Abstract

LiFePhO4 (lithium iron phosphate) batteries, with their advantages compared to common current motorcycle batteries, are considered as an alternative in substituting wet and dry cell battery. The huge demand for motorcycles along with their batteries in Indonesia also make them an interesting product for business. To assess the commercial potential for such a new technology, market share needs to be estimated as well as the techno-economic feasibility. Hence, market share prediction using the residents of Surakarta Region and techno-economic analysis using Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period (PP) indicators were conducted in this study. Calculations using Markov chain method show that lithium iron phosphate batteries tend to dominate the market after certain period. Techno-economic analysis also finds that the commercialization is feasible in three conditions: first mover, even with market leader and equilibrium point. Therefore, there is a great commercial potential for lithium iron phosphate batteries, especially in Indonesia.

1. Introduction

There is an increasing trend of motorcycle sales in Indonesia in recent years. According to Indonesia Statistics Agency [1], 61 million motorcycles were sold nationally in 2010, which increased to 92 million in 2014, resulting in 52% growth in the last five years. As a result, demand of motor accumulators or batteries is also increasing. Two types of battery are commonly found in Indonesia: dry cell batteries and wet cell batteries. The dry cell holds 80% of market share and the rest is wet cell [2]. The demand volume for dry cell motorcycle batteries was 48 million units in 2010, growing to 74 million in 2014 [1]. As the average price of dry cell in Indonesia is IDR 210,000 [3], it is able to generate revenue of 14 trillion rupiahs annually. Therefore, dry cell motorcycle battery business is huge in Indonesian market, especially lithium iron phosphate battery [4]. However, as of 2016, there is not yet a manufacturer in Indonesia, which led to motorcycle battery technology—Lithium Ferro Phosphate (lithium iron phosphate battery) battery.

The lithium battery is one of the promising electrochemical battery system technologies, with high power and energy densities characteristics, increasing the demand for alternative sources of energy [5,6,7,8]. Since the introduction of the lithium type battery, many manufacturers and scientists have tried to improve the performance and utilization of lithium battery [9]. Eddahech et al. [10] revealed that the behaviors of lithium type batteries are strongly related to the battery chemistry and technology. They compared four types of lithium iron phosphate battery technologies, namely NMC, LMO-NMC, NCA, and lithium iron phosphate battery, to distinguish the performance of each type of chemistry related to the durability and energy storage. Not only limited to chemical composition, other studies (e.g., [11]) also aimed to improve the lithium ion battery technology by exploring various circuit models for lithium ion batteries. They proposed twelve circuit models obtained from literature studies and test data for the purpose of vehicle power management control and battery management system development.

The first type of motorcycle battery was wet cell or lead acid battery and after dry batteries started to emerged [12]. Along with development in motorcycle technology, battery technology in motorcycle also needs to be improved [13]. One of the technologies is Lithium iron phosphate battery which is very helpful for motorcycle battery development as it is maintenance free. Today’s lithium iron phosphate battery uses lead acid cathode with 12 V of full-charged capacity, 6 cells, 1–2 years of lifetime, 1.7 kg of weight and an average price of IDR 210,000 [3]. Previous wet cell and dry cell batteries could be substituted with lithium iron phosphate batteries [10]. A former study to identify replacement potential from wet cell and dry cell with lithium iron phosphate battery technology was conducted by Research and Development team of PT Nipress Company (Bogor, Indonesia) in 2015. The result reveals that lithium iron phosphate battery is able to fulfill the current 12 V motorcycle battery requirement with 14.4 V of fully-charged capacity in four cells [14].

One substantive benefit from lithium iron phosphate batteries is the lifetime, which is longer than common wet cell and dry cell batteries [15,16,17]. Another study also showed that Li-ion batteries have shorter life cycle cost compared to lead-acid (wet) batteries and dry-batteries [18]. Thus, lithium iron phosphate battery cell has more advantageous specification which makes it possible to be substitution product for either wet or dry cell. Moreover, demand of lithium iron phosphate battery is predicted to significantly grow in Indonesia due to government program to promote environmentally-friendly technology [19]. However, a lithium iron phosphate battery is 67% more expensive than a recent dry cell battery. Hence, a market assessment is required to figure out market acceptance of lithium iron phosphate battery for motorcycle in Indonesia as well as economic feasibility study to determine whether the new production technology is feasible to be executed.

The market study in this paper was conducted to predict the market share of Li-ion battery. A similar previous study shows that market penetration for battery technology product and utilization is not easy as the product is still unfamiliar to the market [20,21]. Whenever a firm wants to forecast the future demand of its product, it can use previous period selling data from the performance of existing products in order to estimate market demand [22]. On the other side, if the company intends to launch a new product, the company make a prediction of the amount of the product that will be absorbed by the market [23]. Therefore, in this research, Markov chain was used to predict the market share of Li-ion battery. The Markov chain is a mathematic technique for forecasting the change in particular variables based on knowledge of previous change [24,25]. This method merely needs data from one period before to predict future market share. Calculation in Markov chain method is simple and provides result for the next periods.

