Assessment of Financial Development of Countries Based on the Matrix of Financial Assets

Abstract

:1. Introduction

2. Literature Review

- Methodological approaches use the same primary indicators and differ only in their grouping criteria (by markets and financial organizations—in the first approach and additionally by qualitative characteristics—in the second approach);

- Primary indicators are calculated mainly in relation to the gross domestic product (GDP). Gross domestic product is a measure widely used in macroeconomic research; however, it has certain disadvantages. In particular, the methods for calculating this indicator change periodically in different countries. At the same time, the adjustment of methods does not occur simultaneously in different countries and not in the same way. This makes the time series over a long period within the same country incomparable and reduces the objectivity of the results of cross-country analysis;

- Primary indicators do not cover all segments (instruments) of the financial market. In particular, indicators for such segments (instruments) of financial markets as monetary gold and special drawing rights (SDRs), insurance pension and standard guarantees, pension payments, derivative financial instruments, and employee stock options are not used;

- Primary indicators are not calculated for all sectors of the economy, but only for the sector of financial corporations. Moreover, financial flows cover all sectors of the economy without exception. The lack of analysis of the financial development of non-financial sectors of the economy, taking into account their relationship with the financial sector, makes the results of the analysis incomplete and insufficiently formative;

- In scientific research, as a rule, the analysis of the financial development of countries is carried out using not all of the primary indicators presented in Table 1 and Table 2, but only some of them. At the same time, the set of indicators used differs from study to study. This leads to conflicting conclusions from the results of research.

