Pricing the Audit Risk of Innovation: Intangibles and Patents

Abstract

1. Introduction

2. Literature Review and Theoretical Development

2.1. Innovation Input: Knowledge Capital

2.2. Innovation Outcome: Patent Quantity, Quality-Adjusted Quantity, and Scope

3. Research Design and Data

3.1. Audit Fee Model

3.2. Data and Sample

4. Empirical Results

4.1. Main Results

4.2. Cross-Sectional Analyses

4.3. GoingConcern Opinion as Alternative Measure

4.4. Innovation Efficiency, Patent Age, and Audit Fees

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

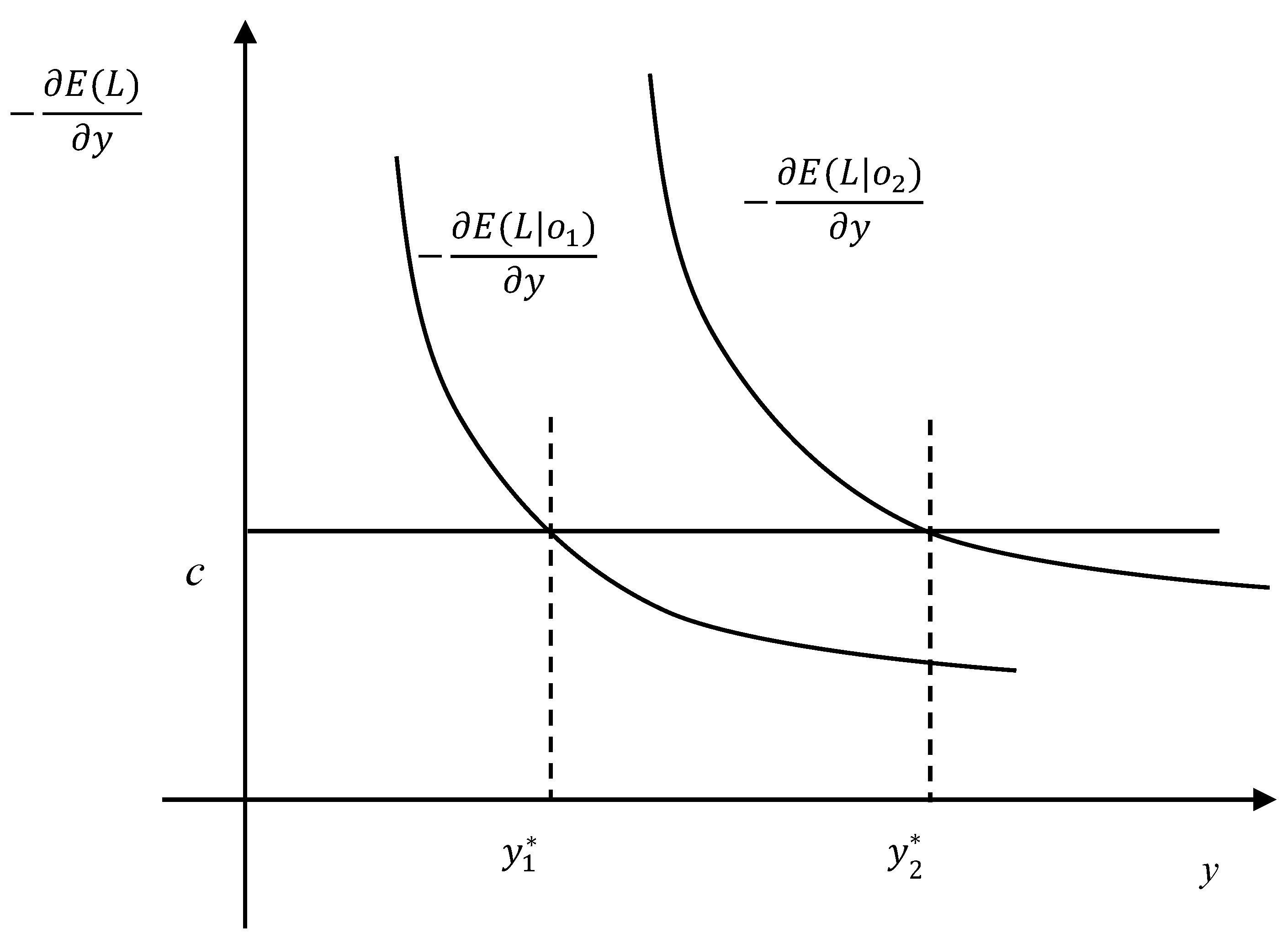

Appendix A. Comparative Static Analysis Based on Simunic’s (1980) Theoretical Model of Audit Fees

