Understanding the Antecedents and Consequences of Sustainable Competitive Advantage: Testing Intellectual Capital and Organizational Performance

Abstract

1. Introduction

2. Literature Review

2.1. An Overview of the Resource-Based View and ICV

2.2. Intellectual Capital and Sustainable Competitive Advantage

2.3. Sustainable Competitive Advantage and Organizational Performance

3. Methodology

4. Results

4.1. Measurement Model Analysis

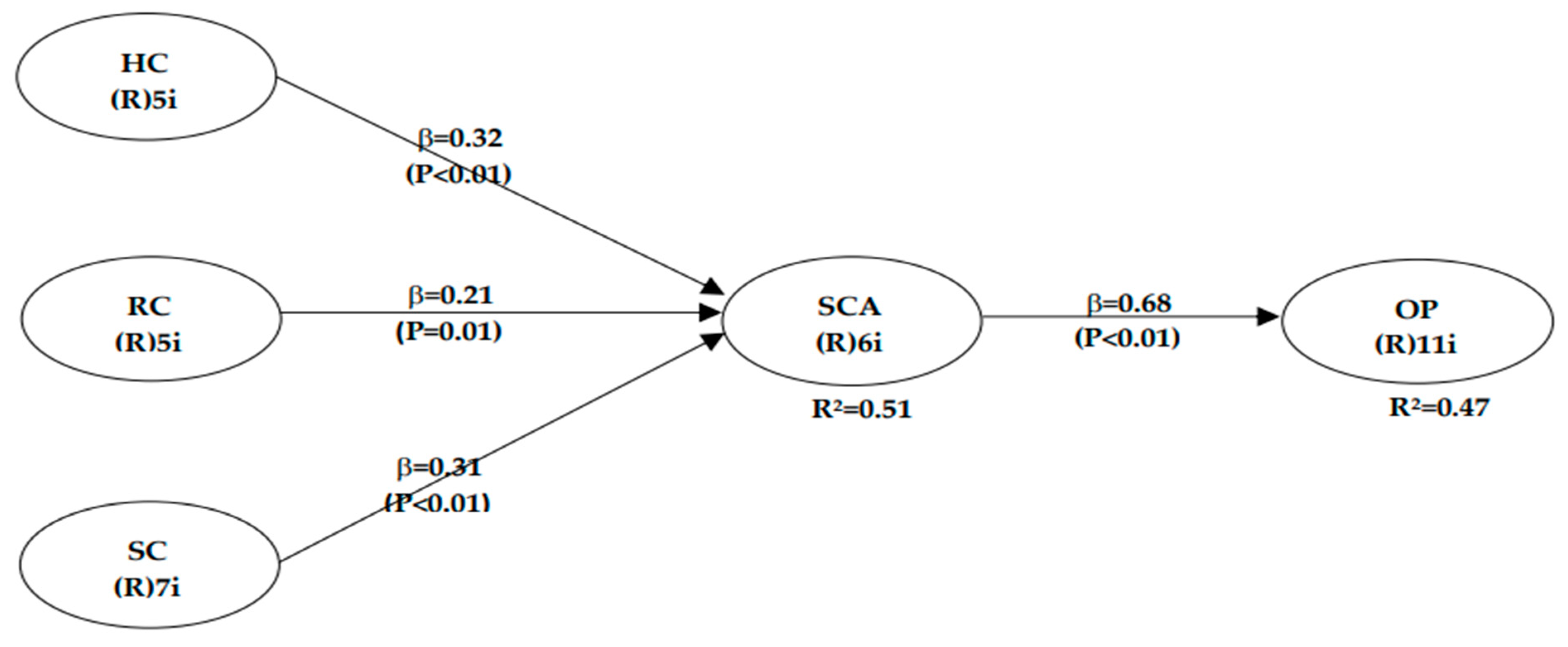

4.2. Structural Model Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Agostini, Lara, Anna Nosella, and Roberto Filippini. 2017. Does Intellectual Capital Allow Improving Innovation Performance. Journal of Intellectual Capital 18: 400–18. [Google Scholar] [CrossRef]

- Agyei, Samuel Kwaku. 2018. Culture, Financial Literacy, and SME Performance in Ghana. Cogent Economics and Finance 6: 1–16. [Google Scholar] [CrossRef]

- Balaji, Y., and M. Makhija. 2001. The Knowledge Imperative. Special Advertising Supplement, March 15. [Google Scholar]

