Analysis of Success Factors, Benefits, and Challenges of Issuing Green Bonds in Lithuania

Abstract

1. Introduction

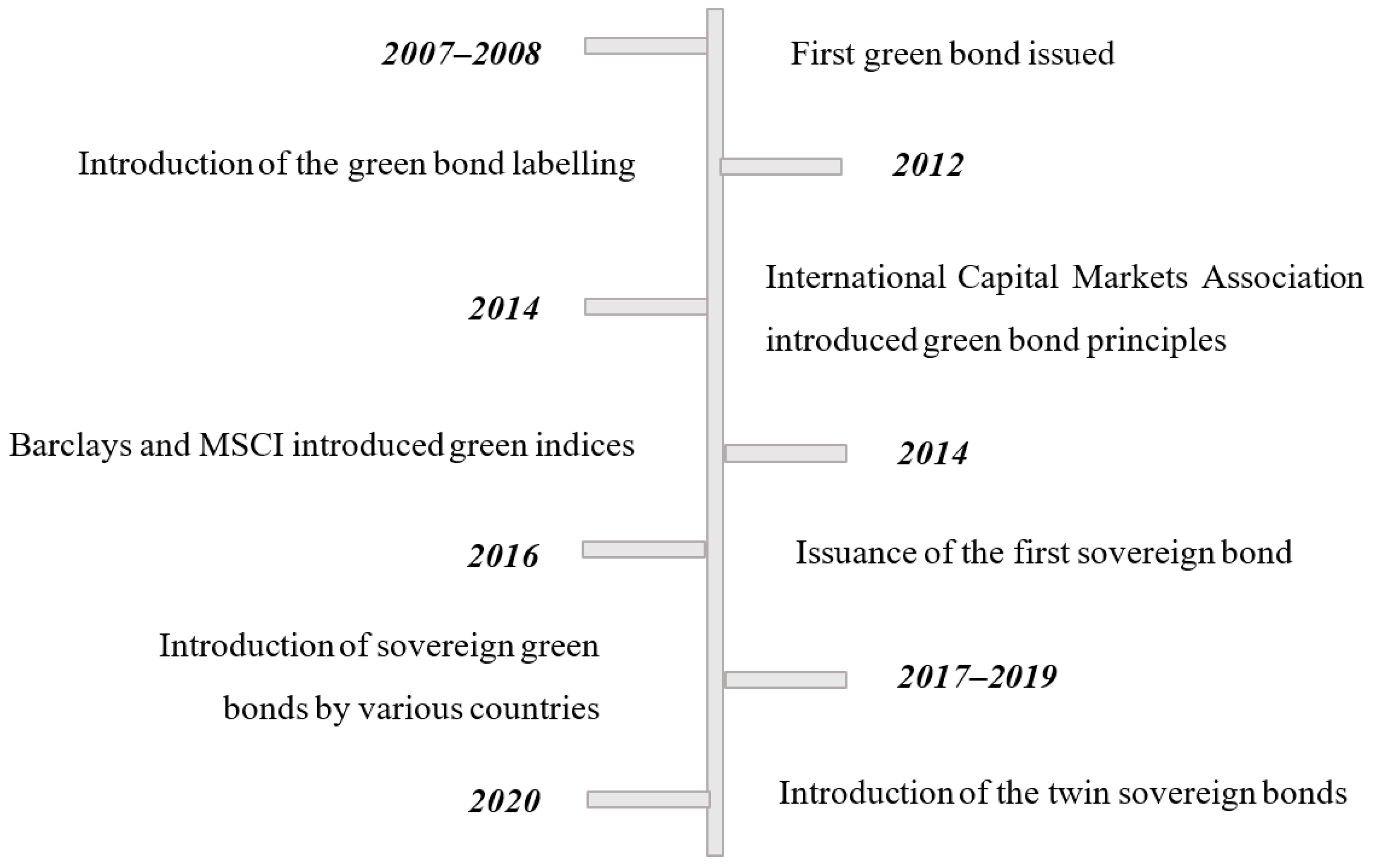

2. Literature Review

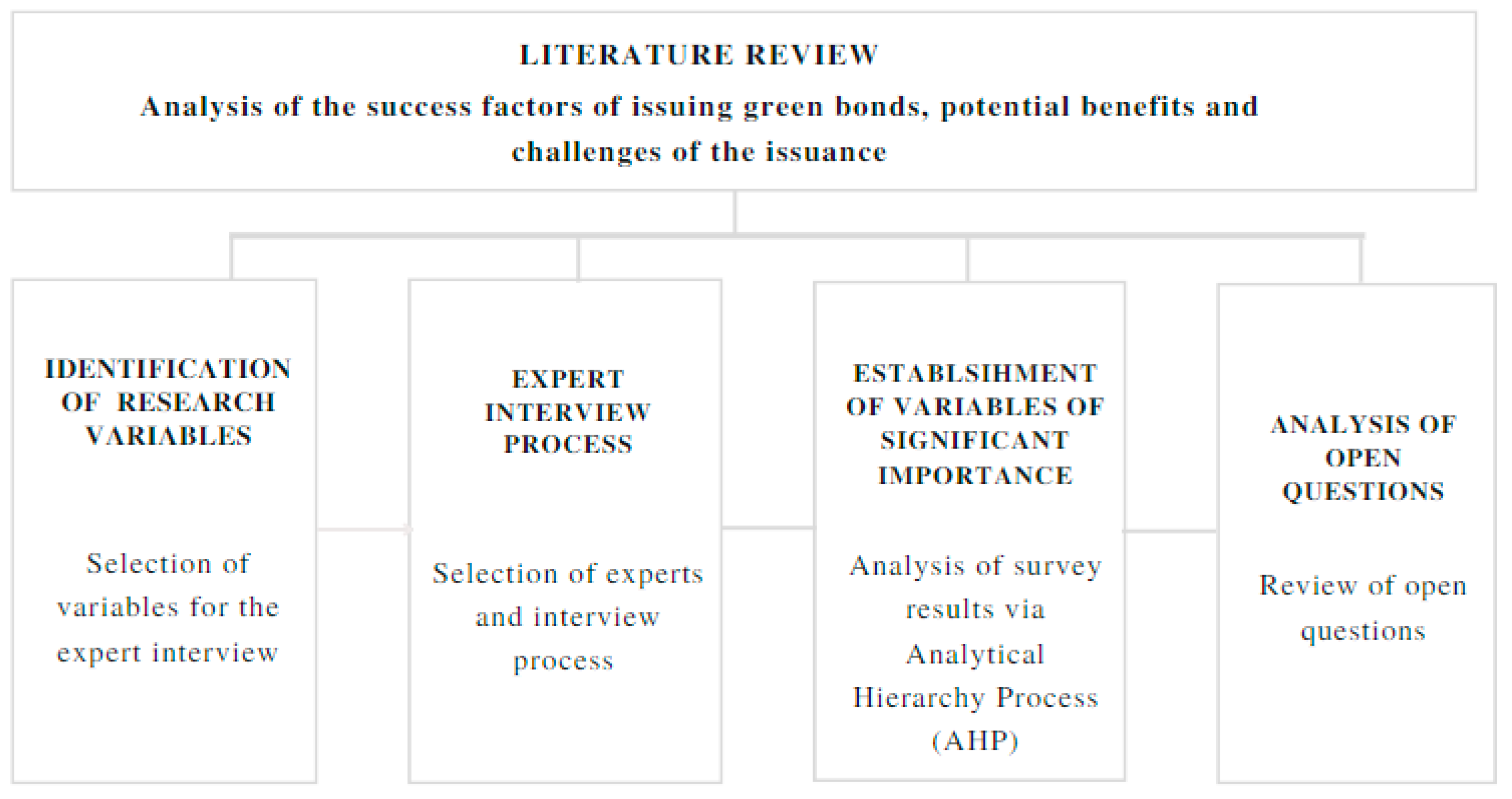

3. Methodology

- Restructuring of the problem into a hierarchical structure. This includes the establishment of the goal of the problem and possible criteria and sub-criteria related to the problem.

- Construction of the pairwise comparison matrix where selected criteria are compared using the rating scale. The multiple square matrices can be represented in the following manner (Yap et al. 2017):

- 3.

- Determination of the weights of the criteria can be represented in the following manner (Yap et al. 2017):

- 4.

- Determination of the consistency of the results. Herein, the consistency index is below 10%. Consistency ratio is computed by the flowing formula:where CR—consistency ratio, CI—consistency index, RI—random index. Random index value depends on the value of n, that is, the size of the pairwise comparison matrix. The random index values are summarized in Table 2.

4. Results

4.1. Data Collection Process

- Good credit rating (Mankata et al. 2022);

- Provision of explicit country-level instruction on the issuance procedure (Mankata et al. 2022);

- Suitable requirements for green project eligibility (Mankata et al. 2022);

- Precedence given to financially sound projects (Mankata et al. 2022);

- Transparent and clearly defined use and management of proceeds (Fatica and Panzica 2021);

- Process for project evaluation and selection (Fatica and Panzica 2021);

- Reporting and external review (Fatica and Panzica 2021);

- Reputation of the issuer (Bhutta et al. 2022; Cheng et al. 2022);

- ESG score (Cheng et al. 2022);

- Size of the green bond issue (Bhutta et al. 2022).

- Instrument for the management of currency risks (Mankata et al. 2022);

- Increase of investor interest in environmental financing (Mankata et al. 2022);

- Strengthening the aptitude of institutional investors (Mankata et al. 2022);

