Abstract

The management of cash requires careful considerations to allow firms to benefit from proper resource allocations while mitigating agency issues. Accounting comparability can play an important role in tackling information asymmetry and agency cost, thus enabling managers to hoard more cash. This research aims to investigate the link between accounting comparability and cash holdings in an emerging market. Using a sample of listed firms in Vietnam from 2010 to 2019 and System Generalized Method of Moments, the study finds that comparability is positively associated with corporate cash holdings, confirming the value of the former as an effective governance mechanism. Additionally, we find a non-linear impact of comparability on cash holdings; in other words, comparability specifically enhances cash holdings for firms with high levels of comparability. We further document that cash holdings improve firm performance only for firms with high levels of comparability. Such evidence implies that only firms with high levels of financial statement comparability show commitment to tackle agency cost and information asymmetry.

1. Introduction

Corporate resource allocations are crucial because good decisions in this field not only enhance firm value, but also mitigate potential conflicts of interest between stakeholders (Kim et al. 2020; Mehrabanpour et al. 2020). Since firms have to compete fiercely for limited market resources, efficient cash management has become a prerequisite for firms to survive and grow. If cash is under-reserved, firms might face problems in sustaining operations in case of liquidity shortage, thwarting investments. On the other hand, firms that reserve high levels of cash are more prone to face more serious opportunity costs, in addition to agency costs (Myers and Rajan 1998; Jensen 1986; Masulis et al. 2009). In order to improve shareholder’s value, management must be able to determine a level of cash holdings where the marginal benefit and the marginal cost of holding one more unit of cash are equal (Opler et al. 2001).

Financial statements allow users to access the information to evaluate a firm’s cash flows, in terms of timing, amount and certainty (Kim et al. 2013, 2016). Information is more likely to serve this purpose if it facilitates performance comparison between entities, or if it is comparable across multiple points in time for the same entity. Theoretically, as investors need to compare alternative investment opportunities, it is compulsory to provide comparable information for them. According to Financial Accounting Standards Board (FASB) (2010), comparable information enables users to identify economic similarities and differences across firms. Therefore, with better accounting comparability, investors now find it cheaper, faster, and more convenient to obtain more pertinent and reliable information to make informed decisions.

Financial statement comparability has been one notable element that affects cash holdings (Mehrabanpour et al. 2020; Kim et al. 2020; Habib et al. 2017). Habib et al. (2017) argue that the effect of accounting comparability on cash holdings is not obvious, at least on the theoretical ground. Trade-off theory suggests that firms have an optimal cash-holding level, where the marginal benefit equals the marginal cost of holding cash. Cash is extremely useful when firms have difficulties in obtaining external financing. Due to information asymmetry problem, the cost of external financing is expected to be higher compared to that of internal source, e.g., cash. Since accounting comparability improves information environment and allows outsiders to evaluate firm performance more efficiently and accurately, this should reduce information asymmetry and the related costs to access external financing (Kim et al. 2013; Habib et al. 2017), lowering firms’ need for cash hoarding. In other words, according to trade-off theory, accounting comparability is expected to be negatively associated with cash holdings.

On the other hand, Huang and Huang (2012) and Myers and Rajan (1998) suggest that firms plagued with information asymmetry find it costly to carry cash, because the agency cost between managers and investors would be higher and would reduce firm value. If comparable financial statements can mitigate information asymmetry and bolster investor trust, then it should allow firms to hold more cash without its value being discounted. This argument supports a positive relationship between cash holdings and financial statement comparability.

Given the importance of accounting comparability and management of cash and the vagueness in their relationship, it is surprising to document scant empirical evidence on the link between comparability and cash holdings (Habib et al. 2017). The current research contributes to the literature in a number of ways. Firstly, it examines the link between accounting comparability and cash holdings in Vietnam, an emerging country with fledgling institutional mechanisms. The agency problems between managers and external shareholders tend to be more pronounced in emerging markets like Vietnam due to weak governance mechanisms (Vo 2018). Furthermore, in markets with weak shareholder protection mechanisms, firm values are discounted when managers retain more cash (Kalcheva and Lins 2007). As a result, firms might be prone to keep less cash to avoid agency cost in those countries. Vietnam is still one of a few countries that have not fully adopted International Financial Reporting Standards (IFRS), which could hamper the effort to raise financial statement comparability. Financial reports in emerging countries have often been questioned in terms of their accuracy, and Li et al. (2014) document a systemic sign of corporate misreporting in BRIC countries. Previous studies on the association between comparability and cash holdings were conducted in the context of developed countries, but there is limited evidence for developing countries. It is interesting to find how accounting comparability helps to alleviate agency problems associated with cash holdings in a developing country.

