1. Introduction

Cultural, linguistic, and geographical proximity has been debated since the 1960s in the gravity model to explain foreign direct investment (FDI). The economics of language (e.g.,

Grin 1994,

2003;

Ginsburgh and Weber 2020) demonstrate that common language has benefits in the bilateral flows. The common language makes reducing transaction and transport costs possible in this context.

The article by

Grin (

2003) surveys the evolution of the economy of language, where the author demonstrates that this impacts microeconomic and macroeconomic issues in a dependency relationship.

As

Leitão (

2017) referred to, the international investment theories (e.g., Uppsala of psychological distance by

Johanson and Vahlne 1990 and transaction costs by

Buckley and Casson 1976,

1992) allow explaining the determinants of FDI by applying the gravity model hypotheses to international business. Furthermore, the empirical studies of

Ly et al. (

2018) and

Duarte and Carvalho (

2018) also state that language contributes to explaining international business. The article by

Ginsburgh and Weber (

2020) adds that language is correlated with cultural identity, international business, and international trade.

The OLI paradigm, where the characteristics and advantages of ownership, location and internalisation are analysed and revisited by

Dunning (

1988), demonstrated that when investors intend to invest in host countries, they should consider the economic, political, and social environment. In this context, the economic, technological, political, legal, ecological, or environmental environment is associated with the language economy and gravity model.

Moreover, the empirical studies use as explanatory variables cultural proximity (language, ex-colonies, or borders), the dimension or economic distance (income per capita or growth of income per capita) and the geographical distance; this aims to explain the relationship between geographical proximity and geographical distance.

As previously mentioned, there are few published studies on the determinants of Portuguese FDI. However, when a meta-analysis is carried out on the subject, it is observed that the relationship between the FDI and the gravity model continues to move the interest of researchers of international business and international economics to different countries or continents (e.g.,

Okara 2023;

Luckstead et al. 2023).

The article by

Luckstead et al. (

2023) develops a theoretical and empirical model for foreign direct investment. The econometric results demonstrate that cultural and geographical distance, borders, former colonies, and trade agreements between European Union member countries are the main explanatory factors of inward FDI. In a complementary perspective,

Okara (

2023) assess the determinants of developing countries using the gravity equation and the political stability relationship, demonstrating that the political environment is an important determinant of FDI.

We introduced the gravity model’s magnitude and role in international business and their effects on determinants of Portuguese FDI. In the next step, we present below the objectives of this research.

Then, this article aims to answer the following questions: To what extent does cultural proximity, measured by the Portuguese language and its former colonies, allow for the increase in Portuguese inward FDI? Does the economic dimension of the Portuguese economy and investor countries positively impact FDI? To what extent does geographical proximity encourage inward FDI?

We used a panel of data from 2005 to 2020 to answer these research questions. We compared the results using the OLS estimator, PPML-Poisson Pseudo-Maximum-Likelihood estimator, and the Panel Quantile Regressions.

