1. Introduction

Commodity producers typically grow one crop per year. Brazil, however, has become an exception in the corn market due to its ability to harvest two crops per year. The first one (“summer crop”) is planted in September–December and harvested in January–April. It is concentrated in the south and south-east and generally used to meet domestic demand for feed. The second crop (“winter crop”) is planted in January–March and harvested in May–August. It is mostly concentrated in the center-west and primarily used to supply the international market.

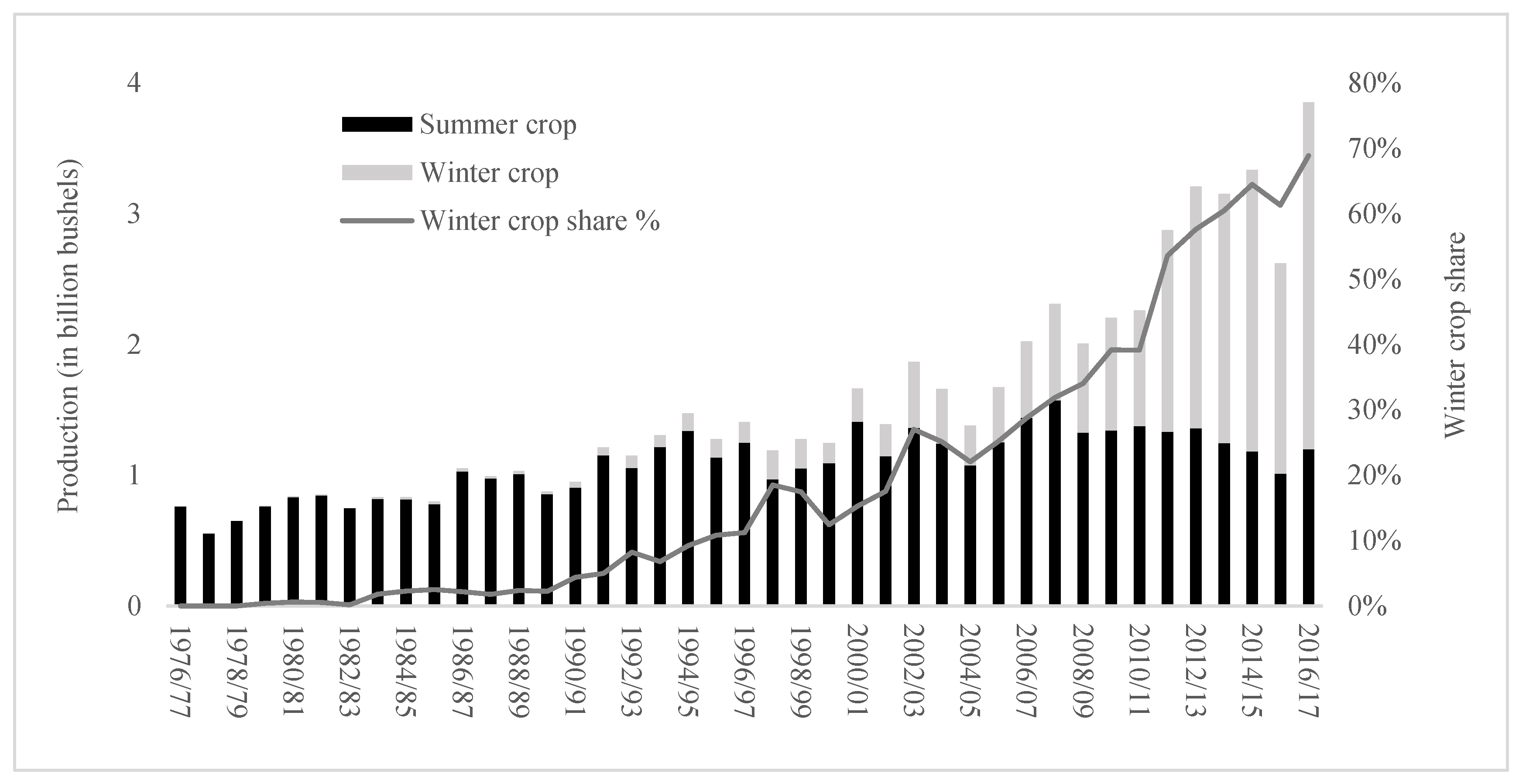

The winter crop was introduced in the 1980s in the south and initially accounted for a minor portion of annual corn production in Brazil. During the 1990s, the winter crop amounted to approximately 100 million bushels (about 10% of annual production). More recently, in the 2000s, grain producers in the fast-growing Brazilian center-west started to invest in the winter crop, which grew to 2.6 billion bushels in 2017 (70% of annual production).

