Banking Profitability: Evolution and Research Trends

Abstract

1. Introduction

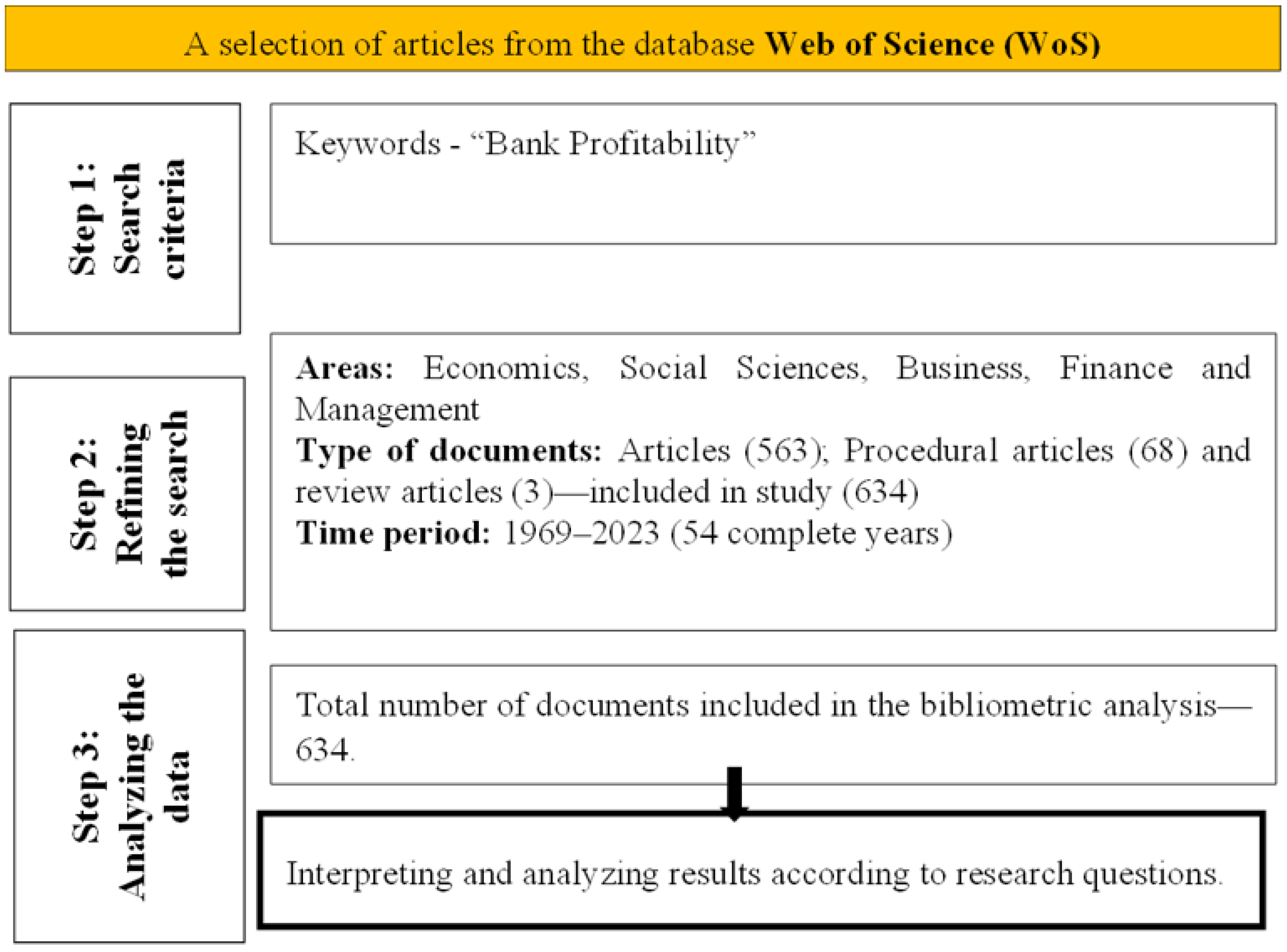

2. Analytical Framework for Bibliometric Research

3. Analysis and Discussion of Results

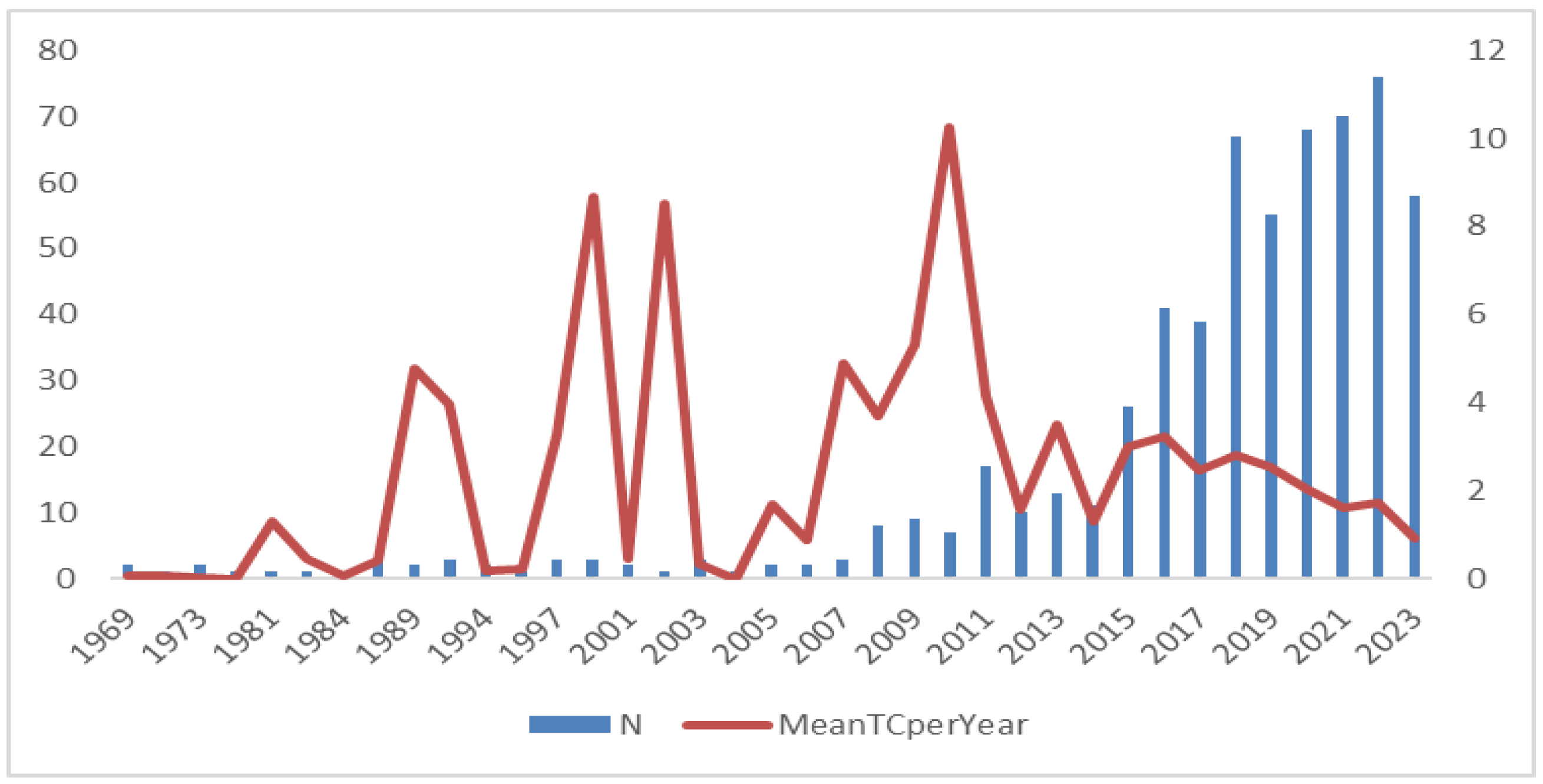

3.1. Research Trends

3.2. Performance Analysis

3.2.1. Journals

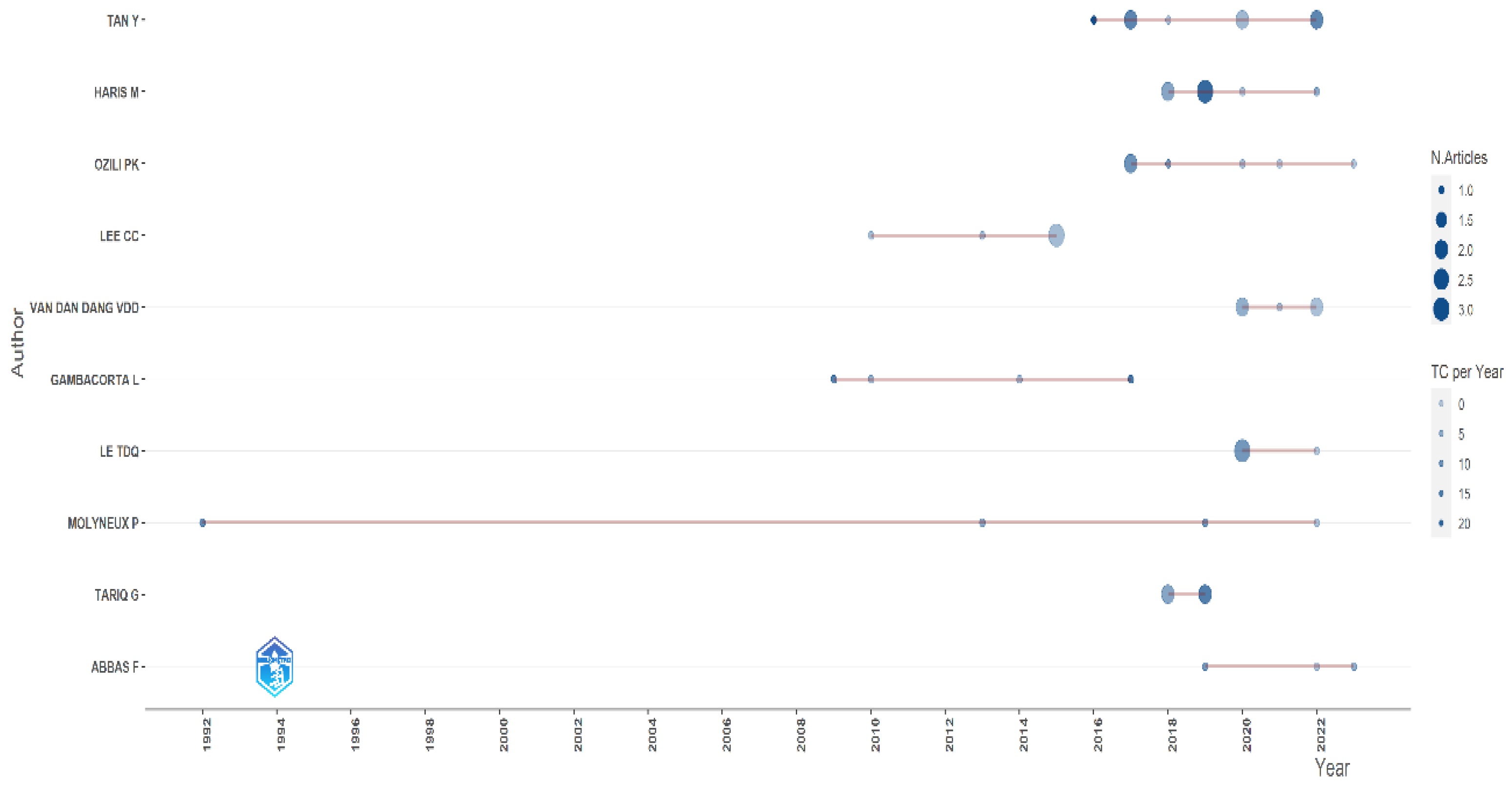

3.2.2. Authors

3.2.3. Papers

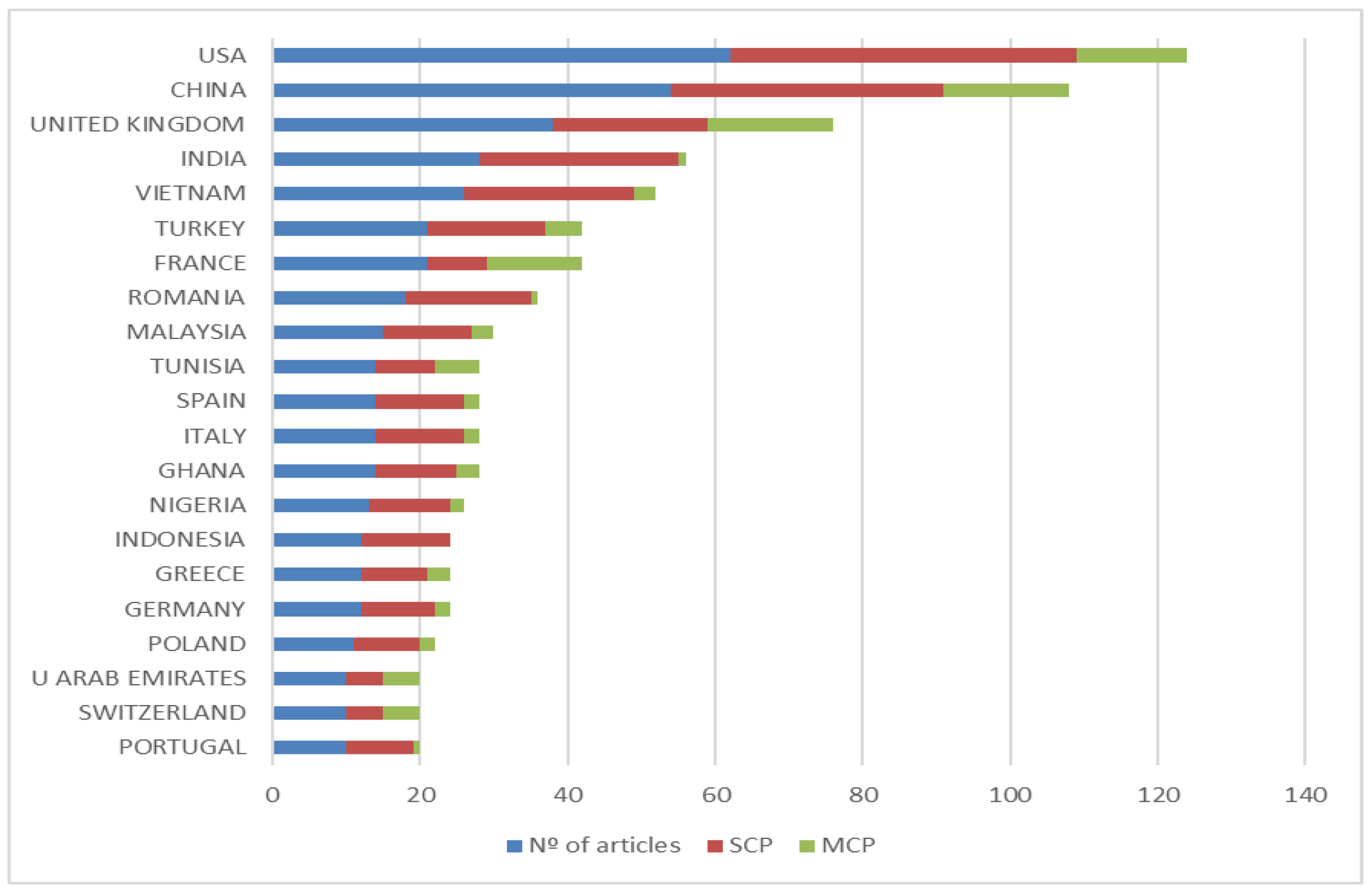

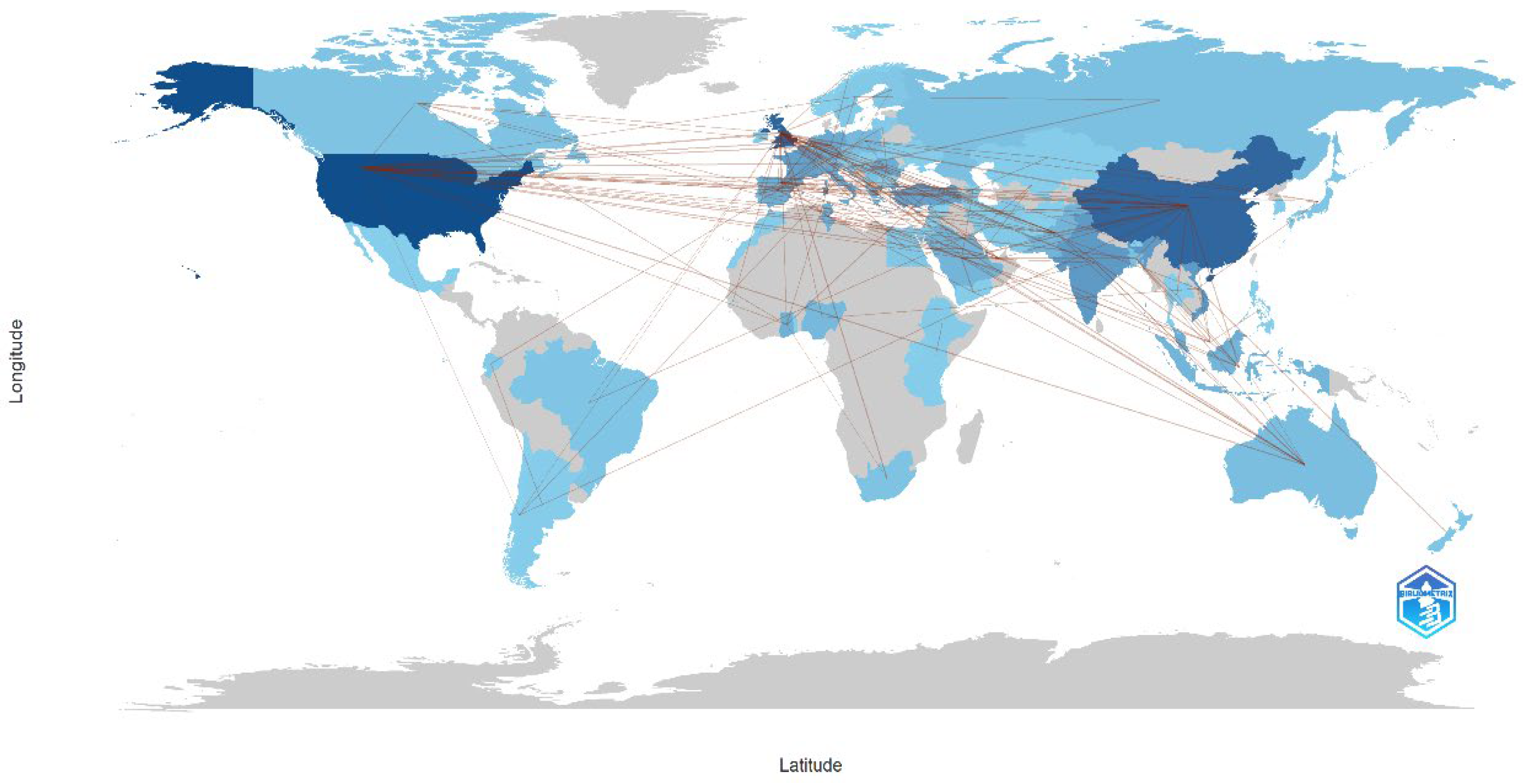

3.2.4. Most Active Countries in the Field of Research

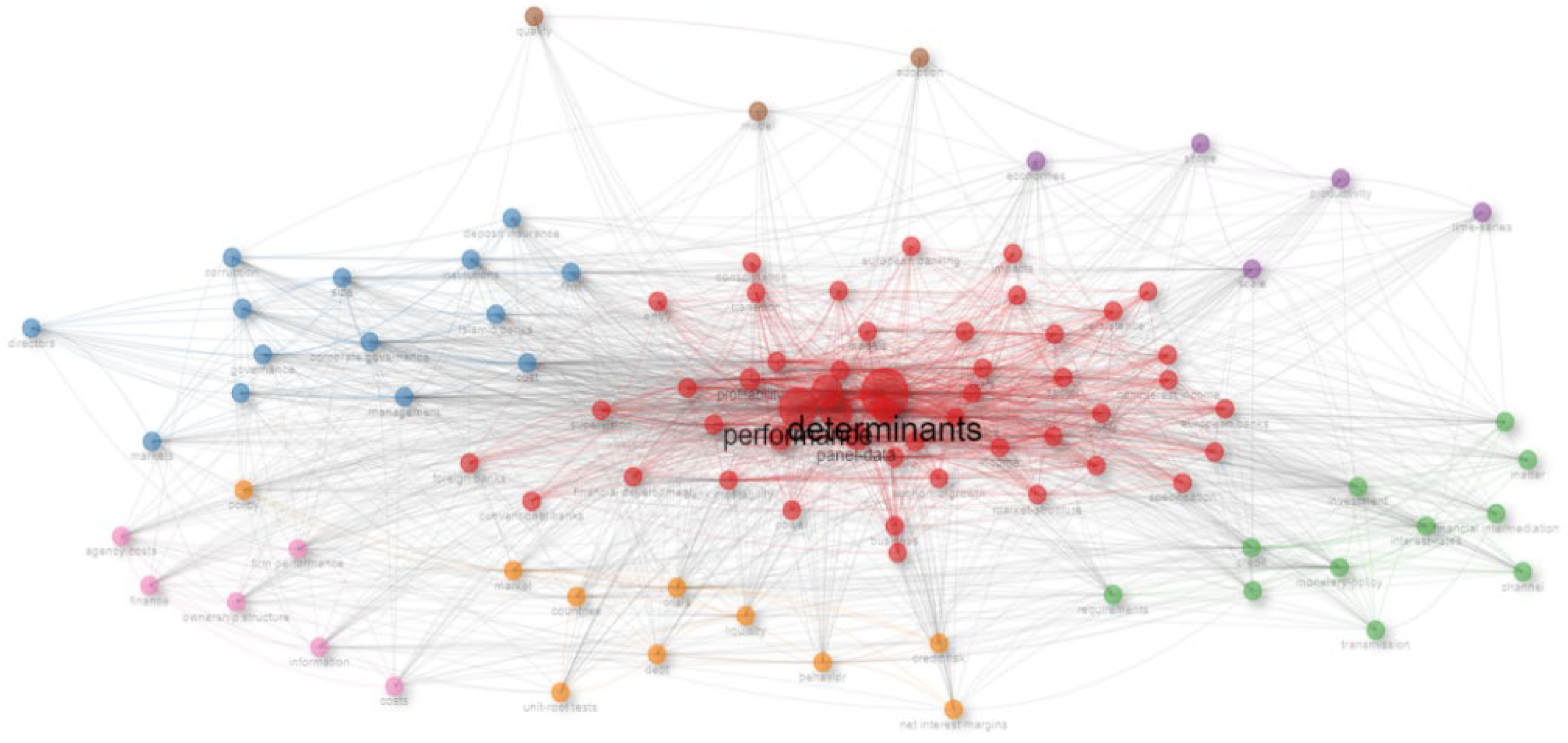

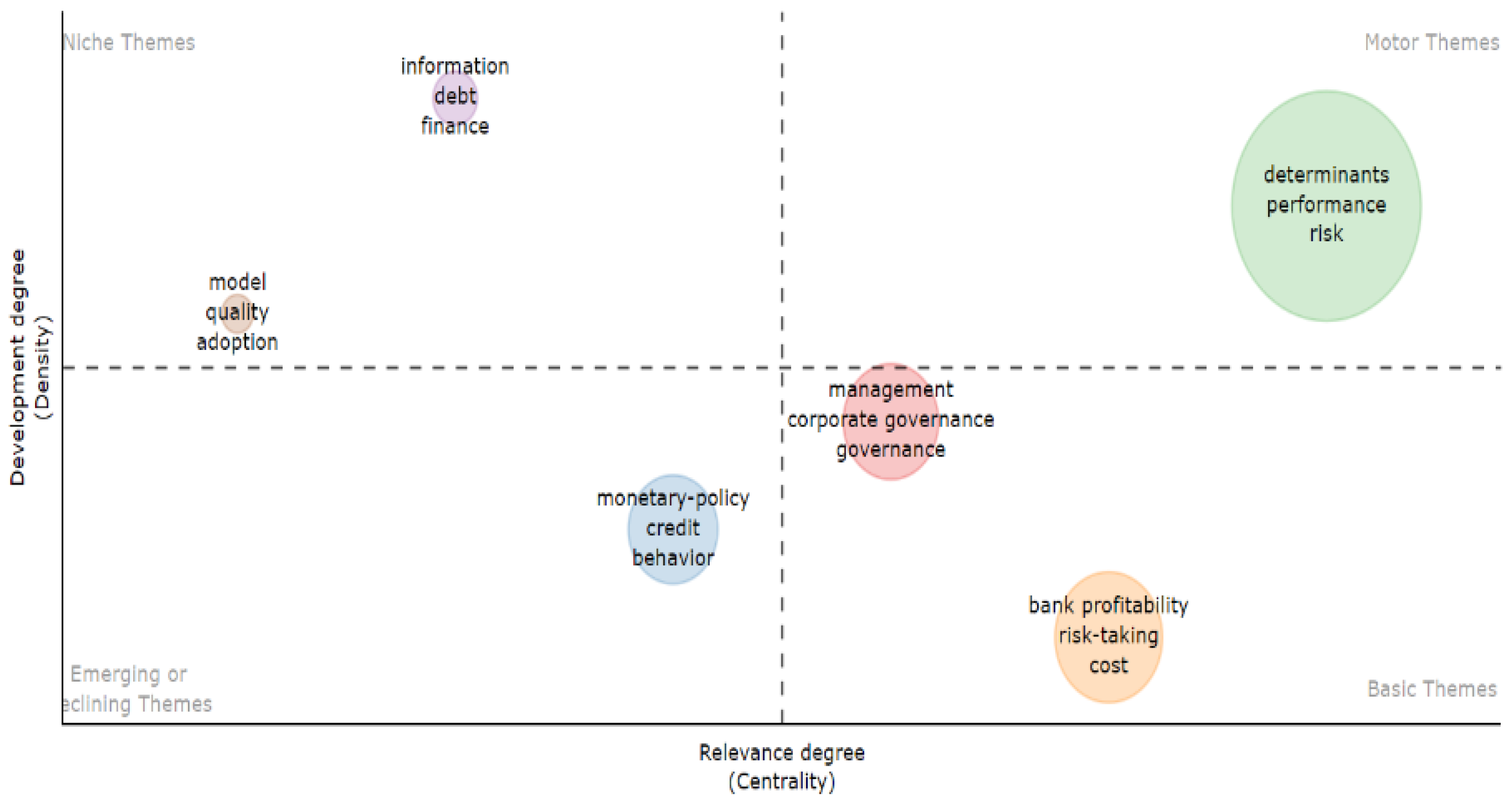

3.3. Main Topics and Keywords

4. Discussion of Results

4.1. Internal Factors

4.2. External Factors

4.3. Future Directions

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abdelaziz, H., Rim, B., & Helmi, H. (2020). The interactional relationships between credit risk, liquidity risk and bank profitability in MENA region. Global Business Review, 23, 561–583. [Google Scholar] [CrossRef]

