The Impact of the Stock Market on Liquidity and Economic Growth: Evidence of Volatile Market

Abstract

1. Introduction

Background

2. A Review of the Literature: Theoretical Review

2.1. Economic Growth Theory

2.2. Stock Markets Functions

2.3. Empirical Literature

3. Methodology

4. Data Sources and Issues

Model Specification

5. Results

5.1. Stationarity Results

5.2. Empirical Results

5.3. Granger Causality Test

5.4. Post-Estimation Diagnostic Tests

5.4.1. Autocorrelation Test

5.4.2. Residual Normality Test

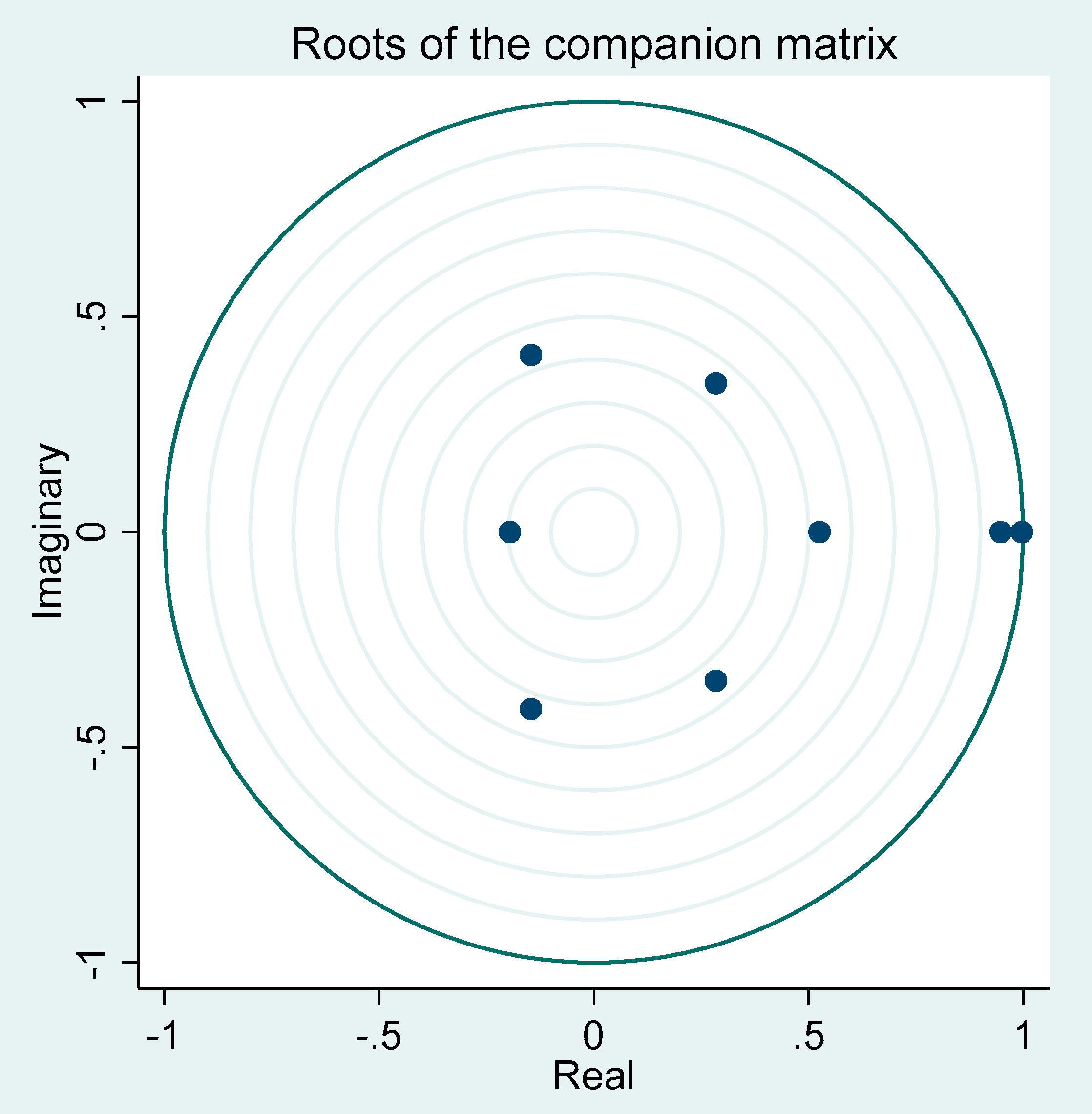

5.4.3. Stability Tests

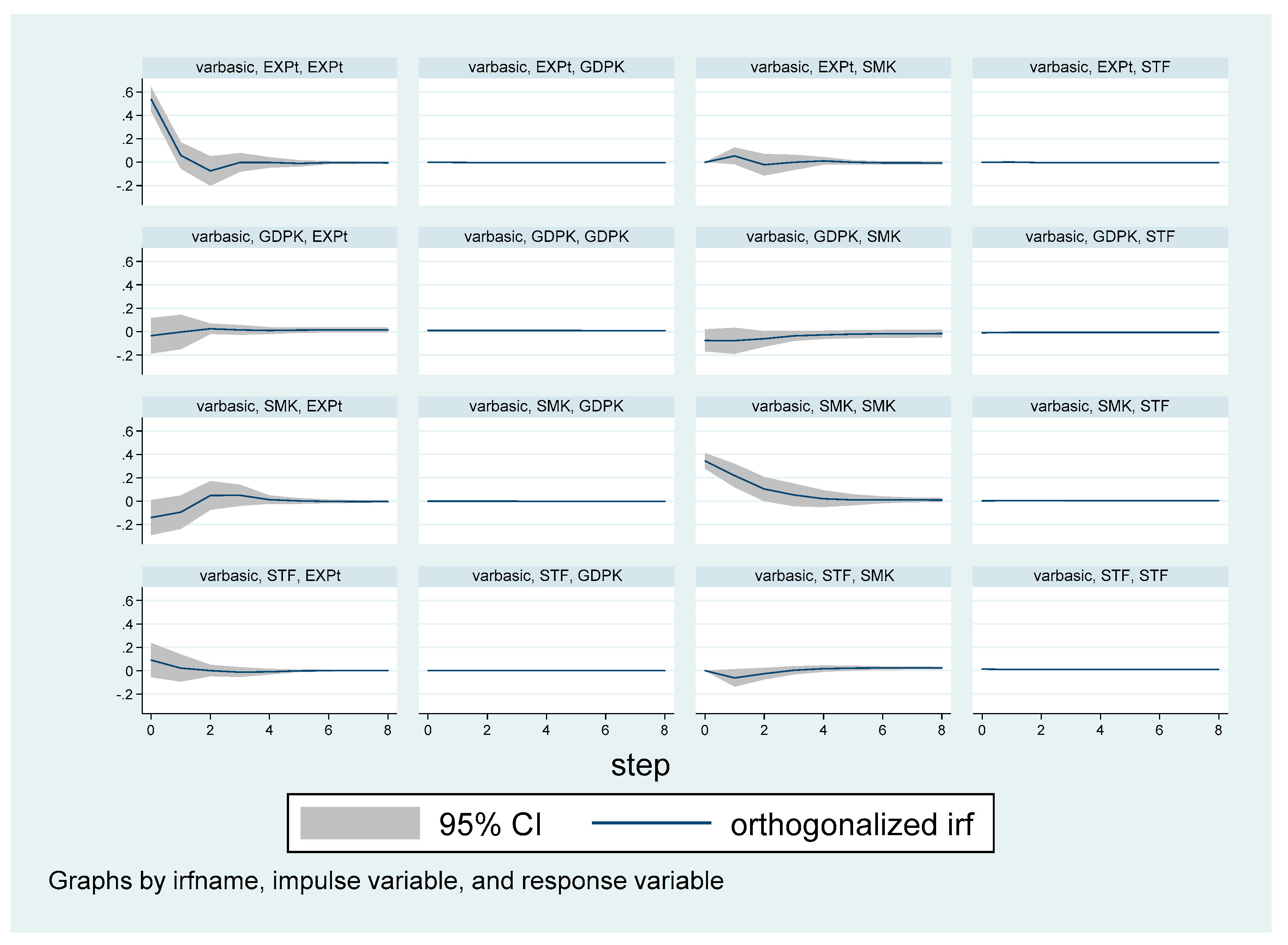

5.4.4. Impulse Response Test

6. Discussion

7. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Acemoglu, Daron. 2012. Introduction to economic growth. Journal of Economic Theory 147: 545–50. [Google Scholar] [CrossRef]

- Agarwal, Prateek. 2019. What is economic growth? Intelligent Economist (blogue). Available online: http://www.intelligenteconomist.com/economic-growth (accessed on 2 March 2022).

- Alajekwu, Udoka Bernard, and Austin Achugbu. 2012. The role of stock market development on economic growth in Nigeria: A time series analysis. African Research Review 6: 51–70. [Google Scholar] [CrossRef][Green Version]

