From Tweets to Trades: A Bibliometric and Systematic Review of Social Media’s Influence on Cryptocurrency

Abstract

1. Introduction

2. Methodology

2.1. Data Collection Method and Procedure

2.2. Data Analysis Techniques

3. Findings

3.1. Main Information About Data

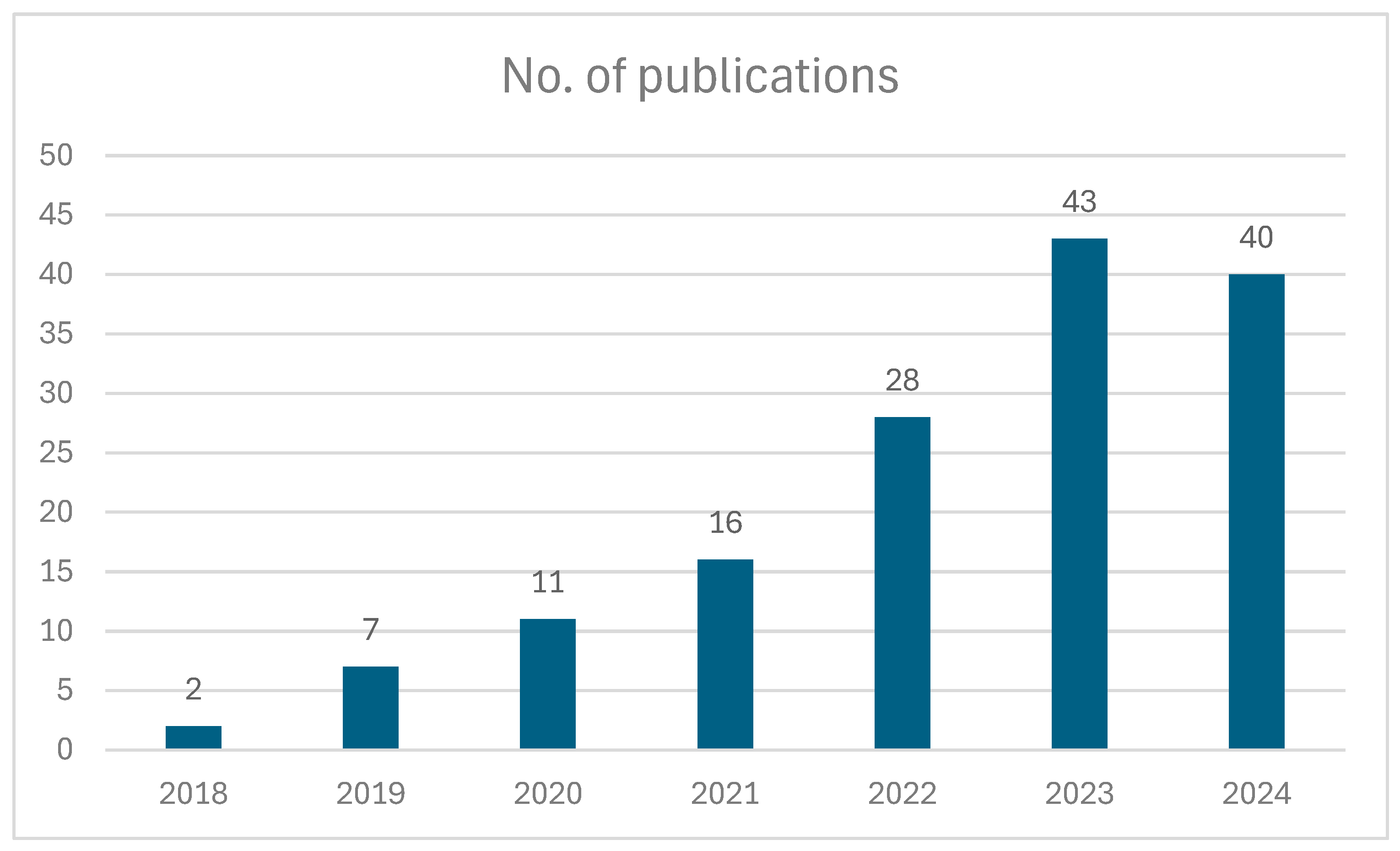

3.2. Publication Trends

- The paucity of early research in 2018–2020 probably caused skepticism regarding cryptocurrencies and their function in financial markets.

- Major cryptocurrency events, such as Bitcoin reaching an all-time high in regulatory talks and Elon Musk’s market-moving tweets, are correlated with a notable surge that began in 2021.

- The peak in 2023 (43 papers) denotes a surge in scholarly interest, suggesting that scholars understood the significance of social media and sentiment analysis in cryptocurrency valuation.

