3.1. Data Description

We used the monthly data of the nominal exchange rate of EUR/PLN (monthly average) and several macroeconomic variables.

The models are estimated using the monthly data from January 1999 to December 2015 for Poland and the Euro Area. Although the Euro Area expanded throughout the research sample, from 12 countries in 1999 to 19 in 2015, in terms of the data availability and clarity of calculations, most of the data for the Euro Area were calculated for 19 countries (EA19). As all the countries that joined the Euro Area after 2002 are relatively small economies, the impact of this simplification should be low, as the time series for EA19 are very highly correlated with the series for the first 12 Euro Area members (EA12). All the data are revised in the series (as of June 2016) and calculated according to the latest methodologies (e.g., EA 2010 in the case of National Account or BPS6 in the case of the balance of payment statistics). Back extending of data and other adjustments are described below. For estimation purposes, all series envisage the interest rates and risk premium indicator to be transformed to indexes, where values are in terms of 2000 = 1 and are later transformed by natural logarithms.

The data regarding the EUR/PLN exchange rate were obtained from Eurostat and involve the average monthly exchange rates calculated from the daily exchange rate by the National Bank of Poland.

The price indexes for the tradable sector are producer price indexes (PPI) for the manufacturing sector and they are provided by the OECD.

Consumer price indexes are Harmonised Indexes of Consumer Prices (HICP) and they are provided by Eurostat.

Short-term interest rates are three-month WIBOR and EURIBOR rates and they are provided by the OECD. They were, in turn, transformed to monthly interest rates, according to the following formula:

where:

—yearly interest rate,

—monthly interest rate.

Long-term interest rates are the average rates of 10-year government bonds and they are provided by the OECD. As the data from the OECD do not include observations for the period from January 1999 to December 2000, this variable has been back extended, utilising

Kelm’s (

2013) dataset, which included an analogous time series.

The indicator of the Harrod–Balassa–Samuelson effect was calculated by the author, according to the following formula:

where:

EMP—denotes the total employment in the sector,

GVA—refers to the Gross Value Added in the Sector,

MA—manufacturing sector,

NMA—aggregate of other sectors than manufacturing,

pl—Poland,

ea—Euro Area.

All the singular factors needed to calculate HBS are gathered from Eurostat. They were disaggregated from the quarterly time series to the monthly series by the method described by

Pipień and Roszkowska (

2015), with their own modifications. These modifications refer to the use of specific explanatory variables—the monthly indicators of economic activity and employment in sectors of interest and balancing procedure. Furthermore, due to data availability, the HBS indicator for the period 1999:01–1999:12 was back extended using Kelm’s data (

Kelm 2013).

The relative terms of trade (TOT) indicator data were taken directly from

Kelm (

2013) until June 2011 and extended until December 2015, using the TOT indicator calculated by the Polish Statistical Office and export and import price data for EA19 outside EA, provided by Eurostat.

The Net Foreign Direct Investment (FDI) is analysed in relative terms, in relation to GDP:

where the

net direct investments are quarterly time series, denominated in PLN, gathered from the International Investment Position statistics from the National Bank of Poland and GDP is the quarterly GDP at the current prices gathered from Eurostat.

The quarterly time series was disaggregated to the monthly time series by the use of the automatic interpolation procedure in Gretl Software. Due to a change in the Balance of Payment methodology, data consistent with the new methodology (BMP6) have only been available since 2004. Thus, earlier data were back extended using Kelm’s data (

Kelm 2013).

Other liabilities than direct investment (OFL) were defined as

Data sources and adjustment procedures were analogous, as in the case of FDI.

As a measure of risk premium in this research, the CBOE Volatility Index (VIX) was utilized. This daily time series was aggregated to monthly figures by the unweighted average. VIX is based on the S&P 500 Index (SPX), the core index for U.S. equities, and estimates of the expected volatility, which is calculated by averaging the weighted prices of SPX puts and calls over a wide range of strike prices. Despite the fact that, in reality, it could not truly reflect forward-realized volatility (see, e.g.,

Adhikari and Hillard (

2014)), it is commonly used by market participants to predict future volatility and could reflect global uncertainty. We found this to be an interesting alternative indicator of risk premium to fiscal indicators commonly used in subject-related literature (

Bęza-Bojanowska and MacDonald 2009;

Kelm 2013) or credit default swap (CDS) differentials (

Kębłowski and Welfe 2012;

Grabowski and Welfe 2020), in particular as global shocks played a role in determining the Polish exchange rate (

Edrem and Geyikci 2021).

