1. Introduction

Economic growth in Nigeria has followed an inconsistent trend regardless of government efforts to attract foreign direct investment (FDI), manage external debt, and achieve sustainable growth.

Obi et al. (

2012) justified FDI and external debt as contributing factors capable of influencing economic growth in Nigeria.

FDI in Nigeria is expected to serve as a significant impulse for growth, driven by market expansion, technological know-how, cost advantages, access to resources, and a potential for increased return on investment. FDI has a number of potential benefits for both the host country and the investing entity. FDI expands growth through job creation, technology transfer, infrastructural development, and increased productivity. Consequently, FDI is a key drive for export expansion and technology diffusion, both of which have positive spillover effects on the broader economy, thus leading to economic growth (

Arezki et al. 2021).

Okonjo-Iweala and Dollar (

2020) argued for the need to leverage FDI inflows to foster sustainable growth, promote diversification, and reduce oil revenue reliance. Over the years, Nigeria has been known to attract large FDI inflows, deliver high return on investment potential, and have a large consumer market. FDI is accepted as an agent of growth in any economy because it brings in additional capital, knowledge, and technology, which enhances productivity and competitiveness. In Africa, Nigeria is the top economy for attracting FDI. The country has experienced various trade policies that focus on distancing the economy from oil revenues and improving industrial sectors and profitability. FDI inflows into Nigeria have shown a fluctuating pattern in recent times, with average FDI inflows of USD 8.9 billion in 2013, around USD 3.5 billion in 2017, and around USD 1.9 billion in 2018, showing a decline due to austerity measures being imposed in 2018. FDI accounted for 3.37% (USD 200.08 million) of the total capital inflows during the Q3 2019 period (

Okonjo-Iweala and Dollar 2020).

A remarkable increase was recorded to the tune of USD 23.98 billion in 2019. However, FDI again experienced a decline thereafter, largely influenced by the global economic slowdown and the COVID-19 pandemic in 2020, by about 59%, with an inflow of USD 2.6 billion, representing a decline of 10% compared to the previous year (

Khan et al. 2021). The challenge lies in attracting substantial FDI inflows capable of impacting inclusive growth.

External debt can be used for investment financing, importing goods and services, and supporting government expenditure, which is crucial for attaining economic growth (

Bello and Shittu 2018). The effects of external debt on the Nigerian economy vary depending on factors such as debt levels, debt sustainability, interest rates, and the effective utilization of borrowed funds. Notably, while external debt can provide financing opportunities, excessive debt burdens can pose challenges and risks to the economic stability of a nation.

The report of the Debt Management Office (DMO) shows the country’s debt stock was USD 0.763 billion in 1977. However, it experienced a huge increase to USD 5.09 billion in 1978, reaching a peak of USD 8.85 billion in 1980, representing an increase of 73.96% between 1978 and 1980. Thereafter, it increased to USD 35.94 billion in 2004. The Nigerian government embarked on an intense call-off of debt between the years 2003 and 2007 due to the over-indebtedness witnessed by Nigeria, which resulted in foreign debt decreasing up to USD 3.4 billion in 2007 (

CBN Statistical Bulletin 2018). Nevertheless, the debt write-off made Nigeria better in terms of debt by 2006, which marked the year that a voluminous amount of its debt was compensated for. However, the debt amount increased almost immediately as a result of a contract agreement signed by the state government, increasing borrowing. Nigeria adopted the structural adjustment program (SAP) in 1986 under the auspices of the World Bank and the International Monetary Fund (IMF) to increase its ability to pay back debt loans (

Ayadi and Ayadi 2008).

Despite debt forgiveness, borrowing increased so fast by the governments that it reached a stage where the debt profile started increasing yearly again from 2007 to 2018, with values of NGN 438.89 billion, 523.25 billion, 590.44 billion, 689.84 billion, 896.85 billion, 1026.90 billion, 1387.33 billion, 1631.50 billion, 2111.51 billion, 3478.91 billion, 5787.51 billion, and 7759.20 billion, respectively (

CBN Statistical Bulletin 2018).

Effective management of external debt is required for maintaining macroeconomic stability, preserving investor confidence, and promoting sustainable economic growth. There are two separate schools of thought on the role of external debt on economic growth, depending on how debt is managed (

Bello and Shittu 2018). The former argues that debt can finance productive investments that stimulate growth. The latter emphasizes that excessive and unsustainable debt burdens can hinder economic growth, with resources that could have been allocated to productive investments being redirected toward debt servicing (

Akinlo 2004). Nigeria has experienced fluctuations in external debt levels over the years. In 2020, Nigeria’s external debt stood at USD 31.98 billion, representing an increase of 18.2% compared to 2019 (

World Bank 2021). High external debt can impose constraints on economic growth by diverting resources away from productive investments, increasing debt servicing costs, and creating vulnerabilities to external shocks. Evidence from the literature confirms that with increased debt comes a corresponding decline in FDI in Nigeria (

Otovwe 2019).

External debt burden diverts the financial resources accumulated from foreign investment to pay or ease the debt burden with a high interest rate, which then reduces the funds in the economy by causing a reduction in productivity, leading to sluggish or stable economic growth. This becomes problematic as such factors limit and hinder the effect of FDI on an economy. This argument creates fiscal gaps that are yet to be addressed in the body of knowledge. The research question requiring urgent empirical attention is as follows: What are the roles of foreign direct investment and external debt in the economic growth of Nigeria?

