Investor Behavior in Gold, US Dollars and Cryptocurrency during Global Pandemics

Abstract

1. Introduction

2. Research Methods, Data and Results

2.1. Sources of Data

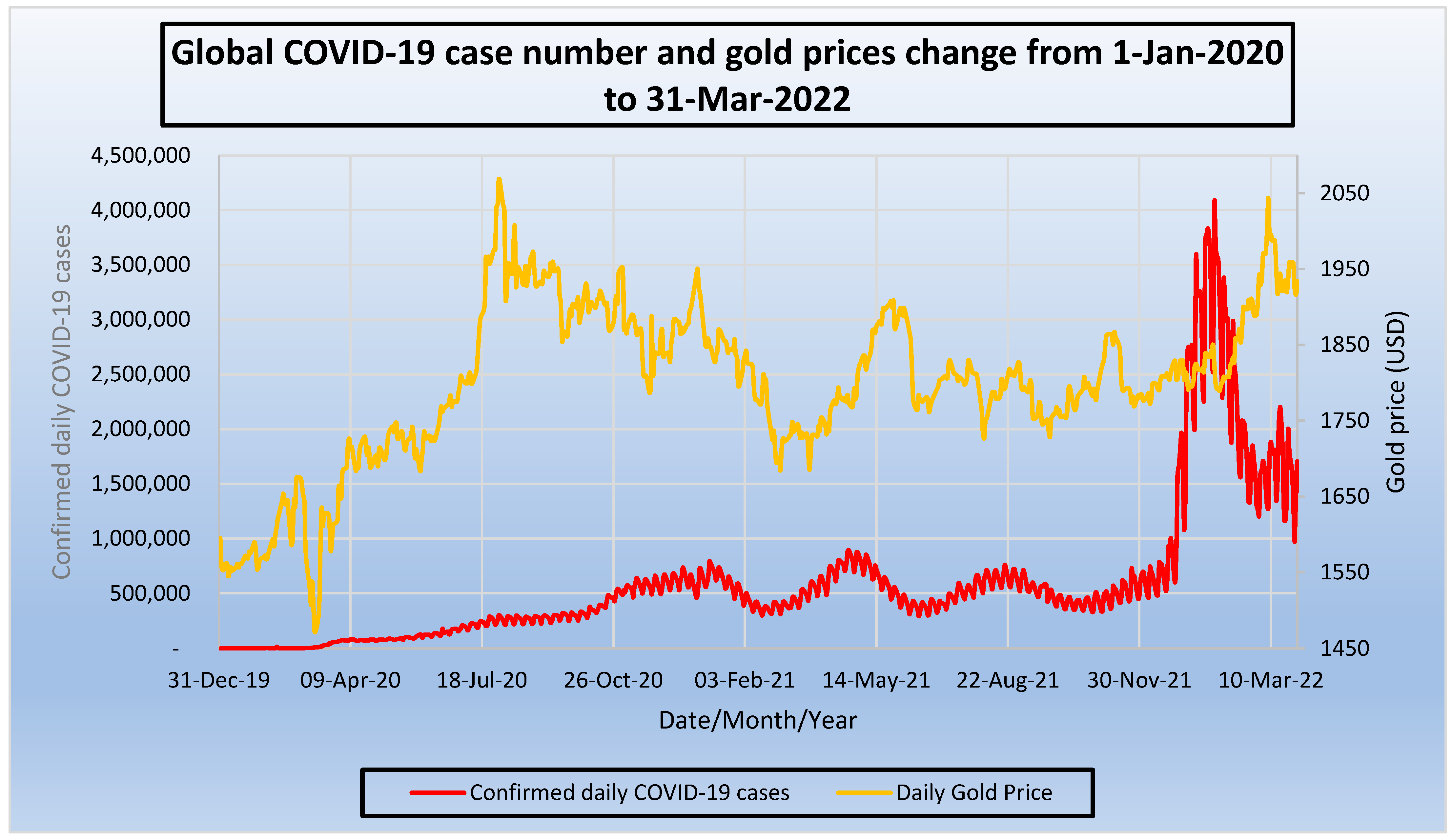

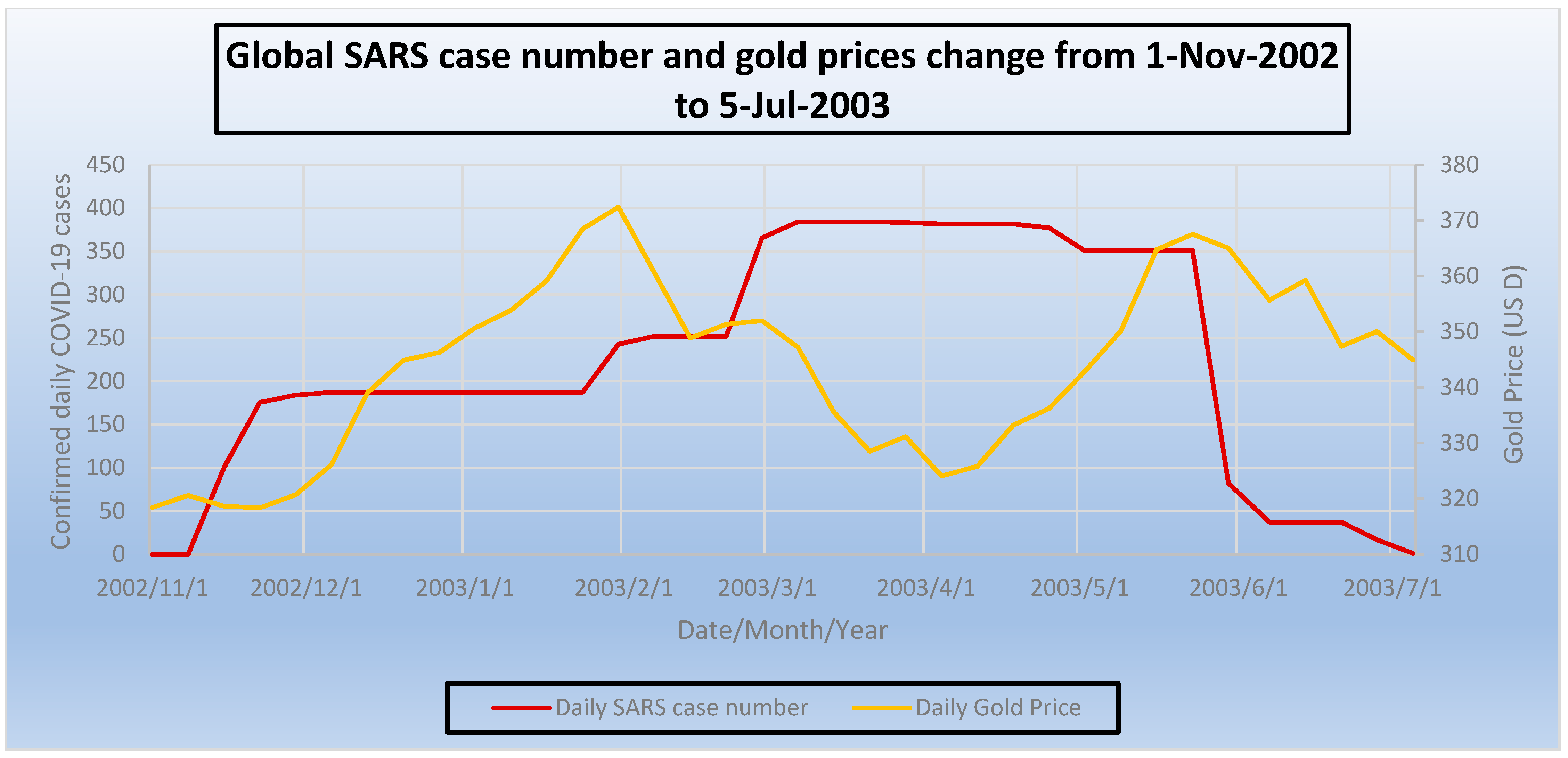

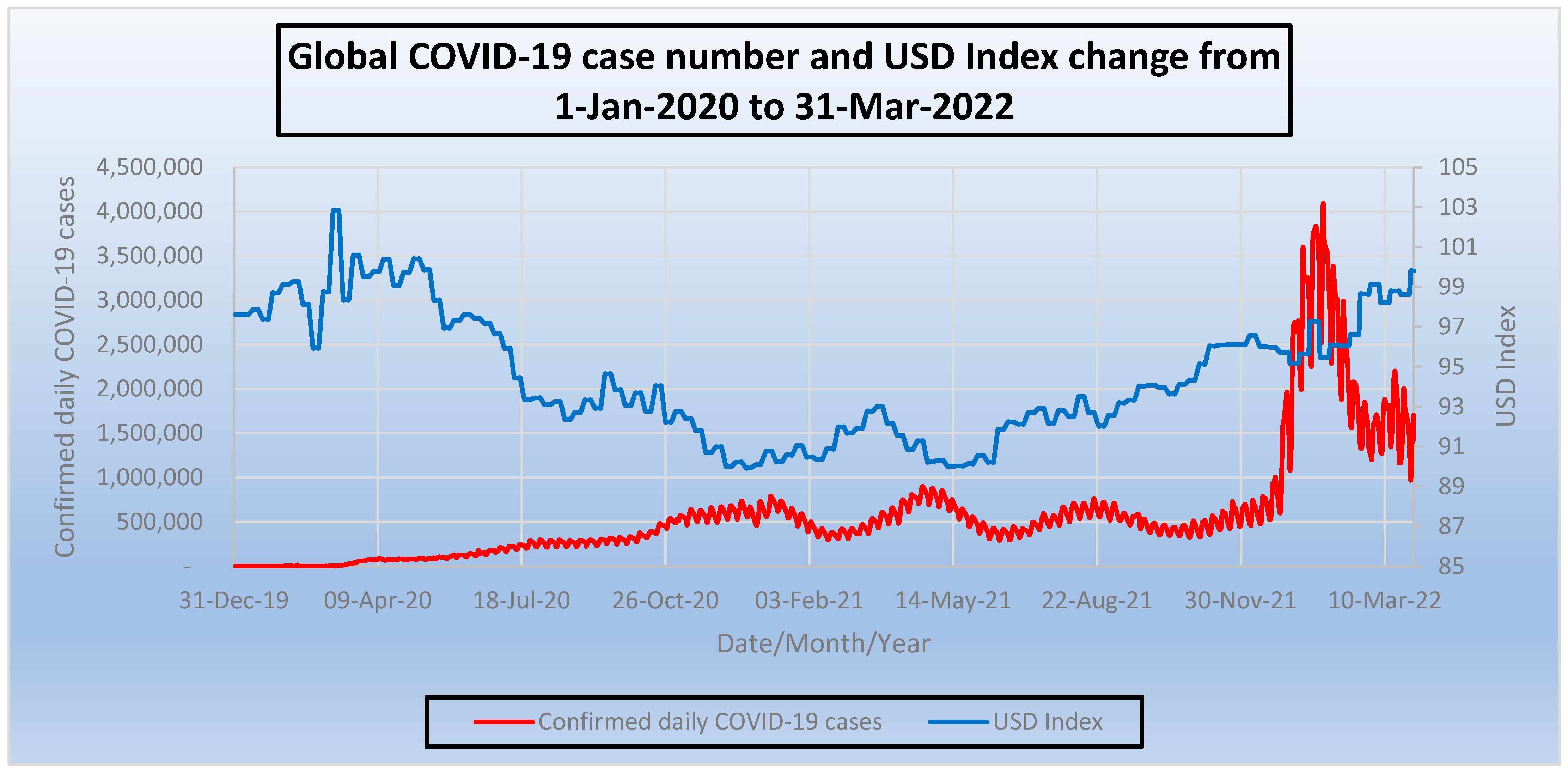

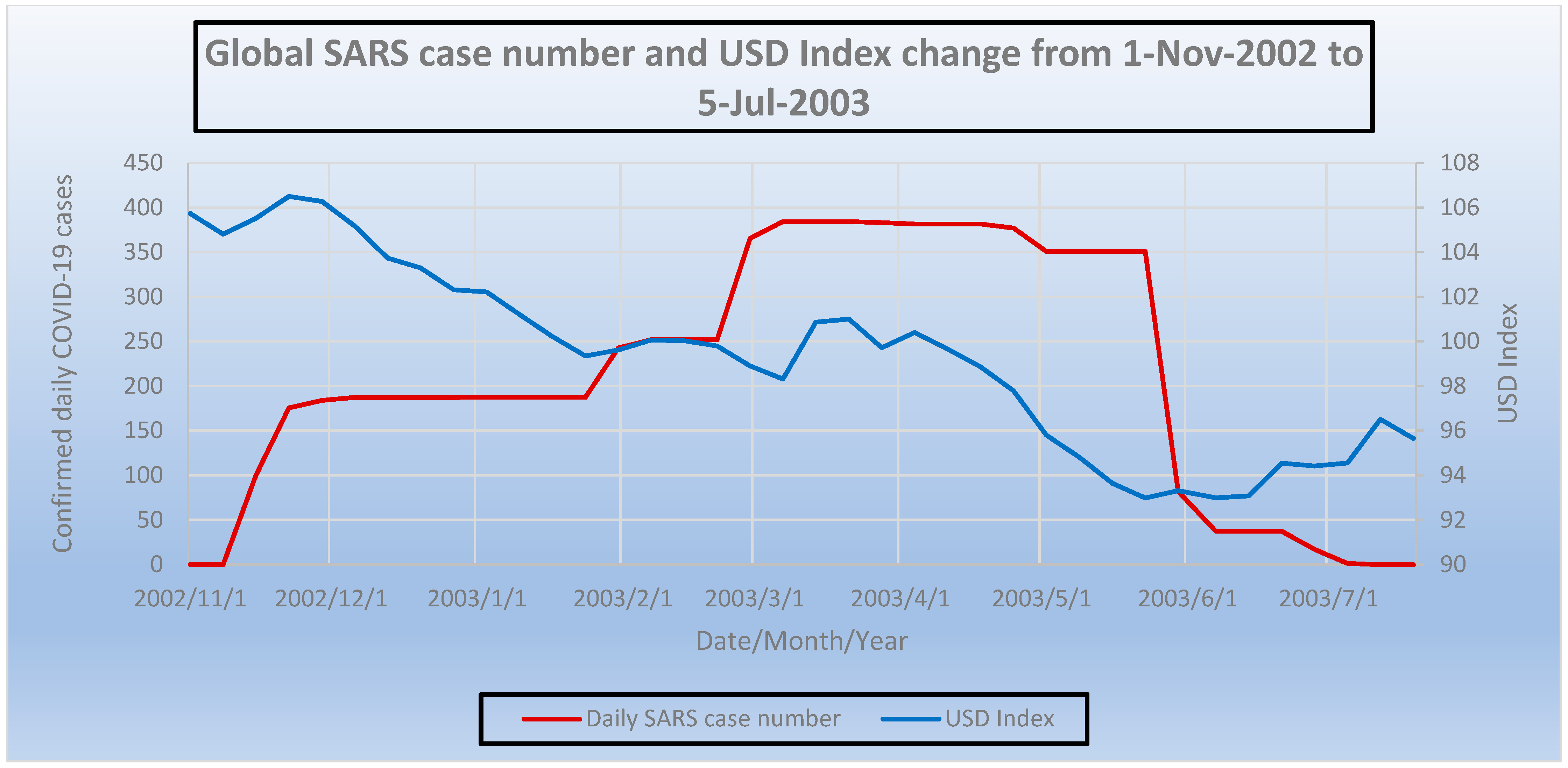

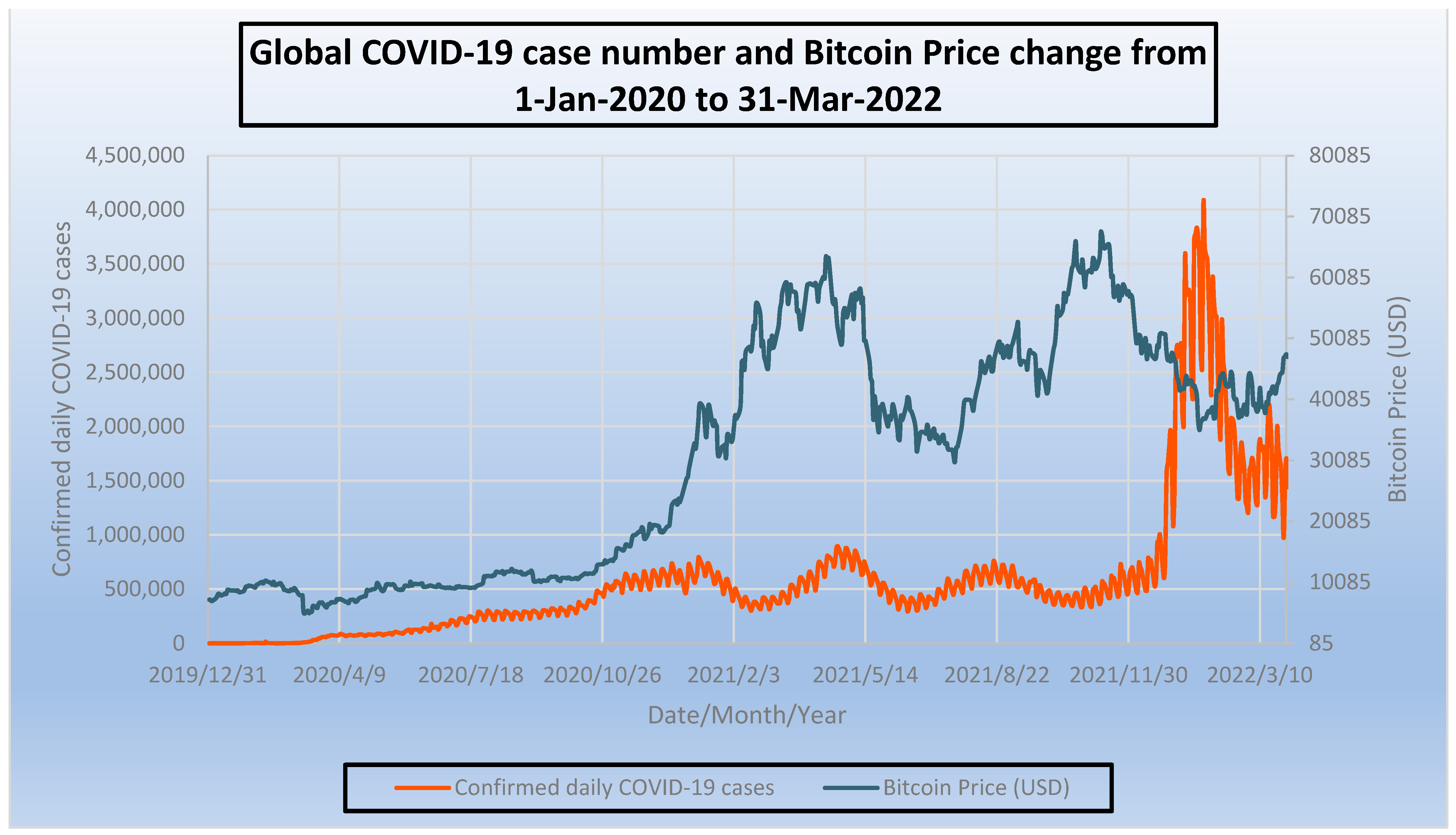

2.2. Trend of Data

2.3. Unit Root Test (Augmented Dickey–Fuller Test)

Results

