Short Run and Long Run Effects of Corruption on Economic Growth: Evidence from Balkan Countries

Abstract

1. Introduction

2. The Balkan Area, an Overview

3. Corruption and Economic Growth

3.1. How Corruption Impacts Economic Growth: The “Grease the Wheels” versus the “Sand the Wheels” Hypotheses

3.2. Short- and Long-Run Impact of Corruption on Economic Growth

4. Methodology and Empirical Strategy

- The rate of economic growth is computed from the historical series of the gross domestic product (GDP). The GDP is given quarterly from the Eurostat dataset. We used a specific filter based on relation to disaggregate the data in monthly observation. We weighed the disaggregation using the price index level dynamics and the industrial production that is given monthly. Consequently, we obtained the monthly historical series of the rate of economic growth for the eight Balkan countries.

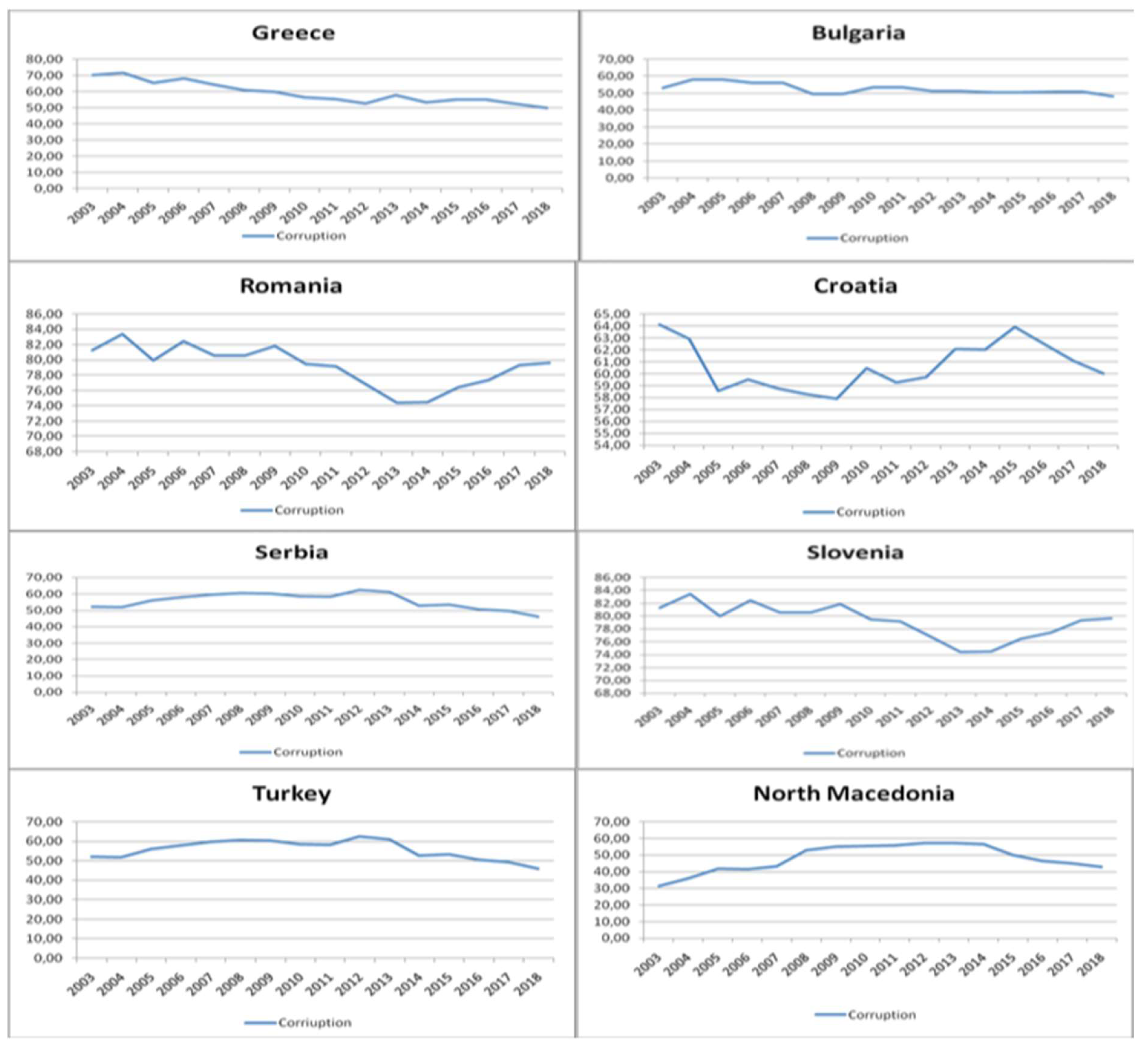

- The CPI has been published annually by Transparency International dataset since 1995.

5. Results

6. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Paper | Methodology | Main Results of Corruption’s Effects |

|---|---|---|

| Leff (1964) | Stylized facts. | Corruption, if “speedy money,” can cause individuals to circumvent bureaucratic red tape. |

| Huntington (1968) | Historical institutionalism. | If bureaucrats are paid directly for their work through bribes, this should make bureaucrats work better and faster. |

| Friedrich (1972) | Political theory. | The violation of moral and political standards can contribute to the good of the system. |

| Rose-Ackerman (1978) | Theoretical models of bureaucracy. | Competitive bureaucratic structure can reduce corrupt incentives. |

| Bhagwati (1982) | Taxonomy of directly unproductive, profit-seeking activities. | No specific indication of the effects of corruption. |

| Macrae (1982) | Game theory. | A simple model is presented showing how bribery might be a dominant strategy. |

| Andvig and Moene (1990) | Theoretical model. | The model highlights how the profitability of bureaucratic corruption may be related to its frequency. |

| Przeworski and Limongi (1993) | Critical discussion of statistical studies in which political regime is included among determinants of growth. | No specific indication of the effects of corruption. |

| Grossman and Helpman (1996) | Political economics model. | The party that is expected to win most of the seats garners greater attention from the lobbies. |

| Mauro (1995, 1997a) | Empirical analysis. The dataset consists of subjective indices of corruption, the amount of red tape, the efficiency of the judicial system, and various categories of political stability for a cross-section of countries (67 countries for the 1960–1985 average). | Corruption is found to lower investment, thereby lowering economic growth. |

