The Effect of Financial Mismatch on Corporate ESG Performance: Evidence from Chinese A-Share Companies

Abstract

1. Introduction

2. Theoretical Framework and Research Hypotheses

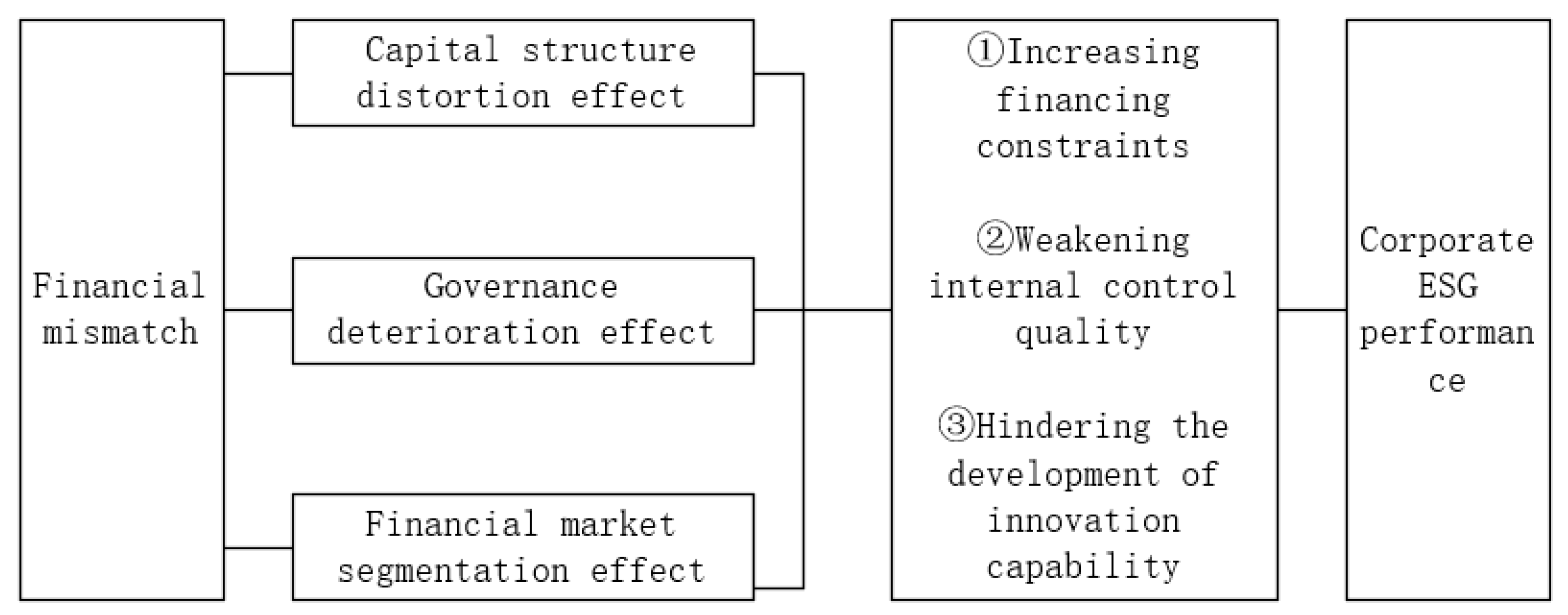

2.1. Mechanism Analysis of the Effect of Financial Mismatch on Corporate ESG Performance

2.2. How Financial Mismatch Affects Corporate ESG Performance

2.2.1. Financing Constraint Mechanism

2.2.2. Internal Control Quality Mechanism

2.2.3. Innovation Capability Mechanism

2.3. Summary

3. Materials and Methods

3.1. Sample Selection and Data Sources

- Exclude firms from the financial and real estate sectors;

- Remove firms designated as ST or *ST;

- Exclude insolvent firms or observations with negative total assets;

- Eliminate samples with missing or abnormal key variables;

- Winsorize all continuous variables at the 1st and 99th percentiles.

