Factors Affecting the Performance of Small and Medium Enterprises Regarding the Sustainable Development Goals—The Case of Foreign Direct Investment Firms in Vietnam

Abstract

1. Introduction

- Job creation: FDI enterprises help create employment opportunities for the local population, contributing to the overall development of the country.

- Capital injection: FDI enterprises bring in large amounts of foreign capital into the country, which can be invested in various sectors, including infrastructure development and technology upgrades.

- Technology transfer: FDI enterprises often bring in advanced technology and management expertise, which can help modernize and improve the efficiency of Vietnamese industries.

- Boosting exports: FDI enterprises can also help increase exports by producing goods for export and by promoting Vietnamese products in international markets.

- Improved business environment: The presence of FDI enterprises can help to attract more investment, improve the business environment, and increase competition, leading to more innovation and growth.

2. Literature Review and Model Building

2.1. Literature Review

2.2. Model Building

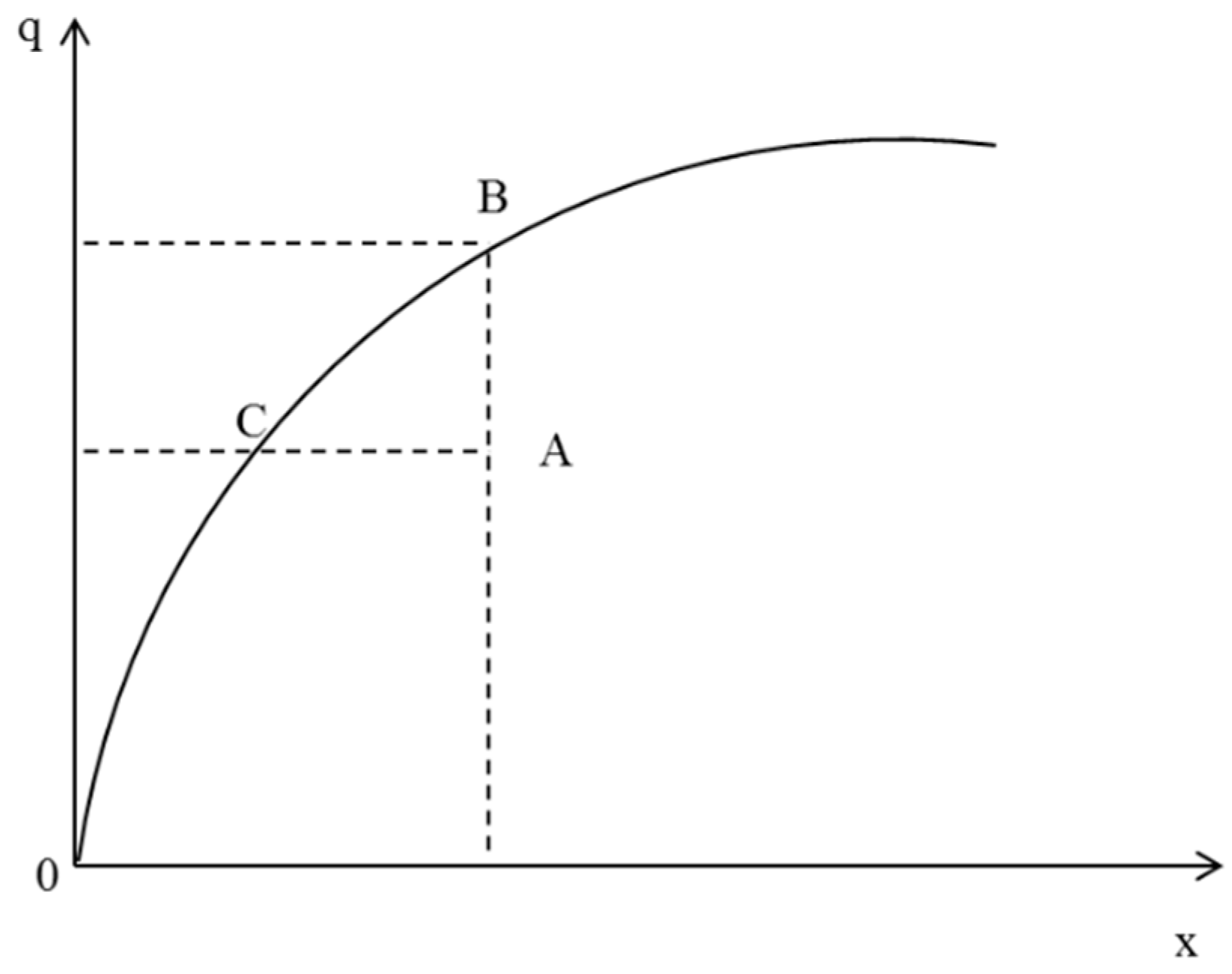

2.3. Data Envelopment and Tobit Regression

2.3.1. Data Wrapping Method

2.3.2. Tobit Regression Model

3. Data and Model Results

3.1. Data Description

3.2. Research Hypotheses

3.3. Research Results

3.3.1. Step 1: Operation Performance of FDI SMEs in Vietnam

3.3.2. Step 2: Factors Affecting the Operation Performance of SMEs in Vietnam

4. Conclusions and Recommendations for FDI SMEs

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Admassie, Assefa, and Francis A. S. T. Matambalya. 2002. Technical Efficiency of Small-and Medium-Scale Enterprises: Evidence from a Survey of Enterprises in Tanzania. Eastern Africa Social Science Research Review 18: 1–29. [Google Scholar] [CrossRef]

- Ahmad, Nawaz, Atif Salman, and Aamir Shamsi. 2015. Impact of financial leverage on firms’ profitability: An investigation from cement sector of Pakistan. Research Journal of Finance and Accounting 6: 75–80. [Google Scholar]

- Anbar, Adem, and Deger Alper. 2011. Bank specific and macroeconomic determinants of commercial bank profitability: Empirical evidence from Turkey. Business and Economics Research Journal 2: 139–52. [Google Scholar]

- Anh, Nguyen Thi Ngoc. 2016. Regional Determinants of FDI Location in Vietnam. Journal of Economics and Development 18: 19–37. [Google Scholar]