Secondly, due to the application of accounting and reporting standards, firms in a country are expected to have some level of comparability in their accounting information, even if managers choose to prepare statements that are not comparable. Consequently, only those with high levels of comparability should demonstrate their willingness and intention to provide investors with better and relevant information. Nonetheless, there have been no studies that differentiate the impact of comparability on cash holdings at high and low levels of comparability, and we aim to void this gap. Thirdly, we ascertain this finding by further examining the effect of cash holdings on firm performance at high and low levels of accounting comparability, and the results consistently suggest that cash positively affects firm performance only for firms with highly comparable financial statements. This evidence supports the argument that firms with different levels of comparability have different incentives to address agency costs between managers and external stakeholders.

The remainder of the paper continues as follows: Section 2 supplies a review of extant literature and builds empirical hypotheses; Section 3 presents research methodology where empirical strategies, models, and variable construction are discussed; Section 4 gives information on data statistics and estimation results, together with robustness tests to ascertain our research findings. Section 5 concludes and provides implications for relevant stakeholders.

2. Literature Review and Hypothesis Development

2.1. Accounting Comparability and Information Quality

FASB (2010) emphasizes the importance of comparability in performance evaluation and investment decisions. As an intra-firm attribute, accounting comparability helps investors to comprehend and recognize financial differences and similarities of comparable firms with fewer required adjustments (De Franco et al. 2011; Kim et al. 2016, 2020; Sohn 2016; Kini et al. 2009; Engelberg et al. 2016). There are different sources to collect information, in addition to the disclosures provided by the focal firm. Furthermore, with fewer adjustments needed to compare items in financial statements, the information processing and handling costs become smaller. With those advantages, comparability is expected to enable investors to make better inferences and deductions about a firm’s performance.

Even though comparability possesses economic significance, early empirical studies on this factor were limited due to problems in identifying proxies for accounting comparability. De Franco et al. (2011) contribute by offering pertinent proxies and use them to investigate whether comparability helps analysts to derive firm value estimates with better accuracy and lower dispersion. De Franco et al. (2011) and Choi et al. (2019) claim that as accounting comparability increases, information from comparable peers improves the quality and quantity of information about the focal firm.

Kim et al. (2013) investigate whether accounting comparability alleviates credit risk. Using Moody’s adjustments to reported earnings to devise comparability measures, the authors show that higher levels of comparability are associated with lower bid–ask spreads and lower bond yields. This evidence implies that comparability enhances information environment, facilitating investors in evaluating firms’ credit risk and determining the pricing of financial products. Using a sample of transactions from over 30 countries from 1998 to 2004, Francis et al. (2015) suggest that international mergers and acquisitions of firms between countries with more commonality in accounting standards are more likely to have higher profitability. Zhang (2018) adds that audit risk and audit delay (audit opinion accuracy and audit quality) reduce (improve) as accounting comparability is better.

Chen et al. (2018) verify whether accounting comparability of target firms allows investors to locate profitable investment opportunities. The authors document that acquirers tend to receive higher returns, obtain better synergies and higher operating performances if target firms produce more comparable financial statements. In addition, fewer impairments and divestitures are recorded if target firms have higher levels of accounting comparability. Furthermore, the positive effect of accounting comparability is stronger when the acquirers have little knowledge about the target firms.

Information asymmetry and agency cost (Shleifer and Vishny 1997; Leuz et al. 2003) can also be mitigated by improving comparability of financial information. Managers are less likely to abuse corporate resources if corporate disclosures are more comparable with those of peers (Kim et al. 2020). Kim et al. (2016) find that comparability reduces crash risk, and this effect is enhanced for firms that operate in a vaguer environment, implying that high comparability would discourage managers to hoard bad news, thus strengthening investor’s confidence in the management. These studies suggest that with more comparable financial statements, managers are less likely to involve in value-destroying activities and investors can understand managers’ deployment of corporate resources better.

In summary, extant studies offer concrete and consistent evidence suggesting that accounting comparability yields more valuable information to the market. Enhanced comparability is associated with lower cost of obtaining and processing information, allowing better exploitation of available information sources (De Franco et al. 2011; Kim et al. 2016; Francis et al. 2015; Chen and Gong 2019). Thanks to comparable financial statements, investors and analysts can filter for firm-specific information, especially bad news, even when managers do not disclose it (Kim et al. 2016), reducing the incentives to conceal bad news because of the smaller expected benefits and larger expected costs.

2.2. Accounting Comparability and Corporate Cash Holdings

As discussed earlier, extant literature supports the argument that comparability improves information environment about a firm. Nonetheless, the research on the impact of comparability on corporate decisions, including cash holdings, is limited (Habib et al. 2017). Meanwhile, the effects of comparability cash holdings are ambiguous, both on the theoretical and empirical grounds.