- Provision of quantifiable and measurable benefits (Mankata et al. 2022);

- Supporting government policies (Mankata et al. 2022);

- Stimulation of public involvement (Mankata et al. 2022);

- Creating and stabilising an efficient bond market (Mankata et al. 2022);

- Low investment risks (Wang 2021);

- Ability to raise large investment amounts needed to finance environmentally friendly projects (Wang 2021);

- Bonds bear more flexibility and liquidity (Wang 2021).

- Greenwashing (Cheng et al. 2022);

- The green bond market might exaggerate its own importance in terms of environmental protection (Bongaerts and Schoenmaker 2019);

- Green bonds provide slight financial and economic benefits for investors willing to engage into projects supporting the environment (Bongaerts and Schoenmaker 2019);

- Issuance costs (Bongaerts and Schoenmaker 2019; Cheng et al. 2022)

- Absence of global market standards (Bongaerts and Schoenmaker 2019).

- What in your view makes a credible green bond?

- What could be other most important success criteria for issuing green bonds in Lithuania?

- What could be other benefits of issuing green bonds in Lithuania?

- What could be other challenges of issuing green bonds in Lithuania?

- Would understanding of the green value added by the green bond issuance help to contribute to its success?

- How could the impact or success of the green bond be enhanced?

4.2. Research Results Obtained via Analytical Hierarchy Process

- Reputation of the issuer (17%);

- Good credit rating of the issuer (15%);

- ESG score of the issuer (12%);

- Suitable requirements for green project eligibility (11%);

- Precedence for financially sound projects (11%);

- Process for project evaluation and selection (10%).

- Using green bonds as an instrument for managing currency risks (16%);

- Raising large investment amounts needed to finance environmentally friendly projects (14%);

- Providing quantifiable and measurable benefits (13%);

- Creating and stabilising efficient bond markets (12%);

- Stimulating the involvement of the public (10%).

