Measuring the Level of the Youth Informal Economy in Lithuania in 2004–2020

Abstract

1. Introduction

2. Literature Review and Hypothesis Setting

3. Materials and Data

3.1. MIMIC

3.2. Direct Survey

4. Results and Discussion

5. Conclusions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Altındağ, Onur, Ozan Bakış, and Sandra Rozo. 2020. Blessing or burden? Impacts of refugees on businesses and the informal economy. Journal of Development Economics 146: 102490. [Google Scholar] [CrossRef]

- Andreotti, Alberta, Enzo Mingione, and Emanuele Polizzi. 2012. Local welfare systems: A challenge for social cohesion. Urban Studies 49: 1925–40. [Google Scholar] [CrossRef]

- Arsić, Milojko, Mihail Arandarenko, Branko Radulović, Sasa Ranđelović, and Irena Janković. 2015. Causes of the shadow economy. In Formalizing the Shadow Economy in Serbia. Cham: Springer, pp. 21–46. [Google Scholar]

- Bachtler, John, and Carlos Mendez. 2020. Cohesion and the EU budget: Is conditionality undermining solidarity. In Governance and Politics in the Post-Crisis European Union. Cambridge: CUP, pp. 121–40. [Google Scholar]

- Baklouti, Nedra, and Younes Boujelbene. 2020. Shadow economy, corruption, and economic growth: An empirical analysis. The Review of Black Political Economy 47: 276–94. [Google Scholar] [CrossRef]

- Balezentis, Tomas, Erika Ribasauskiene, Mangirdas Morkunas, Artiom Volkov, Dalia Streimikiene, and Pierluigi Toma. 2020. Young farmers’ support under the Common Agricultural Policy and sustainability of rural regions: Evidence from Lithuania. Land Use Policy 94: 104542. [Google Scholar] [CrossRef]

- Banks, Nicola. 2016. Youth poverty, employment and livelihoods: Social and economic implications of living with insecurity in Arusha, Tanzania. Environment and Urbanization 28: 437–54. [Google Scholar] [CrossRef]

- Belman, Dale, and Paul Wolfson. 2014. What Does the Minimum Wage Do? Kalamazoo: WE Upjohn Institute. [Google Scholar]

- Berdiev, Aziz, and James Saunoris. 2019. On the relationship between income inequality and the shadow economy. Eastern Economic Journal 45: 224–49. [Google Scholar] [CrossRef]

- Boeri, Tito. 2012. Setting the minimum wage. Labour Economics 19: 281–90. [Google Scholar] [CrossRef]

- Borlea, Sorin Nicolae, Monica Violeta Achim, and Monica Gabriela Miron. 2017. Corruption, shadow economy and economic growth: An empirical survey across the European Union countries. Studia Universitatis Vasile Goldiș Arad, Seria Științe Economice 27: 19–32. [Google Scholar] [CrossRef]

- Bossler, Mario, and Thorsten Schenck. 2022. Wage Inequality in Germany after the Minimum Wage Introduction. Journal of Labor Economics. [Google Scholar] [CrossRef]

- Browman, Alexander, Mesmin Destin, Melissa Kearney, and Phillip Levine. 2019. How economic inequality shapes mobility expectations and behaviour in disadvantaged youth. Nature Human Behaviour 3: 214–20. [Google Scholar] [CrossRef]

- Buckwell, Allan, David Harvey, Kenneth Thomson, and Kevin Parton. 2019. The Costs of the Common Agricultural Policy. New York: Routledge, vol. 7. [Google Scholar]

- Bugajski, Janusz. 2020. Political Parties of Eastern Europe: A Guide to Politics in the Post-Communist Era. New York: Routledge. [Google Scholar]

- Caliendo, Marco, Linda Wittbrodt, and Carsten Schröder. 2019. The causal effects of the minimum wage introduction in Germany—An overview. German Economic Review 20: 257–92. [Google Scholar] [CrossRef]

- Camacho, Carmen, Fabio Mariani, and Luca Pensieroso. 2017. Illegal immigration and the shadow economy. International Tax and Public Finance 24: 1050–80. [Google Scholar] [CrossRef]

- Carlo, Gustavo, Alexandra Davis, and Laura Taylor. 2022. Reducing Youth In-Group Favoritism to Address Social Injustice. Policy Insights from the Behavioral and Brain Sciences 9: 90–95. [Google Scholar] [CrossRef]

