Numerical Simulation of the Heston Model under Stochastic Correlation

Abstract

1. Introduction

2. Stochastic Correlation in the Heston Model

3. Path Simulation

3.1. Discretization for the Variance Process

3.2. Discretization for the Correlation Process

3.3. Discretization for the Log Price Process

3.3.1. The Euler and Milstein Scheme (EM Scheme)

3.3.2. The Hybrid Scheme (HB Scheme)

3.4. HB Scheme with Martingale Correction (HBM Scheme)

4. Numerical Results

4.1. A Comparison of the Numerical Methods EM, HB and HBM

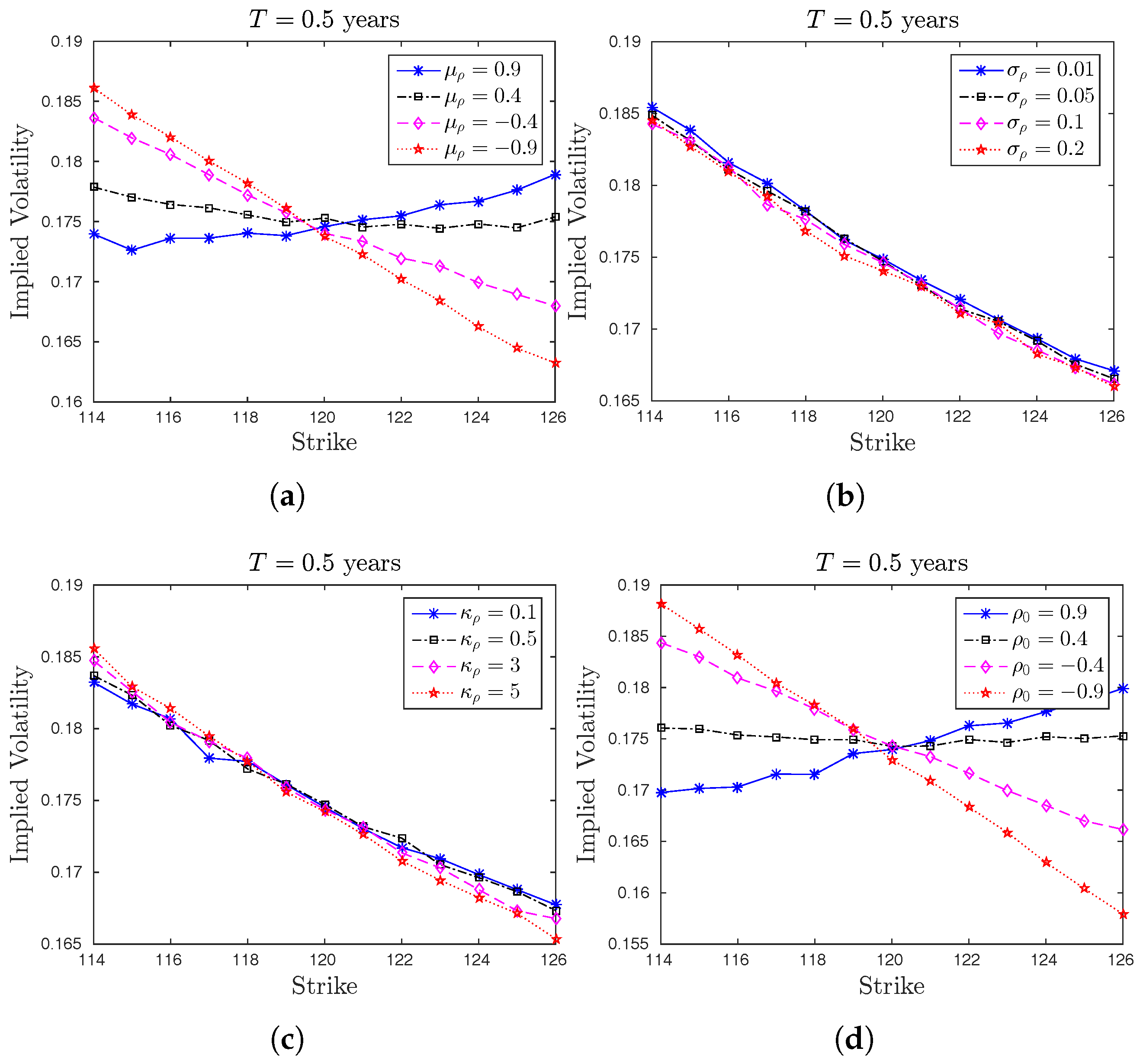

4.2. The Effect of Imposing Stochastic Correlation on Implied Volatility

4.3. A Comparison with the Effect of Stochastic Correlation

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Andersen, Leif. 2008. Simple and efficient simulation of the Heston stochastic volatility model. Journal of Computational Finance 11: 1–42. [Google Scholar] [CrossRef]

- Black, Fischer, and Myron Scholes. 1973. The Pricing of Options and Corporate Liabilities. Journal of Political Economy 81: 637–54. [Google Scholar] [CrossRef]

- Carr, Peter, and Dilip B. Madan. 1999. Option Valuation Using the Fast Fourier Transform. Journal of Computational Finance 2: 61–73. [Google Scholar] [CrossRef]

- Christoffersen, Peter, Steven Heston, and Kris Jacobs. 2009. The Shape and Term Structure of the Index Option Smirk: Why Multifactor Stochastic Volatility Models Work so Well. Management Science 55: 1914–32. [Google Scholar] [CrossRef]

- Elices, Alberto. 2009. Affine Concatenation. Wilmott Journal 1: 155–62. [Google Scholar]

