Abstract

In the National Football League, teams have been subjected to a salary cap, which has prevented teams from paying players in aggregate over a specified value since 1994. The presence of the salary cap provides a unique setting for understanding how tax rates affect the competitiveness of teams. We use data on National Football League teams from 1984 to 2000 to create a difference-in-differences model to estimate the effect of state income taxes on team performance. We use college football teams, who do not pay salaries to their amateur players, as the control group to identify causal estimates. We find that, in the presence of the salary cap, team quality, as estimated by a Simple Rating System value, is significantly lower in high-tax states, particularly after the passage of the salary cap. Our results are robust to numerous specifications of the control group. We also show using a decision tree analysis that teams in high-tax states were more likely to be above average before the salary cap. However, after the salary cap, teams from high-tax states are less likely to be above average.

1. Introduction

“‘That’s Taxachusetts,’ Mr. Belichick said on the Pat McAfee Show during a discussion about free agents. ‘Virtually every player, even the practice squad, even the minimum players are pretty close to $1 million. Once you hit the $1 million threshold, you pay more state tax in Massachusetts.’

It’s ‘just another thing you’ve got to contend with in negotiations up there,’ Mr. Belichick added. “‘It’s not like Tennessee or Florida or Nevada or some of these teams that have no state income tax. You get hit pretty hard on that with the [players’] agents. They’ll come and sledgehammer you down about … the tax they’re paying.’” (The Editorial Board, 2024).

Bill Belichick is notable for two distinctive features: winning six Super Bowls as the head coach of the New England Patriots and being an economics major at Wesleyan University (Denk, 2018). Casual observers may not recognize the importance of Coach Belichick’s economics degree, but in the high-tax state of Massachusetts, his understanding of economics may have been necessary to achieve the prodigious success he was able to enjoy as the leader of the Patriots.

Of course, understanding the incidence of taxation is not only important for National Football League (NFL) coaches, but also managers in every industry. In the United States, interesting distortions are caused by the differences in income tax rates across jurisdictions, such as a metropolitan city and its nearby county, or, of more importance to our study, the difference in income tax rates across states. In order to better understand whether businesses in high-tax states are at a competitive disadvantage compared to their counterparts located in low-tax states, we use teams in the NFL to show that higher taxes tend to decrease team performance. The effect is particularly pronounced in the presence of a binding budget constraint for the firms—the so-called “salary cap” in the NFL.

The salary cap represents a maximum threshold that each team’s payroll must not exceed, as a means of limiting payroll disparities and promoting competitive balance between teams. According to Staudohar (1998), the National Basketball Association (NBA) was the first major professional sports league to implement the salary cap for the 1984–85 season, while the NFL followed with the implementation of the salary cap in 1994. However, significant differences in the structure of the salary cap exist between the two leagues. The NFL has a “hard” salary cap, meaning that the pre-determined salary cap threshold cannot be exceeded under any circumstances by a team in the league. The NBA has a “soft” salary cap, which allow teams to exceed the pre-determined threshold in certain scenarios called “exceptions”. Examples of such exceptions include allowing teams to exceed the salary cap when re-signing players on the current roster or signing rookies to their first contract (Staudohar, 1998).

We study the impact of income taxes on firm performance by estimating the causal impact of tax rates on NFL teams before and after the passage of the salary cap in 1994. The salary cap provides a particular team with a binding budget constraint for how much a team can pay its players in a given year. In 2025, the salary cap is set at $279.2 million. Interestingly, teams in the NFL must also spend a minimum of 89% of the salary cap in a four-year period (DeCort, 2022). Moreover, football teams produce outcomes that are easily comparable and readily available, such as the team’s winning percentage and Simple Rating System value, which measures a team’s quality. Therefore, the NFL provides us with a very good natural experiment for determining the impact of taxes on firms with comparable wage bills across states.

A secondary benefit of using the NFL is that the NFL has a ready-made control group, college football, for estimating the causal impact of taxes on performance. College football teams have identical observable performance measures as NFL teams, but they do not face the consequences of income taxes when assembling their rosters because the players are amateurs during our sample period.

To estimate the causal impact of taxes on firm performance, we estimate a difference-in-difference model with college football teams serving as the control group which is not affected by the salary cap or income tax rates. When we estimate the difference-in-difference model, we find that taxes have a negative impact on the teams’ performance, before and, even more so, after the implementation of the salary cap.

