Is the Nexus between Gender Diversity and Firm Financial Distress Moderated by CEO Duality?

Abstract

1. Introduction

2. Literature Part of the Study

2.1. Board Diversity and Financial Distress

2.2. Effect of Existence of Female Director on Financial Distress

2.3. Moderating Role of CEO Duality

3. Materials and Methods

3.1. Sample Selection and Data

3.2. Variables of the Study

3.3. Econometric Model

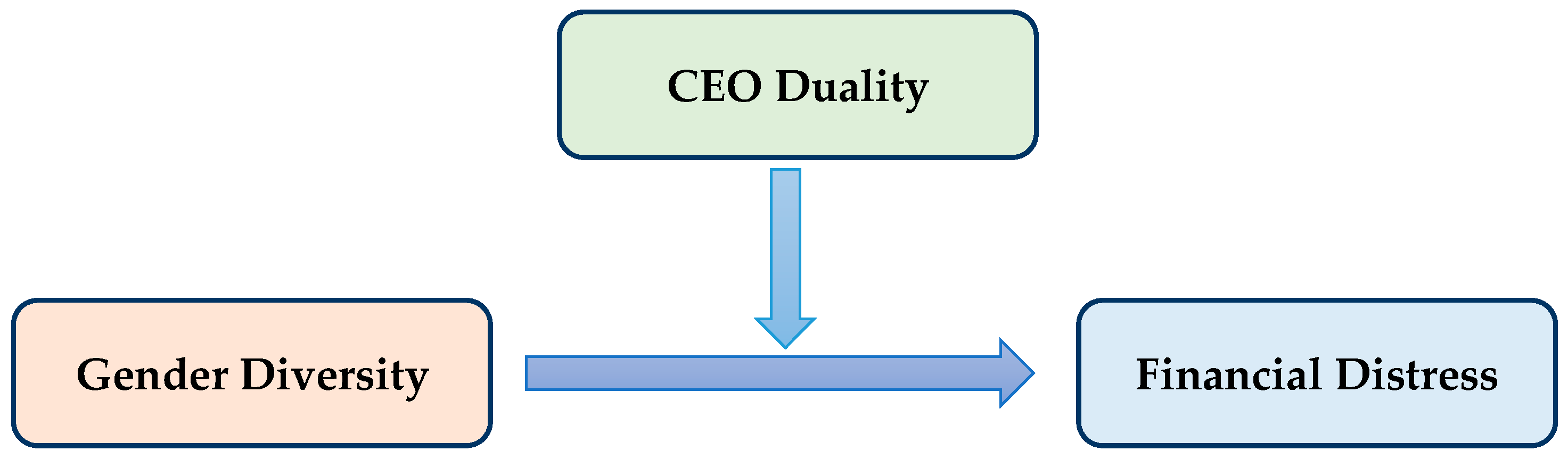

3.4. Conceptual Framework of the Study

4. Results and Discussion

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Results of Regression Analysis

4.4. Diversity, CEO Duality, and FDI

4.5. Moderating Effect of CEOD on the Association

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abbas, Ahmad, and Andi Ayu Frihatni. 2023. Gender diversity and firm performances suffering from financial distress: Evidence from Indonesia. Journal of Capital Markets Studies 7: 91–107. [Google Scholar] [CrossRef]

- Abínzano, Isabel, Lucía Garcés-Galdeano, and Beatriz Martínez. 2024. The role of female directors in family firms’ annual report’ s readability. Baltic Journal of Management 1: 366–84. [Google Scholar] [CrossRef]

- Adams, Renée, and Daniel Ferreira. 2009. Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94: 291–309. [Google Scholar] [CrossRef]

- Ali, Shoukat, Ramiz Ur Rehman, Wang Yuan, Muhammad Ishfaq Ahmad, and Rizwan Ali. 2023. Does foreign institutional ownership mediate the nexus between board diversity and the risk of financial distress? A case of an emerging economy of China. Eurasian Business Review 12: 553–81. [Google Scholar] [CrossRef]