| Osoba (1996) | Historical narrative about corruption in Nigeria. | Corruption is an anti-social behavior conferring improper benefits contrary to legal and moral norms, which undermines the ability of authorities to improve the living conditions of the people. |

| Coolidge and Rose-Ackerman (1997) | Four case studies (Somalia, Nigeria, Botswana, and Uganda) illustrating issues raised by a theoretical model. | A corrupted policy maker (kleptocrat) whose decision variable is the level of government intervention in the economy will select an excessive level of intervention where national income is less than optimal. Like all monopolists, the kleptocrat seeks productive efficiency except in those cases where inefficiency creates extra rents. The kleptocrat may need to permit lower-level officials to share in the corrupt gains, thus introducing additional costs over and above the problems faced by all rulers seeking to control subordinates. |

| Wei (1997) | Model of corruption-induced uncertainty and empirical analysis (Modified Tobit; main data: flow of FDI over 1990–1991; Corruption measures from the 1997 Global Competitiveness Report). | An increase in the uncertainty induced by the corruption from the level of Singapore to that of Mexico, at the average level of corruption in the sample, is equivalent to raising the tax rate of multinational firms by 32%, |

| Groenendijk (1997) | Principal–agent model of corruption. | Trade-off between the general agency problem and the problem of corruption: Acton’s principle that power tends to corrupt and absolute power corrupts absolutely, has led to complicated systems of checks and balances, which have contributed to the obfuscation of party responsibility. |

| Johnson et al. (1997, 1998) | Panel regressions for 1989–1994 to explain the determinants of total output in selected transition economies. The index of crime and corruption by The Great Growth Race—scale is 0–10, where a higher score means less crime and corruption (Dec. 1995–Jan. 1996). | A 1-point increase in external liberalization or privatization translates into about a 10-index-point increase in the size of the official economy. The index of crime and corruption is significant with a positive sign. |

| Acemoglu and Verdier (1998) | Theoretical model. | It may be optimal to allow some corruption and not enforce property rights fully. Less-developed economies may choose lower levels of property rights enforcement and more corruption. |

| Brunetti and Weder (1998) | Comparative analysis of a large number of uncertainty variables (among them corruption) in a standardized dataset, International Country Risk Guide (ICRG; 1982–1995 for 60 countries), and comparative conclusions on the magnitude of their effect on investment. | ICRG indicator is an alternative measure of “corruption in government” to measure the phenomenon more broadly by not only focusing on narrow business transactions. The indicator is significant with the expected negative sign and has a large effect on investment. |

| Tanzi (1998) | Survey of issues related to the causes, consequences, and scope of corruption, and possible corrective actions. | Different results about the effects of corruption. |

| Eilat and Zinnes (2000) | Measures of the size of the shadow economy in 25 transition countries for 1990–1997. Authors examine whether the shadow economy prevents, slows down, or promotes economic growth focusing on transition countries. | In terms of economic growth, a shadow economy may cripple an economy by reducing the tax base and eventually reducing overall tax revenue, which is much needed for government expenditure on public infrastructure. |

| Friedman et al. (2000) | Empirical analysis (regional OLS regressions) about the determinants of unofficial activity in 69 countries. Corruption is measured by the ICRG index for the 1990s (data on 42 countries). | Less corruption correlated with a lower unofficial economy except in transition countries. |

| Mo (2001) | Quantitative estimates (OLS) of the impact of corruption on the growth and importance of the transmission channels. The measure of the corruption level is obtained from the Transparency International Corruption Perception Index (CPI) as average for the period 1980 to 1985 in 49 countries. | A 1% increase in the corruption level reduces the growth rate by about 0.72%. The most important channel through which corruption affects economic growth is political instability, which accounts for about 53% of the total effect. |

| Habib and Zurawicki (2002) | Empirical analyses (OLS; Probit) to assess the impact on FDI of the absolute differences in corruption between the home and the host countries (89 countries for 1996–1998 period). CPI to measure the corruption level. | Foreign investors generally avoid corruption because it is considered wrong, and it can create operational inefficiencies. |

| Lambsdorff (2003) | Empirical analysis (OLS; cross countries estimation on 69 countries) to determine the effects of corruption on productivity. CPI to measure the corruption level (by decomposing it into five subcomponents). | A reduction in Tanzania’s level of corruption to that of the United Kingdom would increase productivity by 10 percent, leading to a 20 percent increase in GDP. Decomposing this impact reveals that bureaucratic quality is the crucial determinant. |

| Akai et al. (2005) | Empirical analysis (state-level cross-section data for the USA; two-stage least square estimates; instrumental variables) to assess the effects of corruption on the rate of economic growth for various time spans—short (1998–2000), middle (1995–2000) and long (1991–2000). Corruption index from a survey of state house reporter’s perception of public corruption in 1998. | The effect of corruption on economic growth is negative and statistically significant in the middle and long spans but insignificant in the short span. |

| Méon and Sekkat (2005) | Empirical analysis (generalized least squares; sample of 63 to 71 countries for the 1970–1998 period) to estimate the relationship between the impact of corruption, on investment and growth, and a wide range of indicators of the quality of governance. Corruption is measured by the CPI index and the Control of Corruption (CCI) from World Governance indicators. | The results reject the “grease the wheels” hypothesis but are consistent with the reverse hypothesis: the “sand the wheels” hypothesis. |

| Méndez and Sepulveda (2006) | Empirical analysis (OLS; cross countries estimation on 77 countries for the period 1960–2000). Corruption is measured by the ICRG index, the Institute for Management Development (IMD) from the World Competitiveness Yearbook and the CPI. | The growth-maximizing level of corruption is significantly greater than zero, with corruption beneficial for economic growth at low levels of incidence and detrimental at high levels of incidence. |

| Olken (2006) | Empirical analysis of Indonesia case study (a large anti-poverty program in Indonesia that distributed subsidized rice to poor households). Estimation of the extent of corruption by comparing administrative data on the amount of rice distributed with survey data on the amount actually received by households. | The welfare losses from corruption may have been large enough to offset the potential welfare gains from the redistributive intent of the program. Corruption may impose substantial limitations on developing countries’ redistributive efforts. |

| Blackburn et al. (2006) | Theoretical model. | Corruption arises from the incentives of public and private agents to conspire in the concealment of information from the government. |