No previous study constructed a market share prediction model of lithium iron phosphate motorcycle battery product in Indonesia. In Indonesia, the utilization of lithium batteries with the composition of LiFePhO4 is still in development stage. Consequently, the lithium iron phosphate motorcycle battery in Indonesia is still unknown by society. Thus, this research aimed to develop market share prediction to examine the commercialization potential of lithium iron phosphate battery batteries. Commercialization potential, however, is crucial, especially for new technology product to survive in a dynamic market environment [26]. This study also provides techno-economic analysis for the investment of lithium iron phosphate motorcycle batteries as the technology of lithium iron phosphate battery batteries is still developing and business aspect needs to be assessed. The techno-economic analysis provides analysis related to economic impact and potential for the business development. The result of Markov chain and the techno-economic analysis could lead to the success of new technology product introduction to gain and utilize the commercial potential of Li-ion battery products based. Moreover, the analysis of the result aids future commercial studies of product technology in Indonesia.

2. Materials and Methods

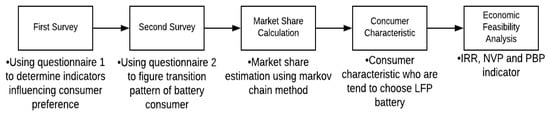

The processes of data collection in this research is illustrated in Figure 1. The first step was survey consisting of two stages. The first survey uses Questionnaire 1 which aimed to determine indicator influencing consumer in motorcycle battery purchase. Pareto chart was the tool used in this stage so that indicators considered important by customer can be developed to build the second questionnaire (Questionnaire 2). Questionnaire 2 was applied to reveal switching pattern of motorcycle battery consumer in Indonesia. Questionnaire 2 examined respondent profile, motorcycle battery currently used, type of battery that would be bought in the future and several questions to indicate which consumer is the most interested in lithium iron phosphate battery. However, with the limitation of time and personnel, the scope of the respondents’ location was limited only to Surakarta region. Nevertheless, respondents from Surakarta Region are a suitable barometer for consumer preferences in Indonesia with major increasement in motorcycle ownership.

Figure 1.

Research Method.

2.1. Markov Chain Method

To predict market share of lithium iron phosphate battery, this study utilized Markov chain method. Markov chain method is a mathematic technique to forecast change of particular variables based on the knowledge of past changes [27,28]. This method was first introduced by Andrey Andreyevich Markov in 1906 [29]. The calculation process starts with the arrangement of prime algebra matrix, then continues with transition probability matrix and eventually estimates market share by multiplying transition probability matrices to market share matrices in period “n”.

In predicting the market share, Markov chain uses consumer’s choice switching pattern in a certain period to forecast future market share [30]. Markov chain has been widely used to study brand changing and market share prediction. In Ref. [31], Markov chain method was utilized to discover changing pattern of GSM card user of a particular provider and prediction of the GSM card market share in the next two period as well as the interpretation of equilibrium period towards market share prediction. Markov chain method has also been conducted to test the brand loyalty of sport shoes consumer [28]. Another study used Markov chain to forecast tourist characteristic pattern and country switching pattern to be chosen as tourism destination in 2009 and 2010 [32].

Basically, Markov chain concept says that, if a certain event in a series of experiment depends on several eventualities, that series of experiment is called as Stochastic Process. A Markov chain is a sequence of random variables X1, X2, X3, … with Markov characteristic which is believe past and future condition is independent. Formally, Markov formulation is expressed in Equation (1) [33].

These are the steps in Markov chain calculation:

1. Prime Algebra Matrices Construction

Algebra matrix is a matrix drawing transition of preliminary condition. This matrix illustrates situation in early time along with the respective state shifting used as research object.

2. Transition Probability Matrices Construction

In accordance with Markov chain definition, probability from state i to state j in a particular iteration (period n to n + 1) can be formulated as Equation (2).

This states that probability in period or step of n + 1 is only affected by step of n and there is no influence from previous steps. Conditional probability or so-called one-step transition probability that condition Xn + 1 in period of n + 1, formulated as:

Abbreviations: Pij: Probability of battery-i consumer switchover to battery-j; Xn = i: Consumer using battery-i in period-n; Xn+1 = j: Consumer using battery-j in period-n + 1; 1, 2, 3 ∈ i and j.

Pij = P [Xn+1 = j| Xn = i], ∀ ’state i,j = 0, 1, 2, … where m and n ≥ 0

Then, probability of m step is:

where ≥ 0, ∀ i,j ∈ S and m = 0,1,2,...

