Abstract

This paper aims to examine whether the status of fiscal decentralization generates efficiency in local spending behavior and leads to local fiscal performance and local economic growth, revealing not only the status of Romania from the point of vertical fiscal imbalance but also the fiscal implication of spending decentralization and local government effectiveness. The methodological background includes qualitative sequential methodology, involving empiric analysis that provides coherence and viability for our study, but also quantitative methods, including Ordinary Least Squares regression (OLS). The empirical results show that fiscal decentralization determines more responsible and efficient local spending, enhancing local performance and contributing to economic growth. Furthermore, the analysis provides evidence on the importance of local fiscal consolidation and gives an overview in terms of spending responsibilities between the central government and local government. The paper contributes to the literature that studies fiscal imbalance, as well as the fiscal implications of decentralized spending and the effectiveness of local governments in driving economic growth. It also contributes to the literature that studies the relationship between fiscal decentralization and local economic growth, as well as the effectiveness of government reforms and strategies.

1. Introduction

In this study, we investigated the determinants of local performance across Romanian municipalities, focusing on the distribution of spending responsibilities between the central and local governments but also including other dimensions to account for fiscal imbalance. According to Oates (1972), the process of fiscal decentralization faces real challenges because there is a global trend based on which fiscal decentralization contributes to economic development. In this situation, global interest in fiscal decentralization has developed, so that its implementation is characterized by local performance, improving economic, social, and territorial cohesion as fundamental pillars of the European Union’s harmonious development, as stated by the Lisbon Treaty (2007). We are using a framework that examines whether the status of fiscal decentralization generates efficiency in local spending behavior and leads to local fiscal performance and local economic growth, revealing not only the status of Romania from the point of vertical fiscal imbalance but also the fiscal implication of spending decentralization and local government effectiveness. To the best of our knowledge, this framework has a unique architecture, either ignored in previous research or used in a highly diluted formulation, being appropriately dosed below with variables that allow for a deeper and more comprehensive understanding of budgetary resources at the level of local communities in the current social-economic context. The goal of this paper is twofold, theoretical and empirical. Firstly, the research methodology is related to qualitative sequential methodology, involving empiric analysis that provides coherence and viability for our study. Secondly, the methodology used includes OLS, and tests the relationship between subnational economic growth and fiscal decentralization.

The contributions of this article are threefold. First, our study reveals the importance of local fiscal consolidation and gives an overview in terms of spending responsibilities between the central government and local government. Second, while the existing literature on the status of fiscal decentralization and specific implication in local spending behavior and fiscal performance is lacking on the profile of Romania, we fill the gap in the literature, and we examined several significant factors related to the fiscal decentralization process and fiscal imbalances. Beyond this, we emphasize the influence of fiscal decentralization on local spending behavior. Third, we show that fiscal decentralization determines more responsible and efficient local spending, enhancing local performance and contributing to economic growth. The paper contributes to the literature on fiscal imbalance as well as the fiscal implications of spending decentralization and local government effectiveness in economic growth, serving as a contribution and point of reference for the literature on the status of fiscal decentralization and local economic growth, spending efficiency, and the output of government reforms and strategy based on local government effectiveness.

In terms of the structure of the paper, the next section examines the literature on fiscal decentralization, fiscal imbalances, and local government behavior, as well as the roles of spending responsibilities between the central government and local government. The next section summarizes the descriptive analysis and exploratory literature review regarding fiscal imbalances in Romanian counties. Section 4 describes the method, variables and data sources; Section 5 summarizes the results of the empirical study conducted on Romanian counties, over the period 2005–2018; and Section 6 outlines the conclusion, the main findings, their implications, and potential policy implication.

2. Literature Review

An important concept developed in the literature is that local governments should be in charge of developmental policies because local developments must be designed and implemented according to their own specific characteristics (Peterson 1995). Moreover, local governments are closer to local citizens knowing their needs and preferences compared to the central government, which is further away from the needs of the local citizens, and, in this context, fiscal decentralization will increase the degree of efficiency in the allocation of resources leading to local performance (Oates 1972, 1993; Tiebout 1956; Ezcurra and Pascual 2008). When analyzing the concept of fiscal decentralization and local government autonomy, it is important to clearly define what it is and to reveal the literature background related to the subject. The Constitution of Romanian (2003) deals in art with the basic principles of local government, stating in paragraph one that “the public administration in the administrative-territorial units is based on the principles of decentralization, local autonomy and deconcentration of public services”. Moreover, additionally, to constitutional regulation, legal principles of local public administration are stated in Law No. 215 on Local Government (2001), which is revealed in Article 2. Paragraph 1 states that “public administration in territorial administrative units is organized and operates under the principles of decentralization, local autonomy, deconcentration of public services, the eligibility of local public administration, law and consulting citizens in solving local problems of special interest”. According to the rules in this field, as stated in Article 2 of the Law No. 215 on Local Government (2001), Paragraph 2, the status of Romania’s national unity and indivisibility cannot be affected by the implementation of local government principles. It should be highlighted that the administrative territorial units, which are understood to be different legal entities with their own legal status granted by the state, fall under the purview of the public administration of which these principles are applicable. Each community within the administrative territorial divisions has a unique heritage, which serves as the foundation for its prosperity and development as well as the higher-level resolution of people’s needs and requirements. In this regard, Article 27 of Law No. 215 on Local Government (2001) states that “local government authorities have the right to establish and collect local taxes and to establish and approve the budgets of local villages, cities, municipalities, and counties according to the law in order to ensure local autonomy”. In order to exercise its powers freely, local government must have its own resources that are distinct from those of the state administration. However, the retrospective of the literature review highlight different opinions on the relationship between fiscal decentralization and economic development. There are different determinants of the performance of local governments that have been discussed in literature, but one is considered by Choi (2021) as the most significant factor in public policy, respectively the capacity of the government. Donahue et al. (2000) described the capacity as a “government’s ability to develop, direct, and control its resources to support the discharge of its policy and program responsibilities”.

