Abstract

Small and medium-sized enterprises (SMEs) play an increasingly important role in global economic development, and they have encountered many unique problems (such as resources and strategic choice). Strategic management accounting (SMA) techniques can help SMEs allocate limited resources rationally and integrate internal and external information to help managers make strategic decisions. However, how and what is the SMA applied in the reality of SMEs, especially in developing countries today. This paper aims to explore the extent to which SMEs of developing countries use SMA. This article used the qualitative research method and the data were collected by interviewing five managers and two employees in M company. The findings indicated that: (1) The senior managers of SMEs do not have an understanding of accounting nor pay enough attention to it, and the role of SMA is even worse; (2) Although the chief financial officers obtain the knowledge of SMA, they cannot fully involve it in their strategic decision making. (3) SMEs have realized that enterprise culture is very important for a company to achieve strategic goals, but it is far from enough to attach importance to and create it. (4) The general managers of SMEs believe that the operating department is the core of the company and all resources should be prioritized to meet their needs.

1. Introduction

With rapid economic development, China has made remarkable achievements and their GDP ranks second in the world. The private economy that gives priority to SMEs, which is an important part of GDP, still is in the primary stage. The development of small and medium-sized enterprises (SMEs) plays a very important role in the global economy and production (Tong et al. 2022), and these companies are considered the backbone of economic growth in all countries for stabilizing the national economy and building a sustainable supply chain (Diabate et al. 2019). SMEs account for more than 99% of global enterprises, employ about 60% of the labor force, provide a large number of employment opportunities for society (OECD 2019), and some of them as suppliers promote productivity for large companies (Singh et al. 2008). However, due to the limited resources and simple organizational structure of SMEs, they are at a disadvantage in product quality, cost control, and the ability to smooth operations compared with large multinational enterprises (Li 2019). Besides, SMEs also face other challenges such as the development of human resources, performance management, and relationships with suppliers and distributors (Teerasoponpong and Sopadang 2022). For example, it is difficult for SMEs to hire high-quality employees and retain them. This is because the flat corporate structure of SMEs usually makes employees feel depressed and that it is very difficult for them to achieve their personal career goals in the short and medium term for most recent college graduates (Zhang et al. 2020). Nixon and Burns (2012) claimed that SMA techniques refer to costing, control, planning, performance management, strategic decision-making, and competence. Therefore, there are increasing researchers paying more attention to the application of SMA in developed countries or the application of SMA by a small number of large enterprises in developing countries (Mitchell and Reid 2000). However, these researchers do not study the relationship between SMA and SMEs. Therefore, this paper tries to investigate the application of SMA in SMEs in developing countries through using a qualitative research method to provide an in-depth study on a small company in China to explore more information about the use of SMA in SMEs of developing countries. This paper tries to explore to what extent SMA is used in SMEs. By interviewing, it may find new findings and some problems with the use of SMA. In addition, it explores what causes these problems, which may contribute to the study of SMA in developing countries.

The rest of this article is arranged as follows: Section 2 provides an overview of the overall literature on this paper’s topic. Section 3 discusses the choice of methodology and provides the reason why this paper chooses the semi-structured interview qualitative research method and uses the research onion according to Saunders et al. (2012) to outline methodology. Section 4 shows the findings and discusses the awareness of SMA and the use of SMA on markets and company. Finally, Section 5 offers the main conclusions and suggestions for future studies.

2. Literature Review

2.1. A Brief Overview of SMA

With the continuous development of globalization, the market has not always been a big scale of a subject as what it is today. Organizations need to be more coordinated to adapt to changes in the external environment and technological progress (Chi et al. 2020). Therefore, the competition faced by enterprises has not only come from domestic but also from overseas. Facing the rapidly changing external environment and strong competitors, the world is looking for the most effective management methods to help companies achieve their strategic goals (Albu and Albu 2012). In the 1980s, the basic concept of strategic management accounting (SMA) was established by Simmonds (Simmonds 1982) as an externally oriented method to supplement the deficiency of management accounting practices (Roslender and Hart 2010). Since then, some SMA practices have been introduced (Cadez and Guilding 2012; Rigby and Bilodeau 2015) and interest has been growing to establish the popularity of such practices among firms and determine their impact on firm performance (Nguyen and Nguyen 2021; Rigby and Bilodeau 2015; Vu et al. 2022). However, from the existing literature, the result is both good and bad, while some empirical studies have documented that SMA practices brought into use have led to better firm performance (Alamri 2018; Pavlatos and Kostakis 2018; Shi 2021; Vu et al. 2022), others have reported disappointing implementation rates (Lachmann et al. 2013; Langfield-Smith and Parker 2008). The main role of strategic management accounting refers to assisting senior leadership to develop competitive strategies and the implementation of strategic planning, which promotes companies to raise awareness of constant concerns and sustainable development from strategic high-degree analysis and thinking (Hadid and Al-Sayed 2021).

2.1.1. Current Analysis of SMA

Nguyen and Le (2020) claimed that seven factors affect the application of SMA, including enterprise size, managers’ awareness of management accounting, cost of applying strategic management accounting, intensity of competition in the strategic market of enterprises, qualifications of accountants, and the concept of just in time. Especially for just in time (Bhamu and Singh Sangwan 2014), SMA seems to be a new concept widely used by manufacturing enterprises in developed countries (Petera and Šoljaková 2019). McLachlin (1997) reported that from the late 1970s, the management concept of just in time has attracted the attention of Western developed countries. Moreover, the term just in time also can be seen as the reason why Japanese companies successfully seized their market positions globally (Cao 2021). One classic example of these companies could be illustrated by the case of Toyota automobile production. This production formation means no inventory or no inventory production as well as continuous flow manufacturing and lean production. Furthermore, the production of just in time is driven by three steps according to demand to set the output and then according to the output to purchase materials. It seems that just in time can save warehouse costs and reduce the waste of production materials. However, it emphasizes that suppliers should be on time, which means that enterprises should have stable suppliers, which also implies that the number of suppliers of companies with just-in-time production concepts is relatively small. However, some enterprises just grasp some characteristics of this model without coming up with a complete set of ideas and systems. For example, some seasonal firms have noticed the significance of stable suppliers but ignored the demand for flexible labours, which resulted in their failure to achieve the same success as other businesses (Cao 2021). Therefore, for SMEs, the use of just in time may have its opportunities and limitations. Besides, in terms of small cross-border e-commerce, they need to recognize the concept of just in time. This is because it takes time to deliver goods overseas. If companies want to reduce transportation costs by shipping, they need to control the quality of products because once a lot of goods are shipped to Amazon’s warehouse, they face quality inspection with a relatively high return cost. In addition, Amazon’s warehouses charge for stock cubage. The longer the product stays in Amazon’s warehouse, the higher the storage costs the company has to pay. Therefore, companies need to control transportation time while ensuring product quality. However, for most SMEs, it is difficult to find a fixed long-term supplier. However, it can be seen as an opportunity for cross-border e-commerce simply because they just need to purchase goods and transport them overseas, rather than manufacture the goods themselves.

