Analyzing Greece 2010 Memorandum’s Impact on Macroeconomic and Financial Figures through FCM

Abstract

1. Introduction

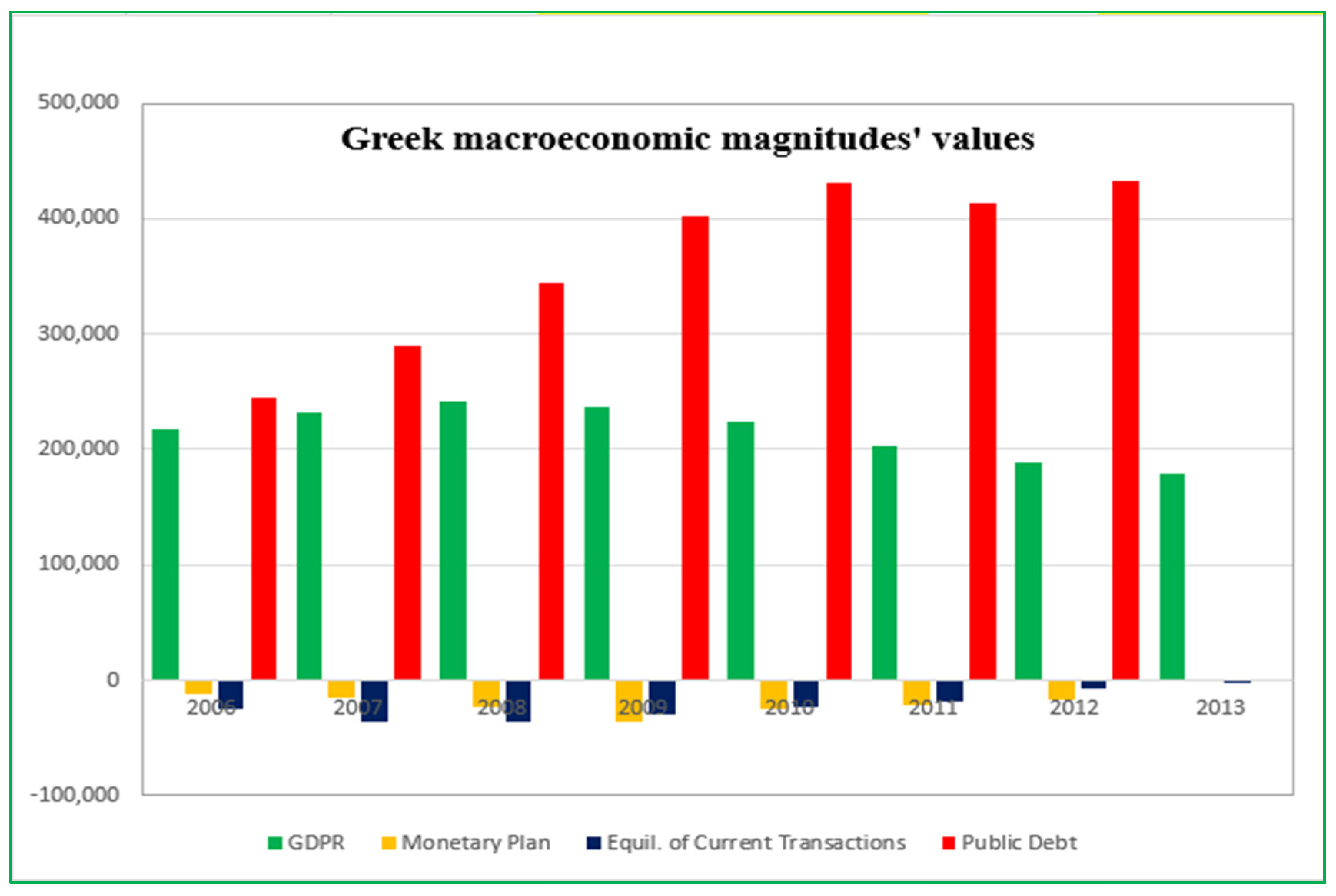

1.1. Analysis of Greece’s Macroeconomic Imbalances and Causes of the Debt Crisis

1.2. Financial Support Mechanism and 2010 Memorandum’s Fiscal Consolidation Measures

1.3. EU and ECB Fiscal and Monetary Policies’ Effect on the Greek Economy

1.4. Research Motivations

1.5. Approach of the Study

2. Materials and Methods

2.1. Research Hypotheses

2.2. Sample Selection and Data Retrieval

3. Results

3.1. Linear Regression Models