- Barney, Jay B. 1991. Firm Resources and Sustained Competitive Advantage. Advances in Strategic Management 17: 203–27. [Google Scholar] [CrossRef]

- Barney, Jay B., David J. Ketchen, and Mike Wright. 2011. The Future of Resource-Based Theory: Revitalization or Decline? Journal of Management 37: 1299–315. [Google Scholar] [CrossRef]

- Bontis, Nick, Massimo Ciambotti, Federica Palazzi, and Francesca Sgro. 2018. Intellectual Capital and Financial Performance in Social Cooperative Enterprises. Journal of Intellectual Capital 19: 712–31. [Google Scholar] [CrossRef]

- Bontis, Nick. 1998. Intellectual Capital: An Exploratory Study That Develops Measures and Models. Management Decision 36: 63–76. [Google Scholar] [CrossRef]

- Bruggen, Alexander, Philip Vergauwen, and Mai Dao. 2009. Determinants of Intellectual Capital Disclosure: Evidence from Australia. Management Decision 47: 233–45. [Google Scholar] [CrossRef]

- Burhan, Nik Ahmad Sufian, Razli Che Razak, Fauzilah Salleh, and María Elena Labastida Tovar. 2017. The Higher Intelligence of the ‘Creative Minority’ Provides the Infrastructure for Entrepreneurial Innovation. Intelligence 65: 93–106. [Google Scholar] [CrossRef]

- Chaudhry, Naveed Iqbal, and Muhammad Amir Chaudhry. 2022. Green Intellectual Capital and Corporate Economic Sustainability: The Mediating Role of Financial Condition. Pakistan Journal of Commerce and Social Science 16: 257–78. [Google Scholar]

- Chen, Yu-Shan. 2008. The Positive Effect of Green Intellectual Capital on Competitive Advantages of Firms. Journal of Business Ethics 77: 271–86. [Google Scholar] [CrossRef]

- Chenhall, Robert H., and Kim Langfield-Smith. 2007. Multiple Perspectives of Performance Measuresr. European Management Journal 25: 266–82. [Google Scholar] [CrossRef]

- Chin, Wynne W. 1998. The Partial Least Squares Approach for Structural Equation Modeling. In Modern Methods for Business Research, 295–358. London: Lawrence Erlbaum Associates. [Google Scholar]

- Coff, Russell, and David Kryscynski. 2011. Drilling for Micro-Foundations of Human Capital-Based Competitive Advantages. Journal of Management 37: 1429–43. [Google Scholar] [CrossRef]

- Coordinating Ministry of Economic Affairs of the Republic of Indonesia. 2021. Siaran Pers HM.4.6/103/SET.M.EKON.3/05/2021. UMKM Menjadi Pilar Penting Dalam Perekonomian Indonesia. Available online: https://ekon.go.id/publikasi/detail/2969/umkm-menjadi-pilar-penting-dalam-perekonomian-indonesia (accessed on 5 January 2022).

- De Castro, Gregorio Martín, Pedro López Sáez, and José Emilio Navas López. 2004. The Role of Corporate Reputation in Developing Relational Capital. Journal of Intellectual Capital 5: 575–85. [Google Scholar] [CrossRef]

- De Pablos, Patricia Ordóñez. 2004. The Nurture of Knowledge-Based Resources through the Design of an Architecture of Human Resource Management Systems: Implications for Strategic Management. International Journal of Technology Management 27: 533–43. [Google Scholar] [CrossRef]

- Denpasar City Communication Informatics and Statistics Office. 2022. Denpasar City MSME Data. Available online: https://bankdata.denpasarkota.go.id/?page=Data-Detail&language=id&domian=bankdata.denpasarkota.go.id&data_id=1606876170 (accessed on 1 April 2022).

- Dimitrakaki, Ioanna. 2022. Organizational Knowledge as a Source of Competitive Advantage-Amazon Case Study. London Journal of Research in Management and Business 22: 27–37. [Google Scholar]

- Duodu, Bismark, and Steve Rowlinson. 2019. Intellectual Capital for Exploratory and Exploitative Innovation. Exploring Linear and Quadratic Effects in Construction Contractor Firms. Journal of Intellectual Capital 20: 382–405. [Google Scholar] [CrossRef]

- Dyer, Jeffrey H., and Harbir Singh. 1998. Relational View: Cooperative Strategy and Sources of Interorganizational Competitive Advantage. Academy of Management Review 23: 660–79. [Google Scholar] [CrossRef]