According to Schneider (2003), fiscal decentralization refers to the degree of fiscal influence that central authorities share with non-central actors. Administrative decentralization, on the other hand, refers to the degree of autonomy that these actors have in relation to central authorities. Political decentralization is defined by the capacity to perform political functions previously reserved for central authorities, such as external representation. The economic literature reveals that decentralization is frequently emphasized for its favorable effects on potential economic gains, or “economic dividend of decentralization” as Morgan (2002) described it. Overall, although decentralization is now a global trend, there is a significant research gap on the economic implications of the process, as noted by Rodríguez-Pose and Ezcurra (2010). Furthermore, studies to date are few, frequently based on specific case studies, and their findings are occasionally contradictory. As per Martinez-Vazquez and McNab (2003), unlimited fiscal decentralization may result in a concentration of resources in various geographic areas, widening the fiscal gaps between local governments. Furthermore, as the retrospective of the literature point out, the wealthiest regions enjoy an advantage in this situation since they are more effective and have superior institutional infrastructure. Decentralization may also result in a transfer of economic development from the periphery to the center if it impairs the state’s ability to distribute resources in order to address regional inequities (Rodríguez-Pose and Ezcurra 2010). To avoid the implication of the danger of descentralization exploited by Prud’homme (1995) and to validate that on the profile of Romania, the positive effects depend on the capacity of the region to achieve territorial cohesion.

The contributions of this article are threefold. First, the study reveals the importance of local fiscal consolidation and gives an overview in terms of spending responsibilities between central government and local government. Second, we fill the gap in the literature, and we examined several significant factors related to fiscal decentralization process and fiscal imbalances, beyond this, we emphasize the in-fluence of fiscal decentralization on local spending behavior. Third, we show that fiscal decentralization determines more responsible and efficient local spending, enhancing local performance and contributing to economic growth. The decentralization process allows local public authorities to have administrative and financial autonomy (Brezovnik 2008). The main problem is the level of this autonomy, reflected in, on the one hand, tax authority and financial equalization, and on the other hand, in competences based on which local government authorizes expenditure (Oplotnik et al. 2012; Oplotnik and Brezovnik 2004). This leads to differences among subnational governments, generating fiscal imbalances, both vertical and horizontal. In literature, fiscal imbalances were investigated mainly from the perspective of fiscal decentralization in relation to: Gini index and fiscal policy Gavriluțǎ (Vatamanu) et al. (2020); income inequality and regional development Tselios et al. (2012); poverty reduction or income inequality Sepulveda and Martinez-Vazquez (2011), Sacchi and Salotti (2011); equity and poverty reduction (Hofman and Guerra 2007), political institutions (Beramendi 2003), or political economy (Lockwood 2005).

3. Fiscal Imbalances in Romania

For all nations, especially large ones, whether they are unitary governments or federations, subnational government inequities remain a constant concern. Romania has a unitary system, but the decentralization process and varying economic development levels of separate territorial units determine specific issues leading to both horizontal and vertical budgetary imbalances (Onofrei et al. 2020, 2022; Bostan et al. 2018, 2022; Costea 2013, 2020; Oprea et al. 2012, 2013; Morariu et al. 2010). Problems similar to those addressed by us are also found in the case of other authors who deal with other national spaces (Alfada 2019; Lukáč et al. 2021; Galizzi et al. 2018; Hajilou et al. 2018; Bonomi Savignon et al. 2019; Papcunová et al. 2020; Mainali 2021). Decentralization is highly desired all across the world. However, the advantages of decentralization are not as evident as the conventional idea of fiscal federalism claims, and any decentralization program should take these severe disadvantages into account. Our analysis regarding fiscal imbalances is performed for NUTS3 level of Romania, respectively counties, over the period of time 2000–2020. Vertical fiscal imbalances (VFI) can be measured using the coefficient of vertical fiscal imbalances (CVI) following the methodologies developed or used in their research by Hunter (1974, 1977); Martinez-Vazquez and Boex (1999, 2001); Shankar and Shah (2001); Schroeder and Smoke (2003); Bird and Tarasov (2002, 2004); Cowell (2011) and Kowalik (2015, 2016) based in general on following synthetized formulas:

where CVI is the coefficient of vertical imbalance; TSNG is total transfers from central government or equalization transfers and other transfers, respectively the total subnational resources not under subnational control; and ESNG is the total subnational expenditures. The value of the coefficient of the vertical imbalance equal or closer to 0 means the total or a high financial control of the central authorities over the local authorities, while the coefficient equal or closer to 1 means the total or a high autonomy of the local authorities in making financial decisions.

CVI = 1 − TSNG/ESNG

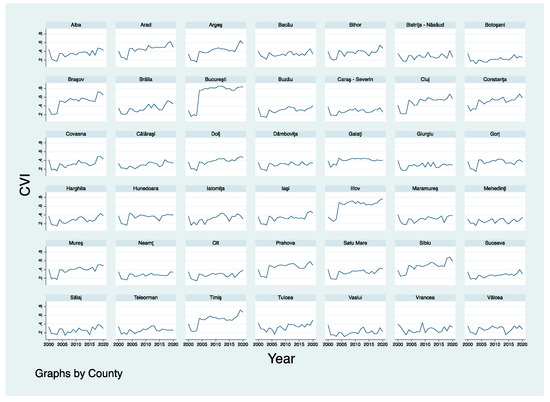

Figure 1 shows a high fluctuation over the period 2000–2020 for all counties of Romania, the tendency being to reduce the level of grants and to increase financial autonomy towards the end of the period in the analysis.

Figure 1.

Vertical fiscal imbalances in Romanian counties, 2000–2020. Source: computed by authors using Stata 15.1 based on own calculation.

Bucharest has the highest level of the coefficient, closer to 1, being the most autonomous local government in Romania. Other counties with the tendency to increase local financial autonomy by reducing grants are Arges, Brașov, Cluj, Constanța, Ilfov, Sibiu and Timiș, especially in the second half of the period, where local authorities identified opportunities to increase own revenues, simultaneously through a better collection of them and through the development process of the counties based on the development of the business environment, the real estate development and the increase in the car park at the level of residents and legal entities. In this context, assuming vertical imbalance is viewed as an appropriate or desirable policy goal.

Some of the counties over the period under analysis have a coefficient of fiscal vertical imbalance closer to 0, such as Botoșani, Sălaj, Vaslui, Vrancea, Vâlcea, and Teleorman. In these counties, transfers are most important as a source of finance for counties expenditures. Transfers to local government are designed to play an equalizing role and to reduce differences in fiscal capacity across jurisdictions but can also reduce their local policy autonomy (OECD 2009; Hajilou et al. 2018). These counties are characterized by high equalizations transfers that cover the local public expenditure. In fact, these counties are dependent so much on the transfers and grants, that can be considered and characterized by a low level of local performance. As Gavriluțǎ (Vatamanu) et al. (2020) demonstrated, sometimes equalization transfers used in a very low managerial performance local management only worsens or sustains the existing inequalities, pressing on already existing disparities. In this context, fiscal decentralization could have spatially regressive effects, as a result of the weakening of the equalization role of the central government (Prud’homme 1995).