- Athanasoglou, Panayiotis P., Sophocles N. Brissimis, and Matthaios D. Delis. 2008. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money 18: 121–36. [Google Scholar] [CrossRef]

- Banker, Rajiv D., and Robert M. Thrall. 1992. Estimation of returns to scale using data envelopment analysis. European Journal of Operational Research 62: 74–84. [Google Scholar] [CrossRef]

- Binam, Joachim Nyemeck, Jean Tonye, Gwendoline Nyambi, and Mireille Akoa. 2004. Factors affecting the technical efficiency among smallholder farmers in the slash and burn agriculture zone of Cameroon. Food Policy 29: 531–45. [Google Scholar] [CrossRef]

- Binam, Joachim Nyemeck, Kalilou Sylla, Ibrahim Diarra, and Gwendoline Nyambi. 2006. Factors Affecting Technical Efficiency among Coffee Farmers in Cote d’Ivoire: Evidence from the Centre West Region. African Development Review 15: 66–76. [Google Scholar] [CrossRef]

- Blazkova, Ivana, and Ondrej Dvoulety. 2018. Sectoral and Firm-Level Determinants of Profitability: A Multilevel Approach. International Journal of Entrepreneurial Knowledge 6: 32–44. [Google Scholar] [CrossRef]

- Cameron, Adrian Colin, and Pravin K. Trivedi. 2010. Microeconometrics Using Stata. College Station: Stata Press, vol. 5. [Google Scholar]

- Capon, Noel, John U. Farley, and Scott Hoenig. 1990. Determinants of Financial Performance: A Meta-Analysis. Management Science 36: 1143–59. [Google Scholar] [CrossRef]

- Charnes, Abraham, William W. Cooper, and Edwardo Rhodes. 1978. Measuring the efficiency of decision making units. European Journal of Operational Research 2: 429–44. [Google Scholar] [CrossRef]

- Chen, Nan, Yahui Wang, Jiaqi Li, Yuqian Wei, and Qing Yuan. 2020. Examining Structural Relationships among Night Tourism Experience, Lovemarks, Brand Satisfaction, and Brand Loyalty on “Cultural Heritage Night” in South Korea. Sustainability 12: 6723. [Google Scholar] [CrossRef]

- Chu, Son Ngoc, and Kaliappa Kalirajan. 2011. Impact of Trade Liberalisation on Technical Efficiency of Vietnamese Manufacturing Firms. Science, Technology and Society 16: 265–84. [Google Scholar] [CrossRef]

- CIEM. 2022. Characteristics of the Vietnamese Business Environment: Evidence from a SME Survey in 2021. CIEM Report. Hanoi: CIEM. [Google Scholar]

- Coelli, T. 1996. A Guide to DEAP Version 2.1: A Data Envelopment Analysis (Computer) Program. Armidale: Centre for Efficiency and Productivity Analysis, University of New England, Australia, pp. 1–49. [Google Scholar]

