Abstract

This study examined the factors associated with consumers’ decisions to use payday loans. Using a sample of 24,201 respondents from the 2015 National Financial Capability Study (NFCS), structural equation modeling was used to analyze the relationships among the variables. The results indicated that payday loan use was associated with a series of consumers’ socio-psychological factors, including financial knowledge, perceived credit score, credit-card payment problems, and having emergency funds. The findings suggested that, to improve borrowing decisions and industry practices, discussions about consumers’ payday loan use and its underlying repayment problems should encompass policy intervention and institutional attention, rather than focusing on behavioral modification at the individual level alone.

Keywords:

payday loan; financial knowledge; National Financial Capability Study; structural equation modeling JEL Classification:

D12; D14

1. Introduction

Many average consumers feel overwhelmed and have limited understanding of the way the modern financial system works, including investments, mortgages, insurance, and various loan types, although they engage in financial market transactions daily. Some economists argued that the highly complex financial market structure and processes, in which numerous daily transactions occur without decision-makers clearly understanding their transactions’ exact consequences, cause this limited understanding (e.g., Atkinson and Morelli 2011; Cardaci 2018; Chang 2014; Madrick 2014; Stiglitz 2012). Those economists insisted that the financial market system evolved to increase profit and is now an interdependent and complex system in which individual consumers’ participation and roles are fairly limited. As the consumer financial market becomes more complex, many consumers are unable to keep abreast of the changes, and often are identified as at-risk because of their limited ability to make sound financial decisions, attributable to their lack of financial knowledge or adequate financial information (Stiglitz 2012). In fact, studies indicated that Americans’ financial literacy is low. The Financial Industry Regulatory Authority (2018) found that over half of Americans have low levels of financial knowledge, and Lusardi and Tufano (2015) found that only one-third understand compounding interest or the way in which credit cards work, measured as their debt literacy level.

Failure to have adequate financial knowledge (e.g., the way interest works in the system of consumer credit) prevents consumers from making sound credit decisions (e.g., higher fees and using high-cost borrowing: Lusardi and Tufano 2015), which makes them vulnerable to debt repayment obligations when they are unprepared for unexpected financial emergencies. For example, the sub-prime mortgage crisis in 2008 showed the way that increasing consumer debts had adverse effects on the lives of average consumers who were not prepared adequately for such emergencies. With the increasing need for consumer credit after the financial crisis (Lusardi and Mitchell 2014), borrowers with poor financial knowledge and no emergency preparedness experienced greater financial distress because of debt repayment problems and were more likely to make suboptimal credit decisions.

The situation is even worse among financially vulnerable consumers who often are excluded from mainstream financial institutions because of their poor financial profiles and ability. Accordingly, many are prone to rely on alternative financial services (AFS), such as payday lenders, to meet their financial needs (Bradley et al. 2009). Studies warned of the hidden risks of using payday loans, which are small, short-term, high-interest-rate loans given to those who can provide evidence of income that must be repaid by the borrower’s next payday (Bhutta et al. 2015; Gallmeyer and Roberts 2009; Morse 2011). Payday loans were found to be a representative example of predatory lending services that impose unfair and abusive loan terms on borrowers (National Consumer Law Center 2013). Fees and interest payments can be astronomical if borrowers cannot pay the debt on time, and payday borrowers, thus, fall into a vicious cycle of debt. The Consumer Financial Protection Bureau (2013) reported that 75% of payday loan users were paying off the original debt over 10 years, such that most of them failed to repay their debts in the short time required.

Many extant studies found that payday loans’ primary borrowers are financially vulnerable, in that they are less educated, more credit-constrained, and have low income and limited access to liquidity from mainstream financial service providers (Brobeck 2008; Collins and Gjertson 2013; Lawrence and Elliehausen 2008). Predatory lending options are one of the few available readily to these consumers in the financial market system. Considering that risk and return are related inversely, major banks and credit companies play a passive role in lending money to such consumers because of their poor credit worthiness to avoid the risk of not receiving their money back. In contrast, payday lenders fill this niche by offering loans to those with poor credit scores and charging high interest and fees.

Individual level factors, such as financial knowledge, are associated with payday loan use. For example, education about personal finance can be beneficial to both K-12 and college students (Beck and Garris 2019), and levels of financial literacy are related to market transactions in high-cost manners (Lusardi and Scheresberg 2013; Lusardi and Tufano 2015). Non-individual level factors, such as institutional factors, also can affect consumers’ decisions to use payday loans. For example, imperfect information about one’s credit score between consumers and financial institutions was identified as a source that leads to suboptimal financial transactions (Levinger et al. 2011; Stiglitz and Weiss 1981). Although multiple pieces of information are collected to construct one’s credit score, consumers may not have a sufficient understanding of, and information about, the way the score is formulated and the way it affects their other financial decisions. Those with poor credit scores can encounter greater difficulty accessing their credit information and using mainstream financial services and should invest more time and energy to improve their scores (Buckland and Dong 2008). Because they do not consider the existing credit market practices and characteristics that affect consumer transactions, discussions about payday loan use attribute the social cost to consumers alone (e.g., individuals’ irresponsibility).

This study’s purpose was to extend the discussion about payday loans by answering the research questions and suggesting a need for a broader and balanced perspective to improve consumers’ wellbeing with respect to consumption choice when they have limited autonomy to exercise (Ozanne et al. 2015). Although the consumer issue of payday loan use is interrelated with the way the credit market works, the purpose of this study was not to underestimate the importance of individuals’ responsible financial management. Rather, this study focused on the potential interactions between factors that reflect social perceptions and practices, and suggests that a combination of both individual and institutional efforts is necessary to improve consumer wellbeing. Discussions about payday loan use can encompass the potential interactions with and within market systems that shape consumers’ perceptions and behavior about the credit market and their own credit. Although there should be idiosyncratic responses to the systems according to each consumer’s individual circumstances, the government and private sector regulatory systems (e.g., the Financial Industry Regulatory Authority) can scrutinize certain areas of financial decisions and behaviors better (e.g., payday loan use) to reshape transactions that result in many undesirable social problems.

To shed light on the discussions about a more balanced approach to consumer payday loan use, this study investigated the factors associated with consumers’ use of these loans using a nationally representative dataset (i.e., the 2015 National Financial Capability Study). Specifically, the study focused on the effect of the following factors and their potential interrelations with payday loan use: financial knowledge and consumer credit-related characteristics, such as perceived credit score, credit-card payment problems, and having emergency funds. The following research questions also were formulated and answered: (1) What factors are related to consumers’ financial decisions regarding payday loan services? (2) What factors mediate the relation with payday loan use? and (3) What are the relationships among consumer credit-related factors, such as perceived credit score, credit-card problems, and emergency funds? The study is structured as follows: the next section provides a literature review about the study’s important concepts (i.e., financial knowledge, perceived credit score, credit-card payment problems, and emergency funds). Section 3 addresses the methodology, which explains the data and analytic model used in this study, and Section 4 and Section 5 present the study’s results, discussion, and implications.

2. Literature Review

2.1. Payday Loan Use

Consumers who do not qualify for financial services that mainstream financial institutions offer or who are unaware of the availability of certain products for which they are looking (e.g., small loans) rely on alternative financial services (AFS), such as payday lenders, for their financial transactions. AFS operate outside federally insured banks and thrifts (Bradley et al. 2009). Payday loans are costly because, typically, payday lenders charge an annualized percentage rate (APR) between 260 and 1040 percent for a one-to-two-week loan (Bhutta et al. 2015).

Studies identified those who have limited eligibility for mainstream services attributable to their lack of credit worthiness and other indicators (e.g., income, net worth, debt) as the socially and financially excluded, consistent with the concept of exclusion (Fernández-Olit et al. 2018; Simpson and Buckland 2009). Simpson and Buckland (2009) described both the unbanked and the underbanked as a major group of the financially excluded, which often is associated with their lack of financial knowledge, as well as their imperfect information about the highly complex financial market system (Stiglitz and Weiss 1981). In particular, in the credit market, a numerical consumer credit score is an example of imperfect information about one’s exact credit worthiness between consumers and evaluators of their credit score. Multiple objective indicators available in the credit markets can be collected to construct one’s credit score; however, it is notable that consumers have limited access to information on the way the score is formulated and the way it affects their financial decisions. Those with poor credit scores can encounter greater difficulty accessing their credit information and using mainstream financial services (Buckland and Dong 2008). In summary, imperfect information is associated with credit constraint, which leads to financial exclusion in the financial market.

