1. Introduction

Municipalities possess the authority to autonomously address public matters taking into account the preferences of inhabitants (

Miceikienė et al. 2021;

Trinajstic et al. 2022). To perform their duties, municipalities enter into IMC due to different reasons. For example, academics (

Wolfschütz and Bischoff 2021) investigated the municipalities of West Germany and found that municipalities with diminishing populations are more expected to join IMC. Also, the subsidies provided by the state have a favorable effect on the emergence of IMC. A study conducted in Poland showed that smaller municipalities are more likely to start IMC due to economies-of-scale challenges (

Chodakowska 2021). A study conducted in the Czech Republic showed that smaller municipalities have a tendency to join IMC, whereas larger municipalities have lower benefits of joining IMC (

Struk and Bakoš 2021). As the citizens’ expectations toward quality public services are increasing (

Bintara et al. 2023;

Olzhebayeva et al. 2023;

Su et al. 2023;

Romero-Subia et al. 2022;

Mao et al. 2021;

Glyptis et al. 2020), municipalities also join together to provide better services, such as transportation, health care and waste management, and to access the financing possibilities that would not be possible for a standalone municipality.

Green bonds are one of the financial market instruments applied widely in different countries for the financing of environmentally sustainable projects (

Bužinskė and Stankevičienė 2023;

Štreimikienė and Pušinaitė 2006). There are many municipalities of different countries benefitting from the issuance of green bonds, while other municipalities, especially the smaller ones, have not yet started the path of green bond issuance. The potential barriers to the issuance of green bonds by municipalities are increased issuance costs, a minimum emission volume, inefficient human resource capacities and a challenging and unclear issuance process.

Little is known about IMC for the issuance of green bonds by municipalities. The scientific literature does not provide a reference to the joint efforts of several municipalities to issue green bonds. Also, the scientific literature does not provide a valuation approach to municipal performance which could help in the assessment of the IMC possibility. Lastly, there is no clear pathway for issuing green bonds by municipalities that have not performed the issuance by themselves before, nor such a pathway for municipalities joining IMC for the issuance of green bonds. We fill these research gaps by the proposition of the valuation approach for the assessment of the IMC possibility and establishing the decision-making algorithm for issuing green bonds in IMC in the illustrative case of Lithuania.

Therefore, this paper surveys the theoretical background behind IMC and seeks to answer the following research questions: (1) how to evaluate the possibility of entering into IMC and (2) how a municipality should issue green bonds in IMC in Lithuania. To establish the answers to the research questions, we propose a conceptual model to evaluate the possibility of entering into IMC and a decision-making algorithm for issuing green bonds by municipalities in IMC in the illustrative case of Lithuania. The conceptual model also focuses on the concept of the zero-waste city and waste reduction due to the recently reported figures by the European Commission that Lithuania is underperforming in meeting the goals of recycling and preparing for the reuse and recycling of packaging (

Europos Komisija 2023). In this way, the relevance of the proposed model corresponds to the current challenge in the country, and it aims to tackle it.

The main goal of the research is to create a valuation approach for measuring IMC possibility and construct an algorithm for issuing green bonds in Lithuania by municipalities. Three hypotheses were raised in support of the research questions. The first hypothesis is focused on the notion that the municipalities would enter into IMC based on the stronger municipal performance of collaborating municipalities. This hypothesis is supported by the fact that IMC faces economic, legal and management challenges (

Ofiarska 2022). The second hypothesis is focused on the notion that the municipalities would enter into IMC taking into account the risks associated with IMC. The identification of risks and their measurement is an important exercise as IMC helps to share the risks (

Bel et al. 2022). The third hypothesis is based on the notion that the municipalities in IMC would be willing to issue green bonds for the financing of zero-waste projects. This hypothesis is supported by the fact that cities and municipalities are financing their environmentally sustainable projects via green bond issuances (

Garcia-Lamarca and Ullstrom 2022) as one of the sources of financing, standing in line with loans acquired from commercial banks (

Gorelick and Walmsley 2020). Therefore, joining forces to issue green bonds might be a preference for municipalities.

We contribute to the existing literature in several ways. Firstly, the various aspects of IMC discussed in the literature are summarized in the literature section to give a detailed overview of the analyzed research field. A considerable amount of input for the research is obtained through the survey of selected municipalities, as a result providing insights into the municipality-specific data. The constructed decision-making algorithm for issuing green bonds by municipalities in IMC can serve as a blueprint for municipalities willing to obtain new financing ways and for smaller municipalities facing challenges of resources and eventually benefitting from IMC.

The article consists of five sections.

Section 1 investigates the concept of IMC and its development in different countries.

Section 2 explains the research methods and establishes the concept of a decision-making algorithm for issuing green bonds by municipalities in IMC in Lithuania.

Section 3, data collection, covers the research findings.

Section 4 raises discussion points.

Section 5 reviews the research limitations, followed by conclusions and guidelines for further research.

