Nowcasting Economic Activity Using Electricity Market Data: The Case of Lithuania

Abstract

1. Introduction

2. Literature Review

2.1. Nowcasting Economic Activity under Uncertain Time

2.2. The Use of Electricity Market Data in Nowcasting

3. Methodology

- Unemployment rate (%);

- Consumer confidence;

- Economic sentiment indicator;

- Exports (thousand euro);

- Exports of goods of Lithuanian origin (thousand euros);

- Imports (thousand euros);

- CPI-based consumer price changes, compared with the previous month (%);

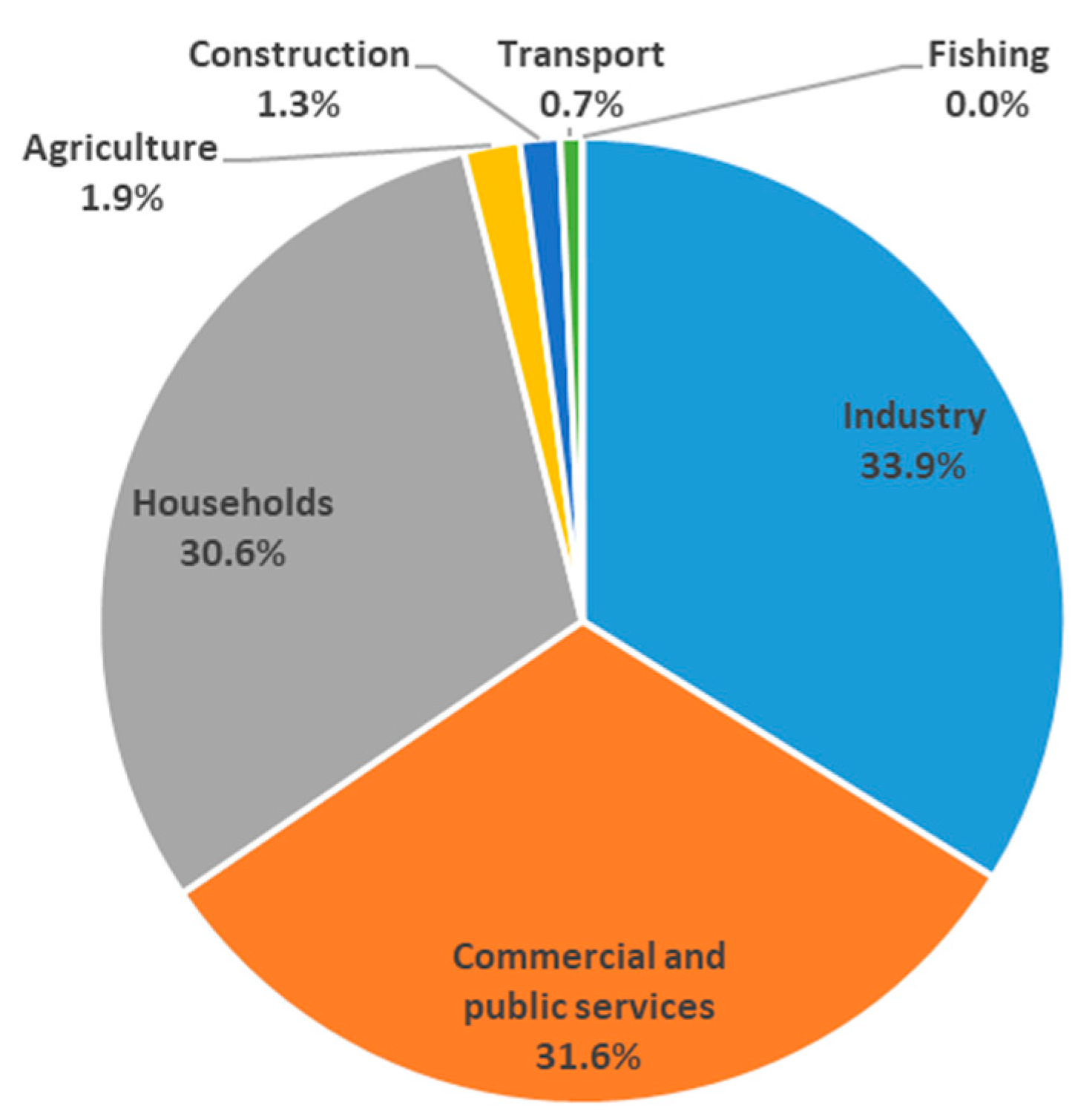

- Industrial production (VAT and excises excluded): B_TO_E Industry (thousand euro);

- Wholesale and retail trade, repair of motor vehicles and motorcycles (thousand euros).

- Step weighting. In general, it employs the step function:In this research, yt is a macroeconomic indicator, are electricity market indicators, S is number of values for each low-frequency value, and β and φτ are parameters to be estimated. The lag value of yt is included in place of . It is chosen based on the delay period of each macroeconomic indicator, and the maximum number of days of delay is taken. k is the number of high-frequency lags to be included in the low-frequency regression equation, and it is also set to the maximum delay period. The step length is set to 7 days. Therefore, every seven lags of the electricity market indicators employ the same coefficient.

- Almon weighting. Almon lag weighting is also called polynomial distributed lag (PDL) weighting and is widely used to place restrictions on lag coefficients in autoregressive models. The model can be written as:P is Almon polynomial order. The coefficients are modelled as a p dimensional lag polynomial in the MIDAS parameters θ for each high-frequency lag up to k.

- Beta weighting. It is based on the normalized beta weighting function and was introduced by Ghysels, Santa-Clara, and Valkanov (Ghysels et al. 2004):σ is a small number (in practice, approximately equal to 2.22 × 10−16). The beta function is very flexible and can take many shapes depending on the values of the parameters θ1, θ2, and θ3. The restriction θ3 = 0 is used, which means that there are zero weights at the high-frequency lag endpoints.

- U-MIDAS. This is unrestricted MIDAS regressions. This technique adds each of the higher-frequency components as a regressor in the lower-frequency regression and is simply the individual coefficients method given by Equation (1).

- Auto/GETS weighting. It is an extension of U-MIDAS that uses variable selection to reduce the number of individual coefficients by excluding individual lags.

