Did Remittance Inflow in Bangladesh Follow the Gravity Path during COVID-19?

Abstract

:1. Introduction

2. Literature Review

2.1. Determinants of Remittance Inflow

2.2. COVID-19 and Its Impact on Remittance Inflow

2.3. COVID-19 and Its Impact on Remittance Inflow: Gravity Model Approach

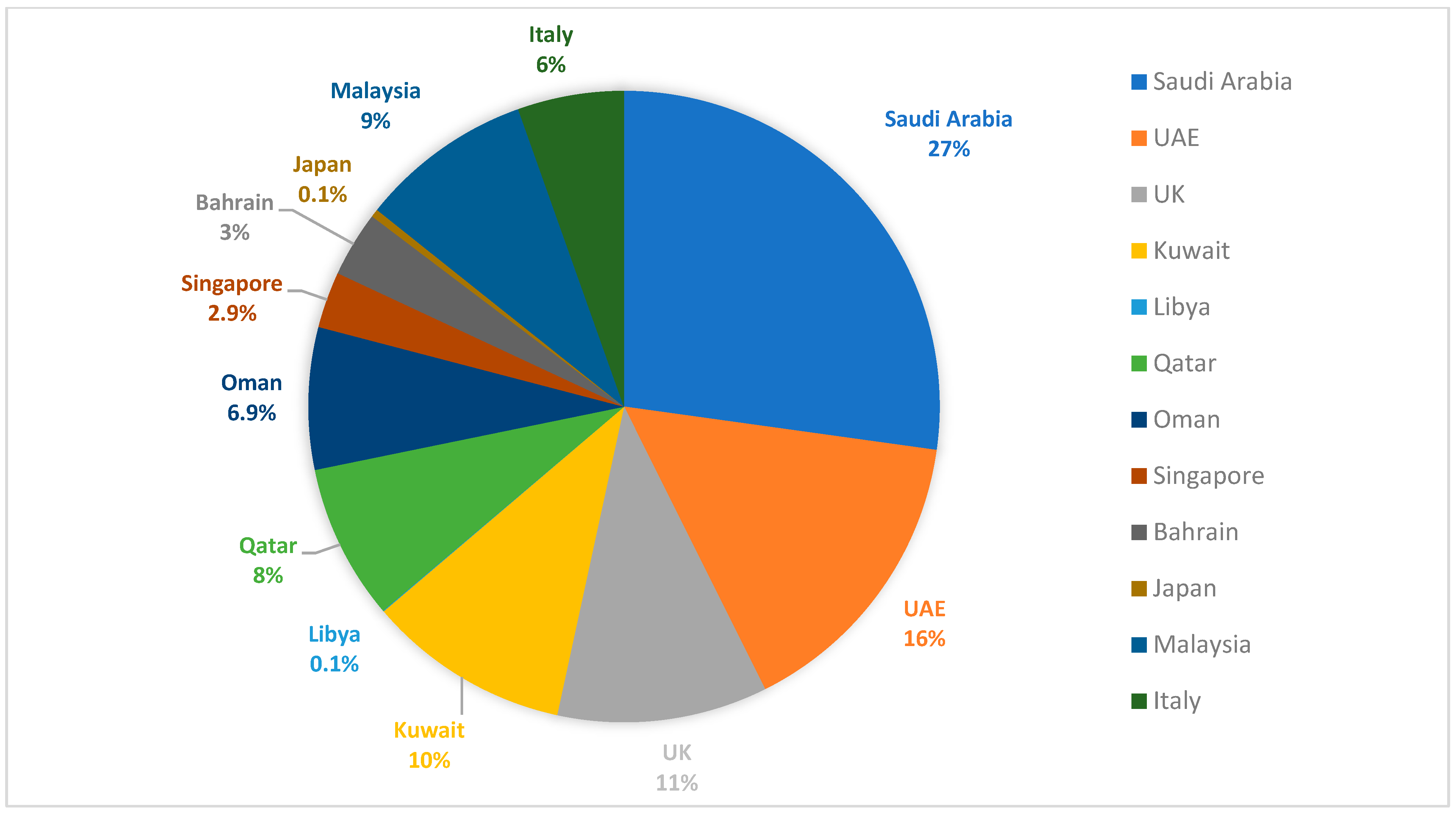

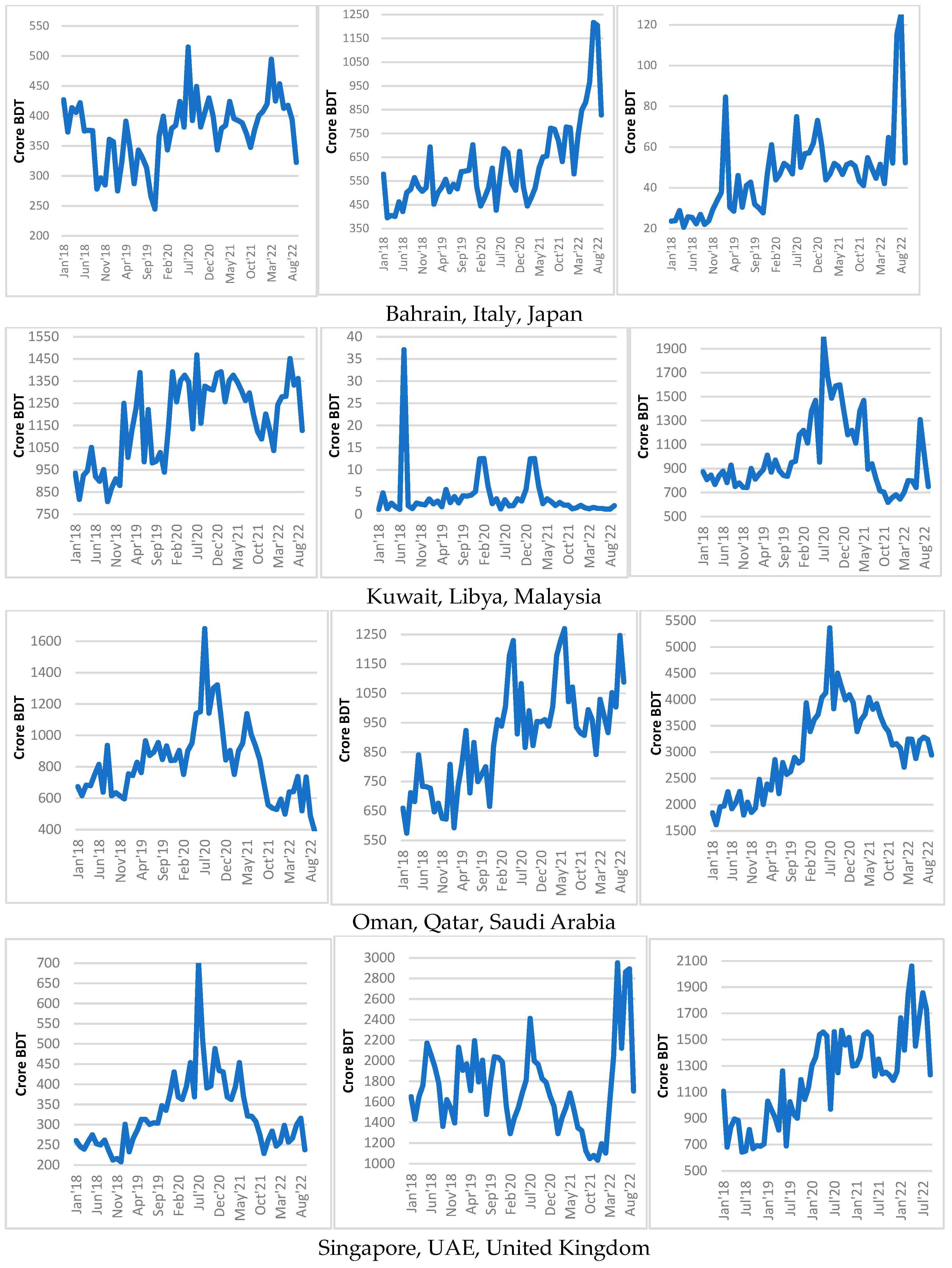

3. Overview of the Remittance Sector in Bangladesh

4. Theoretical Framework and Model Specification

5. Data and Variables

6. Result and Interpretation

Sensitivity Analysis

7. Conclusions and Policy Recommendations

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ahmed, Junaid, and Inmaculada Martinez-Zarzoso. 2014. What Drives Bilateral Remittances to Pakistan? A Gravity Model Approach. Discussion Paper No. 209. Göttingen: Centre for European, Governance and Economic Development Research. [Google Scholar]

- Ahmed, Junaid, Mazhar Mughal, and Inmaculada Martínez-Zarzoso. 2021. Sending Money Home: Transaction Cost and Remittances to Developing Countries. The World Economy 44: 2433–59. [Google Scholar] [CrossRef]

