CEO Turnovers: Transparency of Announcements and the Outperformance Puzzle

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. CEO Turnover Announcement and Performance

2.2. Transparency in CEO Dismissal Announcements

3. Sample, Data, and Methodology

3.1. Sample

3.2. Data

3.3. Turnover Classifications

3.4. The Reasons behind CEO Dismissals

3.5. Variables and Methodology

4. Results

4.1. Characteristics of Turnovers

4.2. Performance and CEO Turnover

4.3. Cross-Sectional Regression

4.4. Long-Term Performance

5. Robustness Check

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Variable Definition

| Variable Name | Description |

| CEO characteristics | |

| Age | A dummy variable that takes the value of 1 if the CEO age is higher than 60 and 0 otherwise. |

| Tenure | The logarithm of the tenure of the departed CEO measured in years. |

| Outside succession | A dummy variable equal 1 if the successor CEO is from outside the company or has been with the firm for less than a year. |

| Duality | A dummy variable equal one if the departed CEO held the title of the chairman prior to the announcement. |

| Announcements characteristics | |

| Nontransparent | A dummy variable equal 1 if the firm official statement accompanied with the announcement of turnover does not state a clear reason for firing the CEO. |

| Perf as reason | A dummy variable equal 1 if the firm official statement accompanied with the announcement of turnover indicates that the CEO is fired for performance-related reasons. |

| Other reasons | Announcements that provide reasons other than performance for the dismissal of the CEO, mainly business misconduct and conflict with the board. |

| Performance variables | |

| CAR[-t,t] | Cumulative abnormal returns calculated over [−t, t] event window using the market model with day 0 being the announcement day. The parameters of the market model are estimated over 250 days, ending 20 days before the announcement of the management change. |

| BHR (1) | The buy and hold abnormal returns computed from the end of the turnover month till 36 months postevent and adjusted against the CRSP value-weighted index. |

| BHR (2) | The buy and hold abnormal returns computed from the end of the turnover month till 36 months postevent and adjusted for industry returns, with industry classification based on Fama–French’s 48 industries. |