4. Results and Discussion

4.1. Nowcasting Unemployment Rate

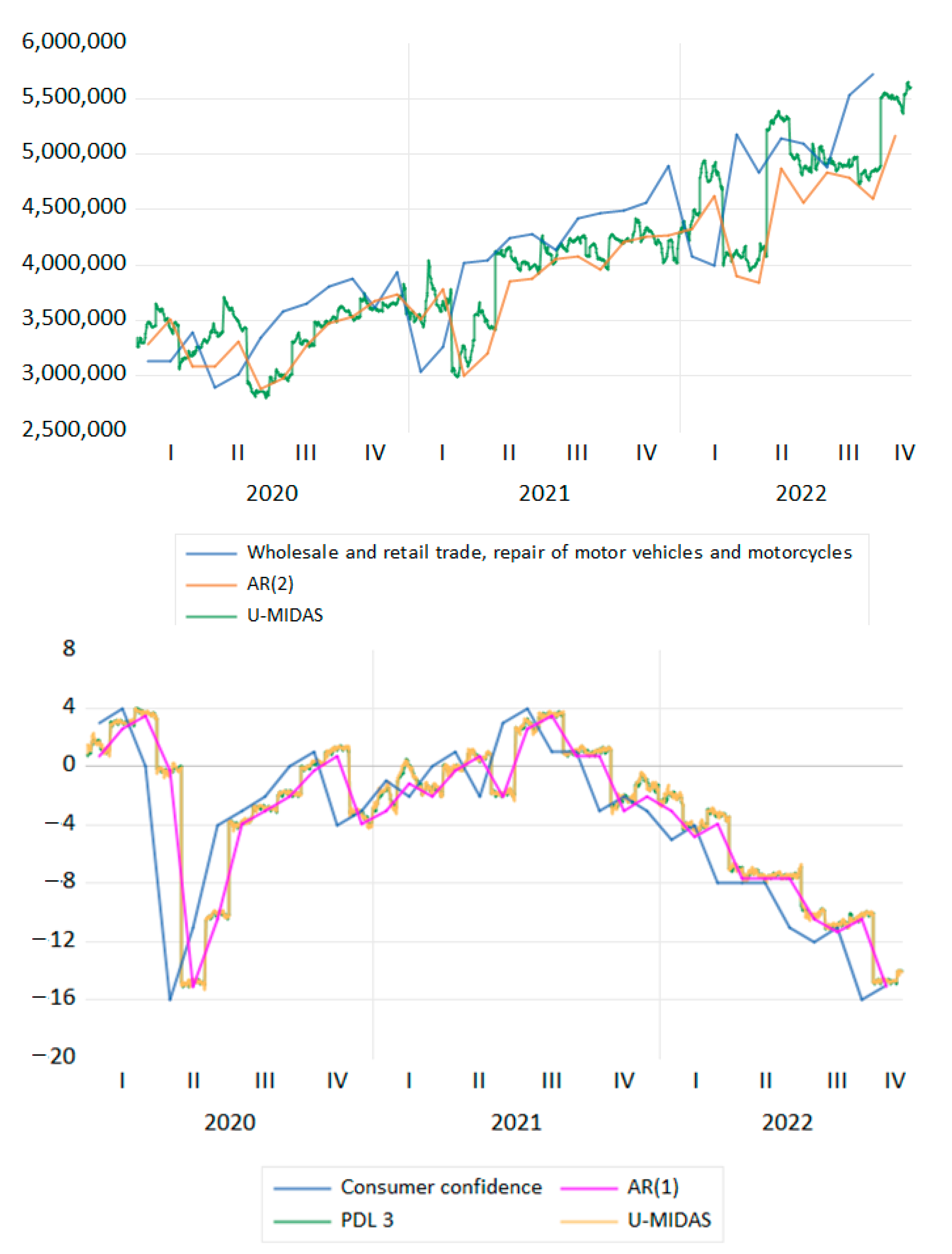

4.2. Nowcasting Consumer Confidence

4.3. Nowcasting Economic Sentiment Indicator

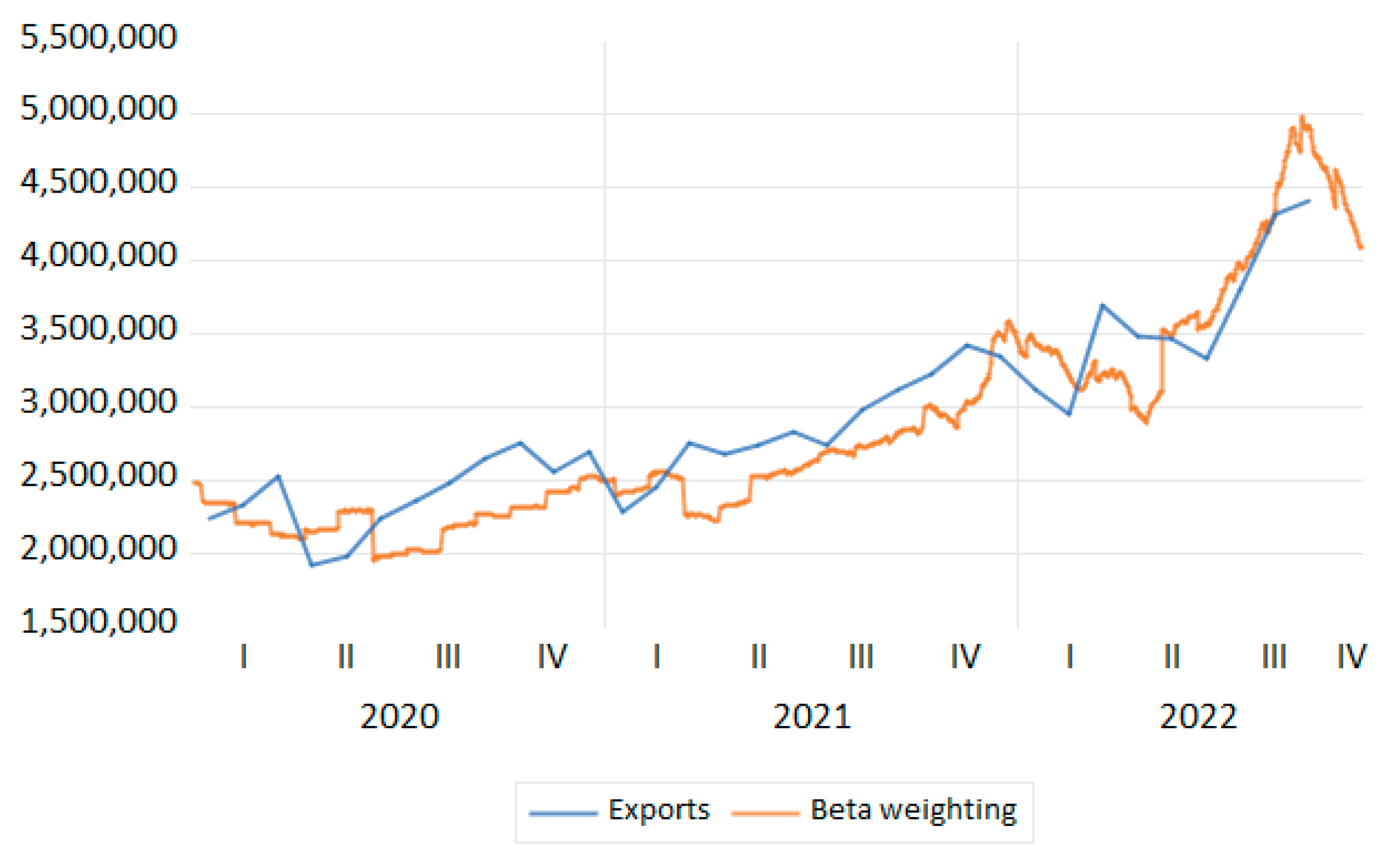

4.4. Nowcasting Exports

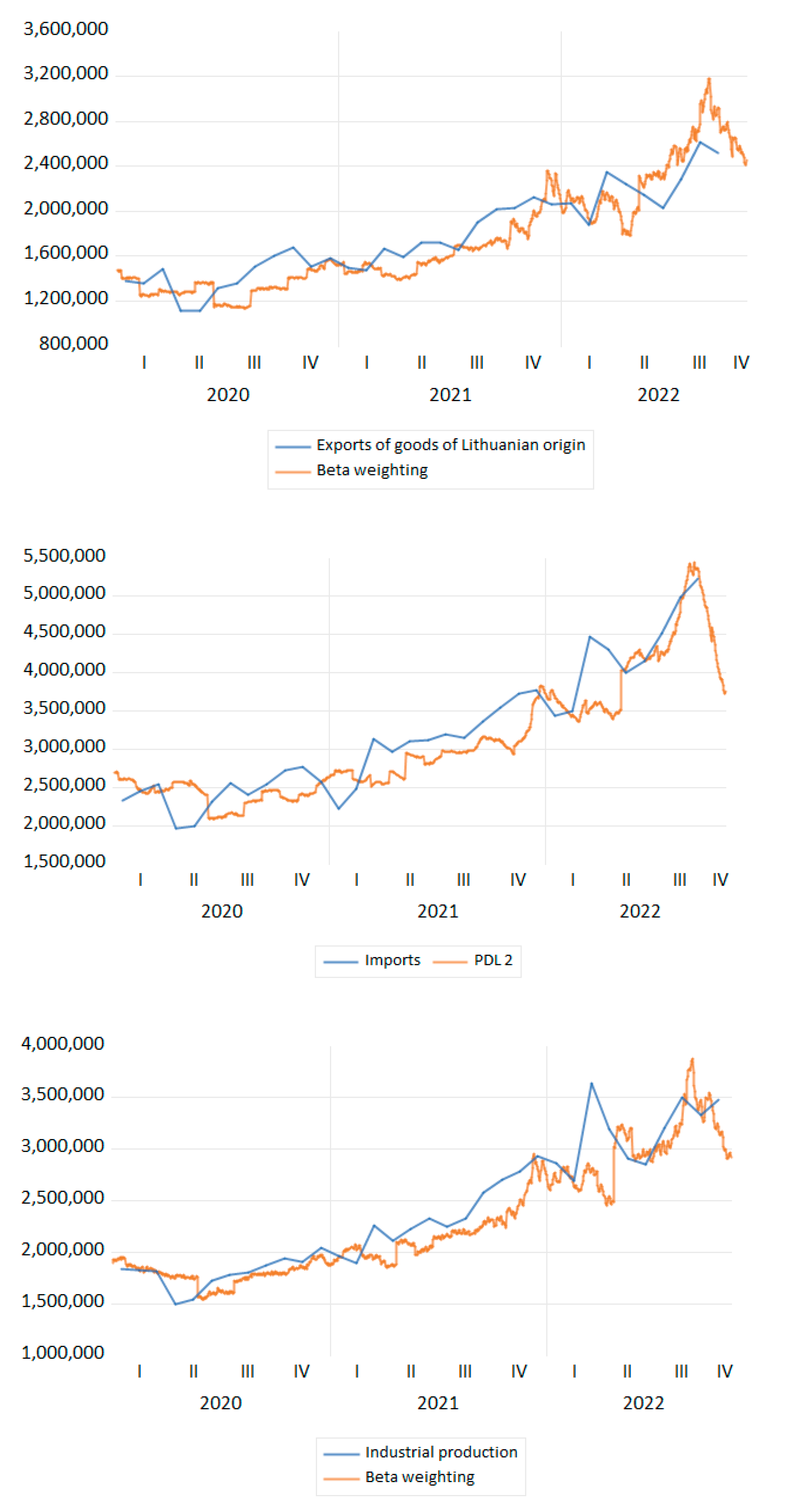

4.5. Nowcasting Exports of Goods of Lithuanian Origin

4.6. Nowcasting Imports

4.7. Nowcasting CPI-Based Consumer Price Changes

4.8. Nowcasting Industrial Production

4.9. Nowcasting Wholesale and Retail Trade, Repair of Motor Vehicles and Motorcycles

4.10. Comparison of Real and Nowcasted Values

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Angelov, Nikolay, and Daniel Waldenström. 2021. The Impact of COVID-19 on Economic Activity: Evidence from Administrative Tax Registers. IFN Working Paper No. 1397. Stockholm: Research Institute of Industrial Economics. [Google Scholar]

- Bai, Jennie, Eric Ghysels, and Jonathan H. Wright. 2013. State Space Models and MIDAS Regressions. Econometric Reviews 32: 779–813. [Google Scholar] [CrossRef]

- Bańbura, Marta, Domenico Giannone, Michele Modugno, and Lucrezia Reichlin. 2013. Now-Casting and the Real-Time Data Flow. Working Paper Series, No 1564; Frankfurt: European Central Bank. [Google Scholar]