The data are named as follows:

- -

Nominal exchange rate—EUR/PLN (source: National Bank of Poland)

- -

“tradable sector” price index for Poland—PPI in manufacturing (source: OECD)

- -

“tradable sector” price index for the foreign economy (Euro Area)—PPI in manufacturing (source: OECD)

- -

Consumer price index for Poland—HICP (source: Eurostat)

- -

Consumer price index for the foreign economy (Euro Area)—HICP (source: Eurostat)

- -

Short-term domestic interest rate—3-month WIBOR rate (source: OECD)

- -

Short-term foreign interest rate—3-month EURIBOR rate (source: OECD)

- -

Long-term domestic interest rate—10-year Polish government bond (source: OECD)

- -

Long-term foreign interest rate—average 10-year government bond interest rate in EA19 countries (source: OECD),

- -

Global risk premium indicator—CBOE volatility index (VIX)

- -

Variable representing the HBS effect indicator (source: personal calculations based on Eurostat)

- -

Relative terms of trade indicator—based on Eurostat prices for exports and imports for Poland and EA19 (source: Eurostat)

- -

Net direct investment (liabilities asset) in relation to GDP (source: personal calculations based on the National Bank of Poland and Eurostat)

- -

Other liabilities’ (net international investment position—net direct investment) relation to GDP (source: personal calculations based on the National Bank of Poland and Eurostat)

All variables, except interest rates, were transformed to natural logarithms. Interest rates were transformed from a yearly to a monthly frequency, according to the following formula:

, where —yearly interest rate, —monthly interest rate.

The analysed time series, the expected nominal exchange rate, price indices, short-term interest rates and long-term interest rates for EA19 were back extended by the data utilised by

Kelm (

2013).

3.2. Empirical Strategy

Vectors of endogenous variables (), in particular VEC models, which we estimated, are written as follows:

—for all considered VEC models for PPP variables, hereon referred to as “PPP”.

—is consistent with capital-enhanced exchange rate equilibrium model (CHEER) and hereon referred to as “CHEER”.

is CHEER model where risk premium was added, so later this specification and hereon referred to as “CHEER_RP”.

is the CHEER_RP model with the HBS Indicator; thus, the specification is called “CHEER_HBS_RP”.

is a hybrid model involving CHEER and the behavioural equilibrium exchange rate (BEER) elements, so the specification is called the “CHEER_BEER” model.

We estimate and analysed separate VEC models for three subsamples as follows: 01 m 1999–06 m 2008; 01 m 1999–06 m 2011 and 01 m 1999–12 m 2015. The reason for such a strategy is the fact that in all of those periods, we may observe different trends in our exchange rate and its potential determinants, which we described in

Section 4.

As different lag selection criteria suggested, in many cases, either a large number of lags (e.g., 12—maximum tested) or economically and unjustifiably low ones (

p = 1), we decided to investigate only

p = 2 or

p = 3 via Akaike’s criterion and sequential likelihood ratio (LR) tests for the hypothesis VAR with two lags against VAR lags with three lags. Those lags are enough to take account of autocorrelation. Furthermore, forecasting properties of models with this many lags that is better than models with a higher number of lags (see

Burda 2017). If both criteria gave different conclusions, we investigated a further two specifications (with 2 and 3 lags) separately.

In order to choose the appropriate cointegration rank, we take account of the Johansen trace test results with the Bartlett Correction (

Johansen 2002) for restricted constant (

rc) and restricted trend (

crt) and the Johansen trace test (

Johansen 1995) with the corrected sample size for unrestricted constant (

uc).

In the Impulse Response Function (IRF) and Forecast Error Variance Decomposition (FEVD) analysis, we did not change the variable order in vectors and applied the Cholesky decomposition. As a result, orthogonal shocks in exchange rate in all models have an instantaneous impact on all variables, while the shock in the last variable in the vector has an instantaneous impact only on itself. For example, in the BEER model, the shock of other (non-FDI) foreign liabilities stock has an instantaneous impact only on other (non-FDI) foreign liabilities stock.

In order to assess the statistical significance of the impulse response, we use 90% of bootstrapped confidence intervals and concentrate on short-term (3 months), medium-term (18 months) and long-term horizons (60 months). For cases where 90% of confidence intervals for impulse responses reach both positive and negative territory, but where 75–80% of confidence intervals are concentrated only in positive or negative territory, we assess those impulse responses as “nearly significant”.

