Buy Now Pay Later—A Fad or a Reality? A Perspective on Electronic Commerce

Abstract

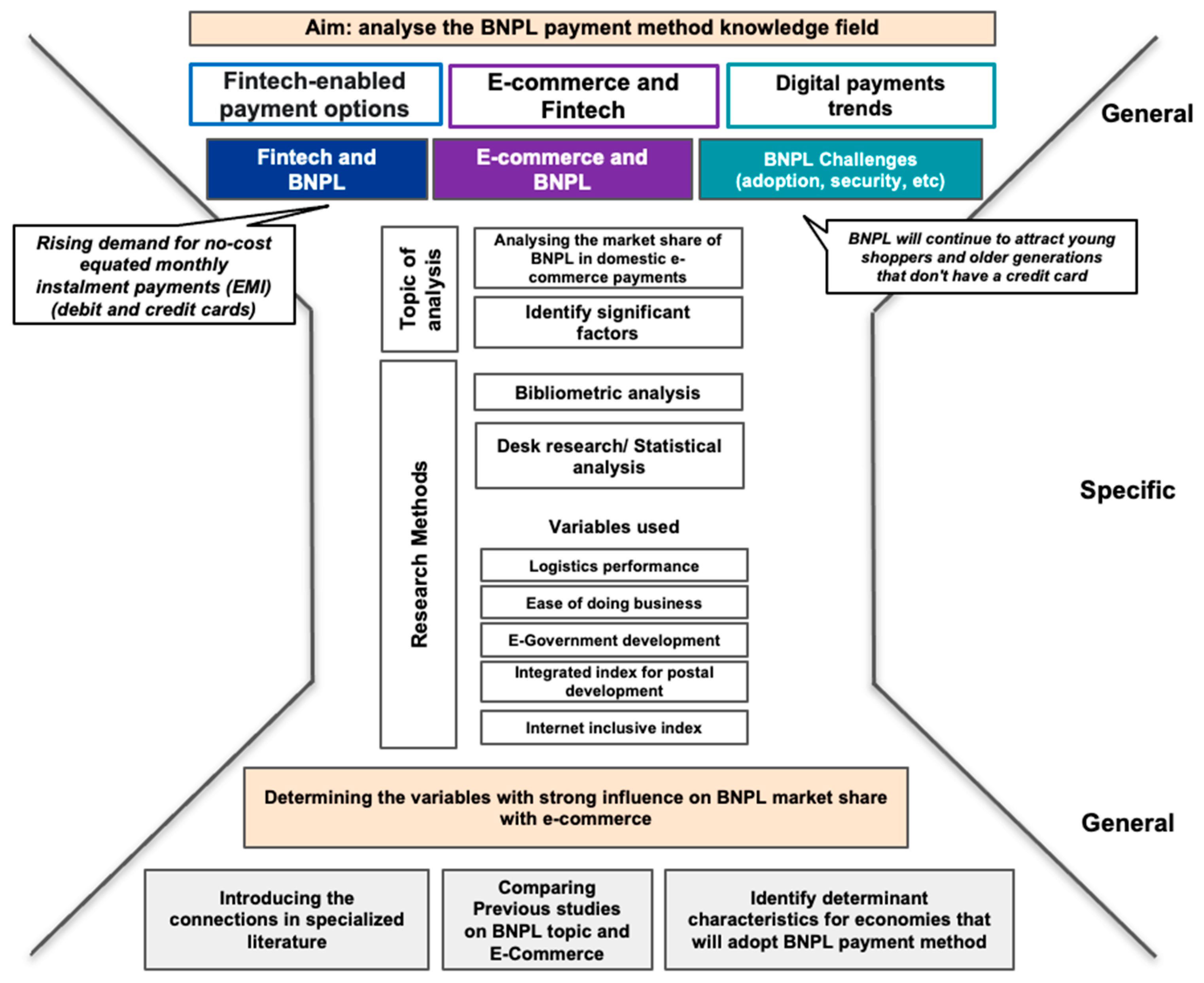

:1. Introduction

2. Literature Review

2.1. E-Commerce and BNPL

- BNPL is embedded in the shopping journey and is promoted across the payment journey right from the product pages, not only at checkout;

- Consumers are starting their shopping journey at BNPL provider apps/websites;

- Leading players have developed strong consumer brands and apps, driving incremental sales through affiliate marketing channels;

- Leading BNPL players aspire to build “super apps” that offer shopping, payments, financing, and banking products in a single platform; BNPL is becoming more available for a wider range of purchases, including everyday purchases;

- Most of BNPL users are younger than 40 years old, but increased demand is noted for all user groups;

- Notably, repayment reminders offered by certain BNPL providers have garnered remarkable support among users;

- The surge in BNPL adoption can be attributed to three essential factors: awareness, accessibility, and affordability;

- Implementing appropriate regulations and employing awareness about behavioural impulses have shown promise in promoting responsible credit management;

- However, it is essential to acknowledge that BNPL products’ lack of understanding and the limited transparency in individuals’ credit profiles may potentially jeopardise their financial wellbeing, with broader implications for the economy overall.