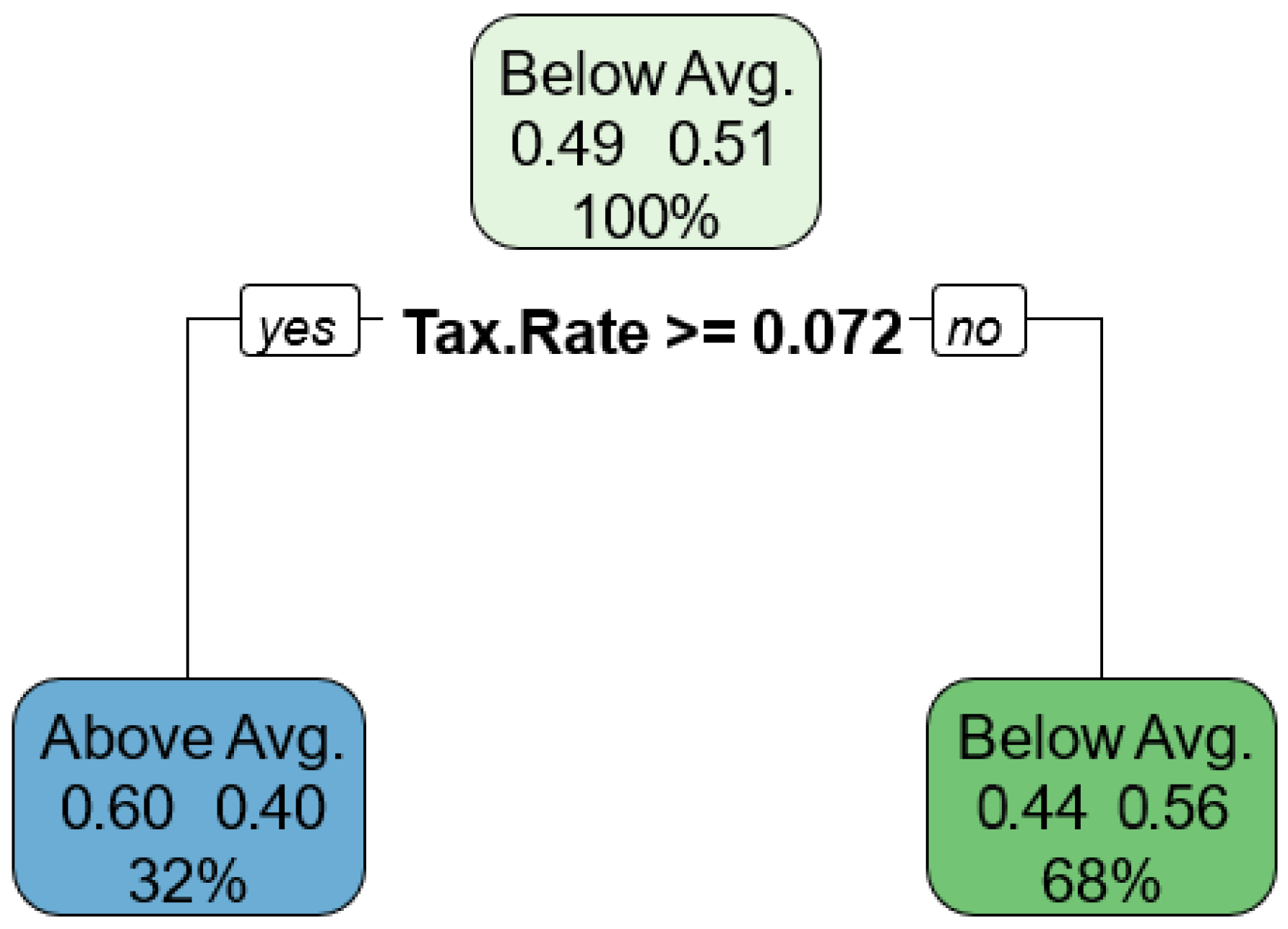

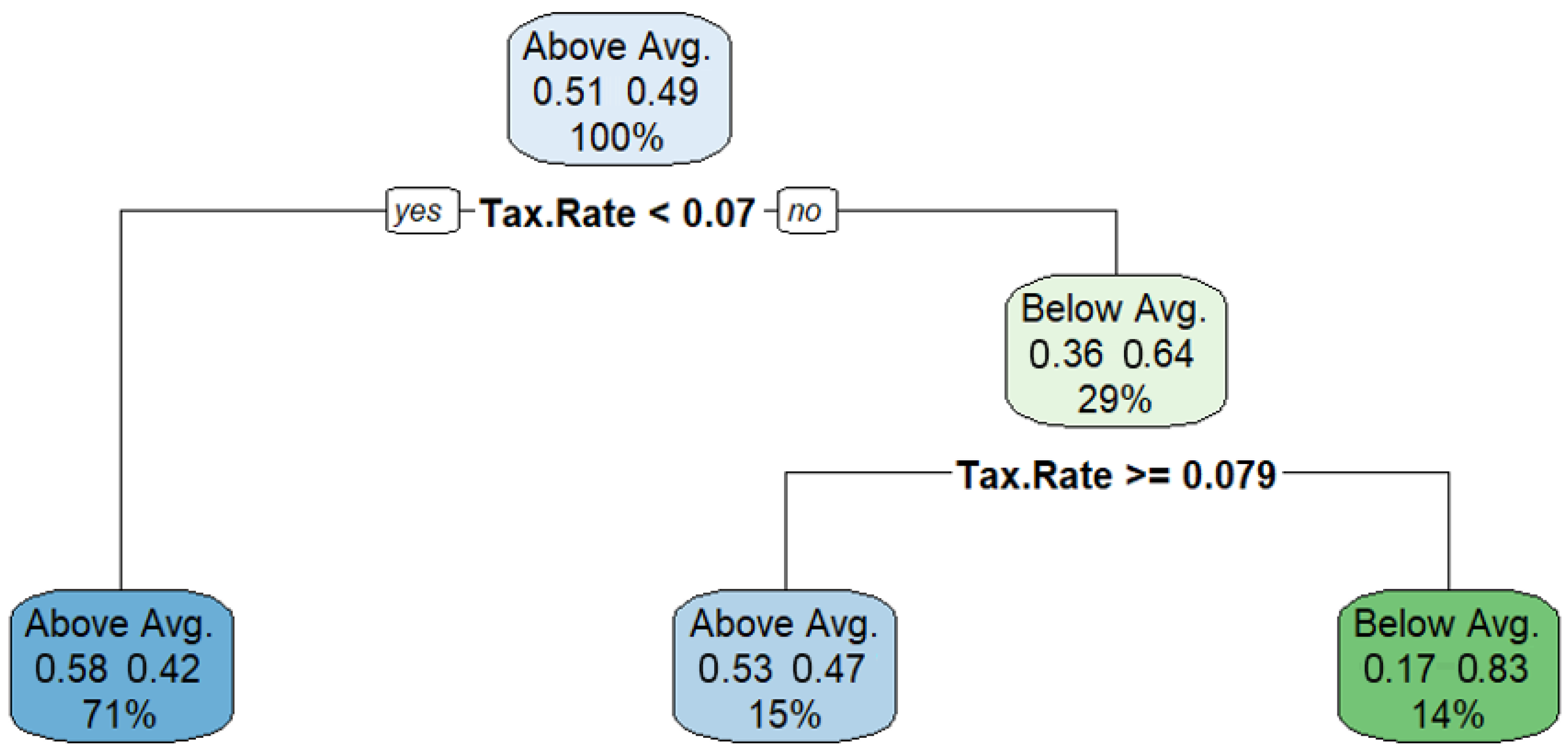

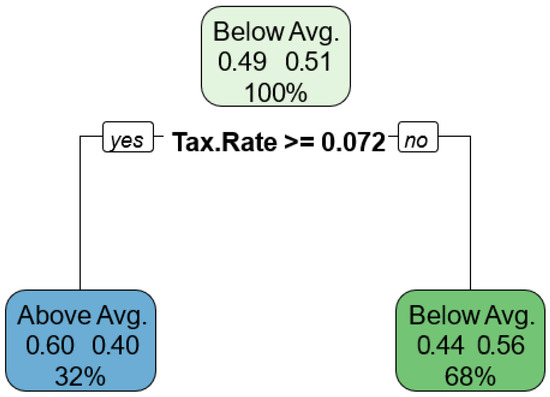

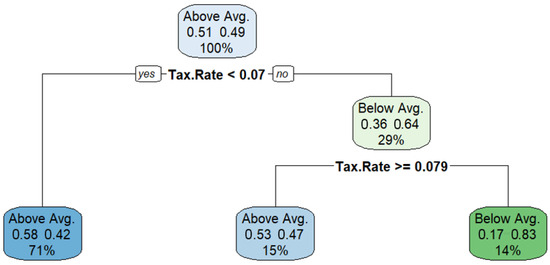

To further identify the impact that taxes have on NFL teams in the presence of the salary cap, we estimate a decision tree for team quality before and after the implementation of the salary cap. Prior to the cap, we find that teams in states with a tax rate higher than 7.2% are more likely to be above average. On the other hand, after the salary cap, teams in states with a tax rate higher than 7% are more likely to be below average.

Our research fits into a broader set of economic literature on local taxation. The literature on the importance of local taxation when determining where someone will live begins with Tiebout (1956) in his foundational paper “A Pure Theory of Local Expenditures”. Tiebout postulated that voters will move to communities which match their preferences. If a professional football player’s preference is to lower his tax burden, he may choose to sign a contract with a team from a low-tax state instead of a team with a high-tax state. Hageman et al. (2021) show that higher state income taxes are related to lower net migration rates, i.e., more citizens choosing to not live in the state. Rohlin et al. (2014) show that the structure of state income taxes affects the location of residential developments and the location of businesses across states. Examining the findings of the prior literature helps to support our hypothesis that teams in high-tax states will have lower team performance.

Prior research has examined the impact that taxes have had on professional sports teams, however the literature is very nascent. In the only current paper published to date on the subject, Hembre (2021) uses all four major American sports leagues—Major League Baseball, the National Football League, the National Basketball Association, and the National Hockey League—to show that taxes negatively impact team performance after the implementation of free agency, an institution which enables players to freely move between teams after the conclusion of a contract. We improve upon Hembre’s important work in several dimensions. First, we focus solely on the National Football League and their use of the salary cap to identify a binding budget constraint. Second, we include a control group, college football teams, instead of having a situation where all units are eventually treated with free agency. Third, we use a shorter sample period, which may mitigate concerns over bias in the estimation of post-treatment effects (Roth et al., 2023). Fourth, we examine a team’s true quality via their Simple Rating System value instead of just the winning percentage. The Simple Rating System value is a better signal of team quality than the inherently noisy winning percentage. Fifth, we estimate a decision tree to identify the relationship between tax rates and team quality.

The remainder of this paper is organized as follows. Section 2 provides a theoretical background for the effect of taxes on teams in the presence of a budget constraint. Section 3 provides an institutional background which describes how the NFL has changed over time and how the teams have adapted to the salary cap. Section 4 describes the data. Section 5 describes the empirical methodology and results. Section 6 concludes and provides areas for potential future research.

2. Theoretical Background

In this section, we discuss the economic theory of taxes as it applies to professional football teams. A careful examination of price theory can illustrate how the expected costs of players’ wages respond due to taxes and how the teams adapt to wage changes when creating their rosters.

We will focus our discussion on two theoretical points. First, the extent to which prices are impacted by taxes is determined by the elasticity of supply and demand. Second, the impact of the price change on the optimal quantity demanded of a good can be decomposed into the substitution and income effects, which result in distortions in the market that may prevent the price system from efficiently allocating resources across position groups. We deal with the impacts of the theoretical points and their effects for professional football teams in turn.

Tax incidence is defined by who bears the cost of the tax, regardless of who legally pays the tax. For an income tax, the workers are legally required to write the check to the government in payment of the tax. However, that does not necessarily mean that workers truly bear the cost of the tax. For instance, firms may bear the cost of the income tax by increasing the wages of workers to offset the tax.

In general, the tax is borne by the more inelastic of suppliers or demanders and the extent the tax is borne by the more inelastic group is driven by the relative difference in elasticities. For instance, in more common labor markets, labor supply is relatively inelastic, and the employees will bear the cost of the tax. On the other hand, sports labor markets are unique in that demand is more inelastic (Alm et al., 2012). When demanders, in this case the teams, are very inelastic and the suppliers, the players, are relatively elastic, the tax will be heavily borne by the teams. For instance, using the estimates provided by Alm et al. (2012) for Major League Baseball, the tax incidence shows that demanders bear 95% of the tax ($147,000 increase in wages on $153,000 of income tax). Therefore, we can expect the pay for players to increase by 9.5%. In the context of the National Football League, 9.5% is a very large amount of the salary cap to lose to taxes. According to overthecap.com, the 2025 salary cap in the National Football League is $279.2 million. Therefore, a 9.5% loss of the salary cap means that a team effectively loses $26.52 million, which is larger than the average salary paid to the league’s highest-paid running back (Saquon Barkley, $20.6 million).

The simple analysis of a 9.5% loss in the salary cap may be true on average, and, in baseball the tax incidence may not vary much from position to position, allowing the average tax incidence to be a reasonable estimate for most players at most positions. However, it is also possible that different positions in football will face different elasticities of supply and demand. For instance, the demand for a team to keep their starting quarterback may be very inelastic due to the unique importance of the position and the lack of good substitutes available in the market. On the other hand, the demand for the long snapper, a player used only in special situations when the team elects to punt the ball or kick a field goal, may be remarkably elastic. If long snapper A does not accept the offered contract, long snapper B may be a remarkably close substitute causing the demand for long snappers to be relatively elastic. In that case, the wages paid to long snappers would be more impacted by an income tax compared to the wages paid to quarterbacks. The impact of tax incidence on players of different positions may exacerbate the impact of taxes on team performance, as the teams scramble to retain quarterbacks and sacrifice other, less-notable positions on the team.

