1. Introduction

During the COVID-19 pandemic, the global health crisis caused a widespread economic downturn, leading to a recession. Governments and the international community swiftly took action to secure financing, addressing the decline in public revenue and increased health and social expenditure. This resulted in a challenging tradeoff between preventing COVID-19 deaths and tackling economic recession. The initial lockdown from 26 March to 4 April 2020 extended to 27 May 2020 due to confirmed cases, impacting essential sectors only. This triggered a supply-side recession. Post-lockdown reopening saw both essential and non-essential sectors operational, leading to a demand-side recession. The workforce, crippled from losing jobs, faced decreased purchasing power, worsening the economic challenges (

Finance Division 2023;

Siam et al. 2021).

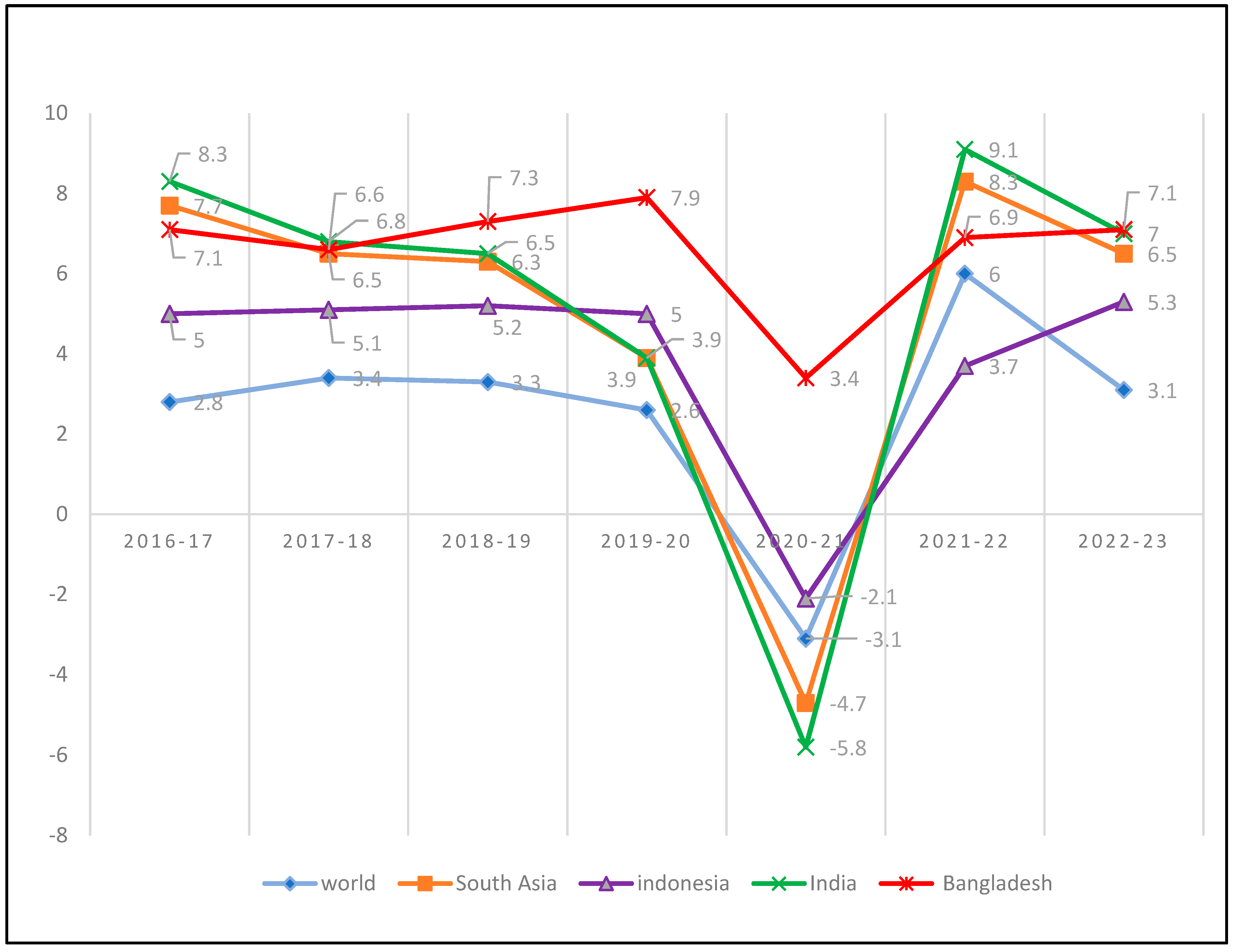

The impact of COVID-19 on both the demand and supply sides of various sectors and sub-sectors in Bangladesh intensified challenges for stakeholders, causing a sharp decline in real GDP growth from 7.9% in FY 2018–2019 to 3.5% in FY 2019–2020, as shown in

Table 1 (

Finance Division 2023). This pandemic shock globally resulted in lower output and increased prices, affecting both domestic and cross-border businesses (

Prusty et al. 2022).

Despite attempts to stimulate the economy through expansionary fiscal and monetary policy, which involved increased government spending and increased money supply, credit to the private sector declined and overall investment did not grow significantly. Concurrently, the inflation rate remained relatively stable (

Table 1). The continuation of lockdown measures further hampered international trade. This impact was felt globally, including in Bangladesh, where extended lockdowns resulted in a series of challenges: decreased consumption, inventory shortages, and disruptions across the supply chain in both formal and informal business sectors (

Buffie et al. 2023).

In FY 2020–2021, despite negative growth trends in the global economy (−3.1%) and like several developing countries such as India and Indonesia, Bangladesh demonstrated a positive V-shaped pattern in its GDP growth, reaching an impressive rate of 3.4% (

World Bank 2021). This upward trajectory reflected the resilience and recovery of the Bangladeshi economy amid a challenging global economic landscape, as illustrated in

Figure 1. In response to pandemic challenges, Southeast Asian economies collectively increased fiscal spending (

Asian Development Bank 2022;

Narayanan et al. 2021;

Nurheryanti et al. 2021).

Recognizing the urgent need to address the severe economic and social impact of the pandemic, the Government of Bangladesh (GoB) took decisive action. Introducing a series of stimulus packages strategically designed for a multi-stage intervention plan from early March 2020, as emphasized by

Alam et al. (

2020) and detailed in the Finance Division’s report (

Finance Division 2023), this initiative underscores the government’s commitment to proactively tackling immediate challenges, laying the foundation for sustained economic recovery. The implementation of these stimulus packages aimed not only to alleviate the disastrous impacts of the pandemic but also to provide tangible relief, serving as a lifeline for those facing severe consequences.

In terms of percentage of GDP, Bangladesh’s stimulus amount surpassed that of other South Asian and Southeast Asian countries. In FY 2021–2022, the stimulus packages increased to 28 support measures, covering cash transfers to the extreme poor, open market sales, employment creation, and working capital loan assistance for specific industries. The cumulative support measures from FY 2019–2020 to FY 2021–2023 amounted to approximately BDT 2,37,679 million (USD 26,900 million) (

Finance Division 2023).

The stimulus packages deployed a combination of fiscal and monetary tools. Fiscal measures included direct aid like cash transfers and humanitarian support, alongside interest rate subsidies. Monetary tools focused on lowering borrowing costs by reducing bank rates, repo rates, and cash reserve ratios while also increasing liquidity through adjustments to the ADR (advanced deposit ratio) and IDR (investment deposit ratio). This multi-pronged approach proved crucial in reviving the economy during the financial crisis and downturn. In fact, the global response to the unprecedented COVID-19 pandemic involved governments worldwide implementing large-scale stimulus packages to rejuvenate the economy and restore output. Therefore, understanding the impact of these stimulus packages is essential to comprehending their role in revitalizing the economy and restoring output.

While anticipating positive outcomes from stimulus packages, it is crucial to rigorously assess the impact and effectiveness of the 28 measures implemented by the GoB during the pandemic. Targeting export-oriented industries, the agricultural sector, the low-income group, and affected businesses, this research aims to understand the design, implementation, challenges, and potential applicability of similar packages in the face of future shocks like COVID-19. Due to time and budget constraints, the study focuses on four key stimulus packages, covering 71.34% of the total allocation. Because of their weight in the allocation, and the impact and implication to the large target population and beneficiaries, these are arguably the most important packages implemented. These packages include salary support for workers in export-oriented RMG industries; working capital loans for affected industries and service sectors; working capital loans for cottage, micro, small, and medium enterprises; and initiatives for revitalizing the rural economy and job creation. Thus, the packages had a significant target population consisting of RMG workers, the rural economy, and women entrepreneurs, and aimed to help people socially and economically, support livelihoods, address the needs of marginalized groups, ensure the survival of both large industries and small businesses, and promote employment (

Finance Division 2023).

This study is motivated by the imperative need to conduct a comprehensive evaluation of the relation between the economy and fiscal stimulus packages implemented by the GoB during the COVID-19 pandemic. Thus, the main objective of the study is to assess the impact and effectiveness of the stimulus measures. Furthermore, the study also tries to understand the linkages between the announced fiscal stimulus and the pandemic recovery process, and ultimately to analyze the challenges in the implementation and offer policy and operational recommendations to enhance the design and delivery of future stimulus measures.

To achieve these objectives, the study outlines the impact and effectiveness of measures using indicators like input impact, process impact, output impact, outcome impact, and result impact by employing a mixed-method approach.