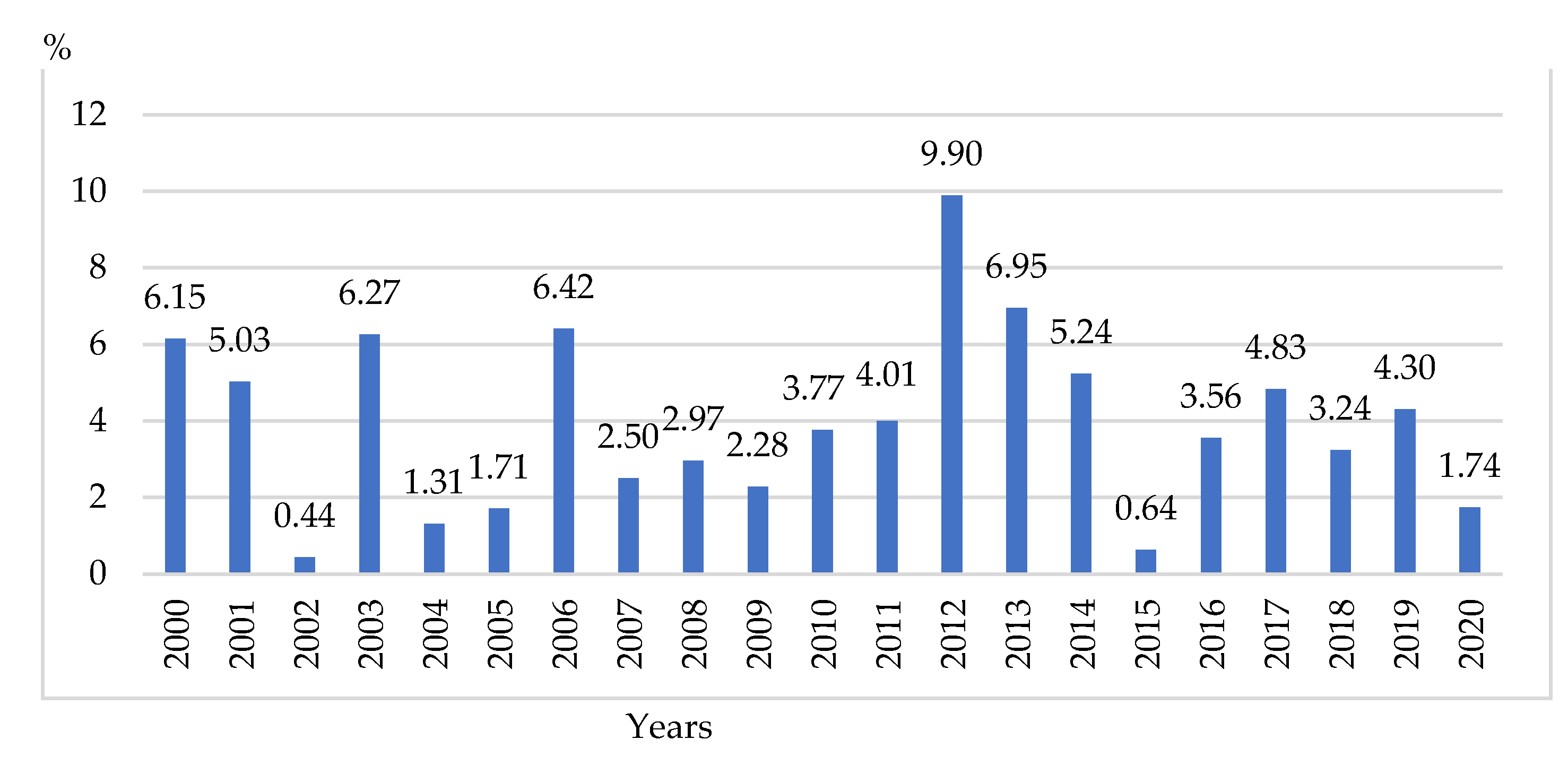

Figure 1 shows the impact of FDI in Portugal in percentage terms on GDP.

Figure 1 shows that FDI had a greater weight on GDP in 2003, 2006, 2012, and 2013, with the highest value recorded in 2012, when net FDI registered 9.90%. However, verifying that the period (2000–2020) does not present a homogeneous distribution. The years 2002 and 2015 are the least relevant regarding the impact of FDI on GDP. In 2002, net FDI registered 0.44% of GDP, and 2005 represented 064%. Between 2004 and 2005, the percentage of FDI on GDP decreased significantly compared with 2003. Checking a new impulse in 2006, FDI recorded 6.42% of GDP.

The article is structured as follows: in

Section 2, we present the literature review, that is, the fundamentals of the gravity model. The methodology and the formulation of hypotheses to be tested in the empirical study appear in

Section 3. The empirical research and interpretation of the econometric model are explained in

Section 4, and finally

Section 5 offers the conclusion and implications for economic policy.

Next, we present a selection of studies on the gravity model and its relationship with the FDI, referring to the main conclusions of the studies applied to the Portuguese economy and evaluating the main theoretical models that validate the gravity model as an explanatory factor of the FDI.

2. Literature Review

In this section, we emphasise the various explanatory factors of foreign direct investment (FDI), namely cultural proximity, geographical distance, and the size of economies, since these are the variables used in our empirical study.

Firstly, we consider the explanatory theories of international investment, emphasising location theory, capital market theory, institutional FDI fitness theory, and the OLI paradigm. Next, we briefly present the gravity model, highlighting its origins and the various developments to show that it is an efficient instrument for explaining international and regional economic phenomena. Finally, a summary of the empirical studies carried out for the Portuguese economy and other countries that used the hypotheses of the gravity model is presented.

The location theories (

Hood and Young 1979), transaction, and internalisation costs (

Buckley and Casson 1976,

1992) highlight location factors such as the economic dimension, the tax burden, macroeconomic stability, and the political and economic social environment as agents of inward FDI. In a more detailed analysis and based on the reference of

Pitelis (

2016), it is possible to state that the theory of market imperfections, where

Hymer (

1960) stands out, demonstrated that the motivations of companies by FDI are not necessarily associated with capital movements and differences in interest rates between countries. Thus, the location theory can be explained by microeconomic and macroeconomic aspects.