2.4. Granger Causality Test

Results

- The null hypothesis for Granger causality has not been accepted for COVID-19 cases to gold price (i.e., the Granger causality exists);

- The null hypothesis for Granger causality has not been accepted for COVID-19 cases to USD index (i.e., the Granger causality exists);

- The null hypothesis for Granger causality has been accepted for COVID-19 cases to bitcoin (i.e., the Granger causality does not exist).

- The null hypothesis for Granger causality has been accepted for SARS cases to gold price (i.e., the Granger causality does not exist);

- The null hypothesis for Granger causality has been accepted for SARS cases to USD index (i.e., the Granger causality does not exist);

- Therefore, there is causality from SARS case numbers to gold price as well as to USD.

2.5. Johansen Co-Integration Test and VECM Parameters for Bivariate Modelling Using Engle—Granger Test

Results

- Co-integration exists between COVID-19 cases and gold price (h = 1) with a beta coefficient of 0.0166.

- Co-integration exists between COVID-19 cases and USD index (h = 1) with a beta coefficient of 1.9004 × 10−7.

- Co-integration exists between COVID-19 cases and bitcoin price (h = 1) with a beta coefficient of 1.9.

- Co-integration exists from SARS cases to gold price (h = 1) and the beta coefficient is −0.0173.

- Co-integration exists from SARS cases to USD index (h = 1) and the beta coefficient is −0.0328.

3. Results Analysis and Findings of the Research

4. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ahmed, Saqib Iqbal, and Julien Ponthus. 2021. Dollar Edges Higher Amid Pandemic Concerns; U.S. Inflation Data Eyed. Reuters. Available online: https://www.reuters.com/business/dollar-steadies-amid-pandemic-concerns-inflation-focus-2021-07-12/ (accessed on 22 December 2022).