- Edvinsson, Leif, and Michael S. Malone. 1997. Intellectual Capital: Realising Your Company’s True Value by Finding Its Hidden Brainpowe. New York, NY: Harper Collins. [Google Scholar]

- Elijah, Asante Boakye, and Adu-Damoah Millicent. 2018. The Impact of a Sustainable Competitive Advantage on a Firm’s Performance: Empirical Evidence from Coca-Cola Ghana Limited. Global Journal of Human Resource Management 6: 30–46. [Google Scholar]

- Fahy, John. 2000. The Resource-Based View of the Firm: Some Stumbling-Blocks on the Road to Understanding Sustainable Competitive Advantage. Journal of European Industrial Training 24: 94–104. [Google Scholar] [CrossRef]

- Florin, Juan, Michael Lubatkin, and William Schulze. 2003. A Social Capital Model of New Venture Performance. Academy of Management Journal 46: 374–84. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larcker. 1981. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research XVIII: 39–50. [Google Scholar] [CrossRef]

- Foss, Nicolai J., and Thorbjørn Knudsen. 2003. The Resource-Based Tangle: Towards a Sustainable Explanation of Competitive Advantage. Managerial and Decision Economics 24: 291–307. [Google Scholar] [CrossRef]

- Grant, Robert M. 1996. Toward a Knowledge-Based Theory of the Firm. Strategic Management Journal 17: 109–22. [Google Scholar] [CrossRef]

- Gross-Gołacka, Elwira, Marta Kusterka-Jefmanska, and Bartłomiej Jefmanski. 2020. Can Elements of Intellectual Capital Improve Business Sustainability? The Perspective of Managers of SMEs in Poland. Sustainability 12: 1545. [Google Scholar] [CrossRef]

- Guimarães, Julio Cesar Ferro de, Eliana Andréa Severo, and César Ricardo Maia de Vasconcelos. 2017. Sustainable Competitive Advantage: A Survey of Companies in Southern Brazil. Brazilian Business Review 14: 352–67. [Google Scholar] [CrossRef]

- Hashim, Fariza. 2012. Challenges for the Internationalization of SMEs and the Role of Government: The Case of Malaysia. Journal of International Business and Economy 13: 97–122. [Google Scholar] [CrossRef]

- Jardon, Carlos M., and Xavier Martínez-Cobas. 2019. Leadership and Organizational Culture in the Sustainability of Subsistence Small Businesses: An Intellectual Capital Based View. Sustainability 11: 3491. [Google Scholar] [CrossRef]

- Jelčić, Karmen. 2007. Intellectual Capital: Handbook of IC Management in Companies. Available online: http:www2.hgk.hr/hrdc/IC_Management-Handbook.pdf (accessed on 6 March 2021).

- Khan, Muhammad Kaleem, R. M. Ammar Zahid, Khuram Shahzad, Muhammad Jameel Hussain, and Mbwana Mohamed Kitendo. 2022. Role of Managerial Ability in Environmental, Social, and Economics Sustainability: An Empirical Evidence from China. Journal of Environmental and Public Health 2022: 1–11. [Google Scholar] [CrossRef]

- Khan, Sher Zaman, Qing Yang, and Abdul Waheed. 2019. Investment in Intangible Resources and Capabilities Spurs Sustainable Competitive Advantage and Firm Performance. Corporate Social Responsibility and Environmental Management 26: 285–95. [Google Scholar] [CrossRef]

- Kianto, Aino, Paavo Ritala, John Christopher Spender, and Mika Vanhala. 2014. The Interaction of Intellectual Capital Assets and Knowledge Management Practices in Organizational Value Creation. Journal of Intellectual Capital 15: 362–75. [Google Scholar] [CrossRef]

- Kock, Ned. 2014. Advanced Mediating Effects Tests, Multi-Group Analyses, and Measurement Model Assessments in PLS-Based SEM. International Journal of E-Collaboration 10: 1–13. [Google Scholar] [CrossRef]

- Kong, Eric, and Gaby Ramia. 2010. A Qualitative Analysis of Intellectual Capital in Social Service Non-Profit Organisations: A Theory–Practice Divide. Journal of Management & Organization 16: 656–76. [Google Scholar] [CrossRef]

- Kücher, Alexander, Stefan Mayr, Christine Mitter, Christine Duller, and Birgit Feldbauer-Durstmüller. 2020. Firm Age Dynamics and Causes of Corporate Bankruptcy: Age Dependent Explanations for Business Failure. Review of Managerial Science 14: 633–61. [Google Scholar] [CrossRef]