| Del Monte and Papagni (2007) | Empirical analysis on the Italian case (time series; Autoregressive Distributed Lags; 20 Italian Regions for the 1963–2001 period). The number of corrupt activities reported to the police per 1 million inhabitants to measure corruption. | The level of corruption differs between Italian regions, and the decrease in the level of corruption after 1993 is explained by political and cultural variables and economic variables. Public expenditure on consumption goods and services seems to be an important cause of corruption. |

| Aidt et al. (2008) | A theoretical model to study the role of political accountability as a determinant of corruption and economic growth. | In a regime with high-quality political institutions, corruption has a substantial negative impact on growth. In a regime with low-quality institutions, corruption has no impact on growth. |

| Bird et al. (2008) | Empirical analysis (cross-section data with mean values for the 1990–1999 period; 105 observations). Corruption is measured with the mean value of six governance dimensions for 1996, 1998, and 2000 (World Bank). | A more legitimate and responsive state is an essential precondition for a more adequate level of tax effort in developing countries and also high-income countries. Improving corruption, voice, and accountability may not take longer nor be necessarily more difficult than changing the opportunities for tax handles and economic structure. |

| Dreher and Schneider (2010) | Empirical analysis (OLS; cross-section of 98 countries; all data are averaged over the 2000–2002 period). Corruption is measured with the ICRG. The focus of the index is capturing the political risk involved in corruption. | There is no robust relationship between corruption and the size of the shadow economy when ICRG is used. Employing an index of corruption based on a structural model, corruption, and the shadow economy are complements in countries with low income. |

| Méon and Weill (2010) | Empirical analysis to assess the interaction between aggregate efficiency, corruption, and other dimensions of governance for a panel of 69 countries, both developed and developing, for the 1994–1997 period. Two composite indices and one survey index assess the consequences of corruption: the World Bank indicator, the CPI, the Wei’s index. | Evidence for the “grease the wheels” hypothesis in its weak and strong forms. Corruption is less damaging to efficiency in countries where institutions are less effective. It may be positively associated with efficiency in countries where institutions are extremely ineffective. |

| Kaufmann (2010) | Empirical analysis on governance and budgetary data from over 35 industrialized countries. Corruption is measured by Control of Corruption (CCI) from World Governance indicators. | Industrialized countries vary in their ability to control corruption. Strong relationship between corruption and fiscal deficits. |

| Muço and Balliu (2018) | Empirical analysis (panel data on 10 Balkan countries—Albania, Bosnia, Serbia, Macedonia, Montenegro, Kosovo, Bulgaria, Croazia, Romania and Slovenia—for the period 1996–2016). Corruption is measured by the CPI index. | Corruption has a positive but very weak impact on real GDP per capita growth, perhaps a low level of corruption can reduce bureaucracy and this can stimulate economic growth. The impact of the components public spending on corruption has a positive impact, but the result in this case is not robust. |

| Gründler and Potrafke (2019) | Empirical analysis (dynamic panel data; instrumental variables; 175 countries for the 2012–2018 period). Corruption is measured by the CPI index. | Corruption is negatively associated with economic growth. Real per capita GDP decreased by around 17% in the long run when the reversed CPI increased by one standard deviation. The effect is pronounced in autocracies and countries with low rule of law. |

| Sharma and Mitra (2019) | Empirical analysis (dynamic panel data; instrumental variables; models generalized method of moments; 103 countries for the 1996–2015 period). Corruption is measured by the ICRG index. | The benefits of corruption control are evident in low- and lower-middle-income countries. For the middle-high-income countries, the effect of corruption control is not very explicit individually. |

| Al Qudah et al. (2020) | Empirical analysis (ARDL model for the 1995–2014 period) to assess the effect of corruption on economic growth in Tunisia. CPI to measure the corruption level. | Corruption has a negative effect on per capita GDP over the long run. Physical capital and the level of government during the previous year are positively significant in the presence of corruption. |

| Afonso and de Sá Fortes Leitão Rodrigues (2022) | Empirical analysis (dynamic panel data; generalized method of moments; 48 countries for the 2012–2019 period). CPI to measure the corruption level. | Developing economies, regardless of government size, benefit less from reducing corruption. Government size is not sufficient to explain the influence of corruption on economic activity. Private investment is a potential transmission channel for corruption. |

| Paulo et al. (2022) | Empirical analysis (panel data; two-way fixed-effect and system-generalized method of moments estimators) on the effects of corruption on the economic development of the Latin American and Caribbean countries, for the 2000–2018 period. CPI to measure the corruption level. | A one-standard-deviation increase in corruption is associated with a decrease of 12.2% in gross domestic product per capita and a decrease of 3.05% in economic growth. This supports the view that corruption “sands the wheels” of development. |

| Kim and An (2022) | Empirical analysis (logit) on the effects of the e-government development level (EGDI) on inward FDI. CPI to measure the corruption level of each of the 16 OECD countries for the 2014–2018 period. | The impact of EGDI on FDI changes for different CPI values. Under the presence of corrupt practices in local markets, e-government information can be a highly crucial location-specific advantage triggering FDI. |

| Asafo-Adjei et al. (2023) | Empirical analysis (instrumental variables panel quantile regression) about the asymmetric relationship between foreign FDI and economic growth amidst financial sector development and corruption covering a sample period of 2002 to 2020 for 48 sub-Saharan economies. CCI to measure corruption. | FDI inflows have a significant positive relationship with economic growth for economies with low growth (less than 50% quantile) but negative at high growth levels. CCI significantly interacts negatively with FDI and GDP per capita irrespective of the GDP levels. |

| Dokas et al. (2023) | Empirical analysis of the direct and indirect impact of corruption on economic growth. Granger causality test for panel data (109 countries for the 2010–2018 period). Nonstationary panel techniques with Fully Modified OLS to assess stationarity and long-run relationships. CCI from the World Bank, ICRG, and the CPI to measure corruption. | Robust negative relationship between corruption and economic growth and corruption and innovation. Innovation was found to reduce the harmful effects of corruption on economic growth, mainly in developed countries. |

| Trabelsi (2024) | Empirical analysis (panel data; GMM; 65 countries over the 1987–2021 period) to assess the impact of corruption on growth. ICGR to measure corruption. | The results indicate that beyond an optimal threshold, both high and low corruption levels can decrease economic growth. Under this optimal threshold, a moderate level of corruption, defined by the point of reversal of the curve of the marginal corruption effect on growth, could have advantages for economic growth. |