- Greenwashing (39%);

- The green bond market might exaggerate its role in environmental protection (23%);

- Green bonds provide slight financial and economic benefits for investors willing to engage in projects supporting the environment (15%);

- Absence of global market standards (12%).

4.3. Research Results Obtained via Open Questions

5. Discussion

6. Limitations and Future Research Recommendations

7. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adekoya, Oluwasegun B., Johnson A. Oliyide, Mahdi Ghaemi Asl, and Saba Jalalifar. 2021. Financing the green projects: Market efficiency and volatility persistence of green versus conventional bonds, and the comparative effects of health and financial crisis. International Review of Financial Analysis 78: 101954. [Google Scholar] [CrossRef]

- Alonso-Conde, Ana-Belén, and Javier Rojo-Suárez. 2020. On the Effect of Green Bonds on the Profitability and Credit Quality of Project Financing. Sustainability 12: 6695. [Google Scholar] [CrossRef]

- Alrawad, Mahmaod, Abdalwali Lutfi, Mohammed Amin Almaiah, Adi Alsyouf, Akif Lutfi Al-Khasawneh, Hussin Mostafa Arafa, Nazar Ali Ahmed, Ahmad M. AboAlkhair, and Magdy Tork. 2023. Managers’ Perception and Attitude toward Financial Risks Associated with SMEs: Analytic Hierarchy Process Approach. Journal of Risk and Financial Management 16: 86. [Google Scholar] [CrossRef]

- Aneja, Ranjan, Shine Raju Kappil, Narasingha Das, and Umer Jeelanie Banday. 2023. Does the green finance initiatives transform the world into a green economy? A study of green bond issuing countries. Environmental Science and Pollution Research 30: 42214–22. [Google Scholar] [CrossRef] [PubMed]

- Bachelet, Maria Jua, Leonardo Becchetti, and Stefano Manfredonia. 2019. The green bonds premium puzzle: The role of issuer characteristics and third-party verification. Sustainability 11: 1098. [Google Scholar] [CrossRef]

- Baker, Malcolm, Daniel Bergstresser, George Serafeim, and Jeffrey Wurgler. 2018. Financing the Response to Climate Change: The Pricing and Ownership of U.S. Green Bonds. SSRN Electronic Journal, 1–44. [Google Scholar] [CrossRef]

- Banga, Josué. 2019. The green bond market: A potential source of climate finance for developing countries. Journal of Sustainable Finance and Investment 9: 17–32. [Google Scholar] [CrossRef]

- Baranowski, Mariusz, and Helen Kopnina. 2022. Socially responsible consumption: Between social welfare and degrowth. Economics and Sociology 15: 319–35. [Google Scholar] [CrossRef]

- Battisti, Enrico, Simona Alfiero, Roberto Quaglia, and Dorra Yahiaoui. 2022. Financial performance and global start-ups: The impact of knowledge management practices. Journal of International Management 28: 100938. [Google Scholar] [CrossRef]

- Benlemlih, Mohammed, Jamil Jaballah, and Lamya Kermiche. 2023. Does financing strategy accelerate corporate energy transition? Evidence from green bonds. Business Strategy and the Environment 32: 878–89. [Google Scholar] [CrossRef]

- Bhutta, Umair Saeed, Adeel Tariq, Muhammad Farrukh, Ali Raza, and Muhammad Khalid Iqbal. 2022. Green bonds for sustainable development: Review of literature on development and impact of green bonds. Technological Forecasting and Social Change 175: 121378. [Google Scholar] [CrossRef]

- Bongaerts, Dion, and Dirk Schoenmaker. 2019. The Next Step in Green Bond Financing. SSRN Electronic Journal, 1–11. [Google Scholar] [CrossRef]

- Boutabba, Mohamed Amine, and Yves Rannou. 2022. Investor strategies in the green bond market: The influence of liquidity risks, economic factors and clientele effects. International Review of Financial Analysis 81: 102071. [Google Scholar] [CrossRef]

- Brunelli, Matteo. 2015. Introduction to the Analytic Hierarchy Process. In SpringerBriefs in Operations Research. Cham: Springer. [Google Scholar] [CrossRef]

- Carney, Mark. 2015. Breaking the Tragedy of the Horizon—Climate Change and Financial Stability—Speech by Mark Carney|Bank of England. Bank of England, pp. 1–16. Available online: https://www.bankofengland.co.uk/speech/2015/breaking-the-tragedy-of-the-horizon-climate-change-and-financial-stability (accessed on 29 April 2023).

- Chang, Li-Chiu, Jia-Yi Liou, and Fi-John Chang. 2022. Spatial-temporal flood inundation nowcasts by fusing machine learning methods and principal component analysis. Journal of Hydrology 612: 128086. [Google Scholar] [CrossRef]

- Cheng, Louis TW, Piyush Sharma, and David C. Broadstock. 2022. Interactive effects of brand reputation and ESG on green bond issues: A sustainable development perspective. Business Strategy and the Environment 32: 570–86. [Google Scholar] [CrossRef]

- Cheong, Chiyoung, and Jaewon Choi. 2020. Green bonds: A survey. Journal of Derivatives and Quantitative Studies 28: 175–89. [Google Scholar] [CrossRef]

- Chopra, Monika, and Chhavi Mehta. 2023. Going green: Do green bonds act as a hedge and safe haven for stock sector risk? Finance Research Letters 51: 103357. [Google Scholar] [CrossRef]

- Dai, Wensheng. 2022. Application of Improved Convolution Neural Network in Financial Forecasting. Journal of Organizational and End User Computing (JOEUC) 34: 1–16. [Google Scholar] [CrossRef]

