Abstract

Indonesia’s government policy recommends that medium and large companies carry out corporate social responsibility programs. These programs provide sustainability for the company because they can involve community social relations, economic growth, and increasing environmental awareness. This study aimed to test corporate social responsibility on firm performance with green innovation as a mediation. This study used PROPER companies in 2015–2019, which were chosen using a purposive sampling method involving annual reports and financial reports, yielding 253 companies as a sample. Data were obtained from the Indonesia Stock Exchange and tested using STATA. This study indicates that corporate social responsibility can increase green innovation in companies with the stability of environmentally friendly materials, emission reductions for the surrounding community, and saving energy use. Corporate social responsibility has a positive effect on firm performance because the company has maintained the continuity of the process. After all, it has a harmonious relationship with the community. Furthermore, green innovation positively affects firm performance because the company can reduce energy use and utilize environmentally friendly resources. Therefore, green innovation can mediate the influence of corporate social responsibility and firm performance. This research contributes to senior managers who are part of their company’s top management to understand the critical role of corporate social responsibility in maintaining the company’s sustainability by paying attention to the part of the company’s environment and implementing government regulations. Corporate social responsibility can maintain good stakeholder relations and increase green innovation and firm performance. Theoretical contributions can enrich research related to the context of sustainable performance.

1. Introduction

A company’s commitment to providing social care through corporate social programs plays a vital role in improving quality and economic development in the community in difficult times such as the current pandemic (Munasinghe et al. 2019). In addition to attempts to enhance the company’s business, this program can affect the business area’s environment and act as a relationship builder with the public, government, and private sector based on mutual benefit (Sapta et al. 2021). There is a need for companies to provide information regarding the implementation of corporate social responsibility applied to the community and government through the company website so that people understand the company’s role in society and the environment (Hermanto et al. 2021). The allocation of program financing in its implementation is at least 3% of the company’s total profit per year (Perda Kaltim Article 23 Paragraph 1 2013). The Government Regulation of the Republic of Indonesia specifies that the company’s obligation to carry out operations is to have sustainability in its business sector by maximizing natural resources as a form of concern for implementing corporate social responsibility (PP RI No. 47 of 2012 2012). PROPER is a Public Disclosure Program for Environmental Compliance. PROPER is one of the government policies to improve environmental management performance. The government expects businesses to follow the laws and regulations that have been established. Therefore, PROPER can represent corporate transparency in Indonesian environmental management. The PROPER assessment consists of two categories: the compliance assessment and the assessment criteria beyond those required by the regulations. Companies are evaluated in terms of their compliance with environmental management regulations. Through an excellent environmental care program, the company can improve its reputation, image, and credibility and positively impact it, which allows it to win awards and increase share prices for stakeholders (Gürlek and Tuna 2017). The company’s ability to make large donations to the community and the environment as part of a corporate social responsibility program improves the company’s image and renders it favorable for consumers (Mazodier et al. 2021; Habib et al. 2022).

Corporate social responsibility is defined by aspects of social relations, economic growth, and environmental awareness that influence companies and economic sectors’ performance (Munasinghe et al. 2019). Incorporating three elements under the auspices of large companies leads to partnership operations in the roles of both the community and the company (Hernández et al. 2020). The company’s strategy in implementing investment in special corporate social responsibility programs can build a reputation and excellent relations with customers and company employees as a means to promote business practices, community welfare, relations with the government, and the action of increasing company shares (Hou 2019). It is critical to note that the principles developed must be consistent with the governance of corporate social responsibility activities (Tjahjadi et al. 2021; Welford 2007). The existence of corporate social responsibility considerably affects the company’s development and its shareholders. The company has a long-term investment with transparent disclosure of corporate social responsibility, which serves to obtain capital but at a lower cost and through proper implementation (Li et al. 2017). Improving corporate social responsibility practices is the key to business survival and is more likely to play an active role as a competitive advantage for various stakeholders (Farooq et al. 2017; Saeidi et al. 2021).

Green innovation that assists companies in entering the competitive business environment as a business survival strategy adopts effective policies and builds relevance among stakeholders (Novitasari and Agustia 2021; Tang et al. 2017). Balancing costs and benefits is the primary objective of the company in order to maximize profits and have excellence in the market scope, making the company seem to act contrary to sustainable management and emphasizing responsibility and green innovation that supports sustainable development (Łaszkiewicz 2019; Santoso et al. 2022). The green innovation used by the company can be in the form of implementing eco-innovation using technology intensity. Eco-innovation is a technique, system, and implementation used to avoid and reduce environmental damage (Leitão et al. 2019; Barba-Sánchez and Atienza-Sahuquillo 2016). The collaborative development of new technology and market knowledge allows for steps to address operational competence in analyzing the company’s internal needs, such as the acquisition of new resources (Calza et al. 2017). In applying attitudes that do not consider cultural diversity, companies need to identify sub-industries, sustainability strategies, internal organizational relationships with green innovation, ownership rights over strategy implementation, and performance measurements (Tariq et al. 2017). Overcoming environmental challenges is a green innovation strategy used to solve multi-strategy consolidated problems (Yin et al. 2018; Basana et al. 2022).

Previous research indicates that corporate social responsibility improves consumer assumptions about firm performance. Consumer satisfaction that involves confidence in the company’s goods and services helps management and stakeholders minimize the harmful effects of corporate social responsibility (Wei et al. 2020). While corporate social responsibility does not affect firm performance when used in all industry categories, reliable managers must be able to manage profits from corporate social responsibility expenditures in particular industries towards firm performance (Feng et al. 2017). There is an impact on corporate social responsibility and green innovation activities, with the environmental strategy becoming eco-innovative and supporting environmental development sustainability (Shahzad et al. 2020b; Saeidi et al. 2021). The adoption of corporate social responsibility and green innovation elevates costs for the company’s operations and weakens investment in technological innovation (Zhou et al. 2019). Corporate environmental responsibility as a company commitment can stimulate eco-innovation and reduce pollution simultaneously with increasing company competitiveness (Sáez-Martínez et al. 2016). Ecco-innovation as a basic form of green innovation can have a positive impact on company performance (Leitão et al. 2019; Barba-Sánchez and Atienza-Sahuquillo 2016; Sáez-Martínez et al. 2016).

Green innovation has a favorable impact on firm performance, where management policies promote commitments to contribute as an attempt to gain domination of multinational companies in Indonesia (Somjai et al. 2020). As a result, corporate social responsibility, green innovation, and firm performance are expected to increase in this country. This study aimed to examine how companies in Indonesia can improve firm performance through green innovation and corporate social responsibility. The relevance of the environmental aspects of corporate social responsibility has the most significant impact on altering consumers, distribution, and human resources, making profits as market expansion access, and sustainable performance in building a company brand in society (Yang et al. 2019; Sapta et al. 2021). This study examined corporate social responsibility, green innovation, and firm performance, which indicate inaccuracies in the results of previous research that have implications for public companies in Indonesia. Stakeholders are more likely to invest in the business’s long-term success by committing strategic resources and gaining a competitive edge (Weber 2017). However, the level of functional movement to characteristics is not yet accurately described heterogeneously (Wang et al. 2016). Corporate social responsibility is necessary to determine a company’s decisions on actions in line with social effects and pressures (Anser et al. 2018). Green innovation plays a role in improving product turnover with dynamic innovation following firm performance and stable finances (Oliveira et al. 2019; Basana et al. 2022). Corporate environmental responsibility is the company’s responsibility to use materials and energy and reduce pollution (Sáez-Martínez et al. 2016). In addition, companies use corporate environmental responsibility to support eco-innovation implementation to produce resource efficiency, technology intensity, and a green market (Leitão et al. 2019).

This study has contributed to companies’ improvement in sustainable environmental care programs according to corporate social responsibility and green innovation governance and improved the advantage of firm performance. The company’s implementation of corporate social responsibility is necessary to consider aspects of the surrounding environment so that the program’s sustainability is equally profitable. Green innovation controls the performance of technology that can be applied by the community so that the strategy develops for firm performance. Therefore, this study can positively impact the parties concerned in responding to the social environment, and companies established in Indonesia can maintain internal and external environmental conditions.

This research makes a practical contribution to top management in carrying out corporate social responsibility and enriching sustainable business theory. The contribution of top management as a managerial issue is related to the company’s role in implementing corporate social responsibility to maintain the sustainability of the company’s processes by strengthening economic growth, harmonious relations with the community, and environmental sustainability. Furthermore, with the theoretical contribution of heterogeneity, this study sets out three broad questions: (1) What is the magnitude of the impact of corporate social responsibility on increasing green innovation? (2) How is green innovation related to increasing firm performance in companies in Indonesia? (3) How does corporate social responsibility affect increasing firm performance? This research uses the following writing structure: First, establishing the theory related to the research construct and developing research hypotheses in Section 2. Second, research methodologies are discussed in Section 3. Third, Section 4 contains the research findings. Fourth, Section 5 includes the discussion, managerial implications, and theoretical contributions set out in Section 6. Finally, conclusions are set out in Section 7.

