Abstract

A correlation between economic development and road freight is demonstrated in the literature review provided in this paper. This relationship was studied in relation to the global gross domestic product (GDP) of the countries under review. Therefore, this paper presents the validation of this correlation in the Colombian case, based not only on global GDP, but also on the GDP for each of the main economic sectors of the country. The correlation was analyzed using several of the following statistical methods: correlation using the non-parametric method (Spearman), the causality relationship using the Granger test, the relationship between variables using Principal Component Analysis (PCA), and multivariate correlation to establish the level of significance of each economic sector by means of the p-value. The study concludes that the best correlation is between the GDP of some economic sectors and the amount of freight transported one year later.

1. Introduction

The importance of the participation of cargo transportation in any country is undoubted, with a large number of documents that support it through the analysis of various indicators, and it is a fundamental principle in transportation economics theories. Therefore, it is vitally important for each country or region to not only have statistical data on the performance of cargo and passenger transportation, but they must also be analyzed with respect to macroeconomic variables that allow for the projection of their behavior, and thus have reliable bases for decision making, both by government entities and by companies in the industrial and transportation sectors.

This study is based on Colombia as a case study, because, even if there are official databases that record macroeconomic information about the country and the road freight transport sector, there is no study that correlates them. Additionally, it is important to disaggregate the national economy into its main sectors in order to reach better defined conclusions than simply analyzing the behavior of global GDP.

Understanding the behavior of economic cycles in periods of crisis and its relationship with the amount of freight transported in a country supports planning for the construction or improvement of road infrastructure, which, in the case of a developing country like Colombia, becomes a fundamental tool for social and economic growth.

In context, in the last decade, 3,204,000,000 tons of cargo were moved in Colombia throughout all transportation modes, with the highest participation coming from road transportation, with 2,574,097,000 tons (80%) (Ministry of Transportation, Republic of Colombia 2022). Nevertheless, in recent years (2019 to 2023), cargo transportation in Colombia, whether dry products (kg) or liquid (gal), has not displayed a significant correlation with the economic condition, measured from the national gross domestic product (GDP). The above is a result of analyzing the data presented by the National Administrative Department of Statistics (DANE) (National Department of Statistics DANE, Republic of Colombia 2023) and the Ministry of Transportation (Ministry of Transportation, Republic of Colombia 2023).

Worldwide GDP has been regarded as one of the key indicators to explain freight transport demand. GDP rules the demand for freight transport through the size of consumer demand and on the sectoral structure of the economy. In reviewing the state of the art in the relationship between cargo transportation and economic development, it is found that the former drives the markets of key sectors of the economy. Therefore, the historical behavior of load indicators should be correlated with the economic performance of a country or region, measured from the GDP (Maparu and Mazumder 2017; Mishra 2019), based on the premise that the investment in transportation and logistics has a relevant impact on better economic development indicators.

This research focused on road freight transportation because it is the mode with the greatest impact on freight transportation in Colombia, due to the orographic complexity and because the region with the highest consumption of goods and services is the capital city (Bogotá), which is located in the central area of the map, far from the coasts. Additionally, rail and river development for multimodal cargo transportation does not cover a significant area of the country. This means that the road mode of transportation presents data with higher participation than the other modes of freight transportation. Usually, the relation between economic development and freight transport is used to make forecasts of future aggregate freight flows and volumes. Generally, GDP is used as an indicator for economic activity in a region or a country (Meersman and Van de Voorde 2013).

Given the above, the principal contribution of this research is the use of the GDP time series for each of the main sectors of the economy (established by the government entity that reports official statistics in Colombia, the National Administrative Department of Statistics). With this information and the time series of road freight transport data, this paper presents a correlation analysis between the two variables, using several methods of proven statistical validity. The causality of one variable with respect to the other is also identified, and the period in years in which one affects the other with the best correlation is obtained.

Finally, in the Discussion section, aspects resulting from the main analysis are evaluated, such as the significance of the participation of the different economic sectors in correlation with freight transport, whether the correlation with the global GDP or with the sectoral GDP is better, and whether the correlation would have been very different if there had been no COVID-19 pandemic period.

In summary, this document presents the validation of the correlation and causality between the economic development of the different economic sectors and the quantity of cargo transported by road. The validation was developed through correlation using the non-parametric method (Spearman), the causality relationship using the Granger test, the relationship between variables using Principal Component Analysis, as well as the application of linear correlations to determine the level of significance of each of the independent variables by means of their respective p-values, and the significance of the linearity of the correlation by means of the resulting adjusted R2 and p-values.

Literature Review

In Mexico’s case, German-Soto et al. (2023) concluded that the urbanization process depended on the improvements in transportation, but transportation required economic development. In another document, Lopez-Rodriguez and Pardo-Rincon (2019) stated that the economic growth of a state depends largely on the exchange of products generated with countries in the rest of the world, thus highlighting the relevance of international trade; from this perspective, road cargo transportation plays a relevant role in the logistics that support the success of commercial transactions abroad. They conclude that the land cargo transportation sector is one of the most dynamic segments in society and that the importance of transportation for the economy arises from the impact on the performance of other sectors. The majority of producers use transportation in some stage of its production and distribution processes, in such a way that the efficiency and transportation rates affect the international competitiveness of national products and the well-being of the consumer. In this way, transportation is directly related to the economy.

Alam (2014) states that investment in road logistics corridors in South Asian countries have positively impacted the region’s GDP growth. In the same theoretical trend, Chen et al. (2015) developed a model based on the economy cycle theory for predicting Shanghai container shipping market crises. Choi et al. (2018) used sixty independent variables in the development of an early-warning index, some of which include shipping, shipbuilding, and finance. McKinnon (2007) exposed the behavior between GDP and the road ton km, which represents two-thirds of the UK’s domestic freight market, and thereby exerts a strong influence on the relationship between economic growth and the total freight ton km. Gao et al. (2016) exposed that, “As the fundamental and leading industry for national economic and social development, the development of transportation industry determines the trend of economic development and reflects the cyclical changes of national economy. Freight, as the basis of transportation industry, is closely related to GDP development”.

Xue et al. (2023) analyzed (in China’s case) the correlation between the overall GDP and railway transportation growth trends, and concluded that “the growth rate of railway operating mileage in the period of rapid economic development was equal to the economic growth rate, which indicates that railway transportation is closely related to economic development”. In other article about China, Yang (2021) affirmed that the relationship between freight transportation and economic development is close, and that development promotes the growth of freight transportation.

In Mexico, the Mexican Transport Institute concluded that the correlation coefficient between the gross value added (GVA) and total ton-kilometers was 0.930, while the correlation between the GVA and ton-kilometers in motor transportation was 0.913, also suggesting a coupling between their values. The Mexican Transportation Institute (2009) and Lavee et al. (2011) examined the relationship between investment in transportation infrastructure capital and the debt-to-gross domestic product (GDP) ratio.

Another document analyzed the behavior of the GDP and the number of land freight vehicles in Slovakia in the period from 1995 to 2015. The authors argued that the growth of the GDP increased the burden on the road network. Moreover, we can assume that the increase in the GDP encouraged the growth in the demand for transport (Varjan et al. 2017). Two of the previous authors explained in more detail the relationship between transport intervention and the direct and wider impacts in economic performance in Slovakia and EU countries in the period from 2009 to 2015. The correlation between the freight transport performance and GDP was significant because it had an R value equal to 0.73 (Gnap et al. 2018).

In the case of the U.S.A., road transport registered as the highest share of GDP compared to other modes of freight transport, including rail (U.S.A. Department of Transportation 2024). Meersman and Van de Voorde (2013) developed a study in which the strong correlation between the GDP and road transport (ton kms) (between 1995 and 2010) in EU27, the Russian Federation, and the U.S.A. was clear, with China being less strong in these last two territories. Similarly, Zhang and Cheng (2023) studied the proportion in which land transport infrastructure participated in the UK GDP in a way superior to that of air transport and maritime and river transport.

Based on the previous paragraphs, the high participation of road transport in a country’s GDP is supported, affirming a correlation between the economy and road freight transport. Europe has developed a methodology that allows for the study of the interaction between the elasticity of road freight transport statistics and macroeconomic variables such as the GDP, including detailed information in the database that not only includes the amount of cargo transported, but also others, such as the types of trucks (Eurostat 2023).

Other articles that also study this topic in European countries highlight that, “In most industrialized countries there has been a strong positive relationship between economic and transport growth, and specifically road transport”; moreover, “It is widely accepted that transport accounts for a significant share of the GDP in industrialized countries. For this reason, the correlation between tonne-kilometres and GDP, known as “coupling”, has traditionally been applied to forecast trends in freight transport demand” (Alises et al. 2014). The same criterion is expressed by Kveiborg and Fosgerau (2007): “Historically, freight transport volumes (tonne-kilometres) and economic activities have followed similar trends”, in the Danish case.

In a study developed for the Netherlands, sectoral GDP variations were used as the only independent variable in a prediction model for road freight transportation. In a wide range of determinants that influence freight transport demand, including economic and logistical structures, the GDP change in different sectors and the world trade index were identified as the most influential determinants on the freight demand (Asgarpour et al. 2023). In the case of Indonesia, Reza (2013) exposed the trend of GDP and cargo transportation volume (expressed as logistics figures) from the 1990s to 2010, showing a similar behavior for the two variables. Bennathan et al. (1992) exposed that, for developed countries (high-income countries) and developing countries (low-income countries), the total ton-kilometers of freight transport by road are clearly explained by the GDP. Road freight in developed and developing market economies shows a very similar response to variations in the GDP. Grenzeback et al. (2013) demonstrated that a model can be used to perform macro-forecasting, for example, by estimating the effect of the changes in the GDP on the freight ton-kilometers by mode in the future.

In the case of Greece, Moschovou (2017) studied information since 2003 to analyze the impact that the country’s economic recession had in recent decades on the GDP data, and one of the sectors most negatively affected was road freight transportation.

