The Relationship between Innovation and the Performance of Small and Medium-Sized Businesses in the Industrial Sector: The Mediating Role of CSR

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Sample

3.2. Variables Measurement

4. Results

4.1. Data Analysis

4.2. Measurement Model

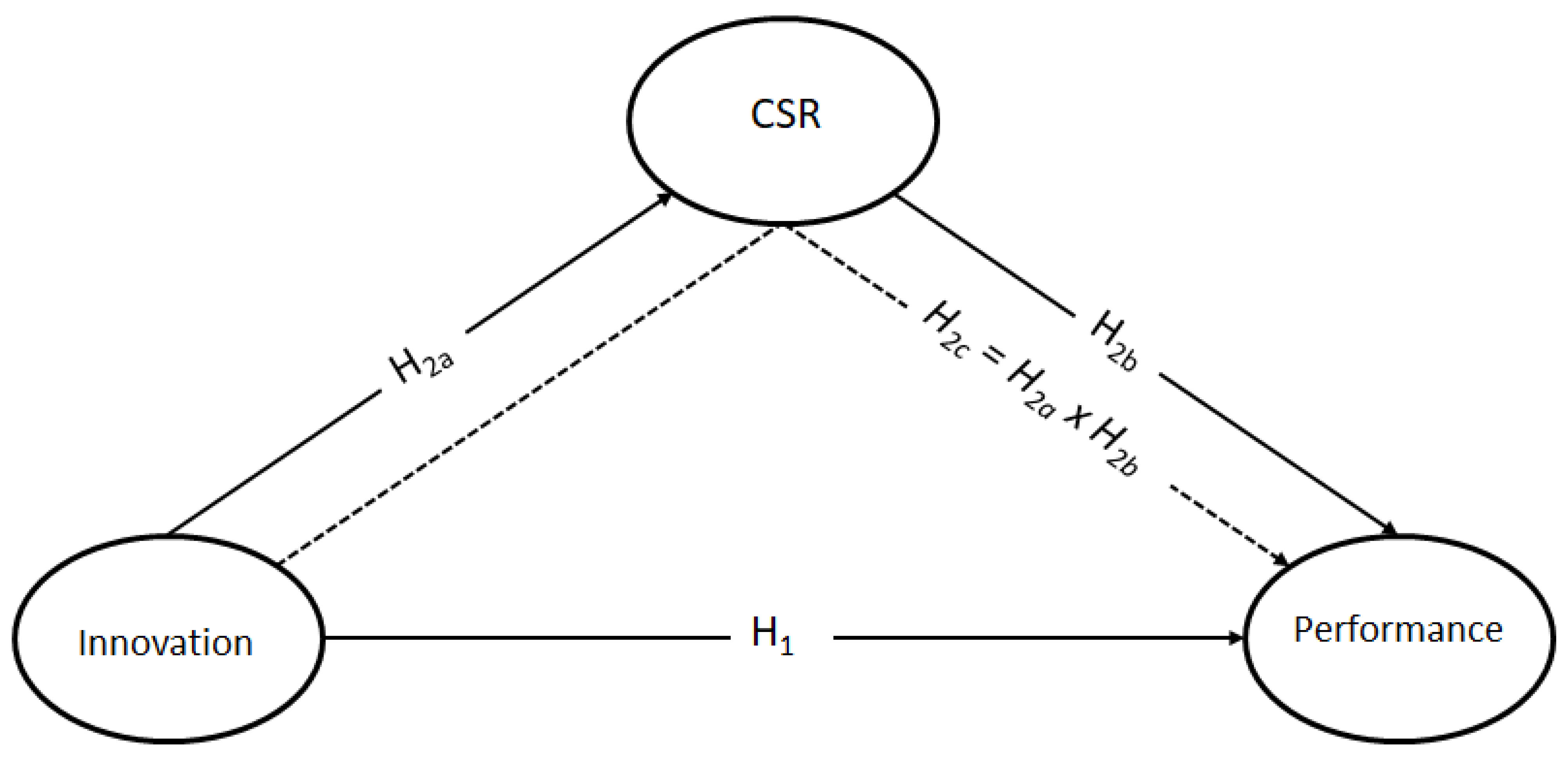

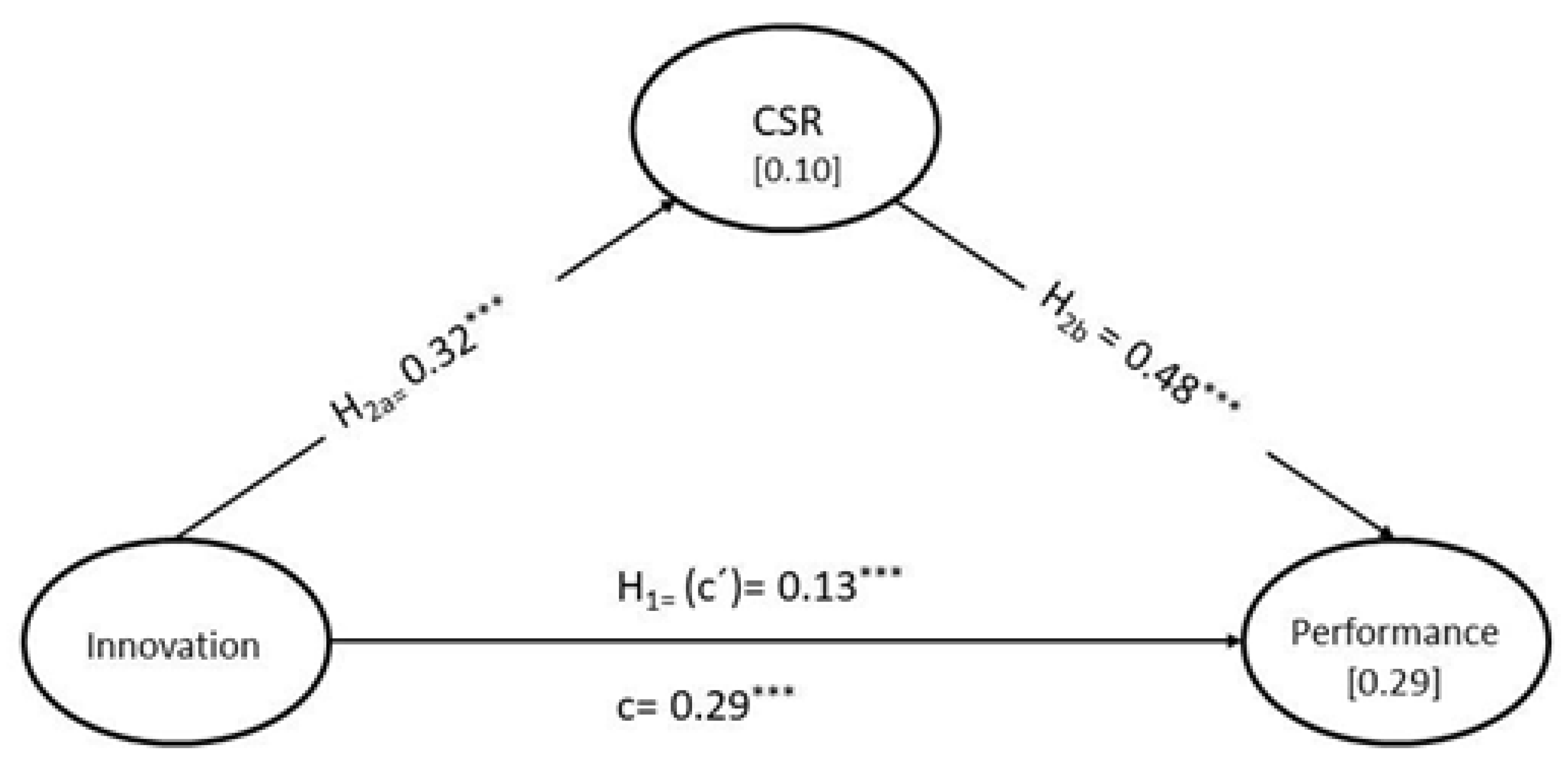

4.3. Structural Model Assessment: Analysis of Direct Effects

4.4. The Mediation Analysis

4.5. Evaluation of the Predictive Validity Using Holdout Samples

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Questions Used in the Survey

| CSR (Lee et al. 2012; Esparza-Aguilar and Fong 2019; Ikram et al. 2019; Adinata 2019; Devie et al. 2018; Caro and Salazar 2019; Agyemang and Ansong 2017) | |

| Please evaluate from 1 (absolutely disagree) to 5 (absolutely agree) the following questions | |

| csr1 | Is widely known by management and applied in company management |

| csr2 | Means achieving social value as well as economic value |

| csr3 | The company carries out its activities consuming less energy and other resources |

| csr4 | Effective recycling measures exist |

| csr5 | Priority to working with local suppliers and raw materials is given |

| csr6 | Transparency when dealing with clients and suppliers has improved in recent years |

| Innovation (Martínez-Ros and Labeaga 2009; Madrid-Guijarro et al. 2009) | |

| Indicate if your company has made the following innovations in the last two years and, if so, indicate the degree of importance of each from 1 (minimum importance) to 5 (greatest importance) | |

| inn1 | Changes or improvements in existing products/services |

| inn2 | The launching of new products/services in the market |

| inn3 | Changes or improvements in production processes |

| inn4 | Acquisition of new property or equipment |

| inn5 | New changes or improvements in organization and/or management |

| inn6 | New changes or improvements in purchasing and/or procurement |

| inn7 | New changes or improvements in commercial and/or sales |

| Performance (Ruiz-Palomo et al. 2019; Úbeda-García et al. 2021; Martinez-Conesa et al. 2017) | |

| In comparison with your competitors, please indicate your level of agreement with the following performance indicators of your company, from 1 (absolutely disagree) to 5 (absolutely agree) | |

| per1 | Your company offers higher quality products |

| per2 | You company has more efficient internal processes |

| per3 | Your company has more satisfied customers |

| per4 | Your company adapts earlier to changes in the market |

| per5 | Your company is growing more |

| per6 | Your company is more profitable |

| per7 | Your company has more satisfied/motivated employees |