3.3. Initial Analysis and Hypothesis

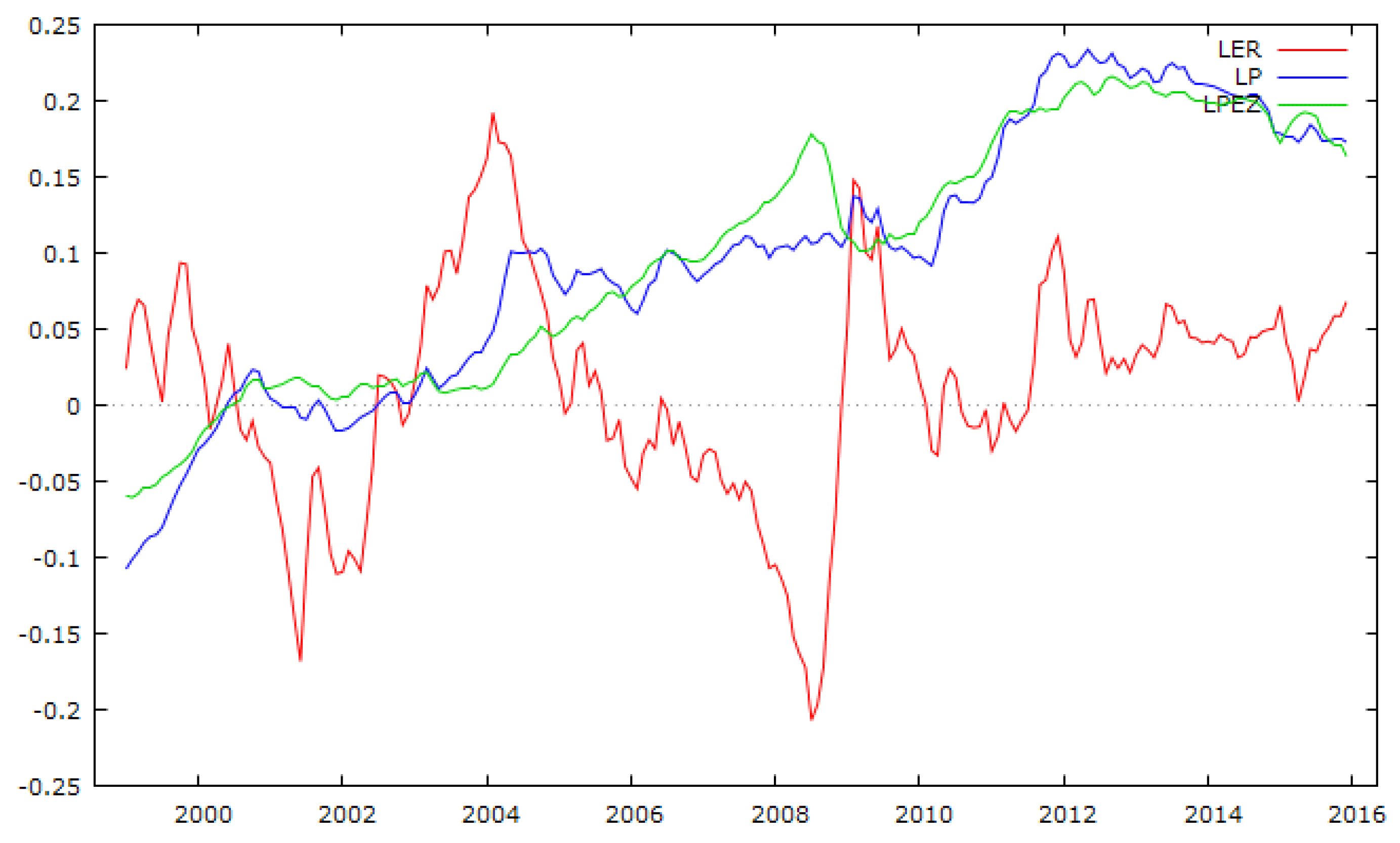

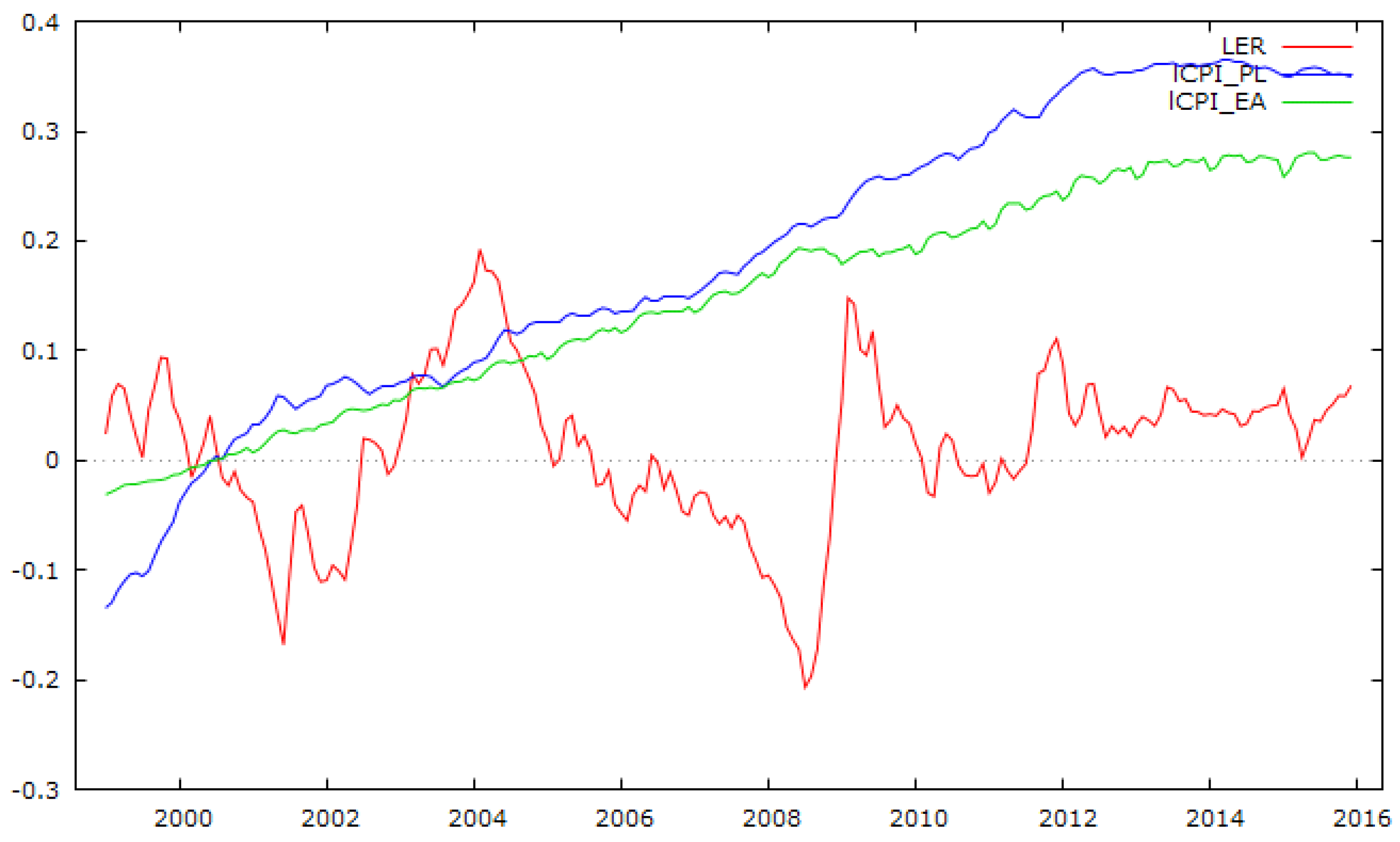

The average annual EUR/PLN exchange in 2015 (4.18) was almost similar to the figures in 1999 (4.23), indicating only a marginal 1.1% nominal appreciation in this time. Even if we take into account some differences in price growth (in the manufacturing sector), we observe only a marginal real appreciation (cumulatively by 3.5%—on average, 0.2% annually—see

Figure 1). If we look at consumer price indices as a deflator (see

Figure 2), we may find meaningful real appreciation (by 18%, 1.0% annually), which is statistically significant, as a positive linear trend for logarithms of real PLN/EUR (deflated HICP) for the period 1999–01 m–2015–12 m is statistically significant at a 0.001 significance level. In subject-related literature, this is explained by the HBS effect (e.g.,

Egert et al. 2003;

Konopczak and Welfe 2017). However, if we only look at the period after the global financial crisis (GFC), no real appreciation trend could be found as there is no significant linear trend for logarithms of real PLN/EUR (deflated CPI) for the post-GFC period, even if we use February 2009, which was the month with the peak of depreciation (EUR/PLN equaled 4.65) as a starting point for observation. On the other hand, for the period 01 m in 1999:02 m in 2009, we observe a statistically significant positive trend for logarithms of real PLN/EUR (deflated HICP).