Additionally, Bromwich (1990) claimed that management scholars should pay more attention to the value creation of an organization. An interrelated approach that combines strategic objectives, management actions, and performance results promote the identification and measurement of the driving factors of enterprise value. The balanced scorecard model, the action–profit–linkage model, and the service-profit chain promote the perfection of enterprise performance management. The balanced scorecard model takes into account multiple factors that affect performance from internal and external to financial and non-financial ones. Compared with traditional performance measurement, it can help companies’ employees show a long-term perspective in decision making and finishing performance index. Concerning the development of performance standards, progress has also been made in the development of SMA. Wisner (2001) pointed out that in some companies, employees should be offered opportunities to participate in the development of performance indicators. There is a slack that exists in target completion by using the top-down method. This is because goal setting seems to be unrealistic under the current market trends and employees may lack incentives to approach the target. If the target set is over practical, then employees lack a sense of motivation for further achievement. Thus, the bottom-up method could enhance communication between staff and senior managers while making performance indicators more rational and sensible to the current situation. Although top managers are often authorized to make decisions independently, this approach still guarantees that part of the power can be delivered to employees.

Kaplan and Norton (1996) argue that a balanced scorecard is not constrained only by financial and non-financial analysis but rather represents different department strategies. The implementation of a balanced scorecard contributes to the achievement of companies’ strategic goals. Four perspectives of a balanced scorecard keep the balance between short-term and long-term targets, expected results, and actual results. Although a balanced scorecard shows the conflict in some measurements, all measurements are made for a company as a whole. Tuan (2020) put forward four aspects of the balanced scorecard, which contribute to companies achieving their strategic goals. In addition, he pointed out that financial performance targets decide companies’ long-term targets. For small and medium-sized enterprises, most products tend to remain stable at the very early stage of their life cycles. This means that they may have rapid growth, which requires that a company improves their operating ability. They need to have budgeted in allocating limited resources because SMEs need to invest in research and development, improve infrastructure, and develop customers’ and suppliers’ relationships. Therefore, budgeting is very important for products at the early stage of the life cycle. During the process of exploring new popular products, companies also need to budget and appropriately allocate resources. Kaplan and Norton (1996) explain that the second perspective is customer orientation. Companies need to find their advanced competitive segments markets by highlighting their strengths. Compared with large companies, small and medium enterprises lack a wider brand profile. They may use differential products to open markets. In addition, from the perspective of internal business processes, different departments need to work together to help companies to compete in their target markets. Powell (2001) pointed out that the value chain should connect different departments with companies’ strategic goals. This is because the value chain combines all strategy-related activities. For example, the operating department needs to investigate which kind of product is popular and meet the customers’ preference for future research and development. If the financial department needs to achieve a target profit, it may need to discuss with the research and development department since the design process determines most of the cost of the product (Leonidou et al. 2022). Therefore, for internal business processes, the company’s departments need to work together to maximize its benefits. The final aspect is the basis for achieving the first three dimensions. It emphasizes learning and growth. As a basis for the company’s development, the company may need to pay more attention to training employees (Li and Guo 2020), which enables them to equip their positions with enough qualifications. At the same time, making appropriate performance measurement criteria about financial and non-financial perspectives enables employees to perform towards their corporate goals.

2.1.2. The Importance of SMA

Dixon’s balanced scorecard (1993) claimed that from the perspective of a company’s long-term strategies, a traditional management accounting system may not provide related and valuable information for senior managers to make strategic decisions. This is because traditional management accounting focuses on internal financial reporting, and it ignores providing external business and some non-financial information (Cadez and Guilding 2012). For cross-border e-commerce companies, they have to compete not only with local industry but also with foreign businesses (Leonidou et al. 2022). Besides, Dixon’s balanced scorecard (Tuan 2020) argues that traditional cost accounting is not flexible enough in cost allocation and cost nature aggregation. In addition, they just perform calculations and bookkeeping step by step. This means that they just spend a lot of energy on completing accounting books rather than thinking about what the cost driver is for these costs. If they can find these cost incentives, they may change product design or material without changing quality to help companies reduce costs and expenses. Using SMA to develop cost strategies and strong economic forecasts can help companies improve their market share in the economic marketplace. Companies may also be able to create a distinct competitive advantage over competitors in their business industry or sector. This advantage means more profits for the company and the opportunity to expand its operations or enter new business markets. SMA can also determine whether a company needs to drop certain business lines to improve its profit margin and cut wasteful operations (Cadez and Guilding 2012). Although cost accounting is a small part of all companies’ operations, it may be able to grab market share with a small price advantage by reducing cost. Cescon et al. (2018) demonstrated that SMA refers to assisting senior leadership to develop competitive strategy and the implementation of strategic planning, which promotes companies that have strong concerns and sustainable development from the strategic high-degree analysis and thinking approach. This cannot only provide the company with internal information related to the strategy, but also provides the company with timely analysis of external information related to customers and competitors, which is in the service of an accounting branch of enterprise strategy management. Different from SMA, traditional management accounting only focuses on financial information. SMA expands the content and processing methods of information to provide broad and in-depth information for managers (Asthana 2012). In addition, it pays more attention to the external environment of the enterprise, comprehensively analyzes the market position of the enterprise, and helps managers to make correct strategic decisions. Dixon and Smith (1993) pointed out this is not only a tool for the more exact allocation of costs but also an important strategic technique, often accompanied by the implementation of activity-based management. Hergert and Morris (1989) explained the reason why non-manufacturing costs are not taken into the calculation of product cost because when analyzing product cost there is deviation existing in traditional costing systems. This means that the traditional costing system may not offer a correct report on external environmental-related cost classification and accumulation. Therefore, the deviation of traditional management accounting in analyzing external environment costs contributes to the demand and development of SMA. Ibragimova (2019) emphasized the importance of SMA for its explanation on similar products’ price, which needs to be lower than market price to achieve a competitive advantageous market. SMA focuses more on market price and then helps companies to reduce their cost to achieve target profit margin (Cadez and Guilding 2008). Besides, if traditional management accounting can better reflect the economic effect of fixed cost utilizing financial statements, it can continue to develop under the current condition of competitive market theory.

Traditional management accounting provides internal financial information for senior managers to make decisions. The decision maker spends 70 per cent of the time waking up and reprocessing these data to fit the strategic purpose (Ward and Mowat 2012). This means that this internal information cannot provide strategic related data for decision making. On the contrary, Ward and Mowat (2012) share a view that SMA methods can adapt to the needs of an enterprise’s strategic management, since SMA methods provide visionary and more effective strategies-related information. It provides non-financial information related to enterprise strategy, focusing on the long-term interests of an enterprise and avoiding short-sighted ideas (Dixon and Smith 1993). SMA takes a comprehensive and sustainable view of cost accounting, budgeting, performance measurement, and strategic decision making. They can give direct information for senior managers to decide on without spending more time reprocessing them. Moreover, it improves enterprises’ strategic performance evaluation systems, which are a kind of strategic management method needed by modern enterprises.

