Abstract

This study explores the impact of environmental accounting practices on corporate environmental performance in Greek enterprises. Grounded in environmental management accounting (EMA), strategic management theory, Stakeholder Theory, and Institutional Theory, it employs a quantitative analysis of data collected via a Likert-type questionnaire in 2024. The focus lies in GRI-based indicators, green technologies, environmental investments, and reporting mechanisms. While international standards such as ISO 14001 and EMAS are considered conceptually, they are not empirically assessed. Data were analyzed using IBM SPSS Statistics (version 29.0) and SmartPLS (version 4.0). The results show that organizations implementing structured environmental accounting systems experience enhanced environmental performance, including greater transparency, regulatory compliance, and innovation capacity. This study fills a gap in the Greek context and emphasizes the strategic role of environmental accounting in advancing sustainability and competitiveness.

1. Introduction

Environmental preservation and sustainability are key challenges in today’s global financial landscape, driven by societal, consumer, and investor expectations. In recent decades, the international community has increasingly emphasized the critical role of businesses in achieving environmental sustainability through concrete, measurable actions (UNEP, 2021; OECD, 2018). Greece offers a particularly relevant context for investigating the adoption of environmental management practices, as the country faces unique economic and institutional challenges following a prolonged financial crisis, which has influenced corporate behavior and regulatory compliance (Tsalis et al., 2020). Although numerous international studies have examined how environmental accounting and sustainability frameworks contribute to corporate environmental performance (e.g., Schaltegger & Zvezdov, 2015; Burritt & Schaltegger, 2010), findings often differ depending on institutional, economic, and sectoral conditions. Even within the European Union, implementation varies significantly due to differences in regulatory enforcement and resource availability across member states (Testa et al., 2018).

In the Greek context, the uptake of environmental accounting tools remains limited and uneven. While earlier studies (e.g., Nikolaou & Tsalis, 2013) highlighted the growing relevance of CSR and environmental practices, more recent research suggests that adoption is still fragmented, particularly among small and medium-sized enterprises (Tsalis et al., 2020). This paper contributes to the growing sustainability accounting literature by shedding light on a unique institutional environment. Greece, as an EU member state with strong regulatory alignment but limited practical uptake of environmental management tools, represents a “natural laboratory” to examine the gap between policy and implementation. Furthermore, the study’s finding that green technology investments exhibit a negative short-term association with environmental performance extends current theory by showing that institutional voids, financing constraints, and capacity gaps can reverse the expected benefits of eco-innovation. This paper seeks to address this research gap by investigating how internal environmental strategies—such as GRI-based sustainability reporting, green investments, and the use of performance indicators—impact corporate environmental performance in Greece. International frameworks such as ISO 14001 (ISO, 2021) and EMAS are included for contextual understanding but are not directly assessed in the empirical analysis.

Corporations are required to conduct themselves ethically, reduce their adverse impacts on the environment, and actively support the preservation of natural resources. Superficial sustainability measures are no longer adequate. Instead, true integration of environmental management is essential. International rules and regulations requiring consideration of environmental implications serve to strengthen this transition (Testa et al., 2018). These expectations apply across all types of organizations, regardless of size or sector.

Other papers have stated that companies that fail to implement sustainable practices face significant financial and reputational consequences (Porter & Kramer, 2006). Furthermore, while large corporations lead in implementing such practices, there is an uneven distribution of capacity and resources across firms, which makes comprehensive sustainability adoption challenging.

The international community no longer accepts superficial sustainability initiatives and expects firms to incorporate significant environmental management measures into their strategy. This progress is supported by worldwide norms and regulations that require firms to examine the environmental impact of their operations. In Greece, the tension between regulatory alignment with EU directives and the limited practical uptake of environmental standards creates a compelling case study. Understanding how environmental management tools are implemented in Greece is particularly valuable, as the country provides an example of an EU economy where structural and economic conditions may influence the practical uptake of sustainability frameworks. Despite regulatory alignment, gaps between policy and implementation offer a rich context for examining the effectiveness of environmental accounting tools.

In this context, environmental accounting has emerged as an important tool for managing environmental issues. It integrates environmental parameters into economic decision-making, going beyond recording costs to analyzing risks and managing environmental data. By determining the true cost of environmental impacts, firms can reduce risks, avoid negative externalities, and enhance both sustainability and profitability (Schaltegger & Burritt, 2017). Furthermore, environmental accounting fosters transparency and responsibility, which improves stakeholder communication and reputation while corresponding consumer and investor expectations of ethical behavior (Bebbington et al., 2001).

Environmental performance and audits are critical markers of company environmental responsibility. While auditing methodically evaluates consequences, performance represents the results of environmental strategies. Companies that achieve high levels of environmental performance manage to reduce emissions, conserve energy, minimize waste, and enhance their sustainability.

ISO 14001 and the Environmental Management and Audit Scheme (EMAS) provide conceptual frameworks aimed at improving environmental performance and complying to international necessities (Darnall et al., 2008). These requirements provide a clear framework for managing environmental performance, allowing businesses to establish a broader approach to environmental responsibility. Companies acquire from these frameworks by increasing their consumer reputation, lowering expenses, and strengthening stakeholder connections.

However, the Greek institutional context poses barriers to widespread adoption of such frameworks, including lack of governmental incentives, limited access to funding for smaller firms, and inconsistencies in enforcement (Tsalis et al., 2020). Large organizations often take the lead in implementing these practices. Therefore, the Greek case offers a meaningful opportunity to study how international environmental frameworks are interpreted and implemented within a context of constrained resources and evolving regulatory support.

The purpose of this paper is to investigate the extent to which environmental strategies and accounting practices influence corporate environmental performance in Greek enterprises. The paper explores the factors that encourage environmental accounting adoption in Greece, along with the challenges that arise as an outcome. Questionnaires are distributed to executives representing various organizations so as to gather data and receive an in-depth understanding of environmental accounting. The paper’s analysis of the findings aims to provide actionable insights to strengthen environmental performance in Greek enterprises while establishing a more sustainable business environment.

The remaining sections of the paper are structured to support these objectives: The literature review examines existing research and identifies gaps. The methodology outlines the research approach and hypotheses, followed by the results, which analyze the data and provide actionable insights. Finally, the conclusion offers practical recommendations for businesses and policymakers to enhance environmental accounting and sustainability practices in Greece.

The contribution of this study is twofold: it contextualizes EMA adoption in Greece, a Southern European economy under financial stress, and it highlights that green technology investments do not automatically lead to improved performance, but require supportive institutional and financial conditions to be effective.

2. Theoretical Framework

Environmental performance is a critical component of modern business practices, particularly in light of global challenges such as climate change, resource depletion, and the need for sustainable development. In order to understand the factors that drive or hinder environmental performance, a strong theoretical foundation is essential. These tools encourage transparency and accountability, allowing organizations to fulfill shareholder and regulatory demands (Schaltegger et al., 2017). Environmental performance indicators (EPIs), such as corporate environmental reports and audits, provide crucial data on resource utilization, pollutant emissions, and waste generation (Searcy, 2012). Companies utilize these metrics to help the United Nations (UN) achieve its sustainable development goals (UNEP, 2021).

Environmental reporting is essential for demonstrating a company’s environmental performance. Since it improves transparency and company reputation, it has become a strategic imperative (KPMG, 2020). Non-financial disclosures are now considered a fundamental part of corporate reporting, through frameworks such as the European Union’s Corporate Social Responsibility (CSR) Directive (European Commission, 2014), updated by the CSRD—Directive (EU) 2022/2464 and CSDDD—Directive (EU) 2024/1760. Furthermore, environmental audits, both internal and external, are critical instruments for evaluating environmental compliance. Internal audits reveal areas for improvement, whereas external audits provide impartial evaluations, as demonstrated by the ISO 14001 framework for environmental management systems (ISO, 2021).

Environmental accounting is another cornerstone of sustainable business practices, integrating environmental costs and benefits into financial decision-making. Quantifying pollutant emissions, energy usage, and trash generation allows businesses to identify cost-cutting and efficiency-enhancing opportunities (Jasch, 2009). Environmental accounting not only helps with cost management, but it also makes it easier to create sustainability plans (Schaltegger & Burritt, 2017). According to Burritt and Schaltegger (2010) and Gale (2006), it helps companies evaluate the cost–benefit dynamics of environmental activities, thereby fostering long-term competitiveness and regulatory compliance.