- Barbaglia, Luca, Lorenzo Frattarolo, Luca Onorante, Filippo Maria Pericoli, Marco Ratto, and Luca Tiozzo Pezzoli. 2022. Testing big data in a big crisis: Nowcasting under COVID-19. International Journal of Forecasting, in press. [Google Scholar] [CrossRef]

- Baumeister, Christiane, and James D. Hamilton. 2019. Structural Interpretation of Vector Autoregressions with Incomplete Identification: Revisiting the Role of Oil Supply and Demand Shocks. American Economic Review 109: 1873–910. [Google Scholar] [CrossRef]

- Bennedsen, Mikkel, Eric Hillebrand, and Siem Jan Koopman. 2021. Modeling, forecasting, and nowcasting U.S. CO2 emissions using many macroeconomic predictors. Energy Economics 96: 105118. [Google Scholar] [CrossRef]

- Blanco, Emilio, Laura D’Amato, Fiorella Dogliolo, and María Lorena Garegnani. 2017. Nowcasting GDP in Argentina: Comparing the Predictive Ability of Different Models. Economic Research Working Papers, No. 74. Buenos Aires: Central Bank of Argentina, Economic Research Department. [Google Scholar]

- Blonz, Joshua, and Jacob Williams. 2020. Electricity Demand as a High-Frequency Economic Indicator: A Case Study of the COVID-19 Pandemic and Hurricane Harvey. FEDS Notes. Washington, DC: Board of Governors of the Federal Reserve System. [Google Scholar]

- Carriero, Andrea, Todd E. Clark, and Massimiliano Marcellino. 2020. Nowcasting Tail Risks to Economic Activity with Many Indicators. Federal Reserve Bank of Cleveland, Working Paper No. 20-13R2. Cleveland: Federal Reserve Bank of Cleveland. [Google Scholar]

- Cavallo, Alberto. 2015. Scraped Data and Sticky Prices. National Bureau of Economic Research. Working Paper, No. 21490. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Chen, Kuan-Jen, Angus C. Chu, and Ching-Chong Lai. 2018. Home production and small open economy business cycles. Journal of Economic Dynamics and Control 95: 110–35. [Google Scholar] [CrossRef]

- Cooper, Ilan, and Richard Priestley. 2013. The World Business Cycle and Expected Returns. Review of Finance 17: 1029–106. [Google Scholar] [CrossRef]

- Diaz, Elena Maria, and Gabriel Perez-Quiros. 2021. GEA tracker: A daily indicator of global economic activity. Journal of International Money and Finance 115: 102400. [Google Scholar] [CrossRef]

- Eckert, Florian, Philipp Kronenberg, Heiner Mikosch, and Stefan Neuwirth. 2020. Tracking Economic Activity with Alternative High-Frequency Data. KOF Working Papers, No. 20-488. Zürich: KOF Swiss Economic Institute, ETH Zurich. [Google Scholar]

- Eraslan, Sercan, and Thomas Götz. 2021. An unconventional weekly economic activity index for Germany. Economics Letters 204: 109881. [Google Scholar] [CrossRef]

- Fenz, Gerhard, and Helmut Stix. 2021. Monitoring the economy in real time with the weekly OeNB GDP indicator: Background, experience and outlook. Monetary Policy and the Economy Q4/20–Q1/21: 17–40. [Google Scholar]

- Ferrara, Laurent, and Xuguang Simon Sheng. 2022. Guest editorial: Economic forecasting in times of COVID-19. International Journal of Forecasting 38: 527–28. [Google Scholar] [CrossRef]

- Fezzi, Carlo, and Valeria Fanghella. 2021. Tracking GDP in real-time using electricity market data: Insights from the first wave of COVID-19 across Europe. European Economic Review 193: 103907. [Google Scholar] [CrossRef]

- Ghysels, Eric, Pedro Santa-Clara, and Valkanov Rossen. 2004. The MIDAS Touch: Mixed Data Sampling Regression Models. CIRANO Working Papers 2004s-20. Montreal: CIRANO. [Google Scholar]

- Ghysels, Eric, Virmantas Kvedaras, and Vaidotas Zemlys-Balevičius. 2020. Chapter 4—Mixed data sampling (MIDAS) regression models. In Handbook of Statistics. Edited by Hrishikesh D. Vinod and Calyampudi RadhakrishnaRao. Amsterdam: Elsevier, vol. 42, pp. 117–53. [Google Scholar] [CrossRef]

- Herrera, Ana María, and Sandeep Kumar Rangaraju. 2020. The effect of oil supply shocks on U.S. economic activity: What have we learned? Journal of Applied Econometrics 35: 141–59. [Google Scholar] [CrossRef]

- Huber, Florian, Gary Koop, Luca Onorante, Michael Pfarrhofer, and Josef Schreiner. 2023. Nowcasting in a pandemic using non-parametric mixed frequency VARs. Journal of Econometrics 232: 52–69. [Google Scholar] [CrossRef]

- Kapetanios, George, and Fotis Papailias. 2018. Big Data & Macroeconomic Nowcasting: Methodological Review. Economic Statistics Centre of Excellence (ESCoE), Discussion Papers ESCoE DP-2018-12. London: Economic Statistics Centre of Excellence (ESCoE), King’s Business School, King’s College London. [Google Scholar]

- Kilian, Lutz. 2019. Measuring global real economic activity: Do recent critiques hold up to scrutiny? Economics Letters 178: 106–10. [Google Scholar] [CrossRef]

- Knotek, Edward S., and Saeed Zaman. 2017. Nowcasting US headline and core inflation. Journal of Money, Credit and Banking 49: 931–68. [Google Scholar] [CrossRef]

- Lehmann, Robert, and Möhrle Sascha. 2022. Forecasting Regional Industrial Production with High-Frequency Electricity Consumption Data. CESifo Working Paper No. 9917. Munich: CESifo. [Google Scholar]

- LITGRID. 2022. Available online: https://www.litgrid.eu/index.php/sistemos-duomenys/79 (accessed on 15 December 2022).