- Euler, Leonhard. 1913. Institutiones Calculi Integralis. Berlin and Heidelberg: Springer, vol. 11. First published in 1768. Reprinted in Opera Omnia. [Google Scholar]

- Grzelak, Lech A., and Cornelis W. Oosterlee. 2011. On the Heston model with Stochastic Interest Rate. SIAM Journal on Financial Mathematics 2: 255–86. [Google Scholar] [CrossRef]

- Heston, Steven L. 1993. A Closed-Form Solution for options with Stochastic Volatility with Applications to Bond and Currency Options. The Review of Financial Studies 6: 327–43. [Google Scholar] [CrossRef]

- Kahl, Christian, and Peter Jäckel. 2005. Not-so-complex Logarithms in the Heston Model. Wilmott Magazine September: 94–103. [Google Scholar]

- Kloeden, Peter, and Eckhard Platen. 1999. Numerical Solution of Stochastic Differential Equations. New York: Springer-Verlag. [Google Scholar]

- Lee, Roger. 2004. Option pricing by transform methods: Extensions, unification, and error control. Journal of Computational Finance 7: 51–86. [Google Scholar] [CrossRef]

- Lewis, Alan L. 2001. Option Valuation under Stochastic Volatility. Newport Beach: Finance Press. [Google Scholar]

- Lipton, Alexander. 2002. The vol smile problem. Risk 8: 61–65. [Google Scholar]

- Ma, Jun. 2009. Pricing Foreign Equity Options with Stochastic Correlation and Volatility. Annals of Economics and Finance 2: 303–27. [Google Scholar]

- Maruyama, Gisiro. 1955. Continuous Markov processes and stochastic equations. Rendiconti del Circolo Matematico di Palermo 4: 48–90. [Google Scholar] [CrossRef]

- Mikhailov, Sergei, and Ullrich Nögel. 2003. Heston’s Stochastic Volatility Model: Implementation, Calibration and some Extensions. Wilmott Magazine July: 74–79. [Google Scholar]

- Milstein, Grigori Noichowitsch. 1974. Approximate integration of stochastic differential equations. Theory of Probability & Its Applications 19: 557–62. [Google Scholar]

- Teng, Long, Cathrin van Emmerich, Matthias Ehrhardt, and Michael Günther. 2014a. A Versatile Approach for Stochastic Correlation using Hyperbolic Functions. International Journal of Computer Mathematics 93: 524–39. [Google Scholar] [CrossRef]

- Teng, Long, Matthias Ehrhardt, and Michael Günther. 2014b. The pricing of Quanto options under dynamic correlation. Journal of Computational and Applied Mathematics 275: 304–10. [Google Scholar] [CrossRef]

- Teng, Long, Matthias Ehrhardt, and Michael Günther. 2016a. Modelling Stochastic Correlation. Journal of Mathematics in Industry 6: 1–18. [Google Scholar] [CrossRef]

- Teng, Long, Matthias Ehrhardt, and Michael Günther. 2016b. The Dynamic Correlation Model and its Application to the Heston model. In Innovations in Derivatives Markets. Edited by Kathrin Glau, Zorana Grbac, Matthias Scherer and Rudi Zagst. Munich: Technical University of Munich. [Google Scholar]

- Teng, Long, Matthias Ehrhardt, and Michael Günther. 2016c. On the Heston model with Stochastic Correlation. International Journal of Theoretical and Applied Finance 19: 1650033. [Google Scholar] [CrossRef]

- Uhlenbeck, George E., and Leonard S. Ornstein. 1930. On the Theory of Brownian Motion. Physical Review 36: 823–41. [Google Scholar] [CrossRef]

- Van Emmerich, Cathrin. 2006. Modelling Correlation as a Stochastic Process. Preprint 06/03. Wuppertal: University of Wuppertal. [Google Scholar]

| Case I | Case II | Case III | Case IV | |

|---|---|---|---|---|

| 1 | ||||

| 1 | 1 | |||

| T (maturity) | 10 | 15 | 5 | 10 |

| EM | HB | HBM | ||||

|---|---|---|---|---|---|---|

| 1 | ||||||

| 1 | ||||||

| 1 | ||||||

| EM | HB | HBM | ||||

|---|---|---|---|---|---|---|

| 1 | ||||||

| 1 | ||||||

| 1 | ||||||

| EM | HB | HBM | ||

|---|---|---|---|---|

| 1 | ||||

| 1 | ||||

| 1 | ||||

| EM | HB | HBM | ||

|---|---|---|---|---|

| 1 | ||||

| 1 | ||||

| 1 | ||||

| EM | HB | HBM | ||

|---|---|---|---|---|

| 1 | ||||

| 1 | ||||

| 1 | ||||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Teng, L.; Ehrhardt, M.; Günther, M. Numerical Simulation of the Heston Model under Stochastic Correlation. Int. J. Financial Stud. 2018, 6, 3. https://doi.org/10.3390/ijfs6010003

Teng L, Ehrhardt M, Günther M. Numerical Simulation of the Heston Model under Stochastic Correlation. International Journal of Financial Studies. 2018; 6(1):3. https://doi.org/10.3390/ijfs6010003

Chicago/Turabian StyleTeng, Long, Matthias Ehrhardt, and Michael Günther. 2018. "Numerical Simulation of the Heston Model under Stochastic Correlation" International Journal of Financial Studies 6, no. 1: 3. https://doi.org/10.3390/ijfs6010003

APA StyleTeng, L., Ehrhardt, M., & Günther, M. (2018). Numerical Simulation of the Heston Model under Stochastic Correlation. International Journal of Financial Studies, 6(1), 3. https://doi.org/10.3390/ijfs6010003