- Ehlers, Torsten, and Frank Packer. 2017. Green Bond Finance and Certification. BIS Quarterly Review, 89–104. [Google Scholar]

- Elsayed, Ahmed H., Nader Naifar, Samia Nasreen, and Aviral Kumar Tiwari. 2022. Dependence structure and dynamic connectedness between green bonds and financial markets: Fresh insights from time-frequency analysis before and during COVID-19 pandemic. Energy Economics 107: 105842. [Google Scholar] [CrossRef]

- Elshafei, Ghada, Dušan Katunský, Martina Zeleňáková, and Abdelazim Negm. 2022. Opportunities for Using Analytical Hierarchy Process in Green Building Optimization. Energies 15: 4490. [Google Scholar] [CrossRef]

- European Commission. 2019. Sustainable Finance Action Plan for Lithuania. Available online: https://reform-support.ec.europa.eu/what-we-do/green-transition/sustainable-finance-action-plan-lithuania_en (accessed on 18 March 2023).

- Fatica, Serena, and Roberto Panzica. 2021. Green bonds as a tool against climate change? Business Strategy and the Environment 30: 2688–701. [Google Scholar] [CrossRef]

- Fatica, Serena, Roberto Panzica, and Michela Rancan. 2019. The Pricing of Green Bonds: Are Financial Institutions Special? Journal of Financial Stability 54: 100873. [Google Scholar] [CrossRef]

- Flammer, Caroline. 2021. Corporate green bonds. Journal of Financial Economics 142: 499–516. [Google Scholar] [CrossRef]

- García, C. José, Begoña Herrero, José Luis Miralles-Quirós, and Maria del Mar Mirallles-Quirós. 2023. Exploring the determinants of corporate green bond issuance and its environmental implication: The role of corporate board. Technological Forecasting and Social Change 189: 122379. [Google Scholar] [CrossRef]

- Ghojogh, Benyamin, Mark Crowley, Fakhri Karray, and Ali Ghodsi. 2023. Principal Component Analysis. In Elements of Dimensionality Reduction and Manifold Learning. Cham: Springer International Publishing, pp. 123–54. [Google Scholar] [CrossRef]

- Gilchrist, David, Jing Yu, and Rui Zhong. 2021. The Limits of Green Finance: A Survey of Literature in the Context of Green Bonds and Green Loans. Sustainability 13: 478. [Google Scholar] [CrossRef]

- Glomsrød, Solveig, and Taoyuan Wei. 2018. Business as unusual: The implications of fossil divestment and green bonds for financial flows, economic growth and energy market. Energy for Sustainable Development 44: 1–10. [Google Scholar] [CrossRef]

- Gupta, Varun, Monika Mittal, Vikas Mittal, and Yatender Chaturvedi. 2022. Detection of R-peaks using fractional Fourier transform and principal component analysis. Journal of Ambient Intelligence and Humanized Computing 13: 961–72. [Google Scholar] [CrossRef]

- Hadas-Dyduch, Monika, Blandyna Puszer, Maria Czech, and Janusz Cichy. 2022. Green Bonds as an Instrument for Financing Ecological Investments in the V4 Countries. Sustainability 14: 12188. [Google Scholar] [CrossRef]

- Han, Yingwei, and Jie Li. 2022. Should investors include green bonds in their portfolios? Evidence for the USA and Europe. International Review of Financial Analysis 80: 101998. [Google Scholar] [CrossRef]

- Hussain, Hafezali Iqbal, Fakarudin Kamarudin, Jason J. Turner, Hassanudin Mohd Thas Thaker, and Nazratul Aina Mohamad Anwar. 2022. Environmnetal Reporting Policy and Debt Maturity: Perspectives from a Developing Country. Transformations in Business and Economics 22: 245–62. [Google Scholar]

- Inderst, Georg, Christopher Kaminker, and Fiona Stewart. 2012. Defining and Measuring Green Investments: Implications for Institutional Investors’ Asset Allocations. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Jain, Kriti, Medha Gangopadhyay, and Kakali Mukhopadhyay. 2022. Prospects and challenges of green bonds in renewable energy sector: Case of selected Asian economies. Journal of Sustainable Finance and Investment. [Google Scholar] [CrossRef]

- Jiang, Lin, Hunter Sullivan, and Bo Wang. 2022. Principal Component Analysis (PCA) Loading and Statistical Tests for Nuclear Magnetic Resonance (NMR) Metabolomics Involving Multiple Study Groups. Analytical Letters 55: 1648–62. [Google Scholar] [CrossRef]

- Jolliffe, Ian. 2022. A 50-year personal journey through time with principal component analysis. Journal of Multivariate Analysis 188: 104820. [Google Scholar] [CrossRef]

- Kėdaitienė, Angelė, and Violeta Klyvienė. 2020. The Relationships between Economic growth, Energy Efficiency and CO2 Emissions: Results for the Euro Area. Ekonomika 99: 6–25. [Google Scholar] [CrossRef]

- Kumar, Sumit. 2022a. Critical assessment of green financing initiatives in emerging market: A review of india’s green bond issuances. Academy of Marketing Studies Journal 26: 1–14. [Google Scholar]

- Kumar, Sumit. 2022b. Effective Hedging Strategy for US Treasury Bond Portfolio Using Principal Component Analysis. Academy of Accounting and Financial Studies Journal 26: 1–11. [Google Scholar]

- Kung, Chih-Chun, Xiaolong Lan, Yunxia Yang, Shan-Shan Kung, and Meng-Shiuh Chang. 2022. Effects of green bonds on Taiwan’s bioenergy development. Energy 238: 121567. [Google Scholar] [CrossRef]

- Lau, Peter, Angela Sze, Wilson Wan, and Alfred Wong. 2022. The Economics of the Greenium: How Much is the World Willing to Pay to Save the Earth? Environmental and Resource Economics 81: 379–408. [Google Scholar] [CrossRef]