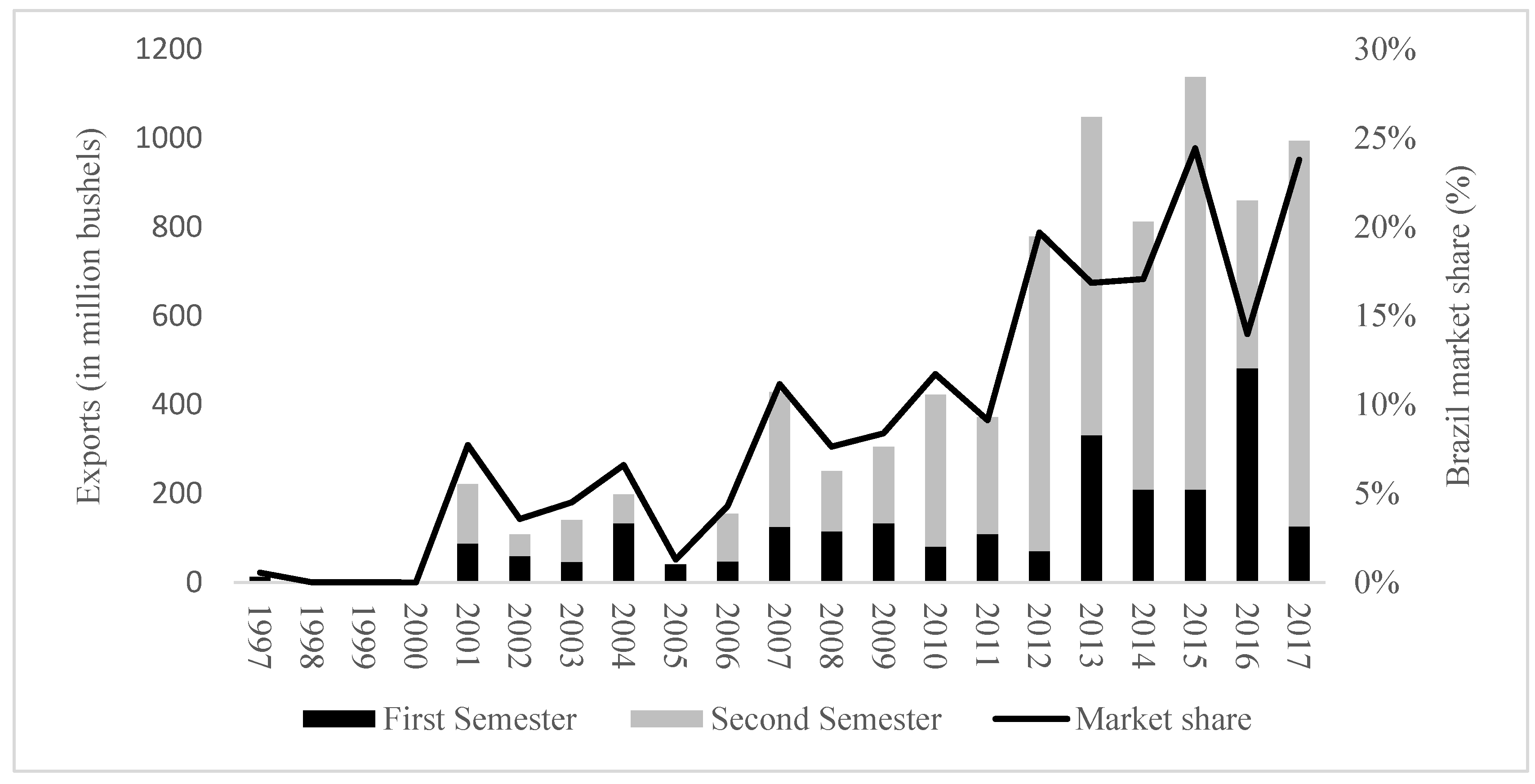

The expansion of the winter crop in Brazil was followed by three events. First, there was a shift in the supply and demand balance throughout the year. New crop used to come to the market only in the first half of the year, but then it started coming to the market during the whole year (and especially in the second half of the year). Another effect was the increasing participation of Brazil in the international market. During 2011–2017, annual exports exceeded 900 million bushels (close to 20% of world exports), compared to about zero in the 1990s. Finally, a higher demand for marketing and risk-management tools has been occurring in the Brazilian corn market. The growth in corn production and the increasing number of producers and merchandisers operating in Brazil enhanced the importance of hedging for market participants. As a consequence, trading volume in the Brazilian corn futures and options markets reached around 1 million contracts in 2017, compared to an annual average of 25,000 contracts in the early 2000s.

Despite these changes in the last 10–15 years, no study has comprehensively explored how these factors have affected corn price dynamics. The objective of this paper is to analyze the impact of Brazilian winter crop growth on market integration, i.e., the dynamics between domestic Brazilian prices and international prices, as well as spot and futures prices in Brazil. Based on previous studies suggesting that increasing activity of buyers and sellers in both spot and futures markets creates a more suitable environment for the development of stable connections between spot and futures prices, it is hypothesized that the expansion of the winter crop in Brazil has strengthened the connection between the Brazilian domestic market and the international market, along with the connection between spot and futures prices domestically.

Using econometric time-series methods, results confirmed the hypothesis, showing the development of a long-run relationship between Brazilian and U.S. prices with the expansion of the winter crop and growth in Brazilian exports, and also a more dominant role of the futures market in the relationship between spot and futures prices domestically, particularly after 2010. These findings are important because the existence of a long-run relationship between these prices facilitates price discovery and risk management in those markets. Therefore, growing corn production in Brazil and the consequent increase in corn trading may have contributed to the development or strengthening of the relationship between spot and futures prices, which would create better opportunities for risk management for market participants in Brazil.

This study will provide a comprehensive analysis of how growth in the Brazilian winter crop has impacted corn price dynamics. Results should offer useful insights for marketing, risk-management and trading strategies adopted by producers, processors and merchandisers operating in Brazil. In addition, findings might also be relevant for market players in the U.S., Europe and Asia, since Brazilian corn has become increasingly present in international trade. Finally, the results can provide interesting points for academic discussion regarding how changes in market structure affect price dynamics and hence the marketing and risk-management strategies adopted by their participants.

2. Brazilian Corn Market: Characteristics and Evolution

Figure 1 shows the increase in Brazilian corn production from 840 million bushels in 1980/81 to 3.8 billion bushels in 2016/17 (average annual growth of around 4%). While the planted area rose from 30 million acres to 43 million acres, productivity increased from 28 to 88 bushels/acre. This is explained by the strong growth of the winter corn crop associated with technological advances. From nearly zero participation in the early 1980s, the winter crop now accounts for 70% of total production (2.6 billion bushels) and planted area (30 million acres) in Brazil.

The growth of Brazilian corn production has occurred especially in the center-west area (

Table 1). While in the 1980s this area accounted for 14% of Brazilian corn production, this share increased to around 44% in 2010–2017. In addition, approximately 90% of center-west corn production comes from the winter crop. The expansion of winter corn crop in the Brazilian center-west is associated with productivity growth and the increase in planted area. Winter crop productivity has increased from 15 and 29 bushels/acre in the 1980s and 1990s, respectively, to 80 bushels/acre between 2010/11 and 2016/17, exceeding the level of summer crop productivity. The winter crop-planted area in the center-west had reached 44% of the country’s planted area in 2016/17, whereas in the 1980s its share was close to zero (

Table 2).

While the Brazilian summer crop comes to the market in the first half of the year and is primarily used to supply domestic meat industries, winter crop sales usually occur during the second half of the year and generally go to the international market. Brazilian corn exports rose from 5% of global market share in the beginning of the 2000s to around 20% during 2015–2017. The majority of corn shipments has occurred in the second semester since 2007 (

Figure 2).