| per8 | Your company has a lower absenteeism |

References

- Achi, Awele, Ogechi Adeola, and Francis Chukwuedo Achi. 2022. CSR and Green Process Innovation as Antecedents of Micro, Small, and Medium Enterprise Performance: Moderating Role of Perceived Environmental Volatility. Journal of Business Research 139: 771–81. [Google Scholar] [CrossRef]

- Acs, Zoltan J., and David B. Audretsch. 1988. Innovation in Large and Small Firms: An Empirical Analysis. The American Economic Review 78: 678–90. [Google Scholar]

- Adinata, Gavrila. 2019. CSR Expenditures, Financial Distress Prediction, and Firm Reputation: A Pathway Analysis. Perspektif Akuntansi 2: 1–18. [Google Scholar] [CrossRef]

- Aguilera Castro, Adriana, and Doria Patricia Puerto Becerra. 2012. Crecimiento Empresarial Basado En La Responsabilidad Social. Barranquilla: Pensamiento & Gestión. [Google Scholar]

- Agyemang, Otuo Serebour, and Abraham Ansong. 2017. Corporate Social Responsibility and Firm Performance of Ghanaian SMEs. Journal of Global Responsibility 8: 47–62. [Google Scholar] [CrossRef]

- Ali, Hafiz Yasir, Rizwan Qaiser Danish, and Muhammad Asrar-ul-Haq. 2020. How Corporate Social Responsibility Boosts Firm Financial Performance: The Mediating Role of Corporate Image and Customer Satisfaction. Corporate Social Responsibility and Environmental Management 27: 166–77. [Google Scholar] [CrossRef]

- Amit, Raphael, and Paul J. H. Schoemaker. 1993. Strategic Assets and Organizational Rent. Strategic Management Journal 14: 33–46. [Google Scholar] [CrossRef]

- Arnold, Marlen G. 2017. Corporate Social Responsibility Representation of the German Water-Supply and Distribution Companies: From Colourful to Barren Landscapes. International Journal of Innovation and Sustainable Development 11: 1. [Google Scholar] [CrossRef]

- Astrachan, Claudia Binz, Vijay K. Patel, and Gabrielle Wanzenried. 2014. A Comparative Study of CB-SEM and PLS-SEM for Theory Development in Family Firm Research. Journal of Family Business Strategy 5: 116–28. [Google Scholar] [CrossRef]

- Audretsch, David B., Alex Coad, and Agustí Segarra. 2014. Firm Growth and Innovation. Small Business Economics 43: 743–49. [Google Scholar] [CrossRef]

- Auken, Howard Van, Antonia Madrid Guijarro, and Domingo Garcia Perez de Lema. 2008. Innovation and Performance in Spanish Manufacturing SMEs. International Journal of Entrepreneurship and Innovation Management 8: 36. [Google Scholar] [CrossRef]

- Bahta, Dawit, Jiang Yun, Md Rashidul Islam, and Muhammad Ashfaq. 2020. Corporate Social Responsibility, Innovation Capability and Firm Performance: Evidence from SME. Social Responsibility Journal 17: 840–60. [Google Scholar] [CrossRef]