- Anamika, Madhumita Chakraborty, and Sowmya Subramaniam. 2021. Does sentiment impact cryptocurrency? Journal of Behavioral Finance 24: 202–18. [Google Scholar] [CrossRef]

- Bajpai, Prableen. 2022. Which Nations Have Been Buying Gold? NASDAQ. Available online: https://www.nasdaq.com/articles/which-nations-have-been-buying-gold (accessed on 21 October 2022).

- Bampinas, Georgios, and Theodore Panagiotidis. 2015. Are gold and silver a hedge against inflation? A two century perspective. International Review of Financial Analysis 41: 267–76. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Brian M. Lucey. 2007. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. The Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Britannica. 2022. Drachma. Available online: https://www.britannica.com/money/drachma (accessed on 15 October 2022).

- Coindesk. 2022. Bitcoin Price. Available online: https://www.coindesk.com/price/bitcoin/ (accessed on 21 October 2022).

- Cryptolist. 2022. Cryptocurrencies with a Fixed Max Supply. Available online: https://cryptoli.st/lists/fixed-supply (accessed on 17 October 2022).

- Das, Debojyoti, Corlise Liesl Le Roux, R. K. Jana, and Anupam Dutta. 2020. Does Bitcoin hedge crude oil implied volatility and structural shocks? A comparison with gold, commodity and the US Dollar. Finance Research Letters 36: 101335. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar] [CrossRef]

- Duggan, W., and B. Curry. 2023. The U.S. Dollar Index. Forbes. Available online: https://www.forbes.com/advisor/investing/dollar-index/ (accessed on 28 October 2022).

- Federal Reserve History. 1971. Nixon Ends Convertibility of U.S. Dollars to Gold and Announces Wage/Price Controls. Federal Reserve History. Available online: https://www.federalreservehistory.org/essays/gold-convertibility-ends (accessed on 21 October 2022).

- Gautam, Roshan, Yoochan Kim, Erkan Topal, and Michael Hitch. 2022. Correlation between COVID-19 cases and gold price fluctuation. International Journal of Mining, Reclamation and Environment 36: 574–86. [Google Scholar] [CrossRef]

- Gherghina, Ştefan Cristian, and Liliana Nicoleta Simionescu. 2023. Exploring the asymmetric effect of COVID-19 pandemic news on the cryptocurrency market: Evidence from nonlinear autoregressive distributed lag approach and frequency domain causality. Financial Innovation 9: 21. [Google Scholar] [CrossRef] [PubMed]

- globaldata.com. 2023. Bitcoin’s Market Capitalization History, Global Data. Available online: https://www.globaldata.com/data-insights/financial-services/bitcoins-market-capitalization-history/ (accessed on 5 February 2023).

- Granger, Clive W. J. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37: 424–38. [Google Scholar] [CrossRef]

- Hall-Smith, Will. 2020. What Are the Top 10 Most Traded Currencies in the World? IG Australia. Available online: https://www.ig.com/au/trading-strategies/what-are-the-top-10-most-traded-currencies-in-the-world-200115 (accessed on 19 October 2022).

- Haque, Md Aminul, Erkan Topal, and Eric Lilford. 2015. Relationship between Gold Price and Australian Dollar-US Dollar Exchange Rate. Mineral Economics Journal 28: 65–78. [Google Scholar] [CrossRef]

- Hong, Yanran, Feng Ma, Lu Wang, and Chao Liang. 2022. How does the COVID-19 outbreak affect the causality between gold and the stock market? New evidence from the extreme Granger causality test. Resources Policy 78: 102859. [Google Scholar] [CrossRef] [PubMed]

- International Monetary Fund (IMF). 2023. Available online: https://data.imf.org/regular.aspx?key=41175 (accessed on 19 October 2022).

- Jackson, James K., Martin A. Weiss, Andres B. Schwarzenberg, Rebecca M. Nelson, Karen M. Sutter, and Michael D. Sutherland. 2021. Global Economic Effects of COVID-19, Congressional Research Service. Available online: https://sgp.fas.org/crs/row/R46270.pdf (accessed on 17 March 2021).

- jcitest MathWorks. 2022. Jcitest, MATLAB Mathworks. Available online: https://au.mathworks.com/help/econ/jcitest.html (accessed on 28 April 2021).

