Near Field Communication: Technology and Market Trends

Abstract

:1. Introduction

2. Literature Review: Technology Analysis

| Model | Explanation |

|---|---|

| Collaborative | In a given state, stakeholders, providers of secure element, the MCPA SP (Mobile Contactless Payment Application Service Provider) and other relevant parties all together define an environment that allows every person to participate. |

| Bilateral | Within certain territorial limits, a provider of secure element and a developer of contactless payment applications reach an agreement. |

| Self-contained | There is no collaboration. The application developer of the mobile contactless payment and NFC secure element supplier are the same subject. |

- (1)

- Card emulation. allows the owner of the phone to use it as a tag for external readers, storing inside all the data related badges, payment cards, loyalty cards, access keys for the use of certain tools (e.g., printers), but also car keys, identity cards and health cards for public transport.

- (2)

- Reader/writer mode. Is possible read or write external tags/smartcards such as those found on smart posters, download coupons directly on the device (ISO 14443)

- (3)

- Peer-to-peer enables the exchange of data between devices (ISO 18092).

| ISO | Strengths | Future Perspective | |

|---|---|---|---|

| Card Emulator Mode |

|

|

|

| Reader/Writer Mode |

|

|

|

| Peer-to-Peer Mode |

|

|

|

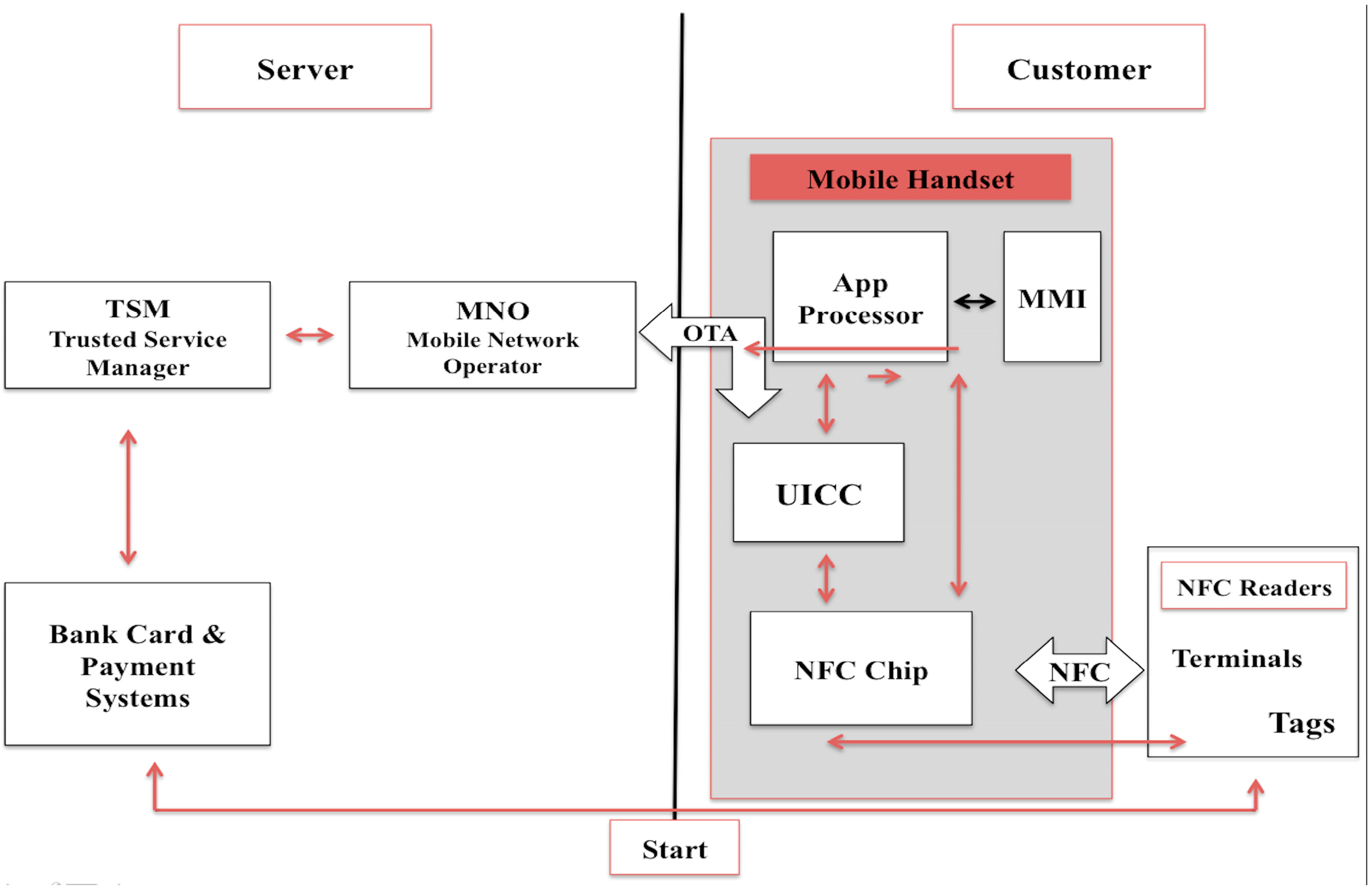

- SIM card: chip heart of all terminals GSM (Group Special Mobile) and is used as a security element for NFC payments.

- Micro SD card: likewise safe, it has been proposed by the banks, but the number of trials conducted on the feasibility there have shown some technical problems including incompatibility with certain phones, difficulties with others and, first of all, it would be the most expensive option among the three alternatives, and the most difficult one.

- Embedded chip: chip set in the terminal, there is no need for the user to change or move anything. In the event that you want to change your phone, the data contained in the secure element terminal are transferred to the new phone OTA (over the air).

- •

- The complete standardization of NFC SIM, obtained with the adoption of infrastructures and protocols by all the actors in the ecosystem.

- •

- The collaboration is focused only on the technological standard; it doesn’t assume any collaboration on the go-to-market strategies, assets structure or joint investments.

- •

- The MNO manages the secure element.

- •

- The financial impact on the collaboration and standardization is limited to economies of scale.

- •

- The main impact on the ecosystem is driven by the cost reduction and the effects of the network for key stakeholders in the private sector, as well as externalities and low barriers to entry.

- •

- The consumer experience is defined interoperable inter-sector and inter-product.

