Abstract

This paper is a contribution to the ongoing debate on the benefits and drawbacks of bank revenue diversification. Revenue diversification may benefit banks if diversified activities are inherently less risky and possess high returns, while it may hurt banks if diversified activities are more risky and have low returns. Analyzing a panel dataset of 200 commercial banks from all South Asian countries, we found that overall revenue diversification into non-interest income has a positive impact on the profitability and stability of South Asian commercial banks. We further observed that different types of non-interest income-generating activities have different impacts on bank performance and stability. While fees and commission incomes have a negative impact on the profitability and stability of South Asian commercial banks, other non-interest income has a positive impact. Our results imply that banks can benefit from revenue diversification if they diversify into specific types of non-interest income-generating activities. Our findings are robust and relevant to the use of alternative measures of revenue diversification, profitability and stability.

JEL Classification:

G01; G21; G32

1. Introduction

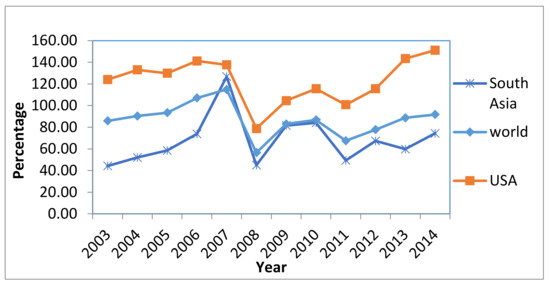

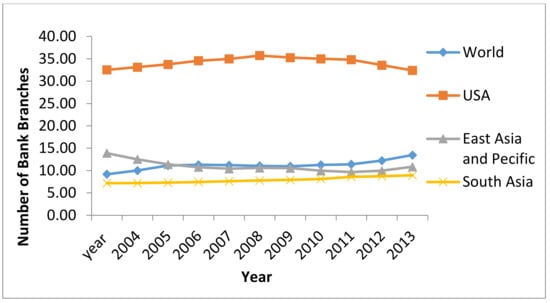

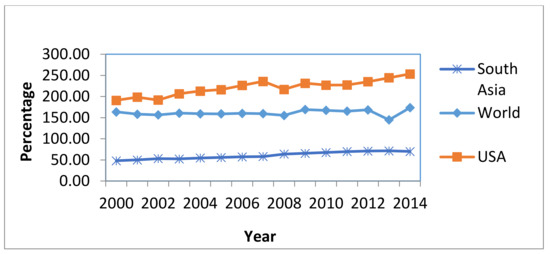

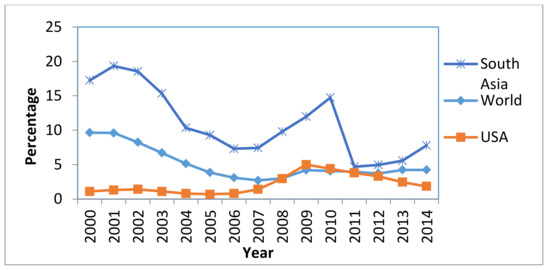

In this paper, we examine the impact of revenue diversification on the profitability and stability of South Asian commercial banks. We have chosen South Asian countries as our sample because it is a unique set of emerging economies. According to the World Bank report of 2016, economic growth in South Asia is the fastest in the world (Markus and Martin 2016). The banking industry is the backbone of these economies and a diverse, profitable and stable banking system is the pre-requisite for strong and prosperous economies. In the absence of sophisticated capital markets, as shown in Figure 1 by the lowest market capitalization as compared to advanced countries and the world average, the banking sector is the only alternative source of financing in these developing countries (Nisar et al. 2015a). Despite the paramount importance of the banking industry for this developing region, banking concentration and the level of domestic credit is very low (Figure 2 and Figure 3). Non-performing loans, although decreasing over the sample period, are considerably higher compared to advanced countries and the world average, as shown in Figure 4. This is partly because of credit appraisal and banking practices, and partly because of unstable economic and political conditions.

Figure 1.

Market capitalization as a percentage of GDP (Source: World Development Indicators-World Bank).

Figure 2.

Commercial bank branches per 100,000 adults (Source: World Development Indicators-World Bank).

Figure 3.

Domestic credit as a percentage of GDP (Source: World Development Indicators-World Bank).

Figure 4.

Non-performing loans as a percentage of gross loans (Source: World Development Indicators-World Bank).

Theoretically and empirically, the impact of diversification on bank performance and stability is debatable. According to portfolio theory, diversified banks benefit from economies of scope which improve performance and reduce risk (Klein and Saidenberg 1997; Elsas et al. 2010). Incomes from different sources which are uncorrelated or imperfectly correlated with each other result in steady and stable streams of overall bank profits (Chiorazzo et al. 2008). On the other hand, if the diversified activity is inherently riskier than the traditional banking business, the costs of diversification may outweigh the benefits, and banks may become riskier and their overall performance may deteriorate (Boyd et al. 1993). This effect would further amplify if incomes from different activities are highly correlated.

Consistent with the above arguments, existing empirical studies report mixed evidence on the impact of revenue diversification on bank profitability and stability. For example, studies such as Stiroh (2004b), Mercieca et al. (2007), Berger et al. (2010), and Maudos (2017) report a negative impact of diversification on bank profitability. On the other hand, authors such as Elsas et al. (2010) and Sanya and Wolfe (2011) find a positive association between non-interest income and profitability. Another group of studies concludes that revenue diversification does not increase profitability (Li and Zhang 2013; Lee et al. 2014b).

Similarly, DeYoung and Roland (2001), Stiroh (2004a), Stiroh (2006), Stiroh and Rumble (2006), and De Jonghe (2010) argue that an increase in non-interest income has a negative effect on bank stability, while Chiorazzo et al. (2008), Sanya and Wolfe (2011), and Lee et al. (2014b) found that income diversification increases bank stability.