3.2. Diagnostic and Exploratory Model

3.3. FCM Simulation Model

3.3.1. Pre-Crisis Scenario (2006–2009)

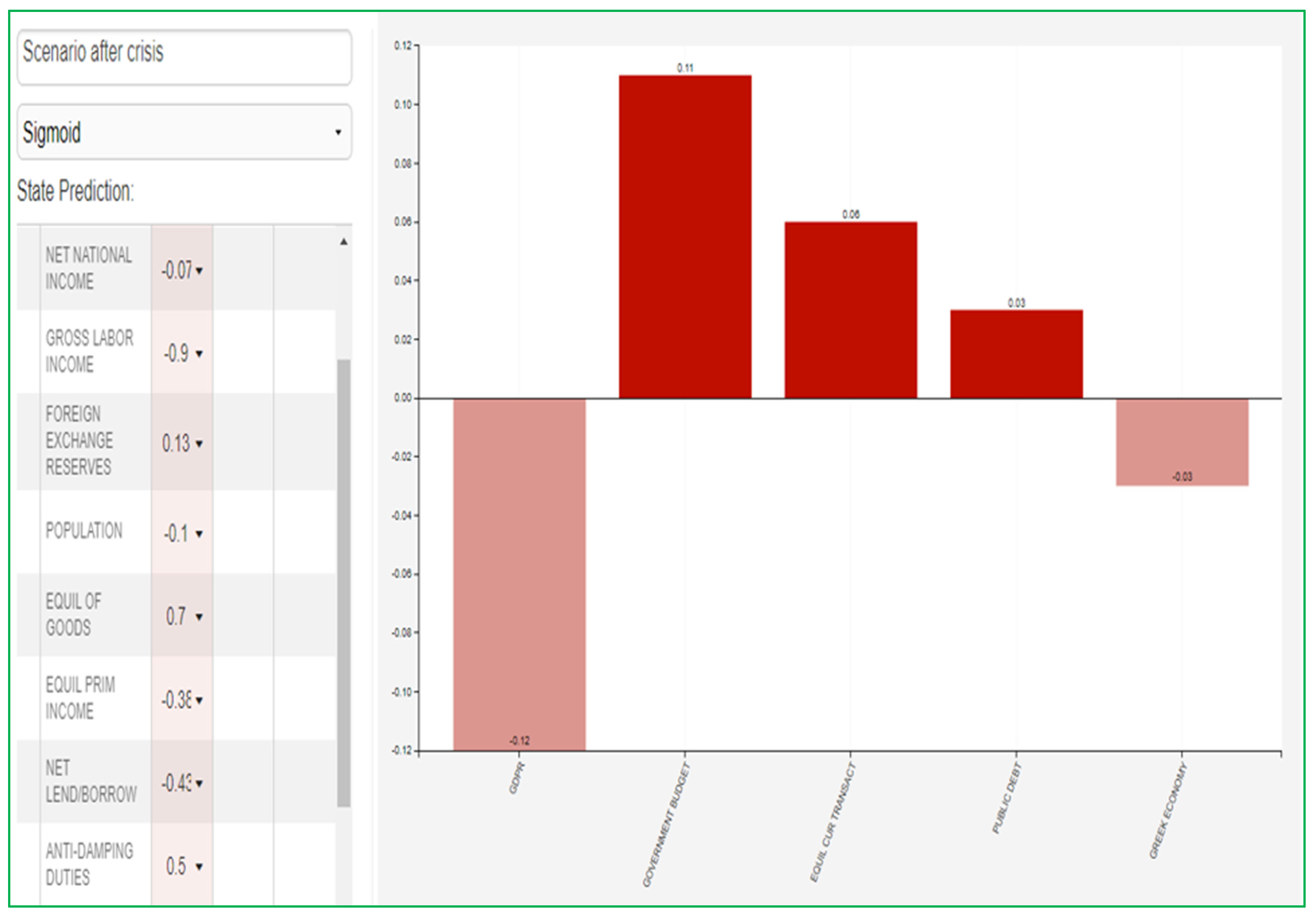

3.3.2. After Memorandum Measures Imposition Scenario (2010–2012)

4. Discussion

5. Conclusions

6. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdulhamed, Mohamed A., Hadeel I. Mustafa, and Zainab I. Othman. 2021. A hybrid analysis model supported by machine learning algorithm and multiple linear regression to find reasons for unemployment of programmers in Iraq. TELKOMNIKA Telecommunication, Computing, Electronics and Control 19: 444–53. [Google Scholar] [CrossRef]