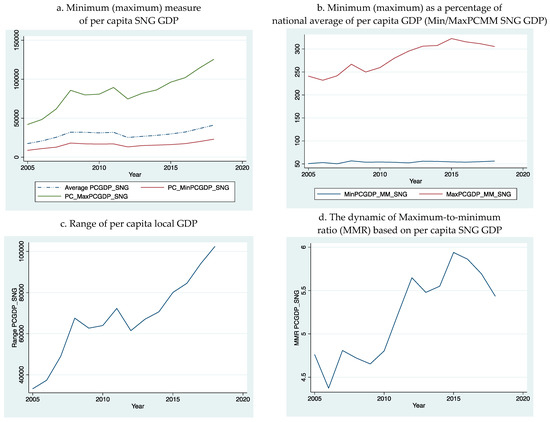

Following the methodologies of Martinez-Vazquez and Boex (2001), Shankar and Shah (2001), Schroeder and Smoke (2003), Bird and Tarasov (2002, 2004), Cowell (2011) and Kowalik (2015, 2016), horizontal fiscal imbalance (equalization) as static measures range from maximum to minimum in a given period of time. The minimum (maximum) as a percentage of the national average is the ratio of the per capita value in the poorest (richest) subnational government to the national per capita average:

and

where ymin means a subnational government with minimum parameter per capita, ymax means county with maximum parameter per capita, ÿ—national average of given parameter. The parameter per capita in our analysis according with database available are per capita total subnational government expenditure and per capita subnational government own revenue, and also may be according to literature subnational government GDP and per capita regional personal income.

ymin/ÿ × 100%

ymax/ÿ × 100%

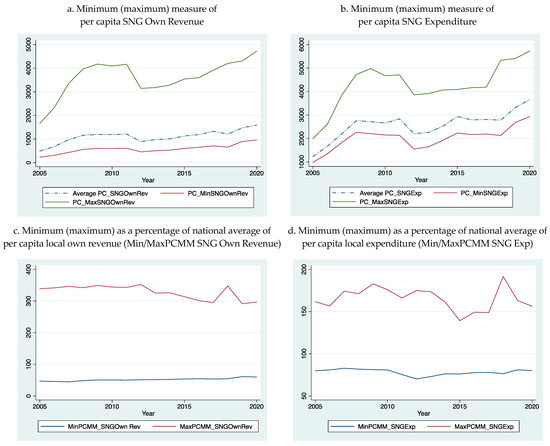

Own calculations presented in Figure 2 reflect the minimum (maximum) per capita of own revenues and local expenditure. The minimum (maximum) measures a relative size of horizontal disparities. According to literature Bird and Tarasov (2004), a high degree of deviation from the average in either direction shows either very rich or very poor subnational government, and a low degree of variation indicates that subnational governments are relatively homogeneous in terms of the variable measured.

Figure 2.

Horizontal disparities of Romanian counties over the period of time 2005–2020. Source: computed by authors using Stata 15.1 based on own calculation.

According to the results displayed in Figure 2a,b, it is revealed that there is a considerable deviation from the national average for the county with the largest own revenues, which is Bucharest. This indicates that there is a high deviation from the average of own revenue parameter for the period 2005–2020. The minimum level of the own revenues of the counties, however, does not have a significant deviation from the average, which proves that low-income counties are relatively homogeneous. From the perspective of dynamics, the trend is to increase own revenue per capita, but being an analysis of nominal income, we cannot conclude whether it is a real increase because it should be corrected with the inflation index. From the perspective of expenditures, there is also a significant deviation from the average, especially at the level of the largest expenditures made, which are also made by Bucharest, the country’s capital. Regarding the minimum level of expenses, the deviation is not very accentuated, which proves that low-expenditure counties are relatively homogeneous in terms of level of local per capita expenditure.

Figure 2b,c shows a high gap between the richest and the poorest county in Romania for both parameters, respectively minimum (maximum) as a percentage of the national average of per capita local own revenue and minimum (maximum) as a percentage of the national average of per capita local expenditure, which conclude that counties are not homogeneous.

The evaluation of results from the standpoint of horizontal inequalities must be done with caution because these differences do not always have negative connotations. We should take into account that they are due to different needs, which involve different costs and different motivations for own revenue-raising capacity. Horizontal disparities, at least at the level of expenditure, can be indirectly corrected with the help of transfers, and if they are not used properly, an inverse effect can occur, meaning a significant decrease in local performance. Bird and Tarasov (2004) conclude that intergovernmental transfers on wrong policy reasons can easily be undesirable economic incentives.

Range (R) is a measure characterizing the empirical area of variation of the examined feature Cowell (2011) and Kowalik (2015), based on the following formula:

R = ymax − ymin

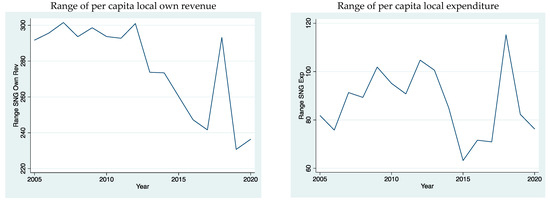

Figure 3 shows that the estimated search range is unstable among the 42nd Romanian counties.

Figure 3.

Range of per capita local own revenue and per capita local expenditure. Source: computed by authors using Stata 15.1 based on own calculation.

The maximum-to-minimum ratio (MMR) is the per capita value for the richest subnational government divided by the per capita value for the poorest subnational government Shankar and Shah (2001), Bird and Tarasov (2002, 2004), Cowell (2011), Li and Xu (2008):

MMR = ymax/ymin

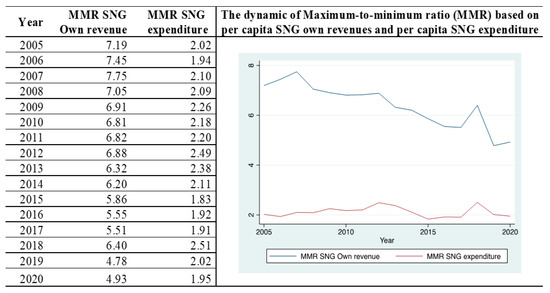

A value of one for MMR would represent perfect equality and larger values show how big are the subnational governments inequalities. Figure 4 presents the status of the maximum-to-minimum ratio of own revenue and local expenditure.