- Akter, Jasmin, Md Jahedul Islam, Puja Bhattacharjee, and Shampa Chakraborty. 2022. The Impact of COVID-19 on the Remittance Inflows in Bangladesh: An ARDL Approach. International Journal of Asian Social Science 12: 147–57. [Google Scholar] [CrossRef]

- Alam, Mohammed Mahinur, Rokeya Khatun, Ripon Roy, and Shahrear Kawsar Towhid. 2015. Determinants of Remittance Inflows to Bangladesh: A Gravity Model Approach using Panel Data. BBTA Journal: Thoughts on Banking and Finance 4: 69–81. [Google Scholar]

- Azizi, Seyed Soroosh. 2021. The impacts of workers’ remittances on poverty and inequality in developing countries. Empirical Economics 60: 969–91. [Google Scholar] [CrossRef]

- Bangladesh Bank. 2022. Major Economic Indicators. [Dataset]. Available online: https://www.bb.org.bd/en/index.php/econdata/econposition (accessed on 15 April 2023).

- Barai, Munim Kumar. 2020. The Development Dynamics of Remittances in Bangladesh. In Bangladesh’s Economic and Social Progress: From A Basket to A Development Model. Edited by Munim K. Barai. Singapore: Palgrave Macmillan, pp. 205–34. [Google Scholar] [CrossRef]

- Barajas, Adolfo, Ralph Chami, Dalia Hakura, Peter Montiel, and Thierry Tressel. 2010. Workers’ remittances and the equilibrium real exchange rate: Theory and evidence. Economia 11: 45–99. [Google Scholar] [CrossRef]

- Beine, Michel, Simone Bertoli, and Jesús Fernández-Huertas Moraga. 2015. A Practitioners’ Guide to Gravity Models of International Migration. The World Economy 39: 496–512. [Google Scholar] [CrossRef]

- Bilgili, Faik. 2015. Business cycle co-movements between renewables consumption and industrial production: A continuous wavelet coherence approach. Renewable and Sustainable Energy Reviews 52: 325–32. [Google Scholar] [CrossRef]

- BMET. 2020. Overseas Employment and Remittances 1976–2020. [Dataset]. Available online: http://www.old.bmet.gov.bd/BMET/viewStatReport.action?reportnumber=21 (accessed on 18 April 2023).

- BMET. 2022. Overseas Employment Country Wise Monthly Statistics. [Dataset]. Available online: http://www.old.bmet.gov.bd/BMET/stattisticalDataAction (accessed on 18 April 2023).

- Caruso, German Daniel, Maria Emilia Cucagna, and Julieta Ladronis. 2021. The distributional impacts of the reduction in remittances in Central America in COVID-19 times. Research in Social Stratification and Mobility 71: 100567. [Google Scholar] [CrossRef] [PubMed]

- Chen, Hong, Shamal S. Chand, and Baljeet Singh. 2020. Impact of COVID-19 on remittance inflows to Samoa. Asian Economics Letters 1: 1–5. [Google Scholar] [CrossRef]

- Chowdhury, Mamta, and Minakshi Chakraborty. 2021. The Impact of COVID-19 on the Migrant Workers and Remittances Flow to Bangladesh. South Asian Survey 28: 38–56. [Google Scholar] [CrossRef]

- Combes, Jean-Louis, Christian Hubert Ebeke, Mathilde Maurel, and Thierry Urbain Yogo. 2014. Remittances and Working Poverty. Journal of Development Studies 50: 1348–61. [Google Scholar] [CrossRef]

- Cooray, Arusha, and Debdulal Mallick. 2013. International business cycles and remittance flows. The BE Journal of Macroeconomics 13: 1–33. [Google Scholar] [CrossRef]

- De, Supriyo, Ergys Islamaj, M. Ayhan Kose, and S. Reza Yousefi. 2019. Remittances over the Business Cycle: Theory and Evidence. Economic Notes 48: e12143. [Google Scholar] [CrossRef]

- Dinarte-Diaz, Lelys Ileana, David Jose Jaume, Eduardo Medina-Cortina, and Hernan Winkler. 2022. Neither by Land nor by Sea: The Rise of Electronic Remittances during COVID-19. Policy Research Working Papers 10057. Washington, DC: World Bank. Available online: https://openknowledge.worldbank.org/entities/publication/b4be879f-263f-5fa2-ada8-001c281f54e8 (accessed on 18 April 2023).