3. Methodology

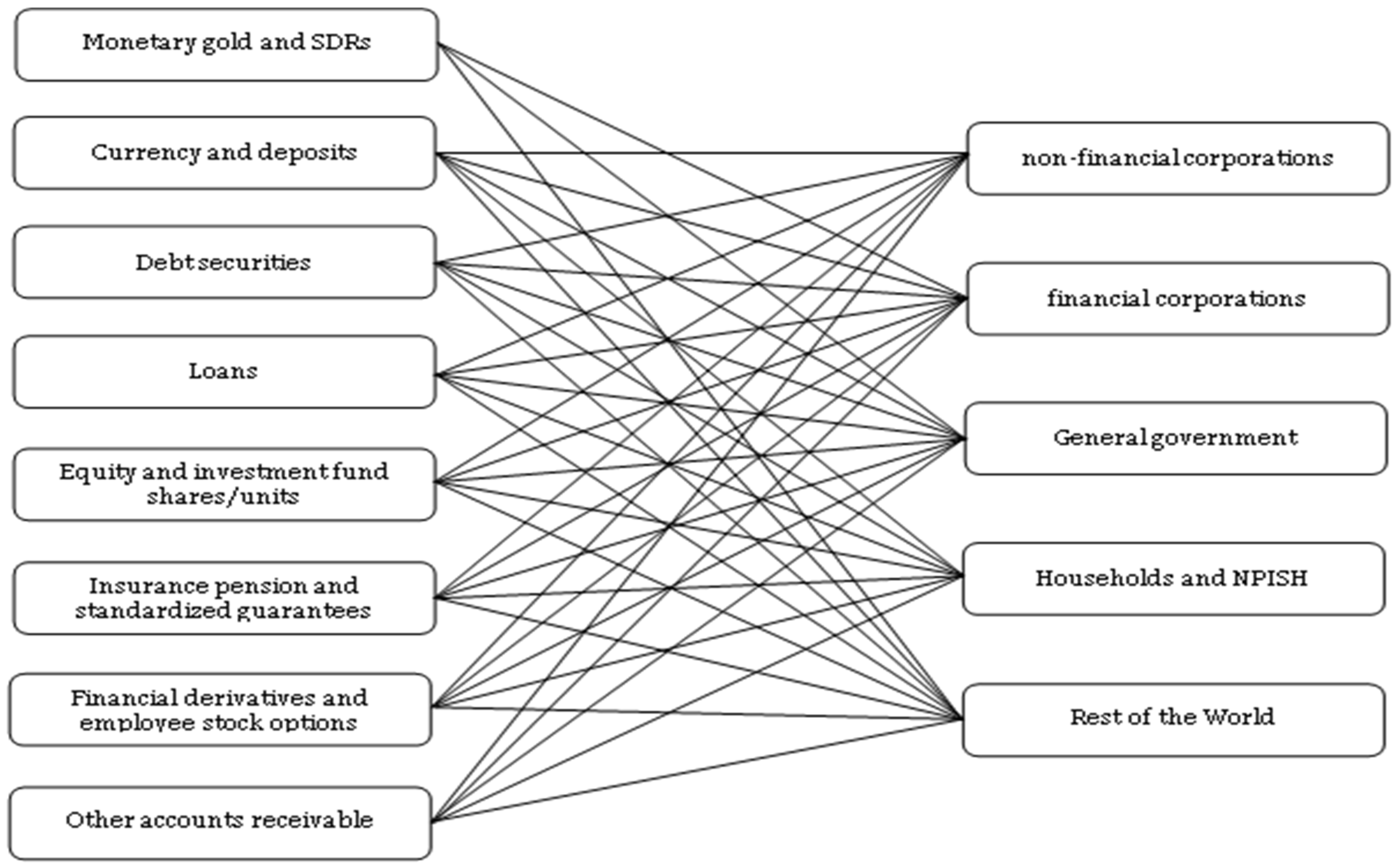

3.1. Matrix Indicator System

3.2. Quantifying the Level of Financial Development of Countries

3.3. Qualitative Assessment of the Level of Financial Development of Countries

3.4. Structural Assessment of the Level of Financial Development of Countries

- IDd—matrix of structural deviations;

- De—matrix of reference values of transformed indicators;

- Dt—matrix of actual values of the transformed indicators of the country, for which perspective directions of financial development are determined.