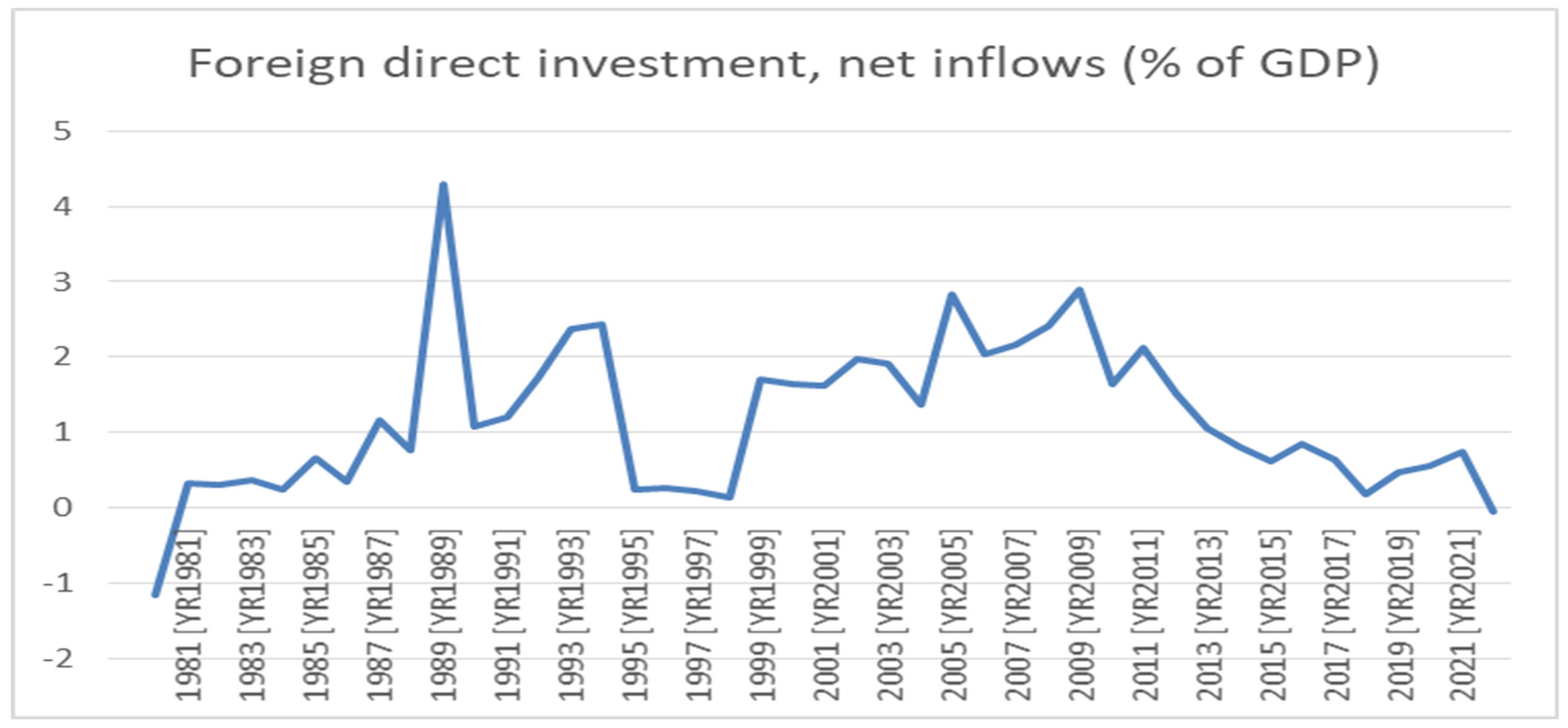

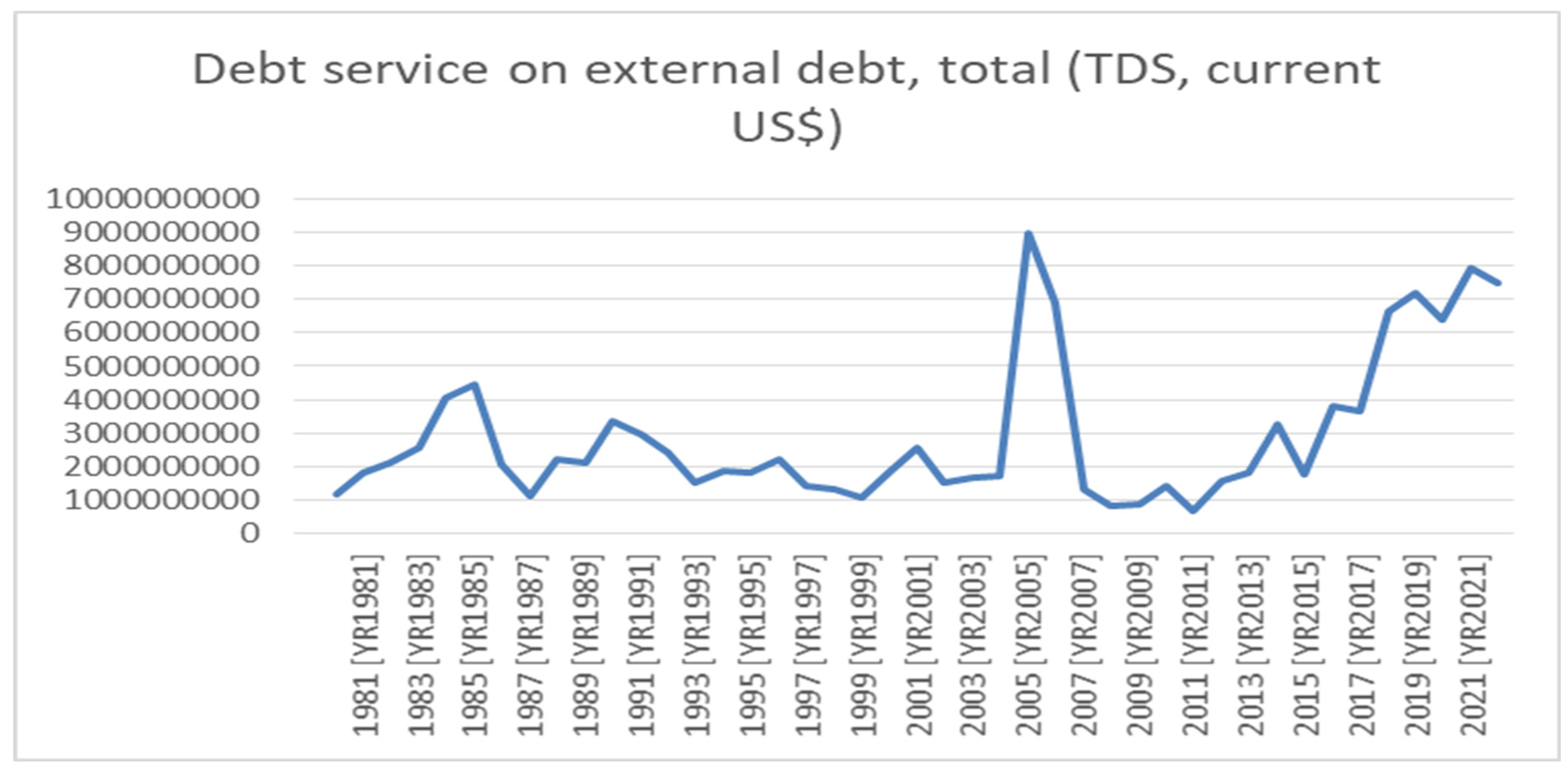

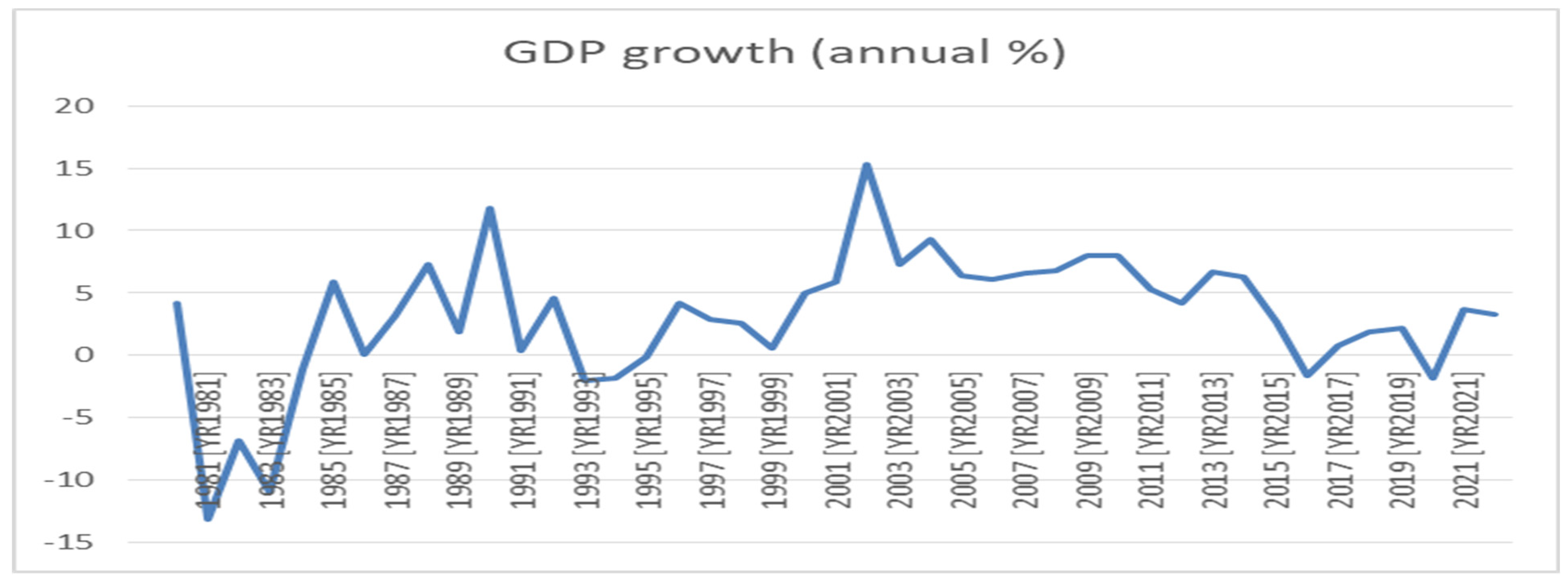

1.1. Trend of Foreign Direct Investment, External Debt Servicing, and Economic Growth in Nigeria

The trend of foreign direct investment, external debt servicing, and economic growth in Nigeria were thoroughly examined to assess the fluctuation or movement of the variables for the period under review (1981–2022). The trend of foreign direct investment, external debt servicing, and economic growth were captured using the FDI flows, external debt servicing in dollars, and GDP growth rate, respectively, and they are graphed below in

Figure 1,

Figure 2, and

Figure 3, respectively.

Figure 1 above presents the trend of foreign direct investments (FDI) in Nigeria from 1981 to 2022. Several key trends and factors influencing FDI movements in Nigeria can be identified by analyzing the data. From the early 1980s to the mid-1990s, FDI in Nigeria remained relatively low, fluctuating between 0.26 and 5.79. The country experienced a significant surge in FDI in 1989, reaching a peak of 4.28. This increase can be attributed to the economic reforms and policies implemented during that period, which aimed to attract foreign investments and promote economic development. Following the peak in 1989, FDI fluctuated over the next decade, influenced by various factors such as political instability, corruption, inadequate infrastructure, and an unfavorable investment climate. These challenges posed obstacles for foreign investors, resulting in relatively low FDI inflows during this period. However, from the early 2000s onwards, there was a gradual increase in FDI in Nigeria. This rise can be attributed to improved economic policies, reforms, and market liberalization, which aimed to attract foreign investors. Additionally, the country’s abundant natural resources, particularly oil and gas reserves, played a role in stimulating FDI inflows. Notably, FDI experienced a significant surge in 2005, reaching 2.84. This increase can be attributed to the booming oil prices and increased interest from multinational corporations seeking to tap into Nigeria’s oil wealth. However, FDI remained volatile in subsequent years, influenced by factors such as global economic conditions, political stability, security concerns, and government policies. From 2011 to 2022, FDI in Nigeria continued to decline, with values ranging from 0.18 to 0.75. Factors such as the decline in global oil prices, security challenges, and policy uncertainties contributed to this trend.

Figure 2 above presents the trend of external debt (EXD) servicing in Nigeria from 1981 to 2021. Over this period, Nigeria’s external debt servicing grew substantially, with some fluctuations and significant spikes. From 1981 to 1991, external debt servicing increased gradually until 1985, except for a decline in 1987. This era marked the period of the structural adjustment program in the country. In the early 1990s, Nigeria experienced low external debt servicing. This period was influenced