2.2. Millennials, Generation Z and Market Growth

3. Methodology

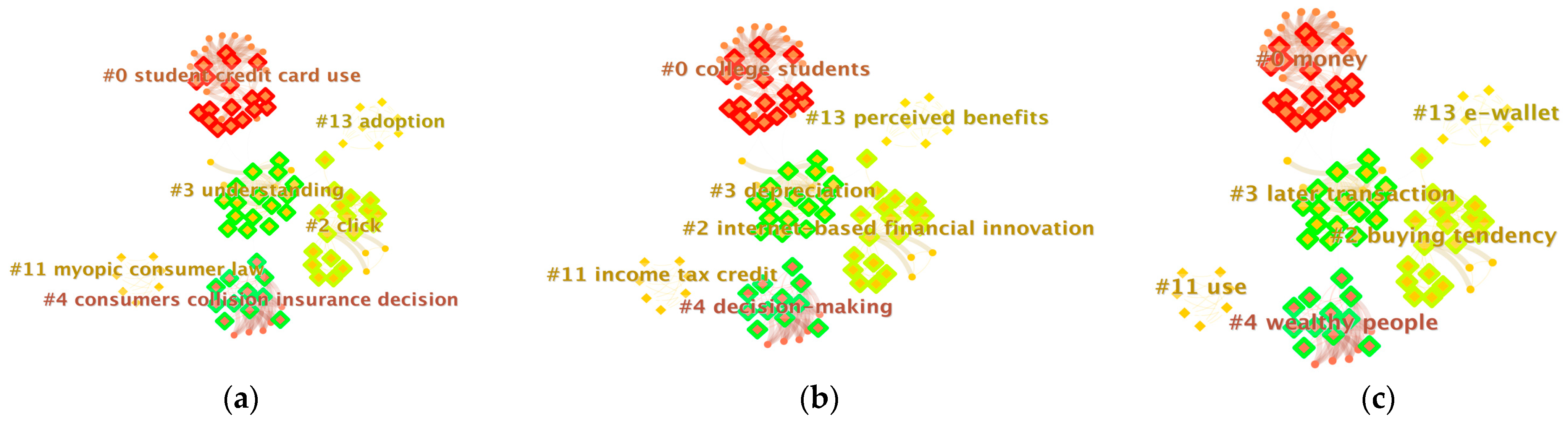

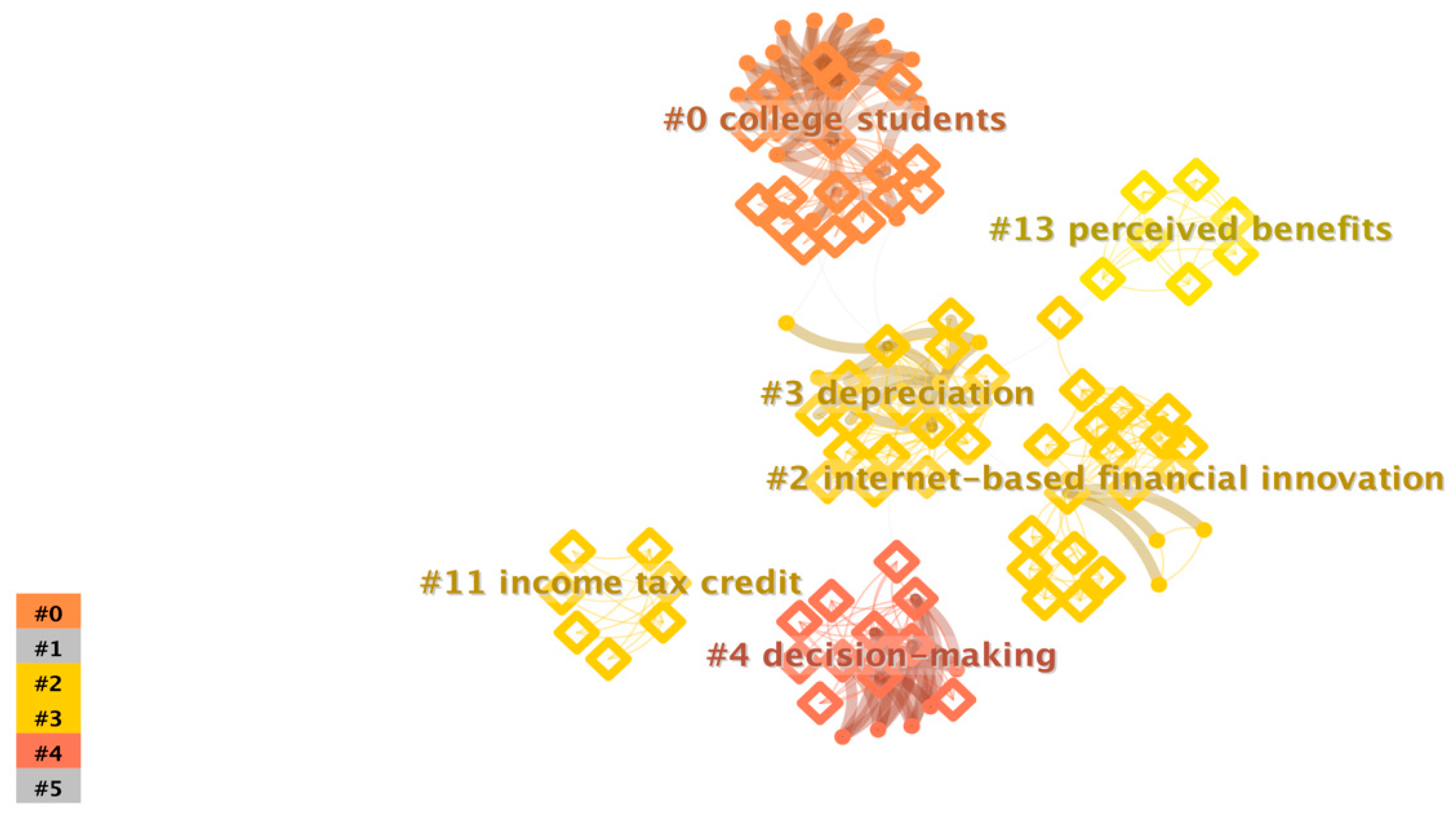

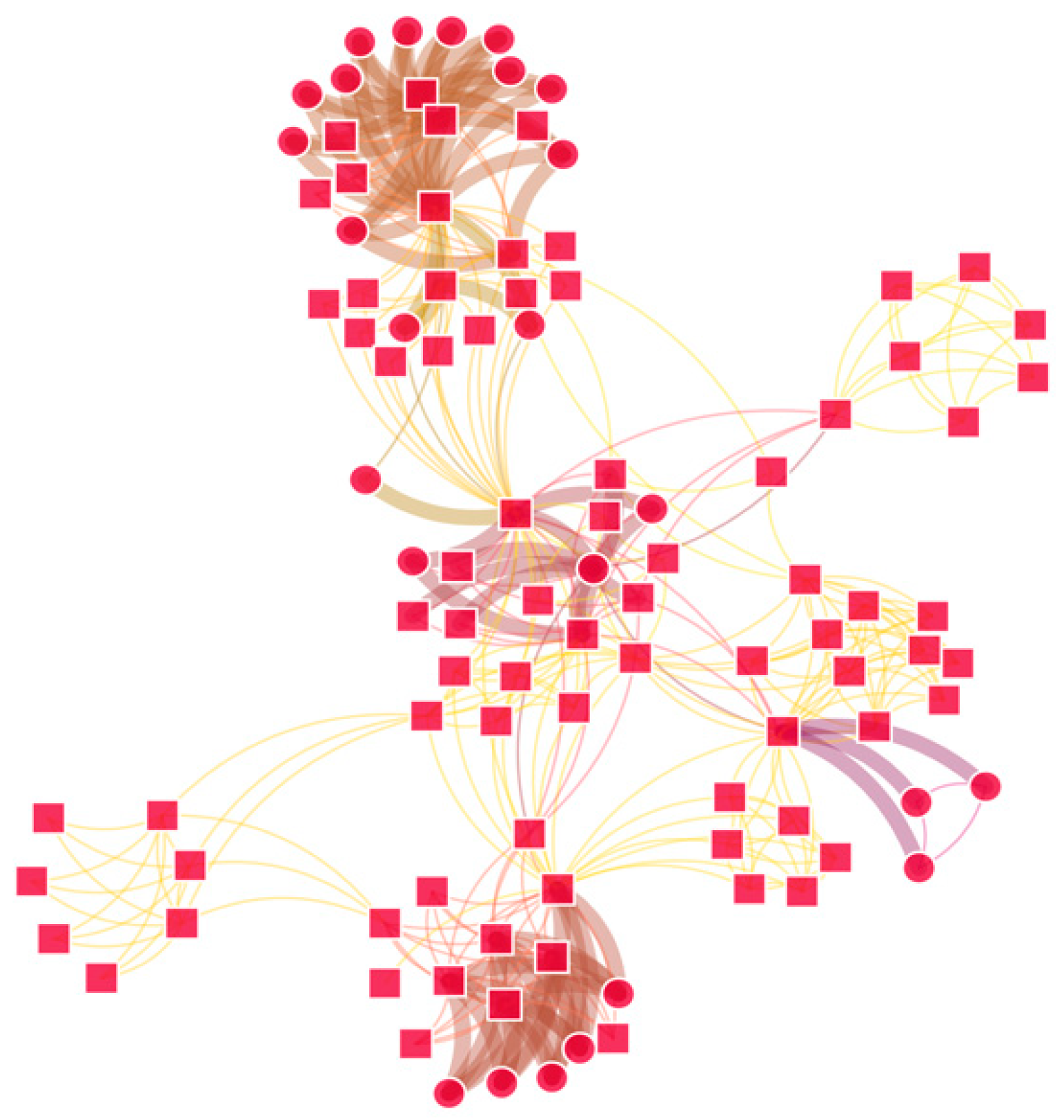

3.1. Bibliometric Analysis

3.2. Empirical Model

- represents the market share of BNPL in domestic e-commerce payments of country ; and