2. Literature Review

2.1. Corporate Social Responsibility

Corporate Social Responsibility is a challenge for companies concerning humane approaches to social and environmental issues. It is used as a test concept by considering its application in the environment and the idea of the business-society interaction (Moon et al. 2005; Tjahjadi et al. 2021). Corporate Social Responsibility is defined in five sections through a comprehensive analysis of 37 relevant definitions from 1980 to 2003, including the environmental, social, economic, stakeholder, and volunteer sections (Dahlsrud 2008). The company incorporates political conflict with the local culture to provoke the economic system (Hermanto et al. 2021). Nonetheless, corporate social responsibility is the business, implying that the corporation runs by stressing the social aspects of responsibly exploiting capabilities. Business sustainability is responsible for the implementation of the results of the relationship between the community and the company, in which the individual policies of the managers require wise decision-making (Wood 1991).

Companies that implement corporate social responsibility will improve the government’s commitment to promoting and trying to provide sustainability for company investments, where this business requires top management’s readiness for the success of the objectives based on environmental business (Abbas 2020; Wongthongchai and Saenchaiyathon 2019; Tarigan et al. 2020). Corporate social responsibility aims to improve strategic implementation and dynamic development in the industrial sector to support countries’ economic activities functioning smoothly (Anser et al. 2018). Community involvement in corporate social responsibility practices helps minimize emissions, while, overall, it leads to an increase in sustainable environmental awareness (Gordon et al. 2012; Santoso et al. 2022).

2.2. Green Innovation

Green innovation refers to diminishing the risk of environmental exploitation and the negative impact caused in terms of resources, including energy (Basana et al. 2022). Environmentally friendly innovation with novel technology and collaboration on energy savings, pollution avoidance, recycling waste, making environmentally friendly products, and managing the company’s surrounding environment are all examples of green innovation (Tang et al. 2017). The company’s green innovation can manufacture items and provide services that are supposed to have little or minimal environmental impact (Wong et al. 2012). Furthermore, implementing green innovation in businesses increases competition (Tarigan et al. 2021). In addition to increasing efficiency in the environment, it involves lowering costs for chemical waste disposal, helping companies comply with government regulations, and generating positive reactions from stakeholders for increasing consumers and attaining superior product quality (Chiou et al. 2011). Eco-innovation is a reasonable basis on which companies can implement green innovation to address rapid climate change as corporate environmental responsibility (Sáez-Martínez et al. 2016). Eco-innovation aims to improve the company’s environmental and economic performance by implementing eco-efficiency (Leitão et al. 2019; Barba-Sánchez and Atienza-Sahuquillo 2016; Sáez-Martínez et al. 2016).

The supporting element in green innovation indicates the company’s support by paying attention to social expectations for pressure from stakeholders who are willing to take responsibility but have a significant impact on social expectations as awareness in taking the opportunity to utilize the environment sustainability (Lee et al. 2018). Furthermore, in encouraging the expansion of green innovation, companies allocate exports intensively and tend to maximize the progress of green innovation practices in order to develop to a better level (Galbreath 2017).

2.3. Firm Performance

Profitability, growth, market value development, customer happiness, employee loyalty, environmental audit accuracy, firm operations, and social activities comprise a comprehensive policy that includes nine multidimensional firm performances (Tarigan et al. 2021). The company’s expertise, blends, and technical capabilities propel it (Abeysekara et al. 2019). Foreign ownership and corporate governance drive the determinants of firm performance with dynamic political continuity (Mardnly et al. 2018). The firm’s competitive recognition in the market reflects its success, and maintaining value creation and value capture operations can help the firm perform better (Lepak et al. 2007; Wongthongchai and Saenchaiyathon 2019; Nguyen et al. 2021). The firm performance focuses on investors globally, removing the limitations of financial investment barriers, establishing developments and new opportunities, and allowing companies to gain performance efficiency (Al-Matari et al. 2014). Finally, management that executes potential logistics renewal in the environment in the practice of business performance must be able to finish long-term strategies, with indirect advantages visible at the start of the economy after its implementation (Agyabeng-mensah et al. 2020; Zhu et al. 2005; Tarigan et al. 2020).

2.4. Corporate Social Responsibility and Green Innovation

The relationship between corporate social responsibility and green innovation is the renewal of applied technology within the company environment that is in line with the community’s needs and the company’s sustainability and strategy. Green innovation and corporate social responsibility have a strong dynamic impact, each with a favorable effect on the other (Handayani et al. 2017; Shahzad et al. 2020a). The continuity of the implementation of corporate social responsibility affects the performance of green innovation that renders the company attractive in the market (Rehfeld et al. 2007). Corporate social responsibility is a government recommendation for companies to pay attention to the environment. Eco-innovation is one form of output by which companies should attain eco-efficiency. Companies can implement eco-innovation to improve products, processes, and markets by reducing the use of natural resources and reducing environmental impacts (Leitão et al. 2019; Barba-Sánchez and Atienza-Sahuquillo 2016). Corporate environmental performance can impact increasing eco-innovation, with the formation of resource efficiency and a green market in 3647 SMEs operating in 38 countries (Sáez-Martínez et al. 2016).

The company has the resources and capabilities to excel competitively, allowing it to link corporate social responsibility performance with green innovation (Broadstock et al. 2019). In addition, companies can distribute and integrate knowledge on corporate social responsibility and green innovation (Gras-gil et al. 2016). The benefits of implementing corporate social responsibility include improved company image and staff skills, customer happiness, increased workforce, and environmental friendliness (Gürlek and Tuna 2017; Mazodier et al. 2021). Therefore, the researcher proposed the following hypothesis:

Hypothesis 1 (H1).

Corporate social responsibility has a positive effect on green innovation.

2.5. Green Innovation and Firm Performance

The link between green innovation and firm performance is the foundation of management’s policy to perceive green innovation as improving firm performance (Novitasari and Agustia 2021; Siagian et al. 2021). However, competition in the aggressive business world has a role in building and establishing effective stakeholder control. Therefore, the accuracy of a policy plays a significant role in providing opportunities for global companies (Antonioli et al. 2013; Xue et al. 2019). Furthermore, green innovation provides financial business and ecological performance (Tariq et al. 2017; Xie et al. 2019). Research by Barba-Sánchez and Atienza-Sahuquillo (2016) states that environmental proactiveness is a form of implementing eco-innovation that focuses on green innovation as reducing and preventing environmental damage. This research shows that environmental proactiveness can have a positive and significant impact on the economic performance and environmental performance of 312 Spanish wineries. Furthermore, Leitão et al. (2019) stated that the technology used, market characteristics, public policies, cooperation relationships, and lean management could significantly impact eco-innovation in 334 Portuguese companies contributing to the economy’s more competitive dynamic. Furthermore, corporate environmental performance can affect increasing firm performance consisting of environmental performance and economic performance in 3647 SMEs operating in 38 countries (Sáez-Martínez et al. 2016).

This practice allows data on market and financial performance to be easily monitored by stakeholders in implementing social performance in the environment (Baah and Jin 2019; Jin et al. 2017). Green innovation saves cost modification models of products, operations, and processing as company finances increase (Khan and Johl 2019; Tarigan et al. 2021). The company can improve its existence as it applies the practices of green innovation and green management (Albort-morant et al. 2016; Awan et al. 2018), especially by providing the benefits of green innovation for the companies to enjoy, which indicates trust in a high price for firm performance (Ho et al. 2016). Therefore, the researcher proposes the following hypothesis:

Hypothesis 2 (H2).

Green innovation has a positive effect on firm performance.

2.6. Corporate Social Responsibility and Firm Performance

Corporate social responsibility and firm performance, which serve as attempts to enhance trust among stakeholders, are the aspects to encourage the sustainability of corporate social responsibility practices. The results of a study by Wei et al. (2020) showed that customer trust could reduce the negative impact of corporate social responsibility and enhance firm performance. In addition, a study by Canh et al. (2019) demonstrated that, while the capital spent to implement corporate social responsibility does not generate a return on investment, it does have a favorable impact on firm performance. CSR implementation is a policy set by the government for companies to pay attention to environmental conditions. The policies set are essential, so companies can quickly create and spread eco-innovation to reduce emissions. For example, public policies have been stipulated in Europe by which companies that reduce emissions can get incentives in the form of tax reductions and receive subsidies from the government, which has a significant impact on eco-innovation in 334 Portuguese companies (Leitão et al. 2019).