- Barclay, Donald, Christopher Higgins, and Ronald Thompson. 1995. The Partial Least Squares (PLS) Approach to Casual Modeling: Personal Computer Adoption Ans Use as an Illustration. New York: Walter de Gruyter. [Google Scholar]

- Barney, Jay. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Becattini, G. 1999. Flourishing Small Firms and the Re-Emergence of Industrial Districts. Paper presented at the 44th World Conference-Innovation and Economic Development: The Role of Entrepreneurship and SMEs, Roma, Italy, June 14–16; pp. 20–23. [Google Scholar]

- Biemans, Wim, and Abbie Griffin. 2018. Innovation Practices of B2B Manufacturers and Service Providers: Are They Really Different? Industrial Marketing Management 75: 112–24. [Google Scholar] [CrossRef]

- Bos-Brouwers, Hilke Elke Jacke. 2009. Corporate Sustainability and Innovation in SMEs: Evidence of Themes and Activities in Practice. Business Strategy and the Environment 19: 417–35. [Google Scholar] [CrossRef]

- Brammer, Stephen, and Andrew Millington. 2008. Does It Pay to Be Different? An Analysis of the Relationship between Corporate Social and Financial Performance. Strategic Management Journal 29: 1325–43. [Google Scholar] [CrossRef]

- Bstieler, Ludwig, Martin Hemmert, and Gloria Barczak. 2015. Trust Formation in University-Industry Collaborations in the U.S. Biotechnology Industry: IP Policies, Shared Governance, and Champions. Journal of Product Innovation Management 32: 111–21. [Google Scholar] [CrossRef]

- Caro, Nebenka, and Inocente Salazar. 2019. La Responsabilidad Social y La Competitividad de Las MYPES de Tingo María. Balance´S 6: 4–12. [Google Scholar]

- Casidy, Riza, Munyaradzi Nyadzayo, and Mayoor Mohan. 2020. Service Innovation and Adoption in Industrial Markets: An SME Perspective. Industrial Marketing Management 89: 157–70. [Google Scholar] [CrossRef]

- Cegarra-Navarro, Juan-Gabriel, Carmelo Reverte, Eduardo Gómez-Melero, and Anthony K. P. Wensley. 2016. Linking Social and Economic Responsibilities with Financial Performance: The Role of Innovation. European Management Journal 34: 530–39. [Google Scholar] [CrossRef]

- Chin, Wynne W. 2010. How to Write Up and Report PLS Analyses. In Handbook of Partial Least Squares. Berlin/Heidelberg: Springer, pp. 655–90. [Google Scholar] [CrossRef]

- Cifuentes-Bedoya, Diego, Felipe Lozada-Valencia, Clara Eugenia Segovia-Borray, and Edisson Otalora-Murcia. 2021. La Responsabilidad Social Empresarial (RSE) y La Creación de Valor Compartido (CVC), Ejes Determinantes Para La Gestión de Las PYMES. Una Revisión Bibliométrica. Revista Ibérica de Sistemas e Tecnologias de Informação E43: 549–67. [Google Scholar]

- Claver-Cortés, Enrique, Bartolomé Marco-Lajara, Mercedes Úbeda-García, Francisco García-Lillo, Laura Rienda-García, Patrocinio Carmen Zaragoza-Sáez, Rosario Andreu-Guerrero, Encarnación Manresa-Marhuenda, Pedro Seva-Larrosa, and Lorena Ruiz-Fernández. 2020. Students’ Perception of CSR and Its Influence on Business Performance. A Multiple Mediation Analysis. Business Ethics: A European Review 29: 722–36. [Google Scholar] [CrossRef]

- Coad, Alexander, and Rekha Rao. 2007. The Employment Effects of Innovations in High-Tech Industries. Papers on Economics and Evolution. Jena: Max Planck Institute of Economics. [Google Scholar]

- Cohen, Jacob. 1988. Statistical Power Analysis for the Behavioral Sciences, 2nd ed. Hillsdale: Erbaum Press. [Google Scholar]

- Dauvergne, Peter. 2005. Handbook of Global Environmental Politics. Cheltenham: Edward Elgar Publishing. [Google Scholar] [CrossRef]

- Demirbas, Dilek, Javed G. Hussain, and Harry Matlay. 2011. Owner-managers’ Perceptions of Barriers to Innovation: Empirical Evidence from Turkish SMEs. Journal of Small Business and Enterprise Development 18: 764–80. [Google Scholar] [CrossRef]

- Demirel, Pelin, and Mariana Mazzucato. 2012. Innovation and Firm Growth: Is R&D Worth It? Industry & Innovation 19: 45–62. [Google Scholar] [CrossRef]

- Devie, Devie, Lovina Pristya Liman, Josua Tarigan, and Ferry Jie. 2018. Corporate Social Responsibility, Financial Performance and Risk in Indonesian Natural Resources Industry. Social Responsibility Journal 16: 73–90. [Google Scholar] [CrossRef]

- Dibrell, Clay, Peter S. Davis, and Justin Craig. 2008. Fueling Innovation through Information Technology in SMEs. Journal of Small Business Management 46: 203–18. [Google Scholar] [CrossRef]

- Eisenhardt, Kathleen M., and Jeffrey A. Martin. 2000. Dynamic Capabilities: What Are They? Strategic Management Journal 21: 1105–21. [Google Scholar] [CrossRef]

- Esparza-Aguilar, José Luis, and Teodoro Reyes Fong. 2019. Prácticas de Responsabilidad Social Empresarial Desarrolladas Por Empresas Familiares Mexicanas y Su Efecto En El Éxito Competitivo y La Innovación. Tec Empresarial 13: 45–57. [Google Scholar] [CrossRef]

- Fan, Mingyue, Sikandar Ali Qalati, Muhammad Aamir Shafique Khan, Syed Mir Muhammad Shah, Muhammad Ramzan, and Raza Saleem Khan. 2021. Effects of Entrepreneurial Orientation on Social Media Adoption and SME Performance: The Moderating Role of Innovation Capabilities. Edited by Wonjoon Kim. PLoS ONE 16: e0247320. [Google Scholar] [CrossRef]

- Flammer, Caroline. 2015. Does Corporate Social Responsibility Lead to Superior Financial Performance? A Regression Discontinuity Approach. Management Science 61: 2549–68. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larcker. 1981. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Galbreath, Jeremy, and Paul Shum. 2012. Do Customer Satisfaction and Reputation Mediate the CSR–FP Link? Evidence from Australia. Australian Journal of Management 37: 211–29. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, Dolores, Luis Enrique Valdez-Juárez, and Ángela María Castuera-Díaz. 2019. Corporate Social Responsibility as an Antecedent of Innovation, Reputation, Performance, and Competitive Success: A Multiple Mediation Analysis. Sustainability 11: 5614. [Google Scholar] [CrossRef]