- Fonchamnyo, Dobdinga Cletus. 2012. The Altruistic Motive of Remittances: A Panel Data Analysis of Economies in Sub Saharan Africa. International Journal of Economics and Finance 4: 192–200. [Google Scholar] [CrossRef]

- Freund, Caroline, and Nikola Spatafora. 2008. Remittances, transaction costs, and informality. Journal of Development Economics 86: 356–66. [Google Scholar] [CrossRef]

- Gupta, Anubhab, Heng Zhu, Miki Khanh Doan, Aleksandr Michuda, and Binoy Majumder. 2021. Economic Impacts of the COVID-19 Lockdown in a Remittance-Dependent Region. American Journal of Agricultural Economics 103: 466–85. [Google Scholar] [CrossRef]

- Gurevich, Tamara, and Peter Herman. 2018. The Dynamic Gravity Dataset: 1948–2016. USITC Working Paper 2018-02-A. [Dataset]. Available online: https://www.usitc.gov/data/gravity/dgd.htm (accessed on 17 April 2023).

- Hafsi, Rachid, Abdelghafour Dadene, and Abdelhak Guennoun. 2021. The Relation between Economic Growth and Oil Production in the Gulf Cooperation Countries: Panel ARDL Approach. International Journal of Energy Economics and Policy 11: 301–7. [Google Scholar] [CrossRef]

- Hassan, Gazi Mainul, and Mark J. Holmes. 2013. Remittances and the real effective exchange rate. Applied Economics 45: 4959–70. [Google Scholar] [CrossRef]

- Hossain, Sharif. 2021. Impacts of COVID-19 on Bangladesh Economy: Is the Post-COVID-19 Bangladesh Economy Risky? Journal of European Economy 20: 42–68. [Google Scholar] [CrossRef]

- ILO. 2020. Experiences of ASEAN Migrant Workers during COVID-19: Rights at Work, Migration and Quarantine during the Pandemic, and Re-Migration Plans. Washington, DC: ILO Brief. [Google Scholar]

- ILO. 2021. Locked Down and in Limbo: The Global Impact of COVID-19 on Migrant Worker Rights and Recruitment. Geneva: International Labor Organization. ISBN 978-9-2-2035416-2. [Google Scholar]

- International Monetary Fund. 2021. World Economic Outlook: Recovery during a Pandemic—Health Concerns, Supply Disruptions, Price Pressures. Washington, DC: International Monetary Fund, October, Available online: https://www.imf.org/en/Publications/WEO/Issues/2021/10/12/world-economic-outlook-october-2021 (accessed on 18 April 2023).

- Kahouli, Bassem, and Samir Maktouf. 2015. The determinants of FDI and the impact of the economic crisis on the implementation of RTA: A static and dynamic gravity model. International Business Review 24: 518–29. [Google Scholar] [CrossRef]

- Karim, Mohammad Rezaul, Mohammad Tarikul Islam, and Bymokesh Talukder. 2020. COVID-19’s Impacts on Migrant Workers from Bangladesh: In Search of Policy Intervention. World Development 136: 105123. [Google Scholar] [CrossRef] [PubMed]

- Katrakilidis, Constantinos, and Emmanouil Trachanas. 2012. What drives housing price dynamics in Greece: New evidence from asymmetric ARDL cointegration. Economic Modelling 29: 1064–69. [Google Scholar] [CrossRef]

- Kpoder, Kangni R., Montfort Mlachila, Saad N. Quayyum, and Vigninou Gammadigbe. 2022. Defying the odds: Remittances during the COVID-19 Pandemic. The Journal of Development Studies 59: 673–90. [Google Scholar] [CrossRef]

- Le, Thanh. 2011. Remittances for economic development: The investment perspective. Economic Modelling 28: 2409–15. [Google Scholar] [CrossRef]

- Lucas, Robert E. B., and Oded Stark. 1985. Motivations to Remit: Evidence from Botswana. Journal of Political Economy 93: 901–18. [Google Scholar] [CrossRef]

- Lueth, Eric, and Marta Ruiz-Arranz. 2006. A Gravity Model of Workers’ Remittances. IMF Working Papers 06(290). Tokyo: International Monetary Fund. [Google Scholar] [CrossRef]

- Lueth, Eric, and Marta Ruiz-Arranz. 2008. Determinants of Bilateral Remittance Flows. The BE Journal of Macroeconomics 8: 1–23. [Google Scholar] [CrossRef]

- Mathieu, Edouard, Hahhah Ritchie, Lucas Rodés-Guirao, Cameron Appel, Daniel Gavrilov, Charlie Giattino, Joe Hasell, Bobbie Macdonald, Saloni Dattani, Diana Beltekian, and et al. 2020. Coronavirus Pandemic (COVID-19). Published online at OurWorldInData.org. [Dataset]. Available online: https://ourworldindata.org/coronavirus (accessed on 20 April 2023).