References

- Acemoglu, Daron, and Thierry Verdier. 1998. Property Rights, Corruption and the Allocation of Talent, A General Equilibrium Approach. The Economic Journal 108: 1381–403. [Google Scholar] [CrossRef]

- Acemoglu, Daron, Simon Johnson, James. A. Robinson, and Pierre Yared. 2008. Income and democracy. American Economic Review 98: 808–42. [Google Scholar] [CrossRef]

- Afonso, António, and Eduardo de Sá Fortes Leitão Rodrigues. 2022. Corruption and economic growth: Does the size of the government matter? Economic Change and Restructuring 55: 543–76. [Google Scholar] [CrossRef]

- Aidt, Toke, Jaysri Dutta, and Vania Sena. 2008. Governance regimes, corruption and growth: Theory and evidence. Journal of Comparative Economics 36: 195–220. [Google Scholar] [CrossRef]

- Aidt, Toke. 2009. Corruption, Institutions, and Economic Development. Oxford Review of Economic Policy 25: 271–91. [Google Scholar]

- Akai, Nobuo, Yusaku Horiuchi, and Masayo Sakata. 2005. Short-Run and Long-Run Effects of Corruption on Economic Growth: Evidence from State-Level Cross-Section Data for the United States. In ANU Working Papers. n. 05/5. Canberra: Australian National University, Asia Pacific School of Economics and Government. [Google Scholar]

- Al Qudah, Anas, Azzouz Zouaoui, and Mostafa E. Aboelsoud. 2020. Does corruption adversely affect economic growth in Tunisia? ARDL approach. Journal of Money Laundering Control 23: 38–54. [Google Scholar] [CrossRef]

- Ali, Abdiweli M., and Hodan S. Isee. 2003. Determinants of Economic Corruption: A Cross-Country Comparison. Cato Journal 22: 449–66. [Google Scholar]

- Aliyu, Shehu Usman Rano, and Akanni Oludele Elijah. 2008. Corruption and Economic growth in Nigeria: 1986–2007. In Munich Personal. MPRA paper No. 12504. Munich: RePEc Archive (MPRA), pp. 1–20. [Google Scholar]

- Andvig, Jens Chr, and Karl Ove Moene. 1990. How corruption may corrupt. Journal of Economic Behaviour and Organization 13: 63–76. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Arnone, Marco, and Eleni Iliopolus. 2005. La Corruzione Costa, Effetti Economici, Istituzionali e Sociali. Milano: Vita e pensiero. [Google Scholar]

- Asafo-Adjei, Emmanuel, Peterson Owusu Junior, Anokye M. Adam, Clement Lamboi Arthur, Ebenezer Boateng, and Kwadwo Ankomah. 2023. Asymmetric relationships among financial sector development, corruption, foreign direct investment, and economic growth in sub-Saharan Africa. Cogent Economics & Finance 11: 2182454. [Google Scholar] [CrossRef]

- Bartlett, Will. 2009. Economic Development in the European Super-Periphery: Evidence from the Western Balkans. Economic Annals 54: 21–44. [Google Scholar] [CrossRef]

- Beck, Paul, and Michael W. Maher. 1986. A comparison of bribery and bidding in thin markets. Economic Letters 20: 1–5. [Google Scholar] [CrossRef]

- Bega, Federico Maria. 2007. La geopolitica delle popolazioni musulmane balcaniche tra minaccia del fondamentalismo islamico e prospettiva di integrazione europea. Rivista di Studi Politici Internazionali 74: 526–38. [Google Scholar]

- Bhagwati, Jagdish. 1982. Directly Unproductive Profit-Seeking (DUP), Activities. Journal of Political Economy 90: 988–1002. [Google Scholar] [CrossRef]

- Bird, Richard M., Jorge Martinez-Vazquez, and Benno Torgler. 2008. Tax Effort in Developing Countries and High-Income Countries: The Impact of Corruption, Voice and Accountability. Economic Analysis and Policy 38: 55–71. [Google Scholar] [CrossRef]

- Bitterhout, Siphiwo, and Beatrice D. Simo-Kengne. 2020. The Effect of Corruption on Economic Growth in the BRICS Countries. A Panel Data Analysis. EDWRG Working Paper Number 03-2020. Johannesburg: Economic and Well-Being Research Group, pp. 66–78. [Google Scholar]

- Blackburn, Keith, Niloy Bose, and M. Emranul Haque. 2006. The incidence and persistence of corruption in economic development. Journal of Economic Dynamics & Control 30: 2447–67. [Google Scholar]

- Bowen, John R. 2005. Il mito del conflitto etnico globale. In Antropologia Della Violenza. Edited by Fabio Dei. Roma: Meltemi, pp. 125–44. [Google Scholar]

- Brunetti, Aymo, and Beatrice Weder. 1998. Investment and Institutional Uncertainty: A Comparative Study of Different Uncertainty Measures. Weltwirtschaftliches Archiv 134: 513–33. [Google Scholar] [CrossRef]

- Buchanan, James M., and Gordon Tullock. 1962. The Calculus of Consent. 3 vols. Ann Arbor: University of Michigan Press. [Google Scholar]

- Coolidge, Jacqueline, and Susan Rose-Ackerman. 1997. High-level rent-seeking and corruption in African Regimes. In Policy Research Working Paper Series, 1780. Washington: The Word Bank. [Google Scholar]

- Coricelli, Fabrizio, and Roberto Rezende Rocha. 1991. Stabilization Programs in Eastern Europe: A Comparative Analysis of the Polish and Yugoslav Programs of 1990. In Policy, Research, and External Affairs. n. 732. Washington: World Bank. [Google Scholar]

- Del Monte, Alfredo, and Erasmo Papagni. 2007. The determinants of corruption in Italy: Regional panel data analysis. European Journal of Political Economy 23: 379–96. [Google Scholar] [CrossRef]

- Djankov, Simeon, and Peter Murrell. 2002. Enterprise Restructuring in Transition: A Quantitative Survey. Journal of Economic Literature 40: 739–92. [Google Scholar] [CrossRef]

- Dokas, Ioanis, Minas Panagiotidis, Stephanos Papadamou, and Eleftherios Spyromitros. 2023. Does innovation affect the impact of corruption on economic growth? International evidence. Economic Analysis and Policy 77: 1030–54. [Google Scholar] [CrossRef]

- Dreher, Axel, and Friedrich Schneider. 2010. Corruption and the Shadow Economy: An Empirical Analysis. Public Choice 144: 215–38. [Google Scholar] [CrossRef]

- Dreher, Axel, and Thomas Herzfeld. 2005. The Economic Costs of Corruption: A Survey and New Evidence. In Public Economics. Munich: University Library of Munich, p. 0506001. Available online: https://econwpa.ub.uni-muenchen.de/econ-wp/pe/papers/0506/0506001.pdf (accessed on 20 January 2020).