Lehtonen (2006) also concluded that, in some developed countries, such as the UK, the phenomenon of a ‘relative decoupling’ is happening, but, in many other countries, the volume of road freight transport is expected to continue following the growth of the GDP. Nonetheless, in the present study, we can say that, in the Colombian case, the decoupling situation is not expected to arise. Beyzatlar et al. (2014) studied the causality between the real GDP and inland freight transportation per capita in ton km. They concluded that the relationship is bidirectional and not homogeneous. This means that neither of the two indicators has more relevance as a causal variable between them.

In other study regarding China, Wang et al. (2021) established that the demand for freight transportation shows an inverted U-shaped trend with economic development, and that there are regional characteristics that define that relationship. Diaz et al. (2016) proposed, for Brazil, a model that relates the impact of variables, such as investment and the extension of transportation infrastructure, population growth, and travel demand, on the GDP’s potential. In the case of India, Ghosh and Dinda (2022) showed a strong linear trend correlation between the GDP per capita (GDPPC) and the transportation infrastructure index (TRNINF) for the periods from 1989 to 2017.

The GDP is also significantly correlated with the rate of motorization in cities, with the number of Twenty Equivalent Units (TEUs) transported, and with the value of investments in transportation infrastructure, among other relationships with the transportation sector (Rodrigue 2024).

In the Colombian case, Caicedo (2013) and Gómez (2016) analyzed the relationship between national economic development and the amount of cargo transported by road. However, they did not perform a statistical or comparative analysis of the indicators. Gonzalez et al. (2022) exposed the difference between the growth of national GDP in Colombia (2005 to 2019) and the behavior of the total tons of cargo transported (2015 to 2020). The first indicator showed an increasing behavior with a low deviation, and the second indicator showed a seasonal cyclical behavior. The document concluded that “the COVID-19 pandemic had a negative effect on the growth of the freight forwarding sector in Colombia. Due to the different restrictions defined by the rapid expansion of the pandemic, freight transportation stopped growing as it was doing in previous years”, and that “the analysis can help planners implement policies to improve freight transport behavior and react to unusual future economic periods”.

By analyzing the figures recorded by the “Anuario de transporte de carga y logística 2014” (Freight transportation and logistics yearbook 2014) by the Inter-American Development Bank (IADB 2014) concerning the GDP per capita and the domestic cargo transported by road for Argentina, Belize, Brazil, Chile, Colombia, Costa Rica, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, and Uruguay, an R2 of only 0.25 is obtained. This means that the amount of cargo transported in the main Latin American countries has no relationship with the general economic behavior of the respective country. This is one of the few documents that does not agree with the hypothesis raised.

The Banco de Desarrollo de America Latina (CAF) (Development Bank of Latin America and the Caribbean 2014) published the “Logistics Profile of Latin America. Workshop on cargo transportation and logistics”, presenting the main action strategies in the region, but the document does not analyze the economic impact of the interventions.

The Economic Commission for Latin America and the Caribbean (ECLAC) published the following: “the estimation of the potential load demand facilitates the optimization of the supply through an efficient allocation of resources and thus satisfy the demand, converging on the development of the countries at the pace established by their objectives, that is, the endowment infrastructure allows the expected GDP growth”. This ratifies the relationship between economic development (measured based on the behavior of five economic sectors) and the condition of cargo transportation for four Latin American countries (ECLAC 2017).

In another document, ECLAC (2018) states the following: “the freight mobility and logistics sectors are sectors that require greater attention and vision in the future, given that they provide the services that form the “blood” that feeds the countries using infrastructure as distribution arteries. As has been shown, the future development of emerging economies, including the LAC region itself, will require freight transportation services of greater volume, quality and diversification” (ECLAC 2018).

Other authors have found that there is a spatial distribution relationship between the economic performance of a country and the amount of cargo transported. This is an important analysis for future research that analyzes the economic behavior and the cargo transported between neighboring countries, as in the case of the “Andean area” in South America (Boldizsár et al. 2023).

In the literature reviewed above, we find that there is no document that analyzes the recent historical correlation between the behavior of the economy and the amount of cargo transported by road, or if that correlation indicates which of the two variables can be considered the dependent one. This validates the contribution of this article to the state of knowledge, especially in developing regions such as Latin America, and in particular Colombia. Finally, the question to be resolved through this research is as follows: does the performance of the economic sectors allow for the establishment of a statistically strong correlation to determine the short-term behavior of cargo volumes transported by road?

2. Methods

The economic theory of transportation, set forth in the literature review, indicates that a greater amount of freight transported in a country should be correlated with a better economic condition. To study the behavior of these variables, the following from Colombia’s official data were used: the global GDP and the GDP for 11 economic sectors [Construction, Commerce (wholesale and retail; repair of motor vehicles and motorcycles; transportation and storage; accommodation and food services), Real Estate Activities, Professional Activities (professional, scientific, and technical activities; administrative and support services activities), Agrobusiness (agriculture, livestock, hunting, forestry and fishing), Finance (financial and insurance activities), Mining (exploitation of mines and quarries), Manufacturing Industries, Home Public Services (supply of electricity, gas, steam, and air conditioning; water distribution; wastewater evacuation and treatment, waste management and environmental sanitation activities), Communications (information and communications) and Public Administration (public administration and defense; mandatory social security plans; education; human health care and social services activities) between the years 2015 and 2022, using the value of current prices in billions of Colombian pesos (COP) (quarterly) data from the National Department of Statistics DANE, Republic of Colombia (2023) (Table A1).

The information used corresponding to cargo transportation includes indicators of cargo transported by land (Logistics Corridors in Colombia between 2019 and 2023) in quarterly values from the Ministry of Transportation, Republic of Colombia (2023) (Table A2).

The methodology applied was to correlate economic and road freight transportation variables, first in the same time series, and then in time series in which one variable begins one or two years before the other. In each case, two analyses were performed: a. with the time series of the economic variables starting before the time series of the cargo transportation; b. with the freight transport time series starting before the GDP time series.

The difference in the beginning of the time series intended to determine whether there was a greater correlation: if the economic variables were initially those of freight transportation, or the opposite. In the first situation, it was deduced that it was the behavior of the economy that influenced the performance of cargo transportation in a period of time equal to the overlap of the time series. In the second situation, it would be the behavior of the transported cargo that would indicate the future data of the economy (GDP).

In the case of the same time series, the data (sectoral GDP and cargo transported) correspond to a period of five consecutive years (2019 to 2023). For the time series with a difference in the beginning, it is as follows:

- GDP data start one year earlier: GDP series (2019 to 2023) and freight series (2020 to 2024).

- GDP data start two years earlier: GDP series (2017 to 2021) and freight series (2019 to 2023).

- Freight data start one year earlier: Freight series (2019 to 2023) and GDP series (2020 to 2024).

- Freight data start two years earlier: Freight series (2019 to 2023) and GDP series (2021 to 2025).

The analyses are presented with a maximum of two years of difference in the beginning of the time series because the results obtained with three and four years of difference present lower correlation values than those obtained with a difference of two years. This means that the data obtained two years apart show that, after only one year of difference between the time series, the correlation decreases. The data used in the research are only available until the year 2023, but, in order to extend the time series, the data were projected until the year 2025. For this, the following instruction was used in R Studio (2023.12.0) statistical software:

predict (object = linearized data series, newdata = data_group, interval = “confidence”, level = 0.95)

2.1. Analysis of the Normality of Variables to Establish Whether to Use a Parametric or Non-Parametric Correlation Method

The statistical behavior of the sectoral and global GDP data series was analyzed using the p-value of the Dickey–Fuller and Shapiro–Wilk tests to establish seasonality and normality, respectively. The data series do not move around a central value, but increase (see Section 3.1). This indicates that there is no seasonality in the series. It is also observed that there is no increasing tendency towards the mean of the data and a reduction in the value at the two extremes; that is, there is no shape similar to a Gaussian bell, which indicates that there is no normal distribution in the series.

The Shapiro–Wilk test p-value results were <0.05 for all of the variables. That means that the variables do not have a normalized distribution, which validates the use of the non-parametric Spearman correlation method (Ramachandran and Tsokos 2015). The statements in R Studio software for the Dickey–Fuller and Shapiro–Wilk tests are as follows:

adf.test(data_series, alternative = “stationary”), and

shapiro.test(data_series)

2.2. Analysis of the Correlation between Variables by Non-Parametric Method (Spearman)

The rho values resulting from applying the Spearman method established which of the indicators correlated significantly with the others (economy vs. freight transportation) and with how many years of difference. Rho values close to 1.0 indicate a strong correlation between variables, while, if the value is close to 0.0, it is considered that there is no correlation (Figures 4–8) (Hauke and Kossowski 2011; Khalid et al. 2019, 2022; Rehman et al. 2018).

The Spearman’s rho value of the correlation between variables was determined in R Studio software using the following statement:

Chart.correlation (data_group, method = “spearman”).