2. Literature Review

Keynes’s (

1936) “The General Theory” revolutionized economics by challenging the classical view of full employment and proposing government intervention through fiscal and monetary policy to manage economic cycles. Similarly, over the years, extensive theoretical and empirical literature on recessions, including the Great Depression (1929–1939), the South Asian financial crisis (1997), and the financial crisis of 2008–2009, highlights the use of monetary and fiscal policies to revive economic stability (

Bernstein 2001;

Goldstein 1998;

Nützenadel 2021). Similarly, evidence from the global response to the COVID-19 economic shock from 2019 to 2023 provides insights into the challenges and opportunities faced by nations during economic recovery.

Examining fiscal stimulus packages during economic downturns, particularly in developed countries,

Giesecke and Schilling (

2010) utilized a dynamic computable general equilibrium (CGE) model to assess New Zealand’s effects. They found a modest positive impact on short-term employment but noted a tradeoff with long-term real consumption. The study highlights the complexities associated with fiscal stimulus packages, emphasizing nuanced policy design. Similarly,

Buchheim and Watzinger (

2017), investigating a German infrastructure investment program at the county level, utilized a quasi-experimental design and revealed a significant employment boost, emphasizing the program’s countercyclical fiscal policy role. Acknowledging limitations, including challenges in generalizing findings and the short-lived nature of employment effects, both studies stress the need for cautious interpretation (

Buchheim and Watzinger 2017).

Studies in Malaysia and Pakistan employed structural equation models to investigate the role of microfinance and training in disaster resilience. Using a structural equation model,

Kot and Imran (

2019) considered micro-training and social capital as moderators, with environmental disaster as the independent variable and women micro enterprise sustainability as the dependent variable. The findings revealed that training and additional credit enabled micro-entrepreneurs, especially women, to prepare for and actively participate in the recovery from environmental disasters. It was also examined in another study how Malaysia’s COVID-19 economic stimulus packages impacted young entrepreneurs (under 40) running SMEs. Although many participants appreciated the wage subsidies, loan moratoriums, and tax deferrals, some felt tax incentives were less helpful. Concerns were raised about delays in receiving aid and the ability to repay loans once support ended. Despite these issues, the overall sentiment was positive, with many viewing the stimulus packages as valuable government assistance (

Lim et al. 2021). Similar to these, some studies were cross-sectional and used Likert scales to construct variables. Although they demonstrated a significant positive correlation between microfinance services and the self-sustainability of women, they did not explore the broader social and economic conditions of women entrepreneurs (

Hameed et al. 2022;

Halimatussadiah et al. 2020;

Prusty et al. 2022). A web-based survey involving 250 stakeholders from India, including academics, entrepreneurs, and industry experts, was conducted to validate constructs related to monetary and fiscal stimulus measures using confirmatory factor analysis. The research utilized structural equation modeling to analyze how different stimulus measures influenced economic recovery, as perceived by the surveyed stakeholders. In a more recent study,

Yasmin et al. (

2023) investigated the effectiveness of government stimulus packages in the UAE during the COVID-19 pandemic. They used input–output analysis to examine how these interventions impacted various economic sectors. The study suggested that the stimulus packages had a positive impact on the overall output of various economic sectors in the UAE, potentially leading to a 2.9% annual increase in GDP over the following four years.

Similar to in other countries, in response to the policy measures in Bangladesh during the pandemic, many studies tried to explain the scenarios and mechanisms of how the economy started to revive.

Reza et al. (

2020) explored the economic repercussions of the COVID-19 pandemic in Bangladesh. The authors pointed to a decline in remittance inflow due to a global labor market slump and a potential decrease in GDP growth. They specifically mentioned a drop in remittance earnings and the impact on micro, small, and medium enterprises (MSMEs) across various sectors. The research by

Lalon (

2020) aimed to explore the potential economic consequences of the COVID-19 pandemic in Bangladesh, highlighting the government and stakeholder initiatives to counter the looming economic challenges. Using a descriptive analysis based on reports and secondary data, the study provided insights into the economic impacts of the pandemic in Bangladesh and examined the policies implemented to recover the economy. Notably, the research revealed that the study did not find evidence of economic impact from the fiscal stimulus package, pointing to areas that may require further investigation or consideration in the literature on the economic effects of pandemic responses.

Ahamed (

2021) examined how the COVID-19 pandemic negatively affected Bangladesh’s economy, highlighted the global economic recession caused by COVID-19, and emphasized the challenges faced by policymakers in formulating effective monetary, fiscal, and financial policies. The study underscores the importance of government intervention and policy foresight to mitigate the long-term effects of the pandemic on Bangladesh’s economic growth and prosperity.

Khatun and Saadat (

2021) analyzed government stimulus packages from a gender perspective, aiming to enhance measures for women’s economic empowerment during the COVID-19 pandemic. Employing both quantitative analysis with secondary data and qualitative analysis with primary data from KII and FGD, the study found that the pandemic disproportionately affected women. Unfortunately, a majority of women did not benefit from credit support. In another study,

Parvez et al. (

2022) examined how Bangladesh’s BDT 400 billion stimulus package aimed at reviving cottage, micro, small, and medium enterprises (CMSME) affected by COVID-19 lockdowns. The analysis showed that the stimulus package helped the recovery of CMSMEs sectors that were hit by the pandemic. The disbursement of the funds was promising in the first phase. The number of enterprises that obtained loans from financial institutions (FIs) was high in the first phase, but it was moderated in the second phase.

Globally, various studies have explored the socio-economic effects of stimulus packages implemented in response to different shocks, using diverse quantitative and qualitative methods to evaluate their impacts on essential economic factors. However, in Bangladesh, there is a notable gap, as few studies have thoroughly analyzed the effects of the government’s COVID-19 stimulus packages. Although some studies described the importance of these packages, few delved into their specific impacts. Acknowledging the existing gap in the research, there is a necessity for an extensive investigation that evaluates the effects on targeted regions and individuals using a combination of quantitative and qualitative analyses of primary data through a mixed-method approach to examine and evaluate the stated objectives. Each package was examined separately due to having different target beneficiary groups, implementation approaches, and objectives. A wide range of stakeholders, including policy implementers, Bangladesh Bank officials, policy analysts, academics, workers, and, particularly, beneficiaries, was extensively consulted to evaluate the impact of the interventions. As a result, this paper will bring transparent and impartial insights, facilitating well-informed decision-making for future stimulus measures in similar crises.