Transitional probability matrix is a matrix where the elements are probability value of switching or transition from state i to state j. Transition from state i to state j for period t is defined as Pij(t). Pij equation can be defined as:

As a matrix, one-step transition probability can be illustrated as:

3. Steady State Probability Calculation

The limit probability towards state-j after through several steps and independent towards early condition is called the steady state probability. In other words, after steps of transition, the transition probability value from one particular condition to another condition has reached the limit and remained unchanged. For example, if the system is already constant in step-j, transition probability to step-j does not depend on early condition. This is clearly illustrated by transition probability matrix from early step to step-j where the matrix possesses identical elements in every row.

4. Future Market Share Probability Prediction

Future market share probability especially for second period can be estimated by multiplying transition probability matrix to market share matrix (first period) [28].

= market share prediction of period-n + 1 from starting year; P = transition probability matrix with 1 column; Qn = market share period-n.

2.2. Techno-Economic Analysis

The techno-economic analysis is intended to develop financial model of business activity by considering and calculating the financial payback period of business development. There are three indicators applied in techno-economic analysis in this study: internal rate of return (IRR), net present value (NPV), and payback period (PBP).

2.2.1. Internal Rate of Return (IRR)

IRR shows minimum limitation of investment feasibility where it is compared to minimum acceptable rate of return (MARR). IRR in this research uses the positive rate of NPV and negative rate of NPV to get more precise estimation by selecting the prediction for lower discount rate and higher discount rate [34,35]. Only if IRR > MARR, will the investment be considered feasible. MARR is minimum desirable interest rate of return. Equation (7) is used to calculate the IRR.

IRR: Internal Rate of Return (%)

NPV1: Present worth from total investment

NPV2: Present worth from profit in the end investment planning horizon period

2.2.2. Net Present Value (NPV)

The NPV is one of the financial tools employed to reveal the level of profit gained from a business. It represents the number of rupiahs today equal to future cashflow. Specifically, Net Present Value is an analysis method that represents the present value from net revenue cashflow [36]. A project will be granted whenever NPV > 0. Equation (8) shows the formula to calculate NPV.

NPV: Net Present Value; C0: initial investment; Ci: business profit; i: interest rate; n: planning horizon

2.2.3. Payback Period (PP) Small

Techno-economic analysis also requires PP assessment to identify how long it will take to payback the capital of a particular project beside its risk. Payback Period aims to examines how long (period) an investment takes to breakeven [37]. Investment become more interesting as the PBP is sooner and the investment is feasible if the PP is sooner than desired payback time. In this study, payback period is targeted to approximately four years. Payback period is calculated by Equation (9).

PP: Payback Period; Initial Investment: the amount of fund investment in the first initiation; Net cashflow: annual net profit.

The analysis results from Markov chain method provide a market share prediction of Lithium iron phosphate batteries for several periods with certain assumptions. The result of this market share prediction is then used for techno-economy analysis for several alternative predictions of market share. Alternative 1 is based on the lesser market share condition based on Markov chain method. Alternative 2 is the medium market share. Alternative 3 is more extensive market share. Techno-economy method in this research, IRR, NPV and PP, were conducted to calculate the investment feasibility based on market prediction that has been described in three alternatives. The three tools were then used to analyze the three alternatives. Then, the calculation result of each tool for each alternative was examined to gain holistic analysis on whether the investment for lithium iron phosphate battery is feasible.

3. Results

3.1. Market Share Prediction

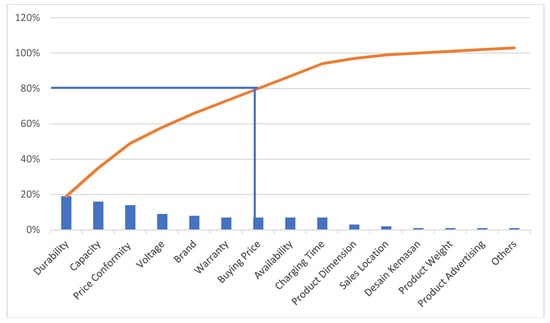

The analysis of market opportunity began with two processes: the first survey that was aimed to discover consumer preference in choosing battery and the second survey that was aimed to predict consumer interest in using lithium battery. In the first survey, the data obtained through Questionnaire 1 were processed using the Pareto method to find the order of indicators that are most considered by consumers. The Pareto chart can be seen in Figure 2.

Figure 2.

Pareto Chart for Consumer Preferences [14].

Figure 2 shows there are several indicators that influence the consumer preference in choosing battery: durability, capacity, price conformity, voltage, brand, warranty and buying price. The data from the first survey were then used in the second survey to assess the motorcycle battery specification. However, not all of the indicator from the first survey were used in the second survey; price conformality and brand were dropped. This is because the price conformality with the benefit from the battery was already represented by buying price and technical variables such as durability, capacity, and voltage. The brand indicator was not used because the product is still in development. Therefore, to assess the market share for lithium-ion based battery, the second survey was employed and then collected data that were processed using Markov chain. In the second survey, the prediction of market share primary used data gained from questionnaires from 100 respondents in Surakarta Region. These 100 correspondents represent motorcycle users in Surakarta, which has 67,789 motorcycles in operation [1]. Three states were used in this research:

- State 1

- Consumer uses wet cell battery (WB)

- State 2

- Consumer uses dry cell battery (DB)

- State 3

- Consumer uses Lithium iron phosphate battery

1. Prime Algebra Matrix

Algebra matrix is constructed to illustrate consumer behavior transition in consuming a certain product. Questionnaire data were arranged in a matrix, as shown in Table 1.