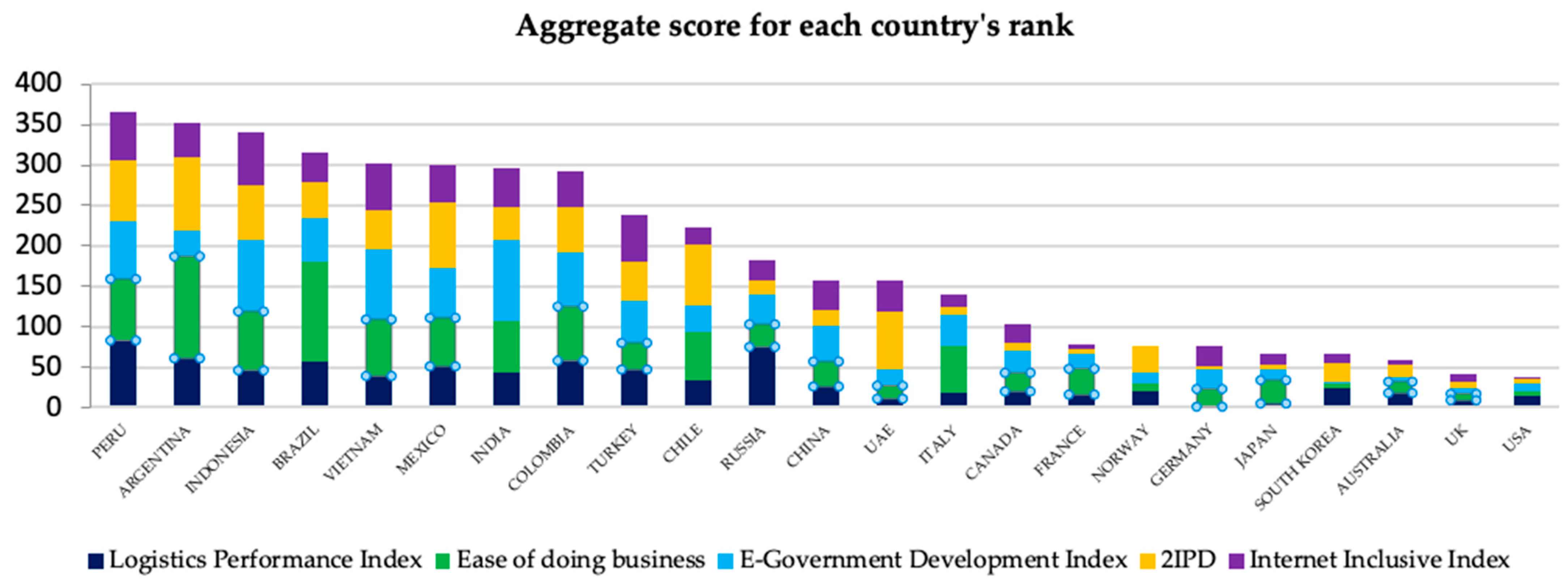

- represents the logistics performance index of country .The connection between market share and logistics performance is highly sustained by the literature, with some recent studies presenting the market share and e-commerce platform development from the perspective of logistics performance (Florido-Benítez 2023; Prajapati et al. 2023; Zhou et al. 2023). These facts led the authors to formulate the first hypothesis of the study, namely (), to identify whether LPI influences MSDEP.

- Ease of doing business (EDB) (The World Bank 2023b) is the indicator published by the World Bank, and it measures business regulations across world economies. The lower that the score is (the rank), the easier that it is to do business in a certain economy. Recent studies (Alaeddine 2023; Costantiello and Leogrande 2023; Gizaw et al. 2023) have used this indicator, and the authors intended to determine whether it might be a significant factor explaining MSDEP, which led to the second hypothesis (). For this purpose, they formulated the equation:where

- represents the market share of BNPL in domestic e-commerce payments of country ; and

- represents the ease of doing business indicator of country ;

- E-Government Development Index (eGD) (United Nation 2023) is a value based on three dimensions, namely an online services index, a telecommunication infrastructure index, and a human capital index. The online service index shows the extent to which the government can provide online communication and support services to citizens. The telecommunication infrastructure index is the score that shows the capacity of a country in terms of ICT infrastructure. Finally, the human capital index represents the inherent human capital. As a methodology, it represents the weighted average of normalised scores of the three previously mentioned variables, and it is calculated as:For this study, the authors used the ranks of the countries involved in the analysis as explanatory variables for MSDEP with simple linear regression:where

- represents the market share of BNPL in domestic e-commerce payments of country ; and

- represents the e-government development index of country ;

- 3.

- UPU’S Integrated Index for Postal Development (2IPD) (Universal Postal Union 2023) is a metric that uses postal big data to highlight postal development around the world. Its rank is given depending on four dimensions: reliability, reach, relevance, and resilience. It is very important for e-commerce development and useful for policy makers, regulators, and operators. Additionally, the scientific world has presented some papers addressing postal development as crucial factor (Kenyon et al. 2005; Mokgohloa et al. 2019). The authors hypothesised that postal development is a significant factor for the market share of BNPL in domestic e-commerce payments ().where

- represents the market share of BNPL in domestic e-commerce payments of country ; and

- represents UPU’s integrated index for postal development of country ;

- 4.

- Internet Inclusive Index (III) (Economist Impact 2022) is a rank created based on scores for four categories: availability, affordability, relevance, and readiness. It was commissioned by Facebook and developed by the Economist Unit, and its aim is to enable outcomes for social and economic development. Hence, the authors used this indicator as an explanatory variable for MSDEP to determine whether the rank of the country for its perspective influences the market share of BNPL in domestic e-commerce payments for that country ().where

- represents the market share of BNPL in domestic e-commerce payments of country ; and

- represents the internet inclusive index of country ;