Assuming that player salaries are impacted by income taxes, it is possible for teams to be impacted by the substitution and income effects. For the substitution and income effects to matter for roster decisions, the taxes would need to impact the wages of different players or positions heterogeneously. For instance, a star quarterback may bear none of the tax because the teams are unwilling to part with the most important and recognized player on the team due to money. On the other hand, the best offensive linemen, who are seldom recognized even by the most ardent fans, may have to bear a large portion of the taxes because teams are more willing to part with them.

The substitution effect shows how teams would change their roster decisions if the relative price of a player or position has changed, even when the team is compensated for the loss of cap space due to the tax. Generally, when a particular position has a higher increase in cost due to a tax, the teams will reallocate resources towards another position.

The income effect, on the other hand, is the result of decreasing the real value of the salary cap due to the tax while keeping the post-tax pay rates in place. Assuming certain football positions are normal goods, the loss of the salary cap will result in less investment in the position; this may be true of most positions on the roster. At the same time, a position group that is considered an inferior good may be more likely to be invested in due to the tax.

Given the unique nature of professional sports, the professional sports industry provides us with an interesting research setting for testing whether state income taxes impact firm success. Despite the research setting, previous research on the topic is limited. Much of the previous research on taxation in sports focuses on the use of taxes for financing stadiums in professional sports (Jensen, 1999; Lathrope, 1997; Phelps, 2003; Swindell & Rosentraub, 1998). A few studies, including Krasney (1993), Ekmekjian (1994), Ringle (1995), Baker (1998), and Ekmekjian et al. (2004), discuss the complexities and challenges of the taxation of non-residential professional athletes. In addition, Conklin and Daniel (2024), find differences in player productivity when playing in high-tax states vs. low-tax states. As mentioned before, Hembre (2021) is the only previous study to directly address our question, finding that teams in states with higher income taxes face a competitive disadvantage in the post-free agency era. Of course, while one could examine the average tax incidence in the market for professional football players, an individual team and player may operate differently than the expectation. For instance, Tom Brady, the starting quarterback for Bill Belichick’s six Super-Bowl winning Patriots team, was well known to sign contracts for less money than he could have received (Reiss, 2013). By accepting less money, Tom Brady was able to ensure that the Patriots were able to sign other star players. Brady’s behavior is akin to a negation of any potential loss to the real value of the salary cap caused by the high tax rates in Massachusetts. We provide a fuller discussion of Tom Brady in Section 3.

Finally, a long-term effect of taxes may culminate in what may be referred to as the “good-team discount.” Essentially, better teams may be able to pay players at a discount because the players want to win Super Bowls during their careers. If a high tax rate in year t decreases the team’s performance, the high tax may have a negative impact on the teams’ performance in year t + 1, even if the tax rate is lower. However, we do not test for this kind of effect but do identify its importance as a basis for further research on the effect of teams and taxation.

3. Institutional Background

In this section, we discuss the institutional background of the National Football League, including the evolution of contracts due to free agency and the salary cap. The section also provides evidence for how teams have adapted to changes made by the NFL.

The NFL has spent the majority of its existence with no free agency and no salary cap, because they were not implemented until 1993 and 1994. Before these days, the majority of players stayed with just a single team for their entire careers. From 1989 to 1992, “Plan B Free Agency” was in place, which allowed each team to protect 37 of the 47 players on their active roster. It allowed for some player movement within the league, but it was mainly among less notable players. Only one “protected player” changed teams during this time. In 1992, three NFL players, Keith Jackson, Gain Veris, and Webster Slaughter were rewarded five days of unrestricted free agency from US District Court Judge Dave Doty, and each one signed with a new team during the five-day period (National Football League, 2025).

From 1977 to ‘88, the NFL had a restricted free agency model. If a player were to be a free agent and agree to a contract with another team, then the original team would have the opportunity to match that contact and bring said player back to the original team. The restricted free agency model made it nearly impossible for players to leave in free agency, since there was no salary cap, there wasn’t a reason outside of personnel decisions to let players leave (National Football League, 2025).

The contracts before the salary cap and free agency were mild compared to what we see today, as the major quarterback contracts of the 1980s signed by the likes of John Elway, Steve Young, Troy Aikman, and others averaged around $1.5–2 million per year (about $4.6–6.1 million in 2025 dollars1). These numbers are low because teams are not competing with anyone and do not have to pay the quarterbacks what they could make on the open market (Over The Cap, 2025).

The moment that open free agency began in the NFL, the ripple effects were felt league wide. Legendary defensive end from the Philadelphia Eagles, Reggie White, immediately left Philadelphia and signed a 3-year $17 million (about $38 million in 2025) contract with the Green Bay Packers. Another All-Pro defensive end from the San Francisco 49ers, Pierce Holt, left and signed a 3-year deal worth $7.5 million (about $16.9 million in 2025) with the Atlanta Falcons. These numbers are significant since they have higher average annual values (AAVs) than we saw with the quarterbacks listed above (Tallent, 2019).

Comparing the contracts that John Elway, Steve Young, and Troy Aikman signed before and after the free agency/salary cap era began is also quite interesting. All three of them signed contracts in 1993, with all of them having significantly higher AAVs than the contracts prior to free agency, with the numbers being between $5 and 7 million per year ($11.3 million–$15.8 million in 2025). Despite the teams now being handicapped in how much they can spend on the roster, these quarterbacks received large raises in salary because the teams were finally forced to pay what the players were actually worth on the open market (Over The Cap, 2025).

The formal introduction of the salary cap brought upon unique challenges for front offices in the NFL. As previously mentioned, the NFL has a “hard” salary cap for which all teams in the league must not exceed. In addition, compared to other professional sports leagues like the NBA, which has salary cap exceptions, or MLB, which does not have a salary cap at all, team owners in the NFL face the difficult task of fairly compensating players under a strict budget constraint. The San Francisco 49ers are a famous example of a team who was heavily affected by the new cap, as at one point they were just $456 under the inaugural cap. They were forced to trade a number of long-tenured players for draft capital, and also utilized signing bonuses as a way to somewhat get around the cap since those are not technically salary. They also had a number of players restructure their deals to allow some acquisitions, namely Deion Sanders, which was the first time that we saw players change their contracts into more team-friendly deals in the name of winning. This approach ultimately paid off, as the 49ers won Super Bowl XXIX, the first season of the salary cap era. Teams caught on to what San Francisco did and now many of those moves are commonplace. The downside of all the restructuring and converting salary into signing bonuses for players is that although it creates more cap space in the current season, it increases the AAV for the rest of the player’s contract. Eventually the higher deferred payments become simply too much to keep such a talented roster together and teams are forced to trade away many key players and reset as a franchise, which the 49ers wound up doing at the end of the decade (Tallent, 2019).

One player who is famous for his team friendly contracts throughout his career is Tom Brady. He did not just restructure his contracts to help the team in the short-term, the deals that he signed were consistently less than what he could have received. In 2005, after winning two Super Bowls, he signed a 6-year, $60 million contract (about $100 million in 2025) right after Peyton Manning signed a deal for 7 years and $98 million (about $164 million in 2025).2 In 2013, Brady signed a 3-year $41 million contract (about $57 million in 2025), and from 2014 to 2018 the Patriots won three Super Bowls. Brady averaged between the 10th and 15th highest paid quarterback in the NFL, despite being a top 3 player at the position every season. While the ability to consistently contend for a Super Bowl was surely a motive for Brady from a competition standpoint, being on a successful team also likely included indirect financial benefits through increased marketability and endorsement compensation, even as he took pay cuts on his team contracts. Nevertheless, the pay cuts that Brady took gave the Patriots more space and flexibility when building their roster, and Brady was rewarded with the elite defenses and phenomenal offensive line play made possible by his team-friendly contracts (Greenawalt, 2021).

4. Data

To understand the impact that income taxes have on the performance of NFL teams after the imposition of the salary cap, we leverage data from a variety of sources for the years 1984 to 2000. As previously discussed, a hard salary cap was implemented in the NFL in 1994. This provides us with an ideal setting for testing whether state income taxes affect team success as the league transitions from not having restraints on team payrolls in the pre-salary cap period to having a fixed budget constraint applied uniformly to all teams in the post-salary cap period. Therefore, the salary cap serves as the treatment in this study, and we have 10 seasons of data prior to treatment and 6 seasons of data after treatment.

We obtain data on a team’s winning percentage, Simple Rating System, and strength of schedule for a given season from Pro Football Reference. The team’s winning percentage is recorded from 0 to 1, where 1 corresponds to an undefeated team. The Simple Rating System (SRS) is a measure created by Pro Football Reference which gives us a better estimate of the true ability of a team. The SRS “uses a team’s point differential and strength of schedule to assign a rating to each team, with 0.0 considered average. The difference in two teams’ SRS ratings can be considered to be a point spread should they play each other, disregarding home field advantage” (Pro Football Reference, 2025). The strength of schedule reflects the “combined winning percentages of the opponents this team played in a given year. Higher SoS [strength of schedule] indicates a tougher schedule, lower indicates easier” (Pro Football Reference, 2025). We use the tax rate for the top income tax bracket for the state a team plays their home games in as the tax rate in our study, such as the New York Giants in New Jersey, obtained from the Book of the States. State populations are obtained from Macrotrends and median household income in the state is obtained from Federal Reserve Economic Data (FRED). To supplement our dataset with a control group for our difference-in-difference models, we also obtain the team’s winning percentage, Simple Rating System, and strength of schedule for a given season from College Football Reference for FBS Division 1 college football teams.