- Gallego-Álvarez, Isabel, José Manuel Prado-Lorenzo, and Isabel-María García-Sánchez. 2011. Corporate Social Responsibility and Innovation: A Resource-based Theory. Management Decision 49: 1709–27. [Google Scholar] [CrossRef]

- García-Piqueres, Gema, and Rebeca García-Ramos. 2020. Is the Corporate Social Responsibility–Innovation Link Homogeneous?: Looking for Sustainable Innovation in the Spanish Context. Corporate Social Responsibility and Environmental Management 27: 803–14. [Google Scholar] [CrossRef]

- Gaynor, Gerard H. 2002. Innovation by Design: What It Takes to Keep Your Company on the Cutting Edge. New York: AMACOM Ame. [Google Scholar]

- González-Fernández, Marcos, and Carmen González-Velasco. 2018. Innovation and Corporate Performance in the Spanish Regions. Journal of Policy Modeling 40: 998–1021. [Google Scholar] [CrossRef]

- Guerrero-Villegas, Jaime, Laura Sierra-García, and Beatriz Palacios-Florencio. 2018. The Role of Sustainable Development and Innovation on Firm Performance. Corporate Social Responsibility and Environmental Management 25: 1350–62. [Google Scholar] [CrossRef]

- Guinet, Jean, and Dirk Pilat. 1999. Promoting Innovation-Does It Matter? Organisation for Economic Cooperation and Development. The OECD Observer 217: 63–65. [Google Scholar]

- Hair, Joe F., Marko Sarstedt, Lucas Hopkins, and Volker G. Kuppelwieser. 2014. Partial Least Squares Structural Equation Modeling (PLS-SEM): An Emerging Tool in Business Research. European Business Review 26: 106–21. [Google Scholar] [CrossRef]

- Hair, Joe F., Matthew C. Howard, and Christian Nitzl. 2020. Assessing Measurement Model Quality in PLS-SEM Using Confirmatory Composite Analysis. Journal of Business Research 109: 101–10. [Google Scholar] [CrossRef]

- Hair, Joe, Carole L. Hollingsworth, Adriane B. Randolph, and Alain Yee Loong Chong. 2017. An Updated and Expanded Assessment of PLS-SEM in Information Systems Research. Industrial Management and Data Systems 117: 442–58. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to Use and How to Report the Results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hamel, Gary, and Coimbatore Krishnarao Prahalad. 2000. The Innovation Cycle: A New Model and Case Study for the Invention to Innovation Process—Engineering Management Journal. Boston: Leading the Revolution Harvard Business School Press, pp. 343–54. [Google Scholar]

- Hamisi, Sama. 2011. Challenges and Opportunities of Tanzanian SMEs in Adapting Supply Chain Management. African Journal of Business Management 5: 1266–76. [Google Scholar]

- Henseler, Jörg. 2018. Partial Least Squares Path Modeling: Quo Vadis? Quality and Quantity 52: 1–8. [Google Scholar] [CrossRef]

- Henseler, Jörg, and Florian Schuberth. 2020. Using Confirmatory Composite Analysis to Assess Emergent Variables in Business Research. Journal of Business Research 120: 147–56. [Google Scholar] [CrossRef]

- Henseler, Jörg, Christian M. Ringle, and Marko Sarstedt. 2016. Testing Measurement Invariance of Composites Using Partial Least Squares. International Marketing Review 33: 405–31. [Google Scholar] [CrossRef]

- Henseler, Jörg, Theo K. Dijkstra, Marko Sarstedt, Christian M. Ringle, Adamantios Diamantopoulos, Detmar W. Straub, David J. Ketchen, Joseph F. Hair, G. Tomas M. Hult, and Roger J. Calantone. 2014. Common Beliefs and Reality About PLS: Comments on Rönkkö and Evermann (2013). Organizational Research Methods 17: 182–209. [Google Scholar] [CrossRef]

- Heunks, Felix J. 1998. Innovation, Creativity and Success. Small Business Economics 10: 263–72. [Google Scholar] [CrossRef]

- Hilmersson, Mikael. 2014. Small and Medium-Sized Enterprise Internationalisation Strategy and Performance in Times of Market Turbulence. International Small Business Journal: Researching Entrepreneurship 32: 386–400. [Google Scholar] [CrossRef]

- Hogan, Suellen J., and Leonard V. Coote. 2014. Organizational Culture, Innovation, and Performance: A Test of Schein’s Model. Journal of Business Research 67: 1609–21. [Google Scholar] [CrossRef]

- Hu, Li-Tze, and Peter M. Bentler. 1998. Fit Indices Sensitivity to Misspecification. Psychological Methods 3: 424–53. [Google Scholar] [CrossRef]

- Hull, Clyde Eiríkur, and Sandra Rothenberg. 2008. Firm Performance: The Interactions of Corporate Social Performance with Innovation and Industry Differentiation. Strategic Management Journal 29: 781–89. [Google Scholar] [CrossRef]

- Ikram, Muhammad, Robert Sroufe, Muhammad Mohsin, Yasir Ahmed Solangi, Syed Zulfiqar Ali Shah, and Farrukh Shahzad. 2019. Does CSR Influence Firm Performance? A Longitudinal Study of SME Sectors of Pakistan. Journal of Global Responsibility 11: 27–53. [Google Scholar] [CrossRef]

- INE Main Figures by Main Activity (CNAE-2009 a 1, 2, 3 y 4 Dígitos) (36167). n.d.a.Available online: https://www.ine.es/jaxiT3/Tabla.htm?t=36167 (accessed on 13 January 2023).

- INE Results by Sector of Activity, Size and Main Variables. n.d.b.Available online: https://www.ine.es/jaxi/Tabla.htm?tpx=49678 (accessed on 11 February 2023).