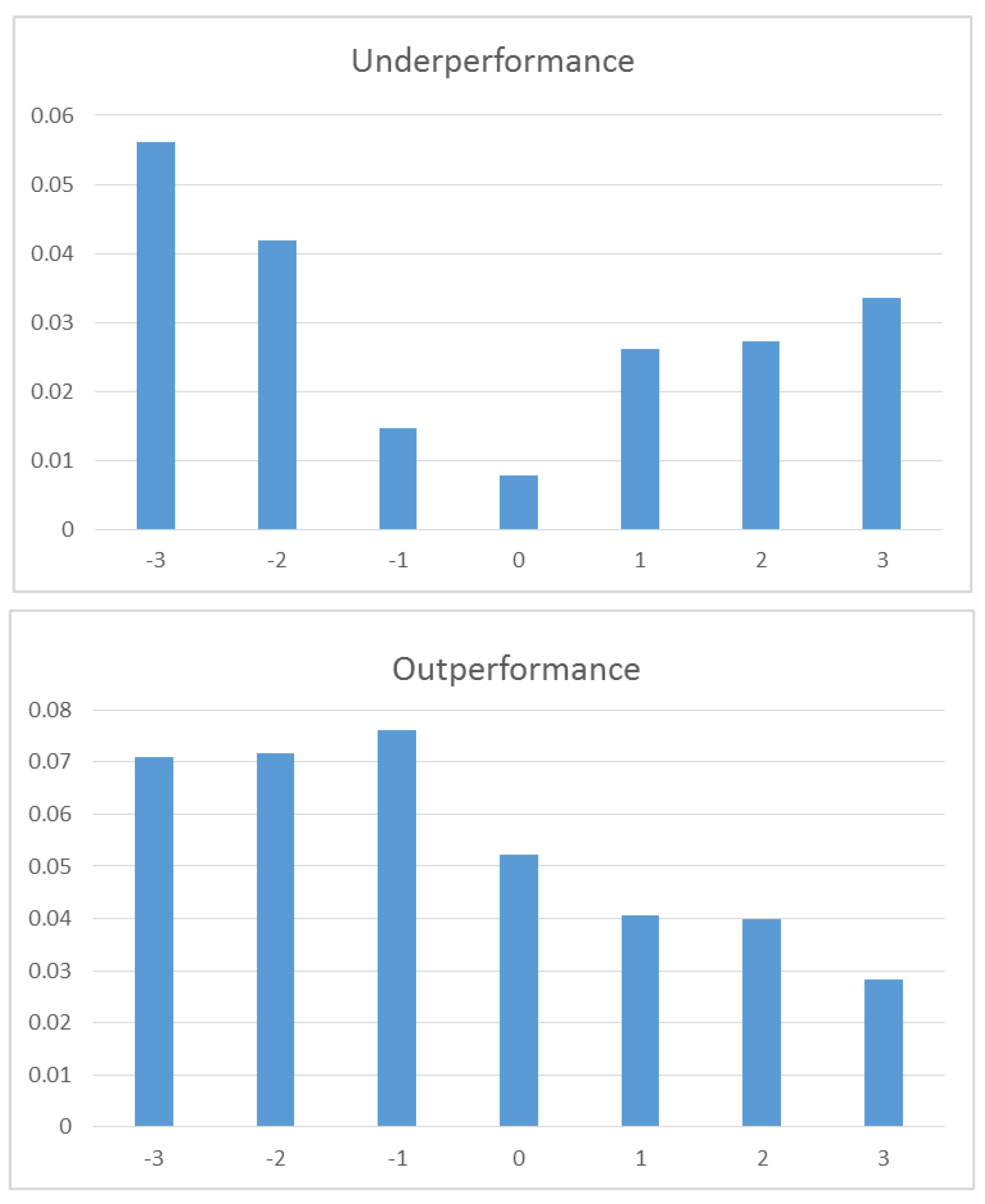

| Outperformance | A dummy variable equal 1 if the preannouncement 3-year monthly CARs are higher than that of a benchmark, and 0 otherwise. Benchmark expected returns are one of two returns: (1) the CRSP index and (2) Fama–French’s 48 portfolios constructed based on industry classification. Refer to the tables’ captions for information about the benchmark employed. |

| Underperformance | A dummy variable equal to 1 if the preannouncement 3-year monthly abnormal CARs are lower than that of a benchmark, and 0 otherwise. Benchmark expected returns are one of two returns: (1) the CRSP index and (2) Fama–French’s 48 portfolios constructed based on industry classification. Refer to the tables’ captions for information about the benchmark employed. |

| OROA | Earnings before interest and tax divided by total assets. |

| Firm characteristics | |

| Size | The logarithm of the market equity of the firm computed at the end of the quarter prior to the announcement of management change. |

| ME/BE | The market equity to book equity ratio computed at the end of the quarter prior to the announcement of management change. |

| 1. | Many studies examine the effect of such factors on the sensitivity of the likelihood of CEO dismissal owing to poor performance. |

| 2. | In case no permanent appointment is available. |

| 3. | Stating that a voluntary turnover is mostly expected does not necessarily mean that a firm’s performance is not expected to improve under the new CEO’s tenure; as in any succession process, the firm’s value depends on the skills and expertise of the new CEO. In addition, new CEOs tend to execute some changes in the business strategy according to their perception of the ideal way to manage a firm, which is more likely to happen when performance was poor under the old CEO’s tenure (Murphy and Zimmerman 1993). |

| 4. | For example, the former CEO of Time, mentioned in the Introduction. |

| 5. | Referred to as the improved management hypothesis. |

| 6. | As conflict involves two parties. |

| 7. | Through clearly stating it or dropping hints about it. Rachel Feintzeig, author of the Wall Street Journal article ‘You’re fired! Additionally, we really mean it!’ points out that sometimes the BOD tries to be ‘nice’ in stating the reason for CEO departures and other times drop hints in its statements regarding the reason for the departures. |

| 8. | We should note that ‘pursue other interests’ turnovers are the less dominant part of the ‘nontransparent’ sample, and our results are robust whether we include those turnovers in the ‘nontransparent’ sample or in the other sample. In addition, investors would speculate that the retirement of a young CEO is less likely to be the real reason for turnover; our results do not materially change if we include CEO early retirements in the ‘nontransparent’ sample. |

| 9. | Consistent with Warner et al. (1988). |

| 10. | The post-turnover BHAR is 60% less than the preturnover BHAR for the outperforming sample, an observation that we have not reported owing to space constraints. |

| 11. | For example, a turnover associated with accounting manipulation might cause the restatement of earnings following a change in management, thereby putting downward pressure on future cash flows. |

References

- Adams, John C., and Sattar A. Mansi. 2009. CEO turnover and bondholder wealth. Journal of Banking & Finance 33: 522–33. [Google Scholar]

- Adams, Renee, Heitor Almeida, and Daniel Ferreira. 2005. Powerful CEOs and their impact on corporate performance. Review of Financial Studies 18: 1403–32. [Google Scholar] [CrossRef]

- Agrawal, Anup, and Mark A. Chen. 2017. Boardroom brawls: An empirical analysis of disputes involving directors. The Quarterly Journal of Finance 7: 1–58. [Google Scholar] [CrossRef]

- Bacidore, Jeffrey M., John A. Boquist, Todd T. Milbourn, and Anjan V. Thakor. 1997. The search for the best financial performance measure. Financial Analysts Journal 53: 11–20. [Google Scholar] [CrossRef] [Green Version]