We use college football as the ideal control group in our study for three reasons. First, during the period of our study (1984–2000), name, image, and likeness (NIL) compensation did not exist. The selected timeframe ensures that players were not allowed to have any legal financial contracts or receive payments, allowing us to isolate the impact of state tax rates more effectively. The structural difference between college and professional football allows us to effectively eliminate the impact of tax considerations on college football players and, ultimately, teams.

Second, college players make decisions in large part on non-financial factors, such as recruiting, program prestige, coaching, and location. They do not consider the immediate impact of taxation and salary. The same cannot be said about professional athletes in the NFL, as they likely see the tax taken out of their check every time they get paid after a game. The distinction further strengthens college football as a control group in our study. Any differences in team success between college and professional football are not attributable to the immediate financial motivations of the players. Since college players are not exposed to income taxes, using college football as the control group allows us to isolate the impact of state tax rates on the NFL.

Third, the NFL and college football share key performance metrics, such as SRS, which facilitates statistical comparison of team success across both groups. Having a secondary measure beyond winning percentage that is consistent for both groups helps us to further understand the relationships between tax rates and team success.

Finally, using college football teams as a control group can help address potential endogeneity concerns if teams in high-tax states differ systematically from those in low-tax states in ways that affect team success beyond the income tax rate itself. The inclusion of college football teams controls for such unobservable state-specific factors that may influence team success, allowing us to better isolate the impact of state income tax rates on performance.

Descriptive statistics for all variables are provided in Table 1. Just over 20% of our sample is from the NFL and the remainder comes from Division 1 FBS college football. The average winning percentage in the dataset is 0.504, which is slightly higher than 0.50 because college football teams often choose to play weaker competition , and the weaker teams are not included in the dataset. The average SRS is 0.288 points. The average tax rate facing teams in our dataset is 0.054, or 5.4%.

Table 1.

Descriptive Statistics.

Prior research (Hembre, 2021) used the winning percentage of a team as the measure of team performance. We also use the winning percentage in our study. The choice of winning percentage is the most obvious measure of team performance because the goal of sports is to win games and it is how teams are judged by fans, ownership, media, and, ultimately, the leagues. For instance, playoff selection and seeding in the NFL is determined predominantly by the winning percentage of the teams.3

As important as the winning percentage is, it does a poor job as a measure of the team’s true quality. For instance, if a good team loses a game in the rain after fumbling numerous times against a bad team, the winning percentage of the good team is negatively impacted and the winning percentage of the bad team is positively impacted. Therefore, the winning percentage is an outcome generated by the team’s quality plus a noisy error term

Winning % = Ability + ε.

Additionally, we expect the impact of randomness to be more pronounced in the NFL compared to most other sports due to the low number of total games played in a season. For reference, the standard NFL schedule over our timeframe was 16 games per team compared to 82 games per team in the NBA and 162 games per team in the MLB. The importance of noise in determining the winning percentage of a team is illustrated in our dataset with a correlation between the winning percentage and SRS of only 0.83. In order to overcome the noisiness of the team’s winning percentage, we use the team’s SRS from Pro and College Football Reference. Given that a team is aware of the noisiness of winning percentage, the goal of roster creation is to maximize the team’s ability subject to the salary cap. Therefore, examining the effect of taxation on the SRS is a significant improvement over examining the winning percentage.