3. Conceptual Framework

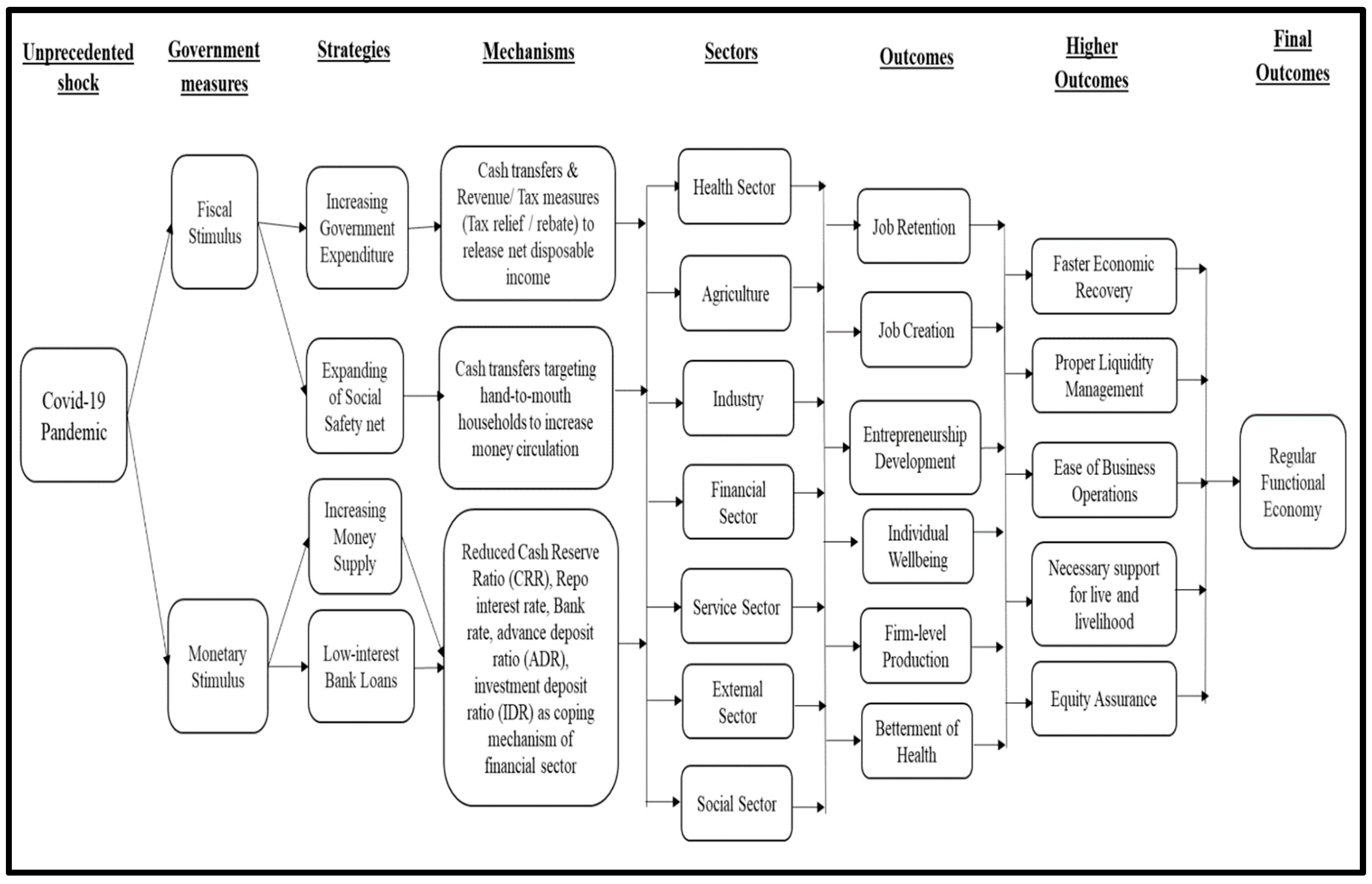

In the conceptual framework depicted in

Figure 2, the government employed two primary strategies within the fiscal stimulus package. Initially, it focused on increasing government expenditure through revenue/tax measures to increase net disposable income. Simultaneously, it extended the social safety net, incorporating cash transfers to benefit impoverished households and boost monetized demand. These strategies align with Keynesian economics, which emphasizes government spending to boost aggregate demand during economic downturns (

Campante et al. 2021).

Moreover, operating through distinct mechanisms, the strategies collectively contribute to enhancing key sectors such as health, agriculture, industry, finance, services, and social, along with the external sector, which reflects a nod to real business cycle theory. This theory emphasizes the role of improvements in these areas to influence economic fluctuations. By investing in these sectors, the government aims to improve long-term productive capacity, a core concept in real business cycle models (

Campante et al. 2021). The anticipated outcomes lead to job retention, job creation, entrepreneurship development, firm-level production, and improvements in both health and individual well-being (

Campante et al. 2021).

The outcomes through demand-side mechanisms (Keynesian) and supply-side mechanisms (real business cycle), are expected to fulfill the broader national goals such as faster economic recovery, proper liquidity management, ease of business operations, necessary support for life and livelihood, and equity assurance. Ultimately, the culmination of these outcomes will result in a regular functional economy (

Figure 2).

4. Methods and Scope

4.1. Study Design

The Hypothesis of this study was formed as “The four stimulus packages were effective for the targeted beneficiaries and impacted the economy positively”.

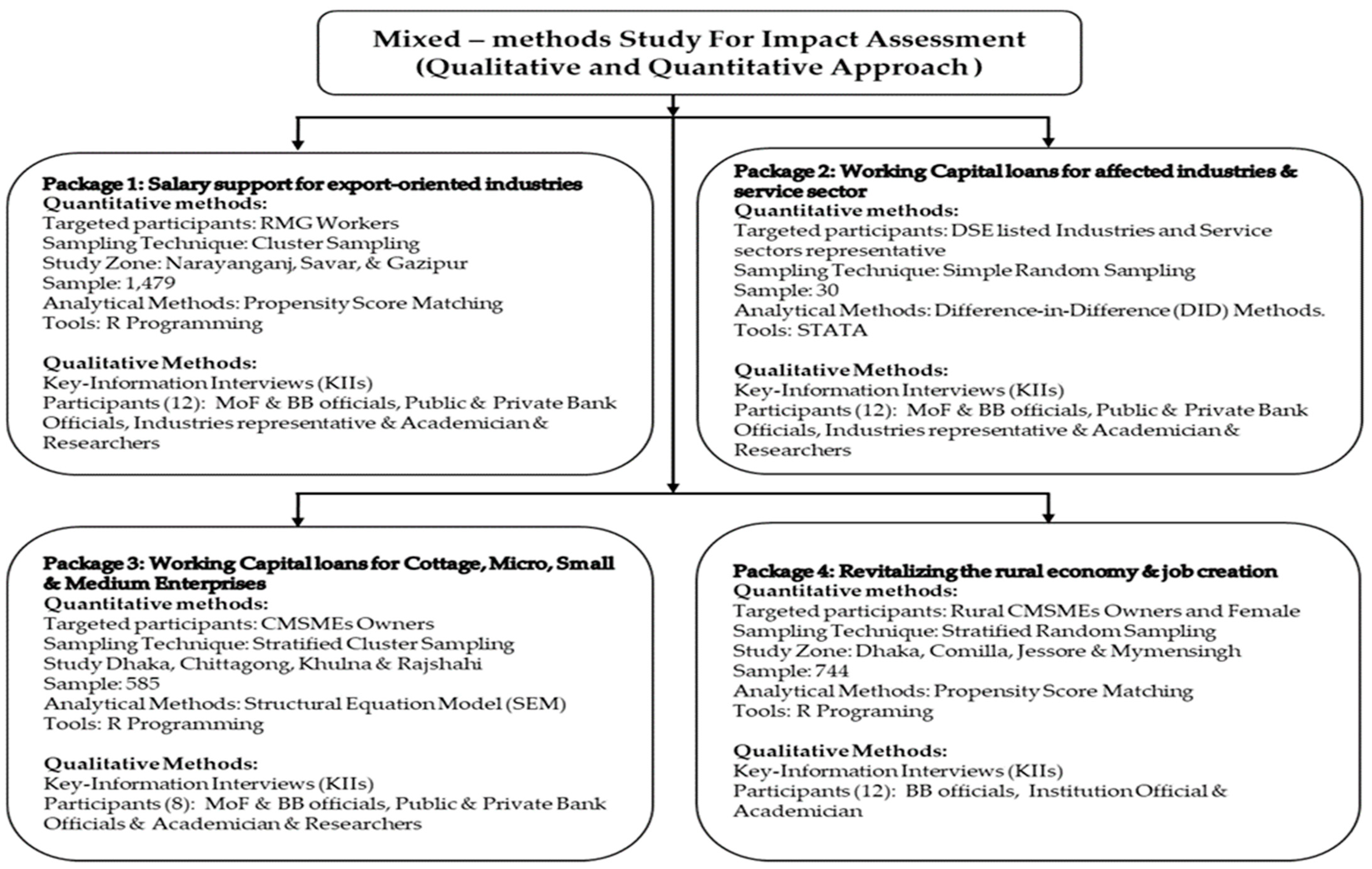

This study employed a mixed-method approach to test the stated hypothesis and evaluate the impact of the selected stimulus packages, examining their implementation process and identifying challenges. Both quantitative and qualitative methods were utilized, with each package studied separately due to differing beneficiary groups, implementation methods, and objectives. The goal was to offer unbiased insights for informed decision-making on future stimulus measures during crises. The study engaged beneficiaries, experts, professionals, and academics, consulting various stakeholders such as policy implementers, Bangladesh Bank officials, policy analysts, and workers. It not only assessed outcomes but also identified implementation challenges, offering relevant policy recommendations to enhance the design and implementation of similar initiatives for future shocks. Both the qualitative and quantitative methods were triangulated in the interpretation. The “Good Reporting of a Mixed-Methods Study (GRAMMS)” checklist was used, and this is attached in

Supplementary File S1 (

O’cathain et al. 2008).

4.2. Data Collection

For the analysis of all four packages, primary data were collected using a structured survey questionnaire, which is given in

Supplementary File S4, for quantitative analysis and key-informant interviews (KIIs) for qualitative insights. Additionally, focused group discussions (FGDs) were conducted for the “Revitalizing the Rural Economy and Job Creation” package. A mail-based survey targeted large industries and service sector enterprises for data collection related to the “Working Capital Loan for Industries and Service Sectors” package. To gather data for the other three packages, a survey was conducted using Kobo Toolbox software. This software ensured data accuracy and quality. Trained enumerators used tablets to collect the data. Details on how the sample size was determined can be found in

Supplementary File S2, and information on the data collection methods is available in

Supplementary File S3.

Utilizing cluster sampling, 1479 RMG workers were included in the sample population for the “Salary Support for Export-Oriented Industry Workers” package. For “Working Capital Loans for Cottage, Micro, Small, and Medium Enterprises”, 585 CMSMEs were included through multistage cluster sampling. Similarly, employing stratified cluster sampling, data from 744 beneficiaries were collected from 5 out of 8 publicly owned institutes for another package.

For quantitative analysis, three packages yielded a substantial number of observations, ensuring unbiased results. However, for the “Working Capital Loan for Industries and Service Sectors” package, the data collection faced limitations, with only 30 out of 128 selected enterprises providing the necessary financial information.

Qualitative analysis also involved key-informant interviews (KIIs) with stakeholders and experts for all packages. Specifically, for the “Revitalizing the Rural Economy and Job Creation” package, KIIs were conducted with administrators overseeing stimulus disbursal and intermediaries. Additionally, three focus group discussions took place with beneficiaries from the Joyeeta Foundation, Bangladesh NGO Foundation, and Social Development Foundation, along with a semi-structured interview involving a beneficiary from the Social Development Foundation.