Based on studies of financial exclusion, patrons of payday loan services were identified as financially vulnerable groups with respect to low financial status and serious credit constraints that often result in very limited access to liquidity from mainstream lenders. Studies found that payday loan users are neither well prepared for emergencies nor able to take out loans from mainstream institutions easily (Bhutta et al. 2015; Lawrence and Elliehausen 2008). According to Bhutta et al. (2015), compared to the general population, payday loan applicants had lower income, were more credit-constrained (e.g., lower credit scores, lower cumulative credit-card limit, no credit left on credit cards), and had limited financial transactions with mainstream financial services (e.g., limited open credit accounts). Payday borrowers also rarely had well-established emergency savings (Chase et al. 2011; Collins and Gjertson 2013) and were persistently short of cash on hand; thus, they considered payday loans as a last resort.

It is clear that payday loans provide immediate credit access to those who have limited or no affiliation with mainstream financial institutions, which allows borrowers to cope with unexpected, irregular expenses that might lead to undesirable disruptions in their finances, including bounced checks, late fees, utility suspensions, repossessions, foreclosures, evictions, and bankruptcies (Morse 2011). However, many still doubt that payday loans are beneficial for the financially distressed and vulnerable by noting that they often fall into a cycle of perpetual debt. Previous studies of payday loans found mixed results on the financial and welfare consequences of payday loan borrowers.

Some studies found that payday loans have positive effects on borrowers’ welfare, in that they increase the availability of consumer credit access upon which they may rely for smooth consumption. Morse (2011) examined whether access to payday loans reduced or increased the effects of distress after a natural disaster in California. She found that although a natural disaster caused an increase both in foreclosures and small property crime (larceny, vehicle theft, burglary) overall, communities with payday lenders experienced far fewer foreclosures and crime than did those without access to such lenders. She suggested that, in times of financial distress attributable to special circumstances, such as a natural disaster, payday lending can increase the welfare of households that might face foreclosures or resort to small property crime by allowing them to smooth financial shocks better. Zinman (2010) conducted a survey that compared Oregon, where payday credit is banned, and Washington, with no binding restrictions, to examine the effects on borrowers’ lives overall of restricting access to payday loans. He found that the policy change reduced payday borrowing in Oregon, but more respondents there were likely to experience a negative effect on their financial conditions, in that they tended to bounce more checks and to be unemployed, and had negative subjective assessments about their recent or future financial situations overall.

However, the majority of studies found that payday loans have negative effects on borrowers’ welfare. Carrell and Zinman (2014) discovered that payday loan access reduced job performance overall. Their results were consistent with the United States (US) Department of Defense’s hypothesized mechanism of payday loans and work performance, in which payday borrowing increased financial stress and compromised military job performance. Melzer (2011) analyzed the effects of credit access to payday loans among low-income households and focused on geographic differences in such loans’ availability. Using the National Survey of America’s Families, he found that payday loan access made it difficult for borrowers to pay their mortgages or rents and utilities, and led them to postpone necessary healthcare (e.g., medical and dental care, medication purchases) after differential loan access by location and state regulations was controlled. Skiba and Tobacman (2008) and Skiba and Tobacman (2011) also found that payday loans had adverse effects on borrowers’ welfare in the long run and emphasized the role of related regulatory policies. Their findings showed that, within two years of application, payday loan access doubled chapter 13 personal bankruptcy filings for first-time applicants in the 20th percentile of the credit score distribution. Furthermore, minorities, women, and homeowners who obtained credit from payday lenders were more likely to file for bankruptcy.

Although the prevalence and risk of greater distress the vulnerable suffer in using AFS based on the concept of financial exclusion, this does not imply necessarily that microfinance and payday loans can be used interchangeably in this study. The term microfinance often is confined to describe unique economic and social structures intended to alleviate poverty. Microfinance refers to a unique financial system, the goal of which is poverty relief and sustainability support for borrowers in certain parts of the world (studied primarily in India, Bangladesh, Sri Lanka, Indonesia, and Bolivia, e.g., Brau and Woller 2004; Morduch 1999; Sriram and Kumar 2007). Microfinance and payday loans both serve those who are excluded from the mainstream banking sector. However, micro-financial institutions lend money to borrowers to offer financial support, generate self-employment, and support microenterprises’ growth to promote financial self-sufficiency (Morduch 1999; Quayes 2012), while payday lenders do not have such social commitments. In addition, microfinance and payday loans have significantly different repayment systems and default risks.

2.2. Financial Knowledge

Studies demonstrated that improved knowledge results in better financial outcomes or, at least, is related closely to positive financial behaviors in cash-flow management, retirement saving, investment, and credit management (Tang et al. 2015). Thus, they found that financial knowledge is a crucial factor that determined credit scores and was linked ultimately to all of consumers’ other financial management decisions, including payday loan use.

With respect to credit management, Hilgert et al. (2003) found a positive association between credit knowledge and management behavior. Using data from the Survey of Consumer Finances (SCF), they created a credit management index from a series of credit management practices, and then divided the index into low, medium, and high levels. Their results showed that households with a good knowledge of credit were likely to have a high credit management index. Similarly, Allgood and Walstad (2016) found that individuals with greater financial knowledge were less likely to engage in problematic credit-card use behavior, shopped for better loans, and exhibited better mortgage/loan payment behavior.

Robb and Woodyard (2011) analyzed objective financial knowledge, satisfaction, self-assessed financial confidence (subjective knowledge), and demographic characteristics’ effects on positive financial practices, including emergency funds, credit reports, absence of overdrafts, credit-card payoff, retirement accounts, and risk management. The results showed that objective financial knowledge is an important factor that explains positive financial practices, but this alone is not a leading factor in better financial behavior, as other factors perceived subjectively, such as perceived level of financial confidence and satisfaction, also were related positively to sound financial practices.

On the other hand, poor financial knowledge is likely to result in poor financial practices. Using a sample of United Kingdom (UK) households, Disney and Gathergood (2013) investigated the way consumers’ understanding of basic financial calculations affected their consumer credit portfolio. The results demonstrated that respondents who borrowed on consumer credit exhibited poorer financial knowledge than those who did not. Moreover, borrowers with less financial knowledge tended to hold high-cost debts, such as payday loans. The researchers discovered that respondents with poor financial knowledge were aware that they did not understand finances, which caused them to be less confident in financial practices. Consequently, these people were less likely to engage in better financial behaviors that might improve their situations. With respect to payday loan users, Rhine and Robbins (2012) indicated the importance of relevant financial knowledge in determining the choice of AFS. According to their study, approximately 20% of households that obtained credit either from payday lenders or pawn shops did not know that banks also offer small, unsecured personal loans (e.g., less than $2500). Although a certain number of payday borrowers may not qualify for these loans, the gap between the small-dollar loan availability consumers perceived and the banks offered provided empirical evidence of the need to improve financial knowledge and access to timely information about financial products and services.

A recent trend in operationalizing financial knowledge is to employ both objective (i.e., test scores) and subjective measures (i.e., self-assessments). Subjective measures reflect people’s financial confidence. Although the imbalance between perceived and actual financial knowledge may cause the over-confidence issue, a growing body of research investigated subjective knowledge’s role, as individuals’ confidence in their financial knowledge helps them engage in more prudent financial practices (Allgood and Walstad 2016; Robb and Woodyard 2011).