- Anderson, Theodore Wilbur, and Cheng Hsiao. 1982. Formulation and estimation of dynamic models using panel data. Journal of Econometrics 18: 47–82. [Google Scholar] [CrossRef]

- Antoniou, Antonios, Yilmaz Guney, and Krishna Paudyal. 2008. The determinants of capital structure: Capital market-oriented versus bank-oriented institutions. Journal of Financial and Quantitative Analysis 43: 59–92. [Google Scholar] [CrossRef]

- Arcand, Jean Louis, Enrico Berkes, and Ugo Panizza. 2015. Too much finance? Journal of Economic Growth 20: 105–48. [Google Scholar] [CrossRef]

- Baumohl, Eduard, and Stefan Lyocsa. 2009. Stationarity of time series and the problem of spurious regression. Faculty of Business Economics in Košice, University of Economics in Bratislava, Munich Personal RePEc Archive. Available online: https://mpra.ub.uni-muenchen.de/27926/ (accessed on 5 March 2023).

- Beck, Thorsten, and Ross Levine. 2004. Stock markets, banks, and growth: Panel evidence. Journal of Banking & Finance 28: 423–42. [Google Scholar] [CrossRef]

- Bernal-Ponce, L. Arturo, Claudia Estrella Castillo-Ramírez, and Francisco Venegas-Martinez. 2020. Impact of exchange rate derivatives on stocks in emerging markets. Journal of Business Economics and Management 21: 610–26. [Google Scholar] [CrossRef]

- Bhowmik, Roni, and Shouyang Wang. 2020. Stock market volatility and return analysis: A systematic literature review. Entropy 22: 522. [Google Scholar] [CrossRef]

- Bongini, Paola, Małgorzata Iwanicz-Drozdowska, Paweł Smaga, and Bartosz Witkowski. 2017. Financial development and economic growth: The role of foreign-owned banks in CESEE countries. Sustainability 9: 335. [Google Scholar] [CrossRef]

- Borteye, Edward Alabie, and Williams Kwasi Peprah. 2022. Correlates of Stock Market Development and Economic Growth: A Confirmatory Study from Ghana. International Journal of Economics and Finance 14: 1. [Google Scholar] [CrossRef]

- Chaudhary, Rashmi, Priti Bakhshi, and Hemendra Gupta. 2020. Volatility in international stock markets: An empirical study during COVID-19. Journal of Risk and Financial Management 13: 208. [Google Scholar] [CrossRef]

- Chen, Andrew Y., Markus Ibert, and Francisco Vazquez-Grande. 2020. The Stock Market–Real Economy. “Disconnect”: A Closer Look. FEDS Notes. Washington, DC: Board of Governors of the Federal Reserve System. [Google Scholar] [CrossRef]