First, the trade-off theory proposes that firms have optimal levels of cash holdings where marginal benefits equate marginal costs. Maintaining cash and cash equivalents allows firms to realize positive NPV investment opportunities, and this is particularly important for financially constrained firms. Transaction and precautionary incentives explain that cash should relieve financial distress costs when firms are not capable of generating adequate cash flows to meet liabilities. De Franco et al. (2011) claim that accounting comparability facilitates investors to comprehend firm performance, thus reducing information asymmetry between the firm and outsiders. As a result, the cost of obtaining external financing should be lower for firms with better accounting comparability, lowering the need to hoard more cash.

In addition, according to the pecking-order theory, because of the issue of asymmetric information, firms do not establish an optimal level of cash, and the level of cash holdings depends on the cost of external financing (Habib et al. 2017). With asymmetric information, the cost of external funding is higher than that of internal sources; as a consequence, firms will resort more to cash that is internally generated or retained prior to their reach for external financing. This would in fact generate a hierarchy in financing new investments: internal funds first, then debt and equity as the last resort. To sum up, more comparable statements help reduce information asymmetry, thus reducing the cost of external financing as well as the need to earmark cash for investment purposes.

On the other hand, Kim et al. (2020) argue that comparability mitigates the information asymmetry between managers and investors, because it increases data availability and requires fewer adjustments to the details in financial statements. Accounting comparability supports investors in making inferences about a firm’ performance through comparing disclosures/financial statements of peers. As financial reports become more comparable, external monitoring from investors can help discipline managers if misusing corporate resources. Holding liquid assets at high level of information asymmetry could result in the value of a firm being discounted (Huang and Huang 2012; Faulkender and Wang 2006). This is rational because maintaining cash generates opportunity cost of capital that costs the firm positive economic returns from investments elsewhere.

It is expected that managers of firms with higher accounting comparability would manage corporate resources more properly and are less likely to invest in negative NPV projects or hoard bad news about its misuse of resources. Therefore, for those firms, investors are less likely to discount firm value when it holds high levels of resources, e.g., cash. Consistently, Kim et al. (2020) find that for firms with better comparability, cash holdings, and capital expenditure create more value to shareholders, and corporate acquisitions are less likely to impose a negative impact on firm value. If comparable financial reports can lessen information asymmetry, a positive association between accounting comparability and cash holdings can be expected.

The agency problems between managers and stakeholders is more pronounced in emerging markets, including Vietnam (Vo 2018). Consistently, in countries where shareholder protection is weak, firm values are lower when managers hold more cash (Kalcheva and Lins 2007). Therefore, investors might negatively evaluate firms with excessive cash holdings (Harford 1999; Masulis et al. 2009), which motivates firms to keep less cash to avoid agency costs. In such a setting, with better external monitoring mechanism that is supported by accounting comparability, managers can convince investors with regard to the value-centric purposes of holding cash (Kim et al. 2020). Our first hypothesis is as follows:

Hypothesis 1.

Accounting comparability is positively associated with cash holdings.

Due to the compulsory application of the same accounting framework within the territory, it is expected that firms should have some level of accounting comparability. Financial statements become more comparable as the same accounting standards and policies are used across multiple points in time, or across entities within the same territory (AccountingTool 2020). Therefore, even if managers choose not to improve information asymmetry and tackle agency cost by providing comparable financial statements, some level of comparability is set up by construction. As a result, we expect only managers that are committed to resolving agency costs/information asymmetry should have the incentive to provide highly comparable financial reports. Due to the expected differences in incentives, the impact of accounting comparability and cash holdings should be different, i.e., there is a non-linear relationship between the two factors.

Previous studies on the link between accounting comparability and cash holdings have not examined whether this link is non-linear, see Habib et al. (2017) and Mehrabanpour et al. (2020). We aim to fill this gap by empirically testing the following hypothesis:

Hypothesis 2.

The impact of accounting comparability on cash holdings is non-linear.

3. Research Methodology

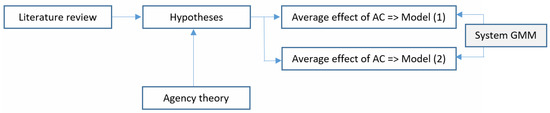

Figure A1 (see Appendix A) outlines the research design in the present study. To test hypothesis H1, the baseline model in this research is as follows:

Cashi,t = β0 + β1Cashi,t−1 + β2Compi,t + β3Sizei,t + β4Levi,t + β5CFOAi,t + β6PTBi,t + β7Abs_AEMJi,t + β8DIVYi,t + Industry dummies + εi,t