2.3. Perceived Credit Score

A credit score is a number that reflects a consumer’s credit history (National Consumer Law Center 2013), and is used to help lenders predict borrowers’ future ability to repay a loan using their past repayment history, credit exposure or use, and tolerance of additional exposure (Makuch 2001). Consequently, lenders make decisions whether to lend money or how much to charge based on the borrower’s credit score. Thus, a higher credit score helps consumers obtain mortgages, loans, credit cards, and insurance policies with better terms (National Consumer Law Center 2013). The credit scoring system is complex and differs by credit bureau; however, FICO credit scores are the most popular and range from 350 to 850 (National Consumer Law Center 2013). When calculating credit scores, FICO considers the borrower’s payment history, amounts owed on credit accounts, length of credit history, opening new credit, and types of credit (National Consumer Law Center 2013). Therefore, it is crucial for consumers to engage in good credit management practices to improve their credit scores or avoid damaging them, which affects even non-financial aspects of their lives in the future.

There is no critical criterion that indicates a credit score is good or bad. However, 750 or above generally is considered very good (National Consumer Law Center 2013); in contrast, patrons of payday loan services have significantly lower credit scores than the general population average. Over their 10 years of observations, Bhutta et al. (2015) found that payday borrowers’ average and median credit scores (below 520) were lower than those of the general population (680 and 703, respectively) although the public’s access to consumer credit score data was fairly restricted.

Studies indicated that consumers’ access to their actual credit score is somewhat limited (Levinger et al. 2011), although consumer protection acts, such as the Truth in Lending Act, the Fair and Accurate Credit Transactions Act, and the Credit Card Accountability Responsibility and Disclosure Act, were enacted to protect consumers by informing them about their credit profiles (Canner and Elliehausen 2013). O’Neil and Xiao (2014) stated that, although consumers can obtain a free annual credit report from the Fair and Accurate Credit Transactions Act, many consumers still are not well aware of this and miss the opportunity to review their credit use and engage in wiser credit behavior. Therefore, surveying credit scores that depend on consumers’ self-assessments can be used as a proxy to measure credit scores and consumers’ confidence.

Courchane et al. (2008) attempted to bridge the gap between perceived and actual credit scores. They matched self-assessed credit scores measured according to five categories (i.e., very bad, bad, average, good, very good) with the actual FICO scores, and found that consumers estimated their credit scores inaccurately; some overestimated and some underestimated. Consumers tended to have better financial outcomes when they perceived that their credit was better, while consumers who underestimated their credit scores were likely to experience less desirable financial outcomes (i.e., paying excessively high interest rates). This indicates that the perceived, rather than actual credit score, plays a significant role in consumers’ financial behavior. Levinger et al. (2011) conducted a similar study that examined consumers’ biased self-assessments and their consequences. According to the results, many respondents underestimated their creditworthiness, which discouraged them from applying for credit even when they were qualified to do so, leading them to perceive that their constraints were much greater when negotiating with lenders and resulted in sub-optimal decisions (e.g., using payday loans/pawnshops).

As these previous studies revealed, consumers behave in financially desirable ways (i.e., avoiding payday loan use and problematic credit-card use) when their perception of their credit score is high. At the very least, consumers may try to maintain or achieve a good credit score by avoiding undesirable credit behaviors (e.g., repayment practices, dependence on AFS) or by securing emergency savings to avoid unwanted credit. Researchers emphasized financial knowledge’s importance in helping consumers assess their credit score more accurately and educating them about ways to improve their scores (Courchane et al. 2008; Levinger et al. 2011).

2.4. Credit-Card Payment Problems

A credit card not only is a convenient method of payment based on one’s credit worthiness (Schooley and Worden 2010), but it also provides a margin to many who do not have sufficient precautionary savings when they encounter unexpected financial emergencies (Bhutta et al. 2015). As household credit-card debt and delinquency increased rapidly in recent years (Federal Reserve Bank of New York 2018), responsible credit-card use received more attention in society (Barba and Pivetti 2009; Schooley and Worden 2010), and studies provided empirical evidence of the crucial need for responsible credit payment behaviors. Stavins (2000) showed that, although the national economy is healthy and per capita income increased, credit-card payment problems, including delinquencies and default rates, nonetheless increased over time. Both Telyukova (2013) and Telyukova and Wright (2008) indicated that some households carry significant levels of credit-card debt even when they have liquid assets in their bank accounts to pay off the debt and discussed this “credit-card debt puzzle” by addressing more responsible and informed debt management. For example, according to Telyukova (2013), 84% of households with revolving credit-card debt had some low-return liquid assets that could be used to pay off the debt, meaning that they carry the debt and pay a revolving charge rather than using a sizeable amount of money they have in the bank. Studies also underscored the adverse effects of credit-card mismanagement on credit-card users’ long-term financial health and other areas of their lives (Barba and Pivetti 2009; Hodson et al. 2014).

With respect to payday loans and credit-card consumers, studies discussed the credit that consumers have available through credit cards as an alternative financing option. Bhutta et al. (2015) pointed out that payday loan applicants lack available liquidity available on their credit cards. Furthermore, 60% of payday loan applicants had a credit card, but their cumulative credit limit on average was only approximately $3000, while their average outstanding balance was approximately $2900. In addition, payday borrowers had fewer open credit accounts, on half of which they were delinquent by at least 30 days, and tended to apply for new credit accounts much more frequently than did the general population. Lawrence and Elliehausen (2008) also found that payday borrowers had a greater need for liquidity because of limited credit available on their credit cards. Additionally, 73% of payday borrowers were denied loans or believed that they might be turned down in the past five years, which was three times that of denials and limitations for the general population. Many payday borrowers did not have bank credit cards or already reached their maximum credit limit, implying that they borrowed heavily against their limits. Payday borrowers with at least one credit card had fewer bank credit-card accounts, but were more likely to have payment problems, and approximately 75% of them did not pay their credit-card balances in full. Payday loan borrowers also were found to use such loans more frequently than did the general population.

Although unused credit limits on credit cards can be seen as precautionary assets, some studies attributed consumers’ choice of payday loans over credit cards to emotional reluctance to use credit cards up to their limits as a form of precautionary assets, which was related to their fear that they lacked the discipline to manage additional debt on credit cards (Katona 1975), or emotional resistance to use them beyond a self-enforced target level of the credit limit (Castronova and Hagstrom 2004; Gross and Souleles 2000). In fact, 60.8% of payday borrowers with credit cards indicated that they refrained from using a credit card in the past year because they were worried that they would exceed their credit limit (Lawrence and Elliehausen 2008). Similarly, Agarwal et al. (2009) found that payday borrowers typically experienced a substantial decrease in credit-card liquidity, but still had unused credit available on their credit cards at the time they took out payday loans, although they had a lower credit limit and lower income than the general population. They indicated that payday borrowers’ failure to use their credit available can be seen as a significant financial mistake because, ultimately, they pay costly, annualized interest rates of at least several hundred percent on short term loans.

Studies also highlighted financial knowledge’s role in improving responsible credit-card payment practices through financial education that can inform consumers of the adverse consequences that result from the hidden costs of easy credit and the importance of saving for emergencies (Norvilitis et al. 2006; Telyukova and Wright 2008).

2.5. Emergency Funds

An emergency fund is defined as “…continency savings (that) act as a form of insurance against unexpected, irregular, and unpredictable expenses” (Collins and Gjertson 2013, p. 12). Unexpected expenditures added to regular expenses may lead to financial deficiencies in cash flow. Timely access to additional liquid financial resources is important to avoid experiencing material hardships, such as reduced food budgets, housing insecurity, loss of utilities, or inability to access healthcare (Collins and Gjertson 2013). Thus, whether or not a person has an adequate emergency fund is used often to evaluate his/her level of personal financial wellbeing (Joo and Grable 2006). Generally, savings equivalent to at least three months of living expenses is recommended (Joo and Grable 2006) so that a household can sustain itself for at least that time without any income inflow.

In general, researchers found that age, education, ethnicity, marital and employment status, income, and financial knowledge are associated significantly with having an emergency fund. For example, older households and those employed full-time, as well as those with higher income, greater wealth, higher education, and greater financial knowledge, were more likely to hold emergency funds, while minority households and those with lower incomes and levels of education were less likely to have emergency savings (e.g., Babiarz and Robb 2014; Brobeck 2008; Joo and Grable 2006). Given that emergency funds provide a cushion against financial shocks, low-income households that lack adequate financial resources are the most vulnerable population in the event of financial emergencies. Most low-income households not only scarcely have anything left over after spending on basic living necessities, but, as stated above, also are less likely to obtain credit from mainstream financial institutions because of credit constraints (Collins and Gjertson 2013). According to Chase et al. (2011), among families that experienced an income drop in the past 12 months, only 20% of low-income families (under $15,000) reported that they had three months of emergency funds, while 75% of the highest income group ($75,000 or more) did.