2. Literature Review

The effects of inter-municipal cooperation (IMC) are broadly investigated in the academic literature. Academics (

Banaszewska et al. 2022) investigated Polish municipalities in terms of improvement in business development opportunities and the economy. The authors found that IMC reduces local unemployment rates by 0.4%. Such results can be explained by the improvement in the coordination of municipal policies. Researchers (

Zafra-Gómez et al. 2020) analyzed Spanish small municipalities to understand the effectiveness of drinking water service provision in the case of direct public provision and IMC. This study revealed that direct public provision corresponds to cost efficiency, whereas IMC corresponds to the effective use of installed capacity. Researchers (

Ferraresi et al. 2018) analyzed Italian municipalities in terms of improvement in effectiveness and found that participation in IMC reduces per capita expenses by 5%, and such effect increases up to six years after entering into IMC (

Ferraresi et al. 2018). IMC helps to reach economies of scale (

Allers and de Greef 2018;

Bel and Sebő 2021;

Gendźwiłł et al. 2019). Researchers (

Sarra et al. 2020) analyzed IMC in waste management in Italian municipalities and found that the optimal population of 55,000 inhabitants corresponds to the trigger to join IMC, whereas the increasing number in population reduces the efficiency. Economic incentives promote cooperation between local governments (

Kovacs 2019).

Research on Japanese municipalities showed that IMC contributes to the effectiveness of public service delivery (

Baba and Asami 2019). Academics (

Casula 2020) concluded that IMC helps to reduce transaction costs and manage risks more effectively in municipalities that are part of IMC. IMC helps to gain the benefits of economies of scale (

Jacobsen and Kiland 2017). Researchers (

Silva et al. 2018) observed that cost reduction, the reach of economies of scale, the incentive of local government and EU funding and the sharing of common goals and solutions motivate municipalities to join IMC.

A study of the small Italian IMC on the improved efficiency and effectiveness of public services (

Giacomini et al. 2018) showed that the success of IMC greatly depends on the selected IMC type and promotion of the service delivery organization model. The selected form of IMC also provides challenges, for example, in the case of the local government structures (

Bel et al. 2022). A study of IMC in fire services provision showed that the selection of the organizational form for IMC might have an impact on citizen satisfaction (

Holum and Jakobsen 2016). A study conducted in the Czech Republic revealed that public officials who had worked in the public sector for a long time provided less support for IMC (

Bakoš et al. 2021).

There exist 60 municipalities in Lithuania which can be considered quite large in terms of the population in comparison with other European countries. A total of 7% of urban municipalities have more than 280,000 inhabitants, 75% of municipalities have less than 29,000 inhabitants, and the smallest municipality has a population of only 3500 inhabitants (

Bučaitė-Vilkė et al. 2018).

In Lithuania, IMC is described in the Law on the Local Self-Government of the Republic of Lithuania, where municipalities can enter into joint activities or contracts with other municipalities or can delegate the implementation of specific services to another municipality (

Mikalauskas 2019). The IMC in Lithuania takes the form of a voluntary basis implying that there is no official register of IMC established that would gather statistics on the cooperation form, duration, participants, etc. (

Mikalauskas 2019). The usual form of cooperation is for project activities in the areas of tourism, environmental protection, social services and education, whereas the creation of a joint company takes place in exceptional cases, such as in the waste management sector—10 regional waste management centers (

Mikalauskas 2019).

Academics (

Bučaitė-Vilkė et al. 2018) observe that Lithuania can be characterized as a country having limited IMC practice. The barriers to the development of the IMC in Lithuania are the insignificant financial self-governance and limited power to act without constraints in delivering the services. It is observed that there exists a lack of necessary conditions and environment for the development of IMC; however, it is assumed that the situation should change via the entering into force of the new Regional Strategy of the years 2017–2030 (

Mikalauskas 2019). There is a gap in scientific evidence in terms of analysis of the maturity of IMC, the management style, the distribution of responsibility and costs or profits.

Researchers (

Golinska-Dawson et al. 2020) observe that the availability of literature and research on IMC in terms of waste management is limited. Researchers (

Sarra et al. 2020) analyzed IMC in waste management in Italian municipalities and found that the optimal population of 55,000 inhabitants corresponds to the trigger to join IMC, whereas an increasing number in population reduces the efficiency. The main benefits of IMC for waste management are simplified access to EU funds, a reduction in waste management costs and lower infrastructure maintenance costs (

Golinska-Dawson et al. 2020).

Academics (

Hiratsuka-Sasaki and Kojima 2020) developed a comprehensive explanation of IMC partnerships for solid waste management. Firstly, inter-municipal organizations can be established with the neighboring municipalities to achieve cooperation for waste treatment. Thus, several municipalities can share the roles of municipal waste treatment among IMC members. Thirdly, larger municipalities can accept the waste from smaller municipalities to perform treatment activities. Municipalities can also cooperate in situations when the waste treatment plant is closed. Also, the establishment of municipal waste plants with enhanced infrastructure such as sewage treatment also encourages municipalities to work together. Lastly, municipalities can also pair together with private sector organizations for effective municipal waste management or consider outsourcing.