2.2. Application of SMA from the Perspective of SMEs

2.2.1. Current Use of SMA in Developing Countries

Oboh and Ajibolade (2017) investigated the scope of practice of SMA in Nigeria and found that the SMA practiced by Nigerian Banks is not a concept but a principle of operation. SMA has contributed to the strategic decisions of Nigerian banks in the field of market competitive advantage and helped them enlarge market share. Oboh and Ajibolade (2017) examined whether Nigerian banks adopt SMA and the benefits that SMA brings to Nigerian banks. The history of Nigerian banks shows that they often have an unstable operating condition, which is caused by poor management and fraudulent decisions. The adoption and implementation of Nigerian banks depend on contingency variables such as history, government, and creativity. According to contingency theory, Nigerian can achieve a competitive advantage in the industry. In addition, for management accountants in Nigeria, the reason for abandoning traditional management accounting techniques for new ones is that they want expected returns. Almaryani and Sadik (2012) suggested Romanian companies find that SMA plays an important role in helping Romanian companies achieve strategic targets. Besides, Romania’s senior managers benefit from SMA in some applications and implementations because of the functions of SMA techniques in performance measurement, planning, budgeting, and competitor analysis. However, there are also some difficulties in the development of SMA in Romania. Facing a rapidly changing business environment, it appears unusual. This may be related to a shorter life cycle of strategic management tools and concepts. Therefore, Oboh and Ajibolade (2017) claimed that SMA technology cannot completely replace the traditional management methods, and it can only be used as a supplement to accounting technology. In Vietnam, management tools are mostly used for financial management accounting, and they rarely use innovative management control methods (Nguyen and Nguyen 2021). This is also happening in large companies in Malaysia. It is worth noting that the information element of SMA has recently been widely used in exploratory research conducted by electrical and electronic companies operating in Malaysia (Noordin et al. 2009). In addition, the Malaysian market believes that competitor information, consumer information, and production-chain-related information are important factors in SMA, which makes companies competitive. Jusoh and Tan (2012) illustrate that Malaysia’s goal is to become a progressive and high-income country by 2020, and it will be able to have its place in a globalized economy. Besides, during the process, it can attract investment and drive productivity and innovation. Malaysia has invested in the study of SMA, and Malaysian enterprises must understand whether the use of SMA technology can improve their competitiveness in the global market.

Therefore, SMA has been developed in developing countries. Many developing countries realized that traditional management accounting is not sufficient in some management accounting tools and techniques and have strengthened their research on SMA. At present, developing countries retain some traditional management accounting implementation, supplemented by SMA to promote the sustainable development of enterprises.

2.2.2. Defining the Connection between SMA and SMEs

Ban and Song (2012) defined the use of SMA, claiming it should include the new tasks of management accounting such as strategic planning, strategic cost analysis, and strategic market analysis. Although SMEs play a pivotal role in global economic development (Nguyen et al. 2020; Zhang et al. 2020), the long-term study of management accounting tends to neglect the special situation of the application of management accounting in SMEs (Mitchell and Reid 2000). An increasing number of literature has been produced on this topic, and it is still scattered and irrelevant (Lavia López and Hiebl 2014). In other words, current research may not be able to have a comprehensive and overall understanding of the specifics of management accounting for SMEs. The possible reason for this is that the result of research on the subject may be separated across different areas such as accounting, entrepreneurial spirit, integrated management, and production control. In addition, articles about management accounting may focus on large companies. However, they do not deal with the problem of management accounting applications in SMEs.

Mitchell and Reid (2000) pointed out that in the management accounting area, SMEs need more attention, since compared with large companies, SMEs are offered different kinds of resources. Therefore, SMEs suffers a variety of difficulties in operating their own business. For example, SMEs tend to show up with a simpler organizational structure, which may enable them to be flexible at getting accustomed to current market changes. However, SMEs normally suffered from limited resources, which makes the expansion of market share more difficult to achieve under the subject of the economic scale. To compete with large companies, SMEs need to adopt appropriate information and control systems to manage scarce resources. Thus, a management accounting system enables SMEs to allocate resources rationally by managing information requirements (Ali Qalati et al. 2020; Helgeson et al. 2022; Laurinkevičiūtė and Stasiškienė 2011; Le and Ikram 2022; Müller et al. 2021; Zhang et al. 2020). Therefore, in SMEs, management accounting plays an important role in an enterprise’s functions. It supports business functions by providing management planning and dealing with or analyzing valuable information (Müller et al. 2021).

However, due to resource constraints, professional management accountants become unbearable for most SMEs, sometimes even ordinary full-time accountants. Mitchell and Reid (2000) argued that SMEs’ lack of resources is normally reflected in a partial or complete lack of management accountants. This is because SMEs owners and employees are not able to achieve adequate training. In addition, another potential reason is that SMEs owners may not recognize the importance of ongoing training in accounting. Therefore, this shows that compared with large companies, the financial decision-making tools of SMEs are simple but also not appreciated (Zhang et al. 2020). Therefore, SME owners serve as general managers who lack valuable information about planning and managing. When SME owners lack professional suggestions, companies’ financial decision making tends to reflect their own opinion. However, empirical findings claim that the success and satisfying performance of SMEs benefits from making full use of financial management and accounting information (Quinn 2011).

2.3. Current Research of SMA Use in China

Li (2019) did research on service companies in China from the perspective of SMA, which indicates that SMA expands the commercial outlook for companies by offering them a better understanding of the relationship between business strategies, accounting, and social life. Besides, traditional accounting is confined to the narrow scope of single enterprises and mainly focuses on the cost control of the production process as well as the processing of accounting information procession, which leads to ignoring the change in the comparative advantage of the enterprise in the competitive market. Fong and Chen (2011) demonstrated that Chinese service companies also realize that the traditional enterprise profit evaluation standard is inadequate. Therefore, to meet the requirements of the market, SMA has to be developed.

Since 2010, e-commerce has developed rapidly and made considerable contributions to the current marketplace of China (Zhang et al. 2020). Alibaba could be the best example of this since it provides a mature e-commerce platform for both enterprises and customers. However, some small e-commerce companies have been eliminated during the process of the expansion of Alibaba, which leads them to find more opportunities in other e-commerce platforms. Therefore, more external information analysis is highly required by SMEs in China, and managers need to pay more attention to timeliness under the consideration of cross-border e-commerce. In addition, SMA enables small enterprises in China to discover information to help to improve their administrative decisions, which in turn enhance commercial performance (Baines and Langfield-Smith 2003). Besides, Fan (2019) pointed out that cross-border e-commerce is a very important opportunity for SMEs to increase considerable revenue in the Chinese market. In other words, if Chinese SMEs want to enlarge their market shares by offering competitive products to customers, they need to analyze the expectations of their target customers and have a better understanding of their preferences. Besides, they also need to know information about competitors such as the approximate cost and price of the product. Approximate cost is used for SMA to identify target cost and narrow its cost gap, which makes product price more competitive without lowering its product quality (Gagne and Discenza 2013). Therefore, in the current marketplace of China, traditional accounting has not been able to better adapt to the needs of the strategic management of SMEs, and the new situation shows more limitations.