To test Hypothesis 2 on the non-linear relationship between the two factors, model (2) is used:

where cash is the dependent variable, measured by cash and cash equivalents divided by net assets (Guizani 2017; Habib et al. 2017). Comp indicates proxies for accounting comparability, and the construction is discussed below. Control variables are included to control for other factors that might affect cash holdings. Larger firms have economies of scale, better diversification, and lower financial constraint, so lower need to hoard cash (Bates et al. 2009; Al-Jajjar and Belghitar 2011; Guizani 2017). Greater investment opportunities require firms to hold more cash to ensure that valuable opportunities are not missed. Furthermore, the cost related to lack of liquidity and financial distress costs are more severe for firms with quality investment opportunities (Williamson 1988; Opler et al. 1999; Guizani 2017). Growth opportunities (PTB) are measured as the ratio of the market value to book value of equity. Cash holdings have been found to be negatively associated with leverage (Al-Jajjar and Belghitar 2011; Ozkan and Ozkan 2004; Guizani 2017). Leverage (Lev) is computed as the ratio of total debt to total assets. DIVY is the dividend yield during the fiscal year and calculated as the ratio of dividend per share to the year-end stock price, and it can be expected that firms that pay dividends tend to have less motivation to hold cash because they are less likely to be risky (Al-Jajjar and Belghitar 2011; Ozkan and Ozkan 2004; Guizani 2017). Cash flow (CFOA) is also accounted for, because firms that have higher operating cash flows, calculated as the ratio of operating cash flow to total assets, may hold more cash (Opler et al. 1999). Consistent with Habib et al. (2017), we control for financial reporting quality (abs_aemj), calculated as the absolute value of performance-adjusted discretionary accruals following modified Jones model (Jones 1991; Dechow et al. 1995). The inclusion of this variable is to control for the possibility that firms that have poor quality reports have more cash (Sun et al. 2012; Habib et al. 2017). Finally, firms of different industries may have different levels of cash due to their intrinsic operating styles. Therefore, industry dummies, following Thomson Reuters classification, are added to control for this potential. Table A1 in Appendix A provides the definition and construction of the variables in the models.

Cashi,t = β0 + β1Cashi,t−1 + β2Compi,t + β3Comp*Compi,t + β4Sizei,t + β5Levi,t + β6CFOAi,t + β7PTBi,t + β8Abs_AEMJi,t + β9DIVYi,t + Industry dummies + εi,t

The current research employs a dynamic model for panel data following studies that document the dynamism in cash holdings (Garcia-Teruel and Martinez-Solano 2008; Drobetz and Gruninger 2007; Guizani 2017). These studies point to the need to control for the dynamism of cash, which results in our use of a dynamic model. A popular estimation strategy for dynamic models is System Generalized Method of Moments, developed by Holtz-Eakin et al. (1988), Arellano and Bond (1991), Arellano and Bover (1995), which is designed to address endogeneity in the dynamic context. Another advantage of System GMM is that it can tackle the endogeneity due to the potential two-way relationship between the dependent and the independent variables. Conventional estimation strategies (OLS, Fixed effects model, and Random effects model) are unable to deal with the endogeneity as efficiently as System GMM (Roodman 2009). Other defects including heteroskedasticity and autocorrelation could also be handled using two-step estimation available for this estimation method (Roodman 2009).

Accounting Comparability Proxies

FASB (2010) defines accounting comparability as the extent of similarity that similar economic transactions are registered. Accounting systems with higher commonality should generate more similar figures upon reflecting the same set of economic transactions. Better comparability helps improve the quality and quantity of information, and lower the cost of collecting and handling of information for performance evaluation and investment selection purposes.

The current research employs the widely-accepted method of De Franco et al. (2011) to empirically gauge accounting comparability of firm i in year t, consistent with several studies in this field (Zhang 2018; Habib et al. 2017; Mehrabanpour et al. 2020; Kim et al. 2020). This method is based on the argument that similar accounting systems should generate similar outputs, e.g., earnings figures, when processing the same inputs, i.e., the same economic transactions/events. De Franco et al. (2011) suggest the use of stock returns and earnings to represent economic events and outputs, respectively. In this setting, earnings figures should be the consequence of mapping economic events to accounting output.

Following De Franco et al. (2011), observations of 16 prior quarters are used to estimate Equation (3). Earnings are the ratio of net income to market value of corporate equity at the beginning of period. Return is the stock return recorded for the respective quarter.

Earningsit = αi + βi*returnit + εit

If firms i and j experience the same events, i.e., same performance in terms of return, earnings of firms i and j are estimated as a function of return as follows:

E(Earnings)iit = αi + βi*returnit

E(Earnings)ijt = αj + βj*returnit

Firm i’s return is used to make sure that the same economic event is considered. Expected earnings of firm i in quarter t using accounting mapping function of firm i to reflect the return of firm i is denoted as E(Earnings)iit. E(Earnings)ijt is the expected earnings for firm j using the accounting mapping function of firm j to reflect the return of firm i in quarter t.