3. Methodology

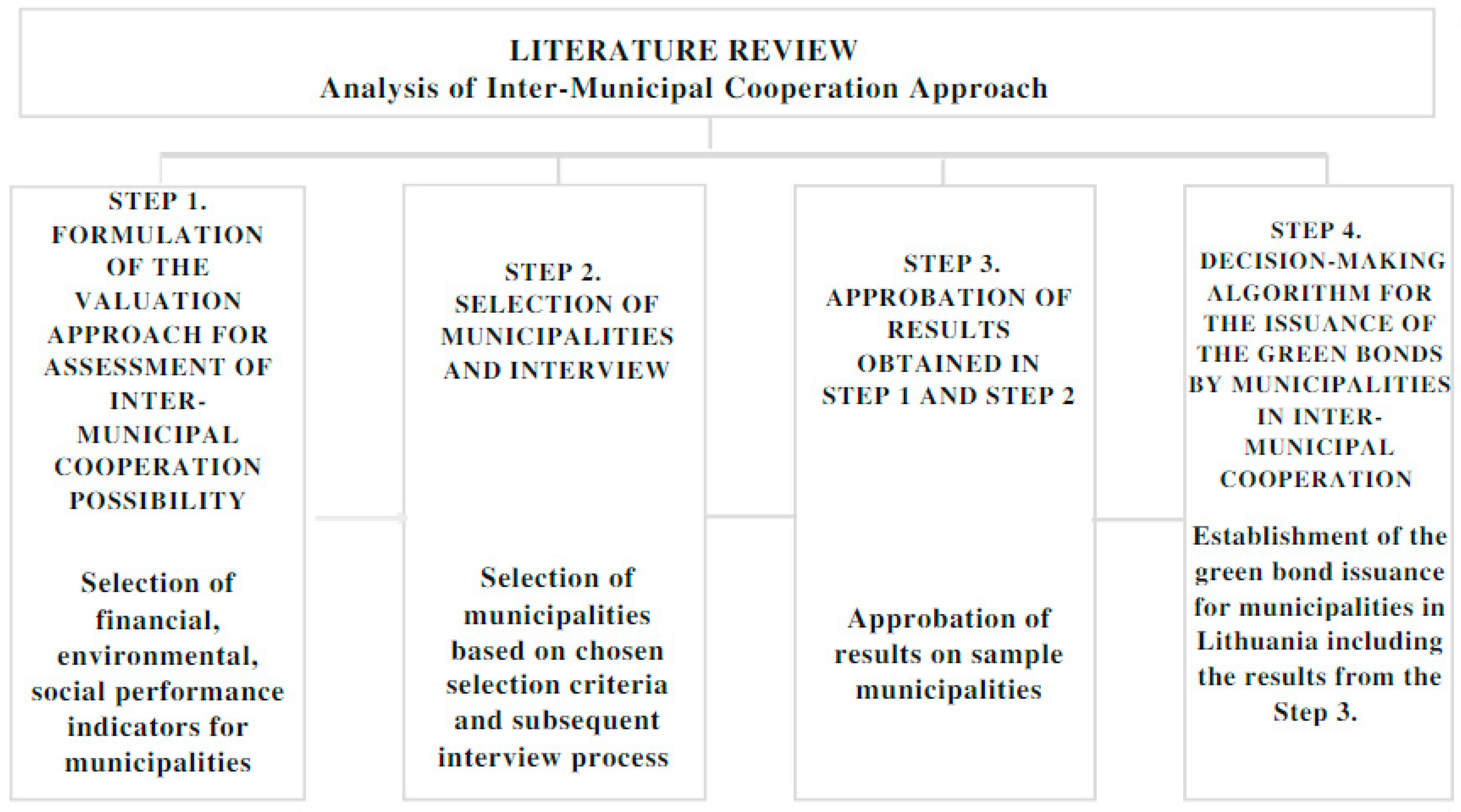

This study proposes a methodology for the establishment of a decision-making algorithm for the issuance of green bonds by municipalities that have entered into IMC for the development of zero-waste cities, which is based on the four-step process depicted in

Figure 1.

The pre-work phase of the research is an analysis of the scientific literature on the IMC approach, triggers for IMC, drivers and barriers. The first step of the research is the construction of the valuation approach for the inter-municipal cooperation possibility. Here, the indicators of financial, environmental and social performance are selected, and, consequently, the related data are collected from the respective sources. The second step of the research covers the selection of municipalities for the study and subsequent interview and data collection from the interviewers based on the selected scope of zero-waste projects. The third step includes the application of the valuation approach for the inter-municipal cooperation possibility in the municipalities selected in the second step. The last step of the research covers the construction of the green bond issuance framework for municipalities for the development of zero-waste cities.