| 1 | Since 2009, the market value of intangible assets for S&P 500 companies has increased by 255%, while the growth of tangible assets is only 97% over the same period, creating an “unbalanced balance sheet” (PwC, 2021). |

| 2 | There are some exceptions (e.g., specific software-delated R&D spending may be capitalized under ASC 985. |

| 3 | On 19 December 2024, FASB issued an Invitation to Comment, “Recognition of Intangibles”, to solicit stakeholder feedback on accounting and reporting on intangibles, including “whether different accounting for intangibles should exist depending on how the asset is obtained (internally developed, acquired in a business combination, or acquired in an asset acquisition” (FASB, 2024a, p. 1) or should the recognition of intangibles be consistently aligned regardless of how they are acquired or generated (FASB, 2024a, p. 14). |

| 4 | The details based on Simunic’s theoretical audit fee model are presented in Appendix A. |

| 5 | |

| 6 | R&D expense data is from the Compustat database, assuming the knowledge capital before 1970 is negligible. For a firm listed after 1970, the initial knowledge capital is set to the firm’s first recorded R&D expense in Compustat. |

| 7 | The data is available at https://kelley.iu.edu/nstoffma/ (accessed on 25 February 2025). |

| 8 | The Pearson correlation coefficient between Log(Patent) and Log(TECHCL) is 0.9745. |

| 9 | Exp(0.096 × 0.733 + 0.018 × 0.919 − 0.060 × 0.171 − 0.067 × 0.452) − 1 = 4.7%. |

| 10 | Here, we assume that the patent granted in year t has an age of two and will have a term of eighteen years. |

References

- Ali, A., & Kallapur, S. (2001). Securities price consequences of the private securities litigation reform act of 1995 and related events. The Accounting Review, 76(3), 431–460. [Google Scholar] [CrossRef]

- Altman, E. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609. [Google Scholar] [CrossRef]

- Antonelli, C. (2019). Knowledge as an economic good: Exhaustibility versus appropriability? The Journal of Technology Transfer, 44(3), 647–658. [Google Scholar] [CrossRef]

- Antonelli, C., Orsatti, G., & Pialli, G. (2023). The knowledge-intensive direction of technological change. Eurasian Business Review, 13, 1–27. [Google Scholar] [CrossRef]

- Appleton, A., Barckow, A., Botosan, C. A., Kawanishi, Y., Kogasaka, A., Lennard, A., Mezon-Hutter, L., Sy, J., & Villmann, R. (2023). Perspectives on the financial reporting of intangibles. Accounting Horizons, 37(1), 1–13. [Google Scholar] [CrossRef]

- Banker, R. D., Wattal, S., & Plehn-Dujowich, J. M. (2011). R&D versus acquisitions: Role of diversification in the choice of innovation strategy by information technology firms. Journal of Management Information Systems, 28(2), 109–144. [Google Scholar]

- Basioudis, I. G., & Francis, J. R. (2007). Big 4 audit fee premiums for national and office-level industry leadership in the United Kingdom. Auditing: A Journal of Practice and Theory, 26(2), 143–166. [Google Scholar] [CrossRef]

- Bentley, K. A., Omer, T. C., & Sharp, N. Y. (2013). Business strategy, financial reporting irregularities, and audit effort. Contemporary Accounting Research, 30(2), 780–817. [Google Scholar] [CrossRef]

- Berglund, N. R., Eshleman, J. D., & Guo, P. (2018). Auditor size and going-concern reporting. Auditing: A Journal of Practice and Theory, 37(2), 1–25. [Google Scholar] [CrossRef]

- Bills, K., Jeter, D. C., & Stein, S. E. (2015). Auditor industry specialization and evidence of cost efficiencies in homogenous industries. The Accounting Review, 90(5), 1721–1754. [Google Scholar] [CrossRef]

- Bills, K. L., Swanquist, Q. T., & Whited, R. L. (2016). Growing pains: Audit quality and office growth. Contemporary Accounting Research, 33(1), 288–313. [Google Scholar] [CrossRef]

- Biscione, A., Burlina, C., & Felice, A. (2024). Knowledge flows and innovation: A pseudo-panel approach. Applied Economics, 56(30), 3636–3651. [Google Scholar] [CrossRef]