by factors such as economic mismanagement, corruption, political instability, and the impact of external shocks, including declining oil prices and economic sanctions. During the 2000s, Nigeria implemented debt management and economic reforms, resulting in a gradual decline in external debt but a surge in 2005. However, there were fluctuations in some years, likely due to varying economic conditions and borrowing for development projects. More recently, from 2010 to 2022, Nigeria’s external debt servicing saw an upward trajectory, more than doubling. Factors contributing to this trend include increased borrowing for infrastructure projects, budget deficits, and the need to finance various sectors, such as education, healthcare, and energy. Debt servicing took away a substantial amount of funds meant for sectoral development in the economy. Consequently, economic growth was impeded.

Figure 3 presents the real gross domestic product (RGDP) growth rate for Nigeria from 1981 to 2022. Evidence from the graph reveals several trends in the country’s economic growth over this period. From 1981 to 1985, Nigeria’s growth rates experienced an upward and downward undulating trend. This resulted in economic challenges, including political instability, fluctuating oil prices, and the global recession. These factors contributed to the volatile growth pattern during the years under investigation. In the late 1980s and early 1990s, Nigeria witnessed relatively stable growth, averaging around 3.72%. This period was characterized by economic reforms, such as structural adjustment programs, aimed at diversifying the economy and reducing dependence on oil. The reforms, along with increased stability, led to a period of moderate growth. The 2000s saw a significant improvement in Nigeria’s economic performance. With an average growth rate of 5.69%, this period was driven by favorable global oil prices, increased foreign investment, and a focus on economic reforms and infrastructure development. Nigeria experienced a contraction in 2016 due to a sharp decline in oil prices, but it rebounded in subsequent years, with growth rates above 2%. From 2011 to 2022, growth in Nigeria continued to be unstable. Factors such as improved oil prices, fiscal reforms, and diversification efforts contributed to the recovery.

Achieving economic growth as a macroeconomic goal has been a major pursuit of policymakers in Nigeria.

Ijuo and Andohol (

2020) emphasized sustainable economic growth through an increasing trend of FDI and the moderation of external debt in Nigeria. However, the interplay between the two macroeconomic variables, among others, and how it translates into sustainable growth in Nigeria is still a subject of concern to policymakers. Consequently, this research aimed to (i) determine the trends of foreign direct investment, external debt servicing, and economic growth in Nigeria; (ii) investigate how foreign direct investment and external debt impact Nigeria’s economic growth; and (iii) study the direction of causality among the three macroeconomic variables.