The following

Section 3.1 and

Section 3.2. describe in more detail the methods needed to deliver step 1 and step 2 of the proposed research methodology, while the results of the four-step model are presented in the results section.

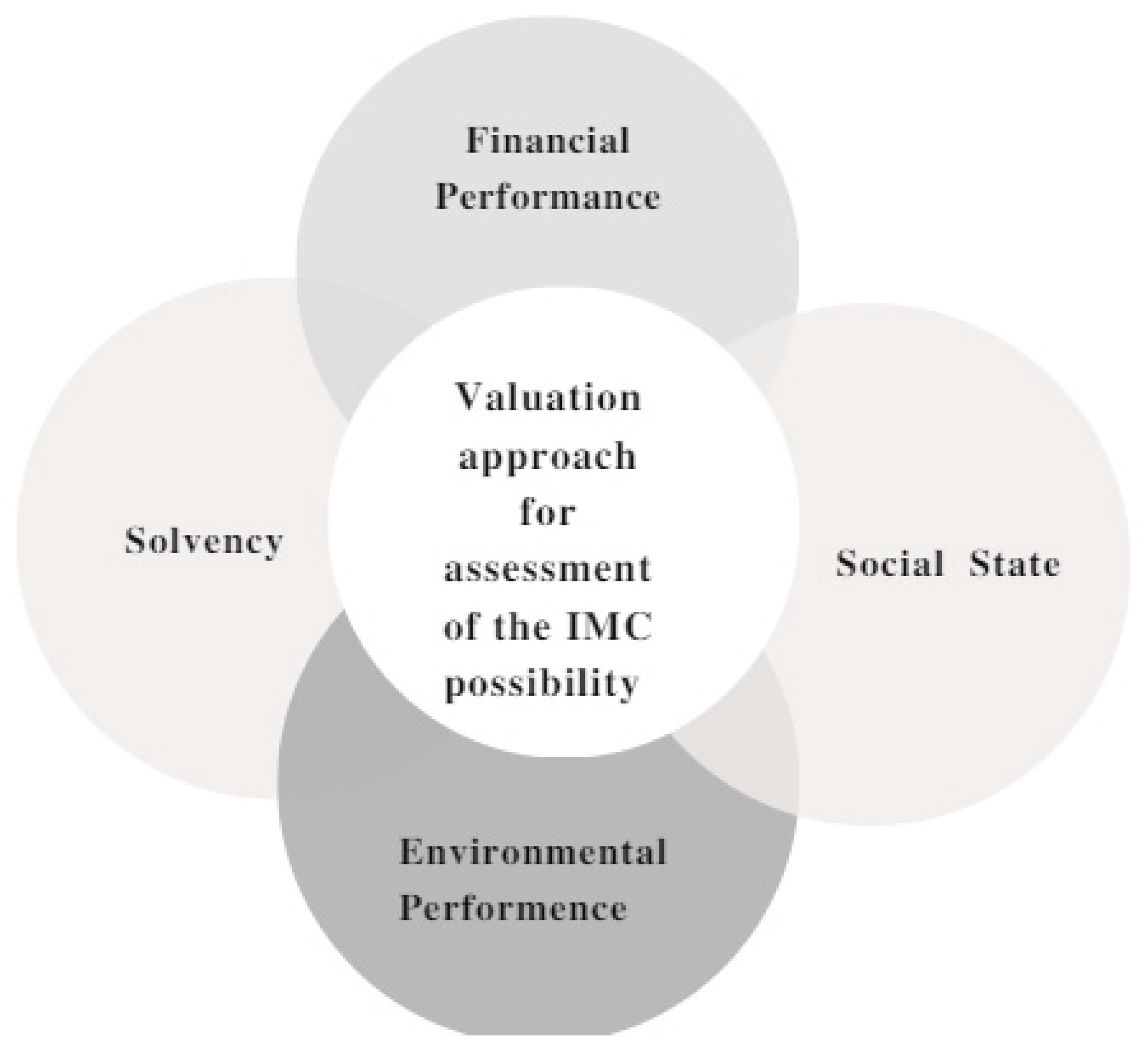

3.1. Valuation Approach for the Assessment of the Inter-Municipal Cooperation Possibility

The valuation approach for the assessment of the IMC possibility is based on the four domains of municipal performance that have an effect on the decision to enter or not into IMC (

Figure 2). The financial performance domain covers the financial position of the municipality and its ability to carry additional costs. The solvency domain provides insights into the ability of the municipality to repay its debts. The social state of the municipality provides insights into potential challenges faced by the municipality such as the number of inhabitants who need to get the waste management service or the income of inhabitants which is related to their ability to pay for the obtained service. The environmental performance domain covers the waste management practices in the municipality.

The four domains of the valuation approach for the assessment of the IMC possibility are based on the following literature and data sources: (1) financial performance—Brown’s 10-Point Test (

Brown 1993), (2) solvency—Wang, Dennis and Tu’s Solvency Test (

Wang et al. 2007), environmental performance—methodology for Key Performance Indicators for Smart Sustainable Cities (

Smiciklas et al. 2017) and social state—official statistics of Lithuania (

State Data Agency 2023).