3.3. Top Articles, Authors, and Publishers

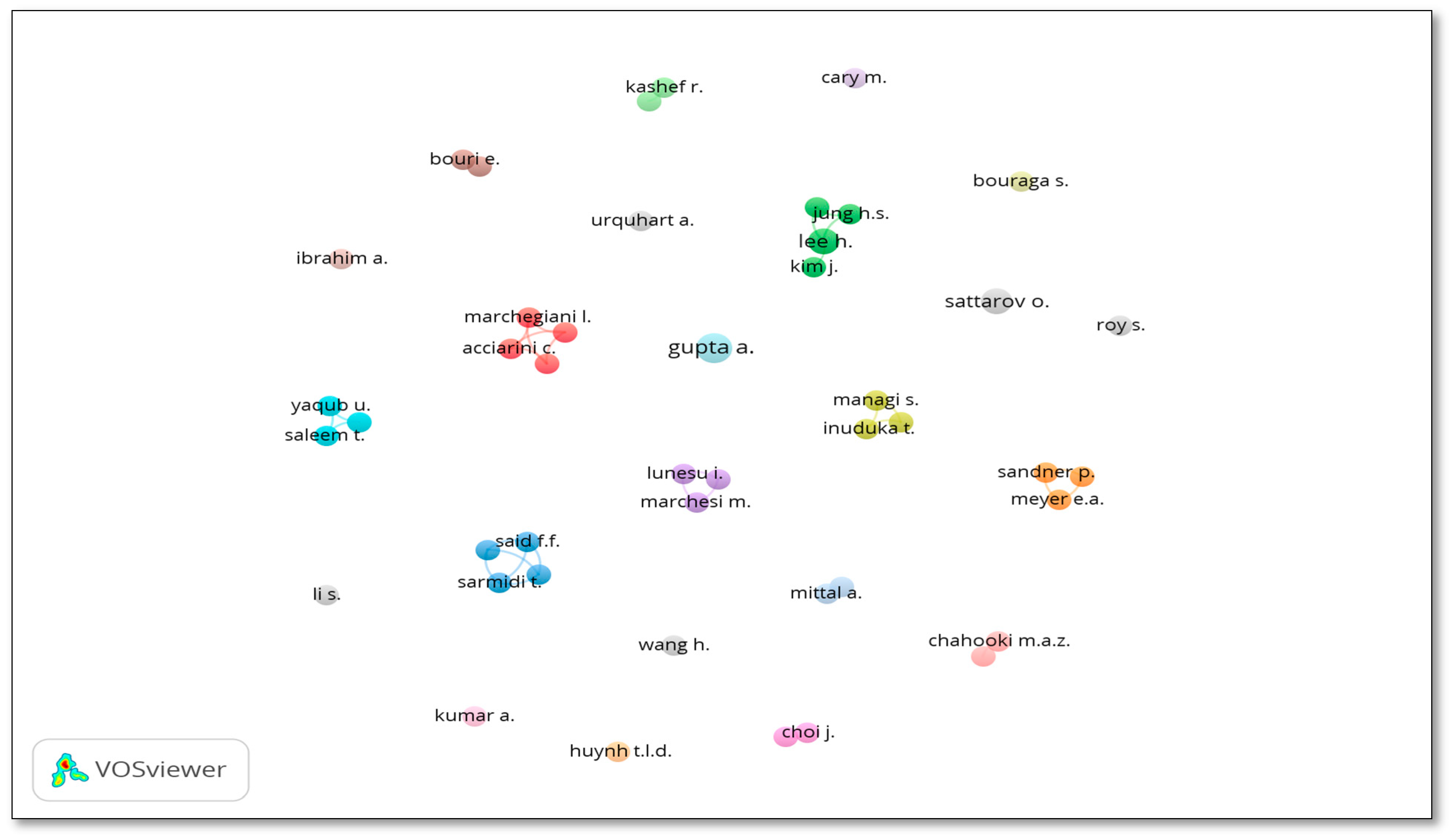

3.4. Co-Author Analysis

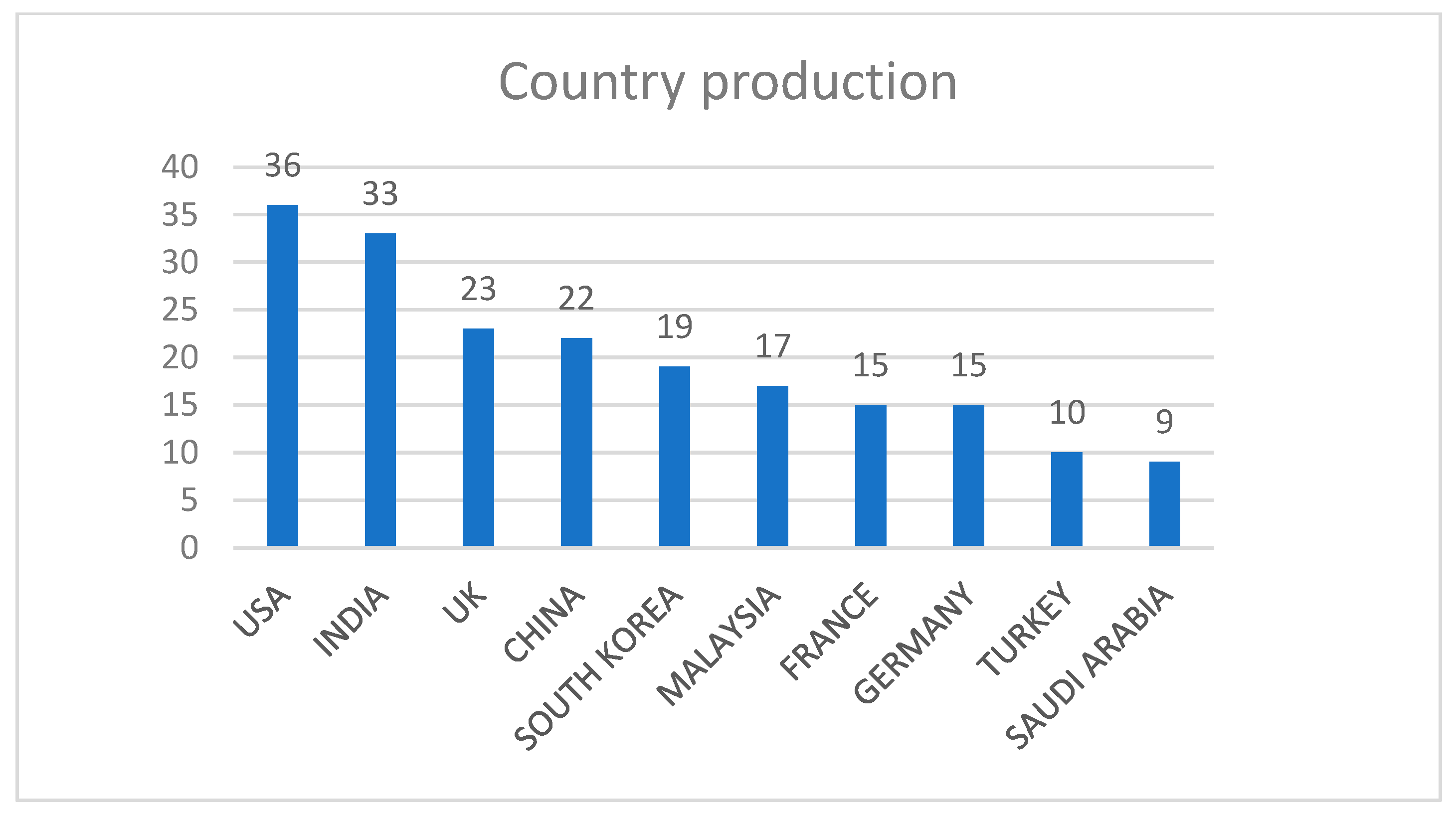

3.5. Country Analysis

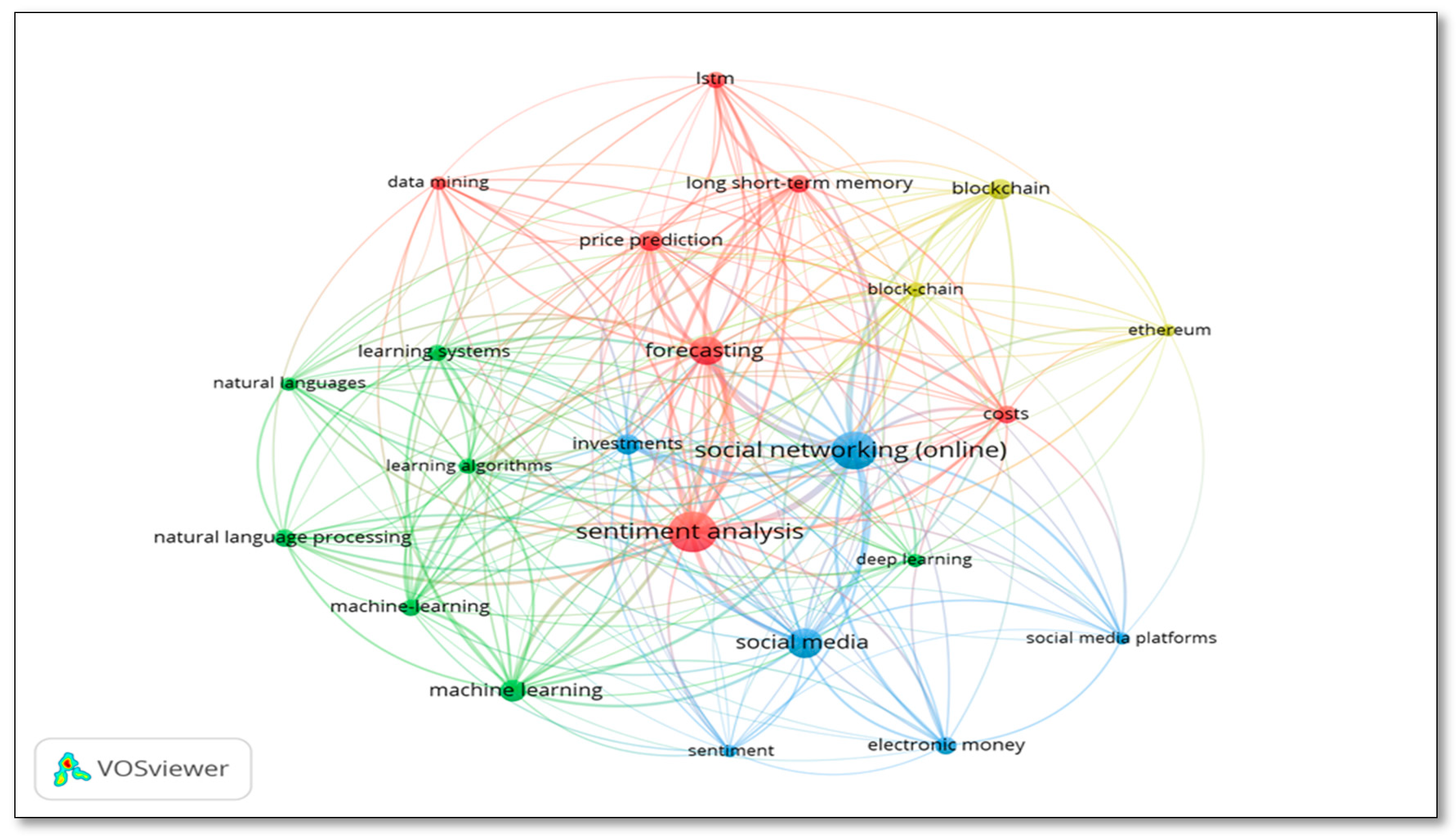

3.6. Keyword Analysis

- 1.

- Sentiment Analysis, Forecasting, and Market Prediction (red cluster)

- 2.

- Machine Learning, NLP, and Algorithmic Trading (green cluster)

- 3.

- Blockchain, Ethereum, and Investment Risks (yellow cluster)

- 4.

- Social Networking, Digital Influence, and Market Behavior (blue cluster)

3.7. Future Research Directions in Social Media Sentiment and Cryptocurrency Markets

- (1)

- Methodological Improvements and Analytical Advancements

- Explore transformer-based and deep learning models, such as LSTM networks, BERT, and GPT, for more precise sentiment classification and forecasting.

- Examine the potential use of explainable AI (XAI) methods to increase the transparency and trusworthiness of sentiment-based trading algorithms.

- Integration of misinformation detection algorithms into social media sentiment analysis frameworks.

- Adoption of high-frequency, real-time sentiment tracking techniques to improve market prediction accuracy.