- Angeletos, George-Marios, and Harris Dellas. 2013. Greece and the euro. In Beyond Austerity: Reforming the Greek Economy. Cambridge: The MIT Press. [Google Scholar]

- Bakhtavar, Ezzeddin, Mahsa Valipour, Samuel Yousefi, Rehan Sadiq, and Kasun Hewage. 2021. Fuzzy cognitive maps in systems risk analysis: A comprehensive review. Complex & Intelligent Systems 7: 621–37. [Google Scholar] [CrossRef]

- Baldwin, R. E., C. Wyplosz, and C. Wyplosz. 2006. The Economics of European Integration. Chicago: McGraw-Hill Education. [Google Scholar]

- Beckmann, Joscha, and Robert Czudaj. 2017a. Capital flows and GDP in emerging economies and global spillovers. Journal of Economic Behavior & Organization 142: 140–63. [Google Scholar] [CrossRef]

- Beckmann, Joscha, and Robert Czudaj. 2017b. Exchange rate expectations since the financial crisis: Performance evaluation and the role of monetary policy and safe haven. Journal of International Money and Finance 74: 283–300. [Google Scholar] [CrossRef]

- Beckmann, Joscha, and Robert Czudaj. 2017c. Exchange rate expectations and economic policy uncertainty. European Journal of Political Economy 47: 148–62. [Google Scholar] [CrossRef]

- Beckmann, Joscha, and Robert Czudaj. 2020. Fiscal policy uncertainty and its effects on the real economy: German evidence. In Chemnitz Economic Papers, No. 039. Chemnitz: Chemnitz University of Technology, Faculty of Economics and Business Administration. Available online: http://hdl.handle.net/10419/227622 (accessed on 5 May 2022).

- Bieler, Andreas, Jamie Jordan, and Adam David Morton. 2019. EU aggregate demand as a way out of crisis? Engaging the post-keynesian critique. Journal of Common Market Studies 57: 805–22. [Google Scholar] [CrossRef]

- BIS. 2010. Quarterly Review. Bank of International Settlements. Basel. Available online: https://www.bis.org/publ/qtrpdf/r_qt1006.pdf (accessed on 23 August 2021).

- Blanchard, Olivier J., and Daniel Leigh. 2013. Growth Forecast Errors and Fiscal Multipliers. In IMF Working Paper No. 13/1. Washington, DC: International Monetary Fund. [Google Scholar] [CrossRef]

- Blanchard, Olivier, and Francesco Giavazzi. 2002. Current account deficits in the euro area: The end of the Feldstein–Horioka puzzle? Brookings Papers on Economic Activity 33: 147–86. [Google Scholar] [CrossRef]

- Cini, Michelle, and Nieves Pérez-Solórzano Borragán. 2016. European Union Politics. Oxford: Oxford University Press. [Google Scholar]

- Clifton, Judith, Daniel Diaz-Fuentes, and Ana Lara Gómez. 2018. The crisis as opportunity? On the role of the Troika in constructing the European consolidation state. Cambridge Journal of Regions, Economy and Society 11: 587–608. [Google Scholar] [CrossRef]

- Costa, Leonardo, Nuno Ornelas Martins, and Francisca Guedes de Oliveira. 2016. Portugal’s bailout and the crisis of the European Union from a capability perspective. Cambridge Journal of Economics 40: 1479–96. [Google Scholar] [CrossRef]

- Dellas, Harris, and George S. Tavlas. 2013. The Gold Standard, the Euro, and the Origins of the Greek Sovereign Debt Crisis. Cato Journal 33: 491–520. Available online: https://EconPapers.repec.org/RePEc:cto:journl:v:33:y:2013:i:3:p:491-520 (accessed on 15 October 2021).