- Leal, José Eugenio. 2020. AHP-expres: A simplified version of the analytical hierarchy process method. MethodsX 7: 100748. [Google Scholar] [CrossRef] [PubMed]

- Lebelle, Martin, Souad Lajili Jarjir, and Syrine Sassi. 2022. The effect of issuance documentation disclosure and readability on liquidity: Evidence from green bonds. Global Finance Journal 51: 100678. [Google Scholar] [CrossRef]

- Liang, Yongtang. 2023. Mitigation Strategy For Lessening the Negative Impacts of Climate Change. Transformations in Business & Economics 22: 87–97. [Google Scholar]

- Lin, Lin, and Yanrong Hong. 2022. Developing a Green Bonds Market:Lessons from China. European Business Organization Law Review 23: 143–85. [Google Scholar] [CrossRef]

- Liu, Yadi, Abdullah A. Al-Atawi, Izaz Ahmad Khan, Neelam Gohar, and Qamar Zaman. 2023. Using the fuzzy analytical hierarchy process to prioritize the impact of visual communication based on artificial intelligence for long-term learning. Soft Computing 27: 157–68. [Google Scholar] [CrossRef]

- Liu, Yan, Claudia M. Eckert, and Christopher Earl. 2020. A review of fuzzy AHP methods for decision-making with subjective judgements. Expert Systems with Applications 161: 113738. [Google Scholar] [CrossRef]

- Löffler, Kristin Ulrike, Aleksandar Petreski, and Andreas Stephan. 2021. Drivers of green bond issuance and new evidence on the “greenium”. Eurasian Economic Review 11: 1–24. [Google Scholar] [CrossRef]

- Maino, Andrea Giulio. 2022. Financing the Energy Transition: The Role, Opportunities and Challenges of Green Bonds. Oxford: The Oxford Institute for Energy Studies. [Google Scholar]

- Malik, Arsalan Haneef, Abu Hassan bin Md Isa, Mohamad bin Jais, Awais Ur Rehman, and Mubashir Ali Khan. 2022. Financial stability of Asian Nations: Governance quality and financial inclusion. Borsa Istanbul Review 22: 377–87. [Google Scholar] [CrossRef]

- Mankata, Lawrence Martin, De-Graft Owusu-Manu, M. Reza Hosseini, and David John Edwards. 2022. Analysis of success-dependent factors for green bond financing of infrastructure projects in Ghana. Journal of Sustainable Finance and Investment 12: 832–48. [Google Scholar] [CrossRef]

- Mathews, John A., and Sean Kidney. 2010. Climate bonds: Mobilizing private financing for carbon management. Carbon Management 1: 9–13. [Google Scholar] [CrossRef]

- Migliorelli, Marco, and Philippe Dessertine. 2019. The Rise of Green Finance in Europe: Opportunities and Challenges for Issuers, Investors and Marketplaces. Available online: http://www.palgrave.com/gp/series/14621 (accessed on 18 March 2023).

- Mohsin, Muhammad, Farhad Taghizadeh-Hesary, and Muhammad Shahbaz. 2022. Nexus between financial development and energy poverty in Latin America. Energy Policy 165: 112925. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Mustafa Raza Rabbani, Sitara Karim, and Syed Mabruk Billah. 2023. Religion vs. ethics: Hedge and safe haven properties of Sukuk and green bonds for stock markets pre- and during COVID-19. International Journal of Islamic and Middle Eastern Finance and Management 16: 234–52. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Thomas Conlon, and John Cotter. 2022. Green bonds and other assets: Evidence from extreme risk transmission. Journal of Environmental Management 305: 114358. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, Anh Huu, Thinh Gia Hoang, Duy Thanh Nguyen, Loan Quynh Thi Nguyen, and Duong Thuy Doan. 2023. The Development of Green Bond in Developing Countries: Insights from Southeast Asia Market Participants. European Journal of Development Research 35: 196–218. [Google Scholar] [CrossRef] [PubMed]

- Nikolaj, Stella Suljić, Bojana Olgić Draženović, and Denis Buterin. 2022. Green Bonds—Sustainable Forms of Financing. In Sustainable Business Management and Digital Transformation: Challenges and Opportunities in the Post-COVID Era. Cham: Springer International Publishing. [Google Scholar] [CrossRef]

- Ning, Yiyi, Jacob Cherian, Muhammad Safdar Sial, Susana Álvarez-Otero, Ubaldo Comite, and Malik Zia-Ud-Din. 2021. Green bond as a new determinant of sustainable green financing, energy efficiency investment, and economic growth: A global perspective. Environmental Science and Pollution Research. [Google Scholar] [CrossRef] [PubMed]

- Otek Ntsama, Ursule Yvanna, Chen Yan, Alireza Nasiri, and Abdel Hamid Mbouombouo Mboungam. 2021. Green bonds issuance: Insights in low- and middle-income countries. International Journal of Corporate Social Responsibility 6: 1–9. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2022. Green finance research around the world: A review of literature. International Journal of Green Economics 16: 56–75. [Google Scholar] [CrossRef]

- Palit, Tanmoy, A. B. M. Mainul Bari, and Chitra Lekha Karmaker. 2022. An integrated Principal Component Analysis and Interpretive Structural Modeling approach for electric vehicle adoption decisions in sustainable transportation systems. Decision Analytics Journal 4: 100119. [Google Scholar] [CrossRef]

- Petroutsatou, Kleopatra, Ilias Ladopoulos, and Konstantina Tsakelidou. 2022. Scientometric Analysis and AHP for Hierarchizing Criteria Affecting Construction Equipment Operators’ Performance. Sustainability 14: 6836. [Google Scholar] [CrossRef]