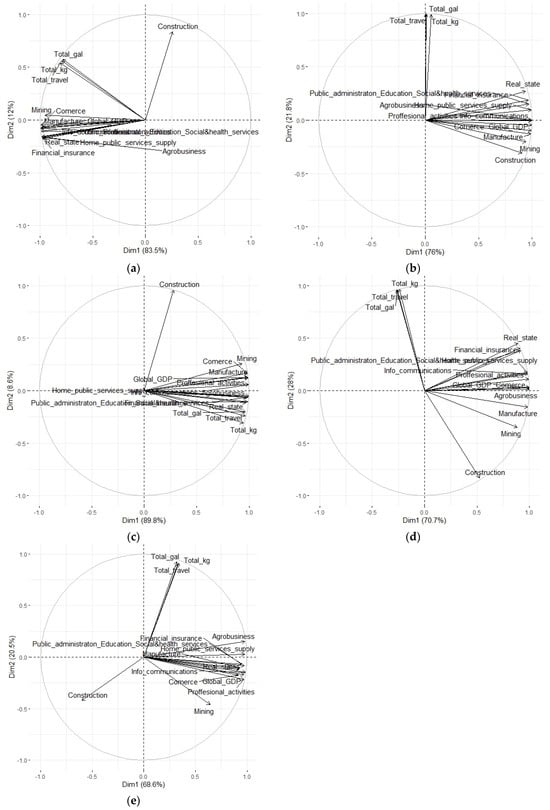

2.3. Analysis of the Correlation between Variables by the Principal Components Method (PCA)

As an additional step, the correlation between variables was corroborated using the Principal Components Analysis (PCA) method using the following R Studio statements:

data.frame_name<- prcomp(data_group, scale = TRUE)

fviz_pca_var(data.frame_name, repel = TRUE)

As a result of the PCA test, the relationship between the variables can be identified graphically. If the vectors of the variables are similar in direction and magnitude, with a small angle between them, the correlation is strong and direct. If the direction between vectors tends to be 180° apart, the correlation is strong but inverse. If the direction between vectors is close to 90°, it is considered that there is not a good correlation between the variables (Figure 9). The comparison of the trends of the series of independent variables was carried out graphically (Figure 10).

2.4. Analysis of Causality between Variables Using the Granger Test

As a complementary analysis for the determination of the significance in the correlation parameters between the variables, a test was performed to determine if there was a causal relationship between them. For this purpose, the Granger test was used, which in R Studio used the following instruction:

grangertest(independent variable data~dependent variable data,order = 1,data = data base)

The causality between the variables was checked if the p-value (Pr(>F)) was less than 0.05.

2.5. Analysis of the Validation of a Multivariate Model

To establish which economic sectors have the greatest significance with the behavior of road freight transport, the p-value resulting from a correlation between variables was analyzed. The following commands were thus performed using R Studio:

Linear modelling name<- lm(dependent variable~independent variable 1 + independent variable 2 + … independent variable n, data = data_file)

> summary(Linear modelling name)

The summary results provide the adjusted R2 value and the p-values of the independent variables to define whether there is a statistical validity in the relationship of the variables. If the adjusted R2 is greater than 0.7 and the p-value is less than 0.05, the formulation of an explanatory model between variables is statistically valid (Sharma and Kar 2018).

3. Results

This section presents the results of the data analysis. Section 3.1 describes the behavior of the time series for each of the three variables of road freight in the country. Section 3.2, Section 3.3 and Section 3.4 present, for different time lags, the Spearman rho values when correlating the global GDP and that of all economic sectors with respect to the three variables of road freight transported. Section 3.5 studies the relationship analysis between variables using the Principal Component Analysis method. Section 3.6 analyzes the causality between the economy and transport using the Granger causality test. Section 3.7 uses the application of linear correlation to determine the level of significance of each of the independent variables by means of their respective p-values, and the significance of the linearity of the correlation by means of the adjusted R2 and the resulting p-values.

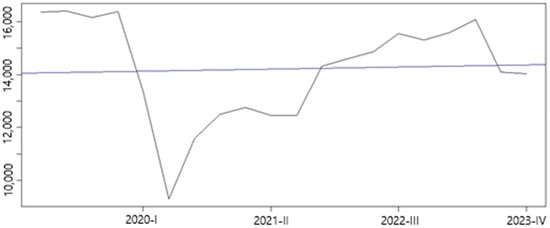

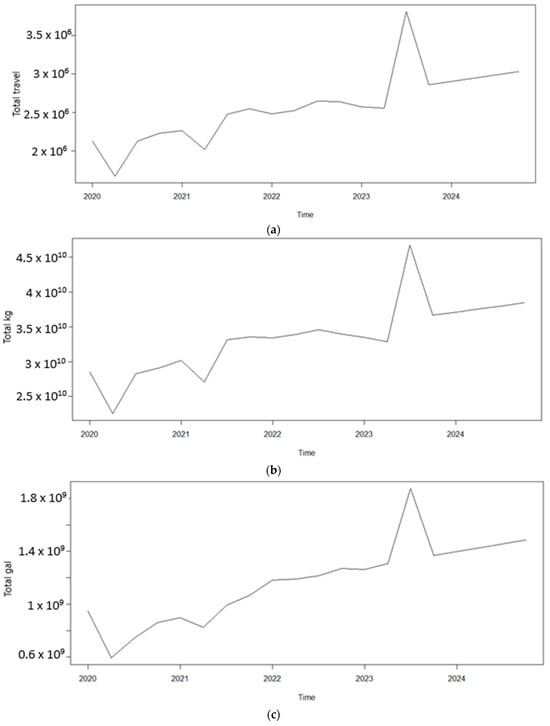

3.1. Descriptive Statistical Analysis of Freight Transportation Variables

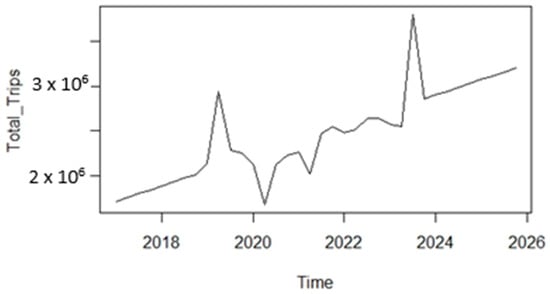

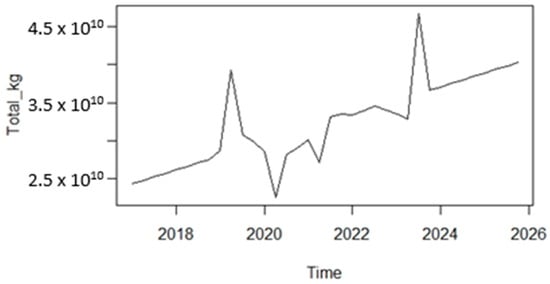

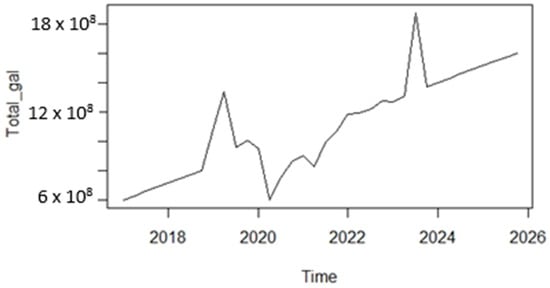

The time series of the three freight transportation variables are non-seasonal. The Dickey–Fuller test gives a p-value result greater than 0.05 for the three variables, as follows: 0.30 for the total trips, 0.23 for the total in kilograms, and 0.38 for the total in gallons. Furthermore, these are also not series with normal distributions. Applying the Shapiro–Wilk normality test, the p-values were greater than 0.05, as follows: 0.18 for the total number of trips, 0.24 for the total number in kilograms, and 0.15 for the total number of gallons. The non-normality of the series validates the use of the non-parametric Spearman correlation method and the resulting rho value to define its validity between two variables. Both non-seasonality and non-normality in the data series can be seen graphically in Figure 1, Figure 2 and Figure 3.

Figure 1.

Total trips data series.

Figure 2.

Total kilograms data series.

Figure 3.

Total gallons data series.

3.2. Correlation Analysis in the Same Year

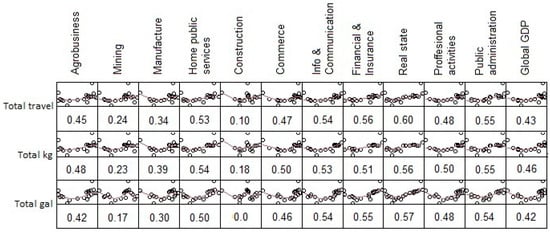

Correlations were carried out for the data of the dependent and independent variables in the same years. That is, the values of the dependent variable in 2019 were correlated with the values of the independent variable(s) for that same year. In the same way, the data were correlated until the year 2025, obtaining the following rho Spearman values (Figure 4).

Figure 4.

Rho values for the correlation between the global and sector GDP vs. three indicators of cargo transported by road. Quarterly accounts between the years 2019 and 2023 for the GDP and cargo (same year).

According to Figure 4: The highest-level correlations (rho ≥ 0.7) are presented for the Mining sector in the three load variables, for the Manufacturing sector related to the number of trips, for the Information and Communications sector regarding the number of trips and the number of gallons, and for the Professional Activities sector, also regarding the number of trips and the number of gallons. The correlations of the statistically acceptable levels (rho ≥ 0.5 < 0.7) are presented for most other economic sectors and cargo variables, except for the Construction sector, and the indicators for the number of trips and the number of kilograms transported. There were no correlations with a low significance value (rho < 0.5). There is consistency between the rho values. The standard deviation of the three freight indicators in each of the economic sectors has an average value of 0.03. This means that, in each economic sector, there is no freight indicator that is more relevant than another.

This analysis presents a good correlation between the global economy in Colombia and land cargo transportation in its three measurement indicators, both for the global GDP and for most economic sectors. The above is interpreted as the impact of a direct relationship (rho > 0) between economic development and the movement of land cargo in the country. However, it cannot be said that the correlation is highly significant (rho > 0.7).

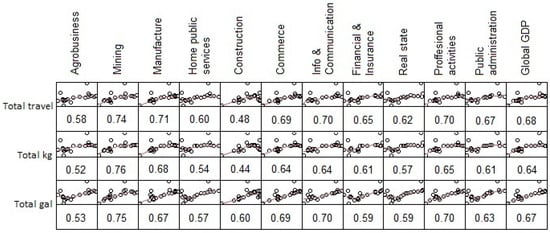

3.3. Analysis of the Correlation between GDP and Transported Cargo, One Year Later

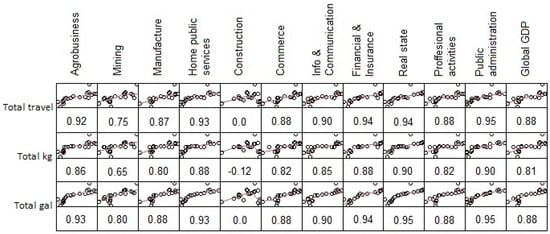

For this analysis, the cargo data transported between the years 2019 and 2023 were correlated with the global and sectoral GDP data from the years 2020 to 2024 (Figure 5). Later, GDP data between 2019 and 2023 were correlated with cargo values between 2020 and 2024 (Figure 6). In this analysis, the following rho values were obtained.