The incentive to plant the winter corn crop in Brazil is related to two main points. The first is associated with the use of early maturing soybean (usually harvested in December–January), especially in the center-west. The motivation comes from the possibility of applying less fungicide and insecticide (given the lower incidence of Asian soybean rust) and obtaining a price premium for exporting soybeans in the beginning of the year

2. Therefore, producers have been able to plant winter corn crop following the soybean harvest. This soybean–corn rotation is also beneficial as it helps producers dilute fixed costs and optimize machinery, labor and land use. The second factor is the strong expansion of the poultry and pork industries, stimulated by domestic income growth and the insertion of Brazil in the international meat market. During 2001–2016, Brazilian producers increased corn consumption for animal feed at an annual rate of 4%, reaching 1.9 billion bushels in 2016. In particular, corn consumption by the poultry industry increased about twofold between 2001 and 2016, reaching around 1 billion bushels.

These recent changes in the Brazilian corn market have affected the supply and demand dynamics during the year. Previously, Brazilian corn production was concentrated in the summer crop and was used mostly in the domestic market for animal feed. More recently, with the expansion of the winter crop, the relative importance of the summer crop has been reduced. Since a large portion of the winter crop is exported, this implies that demand for Brazilian corn exports has grown relatively faster than domestic demand for corn for animal feed. Therefore, in theory, world supply and demand conditions should now play a relatively larger role in Brazilian corn price formation compared to domestic supply and demand conditions.

3. Previous Studies

Several studies have evaluated price linkages between the international market and local markets.

Baffes and Gardner (

2003) examined the relationship between world prices and domestic prices for nine commodities (cocoa, coffee, maize, rice, soybeans, sorghum, sugar, palm oil and wheat) in eight countries (Argentina, Chile, Colombia, Egypt, Ghana, Indonesia, Madagascar, and Mexico). These countries had been through policy reforms in the 1980s and 1990s with the objective of removing “distortionary price and trade policies by moving domestic prices close to international prices”. Overall, despite a wide range of results across commodities and countries, their findings suggest that the interaction between domestic and international prices tends to increase with the adoption of less-restrictive policies in those countries.

Another example is

Balcombe et al. (

2007), who studied price relationships for wheat, maize and soybeans between the U.S., Argentina and Brazil during the 1980s and 1990s. One of their findings was weaker price transmission between the U.S. and Brazil in the wheat market. They conjectured that this could have been caused by trade agreements between Brazil and Argentina that led Brazil to purchase more wheat from Argentina and less from the U.S., i.e., the diminishing participation of Brazil in the international wheat market (outside the trade agreements) weakened the link between Brazilian and U.S. prices.

Following the same idea, although in a slightly different context,

Janzen and Adjemian (

2017) explored price discovery in the wheat market occurring across four futures contracts (Chicago, Minneapolis, Kansas City, and Paris). The three U.S. futures contracts have traditionally been the benchmarks for the international wheat market, while the futures contract traded in Paris has recently been gaining more volume with growing wheat production in Europe (notably Ukraine, Kazakhstan, and Russia). The background story pointed out by the authors is that U.S. wheat exports have been declining over time, whereas European exports have been rising. Their findings show that increasing wheat production/exports and futures trading in Europe happens contemporaneously to a relatively larger share of price discovery occurring in the futures contract traded in Paris. In other words, the emergence of European exports and futures trading led to a larger importance of European prices in the world market.

These studies represent a sample of the literature that has essentially investigated whether more trade between countries leads to stronger relationship between their local (domestic) prices and international prices. Overall, findings suggest that increasing insertion in the world market is typically followed by a stronger link between local and international prices. In addition, other studies have also explored the relationship between local and world prices. For example,

Fossati et al. (

2007) evaluated the relationship between Uruguayan commodity prices (for corn, wheat, sorghum and beef) and corresponding international prices. Results suggest the existence of price relationships between domestic grain markets and the international market. Furthermore,

Esposti and Listorti (

2013) analyzed the interaction between Italian commodity prices and international prices during the price bubble period (2006–2010), finding evidence of cross-market linkages as well.

Another segment of the literature on commodity prices has focused on the interaction between spot and futures prices. This relationship has also been investigated in the context of growing markets, focusing on how increasing trading volume may create or strengthen relationships between spot and futures prices. For instance,

Fortenbery and Zapata (

1997) explored the existence of an equilibrium relationship between spot and futures prices for cheddar cheese. Using data for the first two years (1993–1995) of the new futures contract traded in the Coffee, Sugar and Cocoa Exchange (CSCE) in New York, they found no evidence of a stable equilibrium (co-integration) between the two prices. Later,

Thraen (

1999) revisited this question and used data for the first four years of the cheddar cheese futures contract (1993–1997). With the extended data series, he found evidence of a long-run equilibrium between spot and futures markets for cheddar cheese. One point raised by the authors is that a stable connection between spot and futures prices developed as trading volume in the futures market increased over time, i.e., as there were more buyers and sellers trading in both spot and futures markets.

Maynard et al. (

2001) investigated prices in the shrimp market and came to similar conclusions. They found no long-run relationship between spot prices in the U.S. and futures prices traded in the Minneapolis Grain Exchange between 1994 and 1998, which they attributed to limited trading activity in the futures market. Findings from this line of research generally point to the existence of some threshold of trading activity beyond which it is possible to develop a relationship between spot and futures prices.

Finally, previous research has also investigated the relationship between futures prices for the same commodity in different countries.

Booth and Ciner (

1997), for example, explored the interaction between corn futures prices in the Tokyo Grain Exchange (TGE) and the Chicago Board of Trade (CBOT). Results show that price-changing information from the CBOT is transmitted to TGE and reflected in the opening price of the Japanese market, suggesting that the U.S. futures market was the dominant market in the information mechanism.

Geoffrey Booth et al. (

1998) also contributed to the debate on international price transmission in futures markets by examining the relationship between U.S. and Canadian wheat futures prices. Their findings show that there is a long-run equilibrium (cointegration) between wheat futures prices in the two countries, and that only Canadian prices respond to deviations from that equilibrium. However, the short-run dynamics between U.S. and Canadian wheat prices appears to be limited, since only lagged U.S. (Canadian) price changes affected current changes in U.S. (Canadian) prices. Finally,

Liu and An (

2011) conducted a similar analysis taking into account the U.S. futures markets and Chinese futures and spot markets for copper and soybeans. In general, their results suggest the existence of long-run relationships between prices of each commodity across the two countries. They found bidirectional relationships between spot and futures prices in China, and between futures prices in the U.S. and China. However, their findings also point to the relevant role of the U.S. futures markets in the price discovery process. In general, results from this type of research tend to conclude that there exists a short-run and/or long-run interaction between futures prices for the same commodity traded in exchanges in different countries, and prices traded in U.S. exchanges typically show a leading role in the process of price discovery.