- Pineiro-Chousa, Juan, M. Ángeles López-Cabarcos, Jérôme Caby, and Aleksandar Šević. 2021. The influence of investor sentiment on the green bond market. Technological Forecasting and Social Change 162: 120351. [Google Scholar] [CrossRef]

- Puaschunder, Julia M. 2023. Governance of Climate Justice: Taxation Transfers and Green Bonds. In SDGs in the Americas and Caribbean Region. Implementing the UN Sustainable Development Goals—Regional Perspectives. Cham and New York: Springer. [Google Scholar] [CrossRef]

- Saaty, Thomas L., and Mujgan Sağır Özdemir. 2015. How Many Judges Should There Be in a Group? Annals of Data Science 1: 359–68. [Google Scholar] [CrossRef]

- Sachs, Jeffrey, Wing Thye Woo, Naoyuki Yoshino, and Farhad Taghizadeh-Hesary, eds. 2019. Handbook of Green Finance. Energy Security and Sustainable Development. In Handbook of Green Finance. Singapore: Springer. [Google Scholar] [CrossRef]

- Sevinç, Ali, Şeyda Gür, and Tamer Eren. 2018. Analysis of the Difficulties of SMEs in Industry 4.0 Applications by Analytical Hierarchy Process and Analytical Network Process. Processes 6: 264. [Google Scholar] [CrossRef]

- Sinha, Avik, Shekhar Mishra, Arshian Sharif, and Larisa Yarovaya. 2021. Does green financing help to improve environmental and social responsibility? Designing SDG framework through advanced quantile modelling. Journal of Environmental Management 292: 112751. [Google Scholar] [CrossRef] [PubMed]

- Siracusa, Vittorio. 2021. Green Bonds: The Sovereign Issuer’s Perspective. Sustainable Finance and Investments: Experiences and Perspectives. Available online: https://mib.edu/en/newsroom/mib-lens-live-web-management-series (accessed on 18 March 2023).

- Streimikiene, Dalia, Asta Mikalauskiene, and Greta Burbaite. 2023. The Role of Sustainable Finance in Achieving Sustainable Development Goals. Economics and Sociology 16: 256–83. [Google Scholar]

- Štreimikienė, Dalia, Asta Mikalauskienė, and Ugnė Macijauskaitė-Daunaravičienė. 2022. Role of information management in implementing the Green Deal in the EU and the US. Journal of International Studies 15: 9–27. [Google Scholar] [CrossRef]

- Sun, Licheng, Sui Fang, Sajid Iqbal, and Ahmad Raza Bilal. 2022a. Financial stability role on climate risks, and climate change mitigation: Implications for green economic recovery. Environmental Science and Pollution Research. [Google Scholar] [CrossRef]

- Sun, Lirong, Kaili Wang, Lini Xu, Chonghui Zhang, and Tomas Balezentis. 2022b. A time-varying distance based interval-valued functional principal component analysis method—A case study of consumer price index. Information Sciences 589: 94–116. [Google Scholar] [CrossRef]

- Teti, Emanuele, Icaro Baraglia, Maurizio Dallocchio, and Giovanna Mariani. 2022. The green bonds: Empirical evidence and implications for sustainability. Journal of Cleaner Production 366: 132784. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, Emmanuel Joel Aikins Abakah, OlaOluwa Simon Yaya, and Kingsley Opoku Appiah. 2023. Tail risk dependence, co-movement and predictability between green bond and green stocks. Applied Economics 55: 201–22. [Google Scholar] [CrossRef]

- Tomfort, André. 2022. Making Green Bonds Greener: Proposals to Increase the Efficiency of Green Bonds. Journal of Applied Finance and Banking 13: 39–59. [Google Scholar] [CrossRef]

- Tona, Olgerta, Yixin Zhang, Aleksandre Asatiani, and Juho Lindman. 2023. Role of Data in the Building of Legitimacy for Green Bonds—Capturing, Contextualizing, and Communicating. Paper presented at 56th Hawaii International Conference on System Sciences, Maui, HI, USA, January 3–6; pp. 5400–9, ISBN 978-0-9981331-6-4. [Google Scholar]

- Torvanger, Asbjørn, Maltais Aaron, and Iulia Marginean. 2021. Green bonds in Sweden and Norway: What are the success factors? Journal of Cleaner Production 324: 129177. [Google Scholar] [CrossRef]

- Tripathy, Aneil, Lionel Mok, and Grégoire Lunven de Chanrond. 2020. A Multidisciplinary Literature Review of Academic Research on the Green Bond Market. Journal of Environmental Investing 10: 100–28. [Google Scholar]

- UNEP. 2019. Strengthening the Environmental Dimensions of the Sustainable Development Goals in Asia and the Pacific. Kenya: United Nations Environment Programme. [Google Scholar]

- Vafaei, Nazanin, Rita A. Ribeiro, and Luis M. Camarinha-Matos. 2016. Normalization Techniques for Multi-Criteria Decision Making: Analytical Hierarchy Process Case Study. In Technological Innovation for Cyber-Physical Systems. Cham: Springer, pp. 261–69. [Google Scholar] [CrossRef]

- Verma, Rakesh Kumar, and Rohit Bansal. 2023. Stock Market Reaction on Green-Bond Issue: Evidence from Indian Green-Bond Issuers. The Journal of the Business Perspective 27: 264–72. [Google Scholar] [CrossRef]

- Vojtek, Matej, and Jana Vojteková. 2019. Flood Susceptibility Mapping on a National Scale in Slovakia Using the Analytical Hierarchy Process. Water 11: 364. [Google Scholar] [CrossRef]