Therefore, companies attain a better firm performance by implementing corporate social responsibility (Flammer 2015; Nguyen et al. 2021). Furthermore, corporate social responsibility utilizes resources effectively and enhances firm performance and reputation among stakeholders, clients, and suppliers (Orlitzky et al. 2003). Based on this research, the researcher proposes the following hypothesis:

Hypothesis 3 (H3).

Corporate social responsibility has a positive effect on firm performance.

2.7. Mediation Effects of Green Innovation

Several previous studies have found continuity between corporate social responsibility and firm performance. Consequently, adding green innovation as a mediating variable will affect operational efficiency (Gillani et al. 2020) on environmental management technology and determinants of the success of the company’s sustainability (Hansen and Schaltegger 2016). Green innovation bridges eco-design, renewable energy, green supply chain management, and eco-efficiency, along with enhancing firm performance on the availability of resources and balancing environmental protection in corporate social responsibility policies (Su et al. 2020).

However, if a corporation spends solely because of external pressure, the invention may fail to offer financial benefits to the organization (Arfi et al. 2018). The regulation of companies decreases their environmental impact, which will benefit a company’s competitiveness in the market by making profits and increase firm performance significantly (Zhang et al. 2019a). Therefore, the researcher proposes the following hypothesis:

Hypothesis 4 (H4).

Green innovation can mediate the effect of corporate social responsibility and firm performance.

2.8. Diagnostic Use of Sustainability Control Variables Leverages, Tangibility, Firm Age, Firm Size and Board Size

Research results show that corporate social responsibility can impact firm performance for companies (Wei et al. 2020; Canh et al. 2019; Flammer 2015; Orlitzky et al. 2003). Firm performance can be influenced by raising the capital structure’s leverage. The profit generated by the company can determine conventional leverage as a means of financing. In Saudi Arabia, the United Arab Emirates, and Qatar, leverage is a term that is used to compare a company’s equity to its overall debt (El-Khatib 2017). Companies must maintain the amount of leverage to have better performance, because highly leveraged firms make the company’s performance decline (Gharsalli 2019). Tangibility, firm size, and firm age can determine the amount of conventional leverage (El-Khatib 2017). Apart from the company’s leverage, the value of tangible assets can be used to assess firm performance, size, and age (Gharsalli 2019).

Firm size and tangibility are control variables for companies in determining profitability as a form of firm performance in ASEAN countries, namely, Indonesia, Malaysia, the Philippines, and Thailand (Liang et al. 2020). Firm size has a negative impact on company leverage for the ASEAN countries except for Indonesia, while, tangibility assets impact Malaysia and are positive for the Philippines. Asset turnover, capital assets, and firm size impact firm performance, while leverage has an impact on decreasing the firm performance of companies in Mauritius (Bhattu-Babajee and Seetanah 2021). The significant capital owned by the company can loosen credit policies with prospective customers to increase firm performance through increased sales and growing market share (Habib et al. 2022). Firm size can determine firm performance for the company (Yadav et al. 2020). What is different in determining firm performance is a large number of board sizes with positions on the board of commissioners in the company (Ozbek and Boyd 2020). The board of directors’ function is critical in sustaining the company’s ability to influence financial success through increased investor participation (Yakob and Hasan 2021).

Hypothesis 5 (H5).

Can control the variables of leverage, tangibility, firm age, firm size, and board size effect to firm performance.

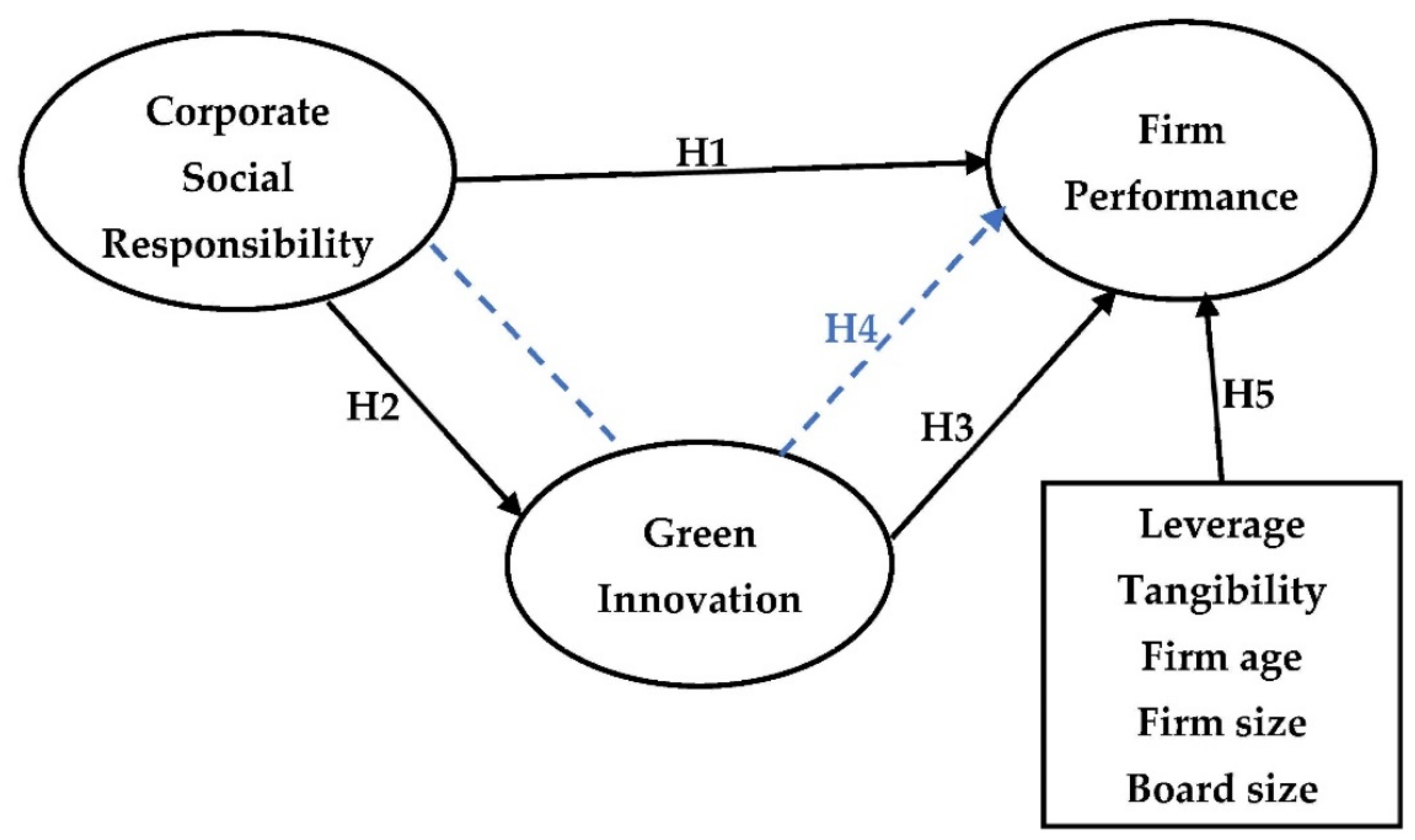

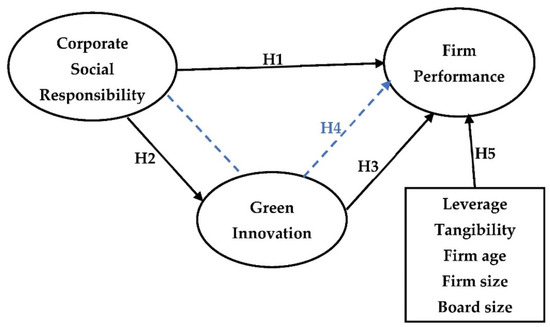

Based on this analysis, this study explores the mechanisms of corporate social responsibility, firm performance, green innovation, and firm size as a control variable. This study examined the direct or indirect relationships between corporate social responsibility, firm performance, and green innovation. Therefore, the conceptual framework is illustrated at Figure 1.

Figure 1.

Research Framework and the Relationship Between Constructs.

3. Methodology

The population in this study was 370 PROPER companies in 2015–2019 from the Indonesia Stock Exchange. The data we use are in the 2015–2019 range because the information is already available and well distributed. The company was able to carry out the corporate social responsibility program established in the previous year’s budget period, and the production process continued to run normally until the end of 2019. Meanwhile, in early 2020, the Indonesian government provided information related to the threat of the COVID-19 Pandemic. In 2020 and 2021, many companies in Indonesia focused on handling the impact of COVID. Large companies quickly paid attention to the health of company employees and the continuity of the production process.