The detailed indicators falling under each of the domains are represented in

Table 1. The following ratios were disregarded from Wang, Dennis and Tu’s Solvency Test because they coincide with Brown’s 10-Point Test: Operating Ratio, Long-Term Liability per Capita and Revenue per Capita. The ratio of Tax per Capita was also removed from the Wang, Dennis and Tu’s Solvency Test group because municipalities are not subject to tax.

The valuation approach for the assessment of the IMC possibility is based on the creation of the index for the evaluation of the risk-adjusted financial condition of municipalities willing to enter into the IMC. The Financial Condition Index for municipalities is proposed by

Ritonga (

2015):

where

w—weight of dimension index, and

DI—dimension index. According to the author, the values of the indicator vary from 0 to 1, indicating 1 as the highest financial condition.

According to

Ritonga (

2015), the calculation of the Financial Condition Index is based on the computation of the Indicator Index, which can be summarized as the min–max method for normalization (

OECD 2008):

where

—individual indicator,

—minimum value of an indicator, and

—maximum value of an indicator, where the values of the

vary from 0 to 1.

The selected method for the calculation of weights for the Financial Condition Index is the Equal Weighting Technique (

Ezell et al. 2021). The method was selected based on the answers of municipal respondents. The Equal Weighting Technique is summarized by the following formula:

where

N—a set of all attributes.

Another component of the Financial Condition Index is the computation of the Dimension Index (

Ritonga 2015):

where

n is the number of indicators forming the Dimension Index. In this study, the Dimension Index is calculated for each of the four domains of municipal performance.

The proposal for the method suggested by

Ritonga (

2015) is to add the risk factor of entering into IMC and other dimensions of municipal performance such as municipal and social. The following formula is proposed for the estimation of the Risk-Adjusted Municipal Condition Index (source: compiled by authors):

where

R—risk of individual indicator. The risk of an individual indicator is obtained via a survey of municipalities. The values of the Risk-Adjusted Municipal Condition Index vary from 0 to 1, indicating 1 as having the highest success in interring IMC.

3.2. Selection of Municipalities and Preparation for the Interview with Representatives of Municipalities

Among the 60 municipalities of Lithuania, 2 municipalities, Vilnius municipality, surrounding the capital of Vilnius, and Tauragė, were selected for participation in the survey and approbation of results. Both municipalities participate in the EU initiative “EU Missions 100 climate-neutral and smart cities by 2030”, where capital and smaller, medium-sized cities from each member state of the EU participate (

European Commission 2023). The aim of this initiative is to promote adaptation to climate change, restoration of water and oceans, healthy soils, and dealing with diseases like cancer. Participation in this initiative shows the commitment of municipalities toward environmentally sustainable decisions, actions and activities and is, therefore, relevant in terms of this study.

Municipalities were asked the following questions:

What are the usual sources of financing environmentally-sustainable projects?

Have you considered to issue debt securities (e.g., green bonds, sustainable bonds, sustainability-linked bonds) for financing of the waste management projects by yourself?

Have you considered to join into the IMC to issue collectively debt securities for the waste management projects?

Evaluate the importance of the indicators within each domain (financial position, solvency, environmental, social).

Evaluate the risks of entering into IMC, taking into account financial position, solvency, environmental, social domains. Domains were asked to be rated from 1, as least risky, to 10, as the riskiest factor when taking the decision for IMC cooperation for zero-waste projects. The below indicators were provided to municipalities for the evaluation, the corresponding data sources of these indicators are also provided in the respective tables.

4. Results

The results section provides insights into the data collection process and obtained results via the application of the four-step research process proposed in

Section 3. Therefore, this section is respectively divided into four corresponding subsections.

4.1. Valuation Approach of the Inter-Municipal Cooperation Possibility

The valuation approach of the IMC possibility starts with the analysis of Brown’s 10-Point Test (

Brown 1993). As Brown’s 10-Point Test is suitable for the format of the balance sheet and income statement of the US municipalities, the additional mapping of formulas to the Lithuanian balance sheet and income statement of municipalities is needed. The formulas proposed by Brown (please refer to

Table 1) have been investigated by researchers (

Natrini and Ritonga 2017), which helped to develop the necessary mapping for Lithuanian municipalities. The findings of the mapping are summarized in

Table 2 with three ratios depicted as “Not identified”.

The next activity of the valuation approach of the IMC possibility is data collection. The following data sources were identified in terms of this study: (1) financial position and solvency—financial reports of selected municipalities; environmental domain—Waste Accounting (

The Environmental Protection Agency 2023); and social domain—Official Statistics Portal (

State Data Agency 2023). The collected data correspond to the years 2019–2021 because waste accounting data were not present for the year 2022 at the time of the development of the study.