- Altman, Edward. 2007. Global debt markets in 2007: New paradigm or the great credit bubble? Journal of Applied Corporate Finance 19: 17–31. [Google Scholar] [CrossRef]

- Anderson, Ronald C., David M. Reeb, Arun Upadhyay, and Wanli Zhao. 2011. The economics of director heterogeneity. Financial Management 40: 5–38. [Google Scholar] [CrossRef]

- Athari, Seyed Alireza. 2023. Corporate Governance and Cash Holdings: New Evidence from Asian Markets. International Journal of Business and Emerging Markets 2023: 1–38. [Google Scholar] [CrossRef]

- Benkraiem, Ramzi, Amal Hamrouni, Faten Lakhal, and Nadia Toumi. 2017. Board independence, gender diversity and CEO compensation. Corporate Governance: The International Journal of Business in Society 17: 845–60. [Google Scholar] [CrossRef]

- Bernile, Gennaro, Vineet Bhagwat, and Scott Yonker. 2018. Board diversity, firm risk, and corporate policies. Journal of Financial Economics 127: 588–612. [Google Scholar] [CrossRef]

- Bhaskar, Lori Shefchik, Gopal V. Krishnan, and Wei Yu. 2017. Debt covenant violations, firm financial distress, and auditor actions. Contemporary Accounting Research 34: 186–215. [Google Scholar] [CrossRef]

- Boyd, Brian K., Katalin Takacs Haynes, and Fabio Zona. 2011. Dimensions of CEO–board relations. Journal of Management Studies 48: 1892–923. [Google Scholar] [CrossRef]

- Brennan, Niamh M., Jill Solomon, Shahzad Uddin, and Jamal Choudhury. 2008. Rationality, traditionalism and the state of corporate governance mechanisms. Accounting, Auditing and Accountability Journal 21: 1026–51. [Google Scholar] [CrossRef]

- Cha, Wonsuk, Michael Abebe, and Hazel Dadanlar. 2019. The effect of CEO civic engagement on corporate social and environmental performance. Social Responsibility Journal 15: 1054–70. [Google Scholar] [CrossRef]

- Cowley, Summer. 2019. Emotional labour in the role of university department chair. SFU Educational Review 12: 9–26. [Google Scholar] [CrossRef][Green Version]

- Davis, Mark H., Sal Capobianco, and Linda A. Kraus. 2010. Gender differences in responding to conflict in the workplace: Evidence from a large sample of working adults. Sex Roles 63: 500–14. [Google Scholar] [CrossRef]

- Dedunu, H. H., and P. A. N. S. Anuradha. 2020. Impact of board diversity on firm performance: Evidence from listed material companies in Sri Lanka. Journal of Business Management 3: 17–33. [Google Scholar]

- Farooq, Muhammad, Qadri Al-Jabri, Muhammad Tahir Khan, Asad Afzal Humayon, and Saif Ullah. 2023. The relationship between corporate governance and financial performance in the Islamic and conventional banking industries: A Malaysian evidence. Journal of Islamic Accounting and Business Research. ahead-of-print. [Google Scholar] [CrossRef]

- Farooq, Muhammad, Qadri Al-Jabri, Muhammad Tahir Khan, Muhamamad Akbar Ali Ansari, and Rehan Bin Tariq. 2024. The impact of corporate governance and firm-specific characteristics on dividend policy: An emerging market case. Asia-Pacific Journal of Business Administration 16: 504–29. [Google Scholar] [CrossRef]

- Freitas Cardoso, Guilherme, Fernanda Maciel Peixoto, and Flavio Barboza. 2019. Board structure and financial distress in Brazilian firms. International Journal of Managerial Finance 15: 813–28. [Google Scholar] [CrossRef]

- Friedman, Marilyn. 1996. The unholy alliance of sex and gender. Metaphilosophy 27: 78–91. [Google Scholar] [CrossRef]

- García, C. José, Begoña Herrero, and Francisco Morillas. 2021. Corporate board and default risk of financial firms. EkonomskaIstrazivanja-Economic Research 35: 511–28. [Google Scholar]

- Griffith, Emily. 2017. Uber’s Stumbles Show the Downside of a Homogeneous Board. The New York Times. June 13. Available online: https://www.nytimes.com/2017/06/13/technology/uber-board-diversity.html (accessed on 15 June 2024).

