Effect of Financial Frictions on Monetary Policy Conduct: A Comparative Analysis of DSGE Models with and without Financial Frictions

Abstract

1. Introduction

2. Model Presentation

2.1. Households

2.2. Capital Goods Producers

2.3. Retailers

2.4. Bankers

2.5. Entrepreneurs

2.6. Monetary Policy and Market Equilibrium

3. Data and Model Calibration

3.1. Data

3.2. Calibration

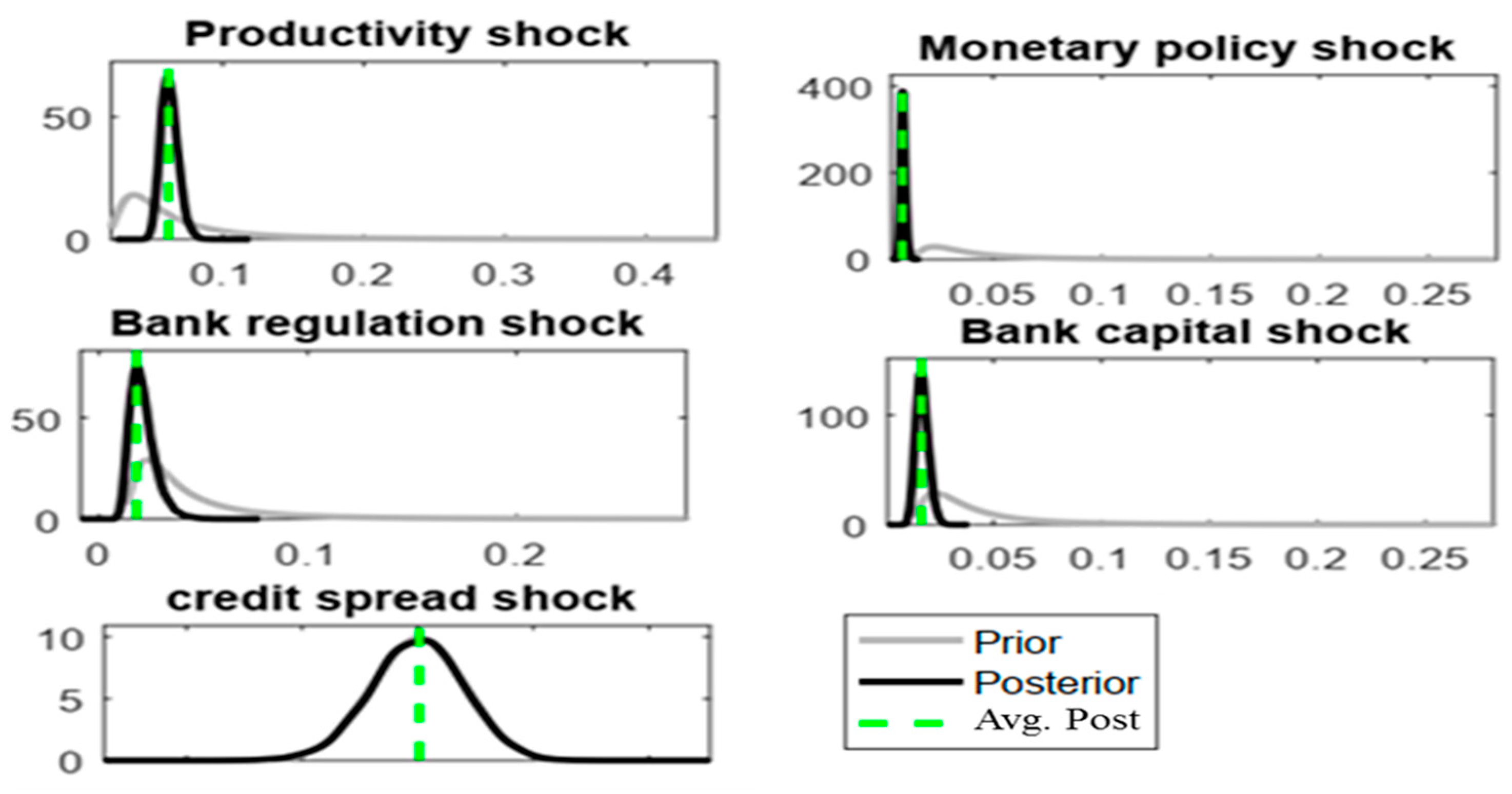

3.3. Shocks and Prior Estimation

4. What Structural Shocks Drive the Tunisian Economy?

