Digital Transformation in Accounting: An Assessment of Automation and AI Integration

Abstract

1. Introduction

2. Literature Review

2.1. The Concept of Digital Accounting

2.2. The Concept of Automated Accounting

2.3. Bibliometric Analysis in Accounting

3. Methodology

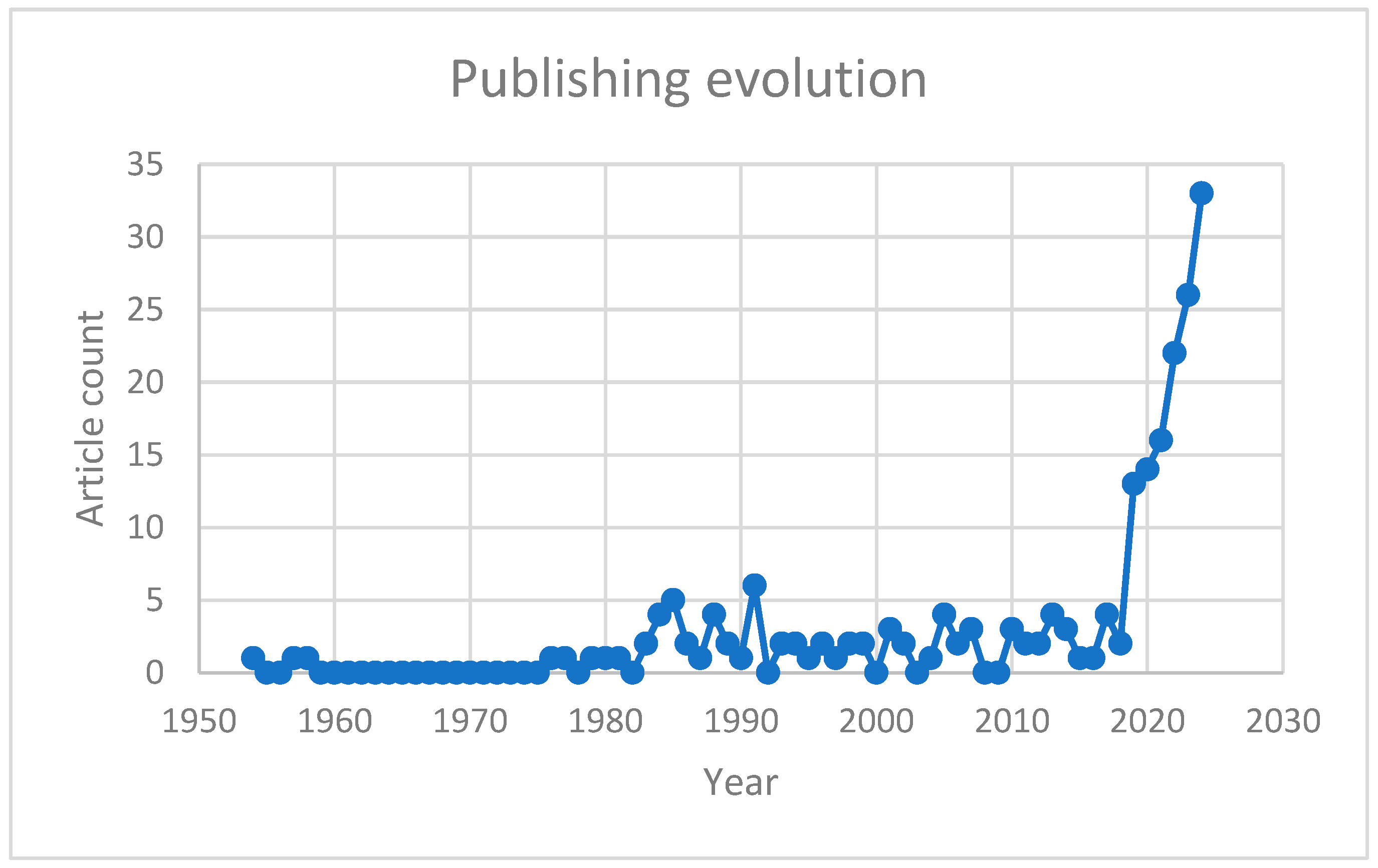

4. Results

5. Discussion and Conclusions

5.1. Discussion

5.2. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Adler, R. W., & Chaston, K. (2002). Stakeholders’ perceptions of organizational decline. Accounting Forum, 26(1), 31–44. [Google Scholar] [CrossRef]

- Al-Fatlawi, Q. A., Al Farttoosi, D. S., & Almagtome, A. H. (2021). Accounting information security and IT governance under COBIT 5 framework: A case study. Webology, 18(2), 294–310. [Google Scholar] [CrossRef]

- Al-Hattami, H. M., & Almaqtari, F. A. (2023). What determines digital accounting systems’ continuance intention? An empirical investigation in SMEs. Humanities and Social Sciences Communications, 10(1), 814. [Google Scholar] [CrossRef]

- Al-Hattami, H. M., Almaqtari, F. A., Abdullah, A. A. H., & Al-Adwan, A. S. (2024). Digital accounting system and its effect on corporate governance: An empirical investigation. Strategic Change, 33(3), 151–167. [Google Scholar] [CrossRef]

- Alkhatib, E., Ojala, H., & Collis, J. (2019). Determinants of the voluntary adoption of digital reporting by small private companies to Companies House: Evidence from the UK. International Journal of Accounting Information Systems, 34, 100421. [Google Scholar] [CrossRef]

- Al-Okaily, M. (2024). Assessing the effectiveness of accounting information systems in the era of COVID-19 pandemic. VINE Journal of Information and Knowledge Management Systems, 54(1), 157–175. [Google Scholar] [CrossRef]

- Al-Okaily, M., Alghazzawi, R., Alkhwaldi, A. F., & Al-Okaily, A. (2023a). The effect of digital accounting systems on the decision-making quality in the banking industry sector: A mediated-moderated model. Global Knowledge, Memory and Communication, 72(8–9), 882–901. [Google Scholar] [CrossRef]

- Al-Okaily, M., Al-Majali, D., Al-Okaily, A., & Majali, T. (2023b). Blockchain technology and its applications in digital accounting systems: Insights from Jordanian context. Journal of Financial Reporting and Accounting. ahead-of-print. [Google Scholar] [CrossRef]

- ALSaqa, Z. H., Hussein, A. I., & Mahmood, S. M. (2019). The impact of blockchain on accounting information systems. Journal of Information Technology Management, 11(3), 62–80. [Google Scholar] [CrossRef]

- Alsharari, N. M., & El-Aziz Youssef, M. A. (2017). Management accounting change and the implementation of gfmis: A Jordanian case study. Asian Review of Accounting, 25(2), 242–261. [Google Scholar] [CrossRef]

- Araújo, R. M., de Azevedo, A. K., Vieira, L. L., & Nascimento, T. C. (2014). Periódicos em ação: Um estudo exploratório-bibliométrico na área de administração, ciências contábeis e turismo. Perspectivas Em Ciencia Da Informacao, 19(1), 90–114. [Google Scholar] [CrossRef]

- Ardianto, A., & Anridho, N. (2018). Bibliometric analysis of digital accounting research. International Journal of Digital Accounting Research, 18, 141–159. [Google Scholar] [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. [Google Scholar] [CrossRef]

- Association of Chartered Certified Accountants. (2013). Digital darwinism: Thriving in the face of technology change. Available online: http://www.accaglobal.com/content/dam/acca/global/PDF-technical/futures/pol-afa-tt2.pdf (accessed on 17 May 2025).