4. Results

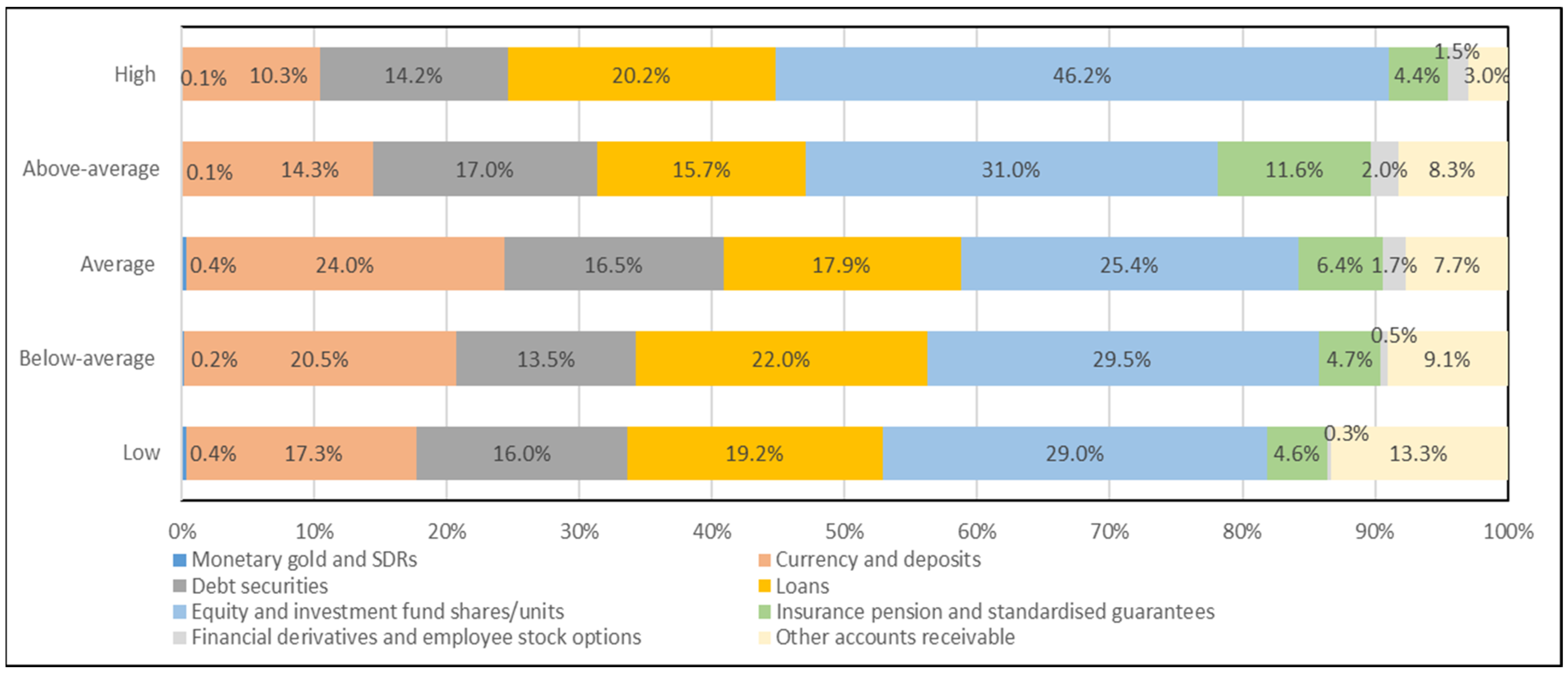

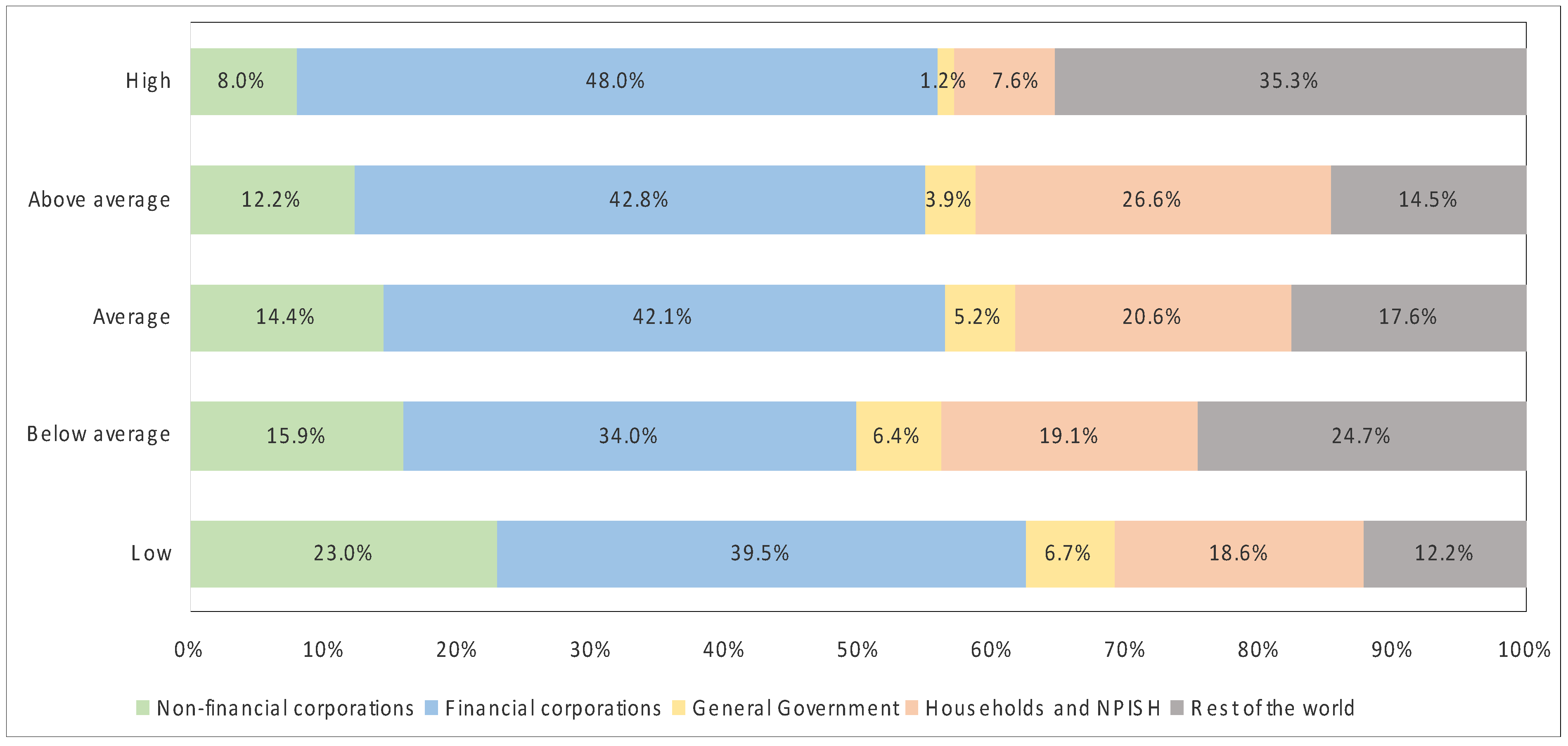

- A high international position is characterized by the maximum share of equity and investment fund shares/unit in combination with the maximum share of the financial corporation sector and the rest of the world sector in terms of financial assets. This is due to the high level of development of the financial sector in economically developed countries, as well as a high level of confidence in their financial institutions and instruments;

- The above average position is characterized by the maximum share of debt securities, insurance pension and standardized guarantees, as well as financial derivatives and employee stock options, combined with the maximum share of the households and NPISH sector. This confirms the emergence of modern financial instruments (debt, insurance, and derivatives) and the large role of households in financial development. In order to move to a higher level of financial development, these countries need to concentrate their efforts on the development of investment instruments and increase their reliability, which will increase the attractiveness of the financial market for foreign investment;

- Countries with an average level of financial development are characterized by the maximum share of currency and deposits. Consequently, in these countries, the use of modern financial instruments is not yet sufficiently adopted, but favorable conditions have already been created for the formation of a sufficiently high level of confidence in the financial system. A further step to increase the level of financial development of these countries may be the development of the insurance and stock markets;

- The “below average” score is characterized by the maximum share of loans in financial assets. This is due to the insufficient level of development of the stock market, and the fact that the banking system in these countries occupies a dominant position in their financial system. In this regard, these countries need to develop stock market instruments;

- A low position is characterized by the maximum share of other accounts receivable in financial instruments and the maximum share of non-financial corporations and general government sectors among other groups of countries. This means that for countries of this group, the financial sector is much less developed than in more economically developed countries. And the maximum share of other accounts receivable means a lower level of use of the main financial instruments. Consequently, the next step in increasing the financial development of these countries will be to both increase the range of financial instruments and further develop the financial sector of the economy.

