Voluntary International Financial Reporting Standards Application: A Bibliometric Review and Future Research Directions

Abstract

1. Introduction

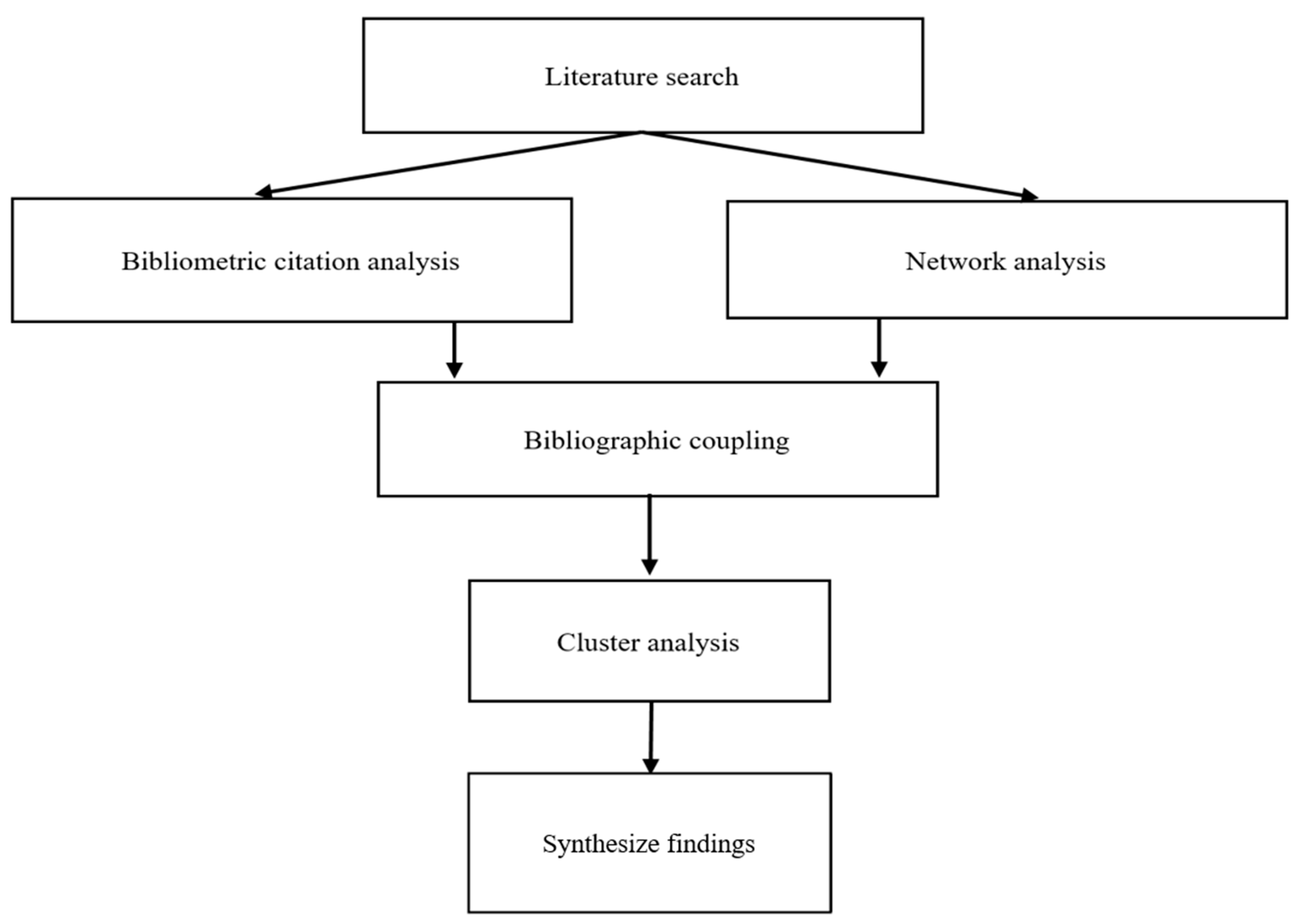

2. Research Methodology

2.1. Bibliometric Analysis

2.2. Research Data

2.3. Research Method

3. Results

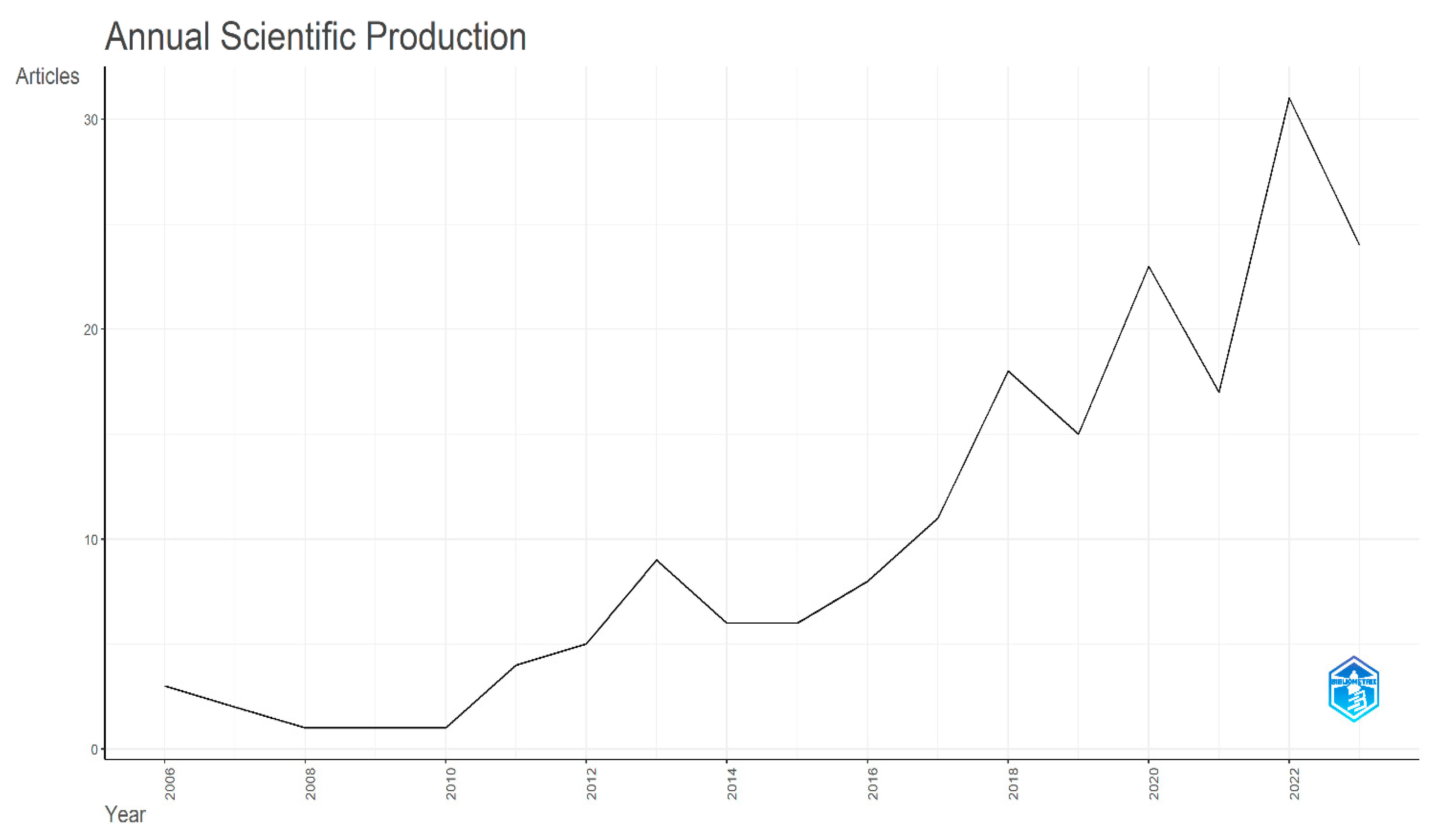

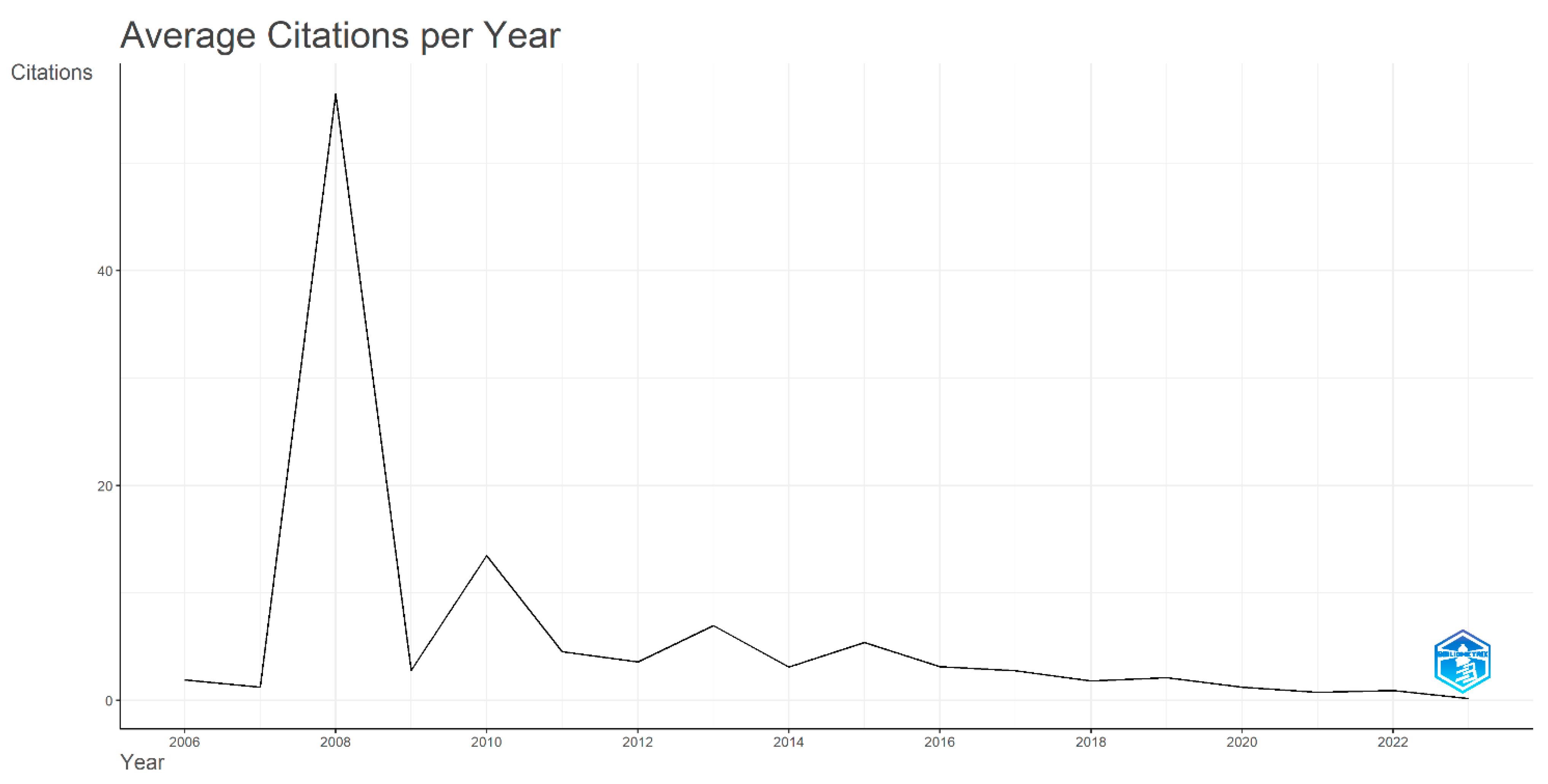

3.1. Examination of the Dataset

3.2. Performance Analysis

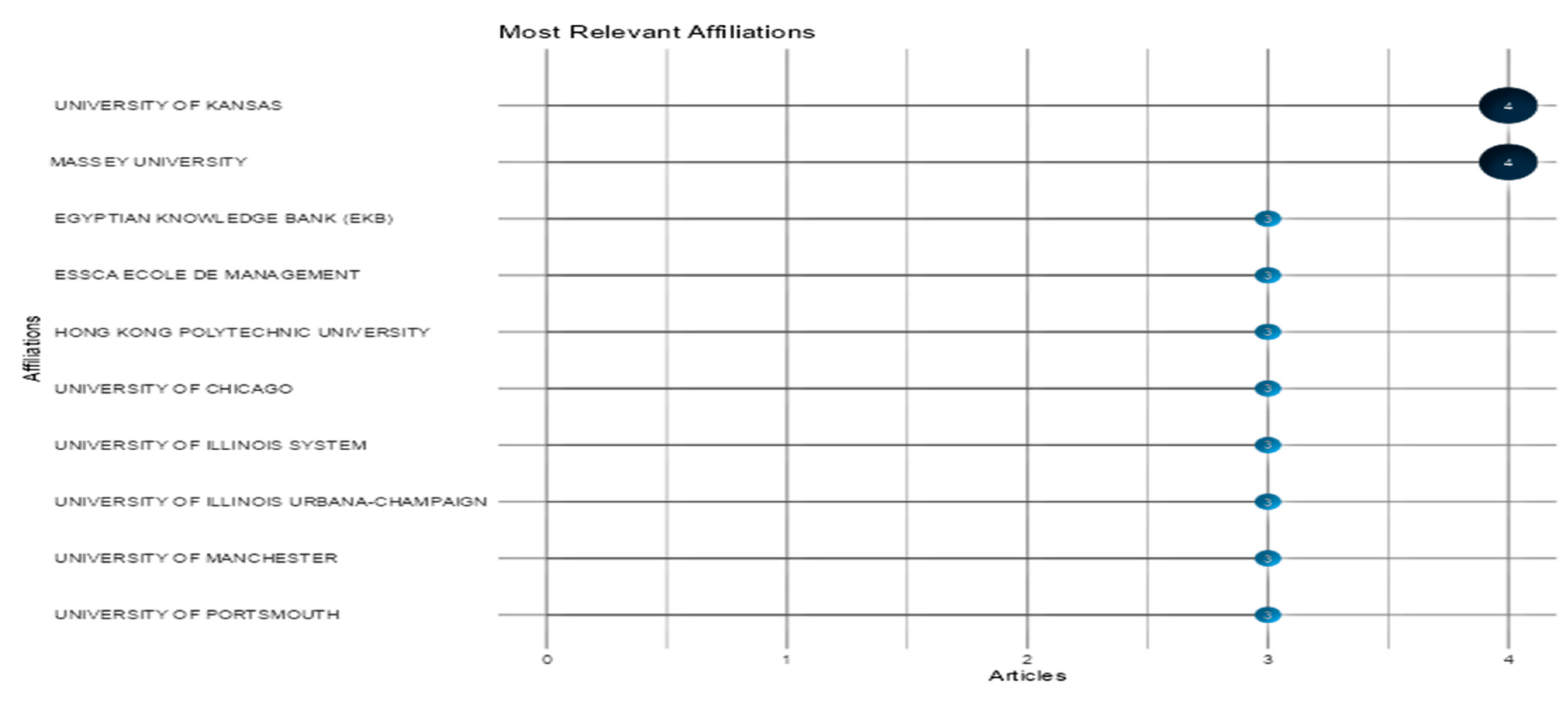

3.2.1. Authors with the Highest Impact

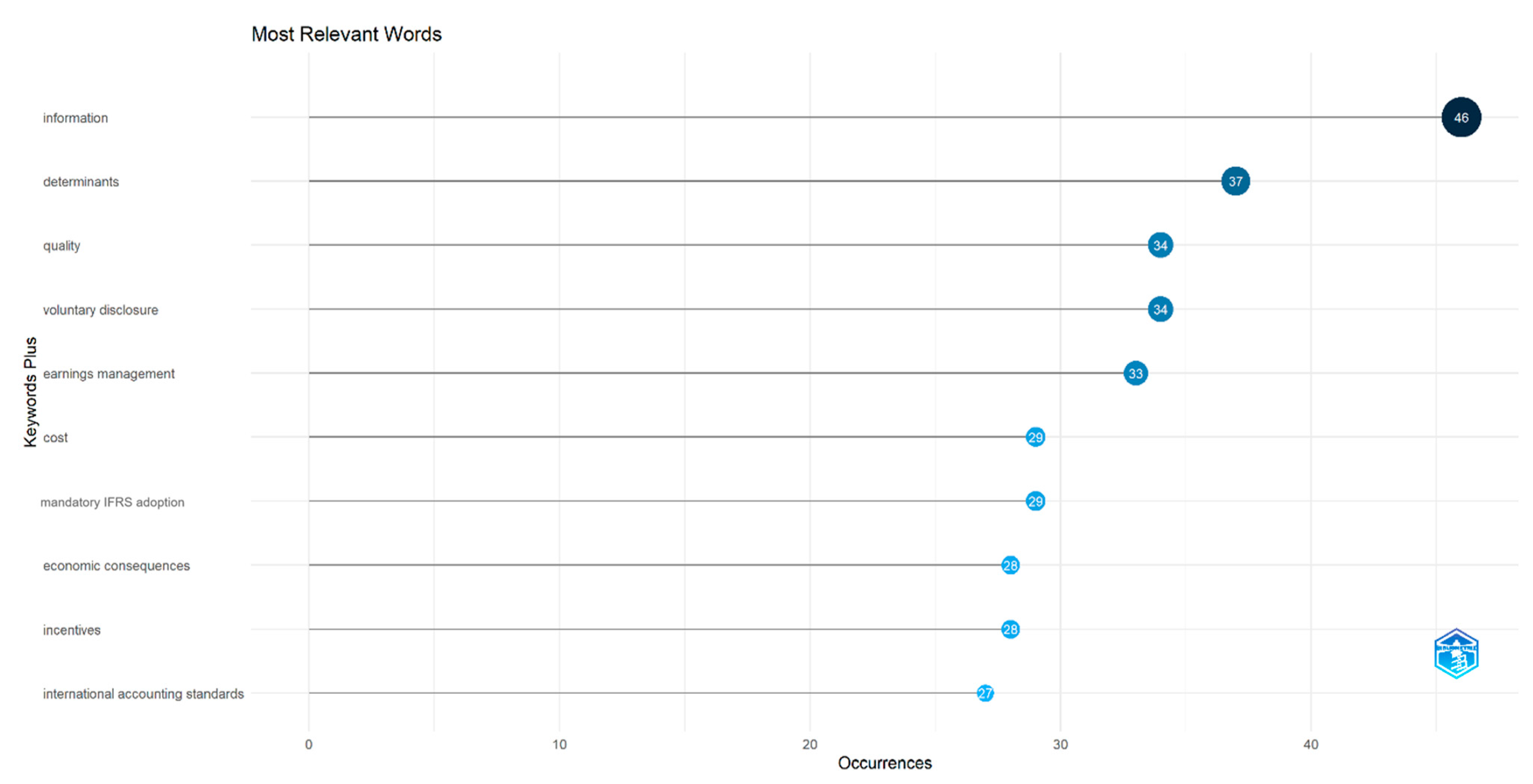

3.2.2. Key Documents and the Most Frequently Utilized Words in the Dataset

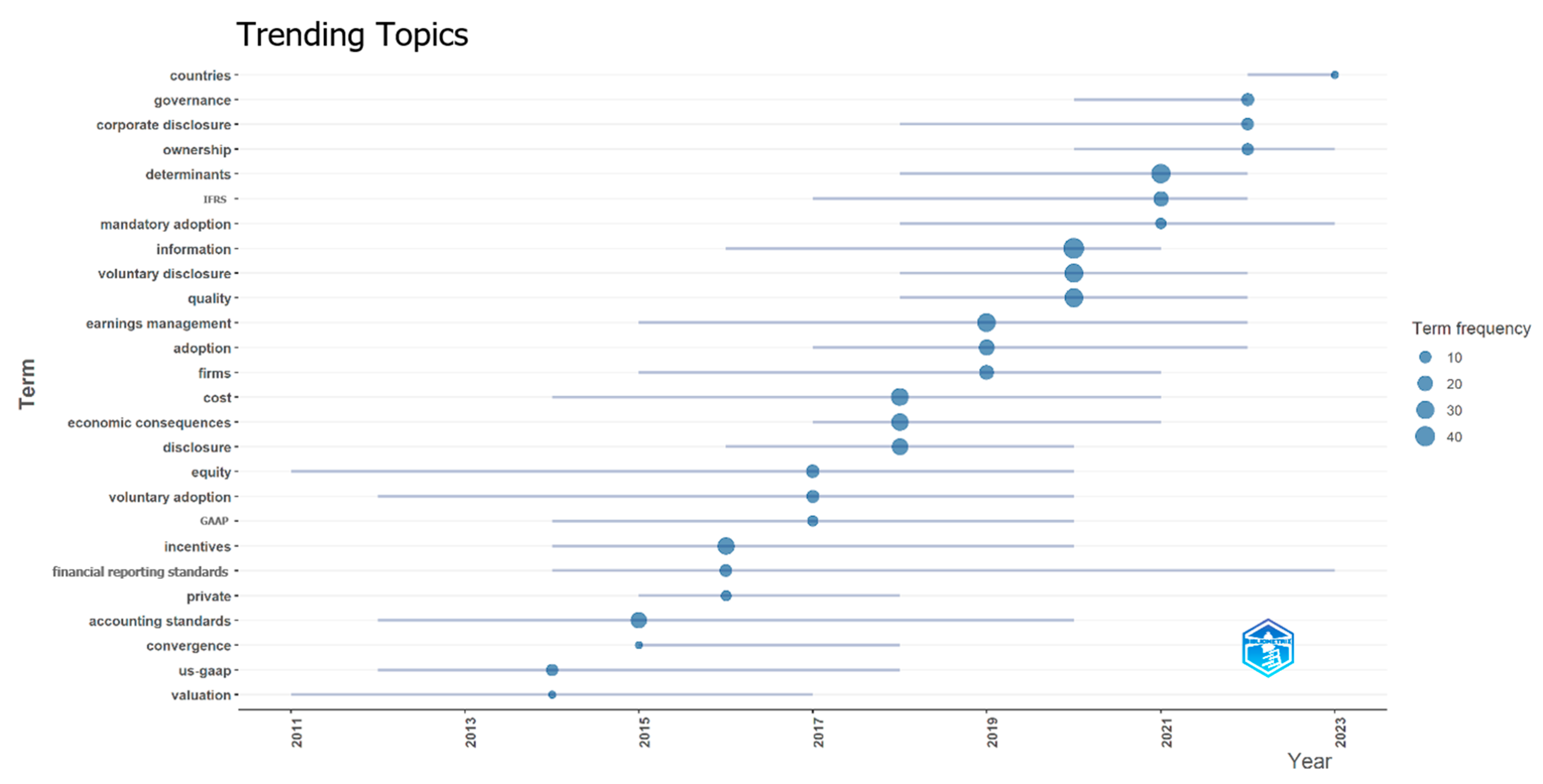

3.3. Scientific Mapping Analysis

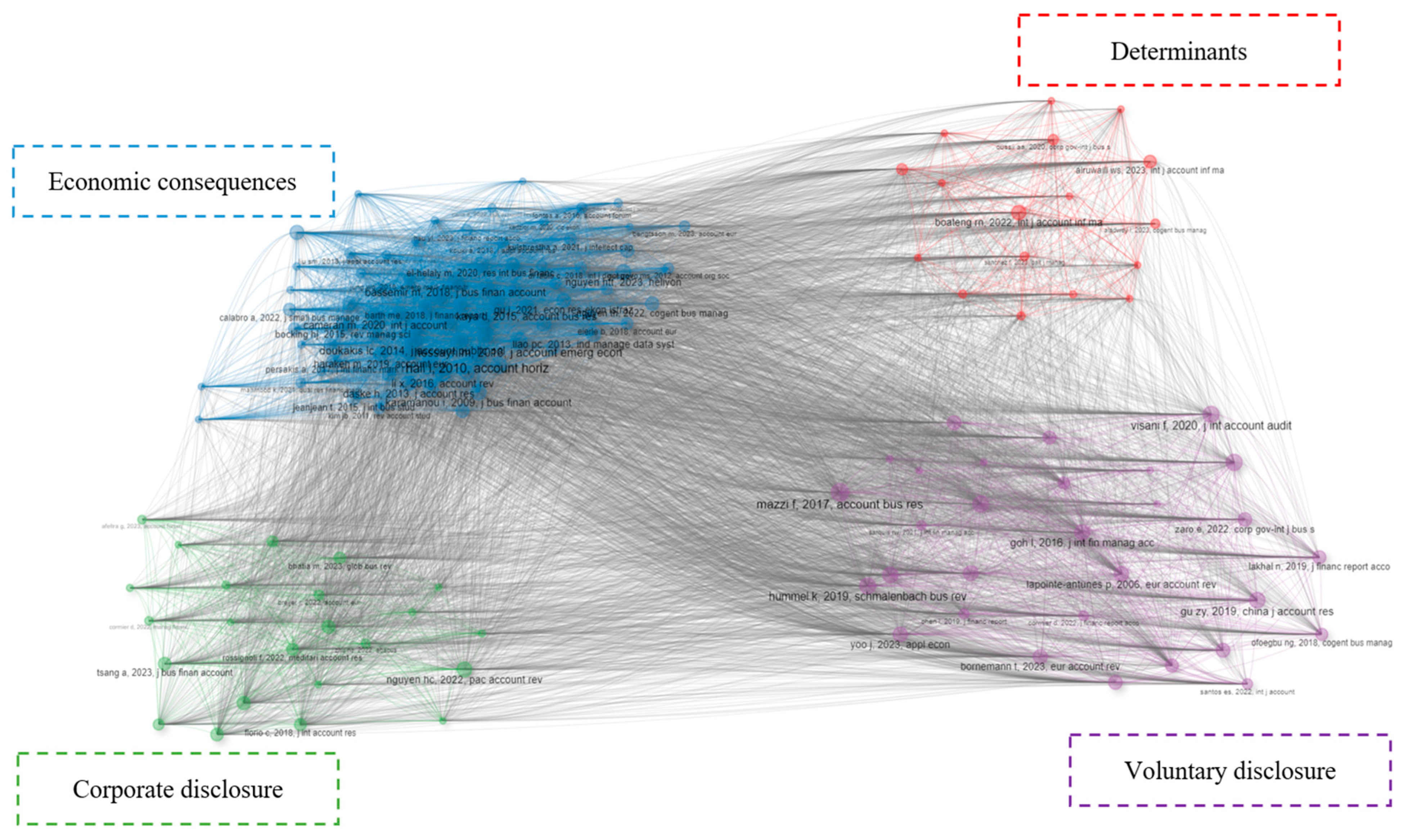

3.3.1. Co-Occurrence Network Mapping

3.3.2. Mapping the Productivity of Items Across Countries

4. Clusters of Research and Future Directions

4.1. Determinants of Voluntary IFRS Application

4.1.1. Firm Characteristics

4.1.2. Corporate Governance

4.2. Corporate Disclosure

4.3. Voluntary Disclosure

4.3.1. Corporate Performance

4.3.2. Regulatory Environment

4.4. Economic Consequences

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdelqader, M., Nimer, K., & Darwish, T. K. (2021). IFRS compliance in GCC countries: Do corporate governance mechanisms make a difference? International Journal of Disclosure and Governance, 18(4), 411–425. [Google Scholar] [CrossRef]