- Coelli, Timothy J., D. S. Prasada Rao, Christopher J. O’Donnell, and George E. Battese. 2005. An Introduction to Efficiency and Productivity Analysis. Berlin: Springer Science Business Media. [Google Scholar]

- Cosh, Andy, Xiaolan Fu, and Alan Hughes. 2010. Organisation structure and innovation performance in different environments. Small Business Economics 39: 301–17. [Google Scholar] [CrossRef]

- DeAngelo, Harry, and Ronald W. Masulis. 1980. Optimal capital structure under corporate and personal taxation. Journal of Financial Economics 8: 3–29. [Google Scholar] [CrossRef]

- Deloof, Marc. 2003. Does Working Capital Management Affect Profitability of Belgian Firms? Journal of Business Finance & Accounting 30: 573–588. [Google Scholar] [CrossRef]

- Fadly, Dalia. 2020. Greening Industry in Vietnam: Environmental Management Standards and Resource Efficiency in SMEs. Sustainability 12: 7455. [Google Scholar] [CrossRef]

- Fareed, Zeeshan, Zahid Ali, Farrukh Shahzad, Muhammad Imran Nazir, and Assad Ullah. 2016. Determinants of Profitability: Evidence from Power and Energy Sector. Studia Universitatis Babes-Bolyai Oeconomica 61: 59–78. [Google Scholar] [CrossRef]

- Farrell, Michael James. 1957. The Measurement of Productive Efficiency. Journal of the Royal Statistical Society: Series A (General) 120: 253–90. [Google Scholar] [CrossRef]

- Fiori, Anna Maria, and Ilaria Foroni. 2019. Reservation Forecasting Models for Hospitality SMEs with a View to Enhance Their Economic Sustainability. Sustainability 11: 1274. [Google Scholar] [CrossRef]

- Flammini, Alessandro, Erik Brundin, Rikard Grill, and Hannes Zellweger. 2020. Supply Chain Uncertainties of Small-Scale Coffee Husk-Biochar Production for Activated Carbon in Vietnam. Sustainability 12: 8069. [Google Scholar] [CrossRef]

- Giang, Mai Huong, Bui Huy Trung, Yuichiro Yoshida, Tran Dang Xuan, and Mai Thanh Que. 2019. The Causal Effect of Access to Finance on Productivity of Small and Medium Enterprises in Vietnam. Sustainability 11: 5451. [Google Scholar] [CrossRef]

- Gill, Amarjit, Nahum Biger, and Neil Mathur. 2010. The relationship between working capital management and profitability: Evidence from the United States. Business and Economics Journal 10: 1–9. [Google Scholar]

- Goddard, John, Manouche Tavakoli, and John O. S. Wilson. 2005. Determinants of profitability in European manufacturing and services: Evidence from a dynamic panel model. Applied Financial Economics 15: 1269–82. [Google Scholar] [CrossRef]

- Gujarati, Damodar N. 2022. Econometrics by Example. Hampshire: Palgrave Macmillan. [Google Scholar]

- Hall, Marshall, and Leonard Weiss. 1967. Firm Size and Profitability. The Review of Economics and Statistics 49: 319. [Google Scholar] [CrossRef]

- Hallberg, Kristin. 1999. Small and Medium Scale Enterprises: A Framework for Intervention. Washington, DC: The World Bank. [Google Scholar]

- Jensen, Michael C. 1986. Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review 76: 323–29. [Google Scholar]

- Joo, Bashir Ahmad, Sana Shawl, and Daniel Makina. 2022. The interaction between FDI, host country characteristics and economic growth? A new panel evidence from BRICS. Journal of Economics and Development 24: 247–61. [Google Scholar] [CrossRef]

- Le, Cong Luyen Viet. 2010. Technical Efficiency Performance of Vietnamese Manufacturing Small and Medium Enterprises. Ph.D. thesis, School of Economics-Faculty of Commerce, University of Wollongong, Dubai, United Arab Emirates. [Google Scholar]

- Le, Thi Thuy Hang, Van Chien Nguyen, and Thi Hang Nga Phan. 2022. Foreign Direct Investment, Environmental Pollution and Economic Growth—An Insight from Non-Linear ARDL Co-Integration Approach. Sustainability 14: 8146. [Google Scholar] [CrossRef]

- Liao, Pengyi, Jun Yan, Jean Michel Sellier, and Yongxuan Zhang. 2022. TADA: A Transferable Domain-Adversarial Training for Smart Grid Intrusion Detection Based on Ensemble Divergence Metrics and Spatiotemporal Features. Energies 15: 8778. [Google Scholar] [CrossRef]