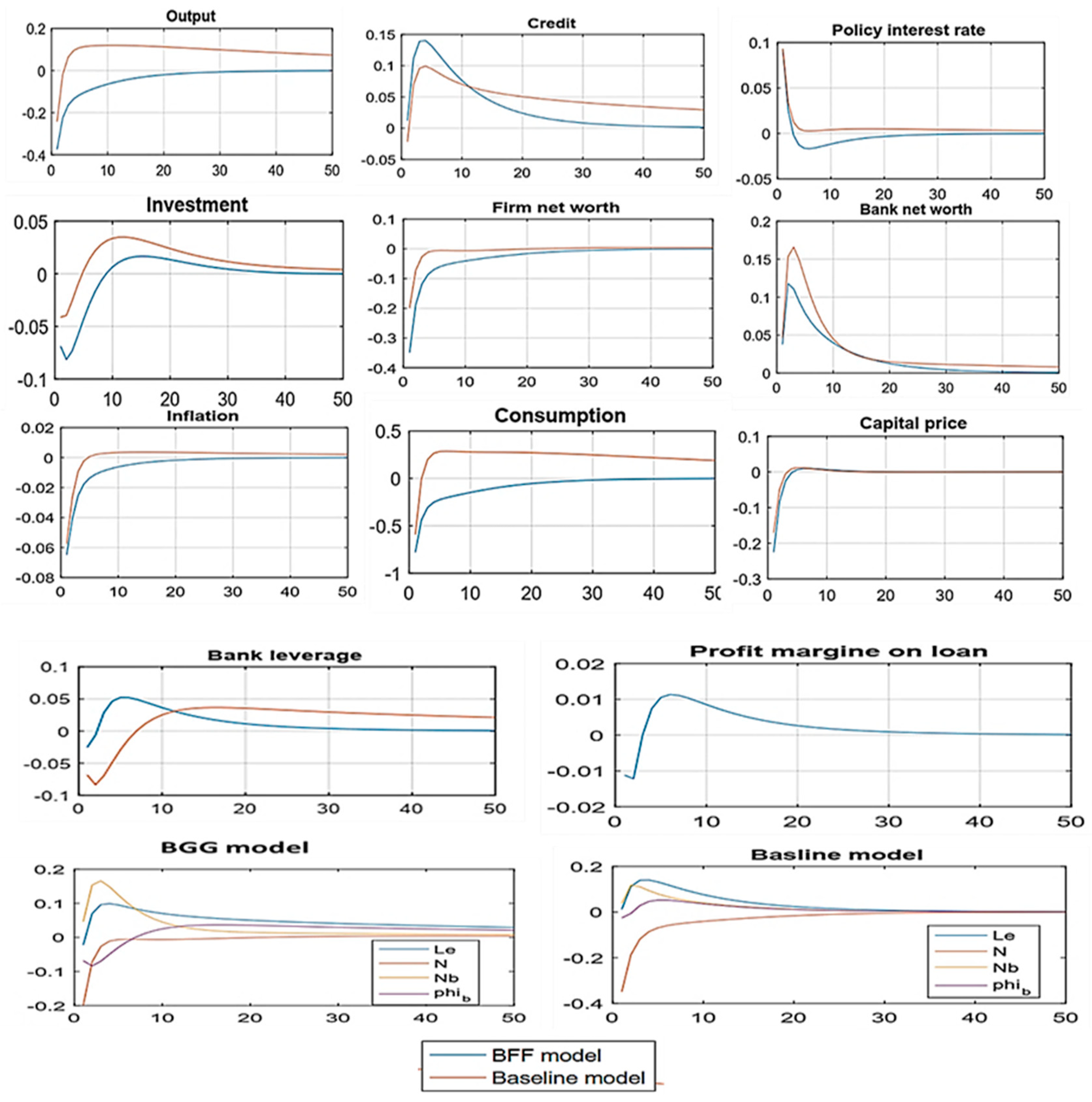

4.1. Restrictive Monetary Policy

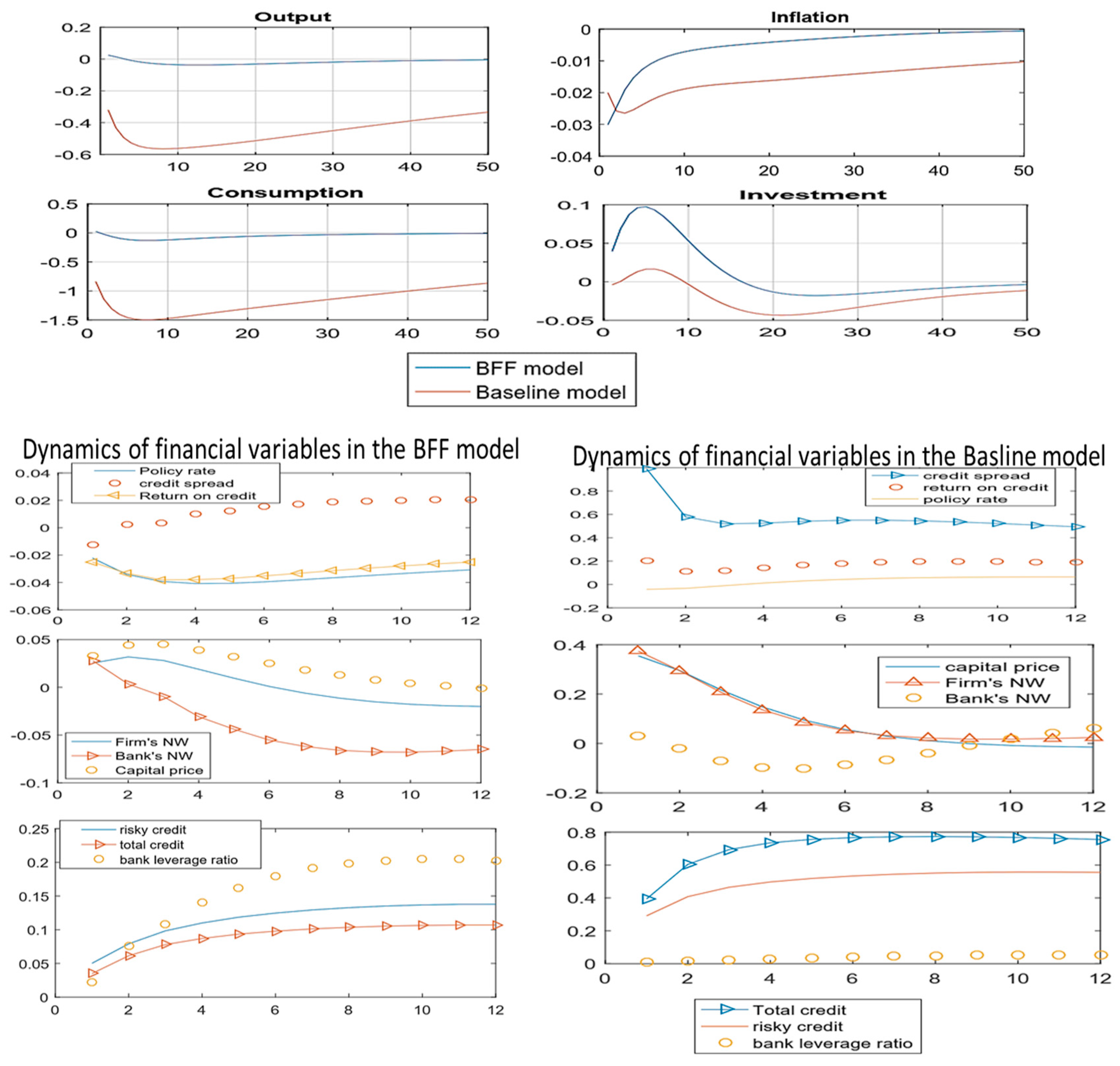

4.2. Adverse Productivity Shock

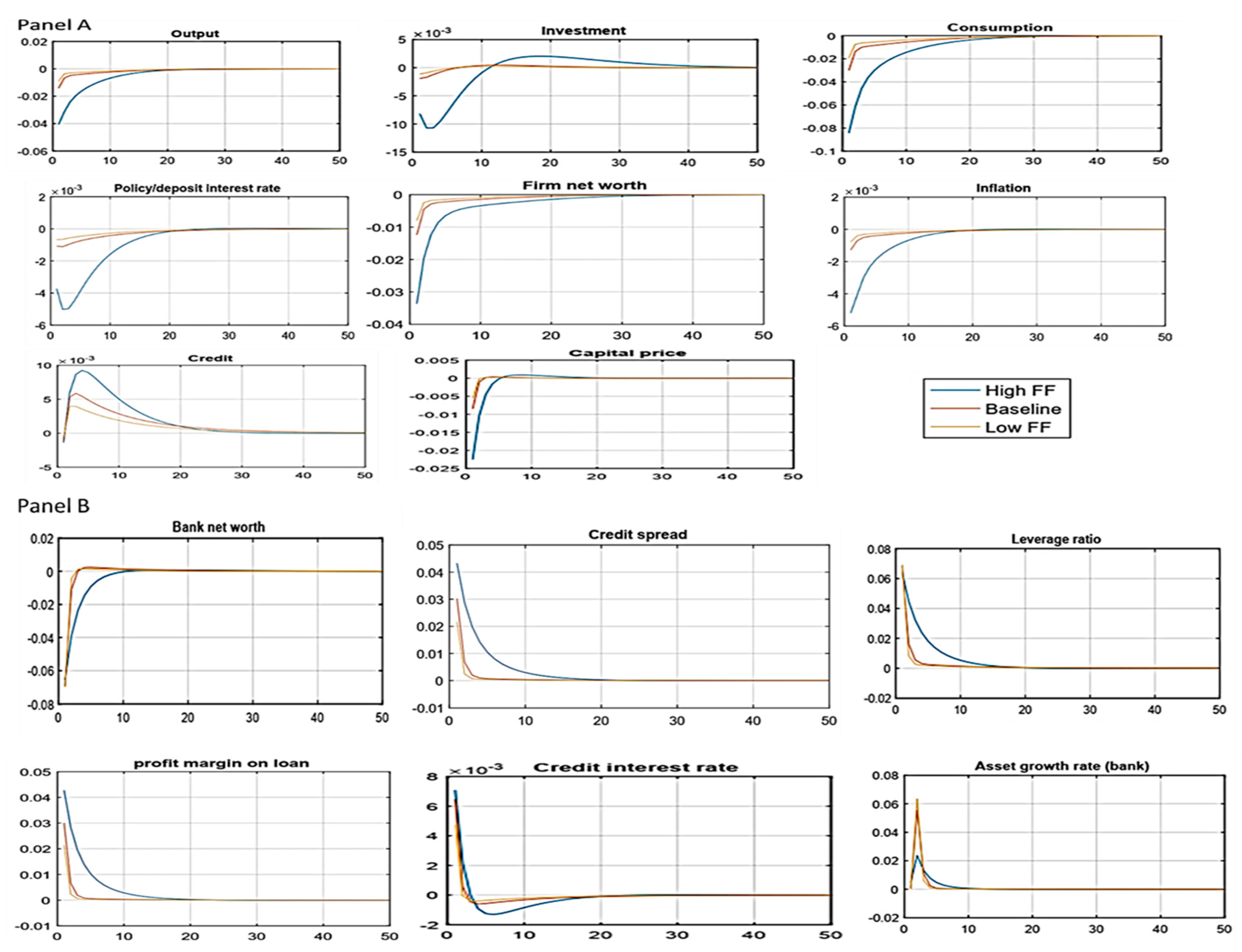

4.3. Negative Bank Capital Shock and Conditions of Low and High Bank Leverage Ratios

5. Model Evaluation

5.1. Relative Fit of DSGE Model with Alternative Bayesian Facto

5.2. Absolute Evaluation: Theoretical Moment Comparison

5.3. Variance Decomposition

6. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdelli, Soulaima, and Besma Belhadj. 2015. The Dynamic Stochastic General Equilibrium Model for the Monetary Policy Analysis in Tunisia. Global Journal of Human-Social Science: E Economics 15: 9–21. [Google Scholar]

- Adrian, Tobias, and Nellie Liang. 2018. Monetary policy, financial conditions, and financial stability. International Journal of Central Banking 14: 73–131. [Google Scholar] [CrossRef]

- Afrin, Sadia. 2017. Monetary policy transmission in Bangladesh: Exploring the lending channel. Journal of Asian Economics 49: 60–80. [Google Scholar] [CrossRef]

- Akinci, Özge. 2021. Financial Frictions and Macro-Economic Fluctuations in Emerging Economies. Journal of Money, Credit and Banking 53: 1267–312. [Google Scholar] [CrossRef]

- Ali, Kishwar, Hongbing Hu, Chee Yoong Liew, and Jianguo Du. 2023. Governance perspective and the effect of economic policy uncertainty on financial stability: Evidence from developed and developing economies. Economic Change Restruction 56: 1971–2002. [Google Scholar] [CrossRef]