- Ahmed, A. S., Neel, M., & Wang, D. (2013). Does mandatory adoption of IFRS improve accounting quality? Preliminary evidence. Contemporary Accounting Research, 30(4), 1344–1372. [Google Scholar] [CrossRef]

- Alruwaili, W. S., Ahmed, A. D., & Joshi, M. (2023). IFRS adoption, firms’ investment efficiency and financial reporting quality: A new empirical assessment of moderating effects from Saudi listed firms. International Journal of Accounting & Information Management, 31(2), 376–411. [Google Scholar] [CrossRef]

- André, P., Walton, P. J., & Yang, D. (2012). Voluntary adoption of IFRS: A study of determinants for UK non-listed firms. In Comptabilités et Innovation. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1978986 (accessed on 3 September 2023).

- Aria, M., & Cuccurullo, C. (2017). Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. [Google Scholar] [CrossRef]

- Ball, R. (2016). IFRS–10 years later. Accounting and Business Research, 46(5), 545–571. [Google Scholar] [CrossRef]

- Bassemir, M., & Novotny-Farkas, Z. (2018). IFRS adoption, reporting incentives and financial reporting quality in private firms. Journal of Business Finance & Accounting, 45(7–8), 759–796. [Google Scholar]

- Bertrand, J., de Brebisson, H., & Burietz, A. (2021). Why choosing IFRS? Benefits of voluntary adoption by European private companies. International Review of Law and Economics, 65, 105968. [Google Scholar] [CrossRef]

- Boateng, R. N., Tawiah, V., & Tackie, G. (2022). Corporate governance and voluntary disclosures in annual reports: A post-International Financial Reporting Standard adoption evidence from an emerging capital market. International Journal of Accounting & Information Management, 30(2), 252–276. [Google Scholar]

- Boolaky, P. K., Omoteso, K., Ibrahim, M. U., & Adelopo, I. (2018). The development of accounting practices and the adoption of IFRS in selected MENA countries. Journal of Accounting in Emerging Economies, 8(3), 327–351. [Google Scholar] [CrossRef]

- Börner, K., Chen, C., & Boyack, K. W. (2003). Visualizing knowledge domains. Annual Review of Information Science and Technology, 37(1), 179–255. [Google Scholar] [CrossRef]

- Broadus, R. N. (1987). Toward a definition of “bibliometrics”. Scientometrics, 12, 373–379. [Google Scholar] [CrossRef]

- Bushee, B. J., & Leuz, C. (2005). Economic consequences of SEC disclosure regulation: Evidence from the OTC bulletin board. Journal of Accounting and Economics, 39(2), 233–264. [Google Scholar] [CrossRef]

- Cameran, M., & Campa, D. (2020). Voluntary IFRS adoption by unlisted European firms: Impact on earnings quality and cost of debt. The International Journal of Accounting, 55(3), 2050013. [Google Scholar] [CrossRef]