The theoretical underpinning of this study is grounded in two complementary frameworks: Stakeholder Theory and Institutional Theory, which collectively explain why and how firms adopt environmental accounting and management practices. Stakeholder Theory posits that firms have responsibilities beyond profit maximization for shareholders, extending to a broader range of stakeholders, including employees, customers, regulators, and environmental groups (Freeman, 1984). In the context of environmental accounting, this theory suggests that organizations are more likely to adopt sustainable practices when they perceive pressure or expectations from key stakeholders. In Greece, growing public awareness and EU-aligned investor expectations regarding sustainability increase the salience of stakeholder interests, especially among firms aiming to secure legitimacy and market access.

Institutional Theory (DiMaggio & Powell, 1983) complements this view by explaining how organizations respond to various institutional pressures—coercive (laws and regulations), normative (professional standards), and mimetic (industry practices)—to gain legitimacy and ensure survival. In the Greek context, coercive pressures derive largely from EU environmental directives and regulations, while voluntary frameworks such as EMAS (EU Eco-Management and Audit Scheme) and ISO 14001 represent normative pressures reinforced by industry associations and global market trends promoting environmental transparency. Mimetic isomorphism, where firms imitate leading competitors, also plays a role, especially among firms seeking international credibility or operating in regulated industries.

These two theories provide the conceptual foundation for the study’s hypotheses regarding the adoption and implementation of environmental accounting practices. Firms in Greece are hypothesized to engage more actively in environmental reporting (particularly through GRI frameworks), green investments, and certification (e.g., ISO 14001, EMAS) as broader institutional mechanisms. Building on these theories, the study explores how institutional constraints and stakeholder expectations shape the adoption of environmental accounting tools and standards. The analysis includes key variables such as environmental investments, green technologies, and sustainability disclosures—core practices aligned with both theoretical frameworks. The deployment of environmental initiatives demonstrates a continued commitment to sustainability. Companies implement an assortment of regulations such as reducing emissions, managing waste, and investing in green technologies. Renewable energy and energy efficiency technologies can significantly reduce CO2 emissions (Frynas et al., 2017; White, 2021). Initiatives to conserve energy reduce expenses and boost competitiveness, while waste management strategies like recycling and material reuse promote both environmental and economic growth (Bocken et al., 2019; Parker & Barnes, 2021). Green innovation, or the development of environmentally friendly products and technological developments, is critical for promoting sustainability and gaining a competitive edge (Boons & Lüdeke-Freund, 2013).

Investment in environmental initiatives is a strategic imperative for long-term sustainability. Firms increasingly allocate resources to infrastructure upgrades, employee training, and research and development (R&D) of green technologies (Hart & Milstein, 2003). According to Weinhofer and Busch (2013), investments in CO2 reduction technology, such as carbon sequestration and renewable energy systems, not only meet regulatory requirements but additionally offer financial benefits. Energy-efficient technology, such as fluorescent bulbs and smart energy systems, offer decreased costs while improving the environment’s performance (Sullivan et al., 2018). Employee training on sustainability principles increases the efficacy of green initiatives by cultivating a culture of environmental responsibility (Jabbour & Santos, 2017). Additionally, research and development of green technologies enables companies to innovate and stay competitive in the market while reducing their environmental impact (Boons & Lüdeke-Freund, 2013).

Environmental accounting systems enable the methodical monitoring of environmental costs and impacts. Sullivan and Gouldson (2017) define surveillance systems as systems which collect statistics regarding emissions of greenhouse gases and utilization of resources to assist businesses create targeted improvement activities. Environmental expense accounting systems promote transparency and encourage strategic decision-making, while performance evaluation tools contribute to assessing how efficient sustainability applications are (Henriques & Sadorsky, 1999). According to Schaltegger and Wagner (2017) and KPMG (2013), sustainability evaluations and achievement indicators are two examples of reporting strategies that help stakeholders understand progress and enhance strong credibility.

Green technologies and prudent expenditures have the potential to revolutionize the way that we approach sustainability. Upgrading to energy-efficient machinery and applying innovative technology reduces operating expenses and adverse environmental effects (Hart & Milstein, 2003; Bocken et al., 2014). Sustainable technology R&D investments drive innovation, energy efficiency, and waste reduction, leading to fresh market opportunities (Boons & Lüdeke-Freund, 2013; Kolk & Pinkse, 2011). Creating sustainable products and services satisfies consumer desires and improves market placement (Nidumolu et al., 2009).

Furthermore, the use of environmental performance tools, accounting systems, and strategic investments emphasizes the importance of sustainability in modern organizations. Companies that use these techniques can reduce their environmental impact, increase efficiency, and boost their reputation. These initiatives not only assist companies to fulfill regulatory and stakeholder obligations, but also place them as trailblazers in the transition to a more sustainable economy. In an environmentally friendly world, an ongoing dedication to environmental responsibility, followed up by creative initiatives and strict reporting, ensures continuous profitable development.

Greek firms respond to strong pressures from regulators, investors, and consumers, which motivates the adoption of environmental accounting and reporting practices. At the same time, Institutional Theory explains why outcomes diverge from international evidence: although coercive pressures from EU environmental directives exist, normative and mimetic mechanisms remain weaker in the Greek context, especially for SMEs lacking resources and support. The negative effect of green technologies reflects precisely these institutional constraints—without adequate financial incentives, technical infrastructure, or policy support, green investments may generate costs without delivering the expected benefits. Thus, the interaction between stakeholder expectations and institutional conditions becomes a key determinant of EMA effectiveness in economies under financial stress.