- Alimi, Kawther, and Mohamed Chakroun. 2021. Wage Rigidity Impacts on Unemployment and Inflation Persistence in Tunisia: Evidence from an Estimated DSGE Mode. Journal of the Knowledge Economy 13: 474–500. [Google Scholar] [CrossRef]

- Ben Salem, Salha, Haykel Hadj Salem, Nadia Mansour, and Moez Labidi. 2022. The Financial Friction and Optimal Monetary Policy: The Role of Interest Rate. In Contemporary Research in Accounting and Finance. Edited by Abdelghani Echchabi, Rihab Grassa and Welcome Sibanda. Springer Books. Singapore: Springer, pp. 151–76. [Google Scholar]

- Ben Salem, Salha, Nadia Mansour, and Moez Labidi. 2023. Credit-Market Imperfection and Monetary Policy Within DSGE Models. In Research Anthology on Macroeconomics and the Achievement of Global Stability. Edited by Information Management Association. Hershey: IGI Global, pp. 370–91. [Google Scholar] [CrossRef]

- Bernanke, Ben S., Mark Gertler, and Simon Gilchrist. 1999. The Financial Accelerator in a Quantitative Business Cycle Framework. In Handbook of Macroeconomics, 1st ed. Edited by John B. Taylor and Michael Woodford. Amsterdam: Elsevier, vol. 1, chp. 21. pp. 1341–93. [Google Scholar]

- Burietz, Aurore, Steven Ongena, and Matthieu Picault. 2023. Taxing banks leverage and syndicated lending: A cross-country comparison. International Review of Law and Economics 73: 106103. [Google Scholar] [CrossRef]

- Calvo, Guillermo A. 1983. Staggered prices in a utility-maximizing framework. Journal of Monetary Economics 12: 383–98. [Google Scholar] [CrossRef]

- Canova, Fabio. 2005. The transmission of US shocks to Latin America. Journal of Applied Econometrics 20: 229–51. [Google Scholar] [CrossRef]

- Chakroun, Mohamed. 2019. Diagnosis of Monetary Policy in Tunisia during the Last Decade: A DSGE Model Approach. Journal of the Knowledge Economy 10: 348–64. [Google Scholar]

- Chen, Kaili, Marcin Kolasa, Jesper Lindé, Hou Wang, Pawel Zabczyk, and Jianping Zhou. 2023. An Estimated DSGE Model for Integrated Policy Analysis. IMF Working Paper No. 135. Available online: https://www.imf.org/en/Publications/WP/Issues/2023/06/29/An-Estimated-DSGE-Model-for-Integrated-Policy-Analysis-535436 (accessed on 29 February 2024).

- Choi, Dong Beom, and Hyun-Soo Choi. 2021. The Effect of Monetary Policy on Bank Wholesale Funding. Management Science 67: 388–416. [Google Scholar] [CrossRef]

- Djebali, Nesrine, and Khemais Zaghdoudi. 2020. Testing the governance-performance relationship for the Tunisian banks: A GMM in system analysis. Financial Innovation 6: 23. [Google Scholar] [CrossRef]

- Doojav, Gan-Ochir, and Kaliappa Kalirajan. 2020. Financial Frictions and Shocks in an Estimated Small Open Economy DSGE Model. Journal of Quantitative Economics 18: 253–91. [Google Scholar] [CrossRef]

- Francis, Leni Anguyo, Rangan Gupta, and Kevin Kotzé. 2020. Monetary policy, financial frictions and structural changes in Uganda: A Markov-switching DSGE approach. Economic Research-Ekonomska Istraživanja 33: 1538–61. [Google Scholar] [CrossRef]

- Gabriel, Vasco J., Paul Levine, and Bo Yang. 2023. Partial dollarization and financial frictions in emerging economies. Review of International Economics 31: 609–51. [Google Scholar] [CrossRef]

- Gaies, Brahim, and Mahmoud-Sami Nabi. 2021. Banking crises and economic growth in developing countries: Why privileging foreign direct investment over external debt? Bulletin of Economic Research 73: 736–61. [Google Scholar] [CrossRef]

- Gallegati, Marco, Federico Giri, and Antonio Palestrini. 2019. DSGE model with financial frictions over subsets of business cycle frequencies. Journal of Economic Dynamics and Control 100: 152–63. [Google Scholar] [CrossRef]