- Matrix of reference values of Italy’s transformed indicators (transformed indicators of the closest best range—“above average”). The results of the calculations are presented in Table 7;

- Matrix of actual values of the converted indicators of Italy (Table 8).

- Matrix of structural deviations of the actual values of the transformed indicators of Italy from the reference values (Table 9).

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdmoulah, Walid. 2021. Competition and financial institutions and markets development: A dynamic panel data analysis. Journal of Financial Economic Policy 13: 539–64. [Google Scholar] [CrossRef]

- Abdul Karim, Zulkefly, Danie Kamal Basa, and Bakri Abdul Karim. 2021. The relationship between financial development and effectiveness of monetary policy: New evidence from ASEAN-3 countries. Journal of Financial Economic Policy, Ahead-of-print. [Google Scholar]

- Akel, Veli, and Talip Torun. 2017. Stock Market Development and Economic Growth: The Case of MSCI Emerging Market Index Countries. In Global Financial Crisis and Its Ramifications on Capital Markets: Opportunities and Threats in Volatile Economic Conditions. Edited by Ümit Hacioğlu and Hasan Dinçer. Cham: Springer, pp. 323–36. [Google Scholar]

- Australian Securities & Investments Commission—ASIC. 2021. ASIC Corporate Plan 2021–2025. Available online: https://asic.gov.au/media/qzcaljce/asic-corporate-plan-2021-25-focus-2021-22-published-26-august-2021.pdf (accessed on 10 November 2021).

- Ayowole, Temitayo Esther, and Demet Beton Kalmaz. 2020. Revisiting the impact of credit market development on Nigeria’s economic growth. Journal of Public Affairs, e2396. [Google Scholar] [CrossRef]

- Bank of Russia. 2021. The Main Directions of Development of the Financial Market of the Russian Federation for 2022 and the Period of 2023 and 2024. Available online: http://www.cbr.ru/Content/Document/File/124658/onrfr_project_2021-09-30.pdf (accessed on 10 November 2021).

- Berdiev, Aziz N., and James W. Saunoris. 2016. Financial development and the shadow economy: A panel VAR analysis. Economic Modelling 57: 197–207. [Google Scholar] [CrossRef]

- Canh, Nguyen Phuc, and Su Dinh Thanh. 2020. Financial development and the shadow economy: A multi-dimensional analysis. Economic Analysis and Policy 67: 37–54. [Google Scholar] [CrossRef]

- Canh, Nguyen Phuc, and Su Dinh Thanh. 2021. Easing economic vulnerability: Multidimensional evidence of financial development. The Quarterly Review of Economics and Finance 81: 237–52. [Google Scholar]

- Canh, Nguyen Phuc, Su Dinh Thanh, and Nadia Doytch. 2020. The drivers of financial development: Global evidence from internet and mobile usage. Information Economics and Policy 53: 100892. [Google Scholar]

- Cave, Joshua, Kausik Chaudhuri, and Subal C. Kumbhakar. 2020. Do banking sector and stock market development matter for economic growth? Empirical Economics 59: 1513–35. [Google Scholar] [CrossRef]

- Cihak, Martin, Aslı Demirgüç-Kunt, Erik Feyen, and Ross Levine. 2012. Benchmarking Financial Systems around the World. Policy Research Working Paper. Washington: World Bank, p. 6175. [Google Scholar]

- Directorate-General for Financial Stability, Financial Services and Capital Markets Union—DG FISMA. 2020. Strategic Plans 2020–2024—Financial Stability, Financial Services and Capital Markets Union. Available online: https://ec.europa.eu/info/publications/strategic-plans-2020-2024-financial-stability-financial-services-and-capital-markets-union_en (accessed on 10 November 2021).

- Dubai Financial Services Authority—DFSA. 2021. Business Plan 2021–2022. Available online: https://365343652932-web-server-storage.s3.eu-west-2.amazonaws.com/files/7416/1096/4358/DFSA_Business_Plan_21-22-hires_spread.pdf (accessed on 10 November 2021).

- Dutch Authority for the Financial Markets. 2020. AFM Strategy 2020–2022. Available online: https://www.afm.nl/en/verslaglegging/strategie-2020-2022 (accessed on 10 November 2021).

- Dutta, Nabamita, and Daniel Meierrieks. 2021. Financial development and entrepreneurship. International Review of Economics & Finance 73: 114–26. [Google Scholar]

- Federal Financial Supervisory Authority. 2018. BaFin’s Digitalisation Strategy 2018–2023. Available online: https://www.bafin.de/EN/DieBaFin/ZieleStrategie/Digitalisierungsstrategie/digitalisierungsstrategie_artikel_en.html (accessed on 10 November 2021).

- Financial Conduct Authority—FCA. 2021. FCA Business Plan 2021–2022. Available online: https://www.fca.org.uk/publication/business-plans/business-plan-2021-22.pdf (accessed on 10 November 2021).

