Relationship between FDI Inflows and Export Performance: An Empirical Investigation by Considering Structural Breaks

Abstract

1. Introduction

2. Literature Review

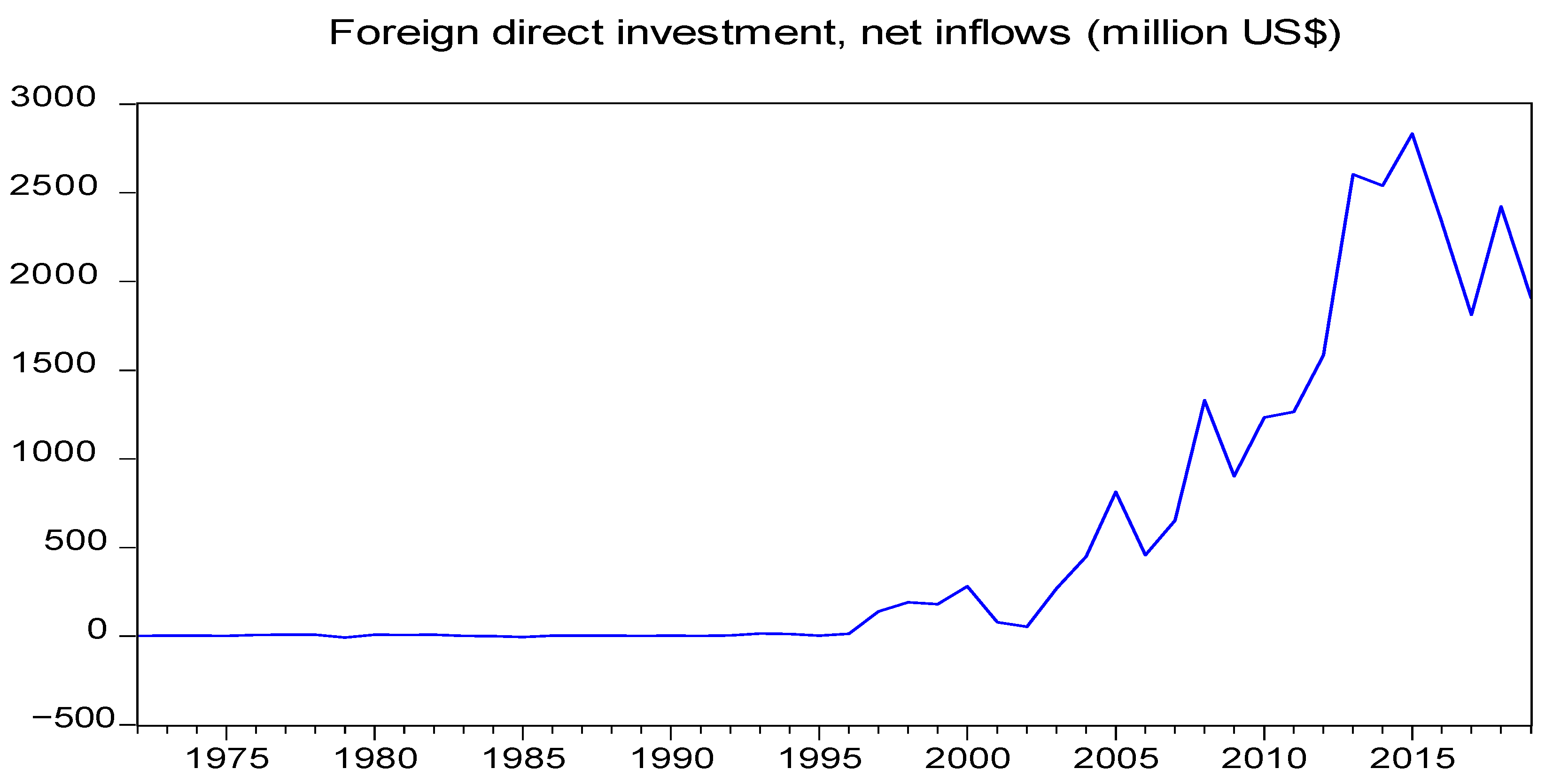

3. Overview of FDI Scenarios of Bangladesh

4. Data and Methodology

4.1. Data

4.2. Methodology

5. Results and Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Without Structural Break

| Variables | ADF Test | PP Test | Order of Integration | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Intercept | Intercept and Trend | Intercept | Intercept and Trend | ||||||