- Providing the single point of contact for the Service Providers to access their customer base through the MNOs.

- Managing the secure download and life-cycle management of the Mobile NFC application on behalf of the Service Providers [33].

| Simple Mode | Delegated Mode | Dual Mode | |

|---|---|---|---|

| Applets Management | SP delegates full management of its application to MNO. | SP can delegate card content management to TSM but each operation requires MNO’s preauthorization (in the form of a token). | Performed by both MNO TSM and SP TSM. |

| Card Content Management and Security Responsibilities | MNO TSM performs the CCM and is responsible for both security domain management and secure element management. | MNO is still responsible for security domain management (allocating the space in the UICC). | Both have reserved domains allocated in the secure element. |

| SP TSM can monitor MNO TSM. | SP TSM is responsible for the secure element management. | The secure element must have at least two security domains. | |

| Data | SP is responsible of the data personalization of its applet through MNO TSM. | SP TSM can install the secure element applet directly or through the MNO TSM, gaining access using the token. | The MNO is able to offer specific space for the SP’s secure domain based on the rules to manage the memory allocated for a secure domain specified by GlobalPlatform. |

| Miscellaneous | For EMV (Europay, MasterCard, Visa) payment applet, the MNO TSM might be EMV certified. | Card content management is fully delegated to a TSM for a sub area of the UICC. Several entities are authorized to perform CCM. |

- Security domains’ Life Cycle on the secure element in order to provide secured blocks of space for services.

- Applets’ Life Cycle on the security domain of a secure element.

- The update of the secure element with to make it work on newer devices.

- The recovery mechanisms to the MNO and Service Provider utilizing the service in case of outages.

- The reporting to each service provider on the amount of space used and the number of services running.

3. NFC Mobile Payment

3.1. The International Trend

3.2. Current and Future Trends

4. Tourism Value Chain and NFC

- Travel organization and booking:The travel organization and booking stage includes all the steps of the trip settings, from the origins to the destination. One of the main NFC applications is related to the air-transport industry. In fact, in the White Paper done by GSMA and IATA “six different use cases have been defined where mobile NFC can bring great benefits to the airlines, airport authorities and the air-traveler, namely: Passenger check-in, Baggage check-in, Security check-point, Lounge access, Boarding, Post-flight” [55]. A direct example of that mentioned by Clark [52,56] concerns Scandinavian Airlines (SAS), which gives SmartPass stickers to Scandinavian Euro Bonus Gold frequent flyers in order to give them a check-in and boarding process that is easier and faster.