- Eilat, Yair, and Clifford Zinnes. 2000. The Evolution of the Shadow Economy in Transition Countries: Consequences for Economic Growth and Donor Assistance. In CAER II Discussion Paper; n. 83; Cambridge: Harvard Institute for International Development. Available online: https://pdf.usaid.gov/pdf_docs/PNACK691.pdf (accessed on 20 January 2020).

- Engle, Robert F., and Clive W. J. Granger. 1987. Co-integration and error correction: Representation, estimation, and testing. Econometrica: Journal of the Econometric Society, 251–76. [Google Scholar]

- Estrin, Saul, Klaus Meyer, and Maria Bytchkova. 2006. Entrepreneurship in transition economies. In The Oxford Handbook of Entrepreneurship. Edited by Mark Casson, Bernard Yeung, Anuradha Basu and Nigel Wadeson. Oxford: Oxford University Press, pp. 693–725. [Google Scholar]

- Fiocca, Mariateresa. 2001. Mediterraneo e Balcani: Due aree di crisi e di opportunità alla periferia dell’Unione Europea. In ISAE Working Papers. Roma: ISTAT. Available online: http://lipari.istat.it/digibib/Isae%20Documenti%20Lavoro/fioccamediterraneo19.pdf (accessed on 21 February 2020).

- Fiorino, Nadia, Emma Galli, and Ilaria Petrarca. 2012. Corruption and Growth: Evidence from the Italian Regions. European Journal of Government and Economics 1: 126–44. [Google Scholar] [CrossRef]

- Friedman, Eric, Simon Johnson, Daniel Kaufmann, and Pablo Zoido-Lobaton. 2000. Dodging the Grabbing Hand: The Determinants of Unofficial Activity in 69 Countries. Journal of Public Economics 76: 459–93. [Google Scholar] [CrossRef]

- Friedrich, Carl Joachim. 1972. The Pathology of Politics, Violence, Betrayal, Corruption, Secrecy and Propaganda. New York: Harper and Row. [Google Scholar]

- Gligorov, Vladimir, Mary Kaldor, and Loukas Tsoukalis. 1999. Balkan reconstruction and European integration. Wiiw Balkan Observatory Working Paper. Available online: https://wiiw.ac.at/balkan-reconstruction-and-european-integration-p-3354.html (accessed on 10 February 2020).

- Golden, Miriam A., and Lucio Picci. 2005. Proposal for a New Measure of Corruption, Illustrated with Italian Data. Economics & Politics 17: 37–75. [Google Scholar]

- Gould, David J., and Jose A. Amaro-Reyes. 1983. The Effects of Corruption on Administrative Performance. World Bank Staff Working Paper. Available online: https://documents1.worldbank.org/curated/ar/799981468762327213/pdf/multi-page.pdf (accessed on 10 February 2020).

- Groenendijk, Nico. 1997. A principal-agent model of corruption. Crime, Law and Social Change 27: 203–27. [Google Scholar] [CrossRef]

- Grossman, Gene M., and Elhanan Helpman. 1996. Electoral competition and special interest politics. The Review of Economic Studies 63: 265–86. [Google Scholar] [CrossRef]

- Gründler, Klaus, and Niklas Potrafke. 2019. Corruption and economic growth: New empirical evidence. Uropean. Journal of Political Economy 60: 101810, CESifo Working Paper Series. Available online: https://www.cesifo.org/DocDL/cesifo1_wp7816.pdf (accessed on 21 February 2020).

- Gundlach, Erich, and Martin Paldam. 2009. A farewell to critical junctures: Sorting out long-run causality of income and democracy. European Journal of Political Economy 25: 340–54. [Google Scholar] [CrossRef]

- Gupta, Sanjeev, Hamid Davoodi, and Rosa Alonso-Terme. 1998. Does corruption affect income inequality and poverty? In International Monetary Fund Working Paper. Available online: https://www.elibrary.imf.org/view/journals/001/1998/076/article-A001-en.xml (accessed on 20 November 2019).

- Habib, Mohsin, and Leon Zurawicki. 2002. Corruption and Foreign Direct Investment. Journal of International Business Studies 33: 291–307. [Google Scholar] [CrossRef]

- Hamilton, Alexander James, and Craig Hammer. 2018. Can We Measure the Power of the Grabbing Hand? A Comparative Analysis of Different Indicators of Corruption. Washington: World Bank Policy Research Working Paper. [Google Scholar] [CrossRef]

- Hirschman, Albert. 1982. Shifting Involvements. Princeton: Princeton University Press. [Google Scholar]

- Hsiao, Cheng. 1997. Statistical Properties of the Two-Stages Least Squares Estimator Under Cointegration. The Review of Economic Studies 64: 385–98. [Google Scholar] [CrossRef]

- Huntington, Samuel P. 1968. Political Order in Changing Societies. New Heaven: Yale University Press. [Google Scholar]

- Johnson, Simon, Daniel Kaufmann, Andrei Shleifer, Marshall I. Goldman, and Martin L. Weitzman. 1997. The Unofficial Economy in Transition. Brookings Papers on Economic Activity 2: 159–239. [Google Scholar] [CrossRef]

- Johnson, Simon, Daniel Kaufmann, and Pablo Zoido-Lobaton. 1998. Regulatory Discretion and the Unofficial Economy. American Economic Review 88: 387–92. [Google Scholar]

- Kaufmann, Daniel. 2010. Can Corruption Adversely Affect Public Finances in Industrialized Countries? OP-ED. April 19. Available online: https://www.brookings.edu/articles/can-corruption-adversely-affect-public-finances-in-industrialized-countries/ (accessed on 23 November 2019).