3.2. Variable Definitions

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Control Variables

3.3. Model Specification

3.4. Descriptive Statistics

4. Results

4.1. VIF Test

4.2. Baseline Regression

4.3. Robustness Tests

4.3.1. Alternative Measurement of the Dependent Variable

4.3.2. Exclusion of Special Years

4.3.3. Propensity Score Matching (PSM)

4.3.4. Lagged Explanatory Variables

5. Discussion

5.1. Transmission Mechanism Test

5.1.1. Intensification of Financing Constraints

5.1.2. Weakening of Internal Control Quality

5.1.3. Hindrances to Innovation Capability Enhancement

5.2. Heterogeneity Analysis

5.2.1. Heterogeneity Based on Corporate Lifecycle

5.2.2. Heterogeneity Based on Ownership Type

5.2.3. Heterogeneity Analysis Based on Industry Pollution Intensity

6. Conclusions and Recommendations

6.1. Conclusions

- Our findings have several policy implications to enhance corporate ESG performance amid financial mismatches.

- Financial regulators and institutions should strive to alleviate financial mismatches by expanding access to long-term financing and patient capital, ensuring that firms—especially private and innovation-oriented ones—can obtain the necessary funding for sustainable projects.

- Policies that strengthen internal corporate governance and risk-management systems can help firms maintain their ESG commitments, even when faced with financial constraints.

- Targeted support should be provided to vulnerable firm groups (e.g., mature or declining firms and non-SOEs) through tailored financial products or incentives to sustain their ESG-related investments.

- For industries that face relatively lower environmental requirements, incentive mechanisms or voluntary guidelines could be introduced to encourage firms to continue investing in ESG practices despite financial pressures. By addressing the root causes of financial mismatch and tailoring strategies based on firm heterogeneity, policymakers can better promote corporate sustainability and align financial resource allocation with the goals of green development and carbon neutrality.

6.2. Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Bai, Y., Qiu, M., & Li, W. (2016). Maturity mismatch of financing and its institutional explanation: A comparison between Chinese and U.S. financial markets. China Industrial Economics, 7, 23–39. [Google Scholar] [CrossRef]

- Brown, J. R., Martinsson, G., & Petersen, B. C. (2012). Do financing constraints matter for R&D? European Economic Review, 56(8), 1512–1529. [Google Scholar] [CrossRef]

- Cao, Y., Yuan, X., & Zhang, J. (2019). Has financial misallocation risk converged under strong regulation? Evidence from the perspective of internet finance development. On Economic Problems, 10, 39–47, 129. [Google Scholar] [CrossRef]

- Carrión-Flores, C. E., & Innes, R. (2010). Environmental innovation and environmental performance. Journal of Environmental Economics and Management, 59(1), 27–42. [Google Scholar] [CrossRef]

- Chari, V. V., Kehoe, P. J., & McGrattan, E. R. (2007). Business cycle accounting. Econometrica, 75(3), 781–836. [Google Scholar] [CrossRef]

- Chen, Y. S., Lai, S. B., & Wen, C. T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics, 67(04), 331–339. [Google Scholar] [CrossRef]

- Cui, H., Wang, B., & Xu, Y. (2023). Green financial innovation, financial resource allocation, and corporate pollution reduction. China Industrial Economics, 10, 118–136. [Google Scholar] [CrossRef]

- Ding, Y., Wei, Y., & Ma, Y. (2022). How does financial misallocation affect high-quality corporate development? Theory and empirical evidence. Financial Regulation Research, 8, 94–114. [Google Scholar] [CrossRef]

- Fan, X., & Xiao, H. (2014). Theoretical reflections on the nature and concept of corporate internal control. Accounting Research, 2, 4–11, 94. [Google Scholar]

- Gao, J., Zhu, D., Lian, Y., & Zheng, J. (2021). Can ESG performance improve corporate investment efficiency? Securities Market Herald, 11, 24–34, 72. [Google Scholar]

- Guo, M., He, Y., & Niu, J. (2023). Internal control, online media coverage, and corporate ESG performance. Journal of Management, 36(3), 103–119. [Google Scholar] [CrossRef]

- Guo, M., Tang, J., & Lin, W. (2021). Strategic aggressiveness and credit rating: A soft information perspective. Forecasting, 40(3), 55–61. [Google Scholar]

- Han, X., & Li, J. (2020). Credit misallocation, non-financial firms’ shadow banking, and the economy’s divergence from the real sector. Journal of Financial Research, 8, 93–111. [Google Scholar]

- He, L., Zhang, L., Zhong, Z., Wang, D., & Wang, F. (2019). Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. Journal of Cleaner Production, 208, 363–372. [Google Scholar] [CrossRef]