- Lavie, Dovev. 2006. The Competitive Advantage of Interconnected Firms: An Extension of the Resource-Based View. Academy of Management 31: 638–58. [Google Scholar] [CrossRef]

- Lentjushenkova, Oksana, Vita Zarina, and Jelena Titko. 2019. Disclosure of Intellectual Capital in Financial Reports: Case of Latvia. Oeconomia Copernicana 10: 341–57. [Google Scholar] [CrossRef]

- Loucks, Elizabeth Stubblefield, Martin L. Martens, and Charles H. Cho. 2010. Engaging Small-and Medium-Sized Businesses in Sustainability. Sustainability Accounting, Management and Policy Journal 1: 178–200. [Google Scholar] [CrossRef]

- Lu, Yuqiu, Guowei Li, Zhe Luo, Muhammad Anwar, and Yunju Zhang. 2021. Does Intellectual Capital Spur Sustainable Competitive Advantage and Sustainable Growth?: A Study of Chinese and Pakistani Firms. SAGE Open 11: 1–18. [Google Scholar] [CrossRef]

- Marzo, Giuseppe, and Elena Scarpino. 2016. Exploring Intellectual Capital Management in SMEs: An in-Depth Italian Case Study. Journal of Intellectual Capital 17: 27–51. [Google Scholar] [CrossRef]

- Matinaro, Ville, Yang Liu, Tzong Ru (Jiun Shen) Lee, and Jurgen Poesche. 2019. Extracting Key Factors for Sustainable Development of Enterprises: Case Study of SMEs in Taiwan. Journal of Cleaner Production 209: 1152–69. [Google Scholar] [CrossRef]

- Mukherjee, Tutun, and Som Sankar Sen. 2019. Intellectual Capital and Corporate Sustainable Growth: The Indian Evidence. Journal of Business Economics and Environmental Studies 9: 5–15. [Google Scholar] [CrossRef]

- Nunnally, Jum C. 1978. Psychometric Theory. New York: McGraw-Hill. [Google Scholar]

- Omar, Muhamad Khalil, Yusmazida Mohd Yusoff, and Maliza Delima Kamarul Zaman. 2017. The Role of Green Intellectual Capital on Business Sustainability. World Applied Sciences Journal 35: 2558–63. [Google Scholar]

- Papula, Ján, and Jana Volná. 2013. Core Competence for Sustainable Competitive Advantage. Multidisciplinary Academic Research 2013: 1–7. Available online: http://www.mac-prague.com/ (accessed on 3 March 2019).

- Patrisia, Dina, Muthia Roza Linda, and Abror Abror. 2022. Creation of Competitive Advantage in Improving the Business Performance of Banking Companies. Jurnal Siasat Bisnis 26: 121–37. [Google Scholar] [CrossRef]

- Radjenović, Tamara, and Bojan Krstić. 2017. Intellectual Capital as the Source of Competitive Advantage: The Resource-Based View. Facta Universitatis, Series: Economics and Organization 14: 127–37. [Google Scholar] [CrossRef]

- Reed, Kira Kristal, Michael Lubatkin, and Narasimhan Srinivasan. 2006. Proposing and Testing an Intellectual Capital-Based View of the Firm. Journal of Management Studies 43: 867–93. [Google Scholar] [CrossRef]

- Saeidi, Sayedeh Parastoo, Saudah Sofian, Parvaneh Saeidi, Sayyedeh Parisa Saeidi, and Seyyed Alireza Saaeidi. 2015. How Does Corporate Social Responsibility Contribute to Firm Financial Performance? The Mediating Role of Competitive Advantage, Reputation, and Customer Satisfaction. Journal of Business Research 68: 341–50. [Google Scholar] [CrossRef]

- Santa, Ricardo, Mario Ferrer, Thomas Tegethoff, and Annibal Scavarda. 2022. An Investigation of the Impact of Human Capital and Supply Chain Competitive Drivers on Firm Performance in a Developing Country. PLoS ONE 17: e0274592. [Google Scholar] [CrossRef]

- Singh, Sanjay Kumar, Jin Chen, Manlio Del Giudice, and Abdul Nasser El-Kassar. 2019. Environmental Ethics, Environmental Performance, and Competitive Advantage: Role of Environmental Training. Technological Forecasting and Social Change 146: 203–11. [Google Scholar] [CrossRef]

- Sveiby, Karl Erik. 1997. The New Organizational Wealth. Managing & Measuring Knowledge-Based Assets. San Fransisco: Berrett-Koehler. [Google Scholar]