| Level | 1st diff. | Level | 1st diff. | Level | 1st diff. | Level | 1st diff. | ||

| LRGDPGR | −0.60 | −3.94 *** | −13.27 *** | −3.80 ** | −10.35 *** | −35.92 *** | −21.06 *** | −36.14 *** | I(0) |

| LRFDI | −1.41 | −3.15 ** | −2.84 | −3.80 ** | −1.29 | −8.82 *** | −2.77 | −8.91 *** | I(1) |

| LREX | −0.76 | −7.91 *** | −1.67 | −7.93 *** | −0.73 | −7.73 *** | −1.65 | −7.77 *** | I(1) |

| Null Hypothesis: No Levels Relationship | ||

|---|---|---|

| F-Statistic | k | |

| Model 1 [Dependent Variable: D(LRFDI)] | 5.928 | 2 |

| Model 2 [Dependent Variable: D(LREX)] | 1.947 | 2 |

| Critical value | ||

| Significance | I(0) | I(1) |

| 10% | 2.63 | 3.35 |

| 5% | 3.1 | 3.87 |

| 1% | 4.13 | 5 |

| Model 1 Dependent Variable: D(LRFDI) Selected Model: ARDL (1,0,0) | |||

|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob. |

| ECT(−1) | −0.63 *** | −5.04 | 0.000 |

| Model 1 | |||

|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob. |

| LREX | 0.006 *** | 9.60 | 0.00 |

| LRGDPGR | 0.002 | 0.125 | 0.90 |

| C | 0.022 | 8.276 | 0.00 |

References

- Abosedra, Salah, Muhammad Shahbaz, and Rashid Sbia. 2015. The Links between Energy Consumption, Financial Development, and Economic Growth in Lebanon: Evidence from Co-integration with Unknown Structural Breaks. Journal of Energy 2015: 965825. [Google Scholar] [CrossRef]

- Aboulilah, Haitham Medhat Abdelaziz Elsayed, Syed Far Abid Hossain, Bui Nhat Vuong, and Tawfiq Jebril. 2022. Exploring the Relationship between WeChat Usage and E-purchase Intention during the COVID-19 Pandemic among University Students in China. Sage Open 12: 21582440221139447. [Google Scholar] [CrossRef]

- Acaravci, Ali, and Ilhan Ozturk. 2012. Foreign direct investment, export and economic growth: Empirical evidence from new EU countries. Romanian Journal of Economic Forecasting 2: 52–67. [Google Scholar]

- Adhikary, Bishnu Kumar. 2012. Impact of foreign direct investment, trade openness, domestic demand, and exchange rate on the export performance of Bangladesh: A VEC approach. Economics Research International 12: 12–22. [Google Scholar] [CrossRef][Green Version]

- Aihounton, Ghislain B. D., and Arne Henningsen. 2021. Units of measurement and the inverse hyperbolic sine transformation. The Econometrics Journal 24: 334–51. [Google Scholar] [CrossRef]

- Andraz, Jorge Miguel, and Paulo Rodrigues. 2010. What causes economic growth in Portugal: Exports or inward FDI? Journal of Economic Studies 37: 267–87. [Google Scholar] [CrossRef]

- Babatunde, Musibau Adetunji. 2017. Foreign direct investment and export performance in Nigeria: A disaggregated Analysis. International Journal of Sustainable Economy 9: 142–58. [Google Scholar] [CrossRef]

- Babu, Abraham. 2018. Causality between foreign direct investments and exports in India. Theoretical & Applied Economics 25: 135–44. [Google Scholar]

- Bangladesh Investment Development Authority (BIDA). 2023. Investment Opportunity. Available online: http://bida.gov.bd/?page_id=146 (accessed on 23 January 2023).