In the past few decades, SMA has attracted a large number of scholars to study it (Nguyen and Nguyen 2021). With the integration of the world economy, there is no denying that a better application of SMA could effectively assist minor enterprises to perform competitively in current market trends. Although many researchers have focused on management accounting or SMA topics, they still tend to focus on developed countries and large companies or organizations (Carlsson-Wall et al. 2015; Cescon et al. 2018; Ibragimova 2019; Lachmann et al. 2013; Li 2019; Nguyen and Nguyen 2021; Turner et al. 2017). These researchers neglected the important role of small and medium companies. Zhang et al. (2020) pointed out that many documents record the role of management accounting in developed countries such as Canada, the UK, and the U.S. However, there is little literature on many developing countries, such as Asian companies. In addition, Roslender and Hart’s (2003) study of the theory and practice of SMA suggests that researchers must continue to study SMA in the future, such as with case studies because the samples chosen by researchers are not enough. Additionally, many companies have limited familiarity with SMA techniques, and they may have limitations in the implementation of techniques. Moreover, Roslender and Hart (2003) also support that the study of SMA should be carried out in a specific period and environment. Therefore, the study of SMA has timeliness. Accordingly, this paper tries to explore more information about the use of SMA in SMEs in China.

3. Methodology and Data

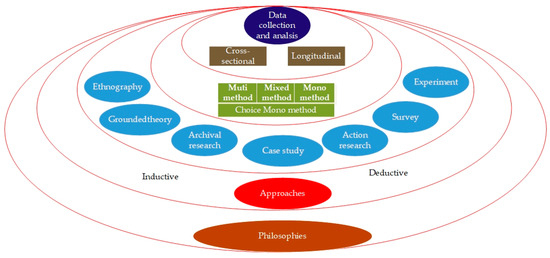

The research process of this paper is based on the study Onion of Saunders et al. (2012) as shown in Figure 1. The research process can be divided into six parts including philosophies, approaches, strategies, choices, time horizons, and techniques and procedures.

Figure 1.

Onion Method (Saunders et al. 2012).

3.1. Philosophy—Pragmatic

Saunders et al. (2012) claimed that pragmatism emphasizes actual results, and there is no single factor that could reflect the overall situation. Therefore, this paper uses the interview method to communicate with executives and employees to achieve the research objectives. By one-to-one interviewing and video chat, this paper attempts to explore more in-depth information about the application of SMA in SMEs. At the same time, from the perspective of employees, this paper represents to what extent SMA technology could effectively penetrate a company’s daily operations. Instead of just listening to executives, all staff members would like to show their good performance to the public.

3.2. Approach—Inductive

The deductive approach is the development of theory, while inductive is to understand the problem and conclude its nature. Darabi et al. (2020) pointed out that theories created by inductive study may be more useful and practical than those theories explained by conducting deductive studies. Before exploring the development of the company, the researcher needs to have a good understanding of its current conditions. For example, a researcher needs to view a certain industry as a whole before conducting certain measures. In this paper, researchers need to know the company’s competitors and industry environment by observation and documents. Darabi et al. (2020) support that researchers need to observe at the beginning of the research. In addition, they need to explain the results and findings. Finally, that information needs to be concluded by researchers. On the contrary, deductive research needs to be supported by the development of existing theories. Therefore, this study chooses the inductive approach.

3.3. Strategy—Case Study

The selection of any strategy should refer to a plan to respond to certain research questions. In addition, a case study can help researchers appropriately identify research questions about why, what, and how, which contributes to researchers having a better understanding of the background of research themes and research topics (Saunders et al. 2012). This paper tries to analyze the case study of M cross-border e-commerce companies and tries to explore the possible application of SMA methods in SMEs. The case study provides opportunities for the author to understand through M company the process of growth and operation conditions.

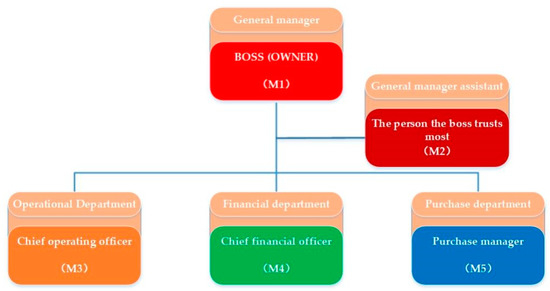

To study SMA in SMEs, it is very important to select a representative enterprise. However, this is extremely difficult because, by the end of 2019, China had 30 million small and medium-sized enterprises (excluding 70 million registered as self-employed businesses). It is impossible to choose a representative which contains all enterprise characteristics. However, we also chose a relatively representative M enterprise. M company has been across-border e-commerce in Shenzhen since 2015. The main business at this time is electronics including computers, communication, and consumer electronics. After 2017, M company changed its strategic planning and main business from electronic products to home textile. The company’s address also moved from Shenzhen to Nantong. Over the past four years, the company has achieved a surge in performance and a breakthrough in market share. In addition, it has realized short-term strategic planning and achieved first place in the city. The organizational structure of M is shown in Figure 2. M company moved from electronics to the textile industry. It is generally believed that Chinese SMEs have entered the third generation of network customization and the big data era (Wang 2021). In addition, there has been a relocation of SMEs from the most developed to less developed areas, as well as changes in their organizational structure, enterprise life cycle and stage, personnel composition, rapid development of foreign trade, and other general characteristics of SMEs (Wang and Zhang 2016; Wang 2021; Li 2015). Therefore, we choose M as the case study because it has many characteristics of ordinary foreign trade SMEs.

Figure 2.

The organizational structure of M.

Parker (2012) explains that empirical research is usually supported by case studies, which can define potential areas of research and unravel the potential implications and motivations behind broad statistical findings. Besides, management accounting case studies are more and more from the point of view of social construction ideas that reality and values of social construction are inseparable. From this perspective, accounting is the economic language that records socioeconomic and policy context. Therefore, field-based case studies can provide an explanation and critical understanding of the nature of the social system in the process of managing accounting practice. Parker (2012) also supports that case studies are the most commonly used qualitative methods for studying management accounting because they provide researchers with the opportunity to understand the rich and situational organizational and management accounting processes. Moreover, case studies can give researchers a deeper understanding of the participants in the study and give researchers opportunities to study organizations, not only in existing events, but also in combination with corporate systems, culture, employees, and goodwill to predict the future of the enterprise.

3.4. Choice—Mono Methods

The qualitative research method was chosen to study the topic of SMA. Parker (2012) claims that qualitative research has an important influence and status in the field of management accounting research. Compared with quantitative research methods, qualitative research methods provide critical reflection and evaluation (Sogunro 2002). Management accounting can be said to be the leader in the application of qualitative research methods. The emergence of qualitative research methods helps to understand and criticize the process of management accounting development. In addition, the result of a quantitative study is usually expressed by a large number of data, and the research is designed to enable researchers to make effective explanations through the comparison and analysis of these data. Moreover, quantitative research is a kind of factual judgment (Barnham 2015), which is based on the methodology of positivism. When quantitative research pays special attention to the establishment and testing of prediction models (Ahrens and Chapman 2006), it largely ignores the importance of understanding the organization and implementation of management accounting. Most importantly, this method is not suitable for detecting the complexity of the management accounting process and its surrounding environment. This paper aims to study the use of strategic management techniques in developing countries and to explore in depth the process and results of implementing these techniques in the form of a case study. However, quantitative research methods cannot describe the process of using management accounting technology in detail, but can only show whether the degree of use is high or low through data and indicators. Besides, SMEs and large enterprises are different. There is obvious heterogeneity existing in small and medium-sized enterprises, which makes the quantitative research method unsuitable. Therefore, the qualitative research method is more appropriate for the study of SMA.