- Azevedo, E. P. R. d. S. (2018). Lobbying in accounting regulation: A bibliometric study in major international journals from 2002 to 2015. Revista Evidenciação Contábil & Finanças, 6(1), 62–82. [Google Scholar] [CrossRef]

- Azman, N. A., Mohamed, A., & Jamil, A. M. (2021). Artificial intelligence in automated bookkeeping: A value-added function for small and medium enterprises. International Journal on Informatics Visualization, 5(3), 224–230. [Google Scholar] [CrossRef]

- Azzari, V., Mainardes, E. W., & da Costa, F. M. (2020). Accounting services quality: A systematic literature review and bibliometric analysis. Asian Journal of Accounting Research, 6(1), 80–94. [Google Scholar] [CrossRef]

- Balstad, M. T., & Berg, T. (2020). A long-term bibliometric analysis of journals influencing management accounting and control research. Journal of Management Control, 30(4), 357–380. [Google Scholar] [CrossRef]

- Berlinski, E., & Morales, J. (2024). Digital technologies and accounting quantification: The emergence of two divergent knowledge templates. Critical Perspectives on Accounting, 98, 102697. [Google Scholar] [CrossRef]

- Beuren, I. M., Machado, D. G., & Dal Vesco, D. G. (2015). Sociometric and bibliometric analysis of research published in management accounting research. Contabilidade Gestao e Governanca, 18(1), 83–105. [Google Scholar]

- Bonyuet, D. (2020). Overview and impact of blockchain on auditing. International Journal of Digital Accounting Research, 20, 31–43. [Google Scholar] [CrossRef] [PubMed]

- Carlson, A. E. (1957). Automation in accounting systems. The Accounting Review, 32(2), 224–228. [Google Scholar]

- Chen, H., Ai, S., Xiong, X., & Feng, D. (2024). Big data analytics and corporate financing constraints: Evidence from a developing country. Managerial and Decision Economics, 46, 2224–2236. [Google Scholar] [CrossRef]

- Cheng, T. T., Lock, E. D., & Prywes, N. S. (1984). Use of very high level languages and program generation by management professionals. IEEE Transactions on Software Engineering, SE-10(5), 552–563. [Google Scholar] [CrossRef]

- Chiarini, A. (2012). Lean production: Mistakes and limitations of accounting systems inside the SME sector. Journal of Manufacturing Technology Management, 23(5), 681–700. [Google Scholar] [CrossRef]

- Chipriyanova, G., & Krasteva-Hristova, R. (2023, June 15–18). Technological aspects of accounting automation system as a decision support system. 14th International Scientific and Practical Conference (Vol. 2, pp. 28–33), Rezekne, Latvia. [Google Scholar]

- Chiu, V., Liu, Q., Muehlmann, B., & Baldwin, A. A. (2019). A bibliometric analysis of accounting information systems journals and their emerging technologies contributions. International Journal of Accounting Information Systems, 32, 24–43. [Google Scholar] [CrossRef]

- Chulanov, K. V., Khymchenko, Y. V., Mykhailov, O. O., & Piven, V. S. (2022). Impact of digitalization on accounting in the transition to Industry 4.0. Available online: https://essuir.sumdu.edu.ua/items/4a9151dd-1b43-4269-a93f-027007eaf37e (accessed on 18 May 2025).

- Chung, K. H., Pak, H. S., & Cox, R. A. K. (1992). Patterns of research output in the accounting literature: A study of the bibliometric distributions. Abacus, 28(2), 168–185. [Google Scholar] [CrossRef]

- Chyzhevska, L., Voloschuk, L., Shatskova, L., & Sokolenko, L. (2021). Digitalization as a vector of information systems development and accounting system modernization. Studia Universitatis Vasile Goldis Arad, Economics Series, 31(4), 18–39. [Google Scholar] [CrossRef]

- Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2011). An approach for detecting, quantifying, and visualizing the evolution of a research field: A practical application to the Fuzzy Sets Theory field. Journal of Informetrics, 5(1), 146–166. [Google Scholar] [CrossRef]

- Cooper, L. A., Holderness, D. K., Sorensen, T. L., & Wood, D. A. (2019). Robotic process automation in public accounting. Accounting Horizons, 33(4), 15–35. [Google Scholar] [CrossRef]

- Cortés-Sánchez, J. D. (2020). A bibliometric outlook of the most cited documents in business, management and accounting in Ibero-America. European Research on Management and Business Economics, 26(1), 1–8. [Google Scholar] [CrossRef]

- Curtis, M. B., Jenkins, J. G., Bedard, J. C., & Deis, D. R. (2009). Auditors’ training and proficiency in information systems: A research synthesis. Journal of Information Systems, 23(1), 79–96. [Google Scholar] [CrossRef]

- da Costa, R. S., & Nogueira, D. P. (2016). Perfil e evolução do ENANPAD: Análise bibliométrica e sociométrica da área de ensino e pesquisa em administração e contabilidade de 2001 a 2014. Espacios, 37(21), 20. [Google Scholar]

- da Silva, M. C., & Niyama, J. K. (2019). Bibliometric analysis of the evolution of scientific research in international accounting in the main english language journals. Revista Ambiente Contabil, 11(2), 65–87. [Google Scholar] [CrossRef]

- Deloitte. (2018). Internal controls over financial reporting considerations for developing and implementing bots (Issue September). Available online: https://dart.deloitte.com/USDART/pdf/a754eed6-c33e-11e8-8215-7ddf50acb392 (accessed on 29 October 2025).

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Dos Santos Teixeira, L. M., & De Souza Ribeiro, M. (2014). Bibliometric study about environmental accounting caracteristics in nacional and international journals [Estudo bibliométrico sobre as características da contabilidade ambiental em periódicos nacionais e internacionais]. Revista de Gestao Social e Ambiental, 8(1), 20–36. [Google Scholar] [CrossRef]

- Ernst & Young Global Limited. (2019). Why robotics may be the future for family offices (Issue May). Ernst & Young Global Limited. [Google Scholar]

- Faria Duarte, A. L., & Zouain, D. M. (2019). Conceptual rescue of accountability: Proposed categorization from bibliometric study. Revista Gestao Organizacional, 12(2), 102–127. [Google Scholar]

- Fernandez, D., Zaino, Z., & Ahmad, H. (2018). An investigation of challenges in Enterprise Resource Planning (ERP) implementation: The case of public sector in Malaysia. International Journal of Supply Chain Management, 7(3), 113–117. [Google Scholar]

- Fernández, D., & Aman, A. (2018). Impacts of robotic process automation on global accounting services. Asian Journal of Accounting and Governance, 9, 123–131. [Google Scholar] [CrossRef]

- Financial Accounting Standards Board. (2016). FASB concepts statement No. 8, conceptual framework for financial reporting. Available online: https://www.fasb.org/page/ShowPdf?path=Concepts_Statement_No._8_Chapter_8_(As_Issued).pdf&title=CONCEPTS%20STATEMENT%20NO.%208%E2%80%94CONCEPTUAL%20FRAMEWORK%20FOR%20FINANCIAL%20REPORTING%E2%80%94CHAPTER%208,%20NOTES%20TO%20FINANCIAL (accessed on 29 October 2025).

- Gahramanov, R. (2022). Implementation of accounting information systems (Vol. 18, pp. 103–111). Pahtei Proceedings of Azerbaijan High Technical Educational Institutions. ISSN: 1609-1620, E-lSSN: 2674-5224. [Google Scholar]

- Garcia, E. L. M., Fadel, M. O., Sanches, S. L. R., & Moraes, R. D. O. (2016). Influência da regulamentação contábil de instrumentos financeiros na produção científica: Uma análise bibliométrica em periódicos nacionais. REUNIR: Revista de Administração, Contabilidade e Sustentabilidade, 6(1), 74. [Google Scholar] [CrossRef][Green Version]

- Genete, L.-D., & Tugui, A. (2008, September 23–25). From ERP systems to digital accounting in relations with customers and suppliers. Selected Papers from the WSEAS Conferences in Spain (pp. 57–63), Santander, Spain. [Google Scholar]

- Gnatiuk, T., Shkromyda, V., & Shkromyda, N. (2023). Digitalization of accounting: Implementation features and efficiency assessment. Journal of Vasyl Stefanyk Precarpathian National University, 10(2), 45–58. [Google Scholar] [CrossRef]

- Goldhar, J. D., & Jelinek, M. (1990). Manufacturing as a service business: CIM in the 21st century. Computers in Industry, 14(1–3), 225–245. [Google Scholar] [CrossRef]

- Gomaa, A. A., Gomaa, M. I., Boumediene, S. L., & Farag, M. S. (2023). The creation of one truth: Single-ledger entries for multiple stakeholders using blockchain technology to address the reconciliation problem. Journal of Emerging Technologies in Accounting, 20(1), 59–75. [Google Scholar] [CrossRef]

- Guimarães, P. P. R. S., Ribeiro, L. M. d. P., Brandão, M. L., & Araújo, U. P. (2019). Bibliometric analysis of brazilian surveys on accounting and costs in agribusiness. Custos e Agronegocio, 15(2), 305–327. [Google Scholar]

- Handoko, L. H., & Mardian, S. (2021). Mapping the knowledge of islamic accounting studies on shariah audit: A bibliometric analysis. Library Philosophy and Practice, 102, 1–16. [Google Scholar]

- Handoyo, S. (2024). Evolving paradigms in accounting education: A bibliometric study on the impact of information technology. International Journal of Management Education, 22(3), 100998. [Google Scholar] [CrossRef]

- Henrique, M. R., Da Silva, J. M., Saporito, A., & Silva, S. B. (2021). Tax accounting: Bibliometric study of the accounting area between the period 2010 to 2020. Revista Contabilidade e Controladoria, 12(3), 148–164. [Google Scholar] [CrossRef]

- Hülle, J., Kaspar, R., & Möller, K. (2011). Multiple criteria decision-making in management accounting and control-state of the art and research perspectives based on a bibliometric study. Journal of Multi-Criteria Decision Analysis, 18(5–6), 253–265. [Google Scholar] [CrossRef]

- International Accounting Standards Board. (2018). Conceptual framework for financial reporting. Available online: https://www.ifrs.org/content/dam/ifrs/publications/pdf-standards/english/2021/issued/part-a/conceptual-framework-for-financial-reporting.pdf (accessed on 25 May 2025).