- Lourenço, Nuno, and António Rua. 2021. The Daily Economic Indicator: Tracking economic activity daily during the lockdown. Economic Modelling 100: 105500. [Google Scholar] [CrossRef] [PubMed]

- Martins, Bruno Juncklaus, Allan Cerentini, Sylvio Luiz Mantelli, Thiago Zimmermann Loureiro Chaves, Nicolas Moreira Branco, Aldo von Wangenheim, Ricardo Rüther, and Juliana Marian Arrais. 2022. Systematic review of nowcasting approaches for solar energy production based upon ground-based cloud imaging. Solar Energy Advances 2: 100019. [Google Scholar] [CrossRef]

- Mellander, Charlotta, José Lobo, Kevin Stolarick, and Zara Matheson. 2015. Night-Time Light Data: A Good Proxy Measure for Economic Activity? PLoS ONE 10: e0139779. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a Unit Root in Time Series Regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Proietti, Tommaso, Alessandro Giovannelli, Ottavio Ricchi, Ambra Citton, Christían Tegami, and Cristina Tinti. 2021. Nowcasting GDP and its components in a data-rich environment: The merits of the indirect approach. International Journal of Forecasting 37: 1376–98. [Google Scholar] [CrossRef]

- Sampi, James, and Jooste Charl. 2020. Nowcasting Economic Activity in Times of COVID-19: An Approximation from the Google Community Mobility Report. World Bank Policy Research Working Paper; No. 9247. Washington, DC: The World Bank. [Google Scholar]

- Statistics Lithuania. 2022. Available online: https://osp.stat.gov.lt/statistiniu-rodikliu-analize#/ (accessed on 15 December 2022).

- Toker, Selma, Nimet Özbay, and Kristofer Månsson. 2022. Mixed data sampling regression: Parameter selection of smoothed least squares estimator. Journal of Forecasting 41: 718–751. [Google Scholar] [CrossRef]

- Utari, Dina Tri, and Hafizah Ilma. 2018. Comparison of methods for mixed data sampling (MIDAS) regression models to forecast Indonesian GDP using agricultural exports. Paper presented at the 8th Annual Basic Science International Conference: Coverage of Basic Sciences toward the World’s Sustainability Challenges; Available online: https://aip.scitation.org/toc/apc/2021/1 (accessed on 20 November 2022).

- Vipin, Arora, and Jozef Lieskovsky. 2014. Electricity Use as an Indicator of U.S. Economic Activity; Working Paper Series; Washington, DC: U.S. Energy Information Administration. Available online: https://www.eia.gov/workingpapers/pdf/electricity_indicator.pdf (accessed on 20 November 2022).

- Wegmüller, Philipp, Christian Glocker, and Valentino Guggia. 2023. Weekly economic activity: Measurement and informational content. International Journal of Forecasting 39: 228–43. [Google Scholar] [CrossRef]

| Macroeconomic Indicator | Delay, in Days |

|---|---|

| Unemployment rate | 30–60 |

| Consumer confidence | 0–30 |

| Economic sentiment indicator | 0–36 |

| Exports | 39–69 |

| Exports of goods of Lithuanian origin | 39–69 |

| Imports | 39–69 |

| CPI-based consumer price changes | 8–39 |

| Industrial production | 22–53 |

| Wholesale and retail trade, repair of motor vehicles and motorcycles | 26–57 |

| Indicator | Mean | Median | Maximum | Minimum | Std. Dev. | No. of Observations | Order of Integration |

|---|---|---|---|---|---|---|---|

| Electricity consumption | 890,154 | 871,866 | 1,235,045 | 705,755 | 116,988 | 154 | I(0) |

| Electricity production | 305,104 | 298,734 | 726,674 | 127,108 | 91,651 | 154 | I(0) |

| Electricity price | 63.16 | 44.51 | 480.36 | 23.31 | 63.85 | 118 | I(1) |

| Unemployment rate | 9.84 | 8.60 | 18.70 | 5.10 | 3.76 | 154 | I(0) |

| Economic sentiment indicator | −0.63 | −0.80 | 11.30 | −26.00 | 6.67 | 118 | I(0) |

| Consumer confidence | −6.36 | −5.00 | 8.00 | −34.00 | 8.06 | 154 | I(0) |

| Imports | 2,382,542 | 2,266,725 | 5,240,538 | 1,033,667 | 667,428 | 153 | I(1) |

| Exports | 2,179,279 | 2,064,967 | 4,410,498 | 900,511 | 571,224 | 153 | I(1) |

| Exports of goods of Lithuanian origin | 1,330,753 | 1,256,003 | 2,615,594 | 670,780 | 343,840 | 153 | I(1) |

| Consumer price changes | 0.32 | 0.20 | 2.90 | −1.30 | 0.65 | 154 | I(0) |

| Industrial production | 1,818,556 | 1,679,641 | 3,641,898 | 1,155,882 | 460,838 | 154 | I(1) |

| Wholesale and retail trade, repair of motor vehicles and motorcycles | 2,838,063 | 2,635,202 | 5,722,806 | 1,195,498 | 904,126 | 153 | I(0) |

| Correlation Probability | d(Electricity Consumption) | d(Electricity Production) | d(Electricity Price) | d(Unemployment Rate) | d(Economic Sentiment) | d(Consumer Confidence) | d(Imports) | d(Exports) | d(Lithuanian Exports) | d(Consumer Price Changes) | d(Industrial Production) | d(Trade) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| d(Electricity consumption) | 1.0000 | |||||||||||

| ----- | ||||||||||||

| d(Electricity production) | 0.3153 | 1.0000 | ||||||||||

| 0.0001 | ----- | |||||||||||

| d(Electricity price) | 0.2314 | 0.0884 | 1.0000 | |||||||||

| 0. 0121 | 0.3434 | ----- | ||||||||||

| d(Unemployment rate) | 0.1589 | 0.0959 | 0.0274 | 1.0000 | ||||||||

| 0.0497 | 0.2381 | 0.7691 | ----- | |||||||||

| d(Economic sentiment) | −0.0203 | −0.0930 | 0.0422 | −0.1914 | 1.0000 | |||||||

| 0.8284 | 0.3185 | 0.6511 | 0.0387 | ----- | ||||||||

| d(Consumer confidence) | 0.1728 | −0.0048 | 0.0462 | −0.0008 | 0.6186 | 1.0000 | ||||||

| 0.0327 | 0.9535 | 0.6211 | 0.9925 | 0.0000 | ----- | |||||||

| d(Imports) | 0.1415 | 0.1229 | 0.2201 | −0.0834 | 0.0858 | −0.0131 | 1.0000 | |||||