- Abu Alrub, A., Ağa, M., & Rjoub, H. (2020). Does the improvement in accounting standard IAS/IFRS cure the financial crisis and bank profitability? Evidence from banking sector in Lebanon. Asia-Pacific Journal of Accounting & Economics, 27, 727–744. [Google Scholar]

- Agarwal, V., & Taffler, R. (2008). Comparing the performance of market-based and accounting-based bankruptcy prediction models. Journal of Banking & Finance, 32(8), 1541–1551. [Google Scholar] [CrossRef]

- Agnese, P., Cerciello, M., Oriani, R., & Taddeo, S. (2024). ESG controversies and profitability in the European banking sector. Finance Research Letters, 61, 105042. [Google Scholar] [CrossRef]

- Ahmad, N., Naveed, A., Ahmad, S., & Butt, I. (2020). Banking sector performance, profitability, and efficiency: A citation-based systematic literature review. Journal of Economic Surveys, 34(1), 185–218. [Google Scholar] [CrossRef]

- Ali, M., & Puah, C. H. (2019). The internal determinants of bank profitability and stability: An insight from banking sector of Pakistan. Management Research Review, 42(1), 49–67. [Google Scholar] [CrossRef]

- Al-Matari, E. M. (2023). The determinants of bank profitability of GCC: The role of bank liquidity as moderating variable—Further analysis. International Journal of Finance and Economics, 28(2), 1423–1435. [Google Scholar] [CrossRef]

- Almeida, L. (2023). Risk and bankruptcy research: Mapping the state of the art. Journal of Risk and Financial Management, 16(8), 361. [Google Scholar] [CrossRef]

- Almeida, L., & Sousa, F. (2025). Determinants of bank profitability in Portugal: Insights from a period of sectoral transformation. Quantitative Finance and Economics, 9(2), 425–448. [Google Scholar] [CrossRef]

- Almeida, L., & Vieira, E. (2023). Technical analysis, fundamental analysis, and ichimoku dynamics: A bibliometric analysis. Risks, 11(8), 142. [Google Scholar] [CrossRef]

- Andrieș, A. M., Căpraru, B., & Nistor, S. (2018). Corporate governance and efficiency in banking: Evidence from emerging economies. Applied Economics, 50(34–35), 3812–3832. [Google Scholar] [CrossRef]