4. Research Method

If the price series are found to be co-integrated, then vector error correction models (VECM) are estimated (Equation (1)):

where

and

are price series,

ê1t-1 is the error correction term (ECT), and

ε1t and

ε2t are white-noise disturbances that may be correlated with each other. The coefficients

α1y and

α2y represent the speed of adjustment, i.e., how rapidly

p1t and

p2t adjust to re-establish the long-run equilibrium. A speed of adjustment parameter close to 1 means the existence of fast adjustment, suggesting rapid reaction and high information flow (

Schroeder 1997).

While the long-run causality between the two price series is conducted by evaluating the statistical significance of co-integrating parameters (α1y and α2y), the short-run causality (immediate effect) is tested by analyzing the statistical significance of the lagged terms. Wald tests are used to test the joint significance of a set of coefficients associated with lags of endogenous variables. For example, the rejection of H0: α12 (1) = α12 (2) = … = α12 (k) = 0 indicates that there is a short-run causality that runs from p2t to p1t.

Since the winter corn crop has increased strongly since 2000, and the participation of Brazilian exports in the world market has risen from nearly zero to 20–25% (as shown in

Figure 2), the study investigates different time periods separately. Comparisons of results across sub-periods can help assess differences in price relationships at different stages of the expansion of the winter crop and growth of Brazilian exports. The sub-periods will be determined according to the results of multiple breakpoint tests. In particular, the Bai–Perron test (BP test) will be adopted, using global information criteria. This procedure identifies endogenously unknown breakpoints (

Bai and Perron 2003). The Liu–Wu–Schwarz LWZ criteria, a modified Schwarz criterion, are used to select the optimum number of breaks (

Liu et al. 1997). If the test shows the presence of breaks in the time series, those dates will be used to split the data into sub-periods.

5. Data

A dataset of daily corn spot and futures prices is used in this research. Spot prices refer to prices for immediate delivery received by producers in two important producing areas in Brazil: Mogiana and Rio Verde. Mogiana is located in the state of São Paulo in south-eastern Brazil. This area used to be the delivery location of the Brazilian futures contract until September 2008, when it started to be finally settled. The region is the most economically developed in the country and close to export ports (about 100 m from Santos and 300 m from Paranaguá, which are the main ports in the country). Rio Verde is located in the state of Goiás in the Brazilian center-west. The region is the new agricultural frontier and has expanded tremendously in the last 10–20 years. Currently, the center-west is the largest and most important agricultural area in the country. However, given its location in the middle of the country, it is far from export ports (about 500 m from Santos and 800 m from Paranaguá). Data on spot prices were provided by the Center for Advanced Studies in Applied Economics (“Luiz de Queiroz” College of Agriculture—University of São Paulo, Brazil).

Futures prices refer to corn contracts traded both in the BM&FBOVESPA (Brazilian futures exchange) and CME Group in the U.S. The Brazilian futures contract was settled by physical delivery until September 2008, and then it was modified to financial settlement. It has seven maturity months (January, March, May, July, August, September and November). The last trading day is the 15th calendar day of the delivery month. The U.S. futures contract is settled by physical delivery and has five delivery months (March, May, July, September and December). The last trading day is the day prior to the 15th calendar day of the delivery month. Daily futures prices are based on the nearest delivery month, and contracts are rolled forward on the first day of the delivery month.

All prices are quoted in Brazilian reals (BRL) per bushel and expressed in logarithms. Futures prices from the CME Group were originally expressed in US dollars and converted to Brazilian reals using the daily exchange rate released by the Brazilian Central Bank. The sample period is from June 1995 to June 2017 (5416 observations), except for Brazilian futures prices because they started trading only in June 1997.

Descriptive statistics for corn prices and returns are reported in

Table 3. Mean returns are not statistically distinguishable from zero for all series. Based on the Jarque-Bera test, the null hypothesis of normality cannot be rejected for all return series. Daily futures returns showed standard deviations of 1.68% for Brazilian futures prices (BMF) and 1.93% for CME futures prices, while daily spot returns had standard deviations of 1.56% for Rio Verde and 1.70% for Mogiana.