- Kim, Keunwoo, and Jaehyung An. 2022. Corruption as a Moderator in the Relationship between E-Government and Inward Foreign Direct Investment. Sustainability 14: 4995. [Google Scholar] [CrossRef]

- Knack, Stephen, and Philip Keefer. 1995. Institutions and Economic Performance: Cross–Country Tests Using Alternative Institutional Measures. Economics and Politics 7: 207–27. [Google Scholar] [CrossRef]

- Krueger, Anne O. 1974. The Political Economy of the Rent-Seeking Society. American Economic Review 64: 291–303. [Google Scholar]

- Lambsdorff, Johann Graf. 2003. How corruption affects productivity. Kyklos 56: 457–74. [Google Scholar] [CrossRef]

- Leff, Nathaniel H. 1964. Economic Development through Bureaucratic Corruption. American Behavioral Scientist 83: 8–14. [Google Scholar] [CrossRef]

- Leite, Carlos A., and Jens Weidmann. 1999. Does Mother Nature Corrupt? Natural Resources, Corruption, and Economic Growth. Working Paper, n. 99/85. Washington: International Monetary Fund, July. [Google Scholar]

- Lucarelli, Stefano, Filippo Umberto Andrini, and Annamaria Bianchi. 2018. Euro depreciation and trade asymmetries between Germany and Italy versus the US: Industry-level estimates. Applied Economics 50: 2–18. [Google Scholar] [CrossRef]

- Lučić, Danilo, Mladen Radišić, and Dušan Dobromirov. 2016. Causality between corruption and the level of GDP. Economic Research-Ekonomska Istraživanja 29: 360–79. [Google Scholar] [CrossRef]

- Lui, Francis T. 1985. An equilibrium queuing model of bribery. Journal of Political Economy 93: 760–81. [Google Scholar] [CrossRef]

- Macrae, John. 1982. Underdevelopment and the Economics of Corruption: A Game Theory Approach. World Development 10: 677–87. [Google Scholar] [CrossRef]

- Mauro, Paolo. 1995. Corruption and Growth. Quarterly Journal of Economics 110: 681–712. [Google Scholar] [CrossRef]

- Mauro, Paolo. 1997a. The Effects of Corruption on Growth, Investment, and Government Expenditure: A Cross-Country Analysis. In Corruption and the Global Economy. Edited by Kimberly Ann Elliott. Washington: Institute for International Economics, pp. 83–107. [Google Scholar]

- Mauro, Paolo. 1997b. Why Worry about Corruption? IMF Economic Issues 6. Available online: https://www.imf.org/EXTERNAL/PUBS/FT/ISSUES6/issue6.pdf (accessed on 19 September 2019).

- Mauro, Paolo. 1998. Corruption and the Composition of Government Expenditure. Journal of Public Economics 69: 263–79. [Google Scholar] [CrossRef]

- Mcmullan, Michael. 1961. A Theory of Corruption. Sociological Review 9: 181–201. [Google Scholar] [CrossRef]

- Méndez, Fabio, and Facundo Sepulveda. 2006. Corruption, Growth and Political Regimes: Cross Country Evidence. European Journal of Political Economy 22: 82–98. [Google Scholar] [CrossRef]

- Méon, Pierre-Guillaume, and Khalid Sekkat. 2005. Does Corruption Grease or Sand the Wheels of Growth? Public Choice 122: 69–97. [Google Scholar] [CrossRef]

- Méon, Pierre-Guillaume, and Laurent Weill. 2010. Is corruption an efficient grease? World Development 38: 244–59. [Google Scholar] [CrossRef]

- Mo, Pak Hung. 2001. Corruption and Economic Growth. Journal of Comparative Economics 29: 66–79. [Google Scholar] [CrossRef]

- Muço, Klodian. 2015. L’analisi del modello di sviluppo albanese nel periodo post-comunismo: Il cambiamento economico e la specializzazione. Doctoral dissertation, Università degli Studi dell’Insubria, Varese, Italy. [Google Scholar]

- Muço, Klodian, and Greta Balliu. 2018. Crescita economica e corruzione: Quale impatto nei paesi balcanici? Moneta e Credito 71: 298–307. [Google Scholar]

- Myrdal, Gunnar. 1968. Asian Drama: An Inquiry into the Poverty of Nations. New York: Random House. [Google Scholar]

- Narayan, Paresh Kumar. 2005. The Saving and Investment Nexus for China: Evidence from Cointegration Tests. Applied Economics 37: 1979–90. [Google Scholar] [CrossRef]

- Nguyen, Diep Van, and My Tien Ha Duong. 2021. Shadow economy, corruption and economic growth: An analysis of BRICS countries. The Journal of Asian Finance, Economics and Business 8: 665–72. [Google Scholar]

- North, Dauglass. 1991. Institutions. Journal of Economic Perspectives 5: 97–112. [Google Scholar] [CrossRef]

- Ofria, Ferdinando. 2006. Effetti distorsivi sull’economia legale: La corruzione. Soveria Mannelli: Rubettino. [Google Scholar]

- Olken, Benjamin A. 2006. Corruption and the Costs of Redistribution: Micro Evidence from Indonesia. Journal of Public Economics 90: 853–70. [Google Scholar] [CrossRef]

- Osoba, Segun O. 1996. Corruption in Nigeria: Historical perspectives. Review of African Political Economy 23: 371–86. [Google Scholar] [CrossRef]

- Panopoulou, Ekaterini, and Nikitas Pittis. 2004. A comparison of autoregressive distributed lag and dynamic OLS cointegration estimators in the case of a serially correlated cointegration error. The Econometrics Journal 7: 585–617. [Google Scholar] [CrossRef]

- Papaioannou, Elias, and Gregorios Siourounis. 2008. Democratization and Growth. Economic Journal 118: 1520–55. [Google Scholar] [CrossRef]

- Paulo, Lucas Dutra de, Ricardo Carvalho de Andrade Lima, and Robson Tigre. 2022. Corruption and economic growth in Latin America and the Caribbean. Review of Development Economics 26: 756–73. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds Testing Approaches to the Analysis of Level Relationship. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Pluskota, Anna. 2020. The Impact of Corruption on Economic Growth and Innovation in an Economy in Developed European Countries. Annales Universitatis Mariae Curie-Skłodowska, Sectio H Oeconomia 54: 77–87. [Google Scholar] [CrossRef]

- Poirson, Ward Elene. 1998. Economic Security, Private Investment, and Growth in Developing Countries. International Monetary Fund, Working Paper, n. 98/4. Available online: https://www.imf.org/external/pubs/ft/wp/wp9804.pdf (accessed on 10 January 2020).

