Abstract

The global movement towards a cashless society has prompted the payment of tax obligations through digital platforms and sources. In this international race to ensure that transaction payments are not hindered by the lack of physical cash, Nigeria is also making progress. Therefore, the focus of this study is to assess the implications of digital payment systems in enhancing the effectiveness of tax revenue collection in Nigeria. The analysis spans from the first quarter of 2009 to the fourth quarter of 2023, utilizing the Autoregressive Distributed Lag and Error Correction Model. The research uses the most active digital payment systems that have been in operation during the study period. These electronic payment types include digital cheques (CHQs), Automated Teller Machines (ATMs), Point-of-Sales (POSs), Mobile payment (MPY), and Web-based payment (WPY). These are the predictor variables, while the tax revenue collection (TXC) during this period is the dependent variable. The control variables include information and telecommunication technology penetration rate (ICTPR), inflation, and gross domestic product. The outcomes of this study reveal that, over the long term, a percentage change in CHQs, ATMs, MPY, and ICTPR is linked to a decline of 8.1%, 12.5%, 6.7%, and 22.4% in TXC, respectively. In contrast, WPY indicates a 7.2% positive increase in TXC while inflation exerts a positive increase of 46.7%. The Error Correction Model (ECM) suggests that the deviations from the long-term equilibrium in earlier years are being corrected at a rate of 3.9% in the current year. In the short term, it is noted that digital payment systems do not influence TXC. On the other hand, GDP maintains a significant negative influence on TXC, in both the long- and short-term. Given these results, the study recommends the establishment of a robust information and communication technology (ICT) infrastructure to enhance effective tax collection, even from rural areas and the informal sector. It is also important for the government to develop strategies that will bring the informal sector into the tax net.

JEL Classification:

H21; H71; L86

1. Introduction

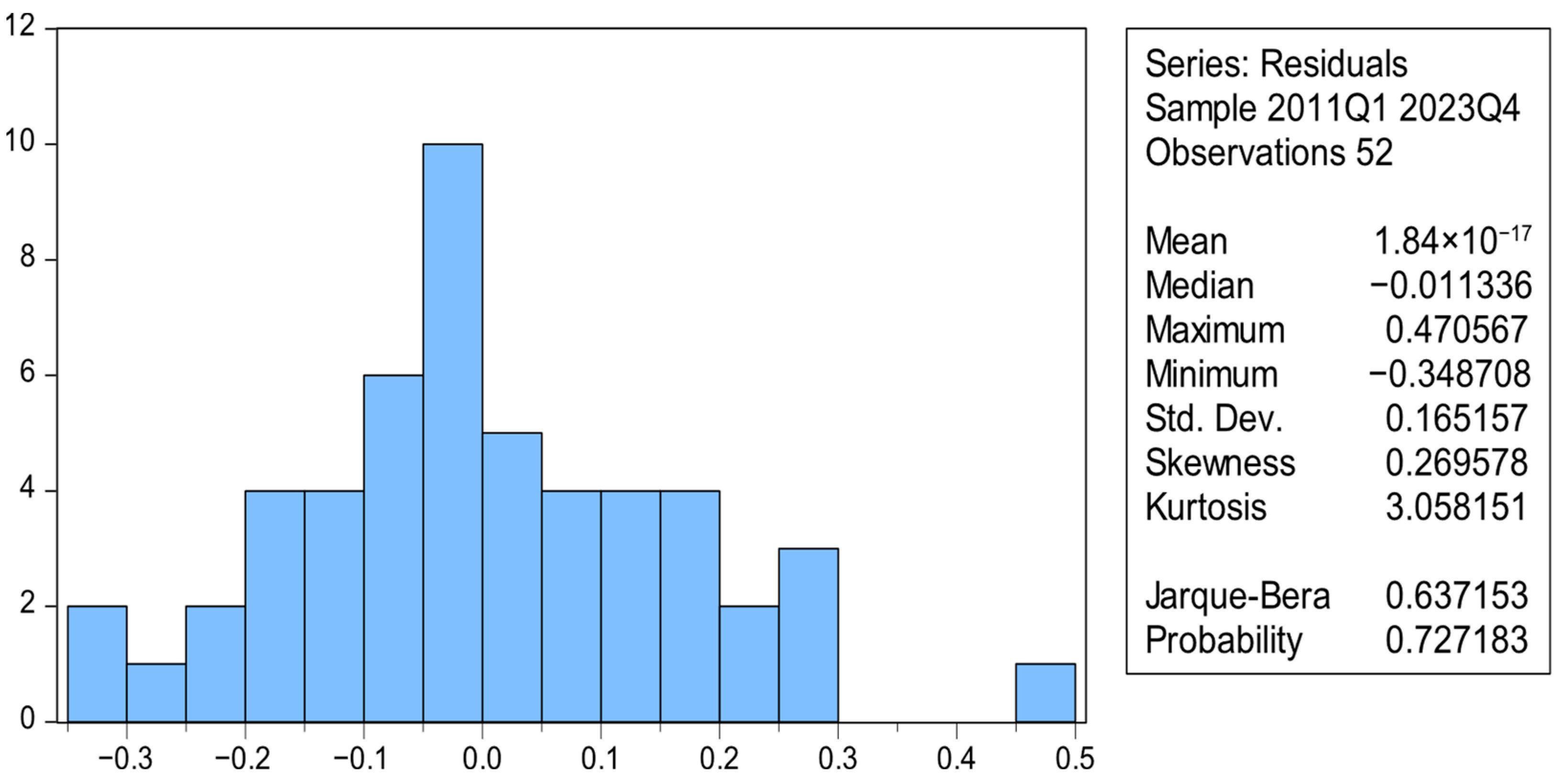

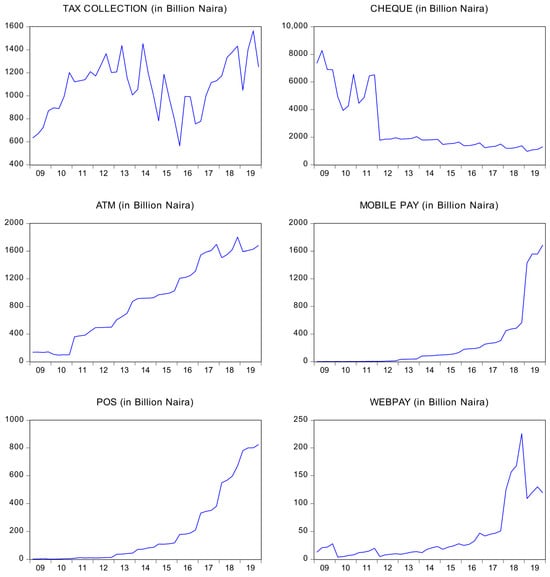

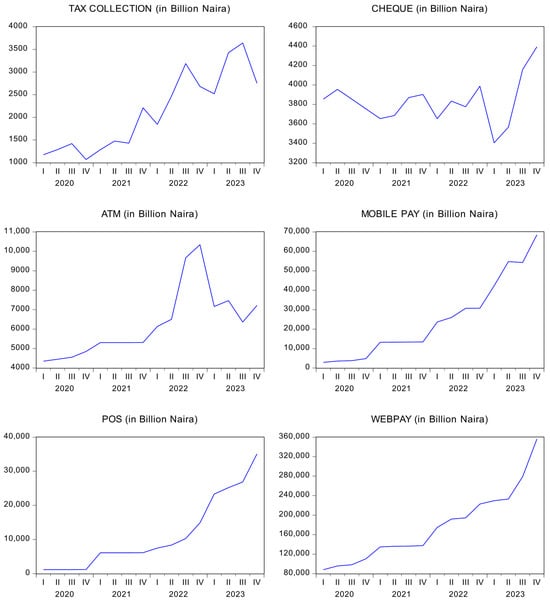

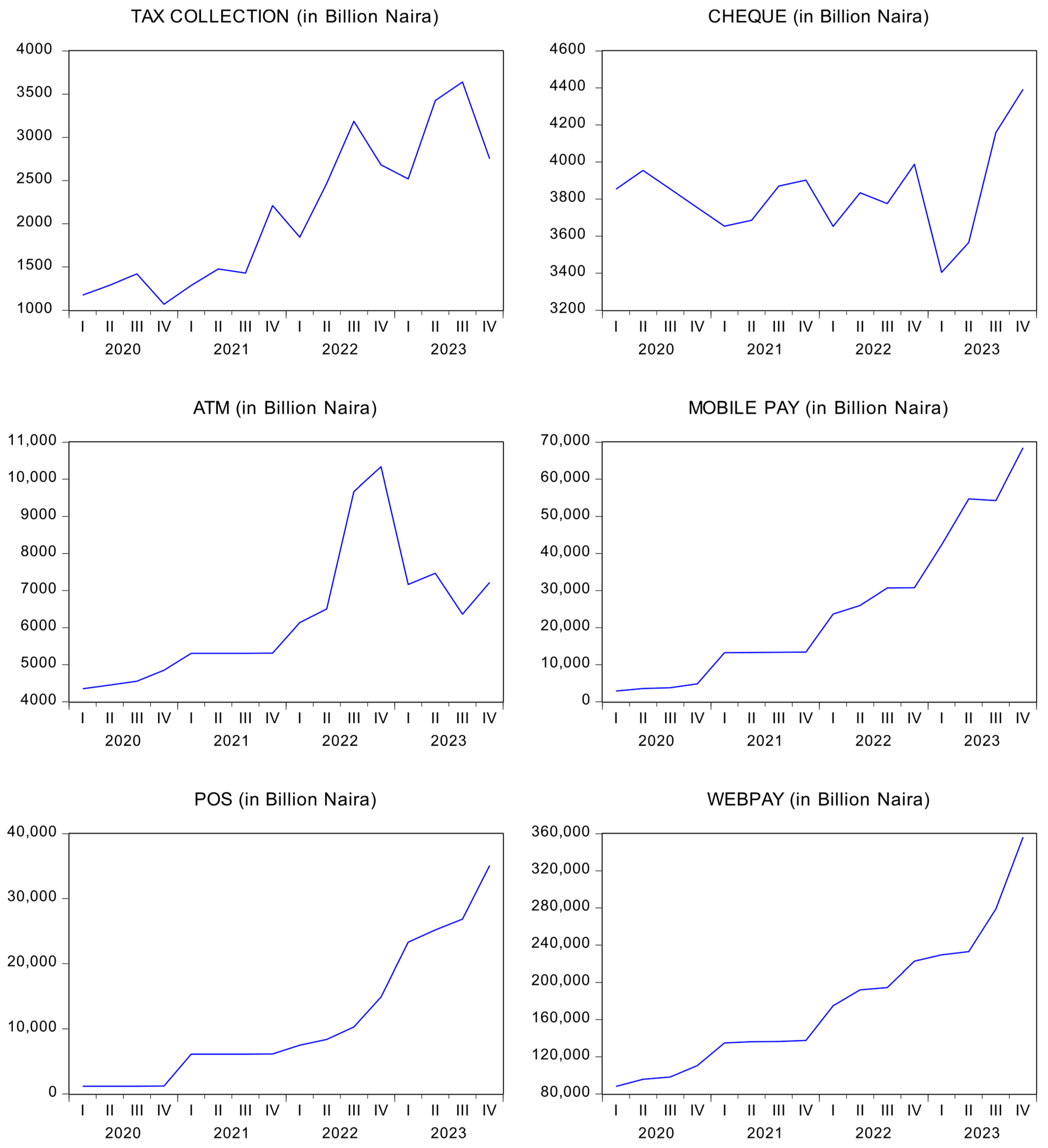

In the past decade, Nigeria has observed a significant shift in digital payment systems, influenced by proactive governmental strategies like the cashless policy. Prior to the COVID-19 pandemic, starting from 2009 precisely, the Central Bank of Nigeria was able to provide the amount of Naira collected by the public through digital cheques, Automated Teller Machines, Point-of-Sales, Web Pay, and mobile pay as 29, 436, 548, 11, 84 and 1, respectively. Appendix A.7 and Appendix A.8 provide in figures and graphs the summary of tax collection and value of digital payments before COVID-19, during and post the COVID-19 pandemic. Looking at Appendix A.7, Figure A4, tax revenue collection is rising and falling but Point-of-Sales (POSs) and mobile pay and Automated Teller Machine (ATM) transactions maintain a steady growth. During and post COVID-19 experiences, as shown in Appendix A.8, Figure A5, reveal that all the digital payments are well embraced by the public except ATM, that showed less usage from first quarter of 2023 to fourth quarter of 2023. Tax collection dropped in the third and last quarter of 2023. This is attributable to the harsh macroeconomic situation prevailing in the country. The COVID-19 pandemic prompted numerous modifications within the Nigerian tax system, with a particular emphasis on the importance of integrating financial technology (fintech), which allows taxpayers to meet their civic duty of tax payment with greater ease. During the pandemic, individuals were unable to visit tax offices as they normally would, yet they still bore the responsibility of remitting their tax obligations to the government. This situation made it clear that an alternative and a more convenient method of collecting taxes from taxable individuals and businesses needed to be implemented. As a result, the filing of tax returns, VAT, and payments of tax liabilities became digitalized in the Nigerian tax system. Consequently, tax offices are no longer crowded with individuals processing tax payments, except for cases that require extensive verification by the tax authorities. The espousal of digital payments has become a fundamental part of today’s economy, fueled by the spread of technology, enlarged internet connectivity, and a heightened demand for appropriate and safe pecuniary facilities (Birigozzi et al., 2025). This is because the availability of formal financial services to individuals and companies can contribute to an increase in tax compliance (Ren et al., 2025).

As stated in the World Payment Report 2020, the rising prevalence of non-cash transactions raises questions about the future viability of cash as a payment method. The report indicates that global non-cash transactions experienced a growth of over 14% in 2019, marking the highest increase in several decades, culminating in more than 708 billion transactions. Furthermore, in 2020, the digital payment segment accounted for a global transaction value of USD 5204 billion, representing the largest category within FinTech, according to the Digital Payment Report 2021. As noted by Cheng et al. (2024), the digital revolution of tax management, which is a vibrant source of government fiscal proceeds, improves the efficiency of tax collection and compliance, diminishes tax evasion, and boosts fiscal revenue, thus offering more stable funding sources for governments across all levels. In its quest to update tax administration in Nigeria, the Federal Inland Revenue Service (FIRS) has launched a Tax Administration Solution (TaxPro-Max). This solution modernizes the registration, filing, and payment of taxes, as well as the automatic crediting of withholding tax and other credits to the Taxpayer’s accounts, among supplementary landscapes. TaxPro-Max also provides Taxpayers with a consolidated view of all transactions conducted with the Service. The application of TAXPRO MAX, stemming from technological developments, allows taxpayers in Nigeria to conduct payments through various electronic channels, such as Point-of-Sale (POS), internet banking, bank transfers, unstructured supplementary service data (USSD), or by using their credit and debit cards from the convenience of their own homes. Risman et al. (2021) state that the integration of digital payment systems, a crucial element of digital finance, has been accelerating rapidly as a result of the significant surge in e-commerce and the rise of fintech.

This shift to cashless businesses is not just a technological swing; it epitomizes a significant economic evolution with far-reaching effects on economic growth and financial inclusion (Birigozzi et al., 2025). As asserted by Ramayanti et al. (2024), digital payment systems simplify business transactions and give users the option to pay for products and services through these payment channels at their chosen time and location. At the same time, banks and financial institutions now reduce customer-related expenses and still ensure their maximum satisfaction as well as expanding access to financial services for the underbanked populace (Birigozzi et al., 2025). The role of digital finance also extends to facilitating urban–rural development and bridging the income divide between those in the urban and rural areas (Xue et al., 2024).

This scenario greatly facilitates the pursuit of financial inclusion goals; however, it has also illuminated concerns among numerous stakeholders, including monetary authorities and scholars (Nelson, 2019; Ozili, 2018a), about its possible negative implications for financial stability. The digital economy introduces obstacles to the collection of value-added tax (VAT), notably in situations where private consumers obtain goods, services, and intangibles from international suppliers (OECD, 2015). However, effective tax collection via digital financing depends on the level of ICT infrastructure quality. A sophisticated ICT infrastructure delivers an effective digital payment system while a poor internet network makes it very difficult for the payment of goods and services. In middle- and low-income countries, the lack of robust ICT infrastructure adversely affects internet access and wanes mobile payment systems, limiting the potential for financial institutions to enhance their service range (Ullah et al., 2025).

The introduction of digital payment systems has been viewed by many researchers as a positive initiative to boosting economic growth (Birigozzi et al., 2025; Kahveci & Gurgur, 2025; Zwingina et al., 2023), enhancing entrepreneurship (Xi & Wang, 2023) and alleviation of financial vulnerability of rural households (Xu & Zhang, 2025). However, numerous researchers have also corroborated the fact that digital payment systems have contributed immensely and positively to effective tax revenue collection (Danchev et al., 2020; Das et al., 2023; Hanza et al., 2025; Hondroyiannis & Papaoikonomou, 2017; Kumar, 2024; Mpofu & Mhlanga, 2022), without being very specific about the type that is more prominent in contributing to government revenue collection to engender more robust financial policies in promoting that type of digital payment. Thus, this present study seeks to examine the effects of different types of digital payment on tax revenue collection in Nigeria. The main justification as to why Nigeria was selected for this research is the significant fall in revenue that the country experienced during the COVID-19 crisis, due to lockdowns and inadequate ICT infrastructure that could support the process of paying taxes to the respective government online.

Additionally, the informal sector is strong in Nigeria, accounting to about 65 percent of GDP. This research adds to the current body of knowledge on the utility of financial inclusion and addresses the remaining gap, as not every single digital payment system has yet been properly assessed to provide the overall and comprehensive picture of its impact on successful taxes collection in the emerging economy.

The subsequent sections of the paper are arranged as follows. Section 2 introduces the literature review, which consists of conceptual definitions, the theoretical framework of the study, and an analysis of prior empirical studies. Section 3 elaborates on the methods and materials utilized in the research. Section 4 presents the findings from data scrutiny, discusses the results, and includes the diagnostic tests. Ultimately, Section 5 concludes with the findings and policy recommendations.

2. Literature Review

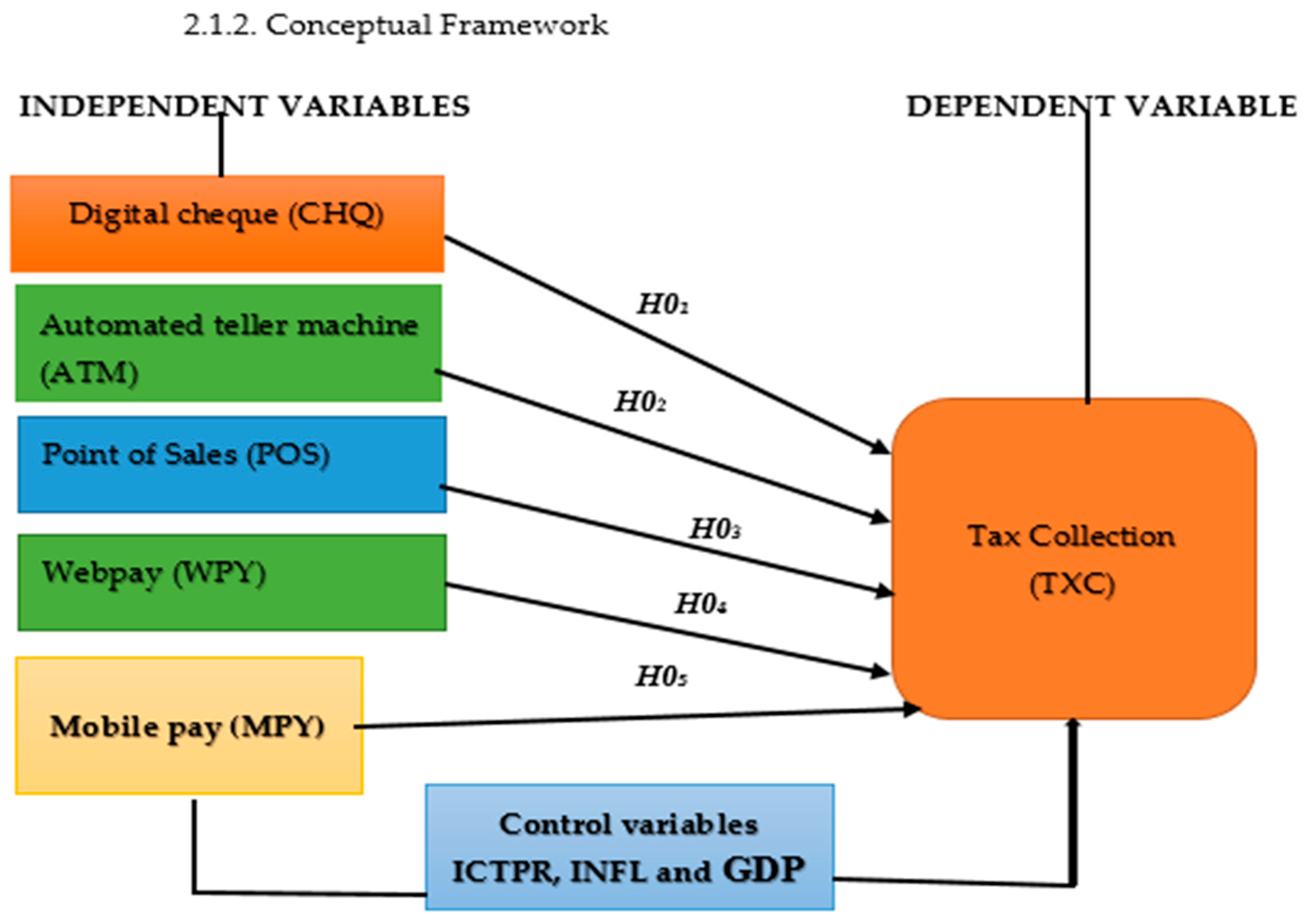

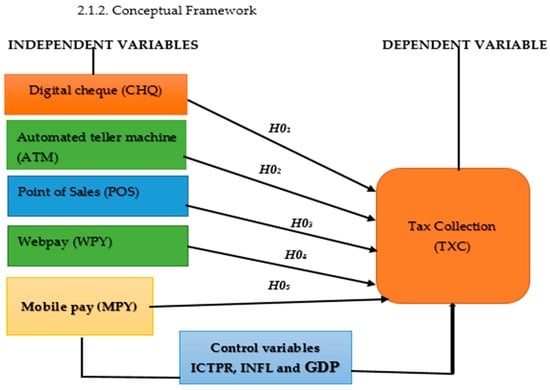

The focus of this study is to analyze the contribution of digital payment devices to effective tax collection in Nigeria. Khando et al. (2023) identify various categories of emerging digital payment technologies in the entire global space with their specific locations. For the purpose of this study, we focus on the ones available in Nigeria with established datasets for a period covering 2009Q1–2023Q4, as provided by the Central Bank of Nigeria (CBN) Statistical Bulletin. The digital payments recognized in this study is shown in Figure 1.

Figure 1.

Conceptual framework model.

The digital payment system statistics provided by CBN from 2009 to 2023 include digital cheques, ATM, POS, Web Pay, Mobile Pay. From 2012 to 2023, we have NEFT and NIP while from 2017 to 2023, the electronic payment systems include m-cash, e-bills pay, Remita, NAPS, and central pay.