Hood and Young’s (

1979) location theory is based on the importance of input costs, country resources, the economic dimension and government policies of the countries where one intends to invest. In addition,

Vernon’s (

1966) theory of the product cycle explains the relationship between FDI and firm behaviour based on Coase’s view of the firm (

Coase 1937). Following the imperfections of markets, it is possible to highlight

Aliber (

1970), which became known in the literature as capital market theory. In general terms, we can conclude that this theory demonstrates that host countries with lower interest rates have a greater capacity to attract FDI since multinational firms have a more remarkable ability to finance themselves, and on the other hand, production costs are lower compared with home economies with appreciated currency.

Investor expectations are driven by the ability of host countries to attract FDI. In this context,

Wilhelms and Witter (

1998) developed an institutional FDI fitness theory based on a pyramid of characteristics where the government and its actions stand out at a higher level, followed by the market, education, and socio-cultural factors. According to

Wilhelms and Witter (

1998), social and cultural factors are the most complex because they can only sometimes respond to FDI intentions. The government and market components are essential to implementing institutional FDI fitness’s economic and financial factors.

Another FDI theory referenced in the literature is the model or paradigm of ownership advantages, localisation advantages, and internalisation advantages (OLI) proposed by

Dunning (

1988). As

Dunning and Lundan (

2008) analysed, the OLI model summarises the main FDI theories: organisational, location, transaction costs, or internalisation. As

Dunning and Lundan (

2008) and

Dunning (

1988) demonstrate, the OLI paradigm assesses the influence of multinationalisation advantages on countries, industries, and firms. Thus, in summary, the ownership advantages (O) and location (L) refer to imperfect competition, where oligopoly prevails. The internalisation advantages (I) are associated with the company’s organisation. However, with globalisation in the 1980s, new investment strategies emerged, such as joint ventures and strategic alliances. In this context,

Mucchielli (

1991) argues that the OLI model does not explain new international investments; this new current was referred to in the literature as synthetic theory. Then,

Dunning (

1993) reformulated the OLI model, known in the literature as the OLI Paradigm revisited. Thus, according to

Dunning (

1993, p. 271), ownership, location, and internalisation advantages are associated with the economic environment, economic system, and economic policies (ESP) paradigm.

Then, we look at the gravity model and its various applications to international economics. As

Venables (

2019) and

Capoani (

2023) demonstrate, over the last few decades, economists have sought to validate the arguments of the gravity model since, in its original form, it was criticised for not presenting a robust theoretical body and the econometric models showed problems of endogeneity and multicollinearity (

Santos Silva and Tenreyro 2006;

Paniagua et al. 2015). As

Venables (

2019) and

Capoani (

2023) referred to, the main contributions to the validation of the gravity model appear with the model of

Krugman (

1979,

1995),

Fujita et al. (

2001), and

Fujita and Krugman (

2004) with the introduction of characteristics of monopolistic competition and transport costs and New Economic Geography arguments (

Krugman 1991,

1995;

Fujita et al. 2001; and

Fujita and Krugman 2004).

It is usual in the literature to consider that the gravity model originated from Newton’s laws (e.g.,

Balogh and Leitão 2019;

Venables 2019;

Capoani 2023). The application of Newton’s laws to regional and international economics was introduced by

Isard and Peck (

1954), developing the concept of geographical distance and economic dimension associated with the location theory and the concepts of transport costs and linguistic similarities between economies. In this context,

Tinbergen (

1962),

Pöyhönen (

1963), and

Linnemann (

1966) developed and formalised the assumptions of the gravity model, taking into account international trade. These authors advanced the expected signs for the economic dimension and the geographical distance. Considering the hypotheses of the Heckscher–Ohlin model (revealed comparative advantages),

Anderson (

1979),

Deardorff (

1998), and

Leamer and Levinsohn (

1995) evaluated the gravity model and the theory of comparative advantages associated with different factorial production endowments.

Furthermore, monopolistic competition models (

Krugman 1979;

Fujita et al. 2001;

Fujita and Krugman 2004) demonstrate that the gravity model evaluates the characteristics of countries (home and host), allowing for analysis of transport and transaction costs, these are associated with economies of scale, industrial concentration, and differentiation in product prices. Therefore, a positive association between the economic dimension and investment flows is generally accepted, demonstrating that the economic size is essential for attracting FDI. On the other hand, the closer the investors are, the greater the capacity to increase FDI, which can justify a negative correlation between geographical distance and FDI.