Figure 4.

The dynamic of the maximum-to-minimum ratio (MMR) based on per capita SNG own revenues and per capita SNG expenditure (Romanian counties, 2005–2020). Source: computed by authors using Stata 15.1 based on data of the DFPLB (2021) and RNSI (Romanian National Institute of Statistics 2021).

According to Figure 4, the maximum-to-minimum ratio of own revenues has values between 4.78 and 7.19, showing counties disparities in own revenue per capita. The maximum-to-minimum ratio of per capita local expenditure has values between 1.83 and 2.51. Thus, from the perspective of own revenues, there are large differences in the capacity of counties to generate own revenues, reflected, in particular, by local taxes and fees but also by alternative sources of revenue formation (such as revenues from European funds or even loans). The Romanian Court of Accounts (2021) identifies a series of irregularities at the county level, among which the most invoked is the unrealistic local budgets, given the real needs of the local community in terms of real financial resources available, including investment objectives to be achieved by non-inventory and non-assessment of the taxable mass in conjunction with the non-establishment of specific indicators for estimating expenditures. These irregularities are mainly due to non-performing management for the application of procedures for tracking and collecting tax receivable due to local budgets by insufficient involvement of local authorities in organizing and monitoring the activities of establishing, evaluating and collecting local taxes and fees.

The Romanian Court of Accounts considers that there is a weak concern of the local public authorities to identify and capitalize on the revenues that may result from carrying out economic activities or from capitalizing on goods from their public and private patrimony. The deficient way in which it was acted for the organization and management of the technical-operative and accounting records has direct consequences in the way of managing the patrimony, both in terms of economy and its efficiency and effectiveness. Thus, the management of public and private assets is underperforming.

The pandemic period dictated the use of information technology, and Romanian counties have been accused of being unconcerned about the acquisition and implementation of viable computer applications. The approach of horizontal disparities is achieved especially by reference to the GDP per capita parameter, that is why Figure 5 presents horizontal disparities of Romanian counties based on GDP per capita.

Figure 5.

Horizontal disparities of Romanian counties based on GDP. Source: computed by authors using Stata 15.1 based on own calculation.

According to Figure 5a, there is a tendency to increase the level of GDP per capita, the deviation from the average being very high in the case of the richest municipality, which is Bucharest, the country’s capital. In addition, there is a fluctuating increase in GDP per capita in the richest municipality. The deviation of poor counties from the average is not very large. From the perspective of the gap (Figure 5b) created between the minimum and maximum as a percentage of the national average of per capita GDP, this is quite accentuated, highlighting that there are very rich counties and very poor counties, and this gap tends to increase, as shown in Figure 5c,d. The high level of maximum-to-minimum ratio around six shows high horizontal disparities between Romanian counties, where Bucharest is the richest one.

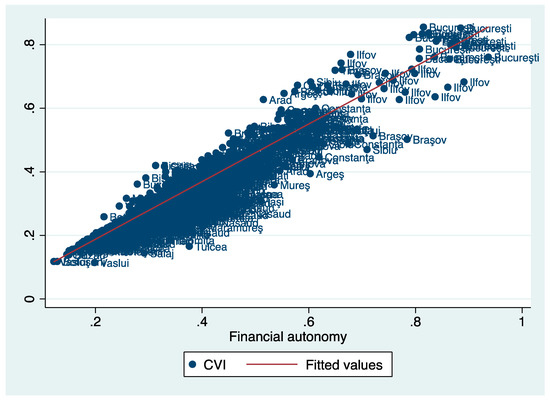

In our case, in a very simplistic approach, Figure 6 shows a positive relationship between vertical fiscal imbalances and financial autonomy. The relationship is justified by the fact that when local authorities have management autonomy, depending on several influencing factors—the most important of which are the demographic structure of the local population, geographical area and public management of local authorities—they can generate local revenue, allowing them to subsequently provide public services at the local level. The relationship between resources and output is clear. The more efficient the public management, the higher the local performance, and this is dealing with the requirements of economic development.

Figure 6.

Vertical fiscal imbalances and financial autonomy in Romanian counties. Source: computed by authors using Stata 15.1 based on own calculation.

In this context, a low level of transfers means a high autonomy of the local authorities in making financial decisions. For these reasons, of the quality of the public management in conditions of autonomy, there are also differences in the financing of the counties through transfers, these being able to be significant and creating vertical fiscal disparities.

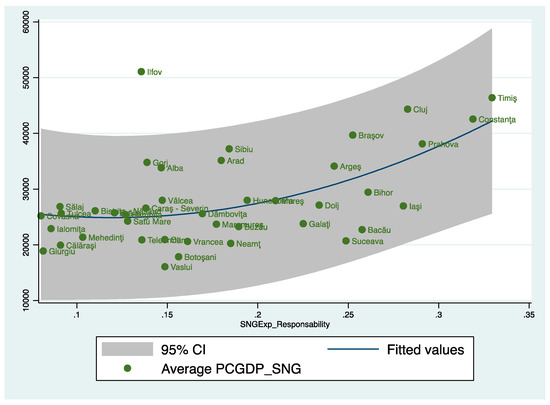

The quality of local government for sustainable development is reflected also by the GDP per capita and the subnational government expenditure responsibility established by the share of subnational government expenditure in general government expenditure (see Figure 7).

Figure 7.

GDP per capita and the subnational government expenditure responsibility as average over the period of time 2005–2018. Source: computed by the authors based on Eurostat database (European Commission 2021) using Stata 15.1.

Bahl and Nath (1986) identify three main reasons based on the way the public expenditure share of local governments appears to be greater, respectively: (1) where the level of economic development is higher, (2) in countries with larger populations, and (3) in countries whose central government budgets carry less of a defense burden. Therefore, a greater assumption of local public spending by local authorities and therefore a substantiation of the decentralization process, represent, first of all, key aspects of development.