- Gryta, T., and J. S. Lublin. 2018. GE’s Overhaul Reflects Broader Reckoning for Conglomerates. The Wall Street Journal. October 1. Available online: https://www.wsj.com/articles/ges-overhaul-reflects-broader-reckoning-for-conglomerates-1538398800 (accessed on 15 July 2024).

- Guizani, Moncef, and Gaafar Abdalkrim. 2022. Does gender diversity on boards reduce the likelihood of financial distress? Evidence from Malaysia. Asia-Pacific Journal of Business Administration 15: 287–306. [Google Scholar] [CrossRef]

- Gyapong, Ernest, Reza M. Monem, and Fang Hu. 2016. Do women and ethnic minority directors influence firm value? Evidence from post-apartheid South Africa. Journal of Business Finance & Accounting 43: 370–413. [Google Scholar]

- Hambrick, Donald C., and Phyllis A. Mason. 1984. Upper echelons: The organization as a reflection of its top managers. Academy of Management Review 9: 193–206. [Google Scholar] [CrossRef]

- Harjoto, Maretno A., Indrarini Laksmana, and Ya-Wen Yang. 2018. Board diversity and corporate investment oversight. Journal of Business Research 90: 40–47. [Google Scholar] [CrossRef]

- Hechavarria, Diana, Amanda Bullough, Candida Brush, and Linda Edelman. 2019. High-growth women’s entrepreneurship: Fueling social and economic development. Journal of Small Business Management 57: 5–13. [Google Scholar] [CrossRef]

- Henseler, Jörg, Christian M. Ringle, and Marko Sarstedt. 2015. A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of The Academy of Marketing Science 43: 115–35. [Google Scholar] [CrossRef]

- Hillman, Amy J., and Thomas Dalziel. 2003. Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management Review 28: 383–96. [Google Scholar] [CrossRef]

- Hillman, Jennifer. 2007. Knowledge and attitudes about HIV/AIDS among community-living older women: Reexamining issues of age and gender. Journal of Women & Aging 19: 53–67. [Google Scholar]

- Jebran, Khalil, Shihua Chen, and Ruibin Zhang. 2020. Board diversity and stock price crash risk. Research in International Business and Finance 51: 101122. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Jo, Hoje, and Maretno A. Harjoto. 2011. Corporate governance and firm value: The impact of corporate social responsibility. Journal of Business Ethics 103: 351–83. [Google Scholar] [CrossRef]

- Khan, Muhammad Tahir, Naveed Saif, Qadri Mohd Al-Jabri, and Haseeb Ur Rahman. 2020. Impact of accrual reversals on corporate performance: Evidence from emerging economy. International Journal of Managerial and Financial Accounting 12: 328–41. [Google Scholar] [CrossRef]

- Khan, Muhammad Tahir, Qadri Muhammad Al-Jabri, and Naveed Saif. 2021. Dynamic relationship between corporate board structure and firm performance: Evidence from Malaysia. International Journal of Finance & Economics 26: 644–61. [Google Scholar]

- Kristanti, Farida Titik, Sri Rahayu, and Akhmad Nurul Huda. 2016. The determinant of financial distress on Indonesian family firm. Procedia-Social and Behavioral Sciences 219: 440–47. [Google Scholar] [CrossRef]

- Lee, Kin Wai, and Tiong Yang Thong. 2022. Board gender diversity, firm performance and corporate financial distress risk: International evidence from tourism industry. Equality, Diversity and Inclusion: An International Journal 42: 530–50. [Google Scholar] [CrossRef]