Companies are quickly adapting to the COVID-19 outbreak, requiring staff to maintain a safe distance, wash their hands, and wear masks. The government urged businesses to shift their budgets at the start of 2020 to limit the spread of COVID and keep workers at a safe distance. The company’s management responded to this condition by enforcing the division of labor based on shifts for the production area and establishing that additional employee would be able to work from home. Due to numerous government restrictions and policies that restrict individual employee movement and company operations, companies will have found it challenging to implement corporate social responsibility in 2020–2021. The restrictions imposed by the government on company operations have resulted in the implementation of corporate social responsibility not being carried out correctly. Large and medium-sized companies have focused their funds and budget on accelerating the vaccination process for their employees to work again with the new normal. Existing data for 2020 and 2021 are not being used effectively, and many companies have been unable to provide standard data as research objects. The sample selection was made using the purposive sampling method based on the availability of annual report data that have been reported and announced on the Indonesia Stock Exchange, with a total of 253 companies used as research samples in the 2015–2019 period. The variables in this study were tested using STATA for the direct relationship and the Sobel calculator (www.quantdpsy.org) for the indirect relationship. The two equations in this research are as follows:

GI = α1 + β1CSR + e

FP = α2 + β2CSR + β3GI + β4Leverage + β5Tangibility + β6FM + β7FS + β8BS + e

Firm performance is the achievement of the company’s objectives in assisting the growth of market share and sales concerning the company’s profitability (García-Villaverde et al. 2017). Referring to the structural perspective, firm performance has a consistent configuration and strategic engagement with the external environment (Mallon et al. 2017). As a result, the company can generate firm performance related to total assets and determine the company’s effectiveness in generating returns on the use of available assets into income. According to Chan et al. (2019), the firm performance ratio is calculated as follows:

Notes

- ROA: Return on Assets

- EBIT: Earnings Before Interest and Tax

- TA: Total Assets

Corporate social responsibility is the creation of the company’s attempts to implement a social value framework, where the company inspires employees directly and enhances business results as a form of corporate social responsibility strategy in exploring community competencies. The implementation of the ISO 26000 guidelines affects competence in social performance (Chakroun et al. 2020). The indicators applied in this analysis align with the Global Reporting Initiative (GRI): 1. Environment, 2. Labor and decent work practices, 3. Human rights, 4. Product responsibility, and 5. Society (Brown et al. 2009; Khan et al. 2011; Zhang et al. 2019b).

Green innovation is a strategy employed by companies to excel in competition, fulfill market demands, and convince stakeholders (Soewarno et al. 2019). Companies can benefit from increased efficiency, lower costs, and more sales by using green innovation to address customer demands for environmental answers when these links lead to enhanced financial performance (Amores-Salvadó et al. 2014). The indicators used in this analysis are as follows: 1. The production process utilizes new technologies to minimize energy, water, and waste, 2. The product utilizes fewer polluting or hazardous substances (environmentally friendly materials), 3. Environmentally friendly products are used (e.g., paper and plastic), 4. The components or materials utilized in the production process can be recycled or reconditioned (Agustia et al. 2019).

This study used leverage, tangibility, firm age, firm size, and board size control variables. Leverage is measured using the ratios of total debt and long-term debt to equity (El-Khatib 2017; Bhattu-Babajee and Seetanah 2021). The ratio of fixed assets to total assets can be used to determine tangibility (Gharsalli 2019; Liang et al. 2020; Bhattu-Babajee and Seetanah 2021). Firm age is determined as the number of years since the company was founded (Chen et al. 2020; El-Khatib 2017). Two alternatives measure firm size, either net sales or total assets (Yadav et al. 2020; Gharsalli 2019). Board size is determined using the total number of people who hold positions on the board of commissioners or the CEO (Ozbek and Boyd 2020; Yakob and Hasan 2021).

4. Results

4.1. Descriptive Statistics and Correlation

Table 1 displays descriptive statistics, indicating that the minimum and maximum of each variable in green innovation are 0.000 and 1000, those of corporate social responsibility are 0.000 and 85,000, and those of firm performance are −0.090 and 0.235.

Table 1.

Descriptive statistics.

Table 2 depicts the Pearson’s correlation test, indicating that the correlation between corporate social responsibility and green innovation is positive, with a significance value of 1%. Likewise, the correlation between green innovation and firm performance is positive, with a significance level of 1%.

Table 2.

Pearson’s correlation.

Model 1 is shown by simple linear regression to test the effect of corporate social responsibility on green innovation, as shown in Table 2 and Table 3. The t-test shows that the influence of corporate social responsibility on green innovation has a t-value of 3.52, with a significance value of 0.001 (sig 1%), showing that corporate social responsibility has a positive effect on green innovation, and the H1 is thus accepted.

Table 3.

Regression Results of Green Innovation and Firm Performance.

Model 2 is shown by multiple linear regression to examine the effect of corporate social responsibility and green innovation on firm performance and test the control variables, including firm age, firm size, the board size, tangibility, and leverage, as shown in Table 2 and Table 3. Based on the results of the t-test, the t-value of green innovation on firm performance is 2.83, with a significance value of 0.005 (sig < 1%), indicating that green innovation has a positive effect on firm performance, which means that H2 is accepted. The t-value of corporate social responsibility on firm performance is 4.43, with a significance value of 0.000 (sig < 1%), indicating that corporate social responsibility positively affects firm performance, which means that H3 is accepted. The t value of firm age on the firm performance on the control variables is −0.07, with a significance value of 0.946 (sig > 10%), indicating that firm age does not affect company performance. The t value of firm size on firm performance is 4.57, with a significance value of 0.000 (sig < 1%), showing that firm size positively affects firm performance. The t value of the board size on firm performance is −1.61, with a significance value of 0.109 (sig > 10%), showing that the board size does not affect firm performance. Tangibility’s t value on firm performance is −4.93, with a significance value of 0.000 (sig 1%), indicating that tangibility positively impacts firm performance. The t value of leverage on firm performance is −0.49, with a significance value of 0.627 (sig > 10%), showing that leverage does not affect firm performance.

4.2. Mediation Effect

The results of the mediation test using Sobel are presented in Table 4.

Table 4.

Test Results of Mediation.

The indirect relationship shows that the t value is 2.205, with a significance value of 0.027 (sig < 5%), indicating that green innovation can mediate the relationship between corporate social responsibility and firm performance, and H4 is thus accepted.

Table 5 shows that the first hypothesis (H1) substantially impacts green innovation, with a p-value less than 0.01. The first hypothesis’s findings suggest that corporate social responsibility can boost green innovation. With a p-value of 0.005, which is less than 0.01 (1 percent), green innovation’s second hypothesis (H2) on firm performance is considered significant. Green innovation’s improved capability can help businesses operate better. The third hypothesis (H3), the influence of corporate social responsibility on business performance, is positive and significant, with a p-value of 0.001 under 0.01. The fourth hypothesis (H4) is that increasing corporate social responsibility through green innovation improves business performance significantly.

Table 5.

Results of the Hypothesis Test.

5. Discussion

This study examined the direct and indirect relationships between green innovation, corporate social responsibility, and firm performance. The indirect relationship examined green innovation as a mediating variable for the relationship between corporate social responsibility and firm performance. The findings obtained in this study are consistent with those hypothesized. The first hypothesis in this study indicates that companies concerned with the environment can improve green innovation. According to Shahzad et al. (2020b), a company’s success in implementing corporate social responsibility will be indicated by an increase in green innovation and the company’s level of environmental empowerment in terms of sustainability. Therefore, the company’s commitment can enhance superior and competitive capabilities with environmental-based actions. This finding is in line with Kraus et al. (2020) and Mbanyele et al. (2022). Companies with corporate social responsibility will produce more efforts in mitigating environmental damage. This study also supports the research results, which state that a good implementation of green innovation can improve firm performance through environmentally friendly products (Wong et al. 2012; Chiou et al. 2011; Handayani et al. 2017; Shahzad et al. 2020a; Leitão et al. 2019; Sáez-Martínez et al. 2016; Barba-Sánchez and Atienza-Sahuquillo 2016). According to Rehfeld et al. (2007), the sustainability of corporate social responsibility can increase green innovation as a customer attraction to the company’s products. Therefore, corporate social responsibility can be a company strategy in increasing green innovation to reduce environmental impact and generate customer satisfaction.

