Measuring the Cohesion of Informal Economy in Agriculture in New European Union Member States

Abstract

1. Introduction

2. Literature Review

3. Methodology

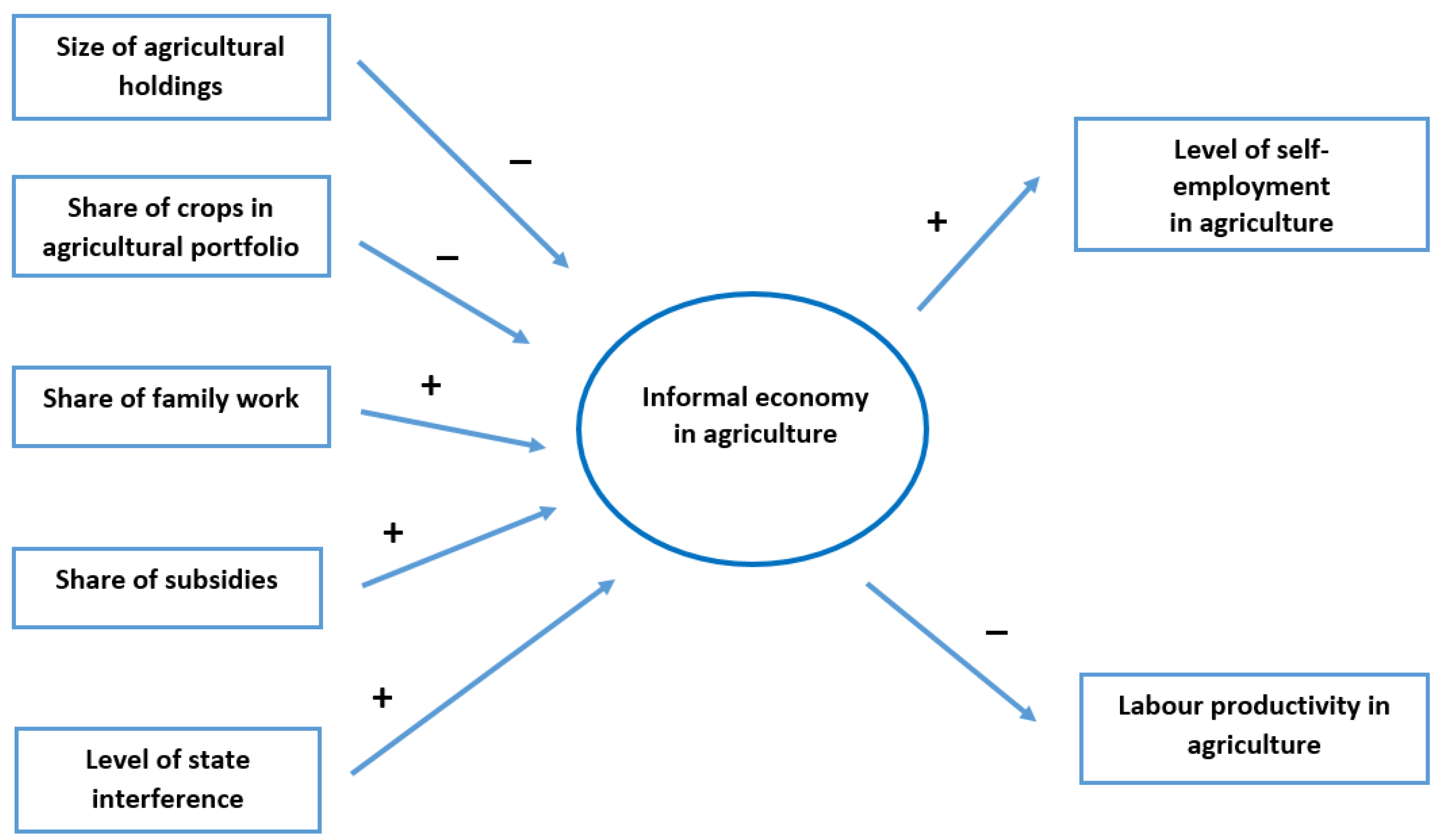

3.1. MIMIC Estimations

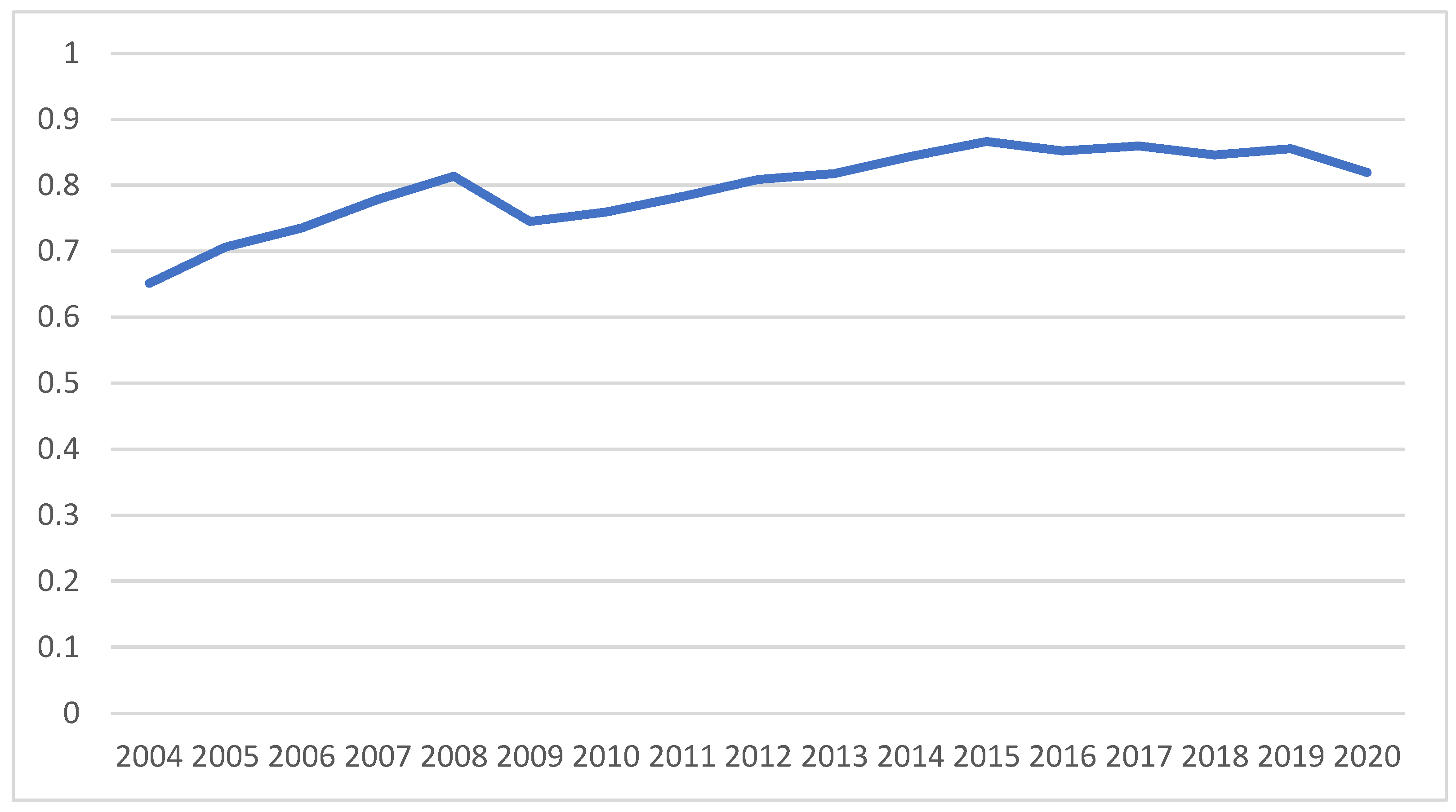

3.2. Measurement of the Convergence

3.3. Description of the Data

4. Results and Discussion

5. Conclusions and Policy Implications

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Calculation Formula | Unit of Measure | Mean | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|---|

| Size of agricultural holdings | Utilized agricultural area/farm number | ha | 41.35 | 49.41 | 0.91 | 158.57 |

| Share of crops in agricultural portfolio | Crop area/Utilised agricultural area | percent | 35.4 | 17.09 | 0 | 68.76 |

| Share of family work | AWUs non-salaried/All AWUs | percent | 68.09 | 23.51 | 16.84 | 94.33 |

| Share of subsidies | Subsidies/factor income of farms | percent | 43.23 | 18.36 | 5.05 | 90.55 |

| Level of state interference | Sum of all capital transfers and state interventioncpurchases except subsidies/Cross value added in agriculture | percent | 2.16 | 1.12 | 0 | 4.13 |

| Level of self-employment in agriculture | All employment in agriculture minus salaried and non-salaried work | percent points | −2.46 | 2.28 | −9.43 | 3.66 |

| Labor productivity in agriculture | Gross value added/total hours worked in agriculture | EUR per hour | 4.59 | 2.25 | 1.11 | 9.58 |