3. Literature Review—Hypothesis Development

3.1. Use of Environmental Performance Tools

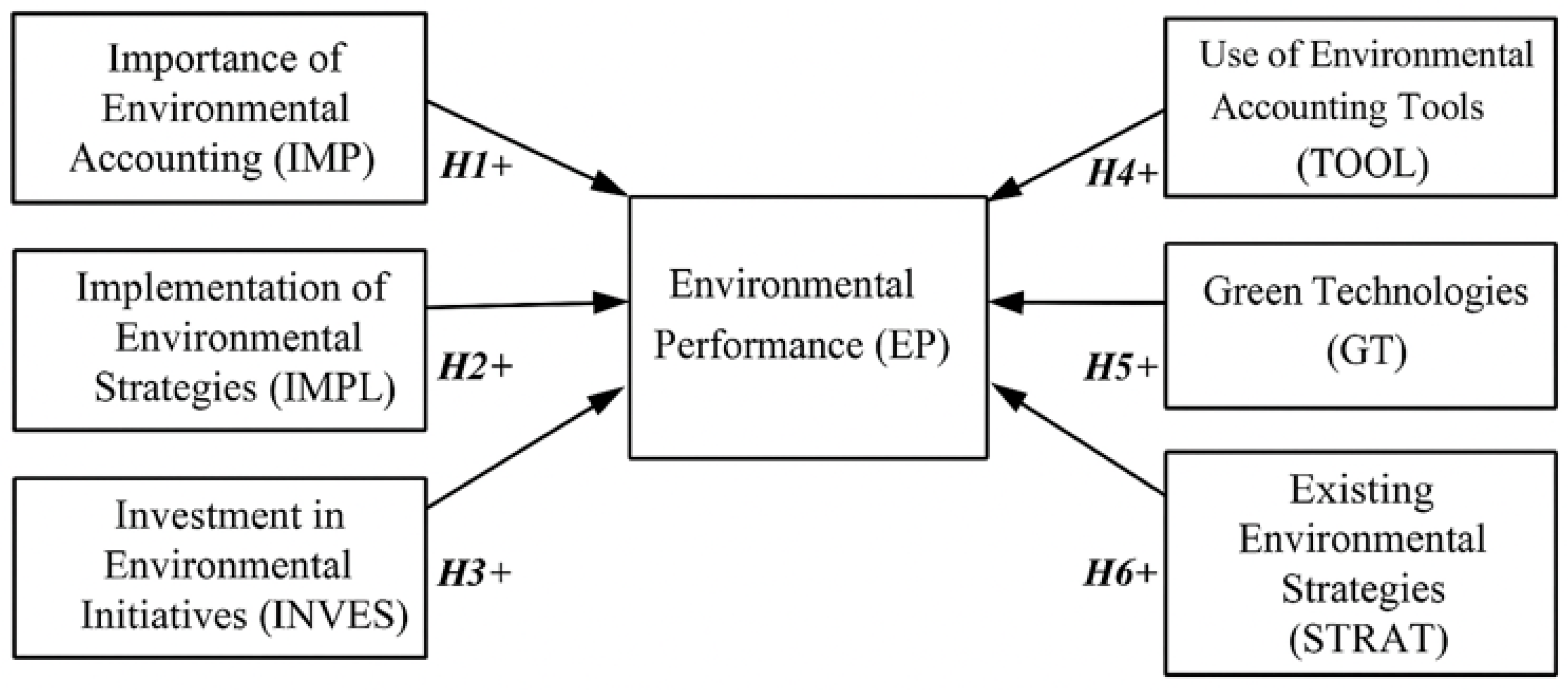

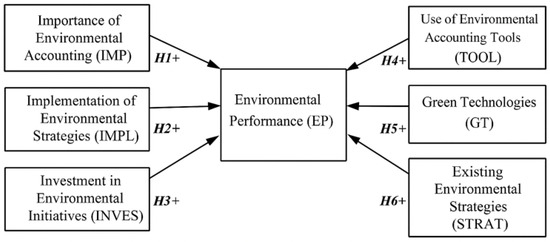

The adoption of environmental performance tools is an important consideration for modern enterprises. According to Hristov and Chirico (2022), Key Performance Indicators (KPIs) play a critical role in assessing and monitoring a company’s environmental performance. Their analysis is based on a systematic review of 82 scientific articles that examine the relationship between KPIs and sustainability. Additionally, a survey was conducted among Italian managers of large companies mainly from the industrial and energy sectors, which are critical for environmental management. This survey revealed that 82% of the companies adopt sustainability-oriented KPIs, linking them directly to their strategies (see Figure 1). The implementation of KPIs has proven to be effective in helping to reduce costs and improve the reputation of companies, with a particular focus on recycling and reusing resources, as done by companies such as Xerox.

Figure 1.

Final model, after structural analysis.

The research by Bednárová et al. (2019) examined the top 100 companies in the Fortune Global 500 list, focusing on their environmental reporting. Using an index developed based on the Global Reporting Initiative (GRI) standards, it was found that 66% of the top global companies follow GRI standards for environmental reporting. Companies operating in environmentally sensitive sectors tend to demonstrate higher transparency in their environmental reporting, seeking to ensure legitimacy as legislation is more stringent in Europe.

Overall, the use of environmental performance tools and the adoption of sustainability practices lead to improved environmental outcomes, reduced operational costs, and enhanced stakeholder credibility—making firms more competitive.

3.2. Importance of Environmental Accounting

Majid et al. (2022) highlighted the importance of environmental accounting in natural resource management and tracking a company’s environmental impact. Environmental accounting contributes to regulatory compliance and transparency required by stakeholders such as investors, consumers, and government agencies.

Majid et al. (2022) analyzed data from 80 construction businesses listed on the Pakistan Stock Exchange from 2011 to 2020. The researchers used STATA 13 and multiple regression models to investigate the impact of environmental accounting on company performance, as well as the mediating effect of sustainability. The findings demonstrated that environmental accounting, when combined with the implementation of sustainability legislation, possesses a considerable negative impact on enterprise financial performance, particularly on variables like return on assets (ROA) and return on equity (ROE). This negative correlation may be attributed to the substantial expenses that firms incur when safeguarding the environment, which are often not offset by short-term financial advantages.

However, this finding contrasts with other studies suggesting a more nuanced or even positive relationship in the long run. For instance, Clarkson et al. (2008) found that firms with superior environmental performance enjoy lower cost of capital and improved access to financing.

According to Majid et al. (2022), utilizing sustainable practices offers a long-term strategic advantage along with meeting environmental regulations. Companies that invest in sustainability may face immediate rises in expenses, but the researchers believe that these investments boost their image and provide access to new markets and investment opportunities. At the same time, it is reported that many businesses in Pakistan voluntarily follow the Global Risk Index (GRI) standards, seeking to protect the environment and reduce risks associated with pollution and environmental disasters. This aligns with prior studies highlighting the long-term financial and reputational benefits of sustainability-driven governance (Porter & Kramer, 2011), while also contrasting with research suggesting that such practices may only be viable for firms with sufficient financial flexibility and may negatively affect less resourceful firms in the short run.

Despite initial findings indicating short-term financial constraints, the broader literature supports the notion that environmental accounting enhances firms’ long-term environmental outcomes. Therefore, there is contradictory evidence in the literature—short-term negative but long-term positive—which provides the rationale to test the following hypothesis:

H1:

Environmental accounting has a positive effect on the overall environmental performance of firms.

3.3. Implementation of Environmental Strategies

The following literature review is based on the studies by Deng et al. (2023) and X. W. Zhang et al. (2020), which focus on greenhouse gas (GHG) emission reduction strategies and their application in industrial and agricultural systems. These strategies have proven to be critical for the realization of ecological goals such as CO2 pollutant reduction and energy efficiency improvement. However, other researchers have pointed out that regional policy inconsistencies and infrastructure deficits can limit the effectiveness of these measures (Z. Zhang et al., 2021). Using the LMDI model, the researchers discovered that economic expansion is the primary cause of increased emissions, although energy efficiency helps to reduce them.

Their findings revealed that both energy structure and industry structure are equally essential in reducing emissions. As stated by Deng et al. (2023), enterprises can profit from these approaches by improving energy efficiency, restructuring their industrial base, and customizing CO2 emission reduction strategies to each region’s needs. Nanjing and Suzhou, for example, require strategies to restructure their industries, whilst Wuxi and Zhenjiang must focus on reorganizing their energy structures.

In the meantime, X. W. Zhang et al. (2020) focuses on the agricultural sector, specifically on the reduction in GHG emissions from rice cultivation in Hainan province. The use of drought-resistant rice varieties and 53% fertilizer reduction strategy led to a 97% reduction in GHG emissions. The results show that the dryland cultivation and plastic coating strategy can bring about significant reductions in methane and nitrous oxide emissions (X. W. Zhang et al., 2020), gases that have a significant contribution to the overall emissions of the agricultural sector. This diversity in results indicates the necessity of sector-specific strategies and regional customization, an aspect often underexplored in generalized policy recommendations.

Such strategies are also applicable in corporate contexts. More precisely, Deng et al. (2023) found that energy efficiency and resource recycling are critical to reducing emissions and meeting a company’s environmental goals. Given the differing outcomes across sectors and regions, further examination of implementation strategies in the Greek industrial context is warranted. Regarding the implementation of environmental strategies, the following hypothesis can be considered:

H2:

Implementing environmental techniques (such as pollutant reduction and waste management) increases environmental efficiency.

3.4. Investment in Environmental Initiatives

Zheng and Jin (2022) undertake a comprehensive examination of investments in environmental initiatives and their impact on corporate sustainability in China. The analysis includes the period from 2010 to 2020 and utilizes the use of data from non-financial listed corporations. Economic fixed-effects regression models were used, which allow for the analysis of how green investments affect firm sustainability.

The research was based on a large sample of 2838 firm observations from 315 listed Chinese companies, drawn from various industrial sectors. The data were mainly collected from the China Stock Market & Accounting Research (CSMAR) database, but also through sustainability reports and annual reports.

According to the findings of the paper, green investments improve business sustainability to a significant extent. In particular, increased investment in emission reduction technologies, infrastructure upgrades and research and development of new green technologies had a positive impact on corporate performance. Companies who invested more in environmental initiatives reduced their operational expenses by an average of 3.5% per year, indicating that green expenditures can deliver immediate economic advantages (Zheng & Jin, 2022). However, some studies caution that these benefits are not uniform across all sectors or company sizes, as smaller firms often lack the capital or technical know-how to implement large-scale green projects effectively (Weng et al., 2015). This underlines the importance of contextual factors, including market maturity and regulatory support, when assessing green investment impacts. According to the paper, companies with executives who have international expertise and awareness of other countries’ environmental regulations had a 9% higher return on green investments versus companies without such leaders.

One of the most interesting results of the paper was the contribution of government subsidies to green investments. Where firms received subsidies for environmental initiatives, there was a 12% increase in return on investment. These subsidies encouraged companies to invest more in technologies related to reducing emissions and upgrading their infrastructure. The effect was particularly evident in industries with heavy environmental burdens, such as chemicals and metallurgy, where subsidies allowed companies to achieve an 8% reduction in emissions over five years (Zheng & Jin, 2022). The diversity of outcomes across sectors and firm types indicates the necessity of studying such investments in different national contexts, such as Greece, where firm structures and regulatory frameworks may differ. Considering the above, the following hypothesis can be stated:

H3:

Investments in green initiatives (education, infrastructure upgrading) have a positive effect on environmental performance.