2.1. Conceptual Definition and Framework Used in This Study

Financial inclusion pertains to the degree to which individuals and enterprises can access and utilize formal financial services, such as savings accounts, credit options, and digital payment platforms (Ocharive & Iworiso, 2024; Ren et al., 2025). As noted by Chen et al. (2024), inclusive finance decreases the percentage of regions that are financially left out, and promotes fiscal decentralization, which in turn results in a rise in government fiscal revenue and an increase in fiscal expenditures. From the viewpoint of practitioners, digital finance is defined as financial services that are delivered through mobile phones, personal computers, the internet, or cards linked to a reliable digital payment system (Ozili, 2018b). According to Gomber et al. (2017), digital finance includes a variety of new financial products, financial enterprises, finance-related software, and novel methods of customer communication and interaction, provided by FinTech companies and innovative financial service providers.

Johri et al. (2024) argue that the implementation of digital financial services leads to improved convenience, affordability, and accessibility to financial services, notably for low-income individuals and small and micro enterprises. Thus, digital payment mechanisms are electronic payment devices, available to people and entities, to conveniently make payments through mobile phones, internet devices, and computers without physical visits to banks or financial organizations. Tax revenue signifies the income that a government accrues through different types of taxation, which encompasses income tax, Value-Added Tax (VAT), corporate tax, among others. Enhanced financial inclusion may result in a greater proportion of economic activities being carried out within the official economy (Ren et al., 2025).

The conceptual framework model depicts the variables and assumptions used in this work. H01–H05 in Figure 1, represent the assumptions that the variables mentioned in the boxes affect tax collection either positively or negatively. They are the prior expectations before estimation and remain invariable, serving as the focus of this study for the purpose clarity and validation. In Nigeria, a Digital Cheque, often referred to as an e-cheque or electronic cheque, represents a digitally formatted alternative to the conventional paper cheque. It enables the electronic transfer of funds between bank accounts, replicating the functions of a physical cheque while eliminating the necessity for a tangible document. Basically, it serves as a secure and convenient method for making payments online or via other automated systems. Automated Teller Machine, abbreviated as ATM, is an electronic banking terminal that facilitates basic banking transactions for customers, such as withdrawing cash, depositing funds, and transferring money, without the need to visit a bank branch or interact with a bank teller. In Nigeria and several other countries, ATMs are widely used for easy access to cash and other banking services. POS, an acronym for Point-of-Sale, typically refers to the portable electronic devices (terminals) that merchants utilize to process payments made through debit cards. These devices are fundamental to agency banking, often called POS or mPOS services, where they support cash withdrawals, transfers, and bill payments.

WebPAY, known as Interswitch WebPAY, is a payment gateway that is integrated into websites to facilitate online transactions. It allows businesses to accept payments from customers through various card types (Visa, Mastercard, Verve, etc.). WebPAY securely transmits transaction details to the cardholder’s bank for authorization and guarantees that the merchant receives the funds. It is a widely chosen option for online businesses in Nigeria because of its security features and ease of integration. Mobile payment is described as an online form of making payment; it uses smartphones or other mobile devices to pay money on goods or services, thereby providing a quick and appropriate method of payment. Mobile pay also serves as an avenue on the digital market in Nigeria because of the low rates of bank penetration; high rates of mobile acceptance have led to a remarkable adoption of mobile money. The access is given to the user with a mobile phone via a digital account held by the mobile network operator.

NEFT is the acronym of the NIBSS Electronic Funds Transfer, a platform that the Nigeria Interbank Settlement System (NIBSS) has developed so that banks are able to carry out electronic money transfer. This is part of the electronic payment journey in Nigeria, and it has catered to various types of transaction, more recently bulk payments and other electronic fund transfers. NIP is also an acronym used to refer to NIBSS Instant Payment that offers real-time interbank funds transfer service. Through this service, money can be transferred in real time between different banks in Nigeria. It is enabled by the NIBSS and is a necessity with numerous electronic payment transactions in the nation.

m-Cash is a mobile payment system which allows users to conduct financial transactions in terms of goods and services using their mobile devices, a practice that is very common and does not allow the user to use internet connection or data connection frequently. It utilizes the Unstructured Supplementary Service Data (USSD) technology to conduct financial transactions between consumers and merchants, thereby opening it to a wide range of mobile users. m-Cash is normally utilized for low-value payments and is often provided by banks and financial organizations. The electronic bill payment platform, known as e-Bills Pay, is operated by NIBSS to simplify the payment of diverse bills, fees, levies, premiums, and subscriptions for individuals and businesses through various methods, including internet banking, bank branches, and USSD. Remita is a widely known electronic payment platform in Nigeria that enables smooth financial transactions for people, businesses, and governmental bodies. Remita was created by System Specs and has gained extensive acceptance across different sectors of the economy. Apart from becoming the default payment gateway for the Federal Government of Nigeria in the implementation of Treasury Single Account (TSA), it also represents an innovative approach to managing electronic payments, collections, employee payrolls, and schedules, integrating all commercial banks. It empowers individuals and organizations to execute complex and multifaceted financial operations while remaining user-friendly and straightforward.

NIBSS Automated Payment System (NAPS) is an automated payment system developed by NIBSS and specifically designed for the swift processing of bulk payments, including payroll, pensions, and direct debit transactions. NAPS is integral to NIBSS’s strategy to enhance digital payment solutions in Nigeria, which is frequently termed the National Payment Stack (NPS). Central Pay is commonly associated with the payment systems and processes formulated by NIBSS, enabling online payment capabilities for businesses. It allows companies to receive online payments from customers through a variety of methods, such as debit cards, internet banking, and USSD. In essence, it serves as the online equivalent of a Point-of-Sale (POS) terminal for e-commerce enterprises.

2.2. Notional Underpinnings

From a theoretical perspective, several researchers (Carrillo et al., 2017) have accepted the concept that digital payment systems boost tax revenues through the promotion of financial inclusion, economic activities, and the strengthening of tax enforcement and compliance. As stated by Kahveci and Gurgur (2025), the implementation of digital payment systems aids in economic growth by increasing transparency, curtailing the informal sector and corruption, and ensuring more effective tax compliance and revenue collection. Kumar (2024) maintains that financial inclusion is instrumental in augmenting taxable economic activities, which not only generates wealth but also boosts consumption and investment activities within the economy, thereby increasing both taxable activities and tax revenues. In addition, financial inclusion formalizes economic activities and reduces the prevalence of the shadow economy. Moyo (2022) and Mpofu (2021) contend that the tax revenue generated from the shadow economic sector is quite minimal, and a significant number of potential taxpayers within the informal economy are not being taxed. Munjeyi and Fourie (2024) believe that the digitalization of payment systems can help in the collection of tax revenue from the informal sector. The combination of financial inclusion, digitalization, and formalization aids in tax monitoring and collection, resulting in a rise in tax revenue (Kumar, 2024). Moreover, the processing of digital transactions is conducted by financial institutions, which are obligated to relay this information to tax authorities. Tax authorities use this data to verify the consistency between reported sales and the actual sales of firms.

According to Madzharova (2014), the realization that third parties document these transactions helps to prevent tax evasion. In Nigeria, the issue of tax evasion is widespread, largely due to the substantial number of informal enterprises in operation. At the same time, the utilization of digital payment systems empowers tax authorities, through banking channels, to collect taxes, particularly Value-Added Tax (VAT), with minimal difficulty (He, 2024). This suggests that, in spite of informal economic activities, tax evasion is diminishing, as the government’s VAT collection, with the assistance of banks, remains remarkably effective via Point-of-Sale (POS) devices, mobile transactions, and web-based transfers. The wider acceptance of digitalization promotes financial inclusion, particularly integrating the marginalized groups of society into the formal workings of the economy (Klapper & Singer, 2014).

2.3. Assessment of Past Works

2.3.1. Digital Payment Systems and Economic Growth

Since the emergence of digital payment systems, several economies globally have benefitted immensely from the innovation. In Sharjah, the UAE, Al-Own et al. (2023) examined the influence of digital payment systems and blockchain technology on economic growth. The results indicated a beneficial effect of digital payments on economic growth. Zwingina et al. (2023) examined the effects of electronic payment systems on Nigeria’s economic growth from 2009 to 2018. The findings indicated that electronic payment systems positively influenced economic growth in Nigeria. In China, Xi and Wang (2023) scrutinized the influence of digital financial addition on the quality of economic growth across various provinces in China. The results showed that digital financial inclusion had a definite impact on the quality of economic growth, particularly in the eastern region, and all the regions with a high degree of marketization. Moreover, it boosted entrepreneurial life and bettered the level of economic gentrification in nearby places. Birigozzi et al. (2025) examined the relationship between the provision of digital payments and the development of GDP based on the panel data of 49 states. The findings revealed an improvement in GDP growth with each percentage increase in the use of digital payments which stood at 6–8 percent of current GDP growth rate. The research also found that digital payments reduced payments costs, expanded financial access, and reshaped financial behaviors. Xu and Zhang (2025) investigated the impacts of digital payments on the financial vulnerability of rural Chinese households. The results of the study proved that the availability of digital payments has significantly reduced the financial exposure of such households. Also, the findings stressed that ensuring the acquisition of commercial insurance, engaging in non-farm activity, and growing family social networks were essential channels through which digital payment had a significant impact on the financial vulnerability of rural households. Emphasizing the expansion of household purchasing due to the involvement of digital payment methods, Kahveci and Gurgur (2025) studied how digital payments influenced the sustainable economic growth of Turkey. The findings showed that there was a positive long-term relationship existing between GDP and digital payment. It also turned out that the use of digital payments was associated with higher consumption and financial activity.

2.3.2. Computerized System of Payments and Tax Collection

The study by Hondroyiannis and Papaoikonomou (2017) found out that raising the price of payment card transactions actually increased tax compliance in Greece, as well as making more Value-Added Tax (VAT) revenue. According to another study, there was a positive relationship between electronic transaction growth and amenability in paying tax in Greece (Danchev et al., 2020).

In Mukuwa and Phiri (2020), the authors have examined how e-Services have affected the tax revenue collection and compliance among SMEs in Developing Countries, specifically in Zambia. In their descriptive analysis, they highlighted that there was significant growth in the amount of revenue collected and taxes met by the SMEs after implementing these e-Services. Through the involvement of multiple regression analysis to address the response of 180 respondents, including employees of the Rwanda Revenue Authority (RRA), and the MTNR Mobile Money (MoMo) Pay station, Remige (2020) examined the role of a cashless economy in uplifting tax collection in Rwanda. The outcomes ascertained that resourceful tax collection is positively underwritten by the cashless economy.

Mpofu and Mhlanga (2022) have presented the analysis of digital financial inclusion and tax services in Africa in the period of the fourth industrial revolution, using secondary data based on literature reviews and reviews of documents. The results of the investigation indicated that digital financial inclusion is a major drive in tax service and collection in the African continent. Even in a more recent study on Africa, Ren et al. (2025) criticized the significant role of financial inclusion and mobile money on increasing taxes in Africa. The experimental results also identified a strong positive linkage between financial inclusion and tax revenue making it clear that increased access to financial services could be a reason for enhancement in tax income earned by the government. However, the research also found that mobile money had a decreasing impact on tax revenue. Such a finding indicates that the digital payment system within Africa is not advanced enough; this is mostly because of poor ICT infrastructure. In Nigeria, Nwankwo et al. (2022) discussed the role of automated imbursement systems in the collection of taxes revenue. Computerized banker apparatus payments, movable backing payments, and web-transferred payment had both encouraging and significant effects on tax revenue, as indicated by the results of the investigative assessments. Point-of-Sale payments, however, were found to have a positive and non-significant effect on the generation of tax revenue in Nigeria during the period under review. In terms of online-based gathering of individual profits tax (PIT), Ali et al. (2023) evaluated the relationship between e-payment programs and the gathering of tax revenue on personal profits with respect to Nigeria. The results revealed that the electronic payment system was momentous and optimistic in the gathering of PIT in Nigeria.