- McCracken, Scott, Carlyn Ramlogan-Dobson, and Marie. M. Stack. 2016. A gravity model of remittance determinants: Evidence from Latin America and the Caribbean. Regional Studies 51: 737–49. [Google Scholar] [CrossRef]

- Morley, Clive, Jaume Rosselló, and Maria Santana-Gallego. 2014. Gravity models for tourism demand: Theory and use. Annals of Tourism Research 48: 1–10. [Google Scholar] [CrossRef]

- Murakami, Enerelt, Satoshi Shimizutani, and Eiji Yamada. 2021. Projection of the Effects of the COVID-19 Pandemic on the Welfare of Remittance-Dependent Households in the Philippines. Economies of Disaster and Climate Change 5: 97–110. [Google Scholar] [CrossRef]

- Poghosyan, Tigran. 2020. Remittances in Russia and Caucasus and Central Asia: The Gravity Model. IMF Working Papers 20. Washington, DC: International Monetary Fund. [Google Scholar] [CrossRef]

- Ratti, Ronald A., and Joaquin L. Vespignani. 2015. OPEC and non-OPEC oil production and the global economy. Energy Economics 50: 364–78. [Google Scholar] [CrossRef]

- Shastri, Shruti. 2021. The impact of infectious diseases on remittances inflows to India. Journal of Policy Modeling 44: 83–95. [Google Scholar] [CrossRef]

- Shimizutani, Satoshi, and Eiji Yamada. 2021. Resilience against the pandemic: The impact of COVID-19 on migration and household welfare in Tajikistan. PLoS ONE 16: e0257469. [Google Scholar] [CrossRef] [PubMed]

- Silva, Adriana R. Cardozo, Luis R. Diaz Pavez, Inmaculada Martínez-Zarzoso, and Felicitas Nowak-Lehmann. 2022. The impact of COVID-19 government responses on remittances in Latin American countries. Journal of International Development 34: 803–22. [Google Scholar] [CrossRef] [PubMed]

- Silva, João M.C. Santos, and Silvana Tenreyro. 2011. Further Simulation Evidence on the Performance of the Poisson Pseudo-Maximum Likelihood Estimator. Economics Letters 112: 220–22. [Google Scholar] [CrossRef]

- Smith, John. 2023. Bilateral Exchange Rate Index Calculation: A Comprehensive Approach. Journal of International Economics 42: 221–36. [Google Scholar]

- The International Monetary Fund. 2022. Financial Access Survey. [Dataset]. Available online: https://data.imf.org/regular.aspx?key=61013712 (accessed on 12 April 2023).

- Tinbergen, Jan. 1962. Shaping the World Economy: Suggestions for an International Economic Policy. New York: The Twentieth Century Fund. [Google Scholar]

- United Nations. 2021. The Sustainable Development Goals Report-2021. New York: United Nations Publications. Available online: https://unstats.un.org/sdgs/report/2021/goal-08/ (accessed on 14 April 2023).

- Wadood, Syed Naimul, and Amzad Hossain. 2017. Microeconomic Impact of Remittances on Household Welfare: Evidence from Bangladesh. Business and Economic Horizons 13: 10–29. [Google Scholar] [CrossRef]

- Withers, Matt, Sophie Henderson, and Richa Shivakoti. 2021. International Migration, Remittances and COVID-19: Economic Implications and Policy Options for South Asia. Journal of Asian Public Policy 15: 284–99. [Google Scholar] [CrossRef]

- World Bank/KNOMAD. 2021. Recovery: COVID-19 Crisis through a Migration Lens. Migration and Development Brief 35. Washington, DC: World Bank. Available online: https://www.knomad.org/publication/migration-and-development-brief-35 (accessed on 14 April 2023).

- World Bank/KNOMAD. 2022a. Remittances Brave Global Headwinds Special Focus: Climate Migration. Migration and Development Brief 37. Washington, DC: World Bank. Available online: https://www.knomad.org/publication/migration-and-development-brief-37 (accessed on 14 April 2023).

- World Bank/KNOMAD. 2022b. A War in a Pandemic. Implications of the Ukraine Crisis and COVID-19 on Global Governance of Migration and Remittance Flows. Migration and Development Brief 36. Washington, DC: World Bank. Available online: https://www.knomad.org/publication/migration-and-development-brief-36 (accessed on 14 April 2023).