- Ivana, Gáborová. 2020. Influence of Innovation Activities on CSR of SMEs in Selected CEE Countries. Ad Alta: Journal of Interdisciplinary Research 10: 70–81. [Google Scholar]

- Jo, Hoje, and Maretno A. Harjoto. 2011. Corporate Governance and Firm Value: The Impact of Corporate Social Responsibility. Journal of Business Ethics 103: 351–83. [Google Scholar] [CrossRef]

- Kaplan, Robert S., and David P. Norton. 2005. The Balanced Scorecard: Measures That Drive Performance. Harvard Business Review 83: 172. [Google Scholar]

- Kariv, Dafna, Teresa V. Menzies, Gabrielle A. Brenner, and Louis Jacques Filion. 2009. Transnational Networking and Business Performance: Ethnic Entrepreneurs in Canada. Entrepreneurship and Regional Development 21: 239–64. [Google Scholar] [CrossRef]

- Kaufmann, Lutz, and Julia Gaeckler. 2015. A Structured Review of Partial Least Squares in Supply Chain Management Research. Journal of Purchasing and Supply Management 21: 259–72. [Google Scholar] [CrossRef]

- Kiende, Caroline Kaua, Elegwa Mukulu, and Romanus Odhiambo. 2019. Influence of Strategic Innovation on the Performance of Small and Medium Women-Owned Enterprises in Kenya. Journal of Entrepreneurship & Project Management 3: 50–67. [Google Scholar]

- Kim, ChungAh, Sang Hyuck Kim, and Keon Hee Lee. 2015. A Comparison Study of Multinational Chain Hotel Employees’ Perceptions of Corporate Social Responsibility in China and Korea. Emerging Markets Finance and Trade 51: 364–76. [Google Scholar] [CrossRef]

- Kitapci, Hakan, Bulent Aydin, and Vural Celik. 2012. The Effects of Organizational Learning Capacity and Innovativeness on Financial Performance: An Empirical Study. African Journal of Business Management 6: 2332–41. [Google Scholar] [CrossRef]

- Kock, Ned. 2015. Common Method Bias in PLS-SEM: A Full Collinearity Assessment Approach. International Journal of E-Collaboration 11: 1–10. [Google Scholar] [CrossRef]

- Kramer, Mark R., and Michael Porter. 2011. The Big Idea: Creating Shared Value. Harvard Business Review 89: 62–77. [Google Scholar]

- Kumar, Kamalesh, Giacomo Boesso, Francesco Favotto, and Andrea Menini. 2012. Strategic Orientation, Innovation Patterns and Performances of SMEs and Large Companies. Journal of Small Business and Enterprise Development 19: 132–45. [Google Scholar] [CrossRef]

- Kutieshat, Ruba, and Panteha Farmanesh. 2022. The Impact of New Human Resource Management Practices on Innovation Performance during the COVID 19 Crisis: A New Perception on Enhancing the Educational Sector. Sustainability 14: 2872. [Google Scholar] [CrossRef]

- Laforet, Sylvie. 2008. Size, Strategic, and Market Orientation Affects on Innovation. Journal of Business Research 61: 753–64. [Google Scholar] [CrossRef]

- Lee, Mui Hean, Angela Ka Mak, and Augustine Pang. 2012. Bridging the Gap: An Exploratory Study of Corporate Social Responsibility among SMEs in Singapore. Journal of Public Relations Research 24: 299–317. [Google Scholar] [CrossRef]

- León-Gómez, Ana, Jose Manuel Santos-Jaén, Daniel Ruiz-Palomo, and Mercedes Palacios-Manzano. 2022. Disentangling the Impact of ICT Adoption on SMEs Performance: The Mediating Roles of Corpo-Rate Social Responsibility and Innovation. Oeconomia Copernicana 13: 831–66. [Google Scholar] [CrossRef]

- Lestari, Setyani Dwi, Farah Margaretha Leon, Sri Widyastuti, Nora Andira Brabo, and Aditya Halim Perdana Kusuma Putra. 2020. Antecedents and Consequences of Innovation and Business Strategy on Performance and Competitive Advantage of SMEs. The Journal of Asian Finance, Economics and Business 7: 365–78. [Google Scholar] [CrossRef]

- Liao, Tung-Shan, and John Rice. 2010. Innovation Investments, Market Engagement and Financial Performance: A Study among Australian Manufacturing SMEs. Research Policy 39: 117–25. [Google Scholar] [CrossRef]

- MacGregor, Steven P, and Joan Fontrodona. 2008. Exploring the Fit between CSR and Innovation. IESE Business School Working Paper. Barcelona: IESE. [Google Scholar]

- Madrid-Guijarro, Antonia, Domingo Garcia, and Howard Van Auken. 2009. Barriers to Innovation among Spanish Manufacturing SMEs. Journal of Small Business Management 47: 465–88. [Google Scholar] [CrossRef]

- Mahmood, Faisal, Faisal Qadeer, Maria Saleem, Heesup Han, and Antonio Ariza-Montes. 2021. Corporate Social Responsibility and Firms’ Financial Performance: A Multi-Level Serial Analysis Underpinning Social Identity Theory. Economic Research-Ekonomska Istraživanja 34: 2447–68. [Google Scholar] [CrossRef]

- Mahoney, Joseph T., and J. Rajendran Pandian. 1992. The Resource-Based View within the Conversation of Strategic Management. Strategic Management Journal 13: 363–80. [Google Scholar] [CrossRef]

- Manley, Scott C., Joseph F. Hair, Ralph I. Williams, and William C. McDowell. 2020. Essential New PLS-SEM Analysis Methods for Your Entrepreneurship Analytical Toolbox. International Entrepreneurship and Management Journal 17: 1805–25. [Google Scholar] [CrossRef]

- Marques, Carla Susana, and João Ferreira. 2009. SME Innovative Capacity, Competitive Advantage and Performance in a ‘Traditional’ Industrial Region of Portugal. Journal of Technology Management & Innovation 4: 53–68. [Google Scholar] [CrossRef]

- Martin, Drew, Anders Gustafsson, and Sunmee Choi. 2016. Service Innovation, Renewal, and Adoption/Rejection in Dynamic Global Contexts. Journal of Business Research 69: 2397–400. [Google Scholar] [CrossRef]

- Martinez-Conesa, Isabel, Pedro Soto-Acosta, and Mercedes Palacios-Manzano. 2017. Corporate Social Responsibility and Its Effect on Innovation and Firm Performance: An Empirical Research in SMEs. Journal of Cleaner Production 142: 2374–83. [Google Scholar] [CrossRef]

- Martínez-Ros, Ester, and Jose M. Labeaga. 2009. Product and Process Innovation: Persistence and Complementarities. European Management Review 6: 64–75. [Google Scholar] [CrossRef]

- Mayr, Susanne, Edgar Erdfelder, Axel Buchner, and Franz Faul. 2007. A Short Tutorial of GPower. Tutorials in Quantitative Methods for Psychology 3: 51–59. [Google Scholar] [CrossRef]

- McDermott, Christopher M., and Daniel I. Prajogo. 2012. Service Innovation and Performance in SMEs. International Journal of Operations & Production Management 32: 216–37. [Google Scholar]