- Development of trading models responsive to minute-by-minute sentiment shifts.

- Investigation into institutional and hedge fund usage of real-time sentiment data.

- Optimization of algorithmic trading models using social media sentiment for improved profit and risk management.

- (2)

- Multi-Platform and Multi-Cryptocurrency Sentiment Analysis

- Comparative analysis across platforms, such as Twitter, Reddit, Discord, YouTube, Telegram, and TikTok, and examine the sentiment dynamics unique to each platform and their differentiated impacts on cryptocurrency prices.

- Creation of sentiment aggregation models that function across multiple platforms.

- Investigation of how Reddit-based discussions (e.g., CryptoCurrency) influence long-term market trends compared to short-lived Twitter hype.

- Exploration of the contribution of Telegram trading groups and YouTube influencers to sentiment-driven price movements.

- Analysis of social sentiment impacts across multiple cryptocurrencies, including Ethereum, Binance Coin, Solana, Cardano, and emerging altcoins.

- Examination of meme coins (e.g., Dogecoin, Shiba Inu) affected disproportionately by viral marketing and influencer activity.

- (3)

- Regulatory Frameworks

- Future research should explore formulating ethical guidelines and policy recommendations to regulate influencer-driven financial discourse. This is crucial in current times as it causes sudden market fluctuations, which could distort market performance, intensify volatility, and weaken investors’ confidence.

- Develop regulatory frameworks that promote transparency and require disclosures from influential market participants (influencers) to prevent manipulative practices within the cryptocurrency ecosystem. Addressing these issues is crucial to enhancing market integrity and protecting vulnerable investors.

- Frameworks that balance investor protection and market freedom in light of sentiment-driven trading.

- Examination of governmental regulations (e.g., under the Trump Administration) and their effect on cryptocurrency markets.

- (4)

- The Role of Behavioral Finance and Investor Psychology

- Future research should adopt an integrated approach that combines machine learning-based sentiment analysis with behavioral and computational finance theories. This fusion would help explain irrational, sentiment-driven behavior in cryptocurrency markets by incorporating factors like herd behavior and FOMO, ultimately enhancing market analysis’s predictive accuracy and depth.