3.5. Use of Environmental Accounting Tools

Applying environmental accounting strategies is vital for monitoring how companies, particularly multinational companies (MNEs), influence the environment. MNEs have significant impacts on natural capital. According to García-López and Pérez-Hernández (2023), it is essential to prevent intangible liabilities brought about by poor environmental practices. Their paper is based on a mixed methodological approach that incorporates a review of the literature and quantitative data on the effect of MNEs on the environment, while emphasizing the significance of using environmental tools to monitor and document these effects.

Specifically, the research examines the use of environmental accounting tools by large companies, focusing on 100 MNEs with a strong presence in sectors directly related to the environment, such as energy, construction and agriculture. The survey sample includes companies from Europe, North America and Asia that are committed to reducing their environmental impacts through the use of accounting tools. García-López and Pérez-Hernández (2023) conclude that the adoption of these tools is crucial to improve environmental performance and avoid intangible liabilities. Nevertheless, some researchers question whether the mere adoption of such tools leads to meaningful change, particularly when implementation is superficial or disconnected from strategic decision-making (Schaltegger & Csutora, 2012). Therefore, assessing their practical effectiveness across contexts becomes important.

One of the main tools being studied is environmental impact monitoring systems. In the survey sample, 75% of MNEs reported using these tools to record impacts on the natural environment. These tools help companies to identify sources of environmental risks and prevent any damage, which helps to reduce intangible liabilities such as future financial losses from legal penalties or remediation of environmental damage. Specific accounting tools for the analysis of environmental performance data are used by 63% of the sampled companies, according to García-López and Pérez-Hernández (2023). These tools allow firms to analyze their environmental performance in detail and identify areas for improvement. In the sample, 70% of companies reported using such tools to be transparent and provide information to stakeholders such as investors and regulators. García-López and Pérez-Hernández (2023) point out that the publication of such data enhances a firm’s credibility and helps to avoid intangible liabilities related to reputation.

In summary, the research shows that the use of environmental accounting tools is critical to manage the environmental impacts and costs of companies. García-López and Pérez-Hernández (2023) conclude that environmental accounting not only protects firms from intangible liabilities, but also enhances their transparency and reputation in the market. Thus, the following hypothesis emerges:

H4:

The integration of environmental accounting tools (cost recording, impact analysis) helps to improve environmental performance.

3.6. Green Technologies

Investing in green technologies is critical to attaining sustainable development, as it provides economic and environmental benefits. Liu et al. (2023) investigate the effectiveness of green technology innovation in China’s provinces between 2006 and 2018, analyzing the role of technology and financial resources in this process. Specifically, the research investigates how government funding, independent R&D of firms, technology credit from banks, and venture capital investment affect the dynamics and efficiency of green technology innovation.

The study by Liu et al. (2023) was based on regional-level data across multiple provinces in China and developed a super-SBM-DEA model, which was combined with the window analysis method, to measure the Green Technology Innovation Efficiency (GTIE). The survey data covered the period 2006–2018, allowing a comprehensive analysis of the trends and evolution of green innovation efficiency during these years. In addition, the PVAR model was used to paper the dynamic impact of technological and economic parameters on GTIE, while the shock response function analysis showed the reaction of GTIE to specific shocks from technological and economic investments.

According to the survey findings, the average value of green technology innovation efficiency across China’s provinces between 2006 and 2018 was only 0.42. However, the average GTIE value increased over the paper period, from 0.34 in 2006 to 0.55 in 2018. This ascending trend illustrates that investments in green technology have the potential to improve innovation efficiency over time, albeit with oscillations.

Similarly, a study by Horbach et al. (2012) in the European context demonstrated that regulatory and customer-related factors significantly drive eco-innovation, particularly in firms investing in cleaner technologies, confirming the positive link between green technology and environmental performance.

Nevertheless, some studies caution that green technology investments require substantial initial costs and carry technological risks, which may hinder smaller or financially constrained firms from achieving immediate performance benefits (e.g., Rennings, 2000; Hojnik & Ruzzier, 2016). This indicates that while the long-term outcomes are generally positive, short-term results can be mixed depending on firm resources and market conditions.

Finally, Liu et al. (2023) research is valuable for emerging economies trying to increase green technology innovation. While investments in green technology require large initial resources, they have the potential to produce long-term economic and environmental advantages. Green technology innovation can be considerably boosted by coordinating and strategic investments that will enable businesses and governments to address the challenges of climate change and sustainable development. Considering both the positive long-term evidence and the challenges identified in some studies, the following hypothesis is proposed:

H5:

Investment in green technologies (innovative machinery, new services) supports improved environmental performance.

3.7. Existing Environmental Strategies

This analysis examines the significance of technology and environmental measures in promoting sustainability, drawing on particular research results on sustainable development and the green economy. Ma and Liu’s (2023) paper focuses on reducing nonrenewable resource usage in four cities in Region A by implementing advanced environmental technology and enhancing the regulatory framework. The paper examines the use of nonrenewable resources in two cities in Region A that are heavily reliant on heavy industry.

In 2017, the consumption rate of these resources was 82% and 99%, respectively, for the two cities. However, with the implementation of new technologies and environmental regulations (environmental regulations), these rates have been reduced to 78% and 79%, respectively, by 2021. The decrease, ranging from 3% to 20%, indicates the effectiveness of these strategies in promoting sustainability. Although the results are promising, the authors also note that sustained results depend on continuous regulatory enforcement and technological upgrading, which may vary significantly across regions and institutional frameworks.

A strategy to reduce dependence on non-renewable resources is a key objective for sustainable development in these cities, which are highly dependent on the exploitation of natural resources for their economic activity. According to Ma and Liu (2023), technical advancements such as deep learning algorithms, which enable improved resource monitoring and optimization while enhancing firms’ overall environmental performance, are relevant (Ma & Liu, 2023). Companies may help to safeguard the environment and promote sustainable development by encouraging the adoption of more sustainable business models as technology progresses and public–private collaborations expand.

In conclusion, this paper confirms that sustainability can be achieved by harnessing technological development, education, and increased compliance with environmental regulations. Strategies that focus on innovation and close monitoring of environmental performance are shaping a new business environment where sustainable development is a key objective. These insights support the view that transparency, regulatory education and sustainability training are essential levers—but also raise the need for localized studies in countries like Greece where institutional capacities may differ. Based on the previous sections, the following hypothesis is formed:

H6:

Existing environmental strategies (transparency, education, sustainability) have a positive impact on the environmental performance of companies.

4. Research Methodology

4.1. Questionnaire

The survey was conducted using a questionnaire that was delivered online via the Google Forms platform. The questionnaires were distributed to employees of medium to large Greek companies, especially those working in environmental accounting, auditing, and performance roles. The companies represented were mainly active in sectors related to the environment, recycling, finance, and consulting, offering a relevant industry perspective for the study.

The questionnaire has 31 questions divided into eight unique sections. The first four questions collected demographic information, while the subsequent questions used a five-point Likert scale. The questions were based on current research that supports the link between environmental accounting and firm success (Weng et al., 2015).

Demographic data collection is critical to understanding the social and professional context in which organizations operate (Clayton et al., 2023). Subsequent questions evaluated the application of environmental policies and instruments, citing Hristov and Chirico (2022) research and Majid et al. (2022) proposal for environmental performance indicators (KPIs).

Furthermore, questions regarding investments in environmental initiatives were based on the research by Deng et al. (2023) and Liu et al. (2023). The use of environmental accounting tools was examined with reference to the works of García-López and Pérez-Hernández (2023) and Zheng and Jin (2022). Finally, sustainability strategies were evaluated according to studies by Ma and Liu (2023) and X. Zhang et al. (2024).

To mitigate common method bias and social desirability effects, several measures were adopted in the questionnaire design and data collection process. First, responses were collected anonymously and on a voluntary basis, reducing the likelihood of respondents providing socially desirable answers. Second, instructions were carefully designed to emphasize the academic purpose of the research and to reassure participants that there were no “right” or “wrong” answers. Third, reverse-coded items and balanced phrasing were incorporated to reduce acquiescence bias. These design features aimed to strengthen reliability and validity, despite the inherent limitations of self-reported data.

