Investigating the Effects of the COVID-19 Pandemic on Stock Volatility in Sub-Saharan Africa: Analysis Using Explainable Artificial Intelligence

Abstract

1. Introduction

2. Literature Review

2.1. Theories Related to the Impact of the Pandemic on Volatility

2.1.1. Black Swan Theory

2.1.2. Herding Behavior Theory

2.1.3. Lucas Critique

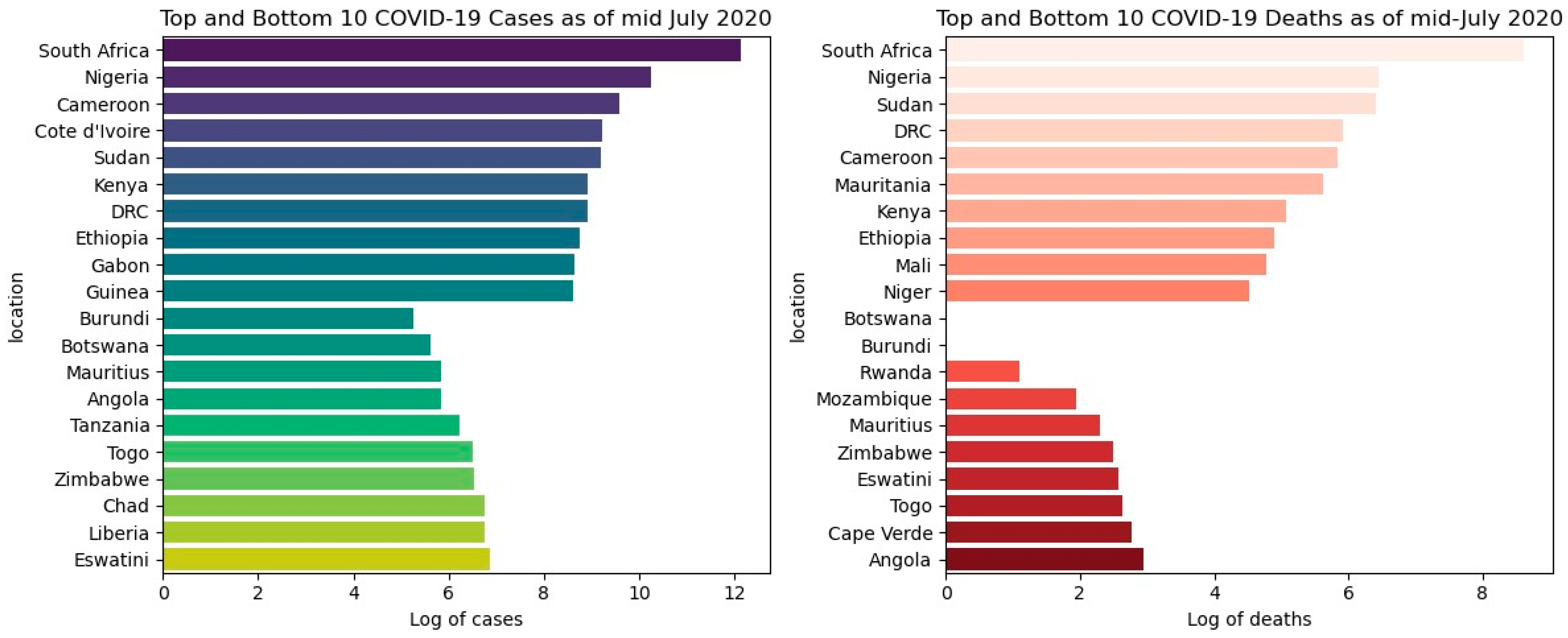

2.2. Outbreak of COVID-19 Pandemic in Sub-Saharan Africa

2.3. Stock Market Development and Challenges in Sub-Saharan Africa

2.4. COVID-19 Pandemic and Stock Market Performance

3. Materials and Methods

3.1. Data and Sources

3.2. Methodology and Justification of Variables

3.2.1. Volatility Estimation

3.2.2. GJR-GARCH Model

3.2.3. The Exponential GARCH (EGARCH)

3.3. Explainable Artificial Intelligence

3.4. Analytical Software

4. Results

4.1. Descriptive Statistics

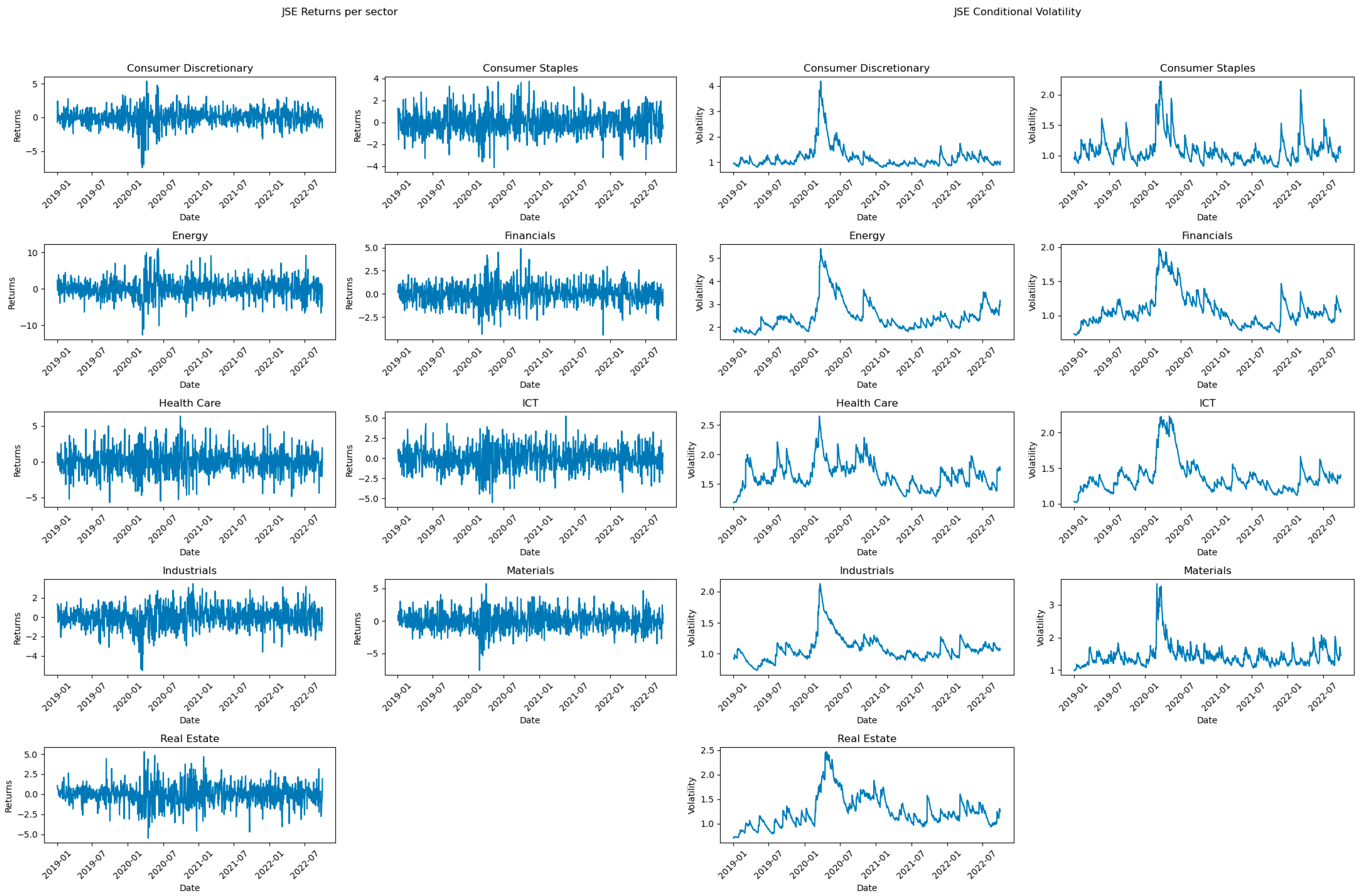

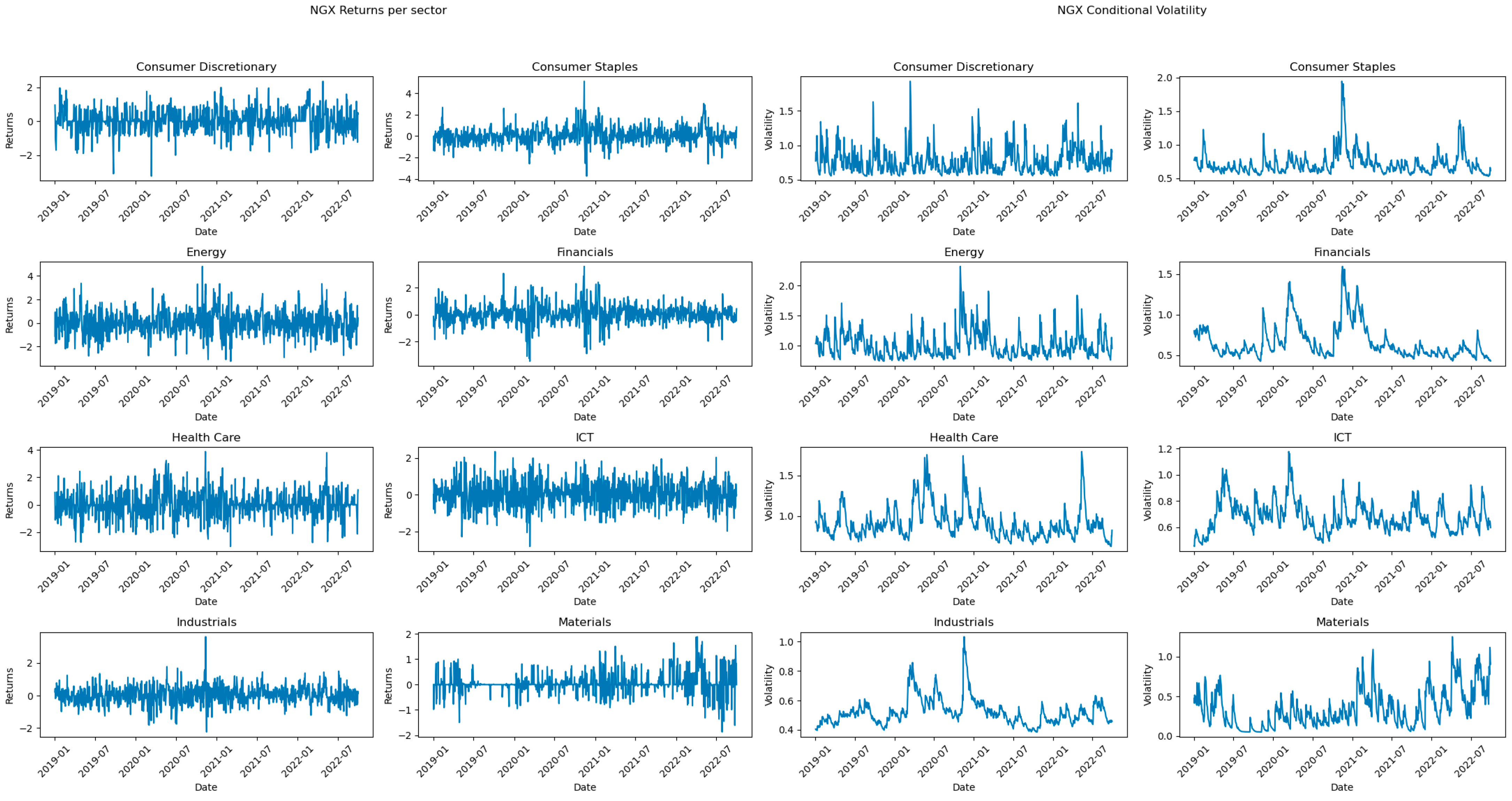

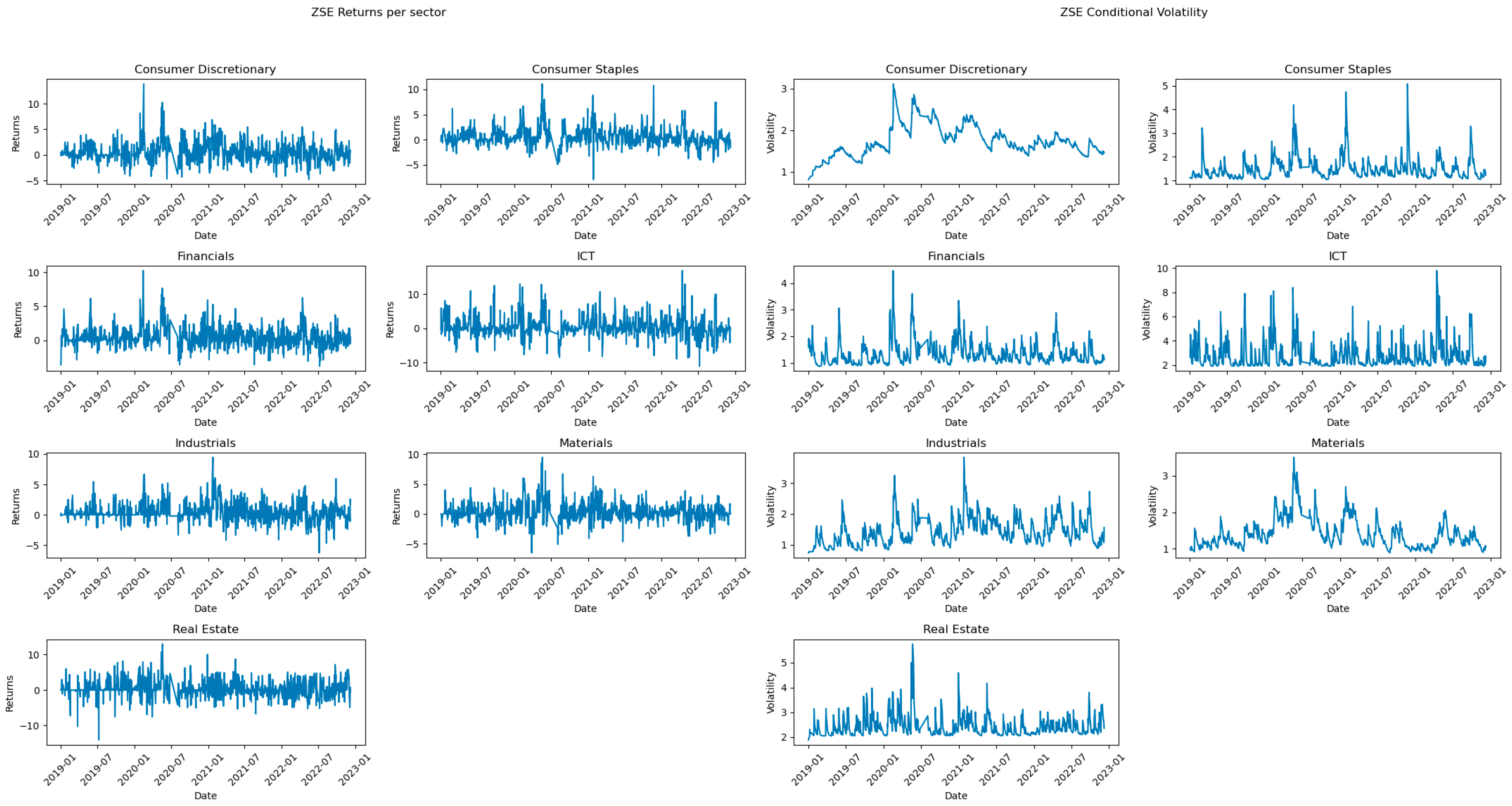