The second hypothesis indicates the relationship between green innovation and firm performance. According to Somjai et al. (2020), companies that adopt green innovation will be better able to provide long-term business management and save costs on financing models and assessments of firm performance. As a result, it can boost sales growth and net profit, improving business performance. The results of this study are in line with Junaid et al. (2022) and Novitasari and Agustia (2021), which state that adopting green innovation results in a decrease in production costs and the use of company resources (reduction in energy consumption and air pollution), which can increase firm performance. This study also supports the research results that state that green innovation impacts improving firm performance (Antonioli et al. 2013; Xue et al. 2019; Sáez-Martínez et al. 2016; Barba-Sánchez and Atienza-Sahuquillo 2016). Furthermore, the results of the study are in line with the statement that green innovation can have an impact on ecology for the environment and financial performance as a form of firm performance (Tariq et al. 2017; Xie et al. 2019; Khan and Johl 2019; Ho et al. 2016). Therefore, companies implementing green innovation practices will increase the company’s dynamic capabilities in environmental management and improve firm performance.

The third hypothesis indicates the relationship between corporate social responsibility and firm performance. In line with the arguments of Saha et al. (2019), Nguyen et al. (2021), and Siagian et al. (2021), if a company can manage its leadership policies on environmental program decisions while allocating consumable capital, it will be as profitable as a success of the program. The money spent on the program will come back to the company in the form of earnings and firm performance, which will improve the company’s image and make it more appealing to the community and its customers (Mazodier et al. 2021; Habib et al. 2022). This finding aligns with Al-Shammari et al. (2021), explaining that corporate social responsibility can improve company reputation, increase stakeholder trust, mitigate company risk, and strengthen company performance. This study also supports the results of Gürlek and Tuna’s research (2017), revealing that corporate social responsibility provides benefits by increasing the company’s image and consumer satisfaction as a form of improving company performance. This research is in line with previous research findings that corporate social responsibility can improve the smooth running of economic activities (Anser et al. 2018). The results of research on corporate social responsibility can significantly increase firm performance for companies (Wei et al. 2020; Canh et al. 2019; Orlitzky et al. 2003; Leitão et al. 2019; Sáez-Martínez et al. 2016; Barba-Sánchez and Atienza-Sahuquillo 2016). Corporate social responsibility provides a competitive advantage by attracting new consumers, increasing customer happiness, increasing customer trust, and increasing market share, contributing to improved business performance.

Furthermore, this study shows the indirect effect between corporate social responsibility and firm performance through the mediation of green innovation. According to Gillani et al. (2020), green innovation can mediate the relationship between corporate social responsibility and company performance by implementing a regulation that corporations follow to lessen their environmental impact. Therefore, companies need to implement corporate social responsibility, which will help maintain harmonious relations between stakeholders around the company. In addition, the company can also improve firm performance as a manifestation of the company’s long-term success and profit.

6. Managerial Implication and Theoretical Contribution

Managerial implication provides enlightenment for industry practitioners in adopting corporate social responsibility for companies. Research results can contribute to improving company performance. Companies adopt corporate social responsibility as an option, not as an obligation, and rely on the company’s social relations, economic growth, and environmental awareness in Indonesia. Corporate social responsibility is the company’s responsibility to provide company resources, especially funds intended to help the community and protect the environment. The implementation of corporate social responsibility requires a large budget, so, in providing funds, it must involve senior managers, namely, the general manager/director, as part of top management. Corporate social responsibility determined by the company with activities is the result of thought and coordination among the company’s top management as business professionals and policymakers. Corporate social responsibility can provide increased green innovation and firm performance. Top management establishes policies for companies to involve the social role of the community and build awareness of employees or organizations that care about the environment in Indonesia (Tarigan et al. 2020).

Industrial practitioners can use corporate strategies to minimize waste, air pollution, and gas emissions and save resources, improving business performance. Green innovation, according to this study, can mitigate the link between corporate social responsibility and firm success. As a result, companies can improve their performance by incorporating corporate social responsibility and green innovation. As a result, the company should be able to continuously improve firm performance, which will have a long-term impact on increasing competitive advantage.

This research provides findings by enriching the theory of sustainable business performance, namely, increasing economic performance, environmental performance, and social performance. This study can provide findings by supporting the results of previous studies on the population of companies in Indonesia in implementing corporate social responsibility recommended by the government but not as an obligation. This study focused on the impact of corporate social responsibility on improving company performance by involving the community’s social role in maintaining the company’s sustainability. The study results provide original insight into empirical data on the impact of corporate social responsibility on green innovation and firm performance. This research contributes by examining the mediating role of green innovation in the relationship between corporate social responsibility and firm performance. Therefore, our research contributes to a pioneering study that combines corporate social responsibility, green innovation, and firm performance in one research model. The results of this study expand the literature on how corporate social responsibility and green innovation can determine the firm performance of PROPER companies in Indonesia as a developing country.

7. Conclusions

The study results indicate that corporate social responsibility can be the company’s mainstay to improve performance. Companies voluntarily adopt corporate social responsibility as an object of observation to maintain a sustainable business that involves the social role of the community and the company’s environment in improving firm performance. The results show that the research has four hypotheses: the adoption of corporate social responsibility can increase green innovation (H1) and firm performance (H2); there is an impact of green innovation on firm performance (H3); the role of green innovation is to mediate the relationship between corporate social responsibility and firm performance (H4). All hypotheses were found to be accepted based on the data analysis results. Therefore, companies in Indonesia demonstrate that, by adopting corporate social responsibility, they can reduce environmental damage with the efforts and funds provided by companies for the environment and improve the company’s image for the community.

The results show that corporate social responsibility can increase green innovation with the emergence of company participation in carrying out and implementing pro-grams related to the community and the environment. By adopting corporate social responsibility, companies in Indonesia can reduce production costs because there is no disruption to work activities from the community around the company, and the energy consumption is decreasing. The study results indicate that corporate social responsibility can be the company’s mainstay in firm performance. Corporate social responsibility owned by the company can impact the level of empowerment of the company’s environment in terms of sustainability. Corporate social responsibility programs run by the company directly affect the company’s performance. The company’s ability to carry out corporate social responsibility programs will manage the company with the community and collaborate with suppliers to maintain stable business continuity. Corporate social responsibility is essential for companies in empowering communities and liaising with other organizations to build good partnerships. Based on the study findings and the acceptance of the four hypotheses, a government policy requiring large corporations to engage in corporate social responsibility is required. Government policies can help businesses by allowing them to take advantage of annual tax deductions. Another thing the government can do is grant some subsidies to products made by companies that can consistently practice corporate social responsibility. To maintain environmental sustainability, the companies must have an environmental impact assessment certificate from the government. Research on the substantial effects of a planned business or activity on the environment is required as one of the prerequisites for the decision-making process about business operations by acquiring a certificate, according to government policy.

Several limitations are identified in this study. First, the study used only PROPER companies listed on the Indonesia Stock Exchange, in which PROPER companies (Program for Assessment of Company Performance Ratings in Environmental Management) are companies ranked in environmental management. Therefore, examining corporate social responsibility and green innovation in this study could be biased and subjective. In this case, the sample used was slightly less reflective of the conclusive findings. It is recommended for further research to use other types of companies, such as mining companies, that impact the environment.

Second, this study analyzes the firm performance of corporate social responsibility and green innovation only. Future research is expected to consider other variables in analyzing firm performance, such as green product innovation, green process innovation, green service innovation, and green organization innovation.

Author Contributions

Conceptualization, M.N. and Z.J.H.T.; methodology, M.N.; software, M.N.; validation, M.N. and Z.J.H.T.; formal analysis, M.N.; investigation, Z.J.H.T.; resources, M.N.; data curation, M.N.; writing—original draft preparation, M.N.; writing—review and editing, Z.J.H.T.; visualization, M.N.; supervision, Z.J.H.T.; project administration, M.N.; funding acquisition, Z.J.H.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abbas, Jawad. 2020. Impact of total quality management on corporate green performance through the mediating role of corporate social responsibility. Journal of Cleaner Production 242: 118458. [Google Scholar] [CrossRef]

- Abeysekara, Nadeesha, Haijun Wang, and Duminda Kuruppuarachchi. 2019. Effect of supply-chain resilience on firm performance and competitive advantage A study of the Sri Lankan apparel industry. Business Process Management Journal 25: 1673–95. [Google Scholar] [CrossRef]

- Agustia, Dian, Tjiptohadi Sawarjuwono, and Wiwiek Dianawati. 2019. The mediating effect of environmental management accounting on green innovation—Firm value relationship. International Journal of Energy Economics and Policy 9: 299–306. [Google Scholar] [CrossRef]