- Chancellor, Will, and Malcolm Abbott. 2015. The Australian construction industry: Is the shadow economy distorting productivity? Construction Management and Economics 33: 176–86. [Google Scholar] [CrossRef]

- Charmes, Jaques. 2020. The success story of a loose but useful concept: Origins, development, magnitude and trends of the informal economy. In Research Handbook on Development and the Informal Economy. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Chen, Hailin, Friedrich Schneider, and Quinly Sun. 2020. Measuring the size of the shadow economy in 30 provinces of China over 1995–2016: The MIMIC approach. Pacific Economic Review 25: 427–53. [Google Scholar] [CrossRef]

- Chen, Heyin, Yu Hao, Jingwei Li, and Xiaojie Song. 2018. The impact of environmental regulation, shadow economy, and corruption on environmental quality: Theory and empirical evidence from China. Journal of Cleaner production 195: 200–14. [Google Scholar] [CrossRef]

- Choi, Jay Pil, and Marcel Thum. 2005. Corruption and the shadow economy. International Economic Review 46: 817–36. [Google Scholar] [CrossRef]

- D’Hernoncourt, Johanna, and Pierre-Guillaume Méon. 2012. The not so dark side of trust: Does trust increase the size of the shadow economy? Journal of Economic Behavior & Organization 81: 97–121. [Google Scholar]

- Dell’Anno, Roberto, and Adriana Ana Maria Davidescu. 2019. Estimating shadow economy and tax evasion in Romania. A comparison by different estimation approaches. Economic Analysis and Policy 63: 130–49. [Google Scholar] [CrossRef]

- Dell’Anno, Roberto, and Desiree Teobaldelli. 2015. Keeping both corruption and the shadow economy in check: The role of decentralization. International Tax and Public Finance 22: 1–40. [Google Scholar] [CrossRef]

- Dell’Anno, Roberto, and Omobola Adu. 2020. The size of the informal economy in Nigeria: A structural equation approach. International Journal of Social Economics 47: 1063–78. [Google Scholar] [CrossRef]

- Di Cataldo, Marco. 2017. The impact of EU Objective 1 funds on regional development: Evidence from the UK and the prospect of Brexit. Journal of Regional Science 57: 814–39. [Google Scholar] [CrossRef]

- Di Nola, Alessandro, Georgi Kocharkov, and Aleksandar Vasilev. 2019. Envelope wages, hidden production and labor productivity. The BE Journal of Macroeconomics 19. [Google Scholar] [CrossRef]

- Dreher, Axel, and Friedrich Schneider. 2010. Corruption and the shadow economy: An empirical analysis. Public Choice 144: 215–38. [Google Scholar] [CrossRef]

- Dube, Arindraijit, Suresh Naidu, and Michael Reich. 2007. The economic effects of a citywide minimum wage. ILR Review 60: 522–43. [Google Scholar] [CrossRef]

- Eijdenberg, Emiel, and Kathreen Borner. 2017. The performance of subsistence entrepreneurs in Tanzania’s informal economy. Journal of Developmental Entrepreneurship 22: 1750007. [Google Scholar] [CrossRef]

- Elbahnasawy, Nasr. 2021. Can e-government limit the scope of the informal economy? World Development 139: 105341. [Google Scholar] [CrossRef]

- Elbahnasawy, Nasr, Michael Ellis, and Assande Desiree Adom. 2016. Political instability and the informal economy. World Development 85: 31–42. [Google Scholar] [CrossRef]

- Elgin, Ceyhun, Collin Williams, Gamze Oz-Yalaman, and Abdullan Yalaman. 2022. Fiscal stimulus packages to COVID-19: The role of informality. Journal of International Development 34: 861–79. [Google Scholar] [CrossRef]

- Esau, Michelle Vera, Carol Hilary Rondganger, and Nicolette Vanessa Roman. 2019. Family political socialisation and its effect on youth trust in government: A South African perspective. Politikon 46: 122–37. [Google Scholar] [CrossRef]

- Franic, Josip. 2020. Dissecting the illicit practice of wage underreporting: Some evidence from Croatia. Economic Research-Ekonomska Istraživanja 33: 957–73. [Google Scholar] [CrossRef]

- Franic, Josip, and Stanislaw Cichocki. 2021. Envelope wages as a new normal? An insight into a pool of prospective quasi-formal workers in the European Union (EU). Employee Relations: The International Journal. [Google Scholar] [CrossRef]