4.3. Data Analysis

For the quantitative analysis of the impact of selected stimulus packages, a quasi-experimental approach was applied. Propensity score matching (PSM) served as the method for the “Salary Support for Export-Oriented Industru Workers” and “Revitalizing the Rural Economy and Job Creation” packages, addressing selection bias in the estimation of treated effects. PSM is recognized for mitigating bias in assessing the impact of economic policy interventions (

Becker and Ichino 2002). The “Working Capital Loan for Industries and Service Sectors” package employed two techniques, namely, difference-in-difference (DID) and the purchasing managers’ index (PMI), to gauge differences over time between receiver and non-receiver groups. The detailed description of how these statistical methods were carried out is given in

Supplementary File S5. Lastly, the “Working Capital Loans for Cottage, Micro, Small, and Medium Enterprises” package utilized structural equation modelling (SEM) to systematically analyze causal relationships between variables. The theories and hypotheses created in order to carry this out are given in

Supplementary File S6.

Besides the quantitative study, for each of the packages, qualitative analysis was also completed. The collection of KIIs was stopped as soon as the saturation level was acquired in the findings. Following the interviews and key-informant interviews (KIIs), the transcripts were promptly transcribed for analysis. These transcripts underwent a thematic analysis process for each of the packages, during which they were systematically organized into four primary thematic areas: planning and implementation, challenges faced during the pandemic, experience of the stimulus package, and opinions for moving forward. The detailed methodology of the study is summarized in

Figure 3.

5. Results

5.1. Salary Support for Export-Oriented RMG Industries

5.1.1. Socioeconomic Distribution of RMG Industry Workers

In the survey, 35.56% were male, and 64.44% were female. Around 67.21% of respondents were above 25 years old, and over 71% had completed school-level education. Approximately 22% were illiterate. Regarding marital status, 90.13% were married, and 74.47% received their salary via mobile financial service (MFS). About 90% resided in urban areas during COVID-19, 39.62% took out a loan to survive, and 60.38% received a COVID-19 hygiene safety kit. Furthermore, 82.33% of respondents expressed difficulty in supporting their extended family during COVID-19 (

Table 2).

5.1.2. Impact of Salary Support on Economic, Health, Social, and Psychological Aspects during COVID-19

In terms of economic impact, as shown in

Table 3, this study found a significant positive impact of salary support on various outcome variables, including food and non-food consumption, rent and utility payments, education expenses, savings, and more. The average treatment effect (ATE) coefficients indicate a positive and statistically significant difference between the control and treatment groups in expenditure categories like rent, utilities, and education. The study suggests that salary support contributed to individuals meeting regular financial obligations, stabilizing economic activity. Despite increased spending on food and non-food items in the treatment group, the positive impact indicates that salary support helped alleviate financial burdens, reducing the need for loans and leading to some cutbacks in non-essential expenses, particularly food products. Overall, salary support plays a crucial role in bolstering economic resilience and maintaining financial commitments during challenging times.

This study revealed the positive impact of salary support on health, emphasizing improved capacity to cover healthcare expenses and afford essential health supplies. Positive coefficients in variables such as “regular payment of healthcare bills”, “capacity for purchasing sanitizer”, and “capacity for purchasing handwashing materials” highlight the role of financial stability in promoting better health outcomes and hygiene practices during crises like the COVID-19 pandemic (

Table 3).

In terms of psychological and social impact, the study indicates positive and significant effects on mental well-being, work motivation, reduced home conflict, and the ability to support extended family. Salary support recipients showed higher agreement levels in these aspects compared to non-recipients, with a meaningful difference in mental health, home conflict, vulnerability, and support for extended family. The study concludes that salary support to the export-oriented sector not only enhanced economic welfare and healthcare access but also contributed to the overall well-being of industry workers by securing psychological and social benefits (

Table 3).

5.1.3. Challenges in Implementing Salary Support Program

The special funds to the export-oriented industries were provided digitally to the workers through mobile financial service (MFS) accounts or bank accounts. Some workers did not have any MFS/bank account, so how they received the support was a challenge initially. Moreover, lockdown restrictions were another challenge to implementing this package. To solve this issue, the commercial banks adopted the “know-your-customer” (KYC) policy, which facilitated mass account opening as factories directly shared the identification information of workers with MFS providers. The loan application process was easy, but RMG factory officials struggled to prepare the documents that were needed to submit the application.

“The loan disbursement process was somewhat challenging amid the lockdown restrictions, … The absence of proper recording of worker’s information by the factories became transparent, but they faced difficulties reaching the workers due to the lockdown restrictions and factory shutdown while implementing the disbursement program. As a result, the disbursement process took additional time and ultimately resulted in a delay in payment of worker’s salary in some instances.”

(KII from private and public sector bank officials)

Commercial banks also faced difficulties while disbursing the loans within a very short time period because it was difficult to verify all the required documents and their capacity for repayment. At the same time, the banks had to bear all the risks while providing the loans.

“The salary support program benefitted the targeted beneficiaries. Demand was too high for the loan package. Within two months, this fund was almost exhausted, and BB ordered the use of the working capital loan fund for further salary payment. The key challenge for the program was selecting the beneficiaries by evaluating their status. Banks were asked to introduce roster duty, and only a small portion of the employees could come to the office. Therefore, there was a manpower shortage, and it impeded the field-level inspection of companies. As a result, banks in most cases depended on reported documents for scrutinizing.”

(Public commercial bank official as KII participant)

The analysis of both quantitative and qualitative data underscores the significant positive impact of the salary incentive on export-oriented RMG industries in Bangladesh during the COVID-19 pandemic. Receivers experienced notable improvements in economic indicators, and the findings were robust across different matching methods. Challenges like digital disbursement and lockdown restrictions were effectively addressed. Factory officials and experts expressed satisfaction, emphasizing the support’s crucial role in preventing economic hardships, supporting mental well-being, and facilitating a smooth return to normalcy. The combined evidence highlights the success of the government’s fiscal stimulus in mitigating the pandemic’s adverse effects on RMG industry workers in Bangladesh.

5.2. Working Capital Loan to Affected Industries and Service Sectors

5.2.1. Overview of the Affected Industries and Service Sector

The survey conducted to assess the pandemic’s impact on the industry and service sector revealed widespread challenges. Among the surveyed firms, 65.4% faced low demand during production, 57.7% experienced inventory shortages, and reduced orders affected over 60% of enterprises. Supply delays, shipping issues, and disrupted distribution channels were prevalent due to lockdown restrictions, with 30.8% of firms having excess finished goods they could not deliver. The detailed overview is presented in

Table 4.

In the same surveyed firms, over 50% encountered difficulties paying employee wages, leading to 53.8% of workers returning home. The majority (84.6%) struggled with settling outstanding loans, facing increased production costs due to rising raw material prices. Higher distribution, freight, and operational expenses were reported, along with challenges in fixed-cost payments like rent and insurance for over half (53.8%). Over one-third (34.6%) had difficulties paying invoices, and a substantial majority (84.6%) reported a cash flow shortage, while almost half (46.2%) dealt with a deficiency of workers (

Table 4).

5.2.2. Impact of Working Capital Loans on the Affected Industries

From

Table 5, it is evident that the impact of stimulus support on net profit (before and after tax) was positive and statistically significant at a level of less than 5%. Similarly, total assets, number of employees, and earnings per share showed positive coefficients with statistical significance at less than 20%. Stimulus support receivers exhibited higher net profits, indicating effective utilization for operationalizing businesses, increasing production, and enhancing output.

The increase in earnings per share for the treatment group compared to the control group signifies higher profits among enterprises receiving stimulus support. Additionally, a positive impact on employment was observed, with supported enterprises avoiding employee retrenchment. However, the impact of other performance variables was not statistically significant, possibly due to the small sample size affecting the power to detect interactions. A larger sample size might reveal significant impacts on return on assets and debt-to-equity ratio.

Despite lacking statistical significance, the positive impact on return on assets suggests higher financial resources contributing to increased revenue and profits for the treatment group. The negative impact on debt-to-equity ratio indicates stimulus support’s role in reducing companies’ debt. Although not statistically significant, these findings align with the parallel trend assumption required for valid estimates in the DID model, as confirmed through graphical representation and statistical diagnostics (

Andrade 2020;

Faber and Fonseca 2014).