4.2. Trend Analysis

GARCH Results

4.3. Explainable Artificial Intelligence (XAI) Results

4.4. Discussion of Results

5. Conclusions and Policy Implication

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdullah, Mohammad, G. M. Wali Ullah, and Mohammad Ashraful Ferdous Chowdhury. 2022. The asymmetric effect of COVID-19 government interventions on global stock markets: New evidence from QARDL and threshold regression approaches. Investment Analysts Journal 51: 268–88. [Google Scholar] [CrossRef]

- Ahmad, Wasim, Ali M. Kutan, and Smarth Gupta. 2021. Black swan events and COVID-19 outbreak: Sector level evidence from the US, UK, and European stock markets. International Review of Economics & Finance 75: 546–57. [Google Scholar]

- Ahmed, Imran, Gwanggil Jeon, and Francesco Piccialli. 2022. From artificial intelligence to explainable artificial intelligence in industry 4.0: A survey on what, how, and where. IEEE Transactions on Industrial Informatics 18: 5031–42. [Google Scholar] [CrossRef]

- Alam, Md Mahmudul, Haitian Wei, and Abu N. M. Wahid. 2021. COVID-19 outbreak and sectoral performance of the Australian stock market: An event study analysis. Australian Economic Papers 60: 482–95. [Google Scholar] [CrossRef]

- Alberg, Dima, Haim Shalit, and Rami Yosef. 2008. Estimating stock market volatility using asymmetric GARCH models. Applied Financial Economics 18: 1201–08. [Google Scholar] [CrossRef]

- Ali, Sajid, Tamer Abuhmed, Shaker El-Sappagh, Khan Muhammad, Jose M. Alonso-Moral, Roberto Confalonieri, Riccardo Guidotti, Javier Del Ser, Natalia Díaz-Rodríguez, and Francisco Herrera. 2023. Explainable Artificial Intelligence (XAI): What we know and what is left to attain Trustworthy Artificial Intelligence. Information Fusion 99: 101805. [Google Scholar] [CrossRef]

- ASEA. 2020. ASEA Newsletter 2020 Q2 Lite. Pleasant Grove: ASEA. Available online: https://african-exchanges.org/download/asea-newsletter-2020-q2-lite/ (accessed on 30 November 2023).