4.2. Sample Selection and Data Collection

Between July and September 2024, the questionnaire(see Appendix A) was emailed to professionals working in Greek companies that combine environmental orientation with active financial operations. Participation was entirely voluntary, and holding an ISO 14001 certification was not a prerequisite. A total of 199 valid responses were received out of 297 invitations, resulting in an estimated response rate of 67%. Following the guidelines of Hair et al. (2014), which recommend a minimum of 10 cases per indicator in PLS-SEM, the achieved sample size (31 indicators, 199 cases) approaches the recommended threshold and provides adequate statistical power for exploratory analysis.

The first section of the questionnaire gathered demographic information. Regarding gender, 53% of respondents were women and 47% men, indicating a balanced distribution. For age, most respondents were under 45 years old, with the largest groups in the 18–24, 25–34, and 35–44 categories, reflecting a younger, professionally active sample. Concerning educational background, the majority of participants held a university or postgraduate degree, while a smaller but notable share reported high school or vocational education. In terms of professional experience, over 70% had more than one year of experience, with most clustered between 1 and 10 years, confirming that the sample consisted of professionals with both academic qualifications and practical exposure. Overall, the final sample is considered suitable for the study’s purposes, representing organizations engaged in environmental responsibility while maintaining financial viability.

Table 1 presents key statistics for the four demographic variables discussed. For gender, the mean is 1.52, with a median and mode indicating a slight predominance of female respondents. The age variable has a mean of 2.51, corresponding to the 25–34 age group, with the median and mode pointing to the 18–24 age group. Regarding education, the mean is 2.29, between university graduate and postgraduate degree, with the mode indicating high school graduates. For work experience, the mean is 2.82, between the 1–5 years and 6–10 years categories, with the mode showing 1–5 years of experience.

Table 1.

Sample demographics.

4.3. Measurements

This paper’s operational model includes 31 variables that have been categorized to completely measure an organization’s environmental performance and related factors. Section 2 of the questionnaire measures the dependent variable, Environmental Performance, by examining the extent to which certain environmental instruments such as KPIs, reporting, and audits are used. The independent variables are organized into six categories: Importance of Environmental Accounting (Section 3), Implementation of Environmental Strategies (Section 4), Investment in Environmental Initiatives (Section 5), Use of Environmental Accounting Tools (Section 6), Green Technologies (Section 7), and Existing Environmental Strategies (Section 8).

The first part collects demographic data (gender, age, education level, and professional experience) to provide context for respondents. This structure was created by adapting validated items from prior studies (Hristov & Chirico, 2022; Bednárová et al., 2019; Ma & Liu, 2023) to fit inside the paper’s framework. A comprehensive strategy ensures reliable data collection for assessing the effects of organizational policies and investments on environmental outcomes.

4.4. Statistical Analysis Methodology

To handle the data gathered via surveys, descriptive analysis using SPSS software and structural equation estimation with SmartPLS were used. Initially, an analysis of the questions was conducted, with indicators such as mean and frequency generated and the results presented in tables and graphs. To guarantee internal consistency, a reliability test using Cronbach’s alpha in SPSS was performed in accordance with Tavakol and Dennick’s (2011) standards. Correlations between variables were also investigated with SPSS and SmartPLS.

Finally, the partial least squares (PLS) method was utilized for structural equation modeling in SmartPLS, as recommended by Hair et al. (2014), to assess construct linkages and test hypotheses. The analysis includes checks for reliability and validity, as well as a review of research hypotheses, indirect effects of mediating variables, and concerns with multicollinearity.

The use of SPSS for descriptive and reliability analysis, as well as SmartPLS for structural modeling, resulted in a strong and comprehensive statistical analysis framework, as recommended in previous studies (Field, 2013).

While perceptual survey data provide valuable insights into managerial interpretations, we explicitly acknowledge that future research should triangulate these findings with objective indicators, such as verified emissions data, corporate financial disclosures, or ESG ratings, in order to enhance robustness and validity.

5. Results

5.1. Measurement Model

The examination of the measurement model began with the evaluation of factor loadings, which were all above the acceptable threshold of 0.7 (see Table 2). The constructs showed high internal consistency and convergent validity, as all reliability coefficients (Cronbach’s alpha, Composite Reliability) and AVE values exceeded the required thresholds.

Table 2.

Descriptive statistics, loading factors, Cronbach’s alpha, composite reliability and average variance extracted.

The reliability of the model was assessed using Cronbach’s alpha and composite reliability (CR), which ranged from 0.929 to 0.981 and 0.949 to 0.986, respectively, confirming the internal consistency of the constructs. Additionally, convergent validity was established through the average variance extracted (AVE), with all values ranging from 0.834 to 0.946, exceeding the required threshold of 0.5.

Specifically, for Environmental Performance, factor loadings were consistently high at 0.970, with mean values ranging from 3.35 to 3.61, Cronbach’s alpha of 0.972, CR of 0.979, and AVE of 0.923. The Importance of Environmental Accounting showed factor loadings between 0.776 and 0.907, mean values from 3.55 to 3.87, Cronbach’s alpha of 0.950, CR of 0.964, and AVE of 0.869. Implementation of Environmental Strategies demonstrated factor loadings between 0.748 and 0.924, mean values ranging from 2.46 to 3.05, Cronbach’s alpha of 0.929, CR of 0.949, and AVE of 0.834. For Investment in Environmental Initiatives, factor loadings ranged from 0.699 to 0.945, mean values from 3.37 to 3.50, Cronbach’s alpha of 0.950, CR of 0.965, and AVE of 0.872.

The Use of Environmental Accounting Tools exhibited factor loadings between 0.830 and 0.933, with mean values from 3.32 to 3.69, Cronbach’s alpha of 0.970, CR of 0.978, and AVE of 0.918. Green Technologies included factor loadings ranging from 0.861 to 0.907, mean values from 3.32 to 3.69, Cronbach’s alpha of 0.938, CR of 0.960, and AVE of 0.889. Lastly, Existing Environmental Strategies demonstrated factor loadings between 0.901 and 0.924, mean values ranging from 3.45 to 3.69, Cronbach’s alpha of 0.981, CR of 0.986, and AVE of 0.946. Overall, the results confirm the reliability and validity of the measurement model.

For the remainder of the investigation, the Fornell–Larcker criterion was applied to evaluate discriminant validity. The square roots of the AVE for each construct (represented by the diagonal elements in Table 3) is significantly higher than the correlations between that construct and each additional construct (illustrated by the off-diagonal elements), indicating discriminant validity, according to this approach. As demonstrated in Table 3, this condition is consistently met across all constructs.

Table 3.

Discriminant validity findings (Fornell–Larcker criterion).

For instance, the square root of the AVE for Green Technologies (GT) is 0.943, which is greater than its correlations with Implementation of Environmental Strategies (IMPL, 0.874), Importance of Environmental Accounting (IMP, 0.817), and other constructs. Likewise, the square root of AVE for Implementation of Environmental Strategies (IMPL) is 0.908, which is significantly higher than the correlations with all other constructs, notably Existing Environmental Strategies (STRAT, 0.813) and Investing in Environmental Initiatives (INVES, 0.885). This pattern remains constant across all constructs, demonstrating the measuring model’s robustness and outstanding discriminant validity.