- McDougall, Patricia Phillips, Jeffrey G. Covin, Richard B. Robinson, Jr., and Lanny Herron. 1994. The Effects of Industry Growth and Strategic Breadth on New Venture Performance and Strategy Content. Strategic Management Journal 15: 537–54. [Google Scholar] [CrossRef]

- McWilliams, Abagail, Donald S. Siegel, and Patrick M. Wright. 2006. Corporate Social Responsibility: Strategic Implications. Journal of Management Studies 43: 1–18. [Google Scholar] [CrossRef]

- Ministry of Industry and Commerce and Management. 2019. Marco Estratégico En Política de PYME 2030. Madrid: Ministry of Industry and Commerce and Management. [Google Scholar]

- Nooteboom, Bart. 1994. Innovation and Diffusion in Small Firms: Theory and Evidence. Small Business Economics 6: 327–47. [Google Scholar] [CrossRef]

- Ortiz-Martínez, Esther, Salvador Marín-Hernández, and Jose-Manuel Santos-Jaén. 2023. Sustainability, Corporate Social Responsibility, Non-Financial Reporting and Company Performance: Relationships and Mediating Effects in Spanish Small and Medium Sized Enterprises. Sustainable Production and Consumption 35: 349–64. [Google Scholar] [CrossRef]

- Palacios-Manzano, Mercedes, Ana Leon-Gomez, and Jose Manuel Santos-Jaen. 2021. Corporate Social Responsibility as a Vehicle for Ensuring the Survival of Construction SMEs. The Mediating Role of Job Satisfaction and Innovation. IEEE Transactions on Engineering Management, 1–14. [Google Scholar] [CrossRef]

- Palacios-Manzano, Mercedes, Ester Gras-Gil, and Jose Manuel Santos-Jaen. 2019. Corporate Social Responsibility and Its Effect on Earnings Management: An Empirical Research on Spanish Firms. Total Quality Management & Business Excellence 32: 921–37. [Google Scholar] [CrossRef]

- Pavelin, Stephen, and Lynda A. Porter. 2008. The Corporate Social Performance Content of Innovation in the U.K. Journal of Business Ethics 80: 711–25. [Google Scholar] [CrossRef]

- Perez-Luño, Ana, Shanthi Gopalakrishnan, and Ramon Valle Cabrera. 2014. Innovation and Performance: The Role of Environmental Dynamism on the Success of Innovation Choices. IEEE Transactions on Engineering Management 61: 499–510. [Google Scholar] [CrossRef]

- Peteraf, Margaret A. 1993. The Cornerstones of Competitive Advantage: A Resource-Based View. Strategic Management Journal 14: 179–91. [Google Scholar] [CrossRef]

- Porter, Michael E., and Mark R. Kramer. 1985. Advantage. In Creating and Sustaining Superior Performance, Simons and Schuster. New York: Free Press. [Google Scholar]

- Porter, Michael E., and Mark R. Kramer. 2006. Strategy and Society: The Link between Competitive Advantage and Corporate Social Responsibility. Harvard Business Review 84: 78–163. [Google Scholar]

- Prior, Diego, Jordi Surroca, and Josep A. Tribó. 2008. Are Socially Responsible Managers Really Ethical? Exploring the Relationship Between Earnings Management and Corporate Social Responsibility. Corporate Governance: An International Review 16: 160–77. [Google Scholar] [CrossRef]

- Ratajczak, Piotr, and Dawid Szutowski. 2016. Exploring the Relationship between CSR and Innovation. Sustainability Accounting, Management and Policy Journal 7: 295–318. [Google Scholar] [CrossRef]

- Rennings, Klaus, and Christian Rammer. 2011. The Impact of Regulation-Driven Environmental Innovation on Innovation Success and Firm Performance. Industry & Innovation 18: 255–83. [Google Scholar] [CrossRef]

- Rhee, Jaehoon, Taekyung Park, and Do Hyung Lee. 2010. Drivers of Innovativeness and Performance for Innovative SMEs in South Korea: Mediation of Learning Orientation. Technovation 30: 65–75. [Google Scholar] [CrossRef]

- Ringle, Christian M., Sven Wende, and Jan-Michael Becker. 2015. SmartPLS 3. Boenningstedt: SmartPLS GmbH. [Google Scholar]

- Roach, David C., Joel A. Ryman, and Joyline Makani. 2016. Effectuation, Innovation and Performance in SMEs: An Empirical Study. European Journal of Innovation Management 19: 214–38. [Google Scholar] [CrossRef]

- Roldán, José L., and Manuel J. Sánchez-Franco. 2012. Variance-Based Structural Equation Modeling: Guidelines for Using Partial Least Squares in Information Systems Research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems. Pennsylvania: IGI Global, pp. 193–221. [Google Scholar]

- Rosenbusch, Nina, Jan Brinckmann, and Andreas Bausch. 2011. Is Innovation Always Beneficial? A Meta-Analysis of the Relationship between Innovation and Performance in SMEs. Journal of Business Venturing 26: 441–57. [Google Scholar] [CrossRef]

- Ruggiero, Pasquale, and Sebastiano Cupertino. 2018. CSR Strategic Approach, Financial Resources and Corporate Social Performance: The Mediating Effect of Innovation. Sustainability 10: 3611. [Google Scholar] [CrossRef]

- Ruiz-Palomo, Daniel, Julio Diéguez-Soto, Antonio Duréndez, and José António C. Santos. 2019. Family Management and Firm Performance in Family SMEs: The Mediating Roles of Management Control Systems and Technological Innovation. Sustainability (Switzerland) 11: 3805. [Google Scholar] [CrossRef]

- Russo, Michael V., and Paul A. Fouts. 1997. A Resource-Based Perspective On Corporate Environmental Performance And Profitability. Academy of Management Journal 40: 534–59. [Google Scholar] [CrossRef]

- Santos-Jaén, José Manuel, Ana León-Gómez, Daniel Ruiz-Palomo, Francisca García-Lopera, and María del Carmen Valls Martínez. 2022. Exploring Information and Communication Technologies as Driving Forces in Hotel SMEs Performance: Influence of Corporate Social Responsibility. Mathematics 10: 3629. [Google Scholar] [CrossRef]

- Santos-Jaén, José Manuel, Antonia Madrid-Guijarro, and Domingo García-Pérez-de-Lema. 2021. The Impact of Corporate Social Responsibility on Innovation in Small and Medium-Sized Enterprises: The Mediating Role of Debt Terms and Human Capital. Corporate Social Responsibility and Environmental Management 28: 1200–15. [Google Scholar] [CrossRef]

