FinTech Adoption in SMEs and Bank Credit Supplies: A Study on Manufacturing SMEs

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Foundation

2.2. Hypothesis Development

3. Research Methodology

3.1. Research Population and Sampling

3.2. Data Collection Process

4. Data Analysis

4.1. Pretest

4.2. Pilot Testing

4.3. Reliability and Convergent Validity

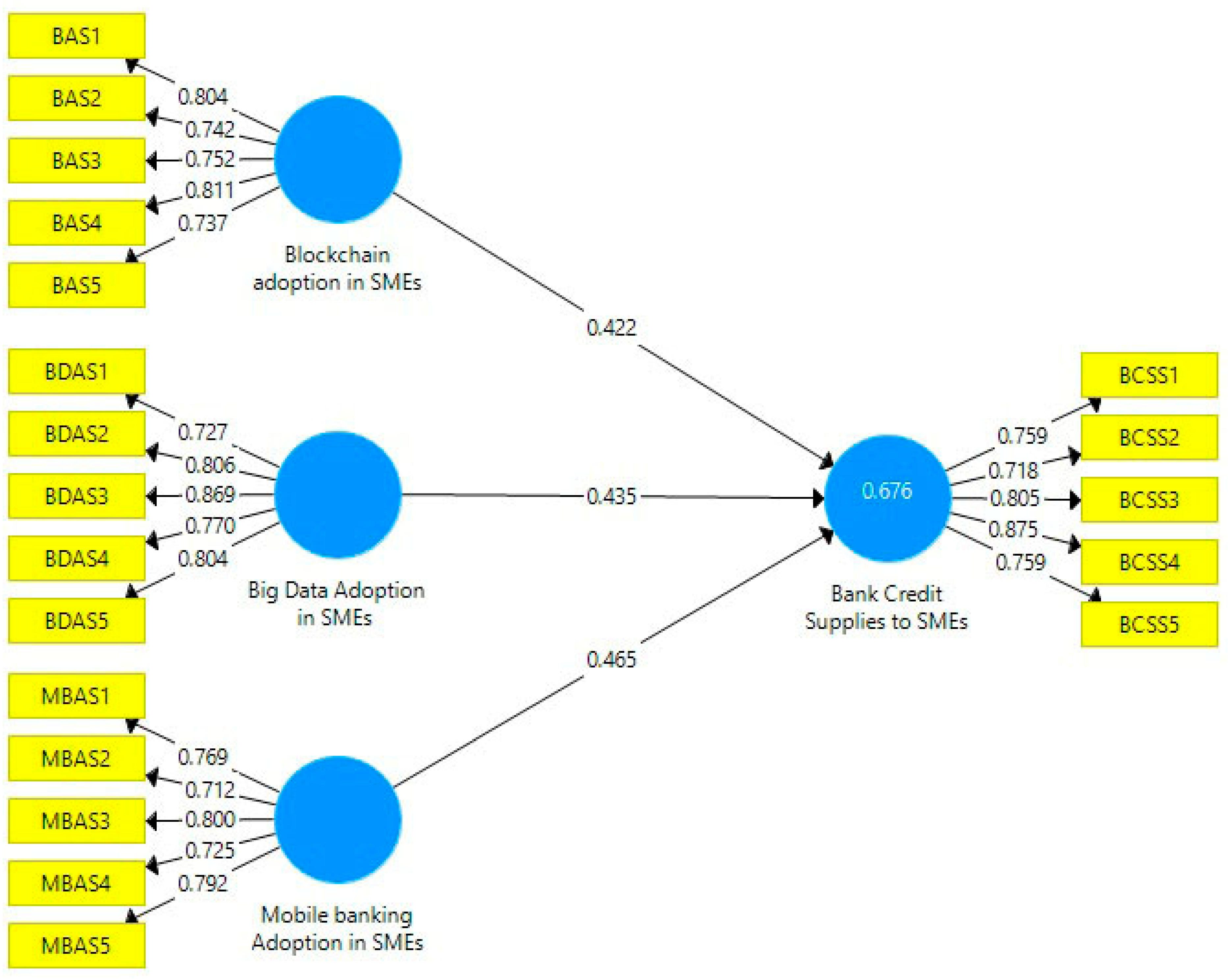

4.4. Discriminant Validity

4.5. Measurement and Structural Model

4.6. Hypotheses Testing

4.7. Discussion of Results

5. Conclusions

Implications

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agarwal, Sumit, and Robert Hauswald. 2010. Distance and private information in lending. The Review of Financial Studies 23: 2757–88. [Google Scholar] [CrossRef]