- Chiang, Thomas, and Dazhi Zheng. 2015. Liquidity and stock returns: Evidence from international markets. Global Finance Journal 27: 73–97. [Google Scholar] [CrossRef]

- Demetriades, Panicos, and Peter L. Rousseau. 2016. The changing face of financial development. Economics Letters 141: 87–90. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, and Ross Levine. 1996. Stock markets, corporate finance, and economic growth: An overview. The World Bank Economic Review 10: 223–39. [Google Scholar] [CrossRef]

- Dinh, Trang Thi-Huyen, Duc Hong Vo, Anh The Vo, and Thang Cong Nguyen. 2019. Foreign direct investment and economic growth in the short run and long run: Empirical evidence from developing countries. Journal of Risk and Financial Management 12: 176. [Google Scholar] [CrossRef]

- Dube, Stanfford Dumisile Gobodi. 2020. The Impact of Macroeconomic Variables on Stock Market Development in Zimbabwe (1990–2018). JournalNX-A Multidisciplinary Peer Reviewed Journal 6. [Google Scholar]

- Elfeituri, Hatem, Lubna Elgehani, and Sabri Elkrghli. 2023. The Impact of Stock Markets on Economic Growth in the Gulf Countries (1993–2019). Ph.D. thesis, Libyan International Medical University, Faculty of Business Administration, Benghazi, Libya. [Google Scholar]

- El-Masry, Ahmed A. 2006. Derivatives use and risk management practices by UK nonfinancial companies. Managerial Finance 32: 37–159. [Google Scholar] [CrossRef]

- Greenwood, Jeremy, and Boyan Jovanovic. 1990. Financial development, growth, and the distribution of income. Journal of Political Economy 98 Pt 1: 1076–107. [Google Scholar] [CrossRef]

- Greenwood, Jeremy, and Bruce D Smith. 1997. Financial markets in development, and the development of financial markets. Journal of Economic Dynamics and Control 21: 145–81. [Google Scholar] [CrossRef]

- Gujarati, Damodar. 2009. Basic Econometrics. New York: Tata McGraw-Hill Education. [Google Scholar]

- Gujarati, Damodar, and C. Dawn Porter. 1999. Essentials of Econometrics. Singapore: Irwin/McGraw-Hill, vol. 2. [Google Scholar]

- Hailemariam, Abiy, and Chi Guotai. 2014. Stock market development and economic growth: Empirical evidence for emerging market economies. International Journal of Economics, Finance and Management Sciences 2: 171–81. [Google Scholar] [CrossRef]

- Heino, Bohn Nielsen. 2005. Non-Stationary Time Series, Cointegration and Spurious Regression. Econometrics 2 Online Course. Available online: http://www.econ.ku.dk/metrics/Econometrics2_05_II/Slides/10_cointegration_2pp.pdf (accessed on 25 March 2023).

- Islam, Md. Saiful, Ruksana Parvin, Mohammad Milon, and Mridul Kanti Das. 2023. The Impact of Gross Domestic Product on the Bangladesh Stock Market: An Empirical Analysis. International Journal of Finance and Accounting 12: 1–12. [Google Scholar] [CrossRef]

- Jarque, Carlos, and Anil Bera. 1987. A test for normality of observations and regression residuals. International Statistical Review 55: 163–72. [Google Scholar] [CrossRef]

- Jecheche, Petros. 2012. The effect of the stock exchange on economic growth: A case of the Zimbabwe stock exchange. Research in Business and Economics Journal 6: 1. [Google Scholar]

- Kanetsi, Bophelo. 2014. Stock market development and economic growth in Africa’s frontier markets. Ph.D. dissertation, Faculty of Commerce, Law and Management, Graduate School of Business Administration, University of the Witwatersrand, Johannesburg, South Africa. [Google Scholar]

- Levine, Ross, and Sara Zervos. 1996. Stock Markets, Banks, and Economic Growth. Policy Research Working Paper 1690. Washington, DC: The World Bank. [Google Scholar]