- Transportation:The main highlighted NFC applications linked to the transportation stage are those related to bus and taxi services. For example, recently in London, the London’s Radio Taxi operator built a huge marketing operation “by placing NFC and QR code stickers in its 2500 vehicles”. In this way [...] “Scanning or tapping the stickers provides passengers with a direct link to the company’s app, which they can then use to call the nearest Radio Taxi with one click as well as see the taxi’s location in real time”. According to Phil Coote, CEO of the company (RapidNFC) that had an important part in the creation of the Radio Taxi stickers, Radio Taxi have significantly increased the number of passengers, thanks to this marketing strategy [57].Concerning bus service, in Rio de Janeiro 5000 NFC and QR code stickers have been placed to provide information on bus time and routes. Those five thousand stickers are part of a bigger project “Rio Smart City” that allow users to get information also to local tourist destination, events and point of interests [58].

- Accommodation:In 2010, the Clarion Hotel in Stockholm, according to Clark [59], by using the RFID installed base locking systems infrastructure, offered the possibility for its customers to receive the room key on their NFC smartphone, skipping (or reducing the time for) the check-in and going directly to their room [60]. Most recently, the Aimia Hotel, part of the resort of Port de Soller, in Mallorca, has placed a panel with NFC tag d in the reception’s area of the hotel, and guests, by tipping on it, can access different information, from those linked to the hotel like the restaurant menu or the hotel’s WIFI password, to those related to local services like weather forecasts, places of interest and public transportation [61].

- Food and beverage:Ho and Chen [62] explained nonetheless in their work how NFC may impact both the user experience and satisfaction, i.e., in a restaurant, through NFC devices, customers could receive personalized menus, without foods they don’t eat. In light of that, Argueta et al. developed a mobile application, NapkiNotes, that exploiting NFC technology “allows users to select dishes from a menu [...], filter food selection based on ingredient, submit the order, and be alerted when the food is ready”. In fact, placing a sticker with NFC tag at each dining table the restaurant staff can easily find who made the order [63].

- Handicrafts:Concerning some of the main NFC applications, more useful in TVC, linked to the handicrafts stage is it possible to associate: the shop in store, save offers and send money [64,65]. In this way, an example of a service that include all these features (and others) is the Google wallet. In fact, the 2.3 version include different features like:

- ○

- Shop in store: Users with mobile phone NFC enabled devices can make contactless purchases in stores. This features makes the tourist’s (and users in general) shopping more attractive by facilitating it.

- ○

- Save offers: Users could be able to store a huge numbers of offers in Google Wallet, regardless where the users have found the offer. This feature cloud be useful for a tourist (or a user in general) who might have saved offers on some couponing websites (for example: Valpak).

- ○

- Tourism assets in destination:Another evidence of how to implement this technology in the tourism is reported by Clark [66], in the London Museum through NFC tags additional information has been provided about the objects and also there were tags for Facebook Check-Ins, and others to share contents on social network like Facebook or Twitter, to improve the customer’s loyalty. A similar experience was set up in Wolfsoniana Museum in Genoa: according to Ceipidor et al. [67], they explained that through a mobile app which can use both NFC and QR technology, it was possible to enhance the visiting experience of the customers, delivering additional user-adjustable contents during the visit, like multimedia and interactive with innovative tools, transforming the Wolfsoniana in a Smart Museum.

- Leisure, excursions and tours:An interesting example of NFC application in the TVC is the one reported by Clark [68] concerning an interactive walking tour exploiting NFC tags and QR codes In fact, the New South Wales Government has supported the development of an interactive walking tour of The Rocks, the oldest district of Sydney. Visitors by tipping or scanning the NFC tag and QR codes will have the access to an interactive self-guided tours.

- Support services:According to Pesonen and Horster [51], Lindsey [69] presented the mobile application EpicMix, designed to be used in ski resorts. In fact, the application was launched in fall 2010, in Vail Resorts in Colorado; Resorts have been equipped with RFID scanners in order to offer to “the users the ability to track physical accomplishments and share the skiing experiences within social networks”. Another interesting example of NFC application linked to support services is the “Shibuya Clickable Project” in Tokyo. In fact, Shibuya is one of Tokyo’s busiest shopping districts. The firsts 300 streets of the area have been equipped NFC tag stickers, which allows users, by tapping the NFC tag, to get information and advertising services. For the future are planned some developments of the “Shibuya Clickable Project” like: emergency and civil disaster information, the chance to get involved in a treasure hunt game as well as an information service for international tourists [70].