- Capkun, V., Collins, D., & Jeanjean, T. (2016). The effect of IAS/IFRS adoption on earnings management (smoothing): A closer look at competing explanations. Journal of Accounting and Public Policy, 35(4), 352–394. [Google Scholar] [CrossRef]

- Chen, E., Gavious, I., & Lev, B. (2017). The positive externalities of IFRS R&D capitalization: Enhanced voluntary disclosure. Review of Accounting Studies, 22, 677–714. [Google Scholar] [CrossRef]

- Chia-Ling, C., & Horng, S. M. (2020). The Effects of Relaxing the Reconciliation Requirement in Foreign Private Issuers’ SEC Filings on Earnings Management Strategies: IFRS Adopters versus US GAAP Adopters. Tai Da Guan Li Lun Cong, 30(2), 71. [Google Scholar] [CrossRef]

- Christensen, H. B. (2012). Why do firms rarely adopt IFRS voluntarily? Academics find significant benefits and the costs appear to be low. Review of Accounting Studies, 17, 518–525. [Google Scholar] [CrossRef]

- Christensen, H. B., Lee, E., Walker, M., & Zeng, C. (2015). Incentives or standards: What determines accounting quality changes around IFRS adoption? European Accounting Review, 24(1), 31–61. [Google Scholar] [CrossRef]

- Chua, Y. L., Cheong, C. S., & Gould, G. (2012). The impact of mandatory IFRS adoption on accounting quality: Evidence from Australia. Journal of International Accounting Research, 11(1), 119–146. [Google Scholar] [CrossRef]