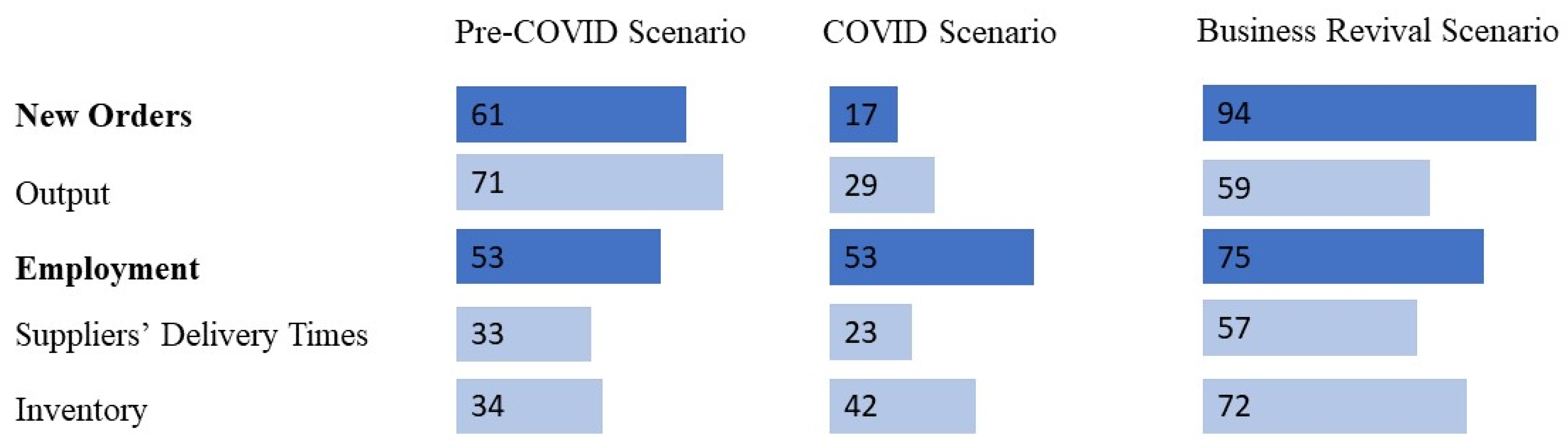

5.2.3. Impact of Working Capital Loans on Purchasing Managers’ Index

Illustrated in

Figure 4, the business revival scenario, which occurred after receiving stimulus support, exhibited the highest PMI for new orders and employment. The remaining components—output, supplier delivery times, and inventory—also displayed expansionary trends. New orders declined during the pandemic but expanded post-stimulus. Similarly, output levels experienced a downturn during the pandemic, followed by an expansionary trend after the stimulus injection.

In the employment scenario, the PMI sub-index remained constant during the pandemic but saw an increase post-stimulus. Companies refrained from employee retrenchment during the pandemic, and with the receipt of stimulus support, they fully operationalized, leading to an increase in the PMI sub-index in the business revival scenario. Supplier delivery times, representing the time between order placement and delivery, increased during the business revival scenario, which is mainly attributed to the easing of lockdown restrictions. However, companies’ increased order frequency post-stimulus contributed to reducing the time lag. Regarding inventory levels, during the pandemic, inventory declined due to halted business activity, contrasting with the post-pandemic scenario where inventory expanded. This expansion post-stimulus can be attributed to the heightened need for raw materials in the production process (

Figure 4).

5.2.4. Implementation Challenges While Providing Loans to Firms and Industries

Organizations receiving the government’s stimulus support in Bangladesh have expressed significant benefits in reviving their businesses that were impacted by the pandemic. This support facilitated the procurement of raw materials, recruitment of new employees, payment of wages, inventory expansion, loan repayment, and sustained production, leading to increased output and profits. Conversely, key informants shared a contrasting perspective. The pandemic severely disrupted production, with companies ceasing new orders and struggling to meet salary obligations. However, the stimulus supports rejuvenated production and order intake, enabling salary payments and generating profits. Despite the positive impact, the strict loan disbursement guidelines from Bangladesh Bank made banks cautious, resulting in some severely affected companies being unable to access the much-needed loans.

“Banks in most cases provided loans to the existing customers. No additional noteworthy advertising campaign was carried out. This is especially true for the public banks. Due to this, the target of exhausting the fund was not fulfilled. Banks also preferred to give loans to existing customers so that loan disbursement rate can be shown high as assessment of new customers will be time-consuming.”

(Public bank official)

The public banks faced challenges in the loan disbursement process compared to private banks, primarily due to manpower and resource constraints. Additionally, private banks encountered internal reporting issues. Instances of miscommunication and information gaps, particularly asymmetric information, were observed between divisional branches and field-level branch offices.

“Challenging during the pandemic. But BB has successfully and effectively accomplished this task. The stimulus support helped businesses to revive and make the businesses operational. There were some issues of defaulted loans, but regular inspection of BB has reduced such cases.”

(Bangladesh Bank official)

“The pandemic has had a devastating effect on businesses. Many enterprises were on the verge of bankruptcy. This loan was a good way to prevent bankruptcy, and the support worked quite well in reviving business activities. However, a moral hazard problem existed in the implementation process. BB gave orders to the commercial banks but left them with full liability to implement the package. Most banks didn’t even have capable staff to look through financial reports.”

(Senior researcher and academician)

Insights from key informants and interviews underscore the stimulus’s vital role in business operations, production revival, and bankruptcy prevention. Despite challenges in loan disbursement and communication, the stimulus’s overall effectiveness, recognized by both industry recipients and financial authorities, indicates a successful intervention in alleviating the pandemic’s economic impact on Bangladesh’s industries.

5.3. Working Capital Loan for Cottage, Micro, Small, and Medium Enterprises

5.3.1. Socio-Economic Distribution of CMSME Stimulus Recipients

The majority of stimulus package recipients, comprising 22.7% cottage enterprises, 31.5% micro-enterprises, 37.4% small enterprises, and 8.4% medium enterprises, acknowledged its positive impact on business recovery. Predominantly, enterprises had less than 10 employees (70.3%), followed by those with 10–24 employees (21.7%). As shown in

Table 5, respondents were mostly male (97.4%) and located in urban areas (63.2%). Additionally, 89.9% had TIN accounts, 17.3% received aid from NGOs, and 92.5% invested the aid in business recovery.

In terms of educational qualifications, a mere 3.1% of respondents reported being uneducated, with the majority having completed primary education (96.9%). Significantly, 24.8% had a higher education level, and 31.4% had a graduate-level education. This diverse educational distribution is crucial, as it is not only indicative of problem-solving aptitude but also of establishing a clear connection between education and tax return outcomes for business owners (

Table 6).

As evident in

Figure 5, the overwhelming majority of recipients (around 90%) acknowledged that the stimulus package significantly contributed to their business recovery, with 44.8% strongly agreeing and approximately 46.2% expressing general agreement.

5.3.2. Impact Assessment of Stimulus Support on Business Recovery

As illustrated in

Table 7, the production of and access to stimulus during the COVID-19 period demonstrated a positive and significant impact on facilitating business recovery. Nevertheless, components such as knowledge, delivery of services and products, and employment generation exhibited positive relationships but lacked significant influence on supporting business recovery.

5.3.3. Implementation Challenges While Giving Loans to CMSMEs

The study identified three key themes from the analysis of the key-informant interviews (KIIs) related to challenges in implementing working capital loans: knowledge and access of loan recipients; production, delivery, and employment levels of SMEs; and difficulties faced during the implementation process.

Quantitative analysis revealed that the knowledge component was statistically insignificant, and there was no positive trend. Interviews with SME owners who received the loan indicated that banks directly contacted them to inform about the stimulus package loans. This common trend among respondents, along with the observation that most respondents were clients of the banks, suggests that the banks were cautious to scrutinize borrowers before providing loans. The ability to produce and deliver goods and services was a key objective of the stimulus package, as was employment of labor. The interviews of SME owners consisted of entrepreneurs engaged in both production and services. Production enterprises had unique problems depending on their specific sector of work. Loans helped them to buy new stocks and employ former employees again.

Producers faced storage challenges, requiring rented warehouses or storage for perishable goods. Reduced demand, especially for specific goods like bricks, led to production adjustments to manage costs. To sustain production and avoid layoffs, loans were instrumental in promptly paying pending wages. In the service sector, the focus was on retaining experienced employees. Both sectors retained employees, occasionally hiring new ones if needed. However, delivery remained a persistent issue. Surveys and interviews both revealed that the delivery of goods and services was a difficult endeavor, as the lockdowns created restrictions on transportation in trucks and ports. All entrepreneurs stated that they were either unable to deliver their products or faced delays.

“I couldn’t bring any of my goods from the port because the trucks couldn’t go. I was called from the port that my goods were shipped in, but I wasn’t able to bring them in. Some of my products weren’t even shipped in as the ports weren’t letting it.”

The loans were effective in employment and production. However, they were essentially of no use to the delivery aspect, as the lockdowns made it impossible for shipments to be made. This particular aspect is important to note for the future.

The challenges and issues faced during the implementation are important to look at, especially to understand the implementers’ perspective. The implementation faced several issues, as described by officials as well as academics. An official in Bangladesh Bank who was directly involved during the pandemic period summarized some of the key issues facing the sector in general as well as specific problems pertaining to the stimulus package, which were household production systems, documentation problems, vast and unregulated sectors, asymmetric information between the central bank and the local branch of both public and private banks, unprofessional and unapproachable behavior of central banks with the local branches, and lastly, the overworking and understaffing problem of the local branches of the banks. The interviews identified key problems with the sector; however, they did not speak specifically of the sectors’ problems. A KII participant who worked in the sector previously provided a statement corroborating this; however, they also mentioned key aspects of private and public sector banks that are important to consider.

“It must be said that the CMSME sector is a rather risky sector to work in. Entrepreneurs are open to risks and also able to escape from lenders if needed. Before the pandemic, only BRAC Bank and Islami Bank had extensive experience with the CMSME sector. The key to ensuring loan and loan recovery is to have a robust and active monitoring and evaluation system. Most banks in the country don’t even have the infrastructure to monitor and evaluate average businesses let alone CMSMEs. In addition, the package had poor disbursal, the banks were extremely cautious as the money being lent was from the Central Banks and they were essentially given full responsibility to deal with it. This was a massive moral hazard. The sector needs rapid changes if it wants to adjust to a rapidly developing Bangladesh.”