In cases in which people accumulate fewer financial resources for emergencies, one of the strategies that consumers can take to finance unexpected expenses is to use high-cost loans, such as payday loans or pawnshops (Chase et al. 2011). Collins and Gjertson (2013) showed that non-savers were twice as likely as were emergency savers to use payday loans and pawnshops in response to unexpected expenses. Lusardi et al. (2011) focused on the ability to cope with a financial shock or unexpected emergency by raising $2000 in a month. 55% of their respondents indicated that they would use multiple coping strategies, including savings (61%), family or friends (34%), mainstream credit (30%), increased work (23%), sale of possessions (19%), and alternative credit sources (11%), while approximately 28% reported that they could not raise $2000 in a month by any means available. Lawrence and Elliehausen (2008) found that nearly all payday borrowers have consumer debts to repay, but have limited financial alternatives available to them; only 38% of them used other options, such as depository institutions or finance companies. A large proportion of payday borrowers had no bank credit, although nearly all of them had a bank checking account. Concurrently, findings about the size of most payday loans, which ranged from $100 to $300, also supported their vulnerability to financial emergencies because of their very limited liquid assets.

2.6. Theoretical Background

There were discussions about the need for changes in consumers’ perceptions from a static and rational existence to one that is context-reflexive and responsive to surroundings (Baker et al. 2005). The transformative consumer research (TCR) approach encompasses discussions that are framed by social problems or opportunities and that contribute to consumers’ wellbeing in reference to their consumption’s effects under given conditions (Davis et al. 2016; Mick 2006; Ozanne et al. 2015). From the perspective of the TCR, which a group of researchers from the Association of Consumer Research introduced, it is not easy to describe consumers with only a few characteristics without understanding the potential of other interactions in the market where their consumption takes place (Mick et al. 2012).

Before the TCR, consumers were considered to be homogeneous in the market and were analyzed according to a certain number of static features, including demographic and economic status (e.g., income level, age, gender, race, education, etc.). However, the TCR highlighted that consumer behavior requires a better understanding of potential interactions with, and dynamics in, their environments, in addition to their static characteristics measured typically with observed features. For example, two consumers from the same demographic cohort (e.g., same age, ethnic background, and initial salary) will not necessarily have the same level of achievement (e.g., wealth) in the long term because personal features’ idiosyncratic dynamics (e.g., perception, knowledge, and preparedness for the future), as well as social environments (e.g., social capital) over their lifetime, result in different outputs. The TCR incorporates other assumptions generally not discussed in mainstream consumer theories, and provides more empirical evidence that raises a question about the assumptions that consumer behaviors often can be hypothesized and tested linearly.

The TCR integrates multi-dimensional characteristics of consumption or financial decision making to understand consumers’ financial vulnerability and their potential suboptimal choices. Baker et al. (2005) argued that consumers’ vulnerability cannot be explained completely by their past or current situation without considering their response to their surroundings (e.g., low income, long-term chronic disease, and living in hazardous rural areas), but by a more holistic approach that includes their different personal/social contexts and possible interactions (e.g., psychological cognition of strategies, educational environments, and preparedness for the future). For example, an understanding of a consumer’s current status includes potential interactive triggers that can influence their vulnerability or the converse (Mick et al. 2012). Consumer decisions and behaviors, including even a decision to patronize a payday lending service, are understood as a result of idiosyncratic factors’ interactive dynamics that describe a decision-maker’s current situation (including community or group effects) and construct specific ways of responding to the environment (e.g., using a payday lender is not considered a problem).

The TCR’s core concepts have close ties to the ecological systemic theory (EST). According to the EST, environmental systems’—macro- and micro-environmental, family, and personal systems—multilayered nature influences consumers’ decisions and behavior (Deacon and Firebaugh 1988). In each environmental system, different degrees and types of relationships with their surroundings influence individuals, and their interactions differ depending upon their roles and each system’s acceptable norms. Similar to the TCR’s explanation, the EST argues that consumers can be transformed by the way they manage resources in these multilayered environmental systems. To manage the resources within each system, consumers must undergo processes that require certain strategies of using, transforming, or allocating the resources available to them in a system (i.e., input, throughput, output, and feedback). Each system has boundaries, roles, and rules that range from who uses resources to the way to use resources to achieve goals and maintain the system. The entire process works systematically and current management decisions and their outputs affect the next process and interact with another new decision about resource management.

Based on the TCR approach and the EST, we explored the influential factors related to payday loan use and assumed that the following factors in multiple systems that include unobserved characteristics would be associated with consumer choice in credit market: financial knowledge and consumer credit-related characteristics (i.e., perceived credit score, credit-card payment problems, and holding emergency funds). We hypothesized not only the effect of each individual factor’s role on a decision to use payday loans, but also their potential relationships with each other and with the loan (i.e., the mediating role). Specifically, among those factors, financial knowledge and perceived credit score were the initial resources (i.e., inputs) in managing consumers’ behavior and decision making. Credit-card payment problems and the existence of emergency funds were the consequent status (i.e., throughput), and the use of payday loans was the final result (i.e., output).

3. Methodology

3.1. Data

We used the 2015 State-by-State Survey of the National Financial Capability Study (NFCS) data released by the Financial Industry Regulatory Authority (FINRA) Investor Education Foundation. The NFCS includes nationwide data for over 25,000 Americans who live throughout the US, and the data are collected every three years (e.g., 2009, 2012, and 2015). Our analytic sample included 24,201 of 27,564 total survey respondents after excluding 3363 who did not reply to the questions necessary for the study. As the NFCS recommended, this study used a sampling weight for the analysis to represent the US population (National Financial Capability Study 2018).

3.2. Measurements

The dependent variable was payday loan use, measured with the question, “In the past 5 years, how many times have you taken out a short term ‘payday’ loan?” Respondents were given five options (1 = never, 2 = one time, 3 = two times, 4 = three times, 5 = over four times), and the answer was coded as a continuous variable.

The independent variables were financial knowledge and characteristics related to consumer credit. Financial knowledge was measured as a latent variable using two items, subjective and objective financial knowledge. Subjective financial knowledge was measured with one question coded as a continuous variable: “On a scale from 1 to 7, where 1 means very low and 7 means very high, how would you assess your overall financial knowledge?” Objective financial knowledge was measured by a six-question quiz in which each multiple-choice question had one correct answer. Therefore, respondents might answer all six questions incorrectly, correctly, or some questions correctly. The results indicated that objective financial knowledge ranged from 0 (i.e., no correct answers = least financial knowledge) to 6 (i.e., all correct answers = greatest financial knowledge) and was coded as a continuous variable. To incorporate both subjective and objective financial knowledge, financial knowledge was constructed as a latent variable.

Consumer credit-related characteristics were (1) perceived credit score; (2) credit-card problems, and (3) emergency funds. Firstly, perceived credit score was measured with the question, “How would you rate your current credit record?” Respondents were given five choices (1 = very bad, 5 = very good). Credit-card problems were measured with five binary questions: (1) I always paid my credit cards in full; (2) in some months, I carried over a balance and was charged interest; (3) in some months, I paid the minimum payment only; (4) in some months, I was charged a late fee for late payment; and (5) in some months, I was charged an over the limit fee for exceeding my credit. All questions were answered with 1 = yes, or 0 = no. Except for the first question, all of the others asked about poor credit-card payment practices; thus, the first question was reverse-coded and the sum of all answers was used to measure the degree of credit-card problems (0 = no credit-card problem, 5 = greatest credit-card problem). Thus, credit-card problems were measured as a continuous variable that ranged from 0 to 5. Emergency funds were measured as a dichotomous variable with the question, “Have you set aside emergency or rainy-day funds that would cover your expenses for three months, in case of sickness, job loss, economic downturn, or other emergencies?” Respondents could answer 1 = yes, or 0 = no.