The literature review demonstrates that one type of empirical study uses only the components of the gravity model presented previously applied to the FDI. However, there are also examples of studies that respectively introduce elements of the gravity model and other macroeconomic variables that make it possible to assess macroeconomic stability, such as inflation, wage costs, exchange rates, or even institutional variables, such as democracy or corruption and their impacts on FDI. However, this category of studies is not truly a gravity model since they use other variables beyond the assumptions of the gravity model. Using these variables together with the variables typically used in the gravity model in the same equation or econometric model may create bias in the gravity model and endogeneity in the model.

In this context, it is observed that recent studies by

Okara (

2023),

Luckstead et al. (

2023),

Bi et al. (

2020),

Leitão (

2017), and

Paniagua et al. (

2015) chose to use only the traditional arguments of the gravity model. The article by

Capoani (

2023), which presents an evolutionary critique of the gravity model, also mentions that using per capita income and population variables (

Linnemann 1966) to assess the market size is preferable. The studies by

Leitão (

2017),

Bi et al. (

2020), and

Okara (

2023) apply per capita income to assess the impact of market size on FDI. Regarding questions of geographical distance, linguistic and cultural proximity, and common religion,

Capoani (

2023) suggests using the CEPII database since it weights distances according to population and presents available data for cultural proximity variables such as language, former colonies, and religion in bilateral terms. Due to the importance of the gravity model we highlighted throughout this study, we chose to focus only on the gravity model using the classic variables usually used in the most diverse empirical studies, particularly for the Portuguese economy.

Considering the 2003–2010 period,

Duarte and Carvalho (

2018) assess the impact of distance and its various components (administrative, cultural, demographic, economic, and political) and exchange rates on FDI inflows in Portugal. The equations used through the Generalized Least Squares (GLS) with random effects for the 34 investor countries demonstrate that administrative distance (colonial and religious) and exchange rates have greater explanatory power on FDI inflows. Furthermore, it is observed that economic distance (measured by market size) promotes FDI inflows. In this line, the study by

Duarte and Carvalho (

2019) carried out for FDI inflows from Eurozone and Ibero-American countries from 2003 to 2015 demonstrated that the economic dimension and geographical proximity measured by the border have a more significant impact on the Portuguese FDI.

The effects of origin country, host country risk, geographical distance, firm size, and corruption distance on Portuguese and Spanish ownership multinational enterprises were investigated by

Faria et al. (

2018). The econometric results demonstrated that corruption distance and host country risk are negatively correlated with ownership of multinational enterprises. However, economic dimension and firm size positively impact the ownership of global enterprises.

The empirical study by

Leitão (

2017) applied to the Portuguese economy for the period 1990–2011 using panel data (OLS estimator and Radom effects) demonstrates that the economic dimension (Portuguese GDP and investors’ GDP) has a positive impact on inflows of FDI, showing that the size of the economies is an important explanatory factor for attracting FDI. In addition, the openness of trade, the common language, the border, and cultural proximity are also variables that encourage foreign investors. Geographical distance negatively correlates with FDI, showing that geographical proximity reduces transport costs.

Another interesting contribution is an article by

Júlio et al. (

2013), in which the authors used the OLS estimator, Tobit model, and Poisson Pseudo-Maximum-Likelihood (PPML) estimator. The econometric results showed that border and economic dimension variables positively affect inward FDI. The openness of trade variable encourages Portuguese FDI, and geographical proximity presents an expected negative correlation with FDI.

Considering the determinants of Location and institutional (globalisation and corruption),

Leitão (

2011) evaluated the Portuguese inward FDI. The empirical results revealed that corruption and taxes are negatively correlated with FDI. Furthermore, the economic dimension and macroeconomic stability, measured by inflation, exhibited that Portugal presented conditions to attract FDI inflows.

Based on location theories, the study by

Leitão and Faustino (

2010) seeks to assess the location determinants of the Portuguese FDI from 1995 to 2007. The econometric results with fixed effects and the GMM-System estimator demonstrate that the Portuguese economy’s economic dimension and degree of openness promote the attraction of FDI. The authors also find a negative association between wage costs and the tax burden on the Portuguese FDI, which makes the FDI attractive.

Testing the relationship between FDI and gravity equation using panel quantile regression was evaluated by

Paniagua et al. (

2015). The authors try to use an alternative methodology to the OLS estimator since this can bias the results since the FDI databases sometimes find negative values or zeros. Several authors have debated this problem in the literature, especially

Santos Silva and Tenreyro (

2006). Thus, using the panel quantile regressions (at 10%, 25%, 50%, 75%, 90%, and 99%) and establishing a comparison with the OLS estimator, it is verified the geographical distance, the colonies, the common language, and the border find mostly the signs advanced by the hypotheses of the gravity model. The study demonstrates that the economic dimension is essential to attract FDI.