- Fredström, Ashkarn, Juhana Peltonen, and Joakim Wincent. 2021. A country-level institutional perspective on entrepreneurship productivity: The effects of informal economy and regulation. Journal of Business Venturing 36: 106002. [Google Scholar] [CrossRef]

- Galdino, Katia, Moses Kiggundu, Carla Jones, and Sangbun Ro. 2018. The informal economy in pan-Africa: Review of the literature, themes, questions, and directions for management research. Africa Journal of Management 4: 225–58. [Google Scholar] [CrossRef]

- Ginevicius, Romualdas, Tomas Kliestik, Andrius Stasiukynas, and Karel Suhajda. 2020. The impact of national economic development on the shadow economy. Journal of Competitiveness 12: 39. [Google Scholar] [CrossRef]

- Harasztosi, Peter, and Atilla Lindner. 2019. Who Pays for the minimum Wage? American Economic Review 109: 2693–727. [Google Scholar] [CrossRef]

- Hart, Keith. 1985. The Informal Economy. Cambridge: Cambridge Anthropology, pp. 54–58. [Google Scholar]

- Heinemann, Friedrich, and Stefani Weiss. 2018. The EU Budget and Common Agricultural Policy beyond 2020: Seven More Years of Money for Nothing? (No. 17). EconPol Working Paper. Munich: IFO Institute—Leibniz Institute for Economic Research at the University of Munich. [Google Scholar]

- Hoinaru, Razvan, Daniel Buda, Sorin Nicolae Borlea, Viorela Ligia Văidean, and Monica Violeta Achim. 2020. The impact of corruption and shadow economy on the economic and sustainable development. Do they “sand the wheels” or “grease the wheels”? Sustainability 12: 481. [Google Scholar] [CrossRef]

- Horodnic, Ioanna Alexandra, and Collin Williams. 2021. Cash Wage Payments in Transition Economies: Consequences of Envelope Wages. Bonn: IZA World of Labor. [Google Scholar]

- Horodnic, Ioanna Alexandra. 2018. Tax morale and institutional theory: A systematic review. International Journal of Sociology and Social Policy 38: 868–86. [Google Scholar] [CrossRef]

- Huynh, Cong Mingh, and Tan Loi Nguyen. 2020b. Shadow economy and income inequality: New empirical evidence from Asian developing countries. Journal of the Asia Pacific Economy 25: 175–92. [Google Scholar] [CrossRef]

- Ilieva-Trichkova, Petya, and Pepeka Boyadjieva. 2020. Young people’s agency over continuing education in situations of early job insecurity: From enabling to stumbling. Studies in Continuing Education 42: 279–97. [Google Scholar] [CrossRef]

- Kabeer, Naila. 2014. Gender and Social Protection Strategies in the Informal Economy. New York: Routledge India. [Google Scholar]

- Karamessini, Maria, Maria Symeonaki, Glykeria Stamatopoulou, and Dimitris Parsanoglou. 2019. Factors explaining youth unemployment and early job insecurity in Europe. In Youth Unemployment and Job Insecurity in Europe. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Kautonen, Teemu, Isabella Hatak, Ewald Kibler, and Thomas Wainwright. 2015. Emergence of entrepreneurial behaviour: The role of age-based self-image. Journal of Economic Psychology 50: 41–51. [Google Scholar] [CrossRef]

- Kelmanson, Ben, Koralai Kirabaeva, Leandro Medina Borislava Mircheva, and Jason Weiss. 2019. Explaining the Shadow Economy in Europe: Size, Causes and Policy Options. Washington, DC: International Monetary Fund. [Google Scholar]

- Kitanova, Magdelina. 2020. Youth political participation in the EU: Evidence from a cross-national analysis. Journal of Youth Studies 23: 819–36. [Google Scholar] [CrossRef]

- Koehler, Gabriele. 2021. Effects of social protection on social inclusion, social cohesion and nation building. In Handbook on Social Protection Systems. Cheltenham: Edward Elgar Publishing, pp. 636–46. [Google Scholar]

- Lee, Yunsoo. 2021. Government for Leaving No One Behind: Social Equity in Public Administration and Trust in Government. Sage Open 11: 21582440211029227. [Google Scholar] [CrossRef]