3.3. Analytic Model

Based on the research questions that assumed inter- and intra-relations between and among variables, in addition to each variable’s effect on payday loan use, this study employed structural equation modeling (SEM) for the main analysis. SEM is known as a statistical tool that identifies influential and mediating paths among behavioral factors (Buhi et al. 2008; Hoyle 1994), and is recommended to evaluate explanatory relations among variables in the social sciences (Kline 2011). In addition, SEM reduces measurement error by using observed items to create a latent variable that is not measured directly, but is inferred from variables that are (Hancock 2003).

In this study, SEM was used to evaluate the association and mediation relationships among the factors (i.e., subjective and objective financial knowledge, perceived credit score, and credit-card problems) on payday loan use. In particular, financial knowledge was constructed as a latent variable using two observed variables, subjective and objective financial knowledge, measured on different scales. One was measured by asking one question answered on a scale of seven, and the other was measured by summing the answers to six binary questions. If a simple sum of the answers to the two items is used to construct a single financial knowledge variable, it may cause a measurement error derived from each of the measurement methods’ inherent variability and the potential bias between them before quantifying each score. However, SEM can produce standardized values based on a correlation (or covariance) matrix among the items observed to avoid such potential measurement error. Stata v. 15.1 was used in the analysis.

3.4. Research Hypotheses

For the analytic models based on the study’s objective, the following hypotheses were proposed and tested in this study:

Hypothesis 1a (H1a).

Financial knowledge and consumer credit-related factors are related to consumers’ financial decision to use a payday loan service;

Hypothesis 2a (H2a).

Financial knowledge consists of both subjective and objective financial knowledge.

Hypothesis 3a (H3a).

Consumer credit-related factors, such as perceived credit score, credit-card problems, and emergency funds, mediate the relationship with payday loan use;

Hypothesis 4a (H4a).

Consumer credit-related factors, such as perceived credit score, credit-card problems, and emergency funds, are associated with each other.

4. Results

4.1. Descriptive Statistics

Table 1 shows our analytic sample’s demographic characteristics (n = 24,201). Over half (61%) were in the intermediate income range ($25,000 to $99,999), and approximately 57% were married. The sample was skewed slightly in favor of females (55%). With respect to job status, 47% of the respondents were employed, and approximately 84% had an average education from high school to any level of college. The respondents’ age was distributed relatively evenly.

Table 1.

Sample characteristics.

Table 1 shows that 51% of the respondents had emergency funds sufficient to survive three months without additional income, which implies that the other half are exposed to financial risk if they lose an income source. Furthermore, 89% of respondents did not use payday loans, while approximately 11% previously used a payday loan at least once. Thus, one in 10 consumers previously used a payday loan. This descriptive information adds to the meaning of the study, in that it shows that some of these consumers faced the risks associated with a payday loan.

The mean of subjective financial knowledge was 5.30 (SD = 1.16). Considering that 1 is the lowest and 7 is the highest level, people generally believed that they had a greater level of financial knowledge. However, for objective financial knowledge, as measured with six questions, respondents scored 3.46, which was significantly lower than the subjective financial knowledge score (t = 144.84, p < 0.001). Respondents showed a tendency to have comparatively higher subjective than objective financial knowledge. The respondents perceived that they had a relatively higher credit score than average (mean (M) = 3.95, SD = 1.21), and reported that they had few credit-card payment problems (M = 1.19, SD = 1.46).

4.2. Model Fit of SEM

The SEM employed for the main analysis in the study used the pseudo-likelihood rather than the maximum-likelihood estimation and, thus, a computing algorithm was not used to determine the general model fit indices (i.e., root-mean-square error of approximation, goodness-of-fit index, and comparative fit index: Kline 2011). The pseudo-likelihood estimation uses two goodness-of-fit measures instead, the standardized root-mean-squared residual (SRMR), which was 0.006, and the coefficient of determination (CD), which was 0.555. Generally, the model fit is acceptable when the SRMR is less than 0.08 (Hu and Bentler 1999). The CD measures the amount of variation, which is R2 in the SEM. The CD showed that the model in the study was significantly meaningful and unique.

4.3. SEM Results

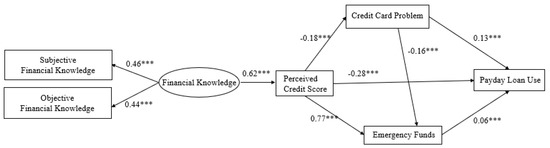

Figure 1 shows that all associations within the seven research hypotheses proposed in the model were significant at p < 0.001. Firstly, financial knowledge was associated positively with perceived credit score (b = 0.62, p < 0.001). Secondly, the perceived credit score was related negatively to credit-card problems (b = −0.18, p < 0.001) and payday loan use (b = −0.28, p < 0.001), but positively to emergency funds (b = 0.77, p < 0.001). Thirdly, credit-card problems were associated negatively with emergency funds (b = −0.16, p < 0.001), but positively with payday loan use (b = 0.13, p < 0.001). Finally, emergency funds were related positively to payday loan use (b = 0.06, p < 0.001).

Figure 1.

Structural equation model of relationship between financial knowledge, perceived credit score, credit-card problems, emergency funds, and payday loan use, with observed coefficients. * p < 0.05; ** p < 0.01; *** p < 0.001.

The direct effects of factors related to payday loan use are presented in the upper part of Table 2. The two input factors (i.e., financial knowledge and perceived credit score) had a consequent association with a coefficient of 0.62 (p < 0.001). Perceived credit score as an input factor had a significant direct effect on throughput factors (i.e., credit-card problems and having emergency funds) with coefficients of −0.18 (p < 0.001) and 0.77 (p < 0.001), respectively. The perceived credit score had both direct and indirect effects on payday loan use with coefficients of −0.28 (direct, p < 0.001), −0.02 (indirect through credit-card problems, p < 0.001), and 0.05 (indirect through the existence of emergency funds, p < 0.001). Two throughput factors (i.e., credit-card problems and holding emergency funds) were associated significantly with a coefficient of −0.16 (p < 0.001). Credit-card problems and having emergency funds as throughput factors had direct effects on the output with coefficients of 0.13 (p < 0.001) and 0.06 (p < 0.001), respectively.

Table 2.

Structural equation model (SEM) results of factors related to payday loan usage: direct, indirect, and total effects.

The lower part of Table 2 shows the variables’ indirect effects. Specifically, the perceived credit score had a significant indirect association with payday loan use. When there was a mediating effect of credit-card problems, the perceived credit score was associated negatively (b* = −0.02, p < 0.001) with payday loan use, while it had a positive association (b* = 0.05, p < 0.001) when there was a mediating effect of emergency funds. Credit-card problems were associated negatively (b* = −0.01, p < 0.001) with payday loan use when there was a mediating effect of emergency funds. All of the direct and indirect effects and the research hypotheses’ associations were significant at p < 0.001.

5. Discussion and Implications

5.1. Discussion

This study approached payday loan use from a holistic perspective that included personal and social contexts, and found that decisions to use payday loans were related to a series of the following factors: financial knowledge and consumer credit-related characteristics (i.e., perceived credit score, credit-card payment problems, and presence of emergency funds). This study assumed that financial knowledge and the perceived credit score would serve as the initial resources, while credit-card payment problems and having emergency funds would play the role of throughput factors in the relationship based on the TCR approach and the EST. The major findings of note are discussed below.

Firstly, the results indicated that objective and subjective financial knowledge were associated significantly with the latent variable of financial knowledge. This indicates that financial knowledge measured both objectively and subjectively served as adequate indicators of financial knowledge when used in combination. The findings highlight individuals’ characteristics that shape their holistic levels of financial knowledge. Despite each type of financial knowledge’s equal directional effects on the composite variable of financial knowledge, each type’s different levels may imply the way financial knowledge is constructed at the individual level. Such knowledge is acquired through diverse sources, including not only education, but also direct and indirect experience (Cynamon and Fazzari 2012; Frank 1997; Schor 1999). Frank et al. (2014) noted that people with a financially vulnerable status tend to have relatively lower criteria for the social norms with which they evaluate themselves or their decisions. These social norms can be formulated through interactions with, or expectations from, their surroundings (e.g., community) where certain criteria not necessarily desirable outside their community are acceptable and even prevail, or the converse. In this sense, to measure the financial knowledge variable, subjective financial knowledge should be considered together with consumers’ objective level of understanding of financial principles and concepts, which provides a more holistic understanding of financial knowledge’s role in consumers’ financial decisions, such as payday loan use.