The study of

Mateus et al. (

2016) used the PPML estimator, demonstrating that economic size, international trade, and freedom (investment freedom and corruption freedom) positively impact inward FDI. Moreover, the variable of labour cost is positively correlated with inward FDI. According to

Mateus et al. (

2016), this result shows that high production levels need higher wages. Finally, the empirical study also found a negative impact of geographical distance on FDI, reflecting a decrease in transaction costs. Following the same line,

Ly et al. (

2018) used a gravity model with a PPML estimator, and the authors found that similar language and cultural proximity are essential to explain the determinants of inward FDI. Again, this study showed that income per capita of origin and destination (economic dimension) is crucial to understanding inward FDI’s regressions.

For the experience of EU member countries from 1991 to 2017, comparing the results using OLS and PPML estimator, the study of

Dorakh (

2020) confirmed that geographical distance aims to decrease the cost of transaction and production. The variable of economic size (home and host income per capita) shows a positive effect on FDI. Therefore, the colony’s and EU members’ proxies showed essential factors to explain the FDI.

The evidence for China and the gravity model was investigated by

Bi et al. (

2020) using panel data (OLS, Tobit, Heckman estimator, and PPML). The econometric results showed that geographical, economic, and cultural distance determine China’s FDI.

The relationship between the tourism sector and FDI in the case of France was researched by

Cró and Martins (

2020) for the period 2000–2017. The empirical results suggest that economic, cultural, and border found support for the gravity model. The study also demonstrated that the variables of taxes and labour costs negatively affect FDI, reflecting excellent conditions to attract FDI in France in this sector.

Kristjánsdóttir and Óskarsdóttir (

2021) considered the determinants of FDI by Iceland and Ireland from European Countries for two different periods: 2000–2007 and 2008–2010. The authors applied the OLS estimator to understand the impact of FDI in these countries’ earlier and later European crises in 2008. In the case of Ireland, only European Member countries (dummy variable) have statistical significance on inward FDI. For Iceland’s experience, economic dimension and cultural distance have an impact and statistical significance on FDI.

The gravity model applied from Taiwan FDI banking to Asian economies was investigated by

Pan et al. (

2022) using OLS, fixed effects, and random effects from 2000 to 2019. The empirical results showed that economic dimension or size, economic freedom, and bilateral trade encourage FDI. Furthermore, geographical distance and control corruption are negatively correlated with FDI. These results reveal that the cost of the transaction decreases, and the control of corruption stimulates the inward.

The empirical study of

Ono and Sekiyama (

2022) confirmed that foreign direct investment is a dynamic process; the lagged variable of FDI presents a positive sign in all specifications with the GMM-system estimator. The effects of governance and economic dimension are essential to understanding the FDI, and when the cost of labour decreased, measured by the GINI index, the inward of FDI increased.

Finally, the recent study of

Warren et al. (

2023) considering different methodologies of panel data (OLS, Fixed Effects, Random Effects, Heckman, Probit, Logit, and PPML) confirmed that economic dimension, geographical distance, and standard language are according to the assumptions of the gravity model. The authors also considered the variable of taxes and exchange rates in this study, and the results demonstrated that these variables are significant with FDI.

After presenting the theoretical aspects of the gravity model and its relationship with the FDI determinants, as well as illustrative studies both for the Portuguese economy and other countries, next we present the methodology to apply in the empirical research, focusing on the data and the hypotheses to be tested.

3. Methodology

In this investigation, the gravity model is applied to explain the Portuguese FDI inflows for 2005–2020. The dataset was selected by 30 countries’ investors with different levels of development and considering cultural, linguistic, and geographical affinities. The list of countries used in this research can be found in

Appendix A. Data were collected from the OECD by FDI flows and by partner countries in millions of USD. As mentioned in the literature (

Paniagua et al. 2015;

Mateus et al. 2016;

Ly et al. 2018;

Dorakh 2020;

Bi et al. 2020;

Cró and Martins 2020;

Warren et al. 2023), the data we use for FDI find some negative values or zeros for foreign direct investment flows which do not allow us to use the logarithmic form for these values. In this context, following the recommendations of

Santos Silva and Tenreyro (

2006) and

Paniagua et al. (

2015), we applied the gravity model comparing the econometric results between the OLS estimator, Poisson Pseudo-Maximum-Likelihood (PPML) estimator and the Panel Quantile Regressions. For a more detailed analysis of the Panel Quantile Regression equation components, see, for example,

Paniagua et al. (

2015) and

Leitão et al. (

2022).