The subsequent activity of the valuation approach of the IMC possibility is the computation of selected indicators for the financial and solvency domains and the analysis of collected data for the environmental and social domains. The results of the valuation approach of the IMC possibility on Vilnius municipality together with the evaluation of each individual indicator are summarized in

Table 3.

The results of the valuation approach of the IMC possibility on Tauragė municipality together with the evaluation of each individual indicator are summarized in

Table 4.

To further empirically test the proposed valuation approach of the IMC possibility, the same set of indicators of four domains was calculated for other 8 municipalities, making a set of 10 evaluated municipalities, namely Kaunas, Klaipėda, Panevėžys, Šiauliai, Alytus, Marijampolė, Utena and Telšiai. This step is needed for the calculation of the Financial Condition Index and Risk-Adjusted Municipal Condition Index.

4.2. Research Results Obtained via Questionnaire of Municipalities

The interview with representatives of the selected municipalities was carried out in February of 2023. For the discretion of the respondents, the results of the survey are represented as answers of Municipality 1 and Municipality 2.

The research results are summarized in

Table 5 and

Table 6. Usually, municipalities finance their projects through the application of EU funds, with the help of private investors, private–public partnerships or soft loans. Neither of the municipalities has considered issuing green bonds for the financing of the green projects they have been developing. Both municipalities were doubtful if green finance mechanisms are generally acceptable by the Law on Local Self-Government of the Republic of Lithuania or the strategic plans they need to follow. The municipalities have not considered entering into IMC to issue green debt securities for the financing of green projects; however, one of the suggestions was that, most probably, it would be easier to do via the Local Government Funding Agency approach.

The municipalities evaluated the importance of the indicators within each of the four domains. The respondents found that each indicator is equally important in its own group. As a result, the equal weights are applied in subsequent calculations for indicators of each of the four valuation domains.

The risk ratings of the indicators by municipalities are summarized in

Table 6. To obtain the final risk rating, the geometric average was calculated to obtain the final risk score for each indicator or group of indicators. The risk rating was applied as a percentage in subsequent calculations.

4.3. Research Results Obtained via Computation of the Risk-Adjusted Municipal Condition Indicator

The results of the estimation of the components of the Risk-Adjusted Municipal Condition Index of Vilnius municipality are summarized in

Table 7. The dimension indexes are calculated for four dimensions, and the weights and risk scores are obtained from the survey of municipalities. The results imply that the financial position and solvency of Vilnius municipality remain stable across the years of observation, whereas waste management and social dimensions have improved performance.

The results of the estimation of the Risk-Adjusted Municipal Condition Index of Vilnius municipality are summarized in

Table 8. Here, the results imply that the municipal condition of the municipality is improving after the slight drop in 2020, which could probably be attributed to the global pandemic. However, the results are not reaching 1, meaning that there is room for improvement in the four domains in terms of entering into IMC.

The results of the estimation of the components of the Risk-Adjusted Municipal Condition Index of Tauragė municipality are summarized in

Table 9. The results imply that the financial position and solvency of Tauragė municipality remain stable across the years of observation, with a solvency drop in 2020, which can be potentially attributed to the pandemic situation. The waste management domain shows slight improvement, whereas a slight decrease can be observed in the social domain.

The results of the estimation of the Risk-Adjusted Municipal Condition Index of Tauragė municipality are summarized in

Table 10. The results show that the municipal conditions have the same tendency as in Vilnius municipality, mainly, improvement after the slight drop in 2020, which could probably be attributed to the global pandemic. However, again the results are not reaching 1 and are closer to 0, implying that it would be more challenging for this municipality to enter into IMC.