- Ashraf, Badar Nadeem. 2020. Economic impact of government interventions during the COVID-19 pandemic: International evidence from financial markets. Journal of Behavioral and Experimental Finance 27: 100371. [Google Scholar] [CrossRef]

- Baek, Seungho, Sunil K. Mohanty, and Mina Glambosky. 2020. COVID-19 and stock market volatility: An industry level analysis. Finance Research Letters 37: 101748. [Google Scholar] [CrossRef]

- Bakry, Walid, Peter John Kavalmthara, Vivienne Saverimuttu, Yiyang Liu, and Sajan Cyril. 2022. Response of stock market volatility to COVID-19 announcements and stringency measures: A comparison of developed and emerging markets. Finance Research Letters 46: 102350. [Google Scholar] [CrossRef]

- Będowska-Sójka, Barbara, and Agata Kliber. 2019. The causality between liquidity and volatility in the Polish stock market. Finance Research Letters 30: 110–15. [Google Scholar] [CrossRef]

- Bhattacharya, Aditya. 2022. Applied Machine Learning Explainability Techniques: Make ML Models Explainable and Trustworthy for Practical Applications Using LIME, SHAP, and More. Birmingham: Packt Publishing Ltd. [Google Scholar]

- Bodie, Zvi. 1976. Common stocks as a hedge against inflation. The Journal of Finance 31: 459–70. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Brooks, Chris. 2019. Introductory Econometrics for Finance. Cambridge: Cambridge University Press. [Google Scholar]

- Chitungo, Itai, Mathias Dzobo, Mbuzeleni Hlongwa, and Tafadzwa Dzinamarira. 2020. COVID-19: Unpacking the low number of cases in Africa. Public Health in Practice 1: 100038. [Google Scholar] [CrossRef] [PubMed]

- Choi, Jae Hoon, and David Munro. 2022. Market liquidity and excess volatility: Theory and experiment. Journal of Economic Dynamics and Control 139: 104442. [Google Scholar] [CrossRef]

- Colin, Bermingham, Cali Claudio, Fenton Nina, and Santos Ricardo. 2022. Finance in Africa: Navigating the Financial Landscape in Turbulent Times. Sydney: European Investment Bank. [Google Scholar]

- Cooper, Ian, and Evi Kaplanis. 1994. Home bias in equity portfolios, inflation hedging, and international capital market equilibrium. The Review of Financial Studies 7: 45–60. [Google Scholar] [CrossRef]

- Del Lo, Gaye, Théophile Basséne, and Babacar Séne. 2022. COVID-19 And the african financial markets: Less infection, less economic impact? Finance Research Letters 45: 102148. [Google Scholar] [CrossRef] [PubMed]

- Djankov, Simeon, and Ugo Panizza. 2020. COVID-19 in Developing Economies. London: Centre for Economic Policy Research. [Google Scholar]

- Elkhishin, Sarah, and Mahmoud Mohieldin. 2021. External debt vulnerability in emerging markets and developing economies during the COVID-19 shock. Review of Economics and Political Science 6: 24–47. [Google Scholar] [CrossRef]

- Foley, Sean, Amy Kwan, Richard Philip, and Bernt Arne Odegaard. 2022. Contagious margin calls: How COVID-19 threatened global stock market liquidity. Journal of Financial Markets 59: 100689. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Gökbulut, R. İlker, and Mehmet Pekkaya. 2014. Estimating and forecasting volatility of financial markets using asymmetric GARCH models: An application on Turkish financial markets. International Journal of Economics and Finance 6: 23–35. [Google Scholar] [CrossRef]

- Harjoto, Maretno Agus, and Fabrizio Rossi. 2021. Market Reaction to the COVID-19 Pandemic: Evidence from Emerging Markets. International Journal of Emerging Markets, ahead-of-print. [Google Scholar] [CrossRef]

- Harjoto, Maretno Agus, Fabrizio Rossi, Robert Lee, and Bruno S. Sergi. 2021. How do equity markets react to COVID-19? Evidence from emerging and developed countries. Journal of Economics and Business 115: 105966. [Google Scholar] [CrossRef] [PubMed]

- Ibrahim, Izani, Kamilah Kamaludin, and Sheela Sundarasen. 2020. COVID-19, government response, and market volatility: Evidence from the Asia-Pacific developed and developing markets. Economies 8: 105. [Google Scholar] [CrossRef]

- IMF. 2024. IMF Staff Completes 2024 Article IV Mission to Zimbabwe. Available online: https://www.imf.org/en/News/Articles/2024/02/13/pr2447-zimbabwe-imf-staff-completes-2024-article-iv-mission (accessed on 8 April 2024).

- Keynes, John Maynard. 1937. The general theory of employment. The Quarterly Journal of Economics 51: 209–23. [Google Scholar] [CrossRef]

- Keynes, John Maynard. 1964. The general theory of employment, interest and money (1936). The Collected Writings of John Maynard Keynes 7: 1971–79. [Google Scholar]

- Kharbanda, Varuna, and Rachna Jain. 2021. Impact of COVID on the stock market: A study of BRIC countries. International Journal of Financial Markets and Derivatives 8: 169–84. [Google Scholar] [CrossRef]

- Kossi, Félix Edoh. 2021. African Stock Exchanges Focus Report. Nairobi: African Securities Exchanges Association. [Google Scholar]

- Kumeka, Terver, Patricia Ajayi, and Oluwatosin Adeniyi. 2022. Is stock market in Sub-Saharan Africa resilient to health shocks? Journal of Financial Economic Policy 14: 562–98. [Google Scholar] [CrossRef]

- Kusumahadi, Teresia Angelia, and Fikri C Permana. 2021. Impact of COVID-19 on global stock market volatility. Journal of Economic Integration 36: 20–45. [Google Scholar] [CrossRef]

- Ledwani, Sanket, Suman Chakraborty, and Sandeep S. Shenoy. 2021. Spatial tale of G-7 and Brics stock markets during COVID-19: An event study. Investment Management and Financial Innovations 18: 20–36. [Google Scholar] [CrossRef]

- Lucas, Robert E. 1976. Econometric policy evaluation: A critique. Carnegie-Rochester Conference Series on Public Policy 1: 19–46. [Google Scholar] [CrossRef]

- Machado, José A. Tenreiro. 2023. COVID-19 and Stock Market Volatility in sub-Saharan Africa. East African Journal of Rural Development 5: 225–48. [Google Scholar]

- Makulo, Jean-Robert, Roger Wumba, Madone Ndona Mandina, Placide Mbala, Adrienne Amuri Aziza, Yannick Mayamba Nlandu, Benjanmin Kabwe, Donatien Mangala, Ben Izizag Bepouka, and Jerome Ossam Odio. 2023. SARS-CoV2 mutations and impact on mortality: Observational study in a sub-saharan Africa hospital. Virology Journal 20: 56. [Google Scholar] [CrossRef]

- Miron, Dumitru, and Cristiana Tudor. 2010. Asymmetric conditional volatility models: Empirical estimation and comparison of forecasting accuracy. Romanian Journal of Economic Forecasting 13: 74–92. [Google Scholar]

- Mishra, Alok Kumar, Badri Narayan Rath, and Aruna Kumar Dash. 2020. Does the Indian financial market nosedive because of the COVID-19 outbreak, in comparison to after demonetisation and the GST? Emerging Markets Finance and Trade 56: 2162–80. [Google Scholar] [CrossRef]

- Molnar, Christoph. 2020. Interpretable Machine Learning. Morrisville: Lulu.com. [Google Scholar]

- MSCI. 2023. S&P Dow Jones. The Global Industry Classification Standard (GICS®). Available online: https://www.msci.com/our-solutions/indexes/gics (accessed on 12 December 2023).