6. Results

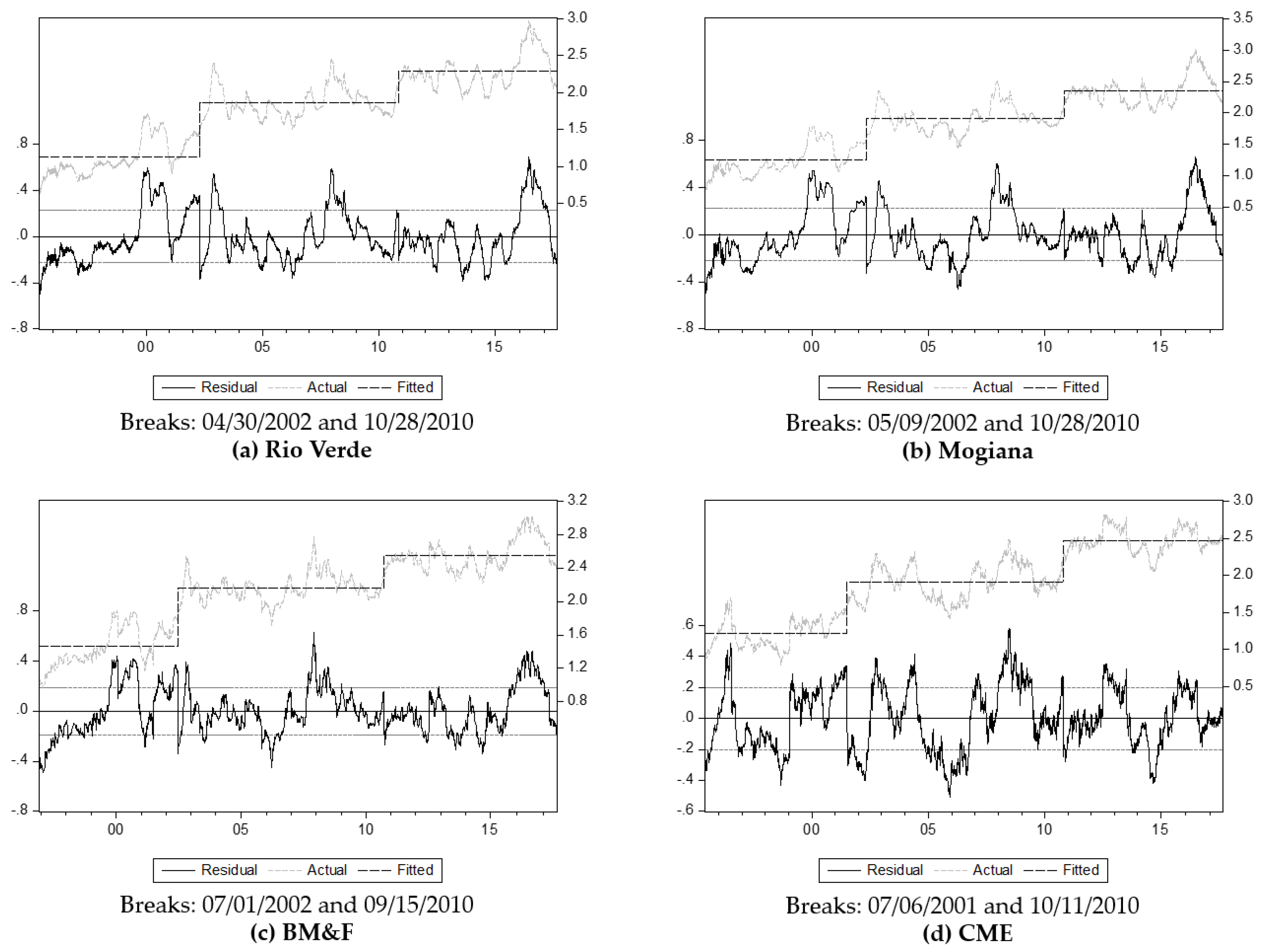

Bai–Perron tests were used to investigate the existence of breakpoints in the price series. The test was run with different maximum numbers of breakpoints (two to five), and showed distinct results. The choice of two breakpoints was based on two reasons. First, when a larger number of breakpoints was tested, the dates of the breakpoints were largely different across all price series. When two breakpoints were assumed, the dates of the breakpoints were more homogenous across price series (in the middle of 2002 and the end of 2010). Second, there is an economic interpretation for those two breakpoints. Before 2002, the winter corn crop and Brazilian exports were minimal. Between 2002 and 2010, the winter corn crop and also exports show rapid expansion, with the center-west region and Brazilian exports becoming increasingly important in the domestic and international corn markets. After 2010, both winter crop and exports have already consolidated large market shares domestically and internationally. Therefore, following Bai–Perron tests, two structural breaks were determined for all prices series and the sample is partitioned into three sub-periods: 06/1995–06/2002, 07/2002–09/2010, and 10/2010–06/2017.

For each period, unit root tests suggest that all price series were integrated of order one. Based on ADF and PP tests, the null hypothesis of the unit root cannot be rejected for price levels, but can be rejected for price differences (returns) in all time periods (

Appendix,

Table A1).

Results of the Engle–Granger bivariate co-integration procedure and Johansen co-integration test in the first time period (06/1995–06/2002) indicate the presence of co-integration vectors only for Brazilian futures prices and spot prices. There is no evidence of co-integration between any Brazilian price and U.S. futures prices in the first period (

Appendix,

Table A2 and

Table A3). For the second and third time periods (07/2002–09/2010 and 10/2010–06/2017), there are co-integration vectors between all price pairs, i.e., Brazilian spot prices are co-integrated with Brazilian and U.S. futures prices (

Appendix,

Table A2 and

Table A3). These findings suggest that Brazilian and U.S. corn prices only developed stable long-run relationships with the emergence of the Brazilian winter crop and the growth in Brazilian exports.

Error correction models (ECM) were estimated for all pairs of co-integrated prices. Vector error correction (VEC) residual tests for serial correlation and heteroscedasticity were performed and there was no evidence of correlation or heteroscedasticity (test results are not presented for brevity, but are available upon request).

Table 4 shows the output for the error correction terms in the models with spot prices in Rio Verde and futures prices, then spot prices in Mogiana and futures prices, and finally the two futures prices. Lagged price changes from the VECM are not presented for brevity, but are also available upon request. Starting with the spot (RV) and futures (BMF) prices in Brazil, the error correction term is statistically distinguishable from zero in both equations in all the first and second periods (

Table 4). This implies that, after deviations from the long-run equilibrium, both spot and futures prices make the adjustment towards equilibrium. However, in the third period, the error correction term is statistically distinguishable from zero only in the spot price equation, i.e., only the spot price then adjusts after deviations from the equilibrium. This suggests a more dominant role of the BMF futures price in the third period, which could be a result of the rapid increase in futures trading in Brazil after 2010 (as mentioned earlier, approximately 1 million futures and options contracts were traded in 2017, compared to an annual average of 25,000 contracts in the early 2000s). Furthermore, lagged spot and futures price changes are statistically distinguishable from zero in both equations at different lag lengths in all periods. This indicates the presence of short-run dynamics between the two prices such that information from the spot (futures) market influences the futures (spot) price.

Regarding the spot price in Brazil (RV) and futures price in the U.S. (CME),

Table 4 shows the estimated VECM for the second and third periods (when the prices are co-integrated). In the second period, the error correction term is statistically distinguishable from zero only in the spot price equation. This indicates that the spot price in Brazil makes the adjustment when there are deviations from the long-run equilibrium established between Rio Verde spot prices and CME futures prices in 2002–2010. In the third period, the error correction term is statistically distinguishable from zero in both equations, suggesting that both prices would make the adjustment towards the long-run equilibrium in 2010–2017 (

Table 4). As opposed to the more “dominant” role of the futures price in 2002–2010, both spot and futures prices start contributing to the adjustment process after 2010. This coincides with the period when Brazilian winter crops and exports are at the highest levels in the entire sample period, suggesting that Rio Verde spot prices would have more influence in the corn market. Furthermore, some coefficients for lagged spot and futures price changes are statistically distinguishable from zero in both equations at different lag lengths in both periods, also indicating the presence of short-run dynamics between spot (RV) and futures (CME) prices as described above.