- Levine, Ross, and Sara Zervos. 1998. Stock markets, banks, and economic growth. American Economic Review 88: 537–58. [Google Scholar]

- Mabilesta, Elaine. 2016. The Risk of Currency Volatility and How to Protect Your Business against Them. Johannesburg Stock Exchange Report. Johannesburg: JSE. [Google Scholar]

- Magweva, Rabson, and Tafirei Mashamba. 2016. Stock market development and economic growth: An empirical analysis of Zimbabwe (1989–2014). Financial Assets and Investing 7: 20–36. [Google Scholar] [CrossRef]

- Malthus, Thomas Robert. 1925. Prawo Ludności. Biblioteka Wyższej Szkoły Handlowej. [Google Scholar]

- Marks, Rose. 1951. The effect of probability, desirability, and “privilege” on the stated expectations of children. Journal of Personality 19: 332–51. [Google Scholar] [CrossRef]

- Mawanza, Wilford, Nkululeko Mpofu, and Silethemba Nyoni. 2020. The Impact of securities markets on economic growth in Zimbabwe. Journal of Economic Info 7: 155–69. [Google Scholar] [CrossRef]

- Napitupulu, Herlina, and Norizan Mohamed. 2023. A Conceptual Model of Investment-Risk Prediction in the Stock Market Using Extreme Value Theory with Machine Learning: A Semisystematic Literature Review. Risks 11: 60. [Google Scholar]

- Nathaniel, Solomon Prince, Joseph Ayoola Omojolaibi, and Chikaodili Josephine Ezeh. 2020. Does stock market-based financial development promotes economic growth in emerging markets?: New evidence from Nigeria. Serbian Journal of Management 15: 45–54. [Google Scholar] [CrossRef]

- O’Shea, Arielle, and Chris Davis. 2021. What Is the Stock Market and How Does It Work? Available online: https:www.nerdwallet.com/article/investing/what-is-the-stock-market (accessed on 10 December 2022).

- Odhiambo, Nicholas M. 2014. Financial systems and economic growth in South Africa: A dynamic complementarity test. International Review of Applied Economics 28: 83–101. [Google Scholar] [CrossRef]

- Onyango, Maxwell, Winnie Nyamute, and Joshua Wanjare. 2023. Effect of Liquidity on the Relationship between Dividend Policy and Value of Firms Listed at the Nairobi Securities Exchange. African Development Finance Journal 5: 53–70. [Google Scholar]

- Osamwonyi, Ifuero, and Godfrey Osaseri. 2020. A Causality Study of Stock Market Development and Economic Growth in Nigeria and Brics. Acta Universitatis Danubius. Administration 12: 7–23. [Google Scholar]

- Pan, Lei, and Vinod Mishra. 2018. Stock market development and economic growth: Empirical evidence from China. Economic Modelling 68: 661–73. [Google Scholar] [CrossRef]

- Polat, Ali, Muhammad Shahbaz, Ijaz Ur Rehman, and Saqlain Latif Satti. 2015. Revisiting linkages between financial development, trade openness and economic growth in South Africa: Fresh evidence from combined cointegration test. Quality & Quantity 49: 785–803. [Google Scholar] [CrossRef]

- Qamruzzaman, Md, and Jianguo Wei. 2018. Financial innovation, stock market development, and economic growth: An application of ARDL model. International Journal of Financial Studies 6: 69. [Google Scholar] [CrossRef]

- Ricardo, David. 1957. Works and Correspondence. Edited by Piero Sraffa. 11 vols. Cambridge: Cambridge University Press. [Google Scholar]

- Rousseau, Peter, and Paul Wachtel. 2011. What is happening to the impact of financial deepening on economic growth? Economic Inquiry 49: 276–88. [Google Scholar] [CrossRef]

- Sala-i-Martin, Xavier. 2001. Comment on Growth Empirics and Reality. The World Bank Economic Review 15: 277–82. [Google Scholar] [CrossRef]

- Samarasinghe, Ama. 2023. Stock market liquidity and bank stability. Pacific-Basin Finance Journal 79: 102028. [Google Scholar] [CrossRef]