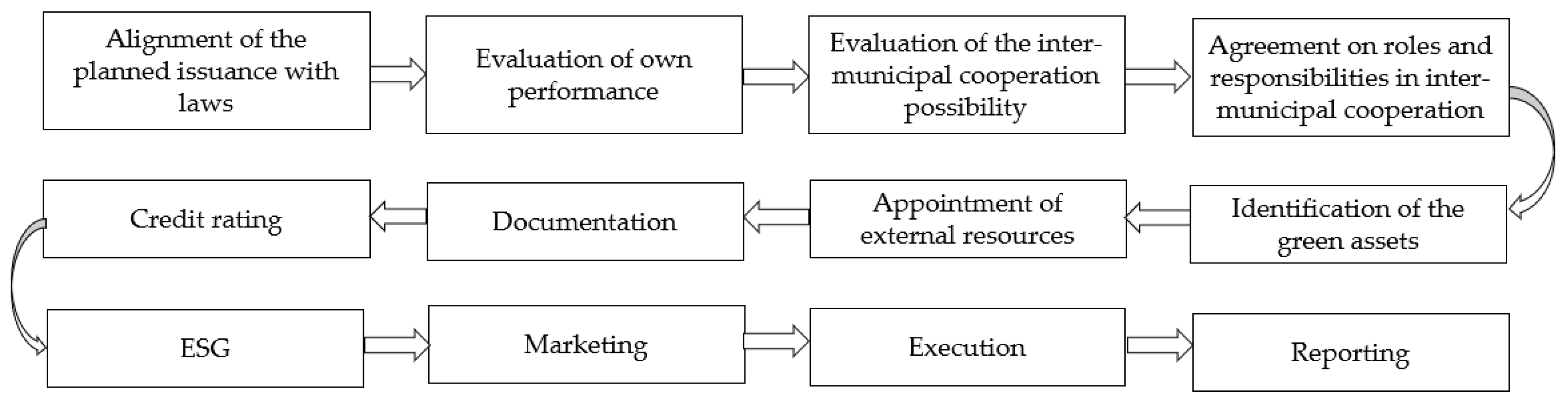

4.4. Research Results of Construction of the Decision-Making Algorithm for Issuing Green Bonds for Municipalities

The final step of the proposed research is to develop a decision-making algorithm for the issuance of green bonds by municipalities in inter-municipal cooperation in Lithuania. The visual representation of the algorithm is provided in

Figure 3, with the corresponding steps.

The decision-making algorithm for the issuance of green bonds is based on a 12-step process. A detailed description of each step with decision points is provided as follows:

Municipalities need to take into account the laws and local regulations in terms of the planned green bond issuance. Points to consider: the mandate to issue bonds by municipalities provided by laws or, in other cases, the process for the negotiation of the issuance with respective government bodies.

The next steps are the evaluation of own performance and the possibility of entering into IMC with another municipality which can be done with the help of the valuation approach for the assessment of the IMC possibility proposed in this paper.

When the assessment is favorable and municipalities decide to enter into IMC, then an agreement on the roles and responsibilities between the municipalities is necessary. Another point to consider is the agreement on the green bond tracking approach. The last point here is to agree on the responsible persons in IMC for the approval of the green bond prospectus.

The green assets or zero-waste projects that will be financed by the proceeds of the issuance of green bonds need to be identified. It is important to mention that the evaluation of the greenness of the municipality is not a suitable measure in this step.

The external stakeholders such as the issuer bank, external auditor, second opinion provider and rating agency need to be appointed.

The necessary documentation related to the green bond issuance needs to be prepared. The documents here include a green bond prospectus, due diligence, audited financial statements along with their publication, a capacity opinion letter and transaction documentation. It is important to mention the necessary approvals of the green bond prospectus by the Lithuanian FSA and municipalities themselves.

Obtaining a credit rating is an important step in the issuance of green bonds process. Firstly, the credit rating agency needs to be selected, and necessary information has to be provided by the municipality for the assessment of the final credit rating.

The ESG part of the green bond issuance includes the preparation of the green bond framework and the issuance of the second party opinion by the selected second party opinion provider in step 5.

The marketing part is another important milestone in the successful issuance of green bonds. Firstly, the private placement for selected investors should take place in order to acquire feedback on the green bond issuance. Thus, the investor presentations are prepared, and meetings with investors take place.

The execution part includes book building, pricing, etc., along with the Final Terms of the green bond issuance preparation with timing for the allocation of bond proceeds and application for listing.

The last step of the green bond issuance process is reporting. The procedures need to be established for tracking and reporting on the use of proceeds.

5. Discussion

This study provides insights into the valuation approach of the IMC possibility and decision-making algorithm for the issuance of green bonds by municipalities in IMC in Lithuania. A study on IMC and its advantages for municipalities in Lithuania was conducted by researcher Mikalauskas, A. in 2019. The study revealed that the advantages of IMC are its help in acquiring new competences and learning from peers, efficient resolution of difficult situations, better provision of services and the ability to provide new services, increased opportunity to access different financing mechanisms, increased visibility of municipalities forming IMC and cost savings due to economies of scale. Exactly the same benefits can be obtained by the issuance of green bonds by municipalities in IMC. Municipalities can acquire new skills through the issuance process, address waste management challenges better, access funds that have not been used before, improve reliability and trust as a government body and use resources more effectively.

The decision to engage in IMC is typically influenced by diverse factors that align with the aforementioned benefits of IMC. The scientific literature does not provide relevant advice on the valuation methods for entering into IMC or not. Therefore, the proposed valuation approach for the assessment of the IMC possibility closes the gap in the scientific literature.

While the issuance of green bonds by municipalities is a familiar approach in some countries, it is a novel concept in Lithuania. The decision-making algorithm for the issuance of green bonds by municipalities in inter-municipal cooperation in Lithuania provides a detailed framework for the successful issuance of green bonds on the municipal level in the country. Firstly, the framework addresses the need raised by municipalities to align the issuance with local laws and regulations. Thus, the decision-making algorithm addresses the observations of academics (

Lackowska et al. 2019) that the common challenge for IMC is the slower decision-making process and duplication of personnel and expenses. Therefore, it is advisable in the framework to align the roles of the treasury, sustainability, IT, reporting, investor relations and law (

International Finance Corporation 2020). Another point in the decision-making algorithm is the agreement on the green bond tracking approach. One of the examples here is the management of proceeds through the designated account, as it is set up in Poland and France (

The World Bank 2018). Lastly, the decision-making algorithm takes into account the success factors and challenges of issuing green bonds in Lithuania (

Bužinskė and Stankevičienė 2023). To begin with success factors, steps 2 and 3 correspond to the reputation of the issuer which is a municipality, step 8 corresponds to the good credit rating of the issuer, and step 5 corresponds to the applicable project requirements in terms of project eligibility and process for project evaluation and selection. On the green bond issuance challenges side, steps 5, 7, 9 and 12 support the reduction in the possibility of greenwashing and address the need to follow the market standard when issuing green bonds.