- World Bank. n.d. World Bank Commodity Monthly Price Data. [Dataset]. Available online: https://databank.worldbank.org/databases/commodity-price-data (accessed on 14 April 2023).

| Variables | Definitions | Sources |

|---|---|---|

| Remittance Inflow | Remittance inflow from partner countries of Bangladesh. | Bangladesh Bank (2022) https://www.bb.org.bd/en/index.php/econdata/econposition accessed on (15 April 2023) |

| Industrial Production Index (IPI) Home Country | The industrial production index (IPI) is a monthly economic indicator measuring real output in the manufacturing, mining, electric, and gas industries relative to a base year. | IMF (2022) https://data.imf.org/regular.aspx?key=61013712 accessed on (18 April 2023) |

| Industrial Production Index (IPI) Partner Country | The industrial production index (IPI) is a monthly economic indicator measuring real output in the manufacturing, mining, electric, and gas industries relative to a base year. | IMF (2022) https://data.imf.org/regular.aspx?key=61013712 accessed on (18 April 2023) |

| Migration Stock | Migrated people from Bangladesh to partner countries. | BMET (2022) http://www.old.bmet.gov.bd/BMET/stattisticalDataAction accessed on (18 April 2023) |

| Exchange Rate | Exchange rate of Bangladesh currency and partner countries’ currencies. | Bangladesh Bank (2022) https://www.bb.org.bd/en/index.php/econdata/econposition accessed on (15 April 2023) |

| Distance | This is the geographical distance between home and partner country. | Gurevich and Herman (2018) https://www.usitc.gov/data/gravity/dgd.htm accessed on (17 April 2023) |

| Common Language | It is a dummy variable. If both the home and the partner country have a common official language, then the dummy = 1, otherwise 0. | Gurevich and Herman (2018) https://www.usitc.gov/data/gravity/dgd.htm accessed on (17 April 2023) |

| Contiguity | It is a dummy variable. If home and partner country share a common land border, the dummy is = 1, otherwise 0. | Gurevich and Herman (2018) https://www.usitc.gov/data/gravity/dgd.htm accessed on (17 April 2023) |

| Island Home Country | It is a dummy variable. If a country is surrounded by water, then the dummy is = 1; otherwise, 0 for home and partner country. | Gurevich and Herman (2018) https://www.usitc.gov/data/gravity/dgd.htm accessed on (17 April 2023) |

| Island Partner Country | It is a dummy variable. If a country is surrounded by water, then the dummy is = 1; otherwise, 0 for home and partner country. | Gurevich and Herman (2018) https://www.usitc.gov/data/gravity/dgd.htm accessed on (17 April 2023) |

| Landlock Home Country | Landlock is a dummy that indicates a country is almost or surrounded by land if a country is landlocked, the dummy is = 1, otherwise 0 for home and partner country. | Gurevich and Herman (2018) https://www.usitc.gov/data/gravity/dgd.htm accessed on (17 April 2023) |

| Landlock Partner Country | Landlock is a dummy that indicates a country almost or surrounded by land if a country is landlocked, the dummy is = 1, otherwise 0 for home and partner country. | Gurevich and Herman (2018) https://www.usitc.gov/data/gravity/dgd.htm accessed on (17 April 2023) |

| COVID Dummy | For COVID Period (2020M1–2022M8), the value is = 1; for 2018M1 to 2019M12, it is 0. | |

| COVID Cases Home Country | Total cumulative monthly confirmed cases per million per month. | Mathieu et al. (2020) https://ourworldindata.org/coronavirus accessed on (20 April 2023) |

| COVID Cases Partner Country | Total cumulative monthly confirmed cases per million per month. | Mathieu et al. (2020) https://ourworldindata.org/coronavirus accessed on (20 April 2023) |

| COVID Mortality Home Country | Total cumulative monthly confirmed deaths per million per month. | Mathieu et al. (2020) https://ourworldindata.org/coronavirus accessed on (20 April 2023) |

| COVID Mortality Partner Country | Total cumulative monthly confirmed deaths per million per month. | Mathieu et al. (2020) https://ourworldindata.org/coronavirus accessed on (20 April 2023) |

| COVID Vaccinations Home Country | Total cumulative number of people who took vaccination for COVID for each month for home country. | Mathieu et al. (2020) https://ourworldindata.org/coronavirus accessed on (20 April 2023) |

| COVID Vaccinations Partner Country | Total cumulative number of people who were vaccinated for COVID each month for partner country. | Mathieu et al. (2020) https://ourworldindata.org/coronavirus accessed on (20 April 2023) |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Remittance | 684 | 936.354 | 864.756 | 1.08 | 5365.21 |