- Blay, A. D., & Geiger, M. A. (2013). Auditor fees and auditor independence: Evidence from going-concern reporting decisions. Contemporary Accounting Research, 30(2), 579–606. [Google Scholar] [CrossRef]

- Corrado, C. A., & Hulten, C. R. (2010). How do you measure a ‘Technological Revolution’? The American Economic Review, 100(2), 99–104. [Google Scholar] [CrossRef]

- Datta, S., Jha, A., & Kulchania, M. (2020). On accounting’s twenty-first century challenge: Evidence on the relation between intangible assets and audit fees. Review of Quantitative Finance and Accounting, 55(1), 123–162. [Google Scholar] [CrossRef]

- Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. The Accounting Review, 70(2), 193–225. [Google Scholar]

- DeFond, M. L., Francis, J. R., & Wong, T. J. (2000). Auditor industry specialization and market segmentation: Evidence from Hong Kong. Auditing: A Journal of Practice and Theory, 19(1), 49–66. [Google Scholar] [CrossRef]

- Deis, D. R., Jr., & Giroux, G. (1996). The effect of auditor changes on audit fees, audit hours, and audit quality. Journal of Accounting and Public Policy, 15(1), 55–76. [Google Scholar] [CrossRef]

- Deloitte. (2023). Deloitte IP 360 survey 2023. Available online: https://www.deloitte.com/au/en/services/financial-advisory/perspectives/deloitte-ip-360-survey.html (accessed on 9 July 2024).

- Demis, H., Dosso, M., Hervás Soriano, F., Millot, V., Squicciarini, M., & Vezzani, A. (2015). World corporate top R&D investors: Innovation and IP bundles. EUR 27129. Publications Office of the European Union. JRC94932. Available online: https://publications.jrc.ec.europa.eu/repository/handle/JRC94932 (accessed on 9 July 2024).

- Financial Accounting Standards Board (FASB). (2024a). Invitation to comment: Recognition of intangibles. File Reference No. 2024-ITC200. Available online: https://www.fasb.org/page/ShowPdf?path=ITC%E2%80%94Recognition%20of%20Intangibles.pdf&title=Invitation%20to%20Comment%E2%80%94Recognition%20of%20Intangibles (accessed on 9 December 2024).

- Financial Accounting Standards Board (FASB). (2024b). Meeting with the Investor Advisory Committee (IAC)—Thursday, May 16, 2024. YouTube. [Video segment 31:00 to 37:40]. Available online: https://www.youtube.com/watch?v=sAoxrQmelPo&t=4s (accessed on 20 August 2024).

- Francis, J., & Schipper, K. (1999). Have financial statements lost their relevance? Journal of Accounting Research, 37(2), 319–352. [Google Scholar] [CrossRef]

- Fraser, I., Tarbert, H., & Tee, K. H. (2009). Do the financial statements of intangible-intensive companies hold less information content for investors? Applied Economics, 19(17), 1433–1438. [Google Scholar] [CrossRef]

- Glaeser, S., & Lang, M. H. (2023). Measuring innovation and navigating its unique information issues: A review of the accounting literature on innovation. working paper. Kenan Institute of Private Enterprise Research Paper No. 4500800. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4500800 (accessed on 3 February 2023).

- Gordon, E., Hsu, H.-T., & Huang, H. (2020). Peer R&D disclosure and corporate innovation: Evidence from american depositary receipt firms. Advances in Accounting 49, 100471. [Google Scholar]

- Griliches, Z. (1979). Issues in assessing the contribution of research and development to productivity growth. The Bell Journal of Economics, 10(1), 92–116. [Google Scholar] [CrossRef]

- Griliches, Z. (1986). Productivity, R&D, and basic research at the firm level in the 1970s. The American Economic Review, 76(1), 141–154. [Google Scholar]

- Gunny, K. A. (2010). The relation between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary Accounting Research, 27(3), 855–888. [Google Scholar]

- Hainmueller, J. (2012). Entropy balancing for causal effects: A multivariate reweighting method to produce balanced samples in observational studies. Political Analysis, 20(1), 25–46. [Google Scholar] [CrossRef]

- Hair, J. F., Anderson, R., Tatham, R. L., & Black, W. C. (2006). Multivariate data analysis. Prentice Hall. [Google Scholar]

- Hall, B. H., Jaffe, A., & Trajtenberg, M. (2001). The NBER patent citation data file: Lessons, insights, and methodological tools. NBER working paper 8498. Available online: http://www.nber.org/papers/w8498 (accessed on 7 October 2019).

