficiency and governance.

Cluster 1, shown in red, is characterized by an intensive focus on the mathematical, statistical, and computational foundations of convergence analysis. This thematic group centers around a dense network of terms such as convergence analysis, convergence of numerical methods, optimization, regression analysis, stability, and parameter estimation, reflecting a rigorous methodological orientation aimed at the formalization, simulation, and validation of quantitative models.

Within this cluster, the importance of advanced numerical methods and computational algorithms—such as genetic algorithms, particle swarm optimization, simulated annealing, and machine learning—stands out as key tools for solving complex estimation, prediction, and optimization problems. These techniques are combined with regression, factor analysis, time series analysis, and probability theory to address both model stability and prediction accuracy. Additionally, concepts related to sampling, hypothesis testing, principal component analysis, and sensitivity analysis reinforce the emphasis on experimental design, statistical validation, and robustness of results.

A distinctive feature of this cluster is its interdisciplinary nature, merging applied statistics, econometrics, operations research, and computational science. This is evident in the presence of notions such as computational complexity, deep learning, support vector machines, and neural networks, alongside methods like Monte Carlo simulation and numerical experiments. Together, Cluster 1 represents a core methodological hub for the study of convergence, where formal precision, quantitative analysis, and the use of optimization algorithms are essential pillars for generating robust and replicable empirical evidence.