Secondly, this study found a positive association between two input factors, financial knowledge and perceived credit scores, in that those with a greater level of financial knowledge tended to have higher perceived credit scores. This appears to be a reasonable result, given that previous studies found that financial knowledge is an important determinant of better financial outcomes and positive financial behaviors, particularly in consumer debt (Hilgert et al. 2003; Robb and Woodyard 2011). With respect to the process through which consumers make decisions, they do so according to their bounded knowledge (Bazeman and Moore 2012). In particular, individuals’ perceived credit score can result to some extent from the interaction with their social surroundings (e.g., community effect), making them believe and behave in a certain way that may make them feel that it is acceptable to carry more debt or use payday loan lending services because it is the norm in their communities (Cynamon and Fazzari 2012).

Some argued that the high debt-to-income ratio among financially vulnerable consumers in the US is the natural result of the complex financial system, in which consumers cannot exert control over their decisions fully (Stiglitz 2012; Stockhammer 2015). Vulnerable groups’ borrowing choices may reflect less autonomy and more dependence in the current financial market system. Although payday lenders are one of the most easily accessible AFS for many Americans’ immediate financial needs, patrons of their services still are financially vulnerable consumers (Lin et al. 2016). In fact, payday loan businesses are located largely in areas in which financially vulnerable people live, or at least borrowers’ proximity to more payday lenders increases their access to AFS (Melzer 2011; Skiba and Tobacman 2011). Under the unequal market structure and predatory lending practices, consumers’ limited capability (i.e., financial knowledge, inaccurate perceptions and behavior) can exacerbate debt borrowing decisions rapidly; however, the limited capability itself is not the issue’s sole cause. Our findings suggested that payday loan use should receive more attention from policy-makers and the industry that extends beyond individual consumer responsibility. Thus, more academic and policy attention must be given to vulnerable consumers’ social structural limitations in addition to improving their financial knowledge.

Thirdly, input factors’ effects on payday loan use differed depending on the mediators. As shown in Table 2, the perceived credit score had mixed effects on payday loan use. When there was a mediating effect of credit-card problems, the perceived credit score was associated negatively with payday loan use. Thus, those who assessed their credit score fairly positively were less involved in negative credit-card payment practices and payday loan use. However, the perceived credit score was associated positively with payday loan use when there was a mediating effect of emergency funds. Consumers may over- or underestimate their credit scores; however, the positive relationship between the perceived credit score and the other financial decisions in this study was consistent with previous findings that emphasized that more accurate perceived credit leads to better financial outcomes (Courchane et al. 2008).

Typically, payday borrowers are constrained financially because of their serious and persistent weak credit histories. Many payday borrowers experience substantial decreases in credit-card availability, low credit limits, and repayment problems (Agarwal et al. 2009) before they use payday loans. For example, approximately 80% of payday applicants had no available credit on their credit cards and 90% had less than $300 of credit available at approximately the time they applied initially for a payday loan (Bhutta et al. 2015). Bhutta et al. (2015) also found that their average credit scores (below 520) were significantly lower than those of the general population (680). For these consumers, credit scores may serve to some extent as an inherent characteristic of their financial profiles, which subjects them to others’ unilateral judgments. Melzer (2011) indicated that credit scores do not improve even after successful repayment of payday loans or borrowers’ efforts to pay off such loans, while, in contrast, their payday loan default history affects their credit scores adversely.

Our finding on the relationship between emergency funds and payday loans is somewhat inconsistent with previous research (e.g., Chase et al. 2011; Collins and Gjertson 2013; Lawrence and Elliehausen 2008), in that we found that those with a three-month emergency fund were more likely to use payday loans. This puzzling relationship may be understood as the aforementioned financial mistake that may be associated with individuals’ emotional reluctance to use liquidity or other types of credit (e.g., credit cards) they have available (Castronova and Hagstrom 2004; Gross and Souleles 2000). It is argued that underusing credit available and resorting instead to payday loans is a significant financial mistake because people end up paying costly interest and fees on payday loans (Agarwal et al. 2009). Studies indicated that many households hold consumer debt and liquid assets at the same time as a method of consumption and saving because they consider liquid assets precautionary savings in case they cannot use credit cards (e.g., Telyukova 2013; Telyukova and Wright 2008). Our findings may reflect the greater value that consumers place on peace of mind attributable to having liquidity on hand and making costly credit decisions, which also can impose external repayment discipline at the same time, which may not always be optimal for consumer wellbeing.

5.2. Implications for Consumers’ Wellbeing

The principal issue in payday loans is related to consumers’ misconceptions about them (Pew Research 2013; Stegman 2001). A payday loan often is considered a small loan available in a consumer’s local community through a simple lending process that can provide some level of immediate cash. However, when borrowers examine the way a payday loan actually works, and the catastrophic consequences it can have with respect to debt repayment, they will be astonished and regret their decision. Although there were discussions in public policy about payday loans, including (1) abusive charges, (2) promotion of a vicious cycle of debt, (3) tendency to target vulnerable consumer groups (e.g., military, poor, and minorities), and (4) irresponsible and unethical lending practices (Stoianovici and Maloney 2008), the discussions were not simple and fruitful, given that payday lenders currently are licensed legally to conduct business in many states, and some consumers who cannot access the mainstream banking industry have no other option than a payday loan.

In addition, existing regulations on consumer credit may contribute to the issue of payday patrons. Credit restrictions or rejection of credit applications because of poor credit history, low income, large amounts of debt, and expenses were enacted (e.g., the Equal Credit Opportunity Act) and enforced by federal agencies (e.g., the Federal Trade Commission). Under this law, all federally insured banks and thrifts should follow the regulations and, thus, those with poor credit histories are excluded from them in principle and resort instead to payday lenders. Credit policies and payday loan issues are two sides of the same coin, and this is an issue that cannot be resolved simply by controlling the payday loan businesses or improving consumers’ financial literacy.

Despite the future challenges of payday loan issues, alternative policy methods, such as developing/funding diverse financial education programs, should receive more attention from researchers, educators, and policy-makers to resolve payday loan issues. A greater level of knowledge in economics and finance is related to consumers’ enhanced financial wellbeing (e.g., Brobeck 2008; Norvilitis et al. 2006; Telyukova and Wright 2008). Some existing consumer financial education programs that various organizations offer (e.g., National Endowment for Financial Education, Cooperative Extension System, and National Foundation for Consumer Credit) cover many areas: (1) improving unbanked consumers’ financial management skills; (2) changing their saving behavior, and (3) intervening in their asset-building behavior, all of which proved such measures’ success and importance (Vitt et al. 2000).

However, previous financial education programs also had some limitations. As we found in this study, borrowers’ financial management skills alone do not delimit payday loan use behavior. Specifically, objective financial knowledge was not the sole factor in the next stages, as subjective financial knowledge also influenced them. This may reflect the need for financial education programs designed to help consumers develop and assess subjective financial knowledge adequately. Financial programs should (1) measure the gap between objective and subjective financial knowledge, (2) find the reasons for the gap, and (3) seek ways to fill it. This implies as well that financial programs should teach and assess the way program attendees evaluate and perceive their own credit scores.

Although the consumer issue of payday loan use is intertwined with market systems in which individuals have limited autonomy to participate, this study’s findings do not demean the importance of individuals’ responsible financial management. Rather, it can be suggested that a balance between individual and institutional effort is important to improve consumer wellbeing. For example, although consumer protection legislation was enacted to help consumers make informed decisions about their credit (Canner and Elliehausen 2013), many are unaware of ways they can access their credit profile, such as the free annual credit report that is available from the Fair and Accurate Credit Transactions Act (O’Neil and Xiao 2014). Well-informed consumers are more likely to use credit responsibly (Canner and Elliehausen 2013; Robb 2011) and, therefore, it is important to guarantee consumers consistent and wider opportunities to be informed timely of complex credit practices and legislation.