Figure 5.

Rho values for the correlation between the global and sectoral GDP vs. three indicators of cargo transported by road. Quarterly accounts: years 2019 to 2023 for cargo, and 2020 to 2024 for GDP (1-year difference).

Figure 6.

Rho values for the correlation between the global and sector GDP vs. three indicators of cargo transported by road. Quarterly accounts: years 2019 to 2023 for GDP, and 2020 to 2024 for cargo (1-year difference).

According to Figure 5: There are no highly significant correlations (rho ≥ 0.7). The correlations of a statistically acceptable level (rho ≥ 0.5 < 0.7) occur mainly in only the following four sectors (36%): Supply of Household Public Services, Information and Communications, Financial and Insurance, and Public Administration. The other sectors (64%) tend to have correlations with a low significance value (rho < 0.5). There is consistency between the rho values. The standard deviation of the three load indicators in each of the economic sectors has an average value of 0.03. This means that, in each economic sector, there is no freight indicator that is more relevant than another. In this case, there is no good correlation between the economy in Colombia and land cargo transportation in its three measurement indicators.

According to Figure 6: The highest-level correlations (rho ≥ 0.7) are presented for almost all sectors (90%), with the exception of the Construction sector, in which the correlation tends toward zero. There is consistency between the rho values. The standard deviation of the three freight indicators in each of the economic sectors has an average value of 0.03. This means that, in each economic sector, there is no cargo indicator that is more relevant than another. This analysis presents a good correlation between the economy in Colombia and land cargo transportation in its three measurement indicators, both for the global GDP and for most economic sectors. The above is interpreted as an impact of a direct relationship (positive rho) between economic development and the movement of land cargo in the country that is generated a year later. It can be stated that the correlation is highly significant (rho > 0.7).

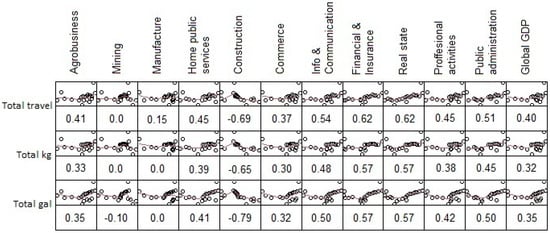

3.4. Analysis of the Correlation between GDP and Transported Cargo, Two Years Later

For this analysis, the cargo data transported between the years 2019 and 2023 were correlated with the global and sectoral GDP data from the years 2021 to 2025. Later, the GDP data between 2017 and 2021 were correlated with the cargo values between 2019 and 2023. In this analysis, the following rho values were obtained (Figure 7 and Figure 8).

Figure 7.

Rho values for the correlation between the global and sector GDP vs. three indicators of cargo transported by road. Quarterly accounts: years 2019 to 2023 for cargo, and 2021 to 2025 for GDP (2-year difference).

Figure 8.

Rho values for the correlation between the global and sector GDP vs. three indicators of cargo transported by road. Quarterly accounts: years 2017 to 2021 for GDP, and 2019 to 2023 for cargo (2-year difference).

According to Figure 7: Only one correlation was presented with a high significance value (rho ≥ 0.7), but with a negative sign, which does not give validity to the analysis approach. The rho values with medium significance (≥0.5, <0.7) corresponds to the Financial and Insurance, Real Estate economic, Information and Communications, and Professional Activities sectors. The Construction sector obtained the three rho values with an inverse relationship, being the only sector with this condition. The low significance rho values (rho < 0.5) appear with a greater tendency in the following sectors: Agriculture, Supply of Household Public Services, Commerce, Professional Activities, Mining, and Manufacturing, with the last two being the only ones that present rho values with a tendency towards zero. The inverse correlations and those of low significance have influenced the correlation with the global GDP to have a low significance (0.32 < rho > 0.40) for the three freight indicators. There is consistency between the rho values. The standard deviation of the three freight indicators in each of the economic sectors has an average value of 0.04. This allows us to affirm that, in each economic sector, there is no load indicator that is more relevant than another. However, the number of trips registers higher rho values than the other two indicators. Since there is no consistency in the correlations of high significance, it cannot be stated that the amount of cargo transported by land has a similar behavior with the economic performance of the country two years later.

According to Figure 8: There were no correlations with a high significance value (rho ≥ 0.7). The rho values between 0.5 and 0.63 have a trend in the Agriculture, Home Public Services Supply, Financial and Insurance, Real Estate, and Public Administration sectors. The low significance rho values (rho < 0.5) are presented in the following sectors: Manufacturing, Commerce, Information and Communications, and Professional Activities. The following economic sectors presented with an inverse correlation and of low and medium significance: Mining and Construction. Inverse correlations (negative rho) detract from the validity of the general correlation being analyzed, since good economic performance is not expected to result in lower quantities of transported cargo. Inverse correlations and those of low significance have influenced the correlation with the global GDP to have a low significance for the three cargo indicators (0.33 < rho > 0.42). There is consistency between the rho values. The standard deviation of the three load indicators in each of the economic sectors has an average value of 0.04. This allows us to affirm that there is no load indicator that is more relevant than another. However, the number of trips registers higher rho values than the other two indicators. Since there is no consistency in correlations of high significance, it cannot be stated that the country’s economic performance has a behavior similar to that of the amount of cargo transported by land two years later.

3.5. Relationship Analysis between Variables Using the Principal Component Analysis Method (PCA)

According to the PCA method, the relationship between variables can be identified graphically. If the vectors of the variables are similar in direction and magnitude, with a small angle between them, the correlation is strong and direct. If the direction between vectors tends to be 180° apart, the correlation is strong but inverse. If the direction between vectors is close to 90°, it is considered that there is not a good correlation between the variables.

According to Figure 9, the PCA method yields admissible results because Dimensions 1 and 2 together explain at least 90% of the data. The Figure 9c shows a good correlation between all of the variables, except for the Construction sector. In the other images of Figure 9, the vectors of the three variables of the transported cargo move away from the vectors of the GDP. This allows us to confirm that the most reliable relationship is that the behavior of the GDP has an effect on the amount of cargo transported one year later.

Figure 9.

Graphic analysis of PCA variables for the global and sector GDP, and three indicators of cargo transported by road, accounting for the years from 2015 to 2025. (a) Years 2015 to 2025 for cargo and GDP (both series start in the same year). (b) Years 2019 to 2023 for cargo, and years 2020 to 2024 for GDP (the first starts one year earlier). (c) Years 2019 to 2023 for GDP, and years 2020 to 2024 for cargo (the first starts one year earlier). (d) Years 2019 to 2023 for cargo, and years 2021 to 2025 for GDP (the first starts two years before). (e) Years 2017 to 2021 for GDP, and years 2019 to 2023 for cargo (the first starts two years before).

Figure 9 also demonstrates that the GDP behavior of the construction sector differs greatly from that of the other economic sectors, regardless of its relationship with freight transportation development. Although in Figure 9 there is text that is hidden by other text and by the vector lines, we make the observation that each vector indicates an economic sector, and the relevant thing about all of the graphs in Figure 9 is to be able to observe if the angle of the road cargo vectors (travel, kg, and gal) are close to the angle of each of the GDP vectors of the economic sectors.

3.6. Granger Causality Test

To complement the Spearman correlation analysis and validate the relationship between economic performance and the amount of cargo transported one year later in Colombia, the Granger causality test was applied.

The resulting p-value confirms the causal relationship between the economy and the cargo transported in the cases where the value was less than 0.05. Construction is the only sector that did not meet the causality condition (Table 1).

Table 1.

Granger causality test p-value.

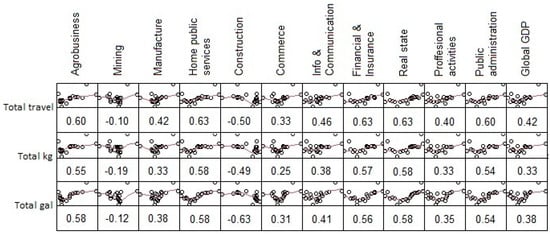

3.7. Significance of Each of the Economic Sectors in Correlation with Economic Development

To continue with the analysis of the correlation between the country’s economic development and the amount of freight transported by road one year later, the correlations were evaluated between the different economic sectors and the three freight variables. Additionally, the correlation of the freight variables was analyzed, but only with the global GDP, because the global GDP is the result of the behavior of all sectoral GDPs, and there is collinearity between them. For this reason, the following independent models were analyzed: multivariate correlation with economic sectors’ GDP in Table 2, Table 3 and Table 4, and univariate correlation with the global GDP in Table 5.

Table 2.

The Pr(>|t|) result of the multivariate correlation. Total travel as the dependent variable.

Table 3.

The Pr(>|t|) result of the multivariate correlation. Total kilograms as the dependent variable.

Table 4.

The Pr(>|t|) result of the multivariate correlation. Total gallons as dependent variable.

Table 5.

Adjusted R2 and Pr(>|t|) results of the correlation between the global GDP and cargo transport variables as dependent variables.

Thus, the quantity transported (total travel) is a dependent variable for a year (n), the multivariate regression data for sectoral GDPs is found in Table 2, and the adjusted R2 is 0.7682, with a p-value of 0.0003515. The results validate the multivariate correlation between the number of cargo trips and the economic sectors in Colombia. The adjusted R2 is greater than 0.7 and the p-value of the correlation is less than 0.05. The most significant economic sectors are those with a p-value of less than 0.05, including Agrobusiness, Mining, Home Public Services Supply, Commerce, Professional Activities, and Public Administration, Education, and Social Health Services (Table 2).