Results for the model with Mogiana spot prices and BMF futures prices are qualitatively the same as those previously discussed for Rio Verde spot prices and BMF futures prices. The error correction term is statistically distinguishable from zero in both equations during the first and second periods, but only in the spot price equation during the third period (

Table 4). Again, this finding may reflect a more dominant futures price in the third period, following the rising trading volume in the futures market. In addition, the growing importance of the center-west region (where Rio Verde is located) has diminished the relevance of the Mogiana region in the corn market, which may also help explain the results in the third period. Finally, the statistical significance of coefficients for lagged spot and futures price changes in both equations suggest the existence of short-run dynamics between the two markets as well.

With respect to the Mogiana spot price in Brazil and the CME futures price, the error correction term is statistically distinguishable from zero in both equations in the second period and only in the futures price equation in the third period (

Table 4). Hence, both spot and futures prices make the adjustment towards their long-run equilibrium during the second period, but only the CME futures price does so in the third period. The estimated coefficient of the error correction term in the futures price equation is smaller in the third period compared to the second period, while it is no longer significant in the spot price equation in the third period. This may reflect a relatively smaller importance of the Mogiana region in the domestic market and especially in the international market, since Brazilian exports originate mostly from the center-west. Finally, there is also evidence of short-run dynamics between these markets through statistically significant lagged price changes in both equations during the second and third periods.

Table 4 also shows results for the error correction model between the futures prices in the U.S. and Brazil in the second and third periods, when the two prices are found to be co-integrated. The error correction term is statistically distinguishable from zero in both equations in both periods and only in the CME equation in the third period. These findings suggest that both futures prices would adjust to deviations from the long-run equilibrium in the second period, while only CME prices would change to reestablish the equilibrium in the third period. It is possible that, with the strong expansion of the winter crop and also futures trading in Brazil during the third period, BMF futures prices became less “influenced” by CME futures prices and started responding more to Rio Verde spot prices (after all, Brazilian hedgers in the center-west would use BMF futures contracts to market their grain). With respect to short-run dynamics, lagged BMF and CME price changes influence current changes in BMF and CME prices in both the second and third periods.

Impulse-response analysis was also used to gather a broader understanding of the interactions between those prices. Following

Lütkepohl and Reimers (

1992) and the discussion in

Martin et al. (

2013), impulse responses are generated by re-expressing the VECMs as VARs in levels. As stated by (

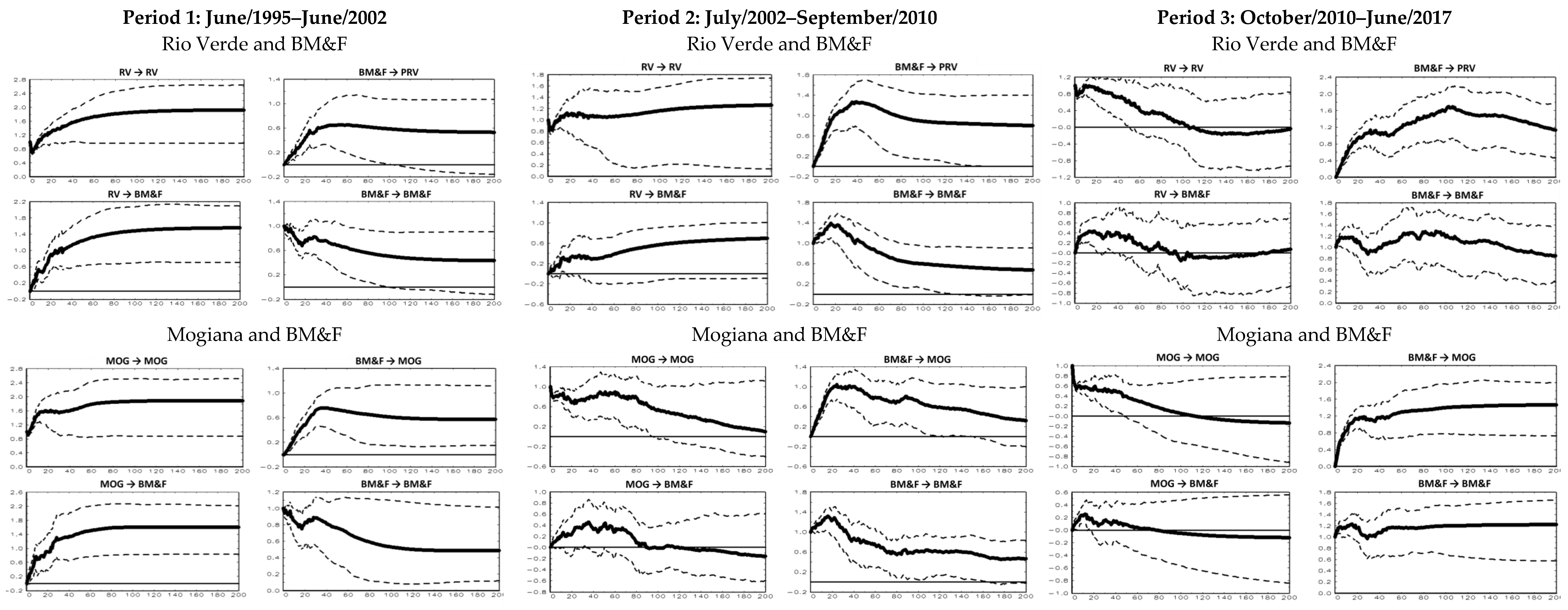

Lütkepohl and Reimers 1992, p. 53), shocks to the variables in the system “will result in time paths of the system that will eventually settle down in a new equilibrium provided no further shocks occur”. These time paths can provide more insights into the behavior of prices over time. A one-unit (standard-deviation) shock in Rio Verde spot prices leads to an initial response of approximately 0.1 to 0.2 units in the BMF price, and the permanent effect on the system will eventually settle down after approximately 100 time periods around 1.4 units in the first periods. However, there is no statistically significant permanent effect of shocks in Rio Verde spot prices on the BMF futures price during the second and third periods (

Appendix Figure A1). Results of impulse response analysis for shocks in Mogiana spot prices on BMF futures prices are qualitatively the same as for shocks in Rio Verde spot prices on BMF futures prices. On the other hand, a one-unit shock in BMF prices would have no statistically significant permanent effect on Rio Verde spot prices in the first period, but would lead to a permanent effect of approximately 1.0 and 1.2 units in the second and third periods, respectively. Impulse response analysis for Mogiana and BMF prices show similar findings for Rio Verde and BMF prices, but with one important exception. In the first period, a one-unit shock in BMF futures prices would lead to a permanent effect of approximately 0.6 units on Mogiana spot prices (

Appendix,

Figure A2). Therefore, shocks in Brazilian spot prices do not have a permanent effect on Brazilian futures prices during the second and third periods, while shocks in the Brazilian futures price have a permanent effect on both spot prices during the same periods.