- Hand, J., & Lev, B. (2003). Intangible assets: Values, measures, and risks. Oxford University Press Inc. [Google Scholar]

- Hay, D., Knechel, R., & Wong, N. (2006). Audit fees: A meta-analysis of the effect of supply and demand attributes. Contemporary Accounting Research, 23(1), 141–191. [Google Scholar] [CrossRef]

- Healy, P. M., Myers, S. C., & Howe, C. D. (2002). R&D accounting and the tradeoff between relevance and objectivity. Journal of Accounting Research, 40(3), 677–710. [Google Scholar]

- Hirshleifer, D., Hsu, P.-H., & Li, D. (2013). Innovative efficiency and stock returns. Journal of Financial Economics, 107(3), 632–654. [Google Scholar] [CrossRef]

- Iqbal, A., Rajgopal, S., Srivastava, A., & Zhao, R. (2024). A better estimate of internally generated intangible capital. Management Science, 71, iv–vi, 1–953, vii–vii. [Google Scholar] [CrossRef]

- Klette, T. J., & Kortum, S. (2004). Innovating firms and aggregate innovation. Journal of Political Economy, 112(5), 986–1018. [Google Scholar] [CrossRef]

- Kogan, L., Papanikolaou, D., Seru, A., & Stoffman, N. (2017). Technological innovation, resource allocation and growth. Quarterly Journal of Economics, 132(2), 665–712. [Google Scholar] [CrossRef]

- Krishnan, G., & Wang, C. (2015). The relation between managerial ability and audit fees and going concern opinions. Auditing: A Journal of Practice and Theory, 34(3), 139–160. [Google Scholar] [CrossRef]

- Krishnan, J., & Krishnan, J. (1997). Litigation risk and auditor resignations. The Accounting Review, 72(4), 539–560. [Google Scholar]

- Laperche, B. (2013). Entrepreneurial behavior and eco-innovation. In E. G. Carayannis (Ed.), Encyclopedia of creativity, invention, innovation and entrepreneurship (pp. 598–603). Springer. [Google Scholar]

- Lev, B. (2019). Ending the accounting-for-intangibles status quo. European Accounting Review, 28(4), 713–736. [Google Scholar] [CrossRef]

- Lev, B., & Gu, F. (2016). The end of accounting and the path forward for investors and managers. John Wiley & Sons Inc. [Google Scholar]

- Li, W. C. Y., & Hall, B. H. (2020). Depreciation of business R&D capital. The Review of Income and Wealth, 66(1), 161–180. [Google Scholar]

- Low, K.-Y. (2004). The effects of industry specialization on audit risk assessments and audit-planning decisions. The Accounting Review, 79(1), 201–219. [Google Scholar] [CrossRef]

- Mackie-Mason, J. (1990). Do taxes affect corporate financing decisions? The Journal of Finance, 45(5), 1471–1493. [Google Scholar] [CrossRef]

- Oswald, D. R. (2008). The determinants and value relevance of the choice of accounting for research and development expenditures in the United Kingdom. Journal of Business Finance and Accounting, 35(1–2), 1–24. [Google Scholar] [CrossRef]

- Oswald, D. R., & Zarowin, P. (2007). Capitalization of R&D and the informativeness of stock prices. European Accounting Review, 16(4), 703–726. [Google Scholar]

- Passov, R. (2003). How much cash does your company need? Harvard Business Review, 81(11), 119–122. [Google Scholar]

- Peters, R. H., & Taylor, L. A. (2017). Intangible capital and the investment-q relation. Journal of Financial Economics, 123(2), 251–272. [Google Scholar] [CrossRef]

- PricewaterhouseCoopers LLP (PwC). (2021). Viewpoint: The unbalanced balance sheet: Making intangibles count. Available online: https://nsacoop.org/articles/unbalanced-balance-sheet-make-intangibles-count (accessed on 27 April 2021).