Based on the studies by

Leitão and Faustino (

2010),

Leitão (

2011),

Júlio et al. (

2013),

Mateus et al. (

2016),

Cró and Martins (

2020), and

Warren et al. (

2023), we formulate the following equation:

where

FDI is the dependent variable representing Portuguese inward foreign direct investment, all variables are expressed in logarithmic form, except the dummy variable lang (common language). The independent variables are the Portuguese per capita income (

LogY), the per capita income of investors (

LogYK), and the

Lang (Portuguese language, taking the value 1—former Portuguese colonies and the value 0—countries that do not speak Portuguese), the geographical distance between the capitals (

LogGDIST), i.e., between Lisbon and the capitals of the investing countries. The random residual term assumes the expression

µit in Equation (1).

Next, the theoretical hypotheses to be tested in the empirical study are presented, considering the literature review and the arguments of the gravity model:

H1a: The economic dimension of host countries is essential to attract foreign investment.

H1b: The economic dimension of investor countries is essential for investing abroad. On the other hand, investments made abroad make it possible to achieve returns.

The hypotheses were created from the location theories and associated with the FDI organisational theories.

Dunning’s (

1988) OLI model on the advantages of multinationalisation demonstrates that ownership advantages can explain the economic dimension. Also, the theories of

Hood and Young (

1979) and

Vernon (

1966) describe the relationship between economic size and FDI. The studies by

Ly et al. (

2018),

Duarte and Carvalho (

2018), and

Warren et al. (

2023) find a positive effect on the size of economies and the inward FDI. Furthermore, studies by

Leitão (

2017),

Bi et al. (

2020), and

Okara (

2023) also found a positive relationship with statistical significance between income per capita and FDI.

The common language and the cultural and historical aspects make it possible to reduce transaction costs. Studies by

Leitão (

2017),

Cró and Martins (

2020),

Venables (

2019), and

Dorakh (

2020) support the formulated hypothesis. As a rule, studies find a positive correlation between cultural factors and inward FDI.

H3: Geographical distance is negatively correlated with Portuguese FDI.

GDIST: Geographical distance between Lisbon and the investor capitals of the Portuguese economy. Like the previous variable, this one was collected from the CEPII database.

As mentioned, we used the CEPII database for common language and geographical distance variables. As referred to in the literature review, the study by

Capoani (

2023) states that this database is adequate as it considers variables weighted on the population. As described by CEPII, the methodology applied to construct these variables is based on the variable geographical distances in bilateral terms for 225 countries. Furthermore, CEPII provides information on geographical coordinates, common languages, and former colonies.

Table 1 reviews the description of the variables used in the sample, the respective statistical source, and the expected signs.

Having presented the methodology and the econometric strategy to be applied in the empirical study, the results, their reading, and interpretation are shown in the following section.

4. Results

The presentation and discussion of the results of this investigation appear in this section. We started by reading descriptive statistics and unit roots. Subsequently, cointegration tests on panel data, serial correlation and multicollinearity follow. The estimators used are OLS, Poisson Pseudo-Maximum-Likelihood (PPML), and panel quantile regressions.

Descriptive statistics appear in

Table 2. The per capita income variable of investors (

LogYK) and the Portuguese FDI inflows (

LogFDI) show higher maximum values (Max.). The Portuguese economic dimension (

LogY) and that of investors (

LogYK) have the highest averages. Furthermore, it is observed that the Portuguese language (

Lang) varies between zero and one for the minimum (Min.) and maximum (Max.) values since it is a dummy variable.

The correlations between the variables used are described in

Table 3. As can be seen, there is a positive correlation between the Portuguese economic dimension (

LogY) and that of foreign investors (

LogYK) and FDI inflows. Language (ex-Portuguese colonies) and geographical distance (

LogGDIST) negatively correlate with Portuguese FDI inflows. These correlations are according to previous studies (

Okara 2023;

Luckstead et al. 2023;

Ly et al. 2018).

It is not very usual in gravity model studies to present unit root tests since there are variables such as the geographical distance constant over time and the use of dummy variables. However, following the recent study by

Warren et al. (

2023), we applied the unit root test proposed by Im unit root test, Pesaran, and Shin, Y. (

Im et al. 2003) in the FDI and economic dimension variables.

Table 4 tests the unit root for all variables except geographical distance (

LogGDIST) because it presents a constant value for each bilateral relationship, and the Lang variable is a dummy variable. As observed in levels and the first differences, the variables of Portuguese inflows FDI (

LogFDI), Portuguese income per capita (

LogY), and investors’ income per capita (

LogYK) are stationary.