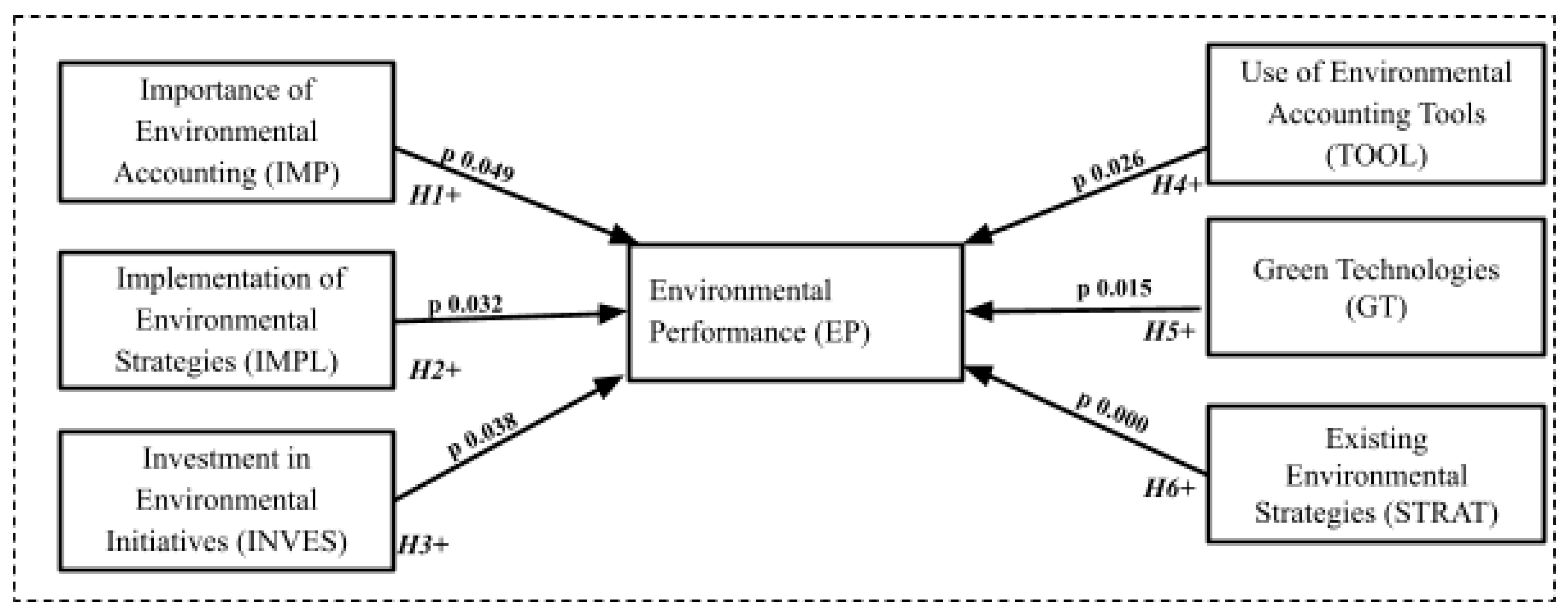

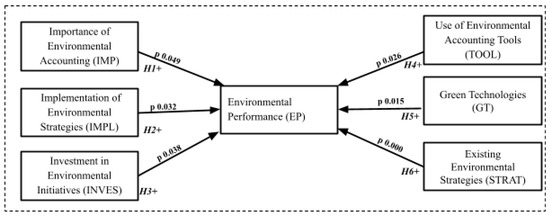

Abbreviations used in Table 3 correspond to the following constructs: GT = Green Technologies, IMPL = Implementation of Environmental Strategies, IMP = Importance of Environmental Accounting, INVES = Investments in Environmental Initiatives, MEAS = Measurement of Environmental Performance, STRAT = Existing Environmental Strategies, TOOL = Environmental Accounting Tools. MEAS specifically refers to the items used to assess Environmental Performance, and it aligns conceptually with the EP construct displayed in Figure 1 and Figure 2.

Figure 2.

Final model, after structural analysis. Source(s): Created by author.

Subsequently we applied the HTMT (Heterotrait–Monotrait Ratio) criterion to evaluate discriminant validity. The HTMT approach assesses how distinct constructions are from one another by considering the correlations between their indicators. Discriminant validity has been demonstrated when HTMT values fall lower than 0.90, which has been considered to be a fair cutoff threshold in the social sciences (Henseler et al., 2015).

All of the paper’s HTMT values, as indicated in Table 4, fall below the 0.90 cutoff, indicating that the constructs are sufficiently discriminating and unique. These results provide more evidence for the measurement model’s validity and dependability.

Table 4.

Discriminant validity findings (Heterotrait–Monotrait Ratio criterion).

The model’s dependability was assessed by analyzing the indicator loadings and discriminant validity. The results showed satisfactory loading values that exceeded the acceptable threshold of 0.7, and discriminant validity was confirmed with the Fornell–Larcker criterion and the Heterotrait–Monotrait ratio. Furthermore, the bootstrap method improved the reliability of the estimates, resulting in consistent results throughout resampling iterations, which will be discussed in greater depth in the following part.

5.2. Structural Model

Proceeding with the analysis of the structural model, all relationships between the independent variables (GreenTech, Implementation, Importance, Investments, Strategies, and Tools) and the dependent variable (Measurement) were examined (see Table 5). The results reveal several statistically significant regression-based associations, although some effect sizes are small. Additionally, Tools show the highest positive effect on Measurement, using a regression coefficient of 0.770 and a p-value of 0.000, demonstrating how crucial they are in improving measurement reliability. Similarly, Strategies show a significant positive regression coefficient (0.239, p = 0.026), as do Importance (0.136, p = 0.049) and Implementation (0.093, p = 0.032). While the regression coefficient between Investments and Measurement is not as strong (0.036), it is still highly significant (p = 0.038). On the other hand, the direct effect of GreenTech on Measurement appears to be negative (−0.335) and statistically significant (p = 0.015), implying that there may be constraints or hurdles in employing green technologies in this context. All proposed hypotheses show statistically significant regression-based effects, with the exception of GreenTech, which demonstrates a significant negative correlation. However, further regression-based analysis is required to confirm negative regression effects. However, as this is a structural regression model, the relationships should be interpreted as statistically significant effects rather than causality. In addition to providing useful details about the intricate dynamics of environmental management practices, our research results emphasize the significance of instruments and tactics in promoting efficient assessment.

Table 5.

Structural model results and hypothesis testing.

This section investigates the indirect effects between elements in the model via intermediate variables, with a focus on routes including at least three variables to determine whether the influence of one factor can be conveyed indirectly to another. The analysis emphasizes the indirect effects among the model’s elements by employing the bootstrapping method, which uses repeated sampling to generate credible estimates of p-values, T-statistics, and other crucial indicators. According to the results described in Table 6, none of the studied factors had statistically significant indirect effects, with all p-values exceeding the usual significance level of 0.05. For example, there is no evidence of significant indirect correlations for measurement (p = 0.275, T = 15.944), importance (p = 0.229, T = 19.207), or implementation (p = 0.236, T = 18.598). Similarly, other factors such as Investments (p = 0.270, T = 16.245), Tools (p = 0.266, T = 16.469), GreenTech (p = 0.238, T = 18.451), and Strategies (p = 0.277, T = 15.776) do not fulfill the threshold for statistical significance. These results imply that although there are indirect channels, they do not have sufficiently significant effects to be regarded as such. However, the research provides insight into the system’s dynamics and possible connections between the elements.

Table 6.

Results of indirect relationships. Source(s): Created by author.

During the current investigation, the Variance Inflation Factor (VIF) approach was employed to determine the presence of multicollinearity among the independent variables. Multicollinearity develops whenever independent variables show a high correlation with other variables, which may result in inflated variances of estimated coefficients and weaken the model’s stability and reliability. The Variance Inflation Function (VIF) quantifies the degree of variation inflating and indicates whether or not there is collinearity. According to established standards, a VIF threshold of 2.5 is usually considered acceptable, but particular structural models may tolerate greater values. In this analysis, as illustrated in Table 7, the VIF values for the independent variables ranged from 3.22 to 4.87. Specifically, the variables Strategies and GreenTech displayed the highest VIF values, at 4.87 and 4.37, respectively. The remaining variables—Importance (3.52), Implementation (3.22), Investments (3.58), and Tools (3.91)—exhibited VIF values below these peaks but still above the general threshold of 2.5. Although these values exceed the conservative threshold of 2.5, they remain within acceptable limits for the analytical framework adopted in this paper. Such results indicate the existence of moderate collinearity among the variables; however, it is not considered severe enough to significantly affect the interpretability or statistical reliability of the results. It is also important to clarify that while Figure 2 presents the direct effects among constructs, Table 6 reports the results of the indirect relationships.1 This distinction has now been made clear to avoid confusion. In conclusion, while there is some multicollinearity among the independent variables, the VIF values show that it does not pose a significant danger to the structural model’s validity or robustness. The analysis can proceed with confidence that the results will remain stable.

Table 7.

Multicollinearity test with the VIF method (Inner model—Matrix). Source(s): Created by author.

5.3. Discussion

Analyzing our findings in the context of environmental performance, the results strongly support the remaining six hypotheses (H1–H6). Each hypothesis highlights the importance of key factors such as environmental accounting, strategies, investments, and green technologies in driving sustainability outcomes.

With respect to H1, the results confirm that environmental accounting has a positive effect on firms’ overall environmental performance. There is a high positive association (ρ = 0.786, p < 0.001) between indicators of using accounting systems to capture environmental expenses and analyze performance data. This complements previous research indicating that systematic integration of environmental accounting techniques enhances operational efficiency and helps to achieve sustainability goals (Hristov & Chirico, 2022; Majid et al., 2022). These findings underscore the importance of enterprises using specialist tools to evaluate and analyze their environmental impacts as a vital step toward sustainable development.