Table 1.

Prime Algebra Matrix.

2. Transitional Probability Matrix

Transitional probability matrix or switchover probability (P) matrix is a matrix with elements that represent customer switching probability values from a certain product or brand to another. Supposed that {Xn, n = 0, 1, 2, …} is a stochastic process which satisfies Markov chain characteristic, thus market share probability for certain period is expressed in Equation (3). The result of transitional probability matrix is demonstrated on Table 2 and Table 3 below.

Table 2.

Type Transition Pattern of Battery Consumer.

Table 3.

Probability Transition.

3. Market Share Prediction

To estimate market share in future period, this study used Equation (6). The calculation result is shown in the following matrices and Table 4.

P × Q0 = Q1

P × Q1 = Q2

P × Q2 = Q3

Table 4.

Market Share Prediction.

3.2. Economic Feasibility Analysis

Economic feasibility analysis is intended to develop business financial model in accordance with payback period that will be earned in a business development. Three conditions of market share were considered as three alternatives chosen in this techno-economic analysis: 44%, 68% and 89% are, respectively, Alternatives 1, 2 and 3. The analysis used net present value (NPV), internal rate of return (IRR) and payback period (PP) as indicators in determining the feasibility of the decision. To assess the economic feasibility, detail of required investment cost to commercialize lithium iron phosphate battery in Indonesia is shown in Table 5, which refers to estimations from the 2015 annual and joint-research report with PT. Nipress [38].

Table 5.

Total Investment Cost for Lithium Iron Phosphate Battery.

In Table 5, the required investment for lithium iron phosphate battery production is IDR 3,431,569,004. Currently, PT. Nipress already has several machines and equipment to produce wet and dry motorcycle batteries. However, to produce lithium iron phosphate batteries, the company needs to invest in additional machinery for lithium iron phosphate battery. The data are based on PT. Nipress R&D division assumes the machinery can be utilized for eight years, which becomes the horizon value of investment planning. Therefore, the R&D department of PT. Nipress estimates that, with the current machinery along with additional investment for lithium iron phosphate battery, the production capacity can reach approximately 110,000 motorcycle lithium iron phosphate batteries annually. Next, the selling price based on PT. Nipress assumption is set at IDR 350,000 [38] and the interest rate at 10.5% [39].

The current market size for motorcycle user in Surakarta is approximately 67,789 units based on the report from the Badan Pusat Statistic (Statistical Centre Bureau) [1]. For Alternative 1, the prediction for market share from Markov chain is 44% with estimated 29,827 units sold annually and production cost IDR 328,759.10 per unit. Alternative 2 has market share assumption at 68% from Markov chain prediction with estimation 46,096 units sold annually and production cost at IDR 315,777.68. Lastly, for Alternative 3, the prediction for market share based on Markov chain analysis is 89% with estimated 60,332 units sold annually and production cost at IDR 310,161.88 per unit. Based on the data obtained from co-research with R&D department of PT. Nipress [38], the calculation for product cost for each alternative is demonstrated in Table 6.

Table 6.

Product Cost Estimation.

Moreover, to calculate the IRR values, the NPV values need to be estimated. To find the NPV value, the discount rates are chosen randomly with three alternatives. The discount rate for Alternative 1 is estimated at 9% for Discount Rate 1 and 25% for Discount Rate 2. The discount rate for Alternative 2 is predicted at 30% for Discount Rate 1 and 60% for Discount Rate 2. For Alternative 3, Discount Rate 1 is estimated at 90% and 70% for Discount Rate 2. The cashflow calculation for NPV is demonstrated on Table 7 and Table 8.

Table 7.

Cashflow Calculation for IRR.

Table 8.

Calculation for NPV Values.

1. Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is appropriate if equal to or exceeding the minimum attractive rate of return (MARR). The MARR in this research referred to the investment interest level at 10.5% and with inflation level at 2.79% as regulated by central bank of Indonesia [39], and assumption of risk level at 5%. Below is the MARR calculation for the IRR:

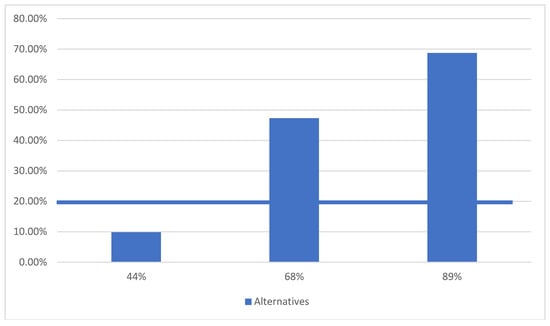

After the MARR has been calculated, the IRR calculation can then be calculated for each alternative, as shown in Table 9 and illustrated in Figure 3.