The research commissioned by Das et al. (2023) aimed to identify whether or not the transition to a cashless economy has filled India with tax. The findings revealed that cashless transactions staged a high increase in the use of automated modes of payment; thus, the capacity of the tax authorities was improved to track the tax duties and exert compliance. To support the positive effect of cashless policies in India, Kumar (2024) evaluated the impact of digital payments on the income of the Goods and Services Tax (GST) in India. The results showed that GST malleability towards digital businesses is around 0.54. This implies that the rise in GST revenue was INR 62 billion in a one-standard-deviation rise in the value of digital dealings, compared to an INR 8 to 12 billion increase in the GST revenue with a one-standard-deviation rise in the Manufacturing indices. These findings mean that one of the strategies that would result in an improved tax collection in India would be the expansion of digital business.

Using the Chinese Local Government debt as a case study, Cheng et al. (2024) tested the relationship that exists between digital tax administration and the local government debt levels. The results of their studies were that the administration of taxes through digital management reduced liability of administration locally. In addition, the heterogeneity decomposition indicated that this effect was greater in the eastern districts as well as in regions with advanced levels of information and communication technology infrastructure.

Tran Thi et al. (2024) examined the relationship between economic development and tax and digital finance in relation to financial development. It was found in the study that low and high levels of financial development were associated with tax revenue and economic growth, and levels of the digital financial inclusion of countries. Digital monetary enclosure also helped such countries and contributed to an increase in tax returns despite the fact that it undermined economic growth in underdeveloped financial systems of nations. Hanza et al. (2025) examined the possible means through which the electronic payment systems affected tax amenability. When electronic payment systems were being studied, the paper found out that there exists a positive correlation with tax acquiescence especially when it came to the evaluation of effectual tax regulations and the implementation of the same in the digital times. Eton et al. (2025) analyzed the digital financing paraphernalia on monetary enclosure in Uganda. According to their study, they found that digital financing made a significant impact on financial inclusion, whereby the levels of financial inclusion were found to be significant due to mobile money and Internet banking.

3. Study Resources and Approaches

The main goal of this research is to assess the role of electronic payment systems in upgrading tax collection effectiveness in Nigeria. This study utilizes various digital payment systems, including digital cheques, automated teller machines, Point-of-Sale payment systems, mobile money, and web-based payment systems as predictor variables, while the total tax revenue collected serves as the response variable. The control variables include Nigeria’s information and communication technology (ICT) penetration rate, inflation, and gross domestic product (GDP). The outcomes of the Augmented Dickey–Fuller (ADF) unit root assessment, as prescribed by Dickey and Fuller (1979), settle that all datasets are fixed at the initial modification, except the ICT penetration rate which is stationary at level. The quarterly data cover 2009Q1 to 2023Q4. Consequently, the study carried out a bound test to check the existence of a long-run relationship, as recommended by Pesaran et al. (2001). The result of this test affirms a long-run association within the series used for evaluation.

Accordingly, this research employs ARDL for its analysis, and the appropriateness of this method for the study is supported by the work of Kumar (2024). According to Pesaran et al. (2001), ARDL is employed to suitably analyze the series that are stable at I(1) and I(0), especially if there is a long-run relationship. This model makes a distinction between the short-run and long-run effects of digital payment systems on tax revenue collection. It is significantly more adaptable than traditional methodologies. For example, conventional co-integration methods require that all variables under examination have the same order of integration, while ARDL allows for variables to be integrated at order zero or one, i.e., I(0) or I(1), or even marginally cohesive. Moreover, the ARDL approach is suitable for small sample sizes and provides reliable estimates. The ARDL also tackles issues concerning the endogeneity of estimates and offers greater flexibility in the selection of lags for both dependent and independent variables. In our context, the ARDL approach is well-suited as not all variables are integrated in the same order.

To analyze the relationship between the digital payment system and tax revenue collection, the model is specified as follows:

To perform econometric scrutiny, as well as include macroeconomic control variables, such as internet penetration, inflation, and GDP, Equation (1) above is developed in Equation (2) as follows:

where ‘ε’ represents the error term, ‘t’ denotes the quarterly data from 2009 to 2023 employed in this study and β stands for the coefficients. The details of the variables are provided in Table 1.

The ARDL model can be represented as follows, using the baseline model indicated in Equation (3) as a preliminary basis:

On this basis:

Δ = represents the difference parameter;

p lag = used for lag of dependent variable;

q lag = represents lags for the exogenous variables;

ln = stipulates the normal logarithm translation;

is used to characterize the time lag lengths;

denotes the drift;

= are coefficients to be assessed;

= are the alternative coefficients to be estimated;

= denotes the error term.

Following Equation (3), the assumption that there is no long-run connection is expressed below:

; (there is no long-term connection)

(null hypothesis is not true)

The long-run model is specified in Equation (4) below:

Equation (5) demonstrates the estimation of the unrestricted ARDL of the error correction model, which is utilized to forecast the short-run parameters of the model when long-run equilibrium is established:

where

represents the number of predictors included in the equation.

= the rate of adjustment to equilibrium.

= is the error correction term, representing the lagged value of the residuals generated from the co-integrating regression of the reliant element and the lapse features. An Error Correction Model (ECM) plays a key role in examining the relationships between time series data, particularly when the variables are co-integrated and display both short-term and long-term dynamics. It aids in comprehending how speedily variables revert to their long-run equilibrium following a shock or disturbance. The ECM outlines the mechanism through which eccentricities from this long-run equilibrium are rectified over time, considering both short-run and long-run forces at work. Established intuitions are formed from co-integrating interactions over an extended period. In conclusion, denotes the residuals, generally known as stochastic error terms, instincts, inventions, or surprises. Table 1 displays the data report as follows:

Table 1.

Data report.

Table 1.

Data report.

| Variable Encryptions | Details | Source |

|---|---|---|

| Dependent Variable: | ||

| TXC | This is the aggregate of tax revenue collection within the study period. The statistics are composed in billions of Naira from 2009Q1 to 2023Q4. | Nigeria Revenue Service |

| Independent Variables: | ||

| CHQ | This is a digital payment system using electronic cheques. The data collection is in billions of Naira. | CBN |

| ATM | The data collection of payments through ATM is in billions of Naira from 2009Q1 to 2023Q4. | CBN |

| POS | POS payments are gathered in billions of Naira within the study period. | CBN |

| MPY | Data for MPY is from 2009Q1 to 2023Q4 are in billions of Naira. | CBN |

| WPY | WPY are collected in billions of Naira within the study period. | CBN |

| Control Variables: | ||

| ICTPR | This is the number of internet subscribers/estimated national population X 100%. The data is from 2009Q-2023Q4. | Nigerian Communications Commission (NCC) |

| INFL | The figures represent the year-on-year percentage change in prices of goods and services. Data covers a period from 2009Q1 to 2023Q4 | National Bureau of Statistics (NBS) |

| GDP | The Gross Domestic Product at basic prices from first quarter 2009 to the fourth quarter of 2023 expressed in billions of Nigerian Naira. | National Bureau of Statistics (NBS) |

Source: Authors’ data description, 2025. Note that all data were collected from 2009Q1 to 2023Q4 and are transformed into natural logarithms. Also, control variables are necessary to account for the interference of macroeconomic factors on the robustness of the model.

4. Results and Interpretation

The main aim of this section is to the display results obtained from the analysis of datasets gathered to assess the contribution of digital payment systems for effective tax collection in Nigeria.

4.1. Summary Statistics and Correlation Analysis

The central tendencies, as represented by the mean and median in Table 2, reveal that the mean values for TXC, CHQ, ATM, MPY, POS, WPY, ICTPR, INFL, and GDP are 7.126, 7.838, 7.074, 5.419, 5.270, 5.543, 2.988, 2.583, and 9.655, respectively. In contrast, the median values for TXC, CHQ, ATM, MPY, POS, WPY, ICTPR, INFL, and GDP are 7.074, 7.565, 7.117, 5.234, 5.220, 3.414, 3.157, 2.565, and 9.689, respectively. The standard deviations are noted as 0.400, 0.602, 1.285, 3.241, 2.788, 4.029, 0.599, 0.312, and 0.532 for TXC, CHQ, ATM, MPY, POS, WPY, ICTPR, INFL, and GDP, respectively. The standard deviation reflects the degree of variability or spread within the datasets, emphasizing the level of deviation from the mean areas. In reviewing these values, it is apparent that they are markedly lower than the mean, suggesting a narrower spread. This implies that the data points are predominantly centered around the mean, which signifies the average values. All skewness values remain below 1 and are closely aligned with 0, which indicates a normal distribution. The kurtosis values for all variables lie between 2 and 3, which reinforces the normality of our dataset’s distribution. Moreover, the Jarque–Bera p-value for each variable is above the 0.05 threshold, thereby confirming the normality of these observations.

Table 2.

Statistics summary.

The study went further to test for the correlation among the variables as well as the variance inflation factor (VIF) used to test for multi-collinearity in Table 3. The findings show a moderate relationship among the variables, with VIF below value of 10 for almost all factors, implying the absence of multi-collinearity.

Table 3.

Correlation analysis and multi-collinearity test.

Following the validation of normal distribution in the datasets provided in Table 2, the research further examined the stationarity of the series to determine the appropriate analytical approach. The unit root test, using the Augmented Dickey–Fuller, indicates that at a 5% critical value, LNCTPR is stable at level or order I(0) while others achieved stationarity at the first difference. This result is noted in Table 4.

Table 4.

Unit root result.

4.2. Unit Root Examination

To this end, the identification of VAR lag selection has proven to be essential for applying the correct lag in the assessment of long-term cointegration. The findings of the VAR lag order choice are summarized in Table 5. However, among the various criteria, our primary focus remains on the lag dimension being selected by the AIC. The reason is that AIC has been applied in the unit root test and has been selected in the lag selection for the purpose of consistency. Furthermore, AIC expedites a harmonious connection between model intricacy and its prognostic strength, effectively curtailing the risk of miscalculating the lag length and contributing to the mitigation of overfitting.

Table 5.

Optimal lag selection.

4.3. VAR Lag Order Selection Criteria

The determination of the optimal lag length for the study variables is essential before the application of the ARDL model. An incorrect choice of lag length may yield inconsistent relationships and could lead to flawed policy proposals. According to the literature, the Akaike Information Criterion (AIC) and the Schwarz Criterion (SC) are the most frequently employed criteria for establishing the appropriate lag length. We utilize AIC to ascertain the lag length of the variables, and the results are displayed in Table 5, which validates that lag 5 is fit for our sample size and is thus regarded as the ideal lag.

4.4. Bounds Cointegration Test

Table 6 indicates that the calculated F-statistic value (4.62) exceeds the upper critical values at the significance levels of 10%, 5%, 2.5%, and 1%. However, the primary critical value utilized for this study is 5%. Consequently, the findings imply that the variables are interrelated in the long term and are in a state of equilibrium. This allows for the estimation of both short- and long-term coefficients of the model.

Table 6.

ARDL bounds test.

4.5. ARDL Long-Run Estimation Result

In Table 7, the long-term results are displayed to indicate how tax revenue collection reacts to each percentage change in the digital payment systems.

Table 7.

ARDL long-run estimation result. Dependent variable: LNTXC.

From the long-run estimates displayed in Table 7, there is a long-term negative and statistically insignificant association between CHQ, ATM, MPY, ICTPR, and TXC. This suggests tax revenue collection through digital cheque, Automated Teller Machine, and mobile pay is not very considerable in the long run. Also, there is evidence that ICT penetration in Nigeria is not yet substantial to boost tax revenue collection in the long run. This finding supports the assertion by Ullah et al. (2025) that ICT infrastructure in emerging economies is still very low to support internet access and digital payment systems. Based on this, tax revenue collection through mobile pay is negatively insignificant in the long term because internet coverage is not in all locations. ATM is also not located in most geographical areas in Nigeria, and most people rarely use digital cheques to make payments.