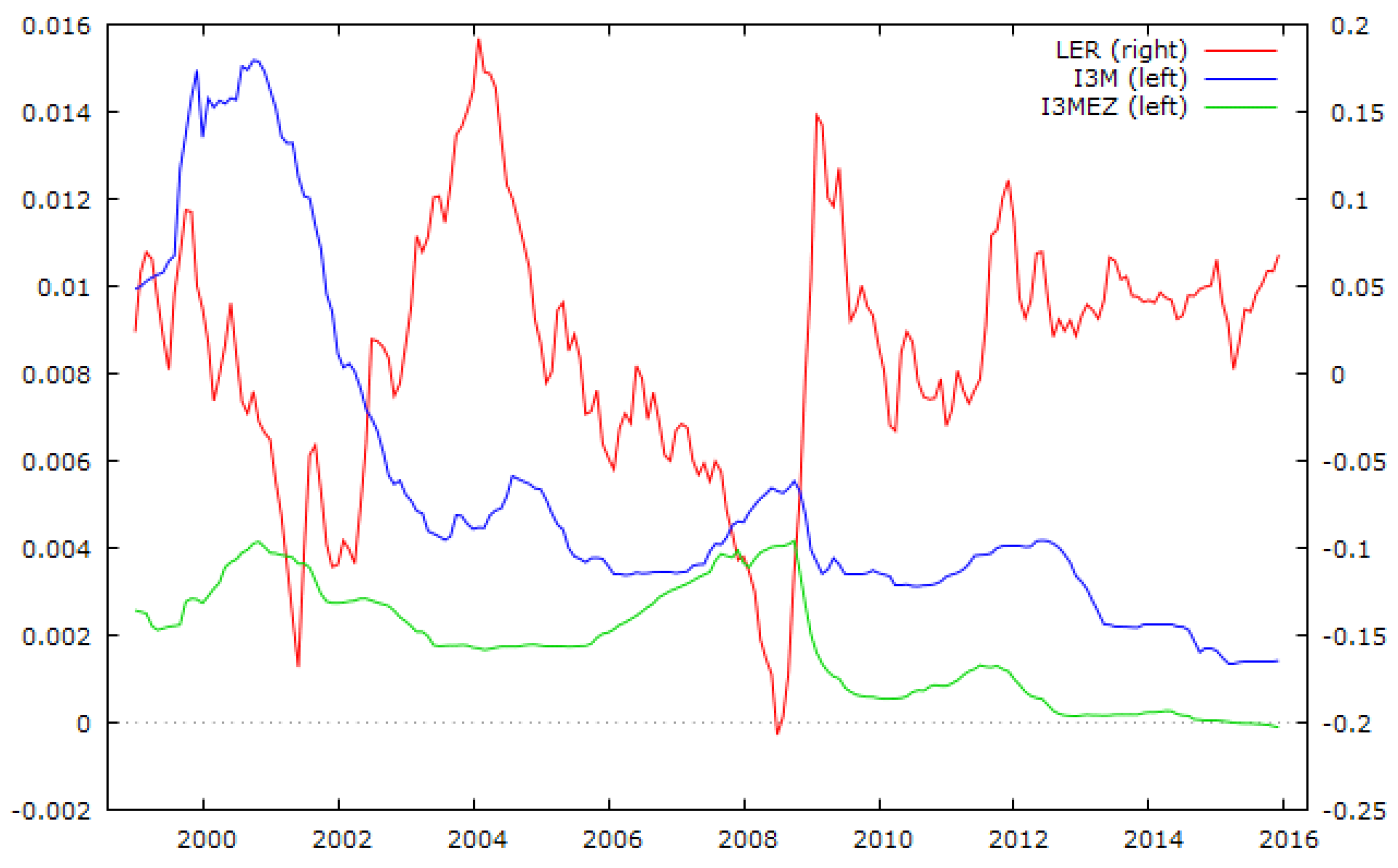

While analysing the evolution of short-term interest rates in Poland and the Euro Area (see

Figure 3), we could observe their growing similarity over time, which could be caused both by the growing similarity of inflation between Poland and the Euro Area, as well as the weakening autonomy of monetary policy induced by the globalization process (

Sławiński 2008).

Cour-Thimann and Jung (

2020) proved that the response to the evolution of FED interest rates played an important role in determining ECB’s monetary policy.

Goczek and Partyka (

2019) indicated that in the long run, domestic interbank rates in seven EEA countries (including Poland) followed Euro interest rates and positive shocks in EURIBOR, positively and significantly (even in the long run), which impacted domestic inter-bank years. In the years 2000–2001, we observed nearly 15 p.p. of nominal (maximal 8 p.p. real) disparity, due to the initially higher inflation in Poland than in the Euro Area and the restrictive monetary policy in Poland. In the subsequent years, both real and nominal disparity diminished substantially. However, even after the GFC local factors, mainly the observable inflation in Poland, still played a role in determining short-term interest rates. For example, the reference rate of NBP increased (to 4.75%) in May 2012, while at the same time, ECB cut its base rate to almost zero, when faced with a debt crisis and recession in the Euro Area. On the other hand, the impact of non-standard ECB policy measures on short-term interest rates in Poland (at least in terms of volatility) seems to be limited (e.g.,

Janus 2020).

Long-term government interest rates in the analysed period also indicate growing similarity over time (see

Figure 4). The largest disparity (reaching around 8 p.p.) was observable in the year 2000, which was caused by inflation disparity between Poland and the EA countries. In the subsequent periods, both nominal and real disparity of long-term interest rates were lower and did not exceed 3 p.p. (2 p.p. after 2009), as they were dependent on inflation expectations and risk premium.

CBOE volatility index (VIX) reached its historical maximum during the Global Financial Crisis in October and November 2008, noting higher levels than during other periods with higher global tensions, as in May 2010 or September 2011. Notably, in periods of this spike of VIX, a sizeable depreciation in EUR/PLN was observed (see

Figure 5).

Between 2000 and 2015, relative productivity in the tradable sector grew, on average, 2.6% annually (cumulatively 48%), which was much faster than real PLN/EUR (CPI deflated): on average, 1.0% annually between 1999 and 2015

2, which means that the transmission of HBS to prices and real exchange rate was incomplete (see similar findings for the years 1995–2010, in

Konopczak (

2013)). However, while in the years 2000–2008, relative productivity in the tradable sector in Poland grew, on average, 2.8%, in the years 2009–2015, it grew only by 0.6% on average. Therefore, the obvious question is if we should indicate the slowing convergence after the GFC. A more profound analysis of the data does not suggest such a thesis.

Firstly, productivity growth in the manufacturing sector in the years 2009–2015 significantly exceeded the analogous indicator for the Euro Area (5.7% vs. 3.4% annually) in this year (see

Table 1). Secondly, during the GFC (between 2008 and 2009), productivity in manufacturing in the EA dropped by over 9%, while in Poland, it grew by over 6%. As a result, relative productivity growth (the HBS indicator) surged to 14%, surging relative productivity growth (the HBS indicator) to 14%. The main cause of this was a deep fall in the GVA in manufacturing in the EA (by 14.5%), while in Poland, the GVA in this sector even showed a slight growth (by 0.7%). Simultaneously, both in Poland and the EA, employment in the manufacturing sector fell to a similar extent (5.2% and 5.6% respectively).