- Argimon, I., Danton, J. M., de Haan, J., Rodriguez-Martin, J., & Rodriguez-Moreno, M. (2023). Low interest rates and banks’ interest margins: Does belonging to a banking group matter? Journal of Banking & Finance, 154, 106966. [Google Scholar] [CrossRef]

- Arslan, H. M., Chengang, Y., Bilal, Siddique, M., & Yahya, Y. (2022). Influence of senior executives characteristics on corporate environmental disclosures: A bibliometric analysis. Journal of Risk and Financial Management, 15(3), 136. [Google Scholar] [CrossRef]

- Asteriou, D., Pilbeam, K., & Tomuleasa, I. (2021). The impact of corruption, economic freedom, regulation and transparency on bank profitability and bank stability: Evidence from the Eurozone area. Journal of Economic Behavior and Organization, 184, 150–177. [Google Scholar] [CrossRef]

- Athari, S. A., & Bahreini, M. (2023). The impact of external governance and regulatory settings on the profitability of Islamic banks: Evidence from Arab markets. International Journal of Finance and Economics, 28(2), 2124–2147. [Google Scholar] [CrossRef]

- Batten, J., & Vo, X. V. (2019). Determinants of bank profitability—Evidence from vietnam. Emerging Markets Finance and Trade, 55(6), 1417–1428. [Google Scholar] [CrossRef]

- Belcaid, K., & Al-Faryan, M. A. S. (2024). Determinants of bank profitability in the context of financial liberalization: Evidence from Morocco. Business Perspectives and Research, 12(1), 164–180. [Google Scholar] [CrossRef]

- Ben Bouheni, F., Sidaoui, M., Leshchinskii, D., Zaremba, B., & Albashrawi, M. (2024). Banking-as-a-service? American and European G-SIBs performance. The Journal of Risk Finance, 25(5), 840–869. [Google Scholar] [CrossRef]

- Bi, H. H. (2023). Four problems of the h-index for assessing the research productivity and impact of individual authors. Scientometrics, 128, 2677–2691. [Google Scholar] [CrossRef]

- Bornmann, L., Mutz, R., Neuhaus, C., & Daniel, H. D. (2008). Citation counts for research evaluation: Standards of good practice for analyzing bibliometric data and presenting and interpreting results. Ethics in Science and Environmental Politics, 8(1), 93–102. [Google Scholar] [CrossRef]