- Public Company Accounting Oversight Board (PCAOB). (2008). Report on the PCAOB’s 2004, 2005, 2006, and 2007 inspections of domestic annually inspected firms. PCAOB Release No. 2008-008. PCAOB. [Google Scholar]

- Public Company Accounting Oversight Board (PCAOB). (2015). Information about 2015 inspections (Vol. 2015/2). PCAOB Staff Inspection Brief. PCAOB. [Google Scholar]

- Simunic, D. (1980). The pricing of audit services: Theory and evidence. Journal of Accounting Research, 18(1), 161–190. [Google Scholar] [CrossRef]

- Simunic, D. A., & Stein, M. T. (1996). The impact of litigation risk on audit pricing: A review of the economics and the evidence. Auditing: A Journal of Practice & Theory 15, 119–134. [Google Scholar]

- Stice, J. D. (1991). Using financial market information to identify pre-engagement factors associated with lawsuits against auditors. The Accounting Review, 66(3), 516–533. [Google Scholar]

- Taylor, S. (2011). Does audit fee homogeneity exist? premiums and discounts attributable to individual partners. Auditing: A Journal of Theory and Practice, 30(4), 249–272. [Google Scholar] [CrossRef]

- Visvanathan, G. (2017). Intangible assets on the balance sheet and audit fees. International Journal of Disclosure and Governance, 14(3), 241–250. [Google Scholar] [CrossRef]

- Whisenant, S., Sankaraguruswamy, S., & Raghunandan, K. (2003). Evidence on the joint determination of audit and non-audit fees. Journal of Accounting Research, 41(4), 721–744. [Google Scholar] [CrossRef]

- Zhang, D., Amin, K. A., & Deis, D. R. (2021). Audit risk associated with long-lived tangible asset intensity, age, and impairment. Journal of Forensic and Investigative Accounting, 13(2), 333–348. [Google Scholar] [CrossRef]

| Variables | Descriptions |

|---|---|

| Log(AF) | = the natural logarithm of (1 + AF), where AF is audit fees; |

| KCINT | = Knowledge capital scaled by total assets, where knowledge capital is estimated by accumulating past R&D investments using a perpetual inventory method, as in Peters and Taylor (2017). |

| Log(Patent) | = the natural logarithm of (1 + Patent), where patent is the number of patents granted during the fiscal year; |

| Log(CPatent) | = the natural logarithm of (1 + CPatent), where CPatent is citation-weighted patents as defined in Kogan et al. (2017); |

| Log(TECHCL) | = the natural logarithm of (1 + TECHCL), where TECHCL is the number of technology classes of patents granted based on the US Patent Classification System; |

| INTAN | = the ratio of intangible assets to total assets; |

| BigN | = 1 if a firm is audited by one of the Big 4 auditors, and 0 otherwise; |

| Specialist | = 1 if an auditor has a market share of two-digit SIC code industry equal to or greater than 30%, as in Bills et al. (2015), and 0 otherwise; |

| Size | = the natural logarithm of a firm’s total assets; |

| Log(Segment) | = the natural logarithm of Segment, which is the number of business segments; |

| Foreign | = foreign operation indicator equal to 1 if foreign exchange gain or loss exceeds USD 10,000 (Krishnan & Wang, 2015) or pretax foreign income or loss exceeds USD 10,000, and 0 otherwise; |

| ACQ | = 1 if a firm has acquisitions in the current fiscal year, and 0 otherwise; |

| Pension | = 1 if a firm’s pension and retirement expense is greater than zero, and 0 otherwise; |

| XISPI | = 1 if a firm’s extraordinary or special items are greater than zero, and 0 otherwise; |

| ROA | = return on assets, defined as income before extraordinary items scaled by total assets; |

| Loss | = 1 if a firm’s ROA is negative, and 0 otherwise; |

| INVREC | = the ratio of inventories and receivables to total assets; |

| Quick | = quick ratio, defined as the ratio of current assets less inventories to total current liabilities; |

| Leverage | = financial leverage, defined as the ratio of total liabilities to total assets; |

| NDI | = 1 if there are new equity issues, and 0 otherwise; |

| NEI | = 1 if there are new debt issues, and 0 otherwise; |

| Concern | = going concern opinions, defined as an indicator variable equal to 1 if a firm received a qualified going concern opinion and 0 otherwise; |

| Restatement | = 1 if there is a financial restatement, and 0 otherwise. |

| FYAudit | = 1 if a firm hires a new auditor, and 0 otherwise |

| Log(REPLAG) | = the natural logarithm of audit report lag, defined as the number of days between fiscal year-end and audit opinion filing date |

| Log(NAF) | = the natural logarithm of (1 + NAF), where NAF is non-audit fees; |

| December | = 1 if a firm’s fiscal year ends in December and 0 otherwise; |

| BtM | = the ratio of a firm’s book value to its market value; |

| SGrowth | = the percentage change in net sales from year t − 1 to t; |

| Litigation | = 1 if a firm is in high litigation risk industries (SIC codes 2833–2836, 3570–3577, 3600–3674, 5200–5961, 7370–7374, 8731–8734) defined by Ali and Kallapur (2001); |