- Gertler, Mark. 2010. Banking crises and real activity: Identifying the linkages. Linkages International Journal of Central Banking 6: 125–35. [Google Scholar]

- Gertler, Mark, and Peter Karadi. 2011. A model of unconventional monetary policy. Journal of Monetary Economics 58: 17–34. [Google Scholar] [CrossRef]

- Giakas, Konstantinos. 2023. Hysteresis, financial frictions and monetary policy. The Journal of Economic Asymmetries 27: e00286. [Google Scholar] [CrossRef]

- Hafstead, Marc, and Josephine Smith. 2012. Financial Shocks, Bank Intermediation, and Monetary Policy in a «DSGE Model». New York: New York University. [Google Scholar]

- Hamzaoui, Nessrine, and Boutheina Regaieg. 2016. Exploration of the Foreign Exchange Forward Premiums and the Spot Exchange Return: A Multivariate Approach. International Journal of Economics and Financial Issues 6: 694–702. [Google Scholar]

- Harding, Martin, and Mathias Klein. 2022. Monetary policy and household net worth. Review of Economic Dynamics 44: 125–51. [Google Scholar] [CrossRef]

- Higgins, C. Richard. 2023. Risk and Uncertainty: The Role of Financial Frictions. Economic Modelling 119: 106138. [Google Scholar] [CrossRef]

- Jouini, Nizar, and Nooman Rebei. 2014. The welfare implications of services liberalization in a developing country. Journal of Development Economics 106: 1–14. [Google Scholar] [CrossRef]

- Kamara, Ahmed, and Niraj P. Koirala. 2023. The Dynamic Impacts of Monetary Policy Uncertainty Shocks. Economies 11: 17. [Google Scholar] [CrossRef]

- Karmelavičius, Jaunius, and Tomas Ramanauskas. 2019. Bank credit and money creation in a DSGE model of a small open economy. Baltic Journal of Economics 19: 296–333. [Google Scholar] [CrossRef]

- Kass, Robert E., and Adrian E. Raftery. 1995. Bayes Factors. Journal of the American Statistical Association 90: 773–95. [Google Scholar] [CrossRef]

- Labus, Miroljub, and Milica Labus. 2019. Monetary Transmission Channels in DSGE Models: Decomposition of Impulse Response Functions Approach. Computational Economics 53: 27–50. [Google Scholar] [CrossRef]

- Lamers, Martien, Frederik Mergaerts, Elien Meuleman, and Rudi Vander Vennet. 2019. The Trade-Off between Monetary Policy and Bank Stability. International Journal of Central Banking 15: 1–42. [Google Scholar] [CrossRef]

- Le, Hai. 2021. The Impacts of Credit Standards on Aggregate Fluctuations in a Small Open Economy: The Role of Monetary Policy. Economies 9: 203. [Google Scholar] [CrossRef]

- Levieuge, Grégory. 2009. The bank capital channel and counter-cyclical prudential regulation in a «DSGE model». Recherches économiques de Louvain 75: 425–60. [Google Scholar] [CrossRef]

- Li, Huiyu. 2022. Leverage and productivity. Journal of Development Economics 154: 102752. [Google Scholar] [CrossRef]

- Li, Xiangfa, and Hua Wang. 2020. The effective of China’s monetary policy: Quantity versus price rules. The North American Journal of Economics and Finance 54: 101097. [Google Scholar] [CrossRef]

- Lubello, Federico, and Abdelaziz Rouabah. 2018. Capturing Macroprudential Policy Effectiveness: A DSGE Approach with Shadow Intermediaries. Working Paper No. 114. Luxembourg: Banque Centrale du Luxembourg. [Google Scholar]

- Lubello, Federico, Ivan Petrella, and Emiliano Santoro. 2018. Chained Financial Frictions and Credit Cycles. Working Paper No. 116. Luxembourg: Banque Centrale du Luxembourg. [Google Scholar]

- Lyu, Juyi, Vo Phuong Mai Le, David Meenagh, and Patrick Minford. 2023. UK monetary policy in an estimated DSGE model with financial frictions. Journal of International Money and Finance 130: 102750. [Google Scholar] [CrossRef]

- Ma, Yong, and Yiqing Jiang. 2023. Gradual financial integration and macroeconomic fluctuations in emerging market economies: Evidence from China. Journal of Economic Interaction and Coordination 18: 275–310. [Google Scholar] [CrossRef] [PubMed]