- Examine how social media influences FOMO (fear of missing out), contributing to irrational cryptocurrency trading decisions.

- Examine how social proof influences investment communities, where individuals base their financial decisions more on the recommendations of influencers than on technical analysis.

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 |

References

- Aharon, D. Y., Demir, E., Lau, C. K. M., & Zaremba, A. (2022). Twitter-Based uncertainty and cryptocurrency returns. Research in International Business and Finance, 59, 101546. [Google Scholar] [CrossRef]

- Ahmad, T., & Abbas, M. (2024). AI based cryptocurrency price prediction: A comparative analysis of traditional & deep learning models with sentiment integration [Master’s thesis, UIS]. [Google Scholar]

- Ali, H., Farman, H., Yar, H., Khan, Z., Habib, S., & Ammar, A. (2022). Deep learning-based election results prediction using Twitter activity. Soft Computing, 26(16), 7535–7543. [Google Scholar] [CrossRef]

- Ansari, Y., Arwab, M., Subhan, M., Alam, M. S., Hashmi, N. I., Hisam, M. W., & Zameer, M. N. (2022). Modeling socio-economic consequences of COVID-19: An evidence from bibliometric analysis. Frontiers in Environmental Science, 10, 941187. [Google Scholar] [CrossRef]

- Ante, L. (2023). How Elon Musk’s twitter activity moves cryptocurrency markets. Technological Forecasting and Social Change, 186, 122112. [Google Scholar] [CrossRef]

- Bennett, D., Mekelburg, E., Strauss, J., & Williams, T. H. (2024). Unlocking the black box of sentiment and cryptocurrency: What, which, why, when and how? Global Finance Journal, 60, 100945. [Google Scholar] [CrossRef]

- Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives, 29(2), 213–238. [Google Scholar] [CrossRef]

- Burra, Y. (2024). The influence of social media on financial markets: A comprehensive behavioral and quantitative analysis. International Journal of Current Business and Social Sciences, 10(5), 1–12. [Google Scholar]

- Cao, T., Yu, J., Decouchant, J., Luo, X., & Verissimo, P. (2020). Exploring the monero peer-to-peer network. In Financial cryptography and data security: 24th international conference, FC 2020, Kota Kinabalu, Malaysia, February 10–14, 2020 revised selected papers 24 (pp. 578–594). Springer International Publishing. [Google Scholar]

- Colombo, J. A., Akhter, T., Wanke, P., Azad, M. A. K., Tan, Y., Edalatpanah, S. A., & Antunes, J. (2023). Interplay of cryptocurrencies with financial and social media indicators: An entropy-weighted neural-MADM approach. Journal of Operational and Strategic Analytics, 1(4), 160–172. [Google Scholar] [CrossRef]

- Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 165, 28–34. [Google Scholar] [CrossRef]

- Dell’Erba, M. (2024). Crypto-Trading Platforms as Exchanges. Michigan State Law Review, 1. Available online: https://ssrn.com/abstract=4405361 (accessed on 8 February 2023). [CrossRef]

- Dhali, M., Hassan, S., Mehar, S. M., Shahzad, K., & Zaman, F. (2023). Cryptocurrency in the darknet: Sustainability of the current national legislation. International Journal of Law and Management, 65(3), 261–282. [Google Scholar] [CrossRef]

- Dhali, M., Hassan, S., & Zulhuda, S. (2024). The regulatory puzzle of decentralized cryptocurrencies: Opportunities for innovation and hurdles to overcome. Journal of Infrastructure, Policy and Development, 8(6), 3377. [Google Scholar] [CrossRef]

- Doğan, E., & Yalçıntaş, S. (2023). An empirical analysis of speculative behavior and the spillover effect in cryptocurrency markets. Journal of Research in Economics, 7(1), 1–21. [Google Scholar] [CrossRef]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Ejaz, H., Zeeshan, H. M., Ahmad, F., Bukhari, S. N. A., Anwar, N., Alanazi, A., Sadiq, A., Junaid, K., Atif, M., Abosalif, K. O. A., Iqbal, A., Hamza, M. A., & Younas, S. (2022). Bibliometric analysis of publications on the omicron variant from 2020 to 2022 in the Scopus database using R and VOSviewer. International Journal of Environmental Research and Public Health, 19(19), 12407. [Google Scholar] [CrossRef]

- Elsayed, A. H., Gozgor, G., & Yarovaya, L. (2022). Volatility and return connectedness of cryptocurrency, gold, and uncertainty: Evidence from the cryptocurrency uncertainty indices. Finance Research Letters, 47, 102732. [Google Scholar] [CrossRef]

- Ferreira, A., & Sandner, P. (2021). EU searches for regulatory answers to crypto assets and their place in the financial markets infrastructure. Computer Law & Security Review, 43, 105632. [Google Scholar]