- Murewanhema, Grant, and Tafadzwa Dzinamarira. 2022. The COVID-19 pandemic: Public health responses in Sub-Saharan Africa. International Journal of Environmental Research and Public Health 19: 4448. [Google Scholar] [CrossRef]

- Ncube, Mbongiseni, Mabutho Sibanda, and Frank Ranganai Matenda. 2023. COVID-19 Pandemic and Stock Performance: Evidence from the Sub-Saharan African Stock Markets. Economies 11: 95. [Google Scholar] [CrossRef]

- Nelson, Daniel B. 1991. Conditional heteroskedasticity in asset returns: A new approach. Econometrica: Journal of the Econometric Society 59: 347–70. [Google Scholar] [CrossRef]

- Njenga, Githinji, Josphat Machagua, and Samwel Gachanja. 2022. Capital Markets in Sub-Saharan Africa. Helsinki: United Nations University World Institute for Development Economics Research. [Google Scholar]

- Nyamunda, Tinashe. 2023. Emergism as Ideology: Zimbabwe’s Ill-Fated Policies for an ‘Emerging’ Upper-Middle-Income Economy. In The Political Economy of Emerging Markets and Alternative Development Paths. Berlin/Heidelberg: Springer, pp. 297–322. [Google Scholar]

- Olawoye, Salewa, and Adesuwa O. Erediauwa. 2023. Monetary policy during the COVID-19 pandemic: A case study of the Central Bank of Nigeria. In COVID-19 and the Response of Central Banks. Cheltenham: Edward Elgar Publishing, pp. 85–103. [Google Scholar]

- Papadamou, Stephanos, Athanasios Fassas, Dimitris Kenourgios, and Dimitrios Dimitriou. 2020. Direct and Indirect Effects of COVID-19 Pandemic on Implied Stock Market Volatility: Evidence from Panel Data Analysis. Munich: University Library of Munich, Germany. [Google Scholar]

- Phan, Dinh Hoang Bach, and Paresh Kumar Narayan. 2020. Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerging Markets Finance and Trade 56: 2138–50. [Google Scholar] [CrossRef]

- Priscilla, Sherin, Saarce Elsye Hatane, and Josua Tarigan. 2022. COVID-19 Catastrophes and Stock Market Liquidity: Evidence from Technology Industry of Four Biggest ASEAN Capital Market. Asia-Pacific Journal of Business Administration, ahead-of-print. [Google Scholar] [CrossRef]

- Sachdeva, Kanika, and Poruran Sivakumar. 2020. COVID-19 and Stock Market Behavior—An Event Study of BRIC Countries. Turkish Journal of Computer and Mathematics Education (TURCOMAT) 11: 741–54. [Google Scholar]

- Sengere, Leonard. 2022. The Zimbabwe Stock Exchange (ZSE) Grew by 314.37% in 2021, Whilst Inflation Rate Was 60.7%. Harare: TechZim. [Google Scholar]

- Takyi, Paul Owusu, and Isaac Bentum-Ennin. 2021. The impact of COVID-19 on stock market performance in Africa: A Bayesian structural time series approach. Journal of Economics and Business 115: 105968. [Google Scholar] [CrossRef] [PubMed]

- Taleb, Nassim Nicholas. 2007. The Black Swan: The Impact of the Highly Improbable. New York: Random house, vol. 2. [Google Scholar]

- Topcu, Mert, and Omer Serkan Gulal. 2020. The impact of COVID-19 on emerging stock markets. Finance Research Letters 36: 101691. [Google Scholar] [CrossRef] [PubMed]

- Toure, Aby. 2020. COVID-19 (Coronavirus) Drives Sub-Saharan Africa toward First Recession in 25 Years. Singapore: The World Bank. [Google Scholar]

- Uddin, Moshfique, Anup Chowdhury, Keith Anderson, and Kausik Chaudhuri. 2021. The effect of COVID-19 pandemic on global stock market volatility: Can economic strength help to manage the uncertainty? Journal of Business Research 128: 31–44. [Google Scholar] [CrossRef] [PubMed]

- UN. 2021. World Economic Situation and Prospects 2021. New York: UN. [Google Scholar]

- WHO. 2020. Coronavirus Disease 2019 (COVID-19): Situation Report. Geneva: WHO, p. 73. [Google Scholar]

- WHO. 2023. Number of Weekly COVID-19 Cases Reported to WHO. Available online: https://data.who.int/dashboards/covid19/cases?n=c (accessed on 29 December 2023).

- Xu, Libo. 2021. Stock Return and the COVID-19 pandemic: Evidence from Canada and the US. Finance Research Letters 38: 101872. [Google Scholar] [CrossRef] [PubMed]

- Yousfi, Mohamed, Younes Ben Zaied, Nidhaleddine Ben Cheikh, Béchir Ben Lahouel, and Houssem Bouzgarrou. 2021. Effects of the COVID-19 pandemic on the US stock market and uncertainty: A comparative assessment between the first and second waves. Technological Forecasting and Social Change 167: 120710. [Google Scholar] [CrossRef] [PubMed]

- Yu, Xiaoling, and Kaitian Xiao. 2023. COVID-19 Government restriction policy, COVID-19 vaccination and stock markets: Evidence from a global perspective. Finance Research Letters 53: 103669. [Google Scholar] [CrossRef] [PubMed]

- Zaremba, Adam, David Y. Aharon, Ender Demir, Renatas Kizys, and Dariusz Zawadka. 2021. COVID-19, government policy responses, and stock market liquidity around the world: A note. Research in International Business and Finance 56: 101359. [Google Scholar] [CrossRef]