6. Conclusions

Payday loans are now one of the most easily accessible AFS with which many Americans meet their immediate financial needs (Lin et al. 2016). Responsible borrowing and repayment decisions at the individual level are emphasized. However, policy-makers and the industry should give more attention to payday loan use, as it can cause serious damage in users’ financial lives. This study investigated payday loan use more comprehensively by considering both personal and social contexts (i.e., financial knowledge, perceived credit score, credit-card payment problems, and existence of emergency funds). The findings suggested that decisions to use payday loans were related to a series of factors that can be improved by efforts from both consumers and the market. Accordingly, further discussions and research on payday loans should incorporate the government and private sector regulatory systems’ roles and effects to improve payday loan decisions and consumer financial capability.

This study had several limitations. Firstly, we used a one-dimensional measure of the financial knowledge variable. Researchers measured financial knowledge in various ways, and this study considered only one of its multiple facets. Future studies should examine financial knowledge operationalized multidimensionally by enhancing the one-dimensional measure. Secondly, this study used cross-sectional data, which cannot identify causal relations. Future research that uses a longitudinal dataset or experimental studies can determine the causal relationship between financial knowledge and payday loan use, as well as mediating variables’ roles. Thirdly, because of data limitations, we used perceived rather than actual credit scores. Consumers may not have reviewed their own credit scores, as studies showed that access to their actual credit score is limited (Levinger et al. 2011). However, self-reported, perceived credit scores potentially can be biased or less accurate than the actual credit score, as the survey respondents may tend to answer in a socially desirable way. According to Fisher (1993), the social desirability bias can occur in self-report methods and may distort respondents’ answers if questions are related to social norms or beliefs rather than internalized values, such that they may reflect “what is more desired or preferred in the society”. Respondents might have known their credit scores, but felt embarrassed to report them accurately and chose to overestimate the scores instead. Although studies found that inaccuracy in self-reported creditworthiness was not critically detrimental (Courchane et al. 2008), and many consumers are not well aware of the way to check their creditworthiness (O’Neil and Xiao 2014), surveying credit scores according to consumers’ self-assessments risks social desirability bias. Thus, future studies should use diverse credit score measurements to avoid this issue.

Author Contributions

Study design: J.M.L.; Conceptualization: J.M.L.; Methodology design: W.H.; Analysis: W.H., Writing: J.M.L., N.P., W.H.; Review: J.M.L., N.P., W.H.; Revision: J.M.L., N.P., W.H.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Agarwal, Sumit, Paige Marta Skiba, and Jeremy Tobacman. 2009. Payday Loans and Credit Cards: New Liquidity and Credit Scoring Puzzles? American Economic Review 99: 412–17. [Google Scholar] [CrossRef]

- Allgood, Sam, and William B. Walstad. 2016. The Effects of Perceived and Actual Financial Literacy on Financial Behaviors. Economic Inquiry 54: 675–97. [Google Scholar] [CrossRef]

- Atkinson, Anthony B., and Salvatore Morelli. 2011. Economic Crisis and Inequality. Human Development Research Paper 5: 112–15. [Google Scholar]

- Babiarz, Patryk, and Cliff Robb. 2014. Financial Literacy and Emergency Saving. Journal of Family and Economic Issues 35: 40–50. [Google Scholar]

- Baker, Stacey Menzel, James W. Gentry, and Terri L. Rittenburg. 2005. Building Understanding of the Domain of Consumer Vulnerability. Journal of Macromarketing 25: 128–39. [Google Scholar] [CrossRef]

- Barba, Aldo, and Massimo Pivetti. 2009. Rising Household Debt: Its Causes and Macroeconomic Implications—A Long-period Analysis. Cambridge Journal of Economics 33: 113–37. [Google Scholar] [CrossRef]

- Bazeman, Max H., and Don A. Moore. 2012. Judgement in Managerial Decision Making. New York: Wiley. [Google Scholar]

- Beck, Joshua J., and Richard P. Garris. 2019. Managing Personal Finance Literacy in the United States: A Case Study. Education Sciences 9: 129. [Google Scholar] [CrossRef]

- Bhutta, Neil, Paige Skiba, and Jeremy Tobacman. 2015. Payday Loan Choices and Consequences. Journal of Money, Credit and Banking 47: 223–60. [Google Scholar] [CrossRef]

- Bradley, Christine, Susan Burhouse, Heather Gratton, and Rae-Ann Miller. 2009. Alternative Financial Services: A Primer. FDIC Quarterly 3: 39–47. [Google Scholar]

- Brau, James C., and Gary M. Woller. 2004. Microfinance: A comprehensive review of the existing literature. The Journal of Entrepreneurial Finance 9: 1–28. [Google Scholar]

- Brobeck, Stephen. 2008. Understanding the Emergency Savings Needs of Low-and Moderate-Income Households: A Survey-Based Analysis of Impacts, Causes, and Remedies. Washington, DC: Consumer Federation of America, pp. 1–20. [Google Scholar]

- Buckland, Jerry, and Xiao-Yuan Dong. 2008. Banking on the Margin in Canada. Economic Development Quarterly 22: 252–63. [Google Scholar] [CrossRef]

- Buhi, Eric R., Patricia Goodson, and Torsten B. Neilands. 2008. Out of Sight, Not Out of Mind: Strategies for Handling Missing Data. American Journal of Health Behavior 32: 83–92. [Google Scholar] [CrossRef]

- Canner, Glenn B., and Gregory E. Elliehausen. 2013. Consumer Experiences with Credit Cards. Federal Reserve Bulletin 99: 1–36. [Google Scholar]

- Cardaci, Alberto. 2018. Inequality, Household Debt and Financial Instability: An Agent-based Perspective. Journal of Economic Behavior & Organization 149: 434–58. [Google Scholar]

- Carrell, Scott, and Jonathan Zinman. 2014. In Harm’s Way? Payday Loan and Military Personnel Performance. The Review of Financial Studies 27: 2805–840. [Google Scholar] [CrossRef]

- Castronova, Edward, and Paul Hagstrom. 2004. The Demand for Credit Cards: Evidence from the Survey of Consumer Finances. Economic Inquiry 42: 304–18. [Google Scholar] [CrossRef]

- Chang, Ha-Joon. 2014. Economics: The User’s Guide. New York: Bloomsbury Press. [Google Scholar]

- Chase, Stephanie, Leah Gjertson, and J. Michael Collins. 2011. Coming Up with Cash in a Pinch: Emergency Savings and Its Alternatives. CFS Issue Brief. Madison: University of Wisconsin-Madison. [Google Scholar]

- Collins, J. Michael, and Leah Gjertson. 2013. Emergency Savings for Low-income Consumers. Focus 30: 12–17. [Google Scholar]

- Consumer Financial Protection Bureau. 2013. Payday Loans and Deposit Advance Products. A White Paper of Initial Data Findings; Washington, DC: Consumer Financial Protection Bureau. Available online: https://files.consumerfinance.gov/f/201304_cfpb_payday-dap-whitepaper.pdf (accessed on 15 October 2018).

- Courchane, Marsha, Adam Gailey, and Peter Zorn. 2008. Consumer Credit Literacy: What Price Perception? Journal of Economics and Business 60: 125–38. [Google Scholar] [CrossRef]

- Cynamon, Barry Z., and Steven M. Fazzari. 2012. The End of the Consumer Age. In After the Great Recession: The Struggle for Economy Recovery and Growth. Edited by Barry Z. Cynamon and Steven M. Fazzari. New York: Cambridge University Press, pp. 129–57. [Google Scholar]

- Davis, Brennan, Julie L. Ozanne, and Ronald Paul Hill. 2016. The transformative consumer research movement. Journal of Public Policy & Marketing 35: 159–69. [Google Scholar]

- Deacon, Ruth E., and Francille M. Firebaugh. 1988. Family Resource Management: Principles and Applications, 2nd ed.Boston: Allyn and Bacon. [Google Scholar]

- Disney, Richard, and John Gathergood. 2013. Financial Literacy and Consumer Credit Portfolios. Journal of Banking & Finance 37: 2246–54. [Google Scholar]

- Federal Reserve Bank of New York. 2018. Quarterly Report on Household Debt and Credit. New York: Federal Reserve Bank of New York. Available online: https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2017Q4.pdf (accessed on 1 May 2018).