- Foley, S., Karlsen, J. R., & Putniņš, T. J. (2019). Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies? The Review of Financial Studies, 32(5), 1798–1853. [Google Scholar] [CrossRef]

- Frans, M. N. (2024). Economic behavioral anomalies in cryptocurrency transactions during the COVID-19 pandemic. Social Science Studies, 4(4), 262–278. [Google Scholar] [CrossRef]

- Frediani, M. E. A. (2024). Crafting the future of finance: A comparative analysis of cryptocurrency regulation in the global economy. Journal of Financial Risk Management, 13(1), 193–206. [Google Scholar] [CrossRef]

- Gandal, N., & Halaburda, H. (2016). Can we predict the winner in a market with network effects? Competition in cryptocurrency market. Games, 7(3), 16. [Google Scholar] [CrossRef]

- George, A. S. (2024). Finance 4.0: The transformation of financial services in the digital age. Partners Universal Innovative Research Publication, 2(3), 104–125. [Google Scholar]

- Giudici, G., Milne, A., & Vinogradov, D. (2020). Cryptocurrencies: Market analysis and perspectives. Journal of Industrial and Business Economics, 47, 1–18. [Google Scholar] [CrossRef]

- Govindaraj, J., & Agarwal, S. (2022). Classification of various factors that have caused major fluctuations in cryptocurrency markets. SJCC Management Research Review, 12, 22–43. [Google Scholar]

- Grujić, M., & Vojinović, Ž. (2024). Investing in blockchain technologies and digital assets: Accounting perspectives. Anali Ekonomskog Fakulteta u Subotici, 60(52), 119–136. [Google Scholar] [CrossRef]

- Jalan, A., Matkovskyy, R., Urquhart, A., & Yarovaya, L. (2023). The role of interpersonal trust in cryptocurrency adoption. Journal of International Financial Markets, Institutions and Money, 83, 101715. [Google Scholar] [CrossRef]

- Karalevicius, V., Degrande, N., & De Weerdt, J. (2018). Using sentiment analysis to predict interday Bitcoin price movements. The Journal of Risk Finance, 19(1), 56–75. [Google Scholar] [CrossRef]

- Khatib, S. F., Abdullah, D. F., Elamer, A., Yahaya, I. S., & Owusu, A. (2023). Global trends in board diversity research: A bibliometric view. Meditari Accountancy Research, 31(2), 441–469. [Google Scholar] [CrossRef]

- Kraaijeveld, O., & De Smedt, J. (2020). The predictive power of public Twitter sentiment for forecasting cryptocurrency prices. Journal of International Financial Markets, Institutions and Money, 65, 101188. [Google Scholar] [CrossRef]

- Liu, Y., & Tsyvinski, A. (2021). Risks and returns of cryptocurrency. The Review of Financial Studies, 34(6), 2689–2727. [Google Scholar] [CrossRef]

- Low, R., & Marsh, T. (2019). Cryptocurrency and blockchains: Retail to institutional. The Journal of Investing, 29(1), 18–30. [Google Scholar] [CrossRef]

- Makarov, I., & Schoar, A. (2020). Trading and arbitrage in cryptocurrency markets. Journal of Financial Economics, 135(2), 293–319. [Google Scholar] [CrossRef]

- Meyer, E. A., Sandner, P., Cloutier, B., & Welpe, I. M. (2023). High on Bitcoin: Evidence of emotional contagion in the YouTube crypto influencer space. Journal of Business Research, 164, 113850. [Google Scholar] [CrossRef]

- Mikhaylov, A. (2020). Cryptocurrency market analysis from the open innovation perspective. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 197. [Google Scholar] [CrossRef]

- Naeem, M. A., Mbarki, I., & Shahzad, S. J. H. (2021). Predictive role of online investor sentiment for cryptocurrency market: Evidence from happiness and fears. International Review of Economics & Finance, 73, 496–514. [Google Scholar]

- Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 27 February 2025).

- Pano, T., & Kashef, R. (2020). A complete VADER-based sentiment analysis of bitcoin (BTC) tweets during the era of COVID-19. Big Data and Cognitive Computing, 4(4), 33. [Google Scholar] [CrossRef]

- Pathak, A. R., Pandey, M., & Rautaray, S. (2021). Topic-level sentiment analysis of social media data using deep learning. Applied Soft Computing, 108, 107440. [Google Scholar] [CrossRef]

- Patil, D., Rane, N. L., Desai, P., & Rane, J. (Eds.). (2024). Trustworthy artificial intelligence in industry and society. Deep Science Publishing. [Google Scholar]

- Philippas, D., Rjiba, H., Guesmi, K., & Goutte, S. (2019). Media attention and Bitcoin prices. Finance Research Letters, 30, 37–43. [Google Scholar] [CrossRef]