- Ionescu, L. (2021). Big data analytics tools and machine learning algorithms in cloud-based accounting information systems. Analysis and Metaphysics, 20, 102–115. [Google Scholar] [CrossRef]

- Ismayilov, N. (2020). Innovative approaches in the accounting and audit of the book value of assets: Bibliometric analysis. Marketing and Management of Innovations, 3, 319–331. [Google Scholar] [CrossRef]

- Jariwala, B. (2015). Exploring arti cial intelligence & the accountancy profession: Opportunity, threat, both, neither? International Federation of Accountatns. Available online: https://www.ifac.org/knowledge-gateway/developing-accountancy-profession/discussion/exploring-artificial-intelligence-accountancy-profession-opportunity-threat-both-neither (accessed on 23 April 2025).

- Jönsson, S., & Grönlund, A. (1988). Life with a sub-contractor: New technology and management accounting. Accounting, Organizations and Society, 13(5), 513–532. [Google Scholar] [CrossRef]

- Keenoy, C. L. (1958). The impact of automation on the field of accounting. The Accounting Review, 33(2), 230–236. [Google Scholar]

- Kerremans, M., Theunisse, H., & Overloop, G. V. (1991). Impact of automation on cost accounting. Accounting and Business Research, 21(82), 147–155. [Google Scholar] [CrossRef]

- Kuhner, C., & Pelger, C. (2015). On the relationship of stewardship and valuation—An analytical viewpoint. Abacus, 51(3), 379–411. [Google Scholar] [CrossRef]

- Kumar, P., Sharma, A., & Salo, J. (2019). A bibliometric analysis of extended key account management literature. Industrial Marketing Management, 82, 276–292. [Google Scholar] [CrossRef]

- Kumar, S., Marrone, M., Liu, Q., & Pandey, N. (2020). Twenty years of the international journal of accounting information systems: A bibliometric analysis. International Journal of Accounting Information Systems, 39, 100488. [Google Scholar] [CrossRef]

- Lea, B. R., & Fredendall, L. D. (2002). The impact of management accounting, product structure, product mix algorithm, and planning horizon on manufacturing performance. International Journal of Production Economics, 79(3), 279–299. [Google Scholar] [CrossRef]

- Lee, Y., Kozar, K. A., & Larsen, K. R. T. (2003). The technology acceptance model: Past, present, and future. Communications of the Association for Information Systems, 12, 752–780. [Google Scholar] [CrossRef]

- Lehner, O. M., Ittonen, K., Silvola, H., Ström, E., & Wührleitner, A. (2022). Artificial intelligence based decision-making in accounting and auditing: Ethical challenges and normative thinking. Accounting, Auditing and Accountability Journal, 35(9), 109–135. [Google Scholar] [CrossRef]

- Leoni, G., & Parker, L. D. (2019). Governance and control of sharing economy platforms: Hosting on Airbnb. British Accounting Review, 51(6), 100814. [Google Scholar] [CrossRef]

- Linnenluecke, M. K., Marrone, M., & Singh, A. K. (2020). Sixty years of Accounting & Finance: A bibliometric analysis of major research themes and contributions. Accounting and Finance, 60(4), 3217–3251. [Google Scholar] [CrossRef]

- Liu, R., Wang, Y., & Zou, J. (2022). Research on the transformation from financial accounting to management accounting based on drools rule engine. Computational Intelligence and Neuroscience, 2022, 9445776. [Google Scholar] [CrossRef] [PubMed]

- Lutfi, A., Alkelani, S. N., Al-Khasawneh, M. A., Alshira’h, A. F., Alshirah, M. H., Almaiah, M. A., Alrawad, M., Alsyouf, A., Saad, M., & Ibrahim, N. (2022a). Influence of digital accounting system usage on SMEs performance: The moderating effect of COVID-19. Sustainability, 14(22), 15048. [Google Scholar] [CrossRef]

- Lutfi, A., Alkelani, S. N., Alqudah, H., Alshira’h, A. F., Alshirah, M. H., Almaiah, M. A., Alsyouf, A., Alrawad, M., Montash, A., & Abdelmaksoud, O. (2022b). The role of E-accounting adoption on business performance: The moderating role of COVID-19. Journal of Risk and Financial Management, 15(12), 617. [Google Scholar] [CrossRef]

- Lytvyn, L., Hryhoruk, A., Verbivska, L., Poprotskyy, O., Medynska, T., & Pelekh, O. (2022). Enterpreneship transformation in the context of the digitization of business processes. Postmodern Openings, 13(2), 396–408. [Google Scholar] [CrossRef]

- Łada, M., & Martinek-Jaguszewska, K. (2023). The autonomization of accounting processes. Zeszyty Teoretyczne Rachunkowosci, 47(3), 95–111. [Google Scholar] [CrossRef]

- Marzi, G., Balzano, M., Caputo, A., & Pellegrini, M. M. (2025). Guidelines for bibliometric-systematic literature reviews: 10 steps to combine analysis, synthesis and theory development. International Journal of Management Reviews, 27(1), 81–103. [Google Scholar] [CrossRef]

- Merigo, J. M., & Yang, J.-B. (2017). Accounting research: A bibliometric analysis. Australian Accounting Review, 27(1), 71–100. [Google Scholar] [CrossRef]

- Merigó, J. M., & Yang, J. B. (2017). A bibliometric analysis of operations research and management science. Omega, 73, 37–48. [Google Scholar] [CrossRef]

- Mohanty, B. K. (2019). Accounting, organizations and society: A bibliometric study based on the science direct database during the year, 2005–2014. Library Philosophy and Practice, 2019, 1–18. [Google Scholar]

- Mongeon, P., & Paul-Hus, A. (2016). The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics, 106(1), 213–228. [Google Scholar] [CrossRef]

- Monteiro, A. P., Vale, J., Silva, A., & Pereira, C. (2021). Impact of the internal control and accounting systems on the financial information usefulness: The role of the financial information quality. Academy of Strategic Management Journal, 20(3), 1–13. [Google Scholar]

- Moraes, G. L. d., Behr, A., & Farias, E. d. S. (2016). Cost accounting in agribusiness: A bibliometric study of the articles published in the journal custos e @gronegócio online. Custos e Agronegocio, 12, 71–94. [Google Scholar]

- Mosweu, O., & Ngoepe, M. (2020). Trustworthiness of digital records in government accounting system to support the audit process in Botswana. Records Management Journal, 31(1), 89–108. [Google Scholar] [CrossRef]

- Moya, S., & Prior, D. (2008). Who publish in Spanish accounting jornals? A bibliometric analysis 1996–2005. Revista Espanola de Financiacion y Contabilidad, 37(138), 353–374. [Google Scholar] [CrossRef]

- Nguyen, N. M., Abu Afifa, M., & Van Bui, D. (2023). Blockchain technology and sustainable performance: Moderated-mediating model with management accounting system and digital transformation. Environment, Development and Sustainability, 27, 7255–7277. [Google Scholar] [CrossRef]

- Nolli, J. G., Giordani, M. D. S., Domingues, M. J. C. d. S., & Zonatto, V. C. d. S. (2020). Avaliação da aprendizagem em ciências contábeis: Um estudo bibliométrico e sociométrico. Revista Contabilidade e Controladoria, 11(2), 40–56. [Google Scholar] [CrossRef]

- Noyons, E. C. M., Moed, H. F., & Van Raan, A. F. J. (1999). Integrating research performance analysis and science mapping. Scientometrics, 46(3), 591–604. [Google Scholar] [CrossRef]

- Olusanmi, O. A., Emeni, F. K., Uwuigbe, U., & Oyedayo, O. S. (2021). A bibliometric study on water management accounting research from 2000 to 2018 in Scopus database. Cogent Social Sciences, 7(1), 1886645. [Google Scholar] [CrossRef]

- Omar, S. S., Nayef, J. M., Qasim, N. H., Kawad, R. T., & Kalenychenko, R. (2024). The role of digitalization in improving accountability and efficiency in public services. Investigacion Operacional, 45(2), 203–223. [Google Scholar]

- Panasenko, S. V., Cheglov, V. P., Ramazanov, I. A., Anatolevna Krasil’nikova, E., & Sharonin, P. N. (2021). Mechanisms of e-commerce enterprises development in the context of digitalization. Nexo Revista Científica, 34(1), 469–476. [Google Scholar] [CrossRef]

- Parra-Sánchez, D. T., & Talero-Sarmiento, L. H. (2024). Digital transformation in small and medium enterprises: A scientometric analysis. Digital Transformation and Society, 3(3), 257–276. [Google Scholar] [CrossRef]