- Fernández-Olit, Beatriz, Juan Diego Paredes-Gázquez, and Marta de la Cuesta-González. 2018. Are Social and Financial Exclusion Two Sides of the Same Coin? An Analysis of the Financial Integration of Vulnerable People. Social Indicators Research 135: 245–68. [Google Scholar] [CrossRef]

- Financial Industry Regulatory Authority. 2018. Can You Ace This Quiz? Test Your Financial Literacy? Available online: http://www.finra.org/investors/highlights/can-you-ace-quiz-test-your-financial-literacy (accessed on 20 September 2018).

- Fisher, Robert J. 1993. Social Desirability Bias and the Validity of Indirect Questioning. Journal of Consumer Research 20: 303–15. [Google Scholar] [CrossRef]

- Frank, Robert H. 1997. The Frame of Reference as a Public Good. The Economic Journal 107: 1832–847. [Google Scholar] [CrossRef]

- Frank, Robert H., Adam S. Levine, and Oege Dijk. 2014. Expenditure Cascades. Review of Behavioral Economics 1: 55–73. [Google Scholar] [CrossRef]

- Gallmeyer, Alice, and Wade T. Roberts. 2009. Payday Lenders and Economically Distressed Communities: A Spatial Analysis of Financial Predation. The Social Science Journal 46: 521–38. [Google Scholar] [CrossRef]

- Gross, David B., and Nicholas Souleles. 2000. Consumer Response to Changes in Credit Supply: Evidence from Credit Card Data. The Wharton Financial Institutions Center Working Paper No. 00-040B. Philadelphia, PA, USA: University of Pennsylvania. Available online: https://pdfs.semanticscholar.org/23bb/b41e39c4c49e570d6ef5c96991b416669dee.pdf (accessed on 18 October 2018).

- Hancock, Gregory R. 2003. Fortune Cookies, Measurement Error, and Experimental Design. Journal of Modern Applied Statistical Method 2: 293–305. [Google Scholar] [CrossRef]

- Hilgert, Marianne A., Jeanne M. Hogarth, and Sondra G. Beverly. 2003. Household Financial Management: The Connection between Knowledge and Behavior. Federal Reserve Bulletin 89: 309–22. [Google Scholar]

- Hodson, Randy, Rachel E. Dwyer, and Lisa A. Neilson. 2014. Credit Card Blues: The Middle Class and the Hidden Costs of Easy Credit. The Sociological Quarterly 55: 315–40. [Google Scholar] [CrossRef]

- Hoyle, Rick H. 1994. Introduction to the Special Section: Structural Equation Modeling in Clinical Research. Journal of Counseling and Clinical Psychology 62: 427–28. [Google Scholar] [CrossRef]

- Hu, Li-Tze, and Peter M. Bentler. 1999. Cutoff Criteria for Fit Indexes in Covariance Structure Analysis: Conventional Criteria versus New Alternatives. Structural Equation Modeling 6: 1–55. [Google Scholar] [CrossRef]

- Joo, So-Hyun, and John E. Grable. 2006. Using Predicted Perceived Emergency Fund Adequacy to Segment Prospective Financial Consulting Clients. Financial Services Review 15: 297–313. [Google Scholar]

- Katona, George. 1975. Psychological Economics. New York: Elsevier Scientific Publishing Company. [Google Scholar]

- Kline, Rex B. 2011. Principles and Practices of Structural Equation Modeling. New York: The Guildford Press. [Google Scholar]

- Lawrence, Edward C., and Gregory Elliehausen. 2008. A Comparative Analysis of Payday Loan Customers. Contemporary Economic Policy 26: 299–316. [Google Scholar] [CrossRef]

- Levinger, Benjamin, Marques Benton, and Stephan Meier. 2011. The Cost of Not Knowing the Score: Self-estimated Credit Scores and Financial Outcomes. Journal of Family and Economic Issues 32: 566–85. [Google Scholar] [CrossRef]

- Lin, Judy T., Christopher Bumcrot, Tippy Ulicny, Annamaria Lusardi, Gary Mottola, Christine Kieffer, and Gerri Walsh. 2016. Financial Capability in the United States 2016. Washington, DC: FINRA Investor Education Foundation. Available online: http://www.usfinancialcapability.org/downloads/NFCS_2015_Report_Natl_Findings.pdf (accessed on 10 January 2019).

- Lusardi, Annamaria, and Olivia S. Mitchell. 2014. The Economic Importance of Financial Literacy. Journal of Economic Literature 52: 5–44. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Carlo de Bassa Scheresberg. 2013. Financial Literacy and High-Cost Borrowing in the United States. No. w18969. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Lusardi, Annamaria, and Peter Tufano. 2015. Debt Literacy, Financial Experiences, and Overindebtedness. Journal of Pension Economics & Finance 14: 332–68. [Google Scholar]

- Lusardi, Annamaria, Daniel J. Schneider, and Peter Tufano. 2011. Financially Fragile Households: Evidence and Implications (No. w17072). Cambridge: National Bureau of Economic Research. Available online: http://www.nber.org/papers/w17072 (accessed on 31 March 2019).

- Madrick, Jeffrey G. 2014. SevenBbad Ideas: How Mainstream Economists Have Damaged America and the World. New York: Vintage. [Google Scholar]

- Makuch, William M. 2001. Chapter 1: Scoring Applications. In Handbook of Credit Scoring. Edited by Elizabeth Mays. Chicago: The Glenlake Publishing Company, pp. 3–21. [Google Scholar]

- Melzer, Brian T. 2011. The Real Costs of Credit Access: Evidence from the Payday Lending Market. The Quarterly Journal of Economics 126: 517–55. [Google Scholar] [CrossRef]

- Mick, David G. 2006. Meaning and mattering through transformative consumer research. Advances in Consumer Research 33: 1–4. [Google Scholar]

- Mick, David G., Simone Pettigrew, Cornelia Pechmann, and Julie L. Ozanne. 2012. Transformative Consumer Research for Personal and Collective Well-Being. New York: Taylor & Francis. [Google Scholar]

- Morse, Adair. 2011. Payday Lenders: Heroes or Villains? Journal of Financial Economics 102: 28–44. [Google Scholar] [CrossRef]

- Morduch, Jonathan. 1999. The Microfinance Promise. Journal of Economic Literature 37: 1569–614. Journal of Economic Literature 37: 1569–614. [Google Scholar] [CrossRef]

- National Consumer Law Center. 2013. The National Consumer Law Center Guide to Surviving Debt. Boston: National Consumer Law Center. [Google Scholar]

- National Financial Capability Study. 2018. About the National Financial Capability Study. Washington, DC: Financial Industry Regulatory Authority. Available online: http://www.usfinancialcapability.org/about.php (accessed on 15 October 2018).

- Norvilitis, Jill M., Michelle M. Merwin, Timothy M. Osberg, Patricia V. Roehling, Paul Young, and Michele M. Kamas. 2006. Personality Factors, Money Attitudes, Financial Knowledge, and Credit-Card Debt in College Students. Journal of Applied Social Psychology 36: 1395–413. [Google Scholar] [CrossRef]

- O’Neil, Barbara, and Jing Jian Xiao. 2014. Post-recession, Post-legislation Credit Use: Insights from an Online Survey. Journal of Personal Finance 13: 65–76. [Google Scholar]

- Quayes, Shakil. 2012. Depth of Outreach and Financial Sustainability of Microfinance Institutions. Applied Economics 44: 3421–33. [Google Scholar] [CrossRef]

- Ozanne, Julie L., David G. Mick, Cornelia Pechmann, and Simone Pettigrew. 2015. Transformative consumer research. Wiley Encyclopedia of Management 9: 1–4. [Google Scholar]