- Chung, H., & Park, S. O. (2017). Voluntary adoption of the IFRS and industry-level comparability: Evidence from Korean unlisted firms. Emerging Markets Finance and Trade, 53(7), 1654–1666. [Google Scholar] [CrossRef]

- Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2011). Science mapping software tools: Review, analysis, and cooperative study among tools. Journal of the American Society for Information Science and Technology, 62(7), 1382–1402. [Google Scholar] [CrossRef]

- Cormier, D., Teller, P., & Dufour, D. (2022). The relevance of XBRL extensions for stock markets: Evidence from cross-listed firms in the US. Managerial Finance, 48(5), 689–705. [Google Scholar] [CrossRef]

- Crawford, L., Lont, D., & Scott, T. (2014). The effect of more rules-based guidance on expense disclosure under International Financial Reporting Standards. Accounting & Finance, 54(4), 1093–1124. [Google Scholar] [CrossRef]

- Daske, H., Hail, L., Leuz, C., & Verdi, R. (2008). Mandatory IFRS reporting around the world: Early evidence on the economic consequences. Journal of Accounting Research, 46(5), 1085–1142. [Google Scholar] [CrossRef]

- Daske, H., Hail, L., Leuz, C., & Verdi, R. (2013). Adopting a label: Heterogeneity in the economic consequences around IAS/IFRS adoptions. Journal of Accounting Research, 51(3), 495–547. [Google Scholar] [CrossRef]