- Petchenko, M., Fomina, T., Balaziuk, O., Smirnova, N., & Luhova, O. (2023). Analysis of trends in the implementation of digitalization in accounting (ukrainian case). Financial and Credit Activity: Problems of Theory and Practice, 1(48), 105–113. [Google Scholar] [CrossRef]

- Phornlaphatrachakorn, K., & Kalasindhu, K. N. (2021). Digital accounting, financial reporting quality and digital transformation: Evidence from Thai listed firms. The Journal of Asian Finance, Economics and Business, 8(8), 409–0419. [Google Scholar] [CrossRef]

- Poje, T., & Zaman Groff, M. (2022). Mapping ethics education in accounting research: A bibliometric analysis. Journal of Business Ethics, 179(2), 451–472. [Google Scholar] [CrossRef] [PubMed]

- Ponomareva, T., & Matiushko, M. (2021). Analysis of software products used for automation of accounting by entrepreneurship subjects. Social Economics, 62, 148–155. [Google Scholar] [CrossRef]

- Poppe, K., Vrolijk, H., & Bosloper, I. (2023). Integration of farm financial accounting and farm management information systems for better sustainability reporting. Electronics, 12(6), 1485. [Google Scholar] [CrossRef]

- Qi, S., Huang, Z., & Ji, L. (2021). Sustainable development based on green GDP accounting and cloud computing: A case study of Zhejiang province. Scientific Programming, 2021, 7953164. [Google Scholar] [CrossRef]

- R Core Team. (2025). R: A language and environment for statistical computing. R Foundation for Statistical Computing. Available online: https://www.R-project.org/ (accessed on 25 May 2025).

- Resler, M. V. (2013). General approach to the implementation of automated management accounting. Business Inform, 1, 321–323. [Google Scholar]

- Rindasu, S.-M. (2017). Emerging information technologies in accounting and related security risks—What is the impact on the romanian accounting profession. Journal of Accounting and Management Information Systems, 16(4), 581–609. [Google Scholar] [CrossRef]

- Robey, D., & Rodriguez-Diaz, A. (1989). The organizational and cultural context of systems implementation: Case experience from Latin America. Information and Management, 17(4), 229–239. [Google Scholar] [CrossRef]

- Rogers, G., Szomszor, M., & Adams, J. (2020). Sample size in bibliometric analysis. Scientometrics, 125(1), 777–794. [Google Scholar] [CrossRef]

- Saleh, M. M. A., Jawabreh, O. A. A., Al Om, R., & Shniekat, N. (2021). Artificial intelligence (AI) and the impact of enhancing the consistency and interpretation of financial statement in the classified hotels in Aqaba, Jordan. Academy of Strategic Management Journal, 20(3), 1–18. [Google Scholar]

- Sani, A., & Tiamiyu, M. (2005). Evaluation of automated services in Nigerian universities. Electronic Library, 23(3), 274–288. [Google Scholar] [CrossRef]

- Scarbrough, P., Nanni, A. J., & Sakurai, M. (1991). Japanese management accounting practices and the effects of assembly and process automation. Management Accounting Research, 2(1), 27–46. [Google Scholar] [CrossRef]

- Schaltegger, S., Gibassier, D., & Zvezdov, D. (2013). Is environmental management accounting a discipline? A bibliometric literature review. Meditari Accountancy Research, 21(1), 4–31. [Google Scholar] [CrossRef]

- Schatsky, D., Muraskin, C., & Gurumurthy, R. (2015). Cognitive technologies: The real opportunities for business. Deloitte Review, 16, 114–129. [Google Scholar]

- Slavinskaitė, N. (2022). Automation of accounting processes: Case study of the companies in Lithuanian. Global Journal of Business, Economics, and Management: Current Issues, 12(3), 316–325. [Google Scholar] [CrossRef]

- Spilnyk, I., Brukhanskyi, R., Struk, N., Kolesnikova, O., & Sokolenko, L. (2022). Digital accounting: Innovative technologies cause a new paradigm. Independent Journal of Management & Production, 13(3), s215–s224. [Google Scholar] [CrossRef]

- Swanson, E. B. (2020). How information systems came to rule the world: Reflections on the information systems field. Information Society, 36(2), 109–123. [Google Scholar] [CrossRef]

- Tingey-Holyoak, J., Pisaniello, J., Buss, P., & Mayer, W. (2021). The importance of accounting-integrated information systems for realising productivity and sustainability in the agricultural sector. International Journal of Accounting Information Systems, 41, 100512. [Google Scholar] [CrossRef]

- van Raan, A. F. J. (2005). Measuring science. In H. F. Moed, W. Glänzel, & U. Schmoch (Eds.), Handbook of quantitative science and technology research (pp. 19–50). Springer. [Google Scholar] [CrossRef]

- Vedernikova, O., Siguenza-Guzman, L., Pesantez, J., & Arcentales-Carrion, R. (2020). Time-driven activity-based costing in the assembly industry. Australasian Accounting, Business and Finance Journal, 14(4), 3–23. [Google Scholar] [CrossRef]

- Vysochan, O. S., Hyk, V., Mykytyuk, N., & Vysochan, O. O. (2023). Taxonomy of financial reporting in the context of digitalization of the economy: Domestic and international analysis scientific research. Studia Universitatis Vasile Goldis Arad, Economics Series, 33(2), 49–70. [Google Scholar] [CrossRef]

- Wang, S., Tang, X., Zhang, B., & Wang, W. (2021). Accounting and management of natural resource consumption based on input-output method: A global bibliometric analysis. Frontiers in Energy Research, 9, 628321. [Google Scholar] [CrossRef]

- White, H. D., & McCain, K. W. (1998). Visualizing a discipline: An author co-citation analysis of information science, 1972–1995. Journal of the American Society for Information Science, 49(4), 327–355. [Google Scholar] [CrossRef]

- Yamaguchi, C. K., dos Santos, A. P. S., & Watanabe, M. (2015). Environmental accounting: A bibliometric study [Contabilidade ambiental: Um estudo bibliométrico]. Espacios, 36(11), 1–8. [Google Scholar]

- Yao, F., Qin, Z., Wang, X., Chen, M., Noor, A., Sharma, S., Singh, J., Kozak, D., & Hunjet, A. (2023). The evolution of renewable energy environments utilizing artificial intelligence to enhance energy efficiency and finance. Heliyon, 9(5), e16160. [Google Scholar] [CrossRef]

- Zhang, H., Zheng, Q., Dong, B., & Feng, B. (2021). A financial ticket image intelligent recognition system based on deep learning. Knowledge-Based Systems, 222, 106955. [Google Scholar] [CrossRef]

- Zhao, J., Zhang, L., & Zhao, Y. (2022). Informatization of accounting systems in small- and medium-sized enterprises based on artificial intelligence-enabled cloud computing. Computational Intelligence and Neuroscience, 2022, 6089195. [Google Scholar] [CrossRef]

- Zhyvko, Z., Nikolashyn, A., Semenets, I., Karpenko, Y., Zos-Kior, M., Hnatenko, I., Klymenchukova, N., & Krakhmalova, N. (2022). Secure aspects of digitalization in management accounting and finances of the subject of the national economy in the context of globalization. Journal of Hygienic Engineering and Design, 39, 259–269. [Google Scholar]

- Zupic, I., & Čater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18(3), 429–472. [Google Scholar] [CrossRef]

| Authors | Journal | Total Citations |

|---|---|---|

| (Chung et al., 1992) | Abacus-A Journal of Accounting and Business Studies | 31 |

| (Moya & Prior, 2008) | Spanish Journal of Finance and Accounting | 7 |

| (Hülle et al., 2011) | Journal of Multi-Criteria Decision Analysis | 10 |

| (Schaltegger et al., 2013) | Meditari Accountancy Research | 58 |

| (Dos Santos Teixeira & De Souza Ribeiro, 2014) | Revista de Gestao Social e Ambiental | 0 |

| (Beuren et al., 2015) | Contabilidade Gestão e Governança | 3 |

| (Yamaguchi et al., 2015) | Espacios | 0 |

| (Garcia et al., 2016) | Reunir-Revista de Administracao Contabilidade e Sustentabilidade | 0 |

| (Moraes et al., 2016) | Custos e Agronegocio Online | 0 |

| (da Costa & Nogueira, 2016) | Espacios | 0 |

| (Merigo & Yang, 2017) | Australian Accounting Review | 54 |

| (Azevedo, 2018) | Revista Evidenciacao Contábil & Finanças | 0 |

| (Ardianto & Anridho, 2018) | International Journal of Digital Accounting Research | 0 |

| (P. Kumar et al., 2019) | Industrial Marketing Management | 11 |

| (Chiu et al., 2019) | International Journal of Accounting Information Systems | 4 |