- Bourke, P. (1989). Concentration and other determinants of bank profitability in Europe, North America and Australia. Journal of Banking and Finance, 13, 65–79. [Google Scholar] [CrossRef]

- Callon, M. (1984). Some elements of a sociology of translation: Domestication of the scallops and the fishermen of St Brieuc Bay. The Sociological Review, 32(1_suppl), 196–233. [Google Scholar] [CrossRef]

- Campmas, A. (2020). How do European banks portray the effect of policy interest rates and prudential behavior on profitability? Research in International Business and Finance, 51, 100950. [Google Scholar] [CrossRef]

- Cantú, C., Claessens, S., & Gambacorta, L. (2022). How do bank-specific characteristics affect lending? New evidence based on credit registry data from Latin America. Journal of Banking & Finance, 135, 105818. [Google Scholar] [CrossRef]

- Căpraru, B., & Ihnatov, I. (2014). Banks’ profitability in selected Central and Eastern European countries. Procedia Economics and Finance, 16, 587–591. [Google Scholar] [CrossRef]

- Chhaidar, A., Abdelhedi, M., & Abdelkafi, I. (2023). The effect of financial technology investment level on European Banks’ profitability. Journal of the Knowledge Economy, 14(3), 2959–2981. [Google Scholar] [CrossRef] [PubMed]

- Chukwuogor, C., Anoruo, E., & Ndu, I. (2021). An empirical analysis of the determinants of the U.S. banks’ profitability. Banks and Bank Systems, 16(4), 209–217. [Google Scholar] [CrossRef]

- Cornelli, G., Frost, J., Gambacorta, L., Rau, P. R., Wardrop, R., & Ziegler, T. (2023). Fintech and big tech credit: Drivers of the growth of digital lending. Journal of Banking & Finance, 148, 106742. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A., & Huizinga, H. (1999). Determinants of commercial bank interest margins and profitability: Some international evidence. The World Bank Economic Review, 13, 379–408. [Google Scholar] [CrossRef]

- Dietrich, A., & Wanzenried, G. (2011). Determinants of bank profitability before and during the crisis: Evidence from Switzerland. Journal of International Financial Markets, Institutions and Money, 21(3), 307–327. [Google Scholar] [CrossRef]

- Duan, Y., & Niu, J. (2020). Liquidity creation and bank profitability. The North American Journal of Economics and Finance, 54, 101250. [Google Scholar] [CrossRef]

- Egghe, L. (2006). Theory and practise of the g-index. Scientometrics, 69, 131–152. [Google Scholar] [CrossRef]

- El-Chaarani, H., Abraham, R., & Azzi, G. (2023). The role of liquidity creation in managing the COVID-19 banking crisis in selected Mena countries. International Journal of Financial Studies, 11(1), 39. [Google Scholar] [CrossRef]

- Figlewski, S., Frydman, H., & Liang, W. (2012). Modeling the effect of macroeconomic factors on corporate default and credit rating transitions. International Review of Economics & Finance, 21(1), 87–105. [Google Scholar] [CrossRef]

- Foos, D., Norden, L., & Weber, M. (2010). Loan growth and riskiness of banks. Journal of Banking & Finance, 34(12), 2929–2940. [Google Scholar] [CrossRef]

- García-Herrero, A., Gavilá, S., & Santabárbara, D. (2009). What explains the low profitability of Chinese banks? Journal of Banking and Finance, 33(11), 2080–2092. [Google Scholar] [CrossRef]

- Grose, C., Kanella, A., Kargidis, T., Mocanu, M., & Spyridis, Τ. (2021). Determinants of bank profitability in UK on the eve of the brexit. In The changing financial landscape: Financial performance analysis of real and banking sectors in Europe (pp. 187–203). Springer. [Google Scholar]

- Gržeta, I., Žiković, S., & Tomas Žiković, I. (2023). Size matters: Analyzing bank profitability and efficiency under the Basel III framework. Financial Innovation, 9(1), 43. [Google Scholar] [CrossRef]

- Gurol, B., & Lagasio, V. (2023). Women board members’ impact on ESG disclosure with environment and social dimensions: Evidence from the European banking sector. Social Responsibility Journal, 19(1), 211–228. [Google Scholar] [CrossRef]

- Haddad, C., & Hornuf, L. (2023). How do fintech startups affect financial institutions’ performance and default risk? European Journal of Finance, 29, 1761–1792. [Google Scholar] [CrossRef]

- Hasan, R., & Ashfaq, M. (2021). Corruption and its diverse effect on credit risk: Global evidence. Future Business Journal, 7(1), 18. [Google Scholar] [CrossRef]

- Heitmann, D., Chowdhury, M. A. F., & Islam, M. S. (2023). Heterogeneous impact of COVID-19 on the US banking sector. The North American Journal of Economics and Finance, 68, 101990. [Google Scholar] [CrossRef]

- Hirsch, J. E. (2005). An index to quantify an individual’s scientific research output. Proceedings of the National Academy of Sciences of the United States of America, 102, 16569–16572. [Google Scholar] [CrossRef] [PubMed]

- Horobet, A., Radulescu, M., Belaşcu, L., & Dita, S. (2021). Determinants of bank profitability in CEE countries: Evidence from GMM panel data estimates. Journal of Risk and Financial Management, 14, 307. [Google Scholar] [CrossRef]

- Horvat, A. M., Milenković, N., Radovanov, B., Zelenović, V., & Milić, D. (2023). DEA efficiency of Serbian banks-comparison of three approaches. Anali Ekonomskog Fakulteta u Subotici, 59(50), 19–35. [Google Scholar] [CrossRef]

- Hossain, M. S., & Ahamed, F. (2021). Comprehensive analysis on determinants of bank profitability in Bangladesh. arXiv, arXiv:2105.14198. [Google Scholar] [CrossRef]

- Houston, J. F., Lin, C., Lin, P., & Ma, Y. (2010). Creditor rights, information sharing, and bank risk taking. Journal of Financial Economics, 96(3), 485–512. [Google Scholar] [CrossRef]

- Jiang, L., & Ji, M. (2023). Risk management committee and bank performance: Evidence from the adoption of the Dodd–Frank Act. Journal of Business Finance and Accounting, 51, 1762–1788. [Google Scholar] [CrossRef]

- Jigeer, S., & Koroleva, E. (2023). The determinants of profitability in the city commercial banks: Case of China. Risks, 11(3), 53. [Google Scholar] [CrossRef]