4. Results

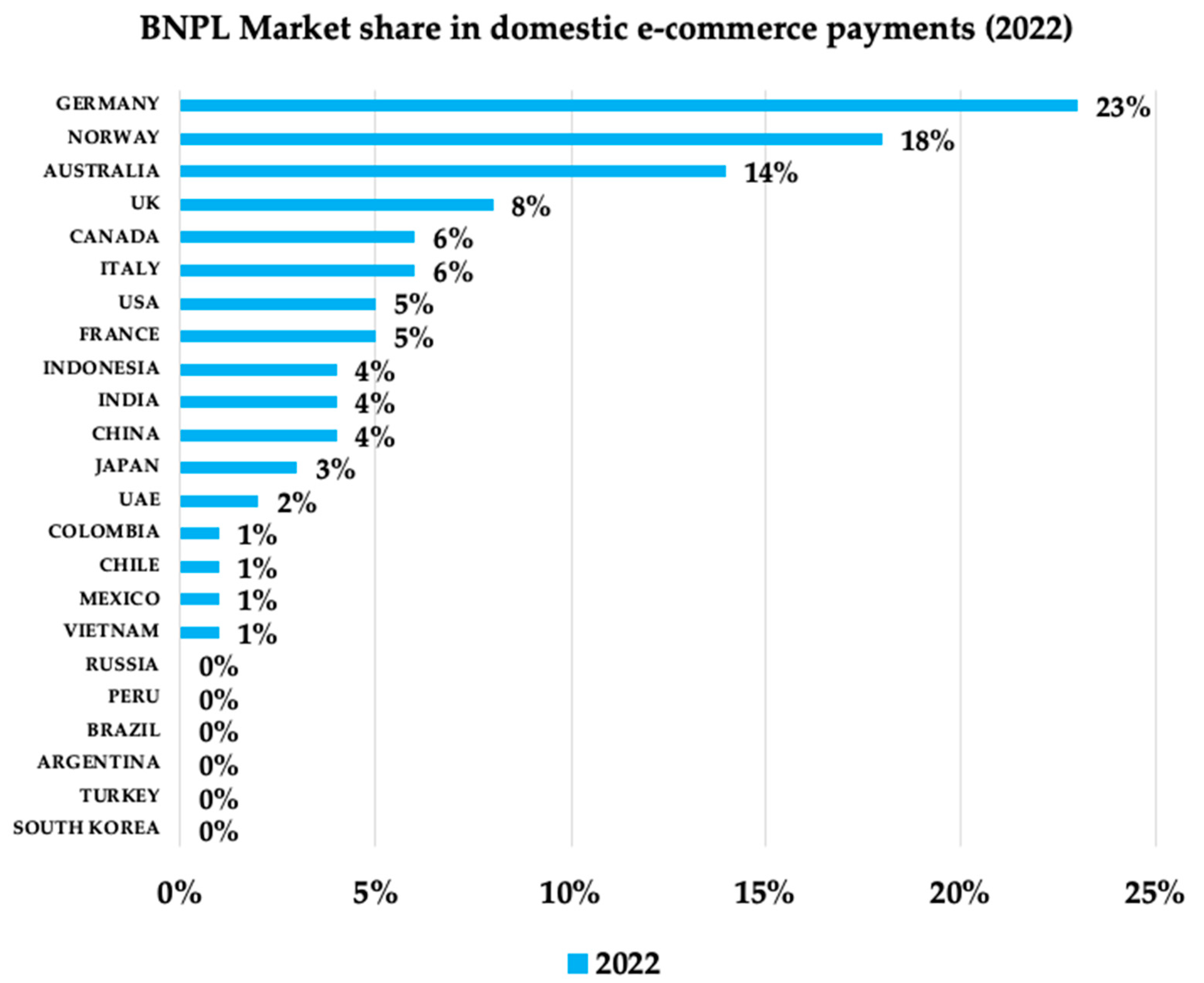

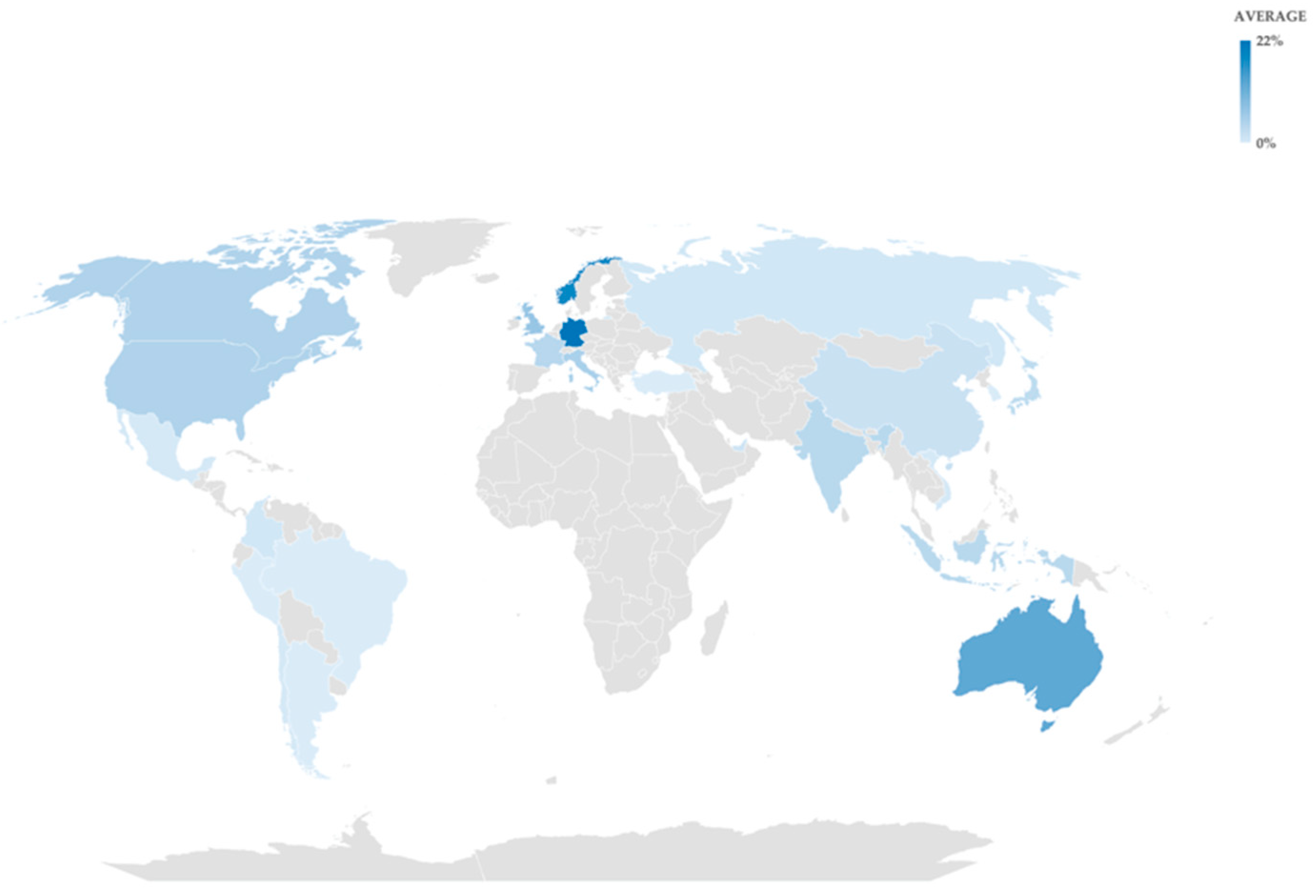

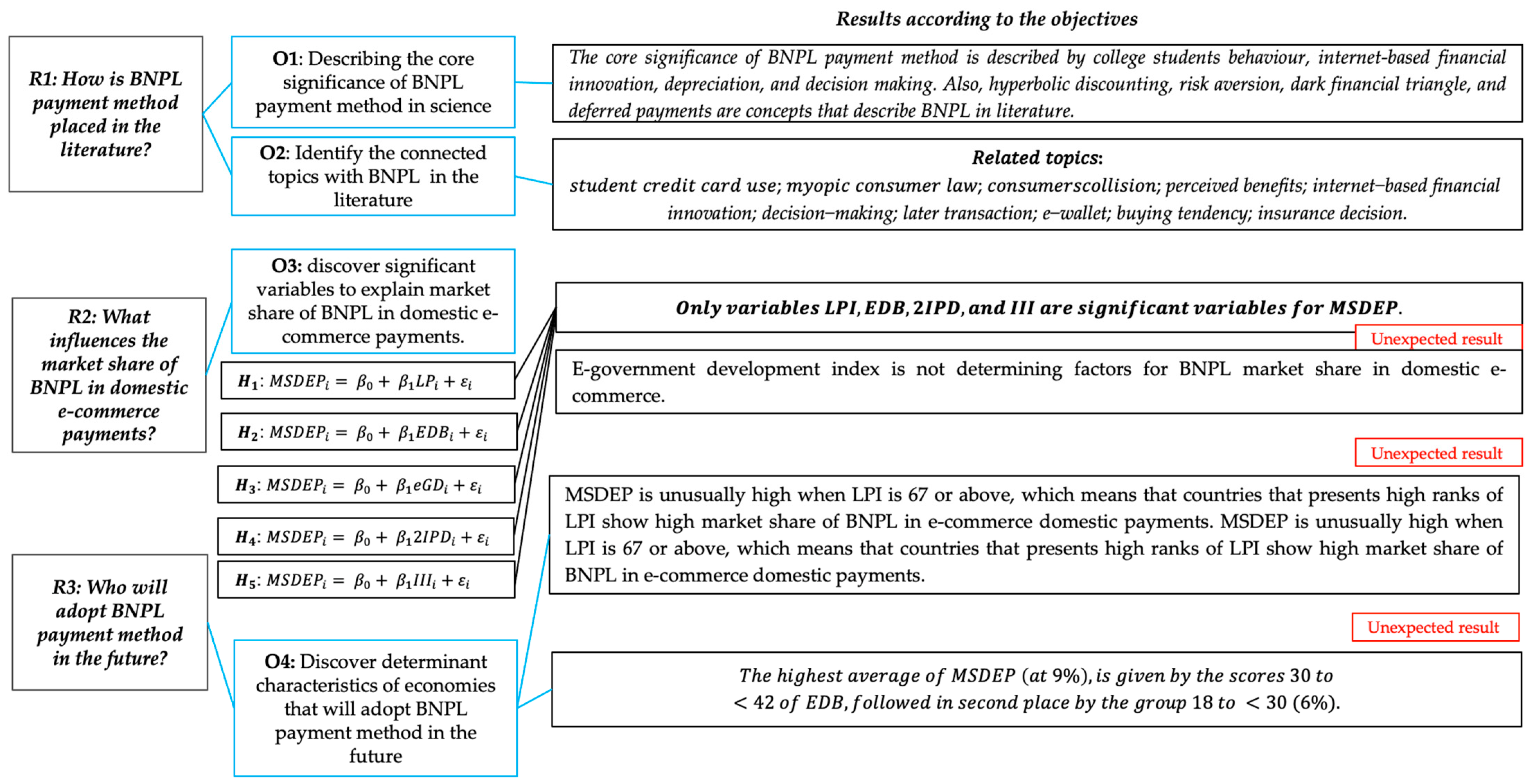

BNPL Descriptive Statistics and Regression Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Dependent Variable | Independent Variables | Multiple R | |||

|---|---|---|---|---|---|

| MSDEP | LPI | 0.088 | −0.001 | 0.549 ** | 0.30 *** |

| EDB | 0.074 | −0.0007 | 0.448 * | 0.2 | |

| eGD | 0.07 | −0.0007 | 0.378 | 0.14 | |

| 2IPD | 0.075 | −0.0009 | 0.464 * | 0.21 | |

| III | 0.08 | −0.001 | 0.387 * | 0.22 |

References

- Aalders, Rachel. 2023. Buy Now, Pay Later: Redefining Indebted Users as Responsible Consumers. Information, Communication & Society 26: 941–56. [Google Scholar] [CrossRef]

- Agarwal, Sumit, and Jian Zhang. 2020. FinTech, Lending and Payment Innovation: A Review. Asia-Pacific Journal of Financial Studies 49: 353–67. [Google Scholar] [CrossRef]

- Aite Novarica. 2021. Buy Now, Pay Later: Market Overview Report. Available online: https://aite-novarica.com/report/buy-now-pay-later-market-overview-report (accessed on 25 March 2023).

- Alaeddine, Hoda. 2023. The Mediating Effect of Ease of Doing Business on the Relationship Between Public Debt and Infrastructure in Arab Countries. BAU Journal—Creative Sustainable Development 4: 10. [Google Scholar] [CrossRef]

- Albritton, Robert. 2019. Buy Now, Pay Later: The Great Unravelling of the Commodity-Form. The Japanese Political Economy 45: 161–83. [Google Scholar] [CrossRef]

- Allen, Liz, Ceri Jones, Kevin Dolby, David Lynn, and Mark Walport. 2009. Looking for Landmarks: The Role of Expert Review and Bibliometric Analysis in Evaluating Scientific Publication Outputs. PLoS ONE 4: e5910. [Google Scholar] [CrossRef] [PubMed]