| Migration Stock | 684 | 187,339.7 | 379,308.7 | 1 | 2,339,854 |

| GDP BD | 684 | 289.705 | 36.886 | 194.632 | 348.449 |

| GDP Partner | 684 | 252.896 | 4007.588 | 1.576 | 104,907.35 |

| Population BD | 684 | 1.642 × 108 | 1,908,561.7 | 1.614 × 108 | 1.663 × 108 |

| BERI | 684 | 372.487 | 441.673 | 0 | 1395.79 |

| Population Partner | 684 | 29,655,025 | 36,419,098 | 1,569,440 | 1.268 × 108 |

| Distance | 684 | 4732.764 | 1750.85 | 2653.964 | 8082.075 |

| Common Language | 684 | Dummy | Variable | 0 | 1 |

| Colony | 684 | Dummy | Variable | 0 | 1 |

| Contiguity | 684 | Dummy | Variable | 0 | 0 |

| Island | 684 | Dummy | Variable | 0 | 1 |

| COVID Cases BD | 684 | 35,517.351 | 66,592.447 | 0 | 336,226 |

| COVID cases Partner | 684 | 113,593.86 | 461,704.39 | 0 | 6,170,622 |

| COVID Mortality BD | 684 | 515.123 | 1146.308 | 0 | 6182 |

| COVID Mortality Partner | 684 | 721.289 | 2875.081 | 0 | 36,570 |

| COVID Vaccination BD | 672 | 2,203,306.6 | 5,705,661.9 | 0 | 30,821,308 |

| Vaccination Partner | 579 | 1,357,291.5 | 4,593,217.6 | 0 | 46,294,329 |

| COVID Dummy | 684 | Dummy | Variable | 0 | 1 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Rem | Rem | Rem | |

| lnGDPBD | −0.238 | −0.177 | −0.0858 |

| (0.189) | (0.194) | (0.266) | |

| lnGDPP | 0.0825 | 0.0795 | 0.190 *** |

| (0.0441) | (0.0433) | (0.0370) | |

| lnDist | −0.695 *** | −0.691 *** | −0.597 *** |

| (0.131) | (0.132) | (0.135) | |

| BERI | 0.000103 * | 0.000101 * | 0.000239 *** |

| (0.0000405) | (0.0000405) | (0.0000420) | |

| lnMigS | 0.0831 *** | 0.0838 *** | 0.0800 *** |

| (0.00931) | (0.00933) | (0.00967) | |

| lnTPopBD | 0.422 | −0.118 | 8.723 * |

| (3.081) | (3.074) | (4.005) | |

| lnTPopP | 0.515 *** | 0.513 *** | 0.477 *** |

| (0.0215) | (0.0215) | (0.0208) | |

| Colony | 1.011 *** | 0.991 *** | 0.997 *** |

| (0.106) | (0.105) | (0.0998) | |

| CommonLang | 1.384 *** | 1.379 *** | 1.326 *** |

| (0.0798) | (0.0802) | (0.0807) | |

| Island | −1.164 *** | −1.152 *** | −1.202 *** |

| (0.103) | (0.102) | (0.0940) | |

| CovDummy | 0.221 *** | 0.209 *** | 0.0948 |

| (0.0571) | (0.0576) | (0.0695) | |

| CovCasesBD | −6.49 × 10−8 | ||

| (0.000000224) | |||

| CovcasesP | 5.44 × 10−8 | ||

| (3.81 × 10−8) | |||

| CovMortBD | 0.00000641 | ||

| (0.0000117) | |||

| CovmortP | 0.00000992 * | ||

| (0.00000416) | |||

| CovVaccBD | −1.09 × 10−8 ** | ||

| (3.63 × 10−9) | |||

| VaccP | −4.60 × 10−9 | ||

| (5.33 × 10−9) | |||

| _cons | −4.700 | 5.167 | −163.1 * |

| (57.46) | (57.31) | (74.86) | |

| N | 684 | 684 | 573 |

| R-sq | 0.814 | 0.814 | 0.823 |

| Pooled OLS Two-Way Fixed-Effect | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| lnRem | lnRem | lnRem | lnRem | lnRem | lnRem | |

| lnGDPBD | −0.0938 | 0.175 | 0.0817 | 0.138 | 0.168 | 0.0941 |

| (0.621) | (0.615) | (0.702) | (0.168) | (0.170) | (0.191) | |

| lnGDPP | −0.122 | −0.126 | 0.217 | −0.169 *** | −0.174 *** | −0.0777 * |

| (0.0986) | (0.0975) | (0.125) | (0.0266) | (0.0267) | (0.0391) | |

| lnDist | −0.698 * | −0.772 * | 0.0169 | 0 | 0 | 0 |

| (0.323) | (0.319) | (0.350) | (.) | (.) | (.) | |

| BERI | 0.00120 *** | 0.00117 *** | 0.00153 *** | 0.000275 * | 0.000282 * | 0.000493 ** |

| (0.000150) | (0.000149) | (0.000181) | (0.000126) | (0.000127) | (0.000172) | |