- Lemos, Sara. 2008. A Survey of the Effects of the Minimum Wage on Prices. Journal of Economic Surveys 22: 187–212. [Google Scholar] [CrossRef]

- Lemos, Sara. 2009. Minimum wage effects in a developing country. Labour Economics 16: 224–37. [Google Scholar] [CrossRef]

- Lichard, Tomaš, Jan Hanousek, and Randall Filer. 2021. Hidden in plain sight: Using household data to measure the shadow economy. Empirical Economics 60: 1449–76. [Google Scholar] [CrossRef]

- Liotti, Giorgio. 2020. Labour market flexibility, economic crisis and youth unemployment in Italy. Structural Change and Economic Dynamics 54: 150–62. [Google Scholar] [CrossRef]

- Liu, Feng, Dev Dutta, and Kwangtae Park. 2021. From external knowledge to competitive advantage: Absorptive capacity, firm performance, and the mediating role of labour productivity. Technology Analysis & Strategic Management 33: 18–30. [Google Scholar]

- Loichinger, Elke, Bernhard Hammer, Alexia Prskawetz, Michael Freiberger, and Joze Sambt. 2017. Quantifying economic dependency. European Journal of Population 33: 351–80. [Google Scholar] [CrossRef]

- Maguire, Sue, Bart Cockx, Juan Dolado, Florentino Felgueroso, Marcel Jansen, Izabela Styczyńska, Elish Kelly, Seamus McGuinness, Werner Eichhorst, Holger Hinte, and et al. 2013. Youth unemployment. Intereconomics 48: 196–235. [Google Scholar] [CrossRef]

- Manning, Alan. 2021. The elusive employment effect of the minimum wage. Journal of Economic Perspectives 35: 3–26. [Google Scholar] [CrossRef]

- Matthews, Alan. 2018. The CAP in the 2021–27 MFF Negotiations. Intereconomics 53: 306–11. [Google Scholar] [CrossRef][Green Version]

- McKeever, Mattew. 1998. Reproduced inequality: Participation and success in the South African informal economy. Social Forces 76: 1209–41. [Google Scholar] [CrossRef]

- Meagher, Kate. 2018. Taxing times: Taxation, divided societies and the informal economy in Northern Nigeria. The Journal of Development Studies 54: 1–17. [Google Scholar] [CrossRef]

- Medina, Leandro, Andrew Jonelis, and Mehmet Cangul. 2017. The Informal Economy in Sub-Saharan Africa: Size and Determinants. Washington, DC: International Monetary Fund. [Google Scholar]

- Meer, Jonathan, and Jeremy West. 2016. Effects of the minimum wage on employment dynamics. Journal of Human Resources 51: 500–22. [Google Scholar] [CrossRef]

- Melrose, Margaret. 2012. Young people, welfare reform and social insecurity. Youth and Policy 108: 1–19. [Google Scholar]

- Mikuš, Ornella, Marin Kukoč, and Mateja Jež Rogelj. 2019. The coherence of common policies of the EU in territorial cohesion: A never-ending discourse? A review. Agricultural Economics 65: 143–49. [Google Scholar] [CrossRef]

- Moon, Seongwuk. 2018. Skill development, bargaining power, and a theory of job design. Journal of Economics & Management Strategy 27: 270–96. [Google Scholar]

- Morkūnas, Mangirdas. 2022. Russian Disinformation in the Baltics: Does it Really Work? Public Integrity 2022: 1–15. [Google Scholar] [CrossRef]

- Neef, Rainer. 2018. Observations on the concept and forms of the informal economy in Eastern Europe. In The Social Impact of Informal Economies in Eastern Europe. New York: Routledge, pp. 1–27. [Google Scholar]

- Němec, Daniel, Eva Kotlánová, Igor Kotlán, and Zuzana Machová. 2021. Corruption, taxation and the impact on the shadow economy. Economies 9: 18. [Google Scholar] [CrossRef]

- Neumark, David, and Peter Shirley. 2022. Myth or measurement: What does the new minimum wage research say about minimum wages and job loss in the United States? Industrial Relations: A Journal of Economy and Society 61: 384–417. [Google Scholar] [CrossRef]

- Neumark, David, Mark Schweitzer, and William Wascher. 2004. Minimum wage effects throughout the wage distribution. Journal of Human Resources 39: 425–50. [Google Scholar] [CrossRef]