- Mansour, Nadia, Salha Ben Salem, and Haykal Haj Salem. 2021. Banking Stability and Prudential Regulation Interactions in DSGE Model for Tunisia. In Lecture Notes in Networks and Systems. Cham: Springer, vol. 194. [Google Scholar]

- Maxted, Peter. 2023. A Macro-Finance Model with Sentiment. Review of Economic Studies 91: 438–75. [Google Scholar] [CrossRef]

- Meh, Césaire A., and Kevin Moran. 2010. The role of bank capital in the propagation of shocks. Journal of Economic Dynamics and Control 34: 555–76. [Google Scholar] [CrossRef]

- Merola, Rossana. 2014. The role of financial frictions during the crisis: An estimated DSGE model. Economic Modelling. [Google Scholar] [CrossRef][Green Version]

- Mohabatpoor, Roholla, Ahmad Googerdchian, Karim Azarbayjani, and Azim Nazari. 2022. Analyzing international capital flows to developing and emerging market countries using a two-country dynamic stochastic general equilibrium (dsge) model under asymmetric information structure. Global Economy Journal 22: 2350009. [Google Scholar] [CrossRef]

- Mohamed, El Fodil Ihaddaden. 2020. Impact of Political Uncertainty on Banking Productivity: Investigating the Jasmin Revolution Effect on the Tunisian Banking System. Economics Bulletin 40: 437–47. [Google Scholar]

- Moraux, Franck, Dinh Anh Phan, and Thi Le Hoa Vo. 2023. Collaborative financing and supply chain coordination for corporate social responsibility. Economic Modelling 121: 106198. [Google Scholar] [CrossRef]

- Ngepah, Nicholas, Margarida Liandra Andrade da Silva, and Charles Shaaba Saba. 2022. The Impact of Commodity Price Shocks on Banking System Stability in Developing Countries. Economies 10: 91. [Google Scholar] [CrossRef]

- Nguyen, Trung Duc, Anh Hoang Le, Eleftherios I. Thalassinos, and Lanh Kim Trieu. 2022. The Impact of the COVID-19 Pandemic on Economic Growth and Monetary Policy: An Analysis from the DSGE Model in Vietnam. Economie 10: 159. [Google Scholar] [CrossRef]

- Palić, Irena. 2018. The empirical evaluation of monetary policy shock in dynamic stochastic general equilibrium model with financial frictions: Case of Croatia. International Journal of Engineering Business Management 10. [Google Scholar] [CrossRef]

- Rannenberg, Ansgar. 2016. Bank Leverage Cycles and the External Finance Premium. Journal of Money, Credit, and Banking 48: 1569–612. [Google Scholar] [CrossRef]

- Rubio, Margarita. 2020. Monetary policy, credit markets, and banks: A DSGE perspective. Economics Letters 19: 109481. [Google Scholar] [CrossRef]

- Soderlind, Paul. 1994. International Spillovers in an Endogenous Growth Model. Empirical Economics 19: 501–15. [Google Scholar] [CrossRef]

- Suh, Hyunduk, and Todd B. Walker. 2016. Taking financial frictions to the data. Journal of Economic Dynamics and Control 64: 39–65. [Google Scholar] [CrossRef]

- Tabak, Benjamin Miranda, Igor Bettanin Dalla Riva e Silva, and Thiago Christiano Silva. 2022. Analysis of connectivity between the world’s banking markets: The COVID-19 global pandemic shock. The Quarterly Review of Economics and Finance 84: 324–36. [Google Scholar] [CrossRef]

- Wong, Benjamin. 2017. Historical Decompositions for Nonlinear Vector Autoregression Models. CAMA Working Papers 2017-62. Canberra: Centre for Applied Macroeconomic Analysis, Crawford School of Public Policy, The Australian National University. [Google Scholar]

- Zhang, Bo, and Peng Zhou. 2021. Financial development and economic growth in a microfounded small open economy model. The North American Journal of Economics and Finance 58: 101544. [Google Scholar] [CrossRef]