| Log(Age) | = the natural logarithm of Age, where Age is the number of years that a firm has been publicly listed; |

| ZScore | = A modified version of Altman’s (>1968) Z-Score, equal to 3.3 × Net Incomet/Assetst−1) + Salest/Assetst−1 + 1.4 × (Retained Earningst/Assetst−1) + 1.2 × (Working Capitalt/Assetst−1) (see Mackie-Mason, 1990; Gunny, 2010). |

| OCF | = net operating cash flows scaled by total assets; |

| PEFF | = patent innovation efficiency, defined as Patenti,t/(R&Di,t−2 + 0.8 × R&Di,t−3 + 0.6 × R&Di,t−4 + 0.4 × R&Di,t−5 + 0.2 × R&Di,t−6) following Hirshleifer et al. (2013), where Patent is the number of patents granted, and R&D is the R&D expenditure; |

| CEFF | = citation-weighted innovation efficiency, defined as CPatenti,t/(R&Di,t−2+ 0.8 × R&Di,t−3 + 0.6 × R&Di,t−4 + 0.4 × R&Di,t−5 + 0.2 × R&Di,t−6), where CPatent is the citation-weighted patents and R&D is the R&D expenditure; |

| PAge | , where patent represents the number of patents granted. |

| Selection Step | Observations |

|---|---|

| The initial sample was drawn from Compustat and Audit Analytics (2000–2019) | 231,963 |

| Remove firm-year observations of utilities (SIC 4900–4999) and financial institutions (SIC 6000–6999) | −81,628 |