- Li, Zhiyong, Jonathan Crook, Galina Andreeva, and Ying Tang. 2020. Predicting the risk of financial distress using corporate governance measures. Pacific-Basin Finance Journal 68: 101334. [Google Scholar] [CrossRef]

- Manzaneque, Montserrat, and Alba María Priego. 2016. Corporate governance effect on financial distress likelihood: Evidence from Spain. Revista de Contabilidad 19: 111–21. [Google Scholar] [CrossRef]

- Muttakin, Mohammad Badrul, Arifur Khan, and Dessalegn Getie Mihret. 2018. The effect of board capital and CEO power on corporate social responsibility disclosures. Journal of Business Ethics 150: 41–56. [Google Scholar] [CrossRef]

- Nolen-Hoeksema, S. 2012. Emotion regulation and psychopathology: The role of gender. Annual Review of Clinical Psychology 8: 161–87. [Google Scholar] [CrossRef]

- Ntim, Collins G., Teerooven Soobaroyen, and Martin J. Broad. 2017. Governance structures, voluntary disclosures and public accountability: The case of UK higher education institutions. Accounting, Auditing and Accountability Journal 30: 65–118. [Google Scholar] [CrossRef]

- Olaoye, Olumide, Mamdouh Abdulaziz Saleh Al-Faryan, and Mosab I. Tabash. 2024. Fiscal policy and sustainable development in sub-Saharan Africa: Unveiling the role of information and communication technology (ICT). Transforming Government: People, Process and Policy. ahead-of-print. [Google Scholar] [CrossRef]

- Olengga, Pupel, and Fitriya Fauzi. 2020. Analisis Potensi Finansial Ditrees Pada Industri Semen Terdaftar Di Bursa Efek Indonesia. Jurnal Ilmiah Bina Manajemen 3: 47–57. [Google Scholar] [CrossRef]

- Park, Jong Hun, Changsu Kim, Young Kyun Chang, Dong-Hyun Lee, and Yun-Dal Sung. 2018. CEO hubris and firm performance: Exploring the moderating roles of CEO power and board vigilance. Journal of Business Ethics 147: 919–33. [Google Scholar] [CrossRef]

- Post, Corinne, and Kris Byron. 2015. Women on boards and firm financial performance: A meta-analysis. Academy of Management Journal 58: 1546–71. [Google Scholar] [CrossRef]

- Qian, Yue. 2017. Gender asymmetry in educational and income assortative marriage. Journal of Marriage and Family 79: 318–36. [Google Scholar] [CrossRef]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. Stata Journal, Stata Corp LP 9: 86–136. [Google Scholar] [CrossRef]

- Ruisah, Ruisah, and M. Ivy Kom. 2018. Gender differences in emotional function responses to antagonists: A study of English literature students. SECRETARY 5: 1–10. [Google Scholar]

- Schopohl, Lisa, Andrew Urquhart, and Hanxiong Zhang. 2021. Female CFOs, leverage and the moderating role of board diversity and CEO power. Journal of Corporate Finance 71: 101858. [Google Scholar] [CrossRef]

- Shen, Runan. 2024. A Study of the Impact of ESG on Total Factor Productivity in a Dual-Carbon Context—Based on the Moderating Role of CEOs’ Overseas Experience. Sustainability 16: 5676. [Google Scholar] [CrossRef]

- Stoet, Gijsbert, Daryl B. O’Connor, Mark Conner, and Keith R. Laws. 2013. Are women better than men at multi-tasking? BMC Psychology 1: 18. [Google Scholar] [CrossRef]

- Tamres, Lisa K., Denise Janicki, and Vicki S. Helgeson. 2002. Sex differences in coping behavior: A meta-analytic review and an examination of relative coping. Personality and Social Psychology Review 6: 2–30. [Google Scholar] [CrossRef]

- Tang, Jianyun, Mary Crossan, and W. Glenn Rowe. 2011. Dominant CEO, deviant strategy, and extreme performance: The moderating role of a powerful board. Journal of Management Studies 48: 1479–503. [Google Scholar] [CrossRef]