Marriott and Marriott (2000) research the development of small companies in the use of management accounting by using qualitative research methods to find barriers and possibilities. They also pointed out that some researchers often fail because SMEs do not respond effectively to the questionnaires prepared by researchers. Marriott and Marriott (2000) support that if conditions permit, both interview and semi-structured data collection models are suitable for the study of SMEs (Rosavina et al. 2019). Therefore, this paper is based on the application of SMA in M using the qualitative research method.

3.5. Time Horizon—Cross-Sectional

Due to time constraints, this research mainly began in June and ended in August. At the same time, to get more credible and comprehensive conclusions, Supplementary interviews were conducted with two other persons (M6 CFO assistant and Employee 3) of the M enterprise through video chat because of COVID-19 quarantine policies. Because the interview was conducted face-to-face, and the characteristics such as focused time and results were known, this method was consistent with the commonly used cross-sectional study. So, this paper was designed to be cross-sectional, and this method is suitable for studying specific events at a certain time (Saunders et al. 2012). The research question appropriately takes a cross-sectional approach because of the trend in order growth and the fact that new businesses may only need to collect at one specific time. Therefore, we think this method is appropriate to investigate the cognition of SMA in M enterprise executives and employees and how it is in the operation of enterprises.

3.6. Data Collection and Analysis

This paper used a semi-structured interview method to collect data. Data was collected including field notes, relevant documents, and interview records. Emerson et al. (1995) claim that the first thing after collecting data is to read the interview record. Therefore, this interview used qualitative research software developed by QSR. Richards (1999) claims that NVivo provides many useful tools for researchers to deal with the extensive data record and record-related information, which helps researchers scan Supplementary text efficiently. Finally, NVivo codes according to different classifications. Kaplan and Maxwell (2005) claims that coding is the main classification method in qualitative research. Codes are used to identify categories of research issues. Therefore, this paper used the interview to collect data and used NVivo to analyze it by coding. See Supplementary A.

3.6.1. Questionnaires

Questionnaires and interviews are the most popular qualitative research methods. This paper is conducted by interview method.

Marriott and Marriott (2000) research the development of small companies in the use of management accounting by using qualitative research methods to find barriers and possibilities. They also point out that some researchers often fail because SMEs do not respond effectively to the questionnaires prepared by researchers. Marriott and Marriott (2000) support that if conditions permit, both interview and semi-structured data collection models are suitable for the study of SMEs. Questionnaires help researchers save time and energy and tend to quantify results, which contributes to statistical processing and analysis. However, it is a structural survey has fixed expressions and question order, it means that questionnaires cannot help researchers explore more potential questions and have a better understanding of the intention, motivation, and thinking process of the subject investigated. However, this paper is aimed to explore to what extent SMA methods are used in SMEs and how these methods help M company achieve their strategic goals. Therefore, questionnaires tend to give a result rather than give a detailed explanation in the perspective of degree.

3.6.2. Semi-Structured Interview

For a deep study of the application of SMA methods in M company, this paper was conducted by semi-structured interview. Girin (2011) explains that an interview is one of the traditional methods to collect information. Researchers try to contact target companies and access interviews from relevant people. Performance management is one of the SMA functions. In this paper, questions about performance management and performance measurement are conducted by semi-structured interviews. This is because a semi-structured interview can give more opportunities for respondents to recall more detailed information. By giving open-ended questions, researchers are more likely to explore potential reasons or the background behind questions. Besides, according to given new information from interviewees, researchers can ask deeper questions about content. In this paper, due to the differences between SMEs, open-ended questions can show more detailed information. Besides, Baker and Cohanier (2014) support that semi-structured interviews can make researchers be outsiders, which contributes to researchers investigating as non-intruders. It means that this method can let interviewees answer open-ended freely.

3.6.3. Study Design

This paper used a semi-structured method to collect data from 13 August to 17 August in 2020 to have an in-depth understanding about whether SMA methods help M company achieve strategic goals and to try to find some problems with the SMA used in this small company. This study chose 7 interviewees who play different roles in M company. They were given a one-to-one interview. The reason why this paper chose different department employees was that this study used a case study in a certain company. M company’s different departments are seen as a whole when helping the company achieve strategic planning. For department managers, they were interviewed for about 1 h. In addition, time allocated to employees was about 30 min. This is because senior managers often take on more responsibilities than employees, which can help researchers collect more information about the use of SMA methods. The two employees were selected for different years of service. By interviewing them, researchers may verify that executive policies are implemented and effective. Besides, different working years may show various opinions about the company. The detailed information is shown in Table 1. The interview was recorded by phone. The interview transcripts are in Supplementary B.

Table 1.

Interviewees’ information and the plan of the interview.

3.6.4. Ethical Considerations

There were 9 participants in the research and given interviews. Therefore, it was very important to emphasize anonymity. In addition, participants could change their minds about being involved or decline to answer a particular question or questions at any time without giving a reason. Before taking an interview, the researcher needs to show goals and the theme of questions about the interview. This is because researchers should respect the right to know and the freedom of participants. See Supplementary C.

4. Findings and Discussions

The use of SMA has positive influences on the development of companies. In addition, SMEs need to use SMA to help them gain a competitive advantage. However, existing research results may not provide more information about how and to what extent SMEs use SMA. Besides, the problem of the use of SMA in SMEs may not show more details. This part gives more details to these questions and adds new findings to previous research.

4.1. Awareness of Strategic Management Accounting

4.1.1. Corporate Executives Do Not Fully Understand Accounting and Do Not Pay Attention to It

Most interviewees have an oversimplified understanding of the accounting function, and their understanding is very basic. They believe that the main responsibility of accounting is to clear and calculate the company’s books and then help the company avoid tax reasonably. Besides, accountants need to ensure that the company’s books comply with the financial requirements of the government. “First of all, they must get the books straight, and then they can help the company in avoiding taxes reasonably” (employee 2). Besides, the general manager’s assistant added some new ideas on accounting, believing that accountants need to calculate the full cost, which enables the general manager to know the profit made by the company. “Accounting is to help enterprises calculate costs so that the company can learn about the profit made by the enterprise, and the expenses” (general manager assistant). However, some employees think there are nuances in accounting functions in different industries. By communicating with the chief financial officer about her working experience, this paper finds that when accountants serve different industries, they may need to learn new accounting professional knowledge about this industry. “…In the past, I have worked in logistics companies and financial leasing companies, engaged basically in the domestic market. In comparison, cross-border e-commerce is engaged in overseas markets. The company I work in now is a company of Amazon engaged in cross-border e-commerce and this is the first time I work as an accountant in this industry. So, you know, to me this is a process of learning” (Chief Financial Officer). Besides, the chief financial officer has a better understanding of the function of accounting, such as supervision. As an accountant, they need to pay more attention to expenses changes. During their process of working, they need to investigate what contributes to the increase in expense and communicate these various findings with general managers, which can help them find cost drivers and reduce operating costs. However, the analysis of variance is limited in the perspective of expenses. As the chief financial officer said, “in the cost accounting process, we will pay attention to the changes of cost, and we will evaluate whether such aspects as logistics and procurement are cost-effective. For example, we will follow the cost of office supplies each month, and if there is a sharp increase, we will investigate and find out what has caused the increase, so that we can reduce the cost and create a greater space of profits for the enterprise”.