- Zaremba, Adam, Renatas Kizys, David Y. Aharon, and Ender Demir. 2020. Infected markets: Novel coronavirus, government interventions, and stock return volatility around the globe. Finance Research Letters 35: 101597. [Google Scholar] [CrossRef]

| Country | First COVID Case | COVID-19 Period |

|---|---|---|

| South Africa | 05 March 2020 | 05 March 2020 to 31 July 2022 |

| Nigeria | 27 February 2020 | 27 February 2020 to 31 July 2022 |

| Zimbabwe | 20 March 2020 | 20 March 2020 to 31 July 2022 |

| Zambia | 18 March 2020 | 18 March 2020 to 31 July 2022 |

| Sector | JSE | NGX | ZSE | LUSE |

|---|---|---|---|---|

| Consumer Discretionary | 32 | 13 | 6 | 2 |

| Consumer Staples | 24 | 22 | 12 | 6 |

| Energy | 4 | 11 | -- | 1 |

| Financials | 73 | 54 | 11 | 7 |

| Health Care | 11 | 8 | -- | -- |

| ICT | 24 | 12 | 2 | 1 |

| Industrials | 43 | 22 | 7 | 2 |

| Materials | 37 | 13 | 7 | 4 |

| Real Estate | 22 | 1 | 3 | -- |

| Utilities | -- | 1 | -- | 1 |

| Total | 270 | 157 | 48 | 24 |

| Variable | Description |

|---|---|

| ∆_Cases | Change in new COVID-19 cases from day t − 1 to day t |

| ∆_Deaths | Change in new COVID-19 deaths from day t − 1 to day t |

| Vaccin_ratio | Vaccin_ratio—represents the total number of vaccinations on day t divided by the cumulative number of confirmed cases on day t |

| CF_rate | The case fatality rate represents the number of deaths on day t divided by the cumulative number of confirmed cases on day t |

| str_index | The change in the government stringency index between day t and day t − 1. The stringency index is a composite measure based on 9 response indicators including school closures, workplace closures, and travel bans, rescaled to a value from 0 to 100 |

| Hosp_rate | Total number of hospitalized patients on day t divided by cumulative number of confirmed cases on day t |

| +ve rate | The share of COVID-19 tests that are positive, given as a rolling 7-day average |

| Ln_Volm | Natural log of total dollar volume of shares traded per sector on day t |

| Inflation | Inflation rate |

| FX_rate | Exchange rate given as number of USD per unit of a country’s currency |

| (A) Descriptive statistics for the variables used to model volatility at the Johannesburg stock exchange | (B) Descriptive statistics for the variables used to model volatility at the Nigerian stock exchange | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | mean | std | min | 25% | 50% | 75% | max | count | mean | std | min | 25% | 50% | 75% | max | |

| new_cases | 5301 | 4121.48 | 5149.19 | 0 | 581 | 1866 | 5771 | 26,389 | 4732 | 292.82 | 449.11 | 0 | 26 | 138 | 416 | 6158 |

| new_deaths | 5301 | 121.12 | 153.64 | 0 | 15 | 67 | 160 | 844 | 4732 | 3.19 | 5.07 | 0 | 0 | 1 | 5 | 31 |

| icu_patients | 5301 | 732.34 | 712.21 | 0 | 194 | 532 | 998 | 2694 | 4732 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| hosp_patients | 5301 | 5350.78 | 4619.42 | 0 | 2003 | 4274 | 7700 | 18,034 | 4732 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| positive_rate | 5301 | 0.11 | 0.09 | 0 | 0.04 | 0.08 | 0.18 | 0.33 | 4732 | 0.05 | 0.06 | 0 | 0 | 0.02 | 0.08 | 0.3 |

| new_vaccinations | 5301 | 26,276.13 | 56,754.24 | 0 | 0 | 0 | 16,390 | 414,065 | 4732 | 4555.02 | 44,753.75 | 0 | 0 | 0 | 0 | 797,209 |

| stringency_index | 5301 | 48.21 | 21.99 | 2.78 | 36.19 | 48.15 | 63.89 | 87.96 | 4732 | 50.71 | 15.27 | 0 | 39.49 | 47.22 | 58.33 | 85.65 |

| FX_rate | 5301 | 15.79 | 1.24 | 13.43 | 14.8 | 15.46 | 16.75 | 19.11 | 4732 | 399.98 | 18.6 | 360.5 | 381.2 | 410.3 | 415.12 | 444.97 |

| Inflation | 5301 | 4.64 | 1.58 | 1.99 | 3.17 | 4.67 | 5.77 | 7.8 | 4732 | 12.84 | 2.11 | 9.4 | 10.96 | 13.17 | 13.93 | 17.67 |

| Dollar_Volm | 5301 | 1.32 × 1010 | 1.57 × 1010 | 80,905,585 | 4.77 × 109 | 9.01 × 109 | 1.59 × 1010 | 4.53 × 1011 | 4732 | 4.63 × 109 | 5.75 × 109 | 1331 | 1.97 × 109 | 3.34 × 109 | 5.56 × 109 | 2.2 × 1011 |

| (C) Descriptive statistics for the variables used to model volatility at the Zimbabwean stock exchange | (D) Descriptive statistics for the variables used to model volatility at the Lusaka stock exchange | |||||||||||||||

| new_cases | 4326 | 322.55 | 807.48 | 0 | 16 | 57.5 | 227 | 9027 | 4504 | 383.7 | 773.47 | 0 | 17 | 85 | 322 | 5555 |

| new_deaths | 4326 | 6.86 | 14.92 | 0 | 0 | 1 | 5 | 107 | 4504 | 4.2 | 10.26 | 0 | 0 | 0 | 3 | 72 |

| icu_patients | 4326 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4504 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| hosp_patients | 4326 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4504 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| positive_rate | 4326 | 0.06 | 0.07 | 0 | 0.01 | 0.03 | 0.08 | 0.44 | 4504 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| new_vaccinations | 4326 | 13,178.34 | 24,821.17 | 0 | 0 | 1597.5 | 16,349 | 175,915 | 4504 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| stringency_index | 4326 | 61.7 | 15.68 | 0 | 51.05 | 57.41 | 71.3 | 87.96 | 4504 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| FX_rate | 4326 | 149.62 | 149.73 | 24.75 | 82.42 | 85.6 | 130.12 | 628.21 | 4504 | 18.69 | 2.25 | 13.94 | 16.97 | 18.13 | 21 | 22.68 |