- Arisandy, Tosi, Yosza Bin Dasril, Shahrul Nizam Bin Salahudin, Much Aziz Muslim, Arisman Adnan, and Goh Khang Wen. 2023. Buy Now Pay Later Services on Generation Z: Exploratory Data Analysis Using Machine Learning. Journal of Theoretical and Applied Information Technology 101: 4194–204. [Google Scholar]

- Backman, Maurie. 2022. Buy Now, Pay Later Services Grow in Popularity. Available online: https://www.fool.com/the-ascent/research/buy-now-pay-later-statistics/#:~:text=56%25%20of%20Americans%20have%20used,in%20less%20than%20a%20year (accessed on 31 March 2023).

- Berg, Tobias, Valentin Burg, Jan Keil, and Manju Puri. 2023. On the Rise of “Buy Now, Pay Later”. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Bian, Wenlong, Lin William Cong, and Yang Ji. 2023. The Rise of E-Wallets and Buy-Now-Pay-Later: Payment Competition, Credit Expansion, and Consumer Behavior. NBER Working Paper Series; Cambridge: National Bureau of Economic Research. [Google Scholar]

- Bolu, Gabriel. 2021. BNPL Is Changing the Way Consumers Shop and Pay. Available online: https://www.w3.org/2021/Talks/20211027_W3C%20BNPL%20Presentation_vF.pdf (accessed on 23 March 2023).

- Borowski, Piotr F., and Barbara Karlikowska. 2023. Clean Hydrogen Is a Challenge for Enterprises in the Era of Low-Emission and Zero-Emission Economy. Energies 16: 1171. [Google Scholar] [CrossRef]

- Chung, Sorim, Thomas Kramer, and Elaine M. Wong. 2018. Do Touch Interface Users Feel More Engaged? The Impact of Input Device Type on Online Shoppers’ Engagement, Affect, and Purchase Decisions. Psychologie & Marketing 35: 795–806. [Google Scholar] [CrossRef]

- CiteSpace. 2003. CiteSpace 2003–2021 Visualizing Patterns and Trends in Scientific Literature. Available online: http://cluster.cis.drexel.edu/~cchen/citespace/ (accessed on 22 June 2023).