Regarding H2, the adoption of environmental strategies, such as pollutant reduction and waste management, demonstrates a significant positive effect on environmental efficiency. Correlation analysis reveals strong relationships between strategies like CO2 emission reduction and environmental performance indicators (ρ = 0.781, p < 0.001). Similarly, waste management practices show strong relationships with the use of environmental reports (ρ = 0.821, p < 0.001). This is consistent with findings by X. Zhang et al. (2024) and Deng et al. (2020). These findings imply that targeted strategic activities are effective ways to improve environmental performance.

The findings also support H3, as investments in green initiatives such as education, training, and infrastructure enhancements have a favorable effect on environmental performance. Investments in emission reduction technologies have a substantial correlation with environmental reporting (ρ = 0.721, p < 0.001). Investments in R&D for green technologies have a high correlation with external inspections (ρ = 0.763, p < 0.001), supporting the argument that R&D efforts are crucial for improving environmental management and sustainability outcomes (Liu et al., 2023; Zheng & Jin, 2022).

The findings support H4, demonstrating that integrating environmental accounting methods considerably improves environmental performance. Environmental data reporting and analysis tools show strong positive associations with performance metrics like external inspections (ρ = 0.707, p < 0.001). Previous research has emphasized the importance of data-driven techniques in promoting sustainable habits (Hristov & Chirico, 2022; García-López & Pérez-Hernández, 2023).

Since expenditures in green technology, such as cutting-edge equipment and novel goods, are closely linked to better environmental performance, the results also support H5. Investments in R&D exhibit high correlations with environmental performance indicators, such as internal inspections (ρ = 0.740, p < 0.001), consistent with prior research highlighting the role of technological innovation in achieving sustainability objectives (Weng et al., 2015; Ma & Liu, 2023). These findings highlight the need of prioritizing green technology investments to drive environmental improvement.

Nevertheless, our empirical model reveals a noteworthy and counterintuitive finding: the direct effect of Green Technologies on environmental performance is negative and statistically significant. This suggests the presence of an implementation gap. While firms may invest in green innovations, the short-term financial and operational burdens—such as high upfront costs, technical complexity, and insufficient institutional support—may outweigh immediate environmental benefits. This pattern is particularly evident in the Greek context, where SMEs face limited access to finance, scarce subsidies, and weaker institutional infrastructure compared to more developed economies. In this sense, our results nuance the mainstream literature by showing that green technology is not universally beneficial, but its effectiveness depends on financial readiness, absorptive capacity, and supportive policy frameworks.

Finally, the findings significantly confirm Hypothesis 6, indicating that existing environmental strategies have a positive impact on firms’ environmental performance. Transparency and compliance tactics have a substantial correlation with external inspections (ρ = 0.872, p < 0.001), showing that explicit regulatory adherence and open reporting methods improve environmental results (Zheng & Jin, 2022). Educational tactics have a strong correlation with environmental performance measures like external inspections (ρ = 0.754, p < 0.001), highlighting the importance of raising awareness for cultivating a sustainable culture.

In conclusion, the results demonstrate that environmental performance is significantly influenced by strategic investments, the adoption of environmental strategies, the use of accounting tools, and the prioritization of green technologies. These findings provide strong evidence for the critical role of systematic and strategic actions in achieving sustainability objectives and enhancing firms’ environmental efficiency.

The empirical findings of this study reinforce Stakeholder Theory by showing that Greek firms respond to strong pressure from regulators, investors, and consumers, which motivates the adoption of environmental accounting and reporting practices.

6. Conclusions

This study set out to investigate the extent to which environmental strategies and accounting practices influence corporate environmental performance in Greek enterprises. By examining the relevant literature, fundamental elements associated with the implementation of tools for environmental management and compliance with environmental regulations have been identified, culminating in the development of a theoretical structure. The examination of the data revealed that greater utilization of environmental performance tools, such as key performance indicators (KPIs) and environmental reporting, is significantly associated with the ability to monitor and report on an organization’s environmental impacts, as well as with the achievement of sustainability goals.

Efforts to reduce CO2 emissions, manage waste, conserve energy, and encourage green innovation have been shown to improve environmental performance. Investments in environmental initiatives, including infrastructure improvements, employee training, and the adoption of green technologies, contribute to more effective sustainability practices and better alignment with environmental standards. These resources assist businesses in assessing and enhancing their sustainability efforts.

6.1. Theoretical Contribution

The present research adds to the theoretical understanding of environmental accounting and performance by synthesizing the literature and conducting empirical assessments of their links. By focusing on the interplay between accounting practices and environmental management, this paper extends existing theories on corporate sustainability and environmental responsibility. This multidimensional approach contributes to the theoretical discourse by offering a holistic understanding of how environmental accounting procedures influence corporate behavior and outcomes. Furthermore, the findings provide a framework for future research into the general effects of environmental accounting across companies and locations.

6.2. Practical Contribution

The questionnaire is very reliable, with a Cronbach’s alpha coefficient of 0.974, exceeding the acceptable criterion of 0.70. This stability establishes a good foundation for future data analyses. This stability provides a solid platform for future data analysis.

The Structural Equation Modeling (SEM) approach established the reliability of the model of measurement variables, along with the validity of their convergent and discriminant characteristics. When the structural model was examined, each of the paper assumptions were confirmed, while there was no evidence of multicollinearity. This helps to enhance the accuracy and reliability of the findings. This statistical treatment enhances the understanding of the contribution of environmental accounting to business performance and highlights its role in strategic decision-making to improve environmental management and the overall image of the firm.

In addition to methodological contributions, the findings provide clear managerial and policy implications. For managers, the results suggest prioritizing environmental accounting tools and reporting mechanisms, as these exert the strongest positive effect on performance (β = 0.77). Transparent disclosure not only improves compliance but also enhances stakeholder trust and competitiveness. For policymakers, the study highlights the need for targeted subsidies and financial incentives to mitigate the short-term negative effects of green technology adoption. Regulators should further support capacity-building initiatives, offering training and technical guidance to SMEs. Collectively, these measures can transform sustainability from a compliance obligation into a source of strategic advantage.

The numbers for Measurement_3 and Measurement_4 follow a similar trend, demonstrating that inspections represent an important monitoring and assessment procedure.

In the third section, which examines the significance of environmental accounting, it turns out that participants consider the contribution of environmental accounting to environmental impact monitoring as highly significant, with Importance_1 holding a median of 4 and an average value of 5.

In the fourth section, concerning the implementation of environmental performance strategies, the responses show that strategies such as CO2 emission reduction (Implementation_1) and waste management (Implementation_2) are rated with a median of 3, reflecting a moderate degree of implementation. The high values reported indicate that participants comprehend the importance of these approaches, while actual implementation remains a place for improvement (Deng et al., 2020).

In the fifth section, respondents express that the high values obtained indicate that participants comprehend the importance of these techniques, though actual implementation continues to provide room for growth (Deng et al., 2020).

Regarding the sixth section, which examines the use of environmental accounting tools, a moderate to high acceptance is noted, with prevailing values of 4 and 5 for environmental impact monitoring tools (Tools_1) and environmental cost recording tools (Tools_2). This trend confirms that environmental accounting is considered crucial for the implementation of environmental objectives, in line with the research by Majid et al. (2022), which highlights its role in enhancing audit quality and overall corporate performance.

In the seventh section, which concerns investments in green technologies, participants show high acceptance with a predominant value of 5 for investments in new products and services (GreenTech_3). These findings indicate an emerging interest in green innovation and green initiatives, which is linked to the growing awareness of environmental sustainability (X. Zhang et al., 2024).

Overall, these findings are comparable with those in the international literature, where Bednárová et al. (2019) and Hristov and Chirico (2022) emphasize the importance of environmental accounting in generating competitive advantage. However, as Ma and Liu (2023) point out, there is still a conservative adoption of innovative environmental solutions, indicating that green growth in enterprises requires further strengthening.