Banking sectors in South Asian countries have been largely transformed over the last two decades due to the privatization of state-owned financial institutions and the liberalization of restrictive financial sector policies. In order to survive in the competitive market environment and to maintain profitability, commercial banks in emerging South Asian economies started diversifying their income from interest to non-interest income sources. Consequently, the share of non-interest income has significantly increased for the banks of this region; banks on average earned about 32% of their operating income from non-interest income sources over the sample period of our study. Doumpos et al. (2016), using a worldwide sample, concluded that revenue diversification is more beneficial for banks working in developing countries as compared to banks in developed countries. This fact warrants an intense investigation into the topic for South Asian banks which has been largely ignored in existing literature. The only exceptions are Nguyen et al. (2012), who focus on the interaction of market power, revenue diversification and bank stability for some selected South Asian countries, and Pennathur et al. (2012), who put some light on the effect of ownership on income diversification and risk for Indian banks. These two studies provide some important insights on South Asian banks, but they do not directly provide evidence on the effect of income diversification on profitability and stability. In this study, we contribute to this growing body of literature by examining the impact of revenue diversification on the profitability and stability of South Asian commercial banks.

In the empirical analysis, we use a panel dataset of 200 commercial banks from all South Asian countries over the period 2000–2014. Using a two-step system generalized method of moments (GMM) estimator, we find that overall revenue diversification has a positive impact on both profitability and stability. However, when we divide non-interest income into its two sub-components, fee and commission incomes and other non-interest income, we observe that fee and commission income has a negative relationship with profitability and stability while other non-interest income shows a positive relationship.

The rest of the article is arranged as follows: Section 2 provides a literature review and hypotheses development. Section 3 offers the details of data and variables used in the study. Section 4 explains the econometric methodology. Section 5 presents the results and discussion. Finally, Section 6 concludes the findings.

2. Literature Review and Hypotheses Development

In this section, we review the existing literature regarding the impact of revenue diversification on bank profitability and stability and present testable hypotheses.

Profitability and stability are different concepts. Profitability is the ability of shareholders or the firm to earn profits in the form of return on equity (ROE) or return on assets (ROA). Stability refers to risk factors and survival chances in the long-run. Profitable banks are generally considered more stable and vice versa. Two measures, risk-adjusted return on assets and Z-Score, have been frequently used to measure bank stability in literature. Both depend on bank profitability and the volatility of profits, where profit volatility is measured with the standard deviation of profits. Many studies have investigated the impact of revenue diversification on profitability and stability. A brief review of these studies follows.

Several studies have reported a negative relationship between non-interest income and profitability. Stiroh (2004b) found a negative relationship between diversification and profitability for US community banks. Similarly, Mercieca et al. (2007) investigated small European credit institutions over the period 1997–2003 and found no direct diversification benefits but rather an inverse association between non-interest income and bank performance. Berger et al. (2010) examined an unbalanced panel of 88 Chinese banks over the period 1996–2006 and found that diversification resulted in reduced profits and higher costs. Maudos (2017) concluded that a rise in share of non-interest income has a negative effect on profitability. Li and Zhang (2013) used Chinese banks data over the period 1986–2008 and concluded that a rise in non-interest income has diversification benefits. However, as non-interest income has higher instability and cyclicality than net interest income, relying more on non-interest income may aggravate the risk/return trade-off. Lee et al. (2014b), with reference to the banks of 22 Asian countries, concluded that non-interest activities do not increase profitability.

In contrast to the above, a parallel literature reports a positive association between non-interest income and profitability for US, European and Asian banks. For instance, Elsas et al. (2010) using banking data from Australia, Canada, France, Germany, Italy, UK, US, Spain and Switzerland concluded that diversification does not reduce shareholder value but rather improves bank profitability. Sanya and Wolfe (2011) found that revenue diversification and profitability are positively related. Saunders et al. (2014) established that bank revenue diversification causes higher profits and less insolvency risk for US banks. Portfolio theory also suggests that non-interest income is an avenue through which risk in banking, which would usually be concentrated in a bank’s loan portfolio, can be spread to other non-interest income-generating activities, thereby increasing profitability. So, in our first hypothesis we will expect a positive relationship between revenue diversification and the profitability of South Asian commercial banks.

Coming to the relationship between revenue diversification and commercial bank stability, a number of studies report a negative relationship between non-interest income and stability for US banks (DeYoung and Roland 2001; Stiroh 2004a; Stiroh 2004b; and Stiroh and Rumble 2006). These studies argue that non-interest income is more volatile than interest income and results in higher costs and lower risk-adjusted profits (stability). De Jonghe (2010), using data for European banks from 1992–2007, also found a negative relationship between income diversification and bank stability. Maudos (2017) also concluded for European banks that a rise in the share of non-interest income increases bank risk (instability).

By contrast, Chiorazzo et al. (2008), using data from 85 Italian banks for 1993–2003, found that income diversification increases risk-adjusted returns. In another study, Lee et al. (2014b) examined the banks of 22 Asian countries and found that the non-interest activities of these banks reduced risk (increased stability). Sanya and Wolfe (2011) investigated the effect of a shift toward non-interest income on bank performance and insolvency risk using a panel dataset of 226 listed banks across 11 emerging economies. Applying system GMM methodology, they concluded that diversification across and within both interest and non-interest income-generating activities decreases insolvency risk (increases stability). Doumpos et al. (2016) also found a positive relationship between diversification and financial strength (stability). So, in our first hypothesis we will also expect a positive relationship between revenue diversification and bank stability. Building on this literature, our first hypothesis is as follows:

H1:

Revenue diversification positively affects the profitability/stability of commercial banks in South Asian countries.

Diversification in different types of non-interest activities may have a different impact on bank profitability and stability depending on the exact nature of non-interest income. For example, it may be fee and commission income from different non-financial services such as issuing bank guarantees, letters of credit, shipping guarantees, making import payments, advising letters of credit, handling export documents and export proceeds, credit card fee, etc. The other non-interest income sources may include charges for any kind of services provided by a bank to customers, like providing safe deposit lockers, issuing demand drafts, check book charges, clearing checks, underwriting initial public offerings (IPOs), capital gains from dealing in government securities and equity markets, trading income, gains from foreign exchange markets, revaluation of fixed assets such as office buildings, selling miscellaneous assets, monthly or annual account maintenance charges, income from selling insurance, and so on.