For the quantity transported (total kilograms) as a dependent variable for a year (n), the multivariate regression data for the sectoral GDPs is found in Table 3, and the adjusted R2 is 0.7611, with a p-value of 0.00356. Like with total travels, the results validate the multivariate correlation between the number of cargo trips and the economic sectors in Colombia. The adjusted R2 is greater than 0.7 and the p-value of the correlation is less than 0.05. The most significant economic sectors are those with a p-value of less than 0.05, including Agrobusiness, Mining, Home Public Services Supply, Commerce, Professional Activities, and Public Administration, Education, and Social Health Services (Table 3).

For the quantity transported (total gallons) as a dependent variable for a year (n), the multivariate regression data for the sectoral GDPs is found in Table 4, and the adjusted R2 is 0.8921, with a p-value of 0.0001238. Like with previous cases, the results validate the multivariate correlation between the number of cargo trips and the economic sectors in Colombia. The adjusted R2 is greater than 0.7 and the p-value of the correlation is less than 0.05. The most significant economic sectors are those with a p-value of less than 0.05, including Agrobusiness, Mining, Home Public Services Supply, Commerce, Professional Activities, and Public Administration, Education, and Social Health Services (Table 4).

Finally, we present the univariate correlation data between the global GDP as an independent variable and the quantity of cargo transported one year later. They were analyzed for each of the three cargo variables (Table 5).

The results in Table 5 validate the correlations between the global GDP and road freight variables. However, the linearity of the correlations is less reliable because the adjusted R2 values are lower than in the multivariate correlations (<0.7). This demonstrates the importance of carrying out an analysis of the performance of the transport sector, not only in terms of overall GDP, but also in terms of a multivariate relationship with different economic sectors.

This information is essential in the infrastructural planning process by the state and private industries, and is a tool for the projections of the freight transport business sector.

4. Discussion

The main objective of this study was to determine the performance of the GDP for the economic sectors so to predict the amount of cargo transported by road in Colombia.

The trend of the rho value was compared for the cases studied. The analysis of variables whose figures corresponded to the data series for the same years (both series started in the same year) (Figure 4) presented rho values <0.7 for 73% of the economic sectors, and <0.68 for the global GDP. Therefore, there is non-highly significant correlation between the two data sets.

For the correlations that estimated that the amount of cargo transported marked the behavior of the GDP (one and two years starting before the cargo data), the results trended towards rho values of medium and low significance (rho < 0.5). The tendency towards these low values means that there is no significant correlation between the variables. For the correlations in which the behavior of the GDP was correlated with the behavior of the amount of cargo transported many years later (one and two years starting before the GDP data), the rho values improved the correlations significantly. In the analysis with a one-year difference (Figure 6), the best correlations are presented, since 82% of the economic sectors presented rho values >0.8, and the global GDP too. However, the construction sector registered rho values tending toward zero, which rules it out of the mathematical prediction model.

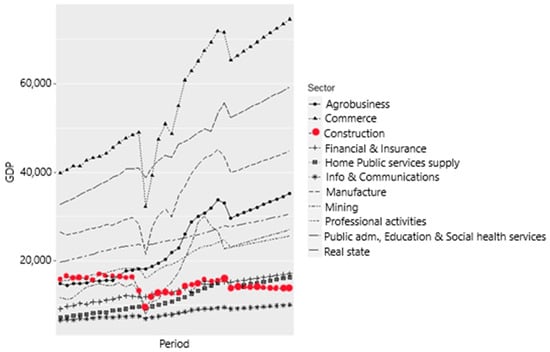

4.1. The Different Behavior of the Construction Sector

Concerning the last issue, the difference in the performance of the construction sector is not only observed in Figure 9. Figure 10 shows that the cycle of the construction sector is different from that of the other sectors analyzed. The trend in the construction sector (the red points in Figure 10) is clearly different from that of other economic sectors. The construction sector shows a horizontal trend, while that of the other sectors shows an increasing trend. They only have similar behavior in the period between 2020 and 2021 (the COVID-19 pandemic), in which a decreasing peak is recorded. That is why the construction sector does not show a correlation with the other economic sectors in the indicator of its participation in the national GDP. The increasing behavior of the sectoral GDP coincides with the also increasing behavior of the freight transport variables observed in Figure 1, Figure 2 and Figure 3.

Figure 10.

Colombia economic sectors GDP (billions COP). Quarterly accounts for the years 2019 to 2023.

Figure 11 shows the non-increasing trend of the Construction sector. Figure 10 clearly shows that, on the contrary, the trend of the other economic sectors is increasing. This gives greater clarity to the different behavior of the Construction sector. Figure 9 also demonstrates that the GDP behavior of the Construction sector differs greatly from that of the other economic sectors, regardless of its relationship with freight transportation development.

Figure 11.

Colombia Construction economic sector GDP trend (billions COP). Quarterly accounts for the years 2017 to 2025.

In all of the correlation analyses performed (Figure 4, Figure 5, Figure 6, Figure 7 and Figure 8), the rho values are in some cases inverse, in others close to zero, and when they are positive, they are not greater than 0.6. Therefore, the Construction sector differs from the others when being considered as an explanatory variable for the behavior of road freight transport in Colombia.

It is true that the Construction sector presents better correlation values in Figure 7, but they are inverse. Even so, correlation analyses were performed for those time series periods (according to Figure 7). The results of the adjusted R2 for the three load variables were not greater than 0.26. These results do not validate an independent correlation for the GDP of the Construction sector and road freight transport in Colombia.

As a similar situation, a study developed in Brazil analyzed the relationship between investment in infrastructure and economic sectors, it turned out that the Construction sector was the only one with a back linkage. The Agricultural, Communications, and Industrial sectors turned out to be the key sectors. This is a situation like the one resulting from this study (Centurião et al. 2024).

4.2. Historical Trend Change Due to the COVID-19 Pandemic

The COVID-19 pandemic resulted in a decline in the dynamics of the economy, and it could be presumed that this also affected the transport sector. Figure 10 clearly shows the decline in economic development of each of the sectors in 2020.

At first glance, one might think that the COVID-19 pandemic period marked a difference in the trend in the behavior of transported cargo. However, we have found that the data analyzed, including the economic statistical data during the pandemic, do not affect the historical trend prior to the pandemic. This can be said because the historical behavior of transported cargo, in the three indicators analyzed, did not register atypical behavior between the years 2020 and 2021 because its trend was increasing (Figure 12).

Figure 12.

Colombia Construction economic sector GDP trend (billions of COP). Quarterly accounts for the years 2019 to 2024. (a) Total travels; (b) Total kilograms; (c) Total gallons.

However, to continue the analysis of how much the results and conclusions of this research would have changed if there had been no pandemic, another data table was generated in which the sectoral GDP values were replaced between the periods 2020-I and 2021-III (Table A3).

With the changes in the database, assuming that there was no pandemic, the Spearman rho values were close to the original ones (Figure 6). There were only better values for the Mining and the Construction sectors, although this last one still shows an inverse trend (Table 6).

Table 6.

Spearman rho values. Data between 2020-I and 2021-III (COVID-19 pandemic) replaced by linear trend.

It is logical to think that, without the economic changes caused by the pandemic between 2020 and 2021, the correlation between the economy and transport would have more significant coefficients. However, this research shows that the correlation remains valid despite the change in trend in the statistics of all the indicators studied.

5. Conclusions

The results obtained coincide with the premise that the economic behavior of the main country’s economic sectors significantly correlates with the amount of cargo transported by road, but one year later. This is stated based on Spearman’s rho values, since, for all sectors except the Construction sector, they are greater than 0.7 (comparing Figure 4, Figure 5, Figure 7 and Figure 8 with Figure 6).

The different behavior of the Construction sector is confirmed in the Principal Component Analysis (PCA) (Figure 9), in which the vector of this economic sector deviates from that of the other sectors. In addition, when performing the Granger test, the Construction sector is the only one that does not meet the causality condition, because it has a p-value greater than 0.05. The other sectors achieve the causality condition between the sectoral GDP and the road freight transport indicators (Table 1).

Another aspect analyzed was the significance of each of the economic sectors in the correlation with the economic development according to the p-values obtained from the linearized multivariate correlations for each of the three indicators of transported cargo (number of trips, kilograms, and gallons). As a result, it is concluded that the multivariate correlation between the GDP of the economic sectors and the cargo transported one year later has greater statistical validity than the correlation between the overall GDP of the country and the cargo indicators. This is because, for the first case, the three adjusted R2 values (for total travels, total kilograms, and total gallons) are greater than 0.7 and the p-value of the correlation is less than 0.05. In the second case, the three adjusted R2 values are lower (<0.7) (Table 2, Table 3, Table 4 and Table 5).

It is valid to assume that a time series analysis to predict indicator data should not include the negative and atypical changes generated by the COVID-19 pandemic in the economy. By analyzing the correlations and causalities between variables (Spearman’s rho and the Granger test p-value), assuming the above premise, the results are more reliable because the down peak of the data between 2020 and 2021 is eliminated. However, this research verified the validity of the correlation between the economy and freight transport by working with real historical numbers, that is, including the consequences of the pandemic in the data.

According to what is written in this section, it is concluded that, in the Colombian case, the phenomenon of coupling occurs, and it is a unidirectional relationship. This information is essential in the infrastructural planning process by the state and is a tool for the projections of the freight transport business sector.

As for recommendations, it is important to increase the number of studies that analyze the impact between economic development and infrastructure in Latin America to unify the criteria and behaviors of the data series. In the region, there are a significant number of sources that provide official data. However, it is not common to find documents in specialized journals that work with statistical analyses such as the one presented herein.