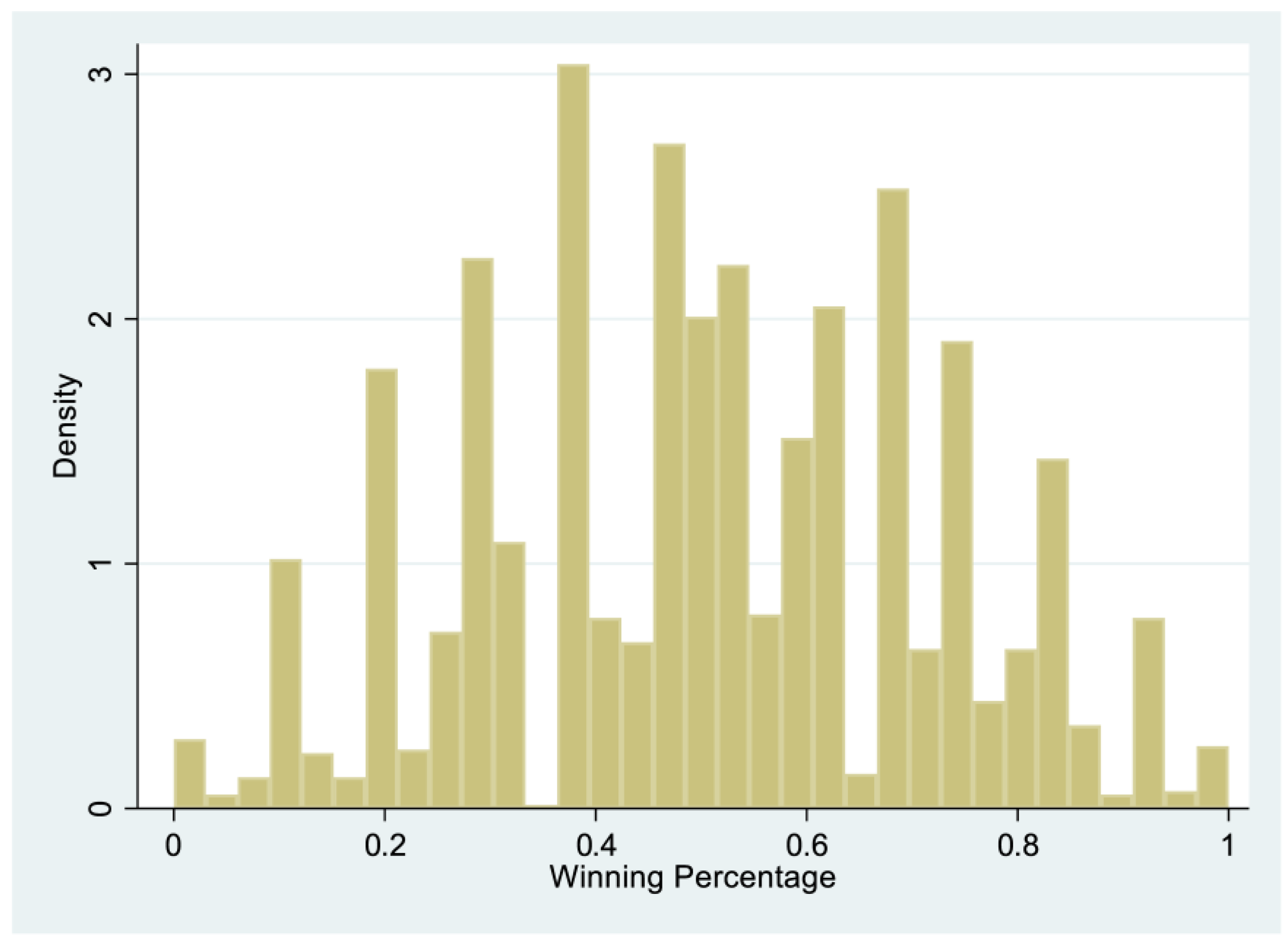

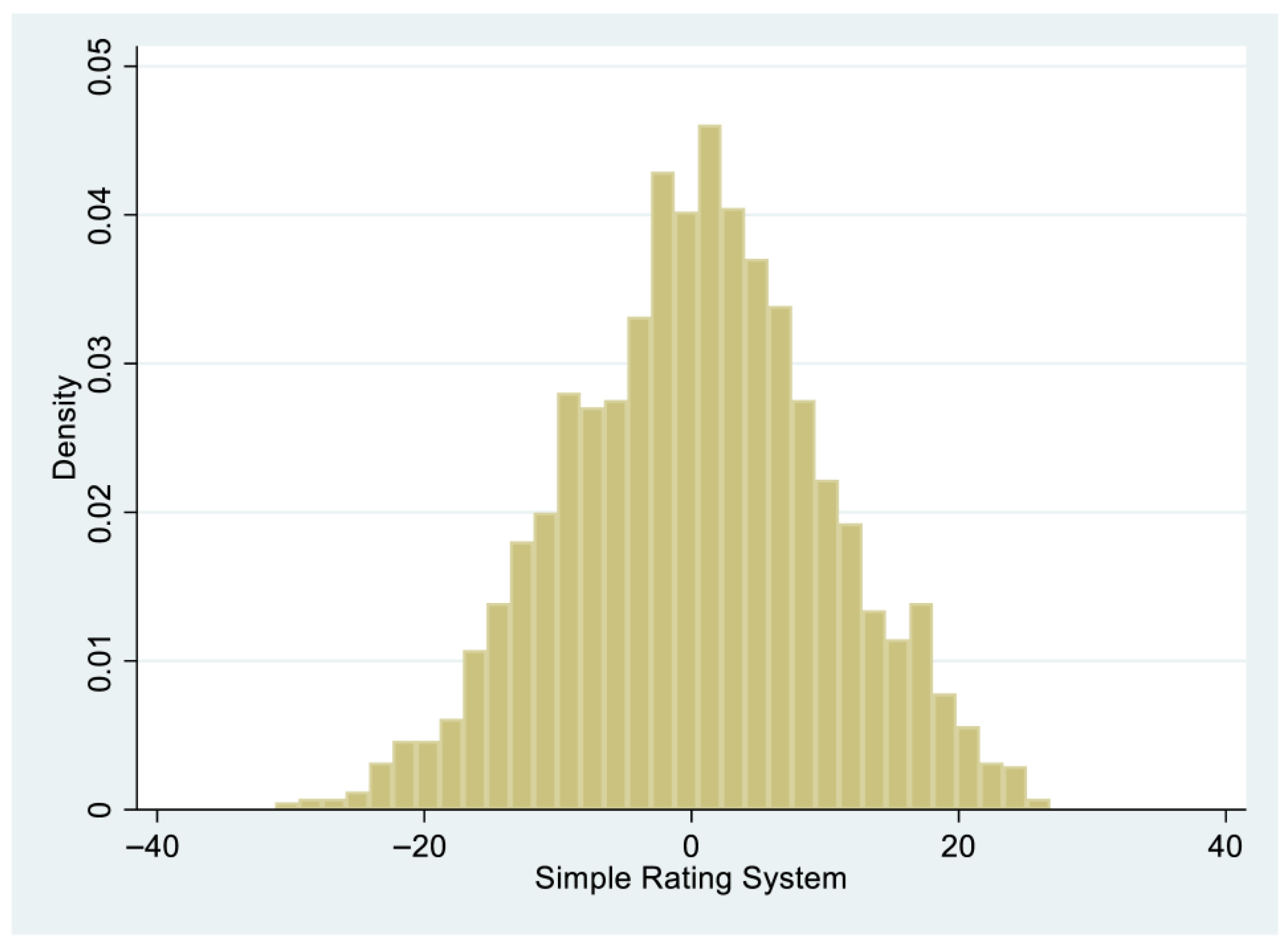

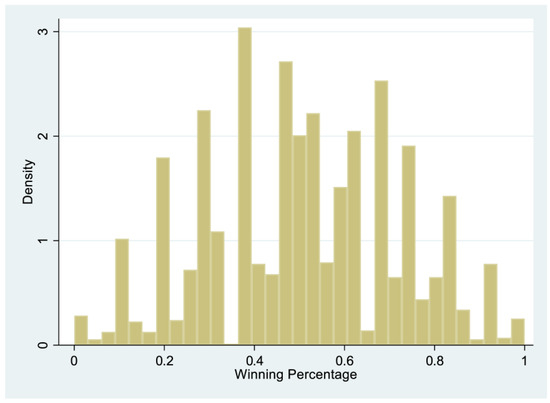

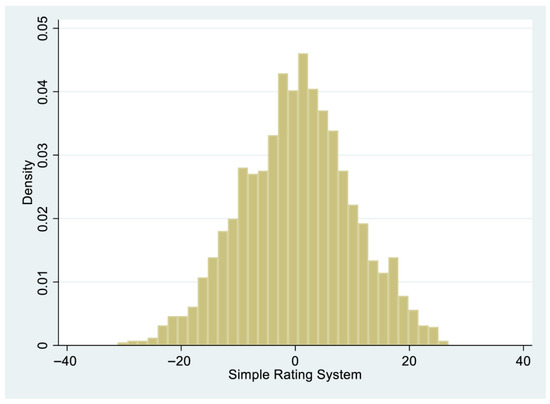

A final benefit of using the SRS values instead of the winning percentage as our measure of team performance is shown in the histograms in Figure 1 and Figure 2. The SRS values appear to closely follow a normal distribution. On the other hand, the winning percentage, which has natural bounds at 0 and 1, is less normally distributed. The normal distribution of the SRS values helps with the validity of the regression analysis.

Figure 1.

Histogram of Team Winning Percentages. Source: Pro Football Reference and College Football Reference. The histogram above shows the distribution of winning percentages (recorded in percentage points) for all of the teams in our sample, including both the NFL and college teams. The results do not follow a clear normal distribution, like those of the SRS values in Figure 2.

Figure 2.

Histogram of Team SRS Values. Source: Pro Football Reference and College Football Reference. The histogram above shows the distribution of the Simple Rating System values for all of the teams in our sample, including both the NFL and college teams. The results do follow a clear normal distribution, unlike those of the winning percentages in Figure 1.

Using the SRS values, we conduct a simple analysis of the impact of state income taxes on NFL team performance in Figure 3. We classify each team as playing either in a high-income tax state or a low-income tax state based on the median state income tax across all teams for a given season. We define a high-income tax state to have a state income tax greater than or equal to the median for the season, and a low-income tax state to have a tax rate less than the median. Our scatterplot below illustrates that prior to the salary cap, teams in high-tax states typically performed better than teams from low tax states. However, we observe a clear shift in NFL team performance in the post-salary cap period, with low-income tax states substantially improving and outperforming high-income tax states. We also observe a substantial decline in performance for high-tax states in the post-salary cap period. This simple analysis does appear to show that state income tax rates have had an impact on the distribution of talent in the league under the salary cap. We formally test these results in the next section.

Figure 3.

Time Series Plot of Average Simple Rating System Values (1984–2000) for high-income tax states vs. low-income tax states in the NFL. Source: Pro Football Reference and College Football Reference. The time series plot above shows the average value of the Simple Rating System values for high-income tax states declines, while the average value for low-income tax states increases in the post-salary cap period, as denoted by the red vertical line.

5. Econometric Strategies and Results

To test the effect of taxation on NFL team performance, we present two sets of analyses. First, in Section 5.1, we show that taxes decrease the SRS of a professional football team, and the impact is particularly pronounced after the implementation of the salary cap. Second, in Section 5.2, we use decision tree classification algorithms to show that teams in high-tax states are more likely to be good teams before the passage of the salary cap. However, after the salary cap, teams from high-tax states are less likely to be good teams.

5.1. Difference-in-Difference Model for Team Performance

In this study, we employ a difference-in-differences (DID) approach to estimate the causal impact of state income tax rates on team success in the NFL. The DID methodology is especially useful for helping to estimate causal relationships and comparing changes in outcomes over time between a treatment group (NFL teams) and a control group (college teams). We use the DID model to determine if there is a measurable impact on team success as a result of state income tax rates. We test our model on two measures of team performance—the winning percentage and the Simple Rating System value of the team. We find that taxes lower a team’s Simple Rating System value, and the effect is particularly pronounced after the passage of the salary cap. On the other hand, we are underpowered to find a statistically negative impact of tax rates on team winning percentage. The model that we estimate is given by the equation

Performancetsτ = β0 + β1Taxtsτ + β2SCtτ + β3Taxtsτ × SCtτ + γ · Xtsτ + Teams + ϵtsτ.

Performancetsτ is team t’s performance in state s during season τ. The performance of the team is measured using either the winning percentage or the team’s SRS. The variables of interest are Taxtsτ, which measures the top state income tax rate, SCtτ, which is equal to one for observations from NFL teams during or after 1994, and Taxtsτ × SCtτ, which is the interaction of the tax rate for NFL teams after the passage of the salary cap in 1994. Xtsτ is a vector of control variables including the median household income in the state, the population of the state, and the strength of schedule for the team during the season. We also include team fixed effects.