According to the database computed by the authors, the outlying county is Bucharest, where variables, respectively the GDP per capita and the subnational government expenditure responsibility, are very high. For this reason, Bucharest was excluded from the graphic representation. Figure 7 plots the prediction from a quadratic regression, and it adds a confidence interval for the other 41 counties. High deviation presents Ilfov County, which despite a representative GDP per capita, local public spending is minimal. In Ilfov County, over 21,362 companies operate covering a wide range of fields, namely almost all sub-branches of the manufacturing industry and the entire film industry (Mediapro Studios in Buftea). Some with an important share in the county’s production are also reflected in the national. The main branches in which investments have been made are transport and storage and industry (manufacturing industry) and trade, these being in fact representative branches of the county. The most important share is held by investments made by national economic agents and those with foreign capital. The fact that a rather important volume of investments was made in the public sector, and the financing from the state and local budget registered a decrease (as Figure 7 shows), attests to an improvement of the activity of the agents in this sector.

They attest to the creation of a favorable economic framework that has in view the stimulation of the commercial companies, the attraction of new investments, aiming at the improvement of the economic activity of the county. However, the performance of economic agents can be observed, but local management tends to become passive to community needs, reflected in very low public expenditure, and therefore a low level of fiscal responsibility.

There are counties with a high GDP per capita, but with a minimum provision of public services (Gorj, Alba), or counties with low level of GDP per capita, but with a significant level of local public spending (Iasi). According to the graphic representation, fitted values or very low deviation are Ialomița, Harghita, Caraș-Severin, Hunedoara, Argeș and Prahova. According to Figure 7, a high level of fiscal responsibility is registered in Timis, Constanța, Cluj, Prahova, Brasov, Bihor and Iasi.

4. Materials and Method

The aim of this paper was to provide empirical evidence on the relationship between subnational economic growth and local responsibility based on capacity of generating own revenues and have a high responsibility of local expenditure, considering fiscal decentralization as determinant of the economic growth. Our analysis includes the 42 Romanian counties corresponding to NUTS3 level of the European Union, over the period 2005–2018. The Romanian counties under analysis are as follows: Alba, Arad, Argeş, Bacău, Bihor, Bistriţa–Năsăud, Botoşani, Brăila, Braşov, Bucureşti, Buzău, Călăraşi, Caraş–Severin, Cluj, Constanţa, Covasna, Dâmboviţa, Dolj, Galaţi, Giurgiu, Gorj, Harghita, Hunedoara, Ialomiţa, Iaşi, Ilfov, Maramureş, Mehedinţi, Mureş, Neamţ, Olt, Prahova, Sălaj, Satu Mare, Sibiu, Suceava, Teleorman, Timiş, Tulcea, Vâlcea, Vaslui, and Vrancea. For empirical evidence, we used OLS regression. The chosen period (2005–2018) is justified by the availability of official databases as Directorate for Fiscal Policies and Local Budgeting under Ministry of Regional Development and Public Administration and European Grants (DFPLB 2021) and Romanian National Institute of Statistics (2021) and European Commission (2021).

The analytical framework of this research is constructed on the models mentioned in the literature, and the econometric model is developed as follows:

Yi = β1 + β2Xi + ui

The dependent variable is per capita subnational GDP (PCGDP_SNG), as the most representative indicator for economic growth and an indicator of Sustainable Development Goals adopted by United Nations (2012), being associated to goal 8, respectively decent work and economic growth.

The independent variables are local expenditure (SNG_EXP) as the financial capacity to cover local administrative competences, and vertical imbalances (CVI) as the capacity of local authorities to reduce equalization transfers and other transfers, respectively to reduce total subnational resources not under subnational control.

Table 1 and Table 2 provide descriptive statistics for the variables included in the t model for the 42 Romanian counties over the period 2005–2018.

Table 1.

Pairwise correlations.

Table 2.

Descriptive statistics.

5. Results

The results of the regressions analysis based on linear regression for panel data models are summarized in Table 3. We used variance inflation factor (VIF) to check for multicollinearity, where a variable whose VIF values are higher than 10 should ask for further investigation.

Table 3.

The results of the regression analysis.

Therefore, the tests for multicollinearity show VIFs of 1.67, meaning a tolerance of 1/VIF lower than 0.1 comparable to a VIF of 10, which means that the variable could be considered as a linear combination of other independent variables. We ran two regressions separately, checking for robust standard errors (to control for heteroskedasticity).

Based on the results of the OLS models provided in Table 3, it is noted that the coefficients of all variables based on the relationship between local economic growth and fiscal decentralization are positive and statistically significant as predicted by our hypothesis.

In our study, total local expenditure (SNG_EXP) GDP determines a significantly positive relationship with GDP, which we conclude that local economic growth is influenced by the effective capacity of local authorities to make expenditures. Under these conditions, as much as local governments make expenditures on account of any kind of transfers as small as possible, it demonstrates a representative capacity for self-management because local spending is covered by own revenues. Literature demonstrates that a high independency of local authorities to transfers determine their ability to remain financially stable (Thiessen 2003).

There are previous studies based on the use of various methodologies applied for evaluating the relationship between fiscal decentralization and economic growth, conclude in particular a positive relationship (Carniti et al. 2019; Ebel and Yilmaz 2004; Gemmell et al. 2013; Iimi 2005; Rodríguez-Pose and Krøijer 2009; Slavinskaitė 2017; Satoła et al. 2019), which justifies the logical reason for the decentralization process itself.

6. Conclusions

This study has successfully answered to the research paper aims, respectively to examine whether the status of fiscal decentralization generates efficiency in local spending and leads to local fiscal performance and local economic growth. The methodological background includes qualitative sequential methodology, involving empiric analysis that provides coherence and viability for our study, but also quantitative methods, including Ordinary Least Squares regression (OLS). The empirical results show that fiscal decentralization determines more responsible and efficient local spending, enhancing local performance and contributing to economic growth. Furthermore, the analysis provides evidence on the importance of local fiscal consolidation and gives an overview in terms of spending responsibilities between the central government and local government. The empirical findings highlight the tendency to reduce the level of grants and to increase financial autonomy towards the end of the period in the analysis (2000–2020). Bucharest has the highest level of the coefficient of vertical imbalances, closer to one, being the most autonomous local government in Romania, followed by Arges, Brașov, Cluj, Constanța, Ilfov, Sibiu and Timiș, especially in the second half of the period. There is a tendency of local authorities to identify opportunities to increase own revenues, simultaneously through a better collection of them and through the development process of the counties based on the development of the business environment, the real estate development and the increase in the car park at the level of residents and legal entities. Based on these results, vertical imbalance can be seen as an appropriate or desirable policy goal.