| (da Silva & Niyama, 2019) | Revista Ambiente Contábil | 0 |

| (Faria Duarte & Zouain, 2019) | Revista Gestão Organizacional | 0 |

| (Nolli et al., 2020) | Revista Contabilidade e Controladoria | 0 |

| (Guimarães et al., 2019) | Custos e Agronegocio Online | 0 |

| (Guimarães et al., 2019) | Custos e Agronegocio | 0 |

| (Mohanty, 2019) | Library Philosophy and Practice | 0 |

| (Cortés-Sánchez, 2020) | European Research on Management and Business Economics | 3 |

| (S. Kumar et al., 2020) | International Journal of Accounting Information Systems | 2 |

| (Balstad & Berg, 2020) | Journal of Management Control | 2 |

| (Linnenluecke et al., 2020) | Accounting and Finance | 0 |

| (Henrique et al., 2021) | Revista Contabilidade e Controladoria | 0 |

| (Ismayilov, 2020) | Marketing and Management of Innovations | 0 |

| (Wang et al., 2021) | Frontiers in Energy Research | 0 |

| (Olusanmi et al., 2021) | Cogent Social Sciences | 0 |

| (Handoko & Mardian, 2021) | Library Philosophy and Practice | 0 |

| Items | Criteria (Search Query) | Extracted Data |

|---|---|---|

| Keywords | (“digital” AND “Accounting system *”) OR (“automat *” AND “Accounting system *”) OR ((“AI” OR “Artificial Intelligence”) AND “Accounting System *”) | WoS: 252 Scopus: 110 Total: 362 Excluded 72 (not related with the search criteria) 82 (duplicate) |

| Inclusion criteria | Documents addressing the topics: | |

| “Accounting and automation” | ||

| “Accounting and digital” | ||

| “Accounting and artificial intelligence” | ||

| Timeframe | Documents published up to 31 December 2024 | |

| Language | English | |

| Filtering and exclusion: | Article titles, keywords, and abstracts were analysed to assess if they met the inclusion criteria | |