- Agyabeng-mensah, Yaw, Esther Ahenkorah, Ebenezer Afum, Adu Nana Agyemang, Carin Agnikpe, and Foday Rogers. 2020. Examining the influence of internal green supply chain practices, green human resource management and supply chain environmental cooperation on firm performance. Supply Chain Management: An International Journal 25: 585–99. [Google Scholar] [CrossRef]

- Albort-morant, Gema, Antonio Leal-millán, and Gabriel Cepeda-carrión. 2016. The antecedents of green innovation performance: A model of learning and capabilities. Journal of Business Research 69: 4912–17. [Google Scholar] [CrossRef]

- Al-Matari, Ebrahim Mohammed, Abdullah Kaid Al-Swidi, and Faudziah Hanim Bt Fadzil. 2014. The measurements of firm performance’s dimensions. Asian Journal of Finance and Accounting 6: 24. [Google Scholar] [CrossRef]

- Al-Shammari, Marwan, Soumendra Nath Banerjee, and Abdul A. Rasheed. 2021. Corporate social responsibility and firm performance: A theory of dual responsibility. Management Decision. [Google Scholar] [CrossRef]

- Amores-Salvadó, Javier, Gregorio Martín-deCastro, and Jose E. Navas-López. 2014. Green corporate image: Moderating the connection between environmental product innovation and firm performance. Journal of Cleaner Production 83: 356–65. [Google Scholar] [CrossRef]

- Anser, Muhammad Khalid, Zhihe Zhang, and Lubna Kanwal. 2018. Moderating effect of innovation on corporate social responsibility and firm performance in the realm of sustainable development. Corporate Social Responsibility and Environmental Management 25: 799–806. [Google Scholar] [CrossRef]

- Antonioli, Davide, Susanna Mancinelli, and Massimiliano Mazzanti. 2013. Is environmental innovation embedded within high-performance organisational changes? The role of human resource management and complementarity in green business strategies. Research Policy 42: 975–88. [Google Scholar] [CrossRef]

- Arfi, Wissal Ben, Lubica Hikkerova, and Jean-Michel Sahut. 2018. External knowledge sources, green innovation, and performance. Technological Forecasting and Social Change 129: 210–20. [Google Scholar] [CrossRef]

- Awan, Usama, Andrzej Kraslawski, and Janne Huiskonen. 2018. Impact of relational governance on performance improvement in export manufacturing firms. Journal of Industrial Engineering and Management 11: 349–70. [Google Scholar] [CrossRef] [Green Version]

- Baah, Charles, and Zhihong Jin. 2019. Sustainable supply chain management and organizational performance: The intermediary role of competitive advantage. Journal of Management and Sustainability 9: 119–31. [Google Scholar] [CrossRef] [Green Version]

- Barba-Sánchez, Virginia, and Carlos Atienza-Sahuquillo. 2016. Environmental Proactivity and Environmental and Economic Performance: Evidence from the Winery Sector. Sustainability 8: 1014. [Google Scholar] [CrossRef] [Green Version]

- Basana, Sautma Ronni, Widjojo Suprapto, Fransisca Andreani, and Zeplin Jiwa Husada Tarigan. 2022. The impact of supply chain practice on green hotel performance through internal, upstream, and downstream integration. Uncertain Supply Chain Management 10: 169–80. [Google Scholar] [CrossRef]

- Bhattu-Babajee, Reena, and Boopen Seetanah. 2021. Value-added intellectual capital and financial performance: Evidence from Mauritian companies. Journal of Accounting in Emerging Economies 12: 486–506. [Google Scholar] [CrossRef]

- Broadstock, David C, Roman Matousek, Martin Meyer, and Nickolaos G. Tzeremes. 2019. Does corporate social responsibility impact firms’ innovation capacity? The indirect link between environmental and social governance implementation and innovation performance. Journal of Business Research 119: 99–110. [Google Scholar] [CrossRef]

- Brown, Halina Szejnwald, Martin de Jong, and David L. Levy. 2009. Building institutions based on information disclosure: Lessons from GRI’s sustainability reporting. Journal of Cleaner Production 17: 571–80. [Google Scholar] [CrossRef]

- Calza, Francesco, Adele Parmentola, and Ilaria Tutore. 2017. Types of Green Innovations: Ways of Implementation in a Non-Green Industry. Sustainability 9: 1301. [Google Scholar] [CrossRef] [Green Version]

- Canh, Nguyen Thi, Nguyen Thanh Liem, Phung Anh Thu, and Nguyen Vinh Khuong. 2019. The impact of innovation on the firm performance and corporate social responsibility of vietnamese manufacturing firms. Sustainability 11: 3666. [Google Scholar] [CrossRef] [Green Version]

- Chakroun, Salma, Bassem Salhi, Anis Ben Amar, and Anis Jarboui. 2020. The impact of ISO 26000 social responsibility standard adoption on firm financial performance Evidence from France. Management Research Review 43: 545–71. [Google Scholar] [CrossRef]

- Chan, Ling-Foon, A. N. Bany-Ariffin, and Annual Bin Md Nasir. 2019. Does the method of corporate diversification matter to firm’s performance? Asia-Pacific Contemporary Finance and Development 26: 207–33. [Google Scholar] [CrossRef]

- Chen, Yongjian (Ken), Nicole Coviello, and Chatura Ranaweera. 2020. How does dynamic network capability operate? A moderated mediation analysis with NPD speed and firm age. Journal of Business and Industrial Marketing 36: 292–306. [Google Scholar] [CrossRef]

- Chiou, Tzu-Yun, Hing Kai Chang, Fiona Lettice, and Sai Ho Chung. 2011. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transportation Research Part E 47: 836. [Google Scholar] [CrossRef]

- Dahlsrud, Alexander. 2008. How corporate social responsibility is defined: An analysis of 37 definitions. Corporate Social Responsibility and Environmental Management 15: 1–13. [Google Scholar] [CrossRef]

- El-Khatib, Rwan. 2017. Determinants of corporate leverage in publicly listed GCC companies—Conventional versus Sukuk. Global Corporate Governance 19: 77–102. [Google Scholar] [CrossRef]

- Farooq, Omer, Deborah E. Rupp, and Mariam Farooq. 2017. The multiple pathways through which internal and external corporate social responsibility influence organizational identification and multifoci outcomes: The moderating role of cultural and social orientations. Academy of Management Journal 60: 954–85. [Google Scholar] [CrossRef]

- Feng, Mingming, Xiaodan Wang, and Jerry Glenn Kreuze. 2017. Corporate social responsibility and firm financial performance: Comparison analyses across industries and CSR categories. American Journal of Business 32: 106–33. [Google Scholar] [CrossRef]

- Flammer, Caroline. 2015. Does corporate social responsibility lead to superiorfinancial performance? A regression discontinuityapproach. Management Science 61: 2549–68. [Google Scholar] [CrossRef] [Green Version]

- Galbreath, Jeremy. 2017. Drivers of Green Innovations: The impact of export intensity, women leaders, and absorptive capacity. Journal of Business Ethics 158: 47–61. [Google Scholar] [CrossRef]

- García-Villaverde, Pedro M., Gloria Parra-Requena, and María J. Ruiz-Ortega. 2017. From pioneering orientation to new product performance through competitive tactics in SMEs. BRQ Business Research Quarterly 20: 275–90. [Google Scholar] [CrossRef]

- Gharsalli, Mazen. 2019. High leverage and variance of SMEs performance. Journal of Risk Finance 20: 155–75. [Google Scholar] [CrossRef]

- Gillani, Fatima, Kamran Ali Chatha, Muhammad Shakeel Sadiq Jajja, and Sami Farooq. 2020. Implementation of digital manufacturing technologies: Antecedents and consequences. International Journal of Production Economics 229: 107748. [Google Scholar] [CrossRef]

- Gordon, Melissa, Michael Lockwood, Frank Vanclay, Dallas Hanson, and Jacki Schirmer. 2012. Divergent stakeholder views of corporate social responsibility in the Australian forest plantation sector. Journal of Environmental Management 113: 390–98. [Google Scholar] [CrossRef]

- Gras-gil, Ester, Mercedes Palacios Manzano, and Joaquín Hernández Fernández. 2016. Investigating the relationship between corporate social responsibility and earnings management: Evidence from Spain. BRQ Business Research Quarterly 19: 289–99. [Google Scholar] [CrossRef] [Green Version]

- Gürlek, Mert, and Muharrem Tuna. 2017. Reinforcing competitive advantage through green organizational culture and green innovation. The Service Industries Journal 38: 467–91. [Google Scholar] [CrossRef]

- Habib, Ashfaq, Muhammad Asif Khan, József Popp, and Mónika Rákos. 2022. The influence of operating capital and cash holding on firm profitability. Economies 10: 69. [Google Scholar] [CrossRef]