- Teichmann, Fabian Maximilian Johannes, Sonia Ruxandra Boticiu, and Bruno S. Sergi. 2023. Wirecard scandal. A commentary on the biggest accounting fraud in Germany’s post-war history. Journal of Financial Crime. ahead-of-print. [Google Scholar] [CrossRef]

- Terjesen, Siri, Ruth Sealy, and Val Singh. 2009. Women directors on corporate boards: A review and research agenda. Corporate Governance: An International Review 17: 320–37. [Google Scholar] [CrossRef]

- Ullah, Irfan, Aurang Zeb, Muhammad Arif Khan, and Wu Xiao. 2020. Board diversity and investment efficiency: Evidence from China. Corporate Governance: The International Journal of Business in Society 20: 1105–32. [Google Scholar] [CrossRef]

- Ullah, Subhan, Pervaiz Akhtar, and Ghasem Zaefarian. 2013. Dealing with endogeneity bias: The generalized method of moments (GMM) for panel data. Industrial Marketing Management 71: 69–78. [Google Scholar] [CrossRef]

- Usman, Muhammad, Junrui Zhang, Muhammad Umar Farooq, Muhammad Abdul Majid Makki, and Nanyan Dong. 2018. Female directors and CEO power. Economics Letters 165: 44–47. [Google Scholar] [CrossRef]

- Weisbach, Michael S. 1988. Outside directors and CEO turnover. Journal of Financial Economics 20: 431–60. [Google Scholar] [CrossRef]

- Widhiadnyana, I. Kadek, and Ni Made Dwi Ratnadi. 2019. The impact of managerial ownership, institutional ownership, proportion of independent commissioner, and intellectual capital on financial distress. Journal of Economics, Business & Accountancy Ventura 21: 351. [Google Scholar]

- Younas, Noman, Shahab UdDin, Tahira Awan, and Muhammad Yar Khan. 2021. Corporate governance and financial distress: Asian emerging market perspective. Corporate Governance: The International Journal of Business in Society 21: 702–15. [Google Scholar] [CrossRef]

- Yousaf, Umair Bin, Khalil Jebran, and Man Wang. 2021. Can board diversity predict the risk of financial distress? Corporate Governance: The International Journal of Business in Society 21: 663–84. [Google Scholar] [CrossRef]

- Zhong, Xi, He Wan, and Ge Ren. 2021. Can TMT vertical pay disparity promote firm innovation performance? The moderating role of CEO power and board characteristics. European Journal of Innovation Management 25: 1161–82. [Google Scholar] [CrossRef]

- Zhou, Min. 2019. Gender differences in the provision of job-search help. Gender & Society 33: 746–71. [Google Scholar]

| Variable | Symbol | Measurement | Reference |

|---|---|---|---|

| Dependent Variables | |||

| Likelihood of Financial Distress | FDI | Altman Z_Score calculated as Z-Score = 6.56 × (Sales/TotalAssets) + 3.26 × (Retained Earnings/Total Asset) + 6.72 × (EBIT/Total Asset) + 1.05 × (Book value of total Equity/Total Assets) | Altman (2007) |

| Independent Variable | |||

| Gender Diversity at Commissioner Board | GDC | Female presence on the board of commissioners | Abbas and Frihatni (2023) |

| Gender Diversity at Directors Board | GDB | Female presence on the board of directors | Abbas and Frihatni (2023) |

| Gender Diversity at Audit Committee | GDA | Female presence on the board of audit committees | Abbas and Frihatni (2023) |

| Moderating Variable | |||

| CEO Duality | CEOD | Calculated as 1 if there is duality on the board and CEO is also a president or chairman and 0 otherwise | Khan et al. (2021) |

| Control Variables | |||

| Firm Size | FS | Natural log of the firm’s total asset | Khan et al. (2020) |

| Firm Leverage | LEV | Ratio of total liabilities divided by total assets | Khan et al. (2020) |

| Firm Liquidity | FL | Dividing current assets by current liabilities | Farooq et al. (2023) |