- Sanzo, María José, Luis Ignacio Álvarez, Marta Rey, and Nuria García. 2012. Perceptions of Top Management Commitment to Innovation and R&D-marketing Relationship Effectiveness: Do They Affect CSR? Annals of Public and Cooperative Economics 83: 383–405. [Google Scholar]

- Sarstedt, Marko, Christian M. Ringle, Jun Hwa Cheah, Hiram Ting, Ovidiu I. Moisescu, and Lacramioara Radomir. 2020. Structural Model Robustness Checks in PLS-SEM. Tourism Economics 26: 531–54. [Google Scholar] [CrossRef]

- Schuberth, Florian. 2020. Confirmatory Composite Analysis Using Partial Least Squares: Setting the Record Straight. Review of Managerial Science. Berlin/Heidelberg: Springer. [Google Scholar] [CrossRef]

- Shefer, Daniel, and Amnon Frenkel. 2005. R&D, Firm Size and Innovation: An Empirical Analysis. Technovation 25: 25–32. [Google Scholar] [CrossRef]

- Shmueli, Galit, Marko Sarstedt, Joseph F. Hair, Jun Hwa Cheah, Hiram Ting, Santha Vaithilingam, and Christian M. Ringle. 2019. Predictive Model Assessment in PLS-SEM: Guidelines for Using PLSpredict. European Journal of Marketing 53: 2322–47. [Google Scholar] [CrossRef]

- Singhal, Cherry, Raj V. Mahto, and Sascha Kraus. 2020. Technological Innovation, Firm Performance, and Institutional Context: A Meta-Analysis. IEEE Transactions on Engineering Management 69: 2976–86. [Google Scholar] [CrossRef]

- Slack, R. E., Sandra Corlett, and Rachael Morris. 2015. Exploring Employee Engagement with (Corporate) Social Responsibility: A Social Exchange Perspective on Organisational Participation. Journal of Business Ethics 127: 537–48. [Google Scholar] [CrossRef]

- Soto-Acosta, Pedro, Simona Popa, and Daniel Palacios-Marqués. 2016. E-Business, Organizational Innovation and Firm Performance in Manufacturing SMEs: An Empirical Study in Spain. Technological and Economic Development of Economy 22: 885–904. [Google Scholar] [CrossRef]

- Straub, Detmar, and David Gefen. 2004. Validation Guidelines for IS Positivist Research. Communications of the Association for Information Systems 13: 380–427. [Google Scholar] [CrossRef]

- Tenenhaus, Michel, Vincenzo Esposito Vinzi, Yves Marie Chatelin, and Carlo Lauro. 2005. PLS Path Modeling. Computational Statistics and Data Analysis 48: 159–205. [Google Scholar] [CrossRef]

- Torugsa, Nuttaneeya Ann, Wayne O’Donohue, and Rob Hecker. 2012. Capabilities, Proactive CSR and Financial Performance in SMEs: Empirical Evidence from an Australian Manufacturing Industry Sector. Journal of Business Ethics 109: 483–500. [Google Scholar] [CrossRef]

- Úbeda-García, Mercedes, Enrique Claver-Cortés, Bartolomé Marco-Lajara, and Patrocinio Zaragoza-Sáez. 2021. Corporate Social Responsibility and Firm Performance in the Hotel Industry. The Mediating Role of Green Human Resource Management and Environmental Outcomes. Journal of Business Research 123: 57–69. [Google Scholar] [CrossRef]

- Yang, Yefei, Antonio K. W. Lau, Peter K. C. Lee, and T. C. E. Cheng. 2020. The Performance Implication of Corporate Social Responsibility in Matched Chinese Small and Medium-Sized Buyers and Suppliers. International Journal of Production Economics 230: 107796. [Google Scholar] [CrossRef]

- Yunis, Manal, Abbas Tarhini, and Abdulnasser Kassar. 2018. The Role of ICT and Innovation in Enhancing Organizational Performance: The Catalysing Effect of Corporate Entrepreneurship. Journal of Business Research 88: 344–56. [Google Scholar] [CrossRef]

- Zahra, Shaker A., R. Duane Ireland, and Michael A. Hitt. 2000. International Expansion by New Venture Firms: International Diversity, Mode of Market Entry, Technological Learning, and Performance. Academy of Management Journal 43: 925–50. [Google Scholar] [CrossRef]

- Zakaria, N., N. A. C. Abdullah, and Rushami Zien Yusoff. 2016. The Innovation-Performance Linkage: Empirical Evidence of Malaysian Manufacturing SMEs. In Challenge of Ensuring Research Rigor in Soft Sciences. International Soft Science Conference. Nicosia: Future Academy, pp. 419–24. [Google Scholar] [CrossRef]

- Zheng, Ying, Yong Wang, and Crystal Jiang. 2019. Corporate Social Responsibility and Likelihood of Financial Distress. QRBD 219: 219–36. [Google Scholar]

- Zhou, Haidi, Qiang Wang, and Xiande Zhao. 2020. Corporate Social Responsibility and Innovation: A Comparative Study. Industrial Management & Data Systems 120: 863–82. [Google Scholar] [CrossRef]

- Zhu, Qinghua, Fei Zou, and Pan Zhang. 2019. The Role of Innovation for Performance Improvement through Corporate Social Responsibility Practices among Small and Medium-Sized Suppliers in China. Corporate Social Responsibility and Environmental Management 26: 341–50. [Google Scholar] [CrossRef]

| Industrial Subsector | Total | Micro Companies | Small Companies | Medium Companies | ||||

|---|---|---|---|---|---|---|---|---|

| N | % | N | % | N | % | N | % | |

| Food and beverage | 166 | 21.59% | 60 | 25.10% | 72 | 17.96% | 34 | 26.36% |

| Textiles | 45 | 5.85% | 14 | 5.86% | 27 | 6.73% | 4 | 3.10% |

| Wood and cork | 45 | 5.85% | 11 | 4.60% | 28 | 6.98% | 6 | 4.65% |

| Paper, publishing, and printing | 62 | 8.06% | 24 | 10.04% | 29 | 7.23% | 9 | 6.98% |

| Chemicals | 19 | 2.47% | 2 | 0.84% | 11 | 2.74% | 6 | 4.65% |

| Manufacture of rubber and plastic products | 49 | 6.37% | 10 | 4.18% | 26 | 6.48% | 13 | 10.08% |

| Other non-metallic minerals | 60 | 7.80% | 16 | 6.69% | 38 | 9.48% | 6 | 4.65% |