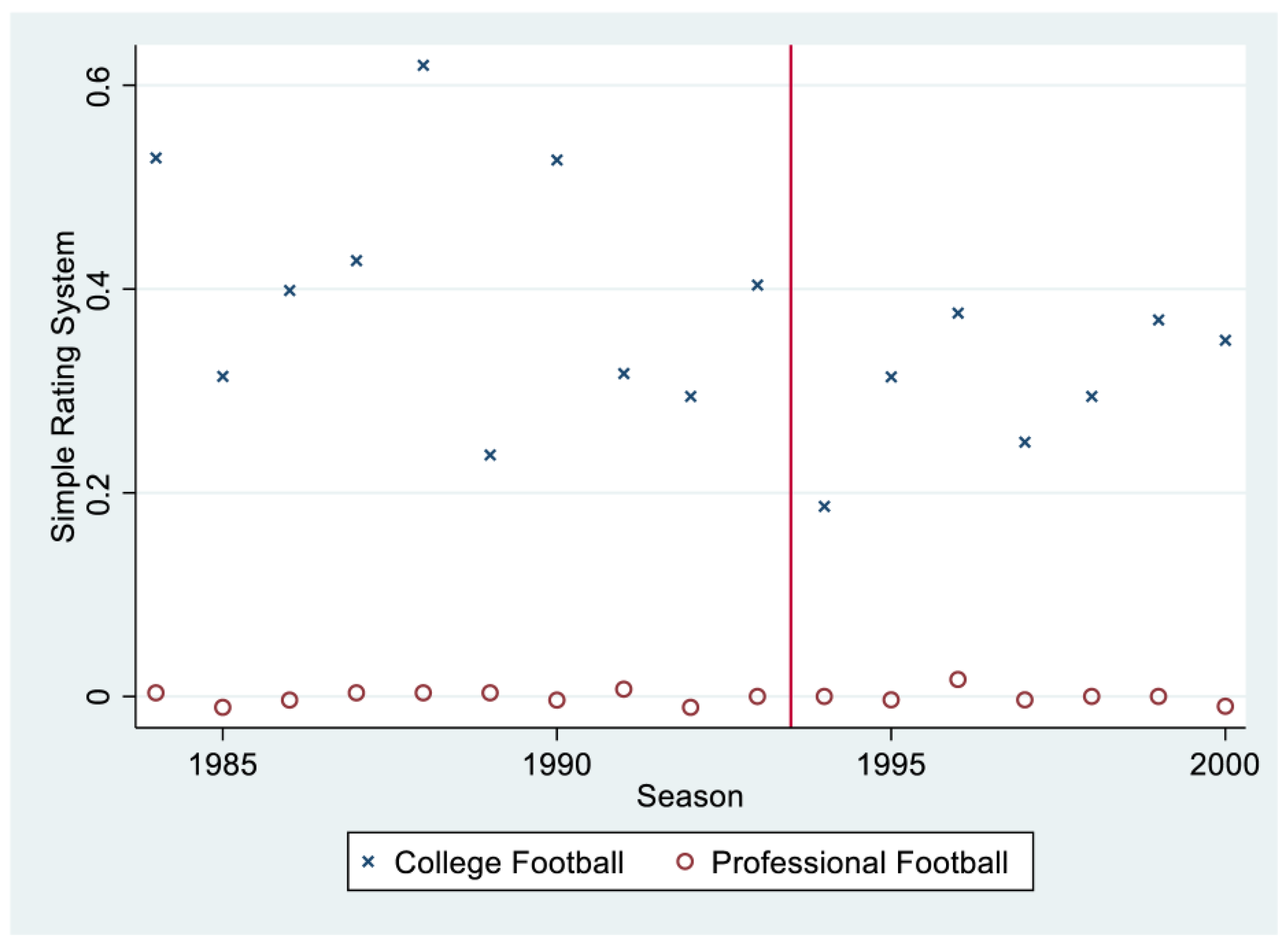

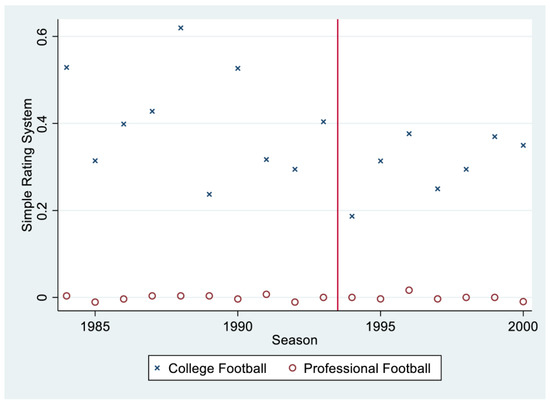

For our model to provide causal estimates of the impact of taxes on team performance after the passage of the salary cap, there are two key assumptions that need to be met (Roth et al., 2023). First, the performance of professional and college teams should not be deviating on average in the lead up to the salary cap in 1994, which is commonly referred to as the “parallel trends assumption.” Given that the average sports team wins 50% of their games, there should not be a violation of the parallel trends assumption with regard to the team’s winning percentages. On the other hand, it is possible for the SRS values to violate the parallel trends assumption. To assuage any concerns of violating parallel trends, we show the average SRS value in our dataset annually for both the college football and professional football teams. The time series plot of average SRS values can be observed in Figure 4 and shows no evidence of a violation of parallel trends. The NFL data are firmly centered around zero in the lead up to the salary cap and the average of zero continues thereafter. On the other hand, the college football teams do not show a clear trend either before or after the passage of the NFL’s salary cap, although the averages are consistently higher than zero. For both the NFL and college teams in our data, we do not observe a consistent trend and the parallel trends assumption appears to be valid.4 Second, the teams should not be changing their performance based on the anticipation, if any, of the salary cap. Sports teams cannot choose to outperform their inherent abilities nor do they have an incentive to purposefully lose games or decrease their team’s quality in the lead up to the salary cap. Therefore, the parallel trends assumption and the assumption of no anticipation effects should be valid and the model will provide causal estimates.

Figure 4.

Time Series Plot of Average Simple Rating System Values (1984–2000). Source: Pro Football Reference and College Football Reference. The time series plot above shows the average value of the Simple Rating System values for the NFL and college teams in our sample. The passage of the salary cap is denoted with the vertical red line. The results are consistent with the parallel trends assumption.

Our model is different from the model presented in Hembre (2021) in four important ways. First, we focus solely on the effect of tax rates on NFL teams instead of all professional sports. The NFL is a league with a hard salary cap in a given season, as opposed to leagues such as the MLB, which has a so-called “luxury tax” for spending above a certain amount on player salaries, and the NBA, which has special rules for teams re-signing players versus teams signing new players. Second, we use a distinct control group, college football teams, which are never impacted by the salary cap or, theoretically, the tax rates due to the fact college football players are not compensated during our sample period. Third, we use a shorter window of time (1984–2000) compared to Hembre (2021) (1980–2017). The shorter window is important because prior research has found that estimates of difference-in-difference models where all units are eventually treated may become biased in periods that occur further after the passage of the policy (Roth et al., 2023). Fourth, we focus on the period with a salary cap instead of simply free agency. The reason we focus on the salary cap is it represents a hard budget constraint for teams. Without a salary cap and with free agency, a team may overcome the negative consequences of high tax rates by simply spending more money.5

The results from estimating Equation (1) are shown in Table 2. The results on winning percentage are shown in column 1 and estimate a negative impact of taxation that is particularly pronounced after the implementation of the salary cap. The results are quantitatively and qualitatively similar to the results of Hembre (2021). A one standard deviation increase in the tax rate (3.4%) is related to a loss in winning percentage of just over 2 percentage points. In the context of an NFL season, the increase in taxes would lead to a loss of 0.32 additional games, which is significant in a 16-game season. However, we do not find a statistically significant relationship between the team’s winning percentage and the top income-tax rate in the team’s state. Unfortunately, winning is an inherently noisy estimate of a team’s quality. Therefore, we may expect to be underpowered to find a statistically significant relationship between the winning percentage and taxation.

Table 2.

Regression Results for the Treatment Effect of Taxation after the Salary Cap.

In order to better identify team quality, we examine the team’s SRS in column 2 of Table 2. We now find a statistically negative relationship between the state’s top income tax rate and the quality of a football team. The effect is particularly pronounced after the passage of the salary cap.

To ensure that our estimates are robust, we also estimate Equation (1) using two different control groups. The first control group we use comprises only college football teams in the so-called “power conferences.” The teams in the power conferences tend to be of higher quality than teams outside of the power conferences and may provide a more comparable baseline to professional football. The regression results for our power conferences control group can be found in Table 3. When we use only power conferences for our control group, we eliminate 452 observations (almost 20%). However, we actually improve the precision of our estimates and find that tax rates have a statistically negative impact on the teams’ winning percentages and SRS scores. The effect is statistically stronger for SRS after the passage of the salary cap. However, we still do not see a statistically negative relationship between tax rates and winning percentages after the passage of the salary cap.

Table 3.

Regression Results Using the Power Conferences as a Control Group.

As a final robustness check, we create our own hand-matched sample of professional and collegiate teams within the same state. For example, Syracuse University is in the sample matched to the Buffalo Bills; Rutgers is in the sample matched to the New York Jets and the New York Giants, who both play their home games in New Jersey. The regression results for our hand-matched sample can be found in Table 4. The full hand-matched sample is detailed in Table 5. A key benefit of the hand-matched sample is that the teams in the control group come from the exact same states as the treatment group. Therefore, we are able to have a control group which is influenced by the same state-specific effects which our DID specification may not address. For instance, a state that is growing economically may have an advantage in attracting free agents in the NFL or better players to the colleges in the state. However, both the treatment and control group would be impacted similarly by the time-varying characteristics. Due to the hand-matching, we eliminate more than 1100 observations (almost 50%) compared to the baseline dataset. However, we now obtain the strongest statistical results in terms of significance in our study. Given the elimination of so many observations, the fact we obtain stronger significance in our statistical findings points towards the validity of the hand-matched sample as a good control group.

Table 4.

Regression Results Using the Hand-Matched Sample.

Table 5.

Hand-Matched Sample Pairs.

Overall, our findings indicate that there is a robust negative relationship between a state’s top income tax bracket and the quality of a professional football team. The effect is particularly pronounced when the quality of a football team is determined by the SRS instead of the noisy estimate of team quality provided by the team’s winning percentage. In fact, the estimates of the impact of taxes on SRS increase in their precision when the sample is restricted to the power conferences or the hand-matched sample compared to the full college football sample despite omitting large numbers of observations. However, the winning percentage does not improve much in its precision, a testament to the noisiness of the winning percentage.

5.2. Determining a Tax Rate Threshold for Competitive Advantage

Given our finding that teams located in states with higher income taxes tend to be less successful, particularly after the league introduced the salary cap in 1994, we now identify if there exists a tax rate threshold at which teams experience a competitive advantage. To address this question, we define an “above average team” as one that finishes the season with an SRS of above 0, while a “below average team” is one that finishes the season with an SRS of below 0. Our approach uses a decision tree classification algorithm to determine if there exists a tax threshold that allows us to accurately classify teams as above or below average. We also use this approach to determine if any changes to the threshold occur after the implementation of the salary cap.