Regarding horizontal disparities, counties show large differences in the capacity of counties to generate own revenues reflected by local taxes and fees, and also by alternative sources of revenue formation (such as revenues from European funds or even loans). The Romanian Court of Accounts identifies a series of irregularities at the county level and based on them the management of public and private assets should be improved.

The quality of local government for sustainable development is also reflected by the GDP per capita and the subnational government expenditure responsibility established by the share of subnational government expenditure in general government expenditure. According to database, the outlying county is Bucharest, and the authors plot the prediction from a quadratic regression. They add a confidence interval for the other 41 counties, where a high deviation presents Ilfov County. Despite a representative GDP per capita, local public spending is minimal because of a favorable economic framework that has in view the stimulation of the commercial companies and the attraction of new investments aimed at the improvement of the economic activity of the county. There are counties with a high GDP per capita, but with a minimum provision of public services (Gorj, Alba), or counties with low level of GDP per capita, but with a significant level of local public spending (Iasi). Fitted values or very low deviation presents Ialomița, Harghita, Caraș-Severin, Hunedoara, Argeș and Prahova; and a high level of fiscal responsibility is registered in Timis, Constanța, Cluj, Prahova, Brasov, Bihor and Iasi.

Subsequently, the study presents scientific proof of the association between subnational economic progress and fiscal decentralization. Using OLS approach, highlight the state of fiscal decentralization as a more responsible and effective form of governance that has contributed to economic growth for Romanian counties from 2005 to 2018. The obtained results highlight the fact that fiscal decentralization determines a more responsible and efficient local spending and local performance, contributing to the economic growth. The good subnational governance is seen as the capability of the local authorities to exert their power and to assure the quality of life for its local citizens. Overall, the findings lead to the conclusion that fiscal decentralization requires the appropriate delegation of authority to correspond with expenditure obligations and the administrative and policy competence to carry them out.

Author Contributions

Conceptualization, M.O., I.B., E.C. and A.F.V.; methodology, M.O., I.B., E.C. and A.F.V.; software, M.O., I.B., E.C. and A.F.V.; validation, M.O., I.B., E.C. and A.F.V.; formal analysis, M.O., I.B., E.C. and A.F.V.; investigation, M.O., I.B., E.C. and A.F.V.; resources, M.O., I.B., E.C. and A.F.V.; data curation, M.O., I.B., E.C. and A.F.V.; writing—original draft preparation, M.O., I.B., E.C. and A.F.V.; writing—review and editing, M.O., I.B., E.C. and A.F.V.; visualization, M.O., I.B., E.C. and A.F.V.; supervision, M.O., I.B., E.C. and A.F.V.; project administration, M.O., I.B., E.C. and A.F.V.; funding acquisition, M.O., I.B., E.C. and A.F.V. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alfada, Anisah. 2019. Does Fiscal Decentralization Encourage Corruption in Local Governments? Evidence from Indonesia. Journal of Risk and Financial Management 12: 118. [Google Scholar] [CrossRef]

- Bahl, Roy W., and Shyam Nath. 1986. Public Expenditure Decentralization in Developing Countries. Environment and Planning C: Government and Policy 4: 405–18. [Google Scholar] [CrossRef]

- Beramendi, Pablo. 2003. Political Institutions and Income Inequality: The Case of Decentralization. Markets and Political Economy Working Paper No. SP II 2003-09. Berlin: Wissenschaftszentrum Berlin. [Google Scholar]

- Bird, Richard M., and Andrey V. Tarasov. 2002. Closing the Gap: Fiscal Imbalances and Intergovernmental Transfers in Developed Federations. WP 02/02, International Studies Program. Atlanta: Andrew Young School of Policy Studies, Georgia State University. [Google Scholar]

- Bird, Richard M., and Andrey V. Tarasov. 2004. Closing the gap: Fiscal imbalances and intergovernmental transfers in developed federations. Environment and Planning C: Government and Policy 22: 77–102. [Google Scholar] [CrossRef]

- Bonomi Savignon, Andrea, Lorenzo Costumato, and Benedetta Marchese. 2019. Performance Budgeting in Context: An Analysis of Italian Central Administrations. Administrative Sciences 9: 79. [Google Scholar] [CrossRef]

- Bostan, Ionel, Andrei-Alexandru Morosan, Cristian-Valentin Hapenciuc, Pavel Stanciu, and Iulian Condratov. 2022. Are Structural Funds a Real Solution for Regional Development in the European Union? A Study on the Northeast Region of Romania. Journal of Risk and Financial Management 15: 232. [Google Scholar] [CrossRef]

- Bostan, Ionel, Carmen Toderașcu, and Anca Florentina Gavriluţă. 2018. Challenges and Vulnerabilities on Public Finance Sustainability. A Romanian Case Study. Journal of Risk and Financial Management 11: 55. [Google Scholar] [CrossRef]

- Brezovnik, Boštjan. 2008. Decentralization in theory and practice. Lex Localis 6: 87–103. [Google Scholar] [CrossRef]

- Carniti, Elena, Floriana Cerniglia, Riccarda Longaretti, and Alessandra Michelangeli. 2019. Decentralization and economic growth in Europe: For whom the bell tolls. Regional Studies 53: 775–89. [Google Scholar] [CrossRef]

- Choi, NakHyeok. 2021. Analyzing Local Government Capacity and Performance: Implications for Sustainable Development. Sustainability 13: 3862. [Google Scholar] [CrossRef]

- Constitution of Romanian. 2003. Available online: https://www.presidency.ro/en/the-constitution-of-romania (accessed on 27 September 2022).

- Costea, Ioana Maria. 2013. Financial Crisis and Insolvency of Administrative-Territorial units. Journal Analele Științifice ale Universității “Alexandru Ioan Cuza” Iași. Seria Științe Juridice 59: 121–30. [Google Scholar]

- Costea, Ioana Maria. 2020. Budgetary Premises of Local Autonomy and Descentralisation. Journal Analele Științifice ale Universității “Alexandru Ioan Cuza” Iași. Seria Științe Juridice 66: 325–42. [Google Scholar]

- Cowell, Frank A. 2011. Measuring Inequality, 3rd ed. LSE Perspectives in Economic Analysis. New York: Oxford University Press. [Google Scholar]

- DFPLB/Directorate for Fiscal Policies and Local Budgeting under Ministry of Regional Development and Public Administration and European Grants. 2021. Statement of Revenue and Expenditure of Administrative-Territorial Units. Available online: http://www.dpfbl.mdrap.ro/sit_ven_si_chelt_uat.html (accessed on 12 August 2022).