- de Villiers, Charl, and Umesh Sharma. 2020. A Critical Reflection on the Future of Financial, Intellectual Capital, Sustainability and Integrated Reporting. Critical Perspectives on Accounting 70: 101999. [Google Scholar] [CrossRef]

- Walsh, Philip R., and Rachel Dodds. 2017. Measuring the Choice of Environmental Sustainability Strategies in Creating a Competitive Advantage. Business Strategy and the Environment 26: 672–87. [Google Scholar] [CrossRef]

- Wang, Zhining, Nianxin Wang, and Huigang Liang. 2014. Knowledge Sharing, Intellectual Capital and Firm Performance. Management Decision 52: 230–58. [Google Scholar] [CrossRef]

- Widener, Sally K. 2006. Human Capital, Pay Structure, and the Use of Performance Measures in Bonus Compensation. Management Accounting Research 17: 198–221. [Google Scholar] [CrossRef]

- Wright, Patrick M., Benjamin B. Dunford, and Scott A. Snell. 2001. Human Resources and the Resource Based View of the Firm. Journal of Management 27: 701–21. [Google Scholar] [CrossRef]

- Xu, Jian, and Binghan Wang. 2018. Intellectual Capital, Financial Performance and Companies’ Sustainable Growth: Evidence from the Korean Manufacturing Industry. Sustainability 10: 4651. [Google Scholar] [CrossRef]

- Yamane, Taro. 1973. Statistics. An Introductory Analysis. New York: Harper & Row, Publishers. [Google Scholar]

- Yusliza, Mohd Yusoff, Jing Yi Yong, M. Imran Tanveer, T. Ramayah, Juhari Noor Faezah, and Zikri Muhammad. 2020. A Structural Model of the Impact of Green Intellectual Capital on Sustainable Performance. Journal of Cleaner Production 249: 119334. [Google Scholar] [CrossRef]

| Independent Samples Test | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Levene’s Test for Equality of Variances | t-Test for Equality of Means | |||||||||

| F | Sig. | t | df | Sig. (2-Tailed) | Mean Difference | Std. Error Difference | 95% Confidence Interval of the Difference | |||

| Lower | Upper | |||||||||

| Total | Equal Variances Assumed | 0.579 | 0.449 | −0.158 | 97 | 0.875 | −0.864 | 5.460 | −11.700 | 9.973 |

| Equal Variances Not Assumed | −0.207 | 15.518 | 0.839 | −0.864 | 4.178 | −9.742 | 8.015 | |||