| 0.0820 | 0.1314 | 0.0176 | 0.3069 | 0.3597 | 0.8725 | ----- | ||||||

| d(Exports) | 0.1751 | 0.1210 | 0.3111 | −0.0167 | 0.1681 | 0.0288 | 0.8031 | 1.0000 | ||||

| 0.0309 | 0.1375 | 0.0007 | 0.8382 | 0.0712 | 0.7248 | 0.0000 | ----- | |||||

| d(Lithuanian exports) | 0.2743 | 0.1488 | 0.3349 | −0.0706 | 0.2098 | 0.1047 | 0.6507 | 0.8712 | 1.0000 | |||

| 0.0006 | 0.0672 | 0.0002 | 0.3871 | 0.0238 | 0.1993 | 0.0000 | 0.0000 | ----- | ||||

| d(Consumer price changes) | −0.0408 | 0. 1239 | 0.0085 | −0.0357 | 0.1038 | 0.0135 | 0.1190 | 0.0804 | 0.1480 | 1.0000 | ||

| 0.6165 | 0.1270 | 0.9277 | 0.6615 | 0.2654 | 0.8687 | 0.1442 | 0.3251 | 0.0689 | ----- | |||

| d(Indus-trial production) | 0.4889 | 0.2885 | 0.3217 | 0.0535 | 0.0261 | 0.0514 | 0.7279 | 0.8037 | 0.8247 | 0.0867 | 1.0000 | |

| 0.0000 | 0.0003 | 0.0004 | 0.5110 | 0.7803 | 0.5283 | 0.0000 | 0.0000 | 0.0000 | 0.2864 | ----- | ||

| d(Trade) | 0.1044 | 0.1423 | 0.2536 | 0.0869 | 0.0275 | −0.0790 | 0.6368 | 0.6796 | 0.4286 | 0.1109 | 0.5246 | 1.0000 |

| 0.2004 | 0. 0802 | 0.0060 | 0.2869 | 0.7693 | 0.3331 | 0.0000 | 0.0000 | 0.0000 | 0.1738 | 0.0000 | ----- |

| Indicator | l = 1 | l = 2 | l = 3 | l = 4 | l = 5 | l = 6 |

|---|---|---|---|---|---|---|

| H0: d(Electricity consumption) does not Granger cause an indicator | ||||||

| d(Unemployment rate) | 0.5444 | 0.2606 | 0.3008 | 0.8114 | 0.8252 | 0.5561 |

| d(Economic sentiment indicator) | 0.7170 | 0.7203 | 0.5004 | 0.4717 | 0.5354 | 0.7884 |

| d(Consumer confidence) | 0.7003 | 0.8479 | 0.9626 | 0.8587 | 0.8954 | 0.8205 |

| d(Imports) | 0.0000 | 0.0000 | 0.0001 | 0.0003 | 0.0000 | 0.0000 |

| d(Exports) | 0.0000 | 0.0001 | 0.0005 | 0.0001 | 0.0002 | 0.0000 |

| d(Exports of goods of Lithuanian origin) | 0.0207 | 0.0178 | 0.0884 | 0.0031 | 0.0050 | 0.0000 |

| d(Consumer price changes) | 0.9754 | 0.1983 | 0.0017 | 0.0034 | 0.0042 | 0.0000 |

| d(Industrial production) | 0.0016 | 0.0024 | 0.0118 | 0.0044 | 0.0041 | 0.0002 |

| d(Wholesale and retail trade) | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| H0: d(Electricity production) does not Granger cause an indicator | ||||||

| d(Unemployment rate) | 0.7086 | 0.5693 | 0.1664 | 0.3729 | 0.0503 | 0.0067 |

| d(Economic sentiment indicator) | 0.1155 | 0.0903 | 0.2573 | 0.0925 | 0.1312 | 0.0689 |

| d(Consumer confidence) | 0.5286 | 0.0279 | 0.0320 | 0.0425 | 0.0338 | 0.1185 |

| d(Imports) | 0.7556 | 0.6399 | 0.9029 | 0.5149 | 0.0515 | 0.0829 |

| d(Exports) | 0.5696 | 0.1906 | 0.4223 | 0.0149 | 0.0026 | 0.0033 |

| d(Exports of goods of Lithuanian origin) | 0.3589 | 0.4827 | 0.6630 | 0.0462 | 0.0027 | 0.0029 |

| d(Consumer price changes) | 0.0654 | 0.2251 | 0.1309 | 0.1024 | 0.3645 | 0.5179 |

| d(Industrial production) | 0.3239 | 0.4406 | 0.5099 | 0.1586 | 0.0060 | 0.0109 |

| d(Wholesale and retail trade) | 0.0779 | 0.0990 | 0.0749 | 0.0568 | 0.0059 | 0.0106 |

| H0: d(Electricity price) does not Granger cause an indicator | ||||||

| d(Unemployment rate) | 0.6487 | 0.8959 | 0.8688 | 0.7986 | 0.8010 | 0.8328 |

| d(Economic sentiment indicator) | 0.5471 | 0.8762 | 0.4692 | 0.5509 | 0.6810 | 0.6919 |

| d(Consumer confidence) | 0.0813 | 0.1990 | 0.1005 | 0.1640 | 0.1931 | 0.2463 |

| d(Imports) | 0.1413 | 0.2174 | 0.0014 | 0.0006 | 0.0024 | 0.0004 |

| d(Exports) | 0.2464 | 0.1345 | 0.0261 | 0.0052 | 0.0105 | 0.0003 |

| d(Exports of goods of Lithuanian origin) | 0.3012 | 0.4508 | 0.1616 | 0.0202 | 0.0118 | 0.0000 |

| d(Consumer price changes) | 0.0263 | 0.2891 | 0.0470 | 0.2423 | 0.1797 | 0.0047 |

| d(Industrial production) | 0.7867 | 0.9456 | 0.0001 | 0.0000 | 0.0000 | 0.0000 |

| d(Wholesale and retail trade) | 0.9589 | 0.9975 | 0.0529 | 0.0561 | 0.0852 | 0.0367 |

| Model Included High-Frequency Variables | Error Metrics | Step Weighting | Almon (PDL) Weighting: Polynomial Degree: 2 | Almon (PDL) Weighting: Polynomial Degree: 3 | Beta Weighting | U-MIDAS | Auto/GETS Weighting |