| Variables | Symbol | Mean | Std.Dev | Min | Max |

|---|---|---|---|---|---|

| Financial distress | FD | 0.81 | 0.78 | −1.71 | 1.97 |

| Gender diversity on the commissioner board | GDC | 0.12 | 0.04 | 0.00 | 0.18 |

| Gender diversity on the board of directors | GDB | 0.19 | 0.14 | 0.00 | 0.28 |

| Gender diversity on the audit committee board | GDA | 0.15 | 0.11 | 0.00 | 0.20 |

| CEO duality | CEOD | 0.13 | 0.06 | 0.00 | 0.17 |

| Firm size | FS | 24.18 | 1.18 | 13.42 | 23.56 |

| Firm leverage | LEV | 0.49 | 0.21 | 0.13 | 0.80 |

| Firm liquidity | FL | 0.23 | 0.31 | 0.01 | 1.32 |

| Variables | FD | GDC | GDB | GDC | CEOD | FS | LEV | FL | |

|---|---|---|---|---|---|---|---|---|---|

| Financial distress | FD | 1.000 | |||||||

| Gender diversity (Commissioner Board) | GDC | 0.114 | 1.000 | ||||||

| Gender diversity (Board of Directors) | GDB | −0.057 | −0.041 | 1.000 | |||||

| Gender diversity (Audit Committee) | GDA | −0.245 | 0.248 | −0.029 | 1.000 | ||||

| CEO duality | CEOD | −0.239 | −0.148 | 0.019 | −0.017 | 1.000 | |||

| Firm size | FS | −0.125 | −0.065 | 0.035 | 0.038 | 0.129 | 1.000 | ||

| Firm leverage | LEV | −0.568 | −0.068 | −0.081 | −0.027 | −0.347 | −0.368 | 1.000 | |

| Firm liquidity | FL | 0.149 | −0.754 | −0.024 | −0.034 | 0.038 | −0.156 | 0.027 | 1.000 |

| Variables | Symbols | VIF | 1/VIF |

|---|---|---|---|

| Financial distress | GDC | 1.458 | 0.702 |

| Gender diversity on the commissioner board | GDB | 1.226 | 0.746 |

| Gender diversity on the board of directors | GDA | 1.238 | 0.768 |

| Gender diversity on the audit committee board | FS | 1.148 | 0.810 |

| CEO duality | LEV | 1.153 | 0.901 |

| Firm size | FL | 1.164 | 0.910 |

| Direct Relationship: Dynamic analysis between gender diversity, CEO duality, and financial distress | |||

| Dependent Variable: Financial distress (FD) | |||

| Variables of the Study | Coefficient | Std. Dev | |

| Lagged dependent variable | FD (t − 1) | 0.7168 ** | 0.1360 |

| Gender diversity on commissioner board | GDC | −0.0131 ** | 0.0093 |

| Gender diversity on board of directors | GDB | 0.0114 | 0.1157 |

| Gender diversity on audit committee | GDA | −0.0844 | 0.0254 |

| CEO duality | CEOD | −0.2689 ** | 0.1401 |

| Firm size | FS | 0.0215 | 0.0110 |

| Firm leverage | LEV | 0.0008 * | 0.0008 |

| Firm liquidity | FL | 0.0050 | 0.0052 |

| Constant | C | −0.14934 | 0.1311 |

| Year dummy | D | Yes | |

| Industry dummy | D | Yes | |

| Standard errors | Error | Clustered | |

| Observations | Obs | 2214 | |

| Number of groups | 235 | ||

| Number of instruments | 97 | ||

| F-statistics (p-value) | 7561.3(0.00) | ||

| Arellano–Bond test AR(1) (p-value) | ARI | −1.61 (0.021) | |

| Arellano–BondtestforAR(2) (p-value) | ARII | 1.17(0.324) | |

| Sargan testofoverid. (p-value) | 19.37(0.624) | ||

| Difference-in-Hansentest (p-value) | 0.16(0.897) | ||

| With GDC | With GDB | With GDA | |||||

| Model 2.1 | Model 2.2 | Model 2.3 | |||||

| Variable | Coeff | Std. D | Coeff. | Std. Dev | Coefficient | Std. Dev | |

| Lagged dependent variable (t − 1) | LFD | 0.138 *** | 0.0621 | 0.127 *** | 0.0067 | 0.127 *** | 0.0073 |