References

- Abid, Mehdi. 2016. Size and Implication of Informal Economy in African Countries: Evidence from a Structural Model. International Economic Journal 30: 571–98. [Google Scholar] [CrossRef]

- Adler-Nissen, Rebecca. 2016. The Vocal Euro-outsider: The UK in a Two-speed Europe. The Political Quarterly 87: 238–46. [Google Scholar] [CrossRef]

- Agostino, Mariarosaria, Marco R. Di Tommaso, Annamaria Nifo, Lauretta Rubini, and Francesco Trivieri. 2020. Institutional quality and firms’ productivity in European regions. Regional Studies 54: 1275–88. [Google Scholar] [CrossRef]

- Alizamir, Saed, Foad Iravani, and Hamed Mamani. 2019. An Analysis of Price vs. Revenue Protection: Government Subsidies in the Agriculture Industry. Management Science 65: 32–49. [Google Scholar] [CrossRef]

- Anderson, Kym, Gordon Rausser, and Johan Swinnen. 2013. Political economy of public policies: Insights from distortions to agricultural and food markets. Journal of Economic Literature 51: 423–77. [Google Scholar] [CrossRef]

- Avallone, Gennaro. 2016. The land of informal intermediation: The social regulation of migrant agricultural labor in the Piana del Sele, Italy. In Migration and Agriculture. London: Routledge, pp. 241–54. [Google Scholar]

- Baráth, Lajos, and Imre Fertő. 2017. Productivity and Convergence in European Agriculture. Journal of Agricultural Economics 68: 228–48. [Google Scholar] [CrossRef]

- Barickman, Bert Jude. 2022. A Bahian counterpoint. In A Bahian Counterpoint. Redwood City: Stanford University Press. [Google Scholar]

- Barlett, Peggy F. 2019. The “Disappearing Middle” and Other Myths of the Changing Structure of Agriculture. In Agricultural Change. London: Routledge, pp. 139–54. [Google Scholar] [CrossRef]

- Bayar, Yilmaz, Hakki Odabas, Mahmut Unsal Sasmaz, and Omer Faruk Ozturk. 2018. Corruption and shadow economy in transition economies of European Union countries: A panel cointegration and causality analysis. Economic Research-Ekonomska Istraživanja 31: 1940–52. [Google Scholar] [CrossRef]

- Beghin, John C., William E. Foster, and Mylene Kherallah. 1996. Institutions and market distortions: International evidence for tobacco. Journal of Agricultural Economics 47: 355–65. [Google Scholar] [CrossRef]

- Bender, Matthew. 2001. An economic comparison of traditional and conventional agricultural systems at a county level. American Journal of Alternative Agriculture 16: 2–15. [Google Scholar] [CrossRef]

- Benjamin, Daniel J., James O. Berger, Magnus Johannesson, Brian A. Nosek, E.-J. Wagenmakers, Richard Berk, Kenneth A. Bollen, Björn Brembs, Lawrence Brown, Colin Camerer, and et al. 2018. Redefine statistical significance. Nature Human Behaviour 2: 6–10. [Google Scholar] [CrossRef]

- Boeri, Tito, and Juan F. Jimeno. 2016. Learning from the Great Divergence in unemployment in Europe during the crisis. Labor Economics 41: 32–46. [Google Scholar] [CrossRef]

- Borsi, Mihály Tamás, and Norbert Metiu. 2015. The evolution of economic convergence in the European Union. Empirical Economics 48: 657–81. [Google Scholar] [CrossRef]

- Breusch, Trevor. 2005. Estimating the Underground Economy Using MIMIC Models. Working Paper. Canberra: National University of Australia. [Google Scholar]