- Rauch, C. (2024). Fintech in capital markets. In The emerald handbook of fintech: Reshaping finance (pp. 381–396). Emerald Publishing Limited. [Google Scholar]

- Saiedi, E., Broström, A., & Ruiz, F. (2021). Global drivers of cryptocurrency infrastructure adoption. Small Business Economics, 57(1), 353–406. [Google Scholar] [CrossRef]

- Shahzad, S. J. H., Anas, M., & Bouri, E. (2022). Price explosiveness in cryptocurrencies and Elon Musk’s tweets. Finance Research Letters, 47, 102695. [Google Scholar] [CrossRef]

- Shen, D., Urquhart, A., & Wang, P. (2019). Does Twitter predict Bitcoin? Economics Letters, 174, 118–122. [Google Scholar] [CrossRef]

- Sundarasen, S., Zyznarska-Dworczak, B., & Goel, S. (2024). Sustainability reporting and greenwashing: A bibliometrics assessment in G7 and non-G7 nations. Cogent Business & Management, 11(1), 2320812. [Google Scholar]

- Symss, J. (2023). Can cryptocurrency solve the problem of financial constraint in corporates? A literature review and theoretical perspective. Qualitative Research in Financial Markets. [Google Scholar]

- Tandon, A., Aakash, A., Aggarwal, A. G., & Kapur, P. K. (2021). Analyzing the impact of review recency on helpfulness through econometric modeling. International Journal of System Assurance Engineering and Management, 12, 104–111. [Google Scholar] [CrossRef]

- Tian, Y., Adriaens, P., Minchin, R. E., Chang, C., Lu, Z., & Qi, C. (2020). Asset tokenization: A blockchain solution to financing infrastructure in emerging markets and developing economies. ADB-IGF special working paper series “Fintech to enable development, investment, financial inclusion, and sustainability”. Asian Development Bank. Available online: https://ssrn.com/abstract=3837703 (accessed on 27 February 2025).

- Valencia, F., Gómez-Espinosa, A., & Valdés-Aguirre, B. (2019). Price movement prediction of cryptocurrencies using sentiment analysis and machine learning. Entropy, 21(6), 589. [Google Scholar] [CrossRef] [PubMed]

- van der Merwe, A. (2021). Cryptocurrencies and other digital asset investments. In M. Pompella, & R. Matousek (Eds.), The palgrave handbook of fintech and blockchain (pp. 445–471). Palgrave Macmillan. [Google Scholar]

- Wilson, C. (2019). Cryptocurrencies: The future of finance? In Contemporary issues in international political economy (pp. 359–394). Springer Nature Singapore. [Google Scholar]

- Wołk, K. (2020). Advanced social media sentiment analysis for short-term cryptocurrency price prediction. Expert Systems, 37(2), e12493. [Google Scholar] [CrossRef]

- Wu, S. (2021). Co-movement and return spillover: Evidence from Bitcoin and traditional assets. SN Business & Economics, 1(10), 122. [Google Scholar]

| Description | Results |

|---|---|

| Timespan | 2018:2024 |

| Documents type: Articles | 151 |

| Annual Growth Rate % | 10.41 |

| Document Average Age | 2.55 |

| Average citations per doc | 19.71 |

| Keywords Plus (ID) | 538 |

| Author’s Keywords (DE) | 490 |

| Authors | 416 |

| Authors of single-authored docs | 25 |

| AUTHORS COLLABORATION | |

| Single-authored docs | 27 |

| Co-Authors per Doc | 2.99 |

| International co-authorships % | 29.8 |

| # | Title | Authors | Year | Source | Summary |

|---|---|---|---|---|---|

| 1 | Does Twitter Predict Bitcoin? [Shen et al. (2019)] | Shen D., Urquhart A., Wang P. | 2019 | Economics Letters (Elsevier B.V.) | Investigates the impact of Twitter activity on Bitcoin price, trading volume, and volatility using Granger causality tests. |

| 2 | The Predictive Power of Public Twitter Sentiment for Forecasting Cryptocurrency Prices [Kraaijeveld and De Smedt (2020)] | Kraaijeveld O., De Smedt J. | 2020 | Journal of International Financial Markets, Institutions and Money (Elsevier B.V.) | Uses sentiment analysis with a cryptocurrency-specific lexicon and Granger causality to study the predictive power of Twitter sentiment on multiple cryptocurrencies. |

| 3 | Price Movement Prediction of Cryptocurrencies Using Sentiment Analysis and Machine Learning [Valencia et al., 2019] | Valencia F., Gómez-Espinosa A., Valdés-Aguirre B. | 2019 | Entropy (MDPI) | Compares neural networks, SVM, and random forests for predicting cryptocurrency price movements based on Twitter sentiment. |

| 4 | Using Sentiment Analysis to Predict Interday Bitcoin Price Movements [Karalevicius et al., 2018] | Karalevicius V. | 2018 | Journal of Risk Finance (Emerald Publishing Limited) | Analyzes financial news articles and blog sentiment to predict Bitcoin price fluctuations. |