6.3. Research Process Limitations and Prospects for Future Research

This study is subject to certain limitations that should be acknowledged. First, the data collection was conducted over a relatively short time frame, which may have influenced the representativeness and generalizability of the findings. Second, while the study aimed to contextualize environmental accounting practices within Greece, a portion of the supporting literature and assessment tools was drawn from international sources, which may limit the direct applicability to business environments and regulatory frameworks. The study references EU environmental legislation as it stood at the time of data collection, future research should consider recent directives such as the Corporate Sustainability Reporting Directive (CSRD, Directive EU 2022/2464) and the Corporate Sustainability Due Diligence Directive (CSDDD, Directive EU 2024/1760), which may significantly influence firm behavior and environmental reporting practices.

Moreover, the questionnaire design focused primarily on the presence and perceived extent of environmental practices, rather than their intensity, strategic integration, or operational effectiveness. This approach, while appropriate for exploratory purposes, may oversimplify the complex nature of environmental management in practice. Additionally, as the questionnaire was completed by individuals directly responsible for environmental practices within their organizations, responses may be subject to social desirability bias, potentially influencing the objectivity of certain assessments. Respondents may have been inclined to present their companies in a more favorable light, which could affect the objectivity of the data. These limitations have been acknowledged following reviewer feedback and are now clearly discussed in this section. Future research could enhance the granularity of measurement by developing more comprehensive, multi-dimensional indicators and combining survey data with qualitative insights (e.g., interviews or case studies). Future studies could also examine how evolving EU regulations affect the strategic integration of environmental accounting practices in Greek firms, and whether compliance with these directives strengthens or modifies the observed relationships between EMA adoption and environmental performance.

There are several promising directions for further research. The development and standardization of industry-specific environmental performance indicators could help align sustainability reporting with sectoral realities. Additionally, a deeper exploration of environmental accounting applications in specific sectors—such as waste management—could reveal how these practices translate into measurable environmental and economic benefits.

Finally, this study reaffirms the strategic importance of environmental performance for businesses striving to balance economic growth with environmental responsibility. Although environmental accounting is not yet widely adopted in Greece, the growing awareness and willingness among enterprises to engage in such practices is encouraging. However, challenges such as financial constraints, lack of specialized expertise, and insufficient infrastructure remain significant barriers.

To address these, organizations must prioritize the establishment of robust environmental management systems, supported by continuous staff training and internal awareness. With stronger regulatory support and committed leadership, even companies at the early stages of environmental integration can achieve meaningful and sustainable outcomes.

Author Contributions

Conceptualization, A.E.V. and G.D.; Methodology, A.E.V. and P.L.; Validation, P.L.; Writing—review and editing, A.T.; Supervision, P.L. and A.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study did not involve any collection of personal or sensitive data. According to Greek national regulations, ethical approval is not required for non-interventional, fully anonymous surveys that do not collect identifiable or sensitive information. This is aligned with the provisions of the Hellenic Authority for Higher Education Ethics Committee (Επιτροπή Hθικής της Έρευνας—ΕHΔΕ), as published in the Government Gazette (FEK 7/15/2024), which states: “The Ethics Committee examines whether a research project is conducted with respect for the value of human beings, the autonomy of the participants, their private life and personal data.” As our study fully complies with these principles and involves no identifiable data, no prior ethics approval was required.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

QUESTIONNAIRE.

Section 1: Demographic Characteristics

Gender:

◻ Male ◻ Female

Age:

◻ 18–24 ◻ 25–34

◻ 35–44 ◻ 45–54 ◻ 55+

Educational Background:

◻ High school graduate ◻ IEK/TEI graduate

◻ University graduate ◻ Master’s degree ◻ Doctoral degree

Professional Experience:

◻ <1 year ◻ 1–5 years

◻ 6–10 years ◻ 11–20 years ◻ >20 years

Section 2: Environmental Performance

How much are the following environmental performance tools used in your organization?

“Not at all” “A little” “Moderate” “Quite a bit” “Very much”

2.1 Use of environmental performance indicators (KPIs) (Measurement_1)

2.2 Use of environmental reporting (Measurement_2)

2.3 Use of internal audits (Measurement_3)

2.4 Use of external inspections (Measurement_4)

Section 3: Importance of Environmental Accounting

How important do you think is the application of environmental accounting?

“Not at all” “A little” “Moderate” “Quite a bit” “Very much”

3.1 Contribution to monitoring and reporting of environmental impacts (Importance_1)

3.2 Contribution to the achievement of environmental and sustainability objectives (Importance_2)

3.3 Contribution to compliance with environmental regulations and legislation (Importance_3)

3.4 Contribution to improving the environmental image of the company (Importance_4)

Section 4: Implementation of Environmental Strategies

How effectively do you implement environmental performance strategies in your business?

“Not at all” “A little” “Moderate” “Quite a bit” “Very much”

4.1 CO2 emission reduction strategies (Implementation_1)

4.2 Waste management and recycling strategies (Implementation_2)

4.3 Energy saving strategies (Implementation_3)

4.4 Strategies to enhance green innovations (Implementation_4)

Section 5: Investment in Environmental Initiatives

To what extent are the following environmental initiatives invested in your business?

“Not at all” “A little” “Moderate” “Quite a bit” “Very much”

5.1 Investments in emission reduction technologies (Investments_1)

5.2 Investments in infrastructure and equipment upgrades (Investments_2)

5.3 Investments in education and awareness programmes (Investments_3)

5.4 Investments in research and development for new green technologies (Investments_4)

Section 6: Use of Environmental Accounting Tools

To what extent are the following environmental accounting tools used in your enterprise?

“Not at all” “A little” “Moderate” “Quite a bit” “Very much”

6.1 Environmental impact monitoring tools (Tools_1)

6.2 Accounting systems for recording environmental costs (Tools_2)

6.3 Specific accounting tools for analysis of environmental performance data (Tools_3)

6.4 Tools for reporting and analysis of environmental performance indicators (Tools_4)

Section 7: Green Technologies

How much do you invest in green technologies?

“Not at all” “A little” “Moderate” “Quite a bit” “Very much”

7.1 Investment in machinery and equipment (GreenTech_1)

7.2 Investment in research and development (GreenTech_2)

7.3 Investment in new products and services (GreenTech_3)

Section 8: Existing Environmental Strategies

What strategies do you intend to adopt to enhance your environmental performance?

“Not at all” “A little” “Moderate” “Quite a bit” “Very much”

8.1 Strategy for the development of innovative green technologies (Strategies_1)

8.2 Strategy for enhancing sustainability through innovation strategies (Strategies_2)

8.3 Strategy to enhance transparency and compliance (Strategies_3)

8.4 Strategy for educational and awareness-raising initiatives (Strategies_4)

Note

| 1 |

References

- Bebbington, J., Gray, R., & Laughlin, R. (2001). Financial accounting: Practice and principles in environmental reporting. Ecological Economics, 39(1), 55–68. [Google Scholar]

- Bednárová, M., Klimko, R., & Rievajová, E. (2019). From environmental reporting to environmental performance. Sustainability, 11(9), 2549. [Google Scholar] [CrossRef]

- Bocken, N. M. P., Short, S. W., Rana, P., & Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production, 65, 42–56. [Google Scholar] [CrossRef]

- Bocken, N. M. P., Short, S. W., Rana, P., & Evans, S. (2019). Sustainable business model innovation: The role of collaboration for sustainable solutions. Journal of Cleaner Production, 45, 245–254. [Google Scholar]

- Boons, F., & Lüdeke-Freund, F. (2013). Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. Journal of Cleaner Production, 45, 9–19. [Google Scholar] [CrossRef]

- Burritt, R., & Schaltegger, S. (2010). Sustainability accounting and reporting: Fad or trend? Accounting, Auditing & Accountability Journal, 23(7), 829–846. [Google Scholar]

- Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4–5), 303–327. [Google Scholar] [CrossRef]

- Clayton, S. D., Pihkala, P., Wray, B., & Marks, E. (2023). Psychological and emotional responses to climate change among young people worldwide: Differences associated with gender, age, and country. Sustainability, 15(4), 3540. [Google Scholar] [CrossRef]

- Darnall, N., Henriques, I., & Sadorsky, P. (2008). Do environmental management systems improve business performance in an international setting? Journal of International Management, 14(4), 364–376. [Google Scholar] [CrossRef]

- Deng, J., Liu, C., & Mao, C. (2020). Analysis of carbon emission factors in Jiangsu province: LMDI model and city-level data analysis. Environmental Economics and Policy Studies, 22(1), 55–70. [Google Scholar]

- Deng, J., Liu, C., & Mao, C. (2023). Carbon emissions drivers and reduction strategies in Jiangsu province. Sustainability, 16(13), 5276. [Google Scholar] [CrossRef]