- Barber, Brad M., and John D. Lyon. 1997. Detecting long-run abnormal stock returns: The empirical power and specification of test statistics. Journal of Financial Economics 43: 341–72. [Google Scholar] [CrossRef] [Green Version]

- Barry, Christopher B., and Stephen Brown. 1984. Differential information and the small firm effect. Journal of Financial Economics 13: 283–94. [Google Scholar] [CrossRef]

- Barry, Christopher B., and Stephen J. Brown. 1985. Differential information and security market equilibrium. Journal of Financial and Quantitative Analysis 20: 407–22. [Google Scholar] [CrossRef]

- Barry, Christopher B., and Stephen J. Brown. 1986. Limited information as a source of risk. The Journal of Portfolio Management 12: 66–72. [Google Scholar] [CrossRef]

- Bawa, Vijay S., Stephen J. Brown, and Roger W. Klein. 1979. Estimation Risk and Optimal Portfolio Choice. New York: North-Holland Publ, 190p. [Google Scholar]

- Cerasi, Vittoria, Sebastian M. Deininger, Leonardo Gambacorta, and Tommaso Oliviero. 2020. How post-crisis regulation has affected bank CEO compensation. Journal of International Money and Finance 104: 102–53. [Google Scholar] [CrossRef] [Green Version]

- Coughlan, Anne T., and Ronald M. Schmidt. 1985. Executive compensation, management turnover, and firm performance: An empirical investigation. Journal of Accounting and Economics 7: 43–66. [Google Scholar] [CrossRef]

- Dedmana, Elisabeth, and Stephen W. J. Lin. 2002. Shareholder wealth effects of CEO departures: Evidence from the UK. Journal of Corporate Finance 8: 81–104. [Google Scholar] [CrossRef]

- Denis, David J., and Diane K. Denis. 1995. Performance changes following top management dismissals. The Journal of Finance 50: 1029–57. [Google Scholar] [CrossRef]

- Dikolli, Shane S., William J. Mayew, and Dhananjay Nanda. 2014. CEO tenure and the performance-turnover relation. Review of Accounting Studies 19: 281–327. [Google Scholar] [CrossRef]

- Ertugrul, Mine, and Karthik Krishnan. 2011. Can CEO dismissals be proactive? Journal of Corporate Finance 17: 134–51. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1980. Agency Problems and the Theory of the Firm. The Journal of Political Economy 88: 288–307. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Furtado, Eugene P. H., and Michael S. Rozeff. 1987. The wealth effects of company initiated management changes. Journal of Financial Economics 18: 147–60. [Google Scholar] [CrossRef]

- Gamache, Daniel L., and Gerry McNamara. 2019. Responding to bad press: How CEO temporal focus influences the sensitivity to negative media coverage of acquisitions. Academy of Management Journal 62: 918–43. [Google Scholar] [CrossRef]

- Gilson, Stuart C. 1989. Management turnover and financial distress. Journal of financial Economics 25: 241–62. [Google Scholar] [CrossRef]

- Goyal, Vidhan, and Chul W. Park. 2002. Board leadership structure and CEO turnover. Journal of Corporate Finance 8: 49–66. [Google Scholar] [CrossRef]

- Hambrick, Donald C., and Phyllis A. Mason. 1984. Upper Echelons: The Organization as a Reflection of Its Top Managers. The Academy of Management Review 9: 193–206. [Google Scholar] [CrossRef] [Green Version]

- Healy, Paul M., and Krishna G. Palepu. 2001. Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics 31: 405–40. [Google Scholar] [CrossRef]

- Hermalin, Benjamin E., and Michael S. Weisbach. 1998. Endogenously chosen boards of directors and their monitoring of the CEO. American Economic Review 88: 96–118. [Google Scholar]

- Huson, Mark R., Robert Parrino, and Laura T. Starks. 2001. Internal monitoring mechanisms and CEO turnover: A long-term perspective. The Journal of Finance 56: 2265–97. [Google Scholar] [CrossRef]

- Huson, Mark R., Paul Malatesta, and Robert Parrino. 2004. Managerial succession and firm performance. Journal of Financial Economics 74: 237–75. [Google Scholar] [CrossRef]

- Jenter, Dirk, and Fadi Kanaan. 2006. CEO turnover and relative performance evaluation. National Bureau of Economic Research 70: 2155–84. [Google Scholar]

- Khanna, Naveen, and Annette B. Poulsen. 1995. Managers of financially distressed firms: Villains or scapegoats? The Journal of Finance 50: 919–40. [Google Scholar] [CrossRef]

- Kim, Yungsan. 1996. Long-term firm performance and chief executive turnover: An empirical study of the dynamics. Journal of Law, Economics, and Organization 12: 480–96. [Google Scholar] [CrossRef]