- Katsiampa, P., McGuinness, P. B., Serbera, J. P., & Zhao, K. (2022). The financial and prudential performance of Chinese banks and Fintech lenders in the era of digitalization. Review of Quantitative Finance and Accounting, 58(4), 1451–1503. [Google Scholar] [CrossRef]

- Kumar, V., Thrikawala, S., & Acharya, S. (2022). Financial inclusion and bank profitability: Evidence from a developed market. Global Finance Journal, 53, 100609. [Google Scholar] [CrossRef]

- Kushairi, N., & Ahmi, A. (2021). Flipped classroom in the second decade of the Millenia: A Bibliometrics analysis with Lotka’s law. Education and Information Technologies, 26(4), 4401–4431. [Google Scholar] [CrossRef] [PubMed]

- Laengle, S., Merigó, J. M., Miranda, J., Słowiński, R., Bomze, I., Borgonovo, E., Dyson, R. G., Oliveira, J. F., & Teunter, R. (2017). Forty years of the European Journal of Operational Research: A bibliometric overview. European Journal of Operational Research, 262(3), 803–816. [Google Scholar] [CrossRef]

- Martynova, N., Ratnovski, L., & Vlahu, R. (2020). Bank profitability, leverage constraints, and risk-taking. Journal of Financial Intermediation, 44, 100821. [Google Scholar] [CrossRef]

- Menicucci, E., & Paolucci, G. (2016). The determinants of bank profitability: Empirical evidence from European banking sector. Journal of Financial Reporting and Accounting, 14, 86–115. [Google Scholar] [CrossRef]

- Migliardo, C., & Forgione, A. F. (2018). Ownership structure and bank performance in EU-15 countries. Corporate Governance (Bingley), 18(3), 509–530. [Google Scholar] [CrossRef]

- Milojević, S., Milašinović, M., Mitrović, A., Ognjanović, J., Raičević, J., Zdravković, N., Knežević, S., & Grivec, M. (2023). Board gender diversity and banks profitability for business viability: Evidence from Serbia. Sustainability, 15(13), 10501. [Google Scholar] [CrossRef]

- Mirović, V., Kalaš, B., Milenković, N., Andrašić, J., & Đaković, M. (2024). Modelling profitability determinants in the banking sector: The case of the Eurozone. Mathematics, 12(6), 897. [Google Scholar] [CrossRef]

- Mirza, N., Umar, M., Afzal, A., & Firdousi, S. F. (2023). The role of fintech in promoting green finance, and profitability: Evidence from the banking sector in the euro zone. Economic Analysis and Policy, 78, 33–40. [Google Scholar] [CrossRef]

- Molyneux, P., Pancotto, L., Reghezza, A., & Rodriguez d’Acri, C. (2022). Interest rate risk and monetary policy normalisation in the euro area. Journal of International Money and Finance, 124, 102624. [Google Scholar] [CrossRef]

- Molyneux, P., Reghezza, A., & Xie, R. (2019). Bank margins and profits in a world of negative rates. Journal of Banking & Finance, 107, 105613. [Google Scholar] [CrossRef]

- Molyneux, P., & Thornton, J. (1992). Determinants of European bank profitability: A note. Journal of Banking and Finance, 16, 1173–1178. [Google Scholar] [CrossRef]

- Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: Opportunities and risks. International Review of Financial Analysis, 81, 102103. [Google Scholar] [CrossRef]

- Naceur, S. B., & Omran, M. (2011). The effects of bank regulations, competition, and financial reforms on banks’ performance. Emerging Markets Review, 12(1), 1–20. [Google Scholar] [CrossRef]

- Nguyen, L., Tran, S., & Ho, T. (2022). Fintech credit, bank regulations and bank performance: A cross-country analysis. Asia-Pacific Journal of Business Administration, 14(4), 445–466. [Google Scholar] [CrossRef]

- Olmo, B. T., Saiz, M. C., & Azofra, S. S. (2021). Sustainable banking, market power, and efficiency: Effects on banks’ profitability and risk. Sustainability, 13(3), 1298. [Google Scholar] [CrossRef]

- Ozili, P. K., & Arun, T. G. (2023). Does economic policy uncertainty affect bank profitability? International Journal of Managerial Finance, 19(4), 803–830. [Google Scholar] [CrossRef]

- Ozili, P. K., & Uadiale, O. (2017). Ownership concentration and bank profitability. Future Business Journal, 3(2), 159–171. [Google Scholar] [CrossRef]

- Present, T., Simoens, M., & Vander Vennet, R. (2023). European bank margins at the zero lower bound. Journal of International Money and Finance, 131, 102803. [Google Scholar] [CrossRef]

- Sahyouni, A., & Wang, M. (2019). Liquidity creation and bank performance: Evidence from MENA. ISRA International Journal of Islamic Finance, 11(1), 27–45. [Google Scholar] [CrossRef]

- Saleh, B., & Paz, V. (2023). Credit risk management and profitability: Evidence from Palestinian banks. Banks and Bank Systems, 18, 25–34. [Google Scholar] [CrossRef]

- Serkbayeva, Z., Zhumabayeva, M., Kassenova, G., Karimbayeva, G., Faizulayev, A., & Kulumbetova, D. (2024). Examining the impact of fintech and other factors on banking practices: QISMUT+ 3 countries. Cogent Business & Management, 11(1), 2385069. [Google Scholar] [CrossRef]

- Shamsul Alam, S. M., Chowdhury, M. A., & Razak, D. B. (2021). Research evolution in banking performance: A bibliometric analysis. Future Business Journal, 7(1), 66. [Google Scholar] [CrossRef]

- Short, B. K. (1979). The relation between commercial bank profit rates and banking concentration in Canada, Western Europe, and Japan. Journal of Banking & Finance, 3(3), 209–219. [Google Scholar]

- Shrestha, P. (2022). Effect of Credit Risk on Profitability of Nepalese Commercial Banks. Butwal Campus Journal, 5, 1–11. [Google Scholar] [CrossRef]

- Swanson, A., & Zanzalari, D. (2020). Do local labor market conditions impact bank profitability? Monetary Economics: Financial System & Institutions eJournal, 39, 314–333. [Google Scholar] [CrossRef]

- Syed, A. M., & Bawazir, H. S. (2021). Recent trends in business financial risk–A bibliometric analysis. Cogent Economics and Finance, 9(1), 1913877. [Google Scholar] [CrossRef]