| Inflation | 4326 | 289.09 | 249.02 | 49.37 | 66.55 | 213.54 | 394.13 | 839.08 | 4504 | 17.07 | 4.74 | 9.7 | 13.9 | 16.09 | 21.83 | 24.8 |

| Dollar_Volm | 4326 | 5,400,966 | 30,335,077 | 0 | 43,116.32 | 359,761.1 | 2,499,130 | 1.23 × 109 | 4504 | 278,375.2 | 13,394,094 | 0 | 0 | 0 | 1480.98 | 8.94 × 108 |

| Variable | Consumer Discretionary | Consumer Staples | Energy | Financials | Health Care | ICT | Industrials | Materials | Real Estate |

|---|---|---|---|---|---|---|---|---|---|

| omega | 0.01 | 0.013 | 0.018 * | 0.003 | 0.024 | 0.005 *** | 0.003 | 0.045 | 0.007 |

| alpha [1] | 0.107 ** | 0.123 | 0.075 *** | 0.043 * | 0.059 | −0.042 *** | 0.087 ** | 0.15 | 0.078 |

| gamma [1] | −0.08 *** | −0.098 ** | −0.061 *** | −0.043 *** | −0.051 ** | −0.041 *** | −0.029 * | −0.078 * | −0.049 *** |

| beta [1] | 0.977 *** | 0.94 *** | 0.992 *** | 0.989 *** | 0.979 *** | 0.992 *** | 0.986 *** | 0.936 *** | 0.991 *** |

| +ve Cases | −1.285 *** | −0.168 | −2.094 *** | −0.385 *** | 0.191 | −0.54 *** | −0.326 *** | −0.544 *** | −0.642 *** |

| ∆_Cases | 0.008 | −0.009 | −0.007 | −0.008 | 0.001 | 0.003 | −0.001 | 0.003 | −0.011 |

| ∆_Deaths | 0.012 | 0.007 | 0.011 | 0.004 | 0.01 | 0.003 | 0.003 | 0.004 | 0.008 |

| str_index | 0.009 *** | 0.002 *** | 0.012 *** | 0.002 *** | −0.005 *** | −0.001 * | 0.002 *** | 0.002 * | 0.004 *** |

| FX_rate | −41.375 *** | −13.044 *** | −78.308 *** | −35.809 *** | −36.609 *** | −35.377 *** | −18.839 *** | −26.257 *** | −30.715 *** |

| Inflation | −0.125 *** | −0.061 *** | 0.146 *** | 0.014 | 0.058 *** | −0.071 *** | 0.01 | 0.133 *** | −0.068 *** |

| Ln_Volm | 0.093 *** | 0.1 *** | −0.081 * | 0.076 *** | 0.057 *** | 0.029 * | 0.004 | −0.011 | 0.044 ** |

| Vaccin_ratio | −0.048 *** | −0.02 *** | −0.072 *** | −0.031 *** | −0.02 *** | −0.069 *** | −0.014 *** | −0.061 *** | −0.012 *** |

| Consumer Discretionary | Consumer Staples | Energy | Financials | Health Care | ICT | Industrials | Materials | |

|---|---|---|---|---|---|---|---|---|

| Variable | ||||||||

| omega | −0.046 | −0.048 | 0.009 | −0.01 | 0.003 | −0.037 | −0.036 | 0.353 |

| alpha [1] | 0.38 | 0.212 * | 0.229 | 0.15 *** | 0.169 *** | 0.147 ** | 0.114 * | 0.652 * |

| gamma [1] | 0.038 | 0.056 ** | 0.036 | 0.04 ** | 0.059 * | 0.01 | 0.003 | 0.509 * |

| beta [1] | 0.804 *** | 0.923 *** | 0.889 *** | 0.98 *** | 0.942 *** | 0.948 *** | 0.969 *** | 1.0 *** |

| ∆_Cases | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ∆_Deaths | 0.004 | −0.002 | 0.007 | 0.002 | 0.006 | 0.001 | −0.002 | −0.002 |

| +ve Cases | 0.005 | −0.43 ** | 0.861 *** | 0.301 * | 0.164 | −0.14 | −0.022 | 0.607 *** |

| Vaccin_ratio | 0.001 *** | 0.0 * | 0.001 *** | 0.001 ** | 0.002 *** | 0.0 *** | 0.001 *** | 0.001 *** |

| str_index | 0.003 *** | 0.002 ** | 0.004 *** | 0.002 ** | −0.004 *** | −0.002 *** | 0.001 ** | 0.003 *** |

| Inflation | −0.05 *** | −0.029 *** | −0.011 | −0.035 *** | −0.078 *** | −0.011 ** | −0.051 *** | 0.016 |

| FX_rate | 0 | −0.002 *** | −0.004 *** | −0.004 *** | −0.001 | −0.002 *** | −0.001 *** | −0.001 |

| Ln_Volm | 0.04 *** | 0.054 *** | 0.04 *** | 0.099 *** | 0.068 *** | 0.001 | 0.009 ** | 0.014 ** |

| Consumer Discretionary | Consumer Staples | Financials | ICT | Industrials | Materials | Real Estate | |

|---|---|---|---|---|---|---|---|

| Variable | |||||||

| Omega | 0.283 | 0.354 | 0.245 *** | 1.735 ** | 0.298 | 0.05 | 0.678 |

| alpha [1] | 0.083 | 0.272 ** | 0.162 *** | 0.801 ** | 0.161 ** | 0.156 ** | 0.241 |

| gamma [1] | 0.024 | −0.053 | −0.085 | −0.567 * | −0.035 | −0.04 | −0.115 |

| beta [1] | 0.83 * | 0.648 *** | 0.757 *** | 0.482 *** | 0.751 *** | 0.855 *** | 0.74 *** |