- Kind, Axel, and Yves Schläpfer. 2010. Is a CEO Turnover Good or Bad News. Working papers 2010/13. Basel: Faculty of Business and Economics—University of Basel. [Google Scholar]

- Klein, Roger, and Vijay S. Bawa. 1977. The effect of limited information and estimation risk on optimal portfolio diversification. Journal of Financial Economics 5: 89–111. [Google Scholar] [CrossRef]

- Leftwich, Richard. 1980. Market failure fallacies and accounting information. Journal of Accounting and Economics 2: 193–211. [Google Scholar] [CrossRef]

- Lim, Weng Marc. 2021. Conditional Recipes for Predicting Impacts and Prescribing Solutions for Externalities: The Case of COVID-19 and Tourism. Tourism Recreation Research. Tourism Recreation Research 46: 314–18. [Google Scholar] [CrossRef]

- Loughran, Tim, and Jay R. Ritter. 2000. Uniformly least powerful tests of market efficiency. Journal of Financial Economics 55: 361–89. [Google Scholar] [CrossRef]

- Lyon, John D., Brad M. Barber, and Chih-Ling Tsai. 1999. Improved methods for tests of long-run abnormal stock returns. The Journal of Finance 54: 165–201. [Google Scholar] [CrossRef]

- Mobbs, Shawn. 2013. CEOs under fire: The effects of competition from inside directors on forced CEO turnover and CEO compensation. Journal of Financial and Quantitative Analysis 48: 669–98. [Google Scholar] [CrossRef]

- Murphy, Kevin, and Jerold Zimmerman. 1993. Financial performance surrounding CEO turnover. Journal of Accounting and Economics 16: 273–315. [Google Scholar] [CrossRef]

- Parrino, Robert. 1997. CEO turnover and outside succession a cross-sectional analysis. Journal of Financial Economics 46: 165–97. [Google Scholar] [CrossRef]

- Reinganum, Marc R. 1985. The effect of executive succession on stockholder wealth. Administrative Science Quarterly 30: 46–60. [Google Scholar] [CrossRef]

- Schneider, Benjamin. 1987. The people make the place. Personnel Psychology 40: 437–53. [Google Scholar] [CrossRef]

- Shen, Wei, and Albert A. Cannella. 2003. Will succession planning increase shareholder wealth? Evidence from investor reactions to relay CEO successions. Strategic Management Journal 24: 191–98. [Google Scholar] [CrossRef]

- Turner, John C., Michael A. Hogg, Penelope J. Oakes, Stephen D. Reicher, and Margaret S. Wetherell. 1987. Rediscovering the Social Group: A Self-Categorization Theory. Oxford: Blackwell Pub. [Google Scholar]

- Warner, Jerold B., Ross Watts, and Karen H. Wruck. 1988. Stock prices and top management changes. Journal of Financial Economics 20: 461–92. [Google Scholar] [CrossRef]

- Watts, Ross L., and Jerold L. Zimmerman. 1983. Agency problems, auditing, and the theory of the firm: Some evidence. The Journal of Law & Economics 26: 613–33. [Google Scholar]

- Weisbach, Michael S. 1988. Outside directors and CEO turnover. Journal of financial Economics 20: 431–60. [Google Scholar] [CrossRef]

- Worrell, Dan L., Wallace N. Davidson III, and John L. Glascock. 1993. Stockholder reactions to departures and appointments of key executives attributable to firings. Academy of Management Journal 36: 387–401. [Google Scholar]

| Variables | Full Sample N = 721 | Forced N = 184 | Voluntary N = 537 | Difference | ||||

|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | Mean | T-Value | |

| Age | 58.63 | 6.32 | 54.24 | 5.64 | 60.13 | 5.85 | −5.89 | (−12.23) *** |

| Tenure | 9.12 | 5.60 | 5.97 | 3.52 | 10.20 | 5.34 | −4.23 | (−9.62) *** |

| No Succ | 23.53% | 0.41 | 49.30% | 0.48 | 14.70% | 0.33 | 34.60% | (10.32) *** |

| Outsider | 24.81% | 0.26 | 35.32% | 0.19 | 21.21% | 0.48 | 14.11% | (3.27) *** |

| Stayed | 32.28% | 0.43 | 2.93% | 0.22 | 42.34% | 0.46 | −39.41% | (−10.24) *** |

| Time-diff | 57.79 | 33.65 | 9.24 | 8.01 | 74.43 | 68.55 | −65.19 | (−8.34) *** |

| duality | 61.10% | 0.48 | 34.21% | 0.45 | 70.32% | 0.45 | −36.11% | (−8.56) *** |

| Preturnover ret | −3.30% | 0.41 | −25.13% | 1.37 | 4.18% | 0.42 | −29.31% | (−7.88) *** |