Notably, GDP has a significant negative impact on tax revenue collection. This supports the fact that 65% of Nigeria’s GDP is derived from the underground economy. Based on this, those in the informal sector do not file business returns with the tax authority and as a result, they evade tax with impunity. It is only through digital payment systems that the government is able to collect some taxes emanating from sales through banks. Also, in the long run, WPY and POS have a significant impact on tax revenue collection at 5% and 1%, respectively. These outcomes confirm the findings of many researchers (Danchev et al., 2020; Das et al., 2023; Hanza et al., 2025; Hondroyiannis & Papaoikonomou, 2017; Kumar, 2024; Mpofu & Mhlanga, 2022) who confirmed that digital payments such as WPY and POS have improved tax revenue collection significantly. The implication is that Nigerians have easy access to the Web and can effectively use it to process tax file and settle tax liability. This is also because the tax authorities have websites to facilitate the online filing of tax returns and easy payment of tax liabilities by both individuals and firms. WebPay allows payments through various card types and securely carries out trusted transactions that enables the cardholder to authorize payments and also guarantee receipt of funds by the intended receiver. POS is commonly used by Nigerians and its functionality in terms of cash withdrawals, transfer of funds, and payment of bills have been effective and trusted by the majority of users. The robustness check using lag 4 in Appendix A.1 confirms these results.

4.6. ARDL Short-Run Estimation Result

The short-run results provided in Table 8, show that CHQ has a positive insignificant influence on tax revenue collection, since the t-statistic is 1.196 and the p-value is 0.239 far above 0.05 level of significance.

Table 8.

ARDL short-run estimation and error correction model. Dependent variable: D(LNTXC).

Similarly, POS and INFL are also positively insignificant in expressing the changes in TXC. On the contrary, other parameters used in this study exhibit a negative insignificant relationship with TXC, while GDP had a negative significant impact on TXC. These outcomes oppose the findings of so many researchers (Danchev et al., 2020; Das et al., 2023; Hanza et al., 2025; Hondroyiannis & Papaoikonomou, 2017; Kumar, 2024; Mpofu & Mhlanga, 2022) who have found, in their earlier studies, that digital payments have improved tax revenue collection significantly. An adjusted R-squared value of 0.534 implies that the independent variables are responsible for approximately 53% of the variability in the TXC. Given the considerable R-squared value, one can assert that the model adequately fits the data.

Moreover, the ECM coefficient is identified as negative and significant at the 1% level, reflecting a rather gradual convergence rate, with the model moving towards equilibrium by 4% each quarter.

4.7. Diagnostic Tests Result

The Durbin–Watson indicates zero autocorrelation, and it is supported by the result of serial correlation in Table 9. Our predictions are correct, as confirmed by the standard error of regression value of 0.159. The value is below the value of 1, implying that our prediction is accurate.

Table 9.

Further diagnostic tests.

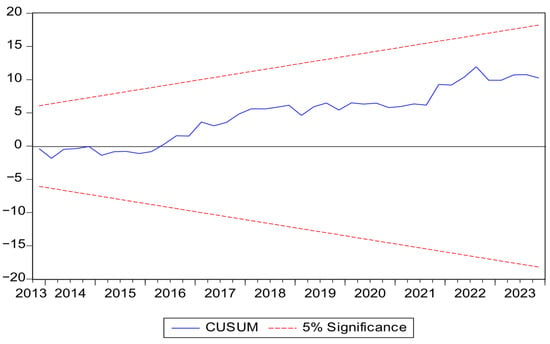

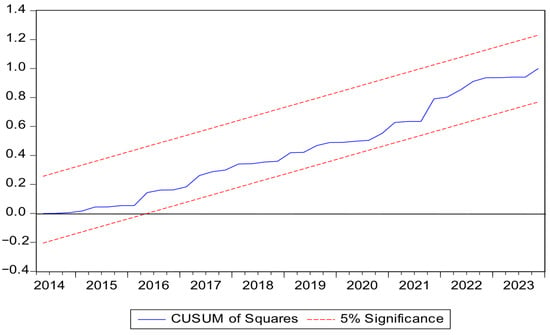

4.8. Post Estimation Robustness and Normality Tests

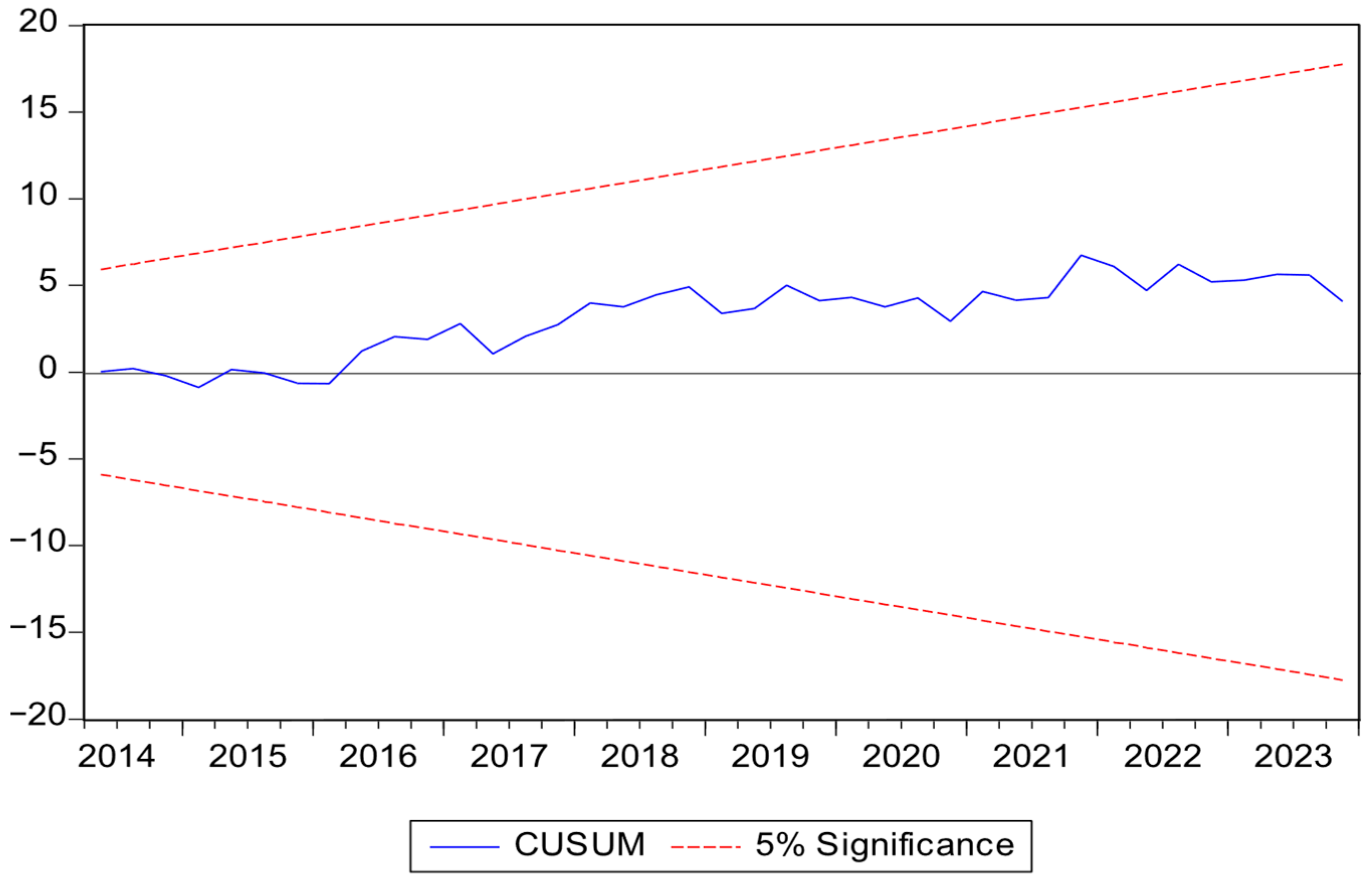

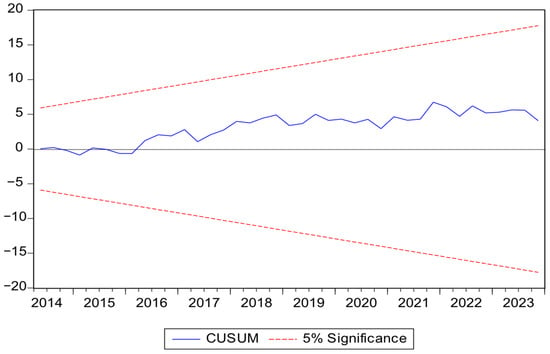

The CUSUM Test (Cumulative Sum Test) is a sequential analysis method of finding changes or drift in the mean of a process. The CUSUM test is an effective statistical process monitoring signal, capable of capturing early evidence of small shifts in the mean of a series that occurs over a sustained period of time as evidence builds. The primary purpose of it is an early warning on the fact that a process has drifted out of its intended state. In the case of such a shift when the blue line cut the 5% boundary represented by the two red lines, there is a shift. In this study, there is no mean shift since the blue line is inside the 5% frontiers, as shown in Figure 2.

Figure 2.

Cumulative sum test.