| ∆_Cases | −0.001 | 0.013 | 0.003 | −0.004 | −0.002 | −0.024 * | −0.015 |

| ∆_Deaths | −0.008 | 0.002 | 0.018 | −0.072 | −0.006 | 0.011 | 0.01 |

| +ve_Cases | 1.092 *** | 1.506 * | 0.088 | −0.502 | 0.779 | 0.587 | −1.312 |

| str_index | 0.003 ** | 0.01 * | 0.004 | 0.007 | −0.001 | 0.008 *** | 0.013 ** |

| FX_rate | 4.811 *** | 8.084 ** | 4.555 * | 11.38 | 0.307 | 13.448 *** | 11.992 ** |

| Ln_Infl | 0.123 *** | 0.258 *** | 0.114 ** | 0.318 * | 0.165 *** | 0.329 *** | 0.22 * |

| Ln_Volm | 0.024 *** | 0.052 | 0.058 *** | 0.127 ** | 0.046 *** | 0.044 *** | 0.085 *** |

| Vaccin_ratio | −0.005 *** | 0.014 *** | 0.003 | 0.028 *** | 0.007 ** | 0.007 *** | 0.009 |

| Consumer Discretionary | Consumer Staples | Energy | Financials | ICT | Industrials | Materials | Utilities | |

|---|---|---|---|---|---|---|---|---|

| Variable | ||||||||

| omega | 0.001 *** | 0.001 *** | 0.001 *** | 0 | 0.0 *** | 0.001 | 0.005 | 0.131 ** |

| alpha [1] | 0.01 *** | 0.01 * | 0.01 *** | 0.984 | 0.01 *** | 0.725 * | 0.424 | 0.323 *** |

| gamma [1] | 0.01 | 0.01 | 0.01 | −0.828 | 0.01 ** | −0.336 | 0.003 | −0.235 *** |

| beta [1] | 0.869 *** | 0.965 *** | 0.965 *** | 0.415 | 0.965 *** | 0.186 | 0.404 | 0.794 *** |

| ∆_Cases | 0 | 0 | 0 | −0.003 | 0 | 0 | −0.001 | −0.01 |

| ∆_Deaths | 0 | 0.001 | −0.001 | −0.003 | 0.001 | −0.024 | −0.003 | −0.006 |

| str_index | 0 | 0 | 0 | −0.0 ** | 0 | 0 | −0.0 *** | 0 |

| +ve_cases | 0.0 *** | −0.0 *** | −0.0 *** | −0.0 ** | 0 | 0 | 0.0 *** | 0 |

| FX_rate | 0 | −0.004 *** | 0.001 | −0.012 *** | −0.001 *** | 0.037 *** | −0.001 | −0.014 |

| Inflation | 0 | −0.002 *** | −0.007 *** | 0.006 *** | −0.001 *** | −0.003 | 0 | 0.091 *** |

| Ln_Volm | −0.0 *** | 0.001 *** | 0.002 *** | 0.008 *** | 0 | 0.028 *** | 0.005 *** | −0.018 *** |

| CF_rate | −0.001 | −0.439 | 2.982 * | −6.879 ** | −0.553 | 3.814 | 10.141 *** | 15.009 |

| JSE | NGX | ZSE | LuSE | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sector | Random Forest | XGBoost | SVM | Random Forest | XGBoost | SVM | Random Forest | XGBoost | SVM | Random Forest | XGBoost | SVM |

| Consumer Discretionary | 0.8732 | 0.5009 | 0.867 | 0.3596 | 0.0423 | 0.2992 | 0.9683 | 0.3101 | 0.8329 | −0.310 | −0.014 | −0.368 |

| Consumer Staples | 0.8574 | 0.2938 | 0.7115 | 0.8012 | 0.0974 | 0.4106 | 0.6505 | 0.0922 | 0.2823 | 0.8117 | −0.001 | −1.561 |

| Energy | 0.9523 | 0.5384 | 0.8487 | 0.1333 | 0.0241 | 0.1586 | 0.7441 | −0.032 | 0.2261 | |||

| Financials | 0.967308 | 0.4004 | 0.8930 | 0.8843 | 0.2851 | 0.6382 | 0.5727 | 0.0866 | 0.1607 | 0.536 | −0.011 | 0.2285 |

| Health Care | 0.8887 | 0.2741 | 0.8344 | 0.7847 | 0.1886 | 0.3015 | ||||||

| ICT | 0.9547 | 0.4457 | 0.9029 | 0.8309 | −0.000 | 0.5130 | 0.3720 | 0.0591 | 0.0402 | 0.5411 | −0.002 | −6.801 |

| Industrials | 0.9583 | 0.3780 | 0.8551 | 0.8009 | 0.0408 | 0.4922 | 0.5457 | 0.0718 | 0.2493 | 0.0275 | −0.015 | −0.002 |

| Materials | 0.7185 | 0.3343 | 0.6384 | 0.7891 | 0.2161 | 0.590 | 0.8076 | 0.3081 | 0.6534 | 0.0712 | −0.004 | −0.424 |

| Real Estate | 0.9261 | 0.4530 | 0.8477 | 0.3583 | 0.1431 | 0.1214 | ||||||

| Utilities | 0.7955 | 0.4243 | 0.4196 | |||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ncube, M.; Sibanda, M.; Matenda, F.R. Investigating the Effects of the COVID-19 Pandemic on Stock Volatility in Sub-Saharan Africa: Analysis Using Explainable Artificial Intelligence. Economies 2024, 12, 112. https://doi.org/10.3390/economies12050112

Ncube M, Sibanda M, Matenda FR. Investigating the Effects of the COVID-19 Pandemic on Stock Volatility in Sub-Saharan Africa: Analysis Using Explainable Artificial Intelligence. Economies. 2024; 12(5):112. https://doi.org/10.3390/economies12050112

Chicago/Turabian StyleNcube, Mbongiseni, Mabutho Sibanda, and Frank Ranganai Matenda. 2024. "Investigating the Effects of the COVID-19 Pandemic on Stock Volatility in Sub-Saharan Africa: Analysis Using Explainable Artificial Intelligence" Economies 12, no. 5: 112. https://doi.org/10.3390/economies12050112

APA StyleNcube, M., Sibanda, M., & Matenda, F. R. (2024). Investigating the Effects of the COVID-19 Pandemic on Stock Volatility in Sub-Saharan Africa: Analysis Using Explainable Artificial Intelligence. Economies, 12(5), 112. https://doi.org/10.3390/economies12050112