- Wang, Chia-Nan, Ying-Fang Huang, I-Fang Cheng, and Van Thanh Nguyen. 2018. A Multi-Criteria Decision-Making (MCDM) Approach Using Hybrid SCOR Metrics, AHP, and TOPSIS for Supplier Evaluation and Selection in the Gas and Oil Industry. Processes 6: 252. [Google Scholar] [CrossRef]

- Wang, Kai-Hua, Chi-Wei Su, Muhammad Umar, and Adelina Dumitrescu Peculea. 2023. Oil prices and the green bond market: Evidence from time-varying and quantile-varying aspects. Borsa Istanbul Review 23: 516–26. [Google Scholar] [CrossRef]

- Wang, Yi. 2021. The Development and Usage of NPV and IRR and Their Comparison. Advances in Economics, Business and Management Research 203: 2044–48. [Google Scholar]

- Yap, Jeremy Y. L., Chiung Ching Ho, and Choo-Yee Ting. 2017. Analytic Hierarchy Process (AHP) for business site selection. AIP Conference Proceedings 2016: 020151. [Google Scholar] [CrossRef]

- Ye, Xiang, and Ehsan Rasoulinezhad. 2023. Assessment of impacts of green bonds on renewable energy utilization efficiency. Renewable Energy 22: 626–33. [Google Scholar] [CrossRef]

- Yu, Dejian, Gang Kou, Zeshui Xu, and Shunshun Shi. 2021. Analysis of Collaboration Evolution in AHP. International Journal of Information Technology and Decision Making 20: 7–36. [Google Scholar] [CrossRef]

- Zenno, Yoshihiro, and Kentaka Aruga. 2023. Investigating Factors Affecting Institutional Investors’ Green Bond Investments: Cases for Beijing and Shenzhen. Sustainability 15: 4870. [Google Scholar] [CrossRef]

- Zeqiraj, Veton, Kazi Sohag, and Ugur Soytas. 2020. Stock market development and low-carbon economy: The role of innovation and renewable energy. Energy Economics 91: 104908. [Google Scholar] [CrossRef]

- Zhang, Linyun, Feiming Huang, Lu Lu, Xinwen Ni, and Sajid Iqbal. 2022. Energy financing for energy retrofit in COVID-19: Recommendations for green bond financing. Environmental Science and Pollution Research 29: 23105–16. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Linhai, Ka Yin Chau, Trung Kien Tran, Muhammad Sadiq, Nguyen Thi My Xuyen, and Thi Thu Hien Phan. 2022. Enhancing green economic recovery through green bonds financing and energy efficiency investments. Economic Analysis and Policy 76: 488–501. [Google Scholar] [CrossRef]

- Zhou, Hongji, and Guoyin Xu. 2022. Research on the impact of green finance on China’s regional ecological development based on system GMW model. Resources Policy 75: 102454. [Google Scholar] [CrossRef]

| Bond Type | ISIN | Issuer | Field | Use of Proceeds | Bond Type |

|---|---|---|---|---|---|

| Sovereign Green Bond | LT0000610305 | Ministry of Finance of the Republic of Lithuania | Formulation and implementation of public finance policies | Green projects (modernisation of apartment buildings and energy efficiency) | Sovereign green bond |

| Corporate green bond | LT0000405938 | UAB “Atsinaujinančios energetikos investicijos” | Collective investment undertaking for informed investors | Renewable solar and wind energy infrastructure projects, energy efficiency | Corporate green bond |

| Corporate green bond | LT0000406530 | EPSO-G UAB | Energy | Electricity transmission via high voltage grids and natural gas transportation via high pressure pipelines | Corporate green bond |

| Corporate green bond | LT0000404238 | AUGA group, AB | Agriculture | Ongoing sustainability projects, to finance solutions of GHG reductions | Corporate green bond |

| Corporate green bond | XS1646530565 | AB “Ignitis grupė” | Energy | Investment in network segment and Green Generation projects | Corporate green bond |

| Corporate green bond | XS1853999313 | AB “Ignitis grupė” | Energy | Investment in network segment and Green Generation projects | Corporate green bond |

| R | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| N | 0 | 0 | 0.52 | 0.9 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.49 |

| Number of Experts | Area of Expertise |

|---|---|

| 3 | Financial markets |

| 4 | Sustainable finance |

| 2 | ESG |

| Intensity of Importance | Definition |

|---|---|

| 1 | Equal importance |

| 3 | Moderate importance |

| 5 | Strong importance |

| 7 | Very strong importance |

| 9 | Extreme importance |

| 2, 4, 6, 8 | Intermediate values |

| Criteria | Ex. 1, % | Ex. 2, % | Ex. 3, % | Ex. 4, % | Ex. 5, % | Ex. 6, % | Ex. 7, % | Ex. 8, % | Ex. 9, % | FW |

|---|---|---|---|---|---|---|---|---|---|---|

| Good credit rating | 21.4 | 15.3 | 17.8 | 19.8 | 20.0 | 19.8 | 7.0 | 5.8 | 6.8 | 15 |

| Provision of explicit country-level instruction on the issuance procedure | 2.7 | 2.8 | 2.2 | 2.5 | 2.7 | 2.3 | 11.1 | 9.6 | 6.5 | 5 |

| Suitable requirements for green project eligibility | 10.1 | 10.7 | 8.2 | 11.8 | 9.7 | 8.9 | 12.0 | 16.0 | 15.4 | 11 |

| Precedence given to financially sound projects | 11.4 | 10.6 | 11.1 | 13.7 | 10.7 | 12.4 | 11.4 | 9.0 | 8.9 | 11 |

| Transparent and clearly defined use and management of proceeds | 4.6 | 5.4 | 4.7 | 4.0 | 4.7 | 4.6 | 14.9 | 13.1 | 12.6 | 8 |