A major limitation in conducting this research was the lack of similar studies in major countries in the Latin American region that have economic and infrastructural conditions like Colombia. If these studies had been found, a comparative analysis of the relationship between economic sectors and the amount of road freight transportation would have been possible.

Thus, in the future, we will also study the cases of countries in the Andean region in road freight transportation, due to the similarity of infrastructural development with Colombia. The next step in our investigations is to study the figures of other means of cargo transportation, such as air or sea, but as an independent analysis. In this case, we only analyzed Colombia and road freight transportation due to the importance it has in the development of the country’s infrastructure.

Author Contributions

Conceptualization, C.F.U.-B.; methodology, C.F.U.-B. and C.A.Z.-M.; software, H.A.R.-Q.; validation, C.F.U.-B., C.A.Z.-M. and H.A.R.-Q.; formal analysis, H.A.R.-Q.; investigation, C.F.U.-B., C.A.Z.-M. and H.A.R.-Q.; resources, C.F.U.-B., C.A.Z.-M. and H.A.R.-Q.; data curation, H.A.R.-Q.; writing—original draft preparation, C.F.U.-B.; writing—review and editing, C.A.Z.-M.; visualization, C.F.U.-B.; supervision, H.A.R.-Q.; project administration, C.F.U.-B., C.A.Z.-M. and H.A.R.-Q.; funding acquisition, C.F.U.-B., C.A.Z.-M. and H.A.R.-Q. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author/s.

Acknowledgments

The authors wish to acknowledge the available open data provided by the National Department of Statistics (DANE) and by the Logistics Portal of the Ministry of Transportation (Colombia). We also thank the participating institutions (Universidad Distrital Francisco José de Caldas and Universidad Militar Nueva Granada, Colombia) for the support granted to the researchers. In the case of the author Carlos Felipe Urazán-Bonells, it is mentioned that this is a product of his academic work as a professor at the Universidad Militar Nueva Granada, Colombia.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

| Agro. | Agrobusiness |

| CAF | Development Bank of Latin America and the Caribbean |

| Comm. | Commerce |

| Const. | Construction |

| COP | Colombian pesos |

| COVID | coronavirus disease |

| DANE | National Administrative Department of Statistics |

| ECLAC | Economic Commission for Latin America and the Caribbean |

| Finan. & Insur. | Financial_insurance |

| GDP | gross domestic product |

| GDPPC | GDP per capita |

| GVA | gross value added |

| IADB | Inter-American Development Bank |

| Info & Comm. | Info_communications |

| Manuf. | Manufacture |

| PCA | Principal Component Analysis |

| Prof. Ativ. | Professional_activities |

| Public Adm. | Public_administraton_Education_Social_health_services |

| UK | United Kingdom |

| U.S.A. | United States of America |

| TEU | Twenty Equivalent Unit |

| TRNINF | Transportation Infrastructure Index |

Appendix A

Table A1.

Sectoral and global GDP. Colombia’s data in billions of Colombian pesos (COP).

Table A1.

Sectoral and global GDP. Colombia’s data in billions of Colombian pesos (COP).

| Quaterly Period | Agrobusiness | Mining | Manufacture | Home Public Services Supply | Construction | Comerce | Information and Communications | Financial and Insurance | Real State | Professional Activities | Public Administraton, Education, Social Health Services | Global_GDP |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2017_I | 14.784 | 11.674 | 26.464 | 7.159 | 15.847 | 39.781 | 6.551 | 9.117 | 19.736 | 15.428 | 32.745 | 225.178 |

| 2017_II | 14.363 | 11.257 | 25.931 | 7.293 | 16.390 | 40.560 | 6.690 | 9.697 | 20.044 | 15.612 | 33.495 | 227.859 |

| 2017_III | 14.780 | 11.697 | 26.168 | 7.557 | 16.139 | 41.326 | 6.649 | 9.880 | 20.411 | 15.800 | 34.111 | 232.030 |

| 2017_IV | 14.887 | 12.910 | 26.458 | 7.780 | 16.098 | 41.385 | 6.931 | 10.366 | 20.785 | 16.058 | 34.884 | 235.404 |

| 2018_I | 15.048 | 14.058 | 27.048 | 7.835 | 15.995 | 42.710 | 6.872 | 10.168 | 21.100 | 16.451 | 35.728 | 240.549 |

| 2018_II | 15.415 | 14.443 | 27.279 | 8.126 | 15.611 | 43.182 | 7.034 | 10.698 | 21.466 | 16.832 | 36.356 | 245.009 |

| 2018_III | 15.432 | 14.896 | 27.640 | 8.282 | 16.992 | 43.545 | 7.199 | 10.704 | 21.947 | 17.031 | 37.255 | 250.176 |

| 2018_IV | 15.602 | 14.391 | 28.191 | 8.373 | 16.512 | 44.271 | 7.243 | 11.057 | 22.312 | 17.283 | 37.877 | 252.057 |

| 2019_I | 15.624 | 14.434 | 27.980 | 8.730 | 16.358 | 45.539 | 7.174 | 11.311 | 22.690 | 17.665 | 38.900 | 256.822 |

| 2019_II | 16.773 | 14.945 | 28.768 | 8.856 | 16.391 | 46.668 | 7.381 | 11.686 | 22.997 | 18.169 | 39.334 | 263.438 |

| 2019_III | 17.747 | 14.192 | 29.260 | 9.093 | 16.160 | 47.715 | 7.321 | 12.047 | 23.266 | 18.273 | 40.728 | 268.314 |

| 2019_IV | 17.814 | 14.747 | 29.823 | 9.445 | 16.368 | 48.344 | 7.505 | 11.940 | 23.435 | 18.351 | 40.800 | 271.494 |

| 2020_I | 18.155 | 13.152 | 28.388 | 9.655 | 13.360 | 48.923 | 7.470 | 11.859 | 23.686 | 18.425 | 40.985 | 267.840 |

| 2020_II | 18.144 | 7.867 | 21.450 | 9.192 | 9.309 | 32.238 | 6.898 | 11.818 | 23.510 | 16.048 | 38.841 | 218.762 |

| 2020_III | 18.768 | 10.626 | 27.699 | 9.695 | 11.582 | 39.171 | 7.190 | 12.427 | 23.795 | 16.978 | 41.015 | 245.173 |

| 2020_IV | 19.426 | 11.202 | 30.202 | 10.094 | 12.493 | 47.448 | 7.403 | 12.705 | 24.052 | 17.941 | 42.642 | 265.966 |

| 2021_I | 20.241 | 13.818 | 31.821 | 10.390 | 12.764 | 50.899 | 7.709 | 12.790 | 24.409 | 18.873 | 43.859 | 280.596 |

| 2021_II | 21.865 | 15.091 | 29.855 | 10.799 | 12.448 | 48.690 | 7.829 | 12.824 | 24.607 | 19.088 | 43.395 | 281.605 |

| 2021_III | 22.911 | 17.445 | 34.774 | 11.302 | 12.458 | 54.985 | 8.154 | 13.263 | 24.894 | 19.966 | 46.356 | 304.916 |

| 2021_IV | 26.042 | 20.628 | 36.789 | 11.754 | 14.311 | 60.787 | 8.454 | 13.776 | 25.227 | 20.853 | 46.959 | 325.468 |

| 2022_I | 28.783 | 23.740 | 39.599 | 12.487 | 14.599 | 62.858 | 8.809 | 12.970 | 25.565 | 21.797 | 47.762 | 344.676 |

| 2022_II | 30.104 | 28.687 | 41.865 | 13.182 | 14.853 | 65.093 | 9.009 | 14.880 | 25.870 | 22.779 | 48.998 | 363.415 |

| 2022_III | 30.725 | 30.223 | 43.258 | 13.806 | 15.549 | 67.410 | 9.129 | 14.645 | 26.315 | 23.244 | 49.831 | 377.709 |

| 2022_IV | 31.846 | 27.824 | 43.747 | 14.342 | 15.302 | 69.297 | 9.172 | 14.630 | 26.685 | 23.412 | 49.268 | 376.722 |

| 2023_I | 33.806 | 26.621 | 45.274 | 14.925 | 15.581 | 71.907 | 9.325 | 15.135 | 27.256 | 24.155 | 53.396 | 392.277 |

| 2023_II | 33.000 | 22.675 | 43.565 | 15.858 | 16.074 | 71.604 | 9.465 | 15.251 | 27.872 | 24.663 | 55.677 | 388.904 |

| 2023_III | 29.669 | 23.082 | 39.889 | 13.923 | 14.087 | 65.260 | 9.105 | 15.143 | 27.713 | 22.952 | 52.364 | 360.685 |

| 2023_IV | 30.276 | 23.524 | 40.429 | 14.183 | 14.039 | 66.293 | 9.206 | 15.359 | 28.020 | 23.241 | 53.126 | 366.050 |

| 2024_I | 30.884 | 23.966 | 40.968 | 14.444 | 13.990 | 67.325 | 9.306 | 15.574 | 28.327 | 23.531 | 53.889 | 371.416 |

| 2024_II | 31.491 | 24.408 | 41.508 | 14.705 | 13.941 | 68.358 | 9.407 | 15.790 | 28.635 | 23.820 | 54.651 | 376.781 |

| 2024_III | 32.099 | 24.850 | 42.047 | 14.965 | 13.893 | 69.390 | 9.508 | 16.005 | 28.942 | 24.109 | 55.413 | 382.147 |

| 2024_IV | 32.706 | 25.292 | 42.586 | 15.226 | 13.844 | 70.423 | 9.608 | 16.221 | 29.249 | 24.399 | 56.176 | 387.512 |

| 2025_I | 33.314 | 25.733 | 43.126 | 15.487 | 13.795 | 71.456 | 9.709 | 16.436 | 29.557 | 24.688 | 56.938 | 392.878 |

| 2025_II | 33.921 | 26.175 | 43.665 | 15.748 | 13.747 | 72.488 | 9.810 | 16.652 | 29.864 | 24.977 | 57.700 | 398.243 |

| 2025_III | 34.529 | 26.617 | 44.205 | 16.008 | 13.698 | 73.521 | 9.910 | 16.867 | 30.171 | 25.267 | 58.463 | 403.609 |

| 2025_IV | 35.136 | 27.059 | 44.744 | 16.269 | 13.649 | 74.553 | 10.011 | 17.083 | 30.478 | 25.556 | 59.225 | 408.974 |

Table A2.