- Al Tarawneh, Mo’men Awad, Thi Phuong Lan Nguyen, David Gun Fie Yong, and Magiswary A/P Dorasamy. 2023. Determinant of M-Banking Usage and Adoption among Millennials. Sustainability 15: 8216. [Google Scholar] [CrossRef]

- Awan, Usama, Saqib Shamim, Zaheer Khan, Najam Ul Zia, Syed Muhammad Shariq, and Muhammad Naveed Khan. 2021. Big data analytics capability and decision-making: The role of data-driven insight on circular economy performance. Technological Forecasting and Social Change 168: 120766. [Google Scholar] [CrossRef]

- Basile, Luigi Jesus, Nunzia Carbonara, Roberta Pellegrino, and Umberto Panniello. 2023. Business intelligence in the healthcare industry: The utilization of a data-driven approach to support clinical decision making. Technovation 120: 102482. [Google Scholar] [CrossRef]

- Berg, Tobias, Manju Puri, and Jörg Rocholl. 2019. Loan Officer Incentives, Internal Rating Models, and Default Rates. European Finance Review 24: 529–78. [Google Scholar] [CrossRef]

- Bertrand, Jérémie, and Paul-Olivier Klein. 2021. Creditor information registries and relationship lending. International Review of Law and Economics 65: 105966. [Google Scholar] [CrossRef]

- Chen, Gengxuan, Qinmin Jia, and Hao Ling. 2023. Rethinking the Rise of Global Central Bank Digital Currencies: A Policy Perspective. Contemporary Social Sciences 2023: 1. [Google Scholar]

- Cornelli, Giulio, Jon Frost, Leonardo Gambacorta, Raghavendra Rau, Robert Wardrop, and Tania Ziegler. 2021. Fintech and big tech credit: What explains the rise of digital lending? CESifo Forum 22: 30–34. [Google Scholar]

- Emeana, Ezinne M., Liz Trenchard, and Katharina Dehnen-Schmutz. 2020. The Revolution of Mobile Phone-Enabled Services for Agricultural Development (m-Agri Services) in Africa: The Challenges for Sustainability. Sustainability 12: 485. [Google Scholar] [CrossRef]

- Fanta, Ashenafi Beyene. 2016. Complementarity between Relationship Lending and Collateral in SME Access to Bank Credit: Evidence from Ethiopia. Journal of African Business 17: 308–18. [Google Scholar] [CrossRef]

- Filomeni, Stefano, Gregory F. Udell, and Alberto Zazzaro. 2021. Hardening soft information: Does organizational distance matter? The European Journal of Finance 27: 897–927. [Google Scholar] [CrossRef]

- Flögel, Franz, and Marius Beckamp. 2020. Will FinTech make regional banks superfluous for small firm finance? Observations from soft information-based lending in Germany. Economic Notes 49: 12159. [Google Scholar] [CrossRef]

- Garg, Poonam, Bhumika Gupta, Ajay Kumar Chauhan, Uthayasankar Sivarajah, Shivam Gupta, and Sachin Modgil. 2021. Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technological Forecasting and Social Change 163: 120407. [Google Scholar] [CrossRef]

- Hair, Joseph F., Rolph E. Anderson, Roland L. Tatham, and W.C. Black. 1998. Multivariate Data Analysis. Englewood Cliff: Prentice Hall. [Google Scholar]

- Hendershott, Terrence, Xiaoquan (Michael) Zhang, J. Leon Zhao, and Zhiqiang (Eric) Zheng. 2021. FinTech as a game changer: Overview of research frontiers. Information Systems Research 32: 1–17. [Google Scholar] [CrossRef]