Regarding Brazilian spot prices and CME futures prices, shocks in both Rio Verde and Mogiana prices seem to have no statistically significant permanent effect on CME prices (

Appendix,

Figure A2). As for a one-unit shock in CME prices on Rio Verde prices, this shows an initial response of 0.2–0.4 units in the second and third periods, but has no statistically significant permanent effect (

Appendix,

Figure A3). Furthermore, a one-unit shock in CME futures prices was found to have a permanent effect of approximately 0.6 units on Mogiana spot prices during the second period, but no permanent effect in the third period.

Finally, with respect to the two futures prices, a one-unit shock in the CME price in the second period translates into a permanent effect of about 0.3 units on the BMF price, while a one-unit shock in the BMF price in the same period would lead to a permanent effect of approximately 0.9 units on the CME price (

Appendix,

Figure A3). However, in the third period, shocks in neither futures price have statistically significant permanent effects on the other. This finding complements VECM results from in the third sub-period, which indicate that the error correction term was not statistically distinguishable from zero in the BMF equation and had a small value in the CME equation (although statistically significant).

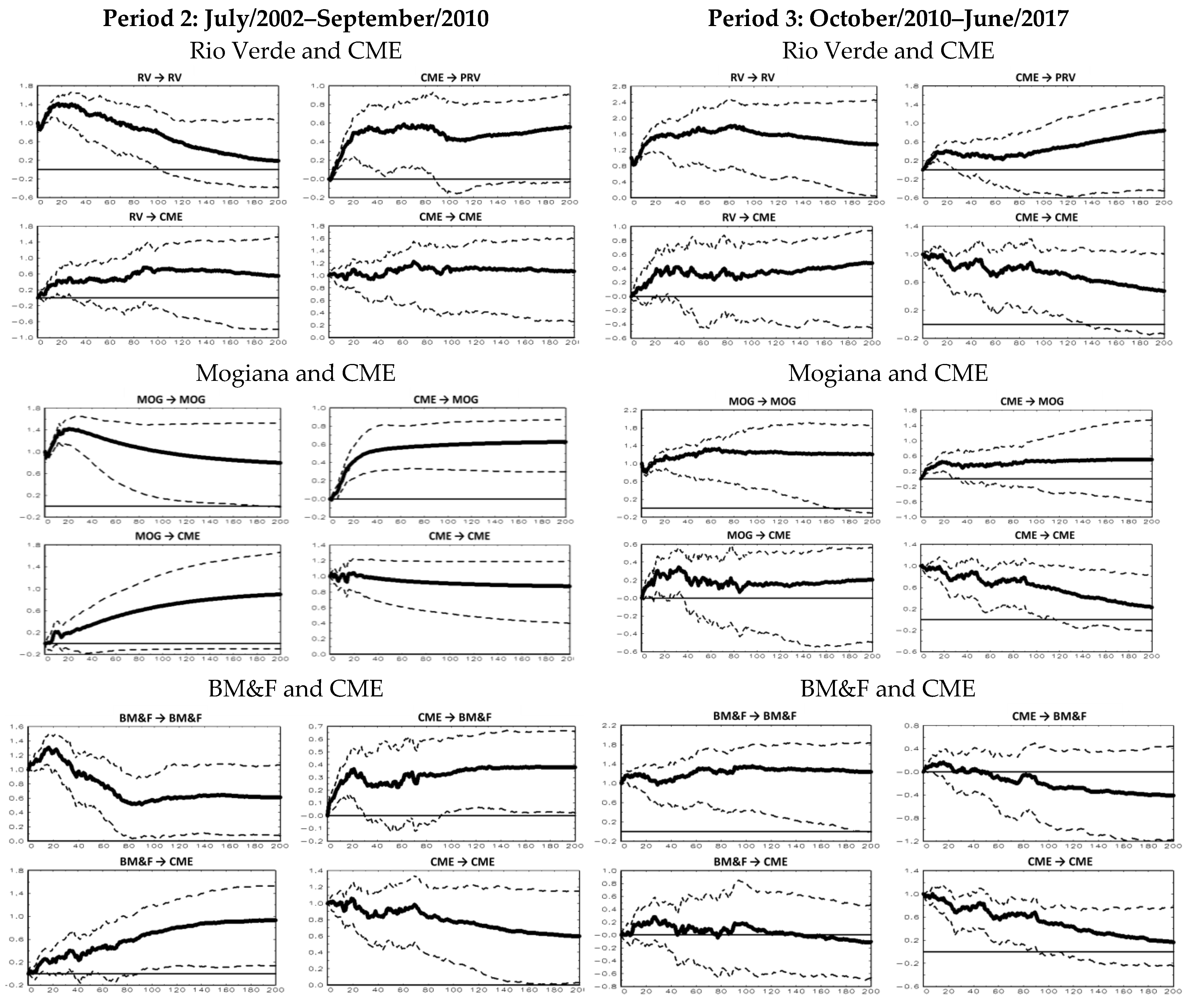

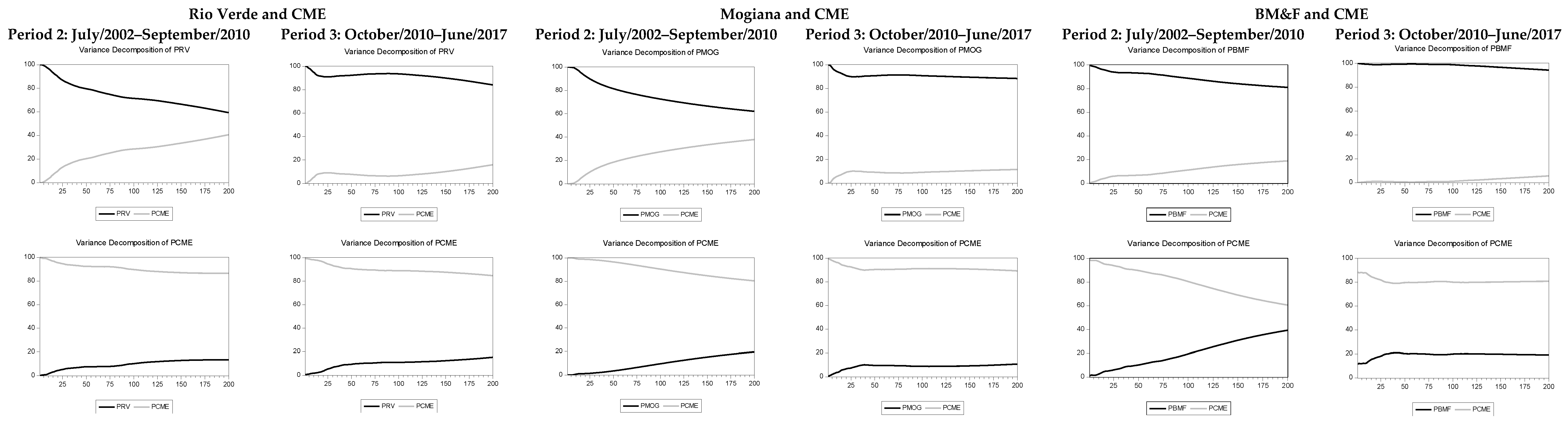

General results from impulse response analysis can also be seen from forecast error variance decomposition (

Appendix,

Figure A4 and

Figure A5). As expected, for each price series, the largest proportion of forecast error variance comes from the own series in the initial time periods. However, other results can emerge in further time periods. Shocks in BMF futures prices explain a relatively small proportion (less than 20%) of the forecast error variance of Rio Verde and Mogiana spot prices in the first period. However, in the second and third periods, shocks in BMF futures prices start explaining a larger proportion of the forecast error variance of those spot prices. This proportion eventually reaches approximately 50% in the second period and about 80% in the third period (

Appendix,

Figure A4). The opposite movement can be seen for shocks of spot prices on BMF futures prices. In the first period, shocks in either spot price explain up to 60–70% of the forecast error variance of BMF futures prices. This proportion decreases to about 20–30% in the second period and to less than 10% in the third period. These findings are consistent with impulse response analysis as they show an increasingly “dominant” role of the BMF futures price in its relationship with Brazilian spot prices. Regarding the Brazilian spot prices and CME futures prices, shocks in CME prices would explain up to 40% of the forecast error variance of either spot prices in the second period (

Appendix,

Figure A5). However, in the third period, this proportion dropped to less than 20%. Shocks in either spot price explained a relatively small proportion (less than 20%) of the forecast error variance of CME futures prices in both the second and third periods. Finally, looking at the relationship between the two futures prices, shocks in CME prices explain a relatively small proportion of the forecast error variance of BMF prices (no more than 20% in the second period and even less than that in the third period). On the other hand, shocks in BMF prices explain up to 40% of the forecast error variance of CME prices in the second period, but this proportion drops to less than 10% in the third period (

Appendix,