- Handayani, Rini, Sugeng Wahyudi, and Suharnomo Suharnomo. 2017. The effects of corporate social responsibility on manufacturing industry performance: The mediating role of social collaboration and green innovation. Business: Theory and Practice 18: 152–59. [Google Scholar] [CrossRef] [Green Version]

- Hansen, Erik G., and Stefan Schaltegger. 2016. The sustainability balanced scorecard: A systematic review of architectures. Journal of Business Ethics 133: 193–221. [Google Scholar] [CrossRef]

- Hermanto, Yustinus B., Lusy Lusy, and Maria Widyastuti. 2021. How financial performance and state-owned enterprise (SOE) values are affected by good corporate governance and intellectual capital perspectives. Economies 9: 134. [Google Scholar] [CrossRef]

- Hernández, Juan Pablo Sánchez-Infante, Benito Yañez-Araque, and Juan Moreno-García. 2020. Moderating effect offirm size on the influence of corporate socialresponsibility in the economic performance of micro-, small- and medium-sized enterprises. Technological Forecasting and Social Change 151: 119774. [Google Scholar] [CrossRef]

- Ho, Ying-Chin, Wen Bo Wang, and Wen Ling Shieh. 2016. An empirical study of green management and performance in Taiwanese electronics firms. Cogent Business and Management 3: 1266787. [Google Scholar] [CrossRef]

- Hou, Tony Chieh-Tse. 2019. The relationship between corporate social responsibility and sustainable financial performance: Firm-level evidence from Taiwan. Corporate Social Responsibility and Environmental Management 26: 19–28. [Google Scholar] [CrossRef] [Green Version]

- Jin, Mingzhou, Renzhong Tang, Yangjian Ji, Fei Liu, Liang Gao, and Donald Huisingh. 2017. Impact of advanced manufacturing on sustainability: An overview of the special volume on advanced manufacturing for sustainability and low fossil carbon emissions. Journal of Cleaner Production 161: 69–74. [Google Scholar] [CrossRef]

- Junaid, Muhammad, Qingyu Zhang, and Muzzammil Wasim Syed. 2022. Effects of sustainable supply chain integration on green innovation and firm performance. Sustainable Production and Consumption 30: 145–157. [Google Scholar] [CrossRef]

- Khan, Md. Habib-Uz-Zaman, Muhammad Azizul Islam, Johra Kayeser Fatima, and Khadem Ahmed. 2011. Corporate sustainability reporting of major commercial banks in line with GRI: Bangladesh evidence. Social Responsibility Journal 7: 347–62. [Google Scholar] [CrossRef] [Green Version]

- Khan, Parvez Alam, and Satirenjit Kaur Johl. 2019. Nexus of comprehensive green innovation, environmental management system-14001-2015 and firm performance: A conceptual framework. Cogent Business and Management 6: 1691833. [Google Scholar] [CrossRef]

- Kraus, Sascha, Shafique Ur Rehman, and F. Javier Sendra García. 2020. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technological Forecasting and Social Change 160: 120262. [Google Scholar] [CrossRef]

- Łaszkiewicz, Edyta. 2019. Eco-innovations in SMEs. Science for Environment Policy 20: 119–31. [Google Scholar] [CrossRef]

- Lee, Jung Wan, Young Min Kim, and Young Ei Kim. 2018. Antecedents of adopting corporate environmental responsibility and green practices. Journal of Business Ethics 148: 397–409. [Google Scholar] [CrossRef]

- Leitão, João, Sónia de Brito, and Serena Cubico. 2019. Eco-Innovation Influencers: Unveiling the Role of Lean Management Principles Adoption. Sustainability 11: 2225. [Google Scholar] [CrossRef] [Green Version]

- Lepak, David P., Ken G. Smith, and M. Susan Taylor. 2007. Introduction to special topic forum value creation and value capture: A multilevel perspective. Academy of Management Review 32: 180–94. [Google Scholar] [CrossRef] [Green Version]

- Li, Yiwei, Mengfeng Gong, Xiu-Ye Zhang, and Lenny Koh. 2017. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. The British Accounting Review 50: 60–75. [Google Scholar] [CrossRef] [Green Version]

- Liang, Chin Chia, Yuwen Liu, Carol Troy, and Wen Wen Chen. 2020. Firm characteristics and capital structure: Evidence from ASEAN-4 economies. Advances in Pacific Basin Business, Economics, and Finance 8: 149–62. [Google Scholar] [CrossRef]

- Mallon, Mark R., Stephen E. Lanivich, and Ryan L. Klinger. 2017. Resource configurations for new family venture growth. International Journal of Entrepreneurial Behavior and Research 24: 521–37. [Google Scholar] [CrossRef]

- Mardnly, Zukka, Sulaiman Mouselli, and Riad Abdulraouf. 2018. Corporate governance and firm performance: An empirical evidence from Syria. International Journal of Islamic and Middle Eastern Finance and Management 11: 591–607. [Google Scholar] [CrossRef]

- Mazodier, Marc, Francois Anthony Carrillat, Claire Sherman, and Carolin Plewa. 2021. Can donations be too little or too much? European Journal of Marketing 55: 271–96. [Google Scholar] [CrossRef]

- Mbanyele, William, Hongyun Huang, Yafei Li, Linda T. Muchenje, and Fengrong Wang. 2022. Corporate social responsibility and green innovation: Evidence from mandatory csr disclosure laws. Economics Letters 212: 1–7. [Google Scholar] [CrossRef]

- Moon, Jeremy, Andrew Crane, and Dirk Matten. 2005. Can corporations be citizens? Corporate citizenship as a metaphor for business participation in society. Business Ethics Quarterly 15: 429–53. [Google Scholar] [CrossRef] [Green Version]

- Munasinghe, Mohan, Priyangi Jayasinghe, Yvani Deraniyagala, Valente José Matlaba, Jorge Filipe dos Santos, Maria Cristina Maneschy, and José Aroudo Mota. 2019. Value–Supply Chain Analysis (VSCA) of crude palm oil production in Brazil, focusing on economic, environmental and social sustainability. Sustainable Production and Consumption 17: 161–75. [Google Scholar] [CrossRef]

- Nguyen, Nguyen Thi Thao, Nguyen Phong Nguyen, and Tu Thanh Hoai. 2021. Ethical leadership, corporate social responsibility, firm reputation, and firm performance: A serial mediation model. Heliyon 7: e06809. [Google Scholar] [CrossRef] [PubMed]

- Novitasari, Maya, and Dian Agustia. 2021. Green supply chain management and firm performance: The mediating effect of green innovation. Journal of Industrial Engineering and Management 14: 391–403. [Google Scholar] [CrossRef]

- Oliveira, Juliana Albuquerquer Saliba de, Leonardo Fernando Cruz Basso, Herbert Kimura, and Vinicius Amorim Sobreiro. 2019. Innovation and financial performance of companies doing business in Brazil. International Journal of Innovation Studies 2: 153–64. [Google Scholar] [CrossRef]

- Orlitzky, Marc, Frank L. Schmidt, and Sara L. Rynes. 2003. Corporate social and financial performance: A meta-analysis. Sage Journals 24: 403–41. [Google Scholar] [CrossRef]

- Ozbek, O. Volkan, and Brian Boyd. 2020. The Influence of CEO duality and board size on the market value of spun-off subsidiaries: The contingency effect of firm size. Journal of Strategy and Management 13: 333–50. [Google Scholar] [CrossRef]

- Perda Kaltim Pasal 23 Ayat 1. 2013. Peraturan Daerah Provinsi Kalimantan Timur No.09 Tahun 2013 Tentang Anggaran Pendapatan dan Belanja Daerah tahun Anggaran [East Kalimantan Provincial Regulation No. 09 of 2013 Concerning the Regional Revenue and Expenditure Budget for the Fiscal Year] 2014. Available online: https://peraturan.bpk.go.id/Home/Details/21308/perda-prov-kalimantan-timur-no-3-tahun-2013 (accessed on 20 December 2021).

- PP RI No. 47 Tahun. 2012. Tentang Tanggung Jawab Sosial dan Lingkungan Perseroan Terbatas [About Social and Environmental Responsibility of Limited Liability Companies]. Available online: https://peraturan.bpk.go.id/Home/Details/5260/pp-no-47-tahun-2012 (accessed on 20 December 2021).