| Remove observations with missing audit fee data | −48,778 |

| Remove observations with missing data on independent variables | −31,355 |

| Final sample size for audit fee models | 70,202 |

| Variables | Mean | Std. Dev. | 25th | 50th | 75th |

|---|---|---|---|---|---|

| AF | 1,326,573 | 2,296,216 | 159,260 | 517,347 | 1,417,910 |

| KCINT | 0.360 | 0.941 | 0 | 0.036 | 0.287 |

| Patent | 12.10 | 95.02 | 0 | 0 | 1 |

| CPatent | 192.23 | 2,396.14 | 0 | 0 | 3 |

| TECHCL | 2.034 | 7.939 | 0 | 0 | 1 |

| INTAN | 0.164 | 0.204 | 0 | 0.074 | 0.265 |

| BigN | 0.662 | 0.473 | 0 | 1 | 1 |

| Specialist | 0.228 | 0.420 | 0 | 0 | 1 |

| Size | 5.359 | 2.496 | 3.724 | 5.471 | 7.101 |

| Segment | 2.257 | 1.798 | 1 | 1 | 3 |

| Foreign | 0.291 | 0.454 | 0 | 0 | 1 |

| ACQ | 0.335 | 0.472 | 0 | 0 | 1 |

| Pension | 0.665 | 0.472 | 0 | 1 | 1 |

| XISPI | 0.649 | 0.477 | 0 | 1 | 1 |

| ROA | −0.256 | 1.051 | −0.143 | 0.016 | 0.067 |

| Loss | 0.440 | 0.496 | 0 | 0 | 1 |

| INVREC | 0.252 | 0.196 | 0.092 | 0.216 | 0.367 |

| Quick | 2.341 | 2.782 | 0.871 | 1.454 | 2.645 |

| Leverage | 0.545 | 0.352 | 0.292 | 0.487 | 0.691 |

| NDI | 0.274 | 0.446 | 0 | 0 | 1 |

| NEI | 0.479 | 0.499 | 0 | 0 | 1 |

| Concern | 0.109 | 0.312 | 0 | 0 | 0 |

| Restatement | 0.106 | 0.308 | 0 | 0 | 0 |

| FYAudit | 0.196 | 0.397 | 0 | 0 | 0 |

| REPLAG | 120.7 | 82.82 | 88 | 104 | 119 |

| NAF | 425,308.9 | 1,545,877 | 9,000 | 67,085.5 | 293,600 |

| December | 0.694 | 0.461 | 0 | 1 | 1 |

| BtM | 0.650 | 0.373 | 0.372 | 0.615 | 0.874 |

| SGrowth | 0.227 | 0.921 | −0.044 | 0.061 | 0.222 |

| Litigation | 0.407 | 0.491 | 0 | 0 | 1 |

| Age | 17.17 | 11.73 | 8 | 14 | 24 |

| PEFF | 0.074 | 0.129 | 0 | 0 | 0.090 |

| CEFF | 1.053 | 2.345 | 0 | 0 | 0.609 |

| PAge | 6.422 | 3.241 | 3.667 | 5.917 | 8.845 |

| Dep. Var. Log (AF) | |||

|---|---|---|---|

| Variables | (1) | (2) | (3) |

| KCINT | 0.077 *** | 0.078 *** | 0.077 *** |

| (12.710) | (12.853) | (12.661) | |

| Log(Patent) | 0.044 *** | ||

| (7.065) | |||

| Log(CPatent) | 0.022 *** | ||

| (7.322) | |||

| Log(TECHCL) | 0.072 *** | ||

| (8.530) | |||

| INTAN | 0.088 *** | 0.087 *** | 0.089 *** |

| (2.649) | (2.621) | (2.658) | |

| BigN | 0.298 *** | 0.295 *** | 0.297 *** |

| (11.188) | (10.916) | (11.194) | |

| Specialist | 0.053 *** | 0.054 *** | 0.053 *** |

| (4.395) | (4.432) | (4.397) | |

| Size | 0.463 *** | 0.466 *** | 0.463 *** |

| (57.508) | (63.231) | (58.249) | |

| Log(Segment) | 0.083 *** | 0.084 *** | 0.081 *** |

| (8.694) | (8.750) | (8.568) | |

| Foreign | 0.103 *** | 0.104 *** | 0.103 *** |

| (6.170) | (6.170) | (6.124) | |

| ACQ | 0.049 *** | 0.048 *** | 0.048 *** |

| (5.863) | (5.790) | (5.818) | |

| Pension | 0.079 *** | 0.078 *** | 0.078 *** |

| (4.857) | (4.845) | (4.815) | |

| XISPI | 0.140 *** | 0.140 *** | 0.139 *** |

| (17.933) | (18.218) | (17.772) | |

| ROA | −0.054 *** | −0.055 *** | −0.054 *** |

| (−9.071) | (−9.173) | (−9.015) | |

| Loss | 0.135 *** | 0.134 *** | 0.134 *** |

| (12.685) | (12.768) | (12.646) | |

| INVREC | 0.346 *** | 0.348 *** | 0.347 *** |

| (9.697) | (9.773) | (9.734) | |

| Quick | −0.015 *** | −0.015 *** | −0.015 *** |

| (−5.671) | (−5.719) | (−5.729) | |

| Leverage | 0.176 *** | 0.179 *** | 0.177 *** |

| (6.883) | (7.054) | (6.890) | |

| NDI | −0.044 *** | −0.044 *** | −0.044 *** |

| (−4.986) | (−5.045) | (−4.970) | |

| NEI | 0.020 *** | 0.019 ** | 0.020 *** |

| (2.655) | (2.401) | (2.659) | |

| Concern | 0.036 * | 0.039 ** | 0.036 * |

| (1.916) | (2.102) | (1.904) | |

| Restatement | 0.038 ** | 0.037 ** | 0.039 ** |

| (2.118) | (2.022) | (2.114) | |

| FYAudit | −0.267 *** | −0.266 *** | −0.266 *** |

| (−10.275) | (−10.211) | (−10.280) | |

| Log(REPLAG) | 0.090 *** | 0.090 *** | 0.091 *** |

| (4.351) | (4.363) | (4.399) | |

| Log(NAF) | 0.018 *** | 0.018 *** | 0.018 *** |