M company had defects in cash management and financial security. Small and medium enterprises are most private companies, and the general manager is also the owner of the company. Before recruiting professional accounting to help company management, the owner is responsible not only for keeping accounts but also for managing cash. The boss has no awareness of the separation of responsibilities. However, when the company has rapid growth, owners find that it is very difficult for them to manage cash flows. After recruiting professional accounting, the company begins to keep accounts safe by using cameras and coffers. As the chief financial officer commented, “in the beginning, I found that the company didn’t have a safe box, which was a safety risk to the cash flow of the company. Of course, all employees must adhere to professional ethics, but some precautions are always necessary. So, I suggested to the boss and the company bought a safe box for the financial office, with one employee holding the key and another holding the pass number. Each expenditure of cash must be supported by relevant vouchers and documents”.

4.1.2. Corporate Executives Do Not Know SMA, and Its Role Has Not Been Fully Played

General managers and other senior managers lack knowledge of SMA and do not know the difference between traditional management accounting and strategic management accounting. “I don’t know” (general manager assistant). “Sorry, I don’t know about it” (Purchasing manager). However, the chief financial officer has a depth understanding of the importance of SMA and the difference between traditional management accounting and SMA. “What we did before was probably to manage the internal capital of the enterprise, which mainly involved transaction recording and amount accounting. In my opinion, the duties of a strategic management accountant may include tax planning, risk prediction, and cost planning. We must know the processes and departments of the enterprise” (chief financial officer). Besides, the chief financial officer gives more details about it, “…strategic management account must first collect information inside and outside the enterprise, put forward feasible strategic plans for the senior managers to choose from, thus assisting them in setting strategic goals…reducing strategic cost through strategic cost management…provide comprehensive budget management …HR management is an important part of the strategic management of an enterprise…It includes personnel strategic planning, daily personnel management, and annual employee performance evaluation to improve corporate and individual performance…risk management… Risks are everywhere in the market…From the perspective of strategic management, performance evaluation is a bridge connecting strategic objectives and daily business activities”. The chief financial officer emphasizes that external information is very important for M company because it is a cross-border e-commerce. For domestic markets, they need to meet the tax expense requirements of the government. However, when the company sells things on Amazon, Amazon also supervises the rationality of the tax amount. “In the era of big data, Amazon will detect the tax bureau. If the tax rate is lower than another commercial tenant in the same industry, the tax bureau will be detected, and Amazon will remind the enterprise on the platform. Big data can regulate the behavior of corporate behavior”.

Although the chief financial officer obtains the knowledge of SMA, this manager cannot be involved in the strategic planning of the company and participate in the accounting for the direct cost of the product. This is because there is no trust between the boss (general manager) and the chief financial officer. For this company, the competitive advantages are the products, such as bedding. Different kinds and compositions of raw materials cause different feelings. In addition, the boss believes that the kinds and compositions of raw materials of products are the secret.

As the chief financial officer comments, “to be honest, I am not involved in the pricing of products, I am not involved in the direct cost accounting of products. This may be because I have not yet established trust with the business owner…the senior management of the company hasn’t communicated with me about the differences of some fabrics and the final direct cost of products”. “If financial staff participate in the checking of products’ direct costs, they will know about the raw materials of our cloth, and the proportion of ingredients. Once an employee leaks the company’s secrets, our competitive edge is deprived. Currently, our home textile products are the core competitive strength of our company and the key to our long-term development” (purchase manager). This distrust may be common in Chinese small and medium enterprises. “In my opinion, the phenomenon is common, a big part of small and medium-sized enterprises are private ones” (chief financial officer). In addition, the reason explained by the CFO is that “since the owners of private enterprises in China don’t have the consciousness of financial management, and the development of small and medium-sized enterprises only began to be encouraged since the reform and opening up. Private enterprises emerged with the reform of China’s economic system and the birth of the market economy”. Besides, accounting or SMA are just tools for small and medium enterprises to respond to government inspections. These companies do not allow financial managers to participate in corporate management because the ownership of SMEs is in the hands of the boss themself. They want to control the money by themselves. “Even so, most of them only regard accountants as a tool to deal with tax authorities and a decoration of the corporate image, but they do not let accountants participate in the management of the enterprise, thus putting accounting work in a rather passive position. Whatever we are talking about, if something is put in a passive position, it can never fulfil its original missions. For SMA, senior executives may not want to share some company secrets with the CFO. Probably in their eyes, accounting is only a job of doing the right calculations. And they believe that whoever controls the money controls the enterprise” (chief financial officer).

4.2. The Use of Strategic Management Accounting on Markets

4.2.1. Product Choice

Although most managers have no awareness of the term SMA and show distrust of financial staff, they use SMA content in practice. By experiencing some decision-making errors, they acquire some valuable experience. If they pay more attention to SMA, they may achieve a competitive advantage early and reduce a lot of losses because of the lack of analysis on the external environment and competitors. M company ignored the characteristics of electronic products. Electronic products update very quickly, and their product life cycle is very short. Managers ignore factors of local advantages and delivery time. This long distance causes M company to have no time and energy to check quality. Besides, they cannot keep up with the product update speed. Once the products sold cannot keep up with the changes in the market, the products are unsalable, and the market share is reduced. All the problems are caused by the lack of enough analysis of the external environment. Therefore, M company pays more attention to analyzing the local competition, local competitive advantages, and investigating overseas customer preference. Managers changed the main business from selling electronic products to home textiles products. “We didn’t specialize in 3C products after returning to Nantong, because Nantong wasn’t close to Shenzhen. We lacked advantages either it is the time of delivery or the control of products. 3C products are fast-moving consumer goods, with a strong benchmark of the market but a short life cycle of products. By contrast, home textile products aren’t updated so fast, quite generous towards small-sized enterprises like us. As it isn’t so risky for us to invest with a capital” (general manager assistant). “I’ve confirmed our company’s segments. We’ll mainly specialize in home textiles. We’ve investigated the new market for half a year, since Nantong is famous for home textile, boasting local advantages, and logistics, suppliers and quality are all under our control…” (general manager assistant). In addition, M company tries to use Softimage, which is a tool to help them analyze competitors in Amazon. In addition, they use an ERP system to help them manage and allocate limited resources. Therefore, SMEs have realized how to allocate limited resources and find segmented markets in order to survive in the competitive market of large companies. Although these considerations need to be conducted by SMA. Because of little reorganization, the company’s owner needs to devote more time and energy to the investigation of external information about the market, customers, and products. “We conducted data research with the help of some software. Besides, we had friends from America, and we would ask them about their daily habits and preferences. There must be a market for life necessities, and they are consumables. Softimage, an exclusive tool of Amazon helped us to analyze the sales volume of Amazon around the globe and analyze the advantages of products. We had competitive advantages in the same product available in the overseas market and China. Whenever we found products with advantages in terms of price and product, we would invest some money to have a try. We studied information of products sold in Amazon, knew the size, talked with our friends in the UK and the US, then customized bed sheets and pillowcases with the data we got” (general manager).