- Johansen, Søren. 1991. Estimation and hypothesis testing of co-integration vectors in Gaussian vector autoregressive models. Journal of Econometrica 59: 1551–80. [Google Scholar] [CrossRef]

- Kim, Yoochan, Apurna Ghosh, Erkan Topal, and Ping Chang. 2022. Relationship of iron ore price with other major commodity prices. Mineral Economics 35: 295–307. [Google Scholar] [CrossRef]

- Kim, Yoochan, Apurna Ghosh, Erkan Topal, and Ping Chang. 2023. Performance of different models in iron ore price prediction during the time of commodity price spike. Resources Policy 80: 103237. [Google Scholar] [CrossRef]

- Kusimba, Chapurukha. 2017. When—And Why—Did People First start Using Money? Theconversation.com. Available online: https://theconversation.com/when-and-why-did-people-first-start-using-money-78887?xid=PS_smithsonian (accessed on 14 November 2022).

- Movsesyan, Marisha. 2022. Most Traded Cryptocurrencies. IFC Markets. Available online: https://www.ifcmarkets.com/en/learn-about-crypto/most-traded-cryptocurrencies (accessed on 20 October 2022).

- Qian, Lingling, Yuexiang Jiang, and Huaigang Long. 2023. Extreme risk spillovers between China and major international stock markets. Modern Finance 1: 30–34. [Google Scholar] [CrossRef]

- Radomski, P. 2023. Will Gold Manage to Break above Its Mid-2022 Top? investing.com. Available online: https://www.investing.com/analysis/will-gold-manage-to-break-above-its-mid2022-top-200634099 (accessed on 27 February 2023).

- Ranjan, Pritosh. 2022. Why Has the Dollar Been so Strong—And Can It Continue? Schoroders Wealth Management. Available online: https://www.schroders.com/en-us/us/wealth-management/insights/why-has-the-dollar-been-so-strong-and-can-it-continue/ (accessed on 20 December 2022).

- Strauss-Kahn, Isabelle. 2019. Central Banks Return to Gold, Gold Hub. Available online: https://www.gold.org/goldhub/research/gold-investor/central-banks-return-to-gold (accessed on 21 October 2022).

- Trichilli, Yousra, and Mouna Boujelbène Abbes. 2022. The impact of COVID-19 on the portfolio optimization. EuroMed Journal of Business 18: 207–28. [Google Scholar] [CrossRef]

- USA Gold. 2023. Daily Gold Price History, USA Gold. Available online: https://www.usagold.com/daily-gold-price-history/ (accessed on 29 March 2022).

- vec model MathWorks. 2022. Estimate VEC Model Parameters. MATLAB Mathworks. Available online: https://au.mathworks.com/help/econ/estimate-vec-model-parameters.html (accessed on 2 February 2021).

- World Health Organization (WHO). 2015. Summary of probable SARS cases with onset of illness from 1 November 2002 to 31 July 2003. Available online: https://www.who.int/publications/m/item/summary-of-probable-sars-cases-with-onset-of-illness-from-1-november-2002-to-31-july-2003 (accessed on 21 October 2022).

- World Health Organization (WHO). 2022. Coronovirus (COVID-19) Dashboard. Available online: https://covid19.who.int (accessed on 1 April 2022).

- Yahoo Finance. 2022. US Dollar/USDX—Index. Available online: https://finance.yahoo.com/quote/DX-Y.NYB/history/ (accessed on 21 October 2022).

- Yoon, N. H. 1989. Myungdojeon–Wealth of ancient Gojoseon. Weolgan Samtur 20: 111–15. [Google Scholar]

- Zhu, Xuehong, Zibo Niu, Hongwei Zhang, Jiaxin Huang, and Xuguang Zuo. 2022. Can gold and bitcoin hedge against the COVID-19 related news sentiment risk? New evidence from a NARDL approach. Resources Policy 79: 103098. [Google Scholar] [CrossRef] [PubMed]

| Currency | Weight Ratio from USD Index | World Currency Trade (%) * | Calculation for Actual % of Different Currency Trade Excluding USD | Over- or Under- Representation (+/−) in USD Index |