- Dawd, I. (2018). Aggregate financial disclosure practice: Evidence from the emerging capital market of Kuwait. Journal of Applied Accounting Research, 19(4), 626–647. [Google Scholar] [CrossRef]

- DeFond, M., Hu, J., Hung, M., & Li, S. (2020). The effect of fair value accounting on the performance evaluation role of earnings. Journal of Accounting and Economics, 70(2–3), 101341. [Google Scholar] [CrossRef]

- De George, E. T., Li, X., & Shivakumar, L. (2016). A review of the IFRS adoption literature. Review of Accounting Studies, 21, 898–1004. [Google Scholar] [CrossRef]

- Dinh, T., Schultze, W., List, T., & Zbiegly, N. (2020). R&D disclosures and capitalization under IAS 38—Evidence on the interplay between national institutional regulations and IFRS adoption. Journal of International Accounting Research, 19(1), 29–55. [Google Scholar]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Downes, J. F., Flagmeier, V., & Godsell, D. (2018). Product market effects of IFRS adoption. Journal of Accounting and Public Policy, 37(5), 376–401. [Google Scholar] [CrossRef]

- Dragomir, V. D. (2010). Environmentally sensitive disclosures and financial performance in a European setting. Journal of Accounting & Organizational Change, 6(3), 359–388. [Google Scholar]

- Fiechter, P., Halberkann, J., & Meyer, C. (2018). Determinants and consequences of a voluntary turn away from IFRS to local GAAP: Evidence from Switzerland. European Accounting Review, 27(5), 955–989. [Google Scholar] [CrossRef]

- Filip, A., Liu, J., & Moraru-Arfire, A. (2022). Shaping the information environment: International evidence on financial reporting frequency and analysts’ earnings forecast errors. Journal of Accounting, Auditing & Finance, 39, 0148558X221141568. [Google Scholar] [CrossRef]

- Goh, L., Joos, P., & Soonawalla, K. (2016). Determinants and valuation implications of compulsory stock option disclosures in a weak regulatory setting—The case of France. Journal of International Financial Management & Accounting, 27(1), 26–64. [Google Scholar] [CrossRef]

- Gu, J. (2021). Voluntary IFRS adoption and accounting quality: Evidence from Japan. Economic Research-Ekonomska Istraživanja, 34(1), 1985–2012. [Google Scholar] [CrossRef]

- Gu, Z., Ng, J., & Tsang, A. (2019). Mandatory IFRS adoption and management forecasts: The impact of enforcement changes. China Journal of Accounting Research, 12(1), 33–61. [Google Scholar] [CrossRef]

- Guerreiro, M. S., Rodrigues, L. L., & Craig, R. (2012). Voluntary adoption of International Financial Reporting Standards by large unlisted companies in Portugal–Institutional logics and strategic responses. Accounting, Organizations and Society, 37(7), 482–499. [Google Scholar] [CrossRef]

- Guo, Y. M., Huang, Z. L., Guo, J., Li, H., Guo, X. R., & Nkeli, M. J. (2019). Bibliometric analysis on smart cities research. Sustainability, 11(13), 3606. [Google Scholar] [CrossRef]

- Hail, L., Leuz, C., & Wysocki, P. (2010). Global accounting convergence and the potential adoption of IFRS by the US (Part I): Conceptual underpinnings and economic analysis. Accounting Horizons, 24(3), 355–394. [Google Scholar] [CrossRef]

- Hassanein, A., Zalata, A., & Hussainey, K. (2019). Do forward-looking narratives affect investors’ valuation of UK FTSE all-shares firms? Review of Quantitative Finance and Accounting, 52, 493–519. [Google Scholar] [CrossRef]

- Heradio, R., De La Torre, L., Galan, D., Cabrerizo, F. J., Herrera-Viedma, E., & Dormido, S. (2016). Virtual and remote labs in education: A bibliometric analysis. Computers & Education, 98, 14–38. [Google Scholar]

- Hessayri, M., & Saihi, M. (2018). Ownership dynamics around IFRS adoption: Emerging markets context. Journal of Accounting in Emerging Economies, 8(1), 2–28. [Google Scholar] [CrossRef]

- Hlel, K., Kahloul, I., & Bouzgarrou, H. (2020). IFRS adoption, corporate governance and management earnings forecasts. Journal of Financial Reporting and Accounting, 18(2), 325–342. [Google Scholar] [CrossRef]

- Horton, J., Serafeim, G., & Serafeim, I. (2013). Does mandatory IFRS adoption improve the information environment? Contemporary Accounting Research, 30(1), 388–423. [Google Scholar] [CrossRef]

- Ismail, R. (2017). An overview of International Financial Reporting Standards (IFRS). International Journal of Engineering Science Invention, 6(5), 15–24. [Google Scholar]

- Jamal, K., Benston, G., Carmichael, D., Christensen, T., Colson, R., Moehrle, S., Rajgopal, S., Stober, T., Sunder, S., & Watts, R. (2008). A perspective on the SEC’s proposal to accept financial statements prepared in accordance with international financial reporting standards (IFRS) without reconciliation to U.S. GAAP. Accounting Horizons, 22, 241–248. [Google Scholar] [CrossRef]

- Jermakowicz, E. K., & Gornik-Tomaszewski, S. (2006). Implementing IFRS from the perspective of EU publicly traded companies. Journal of International Accounting, Auditing and Taxation, 15(2), 170–196. [Google Scholar] [CrossRef]

- Kaklauskas, A. (2015). Biometric and intelligent decision making support (Vol. 81). Springer. [Google Scholar]

- Kashiwazaki, R., Sato, S., & Takeda, F. (2019). Does IFRS adoption accelerate M&A? The consequences of different goodwill accounting in Japan. International Advances in Economic Research, 25, 399–415. [Google Scholar]

- Kassamany, T., Harb, E., Louhichi, W., & Nasr, M. (2023). Impact of risk disclosure on the volatility, liquidity and performance of the UK and Canadian insurance companies. Competitiveness Review: An International Business Journal, 33(1), 30–61. [Google Scholar] [CrossRef]

- Kim, J. B., & Shi, H. (2012). IFRS reporting, firm-specific information flows, and institutional environments: International evidence. Review of Accounting Studies, 17, 474–517. [Google Scholar] [CrossRef]

- Kim, J. B., Tsui, J. S., & Yi, C. H. (2011). The voluntary adoption of International Financial Reporting Standards and loan contracting around the world. Review of Accounting Studies, 16, 779–811. [Google Scholar] [CrossRef]

- Kouki, A. (2018). IFRS and value relevance: A comparison approach before and after IFRS conversion in the European countries. Journal of Applied Accounting Research, 19(1), 60–80. [Google Scholar] [CrossRef]