Lepetit et al. (2008) investigated the relationship between product diversification and bank risk for the European banking industry from 1996–2002, when the composition of non-interest activities was changing. They first show that banks expanding into non-interest income activities represent a higher insolvency risk (instability) than banks that mainly supply loans. However, considering the size effects and splitting the non-interest activities into both trading activities and commission and fee activities, they show that the positive link with risk is mostly accurate for small banks and essentially driven by commission and fee-based activities. A higher share of trading activities (i.e., other non-interest income) is never associated with higher risk (instability). DeYoung and Roland (2001) examined the impact of shocks on fee-based activities on bank profit volatility for large US commercial banks and demonstrated that fee-based activities, which represent a growing share of bank activities, increase the volatility of bank profits (decrease stability).

Contrary to the above, Meslier et al. (2014) used a unique dataset of Philippines’ banks and found that moving towards non-interest activities increases bank risk-adjusted profits particularly when banks are more involved dealing in government securities (other non-interest income). Pennathur et al. (2012) also found for Indian public sector banks that fee-based income significantly reduces default risk (increases stability). Hidayat et al. (2012) studied the relationship between product diversification and bank risk for Indonesian banks during 2002–2008 and concluded that product diversification decreases risk (increases stability) for small banks and increases risk (decreases stability) for large banks in the Indonesian context. Zhou (2014) concludes that there is no significant relationship between revenue diversification and bank risk. Ashraf et al. (2016a), with reference to Gulf Cooperation Council (GCC) region banks, found that banks more involved in fee-based activities are more financially stable compared to banks that mainly generate their incomes only from interest-based activities. Ahamed (2017) concluded that an increased share of non-interest income increases the profitability and risk-adjusted profitability (stability) of Indian banks. We will go one step further and investigate this relationship by dividing non-interest income into fee and commission income and other non-interest income.

With this discussion in mind, to examine the impact of different types of non-interest activities on profitability/stability of South Asian commercial banks, we will test the following hypotheses:

H2:

Diversification into fee and commission income adversely affects the profitability/stability of commercial banks in South Asian countries.

H3:

Diversification into other non-interest income positively affects the profitability/stability of commercial banks in South Asian countries.

3. Data and Variables

3.1. Data

Data for this study was collected from different sources: Annual accounting data for the commercial banks of eight South Asian countries (i.e., Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri-Lanka) over the period 2000–2014 was downloaded from the Bankscope database. Data for macroeconomic variables are taken from World Development Indicators (WDI) database of the World Bank. Some related information is also taken from central banks of individual countries and individual banks’ websites. In order to maintain comparability, all data are in thousand US$. We linked annual bank-level accounting data with annual country-level data.

Initial samples included 231 commercial banks. We deleted the data of 15 banks which had accounting data for less than three years over the sample period from the initial sample. We further deleted the data of 16 Islamic banks from Pakistan, Bangladesh and Maldives. We excluded Islamic banks to avoid any bias in favor of non-interest income. In existing literature, Islamic banks are also considered to have lower credit risk which is also used as an important variable in this study. So, after the exclusion of Islamic banks from our sample we expect that the results of this study will be robust and will not be misleading due to the presence of high non-interest income or low credit risk of the Islamic banks. Our final dataset consists of an unbalanced panel of 200 commercial banks from eight South Asian countries between 2000 and 2014, a time of privatization, deregulation and market-driven reforms. We winsorized all bank-level independent variables at 1% level to eliminate outliers.

Detail about the listed and unlisted banks, public, private and foreign banks and the total number of banks included in the sample from each country is provided in Table 1.

Table 1.

Sample summary.

Descriptive statistics of the main variables is given in Table 2. Mean value of return on assets is about 0.93%, which is higher than 0.85% as measured by Lee et al. (2014b) for 22 Asian countries. This means that South Asian commercial banks are more profitable. The banks have lower funding costs due to a high proportion of demand deposits, are adequately capitalized, and have sufficient liquid assets but have higher non-performing loans.

Table 2.

Descriptive statistics sample 2000–2014.

Banks in South Asia have earned a sizeable portion (32%) of their operating income from non-interest income sources which highlights the importance of studying its effects on overall profitability and stability of South Asian commercial banks. All the variables show low standard deviations except return on equity (ROE) and non-interest income over gross revenue (NII) demonstrating the consistency of dataset.

To check for the collinearity among variables, we examined the correlation coefficients. According to Wooldridge (2015), multicollinearity exists if the correlation coefficient is greater than 0.70. As shown in Table 3, correlations among most of the variables are not very high, proposing low probability of multicollinearity in econometric analysis.

Table 3.

Correlation matrix.

3.2. Variables Definitions

We have used an extensive set of dependent, independent and control variables to support our findings. Among the dependent variables, return on assets and return on equity are used as measures of bank profitability. Risk adjusted return on assets and Z-Score are used as measures of bank stability. Different variations of non-interest income, NII, non-interest income over total assets (NIITA), fee and commission income/gross revenues (NII1) and non-interest income over gross revenues (NII2) are used as alternative measures of income diversification in different models. The remaining variables as listed in Table 4 are used as control variables. Control variables are used to control for the differences in the banking structure and administrative environment (Lee et al. 2014b). The details of all dependent and independent variables are given in Table 4.

Table 4.

Definition and references of dependent and control variables.

4. Methodology

To study the impact of revenue diversification on profitability and stability of South Asian commercial banks in multivariate analysis, we propose following dynamic panel model:

where, representing profitability (ROA/ROE) or stability (risk-adjusted return on average assets (SHROA)/bank stability (Z-Score)) of bank i of country j in time t, is used as dependent variable (Dietrich and Wanzenried 2011; Lee et al. 2014b). The is constant-term. One period lag of is used to control for persistence in dependent variable. The coefficient of lagged dependent variable δ shows the speed of adjustment to equilibrium level. Our main variables of interest are NII, NIITA, NII1 and NII2. represent the vector of bank level control variables including funding cost (FC), capital adequacy (CA), administrative expenses (NIEAA), liquidity (LIQ), investments over total assets (IA), bank size (LOA), credit risk (NPL) and represent macroeconomic variables like global financial crises (GFC), GDP growth rate and inflation. Detailed descriptions of all dependent and control variables are given in Table 4. In all models, Dt are dummy variables representing yearly fixed-effects and control for global business cycles, represents the fixed effect of bank i, is the idiosyncratic error term.