Table 9.

NPV1 and NPV2 Calculation.

Figure 3.

MARR to IRR Calculation Result.

Thus, according to alternatives NPV1 and NPV2, the calculation of IRR is shown below:

Alternative 1:

Alternative 2:

Alternative 3:

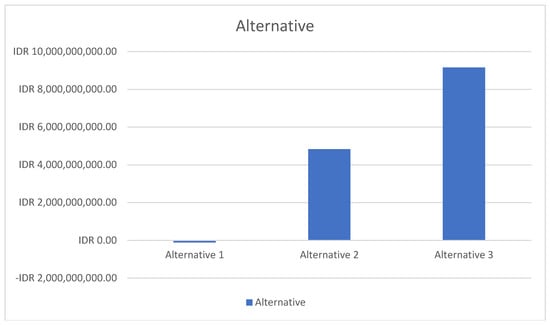

2. Net Present Value (NPV)

The calculation of the feasibility of the lithium iron phosphate battery business in the viewpoint of the NPV calculation requires that income received in a certain future period be equal to or greater than the value of expenditure in the year commencement of investment. Here, NPV calculation is also based on the assumption of market share control which consists of the first alternative with 44% market share, second alternative 68%, and third alternative 89%. Based on these assumptions, the NPV calculation is shown in Table 10 and Figure 4.

Table 10.

NPV Calculation Result.

Figure 4.

NPV Calculation Result.

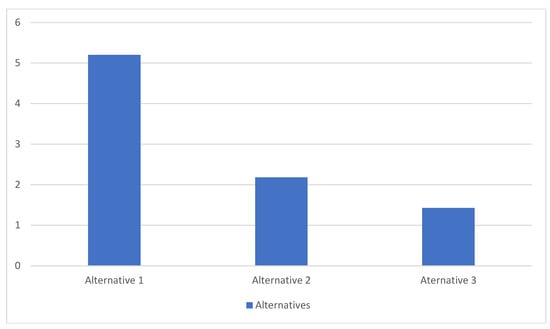

3. Payback Period (PP)

Next, to further refine the feasibility analysis of commercialization potential of lithium iron phosphate battery, Payback Period (PP) method was used to find out how long the investment takes to be returned. Every alternative assumption of market share having different numbers of users will affect the period required for the return of capital. The following is the calculation of Payback Period (PP) term for investment of lithium iron phosphate battery. The result of PP calculation is demonstrated in Table 11 and Figure 5.

Table 11.

Payback Period.

Figure 5.

Payback Period Calculation Result.

4. Discussion

According to Table 1, it can be perceived that most customer currently choose dry cell battery for their motorcycle (80% of respondents), 17% still use wet cell battery and only 3% have tried Lithium-ion battery. However, this trend is likely to change significantly based on respondent’s answer. Only seven current customers tend to keep choosing wet cell, representing new consumers for dry cell. Similar to dry cell in proportion, 42 out of 80 customers still choose dry cell to be purchased, as so do six people for wet cell battery. On the contrary, 41 respondents are interested in new lithium iron phosphate battery technology and three other current respondents will continue to choose lithium iron phosphate battery. In conclusion, only eight respondents tend to choose wet cell in the future while dry cell and lithium iron phosphate battery will have similar number of customers, 48 and 44, respectively. Transition pattern of battery customer from one type to another is elaborated in Table 2. Table 3 shows transition probability assuming that shifting customer between three battery types is stable. It is obvious in Table 3 that most customers for respective type of battery prefer the same type for next purchase. However, there is a tendency for non-lithium iron phosphate battery customer to choose either dry cell or lithium iron phosphate battery in similar probability.

This research takes three market share prediction conditions. First condition is market share in Period 1 where the market share of first mover manufacturer of lithium iron phosphate battery is 44%. It assumes that market leader of battery in Indonesia does not launch any Lithium-ion-based battery yet. In this situation, the market leader still waits to see whether the Lithium-ion motorcycle battery has a good response in market. The second condition happens in Period 2 with assumption that the first mover of lithium iron phosphate battery manufacturer has an equal business level with the market leader. The last condition is in Period 4 where the market share of lithium iron phosphate battery has reached equilibrium point. Market share of lithium iron phosphate battery is 89.86% and the product dominates the market for motorcycle batteries. In this situation, the first mover of lithium iron phosphate battery production will gain the benefit of Time to Market as the technology is still new and the market leader remain idle.