|---|---|---|---|---|

| US Dollars (USD) | N/A | 44.15% | N/A | N/A |

| Euro | 57.6% | 16.14% | 28.7% | |

| Japanese Yen | 13.6% | 8.4% | −1.44% | |

| Pound Sterling | 11.9% | 6.4% | 0.44% | |

| Australian Dollars (AUD) | ~0% | 3.38% | −6.05% | |

| Canadian Dollar | 9.1% | 2.52% | 4.59% | |

| Swedish Krona | 4.2% | 1.11% | 2.21% | |

| Swiss Franc | 3.6% | 4.44% | −0.84% | |

| Chinese Renminbi | ~0% | 2.16% | −3.87% | |

| Hong Kong Dollar | ~0% | 1.77% | −3.17% |

| COVID-19 Case Numbers | Gold Price (USD) | |||

|---|---|---|---|---|

| Lag (Days) | p Value | Decision | p Value | Decision |

| 0 | 0.1975 | Non-stationary | 0.7715 | Non-stationary |

| 1 | 0.1720 | Non-stationary | 0.8025 | Non-stationary |

| 2 | 0.6608 | Non-stationary | 0.8040 | Non-stationary |

| 3 | 0.9757 | Non-stationary | 0.8003 | Non-stationary |

| 4 | 0.9973 | Non-stationary | 0.8247 | Non-stationary |

| 5 | 0.9353 | Non-stationary | 0.8409 | Non-stationary |

| 6 | 0.8734 | Non-stationary | 0.8304 | Non-stationary |

| SARS Case Numbers | USD Index | Bitcoin Price (USD) | ||||

|---|---|---|---|---|---|---|

| Lag (Days) | p Value | Decision | p Value | Decision | p Value | Decision |

| 0 | 0.1975 | Non-stationary | 0.7715 | Non-stationary | 0.4314 | Non-stationary |

| 1 | 0.1720 | Non-stationary | 0.8025 | Non-stationary | 0.4433 | Non-stationary |

| 2 | 0.6608 | Non-stationary | 0.8040 | Non-stationary | 0.4419 | Non-stationary |

| 3 | 0.9757 | Non-stationary | 0.8003 | Non-stationary | 0.4347 | Non-stationary |

| 4 | 0.9973 | Non-stationary | 0.8247 | Non-stationary | 0.4193 | Non-stationary |

| 5 | 0.9353 | Non-stationary | 0.8409 | Non-stationary | 0.4137 | Non-stationary |

| 6 | 0.8734 | Non-stationary | 0.8304 | Non-stationary | 0.4026 | Non-stationary |

| COVID-19 → Gold | COVID-19 → USD Index | COVID-19 → Bitcoin | |

|---|---|---|---|

| Outcome | h = 1 | h = 1 | h = 0 |

| p value | 0.027 | 1.2095 × 10−10 | 0.801 |

| For SARS → GOLD | For SARS → USD | |

|---|---|---|

| Outcome | h = 1 | h = 1 |

| p value | 0.0252 | 0.007 |

| COVID-19 → Gold | COVID-19 → USD Index | COVID-19 → Bitcoin | |

|---|---|---|---|

| Outcome | h = 1 | h = 1 | h = 1 |

| p value | 0.031 | 0.0292 | 0.001 |

| Beta | [1, −0.0166] | [1, −1.9004 × 10−7] | [1, −1.9] |

| SARS → Gold Price | SARS → USD | |

|---|---|---|

| Outcome | h = 1 | h = 1 |

| p value | 0.023 | 0.035 |

| Beta | [1, −0.0173] | [1, −0.0328] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, Y.; Topal, E.; Ghosh, A.K.; Asad, M.W.A. Investor Behavior in Gold, US Dollars and Cryptocurrency during Global Pandemics. Economies 2024, 12, 64. https://doi.org/10.3390/economies12030064

Kim Y, Topal E, Ghosh AK, Asad MWA. Investor Behavior in Gold, US Dollars and Cryptocurrency during Global Pandemics. Economies. 2024; 12(3):64. https://doi.org/10.3390/economies12030064

Chicago/Turabian StyleKim, Yoochan, Erkan Topal, Apurna Kumar Ghosh, and Mohammad Waqar Ali Asad. 2024. "Investor Behavior in Gold, US Dollars and Cryptocurrency during Global Pandemics" Economies 12, no. 3: 64. https://doi.org/10.3390/economies12030064

APA StyleKim, Y., Topal, E., Ghosh, A. K., & Asad, M. W. A. (2024). Investor Behavior in Gold, US Dollars and Cryptocurrency during Global Pandemics. Economies, 12(3), 64. https://doi.org/10.3390/economies12030064