The model (given in Equation (1)) has properties such as unobserved bank specific fixed-effects, dynamic dependent variable and endogenous independent variables. For example, there are many bank-specific unobserved characteristics such as boards, chief executive officers (CEOs), etc. as fixed effects which are not measured. Furthermore, dependent variables can constitute some persistence because of obstacles to banking industry competition and the higher informational opaqueness of banks (Berger et al. 2000). There may be endogeneity between the dependent and main independent variables. For example, banks that earn higher non-interest income have higher profitability, while banks with higher profitability can easily expand into non-interest income-generating activities (Ashraf 2017a).

Differenced and system GMM estimators are considered appropriate for a dynamic panel dataset having small t (15 years) and large N (200 banks), with unobserved fixed-effects and endogeneity between dependent and independent variables (Arellano and Bond 1991; Arellano and Bover 1995; Blundell and Bond 1998). Bond (2002) suggests that the results with difference GMM are inefficient when the coefficient of the lagged dependent variable, δ, is large. In such a case, system GMM provides consistent estimates and is considered superior. Furthermore, a GMM estimator is preferred if the estimated value of δ with the GMM estimator lies between the values estimated with ordinary least square (OLS) and fixed effects (FE) estimators. We observe that the lagged dependent variable has fairly high estimated values, and its estimated values with the system GMM estimator lie between the values estimated with OLS and fixed-effects estimators (Table 5 model 1, 2, 3). Therefore, our preferred estimator is two-step system GMM. Furthermore, we apply the Windmeijer (Windmeijer 2005) correction to the standard errors which improves robustness to heteroskedasticity (Sissy et al. 2017). So, all the main models are estimated with a two-step system GMM estimator.

Table 5.

Results for return on assets (ROA) (profitability) as dependent variable.

To determine the endogenous bank-level variables, we follow Baum et al. (2003) and Baum et al. (2007) and use the Durbin–Wu–Hausman test. We treat capital adequacy (CA) as endogenous and use its one period lag values together with the lag of dependent variable as instruments in all models when ROA, SHROA, ROE or Z-Score are used as dependent variables. Furthermore, we use all dependent variables as instruments in all GMM models. One problem with system GMM methodology can be a large number of instruments (which is called the instrument proliferation problem) that can make the endogenous regressors over-fit in empirical analysis (Roodman 2009). To eliminate this problem, we adhere to the advice of Roodman (2009) and use a collapse option for decreasing the number of instruments in all models. In all GMM models, we use robust standard errors. Time dummies (years) are included in all models, as basic assumptions to apply system GMM are expected to hold in the presence of time dummies (Roodman 2009). We have used Stata 13 to estimate all regression models and two-step system GMM models. To represent bank stability, risk-adjusted return on assets (SHROA) is measured as follows:

where, indicates risk-adjusted returns on assets, for the bank i in the year t. indicates return on average assets, for the bank i in the year t. represents the standard deviation of return on average assets over entire sample period. Z-Score is a more comprehensive and widely used measure of risk-adjusted performance and stability in banking literature. Z-Score merges profitability, leverage and return volatility into one measure. We calculated Z-Score with the following formula:

where, is the return on average assets for bank i from country j at year t. E/TA denotes equity to total assets over the sample period, and is the standard deviation of return on average assets over the entire sample period. From the above formula, it is evident that our measure of bank stability rises with higher profitability and capitalization levels and reduces with uneven earnings.

5. Results and Discussion

5.1. Revenue Diversification and Bank Profitability

Firstly, we estimate Equation (1) to investigate the impact of non-interest income (NII) on bank profitability. Secondly, we use an alternative measure of diversification NIITA (non-interest income/total assets) to reinforce our results. Thirdly, we test hypotheses H2 and H3 after dividing non-interest income into two parts: fee and commission income (NII1) and other non-interest income (NII2).

We have run a baseline model with OLS, fixed-effects and system GMM estimators. As can be seen from the results in Table 5, the estimated value for the coefficient of lagged ROA (0.223) with the system GMM estimator in Model 3 lies between its estimated values with the OLS estimator in Model 1 (0.386) and with the fixed-effects estimator in Model 2 (0.068). The coefficients of the other variables change according to the econometric model employed, suggesting that employing OLS or FEM can lead to inaccurate conclusions. Thus, the two-step system GMM model is the preferred specification and we report and explain only its results in later models.

Diagnostic tests of the two-step system GMM estimator in Model 3 also confirm that our model is well specified. For example, the coefficient of the 1st lag of dependent variable, ROA, is significant and positive with a value less than 1 which indicates persistence in return on assets (Lee et al. 2014a). Secondly, the maximum number of instruments (52) is fairly low as compared to the number of banks (200), showing that our results are not biased due to large number of instruments (there is no instrument proliferation problem). In two-step system GMM, the Hansen test of over-identifying restrictions investigates whether the instruments are valid and as a group appear exogenous. As can be seen in Table 5 under Model 3, an insignificant coefficient for the Hansen test shows that the null hypothesis that instruments are not exogenous is not rejected, and confirms that instruments used are valid. AR (1) and AR (2) check first-order and second-order serial correlations, respectively, in the equation in differences. As expected, a significant value of AR (1) confirms first-order serial correlation in the residuals, while an insignificant AR (2) value confirms that there is no second-order serial correlation in the residuals. The year dummies are included to control for economic cycles. These results of diagnostic tests of two-step system GMM endorse our model for further analysis (Ashraf 2017a).