| Basic and fabricated metals | 142 | 18.47% | 45 | 18.83% | 80 | 19.95% | 17 | 13.18% |

| Machinery and equipment | 101 | 13.13% | 34 | 14.23% | 57 | 14.21% | 10 | 7.75% |

| Electrical equipment, electronic, and optical | 14 | 1.82% | 3 | 1.26% | 7 | 1.75% | 4 | 3.10% |

| Manufacture of motor vehicles | 28 | 3.64% | 7 | 2.93% | 6 | 1.50% | 15 | 11.63% |

| Furniture | 38 | 4.94% | 13 | 5.44% | 20 | 4.99% | 5 | 3.88% |

| TOTAL | 769 | 100% | 239 | 100% | 401 | 100% | 129 | 100% |

| Mean | Loading | t-Student *** | α | ρA | ρC | AVE | |

|---|---|---|---|---|---|---|---|

| Innovation | 0.904 | 0.908 | 0.924 | 0.636 | |||

| INNOV_1 | 3.163 | 0.766 | 34.239 | ||||

| INNOV_2 | 2.778 | 0.716 | 29.487 | ||||

| INNOV_3 | 3.157 | 0.829 | 53.795 | ||||

| INNOV_4 | 3.108 | 0.786 | 39.096 | ||||

| INNOV_5 | 2.880 | 0.814 | 46.774 | ||||

| INNOV_6 | 2.785 | 0.834 | 55.482 | ||||

| INNOV_7 | 2.685 | 0.831 | 52.311 | ||||

| CSR | 0.847 | 0.861 | 0.886 | 0.565 | |||

| CSR_1 | 3.732 | 0.715 | 25.331 | ||||

| CSR_2 | 3.689 | 0.736 | 28.055 | ||||

| CSR_3 | 3.697 | 0.701 | 26.167 | ||||

| CSR_4 | 3.965 | 0.713 | 25.448 | ||||

| CSR_5 | 3.944 | 0.804 | 48.995 | ||||

| CSR_6 | 3.947 | 0.834 | 54.876 | ||||

| Performance | 0.891 | 0.893 | 0.913 | 0.569 | |||

| PERF_1 | 4.077 | 0.709 | 29.182 | ||||

| PERF_2 | 3.899 | 0.751 | 33.596 | ||||

| PERF_3 | 4.039 | 0.808 | 43.905 | ||||

| PERF_4 | 3.971 | 0.780 | 37.696 | ||||

| PERF_5 | 3.793 | 0.768 | 37.782 | ||||

| PERF_6 | 3.702 | 0.768 | 37.528 | ||||

| PERF_7 | 3.860 | 0.771 | 39.786 | ||||

| PERF_8 | 3.956 | 0.673 | 24.973 |

| Constructs | INNOVATION | CSR | PERFORMANCE |

|---|---|---|---|

| INNOVATION | 0.752 | 0.352 | 0.315 |

| CSR | 0.317 | 0.797 | 0.595 |

| PERFORMANCE | 0.524 | 0.285 | 0.755 |

| Effect on Endogenous Variables | Direct Effect | T-Value | 95% Confidence Interval (bias-Corrected) | f2 | Explained Variance (%) | VIF | H | Supported |

|---|---|---|---|---|---|---|---|---|

| CSR | ||||||||

| R2 = 0.101 Q2 = 0.387 | ||||||||

| Innovation | 0.317 | 8.880 *** | [0.261–0.378] | 0.112 | 10.01 | 1.000 | H2a | YES |

| Performance | ||||||||

| R2 = 0.290 Q2 = 0.506 | ||||||||

| Innovation | 0.132 | 3.837 *** | [0.077–0.189] | 0.022 | 3.76 | 1.112 | H1 | YES |

| CSR | 0.482 | 15.550 *** | [0.432–0.535] | 0.294 | 25.25 | 1.112 | H2b | YES |

| Effect of Innovation on Performance | Coefficient | t Value | 95% Confidence Interval | H | Supported | |

|---|---|---|---|---|---|---|

| (Point Estimate) | Lower | Upper | ||||

| Total effect | 0.285 | 8.094 *** | 0.198 | 0.379 | ||

| Direct effect | 0.132 | 3.837 *** | 0.077 | 0.189 | H1 | Yes |

| Indirect effect via CSR | 0.153 | 2.718 *** | 0.121 | 0.190 | H2c | Yes |

| VAF | 0.537 | |||||

| IDR | 1.159 | |||||

| PLS | LM | PLS-LM | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Construct | RMSE | MAE | Q2p | RMSE | MAE | Q2p | RMSE | MAE | Q2p |

| CSR | 0.096 | ||||||||

| Min. | 0.971 | 0.761 | 0.090 | 0.972 | 0.765 | 0.084 | −0.001 | −0.004 | 0.018 |

| Max. | 0.814 | 0.620 | 0.025 | 0.819 | 0.631 | 0.019 | −0.009 | −0.011 | 0.001 |

| Performance | 0.077 | ||||||||

| Min. | 0.740 | 0.575 | 0.018 | 0.741 | 0.578 | 0.006 | −0.007 | −0.013 | 0.004 |

| Max. | 0.891 | 0.686 | 0.068 | 0.897 | 0.686 | 0.061 | −0.001 | 0.000 | 0.015 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Becerra-Vicario, R.; Ruiz-Palomo, D.; León-Gómez, A.; Santos-Jaén, J.M. The Relationship between Innovation and the Performance of Small and Medium-Sized Businesses in the Industrial Sector: The Mediating Role of CSR. Economies 2023, 11, 92. https://doi.org/10.3390/economies11030092

Becerra-Vicario R, Ruiz-Palomo D, León-Gómez A, Santos-Jaén JM. The Relationship between Innovation and the Performance of Small and Medium-Sized Businesses in the Industrial Sector: The Mediating Role of CSR. Economies. 2023; 11(3):92. https://doi.org/10.3390/economies11030092

Chicago/Turabian StyleBecerra-Vicario, Rafael, Daniel Ruiz-Palomo, Ana León-Gómez, and José Manuel Santos-Jaén. 2023. "The Relationship between Innovation and the Performance of Small and Medium-Sized Businesses in the Industrial Sector: The Mediating Role of CSR" Economies 11, no. 3: 92. https://doi.org/10.3390/economies11030092

APA StyleBecerra-Vicario, R., Ruiz-Palomo, D., León-Gómez, A., & Santos-Jaén, J. M. (2023). The Relationship between Innovation and the Performance of Small and Medium-Sized Businesses in the Industrial Sector: The Mediating Role of CSR. Economies, 11(3), 92. https://doi.org/10.3390/economies11030092