- Basilgan, Müslüm, and Ayşe Seha Akman. 2019. An empirical analysis on the impact of the foreign direct investments on export performance: Turkey case. International Journal of Economics and Finance Studies 11: 89–105. [Google Scholar] [CrossRef]

- Bellemare, Mark, and Casey Wichman. 2020. Elasticities and the inverse hyperbolic sine transformation. Oxford Bulletin of Economics and Statistics 82: 50–61. [Google Scholar] [CrossRef]

- Belloumi, Mounir. 2014. The relationship between trade, FDI and economic growth in Tunisia: An application of the autoregressive distributed lag model. Economic Systems 38: 269–87. [Google Scholar] [CrossRef]

- Bhasin, Niti, and Aanchal Gupta. 2017. Macroeconomic impact of FDI inflows: An ARDL approach for the case of India. Transnational Corporations Review 9: 150–68. [Google Scholar] [CrossRef]

- Bhatt, Polto Ranjon. 2011. A causal relationship between exports, foreign direct investment and income for Malaysia. Journal for Global Business Advancement 4: 155–66. [Google Scholar] [CrossRef]

- Borensztein, E., J. De Gregorio, and J. W. Lee. 1998. How does foreign direct investment affect economic growth? Journal of International Economics 45: 115–35. [Google Scholar] [CrossRef]

- Busse, Matthias, and Carsten Hefeker. 2007. Political risk, institutions and foreign direct investment. European Journal of Political Economy 23: 397–415. [Google Scholar] [CrossRef]

- Caves, Richard. 2007. Multinational Enterprise and Economic Analysis, 3rd ed. Cambridge: Cambridge University Press. [Google Scholar]

- Chakraborty, Debashis, Jaydeep Mukherjee, and Jaewook Lee. 2016. Do FDI Inflows influence Merchandise Exports? Causality Analysis on India over 1991–2016. MPRA Paper No. 74851, Munich Personal RePEc Archive. Munich: University Library of Munich. [Google Scholar]

- Dash, Ranjan Kumar, and Chandan Sharma. 2010. Does causality between FDI and trade exist: Evidence from South Asia? International Journal of Trade and Global Markets 3: 390–413. [Google Scholar] [CrossRef]

- Dritsaki, Chaido, and Emmanouil Stiakakis. 2014. Foreign direct investments, exports, and economic growth in Croatia: A time series analysis. Procedia Economics and Finance 14: 181–90. [Google Scholar] [CrossRef]

- Emmanuel, Cousté Philippe, Su Qin, Syed Far Abid Hossain, and Khalid Hussain. 2022. Factors influencing social-media-based entrepreneurship prospect among female students in China. Heliyon 8: e12041. [Google Scholar] [CrossRef]

- Engle, Robert, and Clive Granger. 1987. Co-integration and error correction: Representation, estimation and Testing. Econometrica 55: 286–301. [Google Scholar] [CrossRef]

- Fang, Jing, Alan Collins, and Shujie Yao. 2021. On the global COVID-19 pandemic and China’s FDI. Journal of Asian Economics 74: 101300. [Google Scholar] [CrossRef]

- Friedline, Terri, Masa Rainier, and Chowa Gina. 2015. Transforming wealth: Using the inverse hyperbolic sine (IHS) and splines to predict youth’s math achievement. Social Science Research 49: 264–87. [Google Scholar] [CrossRef] [PubMed]

- Gebremariam, Teamrat Kahssay, and Sun Ying. 2022. The foreign direct investment-Export performance nexus: An ARDL based empirical evidence from Ethiopia. Cogent Economics & Finance 10: 2009089. [Google Scholar]

- Herzer, Dierk, Stephan Klasen, and Felicitas Nowak-Lehmann. 2008. In search of FDI-led growth in developing countries: The way forward. Economic Modelling 25: 793–810. [Google Scholar] [CrossRef]

- Hossain, Syed Far Abid, Xu Shan, Mohammed Musa, and Pritu Rahman. 2023. Social media and increased venture creation tendency with innovative ideas: The case of female students in Asia. In Research Anthology on Applying Social Networking Strategies to Classrooms and Libraries. Hershey: IGI Global, pp. 1716–31. [Google Scholar]

- Islam, Mohammad Mohidul. 2022. The Role of Foreign Direct Investment (FDI) Inflows on Export Performance in Developing Economies: Evidence from Bangladesh. South Asian Journal of Social Studies and Economics 16: 49–57. [Google Scholar] [CrossRef]