| Final dataset | ||

| 208 |

| Description | Results |

|---|---|

| MAIN INFORMATION ABOUT THE DATA | |

| Timespan | 1954:2024 |

| Sources (journals, books, etc.) | 168 |

| Documents | 208 |

| Annual growth rate % | 5.12 |

| Document average age | 13.1 |

| Average citations per doc | 7.144 |

| References | 821 |

| DOCUMENT CONTENTS | |

| Keywords plus (ID) | 665 |

| Author’s keywords (DE) | 644 |

| AUTHORS | |

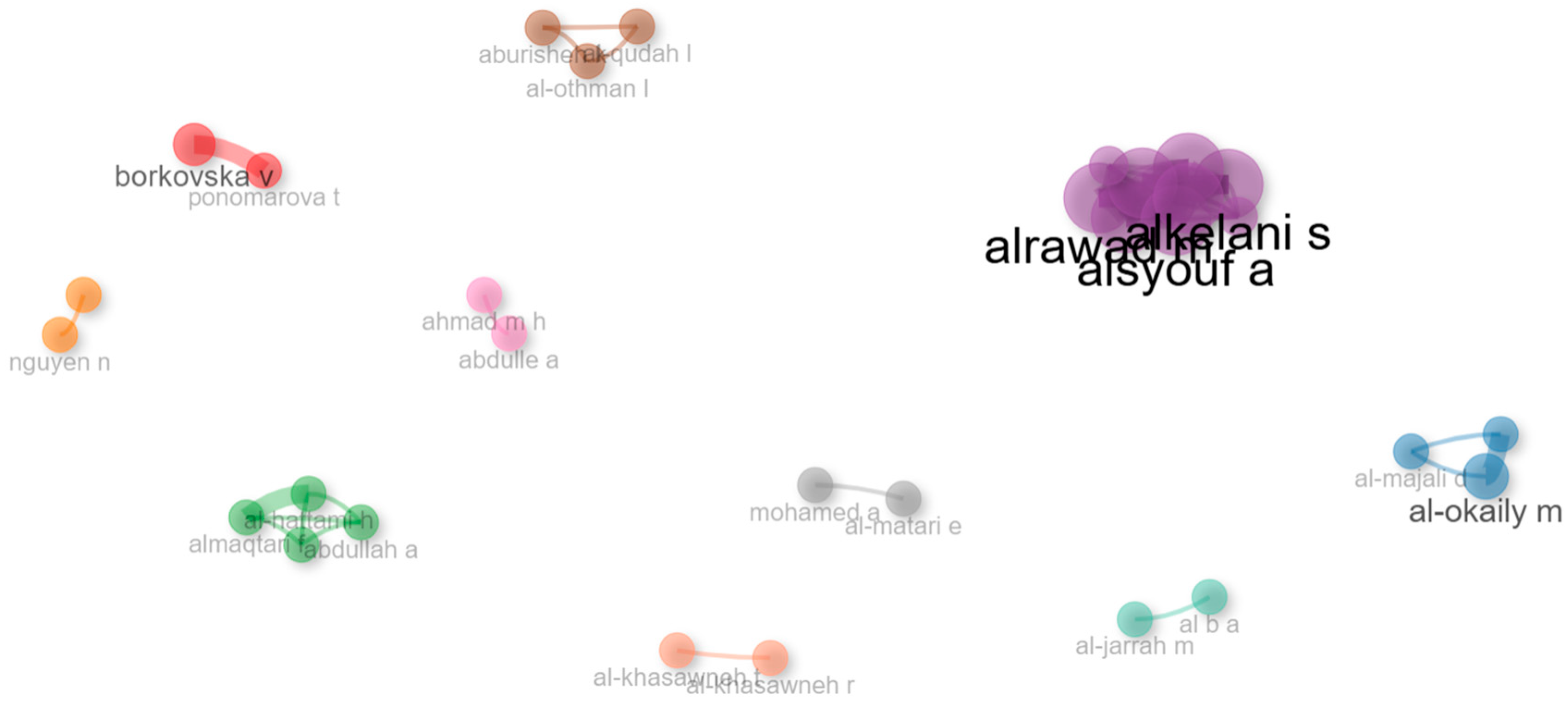

| Authors | 571 |

| Authors of single-authored docs | 57 |

| AUTHOR COLLABORATIONS | |

| Single-authored docs | 60 |

| Co-authors per doc | 2.89 |

| International co-authorships % | 1.442 |

| DOCUMENT TYPE | |

| Article | 210 |

| Source | Articles |

|---|---|

| Financial and Credit Activity: Problems of Theory and Practice | 8 |

| Journal of Risk and Financial Management | 4 |

| Applied Mathematics and Nonlinear Sciences | 3 |

| Computational Intelligence and Neuroscience | 3 |

| European Journal of Economics, Finance and Administrative Sciences | 3 |

| International Journal of Accounting Information Systems | 3 |

| International Journal of Data and Network Science | 3 |

| International Journal of Management | 3 |

| Academy of Accounting and Financial Studies Journal | 2 |

| Academy of Strategic Management Journal | 2 |

| Authors | Articles | Articles Fractionalised |

|---|---|---|

| Al-Okaily M. | 4 | 2.50 |

| Borkovska V. | 4 | 0.73 |

| Shevtsiv L. | 3 | 0.50 |

| Al-Hattami H. | 2 | 0.75 |

| Al-Okaily A. | 2 | 0.50 |

| Alkelani S. | 2 | 0.20 |

| Almaiah M. | 2 | 0.20 |

| Almaqtari F. | 2 | 0.75 |

| Alrawad M. | 2 | 0.20 |

| Alsharari N. | 2 | 1.00 |

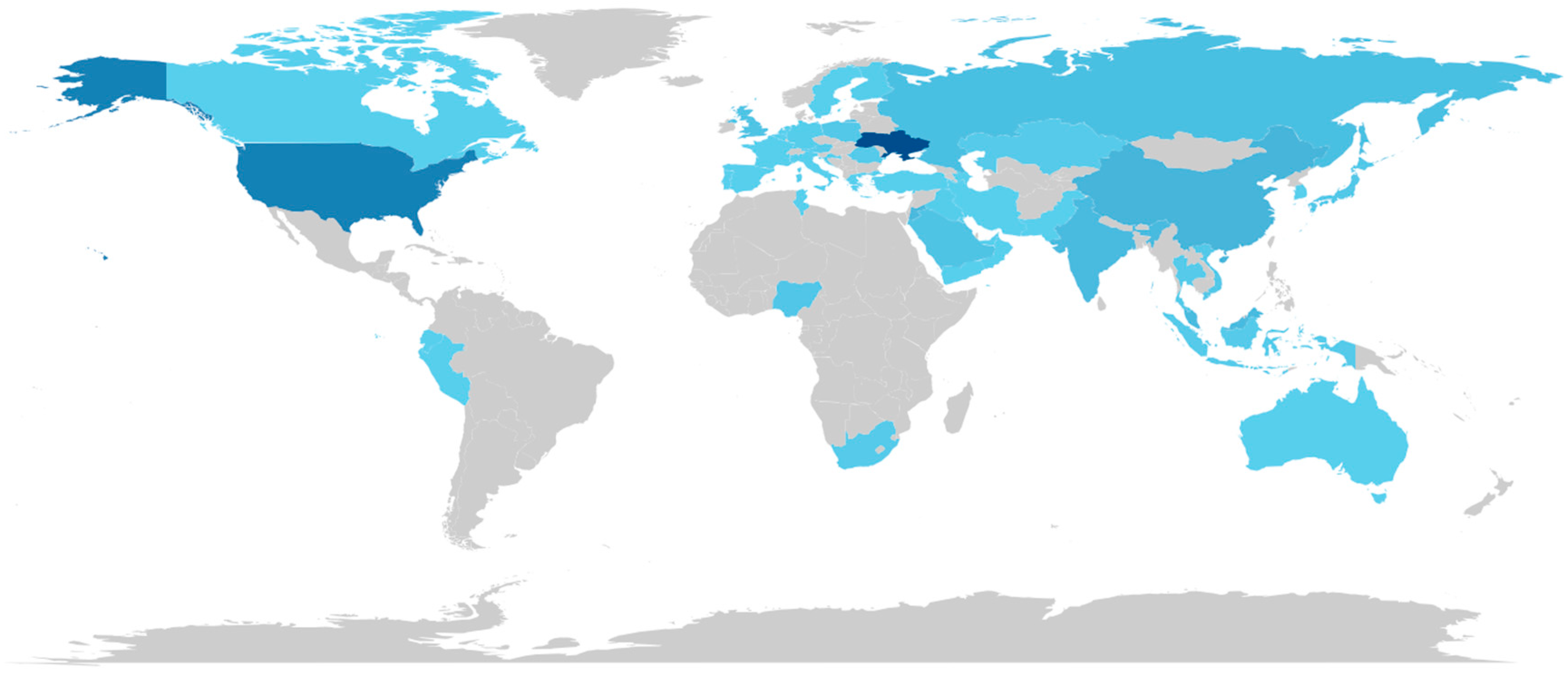

| Country/Territory | Freq |

|---|---|

| Ukraine | 64 |

| USA | 37 |

| China | 13 |

| Jordan | 11 |

| India | 10 |

| Malaysia | 10 |

| Russia | 8 |

| Saudi Arabia | 6 |

| UK | 6 |

| Nigeria | 5 |

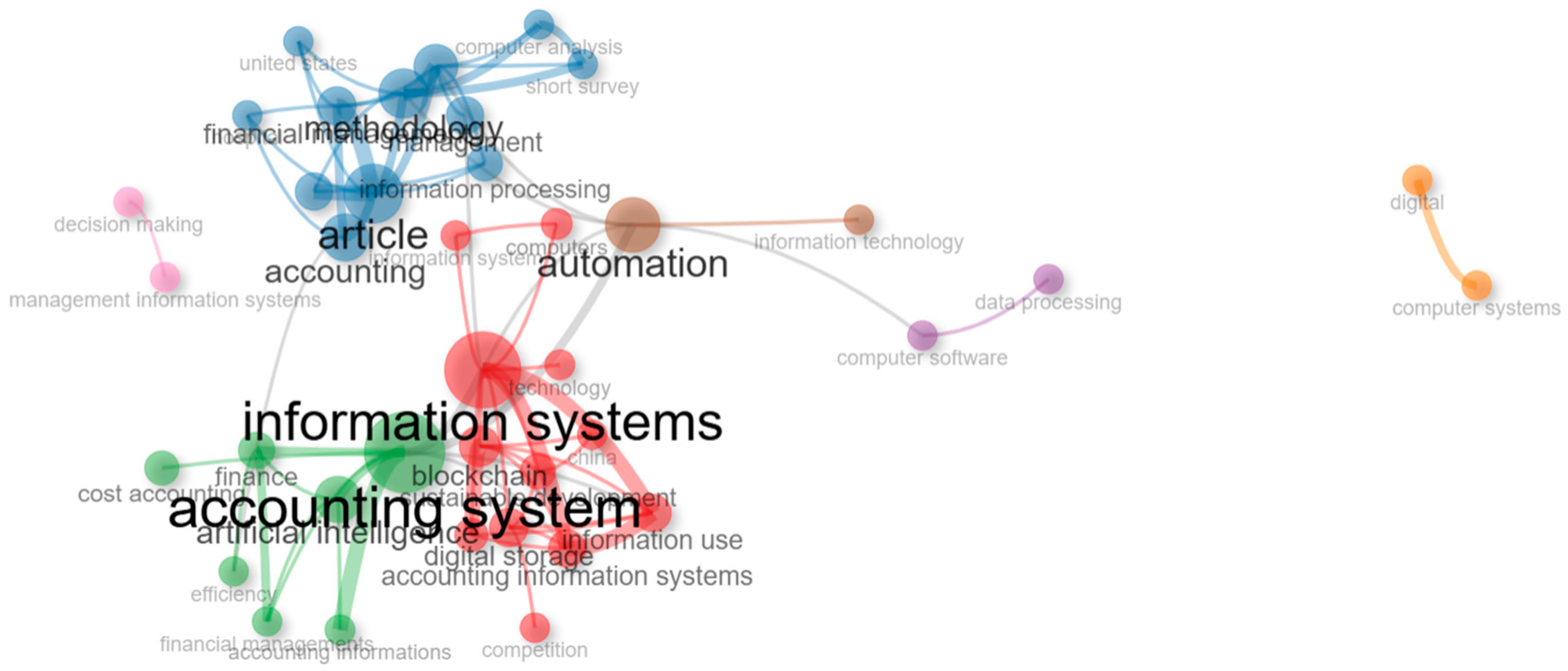

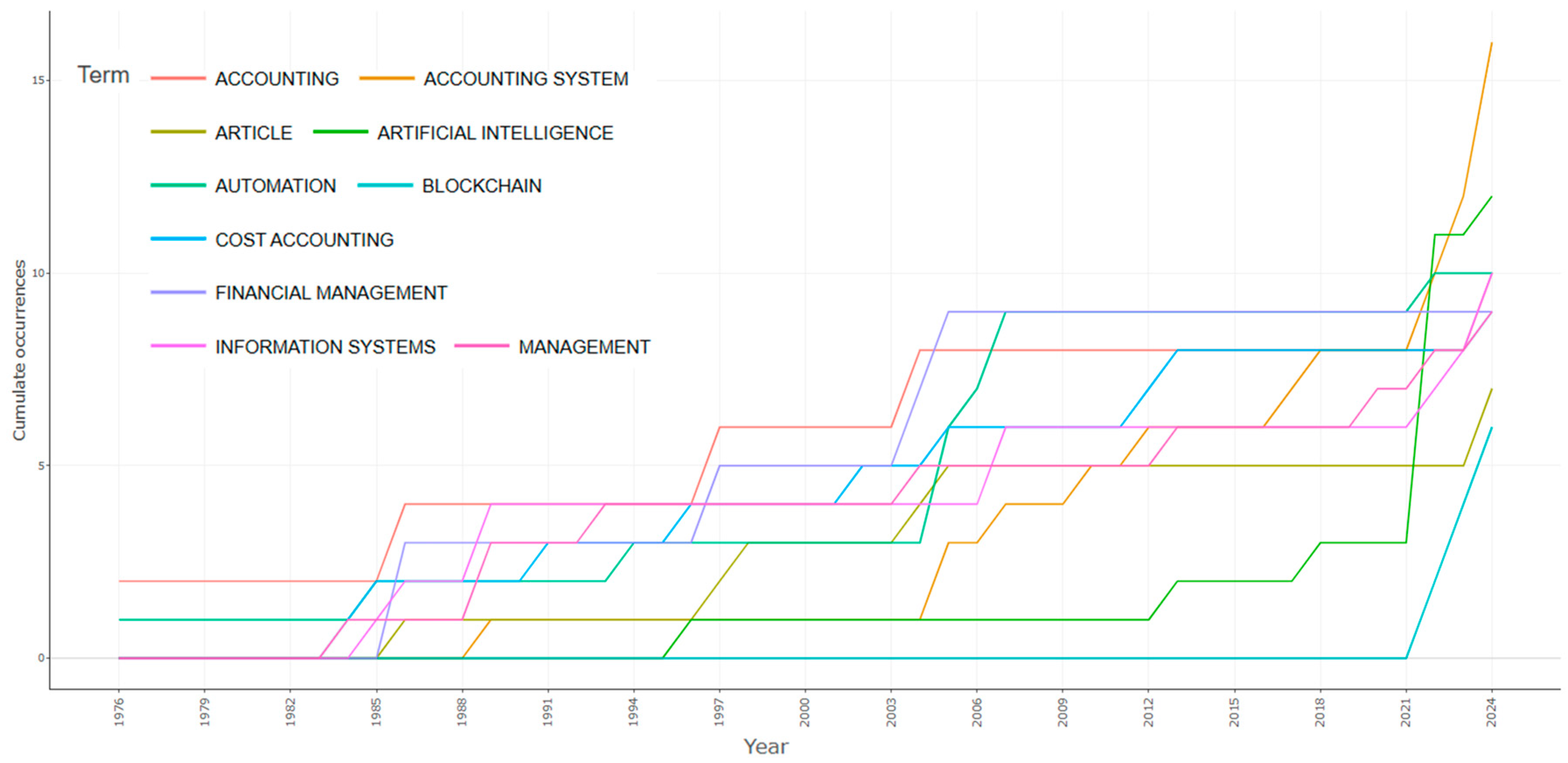

| Term | Frequency | Year (Q1) | Year (Median) | Year (Q3) |

|---|---|---|---|---|

| methodology | 6 | 1984 | 1991 | 1998 |

| accounting | 10 | 1986 | 1997 | 2004 |

| financial management | 9 | 1986 | 1997 | 2004 |

| human | 5 | 1997 | 1998 | 2024 |

| organisation and management | 5 | 1985 | 1998 | 2004 |

| cost accounting | 9 | 1991 | 2002 | 2012 |

| decision-making | 5 | 1986 | 2002 | 2017 |

| management | 9 | 1989 | 2004 | 2020 |

| article | 7 | 1998 | 2004 | 2014 |

| automation | 10 | 1997 | 2005 | 2007 |

| information systems | 10 | 1989 | 2007 | 2023 |

| accounting system | 16 | 2009 | 2020 | 2023 |

| sustainable development | 5 | 2014 | 2021 | 2022 |

| artificial intelligence | 12 | 2021 | 2022 | 2022 |

| digital storage | 5 | 2021 | 2022 | 2024 |

| blockchain | 6 | 2022 | 2023 | 2024 |

| finance | 6 | 2021 | 2023 | 2024 |

| accounting information | 5 | 2022 | 2023 | 2023 |

| Paper | DOI | Total Citations |

|---|---|---|

| (Al-Okaily, 2024) | 10.1108/VJIKMS-08-2021-0148 | 99 |

| (Jönsson & Grönlund, 1988) | 10.1016/0361-3682(88)90020-7 | 75 |

| (Robey & Rodriguez-Diaz, 1989) | 10.1016/0378-7206(89)90046-3 | 72 |

| (Lea & Fredendall, 2002) | 10.1016/S0925-5273(02)00253-0 | 70 |

| (Al-Okaily et al., 2023a) | 10.1108/GKMC-01-2022-0015 | 67 |

| (Bonyuet, 2020) | 10.4192/1577-8517-v20_2 | 62 |

| (Leoni & Parker, 2019) | 10.1016/j.bar.2018.12.001 | 62 |

| (Chiarini, 2012) | 10.1108/17410381211234462 | 57 |

| (Lehner et al., 2022) | 10.1108/AAAJ-09-2020-4934 | 50 |

| (Lutfi et al., 2022a) | 10.3390/su142215048 | 47 |

| (Scarbrough et al., 1991) | 10.1016/S1044-5005(91)70025-5 | 42 |

| (Al-Okaily et al., 2023b) | 10.1108/JFRA-05-2023-0277 | 39 |

| (Lutfi et al., 2022b) | 10.3390/jrfm15120617 | 39 |

| (Zhang et al., 2021) | 10.1016/j.knosys.2021.106955 | 30 |

| (Goldhar & Jelinek, 1990) | 10.1016/0166-3615(90)90126-A | 27 |

| (Omar et al., 2024) | NA | 23 |

| (ALSaqa et al., 2019) | 10.22059/jitm.2019.74301 | 23 |

| (Alkhatib et al., 2019) | 10.1016/j.accinf.2019.06.004 | 22 |