- Kumar Bhardwaj, Amit, Arunesh Garg, and Yuvraj Gajpal. 2021. Determinants of Blockchain Technology Adoption in Supply Chains by Small and Medium Enterprises (SMEs) in India. Mathematical Problems in Engineering 2021: 1–14. [Google Scholar] [CrossRef]

- Li, Chunling, Nosherwan Khaliq, Leslie Chinove, Usama Khaliq, Mirzat Ullah, Zoltán Lakner, and József Popp. 2023. Perceived transaction cost and its antecedents associated with fintech users’ intention: Evidence from Pakistan. Heliyon 9: e15140. [Google Scholar] [CrossRef] [PubMed]

- Liberti, Jose M., and Atif R. Mian. 2008. Estimating the Effect of Hierarchies on Information Use. The Review of Financial Studies 22: 4057–90. [Google Scholar] [CrossRef]

- Liu, Nian, Xinhua Gu, and Chun Kwok Lei. 2022. The equilibrium effects of digital technology on banking, production, and employment. Finance Research Letters 49: 103196. [Google Scholar] [CrossRef]

- Malhotra, Diksha, Poonam Saini, and Awadhesh Kumar Singh. 2022. How blockchain can automate KYC: Systematic review. Wireless Personal Communications 122: 1987–2021. [Google Scholar] [CrossRef]

- Mhlanga, David. 2021. Financial Inclusion in Emerging Economies: The Application of Machine Learning and Artificial Intelligence in Credit Risk Assessment. International Journal of Financial Studies 9: 39. [Google Scholar] [CrossRef]

- Mirza, Nawazish, Ayesha Afzal, Muhammad Umar, and Marinko Skare. 2023. The impact of green lending on banking performance: Evidence from SME credit portfolios in the BRIC. Economic Analysis and Policy 77: 843–50. [Google Scholar] [CrossRef]

- Nuryyev, Guych, Yu-Ping Wang, Jennet Achyldurdyyeva, Bih-Shiaw Jaw, Yi-Shien Yeh, Hsien-Tang Lin, and Li-Fan Wu. 2020. Blockchain Technology Adoption Behavior and Sustainability of the Business in Tourism and Hospitality SMEs: An Empirical Study. Sustainability 12: 1256. [Google Scholar] [CrossRef]

- Okine, Agnes Naa Dedei, Yao Li, Isaac Edem Djimesah, Hongjiang Zhao, Kenneth Wilson Adjei Budu, Elijah Duah, and Kingsford Kissi Mireku. 2023. Analyzing crowdfunding adoption from a technology acceptance perspective. Technological Forecasting and Social Change 192: 122582. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Shahnawaz Khan, and Mohammad Atif. 2023. Machine learning-based P2P lending Islamic Fintech model for small and medium enterprises in Bahrain. International Journal of Business Innovation and Research 30: 565–79. [Google Scholar] [CrossRef]

- Rabbi, Md., Prince Mahmud Hradoy, Mainul Islam, Hsibul Islam, Mst. Yesmine Akter, and Milon Biswas. 2021. BLS: Bank Loan Sanction Using Blockchain Authenticity, Transparency and Reliability. Paper presented at 2021 International Conference on Electronics, Communications and Information Technology (ICECIT), Khulna, Bangladesh, September 14–16. [Google Scholar]

- Rahid, Abu Obida. 2023. SME Financing of Commercial Banks in Bangladesh: Policy Directions Based on SME Loan Borrowers’ View. International Journal of Small and Medium Enterprises 6: 1–8. [Google Scholar] [CrossRef]

- Rajnak, Viktoria, and Thomas Puschmann. 2020. The impact of blockchain on business models in banking. Information Systems and E-Business Management 19: 809–61. [Google Scholar] [CrossRef]

- Saleem, Shahid. 2008. Saleem Smeda SME Policy Paper 2007—A Critical Review, SSRN. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1092050 (accessed on 5 June 2023).