Using the methodology of

Pedroni (

2001) of panel cointegration, it is possible to see in

Table 5 that the variables in studies are cointegrated in the long run.

In

Table 6, we use the multicollinearity test based on the variance inflation factor (VIF) by the variables considered in this research (Portuguese income per capita, investors income per capita, similar language of ex-colonies (

Lang), and geographical distance (

LogGDIST).We can conclude that the variables have no problems of collinearity, considering the argument referred to by

Leitão et al. (

2022), and

Fuinhas et al. (

2021), i.e., the variance inflation factor (VIF) is less to 5.

Considering that the sample uses panel data, one of the appropriate tests to evaluate autocorrelation is the test proposed by

Arellano and Bond (

1991), determined based on the first differences. According to the literature, the test is consistent if no second-order autocorrelation (AR2) problems exist. As seen in

Table 7, the variables used do not present second-order autocorrelation problems (AR2), revealing that the model is consistent.

Table 8 presents the econometric results for the gravity model using the OLS estimator and the PPML (Poisson Pseudo-Maximum-Likelihood) estimator. The variable of the economic dimension of investors (

LogYK) positively impacts FDI, as suggested by the literature and presents statistical significance at 1%, demonstrating that investor countries have a return on investing in Portugal. The studies by

Warren et al. (

2023),

Bi et al. (

2020),

Ly et al. (

2018), and

Mateus et al. (

2016) use the same econometric methods, and the results obtained supported our results. Furthermore, the issue of return to investing countries (

LogYK) associated with the potential market is crucial for investors, supported by the theories of

Wilhelms and Witter (

1998),

Hood and Young (

1979), and

Vernon (

1966).

Regarding the variable common language (

Lang), Portuguese is essential in promoting FDI; this variable is statistically significant at 5% and 10%. This result is in agreement with the Uppsala school (

Johanson and Vahlne 1990), where it is observed that psychological and cultural distance are essential determinants of FDI. The studies of

Leitão (

2017),

Cró and Martins (

2020),

Venables (

2019), and

Dorakh (

2020) support this result. Also, the language economists theories of (

Grin 1994,

2003) and

Ginsburgh and Weber (

2020) demonstrate that common language has benefits in the bilateral flows. Then, common language reduces transaction and transport costs, promoting FDI.

Finally, the geographical distance (

LogGDIST) finds the negative sign advanced by the literature and the variable has statistical significance at 1%. In this context,

Paniagua et al. (

2015),

Mateus et al. (

2016),

Leitão (

2017),

Duarte and Carvalho (

2018), and

Warren et al. (

2023) also support a negative between geographical distance and the inward of FDI, demonstrating that transportation costs tend to decrease with geographical proximity. The empirical studies of

Pan et al. (

2022),

Bi et al. (

2020), and

Dorakh (

2020) also found a negative impact of geographical distance on FDI. This result reflects the idea that geographical proximity promotes inward FDI.

In

Table 9, the Portuguese economic dimension variable, i.e., income per capita (

LogY), is statistically significant for all quantiles except for the 10% quantile. It is observed that from the 25% quantile, the economic dimension has statistical significance at 1%, demonstrating that the Portuguese economy has a specific size to attract FDI.

The economic dimension of investor countries (LogYK) positively impacts Portuguese FDI; the variable is statistically significant at 1% in all quantile regressions. According to the literature and the formulated hypotheses, such results demonstrate that the investor countries present a dimension to expand the business, and, on the other hand, there is a situation of return.

Then, the market size variables converge to the formulated hypothesis. In addition, according to previous studies (

Warren et al. 2023;

Bi et al. 2020;

Ly et al. 2018;

Mateus et al. 2016), we can mention that the size of economies is justified by the objectives of the internationalisation process, where companies seek gains or advantages, and our results validate precisely that. On the other hand, gravity models (

Isard and Peck 1954;

Tinbergen 1962;

Pöyhönen 1963;

Anderson 1979;

Anderson and van Wincoop 2003;

Blonigen et al. 2007) and the models of monopolistic competition (

Krugman 1991,

1995;

Fujita et al. 2001;

Fujita and Krugman 2004) demonstrate the importance of this variable for analysing flows between two countries. Within the framework of investment theories, the OLI model by

Dunning (

1988),

Hood and Young (

1979), and

Vernon (

1966) demonstrate that the size of markets can be an advantage for the process of internationalisation and multinationalisation.