Figure A5). Overall, findings from forecast error decomposition also suggest that shocks in CME futures prices showed a diminishing effect on Brazilian prices (spot and futures) from the second period to the third period, while shocks in Brazilian prices do not generally have a larger effect on CME futures prices.

7. Conclusions

The purpose of this study was to analyze the impact of the expansion of Brazilian winter corn crop on the dynamics between domestic Brazilian prices and international prices as well as spot and futures prices in Brazil. This large growth in corn production has led to rising Brazilian exports (and hence participation in the international market) and increased trading in Brazilian futures markets. Hence, it remained to be seen whether these changes had strengthened the link between the Brazilian domestic market and the international market, along with the connection between spot and futures prices domestically.

In general, the statistical analyses indicate the development of a long-run relationship between U.S. prices and Brazilian prices during the period when Brazilian corn production and exports were expanding rapidly. In 1995–2002, when the Brazilian winter crop and Brazilian corn exports were minimal, there was no evidence of co-integration between U.S. prices and any Brazilian prices. Starting in 2002, when both the winter crop and exports started expanding, a co-integration relationship between U.S. prices and all Brazilian prices developed. These results show evidence that more insertion in the world market stimulates a closer relationship between domestic and international prices, which is consistent with previous work (

Janzen and Adjemian 2017;

Balcombe et al. 2007). In addition, findings also indicate the important role of the U.S. grain futures markets in the price discovery process in Brazil, confirming results obtained for other countries by previous research (

Booth and Ciner 1997;

Geoffrey Booth et al. 1998;

Liu and An 2011).

Finally, the analysis also points to a changing relationship between spot and futures prices in Brazil in 2002–2017, with futures prices taking a more dominant role compared to spot prices. This result is consistent with the increasing trading volume in futures markets in Brazil, and the findings are in line with the findings of

Thraen (

1999);

Maynard et al. (

2001).

Findings from this study should be useful for grain producers, investors, international traders, and policy makers. These changes in spot-futures price relationships have implications for marketing, trading and risk management strategies. For example, as spot and futures markets develop long-run relationships, this needs to be accounted for in hedging strategies. Otherwise, the hedger may determine an incorrect hedge ratio and end up under- or over-hedging. Future research can explore whether marketing strategies used in the past are still effective today, and investigate the potential for new strategies that take into account the price dynamics developed in the last 10 years. Similarly, the recently developed dynamics between futures prices in Brazil and the U.S. also creates opportunities for more research in other areas, such as in new arbitrage strategies between the two futures markets. Analysis of the interaction between domestic and international prices is also important for policy makers, since it helps them understand price volatility and its potential impact on export income, GDP, and tax revenue. Moreover, the identification of ways in which local and international prices interact can improve the design and the evaluation of agricultural policy decisions (such as energy policies) and regulatory decisions (related, for example, to derivatives markets regulation).