| (Saleh et al., 2021) | NA | 21 |

| (Al-Fatlawi et al., 2021) | 10.14704/WEB/V18SI02/WEB18073 | 19 |

| (Alsharari & El-Aziz Youssef, 2017) | 10.1108/ARA-06-2016-0062 | 19 |

| (Kerremans et al., 1991) | 10.1080/00014788.1991.9729827 | 18 |

| (Yao et al., 2023) | 10.1016/j.heliyon.2023.e16160 | 15 |

| (Tingey-Holyoak et al., 2021) | 10.1016/j.accinf.2021.100512 | 15 |

| (Chyzhevska et al., 2021) | 10.2478/sues-2021-0017 | 15 |

| (Monteiro et al., 2021) | NA | 15 |

| (Azman et al., 2021) | 10.30630/JOIV.5.3.669 | 14 |

| (Phornlaphatrachakorn & Kalasindhu, 2021) | 10.13106/jafeb.2021.vol8.no8.0409 | 14 |

| (Kuhner & Pelger, 2015) | 10.1111/abac.12053 | 13 |

| (Fernandez et al., 2018) | NA | 12 |

| (Swanson, 2020) | 10.1080/01972243.2019.1709931 | 12 |

| (Ionescu, 2021) | 10.22381/am2020217 | 11 |

| (Sani & Tiamiyu, 2005) | 10.1108/02640470510603679 | 11 |

| (Zhyvko et al., 2022) | NA | 10 |

| (Mosweu & Ngoepe, 2020) | 10.1108/RMJ-11-2019-0069 | 10 |

| (Vedernikova et al., 2020) | 10.14453/aabfj.v14i4.2 | 10 |

| (Panasenko et al., 2021) | 10.5377/nexo.v34i01.11324 | 10 |

| (Poppe et al., 2023) | 10.3390/electronics12061485 | 9 |

| (Nguyen et al., 2023) | 10.1007/s10668-023-04189-7 | 9 |

| (Qi et al., 2021) | 10.1155/2021/7953164 | 9 |

| (Cheng et al., 1984) | 10.1109/TSE.1984.5010279 | 9 |

| (Vysochan et al., 2023) | 10.2478/sues-2023-0008 | 8 |

| (Zhao et al., 2022) | 10.1155/2022/6089195 | 8 |

| (Petchenko et al., 2023) | 10.55643/fcaptp.1.48.2023.3951 | 8 |

| (Gomaa et al., 2023) | 10.2308/JETA-19-06-01-28 | 8 |

| (Lytvyn et al., 2022) | 10.18662/po/13.2/461 | 8 |

| (Liu et al., 2022) | 10.1155/2022/9445776 | 7 |

| (Al-Hattami et al., 2024) | 10.1002/jsc.2571 | 7 |

| (Al-Hattami & Almaqtari, 2023) | 10.1057/s41599-023-02332-3 | 7 |

| (Berlinski & Morales, 2024) | 10.1016/j.cpa.2023.102697 | 7 |

| Paper | Subject |

|---|---|

| (Al-Okaily, 2024) | This paper evaluates the effectiveness of accounting information systems (AISs) in Jordanian firms during the COVID-19 pandemic. It extends the previous literature by analysing factors like system quality, information quality, and their impact on individual, workgroup, and organisational performance. |

| (Jönsson & Grönlund, 1988) | This study investigates the implications of new industrial technologies on management accounting, particularly in decentralised and flexible production systems. It addresses issues such as product costing challenges and trade-offs between flexibility, quality, and efficiency. |

| (Robey & Rodriguez-Diaz, 1989) | This research explores the cultural and organisational challenges faced by multinational corporations when implementing automated accounting systems in subsidiaries. It highlights the role of local management involvement in successful implementation. |

| (Lea & Fredendall, 2002) | This study examines the interaction between management accounting systems and product mix decisions in highly automated manufacturing environments, using computer simulation to evaluate performance under different scenarios. |

| (Al-Okaily et al., 2023a) | This paper investigates the impact of digital accounting systems on decision-making quality in Jordanian banks. It further analyses the role of data and system quality, mediated by information quality, in improving decision outcomes. |

| (Bonyuet, 2020) | This study reviews the implications of blockchain technology for accounting, focusing on its potential to transform auditing processes and enhance transparency through a decentralised ledger system. |

| (Leoni & Parker, 2019) | This paper examines governance and management control in digital platforms like Airbnb. It highlights how accounting systems enable surveillance and control of users to maintain value creation in sharing-economy platforms. |

| (Chiarini, 2012) | This research compares traditional accounting with Activity-Based Costing (ABC) and Value Stream Accounting in lean production environments, using a case study of a small-to-medium-sized enterprise (SME). |