- Prevalakis, Georges. 1997. I Balcani. Bologna: Il Mulino. [Google Scholar]

- Przeworski, Adam, and Fernando Limongi. 1993. Political Regimes and Economic Growth Political Regimes and Economic Growth. The Journal of Economic Perspectives 7: 51–69. [Google Scholar] [CrossRef]

- Rose-Ackerman, Susan. 1978. Corruption: A Study in Political Economy. New York: Academic Press. [Google Scholar]

- Rose-Ackerman, Susan. 1999. Corruption and Government, Causes, Consequences and Reform. Cambridge: Cambridge University Press. [Google Scholar]

- Seña, Jorge F. Malem. 2004. Globalizzazione, commercio internazionale e corruzione. Bologna: Il Mulino. [Google Scholar]

- Sharma, Chandan, and Arup Mitra. 2019. Corruption and economic growth: Some new empirical evidence from a global sample. Journal of International Development 31: 691–719. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1993. Corruption. Quarterly Journal of Economics 108: 599–617. [Google Scholar] [CrossRef]

- Simovic, Minja. 2021. The Impact of Corruption on Economic Growth in the Countries of Southeast Europe. Transformations in Business & Economics 20: 298–308. [Google Scholar]

- Spyromitros, Eleftherios, and Minas Panagiotidis. 2022. The impact of corruption on economic growth in developing countries and a comparative analysis of corruption measurement indicators. Cogent Economics & Finance 10: 2129368. [Google Scholar]

- Stiglitz, Joseph E., and Sergio Godoy. 2006. Growth, initial conditions, law and speed of privatization in transition countries: 11 Years Later. National Bureau of Economic Research. Available online: https://www.nber.org/papers/w11992 (accessed on 11 February 2020).

- Svejnar, Jan. 2002. Transition economies: Performance and challenges. Journal of Economic Perspectives 16: 3–28. [Google Scholar] [CrossRef]

- Sylos Labini, Paolo. 1989. Sviluppo economico e sviluppo civile. Moneta e Credito 42: 291–304. [Google Scholar]

- Tanzi, Vito. 1998. Corruption Around the World: Causes, Consequences, Scope and Cures. IMF Working Papers 45: 559–94. [Google Scholar]

- Tanzi, Vito, and Hamid Davoodi. 1997. Corruption, Public Investment and Growth. IMF Working Papers 139. Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Corruption-Public-Investment-and-Growth-2353 (accessed on 11 February 2020).

- Tanzi, Vito, and Hamid Davoodi. 2002. Corruption, Public Investment, and Growth. In Governance, Corruption, & Economic Performance. Edited by George T. Abed and Sanjeev Gupta. Washington: International Monetary Fund, Publication Services, pp. 280–99. [Google Scholar]

- Tirolem, Jean. 1996. A Theory of Collective Reputations (with Applications to the Persistence of Corruption and to Firm Quality). Review of Economic Studies 63: 1–22. [Google Scholar] [CrossRef]

- Todaro, Michael P., and Stephen C. Smith. 2009. Economic Development, 10th ed. Singapore: Pearson Education Limited. [Google Scholar]

- Trabelsi, Mohamed A. 2024. The impact of corruption on economic growth: A nonlinear evidence. Journal of Social and Economic Development, 1–10. [Google Scholar] [CrossRef]

- Uddin, Ijaz, and Khalil Ur Rahman. 2023. Impact of corruption, unemployment, and inflation on economic growth evidence from developing countries. Quality & Quantity 57: 2759–79. [Google Scholar]

- Visco, Ignazio. 2014. Contrasto all’economia criminale: Precondizione per la crescita economica, Convegno Banca d’Italia, Fondazione CIRGIS, 7 Novembre 2014. Available online: https://www.bancaditalia.it/pubblicazioni/interventi-governatore/integov2014/visco-071114.pdf (accessed on 21 February 2020).

- Wei, Shang-Jin. 1997. Why Is Corruption So Much More Taxing Than Tax? Arbitrariness Kills. NBER Working Paper, 6255. Available online: https://www.nber.org/papers/w6255 (accessed on 21 February 2020).

- World Bank. 2000. The Road to Stability and Prosperity in South Eastern Europe. A Regional Strategy Paper. Washington: World Bank Publications. [Google Scholar] [CrossRef]

| Countries | F-Test | Co-Integration |

|---|---|---|

| Bulgaria | 468.5487 | yes |

| Greece | 102.5066 | yes |

| Croatia | 478.9577 | yes |

| Romania | 261.0294 | yes |

| Slovenia | 257.3765 | yes |

| North Macedonia | 29.56275 | yes |

| Serbia | 126.8950 | yes |

| Turkey | 76.94814 | yes |

| Countries | Constant | dl_cor | dl_cor(-1) | dl_cor(-2) | dl_cor(-3) | dl_GDP(-1) | dl_GDP(-2) |

|---|---|---|---|---|---|---|---|

| Bulgaria | 0.091 (2.23) | 0.819 (2.23) | −0.102 (−1.343) | 0.095 (3.348) | −0.034 (−2.861) | 0.095 (1.06) | −0.107 (−3.19) |

| Greece | 0.158 (1.849) | 0.788 (14.06) | 0.009 (0.471) | −0.004 (−0.531) | −0.039 (−1.57) | −0.006 (−0.28) | −0.024 (−1.767) |

| Croatia | 0.241 (2.443) | 0.84 (15.11) | 0.055 (1.629) | 0.052 (1.652) | −0.075 (−2.364) | −0.038 (−1.37) | −0.031 (−1.268) |

| Romania | 0.141 (2.466) | 0.878 (16.96) | 0.022 (0.997) | 0.022 (1.057) | −0.018 (−0.801) | −0.038 (−1.703) | −0.038 (−1.714) |