- Kulshrestha, A., & Patro, A. (2021). Intellectual capital reporting and mandatory adoption of post-IFRS–An empirical analysis using computational linguistic tools. Journal of Intellectual Capital, 22(6), 1147–1179. [Google Scholar] [CrossRef]

- Lakhal, N., & Dedaj, B. (2020). R&D disclosures and earnings management: The moderating effects of IFRS and the global financial crisis. Journal of Financial Reporting and Accounting, 18(1), 111–130. [Google Scholar] [CrossRef]

- Lapointe-Antunes, P., Cormier, D., Magnan, M., & Gay-Angers, S. (2006). On the relationship between voluntary disclosure, earnings smoothing and the value-relevance of earnings: The case of Switzerland. European Accounting Review, 15(4), 465–505. [Google Scholar] [CrossRef]

- Liang, T. P., & Liu, Y. H. (2018). Research landscape of business intelligence and big data analytics: A bibliometrics study. Expert Systems with Applications, 111, 2–10. [Google Scholar] [CrossRef]

- Loureiro, G., & Taboada, A. G. (2012). The impact of IFRS adoption on stock price informativeness. Available online: https://www.efmaefm.org/0efmameetings/efma%20annual%20meetings/2012-Barcelona/papers/IFRS-Adoption_and_Stock_Price_Informativeness-5-7-2012.pdf (accessed on 14 September 2023).

- Matonti, G., & Iuliano, G. (2012). Voluntary adoption of IFRS by Italian private firms: A study of the determinants. Eurasian Business Review, 2, 43–70. [Google Scholar] [CrossRef]

- Mazzi, F., André, P., Dionysiou, D., & Tsalavoutas, I. (2017). Compliance with goodwill-related mandatory disclosure requirements and the cost of equity capital. Accounting and Business Research, 47(3), 268–312. [Google Scholar] [CrossRef]

- Mejia, C., Wu, M., Zhang, Y., & Kajikawa, Y. (2021). Exploring topics in bibliometric research through citation networks and semantic analysis. Frontiers in Research Metrics and Analytics, 6, 742311. [Google Scholar] [CrossRef]

- Mensah, E., & Boachie, C. (2023). Analysis of the determinants of corporate governance quality: Evidence from sub-Saharan Africa. International Journal of Disclosure and Governance, 20, 431–450. [Google Scholar] [CrossRef]

- Morris, R. D., & Tronnes, P. C. (2018). The determinants of voluntary strategy disclosure: An international comparison. Accounting Research Journal, 31(3), 423–441. [Google Scholar] [CrossRef]

- Moya, S., & Oliveras, E. (2006). Voluntary adoption of IFRS in Germany: A regulatory impact study. Corporate Ownership & Control, 3(3), 138–147. [Google Scholar]

- Nahar, S., Azim, M. I., & Hossain, M. M. (2020). Risk disclosure and risk governance characteristics: Evidence from a developing economy. International Journal of Accounting & Information Management, 28(4), 577–605. [Google Scholar]

- Nguyen, H. C. (2022). Interim financial reporting disclosure by listed firms in the Asia-Pacific region and influencing factors. Pacific Accounting Review, 35(2), 218–248. [Google Scholar] [CrossRef]

- Ofoegbu, N. G., & Odoemelam, N. (2018). International financial reporting standards (IFRS) disclosure and performance of Nigeria listed companies. Cogent Business & Management, 5(1), 1542967. [Google Scholar] [CrossRef]

- Opare, S., Houqe, M. N., & Van Zijl, T. (2021). Meta-analysis of the impact of adoption of IFRS on financial reporting comparability, market liquidity, and cost of capital. Abacus, 57(3), 502–556. [Google Scholar] [CrossRef]

- Oussii, A. A., & Klibi, M. F. (2020). The impact of audit committee financial expertise on de facto use of IFRS: Does external auditor’s size matter? Corporate Governance: The International Journal of Business in Society, 20(7), 1243–1263. [Google Scholar] [CrossRef]

- Oxelheim, L. (2019). Optimal vs satisfactory transparency: The impact of global macroeconomic fluctuations on corporate competitiveness. International Business Review, 28(1), 190–206. [Google Scholar] [CrossRef]

- Paananen, M., & Lin, H. (2009). The development of accounting quality of IAS and IFRS over time: The case of Germany. Journal of International Accounting Research, 8(1), 31–55. [Google Scholar] [CrossRef]

- Păşcan, I. D. (2015). Measuring the effects of IFRS adoption on accounting quality: A review. Procedia Economics and Finance, 32, 580–587. [Google Scholar] [CrossRef]

- Popay, J., Roberts, H., Sowden, A., Petticrew, M., Arai, L., Rodgers, M., Britten, N., & Duffy, S. (2006). Guidance on the conduct of narrative synthesis in systematic reviews. Journal of Epidemiology and Community Health, 1(1), b92. [Google Scholar]

- Pruzan, P. (2001). Corporate reputation: Image and identity. Corporate Reputation Review, 4, 50–64. [Google Scholar] [CrossRef]

- Ramanna, K. (2013). The international politics of IFRS harmonization. Accounting, Economics and Law, 3(2), 1–46. [Google Scholar] [CrossRef]

- Renders, A., & Gaeremynck, A. (2007). The impact of legal and voluntary investor protection on the early adoption of International Financial Reporting Standards (IFRS). De Economist, 155(1), 49–72. [Google Scholar] [CrossRef]

- Rojas-Sánchez, M. A., Palos-Sánchez, P. R., & Folgado-Fernández, J. A. (2023). Systematic literature review and bibliometric analysis on virtual reality and education. Education and Information Technologies, 28(1), 155–192. [Google Scholar] [CrossRef] [PubMed]

- Sakawa, H., Watanabel, N., & Gu, J. (2021). The internationalization and voluntary adoption of international accounting standards by Japanese MNEs. Management International Review, 61, 713–744. [Google Scholar] [CrossRef]

- Sarquis, R. W., dos Santos, A., Lourenço, I., & Oscar Braunbeck, G. (2021). Joint venture investments: An analysis of the level of compliance with the disclosure requirements of IFRS 12. Journal of International Financial Management & Accounting, 32(2), 207–232. [Google Scholar] [CrossRef]

- Shaffer, G. C. (2009). How business shapes law: A socio-legal framework. Connecticut Law Review, 42(1), 147. [Google Scholar]

- Shimamoto, K., & Takeda, F. (2020). IFRS adoption and accounting conservatism of Japanese firms with governance system transition. International Advances in Economic Research, 26, 161–173. [Google Scholar] [CrossRef]

- Sirgy, M. J. (2002). Measuring corporate performance by building on the stakeholders model of business ethics. Journal of Business Ethics, 35, 143–162. [Google Scholar] [CrossRef]