- Donahue, Amy Kneedler, Sally Coleman Selden, and Patricia W. Ingraham. 2000. Measuring Government Management Capacity: A Comparative Analysis of City Human Resources Management Systems. Journal of Public Administration Research and Theory 10: 381–412. [Google Scholar] [CrossRef]

- Ebel, Robert, and Serdar Yilmaz. 2004. On the Measurement and Impact of Fiscal Decentralization. Washington, DC: Urban Institute. [Google Scholar]

- European Commision. 2021. Eurostat. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 14 August 2022).

- Ezcurra, Roberto, and Pedro Pascual. 2008. Fiscal decentralization and regional disparities: Evidence from several European Union countries. Environment and Planning A: Economy and Space 40: 1185–201. [Google Scholar] [CrossRef]

- Galizzi, Giovanna, Gaia Viviana Bassani, and Cristiana Cattaneo. 2018. Adoption of Gender-Responsive Budgeting (GRB) by an Italian Municipality. Administrative Sciences 8: 68. [Google Scholar] [CrossRef]

- Gavriluțǎ (Vatamanu), Anca Florentina, Mihaela Onofrei, and Elena Cigu. 2020. Fiscal Decentralization and Inequality: An Analysis on Romanian Regions. Ekonomický Časopis 68: 3–32. [Google Scholar]

- Gemmell, Norman, Eichard Kneller, and Ismael Sanz. 2013. Fiscal Decentralization and Economic Growth: Spending versus Revenue Decentralization. Economic Inquiry 51: 1915–31. [Google Scholar] [CrossRef]

- Hajilou, Mehran, Mohammad Mirehei, Sohrab Amirian, and Mehdi Pilehvar. 2018. Financial Sustainability of Municipalities and Local Governments in Small-Sized Cities; a Case of Shabestar Municipality. Lex Localis 16: 77–106. [Google Scholar] [CrossRef]

- Hofman, Bert, and Susana Cordeiro Guerra. 2007. Ensuring Inter-Regional Equity and Poverty Reduction. In Fiscal Equalization. Edited by Jorge Martinez-Vazquez and Bob Searle. Boston: Springer. [Google Scholar] [CrossRef]

- Hunter, James Stuart Hardy. 1974. Vertical intergovernmental financial imbalance: A framework for evaluation. Finanzarchiv 2: 481–92. [Google Scholar]

- Hunter, James Stuart Hardy. 1977. Federalism and Fiscal Balance. Canberra: Australian National University Centre for Research on Federal Financial Relations. [Google Scholar]

- Iimi, Atsushi. 2005. Decentralization and Economic Growth Revisited: An Empirical Note. The Journal of Urban Economics 57: 449–61. [Google Scholar] [CrossRef]

- Kowalik, Paweł. 2015. Horizontal fiscal imbalance in Germany. Business and Economic Horizons 11: 1–13. [Google Scholar] [CrossRef]

- Kowalik, Paweł. 2016. Measurement of vertical fiscal imbalance in Germany. Argumenta Oeconomica 2: 131–46. [Google Scholar] [CrossRef]

- Law No. 215 on Local Government. 2001. Available online: https://edirect.e-guvernare.ro/Uploads/Legi/11683/Legea%20215%20din%202001%20actualizata.pdf (accessed on 25 September 2022).

- Li, Shantong, and Zhaoyuan Xu. 2008. The Trend of Regional Income Disparity in the People’s Republic of China. ADB Institute Discussion Paper No. 85. Tokyo: Asian Development Bank Institute. Available online: http://www.adbi.org/discussionpaper/2008/01/25/2468.regional.income.disparity.prc/ (accessed on 16 August 2022).

- Lisbon Treaty. 2007. Treaty of Lisbon Amending the Treaty on European Union and the Treaty Establishing the European Community, Signed at Lisbon. OJ C 306: 271. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A12007L%2FTXT (accessed on 28 September 2022).

- Lockwood, Ben. 2005. Fiscal Decentralization: A Political Economy Perspective. Warwick Economic Research Papers No. 721. Coventry: University of Warwick, Department of Economics, pp. 1–35. Available online: http://wrap.warwick.ac.uk/274/ (accessed on 18 August 2022).

- Lukáč, Jozef, Katarína Teplická, Katarína Čulková, and Daniela Hrehová. 2021. Evaluation of the Financial Performance of the Municipalities in Slovakia in the Context of Multidimensional Statistics. Journal of Risk and Financial Management 14: 570. [Google Scholar] [CrossRef]

- Mainali, Raju. 2021. Spatial Fiscal Interactions in Colombian Municipalities: Evidence from Oil Price Shocks. Journal of Risk and Financial Management 14: 248. [Google Scholar] [CrossRef]

- Martinez-Vazquez, Jorge, and Jameson Boex. 1999. The Design of Equalization Grants: Theory and Applications. Part One: “Theory and Concepts”. Washington, DC: World Bank Institute, Andrew Young School of Policy Studies, Georgia State University. [Google Scholar]

- Martinez-Vazquez, Jorge, and Jameson Boex. 2001. Russia’s Transition to a New Federalism. Washington, DC: The World Bank. [Google Scholar]

- Martinez-Vazquez, Jorge, and Robert M. McNab. 2003. Fiscal decentralization and economic growth. World Development 31: 1597–1616. [Google Scholar] [CrossRef]

- Morariu, Alunica, Marian Ionel, and Emil Raul Mihailescu. 2010. Legal Regime Applicable to Local Budget’s Execution. Ovidius University Annals, Economic Sciences Series, Ovidius University of Constantza 10: 734–39. [Google Scholar]

- Morgan, Kevin. 2002. English question: Regional perspectives on a fractured nation. Regional Studies 36: 797–810. [Google Scholar] [CrossRef]

- Oates, Wallace E. 1972. Fiscal Federalism. New York: Harcourt Brace Jovanovich. [Google Scholar]

- Oates, Wallace E. 1993. Fiscal Decentralization and Economic Development. National Tax Journal 46: 237–43. [Google Scholar] [CrossRef]