(An academician)

The challenges encompass both macro and micro issues. Macro-level issues include the misalignment of the banking sector with the CMSME sector and inadequate monitoring and evaluation. Micro-level challenges include communication gaps, customer behavior, and limited financial knowledge among citizens. Addressing these requires a comprehensive approach involving documentation, monitoring and evaluating infrastructure, and overall sectoral adjustments.

In conclusion, a thorough analysis of quantitative and qualitative findings provides insights into the impact and effectiveness of Bangladesh’s COVID-19 stimulus packages. Positive trends in production and access are evident, but challenges persist in knowledge dissemination and delivery. The key-informant interviews confirmed these challenges, emphasizing banks’ risk aversion, delivery difficulties during lockdowns, and broader alignment issues with the CMSME sector. Although the stimulus packages positively influenced production and employment, the challenges in delivery services and knowledge dissemination call for prompt attention to documentation, monitoring and evaluation infrastructure, and sectoral adjustments. Future policies should address these challenges to enhance the effectiveness of similar stimulus packages.

5.4. Revitalizing the Rural Economy and Job Creation

5.4.1. Demographic Distribution of Survey Participants

From the detailed characteristics in

Table 8, a total of 751 participants, with a response rate of 97.16%, were included in this part of the study, with 51.1% receiving stimulus loans. The median age of the recipients (39.4) was slightly higher than that of non-recipients (38.1). Approximately half of both males (51.7%) and females (50.0%) received stimulus loans. Among those without institutional education, about one-third received the loan, while around half of individuals with other educational backgrounds obtained it. Participants who received entrepreneurship training had a higher likelihood of receiving a stimulus loan (62.1%).

Regarding loans, around 50.8% of recipients and 49.2% of non-recipients had taken loans other than the COVID-19 stimulus loan. During the lockdown, a slightly higher percentage (52.4%) of COVID-19 loan recipients continued working compared to non-recipients (47.6%). Significantly more recipients (60.3%) found a new source of income during the lockdown, while 39.7% of non-recipients reported the same. Buying behavior for essential items like medicine, sanitizers, and facemasks increased among COVID-19 loan recipients (52.1%, 52.2%, and 51.3%, respectively) compared to non-recipients (47.9%, 47.8%, and 48.7%, respectively).

5.4.2. Impact Assessment of the Stimulus Intervention

In order to understand how well the program worked, six aspects of the respondents were considered, which were economic, business, employment, food consumption, preventive measures, and psychology. The aspects were compared between recipients and non-recipients of the stimulus loan. The comparisons of significant items are listed in

Table 9.

In the economic aspect, stimulus loan recipients demonstrated a higher likelihood of paying land tax (β = 0.65), other taxes (β = 1.14), phone bills (β = 0.58), and fuel prices (β = 0.55). Their savings pattern was more stable (β = 0.49), and businesses receiving microloans had a 2.47-times-higher chance of operating than those without such loans, highlighting the positive impact of the stimulus on recipients’ economic activities (

Table 9).

In the business aspect, microloan recipients exhibited better business operation and earnings during the lockdown (β = 0.37). They also had a higher chance (β = 0.48) of finding new sources of income compared to non-recipients. Access to raw materials was more pronounced among recipients (β = 0.43), showcasing their enhanced ability to engage in business activities, including the purchase of raw materials, facilitated by the new financial injection from the stimulus (

Table 9).

Regarding job creation, microloan recipients demonstrated a commendable capacity for employment generation within their enterprises. However, during the initial phase of the pandemic, they faced challenges meeting payment obligations, particularly to employees, reflecting the broader context of micro-enterprises operating with limited resources. Although some employment-related variables showed fluctuations, the positive trend indicates the stimulus package’s pivotal role in sustaining employment during challenging times (

Table 9).

In terms of food consumption and health, microloan recipients were more likely to purchase sanitizers (β = 0.42) as an additional health precaution. The microloan had no significant effect on food consumption (β = 0.41) during COVID-19 but significantly increased food consumption after the pandemic (β = 2.05). This suggests that the stimulus package was successful, as recipients showed a willingness to spend more on health and hygiene compared to non-recipients (

Table 9).

5.4.3. Implementation Planning of Publicly Owned Organizations

Officials from the seven institutions that cooperated during the data collection process stated that each had certain targets based on their institutional structure and beneficiary type. The institutions had their own objectives and mechanisms for reaching them; however, some of these objectives and their means of reaching them had to be altered for the stimulus disbursals. Primarily, a key component of the planning was to develop a policy document for disbursing the loans.

“We have been working with rural poor since 1999. We have also worked with large donors such as Canadian International Development Agency (CIDA) and are well versed with issues pertaining to rural livelihoods. Hence when we developed our policy guidelines, we were well aware of which groups needed loans.”

SFDF and SMEF, with their extensive experience, responded positively, benefitting from their long-term operations and well-maintained beneficiary data. Their efficiency was evident. On the contrary, the Bangladesh NGO Foundation (BNF) and Social Development Foundation (SDF) faced challenges in policy guideline preparation, given their prior non-involvement in providing loans. Despite providing training, they lacked mechanisms for fund disbursement. Consequently, both foundations had to swiftly develop new processes during the pandemic to implement stimulus packages.

“As a foundation we largely provided training to Non-Government Organizations (NGOs) and Civil Society Organizations (CSOs)… However, when the government announced the stimulus package, we had to build a financing office and a monitoring and evaluation office within a week. Many of our senior and junior colleagues were required to work in both office and field level despite not having experience on the field. In the end we disbursed loans to 27 NGOs total across Bangladesh.”

“This is our first time we ever provided micro loans. We mainly specialized in training programs. However, we always made it an issue to have a robust and dynamic monitoring and evaluation division which kept track of past trainees. This allowed us to select our target beneficiaries very quickly and also ensure that they would return the amount on time…”

The mentioned that institutions initially faced challenges in policymaking and implementation. Despite these difficulties, both institutions disbursed their full allocations successfully. Interviews emphasized the significance of a well-maintained and capable division for handling additional work efficiently. However, the Joyeeta Foundation stands as an exception, having faced issues with poor mechanisms in the beginning, leading to a failure to achieve their goals.

“We don’t directly disburse our loans; we train our beneficiaries and help them create their documents to take to the banks. We work with multiple banks and they normally review our beneficiary’s applications and then disperse them. The loans follow the rules of the bank from which they are disbursed. We are yet to disburse our full allocation and we are facing difficulties in disbursing more as we are largely reliant on the banks’ decisions.”

5.4.4. Challenges Faced by Disbursal Institutions

The sudden shift to an online modality emerged as a key challenge for all institutions, with officials expressing initial unpreparedness. Despite the initial difficulties, most adapted to the change over time. However, the transition posed challenges for field staff, particularly in gaining access to online platforms from rural locations. Field work was identified as a common struggle for all institutions, and BNF officials faced additional difficulties due to the lack of a monitoring and evaluation wing before the pandemic, as noted by KII participants:

“We don’t have field offices and are based entirely in Dhaka. We needed to travel for monitoring and the lockdown became a problem for us.”

SFDF and PDBF highlighted difficulties in supervising field workers during the lockdown, and SMEF faced similar challenges. However, SMEF’s robust monitoring and evaluations division and active client relations division played a crucial role in mitigating these challenges. In contrast, SDF had pre-existing mechanisms in place. A KII attendee summarized these aspects:

“We work with community through members of the community, … The philosophy requires that all field workers are locals and they are to maintain regular contact with not only their supervisors but also the beneficiaries, and not only as institutional representatives but as neighbors. They are to be seen as members of the community as trust is a key aspect of our work ethic.”

Some institutions, particularly those with a significant rural focus like BRDB, SFDF, and PDBF, faced challenges during the pandemic due to a lack of market linkages. As mentioned by a KII participant,

“Joyeeta Foundation has a rented store for their beneficiaries. This is a major advantage as our beneficiaries require markets to sell their goods. Taking goods from rural areas to cities was extremely difficult during the pandemic but is also difficult during normal times. It would be very helpful if we had a system like Aarong or Joyeeta Foundation.”

Overall, the key challenges identified by the institutions were a new modality of work, monitoring and evaluation, new additional expenses, difficulties in transporting goods, identification of staff, and, for the Joyeeta Foundation specifically, inability to control their own disbursals.

The analysis combined quantitative and qualitative data to reveal the multifaceted impact of the COVID-19 stimulus intervention in Bangladesh. Microloan recipients experienced positive outcomes, including economic stability and improved business operations. The loans played a crucial role in meeting financial obligations, sustaining operations during lockdowns, and exploring new income sources. Challenges included initial struggles in employee payments. Qualitative insights highlighted common challenges, and beneficiaries from institutions like the Joyeeta Foundation faced additional stress due to strict policies and delayed disbursements. Overall, although the stimulus significantly benefited many, addressing institutional challenges and tailoring interventions to diverse needs are vital for a more inclusive recovery strategy.

6. Discussion

This study focuses on finding the impact and effectiveness of 4 out of the 28 stimulus packages implemented during the pandemic. Each of these selected packages had distinct objectives, target populations, and implementation methods. In this section, separate discussions of the results for each package are presented.