- Jawaid, Syed Tehseen, Syed Ali Raza, Khalid Mustafa, and Mohd Zaini Abd Karim. 2016. Does inward foreign direct investment lead export performance in Pakistan? Global Business Review 17: 1296–313. [Google Scholar] [CrossRef]

- Johansen, Søren, and Katarina Juselius. 1990. Maximum likelihood estimation and inference on co-integration with applications to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Kalirajan, Kaliappa, Adil Miankhel, and Shandre Thangavelu. 2009. Foreign Direct Investment, Exports, and Economic Growth in South Asia and Selected Emerging Countries: A Multivariate VAR Analysis. CCAS Working paper, 23. Tokyo: Center for Contemporary Asian Studies (CCAS). [Google Scholar]

- Kaur, Manpreet, Surendra S. Yadav, and Vinayshil Gautam. 2013. A bivariate causality link between foreign direct Investment and economic growth: Evidence from India. Journal of International Trade Law and Policy 12: 68–79. [Google Scholar] [CrossRef]

- Khatun, Fahmida, and Mazbahul Ahamad. 2015. Foreign direct investment in the energy and power sector in Bangladesh: Implications for economic growth. Renewable and Sustainable Energy Reviews 52: 1369–77. [Google Scholar] [CrossRef]

- Kivyiro, Pendo, and Heli Arminen. 2015. GDP, FDI, and exports in East and Central African countries: A causality Analysis. International Journal of Business Innovation and Research 9: 329–50. [Google Scholar] [CrossRef]

- Kutan, Ali, and Goran Vukšić. 2007. Foreign direct investment and export performance: Empirical Evidence. Comparative Economic Studies 49: 430–45. [Google Scholar] [CrossRef]

- Lee, Shao-Wei. 2007. Foreign Direct Investment and Export Performance: The Case of Taiwan. M.Econ-Res. Master’s thesis, Economics and Information Systems, University of Wollongong, Wollongong, NSW, Australia. [Google Scholar]

- Li, Xin, Hsu Ling Chang, Chi-Wei Su, and Yin Dai. 2017. Does Foreign Direct Investment Promote Exports in China? China Finance Review International 7: 185–202. [Google Scholar] [CrossRef]

- Lou, Changyuan. 2007. FDI, domestic capital and economic growth: Evidence from panel data at China’s provincial level. Frontiers of Economics in China 2: 92–113. [Google Scholar]

- Lumsdaine, Robin, and David Papell. 1997. Multiple trends breaks and the unit-root hypothesis. Review of Economics and Statistics 79: 212–18. [Google Scholar] [CrossRef]

- Mijiyawa, Abdoul. 2017. Does foreign direct investment promote exports? Evidence from African Countries. The World Economy 40: 1934–57. [Google Scholar] [CrossRef]

- Mitra, Sandip. 2015. Effect of Foreign Direct Investment on GDP, Export and Domestic Investment: Bangladesh Perspective. Journal of Innovation & Development Strategy 9: 53–61. [Google Scholar]

- Mohanty, Saileja, and Narayan Sethi. 2021. Does inward FDI lead to export performance in India? An empirical investigation. Global Business Review 22: 1174–89. [Google Scholar] [CrossRef]

- Mohsin, Abul kalam Mohammed, Hongzhen Lei, Hassanuzzaman Tushar, Sayed far abid Hossain, Moohammed Ebrahim Hossain, and Afroja Hossain Sume. 2021. Cultural and institutional distance of China’s outward foreign direct investment toward the “Belt and Road” countries. The Chinese Economy 54: 176–94. [Google Scholar] [CrossRef]

- Mohsin, Abul kalam Mohammed, Sheikh Hssannuzzaman Tushar, Mohammed Masum Iqbal, Sayed Far Abid Hossain, and Mohammed Kamruzzaman. 2022. Does FinTech credit scale stimulate financial institutions to increase the proportion of agricultural loans? Cogent Economics & Finance 10: 2114176. [Google Scholar]

- Musti, Babagana Mala, and Ahmed Mallum. 2020. Impact of foreign direct investment (FDI) on export performance in Nigeria (1970–2018). International Journal of Advanced Academic Research-Social and Management Sciences 6: 22–38. [Google Scholar]

- Narayan, Paresh, and Baljeet Singh. 2007. The electricity consumption and GDP nexus for the Fiji Islands. Energy Economics 29: 1141–50. [Google Scholar] [CrossRef]