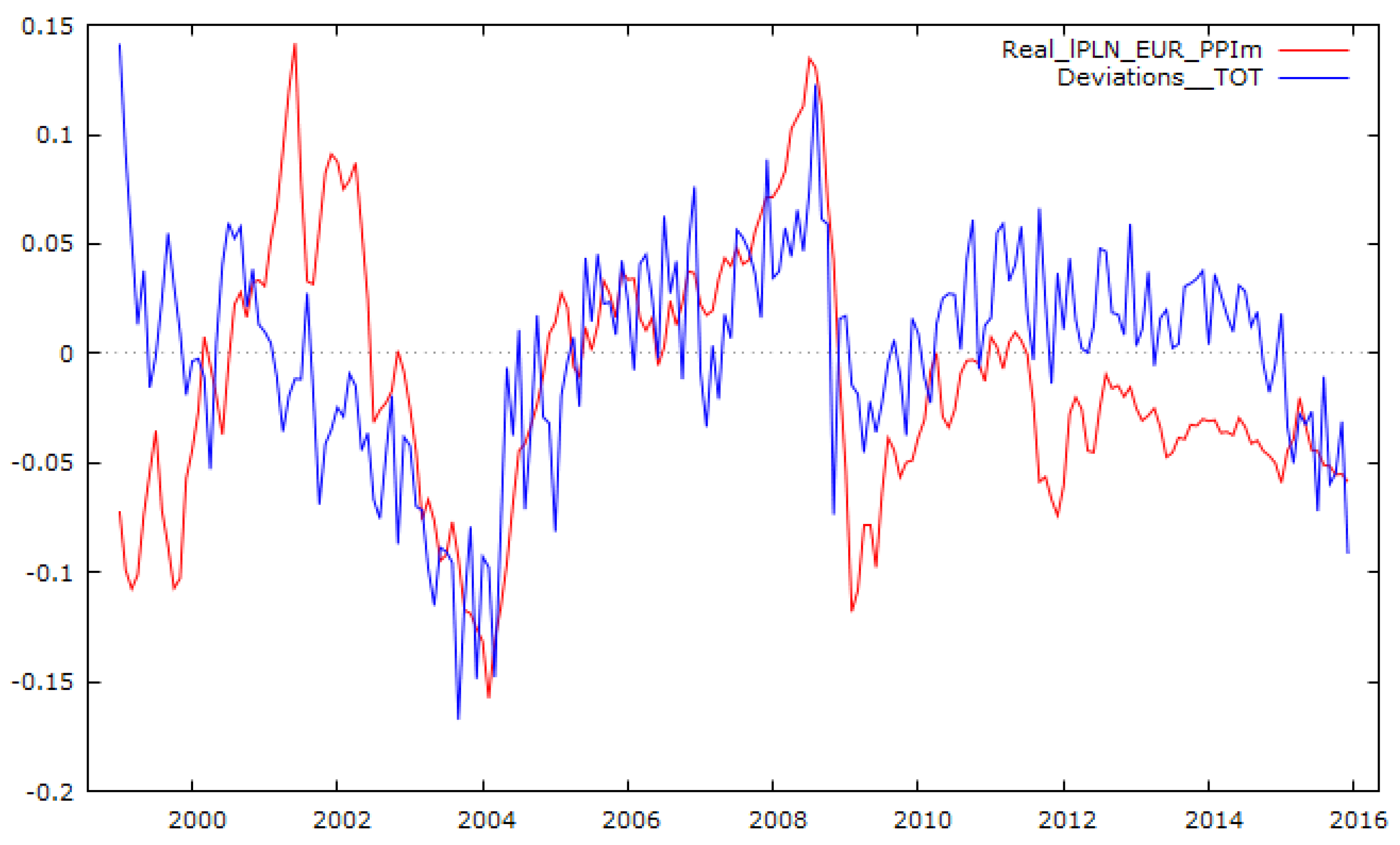

The relative terms of trade also grew in the period 1999–2015 by 32%, albeit this indicator reached its peak in August 2008—almost at the same time when the “appreciation anomaly” reached its peak (see

Figure 6).

Kelm (

2013, p. 395) observed that in the years 1999–2011, the long-term trend for relative TOT and relative productivity (HBS) was positive, while their deviation from trends was correlated negatively. However, this observation is harder to confirm for the years 2011–2015, when the analysed period was extended to those years (see

Figure 7). Similarly, Kelm’s conclusion (

Kelm 2013, p. 396) that the negative deviation in the relative TOT from its trend had a depreciative impact on EUR/PLN is not so obvious for the post-GFC period (see

Figure 8).

In the analysed foreign direct investments, net liabilities increased from 13.4% of GDP in Q1 1999 to 37.5% of GDP in Q3–Q4 2014, declining slightly to 34.5% of GDP in Q4 2015. Simultaneously, other foreign liabilities (net) in the analysed period bottomed out in Q4 2001—9.9% of GDP, yet grew in the subsequent years, reaching peaks (31.8–31.9% of GDP) in Q1 2012 and Q4 2013, while declining to 27.5% in the final years of analysis. While the path of development for FDI is quite stable and nonlinear, the nature of the trend may indicate two phenomena. The first of them is the declining technological gap between Poland and advanced economies. The second is the more complex development of other foreign liabilities, having sizeable deviations from the trend (see

Figure 9). Although this could partly reflect the impact of EUR/PLN fluctuations on debt denominated in foreign currencies, we could observe more idiosyncratic movement, such as the increase in OFL around the year 2007 and H1 2008, in spite of PLN/EUR appreciation, as well as the reduction in OFL since 2014, despite the lack of PLN/EUR appreciation (see

Figure 10).