- Salimon, Maruf Gbadebo, Olanrewaju Kareem, Sany Sanuri Mohd Mokhtar, Olayemi Abdullateef Aliyu, Jibril Adewale Bamgbade, and Adekunle Qudus Adeleke. 2023. Malaysian SMEs m-commerce adoption: TAM 3, UTAUT 2 and TOE approach. Journal of Science and Technology Policy Management 14: 98–126. [Google Scholar] [CrossRef]

- Schuetz, Sebastian, and Viswanath Venkatesh. 2020. Blockchain, adoption, and financial inclusion in India: Research opportunities. International Journal of Information Management 52: 101936. [Google Scholar] [CrossRef]

- Shahadat, M. M. Hussain, Md. Nekmahmud, Pejman Ebrahimi, and Maria Fekete-Farkas. 2023. Digital Technology Adoption in SMEs: What Technological, Environmental and Organizational Factors Influence SMEs’ ICT Adoption in Emerging Countries? Global Business Review, 09721509221137199. [Google Scholar] [CrossRef]

- Sheng, Tianxiang. 2021. The effect of fintech on banks’ credit provision to SMEs: Evidence from China. Finance Research Letters 39: 101558. [Google Scholar] [CrossRef]

- Song, Ziheng, Greer Mellon, and Zihan Shen. 2020. Relationship between racial bias exposure, financial literacy, and entrepreneurial intention: An empirical investigation. Journal of Artificial Intelligence and Machine Learning in Management 4: 42–55. [Google Scholar]

- Tantri, Prasanna. 2020. Creditors’ Rights and Strategic Default: Evidence from India. The Journal of Law and Economics 63: 411–47. [Google Scholar] [CrossRef]

- Tantri, Prasanna. 2021. Fintech for the Poor: Financial Intermediation Without Discrimination. European Finance Review 25: 561–93. [Google Scholar] [CrossRef]

- Taylor, Charles, Aquiles A. Almansi, and Aurora Ferrari. 2020. Prudential Regulatory and Supervisory Practices for Fintech: Payments, Credit and Deposits. Available online: https://documents1.worldbank.org/curated/en/954851578602363164/pdf/Prudential-Regulatory-and-Supervisory-Practices-for-Fintech-Payments-Credit-and-Deposits.pdf (accessed on 5 June 2023).

- Wang, Rui, Zhangxi Lin, and Hang Luo. 2019. Blockchain, bank credit and SME financing. Quality & Quantity 53: 1127–40. [Google Scholar] [CrossRef]

- Yang, Zhenni, Christopher Gan, and Zhaohua Li. 2019. Role of bank regulation on bank performance: Evidence from Asia-Pacific commercial banks. Journal of Risk and Financial Management 12: 131. [Google Scholar] [CrossRef]

- Zamani, Seyedeh Zahra. 2022. Small and Medium Enterprises (SMEs) facing an evolving technological era: A systematic literature review on the adoption of technologies in SMEs. European Journal of Innovation Management 25: 735–57. [Google Scholar] [CrossRef]

- Zhang, Wen, Shaoshan Yan, Jian Li, Xin Tian, and Taketoshi Yoshida. 2022. Credit risk prediction of SMEs in supply chain finance by fusing demographic and behavioral data. Transportation Research. Part E, Logistics and Transportation Review 158: 102611. [Google Scholar] [CrossRef]