| Process for project evaluation and selection | 5.3 | 6.8 | 5.1 | 4.4 | 6.4 | 5.4 | 17.5 | 18.6 | 17.2 | 10 |

| Reporting and external review | 6.2 | 6.5 | 6.8 | 6.4 | 7.5 | 5.6 | 7.5 | 5.0 | 5.8 | 6 |

| Reputation of the issuer | 17.5 | 19.2 | 22.4 | 18.9 | 19.4 | 22.2 | 7.5 | 11.3 | 16.6 | 17 |

| ESG score | 13.8 | 14.8 | 15.2 | 11.9 | 12.4 | 11.67 | 7.9 | 8.9 | 8.1 | 12 |

| Size of the green bond issue | 7.0 | 8.0 | 6.4 | 6.8 | 6.5 | 7.2 | 3.2 | 2.7 | 2.0 | 6 |

| Consistency | 0.7 | 0.1 | 5.5 | 1.00 | 4.4 | 4.7 | 9.5 | 9.5 | 8.4 |

| Criteria | Ex. 1, % | Ex. 2, % | Ex. 3, % | Ex. 4, % | Ex. 5, % | Ex. 6, % | Ex. 7, % | Ex. 8, % | Ex. 9, % | FW |

|---|---|---|---|---|---|---|---|---|---|---|

| Instrument for management of the currency risks | 6.6 | 6.62 | 6.7 | 8.8 | 8.3 | 7.5 | 7.9 | 3.0 | 1.6 | 6 |

| Increase of investor interest in environmental financing | 4.6 | 4.57 | 3.9 | 4.2 | 4.5 | 4.2 | 4.3 | 17.9 | 5.2 | 6 |

| Strengthen aptitude of institutional investors | 3.9 | 3.87 | 3.1 | 3.1 | 3.2 | 3.4 | 3.4 | 19.7 | 6.0 | 6 |

| Provision of quantifiable and measurable benefits | 13.9 | 13.91 | 10.8 | 14.8 | 13.5 | 14.7 | 14.8 | 2.7 | 17.8 | 13 |

| Supporting government polices | 9.99 | 9.99 | 11.1 | 9.99 | 9.8 | 10.1 | 10.8 | 7.9 | 4.8 | 9 |

| Stimulation of involvement of the public | 11.6 | 11.63 | 7.8 | 7.2 | 7.9 | 8.4 | 8.7 | 18.2 | 6.7 | 10 |

| Creating/stabilising efficient bond market | 13.7 | 13.66 | 13.0 | 11.6 | 12.5 | 13.0 | 11.9 | 4.1 | 14.1 | 12 |

| Low investment risks | 16.2 | 16.18 | 14.8 | 18.4 | 20.0 | 17.7 | 14.8 | 3.2 | 19.1 | 16 |

| Ability to raise large investment amounts needed to finance environmentally-friendly projects | 9.9 | 9.93 | 15.8 | 11.2 | 10.6 | 11.3 | 13.4 | 18.3 | 21.4 | 14 |

| Bonds bear more flexibility and liquidity | 9.6 | 9.64 | 13.5 | 10.6 | 9.7 | 9.7 | 10.0 | 4.9 | 3.4 | 9 |

| Consistency | 0.8 | 0.8 | 9.9 | 9.0 | 9.5 | 8.0 | 8.5 | 8.1 | 6.4 |

| Criteria | Ex. 1, % | Ex. 2, % | Ex. 3, % | Ex. 4, % | Ex. 5, % | Ex. 6, % | Ex. 7, % | Ex. 8, % | Ex. 9, % | FW |

|---|---|---|---|---|---|---|---|---|---|---|

| Greenwashing | 53.1 | 51.2 | 45.8 | 45.6 | 44.1 | 35.2 | 10.2 | 29.0 | 32.6 | 39 |

| Green bond market might exaggerate its importnce in environmental protection | 25.8 | 23.3 | 28.8 | 20.1 | 22.6 | 20.7 | 6.5 | 28.4 | 32.6 | 23 |

| Green bonds provide slight financial and economic benefits for investors willing to engage into projects supporting the environment | 6.0 | 10.5 | 11.3 | 16.5 | 16.3 | 23.4 | 7.6 | 29.0 | 18.0 | 15 |

| Issuance costs | 10.60 | 9.9 | 8.01 | 11.6 | 11.4 | 13.8 | 7.6 | 8.5 | 12.3 | 10 |

| Absence of global market standards | 4.6 | 5.2 | 6.1 | 6.1 | 5.7 | 6.9 | 68.1 | 5.1 | 4.7 | 12 |

| Consistency | 7.2 | 7.1 | 4.7 | 6.6 | 8.2 | 8.2 | 3.5 | 0.6 | 8.1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bužinskė, J.; Stankevičienė, J. Analysis of Success Factors, Benefits, and Challenges of Issuing Green Bonds in Lithuania. Economies 2023, 11, 143. https://doi.org/10.3390/economies11050143

Bužinskė J, Stankevičienė J. Analysis of Success Factors, Benefits, and Challenges of Issuing Green Bonds in Lithuania. Economies. 2023; 11(5):143. https://doi.org/10.3390/economies11050143

Chicago/Turabian StyleBužinskė, Julija, and Jelena Stankevičienė. 2023. "Analysis of Success Factors, Benefits, and Challenges of Issuing Green Bonds in Lithuania" Economies 11, no. 5: 143. https://doi.org/10.3390/economies11050143

APA StyleBužinskė, J., & Stankevičienė, J. (2023). Analysis of Success Factors, Benefits, and Challenges of Issuing Green Bonds in Lithuania. Economies, 11(5), 143. https://doi.org/10.3390/economies11050143