5. Conclusions

Author Contributions

Conflicts of Interest

References

- NFC Forum, www.nfc-forum.org. Available online: http://www.nfc-forum.org/resources/faqs#howwork (accessed on 29 April 2014).

- Ortiz, S., Jr. Is near-field communication close to success? Computer 2006, 39, 18–20. [Google Scholar]

- Yaqub-Undergraduate, M.U.; Shaikh-Undergraduate, U.A. Near Field Communication—Its Applications and Implementation in K.S.A. 2012. Available online: http://www4.kfupm.edu.sa/ssc/4845_MohammedUmair_Yaqub.pdf (accessed on 29 April 2014).

- Talone, P.; Russo, G. RFID. Fondamenti di una Tecnologia Silenziosamente Pervasiva; Fondazione Ugo Bordoni: Rome, Italy, 2008. [Google Scholar]

- Zimmerman, T.G. Personal area networks: Near-field intrabody communication. IBM Syst. J. 1996, 35, 609–617. [Google Scholar]

- Want, R. Smartphone. IEEE Pervasive Comput. 2011, 10, pp. 4–7. Available online: http://www.sicherungssysteme.net/fileadmin/NFC_Pervasive_Computing_July-Sept2011.pdf (accessed on 29 April 2014).

- Haselsteiner, E.; Breitfuß, K. Security in near field communication (NFC). In Proceedings of the Workshop on RFID Security, Graz, Austria, 12–14 July 2006; pp. 12–14.

- Madlmayr, G.; Langer, J.; Scharinger, J. Managing an NFC ecosystem. In Proceedings of the 7th International Conference on Mobile Business, 2008 (ICMB ’08), Barcelona, Spain, 7–8 July 2008; pp. 95–101.

- Agrawal, P.; Bhuraria, S. Near Field Communication. SETLabs Breifings 2012, 10, 67–74. [Google Scholar]

- Du, H. NFC technology: Today and tomorrow. Int. J. Future Comput. Commun. 2013, 2, 351–354. [Google Scholar] [CrossRef]