The section that follows addresses the review of literature from theoretical and empirical points of view.

Section 2 addresses the methodological issues, while the final section addresses the analysis, interpretation, and discussion of the findings.

1.2. Literature Review

Theoretical literature takes into account the various theories on foreign debt, foreign direct investment, and economic growth. For instance, the debt overhang theory, as argued by

Krugman (

1980), suggests that excessive external debt adversely affects economic growth. This theory posits that a nation’s unsustainable debt strains the economy by depriving it of resources for productive investment. This could lead to a simultaneous fall in private foreign investment, domestic investment, and economic growth.

The adverse relationship that exists between foreign debt and investment leads to an overcrowding of foreign lending and reduced capital accumulation.

Krugman (

1980) describes this adverse relationship as bankruptcy, where the ability to repay outstanding equipment is below the subscription price. Several academic studies (such as

Krugman 1980;

Sachs 1990) support this theoretical argument about bankruptcy. Among others,

Greene and Villanueva (

1991),

Chowdhury (

2001), and

Elbadawi (

1997) confirmed it by providing substantial evidence of the bankruptcy phenomenon. Bankruptcies are considered the primary cause of distorted and slowed economic growth in heavily indebted countries (

Sachs 1990;

Bulow and Rogoff 1990). Economic growth slows down as these countries lose control of private investors. Again, the debt sustainability theory emphasizes the importance of maintaining a manageable level of external debt relative to a country’s income and debt servicing capacity. The theory presupposes that countries can meet their debt obligations without impeding economic growth if their external debt is at a sustainable level. It suggests that excessive debt burdens can crowd out private investment, constrain fiscal space, and hinder economic growth. Further, the debt-led growth theory assumes that external debt can contribute positively to economic growth under certain conditions. According to this theory, external credit can finance productive investments such as infrastructure development and human capital formation that drive economic growth. However, a prerequisite for debt-driven growth is effective debt management, the appropriate use of borrowed funds, and the ability to generate a sufficient return on investment.

Easterly (

2001) argues in support of the concept of funding gaps. This funding gap usually plagues developing countries and has greatly facilitated so-called foreign borrowing. The difference between the available funds from the government and the aggregate investment need is known as the financial gap. The solution to reducing this gap is to borrow from abroad.

Easterly (

2001) points out that the concept of funding gaps was derived from

Domar’s (

1946) work on capital expansion, growth rate, and employment, which assumes a proportional relationship between business investment and the cumulative rise of gross domestic product (GDP). The financial disparity concept reappears in Rostov’s Stages of Economic Growth of 1960, arguing that a nation must go through a series of events or stages in order to transition from a backward economy to a developed economy. A relative link exists between these investments and economic growth. Rostov concludes that the premise of the launch is that the investment will increase from 5% to 10% of the profits. This means that when the domestic resources of developing countries like Nigeria are not enough to invest in, the gap must be filled with international aid and external debt.

The causality of foreign direct investment on GDP growth could go both ways, as argued by the FDI-driven hypothesis. FDI inflows can boost the development of the host countries by raising the stock of capital, establishing jobs, and facilitating the transfer of technology. (

Borensztein et al. 1998;

de Mello 1997). Recent work tends to show that foreign direct investment has a great effect on economic growth, but it also exhibits an adverse impact on economic growth by crushing domestic investment, increasing external vulnerability, and creating dependence. It can also have negative effects (

Ruane and Ugur 2004). Finally, there may be no link between FDI and economic growth, which supports the so-called neutral hypothesis.

Domar (

1946) developed a model that showed that an economic growth rate depends on its level of savings and its rate of return on capital. If a country has an undeniable level of savings, businesses will be able to borrow and invest. Investment strengthens the economy’s capital supply and can generate economic growth through the continued expansion of products and companies. The return-on-investment component estimates the efficiency of the executed project.

The endogenous growth economic model was introduced to detect the impact of foreign direct investment through technology diffusion on economic growth.

Romer (

1990) argues that economic growth is promoted through foreign direct investment by increasing human resources.

Grossman and Helpman (

1991) believe that technological progress and efficiency are a product of innovation and competition, which in turn drive long-run economic growth. From the analysis carried out within the framework of this theory, it is clear that the theory proposes a strong link connecting foreign direct investment and the economic growth of developing countries.

1.3. Empirical Review

The empirical literature on foreign direct investment, external debt, and economic growth in Nigeria provides valuable information on the application of the aforementioned theories and the link that exists among these macroeconomic variables.

1.4. Empirical Studies with Evidence within Nigeria

Ogbonna et al. (

2021) conducted research to investigate Nigeria’s external debt and economic growth relationship using relevant macroeconomic variables and time series data utilizing the autoregressive distributed lag (ARDL) analytical model. The study observed a statistically significant negative impact of external debt on Nigeria’s economic growth.

Sani (

2018) analyzed the link between Nigeria’s external debt and economic growth through the use of autoregressive distributed lag (ARDL). The study revealed an adverse yet statistically significant impact of external debt on Nigeria’s economic growth.

Onakoya and Ogunade (

2017) conducted a similar study on the empirical link between Nigeria’s external debt and economic growth using an autoregressive distributed lag (ARDL). The result revealed an adverse relationship between Nigeria’s economic growth and external debt.

Ohiomu (

2020) modeled economic growth and the external debt nexus for policy analysis on public debt management and public finance. The study adopted the modified version of the unit root test, ARDL bounds testing, and co-integrating long-run tests. The outcome revealed that the crowding-out effect variable (DS_X) and debt overhang variable (D_Y) depressed the investment level. This would adversely impact Nigeria’s economic growth.

Fonchamnyo et al. (

2021) investigated the impacts of foreign direct investment (FDI) and external debt on domestic investment in SSA from 1990 to 2017. The pooled mean group estimating the ARDL technique and the panel Granger causality test were employed to attain the study’s objectives. The findings showed that, in the short run, FDI was significant and positively impacted domestic investment. However, external debt was not found to be significant. The long-run result indicated that external FDI and debt had a crowding-out impact on domestic investment in the SSA. Again, a circular, unidirectional link was found between external debt and domestic investment, domestic investment and FDI, and FDI and external debt.

Epor et al. (

2024) integrated the contribution of external debt and international trade in the nexus linking FDI with economic growth for Nigeria, Brazil, and Vietnam. The autoregressive distributed lag (ARDL) model was employed based on annual data from the period between 1990 and 2021. Findings revealed that trade and FDI had positive but no significant impacts on economic growth. Further findings revealed that external debt negatively impacted economic growth in these countries in the long run.

John (

2016) reviewed the effects of foreign direct investment on Nigeria’s economic growth using multiple regression techniques and Gretl 1.9.8 econometric software for the analysis based on two macroeconomic variables. The findings revealed that foreign direct investment had a significant positive impact on Nigeria’s economic growth.