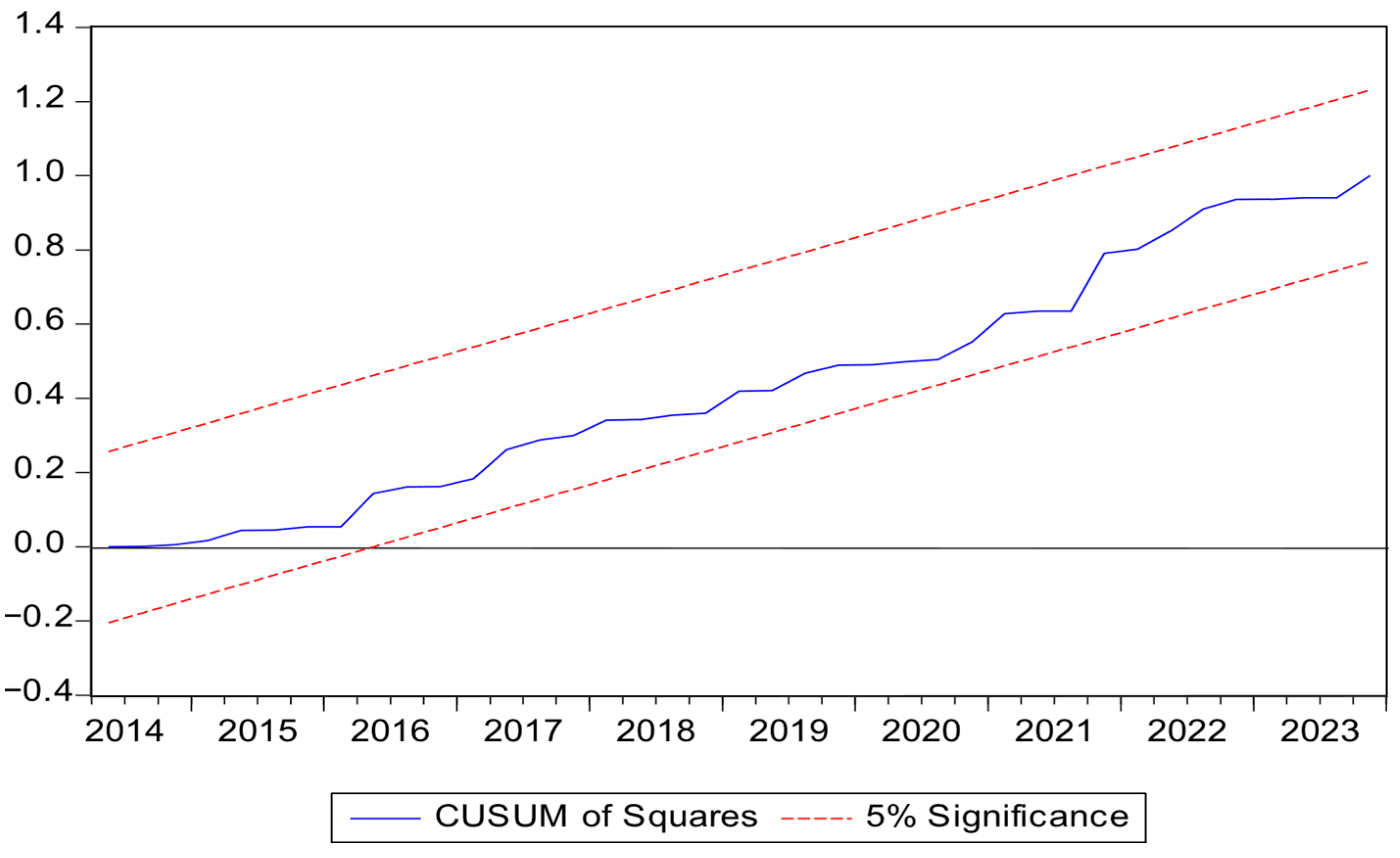

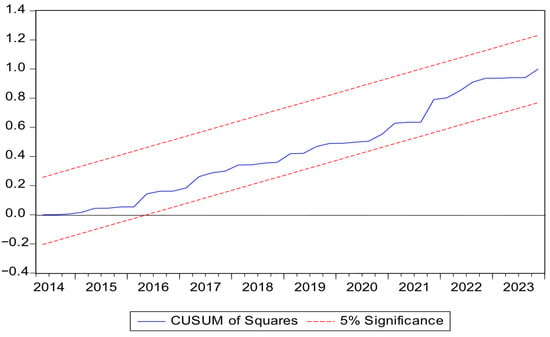

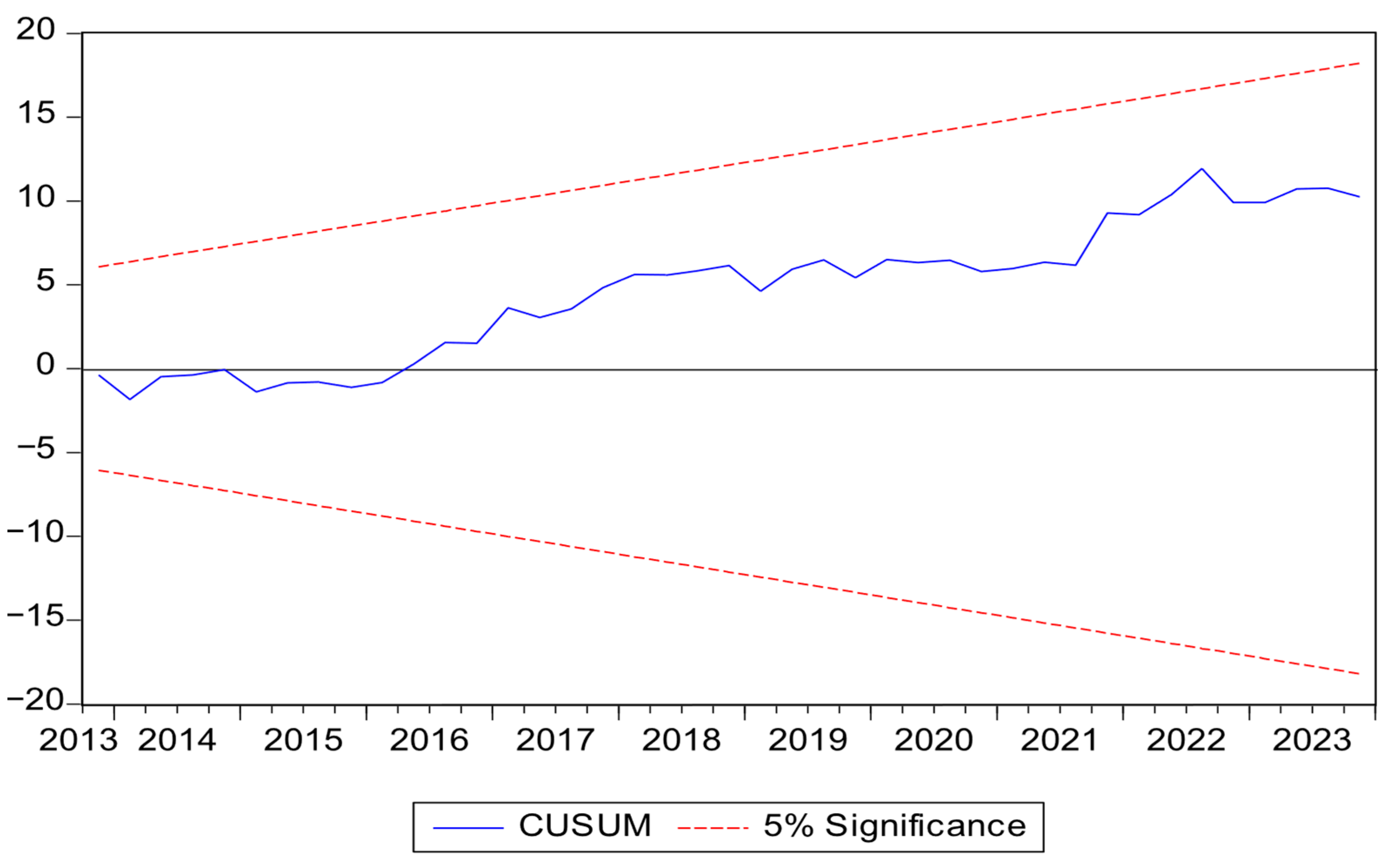

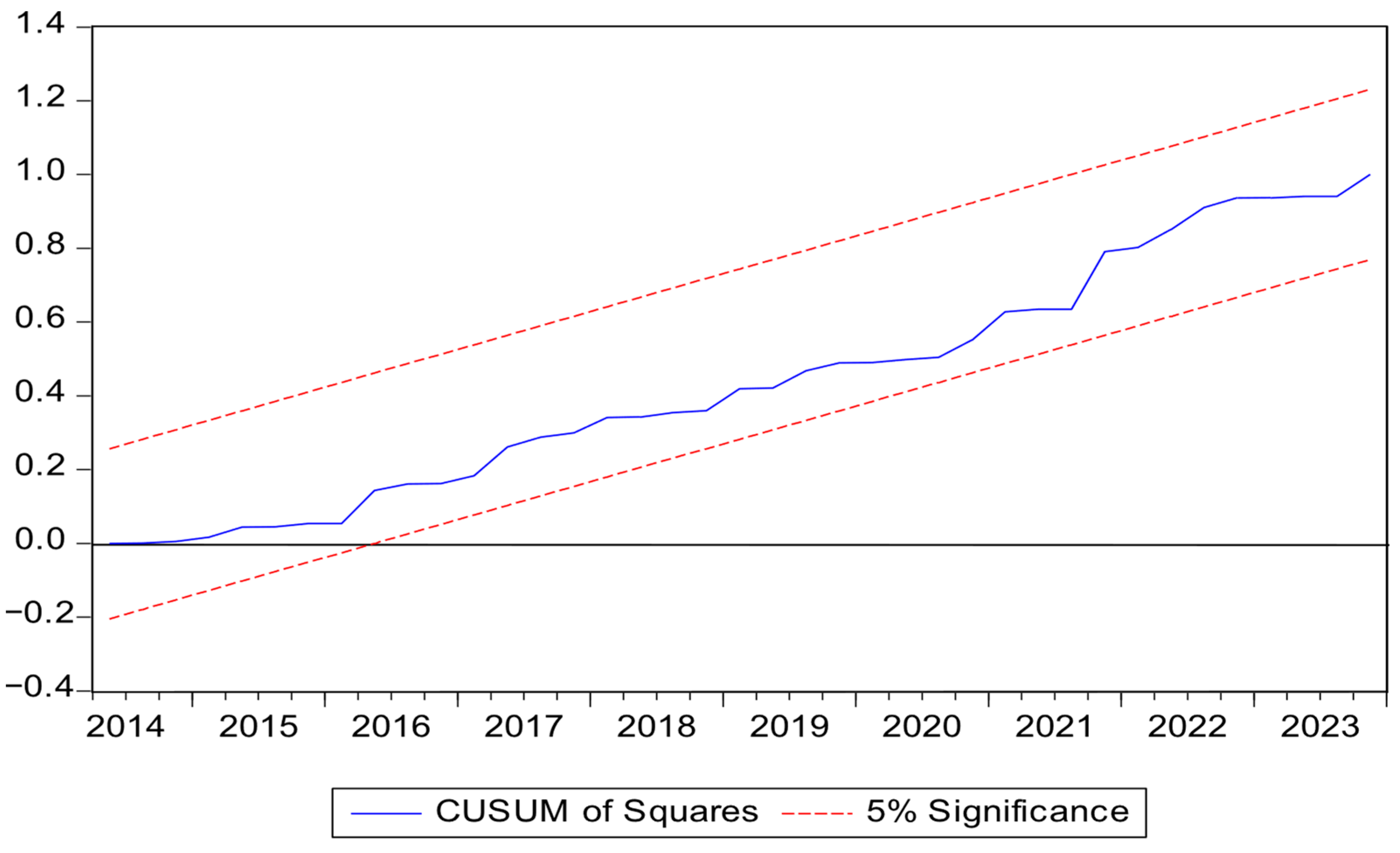

The CUSUM of squares is a statistical test which can detect a change in the variance of a time series regression model or structural break. In simpler words, it will see whether the “volatility” or the size of the error of a model change at any point in time during the analysis period. It applies to the squared residuals locating breaks in the variance of the errors. The null Hypothesis (H0) is that the variance of the errors is fixed (no structural break), whereas the alternative Hypothesis (H1) states that the variance of the errors is not constant (a structural break exists). Based on Figure 2 and Figure A1 of Appendix A.6 of this study, the error term is constant in variance (homoskedasticity), based on the fact that the blue line does not exceed the 5% boundaries indicated by the two dotted red lines (see Figure 3, Figure A2 in Appendix A.4). The Cumulative SUM of squares confirms that the ARDL model applied in this study does not include any variable with structural break.

Figure 3.

Cumulative SUM of squares.