- Clemons, Erik K., Josh Wilson, Christian Matt, Thomas Hess, Fei Ren, Fujie Jin, and Noi Sian Koh. 2016. Global Differences in Online Shopping Behavior: Understanding Factors Leading to Trust. Journal of Management Information Systems 33: 1117–48. [Google Scholar] [CrossRef]

- Coffey, Julia, Kate Senior, Adriana Haro, David Farrugia, Steven Threadgold, Julia Cook, Kate Davies, and Berrie Shannon. 2023. Embodying Debt: Youth, Consumer Credit and Its Impacts for Wellbeing. Journal of Youth Studies, 1–21. [Google Scholar] [CrossRef]

- Consumer Banker Association. 2022. CBA COMMENT LETTER ON BNPL RFI. Available online: https://www.consumerbankers.com/cba-issues/comment-letters/cba-comment-letter-bnpl-rfi (accessed on 25 March 2023).

- Costantiello, Alberto, and Angelo Leogrande. 2023. The Ease of Doing Business in the ESG Framework at World Level. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- CUToday. 2021. CUToday Study Suggests The Explosive Growth in Buy Now, Pay Later Is Just Going to Keep Exploding. Available online: https://www.cutoday.info/Fresh-Today/Study-Suggests-The-Explosive-Growth-in-Buy-Now-Pay-Later-is-Just-Going-to-Keep-Exploding (accessed on 31 March 2023).

- Deloitte Digital. 2023. Unlocking the Potential of Buy Now Pay Later. Available online: https://www.deloittedigital.com/content/dam/deloittedigital/us/documents/offerings/offering-20230127-buy-now-pay-later.pdf (accessed on 25 March 2023).

- Dhamija, Pavitra, and Surajit Bag. 2020. Role of Artificial Intelligence in Operations Environment: A Review and Bibliometric Analysis. The TQM Journal 32: 869–96. [Google Scholar] [CrossRef]

- Di Maggio, Marco, Emily Williams, and Justin Katz. 2022. Buy Now, Pay Later Credit: User Characteristics and Effects on Spending Patterns. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Economist Impact. 2022. The Inclusive Internet Index. Available online: https://impact.economist.com/projects/inclusive-internet-index/2022 (accessed on 22 June 2023).

- European Commission. 2023. Digital Finance Package. Available online: https://finance.ec.europa.eu/publications/digital-finance-package_en (accessed on 16 March 2023).

- Florido-Benítez, Lazaro. 2023. The Role of the Top 50 US Cargo Airports and 25 Air Cargo Airlines in the Logistics of E-Commerce Companies. Logistics 7: 8. [Google Scholar] [CrossRef]

- Gañac, Claro G. 2018. Investigating Consumer Optimum Stimulation Level and Exploratory Online Buying Behavior. DLSU Business & Economics Review 28: 67–85. [Google Scholar]

- Gerrans, Paul, Dirk G. Baur, and Shane Lavagna-Slater. 2022. Fintech and Responsibility: Buy-Now-Pay-Later Arrangements. Australian Journal of Management 47: 474–502. [Google Scholar] [CrossRef]

- Gizaw, Getaye, Habtamu Kefelegn, Bewuketu Minwuye, Gizachew Mengesha, and Daregot Berihun. 2023. Impact of Business Regulations on Foreign Direct Investment Inflows and Economic Growth in East African Countries. Cogent Economics & Finance 11: 2163874. [Google Scholar] [CrossRef]

- GlobalData. 2022. ‘Buy Now Pay Later’ Global Transaction Value Reached $120 Billion in 2021, According to GlobalData. Available online: https://www.globaldata.com/media/banking/buy-now-pay-later-global-transaction-value-reached-120-billion-2021-according-globaldata/ (accessed on 25 March 2023).

- Goyal, Tanu M., and Peter J. Morgan. 2023. Benchmarking Adoption of E-Commerce across the G20 Members. ADBI Working Paper No. 1355. Tokyo: Asian Development Bank Institute (ADBI). [Google Scholar]

- Gupta, Prince. 2022. Impact of Regulatory Uncertainty on Ease of Doing Digital Business in India. Available online: https://cuts-ccier.org/pdf/dp-impact_of_regulatory_uncertainty_on_ease_of_doing_digital_business.pdf (accessed on 22 June 2023).

- Guttman-Kenney, Benedict, Chris Firth, and John Gathergood. 2023. Buy Now, Pay Later (BNPL)...on Your Credit Card. Journal of Behavioral and Experimental Finance 37: 100788. [Google Scholar] [CrossRef]

- Hasan, Mona. 2023. The Impact of Financial Technology (Fintech) on the Financial and Banking Services Sector and Its Applications in the Islamic Financial Industry. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Hendershott, Terrence, Xiaoquan (Michael) Zhang, J. Leon Zhao, and Zhiqiang (Eric) Zheng. 2021. FinTech as a Game Changer: Overview of Research Frontiers. Information Systems Research 32: 1–17. [Google Scholar] [CrossRef]

- IBM. 2023. Cognos Analytics for Individuals. Available online: https://www.ibm.com/products/cognos-analytics/individual (accessed on 22 June 2023).

- Imerman, Michael B., and Frank J. Fabozzi. 2020. Cashing in on Innovation: A Taxonomy of FinTech. Journal of Asset Management 21: 167–77. [Google Scholar] [CrossRef]

- Johnson, Di, John Rodwell, and Thomas Hendry. 2021. Analyzing the Impacts of Financial Services Regulation to Make the Case That Buy-Now-Pay-Later Regulation Is Failing. Sustainability 13: 1992. [Google Scholar] [CrossRef]

- Kastratović, Radovan, and Predrag Bjelić. 2022. E-Commerce and Exports in Europe: A Dynamic Panel Data Approach. The International Trade Journal 36: 502–26. [Google Scholar] [CrossRef]

- Kenyon, Sara, Katie Pike, David Jones, David Taylor, Alison Salt, Neil Marlow, and Peter Brocklehurst. 2005. The Effect of a Monetary Incentive on Return of a Postal Health and Development Questionnaire: A Randomised Trial [ISRCTN53994660]. BMC Health Services Research 5: 55. [Google Scholar] [CrossRef] [PubMed]

- Kliber, Agata, Barbara Będowska-Sójka, Aleksandra Rutkowska, and Katarzina Świerczyńska. 2021. Triggers and Obstacles to the Development of the FinTech Sector in Poland. Risks 9: 30. [Google Scholar] [CrossRef]

- Knewtson, Heather S., and Zachary A. Rosenbaum. 2020. Toward Understanding FinTech and Its Industry. Managerial Finance 46: 1043–60. [Google Scholar] [CrossRef]

- Lazarides, Miltos K., Irene Zacharo Lazaridou, and Nikolaos Papanas. 2023. Bibliometric Analysis: Bridging Informatics with Science. The International Journal of Lower Extremity Wounds, 153473462311535. [Google Scholar] [CrossRef]

- Lia, Della Ayu Zonna, and Salsabilla Lu’ay Natswa. 2021. Buy-Now-Pay-Later (BNPL): Generation Z’s Dilemma on Impulsive Buying and Overconsumption Intention. In Proceedings of the BISTIC Business Innovation Sustainability and Technology International Conference (BISTIC 2021). Amsterdam: Atlantis Press. [Google Scholar]

- MacLean, Don, and Ryad Titah. 2022. A Systematic Literature Review of Empirical Research on the Impacts of E-Government: A Public Value Perspective. Public Administration Review 82: 23–38. [Google Scholar] [CrossRef]

- Marketing Evolution. 2019. Trend Analysis: Preparing for Omnichannel Success with Gen Z. Available online: https://www.marketingevolution.com/knowledge-center/trend-analysis-preparing-omnichannel-success-gen-z (accessed on 28 March 2023).