4.2.2. Product Pricing

M company has realized the importance of market price and given target prices, which are lower than market price. The reason is that they want to penetrate the market in Amazon by giving a lower price with the same quality. Besides, they also provide a target profit which is used to cover the full cost of products. However, M company managers hold the view that the direct cost of products cannot be reduced. Therefore, all product profitability indexes are over 20% to ensure they can cover the full cost of products. Because of the lack of trust of general managers, the chief financial officer cannot be involved in the product pricing. Therefore, the chief financial manager only provides the rank of profit index for the manager to choose which product will be volume sales when the resources are limited. SMEs have fewer resources than large companies, and the resources they do have are limited. The rank of profitability may be a strategic decision. “We will calculate the profit index of the company’s products and arrange them to find the products with profit index higher than their competitors in the industry. We have a certain standard of profit margin, and we basically won’t get involved in products with a profit margin lower than 20%. Because we need to calculate the management cost, rents, salaries, etc., and the profit must cover all these costs. However, sometimes we sell products with a profit margin of lower than 20%, because we need to have a certain market share in the website of Amazon, and we need to have a certain competitive advantage in price. This is a big change in the function of accounting. We should not only consider the internal cost accounting but also consider the external market competitiveness” (chief financial officer). The responses of the CFO show that she has realized the transmission of functions of traditional management accounting and realized that she must connect the external environment with internal conditions. Besides, M company’s manager analyzed the relationship between reducing price and demand from a dynamic perspective. They hold the view that the analysis of elastic demand is not suitable for cross-border e-commerce. “In a dynamic perspective, information spreads fast now, but the phenomenon caused by purchasing behaviors of consumers isn’t shown immediately”. They realized that data analysis is not enough for today’s globally competitive economy; these data need to connect with non-financial analyses. In addition, the CFO also realized the specialty of the company operation and the use of the month-end weighted average method to calculate products’ full cost. “What the accounting department does is to use the month-end weighted average method, which can help reflect the real costs of the products. Cross-border e-commerce, which we are involved in, may be different from many other industries. The volume of business is large, and the costs are constantly changing” (chief financial officer).

4.2.3. Suppliers

Under the modern business environment, just in time is not only used in the manufacturing industry and businesses. It is also used in purchasing. Although M company’s managers are not familiar with the content of SMA, they put just in time into practice. However, it is also based on experience. “Amazon and its clients are demanding of quality. At the beginning, we didn’t notice these, and the company suffered a lot of losses” (purchasing manager). Therefore, during their operation, they pay more attention to quality checks. They have realized that quality is the key element for them to achieve strategic goals, they try to explore some different products with consistent quality to appeal to customers. “Afterwards, we set up a quality inspection group to train professional quality inspection talents. We would inspect the quality of each batch of goods twice. We’ll ask suppliers to supply goods again if there are any problems”. Besides, they try to balance demand and supply to reduce inventories. They realized that a long-term and reliable supplier is significant for them to ensure a continuous supply of products. Moreover, timeliness is very significant for cross-border e-commerce companies. “It’s important to ensure the inventory of Amazon’s warehouses in engaging in Amazon’s cross-border e-commerce. There can be no shortage of goods at any time. Once there is a shortage, causing no sales volume of a product for several days, the ranking of the product will fall behind among similar products, which means that the exposure of the product on the website will be reduced. Over time, the product will become unmarketable. But we can’t keep a lot of inventories in Amazon’s warehouses, since the warehouses are charged according to the products’ volume. The higher the costs of warehousing, the greater our costs will be, and the lower the products’ profit will be…Therefore, we will maintain a steady cooperative relationship with suppliers, who can provide us with goods of ensured quality steadily. Orders for new products were unsteady at the beginning, but over time, there would be certain amounts of orders for some products, and we would sign long-term supply contracts with the suppliers for these products. With steady orders and certain amounts of supply, our company doesn’t need a lot of warehouses itself. When there are orders, we can deliver goods as long as we get the goods from suppliers. In this way, we’ve lowered the costs of stocking in the warehouses as well. For SMEs, they often rent warehouses because of lack of money to buy warehouse” (general management assistant). The use of just in time may help the company keep a certain market share.

4.3. The Use of Strategic Management Accounting on Company Management

4.3.1. Performance Management

M company’s performance measurement criteria include financial and non-financial ones. Besides, they notice the reasonability of performance measurement criteria and communicate with staff to develop performance indicators, which motivates staff to achieve their goals. “The company will communicate with us and set performance goals together. At the same time, in addition to the performance measurement indicators of sales, management leaders will also consider whether we are serious with our work and whether we are harmonious with colleagues. The company will not punish employees for failing to meet a performance target” (employee 2). “Yes, the operations director will first set a performance indicator for the team leader, and then discuss with us, solicit our opinions, and finally determine the exact indicator” (employee 1). “We’ll have corresponding punishing measures in place, such as deducting bonuses. If we find them to be hardworking and conscientious in attitude through communication, we’ll help them to find out and solve problems and train them again” (operating manager). In the growth step of M company, encouragement and motivation is the key to performance management, which contributes to achieving strategic goals.

4.3.2. Department Cooperation

M company has a value chain and pays more attention to cooperation in different departments. These departments are responsible for different things. However, they are linked by their products. Although the financial department cannot participate in the calculation of products’ direct cost, they receive direct cost and deal with this information, which helps managers choose which product can be sold in bulk. “First, the operation department collected data and conduct market research; then the procurement department purchases the products, procurement directly determines the direct cost of the products; the financial department will work with the procurement department in the accounting of the final total cost and profit of the products; operation department will make relevant links to ensure the put away of the products. The logistics department will have an estimation of the time needed from the shipment to the receipt of the products, thus guaranteeing that there are always enough stocks in the Amazon warehouse” (general manager). These departments can be seen as a value chain.

4.3.3. Employees’ Training

M company’s managers lack awareness of financial management training. They believe that the operating department is the most important because it can create sales revenue and profit for the company. Besides, for SMEs, the first thing is to survive in the competitive market. Because of the money limitation, they train the operating department staff first. To sell their products on Amazon, they provide training for quality inspectors. At the step of growth of small companies, they consider that all departments need to serve the operating department. “[The] operation department is our core, and sales staff can bring profit to the company. Training costs a lot of money, and we should use the money where it is most needed”. Although the chief financial officer lacks experience in handling the financial affairs of export industries, she has no chance to receive training due to the company’s limited money, but also because managers do not have financial management awareness and do not understand the importance of SMA. The general manager does not trust the chief financial officer and provides opportunities for her to help the company make strategic decisions. The balanced scorecard method pays more attention to the training of employees. Only by giving employees a chance to equip themselves with professional skills can they work towards strategic goals.

4.3.4. Corporate Cultural

While M company has not set a corporate culture, M company’s managers have realized the importance of building it. “I believe corporate culture matters. It can help the enterprise with management, unify employees, and make them responsible for work, identify with and loyal to the company, transmitting the company’s instructions rapidly, and enlighten employees on the instructions rapidly, to help the company achieve its goals” (general manager assistant). “The company hasn’t constructed its culture yet. It is still under discussion and being prepared. But I believe it to be important to the development of a company since corporate culture enables employees to set up their own goals and learn about the goals and directions of their enterprises, to identify with and believe in their enterprises. In this way, employees will work hard for the companies and help with the realization of the companies’ strategic goals. When the companies have bright development prospects, employees will look forward to growing up with the companies and getting better development” (chief operating officer). For small size companies, the number of employees is limited, which contributes to managers managing their employees. The extremely flat corporate structure facilitates leaders to communicate with their employees. However, the rapid growth of the company leads to many management problems. Employees do not know the company’s strategic goals and even do not know what kind of business this company is. “Since the enterprise attached no importance to corporate cultural construction, we find the management of employees to exceed our abilities…But various problems will arise at work. We find the employees without a clear sense of direction at work. Some interns don’t even know the type and main businesses of our company. All they do is to follow the prescribed order and learn, and they would do whatever you ask them to do. Overall, the employees don’t know about the company’s goals and directions, to lose their directions as well” (general manager assistant).