- Nunkoo, Robin, and Stephen Smith. 2013. Political economy of tourism: Trust in government actors, political support, and their determinants. Tourism management 36: 120–32. [Google Scholar] [CrossRef]

- Oka, Rahul. 2011. Unlikely cities in the desert: The informal economy as causal agent for permanent” Urban” sustainability in Kakuma Refugee Camp, Kenya. Urban Anthropology and Studies of Cultural Systems and World Economic Development 2011: 223–62. [Google Scholar]

- Ouédraogo, Idrissa. 2017. Governance, corruption, and the informal economy. Modern Economy 8: 256. [Google Scholar] [CrossRef]

- Pasovic, Edin, and Adnan Efendic. 2018. Informal economy in Bosnia and Herzegovina-an empirical investigation. The South East European Journal of Economics and Business 13: 112–25. [Google Scholar] [CrossRef]

- Peiró, Jose, Sonia Agut, and Rosa Grau. 2010. The relationship between overeducation and job satisfaction among young Spanish workers: The role of salary, contract of employment, and work experience. Journal of Applied Social Psychology 40: 666–89. [Google Scholar] [CrossRef]

- Popescu, Gheorghe, Adriana Ana Maria Davidescu, and Catalin Huidumac. 2018. Researching the main causes of the Romanian shadow economy at the micro and macro levels: Implications for sustainable development. Sustainability 10: 3518. [Google Scholar] [CrossRef]

- Putniņš, Talis, and Arnis Sauka. 2015. Measuring the shadow economy using company managers. Journal of Comparative Economics 43: 471–90. [Google Scholar] [CrossRef]

- Remeikienė, Rita, Ligita Gasparėnienė, Yilmaz Bayar, Romualdas Ginevičius, and Ieva Marija Ragaišytė. 2022. ICT development and shadow economy: Empirical evidence from the EU transition economies. Economic Research-Ekonomska Istraživanja 35: 762–77. [Google Scholar] [CrossRef]

- Salamońska, Justyna, and Olga Czeranowska. 2019. Janus-faced mobilities: Motivations for migration among European youth in times of crisis. Journal of Youth Studies 22: 1167–83. [Google Scholar] [CrossRef]

- Sassen, Saskia. 1993. The informal economy: Between new developments and old regulations. Yale LJ 103: 2289. [Google Scholar] [CrossRef]

- Schneider, Friedrich. 2019. Restricting or abolishing cash: An effective instrument for eliminating the shadow economy, corruption and terrorism? SUERF Policy Note 90: 1–7. [Google Scholar]

- Schneider, Friedrich. 2021. Development of the Shadow Economy of 36 OECD Countries over 2003–21: Due to the Corona Pandemic a Strong Increase in 2020 and a Modest Decline in 2021. African Journal of Political Science 15: 005. [Google Scholar]

- Schneider, Friedrich, and Dominik Enste. 2013. The Shadow Economy: An International Survey. Cambridge: Cambridge University Press. [Google Scholar]

- Schneider, Friedrich, Mangirdas Morkunas, and Erika Quendler. 2022. An estimation of the informal economy in the agricultural sector in the EU-15 from 1996 to 2019. Agribusiness: An International Journal. [Google Scholar] [CrossRef]

- Šiugždinienė, Jurgita, Eglė Gaulė, and Rimantas Rauleckas. 2019. In search of smart public governance: The case of Lithuania. International Review of Administrative Sciences 85: 587–606. [Google Scholar] [CrossRef]

- Smith, Natalya, and Ekaterina Thomas. 2015. Determinants of Russia’s informal economy: The impact of corruption and multinational firms. Journal of East-West Business 21: 102–28. [Google Scholar] [CrossRef]

- Teobaldelli, Desiree, and Friedrich Schneider. 2013. The influence of direct democracy on the shadow economy. Public Choice 157: 543–67. [Google Scholar] [CrossRef]

- Toleikienė, Rita, Sigitas Balčiūnas, and Vita Juknevičienė. 2020. Youth Attitudes Towards Intolerance to Corruption in Lithuania. Scientific Papers of the University of Pardubice, Series D, Faculty of Economics & Administration 28: 109. [Google Scholar] [CrossRef]

- Tonkiss, Fran. 2009. Trust, confidence and economic crisis. Intereconomics 44: 196–202. [Google Scholar] [CrossRef]