- Financial Supervisory Authority of Norway. 2019. Finanstilsynet’s Strategy for the Period 2019–2022. Available online: https://www.finanstilsynet.no/en/news-archive/press-releases/2019/finanstilsynets-strategy-for-the-period-2019-2022/ (accessed on 10 November 2021).

- Gnangnon, Sena Kimm. 2021. Effect of poverty on financial development: Does trade openness matter? The Quarterly Review of Economics and Finance 82: 97–112. [Google Scholar] [CrossRef]

- Investment Industry Regulatory Organization of Canada—IIROC. 2021. IIROC Priorities for 2022. Available online: https://www.iiroc.ca/news-and-publications/notices-and-guidance/iiroc-priorities-2022 (accessed on 10 November 2021).

- Ito, Hiroyuki, and Masahiro Kawai. 2018. Quantity and Quality Measures of Financial Development: Implications for Macroeconomic Performance. Policy Research Institute, Ministry of Finance, Japan. Public Policy Review 14: 803–33. [Google Scholar]

- Jankovic, Irena, and Mirjana Gligoric. 2017. Financial sector development and economic growth. In Economic and Social Development: Book of Proceedings, 23 International Scientific Conference on Economic and Social Development. Edited by Marijan Cingula, Maciej Przygoda and Kristina Detelj. Madrid: Varazdin Development and Entrepreneurship Agency (VADEA), pp. 100–9. [Google Scholar]

- Jiang, Mingrui, Sumei Luo, and Guangyou Zhou. 2020. Financial development, OFDI spillovers and upgrading of industrial structure. Technological Forecasting and Social Change 155: 119974. [Google Scholar] [CrossRef]

- Jung, Samuel Moon, and Chu-Ping C. Vijverberg. 2019. Financial Development and Income Inequality in China–A Spatial Data Analysis. The North American Journal of Economics and Finance 48: 295–320. [Google Scholar] [CrossRef]

- Kandil, Magda, Muhammad Shahbaz, and Samia Nasreen. 2015. The interaction between globalization and financial development: New evidence from panel cointegration and causality analysis. Empirical Economics 49: 1317–39. [Google Scholar] [CrossRef] [Green Version]

- Kar, Muhsin, and Serife Ozsahin. 2016. Role of financial development on entrepreneurship in the emerging market economies. Eskisehir Osmangazi Universitesi IIBF Dergisi-eskisehir Osmangazi University Journal of Economics and Administrative Sciences 11: 131–51. [Google Scholar]

- Kavya, Balakrishnan, and Shijin Santhakumar. 2020. Economic Development, Financial Development, and Income Inequality Nexus. Borsa Istanbul Review 20: 80–93. [Google Scholar] [CrossRef]

- Khan, Haroon Ur Rashid, Talat Islam, Sheikh Usman Yousaf, Khalid Zaman, Alaa Mohamd Shoukry, Mohamed Sharkawy, Showkat Gani, Alamzeb Aamir, and Sanil Hishan. 2019. The impact of financial development indicators on natural resource markets: Evidence from two-step GMM estimator. Resources Policy 62: 240–55. [Google Scholar] [CrossRef]

- Khan, Muhammad Atif, Lulu Gu, Muhammad Asif Khan, and Judit Oláh. 2020. Natural resources and financial development: The role of institutional quality. Journal of Multinational Financial Management 56: 1–20. [Google Scholar] [CrossRef]

- Kim, Jounghyeon. 2021. Financial development and remittances: The role of institutional quality in developing countries. Economic Analysis and Policy 72: 386–407. [Google Scholar] [CrossRef]

- Kreso, Sead, and Selena Begovic. 2013. Monetary regime, financial development and the process of money multiplication in the European transition countries. Paper presented at 2nd International Scientific Conference on Economic and Social Development (ESD), Moscow, Russia, April 10–13; pp. 426–42. [Google Scholar]

- Lim, Taejun. 2017. Growth, financial development, and housing booms. Economic Modelling 69: 91–102. [Google Scholar] [CrossRef]

- Luo, Yu, Chengsi Zhang, and Yueteng Zhu. 2016. Openness and Financial Development in China: The Political Economy of Financial Resources Distribution. Emerging Markets Finance and Trade 52: 2115–27. [Google Scholar] [CrossRef]

- Mignamissi, Dieudonné, and Audrey J. Djijo. 2021. Digital divide and financial development in Africa. Telecommunications Policy 45: 102199. [Google Scholar] [CrossRef]

- Moyo, Clement, and Pierre Le Roux. 2021. Financial development and economic growth in SADC countries: A panel study. African Journal of Economic and Management Studies 12: 71–89. [Google Scholar] [CrossRef]

- Muhammad, Faqeer, Naveed Razzaq, Khair Memon, and Rehmat Karim. 2021. Do Quality of Governance, Remittance and Financial Development affect Growth? Studies of Applied Economics 39. [Google Scholar] [CrossRef]