| Variable | Theoretical Score | Actual Score | Mean | SD | ||

|---|---|---|---|---|---|---|

| Min | Max | Min | Max | |||

| HC | 1.00 | 5.00 | 2.20 | 5.00 | 4.15 | 0.65 |

| RC | 1.00 | 5.00 | 2.20 | 5.00 | 4.18 | 0.63 |

| SC | 1.00 | 5.00 | 2.13 | 4.38 | 3.69 | 0.57 |

| SCA | 1.00 | 5.00 | 2.00 | 5.00 | 4.28 | 0.59 |

| OP | 1.00 | 5.00 | 2.55 | 5.00 | 4.38 | 0.53 |

| HC | RC | SC | SCA | OP | |

|---|---|---|---|---|---|

| Composite Reliability | 0.895 | 0.885 | 0.916 | 0.909 | 0.933 |

| Cronbach’s Alpha | 0.853 | 0.838 | 0.893 | 0.880 | 0.921 |

| Average Variance Extracted | 0.631 | 0.606 | 0.611 | 0.625 | 0.560 |

| HC | RC | SC | SCA | OP | p Value | |

|---|---|---|---|---|---|---|

| HC1 | (0.795) | 0.294 | −0.035 | 0.157 | 0.026 | <0.001 |

| HC2 | (0.793) | 0.013 | 0.044 | 0.088 | −0.017 | <0.001 |

| HC3 | (0.773) | 0.011 | −0.040 | −0.119 | −0.068 | <0.001 |

| HC4 | (0.850) | −0.149 | −0.056 | −0.089 | 0.101 | <0.001 |

| HC5 | (0.759) | −0.166 | 0.094 | −0.036 | −0.053 | <0.001 |

| RC1 | 0.362 | (0.771) | 0.019 | −0.039 | −0.058 | <0.001 |

| RC2 | 0.022 | (0.791) | 0.088 | −0.164 | −0.152 | <0.001 |

| RC3 | −0.374 | (0.802) | −0.051 | 0.049 | 0.067 | <0.001 |

| RC4 | −0.200 | (0.767) | 0.107 | 0.282 | −0.089 | <0.001 |

| RC5 | 0.205 | (0.761) | −0.166 | −0.126 | 0.236 | <0.001 |

| SC1 | 0.251 | −0.113 | (0.786) | −0.182 | 0.063 | <0.001 |

| SC2 | 0.409 | −0.095 | (0.765) | −0.151 | −0.146 | <0.001 |

| SC3 | 0.291 | −0.296 | (0.823) | 0.025 | 0.040 | <0.001 |

| SC4 | −0.343 | 0.056 | (0.707) | 0.134 | −0.010 | <0.001 |

| SC5 | −0.319 | 0.146 | (0.806) | −0.010 | 0.003 | <0.001 |

| SC6 | −0.244 | 0.086 | (0.837) | 0.112 | 0.072 | <0.001 |

| SC7 | −0.061 | 0.236 | (0.741) | 0.078 | −0.037 | <0.001 |

| SCA1 | 0.185 | 0.182 | 0.062 | (0.813) | −0.217 | <0.001 |

| SCA2 | −0.009 | −0.096 | −0.140 | (0.774) | 0.076 | <0.001 |

| SCA3 | −0.043 | −0.041 | −0.025 | (0.801) | −0.035 | <0.001 |

| SCA4 | −0.132 | 0.130 | −0.061 | (0.783) | −0.071 | <0.001 |

| SCA5 | −0.129 | 0.080 | 0.054 | (0.768) | 0.060 | <0.001 |

| SCA6 | 0.115 | −0.254 | 0.105 | (0.803) | 0.193 | <0.001 |

| OP1 | 0.057 | −0.062 | 0.138 | −0.045 | (0.715) | <0.001 |

| OP2 | 0.009 | 0.054 | 0.170 | −0.117 | (0.726) | <0.001 |

| OP3 | 0.198 | 0.006 | 0.148 | −0.118 | (0.759) | <0.001 |

| OP4 | 0.158 | 0.198 | −0.075 | 0.087 | (0.709) | <0.001 |

| OP5 | 0.130 | 0.095 | 0.103 | −0.062 | (0.742) | <0.001 |

| OP6 | −0.223 | 0.025 | −0.016 | 0.097 | (0.754) | <0.001 |

| OP7 | −0.045 | −0.250 | 0.142 | 0.165 | (0.750) | <0.001 |

| OP8 | 0.023 | −0.053 | −0.177 | 0.035 | (0.788) | <0.001 |

| OP9 | −0.004 | 0.064 | −0.232 | −0.014 | (0.753) | <0.001 |

| OP10 | −0.133 | −0.022 | −0.067 | −0.053 | (0.765) | <0.001 |

| OP11 | −0.154 | −0.040 | −0.112 | 0.024 | (0.768) | <0.001 |

| Variable | Path to | |

|---|---|---|

| SCA | OP | |

| HC | 0.317 (p < 0.001) | |

| RC | 0.215 (p = 0.013) | |

| SC | 0.311 (p < 0.001) | |

| SCA | 0.683 (<0.001) | |

| OP | ||

| R-squared | 0.515 | 0.466 |

| HC | RC | SC | SCA | |

|---|---|---|---|---|

| SCA | 0.203 | 0.125 | 0.188 | |

| OP | 0.466 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Astuti, P.D.; Datrini, L.K.; Chariri, A. Understanding the Antecedents and Consequences of Sustainable Competitive Advantage: Testing Intellectual Capital and Organizational Performance. Economies 2023, 11, 120. https://doi.org/10.3390/economies11040120

Astuti PD, Datrini LK, Chariri A. Understanding the Antecedents and Consequences of Sustainable Competitive Advantage: Testing Intellectual Capital and Organizational Performance. Economies. 2023; 11(4):120. https://doi.org/10.3390/economies11040120

Chicago/Turabian StyleAstuti, Partiwi Dwi, Luh Kade Datrini, and Anis Chariri. 2023. "Understanding the Antecedents and Consequences of Sustainable Competitive Advantage: Testing Intellectual Capital and Organizational Performance" Economies 11, no. 4: 120. https://doi.org/10.3390/economies11040120

APA StyleAstuti, P. D., Datrini, L. K., & Chariri, A. (2023). Understanding the Antecedents and Consequences of Sustainable Competitive Advantage: Testing Intellectual Capital and Organizational Performance. Economies, 11(4), 120. https://doi.org/10.3390/economies11040120