- Volkov, Artiom, Tomas Balezentis, Mangirdas Morkunas, and Dalia Streimikiene. 2019. Who benefits from CAP? The way the direct payments system impacts socioeconomic sustainability of small farms. Sustainability 11: 2112. [Google Scholar] [CrossRef]

- Webb, Aleksandra, Ronald McQuaid, and Sigrid Rand. 2020. Employment in the informal economy: Implications of the COVID-19 pandemic. International Journal of Sociology and Social Policy 40: 1005–19. [Google Scholar] [CrossRef]

- Whiting, Mark, Grant Hugh, and Michael Bernstein. 2019. Fair work: Crowd work minimum wage with one line of code. Paper presented at the AAAI Conference on Human Computation and Crowdsourcing, Washington, DC, USA, October 28–30, vol. 7, pp. 197–206. [Google Scholar]

- Williams, Collin. 2015. Explaining the informal economy: An exploratory evaluation of competing perspectives. Relations Industrielles/Industrial Relations 70: 741–65. [Google Scholar] [CrossRef]

- Williams, Collin. 2017. Tackling employment in the informal economy: A critical evaluation of the neoliberal policy approach. Economic and Industrial Democracy 38: 145–69. [Google Scholar] [CrossRef]

- Williams, Collin, and Friedrich Schneider. 2013. The Shadow Economy. London: Institute of Economic Affairs. [Google Scholar]

- Williams, Collin, Ioanna Alexandra Horodnic, and Jan Windebank. 2015. Explaining participation in the informal economy: An institutional incongruence perspective. International Sociology 30: 294–313. [Google Scholar] [CrossRef]

- Wu, Xiaoyi, Lan Lin, and Jie Wang. 2021. When does breach not lead to violation? A dual perspective of psychological contract in hotels in times of crisis. International Journal of Hospitality Management 95: 102887. [Google Scholar] [CrossRef]

- Wyżnikiewicz, Bohdan. 2019. Do we measure shadow economy correctly? Wiadomości Statystyczne. The Polish Statistician 64: 63–73. [Google Scholar]

- Zaharee, Marcie, Tristan Lipkie, Stewart Mehlman, and Susan Neylon. 2018. Recruitment and Retention of Early-Career Technical Talent: What Young Employees Want from Employers A study of the workplace attributes that attract early-career workers suggests that Millennials may not be so different from earlier generations. Research-Technology Management 61: 51–61. [Google Scholar] [CrossRef]

- Žičkienė, Agnė, Rasa Melnikienė, Mangirdas Morkūnas, and Artiom Volkov. 2022. CAP Direct Payments and Economic Resilience of Agriculture: Impact Assessment. Sustainability 14: 10546. [Google Scholar] [CrossRef]