Related to the techno-economic analysis, MARR calculation results show that the minimum rate for rate of return is 18.72%. Assuming that the first mover of lithium iron phosphate battery production already owns the initial equipment and machinery for wet and dry motorcycle battery production, then the investment is aimed to purchase additional machinery. The calculation of IRR on each alternative shows the results of 9.86% for Alternative 1, 47.33% for Alternative 2, and 68.7% for Alternative 3. Each of these alternatives is structured and assumed under different discount rate conditions and different market share in each investment alternative Alternative 1 assumes a 44% market share for lithium ion batteries, Alternative 2 a market share of 68%, and Alternative 3 a market share of 89%. However, not all of the alternatives show good results. Alternative 1 only reaches 9.86% which is below the MARR level as the market share is only 44%. Alternatives 2 and 3 show decent results, as the value of IRR is above the MARR. Therefore, based on the calculation obtained, it is important for lithium iron phosphate battery business to obtain a minimum market share od 68%.

Next, based on the calculation of NPV in Table 10 and Figure 4, all alternatives have similar baseline investment value of Rp. 3,431,596,004. However, with different market share assumptions, each alternative has a different NPV value. Given the discount rate at 10.5%, the value of NPV for Alternative 1 is found at IDR 112,296,290.95, Alternative 2 at IDR 4,833,287,075.73, and Alternative 3 at IDR 9,160,862,514.17. Similar to IRR analysis result, the minus result of NPV for Alternative 1 is caused by the low market share which only at 44% from overall motorcycle owner at Surakarta. The other two alternative, however, give a positive result as the NPV calculation shows outstanding result. Therefore, the target of market share for the lithium iron phosphate battery need to be above 68% or 89%.

Furthermore, the results of Payback Period (PP) calculation shows that Alternative 1 has payback period of 5.2 years, Alternative 2 2.18 years, and Alternative 3 1.43 years. If the acceptable PP refers to the length of the bank loan for business, which is generally four years, then the investment for lithium iron phosphate battery is only feasible to develop in Indonesia if the market share is 68%.

5. Conclusions

A massive demand for motorcycles in Indonesia results in high need for batteries or accumulators. As motorcycle technology is developing, the battery should as well. LiFePhO4 (lithium iron phosphate) batteries are an example of an excellent invention to support the advancement of motorcycles. Longer lifetime and many other advantages show that it is a big opportunity to substitute common batteries—wet and dry cell—with newest one and establish the manufacturing factory and business. However, as a most-recent technology product, there is still an absence of the company as well as literature, especially in Indonesia.

To assess the commercial potential of lithium iron phosphate battery, market share prediction and techno-economic analysis were conducted. Markov chain method was selected to forecast the market share due to its simplicity and accuracy as well as characteristic of the battery as yet-launched product. Based on the result, there is a tendency of motorcycle battery consumer in Indonesia to switch from wet and dry cell battery to lithium iron phosphate battery. Lithium iron phosphate battery is estimated to dominate the market starting from Period 3 and reach equilibrium point in Period 4. Meanwhile, techno-economic analysis using NPV, IRR and PBP indicated the feasibility of the business. Techno-economic analysis also shows that lithium iron phosphate battery commercialization project is feasible if the market share is at least 68%. This is due to the high production cost of lithium iron phosphate battery. If the market share is lower than 68%, investment in lithium iron phosphate battery is not feasible. Additionally, the techno-economy analysis in this research was limited to a company that already produces wet and dry motorcycle batteries and wants to invest in lithium iron phosphate battery production.

Moreover, as a recently invented product, a deep market study needs to be conducted for lithium iron phosphate battery. Future study may assess more aspects in marketing area, for instance marketing strategy, as the business of lithium iron phosphate battery needs to have massive market share to make it profitable. It is also important for research to identify and update the information regarding market environment and expense identification for economic feasibility such as technology availability. Furthermore, the lithium iron phosphate battery is also categorized as one alternative energy for vehicle in the future. Therefore, the result of commercial assessment of lithium iron phosphate battery can also lead to further study in the supply chain of energy source for electric vehicle. Future studies will have the challenge in solving complex problems to construct a proper value chain of electric vehicle.

Author Contributions

All authors equally contributed to this paper. Conceptualization, W.S., I.K., and R.Z.; Methodology, W.S., I.K., and R.Z.; Validation, W.S. and I.K.; Formal Analysis, W.S. and R.Z.; Investigation, I.K.; Resources, W.S. and R.Z.; Data Curation, W.S., I.K., and R.Z.; Writing—Original Draft Preparation, W.S., I.K., and R.Z.; Writing—Review and Editing, W.S., I.K., and R.Z.; Visualization, I.K.; Supervision, W.S. and R.Z.; Project Administration, W.S. and I.K.; and Funding Acquisition, W.S.

Funding

The research was supported by The Ministries of Research, Technology, and Higher Education with HIBAH KOMPETENSI Research Program (Contract No. 041/SP2H/LT/DRPM/II/2016, 17 February 2016).