- Liem, Le Tran Thanh, Yukihiro Tashiro, Pham Van Trong Tinh, and Kenji Sakai. 2022. Reduction in Greenhouse Gas Emission from Seedless Lime Cultivation Using Organic Fertilizer in a Province in Vietnam Mekong Delta Region. Sustainability 14: 6102. [Google Scholar] [CrossRef]

- Mentel, Grzegorz, Waldemar Tarczyński, Hossein Azadi, Kalandar Abdurakmanov, Elina Zakirova, and Raufhon Salahodjaev. 2022. R&D Human Capital, Renewable Energy and CO2 Emissions: Evidence from 26 Countries. Energies 15: 9205. [Google Scholar] [CrossRef]

- Minh, Nguyen Khac, and Truong Tri Vinh. 2007. A Non-parametric Analysis of Efficiency for Industrial Firms in Vietnam. Edited by Nguyen Khac Minh and Giang Thanh Long. Hanoi: National Economics University Publisher, pp. 1–30. [Google Scholar]

- Nickell, Stephen, and Daphne Nicolitsas. 1999. How does financial pressure affect firms? European Economic Review 43: 1435–56. [Google Scholar] [CrossRef]

- Nikaido, Yuko. 2004. Technical efficiency of small-scale industry: Application of stochastic production frontier model. Economic and Political Weekly 39: 592–97. [Google Scholar]

- Pattitoni, Pierpaolo, Barbara Petracci, and Massimo Spisni. 2014. Determinants of profitability in the EU-15 area. Applied Financial Economics 24: 763–75. [Google Scholar] [CrossRef]

- Pham, Hung T., Thanh L. Dao, and Barry Reilly. 2010. Technical efficiency in the Vietnamese manufacturing sector. Journal of International Development: The Journal of the Development Studies Association 22: 503–20. [Google Scholar] [CrossRef]

- Phan, Trang Hoai. 2022. Working Conditions, Export Decisions, and Firm Constraints-Evidence from Vietnamese Small and Medium Enterprises. Sustainability 14: 7541. [Google Scholar] [CrossRef]

- Pitt, Mark M., and Lung-Fei Lee. 1981. The measurement and sources of technical inefficiency in the Indonesian weaving industry. Journal of Development Economics 9: 43–64. [Google Scholar] [CrossRef]

- Rios, Ana R., and Gerald E. Shively. 2005. Farm size and nonparametric efficiency measurements for coffee farms in Vietnam. In 2005 Annual Meeting, Providence, RI, USA, 24–27 July 2005. New Orleans: American Agricultural Economics Association. Available online: http://ideas.repec.org/p/ags/aaea05/19159.html (accessed on 19 May 2021).

- Serrasqueiro, Zélia Silva, and Paulo Maçãs Nunes. 2008. Performance and size: Empirical evidence from Portuguese SMEs. Small Business Economics 31: 195–217. [Google Scholar] [CrossRef]

- Timmer, C. 1971. Using a probabilistic frontier production function to measure technical efficiency. Journal of Political Economy 19: 776–94. [Google Scholar] [CrossRef]

- Tjalling, Koopmans. 1951. Analysis of production as an efficient combination of activities. In Activity Analysis of Production and Allocation. New York: J. Viley and Sons, pp. 33–37. [Google Scholar]

- Tsai, Jung-Fa, Phi-Hung Nguyen, Ming-Hua Lin, Duy-Van Nguyen, Hsu-Hao Lin, and Anh-Tuan Ngo. 2021. Impacts of Environmental Certificate and Pollution Abatement Equipment on SMEs’ Performance: An Empirical Case in Vietnam. Sustainability 13: 9705. [Google Scholar] [CrossRef]

- Wang, Qizhen, and Suxia Liu. 2022. How Do FDI and Technological Innovation Affect Carbon Emission Efficiency in China? Energies 15: 9209. [Google Scholar] [CrossRef]

| Variable | Name Definition Unit | Measurement Method |

|---|---|---|

| Step 1: | Input Variable | |

| Labor | Value of labor contribution to the production process. Thousand VND | Total salary paid to employees in the fiscal year. |

| Capital | Value of physical assets contributed to production process. Thousand VND | Average value of land, factory and machinery at the beginning and end of the fiscal year. |

| Materials | Value of raw materials contributed to the production process. Thousand VND | Total value of materials used in the fiscal year. |

| Output Variable | ||

| Output | Value of product. Thousand VND | Value of products produced in fiscal year. |