- Hong, H., Li, F. W., & Xu, J. (2019). Climate risks and market efficiency. Journal of Econometrics, 208(1), 265–281. [Google Scholar] [CrossRef]

- Houston, J. F., & Shan, H. (2022). Corporate ESG profiles and banking relationships. The Review of Financial Studies, 35(07), 3373–3417. [Google Scholar] [CrossRef]

- Hu, A. G., & Jefferson, G. H. (2009). A great wall of patents: What is behind China’s recent patent explosion? Journal of Development Economics, 90(1), 57–68. [Google Scholar] [CrossRef]

- Huang, R., & Ritter, J. R. (2009). Testing theories of capital structure and estimating the speed of adjustment. Journal of Finance, 64(06), 2387–2420. [Google Scholar] [CrossRef]

- Jiang, A., Zhang, X., & Fei, K. (2023). Government procurement and corporate ESG performance: Empirical evidence from a-share listed firms. Journal of Central University of Finance and Economics, 7, 15–28. [Google Scholar] [CrossRef]

- Jiang, J., Wang, Z., & Liao, L. (2018). Rural childhood experience and stock market participation. Economic Research Journal, 53(8), 84–99. [Google Scholar]

- Jiang, T. (2022). Mediation and moderation effects in empirical studies of causal inference. China Industrial Economics, 5, 100–120. [Google Scholar] [CrossRef]

- Krueger, P., Sautne, Z., & Starks, L. T. (2020). The importance of climate risks for institutional investors. Review of Financial Studies, 33(03), 1067–1111. [Google Scholar] [CrossRef]

- Lan, F., Hu, X., & Xv, Z. (2024). Can public data openness expand interregional capital flow distance? Evidence from cross-regional mergers and acquisitions. China Industrial Economics, 9, 156–174. [Google Scholar] [CrossRef]

- Li, J., Guan, Y., & Dai, Y. (2023). Financial mismatch and corporate technological innovation: Empirical evidence from Chinese listed firms. Journal of Central University of Finance and Economics, 10, 25–39. [Google Scholar] [CrossRef]

- Li, J., Yang, Z., & Chen, J. (2021). How does ESG improve corporate performance?—A perspective based on corporate innovation. Science of Science and Management of S. & T., 42(9), 71–89. [Google Scholar]

- Li, Q., & Zhang, Y. (2021). Financial openness and resource allocation efficiency: Evidence from the entry of foreign banks into China. China Industrial Economics, 5, 95–113. [Google Scholar] [CrossRef]

- Li, S., & Wen, L. (2025). The impact of patient capital on corporate ESG performance. On Economic Problems, 1, 48–56. [Google Scholar] [CrossRef]

- Li, W., Li, H., & Hao, C. (2013). Executive shareholding reduction, corporate governance, and the growth of GEM companies: Evidence from the growth enterprise market. Management Science, 26(4), 1–12. [Google Scholar]

- Li, Z., Ruan, D., & Zhang, T. (2020). The value creation mechanism of corporate social responsibility: A study based on internal control perspective. Accounting Research, 11, 112–124. [Google Scholar]

- Lin, Y., & Li, Z. (2004). Policy burden, moral hazard, and soft budget constraints. Economic Research Journal, 2, 17–27. [Google Scholar]

- Liu, H., & Li, X. (2012). Pyramid structure, tax burden and firm value: Evidence from local state-owned enterprises. Management World, 8, 91–105. [Google Scholar] [CrossRef]

- Liu, S., Lin, Z., & Leng, Z. (2020). Do tax incentives improve corporate innovation? Evidence based on the firm life cycle theory. Economic Research Journal, 55(6), 105–121. [Google Scholar]

- Liu, X., Gong, C., & Yang, J. (2023). The impact of intelligent manufacturing development on corporate ESG performance. Finance and Accounting Monthly, 44(13), 65–72. [Google Scholar] [CrossRef]

- Lu, F., & Yao, Y. (2004). Rule of law, financial development, and economic growth under financial repression. Social Sciences in China, 1, 42–55, 206. [Google Scholar]

- Lu, X. (2008). Does financial misallocation hinder China’s economic growth? Journal of Financial Research, 4, 55–68. [Google Scholar]

- Ma, Y., Miao, L., & Feng, L. (2025). Research on the implementation effects, multi-objective scheme selection, and element regulation of China’s carbon market. Sustainability, 17(15), 6955. [Google Scholar] [CrossRef]