Uwubanmwen and Ogiemudia (

2016) adopted the error correction model (ECM) and Granger causality methodology with data covering 1979 to 2013 to determine the impacts of FDI on economic growth of Nigeria. Findings revealed that foreign direct investment (FDI) had both a time-lag effect and an immediate impact on the Nigerian economy in the short run, whereas FDI failed to significantly impact the Nigerian economy.

1.5. Evidence outside Nigeria (Intercontinental Approach)

Getinet and Ersumo (

2020) empirically explored the impact of external debt on economic growth in Ethiopia. Autoregressive distributed lag (ARDL) was employed as the study’s estimating technique, with the annual GDP growth rate as the dependent variable. Debt variables included debt servicing capital as a ratio of GDP, debt servicing as a ratio of exports, trade openness, and inflation, all of which served as independent variables in the empirical model while expressing the impact of external debt on economic growth in Ethiopia. The study provided evidence that high external debt inflicted a negative and substantial influence on regional economic growth.

Edo et al. (

2020) applied autoregressive distributed lag (ARDL) panel techniques to investigate the effect of external debt on the economic growth of sub-Saharan African countries. Findings revealed a positive but marginal impact of external debt on short-run economic growth but revealed a long-run negative effect.

Dinh et al. (

2019) adopted the vector error correction model (VECM) together with fully modified ordinary least squares (FMOLS) to investigate the effects of foreign direct investment on the economic growth of developing countries. The results showed a negative effect of foreign direct investment on the economic growth of developing countries in the short term but exhibited a positive effect in the long run.

Pandya and Sisombat (

2017) employed multiple regression analysis to examine the impact of FDI on economic growth in Australia. The results showed the significant contribution of FDI to economic growth in Australia.

Hussain and Haque (

2017) used the cointegration method and the vector error correction model (VECM) to analyze the impact of foreign direct investment on Bangladesh’s economic growth. The outcome of the study showed that FDI had a long-run relationship with Bangladesh’s economic growth, with a positive and significant effect of FDI on the economic growth of Bangladesh.

Khobai et al. (

2017) measured the connection between FDI and economic growth in South Africa by applying quantile regression. The research outcome revealed that foreign direct investment had an adverse yet substantial effect in the extremely low quantile but no substantial effect in the upper quantile.

1.6. Research Gap

There are several gaps in the existing literature on the relationship between foreign direct investment, external debt, and economic growth in the Nigerian context. Some studies have investigated foreign direct investment, external debt, and economic growth separately, but few have comprehensively examined their interrelationships in the context of Nigeria. In addition, more empirical studies are needed to understand the mechanisms by which FDI and external debt influence Nigeria’s economic growth, taking into account causal factors.

2. Methodology

2.1. Theoretical Framework of the Model

The theoretical framework used in this study was inherently based on the endogenous growth theory in the recent literature, in which economic growth by technology diffusion was stimulated through foreign direct investment and international trade. However, it has been projected that growth rates may be related to the growth of external economic sectors (

Romer 1990;

Grossman and Helpman 1991). This study employed the

AK model, also known as the simple endogenous growth model, which expresses the gross real product as a function of gross capital stock, to explain the potential impact of foreign direct investment on external debt in Nigeria’s economic growth.

Let

Yt and

Kt represent the output and capital stock at time

t, while

A represents a constant quantifying the output generated per unit of capital. Under the assumption that a proportion of income (

σ) is preserved and put into investments, and by omitting the time indicators, the equation governing capital accumulation (investment) can be expressed as follows:

Here, the symbol

σ represents the rate of depreciation, and it is assumed that both σ and

δ will stay consistent. By dividing each part of Formula (2) by

K, the equation for capital accumulation gets rephrased as follows:

From Equation (1),

Y/

K =

A, so substituting

A for

Y/

K in Equation (3) results in the following:

Ultimately, through the process of logarithmic transformation and differentiation of Formula (1), coupled with the integration of Equation (3), the expression for the constant growth rate in a stable state can be formulated as follows:

where

Y denotes the expansion rate of output, which materializes as the outcome of the interplay between the rate of savings and the marginal productivity of capital. Formula (5) illustrates two distinct pathways by which foreign direct investment exerts influence on economic growth. Initially, it amplifies the parameter

σ, representing the propensity to save, thus augmenting the pace of investment. Subsequently, it has the potential to enhance factor

A, indicative of the efficacy of capital utilization. A fully developed FDI mechanism channels modest savings into lucrative large-scale ventures, effectively mobilizing savings. Concretely, economic theory postulates a favorable correlation between FDI and economic growth, implying the plausibility of a mutual cause-and-effect connection between these variables.

2.2. Model Specification

The research is aimed at analyzing the impacts of FDI and external debt on the economic growth of Nigeria based on the research conducted by

Chaudhry et al. (

2017). Hence, the functional structure of the model can be expressed as follows:

where

GDP = gross domestic product,

FDI = foreign direct investment,

EXD = external debt,

GDS = gross domestic saving,

GFCE = government final consumption expenditure, and

GCF = gross capital formation. To assess the specific objectives of this study, Equation (6) was modified to investigate the impact of foreign direct investment and external debt on economic growth in Nigeria by replacing

GDS with the government domestic debt (

DMD) and

GFCE with the exchange rate (

EXR). In addition, this study considered inflation rates (

INF) as an additional control variable. Therefore, the new functional form of the model is given as follows:

Therefore, the mathematical form of the model is given as follows:

The econometric form of the model is specified as follows:

Meanwhile, the unknown parameters

B1,

B2,

B3,

B4,

B5, and

B6 are the coefficients or slopes of

FDI,

EXD,

DMD,

EXR,

GCF, and

INF, respectively, while the unknown parameter

b0 is the intercept of

GDP and

ε is the stochastic error term. The dynamic form of the model is as follows:

where

∂i = long-run multiplier (

i = 1, 2, 3, 4, 5, 6, and 7)

Once the presence of cointegration was confirmed, we proceeded to estimate the long-run conditional ARDL model (p, q1, q2, q3, q4, q5, and q6). This process entailed determining the orders of the ARDL model (p, q1, q2, q3, q4, q5, and q6) in relation to the seven variables utilizing the Akaike information criteria (AIC). The subsequent phase involved deriving the short-run dynamic parameters through the estimation of an error correction model linked to the long-run estimations.

2.3. A Priori Expectation

According to

Koutsoyiannis (

1977), a priori economic expectation is an economic theory that connects the sign and magnitude of the parameters in economic relationships. The expected relationship between the dependent variable (

GDP) and the independent variables (

FDI,

EXD,

DMD,

EXR,

GCF, and

INF) should be based on macroeconomic principles. Consequently, it is expected that

B1 > 0,

B2 < 0,

B3 < 0,

B4 < 0,

B5 > 0, and

B6 < 0.

2.4. Estimation Technique

To investigate the impacts of foreign direct investment and external debt on Nigeria’s economic growth, this study structured the estimation techniques into a preliminary analysis, a model estimation technique, and a post-estimation or diagnostic test of the model to enhance detailed analysis.