- Oh, Wankeun, and Kihoon Lee. 2004. Causal relationship between energy consumption and GDP revisited: The case of Korea 1970–1999. Energy Economics 26: 51–59. [Google Scholar] [CrossRef]

- Okechukwu, Obiora, Glauco De Vita, and Yun Luo. 2018. The impact of FDI on Nigeria’s export performance: A sectoral analysis. Journal of Economic Studies 45: 1088–103. [Google Scholar] [CrossRef]

- Pacheco-López, Penélope. 2005. Foreign direct investment, exports and imports in Mexico. World Economy 28: 1157–72. [Google Scholar] [CrossRef]

- Pegkas, Panagiotis. 2015. The impact of FDI on economic growth in Eurozone countries. The Journal of Economic Asymmetries 12: 124–32. [Google Scholar] [CrossRef]

- Perron, Pierre. 1989. The great crash, the oil price shock, and the unit root hypothesis. Econometrica: Journal of the Econometric Society 57: 1361–401. [Google Scholar] [CrossRef]

- Prasanna, Narayan. 2010. Impact of foreign direct investment on export performance in India. Journal of Social Sciences 24: 6571. [Google Scholar] [CrossRef]

- Rahmaddi, Rudy, and Masaru Ichihashi. 2013. The role of foreign direct investment in Indonesia’s manufacturing exports. Bulletin of Indonesian Economic Studies 49: 329–54. [Google Scholar] [CrossRef]

- Shih, Yu-Yuan, and Chih-An Lin. 2022. Co-location with marketing value activities as manufacturing upgrading in a COVID-19 outbreak era. Journal of Business Research 148: 410–19. [Google Scholar] [CrossRef]

- Srivastava, Sadhana. 2006. The role of foreign direct investment in India’s services exports: An empirical Investigation. The Singapore Economic Review 51: 175–94. [Google Scholar] [CrossRef]

- Sunde, Tafirenyika. 2017. Foreign direct investment, exports and economic growth: ADRL and causality analysis for South Africa. Research in International Business and Finance 41: 434–44. [Google Scholar] [CrossRef]

- Temiz, Dilek, and Aytaç Gökmen. 2011. Foreign direct investment (FDI) and export relation in Turkey: 1991–2010. Journal of Transnational Management 16: 157–80. [Google Scholar] [CrossRef]

- Wang, Chengang, Xiaming Liu, and Yingqi Wei. 2004. Impact of openness on growth in different country groups. World Economy 27: 567–85. [Google Scholar] [CrossRef]

- Wang, Chengqi, Peter J. Buckley, Jeremy Clegg, and Mario Kafouros. 2010. The impact of inward foreign direct investment on the nature and intensity of Chinese manufacturing exports. In Foreign Direct Investment, China and the World Economy. London: Palgrave Macmillan, pp. 270–83. [Google Scholar]

- World Development Indicators. 2021. Bangladesh Data, The World Bank. Available online: https://data.worldbank.org/country/bangladesh (accessed on 28 November 2021).

- Zhang, Mingliang, John Fortney, John Tilford, and Kathryn Rost. 2000. An application of the inverse hyperbolic sine transformation—A note. Health Services and Outcomes Research Methodology 1: 165–71. [Google Scholar] [CrossRef]

- Zivot, Eric, and Donald Andrews. 1992. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. Journal of Business & Economic Statistics 10: 251–70. [Google Scholar]

| Country | Author(s) | Study Period | Major Findings |

|---|---|---|---|

| Bangladesh | Islam (2022) | 1995–2020 | FDI in Bangladesh is positively related to the export performance of Bangladesh in the long run, while in the short run, the study found no relationship |

| Bangladesh | Mitra (2015) | 1971–2013 | FDI has a positive impact on the export performance of Bangladesh |

| Bangladesh | Adhikary (2012) | 1980–2009 | FDI has affected the exports of Bangladesh both in the long run as well as the short run |

| Four South Asian countries (including Bangladesh) | Dash and Sharma (2010) | 1990–2007 | Two-way causality between FDI and exports for Bangladesh |

| Variable | Description |

|---|---|

| RGDPGR | RGDPGR stands for Real Gross Domestic Product Growth Rate (constant 2010 USD). In this study, the variable is used following Sunde (2017) and Dritsaki and Stiakakis (2014). |