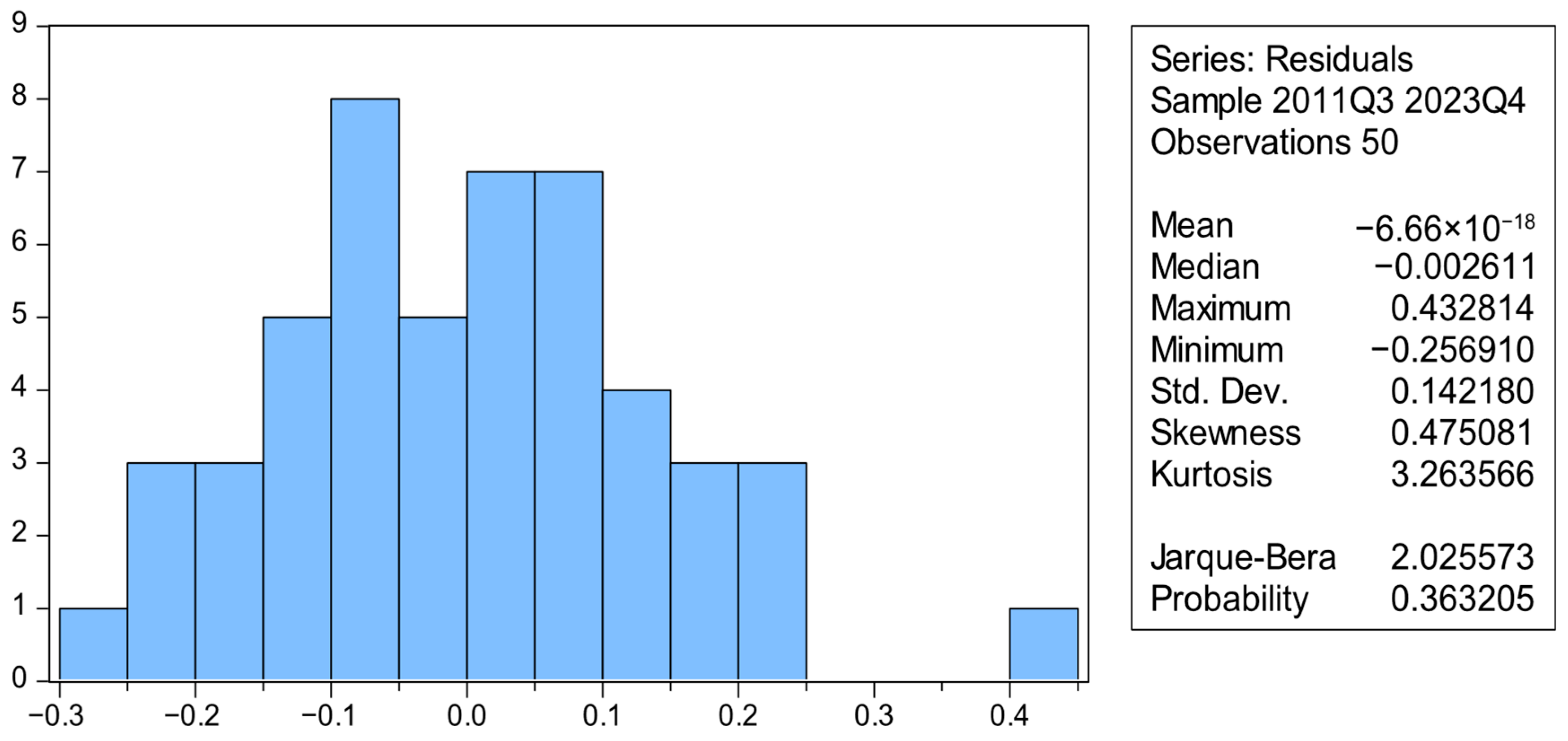

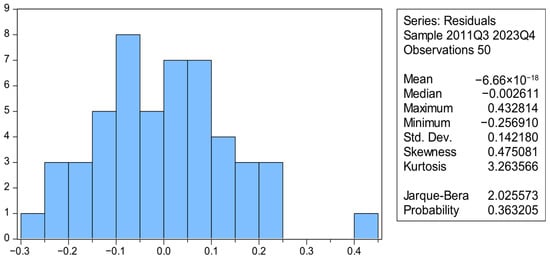

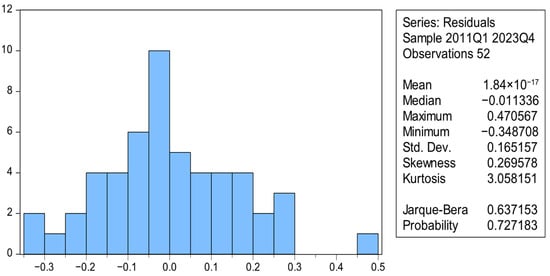

In Figure 4, the Kurtosis of 3.263 indicates that the model is comprehensively normal. The result is supported by the Jarque–Bera p-value of 0.363 that is far above 0.05 significance level. We confirm this result in Appendix A.6, Figure A3. Based on this, we conclude that there is model fitness, and the datasets are normally distributed.

Figure 4.

Normality test.

In a further post-estimation analysis in Table 9, we use the Ramsey RESET test to show that the model is stable. We check for the occurrence of autocorrelation or serial connection within the model. Autocorrelation occurs when two or more independent variables are correlated with one another, rather than being independent. To demonstrate that there is no autocorrelation in the equation, the p-values should not be statistically significant at a 0.05 significance level. As per Table 9, the p-value of 0.113 was not statistically substantial at the 0.05 level, indicating zero autocorrelation in the model.

Heteroskedasticity refers to the irregularity in the variability of error terms caused by the lack of uniformity among a group of predictor variables within a dataset. To illustrate the absence of heteroskedasticity in the equation, the chi-square (Chi-sq) probability value should not fall below 5%. As shown in Table 9, the likelihood value of 0.620 was not substantial at the 0.05 level, which suggests that heteroskedasticity does not exist in the equation.

4.9. Discussion of Findings and Alignment with Theoretical Groundworks

This study analyzes the influence of digital payment systems on tax collection efficiency in Nigeria from Q1 2009 to Q4 2023. It utilizes the ARDL technique to investigate the short-term and long-term dynamics of these systems and their effects on tax revenue collection in various digital payment systems and macroeconomic control variables such as Information and Communication Technology Penetration Rate (ICTPR), inflation, and GDP. The results presented in Table 7 and Table 8 indicate that the Web Payment System (WPY) and POS have positively and considerably facilitated Tax Collection (TXC) in the long term but have no tangible effect in the short run. These results are confirmed in Appendix A.1, Appendix A.2, Appendix A.3, Appendix A.4, Appendix A.5 and Appendix A.6. This suggests that utilizing web payment systems and POS for tax payments are more convenient for firms and individuals who may be too busy to search for ATM locations over time. Even after locating an ATM, they may face challenges such as crowds or network issues that hinder the completion of necessary transactions. In contrast, all digital payment systems have not shown any impact on tax revenue collection in the short run as indicated in Table 8. This may stem from the distinct nature of tax obligations, which tax authorities at all levels (federal, state, and local) have yet to adequately incorporate into their respective tax payment systems. As Ullah et al. (2025) argue, inadequate ICT infrastructure undermines mobile payment systems and restricts financial institutions’ ability to cater to a diverse range of individuals with different financial requirements. Again, the public appreciates the use of digital payment systems over a long period after watching its success and consistency in the delivery of financial services.

However, both in the long and short term, GDP has a significant negative effect on TXC. This owes to the fact that informal sector activities are not taxed and GDP in Nigeria is predominantly dominated by the informal section economic activities. Thus, it is only through digital payment systems that the government is able to collect taxes such as VAT from the informal economy. In the view of Carrillo et al. (2017) and Kahveci & Gurgur (2025), digital payment systems are instrumental in fostering economic growth and minimizing corruption and tax evasion from the informal sector. Kumar (2024) supports the notion that tax revenue collection is significantly improved by digital payment systems. This implies that the electronic collection of taxes can effectively curb revenue leakage due to shadow economic activities (Moyo, 2022; Mpofu, 2021; Munjeyi & Fourie, 2024). Therefore, the findings of this research align with the theoretical premises that digital payment systems enhance tax revenue collection and mitigate tax evasion resulting from underground economic activities.

5. Summary

This investigation assesses the specific response of tax revenue collection to each digital payment system adopted in Nigeria from 2009Q1 to 2023Q4. The study posits that digital payment systems do not enhance tax revenue collection in response to global technological shifts and initiatives aimed at achieving a cashless society. Therefore, the research employs a ARDL method to analyze both the short-term and long-term effects of digital payment methods on tax revenue collection. The findings reveal that, in the long run, only Web-based payments (WPY) and Point-of-Sale (POS) contributed to a rise in tax returns assemblage, while in the short run, almost all the electronic payment systems do not tangibly affect the gathering of tax proceeds.

The implication of this policy is that Nigeria still needs a robust ICT infrastructure to support banks and other financial institutions in maintaining all forms of digital payments within the nation. There is a necessity for a reliable network to facilitate ATM, POS, MPY, and all web-based transactions in remote regions. Many businesses in rural areas only access the internet to conduct transactions when they visit urban centers. Consequently, this study recommends increased government investment in ICT infrastructure to maximize tax collection. Furthermore, to reduce tax evasion, banks can assist in collecting VAT for the government during online payments, even from the informal sector. Thus, it is crucial for the government to enhance the cashless policy and ensure its comprehensive implementation. The execution of the cashless policy will significantly improve tax revenue collection, particularly VAT and other taxes collected by banks on behalf of the government.

It is very key to confirm how best to tax the informal economy to prevent revenue leakage. Through the 2025 tax reform in the country, small businesses are not heavily taxed. Therefore, the government should make the registration process of businesses easy and free to be able to include all informal businesses into the tax net. Also, attractive incentives should be introduced to enable them to identify with tax authorities and thereafter, so that the government can introduce tax gradually until it becomes a pattern they will not avoid. The government should provide an enabling business environment with adequate infrastructure that will boost both local and international business transactions. This research encountered some constraints in terms of data availability to cover other emerging economies in Sub-Saharan Africa. We recommended that future studies should consider all African regions and other global emerging economies.

Author Contributions

Conceptualization, C.O.O.; methodology, C.O.O. and G.E.; software, C.O.O. and G.E.; validation, G.E.; formal analysis, C.O.O.; investigation, C.O.O. and G.E.; resources, G.E.; data curation, G.E.; writing—original draft preparation, C.O.O.; writing—review and editing, C.O.O. and G.E.; visualization, C.O.O.; supervision, G.E.; project administration, C.O.O. and G.E.; funding acquisition, C.O.O. All authors have read and agreed to the published version of the manuscript.

Funding

The research received no external funding.

Data Availability Statement

Data will be made available to users upon reasonable request.

Acknowledgments

The authors recognize the funding support by Covenant University Nigeria.

Conflicts of Interest

The authors are not aware of any present or upcoming conflict of interest.

Appendix A

ROBUSTNESS CHECK USING LAG 4

Appendix A.1. ARDL Long-Run Estimation Result

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 1.202075 | 1.836336 | 0.654605 | 0.5160 |

| LNTXC(-4) | 0.589958 | 0.094202 | 6.262689 | 0.0000 |

| LNCHQ(-4) | −0.005946 | 0.123385 | −0.048190 | 0.9618 |

| LNATM(-4) | 0.014260 | 0.092375 | 0.154375 | 0.8780 |

| LNMPY(-4) | −0.028698 | 0.072529 | −0.395675 | 0.6942 |

| LNWPY(-4) | 0.040754 | 0.034046 | 1.197011 | 0.0374 ** |

| LNPOS(-4) | 0.059409 | 0.088911 | 0.668186 | 0.0114 *** |

| 1LNICTPR(-4) | −0.339616 | 0.335312 | −1.012837 | 0.3164 |

| LNINFL(-4) | 0.412792 | 0.100653 | 4.101125 | 0.0002 *** |

| LNGDP(-4) | 0.139728 | 0.203651 | 0.686113 | 0.4961 |

| Notes: R-Squared = 0.769; Adjusted R-Squared = 0.7165; S.E. of regression = 0.151; F-statistic = 34.15; Prob. (F-statistic) = 0.000; Durbin–Watson = 1.974; AIC = −0.776; SC = 0.415. *** and ** confirms significance level at 1% and 5% respectively. Authors’ computation, 2025. | ||||

Appendix A.2. ARDL Short-Run Estimation and Error Correction Model

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | −0.054316 | 0.065120 | −0.834086 | 0.4091 |

| D(LNTXC(-4)) | 0.634677 | 0.159411 | 3.981380 | 0.0003 *** |

| D(LNCHQ(-4)) | 0.000575 | 0.175937 | 0.003267 | 0.9974 |

| D(LNATM(-4)) | 0.189800 | 0.160975 | 1.179064 | 0.2452 |

| D(LNMPY(-4)) | 0.159640 | 0.151240 | 1.055541 | 0.2974 |

| D(LNWPY(-4)) | 0.031362 | 0.055518 | 0.564907 | 0.5752 |

| D(LNPOS(-4)) | −0.313256 | 0.140938 | 2.222651 | 0.6718 |

| D(LNICTPR(-4)) | 1.600587 | 1.407433 | 1.137239 | 0.2620 |

| D(LNINFL(-4)) | 0.219137 | 0.260378 | 0.841611 | 0.4049 |

| D(LNGDP(-4)) | 0.121513 | 0.279957 | 0.434043 | 0.0025 *** |

| ECM(-4) | −0.330142 | 0.238646 | −1.383393 | 0.0040 *** |

| Notes: R-Squared = 0.569; Adjusted R-Squared = 0.516; S.E. of regression = 0.184; F-statistic = 2.406; Prob. (F-statistic) = 0.003; Durbin–Watson = 2.028; AIC = −0.360; SC = −0.053. *** confirms significance level at 1%. Authors’ computation, 2025. | ||||

Appendix A.3

Figure A1.