- Tan, Y. (2016). The impacts of risk and competition on bank profitability in China. Journal of International Financial Markets, Institutions and Money, 40, 85–110. [Google Scholar] [CrossRef]

- Tan, Y., & Floros, C. (2012). Bank profitability and inflation: The case of China. Journal of Economic Studies, 39, 675–696. [Google Scholar] [CrossRef]

- Tarawneh, A., Abdul-Rahman, A., Amin, S., & Ghazali, M. (2024). A systematic review of fintech and banking profitability. International Journal of Financial Studies, 12(1), 3. [Google Scholar] [CrossRef]

- Thinh, T., Thuy, L., & Tuan, D. (2022). The impact of liquidity on profitability—Evidence of Vietnamese listed commercial banks. Banks and Bank Systems, 17, 94–103. [Google Scholar] [CrossRef] [PubMed]

- Thorbecke, W. (2021). Non-traditional monetary policy and the future of the financial industries. International Journal of Economic Policy Studies, 15(1), 5–21. [Google Scholar] [CrossRef]

- Tran, V., Lin, C., & Nguyen, H. (2016). Liquidity creation, regulatory capital, and bank profitability. International Review of Financial Analysis, 48, 98–109. [Google Scholar] [CrossRef]

- Vennet, R. V. (2002). Cost and profit efficiency of financial conglomerates and universal banks in Europe. Journal of Money, Credit and Banking, 34, 254–282. Available online: https://www.jstor.org/stable/3270685 (accessed on 28 May 2025).

- Wang, L. (2023). Central bank asset purchases, banks’ risky security holdings and profitability: Macro and micro evidence from Japan and the U.S. International Review of Economics and Finance, 87, 347–364. [Google Scholar] [CrossRef]

- Zhao, J., Yu, X. C.-H., Chen, S., & Lee, C.-C. (2022). Riding the FinTech innovation wave: FinTech, patents and bank performance. Journal of International Money and Finance, 122, 102552. [Google Scholar] [CrossRef]

- Zimmerman, G. C. (1996). Factors influencing community bank performance in California. Economic Review-Federal Reserve Bank of San Francisco, 26–40. [Google Scholar]

| Journal | h_index | g_index | TCs | NP |

|---|---|---|---|---|

| Journal of Banking and Finance | 21 | 27 | 2776 | 27 |

| International Journal of Financial Studies | 8 | 13 | 174 | 14 |

| Cogent Economics and Finance | 7 | 11 | 143 | 15 |

| Journal of Risk and Financial Management | 7 | 11 | 143 | 15 |

| Research in International Business and Finance | 6 | 8 | 143 | 8 |

| International Journal of Financial and Economics | 6 | 8 | 112 | 8 |

| Journal of Financial Stability | 6 | 7 | 466 | 7 |

| Journal of Money Credit and and Banking | 6 | 6 | 468 | 6 |

| Applied Economics | 5 | 9 | 179 | 9 |

| Quarterly Review of Economics and Finance | 5 | 7 | 59 | 10 |

| North American Journal of Economics and Finance | 5 | 7 | 87 | 7 |

| Sustainability | 5 | 7 | 59 | 8 |

| International Journal of Emerging Markets | 5 | 7 | 58 | 8 |

| Journal of Financial Services Research | 5 | 6 | 148 | 6 |

| Finance Research Letters | 4 | 9 | 82 | 10 |

| Authors | h_index | g_index | TCs | NP |

|---|---|---|---|---|

| Tan | 7 | 8 | 354 | 8 |

| Haris | 5 | 7 | 42 | 3 |

| Ozili | 4 | 6 | 139 | 6 |

| Lee | 4 | 5 | 78 | 5 |

| Gambacorta | 4 | 4 | 392 | 4 |

| Tariq | 4 | 4 | 116 | 4 |

| Molyneux | 3 | 4 | 494 | 4 |

| Le | 3 | 4 | 39 | 4 |

| Yao | 3 | 3 | 73 | 3 |

| Sufian | 3 | 3 | 62 | 3 |

| Kumar | 3 | 3 | 42 | 3 |

| Agbloyor | 3 | 3 | 28 | 3 |

| Abbas | 2 | 3 | 50 | 3 |

| Bolarinwa | 2 | 3 | 29 | 3 |

| Acharya | 2 | 2 | 37 | 2 |

| 1st Author | Title | TCs | TCs per Year |

|---|---|---|---|

| Demirgüç-Kunt and Huizinga (1999) | Determinants of Commercial Bank Interest Margins and Profitability: Some international Evidence | 649 | 25.96 |

| Houston et al. (2010) | Creditor rights, information sharing, and bank risk taking | 421 | 30.07 |

| Molyneux and Thornton (1992) | Determinants of European bank profitability: A note | 377 | 11.78 |

| Dietrich & Wanzenried (2011) | Determinants of bank profitability before and during the crisis: Evidence from Switzerland | 352 | 27.08 |

| Bourke (1989) | Concentration and other determinants of bank profitability in Europe, North America and Australia | 333 | 9.51 |

| García-Herrero et al. (2009) | What explains the low profitability of Chinese banks? | 263 | 18.79 |

| Foos et al. (2010) | Loan growth and riskiness of banks | 243 | 17.36 |

| Agarwal and Taffler (2008) | Comparing the performance of market-based and accounting-based bankruptcy prediction models | 237 | 14.81 |

| Tan (2016) | The impacts of risk and competition on bank profitability in China. | 193 | 24.13 |

| Vennet (2002) | Cost and profit efficiency of financial conglomerates and universal banks in Europe | 187 | 8.5 |

| Naceur and Omran (2011) | The effects of bank regulations, competition, and financial reforms on banks’ performance | 182 | 14 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sousa, F.; Almeida, L. Banking Profitability: Evolution and Research Trends. Int. J. Financial Stud. 2025, 13, 139. https://doi.org/10.3390/ijfs13030139

Sousa F, Almeida L. Banking Profitability: Evolution and Research Trends. International Journal of Financial Studies. 2025; 13(3):139. https://doi.org/10.3390/ijfs13030139

Chicago/Turabian StyleSousa, Francisco, and Luís Almeida. 2025. "Banking Profitability: Evolution and Research Trends" International Journal of Financial Studies 13, no. 3: 139. https://doi.org/10.3390/ijfs13030139

APA StyleSousa, F., & Almeida, L. (2025). Banking Profitability: Evolution and Research Trends. International Journal of Financial Studies, 13(3), 139. https://doi.org/10.3390/ijfs13030139