Then, absolute values of differences between the two expected earnings between firm i and firm j’s accounting system are calculated and averaged. After that, we take the negative value of the average value (CompAcct), so that higher values of CompAcct indicate higher accounting comparability of the two firms (De Franco et al. 2011):

In order to build comparability measure for a firm in year t, j values of CompAcctijt for firm i are ranked. CompAcctit is the resulting figure after we aggregate values of CompAcctijt for firm i. Comp4it is the average of the highest CompAcct values for four firms j in year t. CompInd is the median value of CompAcct for all firms in the same industry with firm i in year t. By construction, higher values of CompAcct, Comp4, and CompInd should reflect the firm own more similar accounting mapping functions with its peers (De Franco et al. 2011).

4. Results and Discussion

Research data are collected from Refinitiv Thomson Reuters for all non-financial listed firms in Vietnam from 2010 to 2019. We removed observations that have extreme values, such as negative equity or total debt larger than total assets. The final dataset consists of 3325 observations, covering 496 firms. Table 1 provides the descriptive statistics for the variables in the empirical models.

Table 1.

Descriptive statistics.

CompAcct has the average value of −2.6092, and there is a rather wide variation in this variable (3.457), implying that the sampled firms have varied levels of accounting comparability. With regard to the measure of comparability for firms operating in the same industry, CompInd, the standard deviation (mean value) is much lower (higher) than that of CompAcct, respectively, indicating that firms in the same industry have more comparable financial statements, as opposed to the general firms. Comp4, the measure of comparability from the four best comparable firms, has the lowest standard deviation, and highest mean value (−0.009). These statistics suggest that the measures are properly constructed, since they reflect what it should be in terms of the hierarchy of comparability level.

On average, LEV is 0.2356, indicating that about one quarter of total assets are financed by debt. CFOA has an average value of 6.1 per cent, or cash flow from operations is low compared to the amount of the firm assets. PTB has the value of 0.974, suggesting that the market equity is about the same as book value of equity, or firms in the sample do not have high growth opportunities. The average value of abs_aemj is 0.0965, suggesting that on average firms tend to manage earnings upwards. Finally, divy has the average value of 0.0868, or the dividend yield is about 9%.

Table 2 presents the pairwise correlation coefficients of variables in the model. The coefficients of accounting comparability variables have positive values, implying that comparability has a positive association with cash holdings. Firm size and dividend yield are positively associated with comparability, while firms with more earnings management are not likely to produce more comparable financial reports. Nevertheless, the coefficients in the correlation matrix do not constitute a valid base for statistical inferences; as a result, regression analysis is conducted to give a more robust basis for inferences.

Table 2.

Correlation matrix.

Table 3 presents the estimation results on the link between accounting comparability and cash holdings using System Generalized Method of Moments (System GMM). The coefficients of the lagged cash variable are all significant at 1%, suggesting that the use of dynamic model is proper. The p-values of autocorrelation of order 2 and overidentification tests are lower than 10%, indicating that the set of instruments are valid and the estimation results are reliable (Roodman 2009).

Table 3.

Impact of comparability on cash holdings.

The coefficients of Comparability proxies are all significant at 1% and are positive, providing evidence in support of our hypothesis. For the sample of listed firms in Vietnam, firms with more comparable financial reports tend to hold more cash. This is in line with Kim et al. (2020) which finds that for firms with better comparability, investments are managed properly and cash holdings are not discounted as much as for firms with lower comparability. The evidence here supports the argument that comparable financial reports can serve as extra mechanism that reduce the information collection and processing costs, and facilitate the evaluation of managerial performance.

With better comparability, investors can expect managers of firms with better accounting comparability to be more responsible for the resources managed (Kim et al. 2020) and have weaker motivations to hoard bad news (Kim et al. 2016); thus, cash holdings are not subject to severe agency costs as in the case of firms with lower comparability. This is interesting since in an emerging country such as Vietnam, firms could be subject to high levels of agency cost (Vo 2018) and have inadequate shareholder protection (Kalcheva and Lin 2007). It seems that, in an emerging country setting, the benefit of comparability lies in addressing agency cost associated with cash holdings, rather than tackling information asymmetry as found in Habib et al. (2017) and Mehrabanpour et al. (2020). Additionally, the impact of overall comparability (Compacct) is not as strong as that of accounting comparability of firms in the same industry is in line with our expectation: firms should pay more attention and prepare their financial statements to be comparable with those of firms in the same industry, rather than general firms.

We continue to investigate whether the impact of comparability on cash holdings depends on the level of comparability. As discussed, due to the presence of common accounting standards in Vietnam, there should be some commonality in the financial reports, e.g., the items, the way that managers are permitted to account for a transaction. Consequently, the accounting similarity could occur to some extent even if managers do not wish for it. Table 4 presents the estimation results of non-linear impact of comparability on cash holdings. The coefficients of lagged cash holdings are significant, and the p-values of autocorrelation of order 2 and overidentification test are over 10 per cent, indicating that the results from the estimation are valid and reliable for statistical inferences (Roodman 2009).

Table 4.

Non-linear impact of comparability on cash holdings.