- Soderstrom, N. S., & Sun, K. J. (2007). IFRS adoption and accounting quality: A review. European Accounting Review, 16(4), 675–702. [Google Scholar] [CrossRef]

- Stent, W., Bradbury, M. E., & Hooks, J. (2017). Insights into accounting choice from the adoption timing of International Financial Reporting Standards. Accounting & Finance, 57, 255–276. [Google Scholar]

- Thomsen, S., & Pedersen, T. (2000). Ownership structure and economic performance in the largest European companies. Strategic Management Journal, 21(6), 689–705. [Google Scholar] [CrossRef]

- Visani, F., Di Lascio, F. M. L., & Gardini, S. (2020). The impact of institutional and cultural factors on the use of non-GAAP financial measures. International evidence from the oil and gas industry. Journal of International Accounting, Auditing and Taxation, 40, 100334. [Google Scholar] [CrossRef]

- Wagenhofer, A. (2009). Global accounting standards: Reality and ambitions. Accounting Research Journal, 22(1), 68–80. [Google Scholar] [CrossRef]

- Wang, C. (2014). Accounting standards harmonization and financial statement comparability: Evidence from transnational information transfer. Journal of Accounting Research, 52(4), 955–992. [Google Scholar] [CrossRef]

- Weerathunga, P. R., Xiaofang, C., Nurunnabi, M., Kulathunga, K. M. M. C. B., & Swarnapali, R. M. N. C. (2020). Do the IFRS promote corporate social responsibility reporting? Evidence from IFRS convergence in India. Journal of International Accounting, Auditing and Taxation, 40, 100336. [Google Scholar] [CrossRef]

- Wymeersch, E. (2006). The enforcement of corporate governance codes. Journal of Corporate Law Studies, 6(1), 113–138. [Google Scholar] [CrossRef]

- Yang, D. (2014). Exploring the determinants of voluntary adoption of IFRS by unlisted firms: A comparative study between the UK and Germany. China Journal of Accounting Studies, 2(2), 118–136. [Google Scholar] [CrossRef]

- Yoo, J., & Kim, S. (2023). Impact of IFRS adoption on the disclosure of management forecasts by industry concentration. Applied Economics, 56, 674–691. [Google Scholar] [CrossRef]

- Zaid, M. A. (2023). Do professional shareholders matter for corporate compliance with IFRS reporting requirements: The moderating effect of board independence. International Journal of Accounting & Information Management, 31(4), 647–675. [Google Scholar]

- Zaro, E., Flores, E., Fasan, M., Murcia, F. D. R., & Zaro, C. S. (2022). Voluntary adoption of integrated reporting, effective legal system and the cost of equity. Corporate Governance: The International Journal of Business in Society, 22(6), 1197–1221. [Google Scholar] [CrossRef]

- Zeghal, D., Chtourou, S. M., & Fourati, Y. M. (2012). The effect of mandatory adoption of IFRS on earnings quality: Evidence from the European Union. Journal of International Accounting Research, 11(2), 1–25. [Google Scholar] [CrossRef]

- Zhu, N. Z., Wang, K. T., & Wilson, M. (2022). The effect of conditional management earnings forecast mandates on voluntary disclosure and analyst forecast properties. Abacus, 58(3), 479–522. [Google Scholar] [CrossRef]

| Keyword Search | Number of Articles |

|---|---|

| “Voluntary IFRS” | 182 |

| “Voluntary International Financial Reporting Standards” | 186 |

| “Voluntary adoption of IFRS” | 145 |

| “Voluntary adoption of International Financial Reporting Standards” | 103 |

| Description | Results |

|---|---|

| Duration | 2006:2023 |

| Origin (journals, books, etc.) | 95 |

| Publication | 185 |

| Annual growth rate % | 13.01 |

| Document average age | 4.46 |

| Average citations per document | 23.25 |

| References | 8545 |

| Keywords plus (ID) | 500 |

| Author’s keywords (DE) | 539 |

| Contributors | 449 |

| Authors of single-authored docs | 29 |

| Co-authors per doc | 2.72 |

| Percentage of international co-authorships | 41.62 |

| Authors | Title | Source | Total Citations | Total Citations per Year |

|---|---|---|---|---|

| Daske et al. (2008) | Mandatory IFRS reporting around the world: Early evidence on the economic consequences | Journal of Accounting Research | 960 | 60 |

| Daske et al. (2013) | Adopting a label: Heterogeneity in the economic consequences around IAS/IFRS adoptions | Journal of Accounting Research | 332 | 30.18 |

| Horton et al. (2013) | Does mandatory IFRS adoption improve the information environment? | Contemporary Accounting Research | 253 | 23 |

| Hail et al. (2010) | Global accounting convergence and the potential adoption of IFRS by the US (Part I): Conceptual underpinnings and economic analysis | Accounting horizons | 202 | 14.42 |

| Christensen et al. (2015) | Incentives or standards: What determines accounting quality changes around IFRS adoption? | European Accounting Review | 159 | 17.66 |

| Cluster | Topic | Main Research Questions |

|---|---|---|

| Red | Determinants of IFRS voluntary adoption | How do firm characteristics influence the voluntary adoption of the IFRS? |

| What is the relationship between corporate governance factors and the voluntary adoption of the IFRS? | ||

| Green | Corporate disclosure | What is the relationship between corporate disclosure activities and the voluntary adoption of the IFRS? |

| Purple | Voluntary disclosure | How does the voluntary adoption of the IFRS affect corporate performance through voluntary disclosure activities? |

| How does the regulatory environment influence voluntary disclosure activities? | ||

| Blue | Economic consequences | What challenges or benefits do firms encounter after voluntary adoption of the IFRS? |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, N.G.; Nguyen, N.T. Voluntary International Financial Reporting Standards Application: A Bibliometric Review and Future Research Directions. Int. J. Financial Stud. 2025, 13, 77. https://doi.org/10.3390/ijfs13020077

Nguyen NG, Nguyen NT. Voluntary International Financial Reporting Standards Application: A Bibliometric Review and Future Research Directions. International Journal of Financial Studies. 2025; 13(2):77. https://doi.org/10.3390/ijfs13020077

Chicago/Turabian StyleNguyen, Ngoc Giau, and Ngoc Tien Nguyen. 2025. "Voluntary International Financial Reporting Standards Application: A Bibliometric Review and Future Research Directions" International Journal of Financial Studies 13, no. 2: 77. https://doi.org/10.3390/ijfs13020077

APA StyleNguyen, N. G., & Nguyen, N. T. (2025). Voluntary International Financial Reporting Standards Application: A Bibliometric Review and Future Research Directions. International Journal of Financial Studies, 13(2), 77. https://doi.org/10.3390/ijfs13020077