- McKinsey & Company. 2020. Meet Generation Z: Shaping the Future of Shopping. Available online: https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/meet-generation-z-shaping-the-future-of-shopping (accessed on 31 March 2023).

- McKinsey & Company. 2021. Buy Now, Pay Later: Five Business Models to Compete. Available online: https://www.mckinsey.com/industries/financial-services/our-insights/buy-now-pay-later-five-business-models-to-compete (accessed on 31 March 2023).

- Min, Lee Hoei, and Tai Lit Cheng. 2023. Consumers’ Intentıon to Use “Buy Now Pay Later” in Malaysıa. In Proceedings of the CoMBInES—Conference on Management, Business, Innovation, Education and Social Sciences. Kota Batam: Universitas Internasional Batam, pp. 261–78. [Google Scholar]

- Mokgohloa, K., M. G. Kanakana-Katumba, R. W. Maladzhi, and J. A. Trimble. 2019. Postal Development: Literature Review into Adoption Models. Paper presented at the 2019 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Macao, China, December 15–18; pp. 764–68. [Google Scholar]

- Money & Pension Services. 2023. Buy Now Pay Later: A Review of the Market, Risks and Trends, Consumer Understanding, Impact and Outcomes. Available online: https://moneyandpensionsservice.org.uk/2023/06/29/buy-now-pay-later-a-review-of-the-market-risks-and-trends-consumer-understanding-impact-and-outcomes/ (accessed on 25 July 2023).

- Moosa, Imad A. 2022. The Benefits and Costs of Fintech. In Fintech. Cheltenham: Edward Elgar Publishing, pp. 81–104. [Google Scholar]

- Nelaturu, Keerthi, Han Du, and Duc-Phong Le. 2022. A Review of Blockchain in Fintech: Taxonomy, Challenges, and Future Directions. Cryptography 6: 18. [Google Scholar] [CrossRef]

- Ono, Akinori, Azusa Nakamura, Ayako Okuno, and Masayoshi Sumikawa. 2012. Consumer Motivations in Browsing Online Stores with Mobile Devices. International Journal of Electronic Commerce 16: 153–78. [Google Scholar] [CrossRef]

- Oxford Business Group. 2022. Can the “Buy Now, Pay Later” Model Unlock e-Commerce Potential in Emerging Markets? Available online: https://oxfordbusinessgroup.com/articles-interviews/can-the-buy-now-pay-later-model-unlock-e-commerce-potential-in-emerging-markets (accessed on 25 March 2023).

- Park, Daehyeon, and Doojin Ryu. 2023. E-commerce Retail and Reverse Factoring: A Newsvendor Approach. Managerial and Decision Economics 44: 416–23. [Google Scholar] [CrossRef]

- Park, Eun Joo, Eun Young Kim, Venessa Martin Funches, and Wiliam Foxx. 2012. Apparel Product Attributes, Web Browsing, and e-Impulse Buying on Shopping Websites. Journal of Business Research 65: 1583–89. [Google Scholar] [CrossRef]

- Park, Jisook, and Trey Hill. 2018. Exploring the Role of Justification and Cognitive Effort Exertion on Post-Purchase Regret in Online Shopping. Computers in Human Behaviour 83: 235–42. [Google Scholar] [CrossRef]

- Perlin, Dan. 2021. Outlook: Payments, Processing and IT Services. Available online: https://www.rbccm.com/en/insights/tech-and-innovation/episode/2021-outlook-massive-shift-in-e-commerce-spend (accessed on 31 March 2023).

- Prajapati, Dhirendra, Arjun R. Harish, Yash Daultani, Harpreet Singh, and Saurabh Pratap. 2023. A Clustering Based Routing Heuristic for Last-Mile Logistics in Fresh Food E-Commerce. Global Business Review 24: 7–20. [Google Scholar] [CrossRef]

- Pua, Eurice Marie. 2023. Case Study on the Role of Philippine Logistics in E-Commerce and Cross Border Trade. International Journal of Novel Research in Marketing Management and Economic 10: 32–42. [Google Scholar] [CrossRef]

- Rahman, Rashel, Alarifi Abdulrahman Hamad, Rebekah Eden, and Darshana Sedera. 2014. Archival Analysis of Service Desk Research: New Perspectives on Design and Delivery. Paper presented at the 25th Australasian Conference on Information Systems, Auckland, New Zealand, December 8–10. [Google Scholar]

- Relja, Ruffin, Philippa Ward, and Anita L. Zhao. 2023. Understanding the Psychological Determinants of Buy-Now-Pay-Later (BNPL) in the UK: A User Perspective. International Journal of Bank Marketing. ahead-of-print. [Google Scholar] [CrossRef]

- Research and Markets. 2023. Buy Now Pay Later Market Size, Share & Trends Analysis Report by Channel (Online, POS), by Enterprise Size (Large, SME), by End-Use (Consumer Electronics, Fashion & Garment), and Segment Forecasts, 2023–2030. Available online: https://www.researchandmarkets.com/reports/5416019/buy-now-pay-later-market-size-share-and-trends (accessed on 22 June 2023).

- Retailx. 2021. Global 2021 Ecommerce Report. Available online: https://www.asendia.com/resource/global-2021-e-commerce-report (accessed on 22 June 2023).

- Saidu, Mansur Adam, Ladan Shagari Shamsudeen, Auwal Kabir Muhammad, and Abubakar Abdulkadir. 2022. Exploring E-Commerce Opportunities for a Better International Trading and Tax Revenue Generation: A Review for Developing Countries. Journal of Science Technology and Education 10: 109–24. [Google Scholar]

- Saravanan, S., A. Jainullabdeen, and J. Sirajudeen. 2023. Questionnaire Designing for a Survey on Reason for Product Return and Reverse Logistics Performance on Customer Satisfaction in Online Shopping. International Journal of Advances in Engineering and Management (IJAEM) 5: 1537–41. [Google Scholar]

- Soni, Sahil. 2023. Regulating Buy Now, Pay Later: Consumer Financial Protection in the Era of FinTech. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Statista. 2023a. Buy Now, Pay Later (BNPL)—Statistics & Facts. Available online: https://www.statista.com/topics/8107/buy-now-pay-later-bnpl/#topicOverview (accessed on 22 June 2023).

- Statista. 2023b. Market Share of Buy Now, Pay Later (BNPL) in Domestic e-Commerce Payments in 41 Countries and Territories Worldwide from 2016 to 2022. Available online: https://www.statista.com/statistics/1233850/online-bnpl-penetration-country/ (accessed on 22 June 2023).

- Thaichon, Park, Jiraporn Surachartkumtonkun, Sara Quach, Scott Weaven, and Robert W. Palmatier. 2018. Hybrid Sales Structures in the Age of E-Commerce. Journal of Personal Selling & Sales Management 38: 277–302. [Google Scholar] [CrossRef]

- The KEENFOLKS. 2023. The Impact of Technology on Consumer Behaviour. Available online: https://thekeenfolks.com/the-impact-of-technology-on-consumer-behaviour/ (accessed on 31 March 2023).