| Step 2: | Dependent variable | |

| SDTE_VRS Sub-assumption Technical | Operation Efficiency Index | Changes with change in size variable by size, result of step 1. |

| Independent variable | ||

| Size | Size of business | Average number of employees at the beginning of the year and at the end of the year, rounded up to the closest even number if odd. |

| Age | Time in operation | Calculated by taking the year of establishment from 2021. |

| Renewable Consumption | Green Energy | Calculated as the percentage of the total energy consumption of FDI SMEs which involves green energy such as wind, water, and solar |

| Debt/Equity (DE) | Capital structure | Loan capital to equity ratio (data at the end of the fiscal year). |

| Variance | Observations | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| Wage | 1500 | 3,350,982 | 7,105,330 | 250,000 | 90,000,000 |

| Capital | 1500 | 37,921,870 | 127,000,000 | 36,500 | 3,100,000,000 |

| Output | 1500 | 31,496,900 | 67,913,620 | 200,000 | 640,000,000 |

| Size | 1500 | 112.1 | 196.90 | 3 | 2390 |

| Age | 1500 | 26.8 | 22.5 | 2 | 80 |

| Green Energy | 1500 | 51.2 | 26.6 | 19.6 | 90.8 |

| D/E | 1500 | 0.11 | 0.24 | 0.00 | 2.70 |

| Food and Beverage | Wood | Steel | |||||||

|---|---|---|---|---|---|---|---|---|---|

| OTE_CRS | OTE_VRS | SE | OTE_CRS | OTE-VRS | SE | OTE_CRS | OTE_VRS | SE | |

| Mean | 0.668 | 0.825 | 0.900 | 0.865 | 0.890 | 0.696 | 0.691 | 0.839 | 0.908 |

| Standard Deviation | 0.548 | 0.217 | 0.141 | 0.107 | 0.122 | 0.061 | 0.192 | 0.201 | 0.111 |

| Minimum | 0.320 | 0.332 | 0.380 | 0.536 | 0.347 | 0.723 | 0.336 | 0.365 | 0.392 |

| Maximum | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Observations | 423 | 588 | 489 | ||||||

| Size | Age | Green Energy | D/A | |

|---|---|---|---|---|

| Size | 1 | |||

| Age | 0.19 | 1 | ||

| Green Energy | 0.18 | 0.12 | 1 | |

| D/E | 0.13 | 0.16 | 0.11 | 1 |

| Food and Beverage | Wood | Steel | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable OTE_VRS | |||||||||

| Coefficient | SE | Sig. Level | Coefficient | SE | Sig. Level | Coefficient | SE | Sig. Level | |

| Size | 0.00163 | 0.0008 | *** | 0.00181 | 0.008 | *** | 0.00228 | 0.0005 | *** |

| Age | 0.00181 | 0.0008 | *** | 0.00176 | 0.001 | *** | 0.00179 | 0.0009 | *** |

| Green Energy | 0.18966 | 0.00621 | *** | 0.02861 | 0.002 | *** | 0.13636 | 0.0026 | *** |

| D/E | 0.25159 | 0.0510 | *** | 0.03920 | 0.0006 | *** | 0.16856 | 0.0386 | *** |

| Constant | 0.52194 | 0.0204 | 0.8145 | 0.023 | 0.6268 | 0.019 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thu, N.T.P.; Xuan, V.N. Factors Affecting the Performance of Small and Medium Enterprises Regarding the Sustainable Development Goals—The Case of Foreign Direct Investment Firms in Vietnam. Economies 2023, 11, 72. https://doi.org/10.3390/economies11030072

Thu NTP, Xuan VN. Factors Affecting the Performance of Small and Medium Enterprises Regarding the Sustainable Development Goals—The Case of Foreign Direct Investment Firms in Vietnam. Economies. 2023; 11(3):72. https://doi.org/10.3390/economies11030072

Chicago/Turabian StyleThu, Nguyen Thi Phuong, and Vu Ngoc Xuan. 2023. "Factors Affecting the Performance of Small and Medium Enterprises Regarding the Sustainable Development Goals—The Case of Foreign Direct Investment Firms in Vietnam" Economies 11, no. 3: 72. https://doi.org/10.3390/economies11030072

APA StyleThu, N. T. P., & Xuan, V. N. (2023). Factors Affecting the Performance of Small and Medium Enterprises Regarding the Sustainable Development Goals—The Case of Foreign Direct Investment Firms in Vietnam. Economies, 11(3), 72. https://doi.org/10.3390/economies11030072