| size | 8.15 | 1.61 | 8.00 | 1.66 | 8.20 | 1.70 | −0.20 | (−1.59) |

| BE/ME | 0.57 | 0.45 | 0.69 | 0.66 | 0.53 | 0.41 | 0.16 | (4.15) *** |

| Full Sample | Forced | Voluntary | Difference | |

|---|---|---|---|---|

| CAR[−1, 1] | 0.003 (1.36) | 0.006 (1.02) | 0.002 (0.82) | 0.004 (0.95) |

| CAR[−2, 2] | 0.001 (0.41) | −0.003 (−0.39) | 0.003 (1.08) | 0.006 (0.94) |

| N | 682 | 181 | 501 |

| Panel A: Abnormal Returns for Under- and Out-Performance Samples | |||||||||

| Underperformance (1) | Outperformance (2) | Difference (1)–(2) | |||||||

| Variable | Sample | Mean | Median | N | Mean | Median | N | Mean | Median |

| CAR[−1, 1] | Full | 0.009 *** | 0.002 * | 373 | −0.003 | −0.003 | 306 | 0.012 ** | 0.005 * |

| (2.62) | (1.67) | (−1.01) | (−1.00) | (2.51) | (1.93) | ||||

| Forced | 0.017 *** | 0.004 * | 125 | −0.019 * | −0.009 * | 53 | 0.036 *** | 0.013 ** | |

| (2.78) | (1.84) | (−1.76) | (−1.70) | (2.70) | (2.02) | ||||

| Voluntary | 0.004 | 0.001 | 248 | −0.001 | −0.003 | 253 | 0.005 | 0.004 | |

| (1.06) | (0.94) | (−0.24) | (−0.74) | (1.04) | (1.49) | ||||

| CAR[−2, 2] | Full | 0.007 * | 0.001 | 373 | −0.006 * | −0.006 * | 306 | 0.014 ** | 0.007 ** |

| (1.74) | (1.16) | (−1.75) | (−1.86) | (2.50) | (2.20) | ||||

| Forced | 0.010 * | 0.003 | 125 | −0.034 ** | −0.025 ** | 53 | 0.043 *** | 0.028 *** | |

| (1.73) | (1.08) | (−2.55) | (−2.51) | (2.98) | (2.83) | ||||

| Voluntary | 0.006 * | 0.001 | 248 | −0.002 | −0.005 | 253 | 0.008 | 0.006 * | |

| (1.66) | (0.60) | (−0.80) | (−0.85) | (1.42) | (1.79) | ||||

| Panel B: Price Reaction for Announcements Transparency | |||||||||

| CAR[−1, 1] | CAR[−2, 2] | ||||||||

| Sample | Statistic | Nontransparent | Transparent | Difference | Nontransparent | Transparent | Difference | ||

| Forced sample (N = 181) | Mean | −0.007 | 0.014 * | −0.021 * | −0.032 *** | 0.015 * | −0.047 *** | ||

| (−1.02) | (1.73) | (−1.87) | (−2.80) | (1.66) | (−3.25) | ||||

| Median | −0.009 | 0.007 ** | −0.016 ** | −0.026 *** | 0.012 ** | −0.038 *** | |||

| (−1.56) | (2.29) | (−2.49) | (−3.67) | (2.35) | (−4.31) | ||||

| N | 70 | 111 | 70 | 111 | |||||

| Panel C: Transparent Announcements: Performance Versus Other Reasons | |||||||||

| CAR[−1, 1] | CAR[−2, 2] | ||||||||

| Sample | Statistic | Nontransparent | Perf as Reason | Other Reasons | Nontransparent | Perf as Reason | Other Reasons | ||

| Forced sample (N = 181) | Mean | −0.007 | 0.022 ** | 0.004 | −0.032 *** | 0.027 ** | 0.004 | ||

| (−1.02) | (2.27) | (0.42) | (−2.80) | (2.26) | (0.31) | ||||

| Median | −0.009 | 0.012 ** | 0.008 | −0.026 *** | 0.017 ** | 0.007 | |||

| (−1.56) | (2.25) | (1.08) | (−3.67) | (2.18) | (0.92) | ||||

| N | 70 | 57 | 54 | 70 | 57 | 54 | |||

| Dependent Variable: CAR[−1, 1] | Dependent Variable: CAR[−2, 2] | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Intercept | −0.012 | −0.008 | −0.011 | −0.022 | −0.016 | −0.020 |