- Mohammadi, Y., Monavvarifard, F., Salehi, L., Movahedi, R., Karimi, S., & Liobikienė, G. (2023). Explaining the sustainability of universities through the contribution of students’ pro-environmental behavior and the management system. Sustainability, 15(2), 1562. [Google Scholar] [CrossRef]

- Pan, A., Liu, X., Qiu, J., & Shen, Y. (2019). Can green M&A under media pressure promote substantive transformation of heavily polluting firms? China Industrial Economics, 2, 174–192. [Google Scholar] [CrossRef]

- Paroutoglou, E., Fojan, P., Gurevich, L., & Afshari, A. (2022). Thermal properties of novel phase-change materials based on tamanu and coconut oil encapsulated in electrospun fiber matrices. Sustainability, 14(12), 7432. [Google Scholar] [CrossRef]

- Porter, M. E., & van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. Journal of Economic Perspectives, 9(4), 97–118. [Google Scholar] [CrossRef]

- Qi, L., & Guo, F. (2024). The effect of corporate digital transformation on ESG performance. Statistics and Decision, 40(23), 173–177. [Google Scholar] [CrossRef]

- Qian, S., & Dai, X. (2023). Financial misallocation and industrial overcapacity: Empirical evidence from listed companies. East China Economic Management, 37(6), 90–100. [Google Scholar] [CrossRef]

- Qiao, P., & Zhang, Y. (2023). Blockchain, enterprise digital transformation and financing constraints. Investment Research, 42(2), 56–74. [Google Scholar]

- Quan, X., & Yin, H. (2017). China’s short-selling mechanism and corporate innovation: A quasi-natural experiment based on the stepwise expansion of margin trading and securities lending. Management World, 1, 128–144. [Google Scholar] [CrossRef]

- Schuler, D. A., & Cording, M. (2006). A corporate social performance–Corporate financial performance behavioral model for consumers. Academy of Management Review, 31(3), 540–558. [Google Scholar] [CrossRef]

- Shao, T. (2010a). Financial misallocation, ownership and capital return: An empirical study from manufacturing enterprises from 1999–2007. Journal of Financial Research, 9, 47–63. [Google Scholar]

- Shao, T. (2010b). Financial misallocation, ownership structure, and capital return: Evidence from China’s industrial enterprises (1999–2007). Journal of Financial Research, 9, 51–68. [Google Scholar]

- Shen, H., & Zhou, Y. (2017). Environmental law enforcement supervision and corporate environmental performance: Quasi-natural experimental evidence from environmental protection interviews. Nankai Business Review, 20(6), 73–82. [Google Scholar]

- Shen, L., & Chen, Z. (2020). Corporate financial asset allocation and investment-financing maturity mismatch: Mitigation or aggravation? Journal of Financial Regulation Research, 10, 98–114. [Google Scholar] [CrossRef]

- Song, H., & Lu, Y. (2020). How to effectively increase the supply of STEM talents?—Evidence from the top talent training program. Economic Research Journal, 55(2), 52–67. [Google Scholar]

- Song, Z., Storesletten, K., & Zilibotti, F. (2011). Growing like China. American Economic Review, 101(1), 196–233. [Google Scholar] [CrossRef]

- Standing, G. (2017). The corruption of capitalism: Why rentiers thrive and work does not pay. Biteback Publishing. [Google Scholar]

- Sun, J., Wang, B., & Cao, F. (2016). Do corporate strategies influence earnings management? Management World, 3, 160–169. [Google Scholar] [CrossRef]

- Tang, Y., Ma, W., & Xia, L. (2021). Environmental disclosure quality, internal control “level,” and firm value: Evidence from heavily polluting listed companies. Accounting Research, 7, 69–84. [Google Scholar]

- Tao, Y., Hou, W., Liu, Z., & Yang, Z. (2024). How does public environmental concern improve corporate ESG performance? A dual perspective of external pressure and internal attention. Science of Science and Management of S. & T., 45(7), 88–109. [Google Scholar]

- Wang, H. (2023). Does capital market liberalization improve corporate sustainability capacity? Evidence from ESG performance. Research on Financial and Economic Issues, 7, 116–129. [Google Scholar] [CrossRef]

- Wang, J., Liu, X., & Yu, X. (2024). Between banks and enterprises and strategic ESG behavior of borrowers. Journal of Financial Research, 50(4), 109–123. [Google Scholar] [CrossRef]