- Zhang, Xiaoming, Qian Liang, and Chien-Chiang Lee. 2023. How does central bank transparency affect systemic risk? Evidence from developed and developing countries. The Quarterly Review of Economics and Finance 88: 101–15. [Google Scholar] [CrossRef]

| Estimation Sample | Kass and Raftery Criterion (2log (BF)) | ||

|---|---|---|---|

| 2000 Q1 to 2022 Q3 | −314 | −320 | 12 |

| Variable | S.D Baseline Model | S.D BFF Model | SD Real Data | AC (1) Baseline Model | Ac(1) BFF Model | Ac (1) Real Data | AC (2) Baseline Model | AC (2) BFF Model | AC (2) Real Data |

|---|---|---|---|---|---|---|---|---|---|

| Output | 7.325 | 1.66 | 5.926 | 0.9912 | 0.844 | 0.770 | 0.9793 | 0.7625 | 0.539 |

| Consumption | 18.188 | 2.60 | 0.523 | 0.9919 | 0.851 | 0.968 | 0.9817 | 0.7789 | 0.935 |

| Investment | 1.3256 | 1.14 | 0.626 | 0.9803 | 0.976 | 0.925 | 0.9352 | 0.9247 | 0.848 |

| Inflation | 0.2195 | 0.688 | 0.9779 | 0.9317 | 0.824 | 0.725 | 0.8881 | 0.7136 | 0.693 |

| Interest rate | 0.3076 | 0.584 | 0.6751 | 0.9228 | 0.766 | 0.767 | 0.8813 | 0.6517 | 0.746 |

| Firm’s loan | 2.7938 | 1.615 | 1.4525 | 0.9956 | 0.984 | 0.9879 | 0.9588 | 0.912 | |

| Loan | 3.7697 | 1.29 | 0.9343 | 0.9930 | 0.944 | 0.986 | 0.9833 | 0.8776 | 0.971 |

| Leverage ratio | 1.3341 | 3.33 | 2.13 | 0.9889 | 0.969 | 0.989 | 0.9703 | 0.9511 | 0.978 |

| Bank capital | 0.8257 | 1.0024 | 0.9223 | 0.9875 | 0.964 | 0.984 | 0.9325 | 0.9471 | 0.968 |

| Credit spread | - | 0.737 | 1.468 | 0.9099 | 0.524 | 0.305 | 0.8976 | 0.5284 | 0.236 |

| Moral hazard | 0.000 | 0.764 | 0.683 | 0.000 | −0.076 | −0.042 | 0.000 | −0.088 | −0.183 |

| Shock | GDP | Consumption | Investment | Inflation | Policy Rate | Risky Credit | Total Credit | Bank Leverage | Credit Spread |

|---|---|---|---|---|---|---|---|---|---|

| DSGE model with financial friction s | |||||||||

| Monetary policy shock | 51.42 | 46.90 | 8084 | 42.31 | 36.68 | 25.71 | 2.86 | 22.66 | 1.93 |

| Productivity shock | 27.57 | 43.02 | 53.21 | 43.67 | 48.10 | 49.90 | 22.63 | 46.56 | 10.85 |

| Bank capital shock | 18.62 | 9.19 | 37.64 | 13.37 | 14.52 | 23.45 | 70.86 | 29.86 | 27.84 |

| DSGE model without financial friction s | |||||||||

| Monetary policy shock | 1.34 | 1.35 | 1.21 | 9.63 | 11.72 | 1.90 | 3.75 | ||

| Productivity shock | 95.6 | 95.52 | 96.42 | 82.02 | 85.41 | 94.98 | |||

| Bank capital shock | 18.62 | 9.19 | 37.64 | 13.37 | 14.52 | 23.45 | 70.86 | 29.86 | 27.84 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ben Salem, S.; Sayari, S.; Labidi, M. Effect of Financial Frictions on Monetary Policy Conduct: A Comparative Analysis of DSGE Models with and without Financial Frictions. Economies 2024, 12, 72. https://doi.org/10.3390/economies12030072

Ben Salem S, Sayari S, Labidi M. Effect of Financial Frictions on Monetary Policy Conduct: A Comparative Analysis of DSGE Models with and without Financial Frictions. Economies. 2024; 12(3):72. https://doi.org/10.3390/economies12030072

Chicago/Turabian StyleBen Salem, Salha, Sonia Sayari, and Moez Labidi. 2024. "Effect of Financial Frictions on Monetary Policy Conduct: A Comparative Analysis of DSGE Models with and without Financial Frictions" Economies 12, no. 3: 72. https://doi.org/10.3390/economies12030072

APA StyleBen Salem, S., Sayari, S., & Labidi, M. (2024). Effect of Financial Frictions on Monetary Policy Conduct: A Comparative Analysis of DSGE Models with and without Financial Frictions. Economies, 12(3), 72. https://doi.org/10.3390/economies12030072