- Rehfeld, Katharina-Maria, Klaus Rennings, and Andreas Ziegler. 2007. Integrated product policy and environmental product innovations: An empirical analysis. SSRN Electronic Journal 61: 91–100. [Google Scholar] [CrossRef] [Green Version]

- Saeidi, Parvaneh, Lorenzo Adalid Armijos Robles, Sayedeh Parastoo Saeidi, and Maria Isabel Vera Zamora. 2021. How does organizational leadership contribute to the firm performance through social responsibility strategies? Heliyon 7: e07672. [Google Scholar] [CrossRef]

- Sáez-Martínez, Francisco J., Cristina Díaz-García, and Ángela González-Moreno. 2016. Factors Promoting Environmental Responsibility in European SMEs: The Effect on Performance. Sustainability 8: 898. [Google Scholar] [CrossRef] [Green Version]

- Saha, Raiswa, Shashi Kashav, Roberto Cerchione, Rajwinder Sigh, and Richa Dahiya. 2019. Effect of ethical leadership and corporate social responsibility on firm performance: A systematic review. Corporate Social Responsibility and Environmental Management 27: 409–29. [Google Scholar] [CrossRef]

- Santoso, Ruben Wahyu, Hotlan Siagian, Zeplin Jiwa Husada Tarigan, and Ferry Jie. 2022. Assessing the benefit of adopting ERP technology and practicing green supply chain management toward operational performance: An evidence from Indonesia. Sustainability 14: 4944. [Google Scholar] [CrossRef]

- Sapta, I. Ketut Setia, I. Nengah Sudja, I. Nengah Landra, and Ni Wayan Rustiarini. 2021. Sustainability performance of organization: Mediating role of knowledge management. Economies 9: 97. [Google Scholar] [CrossRef]

- Shahzad, Mohsin, Ying Qu, Abaid Ullah Zafar, Saif Ur Rehman, and Tahir Islam. 2020a. Exploring the influence of knowledge management process on corporate sustainable performance through green innovation. Journal of Knowledge Management 24: 2079–106. [Google Scholar] [CrossRef]

- Shahzad, Mohsin, Ying Qu, Saad Ahmed Javed, Abaid Ullah Zafar, and Saif Ur Rehman. 2020b. Relation of environment sustainability to csr and green innovation: A case of pakistani manufacturing industry. Journal of Cleaner Production 253: 119938. [Google Scholar] [CrossRef]

- Siagian, Hotlan, Zeplin Jiwa Husada Tarigan, and Ferry Jie. 2021. Supply chain integration enables resilience, flexibility, and innovation to improve business performance in COVID-19 Era. Sustainability 13: 4669. [Google Scholar] [CrossRef]

- Soewarno, Noorlailie, Bambang Tjahjadi, and Febrina Fithrianti. 2019. Green innovation strategy and green innovation: The roles of green organizational identity and environmental organizational legitimacy. Management Decision 57: 3061–78. [Google Scholar] [CrossRef]

- Somjai, Sudawan, Ratchada Fongtanakit, and Khomsan Laosillapacharoen. 2020. Impact of environmental commitment, environmental management accounting and green innovation on firm performance: An empirical investigation. International Journal of Energy Economics and Policy 10: 204–10. [Google Scholar] [CrossRef]

- Su, Xiaofeng, Anxin Xu, Wenhe Lin, Youcheng Chen, Sangtao Liu, and Wenxing Xu. 2020. Environmental leadership green innovation practices, environmental knowledge learning, and firm performance. SAGE Open 10: 2158244020922909. [Google Scholar] [CrossRef]

- Tang, Mingfeng, Grace Walsh, Daniel Lerner, Markus A. Fitza, and Qiaohua Li. 2017. green innovation, managerial concern and firm performance: An empirical study. Business Strategy and the Environment 27: 39–51. [Google Scholar] [CrossRef]

- Tarigan, Zeplin Jiwa Husada, Hotlan Siagian, and Ferry Jie. 2021. Impact of enhanced enterprise resource planning (ERP) on firm performance through green supply chain management. Sustainability 13: 4358. [Google Scholar] [CrossRef]

- Tarigan, Zeplin Jiwa Husada, Novia Chandra Tanuwijaya, and Hotlan Siagian. 2020. Does top management attentiveness affect green performance through green purchasing and supplier collaboration? Academy of Strategic Management Journal 19: 1–9. [Google Scholar]

- Tariq, Adeel, Yuosre F. Badir, Waqas Tariq, and Umair Saeed Bhutta. 2017. Drivers and consequences of green product and process innovation: A systematic review, conceptual framework, and future outlook. Technology in Society 51: 8–23. [Google Scholar] [CrossRef]

- Tjahjadi, Bambang, Noorlailie Soewarno, and Febriani Mustikaningtiyas. 2021. Good corporate governance and corporate sustainability performance in Indonesia: A triple bottom line approach. Heliyon 7: e06453. [Google Scholar] [CrossRef]

- Wang, Qian, Junsheng Dou, and Shenghua Jia. 2016. A meta-analytic review of corporate social responsibility and corporate financial performance: The moderating effect of contextual factors. Business and Society 55: 1083–121. [Google Scholar] [CrossRef]

- Weber, Olaf. 2017. Corporate sustainability and financial performance of Chinese banks. Sustainability Accounting, Management and Policy Journal 8: 358–85. [Google Scholar] [CrossRef] [Green Version]

- Wei, An-Pin, Chi-Lu Peng, Hao-Chen Huang, and Sang-Pao Yeh. 2020. Effects of Corporate social responsibility on firm performance: Does customer satisfaction matter? Sustainability 12: 7545. [Google Scholar] [CrossRef]

- Welford, Richard. 2007. Corporate governance and corporate social responsibility: Issues for Asia. Corporate Social Responsibility and Environmental Management 14: 42–51. [Google Scholar] [CrossRef]

- Wong, Christina W. Y., Kee-hung Lai, Kuo-Chung Shang, Chin-Shan Lu, and T. K. P. Leung. 2012. Green operations and the moderating role of environmental management capability of suppliers on manufacturing firm performance. International Journal of Production Economics 140: 283–94. [Google Scholar] [CrossRef]

- Wongthongchai, Jirawat, and Krittapha Saenchaiyathon. 2019. The key role of institution pressure on green supply chain practice and the firm’s performance. Journal of Industrial Engineering and Management 12: 432–46. [Google Scholar] [CrossRef]

- Wood, Donna J. 1991. Corporate social performance revisited. Academy Ol ManagemenI Review 16: 691–718. [Google Scholar] [CrossRef]

- Xie, Xuemei, Jiage Huo, and Hailiang Zou. 2019. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. Journal of Business Research 101: 697–706. [Google Scholar] [CrossRef]

- Xue, Min, Francis Boadu, and Yu Xie. 2019. The penetration of green innovation on firm performance: Effects of absorptive capacity and managerial environmental concern. Sustainability 11: 2455. [Google Scholar] [CrossRef] [Green Version]

- Yadav, Inder Sekhar, Debasis Pahi, and Phanindra Goyari. 2020. The size and growth of firms: New evidence on law of proportionate effect from Asia. Journal of Asia Business Studies 14: 91–108. [Google Scholar] [CrossRef]

- Yakob, Noor Azuddin, and Norraidah Abu Hasan. 2021. Exploring the interaction effects of board meetings on information disclosure and financial performance in public listed companies. Economies 9: 139. [Google Scholar] [CrossRef]

- Yang, Minghui, Paulo Bento, and Ahsan Akbar. 2019. Does CSR influence firm performance indicators? evidence from Chinese pharmaceutical enterprises. Sustainability 11: 5656. [Google Scholar] [CrossRef] [Green Version]

- Yin, Jianhua, Lidong Gong, and Sen Wang. 2018. Large-scale assessment of global green innovation research trends from 1981 to 2016: A bibliometric study. Journal of Cleaner Production 197: 827–41. [Google Scholar] [CrossRef]

- Zhang, Dayong, Zhao Rong, and Qiang Ji. 2019a. Green innovation and firm performance: Evidence from list companies in China. Resources, Conservation and Recycling 144: 48–55. [Google Scholar] [CrossRef]

- Zhang, Jhunru, Hadrian Geri Djajadikerta, and Terri Trireksani. 2019b. Corporate sustainability disclosure’s importance in China: Financial analysts’ perception. Social Responsibility Journal 16: 1169–89. [Google Scholar] [CrossRef]

- Zhou, Guichuan, Lan Zhang, and Liming Zhang. 2019. Corporate social responsibility, the atmospheric environment, and technological innovation investment. Sustainability 11: 481. [Google Scholar] [CrossRef] [Green Version]

- Zhu, Qinghua, Joseph Sarkis, and Yong Geng. 2005. Green supply chain management in China: Pressures, practices, and performance. International Journal of Operations &Production Management 25: 449–68. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).