- Wang, S., Xue, X., & Fan, R. (2022). Does financial resource misallocation inhibit the improvement of ecological efficiency?—From the perspective of industrial structure upgrading. Journal of Xi’an Jiaotong University (Social Sciences), 42(3), 71–82. [Google Scholar] [CrossRef]

- Wei, Y., Mao, Z., & Wang, H. (2023). The impact of state-owned capital participation on ESG performance of private enterprises. Journal of Management, 20(7), 984–993. [Google Scholar]

- Wen, S., & Liu, X. (2019). Financial mismatch, environmental pollution, and sustainable growth. Research on Economics and Management, 40(3), 3–20. [Google Scholar] [CrossRef]

- Whited, T. M., & Wu, G. (2006). Financial constraints risk. The Review of Financial Studies, 19(2), 531–559. [Google Scholar] [CrossRef]

- Zhai, S., Cheng, Y., Xu, H., Tong, L., & Cao, L. (2022). Media attention and the quality of corporate ESG information disclosure. Accounting Research, 8, 59–71. [Google Scholar]

- Zhang, L., & Fan, J. (2022). How does financial misallocation hinder technological innovation? A perspective based on technological gaps. International Business (Journal of University of International Business and Economics), 3, 87–105. [Google Scholar] [CrossRef]

- Zhang, L., & Zhang, C. (2024). Board structural power and ESG performance. Soft Science, 38(4), 102–110. [Google Scholar] [CrossRef]

- Zhang, P., & Ma, H. (2012). Credit constraints and resource misallocation: Empirical evidence from China. Journal of Tsinghua University (Science and Technology), 52(9), 1303–1308. [Google Scholar] [CrossRef]

- Zhang, S., Yao, Z., & LI, H. (2024). Research on the impact of ESG performance on corporate value. Journal of Science and Technology Management, 26(4), 7. [Google Scholar]

- Zhang, Z., & Deng, W. (2022). How local government debt affects corporate ESG: Effects and mechanisms. Modern Economic Research, 6, 10–21. [Google Scholar] [CrossRef]

| Variable Symbol | Variable Definition | Construction Method | |

|---|---|---|---|

| Dependent Variable | ESG | Corporate ESG performance | Huazheng ESG ratings from AAA to C are assigned values from 9 to 1, with higher values indicating better corporate ESG performance |

| Independent Variable | Finmis | Financial mismatch | Financial mismatch = |[interest expense/(liabilities − industry average interest rate)]/industry average interest rate| |

| Mechanism Variable | FC | Financing constraint | Whited and Wu (2006) index (WW index), calculated based on firm-level financial indicators; higher values indicate stronger external financing constraints |

| ICQ | Internal control quality | Internal Control Index from the DIB database; higher values indicate more effective and comprehensive internal control systems | |

| Innov | Innovation capability | Weighted number of patents, with invention patents weighted as 3, utility model patents as 2, and design patents as 1; natural logarithm of (weighted total + 1) | |

| Control Variable | Size | Company size | Natural logarithm of total assets at the end of the year |

| Lev | Leverage ratio | Total liabilities divided by total assets, multiplied by 100% | |

| Cash | Cash holding ratio | (Cash and short-term investments) divided by total assets | |

| Age | Firm age | Ln (current year − year of firm registration + 1) | |

| Growth | Growth rate | ((Current revenue − previous revenue)/previous revenue) × 100% | |

| Roa | Return on assets | Net income for the current year divided by total assets at year-end | |

| Iot | Institutional ownership | Number of shares held by institutional investors divided by total number of shares | |

| Dual | Duality | Dummy variable equal to 1 if the CEO and board chair are the same person and 0 otherwise | |

| Indirect | Proportion of independent directors | Number of independent directors divided by total number of board members | |

| Top1 | Top shareholder ownership | Shareholding ratio of the largest shareholder |