Managers hold the view that corporate culture is not necessary for small-sized companies. With the development of the company, they realized the importance of building a corporate culture. For M company, there is no corporate culture to encourage them to work hard. Most small companies use high rewards to contribute to employees to improve performance. “Most directly, it owns to the pretty high commission provided by the company. Working here, as long as I work hard and get the sales increasing, there would be intuitive changes shown with my salary” (Employee 1). Besides, in a small company, a leader’s charisma is an important reason for employees to continue to work in it. This may be seen as a different corporate culture because small companies are often unstable and have a long time to explore their segment of market. They do not have similar resources as large companies, such as high financing capacity, which makes these companies face more risk. Therefore, many employees are unwilling to stay for a long time in a small company. Tian et al. (2022) claimed that cultural control is an important part of the management control system, which can help a company achieve its strategic goals. “Furthermore, I also think that the owner of this company is very powerful and competitive… That is to say, if the boss of the company is rich and competitive, the company could be regarded as with one more guarantee, and I could also stay and develop in the long term with the company. Moreover, the company develops relatively fast and has great prospects, and it is also a leader in the industry in Nantong. I would say that I am quite willing to put my recognition with our boss” (Employee 1). “Our advantage was that we had a forward-looking vision, courage, and personal charisma” (general manager).

5. Conclusions and Policy Implication

Due to the slow development of modern enterprise management systems in developing countries, this paper attempts to uncover the current situation and existing problems of SMA in SMEs of China through in-depth investigation and detailed analysis. The following important conclusions are drawn. First, the senior managers of SMEs do not have an understanding of accounting nor pay enough attention to it, and the role of SMA is even worse. According to the survey, both front-line staff and senior managers do not know or learn to account, and are almost completely unaware of its importance. Second, although chief financial officers obtain knowledge of SMA, they cannot be fully involved in the strategic decision making because the company’s chief financial officer cannot gain the trust of the general manager (usually the boss) and participate in the company’s strategic planning. Third, SMEs have realized that enterprise culture is very important for a company to achieve strategic goals, but this is far from enough to attach importance to and create it. This is mainly due to the limited resources in SMEs, and the establishment of a good corporate culture requires a long-term process, which is difficult to do and achieve good returns in a short term. Therefore, the senior managers are aware of the importance of enterprise culture, but the construction is often overlooked or slow in SMEs. Fourth, the general managers of SMEs believe that the operating department is the core of the company and all resources should be prioritized to meet their needs. Due to the eagerness of corporate executives and the limited resources of SMEs, financial personnel can not get training and learning opportunities. Last but not all, this paper’s analysis and application of SMA in market and company management also analyzes the human resource strategy and innovation of just-in-time production in SMEs of e-commerce.

Based on the above research conclusions and findings, the following suggestions are put forward: (1) We should change the incorrect awareness and understanding of accounting, especially SMA. Some of this is due to China’s inherent historical evolution and special national conditions, but more importantly to the inherent misthinking of corporate executives and the inability to see the immediate effects of accounting. Some accountants are not very confident in their position and role (as M6 said, “I think the role of accounting in SMEs is to do a good job of bookkeeping work, another round we do not do, there is no stage for us to speak, I think there is no need. This is not an accountant’s concern”) and front-line workers have a similar view (as Employee 3 said, “I think accounting is a simple expense account, no other functions”). (2) The government should strengthen the training and education of accounting personnel, general manager, and other senior managers of SMEs, and establish the positive role and sharing of accounting, especially SMA in all aspects of enterprise development. According to Chinese regulations, accountants are required to attend annual government-organized training, but this training is more of a brief introduction to a new change. Therefore, it is necessary to cut the bottom to change the current status quo, or to grasp leadership from the ideological understanding of the beginning. Therefore, it is necessary to strengthen the compulsory training and education of corporate executives. (3) It is necessary to construct and implement enterprise culture as a major work of long-term development of enterprises and let it play a greater role. The concept of corporate culture is well known by most people, but few people know how to establish corporate culture and play the role of corporate culture (as M6 said, “I know the meaning of corporate culture, also know that it has a great role, but I do not know how to do it” and as Employee3 said, “I know the corporate culture, but as an ordinary employee, it doesn’t seem to have much to do with me, and I don’t know how to do it”). (4) SMA contains a variety of strategies and methods, which should not be exhaustive; according to the characteristics of the enterprise, choose the appropriate method for the enterprise. Each enterprise has its special circumstances, as enterprises should pay attention to the four aspects of the BSC approach in a measured and focused main body. Therefore, from an enterprise’s internal self-building (cultural construction, high-level attention, and grass-roots staff participation) and active guidance and support from the government, changes in incorrect understandings of SMA, which play a role in the development of SMEs, can be accomplished.

This paper chose a company to investigate the use of SMA in SMEs in developing countries. Therefore, the sample used in the study is limited and future studies need to increase the size of the sample. They should expand the number of enterprise samples and make longitudinal comparisons in different periods, as well as horizontal comparisons between different regions, which may be a good perspective for further study. Besides, M company is a cross-border e-commerce company with the particularity of the industry. This kind of company needs to take care of external information in a more timely manner than other companies. Therefore, the sample chosen may not reflect all operating problems or the use of SMA.

Due to some limitations in this paper, for future studies, researchers may try to select more samples in different countries and various industries. If researchers can collect enough data, they may compare the use of SMA in different developing countries in SMEs. They also can explore more details about the use of SMA in various industries. Besides, they may try to combine qualitative research methods with quantitative research methods to give a comprehensive understanding of the use of SMA. With the development of the economy, SMEs may pay more attention to SMA in the future.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/economies10040074/s1. Supplementary A: Coding; Supplementary B.1. Interview transcripts (M1 General manager); Supplementary B.2. Interview transcripts (M2 General manager assistant); Supplementary B.3. interview transcripts (M3 Chief Operating Officer); Supplementary B.4. Interview transcripts (M4 Chief Financial Officer); Supplementary B.5. Interview transcripts (M5 Purchasing manager); Supplementary B.6. Interview transcripts (Employee 1); Supplementary B.7. Interview transcripts (Employee 2); Supplementary B.8. interview transcripts (M6 Chief Financial Officer assistant); Supplementary B.9. Interview transcripts (Employee 3); Supplementary C: Table S1. Interviewers’ information and the plan of the interview.

Author Contributions

J.Z. carried out the conceptual design and overall layout, L.M. participated in the overall layout, data collection, and writing. X.C. supervised all the process of the research and did the writing—review and edition. L.A. proposed the suggestions to improve the paper quality and did the writing—review and edition. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

This paper used a semi-structured interview method to collect data. Data collected includes field notes, relevant documents, and interview records.

Conflicts of Interest