- Buehn, Andreas, and Friedrich Schneider. 2012. Corruption and the shadow economy: Like oil and vinegar, like water and fire? International Tax and Public Finance 19: 172–94. [Google Scholar] [CrossRef]

- Bulmer, Simon. 2020. The Member States of the European Union. Oxford: Oxford University Press. [Google Scholar]

- Chen, Martha Alter. 2012. The Informal Economy: Definitions, Theories and Policies. WIEGO Working Paper No. 26. Cambridge: WIEGO, vol. 1, pp. 90141–44. [Google Scholar]

- Chowdhury, Nasima Tanveer. 2016. The Relative Efficiency of Hired and Family Labor in Bangladesh Agriculture. Journal of International Development 28: 1075–91. [Google Scholar] [CrossRef]

- Ciaian, Pavel, Edoardo Baldoni, D’Artis Kancs, and Dušan Drabik. 2021. The Capitalization of Agricultural Subsidies into Land Prices. Annual Review of Resource Economics 13: 17–38. [Google Scholar] [CrossRef]

- Colnago, Paula, and Santiago Dogliotti. 2020. Introducing labor productivity analysis in a co-innovation process to improve sustainability in mixed family farming. Agricultural Systems 177: 102732. [Google Scholar] [CrossRef]

- Cooper, Tamsin, Kaley Hart, and David Baldock. 2009. Provision of Public Goods through Agriculture in the European Union. London: Institute for European Environmental Policy, pp. 1–351. [Google Scholar]

- Csáki, Csaba, and Attila Jámbor. 2013. The impact of EU accession: Lessons from the agriculture of the new member states. Post-Communist Economies 25: 325–42. [Google Scholar] [CrossRef]

- Cutamora, Jezyl C. 2021. The Market Distortion Effect of Government Intervention in Higher Education. Recoletos Multidisciplinary Research Journal 9: 123–31. [Google Scholar] [CrossRef]

- Darpeix, Aurélie, Céline Bignebat, and Philippe Perrier-Cornet. 2014. Demand for Seasonal Wage Labor in Agriculture: What Does Family Farming Hide? Journal of Agricultural Economics 65: 257–72. [Google Scholar] [CrossRef]

- Davies, Rob, and James Thurlow. 2010. Formal-informal economy linkages and unemployment in south africa. South African Journal of Economics 78: 437–59. [Google Scholar] [CrossRef]

- Dell’Anno, Roberto. 2007. The Shadow Economy in Portugal: An Analysis with the Mimic Approach. Journal of Applied Economics 10: 253–77. [Google Scholar] [CrossRef]

- Dell’Anno, Roberto. 2016. Analyzing the Determinants of the Shadow Economy With a “Separate Approach”. An Application of the Relationship Between Inequality and the Shadow Economy. World Development 84: 342–56. [Google Scholar] [CrossRef]

- Drucza, Kristie, and Valentina Peveri. 2018. Literature on gendered agriculture in Pakistan: Neglect of women’s contributions. Women’s Studies International Forum 69: 180–89. [Google Scholar] [CrossRef]

- Dupraz, Pierre, and Laure Latruffe. 2015. Trends in family labor, hired labor and contract work on French field crop farms: The role of the Common Agricultural Policy. Food Policy 51: 104–18. [Google Scholar] [CrossRef]

- Dybka, Piotr, Michał Kowalczuk, Bartosz Olesiński, Andrzej Torój, and Marek Rozkrut. 2019. Currency demand and MIMIC models: Towards a structured hybrid method of measuring the shadow economy. International Tax and Public Finance 26: 4–40. [Google Scholar] [CrossRef]

- Feige, Edgar. 2016. Reflections on the Meaning and Measurement of Unobserved Economies: What Do We Really Know About the ‘Shadow Economy’. Journal of Tax Administration 2: 1. [Google Scholar] [CrossRef]

- Feige, Edgar L., and Ivica Urban. 2008. Measuring underground (unobserved, non-observed, unrecorded) economies in transition countries: Can we trust GDP? Journal of Comparative Economics 36: 287–306. [Google Scholar] [CrossRef]

- Feindt, Peter. 2018. EU agricultural policy. In Handbook of European Policies. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Fergusson, Leopoldo, Carlos Molina, and James Robinson. 2022. The weak state trap. Economica 89: 293–331. [Google Scholar] [CrossRef]