2.5. Model Estimation

In this research, the bounds-testing cointegration methodology was employed to calculate both the enduring and immediate associations as well as the evolving interplay among the concerned variables. The examination of the presence of a cointegration relationship among variables was introduced by

Pesaran et al. (

2001) through the proposition of an autoregressive distributed lag (ARDL) bounds-testing technique. The subsequent ARDL framework was utilized for this study.

2.6. Granger Causality

A Granger causality test procedure was also performed to determine the directional importance of causality between variables. The method used to test for statistical causality in this study was that of

C.W.J. Granger (

1969), who developed the “Granger causality test”. Granger causality tests go beyond the intrinsic values of the explanatory variables themselves to determine what the variables predict. In this study, his two most popular information criteria, the Akaike information criterion (AIC) and the Schwartz information criterion (SIC), were used to determine the significance of the estimates. The

Granger (

1969) causality test assumes only time series data for these variables, say

y1t and

y2t. It contains information relevant to these predicting variables. The test involves estimating the following pair of regressions:

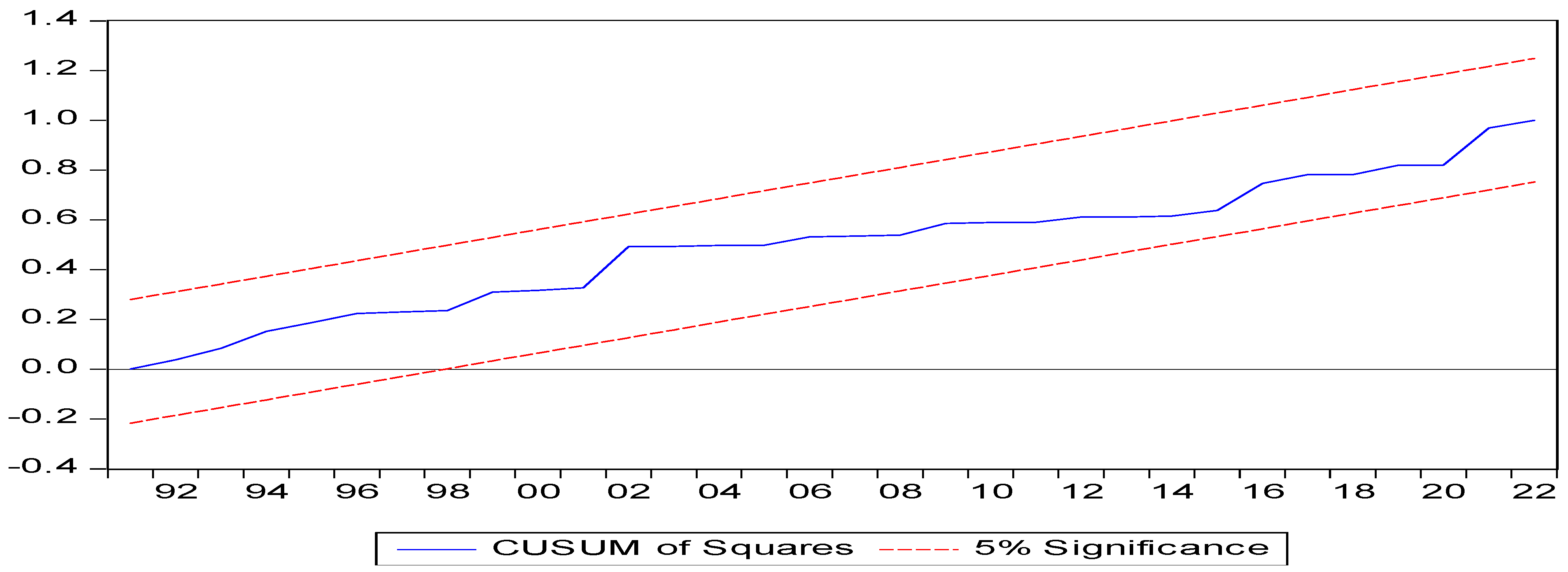

2.7. Post-Estimation Tests

In this study, five main posterior estimation (diagnostic) tests were considered: the Ramsey reset or linearity test, which tests the assumptions for the validity and linearity of the model specification; the Jarque–Bera test, which tests whether the residuals exhibit the normality distribution properly; the Breusch–Godfrey test, which tests for the presence of serial correlation; the autoregressive conditional heteroskedasticity Lagrangian multiplier (ARCH-LM) test, which tests whether the error term (u) in the regression model has a covariance or constant variance; and the CUSUM and CUSUM of squares tests to determine the structural stability of the model. These results are in the

Appendix A.

2.8. Sources of Data

The secondary data for this investigation were primarily acquired from the databases of the World Bank and the Central Bank of Nigeria (CBN). The sources of measurements and data compilation are outlined in

Table 1 below.

2.9. Limitation of This Study

Integrating more explanatory variables into the model may possibly control for and further lower the chances of having multicollinearity, which is a concern in this study. However, due to the challenges of data availability facing developing economies like Nigeria, researchers are compelled to continue with available variables, with other researchers such as

Akinlo (

2004) and

Fonchamnyo et al. (

2021) also adopting a similar number of six observations for their analysis.

2.10. Descriptive Statistics

This study employed descriptive statistics on seven time series variables—gross domestic product (GDP), foreign direct investment (FDI), external debt (EXD), domestic debt (DMD), exchange rate (EXR), gross capital formation (GCF), and inflation rate (INF)—over a 42-year span (1981–2022). The findings are presented in

Table 2 below.

Table 2 above provides a summary of descriptive statistics for the seven variables. The median values provide a measure of central tendency that separates the data into two equal halves. The median GDP was slightly higher at 3.400, indicating that the distribution of GDP was skewed to the left. FDI had a median of 1.079, while EXD and DMD had medians of 6.506 and 6.993, respectively. The median EXR was 109.849, suggesting stability. GCF had a median of 33.972, and INF had a lower median of 12.942. The maximum and minimum values indicate the range of variation within each variable. The maximum GDP growth rate reached 15.300%, while the minimum was −13.100%, indicating significant fluctuations in economic performance. FDI ranged from a minimum of −0.039% to a maximum of 5.791%. EXD ranged from 0.846 to 10.140, and DMD ranged from 2.415 to 10.253. The exchange rate fluctuated between 0.550 and 470.280, reflecting significant volatility. GCF had a range of 14.904 to 89.381, and INF ranged from 5.388 to 72.836.

All variables showed positive kurtosis, with FDI, EXD, and GCF having relatively high values. This suggests that extreme values and outliers were present in the data for these variables. The Jarque–Bera test assesses if the data follows a normal distribution. Higher values indicate departures from normality. GDP, FDI, EXR, GCF, and INF had relatively high Jarque–Bera statistics, indicating departures from normality.