| 5 | A Complete VADER-Based Sentiment Analysis of Bitcoin (BTC) Tweets During COVID-19 [Pano & Kashef, 2020] | Pano T., Kashef R. | 2020 | Big Data and Cognitive Computing (MDPI) | Evaluates text preprocessing strategies for machine learning models predicting Bitcoin price trends. |

| 6 | Media Attention and Bitcoin Prices [Philippas et al. (2019)] | Philippas D., Rjiba H., Guesmi K., Goutte S. | 2019 | Finance Research Letters (Elsevier B.V.) | Uses a dual-process diffusion model to examine the impact of media attention from Twitter and Google Trends on Bitcoin prices. |

| 7 | Predictive Role of Online Investor Sentiment for Cryptocurrency Market [Naeem et al., 2021] | Naeem M.A., Mbarki I., Shahzad S.J.H. | 2021 | International Review of Economics and Finance (Elsevier B.V.) | Studies the impact of Twitter, happiness sentiment and FEARS index on cryptocurrency returns using quantile regression. |

| 8 | Topic-Level Sentiment Analysis of Social Media Data Using Deep Learning [Pathak et al., 2021] | Pathak A.R., Pandey M., Rautaray S. | 2021 | Applied Soft Computing (Elsevier B.V.) | Proposes a deep learning-based sentiment analysis model to assess cryptocurrency market sentiment at a topic level. |

| 9 | Advanced Social Media Sentiment Analysis for Short-Term Cryptocurrency Price Prediction [Wołk, 2020] | Wołk K. | 2020 | Expert Systems (Wiley, Hoboken, New Jersey, USA) | Uses machine learning techniques to analyze Twitter and Google Trends data for short-term cryptocurrency price forecasting. |

| 10 | How Elon Musk’s Twitter Activity Moves Cryptocurrency Markets [Ante, 2023] | Ante L. | 2023 | Technological Forecasting and Social Change (Elsevier B.V.) | Examines the market impact of Elon Musk’s tweets on cryptocurrency volatility. |

| 11 | How Can We Predict the Impact of Social Media Messages on Cryptocurrency? [Tandon et al., 2021] | Tandon C., Revankar S., Palivela H., Parihar S.S. | 2021 | International Journal of Information Management Data Insights (Elsevier B.V.) | Uses ARIMA models to analyze Twitter data and cryptocurrency prices. |

| 12 | Twitter-Based Uncertainty and Cryptocurrency Returns [Aharon et al., 2022] | Aharon D.Y., Demir E., Lau C.K.M., Zaremba A. | 2022 | Research in International Business and Finance (Elsevier B.V.) | Studies the effect of Twitter-based uncertainty on cryptocurrency market returns. |

| 13 | Price Explosiveness in Cryptocurrencies and Elon Musk’s Tweets [Shahzad et al., 2022] | Shahzad S.J.H., Anas M., Bouri E. | 2022 | Finance Research Letters (Elsevier B.V.) | Investigates price bubbles in Bitcoin and Dogecoin linked to Musk’s tweets. |

| 14 | The Role of Interpersonal Trust in Cryptocurrency Adoption [Jalan et al., 2023] | Jalan A., Matkovskyy R., Urquhart A., Yarovaya L. | 2023 | Journal of International Financial Markets (Elsevier B.V.) | Analyzes the influence of trust on cryptocurrency adoption. |

| 15 | High on Bitcoin: Emotional Contagion in the YouTube Crypto Influencer Space [Meyer et al., 2023] | Meyer E.A., Sandner P., Cloutier B., Welpe I.M. | 2023 | Journal of Business Research (Elsevier B.V.) | Investigates the emotional influence of YouTube crypto influencers on viewers. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sundarasen, S.; Saleem, F. From Tweets to Trades: A Bibliometric and Systematic Review of Social Media’s Influence on Cryptocurrency. Int. J. Financial Stud. 2025, 13, 87. https://doi.org/10.3390/ijfs13020087

Sundarasen S, Saleem F. From Tweets to Trades: A Bibliometric and Systematic Review of Social Media’s Influence on Cryptocurrency. International Journal of Financial Studies. 2025; 13(2):87. https://doi.org/10.3390/ijfs13020087

Chicago/Turabian StyleSundarasen, Sheela, and Farida Saleem. 2025. "From Tweets to Trades: A Bibliometric and Systematic Review of Social Media’s Influence on Cryptocurrency" International Journal of Financial Studies 13, no. 2: 87. https://doi.org/10.3390/ijfs13020087

APA StyleSundarasen, S., & Saleem, F. (2025). From Tweets to Trades: A Bibliometric and Systematic Review of Social Media’s Influence on Cryptocurrency. International Journal of Financial Studies, 13(2), 87. https://doi.org/10.3390/ijfs13020087