| Position in the Company | Frequency | Percentage % |

|---|---|---|

| CEO | 113 | 29.6 |

| OWNER | 126 | 33.5 |

| MANAGER | 41 | 10.8 |

| SME CREDIT OFFICER | 21 | 5.4 |

| LOAN OFFICER | 8 | 2 |

| REGIONAL CEO | 10 | 2.5 |

| IT CONSULTANT | 11 | 3 |

| FINTECH EXPERT | 4 | 1 |

| OTHER (FINTECH LENDING TEAM MEMBERS) | 47 | 12.3 |

| TOTAL (N = 381) | 381 | 100% |

| Constructs | Cronbach’s Alpha (α) | Means (SD) | Factor Loading Range |

|---|---|---|---|

| Blockchain adoption in SMEs | 0.779 | 3.98 (1.05) | 0.855–0.713 |

| Big Data adoption in SMEs | 0.857 | 3.32 (1.37) | 0.912–0.795 |

| Mobile banking adoption in SMEs | 0.765 | 3.19 (1.21) | 0.845–0.798 |

| Bank credit supplies to SMEs | 0.812 | 3.58 (1.59) | 0.809–0.710 |

| Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) | |

|---|---|---|---|

| Bank credit supplies to SMEs | 0.844 | 0.889 | 0.616 |

| Big Data adoption in SMEs | 0.857 | 0.897 | 0.635 |

| Blockchain adoption in SMEs | 0.828 | 0.879 | 0.592 |

| Mobile banking adoption in SMEs | 0.819 | 0.872 | 0.578 |

| Loading | Cronbach’s Alpha | CR | AVE | ||

|---|---|---|---|---|---|

| Bank credit supplies to SMEs | |||||

| Item # 01 | 0.804 | ||||

| Item # 02 | 0.742 | ||||

| Item # 03 | 0.752 | 0.844 | 0.889 | 0.616 | |

| Item # 04 | 0.811 | ||||

| Item # 05 | 0.737 | ||||

| Big Data adoption in SMEs | |||||

| Item # 01 | 0.727 | ||||

| Item # 02 | 0.806 | ||||

| Item # 03 | 0.869 | 0.857 | 0.897 | 0.635 | |

| Item # 04 | 0.770 | ||||

| Item # 05 | 0.804 | ||||

| Blockchain adoption in SMEs | |||||

| Item # 01 | 0.769 | ||||

| Item # 02 | 0.712 | ||||

| Item # 03 | 0.800 | 0.828 | 0.879 | 0.592 | |

| Item # 04 | 0.725 | ||||

| Item # 05 | 0.792 | ||||

| Mobile banking adoption in SMEs | |||||

| Item # 01 | 0.759 | ||||

| Item # 02 | 0.718 | ||||

| Item # 03 | 0.805 | 0.819 | 0.872 | 0.578 | |

| Item # 04 | 0.875 | ||||

| Item # 05 | 0.759 |

| Bank Credit Supplies to SMEs | Big Data Adoption in Banks | Blockchain Adoption in Banks | Mobile Banking Adoption in Banks | |

|---|---|---|---|---|

| Bank credit supplies to SMEs | 0.785 | |||

| Big Data adoption in SMEs | 0.563 | 0.797 | ||

| Blockchain adoption in SMEs | 0.734 | 0.688 | 0.770 | |

| Mobile banking adoption in SMEs | 0.744 | 0.509 | 0.617 | 0.760 |

| Hypothesis | Path | Path Coefficient | t-Value | Standard Error | Result |

|---|---|---|---|---|---|

| H1 | BAS → BCSS | 0.432 | 7.089 | 0.056 | Supported |

| H2 | BDAS → BCSS | 0.035 | 7.098 | 0.012 | Supported |

| H3 | MBAS → BCSS | 0.465 | 9.889 | 0.078 | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rehman, S.U.; Al-Shaikh, M.; Washington, P.B.; Lee, E.; Song, Z.; Abu-AlSondos, I.A.; Shehadeh, M.; Allahham, M. FinTech Adoption in SMEs and Bank Credit Supplies: A Study on Manufacturing SMEs. Economies 2023, 11, 213. https://doi.org/10.3390/economies11080213

Rehman SU, Al-Shaikh M, Washington PB, Lee E, Song Z, Abu-AlSondos IA, Shehadeh M, Allahham M. FinTech Adoption in SMEs and Bank Credit Supplies: A Study on Manufacturing SMEs. Economies. 2023; 11(8):213. https://doi.org/10.3390/economies11080213

Chicago/Turabian StyleRehman, Shafiq Ur, Mustafa Al-Shaikh, Patrick Bernard Washington, Ernesto Lee, Ziheng Song, Ibrahim A. Abu-AlSondos, Maha Shehadeh, and Mahmoud Allahham. 2023. "FinTech Adoption in SMEs and Bank Credit Supplies: A Study on Manufacturing SMEs" Economies 11, no. 8: 213. https://doi.org/10.3390/economies11080213

APA StyleRehman, S. U., Al-Shaikh, M., Washington, P. B., Lee, E., Song, Z., Abu-AlSondos, I. A., Shehadeh, M., & Allahham, M. (2023). FinTech Adoption in SMEs and Bank Credit Supplies: A Study on Manufacturing SMEs. Economies, 11(8), 213. https://doi.org/10.3390/economies11080213