- Ehrmann, Michael, Chiara Osbat, Jan Stráský, and Lenno Uusküla. 2013. The Euro Exchange Rate during the European Sovereign Debt Crisis—Dancing to Its Own Tune? ECB Working Paper No. 1532. Available online: http://hdl.handle.net/10419/153965 (accessed on 15 October 2021).

- Eichengreen, B. 1996. Globalizing Capital: A History of the International Monetary System. Princeton: Princeton University Press. [Google Scholar]

- ELSTAT. 2022. Available online: www.statistics.gr (accessed on 20 September 2021).

- European Commission. 2010. The Economic Adjustment Programme for Greece. In Directorate-General for Economic and Financial Affairs Occasional Papers 61. Brussels: European Commission. [Google Scholar]

- EUROSTAT. 2022. Available online: www.etc.europa.eu/eurostat (accessed on 20 September 2021).

- Fernandez-Villaverde, Jesús, Luis Garicano, and Tano Santos. 2013. Political Credit Cycles: The Case of the Euro Zone. Journal of Economic Perspectives 27: 145–66. [Google Scholar] [CrossRef]

- Forbes, Kristin, Marcel Fratzscher, and Roland Straub. 2015. Capital-flow management measures: What are they good for? Journal of International Economics 96: 76–97. [Google Scholar] [CrossRef]

- Freedman, David A. 2009. Statistical Models: Theory and Practice. Cambridge: Cambridge University Press. [Google Scholar]

- Friedman, M. 2007. An interview with Milton Friedman. Interviewed by John B. Taylor, May 2000. In Inside the Economist’s Mind. Conversations with Eminent Economists. Edited by P. Samuelson and W. Barnett. Oxford: Blackwell. [Google Scholar]

- Galenianos, Manolis. 2015. The Greek crisis: Origins and implications, The crisis observatory. In Research Paper 16. Athens: Hellenic Foundation for European and Foreign Policy (ELIAMEP). [Google Scholar]

- Gini, Larisa A. 2015. The Use of Fuzzy Cognitive Maps for the Analysis of Structure of Social and Economic System for the Purpose of Its Sustainable Development. Mediterranean Journal of Social Sciences 6: 5. [Google Scholar] [CrossRef]

- Gomila, Robin. 2021. Logistic or linear? Estimating causal effects of experimental treatments on binary outcomes using regression analysis. Journal of Experimental Psychology: General 150: 700–9. [Google Scholar] [CrossRef] [PubMed]

- Honkapohja, Seppo. 2014. The euro area crisis: A view from the North. Journal of Macroeconomics 39: 260–71. [Google Scholar] [CrossRef]

- Kalemli-Ozcan, Sebnem, Elias Papaioannou, and José-Luis Peydró. 2010. What lies beneath the euro’s effect on financial integration? Currency risk, legal harmonization, or trade? Journal of International Economics 81: 75–88. [Google Scholar] [CrossRef]

- Katsimi, Margarita, and Thomas Moutos. 2010. EMU and the Greek crisis: The political-economy perspective. European Journal of Political Economy 26: 568–76. [Google Scholar] [CrossRef]

- Kosko, Bart. 1986. Fuzzy cognitive maps. International Journal of Man-Machine Studies 24: 65–75. [Google Scholar] [CrossRef]

- Krugman, Paul. 1991. Increasing Returns and Economic Geography. Journal of Political Economy 99: 48–99. [Google Scholar] [CrossRef]

- Krugman, Paul. 2012. Revenge of The Optimum Currency Area. NBER Macroeconomics Annual 27: 439–48. [Google Scholar] [CrossRef]

- Kumari, Khushbu, and Suniti Yadav. 2018. Linear regression analysis study. Journal of the Practice of Cardiovascular Sciences 4: 33–36. [Google Scholar] [CrossRef]

- Lall, Sanjaya. 1974. Oligopolistic reaction and multinational enterprise: By F.T. Knickerbocker. (Boston: Harvard University School of Business Administration, 1973. pp. xiii + 236. £4.00. agents in the UK: Bailey Bros. and Swinfen Ltd.). World Development 2: 84–85. [Google Scholar] [CrossRef]

- Lim, Darren J., Michalis Moutselos, and Michael McKenna. 2018. Puzzled out? The unsurprising outcomes of the Greek bailout negotiations. Journal of European Public Policy 26: 325–43. [Google Scholar] [CrossRef]

- Markantonatou, Maria. 2013. Diagnosis, Treatment, and Effects of the Crisis in Greece: A “Special Case” or a “Test Case”? MPIfG Discussion Paper 13/3. Available online: https://pure.mpg.de/rest/items/item_1719746/component/file_1719744/content (accessed on 16 July 2022).