GMM results are given under Model 3 and Model 4 when NII, and NIITA and under Model 5 when NII1 and NII2, respectively, are used as measures of diversification. In the third column under Model 3 we can see clearly that NII is showing a positive and highly significant relationship with the dependent variable ROA at 1% level of significance. On the basis of this result, we accept our first hypothesis H1 and conclude that in South Asian countries over the sample period diversification as measured by non-interest income has contributed positively and increased the profitability of banks. Our results are consistent with Sanya and Wolfe (2011) who found a positive relationship of non-interest income in 11 emerging economies, and Pennathur et al. (2012), and Ahamed (2017) who concluded that Indian banks have benefited from revenue diversification. Meslier et al. (2014), using data from the Philippines (a developing country like South Asian countries), also found that a move toward non-interest activities increases bank profits.

The relationships of all control variables with dependent variables are proved according to the expected signs that are well supported by literature. Funding cost (FC) shows a negative relationship with profitability, as banks can make profits only if they are successful in raising low-cost funds preferably in the form of current and saving accounts (Dietrich and Wanzenried 2011). Capital adequacy (CA) shows a positive relationship with profitability, as the stabilization and resulting profitability effect of capital is well established in banking (Mercieca et al. 2007; Nguyen et al. 2012). Administrative expenses (NIEAA) shows a negative relationship with ROA, which means that in order to be more profitable banks in South Asian countries should reduce their expenses (Zhang and Daly 2013). Liquidity (LIQ), investments (IA) and bank Size (LOA) show a positive but insignificant relationship with profitability. Credit risk (NPLs) show a negative and significant relationship with profitability, and on the basis of this result we can say that over the sample period credit risk is a major source of low profitability for banks in South Asian markets. This is due to high default rates resulting from unstable economic conditions in these developing economies (Lee et al. 2014a; Lee et al. 2014b; Pennathur et al. 2012).

To ensure the consistency of our results, we changed our measure of diversification to NIITA (non-interest income/total assets) as measured by Nguyen et al. (2012). As we can see under Model 4, NIITA also shows a positive and highly significant relationship at a 1% level of significance with ROA. This result reinforces our earlier results that diversification has helped commercial banks in South Asian countries to increase profitability. Again, all the control variables have conformed with the expected signs.

In order to find answers to the existing puzzle of a positive or negative relationship of non-interest income with profitability, we have tested hypotheses H2 and H3. Results are given under Model 5. Fee and commission income as represented by NII1 shows a negative and significant relationship with ROA. On the basis of this result we accept hypothesis H2 and conclude that fee and commission income is negatively related to the profitability of South Asian commercial banks. This is due to the reason proposed by Stiroh (2006) that non-interest income (fee and commission income) and interest income may be correlated, possibly because of cross-selling of different products to the same customer, which does not actually produce diversification benefits. Mostly corporate customers take financial facilities and non-financial services that generate fee and commission income simultaneously from the same bank. Diversification into fee and commission income brings a diversification discount to South Asian commercial banks as is the case proved for US commercial banks by DeYoung and Roland (2001) and DeYoung and Rice (2004). Lepetit et al. (2008) also found for small European banks that fee and commission income increases risk, and thereby decreases profitability.

But at the same time other non-interest income from various sources (as detailed in the literature review) represented by NII2 has shown a positive and significant relationship with ROA leading to the acceptance of H3 to support a positive relationship of other non-interest income with overall profitability which maintains and further refines our results in the third and fourth models. Lepetit et al. (2008) also found for small European banks that other non-interest income (trading-income) decreases risk, and thereby increases profitability. All the control variables showed expected signs as in previous models.

The negative and significant relationship of global financial crises (GFC) in Models 4 and 5 shows that South Asian commercial banks have also been hit by an indirect and lagged effect of the global financial crisis in 2009 (Nisar et al. 2015b). Macroeconomic variable GDP growth rate has shown an insignificant relationship with profitability in all three GMM models. Inflation has shown a negative and significant relationship, at 5% level of significance with profitability only in Model 5, which supports a common perception that, with increasing inflation, the profitability of businesses declines, especially when rising inflation is not anticipated and incorporated in prices.

5.2. Revenue Diversification and Bank Stability

As an outcome of the global financial crisis of 2007–2008, the key priority for policy makers is now to maintain bank stability. In the quest for profit, banks should carefully consider their risk level (Hsieh et al. 2013). To study how income diversification has affected South Asian commercial banks’ stability, in Equation (1) we have used risk-adjusted return on assets (SHROA), as the dependent variable, which is widely used as measure of bank stability (Mercieca et al. 2007; Lepetit et al. 2008; Turk-Ariss 2010; Lee et al. 2014b; Meslier et al. 2014; Stiroh 2004b; Chiorazzo et al. 2008). If a bank’s risk-adjusted returns are higher, this means it will be in a better position to withstand any crisis in future and will be more stable in long-term than other banks which have lower risk-adjusted returns.

We estimate a baseline model with OLS, fixed-effects and two-step system GMM estimators and choose the system GMM estimator since the estimated value for the coefficient of lagged SHROA (0.358) with the system GMM estimator in Model 3 lies between its estimated values with the OLS estimator in Model 1 (0.414) and with the fixed-effects estimator in Model 2 (0.107). Diagnostic tests of system GMM again endorse that our model is well specified. For example, the coefficient of lagged ratios of SHROA is positive and significant with a value less than 1, and indicates persistence in risk-adjusted return on assets. The number of instruments (40) is fairly low as compared to the number of banks (200), confirming that there is no instrument proliferation problem. The Hansen test is insignificant, showing the instrument set is valid and exogenous. A significant result of AR (1) confirms first-order serial correlation in residuals, while an insignificant AR (2) value confirms that there is no second-order serial correlation in residuals. These results of the diagnostic tests of system GMM in all three models validate the models, and conclusions made on the basis of system GMM estimations. The year dummies are included to control for economic cycles.