- Naceur, Sami Ben, Bertrand Candelon, and Quentin Lajaunie. 2019. Taming financial development to reduce crises. Emerging Markets Review 40: 1–15. [Google Scholar] [CrossRef] [Green Version]

- Nichkasova, Yuliya, Halina Shmarlouskaya, and Kulyash Sadvokassova. 2020. Financial market sustainable development of Kazakhstan: Scenario approach based on fuzzy cognitive maps. Journal of Sustainable Finance & Investment 2020: 1–22. [Google Scholar]

- Organization for Economic Co-operation and Development—OECD. 2021. Financial Accounts Data. Available online: https://stats.oecd.org/Index.aspx?DatasetCode=SNA_TABLE620 (accessed on 10 November 2021).

- Rekunenko, Ihor, Larysa Hrytsenko, Irina Boiarko, and Ruslan Kostyrko. 2019. Financial debt market in the system of indicators of development of the economy of the country. Financial and Credit Activity-Problems of Theory and Practice 2: 430–39. [Google Scholar] [CrossRef] [Green Version]

- Reserve Bank of India—RBI. 2019. National Strategy for Financial Inclusion 2019–2024. Available online: https://rbidocs.rbi.org.in/rdocs/content/pdfs/NSFIREPORT100119.pdf (accessed on 10 November 2021).

- Sahay, Ratna, Martin Cihák, Papa N’Diaye, and Adolfo Barajas. 2015. Rethinking Financial Deepening: Stability and Growth in Emerging Markets. Revista de Economia Institucional 17: 73–107. [Google Scholar] [CrossRef]

- Sanfilippo-Azofra, Sergio, Begoña Torre-Olmo, María Cantero-Saiz, and Carlos López-Gutiérrez. 2018. Financial development and the bank lending channel in developing countries. Journal of Macroeconomics 55: 215–34. [Google Scholar] [CrossRef]

- Sayilir, Ozlem, Murat Dogan, and Nahifa Said Soud. 2018. Financial development and governance relationships. Applied Economics Letters 25: 1466–70. [Google Scholar] [CrossRef]

- Securities and Exchange Commission of Brazil—SEC. 2013. CVM Strategic Planning 2013–2023. Available online: https://www.gov.br/cvm/en/about/anexos/StrategicPlanning_CVM_2013_2023.pdf (accessed on 10 November 2021).

- Securities and Exchange Commission—SEC. 2018. Strategic Plan 2018–2022. Available online: https://www.sec.gov/files/SEC_Strategic_Plan_FY18-FY22_FINAL.pdf (accessed on 10 November 2021).

- Sehrawat, Madhu, and Ananta Kumar Giri. 2015. Financial development and economic growth: Empirical evidence from India. Studies in Economics and Finance 32: 340–56. [Google Scholar] [CrossRef]

- Sethi, Pradeepta, Debkumar Chakrabarti, and Sankalpa Bhattacharjee. 2020. Globalization, financial development and economic growth: Perils on the environmental sustainability of an emerging economy. Journal of Policy Modeling 42: 520–35. [Google Scholar] [CrossRef]

- Setiawan, Budi, Adil Saleem, Robert Jeyakumar Nathan, Zoltan Zeman, Robert Magda, and Judit Barczi. 2021. Financial Market Development and Economic Growth: Evidence from ASEAN and CEE Region. Polish Journal of Management Studies 23: 481–94. [Google Scholar] [CrossRef]

- Sinha, Niharika, and Swati Shastri. 2021. Does financial development matter for domestic investment? Empirical evidence from India. South Asian Journal of Business Studies, Advance online publication. [Google Scholar]

- Sumarni, Leli. 2019. Financial development and economic growth in Indonesia: An ARDL-Bounds testing approach. Economic Journal of Emerging Markets 11: 89–96. [Google Scholar] [CrossRef] [Green Version]

- Swiss Financial Market Supervisory Authority—FINMA. 2021. FINMA’s Strategic Goals 2021–2024. Securities and Exchange Commission. Available online: https://www.finma.ch/en/finma/supervisory-objectives/strategy (accessed on 10 November 2021).

- System of National Accounts—SNA. 2008. European Commission, International Monetary Fund, Organization for Economic Cooperation and Development, United Nations, World Bank. Available online: https://unstats.un.org/unsd/nationalaccount/docs/sna2008.pdf (accessed on 10 November 2021).