2.11. Correlation Statistics

The correlation coefficient among the variables employed for this study is presented in

Table 3 below.

The correlation matrix in

Table 3 provides insights into the relationships between various economic variables in Nigeria from 1981 to 2022. The values range from −1 to 1, where 1 represents a perfect positive correlation, −1 represents a perfect negative correlation, and 0 indicates no correlation. Overall, the findings suggest that FDI, external debt, and domestic debt have positive associations with GDP, while gross capital formation and the inflation rate have negative associations. These relationships indicate that attracting foreign investments and managing debt effectively can have a positive impact on economic growth in Nigeria. However, the negative correlation between GDP and gross capital formation highlights the need for increased investment in the country’s productive sectors to foster sustainable economic growth.

2.12. Unit Root Test

The unit root test was utilized to confirm the absence of spurious regression estimation. These examinations encompassed the augmented Dickey–Fuller (ADF) unit root test and the Phillips–Perron (PP) unit root test. Moreover, stationarity tests were also used to ascertain the right estimation technique (ARDL) to be used, as discussed above.

Based on the outcomes presented in

Table 3, a blend of the I(0) and I(1) series was identified for the ADF and PP unit root assessments. The natural logarithm of external debt, domestic debt, and exchange rate exhibited stationarity with a first-order difference I(1), whereas gross domestic product, foreign direct investment, gross capital formation, and inflation rate demonstrated stationarity at the original level I(0). Consequently, these findings provide the rationale for adopting the ARDL estimation approach. The summary of the unit test results is presented in

Table 4.

2.13. Lag Selection Test

Before conducting the autoregressive distributed lag (ARDL) analysis, it is crucial to perform an additional preliminary test—the lag selection criteria. While the determination of lag lengths in ARDL models can sometimes draw guidance from economic theory, there exist statistical approaches that aid in ascertaining the optimal number of lags to incorporate into the regressors.

From

Table 5, considering the lag selection criteria test, it can be seen that the result exhibits mixed estimates. For instance, all the information criteria (LR, FPE, SC, and HQ) selected lag order one (i.e., lag 1) as the best lag length, except AIC, which chose lag order two. Considering these disparities, this study focused on the F-bounds test in order to ensure a robust analysis. The F-bounds test results are presented in

Table 6.

Table 6 presents the results of the ARDL F-bounds cointegration test conducted to examine the long-run relationship between foreign direct investment, external debt, and economic growth in Nigeria. The test assessed the significance of the F-statistic and compared it against critical value bounds at different significance levels. The F-statistic was approximately calculated to be 5.363, with a value of k equal to 6. In order to determine the significance of this statistic, it was compared to the critical value bounds provided in the table. At the 10% significance level, the critical value bounds were 2.12 (I0 Bound) and 3.23 (I1 Bound). Because the F-statistic exceeded both of these bounds, we can conclude that the relationship between the variables was statistically significant at the 10% level. Similarly, at the 5% significance level, the critical value bounds were 2.45 (I0 Bound) and 3.61 (I1 Bound). Again, the F-statistic surpassed these bounds, indicating statistical significance at the 5% level. This pattern continued for the 2.5% and 1% significance levels, where the F-statistic exceeded the corresponding critical value bounds of 2.75/3.99 and 3.15/4.43, respectively. The results suggest that there exists a long-run relationship between foreign direct investment, external debt, and economic growth in Nigeria. The statistically significant F-statistic indicates that changes in these independent variables have a significant impact on the dependent variable, GDP, in the long run.

3. Results

3.1. Data Analysis and Discussion of Results

This section analyzes the impact of foreign direct investment and external debt on the economic growth of Nigeria. This section presents the results of the autoregressive distributed lag (ARDL) model.

Table 7 reveals that all the variables except the previous gross domestic product GDP (−1) and current foreign direct investment (FDI) are significant at the 5% level. The lag of foreign direct investment, current external debt, and current exchange rate all exert a positive effect on current economic growth in Nigeria. However, current foreign direct investment, current domestic debt, current gross capital formation, and the current inflation rate all exert a negative impact on economic growth in Nigeria. The Durbin–Watson statistic is approximately 2.006 and tends to be greater than the value of R

2, which is approximately 0.669; therefore, the model is free from spurious regression and serial correlation problems. Furthermore, the coefficient of determination (R

2) is approximately 0.669, implying that 66.9% of the variation in the dependent variable can be explained by the explanatory variables. Considering the above results and the presence of long-run relationships, it is pertinent to assess the long-run and short-run effects of foreign direct investment and external debt on economic growth in Nigeria.

As shown in

Table 8 below, the analyses reveal that foreign direct investment (FDI) has a statistically significant positive impact on GDP. Therefore, an increase in FDI is associated with an increase in economic growth in Nigeria. This finding aligns with previous studies that have shown the positive effect of FDI on economic growth. For example, the research by

Akinlo (

2004) found that FDI has a positive and significant impact on economic growth in Nigeria.

Furthermore, the estimate of external debt suggests that an increase in external debt is associated with higher economic growth. However, it is worth noting that this finding contradicts conventional wisdom, as higher levels of external debt are often associated with economic challenges. Previous studies have presented mixed evidence on the impact of external debt on economic growth in Nigeria. For instance,

Edo et al. (

2020) found a positive relationship, while

Getinet and Ersumo (

2020) reported a negative relationship between external debt and economic growth in Nigeria.

Likewise, the estimation of domestic debt (DMD) has a statistically significant negative impact on GDP. Consequently, an increase in domestic debt is associated with a decrease in economic growth. This result is consistent with the notion that high levels of domestic debt can crowd out private investment and hinder economic growth. Similar findings have been reported in previous studies. For instance,

Getinet and Ersumo (

2020) found a negative relationship between domestic debt and economic growth in Nigeria.

In addition, the exchange rate (EXR) result suggests that the impact of the exchange rate on GDP is marginally significant. The

p-value of 0.053 indicates weak statistical significance. Thus, there is some evidence to suggest that a depreciation of the exchange rate may have a positive effect on economic growth in Nigeria. However, the finding is not strongly supported by statistical significance. Previous studies on the relationship between exchange rates and economic growth in Nigeria have produced mixed results, with some studies reporting positive effects (e.g.,

Urama et al. 2022) and others finding negative effects (e.g.,

Iorember et al. 2022).

Table 9 showcases the short-run impacts of foreign direct investment (FDI) and external debt on economic growth in Nigeria. The results reveal that FDI fails to significantly influence the growth of the economy in Nigeria. This suggests that changes in foreign direct investment do not have a significant short-term impact on GDP in Nigeria.

While external debt and exchange rates positively impact growth, the reverse is true for government domestic debt, gross capital formation, and inflation. This implies that a 1% increase in external debt and the exchange rate, all things being equal, will cause GDP to grow by an average of 158% and 2.4%, respectively. However, a 1% increase in government domestic debt, gross capital formation, and inflation will decrease growth by 4.5, 37.3, and 11.6, respectively. This implies that an increase in external debt leads to a positive short-term effect on GDP, suggesting that higher external debt has a simulative impact on economic growth in Nigeria. It also indicates that an increase in domestic debt has a negative short-term effect on GDP. This suggests that higher domestic debt levels tend to hinder economic growth in Nigeria.