| Variable | Mean | Std. Dev. | Median | Min | Max | Sample Size |

|---|---|---|---|---|---|---|

| Finmis | 0.676 | 0.576 | 0.587 | 0.011 | 3.627 | 41,311 |

| ESG | 4.125 | 0.881 | 4.000 | 2.000 | 6.000 | 41,311 |

| Size | 22.128 | 1.28 | 21.936 | 19.745 | 26.131 | 41,311 |

| Lev | 0.41 | 0.207 | 0.399 | 0.05 | 0.924 | 41,311 |

| Cash | 0.049 | 0.068 | 0.048 | −0.154 | 0.244 | 41,311 |

| Age | 2.91 | 0.345 | 2.944 | 1.792 | 3.555 | 41,311 |

| Growth | 0.153 | 0.372 | 0.098 | −0.533 | 2.238 | 41,311 |

| Roa | 0.042 | 0.067 | 0.041 | −0.231 | 0.23 | 41,311 |

| Iot | 0.434 | 0.249 | 0.447 | 0.004 | 0.915 | 41,311 |

| Dual | 0.298 | 0.457 | 0.000 | 0.000 | 1.000 | 41,311 |

| Indirect | 37.617 | 5.312 | 36.360 | 33.33 | 57.14 | 41,311 |

| Top1 | 33.942 | 14.831 | 31.650 | 8.434 | 74.018 | 41,311 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| ESG | ESG | ESG | |

| Finmis | −0.0725 *** (−7.5617) | −0.0637 *** (−7.0463) | |

| L. Finmis | −0.0512 *** (−5.3487) | ||

| Size | 0.2495 *** (16.7025) | 0.2626 *** (15.8706) | |

| Lev | −0.8728 *** (−16.1315) | −0.8304 *** (−13.9744) | |

| Cash | −0.2355 *** (−3.1671) | −0.1905 ** (−2.3211) | |

| Age | −0.1422 (−1.3402) | −0.0684 (−0.5570) | |

| Growth | −0.0997 *** (−8.8133) | −0.0817 *** (−6.7015) | |

| Roa | 0.4203 *** (4.4577) | 0.2236 ** (2.1979) | |

| Iot | −0.1154 * (−1.9045) | −0.1520 ** (−2.3132) | |

| Dual | −0.0056 (−0.3179) | −0.0011 (−0.0588) | |

| Indirect | 0.0087 *** (5.9441) | 0.0080 *** (5.1269) | |

| Top1 | 0.0027 *** (2.6881) | 0.0018 * (1.7307) | |

| _cons | 4.3806 *** (26.0418) | −0.5943 (−1.3925) | −1.2750 *** |

| (−2.6383) | |||

| N | 41,311 | 41,311 | 35,859 |

| R2 | 0.027 | 0.065 | 0.061 |

| Control | No | Yes | Yes |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| Company | Yes | Yes | Yes |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Alternative Measurement of Dependent Variable | Excl. Stock Crash | Excl. COVID-19 | PSM | |

| Finmis | −0.0361 *** (−7.9617) | −0.0657 *** (−7.0547) | −0.0307 *** (−2.8846) | −0.0639 *** (−6.5062) |