| (Lehner et al., 2022) | This paper identifies ethical challenges associated with AI-based accounting systems, such as objectivity, privacy, and accountability, and discusses these within a framework of ethical decision-making. |

| (Lutfi et al., 2022a) | This research develops a model to examine the determinants and performance impact of digital accounting systems (DASs) among SMEs in Jordan, incorporating factors like organisational readiness, government support, and COVID-19’s moderating role. |

| (Scarbrough et al., 1991) | This study identifies key Japanese management accounting practices, particularly in factory automation environments, focusing on target costing and cost analysis for strategic decision-making. |

| (Al-Okaily et al., 2023b) | This paper investigates the antecedents of blockchain technology adoption in digital accounting, emphasising the role of perceived usefulness and ease of use in driving adoption. |

| (Lutfi et al., 2022b) | This study evaluates electronic accounting (e-accounting) systems in Jordanian firms, analysing their impact on user satisfaction and business performance. |

| (Zhang et al., 2021) | This paper proposes a financial ticket recognition system for automating accounting processes, improving efficiency and accuracy in financial document handling. |

| (Goldhar & Jelinek, 1990) | This study discusses the long-term societal and organisational impacts of Computer-Integrated Manufacturing (CIM), focusing on innovation and the strategic use of advanced technologies. |

| (Omar et al., 2024) | This paper explores the role of digitalisation in enhancing public sector accounting transparency and accountability, discussing strategic preparation for digital transitions. |

| (ALSaqa et al., 2019) | This research analyses the potential of blockchain technology in improving accounting information systems, focusing on its implications for automation and reliability. |

| (Alkhatib et al., 2019) | This study investigates factors influencing the voluntary adoption of digital reporting by small private companies in the UK, highlighting the role of technological competence and standardisation benefits. |

| (Saleh et al., 2021) | This study investigates the effect of artificial intelligence on the integration and quality of accounting information systems in Jordanian hotels, highlighting its potential to enhance financial statement interpretation and reduce information risks. |

| (Al-Fatlawi et al., 2021) | This paper explores the role of IT governance in improving the security of accounting information systems in the Iraqi banking sector, demonstrating how governance mechanisms can enhance data security and reduce risks. |

| (Alsharari & El-Aziz Youssef, 2017) | This research examines management accounting changes in the Jordanian Customs Organisation, focusing on the implementation of the Government Financial Management Information System (GFMIS) and its impact on public sector reforms and fiscal management. |

| (Kerremans et al., 1991) | This study analyses the effects of technological advancements in production methods on cost accounting systems in Belgian manufacturing companies, highlighting shifts in cost structures and the need for improved cost traceability. |

| (Yao et al., 2023) | This paper investigates the role of a “Green Institutional Environment” in promoting renewable energy investments, proposing policies to strengthen green accounting systems and regulatory frameworks. |

| (Tingey-Holyoak et al., 2021) | This study develops a model integrating accounting and agricultural information systems to improve water productivity and profitability in Australian potato farming, demonstrating how such systems can enhance sustainability. |

| (Chyzhevska et al., 2021) | This paper discusses how digitalisation transforms business processes and accounting systems, recommending the adoption of technologies like AI, blockchain, and IoT to modernise accounting practices. |

| (Monteiro et al., 2021) | This research examines the role of internal control and accounting information systems in improving the quality of financial reporting and the usefulness of financial information for decision-making. |

| (Azman et al., 2021) | This paper discusses the evolution from manual to automated bookkeeping systems, emphasising AI’s role in improving efficiency and accuracy, particularly for SMEs in Malaysia. |

| (Phornlaphatrachakorn & Kalasindhu, 2021) | This study analyses the impact of digital accounting on financial reporting quality, accounting information usefulness, and strategic decision-making in Thai firms, with digital transformation as a moderating variable. |

| (Kuhner & Pelger, 2015) | This paper uses an analytical model to explore the relationship between stewardship and valuation usefulness in accounting, questioning whether standard-setting adequately addresses stewardship objectives. |

| (Fernandez et al., 2018) | This research identifies challenges in implementing ERP systems in Malaysian public sector organisations, highlighting issues like bureaucracy and lack of skills as barriers to successful adoption. |

| (Swanson, 2020) | This study reviews the historical development of modern information systems, emphasising their role in facilitating transactions and their transformation into vital social and economic infrastructure. |

| (Ionescu, 2021) | This paper analyses the integration of big data analytics and AI into cloud-based accounting information systems, highlighting their potential for advancing real-time automated accounting services. |

| (Sani & Tiamiyu, 2005) | This study evaluates automated information services in Nigerian universities, identifying barriers such as inadequate funding and infrastructure while recommending strategies to improve automation. |

| (Zhyvko et al., 2022) | This paper addresses the digitalisation of management accounting systems, focusing on cybersecurity risks and measures to safeguard data integrity and system security. |

| (Mosweu & Ngoepe, 2020) | This study explores how digital records in Botswana’s public sector ERP systems are authenticated to support auditing, contributing to the literature on the reliability of digital accounting records. |

| (Vedernikova et al., 2020) | This research compares traditional costing with Time-Driven Activity-Based Costing (TDABC) in assembly industries, highlighting the advantages of TDABC in improving cost accuracy and efficiency. |

| (Panasenko et al., 2021) | This paper discusses strategies for e-commerce enterprises to enhance operational efficiency through digital transformation, including the automation of accounting and analytical systems and the adoption of innovative payment technologies. |

| (Poppe et al., 2023) | This study examines the impact of blockchain technology on sustainable performance in Vietnamese manufacturing businesses, highlighting the mediating role of management accounting systems and the moderating role of digital transformation. |

| (Nguyen et al., 2023) | This paper analyses Green GDP (GGDP) and its implications for sustainable development, focusing on the case of Zhejiang Province, China, and its shift from an industrial to a service-oriented economy. |

| (Qi et al., 2021) | This experimental study explores the use of Very High-Level Languages (VHLLs) for management system development, demonstrating productivity gains in accounting system creation by non-programmers. |

| (Cheng et al., 1984) | This research focuses on the digitalisation of financial reporting through the adoption of Extensible Business Reporting Language (XBRL), examining bibliometric trends and the development of geographical research clusters. |

| (Vysochan et al., 2023) | This study applies cloud computing to accounting management systems in Chinese SMEs, demonstrating its efficiency in improving economic settlements while addressing risks associated with accounting informatisation. |

| (Zhao et al., 2022) | This paper analyses the challenges and trends in digitalising accounting in Ukraine, identifying key technologies and obstacles such as insufficient infrastructure, regulatory gaps, and low levels of investment. |

| (Petchenko et al., 2023) | This paper proposes a blockchain-based framework for transaction reconciliation between multiple parties, aimed at reducing costs and reconciliation time while eliminating redundancies in existing accounting systems. |

| (Gomaa et al., 2023) | This study explores the transformation of enterprise activities through the digitalisation of business processes, discussing how technological innovations enhance competitiveness and alter business management practices. |

| (Lytvyn et al., 2022) | This research discusses the transformation from financial to management accounting under artificial intelligence, proposing a self-management accounting system based on a rule engine for improved efficiency and decision-making. |

| (Liu et al., 2022) | This study investigates the impact of digital accounting systems (DASs) on corporate governance in Yemeni pharmaceutical companies, focusing on system quality, information quality, and IFRS adoption as key drivers. |

| (Al-Hattami et al., 2024) | This research addresses system quality, information quality, perceived usefulness, and ease of use as significant factors influencing SMEs’ continued adoption of digital accounting systems. |

| (Al-Hattami & Almaqtari, 2023) | This study focuses on the interplay of socio-material knowledge templates in shaping accounting practices and suggests modular, decentralised accounting as a potential future. |

| (Berlinski & Morales, 2024) | This paper demonstrates that computerised accounting systems improve decision-making, controls, and performance in Somali SMEs, despite challenges with data reliability. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sampaio, C.; Silva, R. Digital Transformation in Accounting: An Assessment of Automation and AI Integration. Int. J. Financial Stud. 2025, 13, 206. https://doi.org/10.3390/ijfs13040206

Sampaio C, Silva R. Digital Transformation in Accounting: An Assessment of Automation and AI Integration. International Journal of Financial Studies. 2025; 13(4):206. https://doi.org/10.3390/ijfs13040206

Chicago/Turabian StyleSampaio, Carlos, and Rui Silva. 2025. "Digital Transformation in Accounting: An Assessment of Automation and AI Integration" International Journal of Financial Studies 13, no. 4: 206. https://doi.org/10.3390/ijfs13040206

APA StyleSampaio, C., & Silva, R. (2025). Digital Transformation in Accounting: An Assessment of Automation and AI Integration. International Journal of Financial Studies, 13(4), 206. https://doi.org/10.3390/ijfs13040206