| RFDI | RFDI stands for Ratio of Real Foreign Direct Investment net inflows to Real Gross Domestic Product. In this study, the variable is used following Mohanty and Sethi (2021), Musti and Mallum (2020), Sunde (2017), Pegkas (2015), Belloumi (2014), Dritsaki and Stiakakis (2014), Kaur et al. (2013), Herzer et al. (2008), Lou (2007), and Borensztein et al. (1998). Data on FDI net inflows (current USD) have been converted to real values by dividing the current values by the GDP deflator (2010 = 1), using 2010 as the base year following Pegkas (2015). |

| REX | REX stands for Ratio of Real Exports of goods and services to Real Gross Domestic Product. In this study, the variable is used following Mohanty and Sethi (2021), Musti and Mallum (2020), Sunde (2017), and Dritsaki and Stiakakis (2014). Exports of goods and services denote the value of all goods and services provided to the rest of the world (WDI 2021). |

| Var. | Description | Unit | Obs. | Mean | Max. | Min. | Std. Dev. | Skewness | Kurt. |

|---|---|---|---|---|---|---|---|---|---|

| RGDPGR | Real Gross Domestic Product Growth Rate | Percentage | 48 | 4.45 | 9.59 | −13.97 | 3.49 | −3.53 | 18.74 |

| RFDI | Ratio of Real Foreign Direct Investment net inflows to Real Gross Domestic Product | Percentage | 48 | 0.39 | 1.74 | −0.05 | 0.52 | 1.08 | 2.82 |

| REX | Ratio of Real Exports of goods and services to Real Gross Domestic Product | Percentage | 48 | 7.87 | 20.57 | 2.28 | 6.35 | 0.90 | 2.07 |

| Variables | ADF Test (Optimal Lag Length = 9) | PP Test (Optimal Lag Length = 6) | Order of Integration | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Intercept | Intercept and Trend | Intercept | Intercept and Trend | ||||||

| Level | 1st diff. | Level | 1st diff. | Level | 1st diff. | Level | 1st diff. | ||

| LRGDPGR | −0.60 (0.858) | −3.94 *** (0.004) | −13.27 *** (0.00) | −3.80 ** (0.026) | −10.35 *** (0.00) | −35.92 *** (0.00) | −21.06 *** (0.00) | −36.14 *** (0.00) | I(0) |

| LRFDI | −1.41 (0.567) | −3.15 ** (0.0305) | −2.84 (0.188) | −3.80 ** (0.026) | −1.29 (0.62) | −8.82 *** (0.00) | −2.77 (0.212) | −8.91 *** (0.00) | I(1) |

| LREX | −0.76 (0.819) | −7.91 *** (0.000) | −1.67 (0.747) | −7.93 *** (0.000) | −0.73 (0.827) | −7.73 *** (0.00) | −1.65 (0.753) | −7.77 *** (0.00) | I(1) |

| Variables | ZA Test | LP Test | ||

|---|---|---|---|---|

| t-Statistic | TB | t-Statistic | TB | |

| LRGDPGR | −4.27 | 1981:01 | −4.76 | 1981:01; 2004:01 |

| ∆LRGDPGR | −20.95 *** | 2007:01 | −21.28 *** | 2004:01; 2010:01 |

| LRFDI | −4.27 | 2003:01 | −5.22 | 1993:01; 2011:01 |

| ∆LRFDI | −9.39 *** | 2011:01 | −10.25 *** | 2002:01; 2011:01 |

| LREX | −3.91 | 1980:01 | −7.16 | 1980:01; 2003:01 |

| ∆LREX | −10.21 *** | 2003:01 | −11.52 *** | 2003:01; 2010:01 |

| Lag | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|

| 0 | NA | 3.63 × 10−10 | −13.22374 | −13.09707 | −13.17794 |

| 1 | 136.5396 | 1.28 × 10−11 * | −16.56651 | −16.05984 * | −16.38331 * |

| 2 | 11.00056 | 1.46 × 10−11 | −16.44986 | −15.56320 | −16.12927 |

| 3 | 7.853699 | 1.80 × 10−11 | −16.26165 | −14.99499 | −15.80366 |

| 4 | 7.350597 | 2.24 × 10−11 | −16.08389 | −14.43723 | −15.48851 |

| 5 | 13.90314 | 2.10 × 10−11 | −16.21319 | −14.18653 | −15.48041 |

| 6 | 18.66090 * | 1.51 × 10−11 | −16.65180 * | −14.24515 | −15.78163 |

| Hypothesized No. of Co-Integrating Equation (CE) | H0: | H1: | Eigenvalue | Trace Test | Maximum Eigenvalue Test | ||||