Decision trees are constructed by recursively splitting the data into partitions based on a specified target field and input features that best separate or classify the data (De Ville, 2013). In our case, the target field represents whether or not a team finishes the season as an above average team as determined by the SRS and the input feature we use to make the classification is the income tax rate for the state in which the team is located. We use the rpart package in R (version 4.2.1) to construct a decision tree for both the pre and post-salary cap periods in our data.6

The decision tree algorithm will work by first splitting the data by a tax threshold that best separates the data into two groups based on our input feature of team quality (above average or below average). The algorithm will choose the tax threshold by minimizing the impurity, or heterogeneity, of each group based on the following Gini impurity measure of classification accuracy:

where G represents the Gini impurity measure, C represents the number of possible classes, and pi represents the probability of observing class i in the group’s data. In our case we have two possible classes (above average or below average). Therefore, the value of pi represents the probability of observing a team in class i within a group created by the tax threshold rate split. This Gini impurity measure is calculated for each group created by the decision tree split, and an overall Gini impurity measure is determined by a weighted average of Gini impurities. For the weighted average, each group’s Gini impurity is weighted by the total number of observations (teams) that were classified into the group by the decision tree split (Daniya et al., 2020). The decision tree algorithm will calculate the Gini impurity for all possible tax threshold rates and will select the tax threshold that minimizes the measure.

Once the initial split is made, the algorithm continues to split each subgroup further by selecting new tax rate thresholds that best separate the data within each subgroup. The process continues until a predefined maximum number of splits is reached, or until further splits do not improve the classification of teams. One common concern with the usage of decision trees is the potential risk of overfitting the decision tree to the data, limiting the usefulness of the decision tree in making accurate classification predictions on new data (Dietterich, 1995). However, in our study, the primary objectives of using the decision tree algorithm are to determine whether a tax threshold for success exists in both the pre and post-salary cap eras, and to determine whether changes to this threshold exist between the two periods. Given that predicting future outcomes is not the focus of this study, overfitting on the training data is not a serious concern in this regard. However, one area for which overfitting could be a problem is if the decision tree ends up being overly complex with little interpretation value, an issue commonly faced in machine learning and artificial intelligence (Quinlan, 1987). In our study, one simple way to avoid overfitting the data is to limit the number of possible data splits (Bramer, 2007). Since the state income tax rate is the only input feature we use in constructing our decision trees, we limit the number of possible splits of the decision tree to be two in order to limit the risk of overfitting the data.

Using this approach, we construct a decision tree for both the pre-salary cap and post-salary cap eras and determine if any differences occur in decision trees between the two periods. Figure 5 represents the decision tree for the pre-salary cap period in the NFL. Within each node, the top label represents the dominant outcome for that category. A node labeled “Above Avg.” indicates that the majority of teams in that category finished with an SRS above 0.0 for the season, while a node labeled “Below Avg.” indicates that the majority of teams in that category finished with an SRS below 0.0 for the season. The middle values in each node represent the estimated probabilities of a team finishing with an SRS above (left value) and below (right value) 0 for the category defined by that node. The bottom value in each node represents the percentage of total observations that fall into the category defined by the node. With these definitions in mind, we now examine the results of our pre-salary cap decision tree for NFL teams.

Figure 5.

Decision Tree for Pre-Salary Cap Period (1984–1993). The decision tree above shows the results of splitting the sample during the pre-salary cap era in the NFL (1984–1993 in our sample). The results show that teams are more likely to be above average when the tax rates are above 7.2%.

From Figure 5, we observe that the decision tree algorithm identified a single split as the optimal classification criterion for NFL teams during the pre-salary cap era. The threshold for classifying above versus below average teams with the highest accuracy before the salary cap is 7.2%. The root node shows that approximately 49% of teams in our data had an SRS of above 0.0 prior to the institution of the salary cap.

Interestingly, the decision tree shows that for teams playing in states with income tax rates of greater than or equal to 7.2% prior to the salary cap, the dominant outcome was finishing as an above average team, as illustrated by the leaf node on the left-hand side of the decision tree. This node shows that, given a state income tax rate of at least 7.2%, teams finished as above average 60% of the time. In contrast, the leaf node on the righthand side of the decision tree shows that for teams playing in states with income tax rates less than 7.2%, the probability of finishing with an SRS of above 0.0 was approximately 44%.

Next, we consider whether our decision tree algorithm illustrates changes in the tax threshold for success for the post-salary cap era. In the root node shown in Figure 6, we now observe that above average teams represent the majority in our post-salary cap data, with approximately 51% of teams finishing with an SRS of above 0.0 during this period. Our decision tree algorithm identifies the optimal tax rate threshold for classifying above average versus below average teams as 7.0%, similar to the tax threshold rate we identified in the pre-salary cap era. However, a significant shift has occurred in our post-salary cap decision tree: the dominant classification for teams in high tax rates has switched from “above average” in the pre-salary cap era to “below average” in the post-salary cap era.

Figure 6.

Decision Tree for Post-Salary Cap Period (1994–2000). The decision tree above shows the results of splitting the sample during the post-salary cap era in the NFL (1994–2000 in our sample). The results show that teams are more likely to be below average when the tax rates are above 7.0%.

In the leaf node on the right-hand side of the decision tree, the estimated probability of finishing with an SRS of above 0.0 is 36%, a significant decrease from the 60% probability observed in the pre-salary cap era using the 7.2% tax rate threshold. On the other hand, the leaf node on the left-hand side of the decision tree shows that the probability of having an above average season for teams in states with income tax rates under 7% in the post-salary cap era is 58%, a significant increase from the 44% observed in the pre-salary cap era.

Additionally, the decision tree for the post-salary cap era introduces an additional split for teams in higher income tax states to achieve optimal classification accuracy. Teams in states with income tax rates of at least 7% but below 7.9% finished with above average seasons approximately 17% of the time, while teams in states with tax rates above 7.9% finished with above average seasons approximately 53% of the time. Since only 15% of our data falls into this latter category, we caution against overemphasizing the higher success rate of teams in this group. With that said, it should be noted that this finding may be potential evidence of a nonlinear effect of state income taxes on NFL team success. Such an effect could occur if teams playing in the most highly taxed states receive benefits (i.e., investments in facilities or infrastructure) that teams in lower taxed states do not receive. Given this possibility, we believe an investigation into the potential of a nonlinear tax effect on team success would be an interesting area of future research to build upon the findings of the current study.

In summary, our decision tree results support our previous findings, showing that the salary cap had a negative impact on the success of teams in states with higher income taxes in the post-salary cap era. Teams in states with income tax rates of at least 7.2% finished as above average 60% of the time before the salary cap, while teams in states with income tax rates of at least 7% finished as above average 36% of the time after the salary cap was implemented. In contrast, teams in states with income tax rates under 7.2% finished as above average 44% of the time in the pre-salary cap era, while teams in states with income tax rates under 7% finished as above average 58% of the time in the post-salary cap era. Thus, the substantial decrease in success for teams in high-tax states and the substantial increase in success for teams in low-tax states after the salary cap was implemented fully support the observations made in our regression analysis.

6. Conclusions

This paper investigates the impact of state income taxes on the success of NFL teams both before and after the institution of the salary cap in 1994. Using a difference-in-difference model with college football teams as the control group, we find a negative causal impact of taxes on team success over our sample period, with the effect being more pronounced after the salary cap was instituted. Additionally, we use a decision tree classification algorithm to show that teams in high income tax states were more likely to be classified as above average prior to the salary cap, but more likely to be classified as below average after the salary cap was instituted.

The results of this study illustrate the disadvantage that teams in high-income tax states can face when competing against teams in low-income tax states. Given the limited research surrounding this disadvantage in professional sports, several interesting areas of future research could be pursued based on our results. One potential area of future research would be to investigate whether teams playing in high-income tax states face a disadvantage in free agency compared to teams in low-income tax states. For leagues with a salary cap, this could involve determining whether teams in high-income tax states are less likely to sign more productive free agents than teams in low-income tax states. Additionally, in leagues with salary cap exceptions or no salary cap at all, one could examine whether teams in high-income tax states need to offer higher salaries to free agents in order to compensate for the greater income tax burden those players would face.

Another interesting area of future research would be to focus on athlete participation for sports that are structured by tournaments and invitationals rather than regular season closed leagues like the NFL. For these sports, one could determine whether athletes are more likely to participate in tournaments that occur in low-tax states compared to high-tax states. Additionally, given the randomness and lack of explanatory power we observe using season-level winning percentage in our study, another potential idea for future research could use game-level data, rather than season-level data to determine if teams in high-tax states face a disadvantage in head-to-head match-ups with teams in low-tax states. Finally, future research could integrate local city taxes, in addition to state taxes, into the analysis to investigate this topic at a more granular level.

The implications of this study are relevant to both the sports industry and general businesses, as well. In the sports industry, understanding the impact of income tax differences between states can help teams refine their strategy when building a roster. For example, a team playing in a high-income-tax state may be more inclined to build their roster through trades or the draft, compared to a team playing in a low-income tax state, who may have a larger incentive to build through free agency. The results of this study are also relevant for leagues from a policy standpoint pertaining to competitive balance initiatives. While the league cannot change income tax differences between states, competitive balance mechanisms such as compensation picks for teams in high-income tax states that lose free agents to teams in low-income tax states may be a realistic solution to any competitive imbalances caused by tax differences.