- Trinugroho, Irwan, Siong Hook Law, Weng Chang Lee, Jamal Wiwoho, and Bruno Sergi. 2021. Effect of financial development on innovation: Roles of market institutions. Economic Modelling 103: 1–16. [Google Scholar] [CrossRef]

- Verma Gakhar, Divya, and Shweta Kundlia. 2018. Impact of financial development on economic growth: Empirical analysis of India. JIMS8M: The Journal of Indian Management & Strategy 23: 4–12. [Google Scholar]

- Wait, Charles, Tafadzwa Ruzive, and Pierre le Roux. 2017. The Influence of Financial Market Development on Economic Growth in BRICS Countries. International Journal of Management and Economics 53: 7–24. [Google Scholar] [CrossRef] [Green Version]

- Wang, Pengfei, Yi Wen, and Zhiwei Xu. 2018. Financial Development and Long-Run Volatility Trends. Review of Economic Dynamics 28: 221–51. [Google Scholar] [CrossRef] [Green Version]

- Yadav, Inder Sekhar, Debasis Pahi, and Rajesh Gangakhedkar. 2019. Financial Markets Development and Financing Choice of Firms: New Evidence from Asia. Asia-Pacific Financial Markets 26: 429–51. [Google Scholar] [CrossRef]

| Financial Market Development Indicators | Financial Sector Development Indicators |

|---|---|

| 1. Ratio of domestic credit provided by the financial sector to GDP, % 2. Ratio of total value of traded shares to GDP, % 3. Ratio of stock market capitalization to the volume of financial assets, % | 1. Ratio of financial sector assets to GDP, % 2. Ratio of employees in the financial sector to the total number of employees, % 3. Ratio of loans to deposits, % 4. Ratio of deposits and loans to GDP, % |

| Indicators | Financial Markets | Financial Institutions |

|---|---|---|

| Depth | 1. Ratio of total value of traded shares to GDP, % 2. Ratio of international debt securities of the government to GDP, % 3. Ratio of total debt securities of financial corporations to GDP, % 4. Ratio of total debt securities of non-financial corporations to GDP, % | 1. Ratio of loans to the private sector to GDP, % 2. Ratio of pension funds’ assets to GDP, % 3. Ratio of UIF assets to GDP, % 4. Ratio of insurance premiums to GDP, % |

| Accessibility | 1. Market capitalization outside the top 10 largest companies, % 2. Total number of debt issuers (domestic and foreign, financial and non-financial corporations) per 100,000 adults | 1. Bank branches per 100,000 adults 2. ATMs per 100,000 adults |

| Efficiency | Stock market turnover ratio (trading volume/stock market capitalization) | 1. Net interest margin of banks, % 2. Interest rate spread, % 3. Ratio of non-interest income to total income, % 4. Overheads to total assets ratio, % 5. Return on assets, % 6. Return on equity, % |

| Stability | Z-score of banks |

| Sectors (j)/Instruments (i) | Non-Financial Corporations (1) | Financial Corporations (2) | General Government (3) | Households and NPISH (4) | Rest of the World (5) |

|---|---|---|---|---|---|

| Monetary gold and SDRs (1) | a11 | a12 | a13 | a14 | a15 |

| Currency and deposits (2) | a21 | a22 | a23 | a24 | a25 |

| Debt securities (3) | a31 | a32 | a33 | a34 | a35 |

| Loans (4) | a41 | a42 | a43 | a44 | a45 |

| Equity and investment fund shares/units (5) | a51 | a52 | a53 | a54 | a55 |

| Insurance pension and standardized guarantees (6) | a61 | a62 | a63 | a64 | a65 |

| Financial derivatives and employee stock options (7) | a71 | a72 | a73 | a74 | a75 |

| Other accounts receivable (8) | a81 | a82 | a83 | a84 | a85 |

| International Positions | Criteria for the Formation of an International Position |

|---|---|

| High | k4 ≤ ID |

| Above average | k3 ≤ ID < k4 |

| Average | k2 ≤ ID < k3 |

| Below average | k1 ≤ ID < k2 |

| Low | 0 ≤ ID < k1 |

| International Positions | Criteria for the Formation of an International Position, US$ Thousands |

|---|---|

| High | 1000 ≤ ID |

| Above average | 500 ≤ ID < 1000 |

| Average | 250 ≤ ID < 500 |

| Below average | 125 ≤ ID < 250 |

| Low | 0 ≤ ID < 125 |

| International Ranking | 2018 | 2019 |

|---|---|---|

| High | Luxembourg (49,796), Ireland (3186), Switzerland (1872), Netherlands (1619), Denmark (1018) | Luxembourg (49,763), Ireland (3539), Switzerland (2041), Netherlands (1668) Denmark (1115), Norway (1068) |

| Above average | Norway (990), Sweden (812), UK (808), USA (742), Iceland (705), Belgium (705) France (658), Canada (623), Japan (612), Finland (592) | Sweden (875), UK (855), USA (828), Iceland (712), Belgium (723) France (704), Canada (700), Japan (628), Finland (622), Austria (505), Germany (501) |

| Average | Austria (496), Germany (474) New Zealand (453), Israel (335), Spain (321), Italy (308), Korea (298), Portugal (256) | New Zealand (469), Israel (392), Spain (326), Italy (320), Korea (311), Portugal (258) |

| Below average | Estonia (159), Czech Republic (157), Slovenia (147), Greece (141) | Estonia (168), Czech Republic (160), Slovenia (154), Greece (150), Hungary (142) |