- MentalModeler. 2022. Available online: https://dev.mentalmodeler.com/ (accessed on 15 October 2021).

- Micossi, Stefano. 2015. The Monetary Policy of the European Central Bank (2002–2015). Centre for European Policy Studies. Available online: https://www.ceps.eu/ceps-publications/monetary-policy-european-central-bank-2002-2015/ (accessed on 23 August 2021).

- Neocleous, Costas, and Christos N. Schizas. 2012. Modeling Socio-politico-economic Systems with Time-dependent Fuzzy Cognitive Maps. Paper presented at WCCI 2012 IEEE World Congress on Computational Intelligence, Brisbane, Australia, June 10–15; Available online: https://web.archive.org/web/20170830001521id_/https://www8.cs.ucy.ac.cy/projects/fcmdss/Modeling%20Socio-politico-economic%20Systems%20with%20Time-dependent%20Fuzzy%20Cognitive%20Maps.pdf (accessed on 14 July 2022).

- Nettleton, David. 2014. Chapter 6—Selection of Variables and Factor Derivation. In Commercial Data Mining. Processing, Analysis and Modeling for Predictive Analytics Projects. Burlington: Morgan Kaufmann, pp. 79–104. [Google Scholar] [CrossRef]

- Papageorgiou, Elpiniki, and Areti Kontogianni. 2012. Using Fuzzy Cognitive Mapping in Environmental Decision Making and Management: A Methodological Primer and an Application. In International Perspectives on Global Environmental Change. Edited by Stephen Young. pp. 427–450, 10.5772/29375. Available online: https://www.intechopen.com/chapters/27194 (accessed on 25 September 2021).

- Papageorgiou, Elpiniki, Chrysostomos Stylios, and Peter Groumpos. 2003. Fuzzy Cognitive Map Learning Based on Nonlinear Hebbian Rule. In Advances in Artificial Intelligence. Lecture Notes in Computer Science. Berlin/Heidelberg: Springer, vol. 2903. [Google Scholar] [CrossRef]

- Papastamkos, Georgios, and Angelos Kotios. 2011. Krise der Eurozone—Krise des Systems oder der Politik? Institut für Europäische Politik. Available online: http://www.iepberlin.de/fileadmin/website/09_Publikationen/Sonstige/2011-11-15_Eurozone__Papastamkos_Kotios (accessed on 23 August 2021).

- Porte, Caroline de la, Philippe Pochet, and Belgium Graham Room. 2001. Social benchmarking, policy making and new governance in the EU. Journal of European Social Policy 11: 291–307. [Google Scholar] [CrossRef]

- Provopoulos, George. 2014. The Greek economy and banking system: Recent developments and the way forward. Journal of Macroeconomics 39: 240–49. [Google Scholar] [CrossRef]

- Quaglia, Lucia, Robert Eastwood, and Peter Holmes. 2009. The Financial Turmoil and EU Policy Cooperation in 2008. Journal of Common Market Studies 47: 63–87. [Google Scholar] [CrossRef]

- Rathgeb, Philip, and Arianna Tassinari. 2020. How the Eurozone disempowers trade unions: The political economy of competitive internal devaluation. Socio-Economic Review 20: 323–50. [Google Scholar] [CrossRef]

- Revuelta, Julio. 2021. The Effects of the Economic Adjustment Programmes for Greece: A Quasi-Experimental Approach. Sustainability 13: 4970. [Google Scholar] [CrossRef]

- Sakas, Damianos P., Ioannis Dimitrios G. Kamperos, Dimitrios P. Reklitis, Nikolaos T. Giannakopoulos, Dimitrios K. Nasiopoulos, Marina C. Terzi, and Nikos Kanellos. 2022. The Effectiveness of Centralized Payment Network Advertisements on Digital Branding during the COVID-19 Crisis. Sustainability 14: 3616. [Google Scholar] [CrossRef]

- Savelyev, Yevhen, Nataliya Komar, Evangelos Siskos, and Konstantia Darvidou. 2019. Greece: A European Mechanism of the Exit from the Crisis. Journal of European Economy 18: 31–53. [Google Scholar] [CrossRef][Green Version]