- Finch, W. Holmes, and Brian F. French. 2011. Estimation of MIMIC Model Parameters with Multilevel Data. Structural Equation Modeling: A Multidisciplinary Journal 18: 229–52. [Google Scholar] [CrossRef]

- Foroni, Claudia, Massimiliano Marcellino, and Dalibor Stevanovic. 2019. Mixed-frequency models with moving-average components. Journal of Applied Econometrics 34: 688–706. [Google Scholar] [CrossRef]

- Garrone, Maria, Dorien Emmers, Hyejin Lee, Alessro Olper, and Johan Swinnen. 2019. Subsidies and agricultural productivity in the EU. Agricultural Economics 50: 803–17. [Google Scholar] [CrossRef]

- Gasson, Ruth. 1986. Part-time farming: Its place in the structure of agriculture. In Agriculture: People and Policies. London: Routledge, pp. 77–92. [Google Scholar] [CrossRef]

- Gertel, J., and S. R. Sippel. 2014. Seasonal Workers in Mediterranean Agriculture. London: Routledge. [Google Scholar]

- Guo, Lili, Houjian Li, Xuxin Cao, Andi Cao, and Minjun Huang. 2021. Effect of agricultural subsidies on the use of chemical fertilizer. Journal of Environmental Management 299: 113621. [Google Scholar] [CrossRef]

- Haß, Marlen. 2022. Coupled support for sugar beet in the European Union: Does it lead to market distortions? Journal of Agricultural Economics 73: 86–111. [Google Scholar] [CrossRef]

- Herwartz, Helmut, Egle Tafenau, and Friedrich Schneider. 2015. One Share Fits All? Regional Variations in the Extent of the Shadow Economy in Europe. Regional Studies 49: 1575–87. [Google Scholar] [CrossRef]

- Hirvonen, Kalle. 2016. Temperature Changes, Household Consumption, and Internal Migration: Evidence from Tanzania. American Journal of Agricultural Economics 98: 1230–49. [Google Scholar] [CrossRef]

- Hopewell, Kristen. 2019. US-China conflict in global trade governance: The new politics of agricultural subsidies at the WTO. Review of International Political Economy 26: 207–31. [Google Scholar] [CrossRef]

- Horodnic, Ioana Alexandra. 2018. Tax morale and institutional theory: A systematic review. International Journal of Sociology and Social Policy 38: 868–86. [Google Scholar] [CrossRef]

- Jaime, Mónica M., Jessica Coria, and Xiangping Liu. 2016. Interactions between CAP Agricultural and Agri-Environmental Subsidies and Their Effects on the Uptake of Organic Farming. American Journal of Agricultural Economics 98: 1114–45. [Google Scholar] [CrossRef]

- Jiang, Lei, Henk Folmer, Minhe Ji, and P. Zhou. 2018. Revisiting cross-province energy intensity convergence in China: A spatial panel analysis. Energy Policy 121: 252–63. [Google Scholar] [CrossRef]

- Jiménez, Daniel, Sylvain Delerce, Hugo Dorado, James Cock, Luis Armando Muñoz, Alejro Agamez, and Andy Jarvis. 2019. A scalable scheme to implement data-driven agriculture for small-scale farmers. Global Food Security 23: 256–66. [Google Scholar] [CrossRef]

- Kelmanson, Ben, Koralai Kirabaeva, Leandro Medina, Borislava Mircheva, and Jason Weiss. 2019. Explaining the Shadow Economy in Europe: Size, Causes and Policy Options. Washington, DC: International Monetary Fund. [Google Scholar]

- Kirwan, Barrett E., and Michael J. Roberts. 2016. Who Really Benefits from Agricultural Subsidies? Evidence from Field-level Data. American Journal of Agricultural Economics 98: 1095–113. [Google Scholar] [CrossRef]

- Kiryluk-Dryjska, Ewa, and Agnieszka Baer-Nawrocka. 2019. Reforms of the Common Agricultural Policy of the EU: Expected results and their social acceptance. Journal of Policy Modeling 41: 607–22. [Google Scholar] [CrossRef]

- Klomp, Jeroen. 2020. The impact of Russian sanctions on the return of agricultural commodity futures in the EU. Research in International Business and Finance 51: 101073. [Google Scholar] [CrossRef]