Acknowledgments

The authors are equally grateful to R. Rizqi Apriandy for his assistance in proof-reading.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Indonesia, B.P.S. Perkembangan Jumlah Kendaraan Bermotor, Rencana Kinerja Tahunan BPS. 2016. Available online: www.bps.go.id/linkTabelStatis/View/id/1413 (accessed on 3 May 2018).

- PT Astra Otoparts. PT Astra Otoparts Tbk Laporan Tahunan 2015 Annual Report; Astra Otoparts: Jakarta, Indonesia, 2015. [Google Scholar]

- Jupentia, J. Persepsi Mengenai Kualitas Produk, Harga Aki Gs Astra, Dan Pelayanan Pada Pt Bintang Putra Autoparts Di Pontianak. BISMA 2016, 1, 1024–1034. [Google Scholar]

- Kurniyati, I.; Sutopo, W.; Hisjam, M.; Astuti, R.W. Techno-economic analysis of lithium-ion battery for motorcycle development. In Proceedings of the International MultiConference of Engineers and Computer Scientists, Hong Kong, China, 16–18 March 2016; Volume 2. [Google Scholar]

- Hannan, M.A.; Hoque, M.M.; Hussain, A.; Yusof, Y.; Ker, P.J. State-of-the-art and energy management system of lithium-ion batteries in electric vehicle applications: Issues and recommendations. IEEE Access 2018, 6, 19362–19378. [Google Scholar] [CrossRef]

- Zhang, L.; Mu, Z.; Sun, C. Remaining Useful Life Prediction for Lithium-Ion Batteries Based on Exponential Model and Particle Filter. IEEE Access 2018, 6, 17729–17740. [Google Scholar] [CrossRef]

- Barcellona, S.; Piegari, L. Lithium Ion Battery Models and Parameter Identification Techniques. Energies 2017, 10, 2007. [Google Scholar] [CrossRef]

- Sutopo, W.; Maryanie, D.I.; Purwanto, A.; Nizam, M. A comparative value chains analysis of solar electricity for energy. In Proceedings of the International MultiConference of Engineers and Computer Scientists, Hong Kong, China, 12–14 March 2014; Volume 2210. [Google Scholar]

- Purwanto, A.; Dyartanti, E.; Inayati; Sutopo, W.; Nizam, M. Synthesis of titania for anode material of Li-Ion battery. In Proceedings of the 2013 Joint International Conference on Rural Information and Communication Technology and Electric-Vehicle Technology (rICT and ICEV-T 2013), Bandung, Indonesia, 26–28 November 2013. [Google Scholar]

- Eddahech, A.; Briat, O.; Vinassa, J.M. Performance comparison of four lithium-ion battery technologies under calendar aging. Energy 2015, 84, 542–550. [Google Scholar] [CrossRef]

- Hu, X.; Li, S.; Peng, H. A comparative study of equivalent circuit models for Li-ion batteries. J. Power Sources 2012, 198, 359–367. [Google Scholar] [CrossRef]

- Lowe, M.; Tokuoka, S.; Trigg, T.; Gereffi, G. Lithium-Ion Batteries for Hybrid and All-Electric Vehicles: The U.S. Value Chain; Center on Globalization, Governance & Competitiveness: Durham, NC, USA, 2010; Volume 1, pp. 1–77. [Google Scholar]

- Canet, A.; Poul, S.; Østergaard, A. Feasibility Study of the Introduction of Electric Vehicles in Samsø; Aalborg University: Aalborg, Denmark, 2011. [Google Scholar]

- Kurniyati, I. Analisis Prediksi Pangsa Pasar dan Kelayakan Ekonomi Produk Aki Sepeda Motor Berteknologi Litium Fero Fosfat (Studi Kasus: Kota Surakarta). Ph.D. Thesis, Universitas Sebelas Maret, Surakarta, Indonesia, 2017. [Google Scholar]

- Atikah, N.; Ghabid, A.H.A.; Sutopo, W.; Purwanto, A.; Nizam, M. Technical feasibility for technology commercialization of battery lithium ion. In Proceedings of the 2014 International Conference on Electrical Engineering and Computer Science (ICEECS 2014), Kuta, Indonesia, 24–25 November 2014; pp. 308–314. [Google Scholar]

- Zhang, Y.; Huo, Q.Y.; Du, P.P.; Wang, L.Z.; Zhang, A.Q.; Song, Y.H.; Li, G.Y. Advances in new cathode material LiFePO4 for lithium-ion batteries. Synth. Met. 2012, 162, 1315–1326. [Google Scholar] [CrossRef]

- Sousa, R.E.; Oliveira, J.; Gören, A.; Miranda, D.; Silva, M.M.; Hilliou, L.; Lanceros-Mendez, S. High performance screen printable lithium-ion battery cathode ink based on C-LiFePO4. Electrochim. Acta 2016, 196, 92–100. [Google Scholar] [CrossRef]