Indicators of cargo transported by land through logistics corridors. Colombia’s data.

Table A2.

Indicators of cargo transported by land through logistics corridors. Colombia’s data.

| Quaterly Period | Total Trips | Total Kilograms | Total Gallons |

|---|---|---|---|

| 2017_I | 1,712,139 | 24,403,893,109 | 598,805,107 |

| 2017_II | 1,754,630 | 24,856,611,315 | 627,361,966 |

| 2017_III | 1,797,121 | 25,309,329,520 | 655,918,824 |

| 2017_IV | 1,839,612 | 25,762,047,726 | 684,475,682 |

| 2018_I | 1,882,102 | 26,214,765,931 | 713,032,541 |

| 2018_II | 1,924,593 | 26,667,484,136 | 741,589,399 |

| 2018_III | 1,967,084 | 27,120,202,342 | 770,146,258 |

| 2018_IV | 2,009,575 | 27,572,920,547 | 798,703,116 |

| 2019_I | 2,128,272 | 28,715,234,440 | 1,071,545,808 |

| 2019_II | 2,937,974 | 39,224,867,127 | 1,335,159,450 |

| 2019_III | 2,284,749 | 30,752,663,253 | 957,446,070 |

| 2019_IV | 2,253,100 | 29,840,117,733 | 1,002,501,912 |

| 2020_I | 2,123,129 | 28,552,312,234 | 950,074,318 |

| 2020_II | 1,671,380 | 22,563,113,345 | 595,634,532 |

| 2020_III | 2,124,219 | 28,234,632,136 | 745,152,235 |

| 2020_IV | 2,228,770 | 29,108,835,203 | 859,227,950 |

| 2021_I | 2,261,989 | 30,174,420,639 | 898,275,486 |

| 2021_II | 2,015,411 | 27,107,307,599 | 825,454,243 |

| 2021_III | 2,470,906 | 33,120,531,267 | 993,196,511 |

| 2021_IV | 2,548,051 | 33,563,269,564 | 1,064,696,558 |

| 2022_I | 2,480,903 | 33,392,600,617 | 1,180,961,171 |

| 2022_II | 2,518,905 | 33,914,633,099 | 1,189,402,223 |

| 2022_III | 2,640,869 | 34,575,554,921 | 1,216,439,646 |

| 2022_IV | 2,635,817 | 33,990,783,320 | 1,270,543,551 |

| 2023_I | 2,573,636 | 33,476,995,991 | 1,262,474,131 |

| 2023_II | 2,550,652 | 32,886,768,444 | 1,307,820,168 |

| 2023_III | 3,806,436 | 46,707,308,514 | 1,875,156,347 |

| 2023_IV | 2,859,390 | 36,627,284,657 | 1,369,840,285 |

| 2024_I | 2,901,881 | 37,080,002,863 | 1,398,397,143 |

| 2024_II | 2,944,372 | 37,532,721,068 | 1,426,954,002 |

| 2024_III | 2,986,863 | 37,985,439,274 | 1,455,510,860 |

| 2024_IV | 3,029,353 | 38,438,157,479 | 1,484,067,719 |

| 2025_I | 3,071,844 | 38,890,875,685 | 1,512,624,577 |

| 2025_II | 3,114,335 | 39,343,593,890 | 1,541,181,436 |

| 2025_III | 3,156,826 | 39,796,312,096 | 1,569,738,294 |

| 2025_IV | 3,199,316 | 40,249,030,301 | 1,598,295,152 |

Table A3.

Sectoral and global GDP. Colombia’s data in billions of Colombian pesos (COP). Data between 2020-I and 2021-III replaced by the linear trend of the other values.

Table A3.

Sectoral and global GDP. Colombia’s data in billions of Colombian pesos (COP). Data between 2020-I and 2021-III replaced by the linear trend of the other values.

| Quaterly Period | Agrobusiness | Mining | Manufacture | Home Public Services Supply | Construction | Comerce | Information and Communications | Financial and Insurance | Real State | Professional Activities | Public Administraton, Education, Social Health Services | Global_GDP |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2017_I | 14,784 | 11,674 | 26,464 | 7159 | 15,847 | 39,781 | 6551 | 9117 | 19,736 | 15,428 | 32,745 | 225,178 |