In Table 6, we can see from the results of Models 3 and 4 that non-interest income NII and NIITA has a positive and significant relationship with risk-adjusted profits (SHROA), which is consistent with Smith et al. (2003), Pennathur et al. (2012), and Ahamed (2017). In light of these results, we accept the second part of hypothesis H1 and conclude that overall non-interest income is decreasing the risk of banks in South Asia and making them more stable in the long term by contributing to risk-adjusted profits. We look deeper by splitting non-interest income into fee and commission income and other non-interest income in Model 5. Similar to Mercieca et al. (2007), we found that fee and commission income shows a negative relationship with risk-adjusted profits. On the basis of this result, we accept our hypothesis H2. This result is consistent with a number of US banking studies, Stiroh (2004b) and Stiroh and Rumble (2006) also found a negative effect of a shift toward fee-based income on risk-adjusted profits. Other non-interest income (NII2) has shown a positive and highly significant relationship with risk-adjusted profits leading to the acceptance of hypothesis H3. On the basis of this result, we conclude that other non-interest income contributes to the stability of the banking sector in South Asia by increasing the risk-adjusted profitability. Lepetit et al. (2008) also found similar results that other non-interest income (trading income) does not increase risk.

Table 6.

Results for risk adjusted return on assets (SHROA) (bank stability) as dependent variable.

Results of control variables are also largely consistent with expectations. For instance, funding cost (FC) shows a negative and significant relationship with risk-adjusted profits. Capital adequacy (CA) has shown a positive and significant relationship with risk-adjusted profits in Model 3, which implies that banks in South Asian countries are adequately capitalized and stable. This result is consistent with the findings of Ashraf et al. (2016b) for Pakistani banks. Liquidity (LIQ) has also shown a positive and significant relationship with risk-adjusted profits in all three GMM models. This means that adequate liquidity levels ensure higher risk-adjusted profitability (stability) by guarding against the insolvency risk. Non-performing loans have shown a negative and significant relationship with risk adjusted profits in all three system-GMM models (Chiorazzo et al. 2008; Lee et al. 2014b; Pennathur et al. 2012). This means that non-performing loans are a major source of risk and threat to the long-term stability of banks in South Asia. South Asian commercial bank managers need to focus on improving the quality of their loan portfolio. All other control variables have also behaved according to the expected signs. The coefficient of the dummy variable for global financial crises (GFC) in all three models has shown a negative and significant relationship at a 5% level of significance. This shows that GFC has somehow affected the stability of South Asian commercial banks. The GDP growth rate has shown a positive but insignificant relationship with stability. Inflation has shown a negative and significant relationship with stability only in Model 3 but an insignificant relationship with stability in Models 4 and 5.

5.3. Robustness of Results

We have performed several robustness tests. First, we used an alternative measure of profitability, return on equity (ROE), to examine the effect of income diversification on bank profitability. After running baseline models and favorable diagnostic test results, we have used two-step system GMM methodology. As can be seen in Table 7, diversification has shown the expected positive and significant relationship with ROE in the GMM Models 3 and 4, exactly as was the case when ROA was used as a measure of profitability. Similar to the results in Table 5, the fee and commission income has shown a negative relationship with profitability and other non-interest income has shown a positive and significant relationship with ROE but at a 10% level of significance.

Table 7.

Results for alternative measure of bank profitability ROE as dependent variable.

All the control variables also obtained a similar relationship with the dependent variable as in previous models in Table 5. In a further improvement, liquidity (LIQ) has also shown a positive and significant relationship with ROE in Models 3 and 4. From this result, we can conclude that more liquid banks will be more profitable as they have more funds to avail of the investment and loan opportunities, increasing their profitability as measured by ROE. Investments have also shown a significant positive relationship with ROE at a 5% level of significance. Capital (CA) is proved to be insignificant. The two macroeconomic variables, GDP growth rate and inflation, have shown insignificant relationships with ROE. As far as our main variables of interest (NII, NIITA, NII1 and NII2) are concerned, the ROE models reinforce our previous results in Table 5 and confirm their robustness. We have also used ROAA (return on average assets) as a measure of profitability instead of ROA and obtained similar results as in Table 5. This also confirms the robustness of our findings.

Secondly, we use an alternative measure of bank stability, Z-score, to verify the robustness of results for the effect of revenue diversification on bank risk-adjusted returns/stability (Table 6). Several studies such as Ashraf et al. (2016c), Ashraf (2017b), Nguyen et al. (2012), and Sanya and Wolfe (2011) have used Z-score to measure bank risk. Again, after running baseline models and favorable diagnostic tests as detailed in Table 8, we have preferred two-step system GMM models. Funding cost (FC) and administrative expenses (NIEAA) have shown negative and significant relationships with Z-Score only in Model 4, when income diversification is measured by NIITA. Capital adequacy has shown a positive and significant relationship with bank stability as measured by Z-score in all three GMM models, which implies that capital adequacy contributes to the stability of commercial banks in South Asia. Liquidity failed to show as significant a relationship with Z-Score as it showed with risk-adjusted profits (SHROA). Furthermore, we used the macroeconomic variables of GDP growth rate and inflation to control for macroeconomic effects. But both variables have shown insignificant relationships with bank stability as measured by Z-Score. All the remaining control variables have shown results similar to those in Table 6 in Section 5.2.

Table 8.

Results for alternative measure of bank stability (Z-Score) as dependent variable.

Our main variables of interest, NII, NIITA, NII1 and NII2, have again shown the same signs and significance with Z-Score as had been shown when risk-adjusted return on assets (SHROA) was used as the dependent variable (results given in Table 6). So, our results in Models 3, 4 and 5 in Table 8 have proved the robustness of our earlier two-step system GMM results in Table 6. Now we can say that our results for bank stability are robust to different measures of bank stability. We can also claim with greater confidence that income diversification has contributed positively to the stability of commercial banks in South Asia in the given period. When non-interest income is divided into two parts, then fee and commission income negatively affect bank stability while other non-interest income contributes positively to stability (Z-Score) of the sample banks, as proved in Section 5.2 in Table 6.

Thirdly, as India is the largest economy in South Asia, a sizable portion (38.5%) of our sample consists of Indian banks. In order to verify that our findings are not dominated/biased due to a large number of banks from one country, after removing Indian banks’ data from the sample we re-estimated the main models for the effect of revenue diversification on profitability and stability. The results are given in Table 9 and Table 10 below.

Table 9.

ROA (Profitability) as dependent variable for sample excluding Indian banks.

Table 10.

SHROA (bank stability) as dependent variable for sample excluding Indian banks.