| Slovenia | 0.145 (2.771) | 0.71 (11.65) | 0.045 (2.289) | 0.029 (1.45) | −0.102 (−3.003) | −0.023 (−0.903) | −0.012 (−0.506) |

| North Macedonia | 0.06 (1.02) | 0.654 (5.982) | −0.06 (−2.54) | −0.001 (−0.121) | −0.101 (−2.784) | 0.056 (2.26) | −0.1 (−1.183) |

| Serbia | 0.308 (2.1) | 0.76 (11.45) | 0.028 (0.89) | −0.047 (−1.638) | −0.046 (−2.195) | −0.116 (−1.028) | 0.007 (2.222) |

| Turkey | 0.165 (2.881) | 0.77 (11.46) | 0.039 (1.377) | 0.407 (1.623) | −0.037 (−1.22) | −0.049 (−1.232) | −0.047 (−1.446) |

| Countries | l_GDP (-1) | l_cor (-1) |

|---|---|---|

| Bulgaria | −0.01 (−2.966) | 0.002 (0.171) |

| Greece | −0.02 (−2.215) | 0.035 (3.085) |

| Croatia | −0.027 (−2.355) | −0.01 (−0.485) |

| Romania | −0.021 (−2.38) | 0.04 (1.681) |

| Slovenia | −0.013 (−2.531) | −0.018 (−1.599) |

| North Macedonia | −0.008 (−0.736) | 0.0008 (0.051) |

| Serbia | −0.033 (−1.918) | −0.022 (−0.962) |

| Turkey | −0.014 (−2.604) | −0.0001 (−0.012) |

| Countries | F-Test | Co-Integration |

|---|---|---|

| Bulgaria | 468.5487 | yes |

| Greece | 99.43956 | yes |

| Croatia | 478.9577 | yes |

| Romania | 87.67751 | yes |

| Slovenia | 257.3765 | yes |

| North Macedonia | 29.56275 | yes |

| Serbia | 126.8950 | yes |

| Turkey | 100.3660 | yes |

| Countries | Constant | dl_cor | dl_cor(-1) | dl_cor(-2) | dl_cor(-3) | dl_GDP(-1) | dl_GDP(-2) |

|---|---|---|---|---|---|---|---|

| Bulgaria | 0.091 (2.23) | 0.819 (2.23) | −0.102 (−1.343) | 0.095 (3.348) | −0.034 (−2.861) | 0.095 (1.06) | −0.107 (−3.19) |

| Greece | 0.147 (1.742) | 0.784 (13.64) | n.a. | n.a. | n.a. | 0.095 (0.893) | −0.029 (−2.640) |

| Croatia | 0.241 (2.443) | 0.84 (15.11) | 0.055 (1.629) | 0.052 (1.652) | −0.075 (−2.364) | −0.038 (−1.37) | −0.031 (−1.268) |

| Romania | 0.146 (2.473) | 0.875 (16.21) | n.a | n.a | n.a | −0.01 (−1.499) | −0.01 (−1.45) |

| Slovenia | 0.145 (2.771) | 0.71 (11.65) | 0.045 (2.289) | 0.029 (1.45) | −0.102 (−3.003) | −0.023 (−0.903) | −0.012 (−0.506) |

| North Macedonia | 0.061 (1.02) | 0.654 (5.982) | −0.06 (−2.54) | −0.001 (−0.121) | −0.101 (−2.784) | 0.056 (2.26) | −0.1 (−1.183) |

| Serbia | 0.308 (2.1) | 0.76 (11.45) | 0.028 (0.89) | −0.047 (−1.638) | −0.046 (−2.195) | −0.116 (−1.028) | 0.007 (2.222) |

| Turkey | 0.171 (3.004) | 0.772 (11.63) | n.a. | n.a. | n.a. | −0.001 (−0.11) | 0.001 (0.139) |

| Countries | l_GDP(-1) | l_cor(-1) |

|---|---|---|

| Bulgaria | −0.01 (−2.966) | 0.002 (0.171) |

| Greece | −0.021 (−0.28) | 0.032 (2.625) |

| Croatia | −0.027 (−2.355) | −0.01 (−0.485) |

| Romania | −0.019 (−2.36) | 0.031 (1.871) |

| Slovenia | −0.013 (−2.531) | −0.018 (−1.599) |

| North Macedonia | −0.008 (−0.736) | 0.0008 (0.051) |

| Serbia | −0.033 (−1.918) | −0.022 (−0.962) |

| Turkey | −0.014 (−2.744) | −0.006 (−0.567) |

| Countries | RESET | LM | CUSUM | CUSUMq | Adj. R2 |

|---|---|---|---|---|---|

| Bulgaria | 50.33 | 2.958 | Stable | Unstable | 0.955 |

| Greece | 46.80 | 5.05 | Stable | Unstable | 0.832 |

| Croatia | 37.929 | 3.749 | Stable | Unstable | 0.876 |

| Romania | 103.554 | 10.537 | Stable | Unstable | 0.95 |

| Slovenia | 109.386 | 7.162 | Stable | Unstable | 0.899 |

| North Macedonia | 28.35 | 3.454 | Stable | Unstable | 0.701 |

| Serbia | 10.078 | 9.193 | Stable | Unstable | 0.804 |

| Turkey | 75.232 | 0.17 | Stable | Unstable | 0.87 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lucarelli, S.; Muço, K.; Valentini, E. Short Run and Long Run Effects of Corruption on Economic Growth: Evidence from Balkan Countries. Economies 2024, 12, 86. https://doi.org/10.3390/economies12040086

Lucarelli S, Muço K, Valentini E. Short Run and Long Run Effects of Corruption on Economic Growth: Evidence from Balkan Countries. Economies. 2024; 12(4):86. https://doi.org/10.3390/economies12040086

Chicago/Turabian StyleLucarelli, Stefano, Klodian Muço, and Enzo Valentini. 2024. "Short Run and Long Run Effects of Corruption on Economic Growth: Evidence from Balkan Countries" Economies 12, no. 4: 86. https://doi.org/10.3390/economies12040086

APA StyleLucarelli, S., Muço, K., & Valentini, E. (2024). Short Run and Long Run Effects of Corruption on Economic Growth: Evidence from Balkan Countries. Economies, 12(4), 86. https://doi.org/10.3390/economies12040086