| (−0.29) | (−0.18) | (−0.28) | (−0.37) | (−0.26) | (−0.35) | |

| Outside succession | 0.010 | 0.012 | 0.011 | 0.009 | 0.012 | 0.010 |

| (1.01) | (1.21) | (1.10) | (0.72) | (0.97) | (0.86) | |

| Tenure | 0.006 | 0.006 | 0.005 | 0.007 | 0.006 | 0.006 |

| (1.57) | (1.48) | (1.37) | (1.29) | (1.19) | (1.08) | |

| Age | −0.001 | −0.002 | −0.002 | −0.002 | −0.003 | −0.003 |

| (−0.21) | (−0.43) | (−0.45) | (−0.34) | (−0.58) | (−0.60) | |

| Duality | 0.005 | 0.004 | 0.004 | −0.003 | −0.004 | −0.005 |

| (1.09) | (0.93) | (0.85) | (−0.61) | (−0.79) | (−0.86) | |

| Size | −0.003 | −0.003 | −0.003 | −0.003 | −0.004 | −0.004 |

| (−1.34) | (−1.37) | (−1.34) | (−1.17) | (−1.19) | (−1.17) | |

| BE/ME | −0.005 | −0.003 | −0.002 | −0.001 | 0.002 | 0.002 |

| (−0.46) | (−0.27) | (−0.24) | (−0.08) | (0.14) | (0.17) | |

| Preturnover CAR | −0.016 ** | −0.021 ** | ||||

| (−2.47) | (−2.46) | |||||

| Outperformance | −0.012 ** | −0.004 | −0.015 ** | −0.007 | ||

| (−2.05) | (−0.84) | (−2.15) | (−0.99) | |||

| Forced | 0.006 | 0.007 | 0.017 * | −0.009 | −0.007 | 0.005 |

| (0.82) | (0.94) | (1.93) | (−0.92) | (−0.73) | (0.92) | |

| Outperf*forced | −0.031 ** | −0.037 ** | ||||

| (−2.21) | (−2.28) | |||||

| Year fixed effect | yes | yes | yes | yes | yes | yes |

| Adjusted R2 | 0.028 | 0.015 | 0.026 | 0.024 | 0.010 | 0.019 |

| N | 674 | 674 | 674 | 674 | 674 | 674 |

| Dependent Variable: CAR[−1, 1] | Dependent Variable: CAR[−2, 2] | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Intercept | −0.052 | −0.010 | −0.027 | −0.097 | −0.019 | 0.017 |

| (−0.81) | (−0.15) | (−0.42) | (−1.37) | (−0.28) | (0.48) | |

| Outside succession | 0.103 * | 0.093 * | 0.090 * | 0.095 | 0.078 | 0.073 |

| (1.92) | (1.71) | (1.65) | (1.33) | (1.07) | (1.01) | |

| Tenure | 0.025 *** | 0.023 *** | 0.024 *** | 0.028 *** | 0.024 ** | 0.026 *** |

| (2.99) | (2.69) | (2.86) | (2.93) | (2.52) | (2.85) | |

| Age | −0.005 | −0.010 | −0.011 | −0.001 | −0.010 | −0.01 |

| (−0.35) | (−0.55) | (−0.59) | (−0.05) | (−0.52) | (−0.50) | |

| Duality | 0.018 | 0.019 | 0.018 | 0.005 | 0.008 | 0.004 |

| (1.60) | (1.62) | (1.50) | (0.67) | (0.57) | (0.31) | |

| Size | −0.003 | −0.004 | −0.003 | −0.003 | −0.004 | −0.002 |

| (−0.86) | (−0.94) | (−0.68) | (−0.54) | (−0.89) | (−0.42) | |

| BE/ME | −0.011 | −0.019 | −0.020 | −0.010 | −0.022 | −0.022 |

| (−0.75) | (−1.30) | (−1.40) | (−0.57) | (−1.22) | (−1.29) | |

| Outperformance | −0.033 ** | −0.032 ** | −0.039 ** | −0.039 ** | ||

| (−2.21) | (−2.28) | (−2.37) | (−2.49) | |||

| Nontransparent | −0.015 | −0.042 *** | ||||

| (−1.48) | (−2.69) | |||||

| Perf as Reason | 0.022 * | 0.045 *** | ||||

| (1.76) | (2.70) | |||||

| Year fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.101 | 0.143 | 0.152 | 0.042 | 0.121 | 0.123 |

| N | 178 | 175 | 175 | 178 | 175 | 175 |

| Panel A: Post-Succession 3-Year BHAR for The Full Sample | ||||||||

| Full Sample | Under−Perf (1) | Out−Perf (2) | Difference (1)–(2) | |||||

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| BHR(1) | 0.12 *** | 0.03 *** | 0.27 *** | 0.11 *** | −0.05 | −0.04 | 0.32 *** | 0.30 *** |

| (4.78) | (2.77) | (4.32) | (3.27) | (−0.91) | (−0.25) | (2.86) | (2.60) | |

| BHR(2) | 0.09 ** | 0.01 | 0.19 *** | 0.03 | −0.02 | −0.06 * | 0.21 *** | 0.09 ** |

| (2.54) | (0.84) | (3.02) | (1.02) | (−0.78) | (−1.87) | (2.92) | (2.01) | |

| N | 706 | 382 | 324 | |||||

| Panel B: Post Turnover 3-Year BHAR for the Forced Sample | ||||||||

| Forced Sample | Under-Perf (1) | Out-Perf (2) | Difference (1)–(2) | |||||

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| BHR(1) | 0.29 ** | 0.04 *** | 0.45 *** | 0.18 *** | −0.11 | −0.13 * | 0.55 ** | 0.30 *** |