- Shapiro, Samuel Sanford, and Martin B. Wilk. 1965. An analysis of variance test for normality (complete samples). Biometrika 52: 591–611. [Google Scholar] [CrossRef]

- Sharif, Amir M., and Zahir Irani. 2006. Applying a Fuzzy-morphological Approach to Complexity within Management Decision Making. Management Decision 44: 930–61. [Google Scholar] [CrossRef]

- Simou, Effie, and Eleni Koutsogeorgou. 2014. Effects of the economic crisis on health and healthcare in Greece in the literature from 2009 to 2013: A systematic review. Health Policy 115: 111–19. [Google Scholar] [CrossRef] [PubMed]

- Siskos, E., and A. Rogach. 2014. Global Economy: Issues and Challenges of Post-Crisis Development. Technological Educational Institute of Western Macedonia 6: 105–22. Available online: https://www.researchgate.net/publication/361865655_Global_Economy_Issues_and_Challenges_of_Post-Crisis_Development (accessed on 10 August 2021).

- Swiston, Andrew J. 2005. A Global View of the U.S. Investment Position. IMF Working Papers 2005: 24. [Google Scholar] [CrossRef]

- van Vliet, Mathijs, Kasper Kok, and Tom Veldkamp. 2010. Linking stakeholders and modellers in scenario studies: The use of Fuzzy Cognitive Maps as a communication and learning tool. Futures 42: 1–14. [Google Scholar] [CrossRef]

- Wolf, M. 2013. Why the Euro Crisis Is Not Yet Over. Available online: https://www.ft.com/content/74acaf5c-79f2-11e2-9dad-00144feabdc0 (accessed on 23 August 2021).

- Zartaloudis, Sotirios. 2013. Greece and the recent financial crisis: Meltdown or configuration? In The Politics of Financial Crisis Since 1980. Edited by F. Panizza and G. Phillip. London: Routledge. [Google Scholar]

| Variables | Min | Max | Mean | St. Deviation |

|---|---|---|---|---|

| Equil. of Current Transactions | −36,566 | −1318 | −14,000.56 | 11,815.63 |

| Public Debt | 162,937 | 442,613 | 366,527.74 | 100,185.82 |

| Government Budget | −35,981 | 2099 | −12,836.56 | 10,603.17 |

| GDPR | 93,064 | 241,990 | 175,306.4 | 39,804.9 |

| GDPR | Government Budget | Public Debt | Equil. of Current Transactions | Population | Net National Income | Equilibrium of Goods | Equil. of Primary Income | Antidamping Duties | Net Lending/Borrowing | Gross Labor Income | Foreign Exchange Reserves | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GDPR | 1 | −0.733 ** | −0.195 | −0.916 ** | 0.877 ** | 0.997 ** | −0.874 ** | −0.914 ** | 0.428 * | −0.679 ** | 0.962 ** | −0.670 ** |

| Government Budget | −0.733 ** | 1 | −0.030 | 0.597 ** | −0.878 ** | −0.690 ** | 0.442 | 0.613 ** | −0.062 | 0.515 * | −0.761 ** | 0.539 * |

| Public Debt | −0.195 | −0.030 | 1 | 0.439 | −0.227 | −0.297 | 0.482 * | 0.158 | 0.825 ** | 0.507 * | −0.418 | 0.714 ** |

| Equil. of Current Transactions | −0.916 ** | 0.597 ** | 0.439 | 1 | −0.754 ** | −0.936 ** | 0.943 ** | 0.880 ** | 0.653 ** | 0.988 ** | −0.959 ** | 0.624 ** |

| Population | 0.877 ** | −0.878 ** | −0.227 | −0.754 ** | 1 | 0.868 ** | −0.588 * | −0.651 ** | 0.224 | −0.694 ** | 0.918 ** | −0.601 ** |

| Net National Income | 0.997 ** | −0.690 ** | −0.297 | −0.936 ** | 0.868 ** | 1 | −0.917 ** | −0.886 ** | 0.393 | −0.699 ** | 0.968 ** | −0.699 ** |

| Equilibrium of Goods | −0.874 ** | 0.442 | 0.482 * | 0.943 ** | −0.588 * | −0.917 ** | 1 | 0.791 ** | 0.585 * | 0.927 ** | −0.910 ** | 0.687 ** |