- The World Bank. 2022. COVID-19 Drives Global Surge in Use of Digital Payments. Available online: https://www.worldbank.org/en/news/press-release/2022/06/29/covid-19-drives-global-surge-in-use-of-digital-payments (accessed on 25 March 2023).

- The World Bank. 2023a. Logistics Performance Index. Available online: https://lpi.worldbank.org/ (accessed on 22 June 2023).

- The World Bank. 2023b. Business Ready (B-READY). Available online: https://www.worldbank.org/en/businessready (accessed on 22 June 2023).

- Theocharis, Stamatios, and George A. Tsihrintzis. 2023. E-Government: The Concept, the Environment and Critical Issues for the Back-Office Systems. In Semantic Knowledge Modelling via Open Linked Ontologies: Ontologies in E-Governance. Cham: Springer International Publishing, pp. 7–49. [Google Scholar]

- Tripathy, Arun Kumar, and Anshul Jain. 2020. FinTech Adoption: Strategy for Customer Retention. Strategic Direction 36: 47–49. [Google Scholar] [CrossRef]

- Trustpilot. 2018. Why an Omni-Channel Experience Is Your Best Christmas Present. Available online: https://uk.business.trustpilot.com/reviews/build-trusted-brand/why-an-omni-channel-experience-is-your-best-christmas-present (accessed on 28 March 2023).

- Trustpilot. 2022. How Brands Can Adapt to Gen Z’s New Shopping Habits. Available online: https://business.trustpilot.com/reviews/browsers-to-buyers/how-brands-can-adapt-to-gen-z-new-shopping-habits (accessed on 31 March 2023).

- United Nation. 2023. E-Government Development Index (EGDI). Available online: https://publicadministration.un.org/egovkb/en-us/About/Overview/-E-Government-Development-Index (accessed on 22 June 2023).

- Universal Postal Union. 2023. Integrated Index for Postal Development (2IPD). Available online: https://www.upu.int/en/Universal-Postal-Union/Activities/Research-Publications/Integrated-Index-for-Postal-Development (accessed on 22 June 2023).

- Vijai, C. 2019. Fintech in India—Opportunities and Challenges. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Vogue Business. 2021. Gen Z Shopping Trends Undercovered. Available online: https://www.voguebusiness.com/consumers/gen-z-shopping-trends-uncovered-pay-pal (accessed on 28 March 2023).

- World Economic Forum. 2017. Deloitte Beyond Fintech: A Pragmatic Assessment of Disruptive Potential in Financial Services. Cologny: World Economic Forum. [Google Scholar]

- Yang, Hu, Yu Zhang, Kedong Chen, and Ji Li. 2023. The Double-Edged Sword of Delivery Guarantee in E-Commerce. Decision Support Systems, 114042. [Google Scholar] [CrossRef]

- Yang, Yuyan. 2023. Research on High-Quality Development Countermeasures of Modern Metropolitan Area. Paper presented at the 2022 4th International Conference on Economic Management and Cultural Industry, Chongqing, China, October 14–16. [Google Scholar]

- Zhou, Haidi, Qiang Wang, Liang Wang, Xiande Zhao, and Gengzhong Feng. 2023. Digitalization and Third-Party Logistics Performance: Exploring the Roles of Customer Collaboration and Government Support. International Journal of Physical Distribution & Logistics Management 53: 467–88. [Google Scholar] [CrossRef]

| Cluster ID | Size | Silhouette Mean | Year | Label (LSI) |

|---|---|---|---|---|

| 0 | 31 | 0.714 | 2014 | Credit card use; college students; hyperbolic discounting; experimental study |

| 2 | 21 | 0.913 | 2016 | Cross-border e-commerce; platform competition; internet-based financial innovation; conversion tools; consumer credit; impulse buying tendencies; conversion tools; consumer credit; cross-border e-commerce; platform competition |

| 3 | 20 | 0.826 | 2013 | Deferred payments; consumer decisions; mental accounting; dark financial triangles; consumer decisions |

| 4 | 16 | 0.881 | 2009 | Risk aversion; mental accounting; dark financial triangles; mental accounting |

| 11 | 7 | 1 | 2020 | Income tax credits; behavioural economics |

| 13 | 7 | 0.967 | 2019 | Adoption of e-wallets; perceived ease of use; perceived usefulness; perceived security; perceived benefits |

| Descriptive Statistics | MSDEP | LPI | EDB | eGD | 2IPD | III |

|---|---|---|---|---|---|---|

| Mean | 0.033 | 33.870 | 44.870 | 39.435 | 37.391 | 31.5 |

| Standard Error | 0.009 | 4.746 | 7.199 | 5.957 | 6.009 | 4.285 |

| Median | 0.018 | 26 | 32 | 34 | 34 | 30.5 |

| Mode | 0 | N/A | N/A | N/A | N/A | 25 |

| Standard Deviation | 0.044 | 22.760 | 34.526 | 28.567 | 28.817 | 20.099 |

| Sample Variance | 0.002 | 518.028 | 1192.028 | 816.075 | 830.431 | 403.976 |

| Kurtosis | 5.514 | −0.581 | 0.563 | −0.570 | −1.267 | −1.258 |

| Skewness | 2.247 | 0.547 | 0.984 | 0.631 | 0.418 | 0.132 |

| Range | 0.180 | 82 | 121 | 98 | 88 | 64 |

| Minimum | 0 | 1 | 5 | 2 | 3 | 2 |

| Maximum | 0.180 | 83 | 126 | 100 | 91 | 66 |

| MSDEP | LPI | EDB | eGD | 2IPD | III | |

|---|---|---|---|---|---|---|

| MSDEP | 1 | |||||

| LPI | −0.549 * | 1 | ||||

| EDB | −0.448 * | 0.659 * | 1 | |||

| eGD | −0.378 | 0.627 * | 0.621 * | 1 | ||

| 2IPD | −0.464 * | 0.64 * | 0.643 * | 0.524 * | 1 | |

| III | −0.387 * | 0.641 * | 0.57 * | 0.859 * | 0.715 * | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lupșa-Tătaru, D.A.; Nichifor, E.; Dovleac, L.; Chițu, I.B.; Todor, R.D.; Brătucu, G. Buy Now Pay Later—A Fad or a Reality? A Perspective on Electronic Commerce. Economies 2023, 11, 218. https://doi.org/10.3390/economies11080218

Lupșa-Tătaru DA, Nichifor E, Dovleac L, Chițu IB, Todor RD, Brătucu G. Buy Now Pay Later—A Fad or a Reality? A Perspective on Electronic Commerce. Economies. 2023; 11(8):218. https://doi.org/10.3390/economies11080218

Chicago/Turabian StyleLupșa-Tătaru, Dana Adriana, Eliza Nichifor, Lavinia Dovleac, Ioana Bianca Chițu, Raluca Dania Todor, and Gabriel Brătucu. 2023. "Buy Now Pay Later—A Fad or a Reality? A Perspective on Electronic Commerce" Economies 11, no. 8: 218. https://doi.org/10.3390/economies11080218

APA StyleLupșa-Tătaru, D. A., Nichifor, E., Dovleac, L., Chițu, I. B., Todor, R. D., & Brătucu, G. (2023). Buy Now Pay Later—A Fad or a Reality? A Perspective on Electronic Commerce. Economies, 11(8), 218. https://doi.org/10.3390/economies11080218