- Koutsou, Stavriani, Maria Partalidou, and Michael Petrou. 2011. Present or Absent Farm Heads? A Contemporary Reading of Family Farming in Greece. Sociologia Ruralis 51: 404–19. [Google Scholar] [CrossRef]

- Kutan, Ali M., and Taner M. Yigit. 2009. European integration, productivity growth and real convergence: Evidence from the new member states. Economic Systems 33: 127–37. [Google Scholar] [CrossRef]

- Lang, Andrew. 2019. Heterodox markets and ‘market distortions’ in the global trading system. Journal of International Economic Law 22: 677–719. [Google Scholar] [CrossRef]

- Medina, Leandro, and Friedrich Schneider. 2019. Shedding Light on the Shadow Economy: A Global Database and the Interaction with the Official One. CESifo Working Paper No. 7981. Available online: https://papers.ssrn.com/sol3/papers.cfm?Abstract_id=3502028 (accessed on 24 September 2022).

- Medina, Leandro, Andrew Jonelis, and Mehmet Cangul. 2017. The Informal Economy in Sub-Saharan Africa: Size and Determinants. IMF Working Papers. Singapore: International Monetary Fund, p. 17. [Google Scholar] [CrossRef]

- Monarca, Umberto, Ernesto Cassetta, Consuelo Rubina Nava, and Rosanna Pittiglio. 2022. Illegal gambling: Measuring the market using the MIMIC model. Regional Studies 56: 1949–60. [Google Scholar] [CrossRef]

- Mooney, Patrick. 2019. My Own Boss?: Class, Rationality, and the Family Farm. London: Routledge. [Google Scholar]

- Morkūnas, Mangirdas, Elzė Rudienė, and Aleksander Ostenda. 2022. Can climate-smart agriculture help to assure food security through short supply chains? A systematic bibliometric and bibliographic literature review. Business, Management and Economics Engineering 20: 207–23. [Google Scholar] [CrossRef]

- Moschini, Giancarlo, Harun Bulut, and Luigi Cembalo. 2005. On the Segregation of Genetically Modified, Conventional and Organic Products in European Agriculture: A Multi-market Equilibrium Analysis. Journal of Agricultural Economics 56: 347–72. [Google Scholar] [CrossRef]

- Neef, Andreas. 2020. Legal and social protection for migrant farm workers: Lessons from COVID-19. Agriculture and Human Values 37: 641–42. [Google Scholar] [CrossRef]

- Papadopoulos, Apostolos G. 2015. The Impact of the CAP on Agriculture and Rural Areas of EU Member States. Agrarian South: Journal of Political Economy: A triannual Journal of Agrarian South Network and CARES 4: 22–53. [Google Scholar] [CrossRef]

- Pasovic, Edin, and Adnan S. Efendic. 2018. Informal Economy in Bosnia and Herzegovina—An Empirical Investigation. South East European Journal of Economics and Business 13: 112–25. [Google Scholar] [CrossRef]

- Pfau-Effinger, Birgit. 2009. Varieties of Undeclared Work in European Societies. British Journal of Industrial Relations 47: 79–99. [Google Scholar] [CrossRef]

- Pryce, Gwilym. 2003. Greening by the Market? Distortions Caused by Fiscal Incentives to Build on Brownfield Land. Housing Studies 18: 563–85. [Google Scholar] [CrossRef]

- Remeikienė, Rita, Ligita Gasparėnienė, Viktoras Chadyšas, and Martin Cepel. 2018. Identification of the shadow economy determinants for the eurozone member states: Application of the mimic model. Journal of Business Economics and Management 19: 777–96. [Google Scholar] [CrossRef]

- Ribašauskienė, Erika, Diana Šumylė, Artiom Volkov, Tomas Baležentis, Dalia Streimikiene, and Mangirdas Morkunas. 2019. Evaluating Public Policy Support for Agricultural Cooperatives. Sustainability 11: 3769. [Google Scholar] [CrossRef]

- Rizov, Marian, Jan Pokrivcak, and Pavel Ciaian. 2013. CAP Subsidies and Productivity of the EU Farms. Journal of Agricultural Economics 64: 537–57. [Google Scholar] [CrossRef]