|---|---|---|---|---|---|---|---|---|---|

| 5% Critical Value | Prob. | 5% Critical Value | Prob. | ||||||

| None ** | r = 0 | r = 1 | 0.49259 | 36.940 | 29.797 | 0.006 | 26.459 | 21.131 | 0.008 |

| At most 1 | r ≤ 1 | r = 2 | 0.21903 | 10.481 | 15.494 | 0.245 | 9.641 | 14.264 | 0.236 |

| At most 2 | r ≤ 2 | r = 3 | 0.02130 | 0.839 | 3.841 | 0.359 | 0.839 | 3.841 | 0.359 |

| Dependent Variable | Sources of Causation | Short-Run Relationship | Long-Run Relationship | |||

|---|---|---|---|---|---|---|

| Short-Run | Long-Run | |||||

| LRFDI | LREX | LRGDPGR | ECTt−1 | |||

| LRFDI | - | 17.446 *** (0.0078) | 11.797 * (0.0666) | −0.972 *** (0.0007) | REX causes RFDI RGDPGR causes RFDI | Yes |

| Diagnostic tests | Result | Decision | ||||

| Breusch–Pagan–Godfrey test of heteroscedasticity | 19.838 (0.5315) | There is no heteroscedasticity in the model | ||||

| Breusch–Godfrey serial correlation LM test | 4.658 (0.0974) | There is no serial correlation in the residuals in the model | ||||

| Jarque–Bera test for normality | 1.821 (0.402) | Residuals are normally distributed | ||||

| With Considering Structural Breaks | Without Considering Structural Breaks | |

|---|---|---|

| Model | VECM | ARDL |

| Major Findings | The empirical result of VECM for RFDI equation suggests the evidence of a long-run causality from REX and RGDPGR to RFDI and the evidence of a positive short-run causal relation from REX to RFDI as well as a positive short-run causal relation from RGDPGR to RFDI. The empirical result of VECM for REX equation indicates that there is no long-run causality from RFDI and RGDPGR to REX. In addition, there is no short-run causal relation from RFDI to REX and from RGDPGR to REX. | There is a long-run relationship among the selected variables for Model 1 [Dependent Variable: D(LRFDI)]. The error correction term (ECT) for Model 1 is negative and significant at the 1% level of significance. It suggests that there is a long-run relationship among RFDI, RGDPGR, and REX. It is also apparent that REX has a positive relationship with RFDI in the long-run. On the other hand, estimated results show that there is no long-run relationship among the selected variables for Model 2 [Dependent Variable: D (LREX)]. |

| Source | see Table 8 | see Appendix A Table A2, Table A3 and Table A4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmed, S.F.; Mohsin, A.K.M.; Hossain, S.F.A. Relationship between FDI Inflows and Export Performance: An Empirical Investigation by Considering Structural Breaks. Economies 2023, 11, 73. https://doi.org/10.3390/economies11030073

Ahmed SF, Mohsin AKM, Hossain SFA. Relationship between FDI Inflows and Export Performance: An Empirical Investigation by Considering Structural Breaks. Economies. 2023; 11(3):73. https://doi.org/10.3390/economies11030073

Chicago/Turabian StyleAhmed, Sayed Farrukh, A. K. M. Mohsin, and Syed Far Abid Hossain. 2023. "Relationship between FDI Inflows and Export Performance: An Empirical Investigation by Considering Structural Breaks" Economies 11, no. 3: 73. https://doi.org/10.3390/economies11030073

APA StyleAhmed, S. F., Mohsin, A. K. M., & Hossain, S. F. A. (2023). Relationship between FDI Inflows and Export Performance: An Empirical Investigation by Considering Structural Breaks. Economies, 11(3), 73. https://doi.org/10.3390/economies11030073