The “Salary Support for Export-Oriented Industries” package aimed to assess its impact on the socio-economic conditions of recipient workers, particularly in the ready-made garments (RMG) sector. Through a household questionnaire survey with a gender composition of 35.56% male and 64.44% female, the study utilized propensity score matching (PSM) to estimate the average treatment effect (ATE). The results revealed a positive impact on household well-being, job retention, and various aspects of individual lives. Despite challenges during implementation, the package significantly improved the overall outcomes for recipients. A similar study in India showed mixed short-term results, with challenges related to decreased sales and laborers returning to villages (

Prusty et al. 2022). Meanwhile, Germany’s fiscal stimulus package, analyzed using a dynamic new Keynesian multi-sector general equilibrium model, demonstrated significant short-run mitigation of output and consumption losses, reducing welfare costs for beneficiaries (

Hinterlang et al. 2021).

Our study on “Working Capital Loans to Affected Industries and Service Sectors” aimed to analyze the impact of these loans on the recovery of businesses. Positive outcomes were observed for loan recipients, with a survey conducted on 30 enterprises using a difference-in-difference method. The study revealed a significant positive impact on net profit, earnings per share, and employment. The PMI sub-index in the business revival scenario showed increased new orders and employment, indicating successful operationalization and production continuity. The overall PMI value was 73.6 out of 100, comparing February 2021 to February 2020. Qualitative insights highlighted the crucial role of the stimulus in helping businesses overcome pandemic-induced challenges. An AGE model applied to Oceania’s economies demonstrated the protective impact of fiscal stimulus on output but insufficient prevention of joblessness in certain sectors, emphasizing the need for continuous support (AGE model study; government support feedback).

The third segment of the study examined the impact of “Working Capital Loans for CMSMEs” during COVID-19. Beneficiary CMSMEs experienced increased production and positive job outcomes but challenges in delivery due to lockdowns. The stimulus had a significant positive effect on access and production but limited impact on delivery and employment. The knowledge component was statistically insignificant, and qualitative insights revealed banks’ risk aversion. Despite being announced for women entrepreneurs, 94% of beneficiaries were men. The loans were effective in employment and production but faced challenges in delivery. Systematic issues like marketing, asymmetric information, paperwork, and unpreparedness of banks were identified. A study by

Gourinchas et al. (

2021) across 27 countries found fiscal support reduced demand-constrained sectors, positively impacting employment. However, challenges in fund disbursement to those in need were noted. Another study in India supported the need for fiscal stimulus packages in SMEs during COVID-19 for business recovery (

Gourinchas et al. 2021;

Prusty et al. 2022).

In examining the package “Revitalizing the Rural Economy and Job Creation”, which focused on evaluating the micro-credit stimulus impact on marginalized groups and women entrepreneurs, positive outcomes were observed. Quantitative methods assessed economic, employment, and health-related effects. Stimulus recipients demonstrated a higher percentage of finding new income sources during lockdown (60.3% vs. 39.7% non-recipients). Buying behavior for health items increased among recipients (medicine: 52.1%, sanitizers: 52.2%, facemasks: 51.3%) compared to non-recipients. Recipients showed regular tax and bill payments and stable savings. Although micro-credit had no significant impact on pandemic food consumption, post-pandemic effects were significant for beneficiaries. Businesses of micro-credit recipients displayed higher resilience and employment generation. Challenges included delayed disbursals and beneficiary selection issues. Qualitative aspects reinforced positive socio-economic welfare for microcredit recipients, yet concerns were raised about short timeframes and restrictive policies. A similar study in Pakistan confirmed that women with microfinance access have better overall welfare (

Hameed et al. 2022).

In summarizing the study, all four packages effectively achieved socio-economic relief and livelihood support, and addressed the needs of marginalized groups, overcoming management and implementation challenges. On a macro level, Bangladesh experienced a drop in GDP growth in FY 2020–2021 due to the pandemic, but subsequent years (FY 2021–2022 and FY 2022–2023) saw positive growth rates of 6.9% and 7.1%, respectively, reflecting the impact of the stimulus packages. Hence, the hypothesis developed in the study proved to be positive. Similar trends were observed in Vietnam, with both countries demonstrating recovery. Studies, including those of

Walmsley et al. (

2022) and

Li and Spencer (

2016), noted the positive impact of fiscal stimuli on the US economy. Past global financial crises, like in China, the US, and Australia, showed successful GDP growth and economic stability. In India, initial challenges during COVID-19 were gradually overcome, leading to positive sectorial growth (

Chen and Langwasser 2021;

Prusty et al. 2022).

Despite the success, implementing the packages in Bangladesh involved challenges. Some organizations outperformed others due to efficient fund distribution protocols. Challenges included identifying beneficiaries, resource limitations affecting support coverage, and banks lacking suitable setups for small business loans. Delays in loan distribution resulted from insufficient promotion, technology, and documentation, with thorough scrutiny further slowing the process. Additionally, challenges in beneficiary identification and limited financial data availability in the “Working Capital Loan for Industries and Service Sectors” package posed limitations. The sudden onset of COVID-19 and time constraints restricted baseline data collection for three packages. Social safety net programs were excluded due to time constraints, suggesting a need for a separate study on them.

However, this research aims to provide an unbiased assessment of the impact of the four stimulus packages, offering detailed insights into their effects on specific target groups. The study highlights execution challenges, providing valuable lessons for future policymaking in similar crisis scenarios. Qualitative analysis, incorporating expert perspectives, identifies challenges that can inform the design and implementation of future incentive policies during crises, contributing to shaping future strategies.

7. Conclusions

The global COVID-19 pandemic prompted governments worldwide, including that of Bangladesh, to implement strategic stimulus policies, with Bangladesh introducing 28 packages, primarily fiscal and monetary measures. This study focuses on four key fiscal packages: “Salary Support for Export-Oriented RMG Industries”, “Working Capital Loans for Affected Industries and Service Sectors”, “Working Capital Loans to CMSMEs for Job Retention”, and “Revitalizing the Rural Economy and Job Creation”, combining fiscal aid with microfinance for marginalized groups. Utilizing both quantitative data analysis and qualitative interviews, the study comprehensively assessed their impact, efficacy, and implementation challenges, revealing positive outcomes for beneficiaries despite recurring challenges during execution.

The assessment of the “Special Funds for Export-Oriented Industries” package, employing propensity score matching (PSM) and qualitative analysis, indicated positive impacts on the socio-economic well-being of benefitting RMG workers. Despite challenges in beneficiary identification and mobile financial access, the results showed increased financial stability, improved healthcare and education access, and enhanced social well-being. The analysis of Bangladesh’s “Working Capital Loans to Affected Industries and Service Sectors” package, using a difference-in-difference model and the PMI index, revealed encouraging outcomes for recipient companies, with enhanced profitability, increased new orders, and maintained employee retention. The evaluation of “Working Capital Loans for CMSMEs”, employing structural equation modelling (SEM), highlighted positive influences on access and production, despite challenges in service delivery and employment generation. The final part, “Revitalizing the Rural Economy and Job Creation”, focusing on marginalized groups and female entrepreneurs, using PSM and qualitative analysis, revealed positive socio-economic changes for loan recipients, including improved payments and stable savings. Thus, the study proved the hypothesis and achieved the objective that was set forth. Challenges in implementing institutions included delayed disbursements and monitoring issues.

Although limitations existed, such as data constraints and a constrained time frame excluding social safety net programs, the study yielded valuable insights for future policy formulation. Despite these constraints, the study successfully delivered unbiased impact estimations on targeted populations, identifying crucial implementation hurdles as valuable lessons for future crisis interventions. To analyze the micro-level impact of four key stimulus packages, our study utilized primary data from beneficiaries and professionals, providing a nuanced understanding from the beneficiary’s perspective. Qualitative insights from field experts will guide future implementations. These findings will significantly contribute to shaping future economic measures, documenting results, capturing key insights, and highlighting implementation obstacles. This knowledge base facilitates essential adjustments for impactful programs during future similar shocks.

In summary, the implemented stimulus packages achieved their objectives and positively impacted beneficiaries. Acknowledging their successes, it is crucial to address implementation problems for future effectiveness. Comprehensive policies in monitoring, evaluation, data management, and stakeholder communication are needed to enhance future aid packages. These reforms ensure sustained success and the adaptability of economic stimulus initiatives in addressing evolving challenges and fostering long-term resilience.

Supplementary Materials

The following supporting information can be downloaded at:

https://www.mdpi.com/article/10.3390/economies12050108/s1, Supplementary File S1: GRAAMS Checklist; Supplementary File S2: Sample Size Calculation; Supplementary File S3: Detailed Methodology for All Packages; Supplementary File S4: Survey Questionnaire for All Packages; Supplementary File S5: Detailed Methodological Background; Supplementary File S6: Theories and Hypotheses Development for working capital loan for CMSMEs.

Author Contributions

Conceptualization, R.A. and S.R.D.; methodology, R.A. and S.R.D.; software, R.A.; validation S.R.D., R.A. and M.T.; formal Analysis, R.A. and S.R.D.; investigation, S.R.D. and R.A.; resources, R.A.; data curation, R.A.; writing—original draft preparation, R.A., N.R. and S.T.; writing—review and editing, N.R., R.A. and S.T.; visualization, R.A. and S.T.; supervision, M.T.; project administration, M.T.; funding acquisition, M.T. All authors have read and agreed to the published version of the manuscript.

Funding

This study was funded by Strengthening Public Financial Management Program to Enable Service Delivery (SPFMS), Finance Division, Ministry of Finance, Government of the People’s Republic of Bangladesh (Contract No: 07.0.0000.000.07.128.22-1782).