| Low | Hungary (121), Chile (120), Slovak Republic (107), Latvia (101), Lithuania (81), Poland (70), Brazil (69), Russia (62), Mexico (41), Colombia (35, Turkey (32), India (9) | Chile (124), Slovak Republic (110), Latvia (103), Lithuania (87), Poland (73), Brazil (*) Russia (*), Mexico (45), Colombia (33), Turkey (34), India (*) |

| Financial Instruments | Economic Sectors | ||||

|---|---|---|---|---|---|

| Non-Financial Corporations | Financial Corporations | General Government | Households and NPISH | Rest of the World | |

| Monetary gold and SDRs | 0.00 | 0.08 | 0.02 | 0.00 | 0.02 |

| Currency and deposits | 1.65 | 4.78 | 0.50 | 5.55 | 2.07 |

| Debt securities | 0.19 | 10.22 | 0.57 | 1.17 | 4.44 |

| Loans | 0.98 | 11.75 | 0.63 | 0.20 | 1.78 |

| Equity and investment fund shares/units | 5.09 | 10.48 | 0.90 | 10.27 | 5.69 |

| Insurance pension and standardized guarantees | 0.13 | 1.67 | 0.00 | 8.95 | 0.05 |

| Financial derivatives and employee stock options | 0.02 | 1.36 | 0.00 | 0.00 | 0.83 |

| Other accounts receivable | 4.22 | 2.17 | 0.89 | 0.32 | 0.37 |

| Financial Instruments | Economic Sectors | ||||

|---|---|---|---|---|---|

| Non-Financial Corporations | Financial Corporations | General Government | Households and NPISH | Rest of the World | |

| Monetary gold and SDRs | 0.00 | 0.66 | 0.00 | 0.00 | 0.0 |

| Currency and deposits | 2.2 | 8.20 | 0.54 | 8.52 | 4.54 |

| Debt securities | 0.33 | 12.58 | 0.25 | 1.56 | 6.30 |

| Loans | 0.48 | 12.24 | 0.89 | 0.07 | 1.48 |

| Equity and investment fund shares/units | 4.53 | 6.00 | 1.01 | 9.76 | 3.68 |

| Insurance pension and standardized guarantees | 0.07 | 0.09 | 0.01 | 6.54 | 0.01 |

| Financial derivatives and employee stock options | 0.09 | 0.89 | 0.00 | 0.00 | 0.61 |

| Other accounts receivable | 3.43 | 0.16 | 0.72 | 0.82 | 0.64 |

| Financial Instruments | Economic Sectors | ||||

|---|---|---|---|---|---|

| Non-Financial Corporations | Financial Corporations | General Government | Households and NPISH | Rest of the World | |

| Monetary gold and SDRs | 0.00 | −0.58 | 0.02 | 0.00 | −0.03 |

| Currency and deposits | −0.61 | −3.42 | −0.04 | −2.97 | −2.47 |

| Debt securities | −0.14 | −2.36 | 0.32 | −0.39 | −1.84 |

| Loans | 0.50 | −0.49 | −0.26 | 0.13 | 0.30 |

| Equity and investment fund shares/units | 0.56 | 4.48 | −0.11 | 0.51 | 2.01 |

| Insurance pension and standardized guarantees | 0.06 | 1.58 | −0.01 | 2.41 | 0.04 |

| Financial derivatives and employee stock options | −0.07 | 0.47 | 0.00 | 0.00 | 0.22 |

| Other accounts receivable | 0.79 | 2.02 | 0.17 | −0.50 | −0.27 |

—positive values of deviations (>0),

—positive values of deviations (>0),  —no deviations (=0),

—no deviations (=0),  —insignificant negative values of deviations (equal and less than 1.0 p.p.),

—insignificant negative values of deviations (equal and less than 1.0 p.p.),  —significant negative values of deviations (more than 1.0 p.p.). Source: authors’ calculations based on the official statistical data (OECD 2021).

—significant negative values of deviations (more than 1.0 p.p.). Source: authors’ calculations based on the official statistical data (OECD 2021).Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gospodarchuk, G.; Zeleneva, E. Assessment of Financial Development of Countries Based on the Matrix of Financial Assets. Economies 2022, 10, 122. https://doi.org/10.3390/economies10050122

Gospodarchuk G, Zeleneva E. Assessment of Financial Development of Countries Based on the Matrix of Financial Assets. Economies. 2022; 10(5):122. https://doi.org/10.3390/economies10050122

Chicago/Turabian StyleGospodarchuk, Galina, and Elena Zeleneva. 2022. "Assessment of Financial Development of Countries Based on the Matrix of Financial Assets" Economies 10, no. 5: 122. https://doi.org/10.3390/economies10050122

APA StyleGospodarchuk, G., & Zeleneva, E. (2022). Assessment of Financial Development of Countries Based on the Matrix of Financial Assets. Economies, 10(5), 122. https://doi.org/10.3390/economies10050122