| lnMigS | 0.263 *** | 0.265 *** | 0.277 *** | 0.0336 * | 0.0449 ** | 0.0794 *** |

| (0.0250) | (0.0246) | (0.0273) | (0.0150) | (0.0146) | (0.0147) | |

| lnTPopBD | −6.385 | −8.919 | 2.129 | 5.330 | 4.884 | 5.281 |

| (11.22) | (11.14) | (12.49) | (3.215) | (3.280) | (3.513) | |

| lnTPopP | 0.583 *** | 0.577 *** | 0.547 *** | −0.483 | −0.658 | 0.809 |

| (0.0633) | (0.0628) | (0.0678) | (0.778) | (0.791) | (0.805) | |

| Colony | 2.699 *** | 2.550 *** | 2.359 *** | 3.281 | 4.023 | 0 |

| (0.257) | (0.259) | (0.275) | (2.835) | (2.879) | (.) | |

| CommonLang | 0.253 | 0.303 | 0.176 | −0.354 | −1.189 | 4.826 |

| (0.185) | (0.182) | (0.197) | (3.332) | (3.382) | (3.441) | |

| Island | −1.204 *** | −1.163 *** | −1.325 *** | −0.308 | 0.328 | 0.307 |

| (0.142) | (0.140) | (0.148) | (2.395) | (2.430) | (2.443) | |

| CovDummy | 0.0517 | −0.0222 | 0.0723 | 0.0703 | 0.0595 | 0.0643 |

| (0.210) | (0.209) | (0.237) | (0.0518) | (0.0520) | (0.0571) | |

| CovCasesBD | −8.87 × 10−8 | −0.000000507 * | ||||

| (0.000000825) | (0.000000207) | |||||

| CovcasesP | 0.000000120 | 7.52 × 10−8 ** | ||||

| (0.000000116) | (2.88 × 10−8) | |||||

| CovMortBD | 0.0000194 | −0.0000114 | ||||

| (0.0000457) | (0.0000119) | |||||

| CovmortP | 0.0000651 *** | 0.00000155 * | ||||

| (0.0000187) | (0.00000456) | |||||

| CovVaccBD | −1.26 × 10−8 | −1.33 × 10−8 *** | ||||

| (1.10 × 10−8) | (2.68 × 10−9) | |||||

| VaccP | −1.07 × 10−8 | 9.45 × 10−10 | ||||

| (1.31 × 10−8) | (3.08 × 10−9) | |||||

| Month Dummy | No | No | No | Yes | Yes | Yes |

| Country Dummy | No | No | No | Yes | Yes | Yes |

| Constant | 121.3 | 168.4 | −47.73 | −87.98 | −77.17 | −112.2 |

| (209.6) | (208.1) | (233.6) | (56.36) | (57.31) | (61.14) | |

| N | 684 | 684 | 573 | 684 | 684 | 573 |

| R-sq | 0.554 | 0.561 | 0.549 | 0.977 | 0.976 | 0.978 |

| adj. R-sq | 0.545 | 0.552 | 0.539 | 0.976 | 0.975 | 0.976 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Goswami, G.G.; Barai, M.K.; Atique, M.A.; Rahman, M. Did Remittance Inflow in Bangladesh Follow the Gravity Path during COVID-19? Economies 2023, 11, 285. https://doi.org/10.3390/economies11110285

Goswami GG, Barai MK, Atique MA, Rahman M. Did Remittance Inflow in Bangladesh Follow the Gravity Path during COVID-19? Economies. 2023; 11(11):285. https://doi.org/10.3390/economies11110285

Chicago/Turabian StyleGoswami, Gour Gobinda, Munim Kumar Barai, Mahnaz Aftabi Atique, and Mostafizur Rahman. 2023. "Did Remittance Inflow in Bangladesh Follow the Gravity Path during COVID-19?" Economies 11, no. 11: 285. https://doi.org/10.3390/economies11110285

APA StyleGoswami, G. G., Barai, M. K., Atique, M. A., & Rahman, M. (2023). Did Remittance Inflow in Bangladesh Follow the Gravity Path during COVID-19? Economies, 11(11), 285. https://doi.org/10.3390/economies11110285