- OECD. 2009. Taxes and Grants: On the Revenue Mix of Sub-Central Governments. Working Paper No. 7. Paris: Organization for Economic Cooperation and Development. [Google Scholar]

- Onofrei, Mihaela, Anca Gavriluţă, Ionel Bostan, Florin Oprea, Gigel Paraschiv, and Cristina Mihaela Lazăr. 2020. The Implication of Fiscal Principles and Rules on Promoting Sustainable Public Finances in the EU Countries. Sustainability 12: 2772. [Google Scholar] [CrossRef]

- Onofrei, Mihaela, Ionel Bostan, Bogdan Narcis Firtescu, Angela Roman, and Valentina Diana Rusu. 2022. Public Debt and Economic Growth in EU Countries. Economies 10: 254. [Google Scholar] [CrossRef]

- Oplotnik, Žan, and Boštjan Brezovnik. 2004. Financing Local Government in Theory and Practice: Short Lesson from Slovenia. Zagreb International Review of Economics & Business 7: 75–93. Available online: https://hrcak.srce.hr/35615 (accessed on 23 August 2022).

- Oplotnik, Žan, Boštjan Brezovnik, and Borut Vojinović. 2012. Local Self-Government Financing and Costs of Municipality in Slovenia. Transylvanian Review of Administrative Sciences 37: 128–42. [Google Scholar]

- Oprea, Florin, Irina Bilan, and Ovidiu Stoica. 2012. Fiscal Vulnerability and Economic Crisis—Romanian Lessons. In Innovation and Sustainable Economic Competitive Advantage. From Regional Development to World Economies. Proceedings of the 18th International Business Information and Management Association, Istanbul, Turkey, 9–10 May 2012. Edited by Khalid S. Soliman. Norristown: IBIMA Publishing, pp. 1795–806. ISBN 978-0-9821489-7-6. [Google Scholar]

- Oprea, Florin, Seyed Mehdian, and Ovidiu Stoica. 2013. Fiscal and Financial Stability in Romania—An Overview. Transylvanian Review of Administrative Sciences 40: 159–82. Available online: https://rtsa.ro/tras/index.php/tras/article/view/148/144 (accessed on 25 September 2022).

- Papcunová, Viera, Jarmila Hudáková, Michaela Štubnová, and Marta Urbaníková. 2020. Revenues of Municipalities as a Tool of Local Self-Government Development (Comparative Study). Administrative Sciences 10: 101. [Google Scholar] [CrossRef]

- Peterson, Paul E. 1995. The Price of Federalism. Washington, DC: Brookings Institution. [Google Scholar]

- Prud’homme, Rémy. 1995. The Dangers of Decentralization. The World Bank Research Observer 10: 201–20. Available online: http://documents.worldbank.org/curated/en/602551468154155279/The-dangers-of-decentralization (accessed on 4 August 2022).

- Rodríguez-Pose, Andrés, and Anne Krøijer. 2009. Fiscal Decentralization and Economic Growth in Central and Eastern Europe. Growth and Change: A Journal of Urban and Regional Policy 40: 387–417. [Google Scholar] [CrossRef]

- Rodríguez-Pose, Andrés, and Roberto Ezcurra. 2010. Does decentralization matter for regional disparities? A cross-country analysis. Journal of Economic Geography 10: 619–44. [Google Scholar] [CrossRef]

- Romanian Court of Accounts. 2021. Local Public Finance Reports 2019. Bucharest: Romanian Court of Accounts. Available online: https://www.curteadeconturi.ro/publicatii/65-rapoarte-privind-finantele-publice-locale/67-rapoartele-privind-finantele-publice-locale-2019 (accessed on 17 August 2022).

- Romanian National Institute of Statistics. 2021. Database. Available online: http://statistici.insse.ro:8077/tempo-online (accessed on 16 August 2022).

- Sacchi, Agnese, and Simone Salotti. 2011. Income Inequality, Regional Disparities, and Fiscal Decentralization in Industrialized Countries. Roma: Collana del Dipartemento di Economia, Universita degli Studi Roma. [Google Scholar]

- Satoła, Lukasz, Aldona Standar, and Agnieszka Kozera. 2019. Financial Autonomy of Local Government Units: Evidence from Polish Rural Municipalitie. Lex Localis-Journal of Local Self-Government 17: 321–42. [Google Scholar] [CrossRef]

- Schneider, Aaron. 2003. Decentralization: Conceptualization and measurement. Studies in Comparative International Development 38: 32–56. [Google Scholar] [CrossRef]

- Schroeder, Larry, and Paul Smoke. 2003. Intergovernmental Fiscal Transfers: Concepts, International Practice and Policy Issues. In Intergovernmental Fiscal Transfers in Asia: Current Practice and Challenges for the Future. Edited by Paul Smoke and Yun-Hwan Kim. Mandaluyong City: Asian Development Bank, pp. 20–59. [Google Scholar]

- Sepulveda, Cristian, and Jorge Martinez-Vazquez. 2011. The Consequences of Fiscal Decentralization on Poverty and Income Inequality. Environment and Planning C: Politics and Space 29: 321–43. [Google Scholar] [CrossRef]

- Shankar, Raja, and Anwar Shah. 2001. Bridging the Economic Divide within Nations: A Scorecard on the Performance of Regional Policies in Reducing Regional Income Disparities. Policy Research Paper 2717. Washington, DC: World Bank. [Google Scholar]

- Slavinskaitė, Neringa. 2017. Fiscal decentralization and economic growth in selected European countries. Journal of Business Economics and Management 18: 745–57. [Google Scholar] [CrossRef]

- Thiessen, Ulrich. 2003. Fiscal decentralization and economic growth in high income OECD countries. Fiscal Studies 24: 237–74. [Google Scholar] [CrossRef]

- Tiebout, Charles M. 1956. A Pure Theory of Local Expenditures. The Journal of Political Economy 64: 416–24. [Google Scholar] [CrossRef]

- Tselios, Vassilis, Andrés Rodríguez-Pose, Andy Pike, John Tomaney, and Gianpiero Torrisi. 2012. Income Inequality, Decentralization, and Regional Development in Western Europe. Environment and Planning A: Economy and Space 44: 1278–301. [Google Scholar] [CrossRef]

- United Nations/Development Programme. 2012. Sustainable Development Goals. New York: United Nations. Available online: https://www.undp.org/sustainable-development-goals (accessed on 29 September 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).