| 2017_II | 14,363 | 11,257 | 25,931 | 7293 | 16,390 | 40,560 | 6690 | 9697 | 20,044 | 15,612 | 33,495 | 227,859 |

| 2017_III | 14,780 | 11,697 | 26,168 | 7557 | 16,139 | 41,326 | 6649 | 9880 | 20,411 | 15,800 | 34,111 | 232,030 |

| 2017_IV | 14,887 | 12,910 | 26,458 | 7780 | 16,098 | 41,385 | 6931 | 10,366 | 20,785 | 16,058 | 34,884 | 235,404 |

| 2018_I | 15,048 | 14,058 | 27,048 | 7835 | 15,995 | 42,710 | 6872 | 10,168 | 21,100 | 16,451 | 35,728 | 240,549 |

| 2018_II | 15,415 | 14,443 | 27,279 | 8126 | 15,611 | 43,182 | 7034 | 10,698 | 21,466 | 16,832 | 36,356 | 245,009 |

| 2018_III | 15,432 | 14,896 | 27,640 | 8282 | 16,992 | 43,545 | 7199 | 10,704 | 21,947 | 17,031 | 37,255 | 250,176 |

| 2018_IV | 15,602 | 14,391 | 28,191 | 8373 | 16,512 | 44,271 | 7243 | 11,057 | 22,312 | 17,283 | 37,877 | 252,057 |

| 2019_I | 15,624 | 14,434 | 27,980 | 8730 | 16,358 | 45,539 | 7174 | 11,311 | 22,690 | 17,665 | 38,900 | 256,822 |

| 2019_II | 16,773 | 14,945 | 28,768 | 8856 | 16,391 | 46,668 | 7381 | 11,686 | 22,997 | 18,169 | 39,334 | 263,438 |

| 2019_III | 17,747 | 14,192 | 29,260 | 9093 | 16,160 | 47,715 | 7321 | 12,047 | 23,266 | 18,273 | 40,728 | 268,314 |

| 2019_IV | 17,814 | 14,747 | 29,823 | 9445 | 16,368 | 48,344 | 7505 | 11,940 | 23,435 | 18,351 | 40,800 | 271,494 |

| 2020_I | 19,879 | 17,237 | 31,744 | 9936 | 15,985 | 51,225 | 7669 | 12,267 | 23,692 | 19,078 | 41,867 | 286,002 |

| 2020_II | 20,820 | 17,925 | 32,615 | 10,289 | 15,893 | 52,605 | 7822 | 12,484 | 23,972 | 19,433 | 42,693 | 293,170 |

| 2020_III | 21,761 | 18,613 | 33,487 | 10,642 | 15,802 | 53,985 | 7946 | 12,701 | 24,252 | 19,787 | 43,511 | 300,338 |

| 2020_IV | 22,703 | 19,301 | 34,358 | 10,995 | 15,711 | 55,366 | 8069 | 12,917 | 24,532 | 20,141 | 44,328 | 307,506 |

| 2021_I | 23,644 | 19,989 | 35,230 | 11,348 | 15,619 | 56,746 | 8192 | 13,134 | 24,812 | 20,495 | 45,146 | 314,674 |

| 2021_II | 24,585 | 20,677 | 36,102 | 11,701 | 15,528 | 58,126 | 8315 | 13,351 | 25,091 | 20,850 | 45,963 | 321,842 |

| 2021_III | 25,527 | 21,365 | 36,973 | 12,053 | 15,436 | 59,507 | 8438 | 13,568 | 25,371 | 21,204 | 46,780 | 329,009 |

| 2021_IV | 26,042 | 20,628 | 36,789 | 11,754 | 14,311 | 60,787 | 8454 | 13,776 | 25,227 | 20,853 | 46,959 | 325,468 |

| 2022_I | 28,783 | 23,740 | 39,599 | 12,487 | 14,599 | 62,858 | 8809 | 12,970 | 25,565 | 21,797 | 47,762 | 344,676 |

| 2022_II | 30,104 | 28,687 | 41,865 | 13,182 | 14,853 | 65,093 | 9009 | 14,880 | 25,870 | 22,779 | 48,998 | 363,415 |

| 2022_III | 30,725 | 30,223 | 43,258 | 13,806 | 15,549 | 67,410 | 9129 | 14,645 | 26,315 | 23,244 | 49,831 | 377,709 |

| 2022_IV | 31,846 | 27,824 | 43,747 | 14,342 | 15,302 | 69,297 | 9172 | 14,630 | 26,685 | 23,412 | 49,268 | 376,722 |

| 2023_I | 33,806 | 26,621 | 45,274 | 14,925 | 15,581 | 71,907 | 9325 | 15,135 | 27,256 | 24,155 | 53,396 | 392,277 |

| 2023_II | 33,000 | 22,675 | 43,565 | 15,858 | 16,074 | 71,604 | 9465 | 15,251 | 27,872 | 24,663 | 55,677 | 388,904 |

| 2023_III | 29,669 | 23,082 | 39,889 | 13,923 | 14,087 | 65,260 | 9105 | 15,143 | 27,713 | 22,952 | 52,364 | 360,685 |

| 2023_IV | 30,276 | 23,524 | 40,429 | 14,183 | 14,039 | 66,293 | 9206 | 15,359 | 28,020 | 23,241 | 53,126 | 366,050 |

| 2024_I | 30,884 | 23,966 | 40,968 | 14,444 | 13,990 | 67,325 | 9306 | 15,574 | 28,327 | 23,531 | 53,889 | 371,416 |

| 2024_II | 31,491 | 24,408 | 41,508 | 14,705 | 13,941 | 68,358 | 9407 | 15,790 | 28,635 | 23,820 | 54,651 | 376,781 |

| 2024_III | 32,099 | 24,850 | 42,047 | 14,965 | 13,893 | 69,390 | 9508 | 16,005 | 28,942 | 24,109 | 55,413 | 382,147 |

| 2024_IV | 32,706 | 25,292 | 42,586 | 15,226 | 13,844 | 70,423 | 9608 | 16,221 | 29,249 | 24,399 | 56,176 | 387,512 |

| 2025_I | 33,314 | 25,733 | 43,126 | 15,487 | 13,795 | 71,456 | 9709 | 16,436 | 29,557 | 24,688 | 56,938 | 392,878 |

| 2025_II | 33,921 | 26,175 | 43,665 | 15,748 | 13,747 | 72,488 | 9810 | 16,652 | 29,864 | 24,977 | 57,700 | 398,243 |

| 2025_III | 34,529 | 26,617 | 44,205 | 16,008 | 13,698 | 73,521 | 9910 | 16,867 | 30,171 | 25,267 | 58,463 | 403,609 |

| 2025_IV | 35,136 | 27,059 | 44,744 | 16,269 | 13,649 | 74,553 | 10,011 | 17,083 | 30,478 | 25,556 | 59,225 | 408,974 |

References

- Alam, M. Absar. 2014. Process of Cooperation and Integration in South Asia: Issues in Trade and Transport Facilitation. Vikalpa 39: 87–102. [Google Scholar] [CrossRef]

- Alises, Ana, Vassallo José Manuel, and Guzmán Andrés Felipe. 2014. Road freight transport decoupling: A comparative analysis between the United Kingdom and Spain. Transport Policy 32: 186–93. [Google Scholar] [CrossRef]

- Asgarpour, Sahand, Andreas Hartmann, Konstantinos Gkiotsalitis, and Robin Neef. 2023. Scenario-Based Strategic Modeling of Road Transport Demand and Performance. Transportation Research Record 2677: 1415–40. [Google Scholar] [CrossRef]

- Bennathan, Esra, Julie Fraser, and Louis Thompson. 1992. What Determines Demand for Freight Transport? Policy Research Working Paper Series 998; Washington, DC: The World Bank. [Google Scholar]

- Beyzatlar, Mehmet, Muge Karacal, and Hakan Yetkiner. 2014. Granger-causality between transportation and GDP: A panel data approach. Transportation Research Part A: Policy and Practice 63: 43–55. [Google Scholar] [CrossRef]

- Boldizsár, Adrienn, Ferenc Mészáros, and Tibor Sipos. 2023. Spatiality in freight transport efficiency. Acta Oeconomica 73: 327–45. [Google Scholar] [CrossRef]

- Caicedo, Pablo Fernando. 2013. Análisis del Sector de Transporte por Carretera en la Economía Colombiana, Dificultades y Retos. In Trabajo Final para la Especialización en Finanzas y Administración pública. Bogotá: Universidad Militar Nueva Granada. Available online: https://repository.unimilitar.edu.co/bitstream/handle/10654/11806/An%C3%A1lisis%20del%20Sector%20de%20Transporte%20por%20Carretera%20en%20la%20Econom%C3%ADa%20Colombiana%2C%20Dificultades%20y%20Retos.pdf?sequence=2 (accessed on 21 February 2024).

- Centurião, Daniel, Boldrine Abrita Mateus, Rondina Neto Angelo, Ana Paula Camilo, Rafaella Vignandi, Guilherme Espíndola Junior, Vanessa Weber, Nelagley Marques, and Maciel Franco. 2024. Impacts of road transport infrastructure investments on the Latin American Integration Route. Regional Science Policy & Practice 16: 100061. [Google Scholar] [CrossRef]

- Chen, Jing, Linjun Lu, Jianjohn Lu, and Yinghao Luo. 2015. An Early-Warning System for Shipping Market Crisis Using Climate Index. Journal of Coastal Research 73: 620–27. [Google Scholar] [CrossRef]

- Choi, Jung, Kang Hyuk Kim, and Hee Jung Han. 2018. Development of early warning index in Korean shipping industry by using signal approach. Maritime Policy & Management 45: 1007–20. [Google Scholar] [CrossRef]

- Development Bank of Latin America and the Caribbean (CAF). 2014. Perfil logístico de America Latina. Taller sobre transporte de carga y logística. Available online: https://www.caf.com/es/actualidad/noticias/2018/03/corredores-logisticos-de-integracion-para-mejorar-la-productividad-y-el-bienestar-en-america-latina/ (accessed on 21 February 2024).

- Diaz, Rafael, Joshua Behr, and ManWo Ng. 2016. Quantifying the economic and demographic impact of transportation infrastructure investments: A simulation study. Simulation 92: 377–93. [Google Scholar] [CrossRef]

- Economic Commission for Latin America and the Caribbean (ECLAC). 2017. Estimación de la demanda de transporte mediante el método insumo producto: Casos de Brasil, Chile, Ecuador y Nicaragua. Boletín FAL, edición 358, No. 6. Available online: https://www.cepal.org/sites/default/files/publication/files/43364/S1701171_es.pdf (accessed on 14 February 2024).

- Economic Commission for Latin America and the Caribbean (ECLAC). 2018. Geografía del transporte de carga Evolución y desafíos en un contexto global cambiante. Serie Recursos Naturales e Infraestructura, No. 175. Available online: https://repositorio.cepal.org/server/api/core/bitstreams/7f73bedc-aecf-40fb-a751-2f123c627a67/content (accessed on 14 February 2024).

- Eurostat. 2023. Methodologies Used in Road Freight Transport Surveys in Member States, EFTA and 3 Candidate Countries. Available online: https://ec.europa.eu/eurostat/documents/3859598/18003990/KS-GQ-23-014-EN-N.pdf/bb6658f5-0226-8c2d-993a-326f6d296750?version=1.0&t=1701353108468 (accessed on 9 June 2024).

- Gao, Yuee, Yaping Zhang, Hejiang Li, Ting Peng, and Siqi Hao. 2016. Study on the Relationship between Comprehensive Transportation Freight Index and GDP in China. Procedia Engineering 137: 571–80. [Google Scholar] [CrossRef]

- German-Soto, Vicente, Alexsandra de la Peña Flores, and Karina García Bermúdez. 2023. Desarrollo económico, inversión en transporte y urbanización en México: Causalidad y efectos. Nóesis. Revista de Ciencias Sociales 32: 67–88. [Google Scholar] [CrossRef]

- Ghosh, Prabir Kumar, and Soumyananda Dinda. 2022. Revisited the Relationship Between Economic Growth and Transport Infrastructure in India: An Empirical Study. The Indian Economic Journal 70: 34–52. [Google Scholar] [CrossRef]

- Gnap, Josep, Vladimir Konečný, and Pavol Varjan. 2018. Research on Relationship between Freight Transport Performance and GDP in Slovakia and EU Countries. Naše More 65: 32–39. [Google Scholar] [CrossRef]

- Gonzalez, Juan Nicolás, Alberto Camarero-Orive, Nicoletta González-Cancelas, and Andrés Felipe Guzman. 2022. Impact of the COVID-19 pandemic on road freight transportation—A Colombian case study. Research in Transportation Business & Management 43: 100802. [Google Scholar] [CrossRef]

- Gómez, Alfredo. 2016. Evolución del transporte terrestre de carga en Colombia y su impacto en empresas del sector industrial del Valle de Aburrá; Medellín: Universidad EAFIT. Available online: https://core.ac.uk/download/pdf/47253079.pdf (accessed on 21 February 2024).

- Grenzeback, Lance, Austin Brown, Michael Fischer, Nathan Hutson, Christopher Lamm, Yi Lin Pei, Laura Vimmerstedt, Anant Vyas, and James Winebrake. 2013. Freight Transportation Demand: Energy-Efficient Scenarios for a Low-Carbon Future. Prepared by Cambridge Systematics, Inc., and the National Renewable Energy Laboratory (Golden, CO) for the U.S. Department of Energy, Washington, DC. Transportation Energy Futures Series, DOE/GO-102013-3711. Cambridge, MA: Cambridge Systematics, Inc. 82p. [Google Scholar]

- Hauke, Jan, and Tomasz Kossowski. 2011. Comparison of values of Pearson’s and Spearman’s correlation coefficients on the same sets of data. Quaestiones Geographicae 30: 87. [Google Scholar] [CrossRef]

- Inter-American Development Bank (IADB). 2014. Anuario de transporte de carga y logística. Available online: https://publications.iadb.org/es/anuario-estadistico-de-transporte-de-carga-y-logistica (accessed on 21 February 2024).

- Khalid , Usama, Zia Ur Rehman, Chencong Liao, Khalid Farooq, and Hassan Mujtaba. 2019. Compressibility of Compacted Clays Mixed with a Wide Range of Bentonite for Engineered Barriers. Arabian Journal for Science and Engineering 44: 5027–42. [Google Scholar] [CrossRef]

- Khalid, Usama, Zia Ur Rehman, Hassan Mujtaba, and Khalid Farooq. 2022. 3D response surface modeling based in-situ assessment of physico-mechanical characteristics of alluvial soils using dynamic cone penetrometer. Transportation Geotechnics 36: 100781. [Google Scholar] [CrossRef]

- Kveiborg, Ole, and Mogens Fosgerau. 2007. Decomposing the decoupling of Danish road freight traffic growth and economic growth. Transport Policy 14: 39–48. [Google Scholar] [CrossRef]