- Sakuramoto, Naomi, Tokihiro Fukatsu, and Kazunari Yokoyama. 2008. A research concept for the development of a new farming diary system using automatic tracing of farmers’ labor data. Paper presented at the World Conference on Agricultural Information and IT, IAALD AFITA WCCA 2008, Tokyo, Japan, August 24–27; pp. 977–80. [Google Scholar]

- Sarstedt, Marko, and Erik Mooi. 2019. Regression analysis. In A Concise Guide to Market Research. Berlin/Heidelberg: Springer, pp. 209–56. [Google Scholar]

- Schneider, Friedrich, and Dominink Enste. 2013. The Shadow Economy: An International Survey. Cambridge: Cambridge University Press. [Google Scholar]

- Schneider, Friedrich, Mangirdas Morkunas, and Erika Quendler. 2022. An estimation of the informal economy in the agricultural sector in the EU-15 from 1996 to 2019. Agribusiness Early View. [Google Scholar] [CrossRef]

- Schneider, Friedrich. 2005. Shadow economies around the world: What do we really know? European Journal of Political Economy 21: 598–642. [Google Scholar] [CrossRef]

- Scown, Murray W., Mark V. Brady, and Kimberly A. Nicholas. 2020. Billions in Misspent EU Agricultural Subsidies Could Support the Sustainable Development Goals. One Earth 3: 237–50. [Google Scholar] [CrossRef]

- Soares, Cláudia, and Óscar Afonso. 2019. The Non-Observed Economy in Portugal: The monetary model and the MIMIC model. Metroeconomica 70: 172–208. [Google Scholar] [CrossRef]

- Sourisseau, Jean-Michel, ed. 2015. Family Farming and the Worlds to Come. Dordrecht: Springer. [Google Scholar]

- Stiglitz, Joseph, and Mark Pieth. 2016. Overcoming the Shadow Economy. Columbia Academic Commons. New York: Columbia University. [Google Scholar]

- Strange, Marty. 2008. Family Farming: A New Economic Vision. Lincoln: University of Nebraska Press. [Google Scholar]

- Suess-Reyes, Julia, and Elena Fuetsch. 2016. The future of family farming: A literature review on innovative, sustainable and succession-oriented strategies. Journal of Rural Studies 47: 117–40. [Google Scholar] [CrossRef]

- Thiessen, Ulrich. 2003. The impact of fiscal policy and deregulation on shadow economies in transition countries: The case of Ukraine. Public Choice 114: 295–318. [Google Scholar] [CrossRef]

- Toader, Maria, and Gheorghe Valentin Roman. 2015. Family Farming—Examples for Rural Communities Development. Agriculture and Agricultural Science Procedia 6: 89–94. [Google Scholar] [CrossRef]

- Volkov, Artiom, Tomas Balezentis, Mangirdas Morkunas, and Dalia Streimikiene. 2019. In a Search for Equity: Do Direct Payments under the Common Agricultural Policy Induce Convergence in the European Union? Sustainability 11: 3462. [Google Scholar] [CrossRef]

- Vozarova, Ivana Kravcakova, and Rastislav Kotulic. 2016. Quantification of the Effect of Subsidies on the Production Performance of the Slovak Agriculture. Procedia Economics and Finance 39: 298–304. [Google Scholar] [CrossRef]

- Williams, Colin. 2014. Confronting the Shadow Economy: Evaluating Tax Compliance and Behaviour Policies. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Williams, C. C., and A. Horodnic. 2018. Tackling Undeclared Work in the Agricultural Sector. Brussels: European Platform Undeclared Work. [Google Scholar]

- Williams, Colin C., Jan Windebank, Marijana Baric, and Sara Nadin. 2013. Public policy innovations: The case of undeclared work. Management Decision 51: 1161–75. [Google Scholar] [CrossRef]

- Wiśniewski, Łukasz, and Roman Rudnicki. 2016. Labor input in polish agriculture against size of agricultural holdings—spatial analysis. Journal of Agribusiness and Rural Development 41: 413–424. [Google Scholar] [CrossRef]