The coefficients of comparability variable are still positive and significant at 1%. Interestingly, the squared comparability variables are significantly positive, suggesting that high levels of comparability tend to enable firms to even hoard more cash without worrying about agency costs. This piece of evidence confirms that the positive link between comparability and cash holdings becomes stronger at high levels of comparability. In other words, when firms choose to produce highly comparable financial reports, this would be a clear signal to the investors about the commitment to tackling agency cost and managerial misuse of corporate resources. This result is original and points to the need of examining the true intention of comparability at the low and high level of comparability, rather than only at average as in Habib et al. (2017) and Mehrabanpour et al. (2020). Furthermore, consistent with the results from Table 3, the impact of overall comparability (Compacct) is not as strong as that of accounting comparability of firms in the same industry (CompInd and Comp4).

We provide a robustness check on the finding that the impact of comparability on cash may differ depending on the level of comparability. If financial statement comparability only acts as an additional governance mechanism when it has high levels, then only at high comparability levels can cash holdings exert a more positive or less negative effect on firm performance. Performance is proxied by return on assets (Gunday et al. 2011; Nguyen et al. 2019, 2020). Table 5 provides the estimation of the impact of cash holdings on firm performance. We split the sample into two sub-samples for each measure of comparability. The benchmark is the median value of each measure of comparability, and a firm is considered to have high levels of comparability if its comparability value is higher than the median of the corresponding comparability measure, and vice versa.

Table 5.

Impact of cash on firm performance of samples based on comparability levels.

The estimates in Table 5 show that cash holdings only have positive and significant coefficients for firms that have high levels of comparability. Meanwhile, the coefficients of cash holdings for firms that have low levels of comparability are all insignificant at 10%. This evidence strongly supports the argument that a modest level of comparability does not necessarily indicate firms’ commitment to tackle information asymmetry and/or contain agency costs. The low level of comparability could merely be the result of the application of the existing accounting framework across firms in the same country. Consequently, only high levels of comparability authentically indicate firms’ true intention to provide comparable and relevant information for investors to evaluate their performance efficiently. Again, the evidence suggests that it is necessary to perform an investigation of the non-linear impact of accounting comparability on cash holdings, which has never been done before, see Habib et al. (2017); Mehrabanpour et al. (2020).

5. Conclusions and Implications

Cash hoarding is an important decision that firms have to make to gain more from the ability to exploit investment opportunities without having to reach for costly external financing, while limiting the opportunity cost of forgoing the returns that could be obtained elsewhere. Accounting comparability can be a critical factor affecting cash holdings, but its impact is quite ambiguous in both theoretical and empirical grounds. Given the importance of accounting comparability and management of cash, it is surprising to find scant empirical evidence on the link between comparability and cash holdings.

The current research extends the literature in a number of ways. Firstly, it investigates the relation between accounting comparability and cash holdings in Vietnam. This country houses an interesting research setting, because the comparability should be low across firms because of the country having not yet adopted IFRS, and agency costs could therefore be pervasive in the economy. Secondly, there have been no studies that differentiate the impact of comparability on cash holdings at high and low levels of comparability, while we believe that only high levels of comparability tend to signal firms’ true commitment to mitigate information asymmetry and agency cost. Finally, we provide evidence to test if the preferable impact of comparability is more pronounced at its high levels.

Using a sample of listed firms in Vietnam from 2011 to 2019, we find that accounting comparability is positively related to cash holdings. This evidence supports the argument that comparable financial statements act as an additional governance mechanism to monitor managers, alleviate agency problems, and allow firms to hold more cash without investors reducing firm value. We also find evidence supporting the argument that only those with high levels of comparability tend to demonstrate their willingness to provide investors with better and relevant information. The findings from this research imply that investors should prioritize firms with high levels of financial statement comparability, because these firms make extra efforts in allowing investors to monitor management in terms of their deployment of corporate resources in an efficient manner. Finally, firms should pay attention to peers, especially those in the same industry, in preparing financial statements.

This study would benefit more if it could expand the sample to conclude other developing countries to see whether the findings can be generalized. In addition, future research can look into whether firms have a trade-off or supplementary relationship between high levels of accounting comparability and other governance mechanisms, i.e., board characters, voting rights, etc.

Author Contributions

Conceptualization, methodology, software validation, formal analysis, data curation, writing—original draft preparation, writing—review and editing: L.T.N.; Conceptualization, formal analysis, data curation, writing—review and editing: K.V.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research is funded by Vietnam National University Ho Chi Minh City, Vietnam (VNU-HCM) under Grant number C2020-34-03.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

Research design.

Table A1.

Variable definition.

Table A1.