| Diversity on commissioner board | GDC | −0.318 ** | 0.013 | ||||

| Diversity on board of directors | GDB | −0.151 | 0.0177 | ||||

| Diversity on audit committee | GDA | −0.345 * | 0.1318 | ||||

| CEO duality | CEOD | −0.612 *** | 0.087 | −0.267 | 0.0442 | −0.271 ** | 0.0917 |

| CEOD × GDC (Moderating) | 0.418 *** | 0.059 | |||||

| CEOD × GDB (Moderating) | 1.127 *** | 0.1869 | |||||

| CEOD × GDA (Moderating) | 0.360 *** | 0.121 | |||||

| Firm size | FS | 0.0472 *** | 0.0155 | 0.0302 *** | 0.0029 | 0.0498 *** | 0.0022 |

| Firm leverage | LEV | −0.9054 ** | 0.0508 | –0.9091 ** | 0.0407 | −0.9148 *** | 0.0517 |

| Firm liquidity | FL | 0.1927 *** | 0.0137 | 0.2484 *** | 0.0141 | 0.2052 *** | 0.1471 |

| Constant | C | −0.161 | 0.1326 | 0.2451 ** | 0.1286 | −0.2428 | 0.1212 |

| Year dummy | D | Yes | Yes | Yes | |||

| Industry dummy | D | Yes | Yes | Yes | |||

| Standard error | Error | Clustered | Clustered | Clustered | |||

| Observations | Obs. | 1238 | 1225 | 1225 | |||

| Groups | 232 | 231 | 231 | ||||

| Number of instruments | 98 | 94 | 97 | ||||

| F-statistics (p-value) | 5194.0(0.00) | 9249.7(0.00) | 5140.1(0.00) | ||||

| Arellano–BondtestAR(1) (p-value) | ARI | 1.74 (0.0298) | 1.66 (0.0518) | 1.48 (0.0345) | |||

| Arellano–BondtestAR(2) (p-value) | ARII | 1.62(0.141) | 1.07(0.371) | 1.01(0.274) | |||

| Sargan–Hansentest (p-value) | 0.77(0.780) | 1.47(0.811) | 1.69(0.721) | ||||

| Difference-in-Hansentest (p-value) | 0.33(0.840) | 0.54(0.722) | 0.61(0.813) | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, M.T.; Ahmad, W.; Khan, S.N.; Antohi, V.M.; Fortea, C.; Zlati, M.L. Is the Nexus between Gender Diversity and Firm Financial Distress Moderated by CEO Duality? Economies 2024, 12, 240. https://doi.org/10.3390/economies12090240

Khan MT, Ahmad W, Khan SN, Antohi VM, Fortea C, Zlati ML. Is the Nexus between Gender Diversity and Firm Financial Distress Moderated by CEO Duality? Economies. 2024; 12(9):240. https://doi.org/10.3390/economies12090240

Chicago/Turabian StyleKhan, Muhammad Tahir, Waqar Ahmad, Sajjad Nawaz Khan, Valentin Marian Antohi, Costinela Fortea, and Monica Laura Zlati. 2024. "Is the Nexus between Gender Diversity and Firm Financial Distress Moderated by CEO Duality?" Economies 12, no. 9: 240. https://doi.org/10.3390/economies12090240

APA StyleKhan, M. T., Ahmad, W., Khan, S. N., Antohi, V. M., Fortea, C., & Zlati, M. L. (2024). Is the Nexus between Gender Diversity and Firm Financial Distress Moderated by CEO Duality? Economies, 12(9), 240. https://doi.org/10.3390/economies12090240