|---|---|---|---|---|---|---|---|

| Electricity consumption | RMSE MAE SMAPE | 0.9162 0.7188 9.6339 | 0.9151 0.7179 9.6192 | 0.9159 0.7187 9.6358 | 0.9254 0.7322 9.8156 | 0.9178 0.7213 9.6757 | 0.9172 0.7210 9.6689 |

| Electricity production | RMSE MAE SMAPE | 0.9045 0.6948 9.3092 | 0.8710 0.6687 8.9896 | 0.9048 0.6963 9.3258 | 0.8927 0.6889 9.2496 | 0.9076 0.6965 9.3305 | 0.9036 0.6940 9.3017 |

| Electricity consumption and production | RMSE MAE SMAPE | 0.9509 0.7341 9.6605 | 0.9377 0.7296 9.6221 | 0.9485 0.7347 9.6745 | 0.9488 0.7388 9.8660 | 0.9502 0.7357 9.6826 | 0.9498 0.7355 9.6866 |

| Modified AR(2) | RMSE MAE SMAPE | 0.7474 0.6367 8.7458 | |||||

| Model Included High-Frequency Variables | Error Metrics | Step Weighting | Almon (PDL) Weighting: Polynomial Degree: 2 | Almon (PDL) Weighting: Polynomial Degree: 3 | Beta Weighting | U-MIDAS | Auto/GETS Weighting |

|---|---|---|---|---|---|---|---|

| Electricity consumption | RMSE MAE SMAPE | 3.8107 2.5008 86.7487 | 3.8014 2.5067 88.2265 | 3.8132 2.5000 86.7099 | 3.8216 2.5137 87.9180 | 3.8175 2.5014 86.3413 | 3.8227 2.5043 86.3871 |

| Electricity production | RMSE MAE SMAPE | 3.7807 2.6036 93.3369 | 3.7813 2.6099 93.5773 | 3.7793 2.6021 93.2429 | 3.7736 2.6051 93.3055 | 3.7819 2.6045 93.3162 | 3.7758 2.5998 92.8436 |

| Electricity consumption and production | RMSE MAE SMAPE | 3.8116 2.6468 94.8711 | 3.8069 2.6585 95.8081 | 3.8144 2.6476 94.9884 | 3.7917 2.5607 90.5334 | 3.8188 2.6457 94.6325 | 3.8255 2.6466 94.1913 |

| AR(1) | RMSE MAE SMAPE | 3.8018 2.5503 89.3181 | |||||

| Model Included High-Frequency Variables | Error Metrics | Step Weighting | Almon (PDL) Weighting: Polynomial Degree: 2 | Almon (PDL) Weighting: Polynomial Degree: 3 | Beta Weighting | U-MIDAS | Auto/GETS Weighting |

|---|---|---|---|---|---|---|---|

| Electricity consumption | RMSE MAE SMAPE | 455,945 365,603 12.8055 | 455,233 365,169 12.7881 | 456,714 366,325 12.8288 | 464,425 372,077 13.0131 | 455,741 365,576 12.8044 | 456,429 365,846 12.8070 |

| Electricity production | RMSE MAE SMAPE | 491,984 399,114 14.0384 | 488,488 394,817 13.8692 | 491,246 398,383 14.0082 | 491,178 397,743 13.9728 | 492,452 399,681 14.0607 | 490,543 397,324 13.9614 |

| Electricity price | RMSE MAE SMAPE | 314,133 276,658 9.9670 | 310,831 274,555 9.9063 | 312,112 275,331 9.9291 | 302,559 271,663 9.8586 | 317,002 278,567 10.0142 | 308,625 271,218 9.8807 |

| Electricity price and consumption | RMSE MAE SMAPE | 414,275 330,644 10.9346 | 405,986 327,406 10.8275 | 412,582 329,591 10.9086 | 338,208 290,853 10.4921 | 418,202 332,447 10.9746 | 380,743 313,946 10.6020 |

| Modified AR(2) | RMSE MAE SMAPE | 450,302 356,616 12.4634 | |||||

| Model Included High-Frequency Variables | Error Metrics | Step Weighting | Almon (PDL) Weighting: Polynomial Degree: 2 | Almon (PDL) Weighting: Polynomial Degree: 3 | Beta Weighting | U-MIDAS | Auto/GETS Weighting |

|---|---|---|---|---|---|---|---|

| Electricity consumption | RMSE MAE SMAPE | 311,214 249,809 14.3337 | 307,917 247,461 14.2065 | 310,786 249,179 14.2971 | 310,041 249,044 14.2829 | 311,740 250,226 14.3559 | 311,196 249,809 14.3285 |

| Electricity production | RMSE MAE SMAPE | 319,899 263,628 15.2377 | 317,563 259,786 14.9875 | 319,375 263,170 15.2090 | 324,357 268,352 15.5558 | 320,096 263,947 15.2590 | 321,014 264,817 15.3245 |

| Electricity price | RMSE MAE SMAPE | 235,221 199,113 11.3411 | 232,658 197,223 11.2910 | 234,854 197,802 11.2903 | 210,438 179,967 10.4422 | 236,641 199,835 11.3630 | 224,824 189,778 10.9809 |

| Electricity price and consumption | RMSE MAE SMAPE | 275,107 220,718 11.9430 | 267,422 212,676 11.5294 | 271,170 217,426 11.7991 | 346,051 273,638 15.5648 | 277,904 222,523 12.0165 | 256,540 208,081 11.4586 |

| Modified AR(2) | RMSE MAE SMAPE | 289,595 228,748 13.1592 | |||||

| Model Included High-Frequency Variables | Error Metrics | Step Weighting | Almon (PDL) Weighting: Polynomial Degree: 2 | Almon (PDL) Weighting: Polynomial Degree: 3 | Beta Weighting | U-MIDAS | Auto/GETS Weighting |

|---|---|---|---|---|---|---|---|

| Electricity consumption | RMSE MAE SMAPE | 586,580 453,913 14.3131 | 585,508 452,626 14.2614 | 588,066 454,250 14.3162 | 604,184 468,836 14.6829 | 586,315 453,805 14.3103 | 587,298 454,637 14.3313 |

| Electricity price | RMSE MAE SMAPE | 566,552 449,927 14.1709 | 553,270 441,618 13.8965 | 561,430 448,013 14.0911 | 537,808 430,359 13.6044 | 568,252 452,366 14.2472 | 579,460 460,907 14.4646 |