Variable definition.

| Variable | Definition |

|---|---|

| Cash | Cash holdings: Cash and cash equivalents to net assets |

| Comp | Accounting comparability: 3 proxies include CompAcct, CompInd and Comp4. The construction of these variables is described in Section 3. |

| Size | Firm size: Logarithm of total assets |

| PTB | Growth opportunities: ratio of market value to book value of equity |

| Lev | Leverage: ratio of total debt to total assets |

| DIVY | Dividend yield: ratio of dividend per share to the year-end stock price |

| CFOA | Cash flow: ratio of operating cash flow to total assets |

| Abs_aemj | Financial reporting quality: absolute value of performance-adjusted discretionary accruals following modified Jones model |

| Industry dummies | Industry characteristics: industry dummies based on Thomson Reuters classification |

References

- AccountingTool. 2020. Comparability Definition. Available online: https://www.accountingtools.com/articles/2017/5/5/comparability (accessed on 1 April 2021).

- Al-Jajjar, Basil, and Yacine Belghitar. 2011. Corporate cash holdings and dividend payments: Evidence from simultaneous analysis. Managerial and Decision Economics 32: 231–41. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Bates, Thomas, Kathleen Kahle, and Rene Stulz. 2009. Why do U.S. firms hold so much more cash than they used to? Journal of Finance 65: 1985–2021. [Google Scholar] [CrossRef]

- Chen, Anthony, and James Jianxin Gong. 2019. Accounting comparability, financial reporting quality, and the pricing of accruals. Advances in Accounting 45: 1–16. [Google Scholar] [CrossRef]

- Chen, Ciao-Wei, Daniel Collins, Todd Kravet, and Richard Mergenthaler. 2018. Financial statement comparability and the efficiency of acquisition decisions. Contemporary Accounting Research 35: 164–202. [Google Scholar] [CrossRef]

- Choi, Jong-Hag, Sunhwa Choi, Linda Myers, and David Ziebart. 2019. Financial statement comparability and the informativeness of stock prices about future earnings. Contemporary Accounting Research 36: 389–417. [Google Scholar] [CrossRef]

- De Franco, Gus, Sagar P. Kothari, and Rodrigo S. Verdi. 2011. The benefits of financial statement comparability. Journal of Accounting Research 49: 895–931. [Google Scholar] [CrossRef]

- Dechow, Patricia, Richard Sloan, and Amy Sweeney. 1995. Detecting earnings management. The Accounting Review 70: 193–225. [Google Scholar]

- Drobetz, Wolfgang, and Matthias Gruninger. 2007. Corporate cash holdings: Evidence from Switzerland. Financial Markets and Portfolio Management 21: 293–324. [Google Scholar] [CrossRef]

- Engelberg, Joseph, Arzu Ozoguz, and Sean Wang. 2016. Know thy neighbor: Industry cluster, information spillover and market efficiency. Journal of Financial and Quantitative Analysis 53: 1937–61. [Google Scholar] [CrossRef]

- Financial Accounting Standards Board (FASB). 2010. Statement of Financial Accounting Concepts No. 8. Conceptual Framework for Financial Reporting. Norwalk: FASB. Available online: http://www.fasb.org/jsp/FASB/Page/PreCodSectionPage&cid=1176156317989 (accessed on 2 January 2021).

- Faulkender, Michael, and Rong Wang. 2006. Corporate financial policy and the value of cash. The Journal of Finance 61: 1957–90. [Google Scholar] [CrossRef]

- Francis, Jere, Shawn Huang, and Inder Khurana. 2015. The role of similar accounting standards in cross-border mergers and acquisitions. Contemporary Accounting Research 33: 1298–330. [Google Scholar] [CrossRef]

- Garcia-Teruel, Pedro J., and Pedro Martinez-Solano. 2008. On the determinants of SME cash holdings: Evidence from Spain. Journal of Business Finance & Accounting 35: 127–49. [Google Scholar]

- Guizani, Muncef. 2017. The financial determinants of corporate cash holdings in an oil rich country: Evidence from Kingdom of Saudi Arabia. Borsa Istanbul Review 17: 133–43. [Google Scholar] [CrossRef]

- Gunday, Gurhan, Gunduz Ulusoy, Kemal Kilic, and Lutfihak Alpkan. 2011. Effects of innovation types on firm performance. International Journal of Production Economics 133: 662–76. [Google Scholar] [CrossRef]

- Habib, Ahsan, Mostafa Monzur Hasan, and Ahmed Al-Hadi. 2017. Financial statement comparability and corporate cash holdings. Journal of Contemporary Accounting & Economics 13: 304–21. [Google Scholar]

- Harford, Jarrad. 1999. Corporate cash reserves and acquisitions. The Journal of Finance 54: 1969–97. [Google Scholar] [CrossRef]

- Holtz-Eakin, Douglas, Whitney Newey, and Harvey Rosen. 1988. Estimating vector autoregressions with panel data. Econometrica 56: 1371–95. [Google Scholar] [CrossRef]

- Huang, Jing-Zhi, and Ming Huang. 2012. How much of the corporate-treasury yield spread is due to credit risk? The Review of Asset Pricing Studies 2: 153–202. [Google Scholar] [CrossRef]