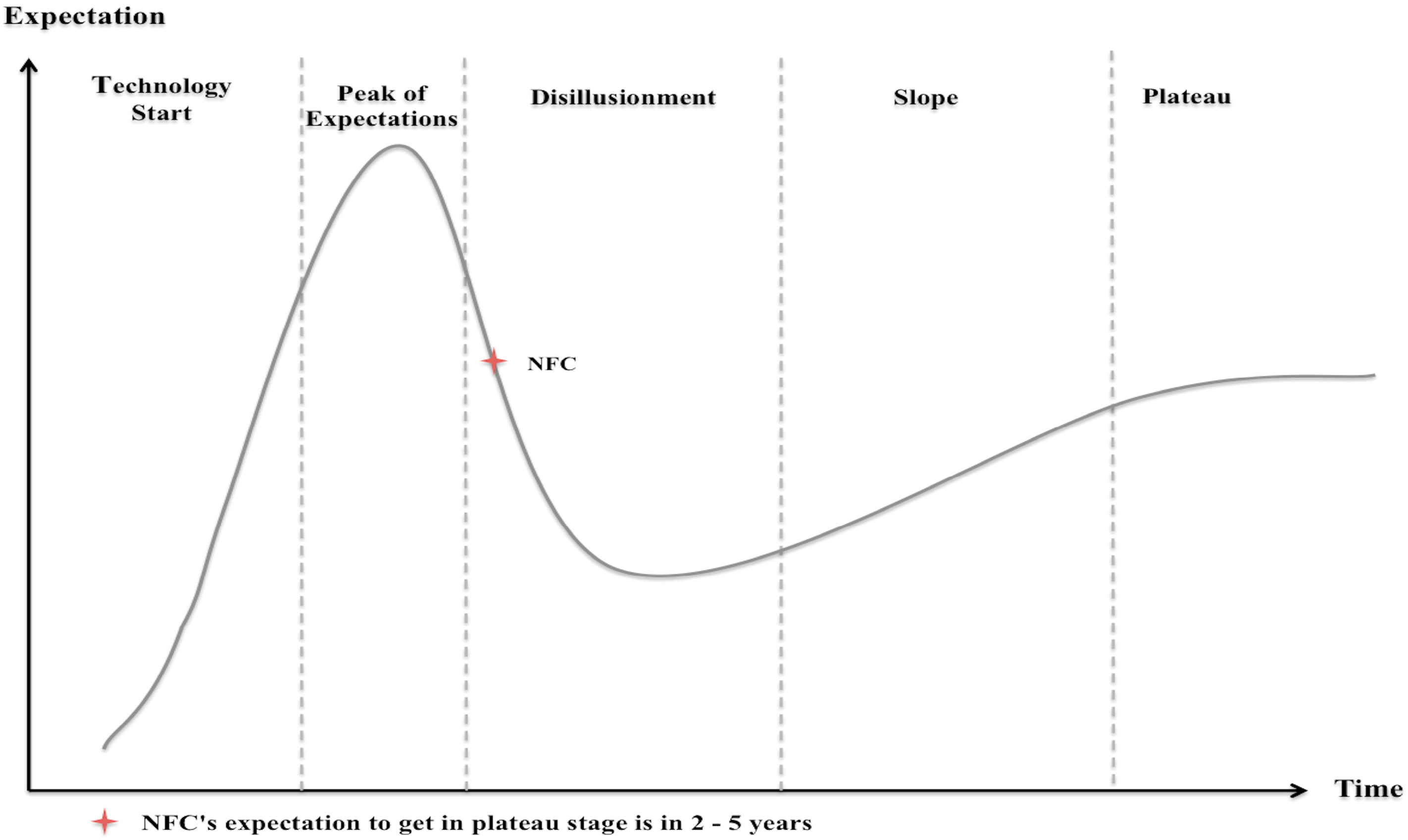

- Fenn, J. Hype Cycle for Emerging Technologies, 2010. Available online: http://www.chinnovate.com/wp-content/uploads/2011/09/Hype-Cycle-for-Emerging-Technologies-2010.pdf (accessed on 29 April 2014).

- Linden, A.; Fenn, J. Understanding Gartner’s Hype Cycles; Strategic Analysis Report N° R-20-1971; Gartner Inc.: Stamford, CT, USA, 2003. [Google Scholar]

- Schilling, M.A.; Esmundo, M. Technology S-curves in renewable energy alternatives: Analysis and implications for industry and government. Energy Policy 2009, 37, 1767–1781. [Google Scholar] [CrossRef]

- Lucchetti, M.C.; Arcese, G. Innovazione. In Tecnologia & Produzione, 2nd ed.; Chiacchierini, E., Ed.; CEDAM: Padua, Italy, 2012; pp. 99–152. [Google Scholar]

- Arcese, G.; Flammini, S.; Martucci, O. Dall’Innovazione alla Startup—L’esperienza d’imprenditori italiani in Italia e in California, 1st ed.; McGraw-Hill: Milan, Italy, 2013. [Google Scholar]

- Pettey, C.; van der Meulen, R. Gartner’s 2012. Hype Cycle for Emerging Technologies Identifies “Tipping Point” Technologies That Will Unlock Long-Awaited Technology Scenarios; Gartner Inc.: Stamford, CT, USA, 2012. [Google Scholar]

- Fenn, J.; Raskino, M. Mastering the Hype Cycle: How to Choose the Right Innovation at the Right Time; Harvard Business Press: Boston, MA, USA, 2008. [Google Scholar]

- Dahlberg, T.; Mallat, N.; Ondrus, J.; Zmijewska, A. Past, present and future of mobile payments research: A literature review. Electron. Commer. Res. Appl. 2008, 7, 165–181. [Google Scholar] [CrossRef]

- Mobey Forum. White Paper Business Models for NFC Payments. 2011. Available online: http://www.sicherungssysteme.net/fileadmin/Mobey_Forum_White_Paper_Business_models_for_NFC_payments.pdf (accessed on 29 April 2014).