All diagnostic tests have presented favorable results, as can be seen in Table 9. Our main variables of interest diversification (NII and NIITA) have again registered positive signs with profitability in Models 3 and 4. As expected, fee and commission income has shown a negative relationship at a 10% level of significance and other non-interest income has shown a positive and highly significant relationship at a 1% level of significance with profitability. Most of the control variables enter in the expected directions. So, the GMM results in Table 9 without Indian banks’ data have enhanced the robustness of our prior results with the full sample.

6. Conclusions

In this paper, we examine the impact of revenue diversification on the profitability and stability of South Asian commercial banks. Applying two-step system GMM methodology for 200 commercial banks from South Asian countries over the period 2000–2014, we find that bank revenue diversification has a positive impact on profitability and stability.

We also divided non-interest income into fees and commission income and other non-interest income. We found that fee and commission income has a negative impact on the profitability and stability of South Asian countries’ commercial banks, while other non-interest income has a positive impact. These results suggest that different types of non-interest income-generating activities have different impacts on bank profits and stability. Our results are robust in terms of the use of alternative measures of revenue diversification, profitability and stability.

Our results have important implications for managers and regulators in the banking industry in South Asia and other developing countries. Banks that are still engaged in only interest-generating activities can initiate non-interest-generating activities to reap the benefits from emerging trends in the industry in order to compete with their peers. Banks that are already engaged in both interest and non-interest income-generating activities can carefully enhance their non-interest income portfolio into other non-interest income avenues instead of only fees and commission income.

Author Contributions

Shoaib Nisar carried out the empirical analysis. Ke Peng and Susheng Wang contributed to the conceptualization of the paper. Badar Nadeem Ashraf improved the draft and empirical analysis.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahamed, M. Mostak. 2017. Asset quality, non-interest income, and bank profitability: Evidence from Indian banks. Economic Modelling 63: 1–14. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental-variable estimation of error-components models. Journal of Econometric 68: 29–52. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2017a. Do trade and financial openness matter for financial development? Bank-level evidence from emerging market economies. Research in International Business and Finance. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2017b. Political institutions and bank risk-taking behavior. Journal of Financial Stability 29: 13–35. [Google Scholar] [CrossRef]

- Ashraf, Dawood, Mohamed Ramady, and Khalid Albinali. 2016a. Financial fragility of banks, ownership structure and income diversification: Empirical evidence from the GCC region. Research in International Business and Finance 38: 56–68. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem, Sidra Arshad, and Yuancheng Hu. 2016b. Capital regulation and bank risk-Taking behavior: Evidence from Pakistan. International Journal of Financial Studies 4: 16. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem, Changjun Zheng, and Sidra Arshad. 2016c. Effects of national culture on bank risk-taking behavior. Research in International Business and Finance 37: 309–26. [Google Scholar] [CrossRef]

- Baum, Christopher F., Mark E. Schaffer Heriot, and Steven Stillman. 2003. Instrumental variables and GMM: Estimation and testing. The Stata Journal 3: 1–31. [Google Scholar]

- Baum, Christopher F., Mark E. Schaffer, and Boston College. 2007. Enhanced routines for instrumental variables/generalized method of moments estimation and testing. The Stata Journal 7: 465–506. [Google Scholar]

- Berger, Allen N., Seth D. Bonime, Daniel M. Covitz, and Diana Hancock. 2000. Why are bank profits so persistent? The roles of product market competition, informational opacity, and regional/macroeconomic shocks. Journal of Banking Finance 24: 1203–35. [Google Scholar] [CrossRef]

- Berger, Allen N., Iftekhar Hasan, and Mingming Zhou. 2010. The effects of focus versus diversification on bank performance: Evidence from Chinese banks. Journal of Banking and Finance 34: 1417–35. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Bond, Stephen R. 2002. Dynamic panel data models: A guide to micro data methods and practice. Portuguese Economic Journal 1: 141–62. [Google Scholar] [CrossRef]

- Boyd, John H., Stanley L. Graham, and R. Shawn Hewitt. 1993. Bank holding company mergers with nonbank financial firms: Effects on the risk of failure. Journal of Banking & Finance 17: 43–63. [Google Scholar]

- Chiorazzo, Vincenzo, Carlo Milani, and Francesca Salvini. 2008. Income diversification and bank performance: Evidence from Italian banks. Journal of Financial Services Research 33: 181–203. [Google Scholar] [CrossRef]

- De Jonghe, Olivier. 2010. Back to the basics in banking? A micro-analysis of banking system stability. Journal of Financial Intermediation 19: 387–417. [Google Scholar] [CrossRef]

- DeYoung, Robert, and Tara Rice. 2004. Non-interest Income and Financial Performance at U.S. Commercial Banks. The Financial Review 39: 101–27. [Google Scholar] [CrossRef]

- DeYoung, Robert, and Karin P. Roland. 2001. Product mix and earnings volatility at commercial banks: Evidence from a degree of total leverage model. Journal of Financial Intermediation 10: 54–84. [Google Scholar] [CrossRef]

- Dietrich, Andreas, and Gabrielle Wanzenri. 2011. Determinants of bank profitability before and during the crisis: Evidence from Switzerland. Journal of International Financial Markets, Institutions and Money 21: 307–27. [Google Scholar] [CrossRef]

- Doumpos, Michael, Chrysovalantis Gaganis, and Fotios Pasiouras. 2016. Bank Diversification and Overall Financial Strength: International Evidence. Financial Markets Institutions & Instruments 25: 169–213. [Google Scholar]

- Elsas, Ralf, Andreas Hackethal, and Markus Holzhäuser. 2010. The anatomy of bank diversification. Journal of Banking and Finance 34: 1274–87. [Google Scholar] [CrossRef]

- Hidayat, Wahyu Yuwana, Makoto Kakinak, and Hiroaki Miyamoto. 2012. Bank risk andnon-interest income activities in the Indonesian banking industry. Journal of Asian Economics 23: 335–43. [Google Scholar] [CrossRef]