Institutional Review Board Statement

This study adhered to the principles and guidelines for data collection as stipulated and approved by the Institutional Review Board of the Bangladesh Institute of Governance and Management (BIGM), (BIGM/Research & Publication/01/21/18-51(A)). This study was recognized for its significant contribution to the progress of academic research and existing literature with considerable public interest.

Informed Consent Statement

Every participant involved in the surveys and interviews conducted in this study gave informed consent, confirming their voluntary participation and the right to decline, with the assurance of complete anonymity.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors extend their gratitude to all individuals who devoted their time and effort to take part in this study.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Ahamed, Faruque. 2021. Macroeconomic impact of COVID-19: A case study on bangladesh. IOSR Journal of Economics and Finance (IOSR-JEF) 12: 2021. [Google Scholar]

- Alam, Md. Shahbub, Md. Jafor Ali, Abul Bashar Bhuiyan, Mohammad Solaiman, and Mohammad Abdur Rahman. 2020. The Impact of COVID-19 Pandemic on the Economic Growth in Bangladesh: A Conceptual Review. American Economic & Social Review 6: 1–12. [Google Scholar] [CrossRef]

- Andrade, Chittaranjan. 2020. The limitations of online surveys. Indian Journal of Psychological Medicine 42: 575–76. [Google Scholar] [CrossRef]

- Asian Development Bank. 2022. Southeast Asia Rising from the Pandemic. Manila: Asian Development Bank. [Google Scholar] [CrossRef]

- Becker, Sascha O., and Andrea Ichino. 2002. Estimation of Average Treatment Effects Based on Propensity Scores. The Stata Journal 2: 358–77. [Google Scholar] [CrossRef]

- Bernstein, Michael A. 2001. The Great Depression as Historical Problem. OAH Magazine of History 16: 3–10. [Google Scholar] [CrossRef]

- Buchheim, Lukas, and Martin Watzinger. 2017. The Employment Effects of Countercyclical Infrastructure Investments. München: Ludwig-Maximilians-Universität München. [Google Scholar]

- Buffie, Edward F., Christopher Adam, Luis Felipe Zanna, and Kangni Kpodar. 2023. Loss-of-Learning and the Post-COVID Recovery in Low-Income Countries. Journal of Macroeconomics 75: 103492. [Google Scholar] [CrossRef]

- Campante, Filipe, Federico Sturzenegger, and Andrés Velasco. 2021. Advanced Macroeconomics: An Easy Guide. London: LSE Press. [Google Scholar]

- Chen, Jiawen, and Kristin Langwasser. 2021. COVID-19 Stimulus Payments and the Reserve Bank’s Transactional Banking Services. Bulletin, June 17. [Google Scholar]

- Faber, J., and L. M. Fonseca. 2014. How sample size influences research outcomes. Dental Press Journal of Orthodontics 19: 27–29. [Google Scholar] [CrossRef] [PubMed]

- Finance Division (Govt. of Bangladesh). 2023. Bangladesh Economic Review 2023. Available online: https://mof.portal.gov.bd/site/page/28ba57f5-59ff-4426-970a-bf014242179e/Bangladesh-Economic-Review-2023 (accessed on 20 April 2024).

- Giesecke, James A., and Chris Schilling. 2010. The Economic Impact of the New Zealand Fiscal Stimulus Package. New Zealand Economic Papers 44: 231–57. [Google Scholar] [CrossRef]

- Goldstein, Morris. 1998. The Asian Financial Crisis: Causes, Cures, and Systemic Implications. Washington, DC: Peterson Institute, vol. 55. [Google Scholar]

- Gourinchas, Pierre-Olivier, Ṣebnem Kalemli-Özcan, Veronika Penciakova, and Nick Sander. 2021. Fiscal Policy in the Age of COVID: Does It ‘Get in All of the Cracks?’. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Halimatussadiah, Alin, Amalia Cesarina, Atiqah Amanda Siregar, Chairina Hanum, Dewa Wisana, Fandy Rahardi, Hamdan Bintara, Jahen Rezki, Meila Husna, M. Shauqie Azar, and et al. 2020. Thinking Ahead: Indonesia’s Agenda on Sustainable Recovery from COVID-19 Pandemic. Jakarta: Institute for Economic and Social Research, LPEM FEB UI. [Google Scholar]

- Hameed, Waseem Ul, Muhammad Haseeb, Jawad Iqbal, Leonardus W. W. Mihardjo, and Kittisak Jermsittiparsert. 2022. Environmental Disaster and Women Self-sustainability—A Survey Study on Microfinance Female Clientele in Pakistan. International Journal of Finance & Economics 27: 3599–622. [Google Scholar]

- Hinterlang, Natascha, Stéphane Moyen, Oke Röhe, and Nikolai Stähler. 2021. Gauging the Effects of the German COVID-19 Fiscal Stimulus Package. Deutsche Bundesbank Discussion Paper No. 43/2021. Available online: https://ssrn.com/abstract=3988529 (accessed on 3 April 2023).

- Keynes, John Maynard. 1936. The General Theory of Employment, Interest and Money. San Diego: Harcourt Brace and Company. [Google Scholar]

- Khatun, Fahmida, and Syed Yusuf Saadat. 2021. How Useful the Stimulus Packages Have Been for Women in Tackling the Impact of COVID-19: Findings from a Rapid Assessment in Bangladesh. Dhaka: Centre for Policy Dialogue. [Google Scholar]

- Kot, Sebastian, and Muhammad Imran. 2019. The moderating role of environmental disaster in relation to microfinance’s non-financial services and women’s micro-enterprise sustainability. Journal of Security & Sustainability Issues 8: 355. [Google Scholar]

- Lalon, Raad Mozib. 2020. COVID-19 vs. Bangladesh: Is It Possible to Recover the Impending Economic Distress amid This Pandemic? Journal of Economics and Business 3: 825–36. [Google Scholar] [CrossRef]

- Lim, Tan-Chin, Lian Kee Phua, Sin Yin Teh, and Char-Lee Lok. 2021. Effectiveness of the COVID-19 economic stimulus packages: Viewpoints from malaysian young entrepreneurs. Studies of Applied Economics 39: 1–7. [Google Scholar] [CrossRef]

- Li, Shuyun May, and Adam Hal Spencer. 2016. Effectiveness of the Australian Fiscal Stimulus Package: A DSGE Analysis. Economic Record 92: 94–120. [Google Scholar] [CrossRef]

- Narayanan, Badri G., Rahul Sen, Sadhana Srivastava, and Somya Mathur. 2021. A Method to Analyze the Sectoral Impact of Fiscal Support for COVID-19 Affected Economies: The Case of Oceania. MethodsX 8: 101293. [Google Scholar] [CrossRef] [PubMed]

- Nurheryanti, Vika, Hantoro Ksaid Notolegowo, Shaffa Septiani Aisy, Shofira Ainun Rahmah, and Yolanda Dienul Fathia. 2021. Impact of Fiscal Stimulus on Economic Output and Labor Income in Indonesia. Dinamika Ekonomi 13: 184–92. [Google Scholar] [CrossRef]

- Nützenadel, Alexander. 2021. The Financial Crisis of 2008—Experience, Memory, History. Journal of Modern European History 19: 3–7. [Google Scholar] [CrossRef]

- O’cathain, Alicia, Elizabeth Murphy, and Jon Nicholl. 2008. The Quality of Mixed Methods Studies in Health Services Research. Journal of Health Services Research & Policy 13: 92–98. [Google Scholar]

- Parvez, Md Al-Amin, Md Abir Hossain, and Soumen Chakravarty. 2022. How Does the COVID-19 CMSME Stimulus Package Perform in Bangladesh? Paper presented at the 9th Annual Banking Conference, Dhaka, Bangladesh, November 9. [Google Scholar]

- Prusty, Sadananda, Anubha, and Saurabh Gupta. 2022. On the Road to Recovery: The Role of Post-Lockdown Stimulus Package. FIIB Business Review 11: 206–24. [Google Scholar] [CrossRef]

- Reza, Farhadur, Erad Kawsar, and Tasvir Bin Mahabub. 2020. COVID-19 Impact and Responses: Bangladesh. Dhaka: Build Bangladesh. [Google Scholar]

- Siam, Md. Hasanul Banna, Md. Mahbub Hasan, Shazed Mohammad Tashrif, Md Hasinur Rahaman Khan, Enayetur Raheem, and Mohammad Sorowar Hossain. 2021. Insights into the First Seven-Months of COVID-19 Pandemic in Bangladesh: Lessons Learned from a High-Risk Country. Heliyon 7: e07385. [Google Scholar] [CrossRef]

- Walmsley, Terrie, Juan Machado, Adam Rose, Dan Wei, Richard John, Jakub Hlavka, and Katie Byrd. 2022. The Impact of COVID-19 Fiscal Stimulus on the US Economic Recovery. National Tax Journal. submitted. [Google Scholar]

- World Bank. 2021. Indonesia’s Economy Grew in 2021 Despite COVID-19. The World Bank, December 16. [Google Scholar]

- Yasmin, Tahira, Ghaleb A. El Refae, and Shorouq Eletter. 2023. Examining the impact of effective government stimulus packages amid COVID-19 pandemic in UAE: An input-output analysis. International Journal of Trade and Global Markets 18: 63–81. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).