| N | 41,311 | 39,124 | 24,281 | 35,960 |

| R2 | 0.042 | 0.067 | 0.048 | 0.067 |

| Control | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes |

| Company | Yes | Yes | Yes | Yes |

| Variable | (1) | Variable | (2) |

|---|---|---|---|

| ESG | ESG | ||

| Finmis | −0.0637 *** (−7.0463) | Finmis | −0.0590 *** (−5.9965) |

| Size | 0.2495 *** (16.7025) | L. Size | 0.2149 *** (13.3854) |

| Lev | −0.8728 *** (−16.1315) | L. Lev | −0.7233 *** (−12.2686) |

| Cash | −0.2355 *** (−3.1671) | L. Cash | −0.1294 * (−1.6752) |

| Age | −0.1422 (−1.3402) | L. Age | 0.0688 (0.5890) |

| Growth | −0.0997 *** (−8.8133) | L. Growth | 0.0506 *** (4.0593) |

| Roa | 0.4203 *** (4.4577) | L. Roa | 1.3806 *** (13.6740) |

| Iot | −0.1154 * (−1.9045) | L. Iot | −0.0349 (−0.5263) |

| Dual | −0.0056 (−0.3179) | L. Dual | 0.0042 (0.2263) |

| Indirect | 0.0087 *** (5.9441) | L. Indirect | 0.0047 *** (3.1447) |

| Top1 | 0.0027 *** (2.6881) | L. Top1 | 0.0012 (1.1320) |

| _cons | −0.5943 (−1.3925) | _cons | −0.6124 (−1.3195) |

| N | 41,311 | N | 35,859 |

| R2 | 0.065 | R2 | 0.072 |

| Control | Yes | Control | Yes |

| Year | Yes | Year | Yes |

| Industry | Yes | Industry | Yes |

| Company | Yes | Company | Yes |

| Variable | (1) | (2) |

|---|---|---|

| ESG | ESG | |

| Group | WW = 0 | WW = 1 |

| Finmis | −0.0204 (−1.0809) | −0.0874 *** (−6.1170) |

| N | 11,725 | 11,937 |

| R2 | 0.085 | 0.067 |

| Control | Yes | Yes |

| Year | Yes | Yes |

| Industry | Yes | Yes |

| Company | Yes | Yes |

| Chow test p | 0.000 *** | |

| Variable | (1) | (2) |

|---|---|---|

| ESG | ESG | |

| Group | Ic = 0 | Ic = 1 |

| Finmis | −0.1062 *** (−6.9274) | −0.0008 (−0.0439) |

| N | 12,219 | 12,438 |

| R2 | 0.073 | 0.081 |

| Control | Yes | Yes |

| Year | Yes | Yes |

| Industry | Yes | Yes |

| Company | Yes | Yes |

| Chow test p | 0.000 *** | |

| Variable | (1) | (2) |

|---|---|---|

| ESG | ESG | |

| Group | Innovate = 0 | Innovate = 1 |

| Finmis | −0.0819 *** (−5.4967) | −0.0237 (−1.3315) |

| N | 13,388 | 13,766 |

| R2 | 0.080 | 0.073 |

| Control | Yes | Yes |

| Year | Yes | Yes |

| Industry | Yes | Yes |

| Company | Yes | Yes |

| Chow test p | 0.000 *** | |

| Variable | (1) | (2) |

|---|---|---|

| ESG | ESG | |

| Group | Innovate = 0 | Innovate = 1 |

| Finmis | −0.0245 *** (0.0075) | −0.0055 *** (0.0019) |

| N | 13,173 | 17,394 |

| R2 | 0.5426 | 0.5333 |

| Control | Yes | Yes |

| Year | Yes | Yes |

| Industry | Yes | Yes |

| Company | Yes | Yes |

| Chow test p | 0.000 *** | |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Heterogeneity by Lifecycle Stage | Heterogeneity by Ownership Type | ||||

| Growth Stage | Maturity Stage | Decline Stage | Non-SOE | SOE | |

| Variable | ESG | ESG | ESG | ESG | ESG |

| Finmis | −0.0356 *** | −0.0709 *** | −0.0938 *** | −0.0563 *** | −0.0523 *** |

| (−3.2048) | (−2.6613) | (−4.7455) | (−5.0110) | (−3.1743) | |

| N | 28,484 | 4763 | 7819 | 23,166 | 13,163 |

| R2 | 0.065 | 0.085 | 0.064 | 0.069 | 0.047 |

| Control | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes |

| Company | Yes | Yes | Yes | Yes | Yes |

| Chow test p | 0.000 *** | 0.000 *** | |||

| Heavy-Polluting Industry | |

|---|---|

| Variable | ESG |

| Pol × Finmis | 0.0093 *** |

| (2.01) | |

| N | 41,311 |

| R2 | 0.300 |

| Control | Yes |

| Year | Yes |

| Company | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, X.; Heng, W.; Zeng, H.; Xian, C. The Effect of Financial Mismatch on Corporate ESG Performance: Evidence from Chinese A-Share Companies. Int. J. Financial Stud. 2025, 13, 184. https://doi.org/10.3390/ijfs13040184

Li X, Heng W, Zeng H, Xian C. The Effect of Financial Mismatch on Corporate ESG Performance: Evidence from Chinese A-Share Companies. International Journal of Financial Studies. 2025; 13(4):184. https://doi.org/10.3390/ijfs13040184

Chicago/Turabian StyleLi, Xiaoli, Wenxin Heng, Hangyu Zeng, and Chengyi Xian. 2025. "The Effect of Financial Mismatch on Corporate ESG Performance: Evidence from Chinese A-Share Companies" International Journal of Financial Studies 13, no. 4: 184. https://doi.org/10.3390/ijfs13040184

APA StyleLi, X., Heng, W., Zeng, H., & Xian, C. (2025). The Effect of Financial Mismatch on Corporate ESG Performance: Evidence from Chinese A-Share Companies. International Journal of Financial Studies, 13(4), 184. https://doi.org/10.3390/ijfs13040184