- Hsieh, Meng-Fen, Pei-Fen Chen, Chien-Chiang Lee, and Shih-Jui Yang. 2013. How Does Diversification Impact Bank Stability? The Role of Globalization, Regulations, and Governance Environments. Asia-Pacific Journal of Financial Studies 42: 813–44. [Google Scholar] [CrossRef]

- Klein, Peter G., and Marc R. Saidenberg. 1997. Diversification, Organization Andefficiency: Evidence from Bank Holding Companies. Working Paper, 97/27. Philadelphia: Wharton School Center for Financial Institutions. [Google Scholar]

- Lee, Chien-Chiang, Meng-Fen Hsieh, and Shih-Jui Yang. 2014a. The relationship between revenue diversification and bank performance: Do financial structures and financial reforms matter? Japan and the World Economy 29: 18–35. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, Shih-Jui Yang, and Chi-Hung Chang. 2014b. Non-interest income, profitability, and risk in banking industry: A cross-country analysis. North American Journal of Economics and Finance 27: 48–67. [Google Scholar] [CrossRef]

- Lepetit, Laetitia, Emmanuelle Nys, Philippe Rous, and Amine Tarazi. 2008. Bank Income Structure and Risk: An Empirical Analysis of European Banks. Journal of Banking and Finance 32: 1452–67. [Google Scholar] [CrossRef]

- Li, Li, and Yu Zhang. 2013. Are there diversification benefits of increasing non-interest income in the Chinese banking industry? Journal of Empirical Finance 24: 151–65. [Google Scholar] [CrossRef]

- Markus, Kitzmuller, and Rama Martin. 2016. South Asia Economic Focus, Spring 2016: Fading Tailwinds. Washington: World Bank. [Google Scholar]

- Maudos, Joaquín. 2017. Income structure, profitability and risk in the European banking sector: The impact of the crisis. Research in International Business and Finance 39: 85–101. [Google Scholar] [CrossRef]

- Mercieca, Steve, Klaus Schaeck, and Simon Wolfe. 2007. Small European banks: Benefits from diversification? Journal of Banking and Finance 31: 1975–98. [Google Scholar] [CrossRef]

- Meslier, Céline, Ruth Tacneng, and Amine Tarazi. 2014. Is bank income diversification beneficial? Evidence from an emerging economy. Journal of International Financial Markets, Institutions and Money 31: 97–126. [Google Scholar] [CrossRef]

- Nguyen, James. 2012. The relationship between net interest margin and noninterest income using a system estimation approach. Journal of Banking and Finance 36: 2429–37. [Google Scholar] [CrossRef]

- Nguyen, My, Michael Skully, and Shrimal Perera. 2012. Market power, revenue diversification and bank stability: Evidence from selected South Asian countries. Journal of International Financial Markets, Institutions and Money 22: 897–912. [Google Scholar] [CrossRef]

- Nisar, Shoaib, Wang Susheng, Ahmed Jaleel, and Peng Ke. 2015a. Determinants of Bank’s Profitability in Pakistan: A Latest Panel Data Evidence. Available online: http://ijecm.co.uk/wp-content/uploads/2015/04/3429.pdf (accessed on 29 March 2018).

- Nisar, Shoaib, Wang Susheng, Peng Ke, and Ahmed Jaleel. 2015b. Effect of Investments on Banking Sector Profitability during Global Financial Crisis: Evidence from an Emerging Market. In Advances in Education Research. Surrey: Information Engineering Research Institute Press, vol. 76, pp. 256–61. [Google Scholar]

- Pennathur, Anita K., Vijaya Subrahmanyam, and Sharmila Vishwasrao. 2012. Income diversification and risk: Does ownership matter? An empirical examination of Indian banks. Journal of Banking and Finance 36: 2203–15. [Google Scholar] [CrossRef]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. Stata Journal 9: 86. [Google Scholar] [CrossRef]

- Sanya, Sarah, and Simon Wolfe. 2011. Can Banks in Emerging Economies Benefit from Revenue Diversification? Journal of Financial Services Research 40: 79–101. [Google Scholar] [CrossRef]

- Saunders, Anthony, Markus M. Schmid, and Ingo Walter. 2014. Non-Interest Income and Bank Performance: Is Banks’ Increased Reliance on Non-Interest Income Bad? SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Sissy, Aisha Mohammed, Mohammed Amidu, and Joshua Yindenaba Abor. 2017. The effects of revenue diversification and cross border banking on risk and return of banks in Africa. Research in International Business and Finance 40: 1–18. [Google Scholar] [CrossRef]

- Smith, Rosie, Christos Staikouras, and Geoffrey Wood. 2003. Non-Interest Income and Total Income Stability. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Stiroh, Kevin J. 2004a. Diversification in banking: Is non-interest income the answer? Journal of Money, Credit and Banking 36: 853–82. [Google Scholar] [CrossRef]

- Stiroh, Kevin J. 2004b. Do community Banks benefit from revenue diversification? Journal of Financial Services Research 25: 135–60. [Google Scholar] [CrossRef]

- Stiroh, Kevin J. 2006. A portfolio view of banking with interest and noninterest activities. Journal of Money, Credit and Banking 38: 1351–62. [Google Scholar] [CrossRef]

- Stiroh, Kevin J., and Adrienne Rumble. 2006. The dark side of diversification: The case of US financial holding companies. Journal of Banking and Finance 30: 2131–61. [Google Scholar] [CrossRef]

- Turk-Ariss, Rima. 2010. On the implications of market power in banking: Evidence from developing countries. Journal of Banking and Finance 34: 765–75. [Google Scholar] [CrossRef]

- Windmeijer, Frank. 2005. A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics 126: 25–51. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2015. Introductory Econometrics: A Modern Approach. Ontario: Nelson Education. [Google Scholar]

- Zhang, Xiaoxi, and Kevin Daly. 2013. The Impact of Bank Specific and Macroeconomic Factors on China’s Bank Performance. Global Economy and Finance Journal 6: 1–25. [Google Scholar]

- Zhou, Kaiguo. 2014. The Effect of Income Diversification on Bank Risk: Evidence from China. Emerging Markets Finance and Trade 50: 201–13. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).