- Falke, O.; Rukzio, E.; Dietz, U.; Holleis, P.; Schmidt, A. Mobile Services for Near Field Communication; Tech. Rep., LMU-MI-2007-1. University of Munich, Department of Computer Science, Media Informatics Group: Munich, Germany, 2007. Available online: http://www.mmi.ifi.lmu.de/pubdb/publications/pub/falke2007mobileServicesTR/falke2007mobileServicesTR.pdf (accessed on 29 April 2014).

- Ok, K.; Coskun, V.; Aydin, M.N.; Ozdenizci, B. Current benefits and future directions of NFC services. In Proceedings of the 2010 International Conference on Education and Management Technology (ICEMT), Cairo, Egypt, 2–4 November 2010; pp. 334–338.

- Moscoso, O.Z.; Lekse, D.; Smith, A.; Holstein, L. Understanding the current state of the NFC payment ecosystem: A graphbased analysis of market players and their relations. Enfoque UTE 2012, 3, 13–32. [Google Scholar]

- NFC Mobile Money Summit. Visa Follow Four Rules Reproduce Age Plastic. 2013. Available online: http://www.mobileworldlive.com/visa-follow-four-rules-reproduce-age-plastic (accessed on 29 April 2014).

- European Payments Council. Available online: http://www.europeanpaymentscouncil.eu/content.cfm?page=sepa_vision_and_goals (accessed on 29 April 2014).

- Wu, S.H.; Yang, C. A study on designing the new near field communication technology—NFC-micro SD Technology. Inf. Technol. J. 2013, 13, 1455–1458. [Google Scholar] [CrossRef]

- Edgar, Dunn & Company (EDC). Advanced Payments Report 2012. 2012. Available online: http://www.edgardunn.com/press/issues-and-opportunities/93-2012-advanced-payments-report (accessed on 29 April 2014).

- Liu, Y.; Kostakos, V.; Deng, S. Risks of using NFC mobile payment: Investigating the moderating effect of demographic attributes. In Proceedings of the 15th International Conference on Electronic Commerce, Turku, Finland, 13–15 August 2013; pp. 125–134.

- Mahajan, V.; Muller, E.; Bass, F.M. New product diffusion models in marketing: A review and directions for research. J. Market. 1990, 54, 1–26. [Google Scholar] [CrossRef]

- Global Platform. Global Platform’s Proposition for NFC Mobile: Secure Element Management and Messaging, White Paper, 2009. Available online: http://www.globalplatform.org/documents/GlobalPlatform_NFC_Mobile_White_Paper.pdf (accessed on 29 April 2014).

- GSMA. NFC—The Technology. 2013. Available online: http://www.gsma.com/mobilenfc/nfc-the-technology (accessed on 29 April 2014).

- Easley, D.; Kleinberg, J. Networks, Crowds, and Markets; Cambridge University Press: Cambridge, UK, 2010; Volume 8. [Google Scholar]

- EPC (European Payment Council)—GSMA. Trusted Service Manager, Service Management Requirements and Specifications. 2010. Available online: http://www.gsma.com/digitalcommerce/epc-gsma-trusted-service-manager-service-management-requirements-and-specifications-january-2010 (accessed on 29 April 2014).

- Corda, A.; Bobo, L.; Azoulai, J. U.S. Patent Application. 2008. Available online: http://www.google.com/patents/US20100205432 (accessed on 20 June 2014).

- GSMA. The Role of the Trusted Service Manager in Mobile Commerce. December 2013. Available online: http://www.gsma.com/digitalcommerce/wp-content/uploads/2013/12/GSMA-TSM-White-Paper-FINAL-DEC-2013.pdf (accessed on 22 June 2014).

- Mobey Forum. The MPOS Impact: Shifting the Balance of Power. November 2013. Available online: http://www.mobeyforum.org/w/wp-content/uploads/Mobey-Forum-Whitepaper_The-MPOS-Impact.pdf (accessed on 22 June 2014).

- Warakagoda, N. Near Field Communication (NFC) Opportunities & Standards. Available online: http://www.umts.no/files/081028%20nfc_standards_payments%20Narada.pdf (accessed on 29 April 2014).

- Mulliner, C. Vulnerability analysis and attacks on NFC-enabled mobile phones. In Proceedings of the International Conference on Availability, Reliability and Security (ARES ’09), Fukuoka, Japan, 16–19 March 2009; pp. 695–700.

- Neilsen Report. The Mobile Consumer—A Global Snapshot. 2013. Available online: http://www.nielseninsights.it/wpcontent/uploads/2013/03/03.global_mobile_report_02_25.pdf (accessed on 29 April 2014).