3.5. Parameter Estimates

We present estimated coefficient of cointegration relationships and adjustment vectors in

Supplementary S4. It allowed us to compare models results with results from different papers (as Kelm 2013). Furthermore, in

Supplementary S5, we present R-square and adjusted R-square measures for first differences of logarithms of exchange rate. It allows one to assess how the model fits with the data. Adjusted R-square takes into account number of parameters, favouring more parsimonious specifications.

The main conclusions from the analysis cointegration relationship parameter are as follows. Firstly, for PPP models, estimated coefficients for all subsamples suggest that symmetry restrictions occur. Furthermore, adjustment vector in the model estimated for the sample ending in June 2008 shows no error correction for exchange rate deviation (positive coefficient for exchange rate), while for the longer sample, it is negative, indicating error correction and maintaining the PPP relationship. Secondly, parameter estimates for more complicated specifications, even with one cointegrating relationship, such as the CHEER-BEER model with three lags, are ambiguous. Analysis of adjusted R-square measure suggests that for samples ending in June 2008 and December 2015, the CHEER-BEER model with two lags explains the most exchange rate variability, while for the sample ending in June 2015, the CHEER model with three lags fits.

3.6. IRF Analysis

The most important synthetic results of IRFs of different shocks on EUR/PLN are presented in

Supplementary S3. Not surprisingly, in the case of all model specifications and all subsamples, the impact of EUR/PLN is permanent, almost statistically significant and positive (see

Table S1).

Quite surprisingly, the impact of a positive price shock (shock in PPI for PPP, CHEER and CHEER_RP models and shock in HICP for CHEER_HBS_RP and BEER) is negative (meaning appreciation) and statistically or nearly statistically significant for all specifications in the short run. In the medium and long term, this impact is not statistically significant (or at best, nearly statistically significant) in most specifications and the direction of this impulse is not clear (see

Table S2).

The impact of foreign price shocks on the exchange rate in Poland according to the investigated specification differs between the pre-GFC subsample and subsamples, including the GFC and the post-GFC period. In the pre-GFC subsample, in most specifications, it is not significant, regardless of the direction, while nearly significant only within the CHEER_RP framework. In subsamples that include the post-GFC period, in particular in subsample 01 m 1999–12 m 2015, the positive foreign price shock drives statistically significant appreciation of EUR/PLN (see

Table S3).

The impact of a positive shock in WIBOR3M on the exchange rate for most specifications and subsamples is negative (indicating appreciation), while in most specifications, significant or nearly significant in 1.5-year and 5-year horizons, whereas in the short run, more differentiated in various specifications (see

Table S4). Those results are qualitatively similar to the nominal effective exchange rate (NEER) impulse response of monetary policy shocks in the Quarterly Model of (Monetary) Transmission (QMOTR)—where, after initial appreciation, it drops to almost zero after two quarters and partly rebounds in the subsequent quarters (

Chmielewski et al. 2018, p. 28).

The impact of a positive EURIBOR3M shock differs in the pre-GFC subsample and subsamples, including the post-GFC period. While in the pre-GFC subsample, the impulse response of EUR/PLN is not statistically significant and has no consistent direction among the specifications, in subsamples, including the post-GFC period, the impulse response is clearly negative and statistically significant or nearly statistically significant (see

Table S5). These results could be interpreted in two ways. On the one hand, it could indicate strong spillovers of conventional ECB policy instruments on the Polish exchange market after the GFC. This is partly consistent with the results of a study by

Keppel and Prettner (

2015)

3, in which they found a statistically significant impact of an increase in the interest rates of the Euro Area on the appreciation of Central European currencies, only in the short run, as opposed to the results of a recent paper by

Grabowski and Stawarz-Grabowska (

2021)

4, who found no significant spillovers from the ECB’s conventional

5 monetary policy measures to the exchange rate markets of the three Central and Eastern European (CEE-3) countries—Poland, Czech Republic and Hungary. On the other hand, in the absence of EA real activity indicators or stock market indicators in the analysed models, EURIBOR3M shocks may partly reflect shocks of real activity, in particular as the biggest ECB interest rate cuts appeared in last months of 2008 and 2011, just when the EA economy entered into recession.

Impact of shocks in 10-year Polish government yields on EUR/PLN exchange rate varies among specification and subsamples, with most models being not statistically significant. However, for the subsample 01 m 1999–12 m 2015, we could observe a “clearly” negative impulse response of EUR/PLN in 1.5-year and 5-year horizons (albeit, in most specifications, not significant), while in a 3-month horizon, positive impulse response (see

Table S6).

The impact of positive shock in weighted average yield of 10-year bonds of EA countries for most subsamples and among most specifications is not statistically significant in all horizons (see

Table S7).