Additionally, changes in the exchange rate have a positive impact on GDP in the short run. Therefore, currency depreciation (an increase in the exchange rate) stimulates economic growth in Nigeria. Moving on to the error correction mechanism (ECM), the coefficient for ECM(−1) is −0.910 with a standard error of 0.136. This coefficient is highly statistically significant (p < 0.001) with a t-statistic of −6.705. The negative sign indicates that disequilibrium in the short run is corrected at a speed of 91% per quarter, adjusting towards long-run equilibrium. The ECM captures the adjustment process and acts as an error correction term, ensuring that deviations from the long-run equilibrium are corrected over time.

3.2. Granger Causality Test

The Granger causality test stands as a statistical test of hypothesis to ascertain whether one time series can effectively predict another.

Table 10 presents the results of pairwise Granger causality tests conducted to investigate the relationships between various independent variables (FDI, EXD, DMD, EXR, GCF, and INF) and gross domestic product (GDP) relative to Nigeria’s economic growth between 1981 and 2022. The tests aim to determine whether there is evidence of Granger causality, implying that changes in the independent variables lead to changes in GDP and vice versa. Upon examination of the F-statistics and associated probabilities, it can be observed that FDI does Granger cause GDP. The F-statistic of 0.377 with a probability of 0.543 suggests that there is significant Granger causality between foreign direct investment and GDP. The result can be measured in terms of the null hypothesis. In other words, FDI does have a measurable causal impact on economic growth in Nigeria. Furthermore, EXD does Granger cause GDP. The F-statistic of 0.530 with a probability of 0.471 indicates that external debt does Granger cause GDP. Thus, changes in external debt levels do significantly influence Nigeria’s economic growth. Likewise, DMD does Granger cause GDP. The F-statistic of 1.214 with a probability of 0.278 suggests that domestic debt does have a statistically significant Granger causal relationship with GDP.

4. Discussion

This section discusses the results of the research conducted in this study, as showcased in the various objectives and methodologies employed. The consequences and implications of foreign direct investment and external debt on economic growth within Nigeria were investigated using theoretically supported variables. The autoregressive distributed lag model was employed as the main estimating technique to analyze the impact of foreign direct investments and external debt on the economic growth of Nigeria. Further, this study examined the causal relationship between foreign direct investment, external debt, and economic growth in Nigeria using the Granger causality test. Consequently, we provided evidence from the trend analysis that from 2011 to 2022, FDI in Nigeria continued to decline, whereas Nigeria’s external debt servicing continued to grow on an upward trajectory, more than doubling

Otovwe (

2019), who argued that political instability, widespread corruption, security issues, a lack of transparency, poor quality of infrastructure, and import restrictions limit Nigeria’s FDI potential. The results from the ARDL analysis confirmed that the lag of foreign direct investment, current external debt, and current exchange rate all exert a positive effect on current economic growth in Nigeria. A 1% increase in FDI, current external debt, and current exchange rate increases growth by 1.49%, 1.58%, and 0.02%, respectively. The implication is that a decline in FDI may slow down growth proportionately. Consequently, the marginal growth rate is only 1.49%. While the result of FDI with respect to growth may be expected as it follows a priori expectations, current external debt may increase growth only if borrowing is geared towards effective productivity in the economy. Considering the report from

Otovwe (

2019), productivity driven by external debt may not be expected. Consequently, there will be a marginal growth rate of only 1.58%, and this may cause the current exchange rate to marginally (0.02%) impact growth. Considering these results, policymakers can develop policies on exchange rate increases to discourage the importation of domestic products and protect infant industries. However, the fact that current domestic debt, current gross capital formation, and the current inflation rate all exert a negative impact on economic growth in Nigeria has serious policy implications. A 1% increase in these variables would decrease growth by 4.94%, 0.41%, and 0.12%, respectively. While it is believed that an increase in the current domestic debt and current inflation rate may decrease growth when not properly managed, current gross capital formation can only retard growth if foreign investors are not properly monitored to bring in the gains of investment for domestic use. Domestic debt in Nigeria has not been channeled towards productive investment purposes. Past experiences have shown that such funds are seen as “national cake” by the ruling class. The funds are diverted from their original purposes by corrupt leaders. The growing concern is that there is little or no policy to monitor the misuse of funds, and where such policies do exist, they are hardly enforced. Consequently, debt servicing becomes a burden and therefore exerts negative effects on growth in the long run. Conventionally, current gross capital formation in Nigeria has been in reverse gear as investors are withdrawing and relocating from the country to other neighboring countries, such as Ghana and the Republic of Benin. Consequently, the negative impact of GCF on growth is a reality.

The results from the Granger causality test examining the F-statistics and associated probabilities show that FDI does Granger cause GDP. Again, the F-statistic of 0.377 with a probability of 0.543 suggests that there is significant Granger causality between foreign direct investment and GDP. From these results, we confirm that this study’s three objectives have been achieved.

Policy Implications and Recommendations

Based on the findings and conclusions made in this study, the following policy implications and recommendations are suggested: Promoting Foreign Direct Investment (FDI): This study found that FDI has a positive impact on economic growth in Nigeria in the long run. This suggests that policymakers should create an attractive investment climate and implement policies that encourage foreign investors to invest in the country. Managing External Debt: This study indicates that external debt has a positive impact on economic growth in Nigeria, contrary to conventional wisdom. This finding suggests that policymakers should carefully manage external debt by borrowing for productive investments that can generate sufficient returns to service the debt. Addressing Domestic Debt: This study highlights that domestic debt has a negative impact on economic growth in Nigeria. Policymakers should focus on prudent debt management practices and strive to reduce domestic debt levels. This can be achieved through effective fiscal discipline to improve revenue generation. Exchange Rate Management: The impact of the exchange rate on economic growth in Nigeria was found to be marginally significant. Policymakers should pay attention to exchange rate stability and avoid excessive volatility, as it can affect investor confidence and hinder economic growth. Enhancing Gross Capital Formation: This study reveals that gross capital formation has a negative impact on economic growth, both in the long run and in the short run. Policymakers should focus on improving the efficiency and productivity of physical capital investment, infrastructure, and human resource development. Managing Inflation: This study indicates that inflation has a negative impact on economic growth in Nigeria. Policymakers should prioritize price stability by implementing appropriate monetary policies to control inflation. In conclusion, the policy implications derived from this study’s findings suggest that Nigeria should focus on attracting foreign direct investment, managing external and domestic debt effectively, maintaining exchange rate stability, enhancing gross capital formation, and managing inflation. By implementing appropriate policies and reforms in these areas, policymakers can create an environment conducive to sustainable economic growth and development in Nigeria.