- GSMA. Socio-Economic Benefits of SIM-Based NFC. 2011. Available online: http://www.booz.com/media/file/GSMA-Booz-Study_Socio-economic-benefits-of-SIM-based-NFC.pdf (accessed on 29 April 2014).

- Acker, O.; Knott, M.; Marcelis, Y. Socio-Economic Benefits of SIM-Based NFC. GSMA, 2011. Available online: http://www.gsma.com/digitalcommerce/wp-content/uploads/2012/03/gsmaboozstudysocioeconomicbenefitsofsimbasednfc1.pdf (accessed on 29 April 2014).

- Osservatorio NFC & Mobile Payment. Mobile Payment: l’Italia s’è desta! 2013. Available online: http://www.osservatori.net/c/document_library/get_file?folderId=1241114&name=DLFE-22128.pdf (accessed on 29 April 2014).

- Juniper Research. NFC Mobile Payments & Retail Marketing—Business Models & Forecasts 2012–2017. 2012. Available online: http://www.juniperresearch.com/viewpressrelease.php?pr=315 (accessed on 29 April 2014).

- ABI Research. ABI: NFC Payments to Hit $100 bn; ABI Research: New York, NY, USA, 2012. [Google Scholar]

- Clark, S. Isis NFC Mobile Wallet Goes Live across the US. 2013. Available online: http://www.nfcworld.com/2013/11/14/326846/isis-nfc-mobile-wallet-goes-live-across-us/ (accessed on 29 April 2014).

- Pyments.com. UL: HCE Can Speed NFC to Market, but Beware the Risks. 2014. Available online: http://www.pymnts.com/news/2014/ul-hce-can-speed-nfc-to-market-but-beware-the-risks/#.U2AJMa1_sa8 (accessed on 29 April 2014).

- Telecom Italia. 2014. Available online: http://www.telecomitalia.com/tit/it/innovation/hot-topics/mobile/NFC-auto.html (accessed on 29 April 2014).

- Buhalis, D.; Law, R. Progress in information technology and tourism management: 20 years on and 10 years after the Internet—The state of eTourism research. Tour. Manag. 2008, 29, 609–623. [Google Scholar] [CrossRef]

- Guttenber, D. Virtual reality: Applications and implications for tourism. Tour. Manag. 2010, 31, 637–651. [Google Scholar] [CrossRef]

- Wang, D.; Park, S.; Fesenmaier, D.R. The role of smartphones in mediating the touristic experience. J. Travel Res. 2012, 51, 371–387. [Google Scholar] [CrossRef]

- Ricci, F. Mobile recommender systems. Inf. Technol. Tour. 2010, 12, 205–231. [Google Scholar] [CrossRef]

- Pesonen, J.; Horster, E. Near field communication technology in tourism. Tour. Manag. Perspect. 2012, 4, 11–18. [Google Scholar] [CrossRef]

- Egger, R. The impact of near field communication on tourism. J. Hosp. Tour. Technol. 2013, 4, 119–133. [Google Scholar] [CrossRef]

- Madlmayr, G.; Scharinger, J. Neue Dimensionen von Mobilen Tourismusanwendungen Durch Near Field Communication Technologie. In mTourism. Mobile Dienste im Tourismus Wiesbaden; Egger, R., Jooss, M., Eds.; Gabler Verlag: Wiesbaden, Germany, 2010; pp. 75–88. [Google Scholar]

- DEVCO and UNWTO. Sustainable Tourism for Development. 2013. Available online: http://icr.unwto.org/content/guidebook-sustainable-tourism-development (accessed on 24 June 2014).

- GSMA. The Benefits of Mobile NFC for Air Travel, White Paper Version 1.0—Non Confidential. 2011. Available online: http://www.iata.org/whatwedo/passenger/fast-travel/Documents/iata-public-whitepaper-issue1.pdf (accessed on 26 June 2014).

- Clark, S. SAS to Introduce NFC to Airports. 2011. Available online: http://www.nfcworld.com/2011/06/15/38035/sas-to-introduce-nfc-to-airports (accessed on 26 June 2014).

- Clark, S. London Taxi Firm Promotes App Downloads with NFC and QR Stickers. 2014. Available online: http://www.nfcworld.com/2014/05/20/329236/london-taxi-firm-promotes-app-downloads-nfc-qr-stickers/ (accessed on 26 June 2014).