| Equil. of Primary Income | −0.914 ** | 0.613 ** | 0.158 | 0.880 ** | −0.651 ** | −0.886 ** | 0.791 ** | 1 | 0.347 | 0.840 ** | −0.839 ** | 0.508 * |

| Antidamping Duties | 0.428 * | −0.062 | 0.825 ** | 0.653 ** | 0.224 | 0.393 | 0.585 * | 0.347 | 1 | 0.586 * | 0.205 | 0.419 |

| Net Lending/Borrowing | −0.679 ** | 0.515 * | 0.507 * | 0.988 ** | −0.694 ** | −0.699 ** | 0.927 ** | 0.840 ** | 0.586 * | 1 | −0.817 ** | 0.586 * |

| Gross Labor Income | 0.962 ** | −0.761 ** | −0.418 | −0.959 ** | 0.918 ** | 0.968 ** | −0.910 ** | −0.839 ** | 0.205 | −0.817 ** | 1 | −0.767 ** |

| Foreign Exchange Reserves | −0.670 ** | 0.539 * | 0.714 ** | 0.624 ** | −0.601 ** | −0.699 ** | 0.687 ** | 0.508 * | 0.419 | 0.586 * | −0.767 ** | 1 |

| Variables | Standardized Coefficient | R2 | t-Test | F | p-Value |

|---|---|---|---|---|---|

| Constant | - | 0.852 | 2.688 | 8.268 | 0.024 * |

| Equilibrium of Goods | 2.275 | 4.428 | 0.003 ** | ||

| Net National Income | 3.195 | 4.581 | 0.003 ** | ||

| Net Lending/Borrowing | 1.536 | 2.875 | 0.024 * |

| Variables | Standardized Coefficient | R2 | t-Test | F | p-Value |

|---|---|---|---|---|---|

| Constant | - | 0.998 | 6.185 | 40.389 | 0.000 ** |

| Net Lending/Borrowing | 0.899 | 42.584 | 0.000 ** | ||

| Population | −0.134 | −6.355 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | t-Test | F | p-Value |

|---|---|---|---|---|---|

| Constant | - | 0.928 | 2.941 | 8.349 | 0.000 ** |

| Population | −0.549 | −3.415 | 0.009 ** | ||

| Foreign Exchange Reserves | 0.464 | 2.890 | 0.020 * |

| Variables | Standardized Coefficient | R2 | t-Test | F | p-Value |

|---|---|---|---|---|---|

| Constant | - | 0.998 | −7.400 | 9.446 | 0.028 * |

| Net National Income | 0.702 | 31.665 | 0.000 ** | ||

| Equil. of Primary Income | −0.132 | −21.419 | 0.000 ** | ||

| Population | 0.111 | 9.535 | 0.000 ** | ||

| Antidamping Duties | −0.024 | −4.325 | 0.008 ** | ||

| Gross Labor Income | 0.087 | 3.073 | 0.028 * |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Migkos, S.P.; Sakas, D.P.; Giannakopoulos, N.T.; Konteos, G.; Metsiou, A. Analyzing Greece 2010 Memorandum’s Impact on Macroeconomic and Financial Figures through FCM. Economies 2022, 10, 178. https://doi.org/10.3390/economies10080178

Migkos SP, Sakas DP, Giannakopoulos NT, Konteos G, Metsiou A. Analyzing Greece 2010 Memorandum’s Impact on Macroeconomic and Financial Figures through FCM. Economies. 2022; 10(8):178. https://doi.org/10.3390/economies10080178

Chicago/Turabian StyleMigkos, Stavros P., Damianos P. Sakas, Nikolaos T. Giannakopoulos, Georgios Konteos, and Anastasia Metsiou. 2022. "Analyzing Greece 2010 Memorandum’s Impact on Macroeconomic and Financial Figures through FCM" Economies 10, no. 8: 178. https://doi.org/10.3390/economies10080178

APA StyleMigkos, S. P., Sakas, D. P., Giannakopoulos, N. T., Konteos, G., & Metsiou, A. (2022). Analyzing Greece 2010 Memorandum’s Impact on Macroeconomic and Financial Figures through FCM. Economies, 10(8), 178. https://doi.org/10.3390/economies10080178