| (9.331) | (9.371) | (9.325) | |

| December | 0.038 * | 0.038 * | 0.037 * |

| (1.927) | (1.916) | (1.898) | |

| BtM | −0.130 *** | −0.130 *** | −0.128 *** |

| (−4.695) | (−4.814) | (−4.669) | |

| SGrowth | −0.016 *** | −0.016 *** | −0.016 *** |

| (−4.604) | (−4.669) | (−4.625) | |

| Litigation | 0.002 | 0.004 | 0.005 |

| (0.110) | (0.187) | (0.246) | |

| Log(Age) | −0.013 | −0.011 | −0.014 |

| (−1.261) | (−1.068) | (−1.378) | |

| FE: Industry and Year | Yes | Yes | Yes |

| Observations | 70,202 | 70,202 | 70,202 |

| Adjusted R-squared | 0.825 | 0.825 | 0.825 |

| Dep. Var. Log (AF) | |||

|---|---|---|---|

| Variables | (1) | (2) | (3) |

| KCINT15 | 0.065 *** | ||

| (12.703) | |||

| KCINT20 | 0.082 *** | ||

| (12.852) | |||

| KCINT25 | 0.101 *** | ||

| (12.996) | |||

| Log(Patent) | 0.044 *** | 0.044 *** | 0.043 *** |

| (7.051) | (7.036) | (7.016) | |

| INTAN | 0.088 *** | 0.090 *** | 0.091 *** |

| (2.613) | (2.654) | (2.692) | |

| Other Controls | Included | Included | Included |

| FE: Industry and Year | Yes | Yes | Yes |

| Observations | 70,202 | 70,202 | 70,202 |

| Adjusted R-squared | 0.825 | 0.825 | 0.825 |

| Variables | (1) High Tech | (2) Other | (3) Low | (4) High | (5) Small | (6) Large |

|---|---|---|---|---|---|---|

| KCINT | 0.096 *** | 0.060 *** | 0.090 *** | 0.074 *** | 0.073 *** | 0.113 ** |

| (11.824) | (6.424) | (11.444) | (10.578) | (11.470) | (2.543) | |

| Log(Patent) | 0.018 ** | 0.067 *** | 0.048 *** | 0.026 *** | 0.062 *** | 0.034 *** |

| (2.227) | (7.877) | (5.519) | (3.677) | (4.842) | (5.141) | |

| Other Controls | Included | Included | Included | Included | Included | Included |

| FE: Industry and Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 23,660 | 46,542 | 29,419 | 29,418 | 35,101 | 35,101 |

| Adjusted R-squared | 0.806 | 0.835 | 0.825 | 0.827 | 0.628 | 0.705 |

| Test of difference | ||||||

| KCINT | 8.35 *** (<0.01) | 2.33 (0.12) | 0.96 (0.32) | |||

| Log(Patent) | 20.34 *** (<0.01) | 9.68 *** (<0.01) | 5.68 ** (0.02) | |||

| Dep. Var. Concern | ||

|---|---|---|

| Variables | (1) | (2) |

| KCINT | 0.062 *** | 0.064 *** |

| (3.282) | (3.366) | |

| Log(Patent) | −0.058 ** | |

| (−2.365) | ||

| Log(Cpatent) | −0.036 *** | |

| (−3.514) | ||

| INTAN | 0.824 *** | 0.821 *** |

| (9.475) | (9.428) | |

| Other Controls | Included | Included |

| FE: Industry and Year | Yes | Yes |

| Observations | 14,692 | 14,692 |

| Pseudo R-Squared | 0.190 | 0.191 |

| Variables | (1) | (2) |

|---|---|---|

| KCINT | 0.059 *** | 0.069 *** |

| (4.653) | (5.368) | |

| Log(Patent) | 0.057 *** | |

| (4.897) | ||

| Log(CPatent) | 0.034 *** | |

| (3.914) | ||

| PEFF | −0.389 *** | |

| (−3.807) | ||

| CEFF | −0.021 *** | |

| (−3.580) | ||

| PAge | 0.014 *** | 0.015 *** |

| (3.545) | (3.659) | |

| Other Controls | Included | Included |

| FE: Industry and Year | Yes | Yes |

| Observations | 15,504 | 15,504 |

| Adjusted R-squared | 0.811 | 0.811 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, D.; Deis, D.R.; Hsu, H.-T. Pricing the Audit Risk of Innovation: Intangibles and Patents. Int. J. Financial Stud. 2025, 13, 42. https://doi.org/10.3390/ijfs13010042

Zhang D, Deis DR, Hsu H-T. Pricing the Audit Risk of Innovation: Intangibles and Patents. International Journal of Financial Studies. 2025; 13(1):42. https://doi.org/10.3390/ijfs13010042

Chicago/Turabian StyleZhang, Daqun, Donald R. Deis, and Hsiao-Tang Hsu. 2025. "Pricing the Audit Risk of Innovation: Intangibles and Patents" International Journal of Financial Studies 13, no. 1: 42. https://doi.org/10.3390/ijfs13010042

APA StyleZhang, D., Deis, D. R., & Hsu, H.-T. (2025). Pricing the Audit Risk of Innovation: Intangibles and Patents. International Journal of Financial Studies, 13(1), 42. https://doi.org/10.3390/ijfs13010042