Robustness check at lag 4.

Figure A1.

Robustness check at lag 4.

Appendix A.4

Figure A2.

Robustness check at lag 4.

Figure A2.

Robustness check at lag 4.

Appendix A.5. Further Diagnostic Tests

| Test Type | F-Statistics | p-Value |

| Ramsey RESET Test for model stability | 0.404 | 0.688 |

| Breusch–Godfrey Serial Correlation LM Test | 1.961 | 0.169 |

| Heteroskedasticity Test: Breusch-Pagan-Godfrey | 0.453 | 0.910 |

| Jarque–Bera Normality test | 0.637 | 0.727 |

Robustness check at lag 4

Appendix A.6

Figure A3.

Robustness check at lag 4.

Figure A3.

Robustness check at lag 4.

Appendix A.7. Digital Payments Before COVID-19 Pandemic

Figure A4.

Trend of Digital payment data before COVID-19 pandemic.

Figure A4.

Trend of Digital payment data before COVID-19 pandemic.

Appendix A.8. Digital Payments During and Post COVID-19 Pandemic

Figure A5.

Trend of Digital payment data during and post COVID-19 pandemic.

Figure A5.

Trend of Digital payment data during and post COVID-19 pandemic.

References

- Ali, A. S., Ironkwe, U. I., & Nwaiwu, J. (2023). Internet payment system and Personal Income Tax payment in Nigeria. Business Management GPh—International Journal, 6(10), 315–333. [Google Scholar] [CrossRef]

- Al-Own, B., Saidat, Z., Kasem, J., & Qasaimeh, G. (2023, March 7–8). Impact of digital payment systems and blockchain on economic growth. International Conference on Business Analytics for Technology and Security (ICBATS) (pp. 1–5), Dubai, United Arab Emirates. [Google Scholar] [CrossRef]

- Birigozzi, A., Silva, C. D., & Luitel, P. (2025). Digital payments and GDP growth: A Behavioural quantitative analysis. Research in International Business and Finance, 75(1), 1–18. [Google Scholar] [CrossRef]

- Carrillo, P., Pomeranz, D., & Singhal, M. (2017). Dodging the taxman: Firm misreporting and limits to tax enforcement. American Economic Journal: Applied Economics, 9(2), 144–164. [Google Scholar] [CrossRef]

- Chen, Y., Huang, Q., & Zhang, Q. (2024). The impact of digital inclusive financial development on local government expenditure: Evidence from China. PLoS ONE, 19(5), e0300775. [Google Scholar] [CrossRef] [PubMed]

- Cheng, Q., Chen, B., & Luo, J. (2024). The impact of digital tax administration on local government debt: Based on the revision of the tax collection and administration law. Finance Research Letters, 67, 105938. [Google Scholar] [CrossRef]

- Danchev, S., Gatopoulos, G., & Vettas, N. (2020). Penetration of digital payments in Greece after capital controls: Determinants and impact on VAT revenues. CESifo Economic Studies, 66(3), 198–220. [Google Scholar] [CrossRef]

- Das, S., Gadenne, L., Nandi, T., & Warwick, R. (2023). Does going cashless make you Tax-rich? Evidence from India’s demonetization experiment. Journal of Public Economics, 224, 104907. [Google Scholar] [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366), 427–431. [Google Scholar] [CrossRef]

- Eton, M., Mwosi, F., Amanda, I. Y., Ocan, J., & Ogwel, B. P. (2025). Exploring the effect of Digital finance on financial inclusion in Uganda, a reflection from Lira City. Journal of Electronic Business & Digital Economics, 4(1), 183–199. [Google Scholar] [CrossRef]

- Gomber, P., Koch, J. A., & Siering, M. (2017). Digital Finance and FinTech: Current research and future research directions. Journal of Business Economics, 87(1), 537–580. [Google Scholar] [CrossRef]

- Hanza, R., Alnor, N., Eisa, M., Alhebri, A., & Eltahir, I. (2025). The influence of electronic Payment methods on tax compliance. International Journal of Innovative Research and Scientific Studies, 8(2), 3046–3055. [Google Scholar] [CrossRef]

- He, Y. (2024). Digital technology reshapes the tax collection and administration system: Impacts, challenges and future prospects. Scientific Journal of Economics and Management Research, 6(9), 85–91. [Google Scholar] [CrossRef]

- Hondroyiannis, G., & Papaoikonomou, D. (2017). The effect of card payments on VAT Revenue: New evidence from Greece. Economics Letters, 157, 17–20. [Google Scholar] [CrossRef]

- Johri, A., Asif, M., Tarkar, P., & Khan, W. (2024). Digital financial inclusion in micro Micro enterprises: Understanding the determinants and impact on ease of doing business from World Bank Survey. Humanities & Social Sciences Communications, 11, 361. [Google Scholar] [CrossRef]

- Kahveci, E., & Gurgur, T. (2025). Digital payments and sustainable economic growth: Transmission mechanisms and evidence from an emerging economy, Turkey. Journal of Theoretical and Applied Electronic Commerce Research, 20(2), 142. [Google Scholar] [CrossRef]

- Khando, K., Islam, M. S., & Gao, S. (2023). The emerging technologies of digital payments and associated challenges: A systematic literature review. Future Internet, 15(1), 21. [Google Scholar] [CrossRef]

- Klapper, L., & Singer, D. (2014). The opportunities of digitizing payments (English). World Bank Group. Available online: http://documents.worldbank.org/curated/en/188451468336589650 (accessed on 3 May 2025).

- Kumar, S. (2024). Do digital payments spur GST Revenue: Indian experience. Bulletin of Monetary Economics and Banking, 27(3), 459–482. [Google Scholar] [CrossRef]

- Madzharova, B. (2014). The impact of cash and card transactions on VAT collection efficiency. In The usage, costs and benefits of cash—Revisited. Proceedings of the 2014 international cash conference (pp. 521–559). Deutsche Bundesbank. [Google Scholar]

- Moyo, B. (2022). Factors affecting the probability of formalizing informal sector activities in Sub-Saharan Africa: Evidence from World Bank enterprise surveys. African Journal of Economic and Management Studies, 13(3), 480–507. [Google Scholar] [CrossRef]

- Mpofu, F. Y. (2021). Taxing the informal sector through presumptive taxes in Zimbabwe: An avenue for a broadened tax base, stifling of the informal sector activities or both. Journal of Accounting and Taxation, 13(3), 153–177. [Google Scholar] [CrossRef]

- Mpofu, F. Y., & Mhlanga, D. (2022). Digital financial inclusion, digital financial services tax and financial inclusion in the fourth industrial revolution era in Africa. Economies, 10(8), 184. [Google Scholar] [CrossRef]

- Mukuwa, V., & Phiri, J. (2020). The effects of E-services on revenue collection and tax compliance among SMEs in developing countries: A case study of Zambia. Open Journal of Social Sciences, 8(1), 98–108. [Google Scholar] [CrossRef]

- Munjeyi, E., & Fourie, H. (2024). A framework for digitalizing tax revenue collection for the Informal economic sphere in Zimbabwe. Cogent Economics & Finance, 12(1), 2409427. [Google Scholar] [CrossRef]

- Nelson, B. (2019). Digital currencies and payments: Financial stability and monetary policy Implications. The Journal of Investing Cryptocurrency, 28(3), 70–72. [Google Scholar] [CrossRef]

- Nwankwo, C. T., Uguru, L. C., & Chukwu, U. C. (2022). Effect of electronic payment system on tax revenue generation in Nigeria. International Journal of Business and Management Invention, 11(12), 40–49. [Google Scholar]

- Ocharive, A., & Iworiso, J. (2024). The impact of digital financial services on financial Inclusion: A panel data regression method. International Journal of Data Science and Analysis, 10(2), 20–30. [Google Scholar] [CrossRef]

- OECD. (2015). Addressing the tax challenges of the digital economy, action 1—2015 final report. OECD/G20 Base Erosion and Profit Shifting Project. OECD Publishing. [Google Scholar] [CrossRef]

- Ozili, P. K. (2018a). Banking stability determinants in Africa. International Journal of Managerial Finance, 14(4), 462–483. [Google Scholar] [CrossRef]

- Ozili, P. K. (2018b). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329–340. [Google Scholar] [CrossRef]

- Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bonds testing approaches to the analysis of level relationships. Journal of Applied Economics, 16(3), 289–326. [Google Scholar] [CrossRef]

- Ramayanti, R., Rachmawati, N. A., Azhar, Z., & Azman, N. H. N. (2024). Exploring intention and actual use in digital payments: A systematic review and roadmap for future research. Computers in Human Behavior Reports, 13(1), 100348. [Google Scholar] [CrossRef]

- Remige, I. (2020). Cashless economy and efficient tax collection: Case study—Rewanda revenue authority and Rwanda mobile telephone network (MTNR). Journal of Research Innovation and Implications in Education, 4(1), 29–40. Available online: https://jriiejournal.com/wp-content/uploads/2020/03/JRIIE-4-1-004.pdf (accessed on 30 July 2025).

- Ren, P., Moumbark, T., Appiah, E., & Koudalo, Y. M. A. (2025). Financial inclusion, mobile money, and tax revenue in Africa. SAGE Open, 15(1), 1–20. [Google Scholar] [CrossRef]

- Risman, A., Mulyana, B., Silvatika, B. A., & Sulaeman, A. S. (2021). The effect of digital finance on financial stability. Management Science Letters, 11(1), 1979–1984. [Google Scholar] [CrossRef]

- Tran Thi, K. O., Nguyen, D. M., Le Nguyen, T. T., Tran, Y. T. T., Nguyen Ngoc, V. T., & Hoang, A. T. (2024). The relationship between the digital finance, tax and economic growth: In the context of financial development. Macroeconomics and Finance in Emerging Market Economies, 1–23. [Google Scholar] [CrossRef]

- Ullah, S., Liew, C. Y., & Nobanee, H. (2025). Digital transactions and financial development: The moderating role of global integration across income levels. International Review of Economics and Finance, 98(1), 103861. [Google Scholar] [CrossRef]

- Xi, W., & Wang, Y. (2023). Digital financial inclusion and quality of economic growth. Heliyon, 9(9), e19731. [Google Scholar] [CrossRef] [PubMed]

- Xu, F., & Zhang, L. (2025). The impact of digital payments on the financial vulnerability of Rural households: Empirical evidence from China. Frontiers in Sustainable Food Systems, 9(1), 1553237. [Google Scholar] [CrossRef]

- Xue, Q., Feng, S., & Li, M. (2024). The impact of digital finance on industrial structure: Evidence from China. SAGE Open, 2024, 1–19. [Google Scholar] [CrossRef]

- Zwingina, C. T., Onoh, U. A., & Ezechi, C. P. D. (2023). Impact of electronic payment systems On economic growth of Nigeria. Asian Journal of Economics and Business, 4(1), 71–88. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).