| (2.08) | (2.77) | (2.98) | (3.07) | (−1.31) | (−1.71) | (2.36) | (2.97) | |

| BHR(2) | 0.21 ** | 0.01 | 0.36 ** | 0.04 * | −0.14 * | −0.15 ** | 0.50 *** | 0.19 *** |

| (2.23) | (0.54) | (2.51) | (1.85) | (−1.78) | (−2.07) | (2.92) | (2.60) | |

| N | 177 | 126 | 51 | |||||

| Panel C: BHAR for the Forced Sample, CEO Fired for Business Misconducts Excluded | ||||||||

| Under-Perf (1) | Out-Perf (2) | Difference (1)–(2) | ||||||

| Mean | Median | Mean | Median | Mean | Median | |||

| BHR(1) | 0.52 *** | 0.19 *** | −0.10 | −0.14 | 0.63 ** | 0.33 *** | ||

| (3.17) | (3.07) | (−1.21) | (−1.54) | (2.46) | (3.07) | |||

| BHR(2) | 0.42 *** | 0.07 ** | −0.13 | −0.18 * | 0.55 ** | 0.25 *** | ||

| (2.68) | (2.25) | (−1.48) | (−1.83) | (2.42) | (2.64) | |||

| N | 112 | 44 | ||||||

| Dependent Variable: CAR[−1, 1] | Dependent Variable: CAR[−2, 2] | |||||

|---|---|---|---|---|---|---|

| Full Sample | Forced | Voluntary | Full Sample | Forced | Voluntary | |

| Underperformance | 0.009 ** | 0.021 *** | 0.002 | 0.009 ** | 0.011 | 0.008 |

| (2.42) | (2.89) | (0.48) | (2.09) | (1.61) | (1.36) | |

| N | 299 | 113 | 186 | 299 | 113 | 186 |

| Outperformance | −0.002 | −0.019 * | 0.001 | −0.006 * | −0.030 *** | −0.001 |

| (−0.65) | (−1.82) | (0.82) | (−1.83) | (−2.67) | (−0.30) | |

| N | 380 | 65 | 315 | 380 | 65 | 315 |

| Difference | 0.011 | 0.039 | −0.001 | 0.015 | 0.042 | 0.007 |

| (2.39) ** | (3.19) *** | (−0.19) | (2.80) *** | (2.79) *** | (1.45) | |

| [1.48] | [2.85] *** | [0.85] | [1.60] | [2.74] *** | [0.89] | |

| CAR[−1, 1] | CAR[−2, 2] | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| intercept | −0.005 | −0.020 | −0.017 | −0.062 |

| (−0.07) | (−0.32) | (−0.24) | (−0.91) | |

| Outside succession | 0.092 * | 0.089 * | 0.079 | 0.073 |

| (1.72) | (1.65) | (1.09) | (1.02) | |

| Tenure | 0.024 *** | 0.024 *** | 0.025 ** | 0.027 *** |

| (2.65) | (2.81) | (2.52) | (2.83) | |

| Age | −0.009 | −0.010 | −0.010 | −0.009 |

| (−0.53) | (−0.58) | (−0.49) | (−0.47) | |

| Duality | 0.018 | 0.017 | 0.007 | 0.004 |

| (1.53) | (1.43) | (0.51) | (0.26) | |

| Size | −0.003 | −0.002 | −0.004 | −0.001 |

| (−0.81) | (−0.58) | (−0.77) | (−0.31) | |

| BE/ME | −0.019 | −0.020 | −0.020 | −0.021 |

| (−1.32) | (−1.41) | (−1.15) | (−1.23) | |

| Outperformance | −0.034 *** | −0.033 *** | −0.036 ** | −0.036 *** |

| (−2.58) | (−2.63) | (−2.47) | (−2.60) | |

| Nontransparent | −0.014 | −0.041 *** | ||

| (−1.25) | (−2.60) | |||

| Perf as reason | 0.021 * | 0.044 *** | ||

| (1.68) | (2.64) | |||

| Year fixed effect | yes | yes | yes | yes |

| Adjusted R2 | 0.14 | 0.15 | 0.11 | 0.11 |

| N | 175 | 175 | 175 | 175 |

| CAR[−1, 1] | CAR[−2, 2] | |||||

|---|---|---|---|---|---|---|

| CAR | Standardized Residuals | Standardized Cross-Sectional | CAR | Standardized Residuals | Standardized Cross-Sectional | |