- Wuepper, David, Stefan Wimmer, and Johannes Sauer. 2021. Does family farming reduce rural unemployment? European Review of Agricultural Economics 48: 315–37. [Google Scholar] [CrossRef]

| Model; Latent Variable—Informal Economy in Agriculture (IEAg) | 1 | 2 |

|---|---|---|

| Causes | ||

| Size of agricultural holdings | −0.241 * | −0.212 ** |

| Share of crops in agricultural portfolio | −0.064 ** | −0.077 ** |

| Share of family work | 0.584 *** | 0.602 *** |

| Share of subsidies | 0.304 *** | 0.312 *** |

| Level of state interference | 0.021 * | 0.025 ** |

| Dummy variable for Cyprus | 0.442 *** | |

| Indicators | ||

| Level of self-employment in agriculture | 0.102 *** | 0.113 *** |

| Labor productivity in agriculture | −0.714 *** | −0.736 *** |

| Statistical tests | ||

| RMSEA | 0.065 | 0.058 |

| CFI | 0.912 | 0.943 |

| SRMR | 0.017 | 0.015 |

| Observation | 170 | 170 |

| Country/Year | Average | Minimum Value | Maximum Value | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Czechia | 9% | 6% | 15% | 15% | 12% | 12% | 10% | 8% | 11% | 10% | 10% |

| Estonia | 10% | 6% | 17% | 17% | 14% | 13% | 11% | 10% | 14% | 12% | 11% |

| Cyprus | 86% | 80% | 91% | 91% | 90% | 88% | 87% | 86% | 91% | 88% | 87% |

| Latvia | 45% | 35% | 54% | 54% | 54% | 52% | 49% | 47% | 51% | 49% | 47% |

| Lithuania | 15% | 11% | 27% | 27% | 24% | 20% | 17% | 14% | 18% | 16% | 14% |

| Hungary | 19% | 18% | 24% | 24% | 21% | 18% | 19% | 18% | 21% | 21% | 20% |

| Malta | 22% | 20% | 27% | 27% | 26% | 24% | 21% | 21% | 23% | 22% | 21% |

| Poland | 57% | 54% | 68% | 68% | 66% | 61% | 57% | 55% | 56% | 56% | 56% |

| Slovenia | 56% | 52% | 62% | 62% | 61% | 58% | 57% | 56% | 59% | 58% | 57% |

| Slovakia | 5% | 3% | 11% | 11% | 8% | 7% | 5% | 4% | 7% | 7% | 6% |

| Total (unweighted average) | 33% | 29% | 40% | 40% | 38% | 35% | 33% | 32% | 35% | 34% | 33% |

| Country/Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||

| Czechia | 9% | 8% | 7% | 7% | 7% | 6% | 7% | 7% | 8% | ||

| Estonia | 9% | 9% | 8% | 6% | 6% | 6% | 7% | 7% | 9% | ||

| Cyprus | 87% | 86% | 85% | 85% | 83% | 83% | 80% | 82% | 87% | ||

| Latvia | 45% | 43% | 40% | 40% | 40% | 38% | 36% | 35% | 37% | ||

| Lithuania | 13% | 13% | 12% | 11% | 12% | 12% | 11% | 11% | 13% | ||

| Hungary | 18% | 19% | 18% | 18% | 18% | 18% | 19% | 19% | 21% | ||

| Malta | 22% | 21% | 21% | 21% | 21% | 20% | 20% | 20% | 22% | ||

| Poland | 55% | 56% | 56% | 56% | 55% | 56% | 56% | 54% | 57% | ||

| Slovenia | 57% | 56% | 55% | 55% | 53% | 53% | 52% | 53% | 55% | ||

| Slovakia | 6% | 5% | 4% | 3% | 3% | 4% | 3% | 3% | 5% | ||

| Total (unweighted average) | 32% | 32% | 31% | 30% | 30% | 30% | 29% | 29% | 31% | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Morkunas, M. Measuring the Cohesion of Informal Economy in Agriculture in New European Union Member States. Economies 2022, 10, 285. https://doi.org/10.3390/economies10110285

Morkunas M. Measuring the Cohesion of Informal Economy in Agriculture in New European Union Member States. Economies. 2022; 10(11):285. https://doi.org/10.3390/economies10110285

Chicago/Turabian StyleMorkunas, Mangirdas. 2022. "Measuring the Cohesion of Informal Economy in Agriculture in New European Union Member States" Economies 10, no. 11: 285. https://doi.org/10.3390/economies10110285

APA StyleMorkunas, M. (2022). Measuring the Cohesion of Informal Economy in Agriculture in New European Union Member States. Economies, 10(11), 285. https://doi.org/10.3390/economies10110285