| Electricity price and consumption | RMSE MAE SMAPE | 416,348 340,265 11.2080 | 381,638 308,322 10.3410 | 409,549 335,361 11.0905 | 580,363 464,490 14.4943 | 418,805 342,330 11.2589 | 434,113 355,546 11.6417 |

| Modified AR(2) | RMSE MAE SMAPE | 580999 443028 13.9565 | |||||

| Model Included High-Frequency Variables | Error Metrics | Step Weighting | Almon (PDL) Weighting: Polynomial Degree: 2 | Almon (PDL) Weighting: Polynomial Degree: 3 | Beta Weighting | U-MIDAS | Auto/GETS Weighting |

|---|---|---|---|---|---|---|---|

| Electricity consumption | RMSE MAE SMAPE | 0.9527 0.7303 120.4018 | 0.9532 0.7312 119.8994 | 0.9509 0.7282 119.6651 | 0.9428 0.7169 113.9689 | 0.9515 0.7298 120.0368 | 0.9549 0.7315 120.4331 |

| Electricity price | RMSE MAE SMAPE | 2.5303 1.7425 174.8308 | 2.5455 1.7622 175.1857 | 2.5270 1.7410 174.7358 | 2.5490 1.7568 174.8233 | 2.5275 1.7391 174.7478 | 2.4254 1.6743 174.1631 |

| Electricity consumption and price | RMSE MAE SMAPE | 2.4291 1.6555 163.3825 | 2.4409 1.6672 162.5086 | 2.4163 1.6458 163.0349 | 1.6237 1.1595 154.2820 | 2.3853 1.6290 163.0523 | 2.3214 1.5928 163.3037 |

| AR(1) | RMSE MAE SMAPE | 0.9094 0.6772 114.8734 | |||||

| Model Included High-Frequency Variables | Error Metrics | Step Weighting | Almon (PDL) Weighting: Polynomial Degree: 2 | Almon (PDL) Weighting: Polynomial Degree: 3 | Beta Weighting | U-MIDAS | Auto/GETS Weighting |

|---|---|---|---|---|---|---|---|

| Electricity consumption | RMSE MAE SMAPE | 379,730 279,626 11.2332 | 377,725 278,149 11.1745 | 379,625 279,652 11.2366 | 380,562 280,463 11.2647 | 380,209 279,808 11.2374 | 380,121 279,670 11.2317 |

| Electricity production | RMSE MAE SMAPE | 353,353 259,924 10.5062 | 352,805 259,158 10.4776 | 353,148 259,782 10.5028 | 345,049 251,454 10.1210 | 353,445 260,243 10.5196 | 354,461 261,271 10.5697 |

| Electricity price | RMSE MAE SMAPE | 289,410 216,678 8.9000 | 290,894 214,488 8.8274 | 289,577 216,110 8.8804 | 265,535 197,893 8.2428 | 290,774 217,498 8.9315 | 285,210 212,603 8.7710 |

| Electricity production and price | RMSE MAE SMAPE | 299,661 221,423 8.9961 | 305,900 222,047 9.0002 | 300,579 220,877 8.9644 | 295,252 214,106 8.7085 | 300,727 222,271 9.0290 | 291,054 215,231 8.7993 |

| Electricity consumption, production, and price | RMSE MAE SMAPE | 279,899 205,096 8.4420 | 287,570 209,066 8.5580 | 281,291 205,560 8.4537 | 263,542 191,519 7.9054 | 280,429 206,338 8.4822 | 274,060 201,221 8.3163 |

| Modified AR(2) | RMSE MAE SMAPE | 373,471 283,334 11.5615 | |||||

| Model Included High-Frequency Variables | Error Metrics | Step Weighting | Almon (PDL) Weighting: Polynomial Degree: 2 | Almon (PDL) Weighting: Polynomial Degree: 3 | Beta Weighting | U-MIDAS | Auto/ GETS Weighting |

|---|---|---|---|---|---|---|---|

| Electricity consumption | RMSE MAE SMAPE | 490,105 407,913 10.3014 | 490,474 410,223 10.3643 | 492,261 411,054 10.3900 | 528,777 434,912 10.9728 | 489,344 406,572 10.2666 | 489,940 407,037 10.2775 |

| Electricity production | RMSE MAE SMAPE | 572,953 480,521 12.1206 | 570,672 478,732 12.0788 | 573,001 480,871 12.1303 | 572,539 480,029 12.1114 | 573,276 480,912 12.1318 | 569,469 476,925 12.0288 |

| Electricity price | RMSE MAE SMAPE | 824,322 646,186 16.0939 | 820,388 649,943 16.1344 | 815,554 639,747 15.9311 | 826,042 645,457 16.0328 | 825,428 647,064 16.1175 | 766,679 610,801 15.1843 |

| Electricity consumption and production | RMSE MAE SMAPE | 514,576 433,943 10.9762 | 515,226 436,936 11.0565 | 518,658 439,320 11.1214 | 573,328 494,405 12.3684 | 512,053 431,238 10.9062 | 509,925 428,729 10.8395 |

| Modified AR(2) | RMSE MAE SMAPE | 553,927 465,897 11.7100 | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stundziene, A.; Pilinkiene, V.; Bruneckiene, J.; Grybauskas, A.; Lukauskas, M. Nowcasting Economic Activity Using Electricity Market Data: The Case of Lithuania. Economies 2023, 11, 134. https://doi.org/10.3390/economies11050134

Stundziene A, Pilinkiene V, Bruneckiene J, Grybauskas A, Lukauskas M. Nowcasting Economic Activity Using Electricity Market Data: The Case of Lithuania. Economies. 2023; 11(5):134. https://doi.org/10.3390/economies11050134

Chicago/Turabian StyleStundziene, Alina, Vaida Pilinkiene, Jurgita Bruneckiene, Andrius Grybauskas, and Mantas Lukauskas. 2023. "Nowcasting Economic Activity Using Electricity Market Data: The Case of Lithuania" Economies 11, no. 5: 134. https://doi.org/10.3390/economies11050134

APA StyleStundziene, A., Pilinkiene, V., Bruneckiene, J., Grybauskas, A., & Lukauskas, M. (2023). Nowcasting Economic Activity Using Electricity Market Data: The Case of Lithuania. Economies, 11(5), 134. https://doi.org/10.3390/economies11050134