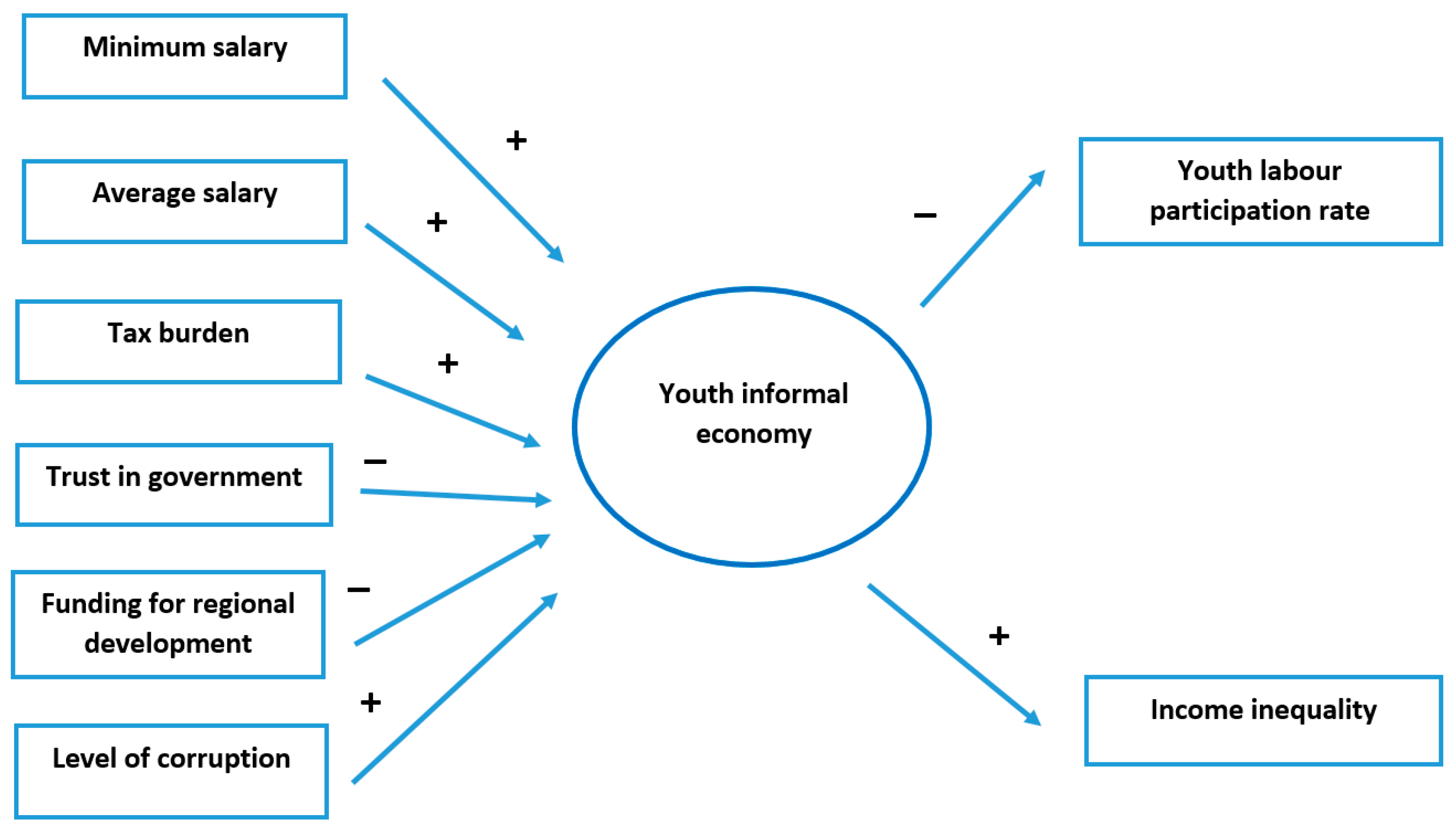

| Model; Latent Variable—Youth Informal Economy | 6-1-2 | 5-1-2 |

|---|---|---|

| Causal variables | ||

| Minimum monthly salary in the country | 0.5024 *** | 0.5469 *** |

| Average wage in the country | 0.2589 *** | 0.2711 *** |

| Total tax burden in the country | 0.3012 *** | 0.2887 *** |

| Trust in Government | −0.0106 * | −0.012 ** |

| Funding for regional development | −0.0178 ** | −0.0211 ** |

| Level of Corruption | 0.4187 ** | |

| Indicator variables | ||

| Youth labour participation rate | −0.4338 *** | −0.4981 *** |

| Income inequality | 0.0573 ** | 0.0711 ** |

| Statistical tests | ||

| RMSEA | 0.059 | 0.037 |

| CFI | 0.914 | 0.963 |

| SRMR | 0.041 | 0.024 |

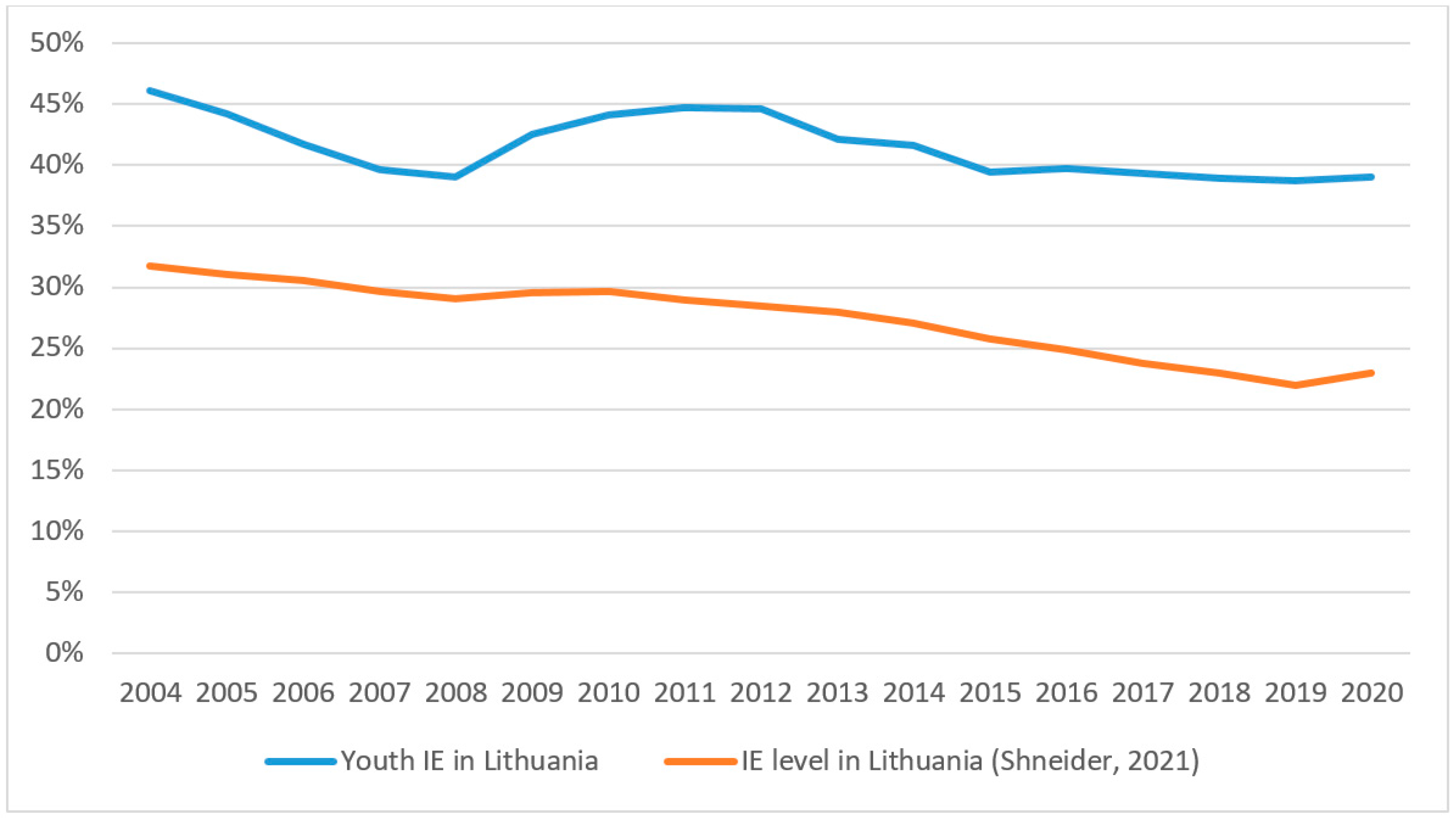

| Year | Average | Minimum Value | Maximum Value | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Youth IE in Lithuania | 41.5% | 38.7% | 46.1% | 46.1% | 44.2% | 41.7% | 39.6% | 39.0% | 42.5% | 44.1% | 44.7% |

| IE level in Lithuania (Schneider 2021) | 27.4% | 21.9% | 31.7% | 31.7% | 31.1% | 30.6% | 29.7% | 29.1% | 29.6% | 29.7% | 29.0% |

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Correlation | |

| Youth IE in Lithuania | 44.6% | 42.1% | 41.6% | 39.4% | 39.7% | 39.3% | 38.9% | 38.7% | 39.0% | 0.742 | |

| IE level in Lithuania (Schneider 2021) | 28.5% | 28.0% | 27.1% | 25.8% | 24.9% | 23.8% | 23.0% | 21.9% | 23.0% | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Morkunas, M. Measuring the Level of the Youth Informal Economy in Lithuania in 2004–2020. Economies 2022, 10, 275. https://doi.org/10.3390/economies10110275

Morkunas M. Measuring the Level of the Youth Informal Economy in Lithuania in 2004–2020. Economies. 2022; 10(11):275. https://doi.org/10.3390/economies10110275

Chicago/Turabian StyleMorkunas, Mangirdas. 2022. "Measuring the Level of the Youth Informal Economy in Lithuania in 2004–2020" Economies 10, no. 11: 275. https://doi.org/10.3390/economies10110275

APA StyleMorkunas, M. (2022). Measuring the Level of the Youth Informal Economy in Lithuania in 2004–2020. Economies, 10(11), 275. https://doi.org/10.3390/economies10110275