| Full sample | ||||||

| Outperf | −0.001 | −1.83 * | −1.44 | −0.005 | −3.60 *** | −2.61 *** |

| Underperf | 0.009 | 5.40 *** | 3.29 *** | 0.010 | 3.56 *** | 2.41 ** |

| Forced sample | ||||||

| Outperf | −0.019 | −5.89 *** | −2.60 *** | −0.030 | −5.36 *** | −2.80 *** |

| Underperf | 0.021 | 5.66 *** | 2.75 *** | 0.011 | 2.48 ** | 1.38 |

| Dependent Variable: Average Monthly Abnormal Return (a) | ||||||

|---|---|---|---|---|---|---|

| Full Sample | Forced Sample | |||||

| n = 12 | n = 24 | n = 36 | n = 12 | n = 24 | n = 36 | |

| Full sample | 0.002 | 0.002 ** | 0.002 | 0.003 | 0.003 | 0.001 |

| (1.05) | (1.98) | (1.54) | (1.05) | (1.01) | (0.67) | |

| Outperformance | −0.001 | 0.001 | 0.001 | −0.007 * | −0.004 | −0.003 |

| (−0.30) | (0.57) | (0.21) | (−1.70) | (−1.37) | (−1.26) | |

| Underperformance | 0.004 * | 0.004 * | 0.003 * | 0.009 ** | 0.007 ** | 0.005 * |

| (1.76) | (1.94) | (1.89) | (2.06) | (2.24) | (1.91) | |

| Panel A: Post-Turnover 3-Year BHAR for the Full Sample | ||||||||

| Full Sample | Underperf (1) | Outperf (2) | Difference (1)–(2) | |||||

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| BHR(1) | 0.14 *** | 0.03 *** | 0.27 *** | 0.11 *** | 0.04 | 0.04 | 0.23 ** | 0.30 |

| (4.78) | (2.77) | (3.72) | (3.27) | (0.91) | (0.95) | (2.26) | (1.60) | |

| BHR(2) | 0.10 ** | 0.01 | 0.20 *** | 0.03 | 0.02 | −0.06 * | 0.22 *** | 0.09 |

| (2.57) | (0.84) | (3.02) | (0.62) | (0.78) | (−1.67) | (2.21) | (1.51) | |

| N | 706 | 297 | 409 | |||||

| Panel B: Post Turnover 3-year BHAR for the Forced Sample | ||||||||

| Forced Sample | Underperf (1) | Outperf (2) | Difference (1)–(2) | |||||

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| BHR(1) | 0.28 *** | 0.04 * | 0.47 *** | 0.18 *** | −0.05 | −0.13 | 0.52 ** | 0.30 *** |

| (2.58) | (1.87) | (2.88) | (3.07) | (−0.67) | (−1.01) | (2.36) | (2.97) | |

| BHR(2) | 0.22 *** | 0.01 | 0.39 ** | 0.04 * | −0.09 | −0.15 * | 0.48 *** | 0.19 *** |

| (2.08) | (0.54) | (2.48) | (1.89) | (−1.31) | (−1.87) | (2.92) | (2.60) | |

| N | 177 | 113 | 64 | |||||

| Preturnover | Post-Turnover | Difference | T-Statistics | N | |

|---|---|---|---|---|---|

| A: Unadjusted OROA | |||||

| Full sample | 0.089 | 0.069 | −0.020 ** | (−2.23) | 165 |

| Underperformance | 0.081 | 0.069 | −0.012 | (−1.11) | 102 |

| Outperformance | 0.099 | 0.070 | −0.029 ** | (−2.12) | 63 |

| B: Industry Adjusted OROA | |||||

| Full sample | 0.055 | 0.032 | −0.023 ** | (−2.07) | 165 |

| Underperformance | 0.037 | 0.029 | −0.008 | (−1.08) | 102 |

| Outperformance | 0.072 | 0.037 | −0.035 * | (−1.91) | 63 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Farah, P.; Li, H. CEO Turnovers: Transparency of Announcements and the Outperformance Puzzle. Int. J. Financial Stud. 2021, 9, 34. https://doi.org/10.3390/ijfs9030034

Farah P, Li H. CEO Turnovers: Transparency of Announcements and the Outperformance Puzzle. International Journal of Financial Studies. 2021; 9(3):34. https://doi.org/10.3390/ijfs9030034

Chicago/Turabian StyleFarah, Paul, and Hui Li. 2021. "CEO Turnovers: Transparency of Announcements and the Outperformance Puzzle" International Journal of Financial Studies 9, no. 3: 34. https://doi.org/10.3390/ijfs9030034

APA StyleFarah, P., & Li, H. (2021). CEO Turnovers: Transparency of Announcements and the Outperformance Puzzle. International Journal of Financial Studies, 9(3), 34. https://doi.org/10.3390/ijfs9030034