The results of this study are also relevant to any firm competing in a market with firms from other states. Differing income tax rates between states could affect strategic decisions for firms such as geographical areas for expansion, competition for labor, and compensation for employees. Although several factors contribute to a firm’s competitive advantage, the results of the current study show that differing income tax rates can influence a firm’s success and lead to varying outcomes for competing firms.

Author Contributions

B.P. contributed to this paper by creating the initial research idea, creating the econometric model, writing parts of the original draft, and revising the paper based on referee reports. R.P. contributed to this paper by creating the initial research idea, creating the econometric model, performing the decision tree analysis, writing parts of the original draft, and revising the paper based on referee reports. D.A. contributed to this paper by collecting the data, performing the econometric analysis, writing parts of the original draft, and revising the paper based on referee reports. S.F. contributed to this paper by collecting the data, performing the econometric analysis, writing parts of the original draft, and revising the paper based on referee reports. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Acknowledgments

We thank Rodney Paul, Brian Payne, Andrew Weinbach, and participants of the Academy of Economics and Finance 2025 Conference for helpful comments when creating this paper. We also thank Brian McDermott, a tax executive in the media and entertainment industry, for his insightful comments on the topic made during multiple visits to St. Bonaventure University. Any remaining errors are our own.

Conflicts of Interest

The authors declare no conflicts of interest.

Notes

| 1 | Calculated using the BLS’s Inflation Calculator from January 1985 to August 2025 available at https://www.bls.gov/data/inflation_calculator.htm (accessed on 1 October 2025). All other real values are calculated using the same resource from March of the relevant year to August 2025. |

| 2 | These numbers are small in comparison to the highest-paid quarterbacks today. In fact, the 10-highest paid quarterbacks according to overthecap.com on 1 October 2025 all earn an average of more than $50 million per season during their current contracts. |

| 3 | The NFL also includes consideration for winning a team’s division, but the winner of a division is determined by the highest winning percentage of the teams in the division. |

| 4 | The time series plots are not a perfect test of the parallel trends assumption. However, it is a standard method to understanding whether the parallel trends assumption holds, at least in the pre-treatment period. Based on our findings, the pre-treatment SRS values are following a parallel trend. Of course, one threat to our DID model, similar to any DID model, is that the post-treatment SRS values would not be parallel in the absence of the treatment. Unfortunately, it is impossible to empirically test the post-treatment period for parallel trends and biased estimates of the model may occur (Cunningham, 2021). |

| 5 | There is anecdotal evidence that team owners are willing to go beyond self-imposed budgets for the sake of winning, such as Steve Cohen’s comments on the Mets’ 2025 payroll (Castillo, 2025). |

| 6 | https://cran.r-project.org/web/packages/rpart/index.html (accessed on 1 March 2025). |

References

- Alm, J., Kaempfer, W. H., & Sennoga, E. B. (2012). Baseball salaries and income taxes: The “Home Field Advantage” of income taxes on free agent salaries. Journal of Sports Economics, 13, 619–634. [Google Scholar] [CrossRef]

- Baker, W. H. (1998). Taxation and professional sports—A look inside the huddle. Marquette Sports Law Journal, 9, 287. [Google Scholar]

- Bramer, M. (2007). Avoiding overfitting of decision trees. In Principles of data mining (pp. 119–134). Springer. [Google Scholar]

- Castillo, J. (2025). Mets owner wants winner, but excessive spending not “optimal”. Available online: https://www.espn.com/mlb/story/_/id/43905008/mets-owner-wants-winner-excessive-spending-not-optimal (accessed on 15 March 2025).

- Conklin, M., & Daniel, J. (2024). Taxes and athletic performance: Why NBA players perform better in low-tax states. Houston Business and Tax Law Journal, 24, 185. [Google Scholar] [CrossRef]

- Cunningham, S. (2021). Causal inference: The mixtape. Yale University Press. [Google Scholar]

- Daniya, T., Geetha, M., & Kumar, K. S. (2020). Classification and regression trees with gini index. Advances in Mathematics: Scientific Journal, 9, 8237–8247. [Google Scholar] [CrossRef]

- DeCort, C. (2022). NFL salary cap explained. Available online: https://www.the33rdteam.com/nfl-salary-cap-explained/ (accessed on 10 March 2025).

- Denk, E. (2018). Bill belichick uses his economics degree, even if he doesn’t realize it. Available online: https://medium.com/@ErichDenk/bill-belichick-uses-his-economics-degree-even-if-he-doesnt-realize-it-a3aec6f5ad79 (accessed on 12 March 2025).

- De Ville, B. (2013). Decision trees. Wiley Interdisciplinary Reviews: Computational Statistics, 5, 448–455. [Google Scholar]

- Dietterich, T. (1995). Overfitting and undercomputing in machine learning. ACM Computing Surveys (CSUR), 27(3), 326–327. [Google Scholar] [CrossRef]

- Ekmekjian, E. C. (1994). The jock tax: State and local income taxation of professional athletes. Seton Hall Journal of Sport Law, 4, 229. [Google Scholar]

- Ekmekjian, E. C., Wilkerson, J. C., & Bing, R. W. (2004). The jock tax contest: Professional athletes vs. the states-background and current developments. Journal of Applied Business Research (JABR), 20(2), 19–30. [Google Scholar] [CrossRef]

- Greenawalt, T. (2021). Would the Patriots still have won big if Tom Brady didn’t take pay cuts? Available online: https://sports.yahoo.com/would-the-patriots-still-have-won-big-if-tom-brady-didnt-take-pay-cuts-181906268.html (accessed on 13 March 2025).

- Hageman, A. M., Robb, S. W. G., & Schwebke, J. M. (2021). SALTy citizens: Which state and local taxes contribute to state-to-state migration? Journal of the American Taxation Association, 43(1), 51–77. [Google Scholar] [CrossRef]

- Hembre, E. (2021). State income taxes and team performance. International Tax and Public Finance, 29, 704–725. [Google Scholar] [CrossRef]

- Jensen, S. A. (1999). Financing professional sports facilities with federal tax subsidies: Is it sound tax policy. Marquette Sports Law Journal, 10, 425. [Google Scholar]

- Krasney, J. L. (1993). State income taxation of nonresident professional athletes. Tax Law, 47, 395. [Google Scholar]

- Lathrope, D. J. (1997). Federal tax policy, tax subsidies, and the financing of professional sports facilities. South Texas Law Review, 38, 1147. [Google Scholar]

- National Football League. (2025). The history of NFL free agency. Available online: https://operations.nfl.com/inside-football-ops/nfl-operations/2025-nfl-free-agency/the-history-of-nfl-free-agency/ (accessed on 10 May 2025).

- Over The Cap. (2025). NFL quarterback contract history. Available online: https://overthecap.com/contract-history/quarterback#google_vignette (accessed on 12 March 2025).

- Phelps, Z. A. (2003). Stadium construction for professional sports: Reversing the inequities through tax incentives. St. John’s Journal of Legal Commentary, 18, 981. [Google Scholar]

- Pro Football Reference. (2025). Football glossary and football statistics glossary. Available online: https://www.pro-football-reference.com/about/glossary.htm (accessed on 25 February 2025).

- Quinlan, J. R. (1987). Simplifying decision trees. International Journal of Man-Machine Studies, 27(3), 221–234. [Google Scholar] [CrossRef]

- Reiss, M. (2013). For Tom Brady, less is more. Available online: https://www.espn.com/nfl/story/_/id/8989537/tom-brady-team-friendly-contract-paves-way-more-titles (accessed on 10 March 2025).

- Ringle, L. A. (1995). State and local taxation of nonresident professional athletes. Sports Lawyers Journal, 2, 169. [Google Scholar]

- Rohlin, S., Rosenthal, S. S., & Ross, A. (2014). Tax avoidance and business location in a state border model. Journal of Urban Economics, 83, 34–49. [Google Scholar] [CrossRef]

- Roth, J., Sant’anna, P. H., Bilinski, A., & Poe, J. (2023). What’s trending in difference-in-differences? A synthesis of the recent econometrics literature. Journal of Econometrics, 235, 2218–2244. [Google Scholar] [CrossRef]

- Staudohar, P. D. (1998). Salary caps in professional team sports. Compensation and Working Conditions, 3(1), 3–11. [Google Scholar]

- Swindell, D., & Rosentraub, M. S. (1998). Who benefits from the presence of professional sports teams? The implications for public funding of stadiums and arenas. Public Administration Review, 58, 11–20. [Google Scholar] [CrossRef]

- Tallent, A. (2019). The NFL salary cap turns 25: How it began and where it is now. Available online: https://athlonsports.com/nfl/nfl-salary-cap-turns-25-matter-survival-standard-operating-procedure (accessed on 15 March 2025).

- The Editorial Board. (2024). Massachusetts fumbles the tax ball. Available online: https://www.wsj.com/opinion/massachusetts-taxes-bill-belichick-new-england-patriots-bd13270c (accessed on 27 August 2024).

- Tiebout, C. M. (1956). A pure theory of local expenditures. Journal of Political Economy, 64(5), 416–424. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).