- Diouf, B.; Pode, R. Potential of lithium-ion batteries in renewable energy. Renew. Energy 2015, 76, 375–380. [Google Scholar] [CrossRef]

- Sutopo, W.; Maryanie, D.I.; Purwanto, A.; Nizam, M. A comparative value chains analysis of battery technologies for electric vehicles. In Proceedings of the 2013 Joint International Conference on Rural Information and Communication Technology and Electric-Vehicle Technology (rICT and ICEV-T 2013), Bandung, Indonesia, 26–28 November 2013. [Google Scholar]

- Offer, G.J.; Contestabile, M.; Howey, D.A.; Clague, R.; Brandon, N.P. Techno-economic and behavioural analysis of battery electric, hydrogen fuel cell and hybrid vehicles in a future sustainable road transport system in the UK. Energy Policy 2011, 39, 1939–1950. [Google Scholar] [CrossRef]

- Pollet, B.G.; Staffell, I.; Shang, J.L. Current status of hybrid, battery and fuel cell electric vehicles: From electrochemistry to market prospects. Electrochim. Acta 2012, 84, 235–249. [Google Scholar] [CrossRef]

- Kahn, K.B. Solving the problems of new product forecasting. Bus. Horiz. 2014, 57, 607–615. [Google Scholar] [CrossRef]

- Khajavi, S.H.; Partanen, J.; Holmström, J.; Tuomi, J. Risk reduction in new product launch: A hybrid approach combining direct digital and tool-based manufacturing. Comput. Ind. 2015, 74, 29–42. [Google Scholar] [CrossRef]

- Grinstead, C.M.; Snell, J.L. Markov Chains. In Introduction to Probability; American Mathematical Society: Providence, RI, USA, 2010; pp. 1–66. [Google Scholar]

- Dyer, M.; Goldberg, L.A.; Jerrum, M.; Martin, R. Markov chain comparison. Probab. Surv. 2006, 3, 89–111. [Google Scholar] [CrossRef]

- Bandarian, R. Evaluation of commercial potential of a new technology at early stage of develpoment with fuzzy logic. J. Technol. Manag. Innov. 2007, 2, 73–85. [Google Scholar]

- Meyn, S.P.; Tweedie, R.L. Markov Chains and Stochastic Stability; Springer: Berlin/Heidelberg, Germany, 1993; p. 792. [Google Scholar]

- Uslu, A.; Can, T. Analysis of brand loyalty with markov chains. 1st Int. Jt. Symp. Bus. Adm. Bus. Adm. New Millenn 2000, 1, 583–591. [Google Scholar]

- Wai-Ki, C.; Michael, K.N. Markov Chains: Models, Algorithms and Applications; Springer Science + Business Media Inc.: Hongkong, China, 2006; Volume 83. [Google Scholar]

- Chan, K.C. Market share modelling and forecasting using markov chains and alternative models. Int. J. Innov. Comput. Inf. Control 2015, 11, 1205–1218. [Google Scholar]

- Pramuditya, S.A. Peramalan Pangsa Pasar Kartu Gsm Dengan Pendekatan Rantai Markov. Euclid 2014, 1, 116–124. [Google Scholar]

- Choi, J.G.; Mok, J.W.; Han, J.S. The use of Markov chains to estimate destination switching and market share. Tour. Econ. 2011, 17, 1181–1196. [Google Scholar] [CrossRef]

- Karlin, S. An Introduction to Stochastic Modeling, 3rd ed.; Academic Press: Cambridge, MA, USA, 2010. [Google Scholar]

- Blank, L.; Tarquin, A. Engineering Economy, 8th ed.; McGraw-Hill Education: New York, NY, USA, 2018. [Google Scholar]

- Patrick, M.; French, N. The internal rate of return (IRR): Projections, benchmarks and pitfalls. J. Prop. Investig. Financ. 2016, 34, 664–669. [Google Scholar] [CrossRef]

- Zhao, Y.; Hong, H.; Jin, H. Thermo-economic Optimization of Solar-Coal Hybrid Systems. Energy Procedia 2015, 75, 457–461. [Google Scholar] [CrossRef]

- Lin, W.M.; Chang, K.C.; Chung, K.M. Payback period for residential solar water heaters in Taiwan. Renew. Sustain. Energy Rev. 2015, 41, 901–906. [Google Scholar] [CrossRef]

- Kurniyati, I. Techno-Economic Analysis of Lithium-Ion Battery for Motorcycle Development at PT. Nipress; Universitas Sebelas Maret: Surakarta, Indonesia, 2015. [Google Scholar]

- Indonesia, B. Suku Bunga Dasar Kredit—Bank Sentral Republik Indonesia. 2016. Available online: https://www.bi.go.id/id/perbankan/suku-bunga-dasar/Default.aspx (accessed on 25 June 2018).

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).