- Samarasinghe, Ama, and Katherine Uylangco. 2021. An examination of the effect of stock market liquidity on bank market power. International Review of Financial Analysis 77: 101810. [Google Scholar] [CrossRef]

- Şendeniz-Yüncü, İlkay, Levent Akdeniz, and Kürşat Aydoğan. 2018. Do stock index futures affect economic growth? Evidence from 32 countries. Emerging Markets Finance and Trade 54: 410–29. [Google Scholar] [CrossRef]

- Shoko, Twoboy, Jonathan Shoko, Stanfford Dumisile Gobodi Dube, and Thabani Nyoni. 2020. An Empirical Investigation of The Impact Of Banking Sector Capitalization On Stock Market Developments In Zimbabwe. EPRA International Journal of Economic Growth and Environmental Issues 8. [Google Scholar]

- Shravani, and Supran Kumar Sharma. 2020. Scrutinising causal relationship between stock market development and economic growth: Case of India. International Journal of Indian Culture and Business Management 20: 429–43. [Google Scholar] [CrossRef]

- Sill, Keith. 1997. The economic benefits and risks of derivative securities. Business Review, 15–26. [Google Scholar]

- Smith, Adam. 1954. Bogactwo Narodów. PWN, Warszawa 2: 42–46. [Google Scholar]

- Topcu, Mert, and Omer Serkan Gulal. 2020. The impact of COVID-19 on emerging stock markets. Finance Research Letters 36: 101691. [Google Scholar] [CrossRef]

- Vo, Duc Hong, Son Van Huynh, Anh The Vo, and Dao Thi-Thieu Ha. 2019. The importance of the financial derivatives markets to economic development in the world’s four major economies. Journal of Risk and Financial Management 12: 35. [Google Scholar] [CrossRef]

- Zimstat. 2021. Zimbabwe Poverty Update 2019-19. Washington, DC: ZIMSTAT and World Bank. [Google Scholar]

- Zivengwa, Tichaona, Joseph Mashika, Fanwell K. Bokosi, and Tendai Makova. 2011. Stock market development and economic growth in Zimbabwe. International Journal of Economics and Finance 3: 140–50. [Google Scholar] [CrossRef]