6. Limitations and Future Research Recommendations

The proposed survey and research methodology have several limitations. Firstly, data availability is one of the key limitations in the proposed valuation approach for the assessment of the IMC possibility. For example, limited data are available for waste management which makes evaluation of the environmental domain insubstantial. Also, information about the social state of municipalities is also very limited and concentrated around statistics, without sufficient information about the well-being of the citizens in the municipality. Thus, the valuation approach for the assessment of the IMC possibility is based on the empirical test of four dimensions of the 10 municipalities out of 60. This means that the results of the study may vary after the computation of the indicators of the remaining 50 municipalities, and the proposed results should be interpreted as an illustration of the proposed model. Thirdly, the selection of dimensions and indicators falling under the dimensions can be expanded in the valuation approach for the assessment of the IMC possibility. The selected indicators for the waste and social dimensions were chosen from the standpoint of data availability; therefore, expansion of the model with project-specific indicators would be beneficial. Lastly, the number of municipalities participating in the survey was limited to two, due to the focus on environmentally sustainable activities. However, more municipalities could be potentially included in the valuation of weights and risks of entering into IMC assuming that additional municipalities have the expertise needed to evaluate the four dimensions.

The valuation approach for the assessment of the IMC possibility is a flexible tool that can be expanded according to the needs of the project or function municipalities that are willing to cooperate together. As a result, future research could be focused on the development of standardized sets of indicators for different variations of projects, making the selection processes of indicators easier for municipalities. Alternatively, future research can be focused on the analysis of the demand side of green bond issuance to provide insights into the decision-making algorithm for the issuance of green bonds by municipalities in inter-municipal cooperation in Lithuania.

Future research can be also focused on the comparative analysis and modeling of the various financing options of municipal projects, such as bank credits, and the applicability of these financing models in IMC. Also, the effects of prices and costs of issuing green bonds in IMC can be investigated to support the computation of the Adjusted Municipal Condition Index.

7. Conclusions

Green bonds are popular financial market instruments used to finance green transition. Green bonds are issued globally by various kinds of investors, spanning from corporations to governments, municipalities or governmental organizations.

This research addressed gaps in the scientific literature, particularly in areas such as the green bond issuance process for municipalities new to this pathway and the issuance of green bonds for municipalities in the context of IMC. The research also answered the research question related to green bonds by providing clear guidelines on the issuance of green bonds by municipalities in IMC in Lithuania. The research has also closed the gap in the scientific literature and answered the research question on the assessment of the IMC possibility.

The study introduced a valuation approach for evaluating the possibility of IMC, grounded in four domains: financial performance, solvency, social state and environmental performance. The financial performance domain is based on the estimation of 10 ratios, solvency—estimation of 11 ratios, social state—3 statistical data points and environmental performance—4 data points.

The research employed the concept of the Financial Condition Index and further proposed the Risk-Adjusted Municipal Condition Index in combination with four domains of the valuation approach for the assessment of the IMC possibility. The Risk-Adjusted Municipal Condition Index was tested on two municipalities, Vilnius and Tauragė, where the results showed that both municipalities have a similar tendency of the ratio; however, for Tauragė, it would be more difficult to enter into IMC.

The study also proposed a decision-making algorithm for the issuance of green bonds by municipalities in inter-municipal cooperation in Lithuania that is based on 12 steps: (1) alignment of the planned issuance with laws, (2) evaluation of own performance, (3) evaluation of the IMC possibility, (4) agreement of roles and responsibilities in IMC, (5) identification of the green assets, (6) appointment of external resources, (7) documentation, (8) credit rating, (9) ESG, (10) marketing, (11) execution and (12) reporting. The proposed algorithm can serve as a guide for decision makers on the activities related to green bond issuance.

The findings of the research can serve as a tool for municipalities to make rational and sound decisions on entering into IMC, taking into account the associated risks. The valuation approach for IMC can help municipalities not only evaluate IMC but also their own performance. The decision-making algorithm can also help municipalities to structure their actions toward green bond issuance.

The continuation of the proposed research could focus on the development and standardization of the indicators of the valuation approach for the assessment of the IMC possibility. In this way, future research could be focused on the indicators applicable for different variations of environmentally sustainable projects, making the selection processes of indicators easier for municipalities.