- Clark, S. Rio Gets 5,000 NFC Tags. 2014. Available online: http://www.nfcworld.com/2014/06/20/329851/rio-gets-5000-nfc-tags/ (accessed on 24 June 2014).

- Clark, S. NFC Phones Replace Room Keys and Eliminate Check-In at Swedish Hotel. 2010. Available online: http://www.nfcworld.com/2010/11/03/34886/nfc-keys-hotelsweden/ (accessed on 29 April 2014).

- Clarion Hotel Stockholm, NFC Project. Available online: http://www.clarionstockholm.com/nfc-project (accessed on 29 April 2014).

- Boden, R. Spanish Hotel Delivers Guest Information via NFC. 2013. Available online: http://www.nfcworld.com/2013/07/24/325127/spanish-hotel-delivers-guest-information-via-nfc/ (accessed on 24 June 2014).

- Ho, T.; Chen, R. Leveraging NFC and LBS technologies to improve user experiences. In Proceedings of the 2011 International Joint Conference on Service Sciences, Taipei, Taiwan, 25–27 May 2011; pp. 17–21.

- Argueta, D.; Lu, Y.T.; Ma, J.; Rodriguez, D.; Yang, Y.H.; Phan, T.; Jeon, W. Enhancing the restaurant dining experience with an NFC-enabled mobile user interface. In Mobile Computing, Applications, and Services 5th International Conference, MobiCASE 2013, Paris, France, November 7–8, 2013, Revised Selected Papers; Springer International Publishing Cham: Dordrecht, The Netherlands, 2014; pp. 314–321. [Google Scholar]

- Clark, S. Google Confirms Commitment to NFC with New Google Wallet App. 2013. Available online: http://www.nfcworld.com/2013/09/17/325947/google-confirms-commitment-nfc-new-google-wallet-app/ (accessed on 26 June 2014).

- Google Wallet. 2014. Available online: http://www.google.com/wallet/faq.html#tab=faq-general (accessed on 26 June 2014).

- Clark, S. Museum of London Adds NFC. 2011. Available online: http://www.nfcworld.com/2011/08/16/39129/museum-of-london-adds-nfc/ (accessed on 29 April 2014).

- Ceipidor, U.B.; Medaglia, C.M.; Volpi, V.; Moroni, A.; Sposato, S.; Carboni, M.; Caridi, A. NFC technology applied to touristic-cultural field: A case study on an Italian museum. In Proceedings of the 2013 5th International Workshop on Near Field Communication (NFC), Zürich, Switzerland, 5 February 2013; pp. 1–6.

- Clark, S. Sydney Picks NFC and QR Codes to Guide Visitors around the Rocks. 2012. Available online: http://www.nfcworld.com/2012/07/02/316609/sydney-picks-nfc-and-qr-codes-to-guide-visitors-around-the-rocks/ (accessed on 24 June 2014).

- Lindsey, J. Vail’s EpicMix App Brings Location Tracking, Social Networking to Ski Slopes. 2010. Available online: http://www.wired.com/playbook/2010/09/vails-epicmix-app (accessed on 26 June 2014).

- Boden, R. NFC Lamp Post Information Service to Launch in Tokyo. 2013. Available online: http://www.nfcworld.com/2013/05/24/324237/nfc-lamp-post-information-service-to-launch-in-tokyo/ (accessed on 24 June 2014).

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Arcese, G.; Campagna, G.; Flammini, S.; Martucci, O. Near Field Communication: Technology and Market Trends. Technologies 2014, 2, 143-163. https://doi.org/10.3390/technologies2030143

Arcese G, Campagna G, Flammini S, Martucci O. Near Field Communication: Technology and Market Trends. Technologies. 2014; 2(3):143-163. https://doi.org/10.3390/technologies2030143

Chicago/Turabian StyleArcese, Gabriella, Giuseppe Campagna, Serena Flammini, and Olimpia Martucci. 2014. "Near Field Communication: Technology and Market Trends" Technologies 2, no. 3: 143-163. https://doi.org/10.3390/technologies2030143

APA StyleArcese, G., Campagna, G., Flammini, S., & Martucci, O. (2014). Near Field Communication: Technology and Market Trends. Technologies, 2(3), 143-163. https://doi.org/10.3390/technologies2030143