| Variable | Obs | Mean | Std.Dev | Min | Max |

|---|---|---|---|---|---|

| GDPk | 44 | 4.11 | 0.12 | 3.91 | 4.33 |

| SMK | 44 | 7.06 | 1.56 | 3.64 | 10.01 |

| STL | 44 | 8.04 | 0.86 | 0.21 | 4.16 |

| STF | 44 | 13.04 | 0.63 | 11.91 | 14 |

| EXPt | 44 | 1.22 | 0.83 | −2.3 | 2.39 |

| ADF TEST Z(t) | 5% CRITICAL VALUE | |

|---|---|---|

| H02: The level of the variable is non-stationary | ||

| GDPK | 1.618 | 3.000 |

| SMK | 1.892 | 3.000 |

| STF | 0.235 | 3.000 |

| STL | 1.762 | 3.000 |

| EXPt | 0.435 | 3.000 |

| H12: The first difference of the variable is non-stationary | ||

| In(GDPK) | 5.517 | 3.600 |

| In(SMK) | 4.314 | 3.600 |

| In(STF) | 5.635 | 3.600 |

| In(STL) | 4.123 | 3.600 |

| In(EXPt) | 3.750 | 3.000 |

| VARIABLES | GDPGK | SMK | STF | STL | EXPt |

|---|---|---|---|---|---|

| L.GDPG | 0.726 *** | −215.4 | 1.470 *** | −6.262 | 1.088 *** |

| (0.267) | (230.1) | (0.34) | (4.468) | (0.183) | |

| L2. GDPK | −0.244 | 189.4 | −0.676 ** | 5.91 | 0.921 *** |

| (0.218) | (188.3) | (0.278) | (4.419) | (0.15) | |

| L.SMK | 0.000568 * | 0.538 ** | −0.00035 | 0.714 *** | 0.001000 *** |

| (0.00031) | (0.268) | (0.0004) | (0.132) | (0.00021) | |

| L2.SMK | 0.000522 | 0.23 | −0.00025 | −0.185 | 0.00112 *** |

| (0.00056) | (0.483) | (0.00071) | (0.126) | (0.00038) | |

| L.STF | 0.365 *** | 46.86 | −0.592 *** | −4.989 ** | −0.0157 |

| (0.113) | (97.98) | (0.145) | (2.515) | (0.0779) | |

| L2.STF | −0.211 * | 139 | −0.722 *** | 6.053 ** | −0.156 ** |

| (0.111) | (96.24) | (0.142) | (2.519) | (0.0765) | |

| L.LEXPt | −0.700 * | −88.36 | 0.305 | 0.1 | 0.418 * |

| (0.358) | (308.8) | (0.456) | (0.0664) | (0.245) | |

| L2. EXPt | 0.692 | 11.92 | 2.692 *** | −0.145 * | 0.730 ** |

| (0.472) | (407.9) | (0.602) | (0.0766) | (0.324) | |

| L.SKL | 0.235 | 6.86 | −0.592 *** | −4.985 * | −0.0167 |

| (0.213) | (7.98) | (0.145) | (2.515) | (0.0779) | |

| L2.SKL | −0.145 | 139 | −0.773 | 6.053 ** | −0.153 * |

| (0.132) | (96.24) | (0.132) | (2.519) | (0.0745) | |

| Constant | 3.791 | −9.541 | 106.3 *** | −8.786 *** | 32.65 *** |

| −6.808 | (5.877) | (8.678) | (2.854) | (4.67) |

| NULL Hypothesis | |

|---|---|

| SMK does not granger cause GDPK | 11.172 *** |

| STF does not granger cause GDPK | 12.871 *** |

| STL does not granger cause GDPK | 13.867 *** |

| GDPK does not granger cause SMK | 4.756 |

| STF does not granger cause SMK | 4.603 |

| STL does not granger cause SMK | 5.6216 |

| GDPK does not granger cause STF | 79.492 *** |

| SMK do not granger cause STF | 50.832 *** |

| STL does not granger cause STF | 135.84 *** |

| GDPK does not cause STL | 78.317 *** |

| SMK does not granger cause STL | 23.717 *** |

| STF does not granger cause STL | 54.025 *** |

| Lag | Df | ||

|---|---|---|---|

| 1 | 13.762 | 16 | 0.616 |

| 2 | 17.000 | 16 | 0.342 |

| Equations | Df | ||

|---|---|---|---|

| D.GDPk | 8.700 | 2 | 0.444 |

| D_SMK | 1.355 | 2 | 0.508 |

| D.STF | 0.462 | 2 | 0.793 |

| D.STL | 1.749 | 2 | 0.417 |

| D.EXPt | 1.862 | 2 | 0.235 |

| ALL | 12.265 | 10 | 0.140 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chikwira, C.; Mohammed, J.I. The Impact of the Stock Market on Liquidity and Economic Growth: Evidence of Volatile Market. Economies 2023, 11, 155. https://doi.org/10.3390/economies11060155

Chikwira C, Mohammed JI. The Impact of the Stock Market on Liquidity and Economic Growth: Evidence of Volatile Market. Economies. 2023; 11(6):155. https://doi.org/10.3390/economies11060155

Chicago/Turabian StyleChikwira, Collin, and Jahed Iqbal Mohammed. 2023. "The Impact of the Stock Market on Liquidity and Economic Growth: Evidence of Volatile Market" Economies 11, no. 6: 155. https://doi.org/10.3390/economies11060155

APA StyleChikwira, C., & Mohammed, J. I. (2023). The Impact of the Stock Market on Liquidity and Economic Growth: Evidence of Volatile Market. Economies, 11(6), 155. https://doi.org/10.3390/economies11060155