- Jensen, Michael. 1986. Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review 76: 323–29. [Google Scholar]

- Jones, Jennifer. 1991. Earnings Management during Import relief Investigations. Journal of Accounting Research 29: 193–228. [Google Scholar] [CrossRef]

- Kalcheva, Ivalina, and Karl Lins. 2007. International evidence on cash holdings and expected managerial agency problems. Review of Financial Studies 20: 1087–112. [Google Scholar] [CrossRef]

- Kim, Seil, Pepa Kraft, and Stephen Ryan. 2013. Financial statement comparability and credit risk. Review of Accounting Studies 18: 783–823. [Google Scholar] [CrossRef]

- Kim, Jeong-Bon, Leye Li, Louise Yi Lu, and Yangxin Yu. 2016. Financial statement comparability and expected crash risk. Journal of Accounting and Economics 61: 294–312. [Google Scholar] [CrossRef]

- Kim, Jeong-Bon, Leye Li, Louise Yi Lu, and Yangxin Yu. 2020. Financial statement comparability and managers’ use of corprate resources. Accounting & Finance 61: 1697–42. [Google Scholar]

- Kini, Omesh, Shehzad Mian, Michael Rebello, and Anand Venkateswaran. 2009. On the structure of analyst research portfolios and forecast accuracy. Journal of Accounting Research 47: 867–909. [Google Scholar] [CrossRef]

- Leuz, Christian, Dhananjay Nanda, and Peter Wysocki. 2003. Earnings management and investor protection: An international comparison. Journal of Financial Economics 69: 505–27. [Google Scholar] [CrossRef]

- Li, Shaomin, Seung Ho Park, and Rosey Shuji Bao. 2014. How much can we trust the financial report? Earnings management in emerging countries. International Journal of Emerging Markets 9: 33–53. [Google Scholar] [CrossRef]

- Masulis, Ronald, Cong Wang, and Fei Xie. 2009. Agency problems at dual-class companies. The Journal of Finance 64: 1697–727. [Google Scholar] [CrossRef]

- Mehrabanpour, Mohammadreza, Omid Faraji, Reza Sajadpour, and Mohammad Alipour. 2020. Financial statement comparability and cash holdings: The mediating role of disclosure quality and financing constraints. Journal of Financial Reporting and Accounting 18: 1–23. [Google Scholar] [CrossRef]

- Myers, Stewart, and Raghuram G. Rajan. 1998. The paradox of liquidity. The Quarterly Journal of Economics 113: 733–71. [Google Scholar] [CrossRef]

- Nguyen, Thi Canh, Thanh Liem Nguyen, Anh Thu Phung, and Vinh Khuong Nguyen. 2019. The impact of innovation on the firm performance and corporate social responsibility of Vietnamese manufacturing firms. Sustainability 11: 3666. [Google Scholar]

- Nguyen, Vinh Khuong, Thanh Liem Nguyen, Anh Thu Phung, and Hong Thuy Khanh Thai. 2020. Does corporate tax avoidance explain firm performance? Evidence from an emerging economy. Cogent Business & Management 7: 1–17. [Google Scholar]

- Opler, Tim, Lee Pinkowitz, Rene Stulz, and Rohan Williamson. 1999. The determinants and implications of corporate cash holdings. Journal of Financial Economics 52: 3–46. [Google Scholar] [CrossRef]

- Opler, Tim, Lee Pinkowitz, Rene Stulz, and Rohan Williamson. 2001. Corporate cash holdings. Journal of Applied Corporate Finance 14: 55–67. [Google Scholar] [CrossRef]

- Ozkan, Aydin, and Neslihan Ozkan. 2004. Corporate cash holdings: An empirical investigation of UK companies. Journal of Banking and Finance 2: 2103–34. [Google Scholar] [CrossRef]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal 9: 86–136. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert Vishny. 1997. A survey of corporate governance. The Journal of Finance LII: 737–83. [Google Scholar] [CrossRef]

- Sohn, Byungcherl Charlie. 2016. The effect of accounting comparability on the accrual-based and real earnings management. Journal of Accounting Policy 35: 513–39. [Google Scholar] [CrossRef]

- Sun, Qian, Kenneth Yung, and Hamid Rahman. 2012. Earnings quality and corporate cash holdings. Accounting and Finance 52: 543–71. [Google Scholar] [CrossRef]

- Vo, Xuan Vinh. 2018. Foreign ownership and corporate cash holdings in emerging markets. International Review of Finance 18: 297–303. [Google Scholar] [CrossRef]

- Williamson, Oliver. 1988. Corporate finance and corporate governance. Journal of Finance 43: 567–91. [Google Scholar] [CrossRef]

- Zhang, Joseph. 2018. Accounting comparability, audit effort, and audit outcomes. Contemporary Accounting Research 35: 245–76. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).