Contrary to the author’s expectations, the impact of the VIX shock on the EUR/PLN exchange rate in subsamples, including the post-GFC period, is not statistically significant. On the other hand, in subsample 1 m in 1999, 12 m in 2015, it is positive (but mainly in 1.5-year and 5-year horizons), which is consistent with the theory. However, for the subsample before the GFC (1 m in 1999, 6 m in 2008), we observe, in many cases (in particular in a month horizon), the negative impulse response of EUR/PLN, which is contrary to expectations (see

Table S8). A graphical analysis of VIX and EUR/PLN trajectories allows us to realize that in late 2007 and early 2008, as in the case of 2001, increasing VIX corresponded with the appreciation of the Zloty (see

Figure 5).

The impact of a positive shock in relative productivity (the HBS indicator) on EUR/PLN is not significant within the CHEER_BERR framework when richer structural mechanisms are considered. Interestingly, in the case of the pre-GFC subsample for the CHEER_HBS_RP model, we could observe the impulse response of the EUR/PLN, which is consistent with the graphical analysis performed in

Figure 6 and

Figure 8. It is also consistent with

Kelm’s (

2013, p. 395) conclusion that the positive deviation in relative productivity induces depreciation and vice versa. However, in subsamples, including the post-GFC period, in particular for subsample 1 m in 1999, 12 m in 2015, this conclusion is not maintained (see

Table S9). In our view, other factors that are described below explain the short- and medium-term exchange rate fluctuations better, while the HBS indicator analysis makes more sense in the long- or very-long-term horizon.

The impact of positive shocks of relative terms of trade, FDI to GDP and OFL to GDP on exchange rate was analysed only within CHEER_BEER models. Not surprisingly, the TOT positive shock in all subsamples and horizons induces the appreciation of Zloty against Euro and this effect is particularly visible for subsample 1 m in 1999, 6 m in 2011, which corresponds with Kelm’s findings (

Kelm 2013, pp. 410–21). However, in subsample 1 m in 1999, 12 m in 2015, its importance, in particular, in a longer-term horizon, is less visible (see

Table S10). Interestingly,

Grabowski and Welfe (

2020), in their model based on sample 2001:01–2018:12, found negative long-term relationships between the EUR/PLN exchange rate and the terms of trade, meaning a significant impact of the increase in the terms of trade on the appreciation of the Polish zloty.

The impact of FDI shock for most specifications and subsamples remains statistically insignificant. Only in the case of sample 1 m in 1999, 12 m in 2015, we observe the expected impact (clearly negative for positive shocks and statistically significant in the long run for some specifications (see

Table S10)).

The impact of a positive OFL shock on EUR/PLN in all specifications is consistent with the NFA theory (positive), indicating that the increase in OFL is associated with the depreciation of the Zloty. However, in subsamples, including the aftermath of the GFC period, it is statistically (or nearly statistically) significant only in short-term horizons (see

Table S11). All in all, our findings should not be compared directly with the findings of

Kelm (

2013) or

Grabowski and Welfe (

2020), due to the different tools used in the structural analysis (interpretation of cointegration matrix vs. IRFs). Furthermore,

Grabowski and Welfe (

2020) applied overall NFA, similarly to

Caputo (

2018), without differentiating between FDIs and OFLs. However, our findings are still not contradictory to the aforementioned papers, albeit our analysis suggests that the significance of TOT, FDI and OFLs may be less robust than what the above authors stated.

3.7. Main Sources of Exchange Rate Variability—FEVD Analysis

We presented the detailed results for the specific models and subsamples in

Supplementary S3, while in this section, we describe the most important findings. Not surprisingly, the exchange rate shocks are the most important source of forecast error variance in the short-term horizons, as they account for 82–98% of forecast error variance, taking account of the positive and significant impact of positive exchange rate shocks on the exchange rate in all specifications for all subsamples. Furthermore, as this is also the case in longer horizons, such as 5 years, it is, depending on the specifications, one of the most important sources of forecast error variance. Relatively speaking, the least important of these shocks is observed for subsample 01 m 1999–06 m 2011. Those results seem to correspond to

Dąbrowski et al. (

2020), where the financial shocks accounted for over 70% of real exchange rate forecast error variance in turbulent times and 59% in normal times in a one-quarter horizon and this is also an important (in turbulent times, the most important) source of forecast error variance in a 5-year horizon.

The second most important source of exchange rate terms of trade shocks involves foreign price shocks and foreign short-term interest rate shocks, depending on the model specifications. The importance of terms of trade shock are the most robust in subsamples, including the post-GFC period (in particular, in subsample 1999:01–2011:06) in an 18-month horizon. Furthermore, we could observe the growing importance of short-term interest rate shocks and foreign price shocks in the models analysed for the post-GFC subsamples. Foreign price shocks are very important within PPP, CHEER and CHEER_RP, while less important within the CHEER_HBS_RP and CHEER_BEER models, which may suggest the omission of variable bias in specifications without productivity differentials, terms of trade and net foreign asset variables. The importance of foreign short-term interest rate shocks is comparable between specifications, which, in turn, facilitates finding a robust impact. Domestic interest rate shocks have been an important source of medium- and long-term forecast error variance decomposition within some specifications (mostly in the CHEER_RP model analysed for the pre-GFC sample). However, we observe big differences in this shock importance between various specifications (even for the same subsamples). Furthermore, the relative importance of domestic short-term interest rate shocks is lower in the post-GFC subsamples, particularly in subsample 1999:01–2015:12.