The linguistic proximity (

Lang) and geographical distance (

LogGDIST) variables demonstrate that cultural and linguist affinities promote Portuguese FDI. Regarding geographical distance (

LogGDIST), the negative sign mentioned in the literature is found, and the variable presents statistical significance at 1% throughout the regressions, demonstrating that geographical proximity allows for reducing transport and transaction costs. The results indicate that cultural, linguistic, and geographical proximity explain the inward Portuguese foreign direct investment. As mentioned, the economics of language analysed by

Grin (

1994),

Grin (

2003), and

Ginsburgh and Weber (

2020) demonstrate that common language and geographical proximity reduce transaction and transport costs.

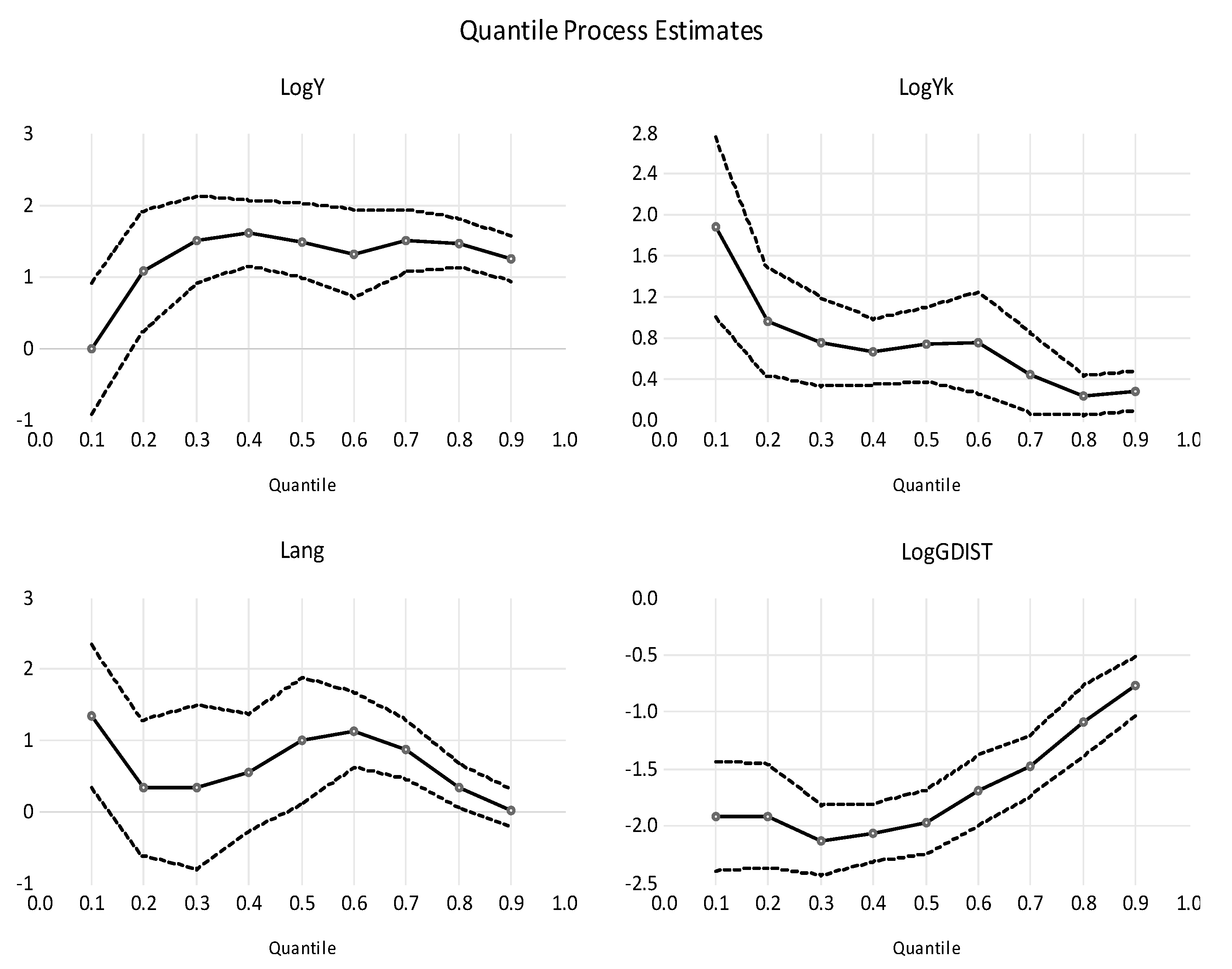

Figure 2 above identifies the results for the quantile panel regressions. The points listed in the figure for each variable are confidence points for determining the regressors.

After presenting this investigation’s results, the conclusions and some implications for economic policy are shown below.